Abstract

Markets for information products exhibit varying degrees of competition on both the supply and the demand side. This paper studies the potential complementarity of information products, equilibrium information buying behaviors and information price setting in such markets. Our game-theoretic model consists of two information providers selling imperfect information to two competing clients and allows for different information quality levels as well as varying degrees of client competition. Absent of client competition, information providers compete on the statistical properties of the information they supply (i.e., the accuracy of the information). The competitive price can be high because of potential complementarity among information products when these are not very reliable. However, this may change when the clients are competing against each other. We adopt a reduced-form model of buyer competition that reflects situations where information buyers face discrete alternatives. We find that a buyer gains more through information acquisition when its competitor is less informed, suggesting a first mover advantage in information acquisition. More importantly, we also find that intense client competition can make the information products more substitutable, resulting in a lower equilibrium price for information. Furthermore, this effect leads to harsh competition between information providers and consequently provides incentives for exclusive contracting. In summary, it is found that the “quality” of information has a very different impact on sellers’ profits depending on the degree of client competition.

Similar content being viewed by others

Notes

See “Analyzing the Analyst”, Information Week, November 17, 1997.

An important feature of this type of models is that better information held by one firm hurts its competitors. While this is consistent with literature on information markets (Raju and Roy 2000), it does not cover the full spectrum of competitive dynamics at the information buyer side.

The reason why the firms’ information acquisition decisions are public knowledge is linked to the oligopolistic nature of information markets. These markets are essentially Business-to-Business markets with few players (e.g., IT-sector market research includes 4–10 competing firms, such as Forrester,Gartner, Jupiter, etc.) and a high level of professionalization (e.g. Airbus would know if McKinsey, Bain, BCG or Booz works for Boeing or not). Moreover, consulting firms and market research firms tend to advertise their client base (without saying specifics about assignments).

We do not consider the case when the actions of a player reveal the content of the acquired information, which is mostly relevant in the context of financial markets; see, for example, Admati and Pfleiderer (1987).

We abstract away from the specific differentiation activities at the clients’ side and focus on the impact of information on their hedging strategies between two alternatives. For example, fashion designers need to know what is the color of this summer, pink or blue. Mobile phone makers would like to know which 3G standard will be supported by the government. However, in each case, firms’ realized profits are not independent from the choices of their competitors.

In the case when \(ta \leq 1\), the decision problem is balanced enough for the clients, so that they never purchase two pieces of information. In fact, one can show that, then, information goods are always substitutes unless the information products are negatively correlated (which is a quite unreasonable assumption as in practice, competing information products are almost always positively correlated). We also conducted further calculation for the symmetric case, when \(t=1\) and found that clients’ hedging strategies exhibit similar patterns as in the asymmetric case. Moreover, stronger client competition leads to stronger competition for information sellers as well and results in lower equilibrium information prices. In some cases, a pure strategy equilibrium in prices cannot be identified. However, a key result, that the sellers’ incentive to engage in exclusive contracting becomes stronger when client competition is intense remains valid.

It is worth noticing that in our model of client competition, firms’ choices are not strategic substitutes by design. Rather, this feature comes from the unreliability of information. To see this, consider the case of perfect information. When the information always points to the true/correct direction, both clients will do exactly what the information says, implying strategic complements. It is when the information is less reliable that clients start hedging between the two alternatives to avoid head-on competition.

Note that \(\frac {\partial \sigma _{i}^{i}(s_{i}=L)}{\partial q}=\frac {(1+a)t}{(1-a)(q+t-qt)^{2}}>0\) and \(\frac {\partial \sigma _{i}^{i}(s_{i}=L)}{\partial a}=\frac {q+qt-t}{(1-a)^{2}(q+t-qt)}>0\).

The finding may not hold in the models with strategic complements under demand uncertainty, but it will hold if the uncertainty is on the cost side of the clients.

It is worth noticing that we have defined information complementarity/substitutability based on an informationally inferior client. This is a conservative approach given the lower benefit of making up for information inferiority. Other definitions based on information superiority (i.e., complements if \(V_{ij}^{0}>V_{i}^{0}+V_{j}^{0}\)) or partial information inferiority (i.e., complements if \(V_{ij}^{i}>V_{i}^{i}+V_{j}^{i}\)) give the same qualitative results.

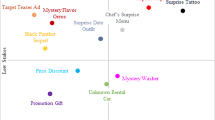

In all the figures the parameter t is set to 5, but the figures do not change qualitatively at other t values.

When buyer competition is very strong, \(P^{{\rm duopoly}}\) has a sudden increase then starts to decrease again (see the kink at the end of the curve) due to the change from non-exclusive contracts to exclusive contracts. The same explanation (change from a non-exclusive to an exclusive contract) holds for the monopoly price, which also has a kink, although at the beginning of the curve.

Exclusive contracts may not be observed when neither client observes the other firm’s information acquisition strategy. In this case, each client will try to solve the competitor’s information acquisition problem by assigning rational expectations to each information acquisition strategy (leading to a potential mixed-strategy equilibrium) and in equilibrium, our results regarding information complementarity and prices remain robust. However, exclusive contract arrangements may not be credible (e.g., an exclusive contract between seller 1 and client A may not prevent the seller from selling to client B).

We would like to thank the Editor for this valuable insight.

References

Admati, A.R., & Pfleiderer, P. (1987). Viable allocations of information in financial markets. Journal of Economic Theory, 43, 76–115.

Arora, A., & Fosfuri, A. (2005). Pricing diagnostic information. Management Science, 51(7), 1092–1100.

Bakos, Y., & Brynjolfsson, E. (1999). Bundling information goods: Pricing, profits, and efficiency. Management Science, 45(12), 1613–1630.

Bakos, Y., & Brynjolfsson, E. (2000). Bundling and competition on the Internet. Marketing Science, 19(1), 63–82.

Baye, M.R., & Morgan, J. (1999). A folk theorem for one-shot Bertrand games. Economics Letters, 65, 59–65.

Chen, Y., Narasimhan, C., Zhang, Z.J. (2001). Individual marketing with imperfect targetability. Marketing Science, 20, 23–41.

Christen, M. (2005). Research note: Cost uncertainty is bliss: the effect of competition on the acquisition of cost information for pricing new products. Management Science, 51(4), 668–676.

Chu, W., & Messinger, P.R. (1997). Information and channel profits. Journal of Retailing, 73(4), 487–517.

ESOMAR (2005). Esomar World Research Report: Industry Study on 2004.Tech. rep., The European Society for Opinion and Market Research.

Gal-Or, E. (1986). Information transmission: Cournot and Bertrand equilibria. Review of Economic Studies, 53, 85–92.

Iyer, G., & Soberman, D. (2000). Markets for product modification information. Marketing Science, 19(3), 203–225.

Jensen, F.O. (1991). Information services. Congram In Friedman (Ed.), The AMA handbook of marketing for the service industries (pp. 423–443). New York: AMA-COM.

Pasa, M., & Shugan, S.M. (1996). The value of marketing expertise. Management Science, 42(3), 370–378.

Raju, J.S., & Roy, A. (2000). Market information and firm performance. Management Science, 46(8), 1075–1084.

Sarvary, M. (2002). Temporal differentiation and the market for second opinions. Journal of Marketing Research, 39, 129–136.

Sarvary, M., & Parker, P.M. (1997). Marketing information: A competitive analysis. Marketing Science, 16(1).

Villas-Boas, M.J. (1994). Sleeping with the enemy: Should competitors share the same advertising agency? Marketing Science, 13(2), 190–202.

Vives, X. (1984). Duopoly information equilibrium: Cournot and Bertrand. Journal of Economic Theory, 34, 71–94.

Vives, X. (1999). Oligopoly pricing: old ideas and new tools. Cambridge, MA: The MIT Press.

Winkler, R.L. (1981). Combining probability distributions from dependent information sources. Management Science, 27(4), 479–89.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Both clients buy one piece of information from different sellers We first show that \(\sigma _{i}^{j}(s_{i}=R)=0\). When \(s_{i}=R\), if \(s_{j}=R\), then \(Pr(T=R\mid s_{i}=R,s_{j}=R)=\frac {2q-1+\eta }{2\eta }=q+\frac {(1-\eta )(2q-1)}{2\eta }>q\). Thus both clients would invest only in R. If \(s_{j}=L\), then \(Pr(T=R\mid s_{i}=R,s_{j}=L)=1/2\), and both would still invest in R. Therefore, when \(s_{i}=R\), the client who buys \(s_{i}\) only invests in R, i.e., \(\sigma _{i}^{j}(s_{i}=R)=0\). We can derive a client’s strategy when its information predicts L. Remember that \(\sigma _{i}^{j}(s_{i}=L)\) is the proportion of the total resource allocated to L, thus \(\sigma _{i}^{j}(s_{i}=L)\) is the equilibrium of the following game:

Clients’ expected returns when each has one piece of information from a different seller, and both predict L

L | R | |

|---|---|---|

L | \(aq+\frac {(1-a)(1-\eta )}{2},\,aq+\frac {(1-a)(1-\eta )}{2}\) | \(q,\,\frac {t}{2}(1+a-2q+\eta -a\,\eta )\) |

R | \(\frac {t}{2}(1+a-2q+\eta -a\,\eta ),\,q\) | \(at\,(1-q),\,at\,(1-q)\) |

We take the payoff of (L,L) as an example to illustrate the calculation of the payoff in each cell. Suppose client A has \(s_{1}=L\) and B has \(s_{2}\). Then A knows that with probability \(\eta =Pr(s_{2}=L\mid s_{1}=L)\), \(s_{2}=L\) and with probability \(1-\eta \), \(s_{2}=R\). Furthermore, in cell (L,L), he knows that if \(s_{2}=R\), B plays R, thus A gets 1 if \(T=L\). If \(s_{2}=L\), B plays L, and A gets a if \(T=L\).

Thus A’s expected return in cell (L,L) is

The clients’ hedging strategy is the equilibrium mixed strategy for the above game. Standard computation gives us Eqs. (5) and (6).

We now provide the equilibrium return in the other four cases of clients’ information acquisition. Full details of the mathematical derivation are available from the authors.

Proof of Lemma 3

To check if the prices in Eq. (9) are in equilibrium, we need to check: 1) will clients deviate from equilibrium buying behavior, 2) will the sellers deviate from equilibrium prices. Two cases have to be considered.

-

\(V_{ij}<2\,V_{i}\). In this case, \(2\,\pi _{i}-\pi _{ij}>\pi _{0}\). Suppose both sellers set the price at \(P=V_{ij}-V_{i}-\epsilon \). If a client buys two pieces of information, then she has a return of \(\pi _{ij}-2P=2\,\pi _{i}-\pi _{ij}+2\,\epsilon \). If she buys only one piece, the return is \(\pi _{i}-P_{i}=2\,\pi _{i}-\pi _{ij}+\epsilon \). Therefore, the client will buy two pieces. A seller, say i, won’t lower his price as he can sell to both clients at this price. If he raises the price to \(P'_{i}=V_{ij}-V_{i}+\omega \), then a client’s return is \(2\pi _{i}-\pi _{ij}-\omega \) if she only buys information i and \(2\pi _{i}-\pi _{ij}-\omega +\epsilon \) if she buys both pieces. Therefore, each client will only buy one piece from seller j where a client’s return is \(2\,\pi _{j}-\pi _{ij}+\epsilon \). The seller i, who raises his price then has zero sales. Thus \(P^{*}=V_{ij}-V_{i}\) is the equilibrium price when \(V_{ij}<2\,V_{i}\).

-

\(V_{ij}\geq 2\,V_{i}\). In this case, \(2\,\pi _{i}-\pi _{ij}\geq \pi _{0}\). Suppose both sellers set the price at \(P=\frac {V_{ij}}{2}-\epsilon \). Buying one piece gives a return of \(\pi _{i}-P=\pi _{i}-\frac {\pi _{ij}-\pi _{0}}{2}-\epsilon =\frac {2\,\pi _{i}-\pi _{ij}+\pi _{0}-2\epsilon }{2}<\pi _{0}\). This means buying a single piece of information yields less return than not buying anything. Buying two pieces gives the client a return of \(\pi _{ij}-2P=\pi _{0}+2\epsilon \). A client will then buy the two information products together. No seller will lower his price as clients are willing to buy at the current price. If seller i raises his price to \(P'_{i}=\frac {V_{ij}}{2}+\omega \), a client will have a return of \(\pi _{0}-\omega +\epsilon \) if she still buys two pieces. Note that buying a single piece, either from i or j, a client will have less return than not buying anything. Consequently, when \(\epsilon \rightarrow 0\), a client will not buy any information and maintain an expected return of \(\pi _{0}\). In other words, when a seller raises his price above \(P=\frac {V_{ij}}{2}\), both firms have zero sales. Therefore the sellers have no incentive to either raise or lower their prices. In other words, \(P^{*}=\frac {V_{ij}}{2}\) is the equilibrium price when \(V_{ij}\geq 2\,V_{i}\). Now, we have:

Letting \(a=1\), we can have \(V_{i}=\frac {q+qt-t}{2}\) and \(V_{ij}=\frac {q^{2}-(1-q)^{2}t}{2}\). With some simplification, we arrive at Eq. (9). □

Derivation of the equilibria in the full model

In deriving the symmetric equilibrium, we first examine if a particular client information acquisition scenario supports any symmetric price equilibrium. After identifying those scenarios, we study all the potential symmetric equilibrium candidates and check if an information seller would deviate (increase or decrease its price) given that the other seller keeps that price. Of course price deviation may lead to a different client purchase scenario, which is then further checked based on the deviated price pair.

Lemma 4

Symmetric equilibrium prices are only possible in the following three information purchase scenarios: (1) only one client buys from both sellers, (2) each client buys one piece of information but from different sellers, (3) each client buys two pieces of information.

Proof

As mentioned in the buyer behaviors section, there are 7 purchase scenarios in total. We first show that four of them can not be supported by symmetric pricing in equilibrium. It is easy to find that no price can support the following three purchase scenarios: 1) neither client buys any information product; 2) only one client buys one information product; 3) both clients buy only one information product from the same seller. In these three scenarios, at least one seller receives nothing. This zero-seller will then have a strong incentive to lower its price or undercut its competitor so as to make a sale. Therefore no symmetric pricing is sustainable in these three scenarios.

For the scenario when one client buys one information product and the other client buys two information products, suppose it is supported by a symmetric price P. This leads to three information products sold in total. Given the symmetry of the sellers, each has the same possibility of selling one information product or two. Stated in another way, each seller has an expected sale of 1.5 information products. At any price level P that supports this purchase scenario, a seller will have an incentive to lower its price by \(\epsilon \) so that it can make sure of selling two information products. Thus this scenario can not be an equilibrium. □

Lemma 5

There exists a symmetric equilibrium in price where each seller sells to a common client and the other client does not buy any information. The equilibrium is strictly Pareto dominated by selling to both clients and the price is:

Proof

We show that any price P, supporting the purchase scenario where only one client buys two information products and the other buys nothing, is not a Pareto optimal equilibrium. Consider first the case where \(\pi _{ij}^{0}-\pi _{i}^{0} \geq \pi _{j}^{0}-\pi _{0}^{0}\), then the maximal price that the two sellers can charge is \(\frac {1}{2}\,\left (\pi _{ij}^{0}-\pi _{0}^{0}\right )\), and both sellers sell one piece of information with maximal profit of \(\frac {1}{2}\,\left (\pi _{ij}^{0}-\pi _{0}^{0}\right )\). Notice that \(\pi _{ij}^{0}-\pi _{i}^{0}{}-{}\left (\pi _{j}^{0}-\pi _{0}^{0}\right )-\left [\pi _{ij}^{ij}-\pi _{i}^{ij}-\left (\pi _{j}^{ij}-\pi _{0}^{ij}\right )\right ]{} ={}\frac {(a-1)\left [q^{2}+(1-q)^{2}t\right ]}{2}\leq 0\). This means that if \(\pi _{ij}^{0}-\pi _{i}^{0} \geq \pi _{j}^{0}-\pi _{0}^{0}\), then \(\pi _{ij}^{ij}-\pi _{i}^{ij}\geq \pi _{j}^{ij}-\pi _{0}^{ij}\). If both sellers set their prices at \(P=\,\frac {1}{2}\,\left (\pi _{ij}^{ij}-\pi _{0}^{ij}\right )\), both clients will buy two information products and the sellers earn a profit of \(2\cdot P=\pi _{ij}^{ij}-\pi _{0}^{ij}\). It can be checked that when \(\pi _{ij}^{0}-\pi _{i}^{0} \geq \pi _{j}^{0}-\pi _{0}^{0}\;\), \(\pi _{ij}^{ij}-\pi _{0}^{ij}>\frac {1}{2}\,\left (\pi _{ij}^{0}-\pi _{0}^{0}\right )\;\). Thus, from the sellers’ point of view, each selling one piece to a single client is at least Pareto inferior to selling two pieces.

Secondly, consider the case where \(\pi _{ij}^{0}-\pi _{i}^{0} < \pi _{j}^{0}-\pi _{0}^{0}\). – If the price \(P>\pi _{j}^{0}-\pi _{0}^{0}\), clients will buy nothing and the scenario is not supported. – If \(\pi _{j}^{0}-\pi _{0}^{0}\geq P>\pi _{ij}^{0}-\pi _{i}^{0}\), a client will buy one piece of information as this leaves him/her a positive rent and the scenario is not supported. – If \(P\leq \pi _{ij}^{0}-\pi _{i}^{0}\), the maximal price is \(\pi _{ij}^{0}-\pi _{i}^{0}\,\). When \(\pi _{ij}^{0}-\pi _{i}^{0}<\pi _{i}^{ij}-\pi _{0}^{ij}\), the purchase scenario is not supported as the other client will buy one piece. When \(\pi _{ij}^{0}-\pi _{i}^{0}\geq \pi _{i}^{ij}-\pi _{0}^{ij}\), it can be easily checked that \(\pi _{ij}^{ij}-\pi _{i}^{ij}\geq \pi _{i}^{ij}-\pi _{0}^{ij}\,\). Notice that \(\pi _{ij}^{0}-\pi _{i}^{0}- \pi _{ij}^{ij}-\pi _{0}^{ij}\,=\,-\frac {1}{2}\big [1-(1-a)q\big ](q+qt-t)<0\,\). This means that the equilibrium is Pareto inferior to selling two pieces.

The existence of the equilibrium can be seen from the conditions in the Lemma. The first condition means that the sellers will not deviate by lowering the price to sell two pieces. This condition also suggests that \(\left (\pi _{i}^{ij}-\pi _{0}^{ij}\right )<\frac {1}{2}\left (\pi _{ij}^{0}-\pi _{0}^{0}\right )\), which means that the buyer who does not buy anything will not earn a positive profit by buying from either sellers. □

Proof of Proposition 1

We first show that the price supports equilibrium purchase decision. From Lemma 4, we know that only two purchase scenarios can be supported by a symmetric pricing equilibrium. We first find the prices supporting these two purchase scenarios. From the previous section, given the quality threshold \(q>\frac {t}{1+t}\) and the conditional independence of the information products, simplification yields, \(\pi _{ij}^{j}-\pi _{i}^{j}=\pi _{ij}^{ij}-\pi _{i}^{ij}\) and \(\pi _{i}^{j}-\pi _{0}^{j}=\pi _{i}^{ij}-\pi _{0}^{ij}\). When the two information products \(s_{1}\) and \(s_{2}\) are substitutes, \(\pi _{ij}^{ij}-\pi _{i}^{ij}\leq \pi _{j}^{ij}-\pi _{0}^{ij}\,\). This leads to \(\pi _{ij}^{j}-\pi _{i}^{j}\leq \pi _{i}^{j}-\pi _{0}^{j}\,\). Assume a price \(P'\,>\,\pi _{i}^{j}-\pi _{0}^{j}\), then only one client buys one piece and the other buys nothing, which can not be supported. If \(\pi _{i}^{j}-\pi _{0}^{j}\,\geq \,P'\,>\,\pi _{ij}^{j}-\pi _{i}^{j}\), it is easily checked that \(\pi _{ij}^{j}-\pi _{i}^{j}=\pi _{ij}^{ij}-\pi _{i}^{ij}\). Then each client buys a single piece from different sellers. If \(\pi _{ij}^{j}-\pi _{i}^{j}>P'\), then each client buys two information products. Therefore, when selling two information products, the maximal symmetric price is \(\pi _{ij}^{j}-\pi _{i}^{j}\). When selling one information product to different clients, it is \(\pi _{i}^{j}-\pi _{0}^{j}\).

We then show the conditions under which sellers would not deviate. When \(P^*=\pi _{ij}^{j}-\pi _{i}^{j}\), each seller sells two pieces. In this case, a seller won’t lower its price as it is already selling two pieces. To check if a seller, say firm 2, will raise its price above \(\pi _{ij}^{j}-\pi _{i}^{j}\), fix \(P_{1}=P^{*}\) and let \(P_{2}'>P_{1}\). Given \(P_{2}'\), we need to calculate seller 2’s demand, denoted by \(D_{2}'\left (P_{2}'\,,\,P_{1}^{*}\right )\), and thus its profit \(\Pi _{2}'\). Seller 2 will deviate if and only if \(\Pi _{2}'>\Pi _{2}^{*}\), where \(\Pi _{2}'=D_{2}'\left (P_{2}'\,,\,P_{1}^{*}\right )\cdot P_{2}'\) and \(\Pi _{2}^{*}=D_{2}^{*}\left (P_{2}^{*}\,,\,P_{1}^{*}\right )\cdot P_{2}^{*}\). To calculated seller 2’s demand, we first need to find the equilibria of clients’ purchase behaviors, which depend on the prices \(P_{1}\) and \(P_{2}'\).

When \(P_{2}'>\pi _{2}^{1}-\pi _{0}^{1}\,\), one can show that there are two possible equilibria in clients’ information purchase: (only one client buys \(s_{1}\), the other buys nothing), and (both clients buy only \(s_{1}\)). In either case, seller 2 makes no sale. That is, in either equilibrium, seller 2 has zero demand(\(D_{2}'=0\)).

Similarly, when \(P_{2}'\leq \pi _{2}^{1}-\pi _{0}^{1}\) and \(P_{2}'>\pi _{12}^{1}-\pi _{1}^{1}\,\): there are two possible purchase equilibria (pairs of best responses) in case 2): (only one client buys \(s_{1}\), the other buys nothing), and (both clients buy only \(s_{1}\)). In either case, research firm 2 makes no sale (\(D_{2}'=0\)).

When \(P_{2}'\leq \pi _{2}^{1}-\pi _{0}^{1}\) and \(P_{2}'\leq \pi _{12}^{1}-\pi _{1}^{1}\,\): The purchase equilibrium is that one client buys one piece from seller 1 and the other client buys two pieces. Thus research firm 2 sells one report \(D_{2}'=1\)at the price: \(P_{2}'=\,\text {\text {Min}}\big \{\pi _{2}^{1}-\pi _{0}^{1}\,,\,\pi _{12}^{1}-\pi _{1}^{1} \big \}\).

The above analyses indicate that, if a seller raises its price above \(P^{*}\), it can only make a sale in the last case with a profit of \(\Pi _{2}'=\,\text {\text {Min}}\big \{\pi _{2}^{1}-\pi _{0}^{1}\,,\,\pi _{12}^{1}-\pi _{1}^{1}\big \}\). Note that with \(P_{2}^{*}\), \(D_{2}^{*}=2\) and thus \(\Pi _{2}^{*}=2\left (\pi _{ij}^{ij}-\pi _{i}^{ij}\right )\). With the notion that \(\pi _{ij}^{j}-\pi _{i}^{j}=\pi _{ij}^{ij}-\pi _{i}^{ij}\), it is obvious that, when either of the two conditions in Eq. (10) are satisfied, raising price is less profitable than staying at \(P^{*}\). In other words, no seller has an incentive to deviate.

Recall that in Lemma 4, we show that only two purchase scenarios are supported by symmetric pricing equilibrium. We now show that under either of these two conditions in Eq. (10), non-exclusive contract is optimal for both sellers. As we show in the beginning of the proof, with exclusive contract \(\Pi ^{*}=P^{*}=\pi _{i}^{j}-\pi _{0}^{j}\), and with non-exclusive contract, \(\Pi ^*=2\cdot P^{*}=2\left (\pi _{ij}^{ij}-\pi _{i}^{ij}\right )\). Under the first condition, clearly, non-exclusive contract is better than exclusive contract. Under the second condition, on the other hand, no symmetric pricing can support exclusive contract. To see this, assume a price \(P''\) can support exclusive contract. If \(\pi _{ij}^{j}-\pi _{i}^{j}< P''<\pi _{i}^{j}-\pi _{0}^{j}\), both clients will buy only one piece of information from different sellers. Then both sellers will raise price till \(P''=\pi _{i}^{j}-\pi _{0}^{j}\,\). However, given its competitor’s price at \(P''=\pi _{i}^{j}-\pi _{0}^{j}\,\), a seller will have an incentive to lower its price to \(\pi _{j}^{j}-\pi _{0}^{j}\) if \(\pi _{i}^{j}-\pi _{0}^{j}\,<\,2\,\left (\pi _{j}^{j}-\pi _{0}^{j}\right )\,\) so that it can sell two pieces of information. In other words, a seller will deviate if \(\pi _{i}^{j}-\pi _{0}^{j}\,<\, 2\,\left (\pi _{j}^{j}-\pi _{0}^{j}\right )\,\). From the first inequality in the second condition,

From the second inequality in the second condition,

Combining Eqs. (16) and (17) yields:

That is, the second condition in Eq. (10) implies \(\pi _{i}^{j}-\pi _{0}^{j}\,<\, 2\,\left (\pi _{j}^{j}-\pi _{0}^{j}\right )\,\). Therefore, a seller will always deviate from exclusive contracting when the second condition is satisfied. □

Proof Proposition 2

The proof is similar to that of Proposition 1. In the first part of the proof of proposition 1, we show that \(P^{*}\,=\,\pi _{i}^{j}-\pi _{0}^{j}\) is the maximal price supporting the purchase scenario where each client buys a single piece but from different sellers. We now show that no seller will deviate under Eq. (11). Fix \(P_{1}=P^{*}\), we check if seller 2 will raise or lower \(P_{2}\). Suppose seller 2 raises his price to \(P_{2}'>P^*=\pi _{i}^{j}-\pi _{0}^{j}\), we first need to find the clients’ best responses in terms of information acquisition. Then we can calculate the equilibrium in information acquisition and seller 2’s demand under \(P_{2}'\). Looking at the clients’ purchase decision, we have:

If A buys nothing, then B’s best response is to buy \(s_{1}\). B prefers buying \(s_{1}\) to both \(s_{1}\) and \(s_{2}\) because: \(\pi _{2}^{1}-\pi _{0}^{1}>\pi _{12}^{1}-\pi _{2}^{1}=\pi _{12}^{0}-\pi _{1}^{0}\Rightarrow \pi _{12}^{0}-P_{1}-P_{2}'<\pi _{12}^{0}-\left (\pi _{2}^{1}-\pi _{0}^{1}\right )-P_{1}<\pi _{1}^{0}-P_{1}\). B prefers buying \(s_{1}\) to \(s_{2}\) as \(\pi _{1}^{0}=\pi _{2}^{0}\). B prefers buying \(s_{1}\) to nothing as \(\pi _{1}^{0}-P_{1}>\pi _{0}^{0}\).

If A buys \(s_{1}\), then B’s best response is to buy nothing. B prefers buying nothing to \(s_{1}\) because: \(\pi _{2}^{1}>\pi _{1}^{1}\Rightarrow \pi _{1}^{1}-P_{1}=\pi _{1}^{1}-\left (\pi _{2}^{1}-\pi _{0}^{1}\right )<\pi _{0}^{1}\). B prefers buying nothing to \(s_{2}\) or both \(s_{1}\) and \(s_{2}\) because: \(\pi _{12}^{1}-P_{1}-P_{2}'=\pi _{12}^{1}-\left (\pi _{2}^{1}-\pi _{0}^{1}\right )-P_{2}'\leq \pi _{2}^{1}-P_{2}'<\pi _{0}^{1}\).

If A buys \(s_{2}\), then B’s best response is to buy \(s_{1}\). B prefers buying \(s_{1}\) to nothing because: \(\pi _{1}^{2}-P_{1}>\pi _{0}^{2}\). B prefers buying \(s_{1}\) to \(s_{2}\) because: \(\pi _{1}^{2}>\pi _{1}^{1}\) and \(P_{1}<P_{2}'\). B prefers buying \(s_{1}\) to both \(s_{1}\) and \(s_{2}\) because: buying both \(s_{1}\) and \(s_{2}\) gives B \(\pi _{12}^{2}-P_{1}-P_{2}'\) while buying \(s_{1}\) gives B \(\pi _{1}^{2}-P_{1}\). \(\left (\pi _{12}^{2}-P_{1}-P_{2}'\right )-\left (\pi _{1}^{2}-P_{1}\right )=\pi _{12}^{2}-\pi _{1}^{2}-P_{2}'<0\). If A buys both \(s_{1}\) and \(s_{2}\), then B’s best response is to buy \(s_{1}\).

B prefers buying \(s_{1}\) to nothing because: \(\pi _{1}^{12}-P_{1}=\pi _{0}^{12}\). B prefers buying \(s_{1}\) to \(s_{2}\) because: \(\pi _{1}^{12}-P_{1}>\pi _{2}^{12}-P_{2}'\). B prefers buying \(s_{1}\) to both \(s_{1}\) and \(s_{2}\) because: \(\pi _{12}^{12}-P_{1}-P_{2}'<\pi _{12}^{12}-2\left (\pi _{1}^{12}-\pi _{0}^{12}\right )<\pi _{0}^{12}\).

Therefore, the purchase equilibrium is: (only one client buys a single piece from seller 1, and the other buys nothing). Thus, seller 2 makes no sales \(D_{2}'=0\)if he raises price above \(P^{*}\). In other words, seller 2 won’t raise his price. In the proof of Proposition 1, we show that a seller will lower his/her price below \(\pi _{i}^{j}-\pi _{0}^{j}\) and deviate from exclusive contract only if \(2\;\left (\pi _{j}^{j}-\pi _{0}^{j}\right )<\pi _{i}^{j}-\pi _{0}^{j}\). The second term in condition Eq. (11) indicates that no seller will lower his/her price. Therefore, under condition Eq. (11), no seller will deviate. Furthermore, the first term in Eq. (11) suggests that exclusive contract is better than non-exclusive contract for the information sellers. □

Proof of Proposition 3

Here, the information products are competitive complements, \(\pi _{ij}^{ij}-\pi _{i}^{ij}>\pi _{i}^{ij}-\pi _{0}^{ij}\). Clearly, when \(P^{*}\,=\,\frac {1}{2}\;\left (\pi _{ij}^{ij}-\pi _{0}^{ij}\right )\), both clients will buy two information products. Thus this price supports the second purchase scenario in Lemma 4. We now check if a seller will deviate in terms of price. From the sellers’ point of view, since both are selling two information products, they won’t lower their prices. To check if a seller will raise his/her price, again fix \(P_{1}=P^{*}=\frac {1}{2}\;\left (\pi _{ij}^{ij}-\pi _{0}^{ij}\right )\), and suppose \(P_{2}'>P^{*}\). In calibrating clients’ best responses, consider two cases: \(P_{2}'>\pi _{12}^{0}-\pi _{1}^{0}\) and \(P_{2}'\leq \pi _{12}^{0}-\pi _{1}^{0}\).

-

1)

—– \(P_{2}'>\pi _{12}^{0}-\pi _{1}^{0}\): If A buys nothing, then B’s best response is to buy \(s_{1}\) if \(\pi _{1}^{0}-\pi _{0}^{0}\geq P_{1}\), and nothing if \(\pi _{1}^{0}-\pi _{0}^{0}<P_{1}\). B prefers buying \(s_{1}\) to \(s_{2}\) as \(\pi _{1}^{0}-P_{1}>\pi _{2}^{0}-P_{2}'\). B prefers buying only \(s_{1}\) to both \(s_{1}\) and \(s_{2}\) because: \(\pi _{12}^{0}-P_{1}-P_{2}'<\pi _{12}^{0}-P_{1}-\left (\pi _{12}^{0}-\pi _{1}^{0}\right )=\pi _{1}^{0}-P_{1}\). Thus B will choose between buying \(s_{1}\) and buying nothing, which then depends on the price of \(s_{1}\).

If A buys \(s_{1}\), then B’s best response is to buy nothing. B prefers buying nothing to either \(s_{1}\) or \(s_{2}\) because: \(P_{1}=\frac {1}{2}\;\left (\pi _{12}^{12}-\pi _{0}^{12}\right )>\pi _{2}^{1}-\pi _{0}^{1}>\pi _{1}^{1}-\pi _{0}^{1}\). B prefers buying nothing to both \(s_{1}\) and \(s_{2}\) because: \(\pi _{12}^{12}-\pi _{0}^{12}=\pi _{12}^{1}-\pi _{0}^{1}\), thus \(\pi _{12}^{1}-P_{1}-P_{2}'<\pi _{0}^{1}\).

If A buys \(s_{2}\), then B’s best response is to buy nothing by the same reasoning as if A buys \(s_{1}\).

If A buys both \(s_{1}\) and \(s_{2}\), then B’s best response is to buy nothing by the same reasoning as if A buys \(s_{1}\).

Therefore there are two possible information purchase equilibria in case 1): (only one client buys a single piece from seller 1, the other buys nothing), (neither client buys anything). In either case, seller 2 makes no sale (\(D_{2}'=0\)).

-

2)

—– \(P_{2}'\leq \pi _{12}^{0}-\pi _{1}^{0}\): If A buys nothing, then B’s best response is either to buy nothing or to buy both \(s_{1}\) and \(s_{2}\). B prefers buying \(s_{1}\) and \(s_{2}\) to \(s_{1}\) as \(\pi _{12}^{0}-P_{1}-P_{2}'>\pi _{12}^{0}-P_{1}-\left (\pi _{12}^{0}-\pi _{1}^{0}\right )=\pi _{1}^{0}-P_{1}\). B prefers buying \(s_{1}\) to \(s_{2}\) as \(\pi _{1}^{0}-P_{1}>\pi _{2}^{0}-P_{2}'\). Thus buying a single piece of information (either \(s_{1}\) or \(s_{2}\)) is not in B’s best response.

If A buys only \(s_{1}\) or only \(s_{2}\), or both \(s_{1}\) and \(s_{2}\), B will buy nothing by the same reasoning as in case 1).

The above best responses give rise to two possible information purchase equilibria in case 2): (neither client buys anything), (one client buys both information products, the other buys nothing). In the first equilibrium, seller 2 makes no sale \(D_{2}'=0\). While in the second equilibrium, seller 2 can sell one piece \(D_{2}'=1\)at a maximal price of \(\pi _{12}^{0}-\pi _{1}^{0}\), obviously, \(\pi _{12}^{0}-\pi _{1}^{0}< 2\,P^{*}=\pi _{12}^{12}-\pi _{12}^{0}\). Seller 2 will be worse off by raising his/her price.

Summarizing case 1) and 2), we know that seller 2 won’t raise its price at all. Thus seller 2 will not deviate. □

Asymmetric equilibria

Lemma 6

When \(2\big (\pi _{i}^{ij}-\pi _{0}^{ij}\big )<\pi _{j}^{0}-\pi _{0}^{0}\) and \(\pi _{ij}^{0}-\pi _{i}^{0}>\pi _{j}^{0}-\pi _{0}^{0}\), any price pair that satisfies the following conditions can be achieved in the Nash equilibrium where only one client buys from both sellers and the other client does not buy any information:

Proof

From a client’s point of view, because \(P_{i}^{*}>\pi _{j}^{0}-\pi _{0}^{0}\), her best action is to buy two pieces together if her competitor does not buy anything. From Proposition 1, we know that \(\pi _{j}^{0}-\pi _{0}^{0}>\pi _{i}^{j}-\pi _{0}^{j}>\) and \(\pi _{j}^{0}-\pi _{0}^{0}>\pi _{i}^{ij}-\pi _{0}^{ij}>\), which means the client will not buy a single piece if her competitor buys one piece or two pieces. Similarly, we know that \(P_{i}^{*}+P_{j}^{*}=\pi _{ij}^{0}-\pi _{0}^{0}>\pi _{ij}^{j}-\pi _{0}^{j}>\) and \(P_{i}^{*}+P_{j}^{*}=\pi _{ij}^{0}-\pi _{0}^{0}>\pi _{ij}^{ij}-\pi _{0}^{ij}>\), which means that she will not buy two pieces together if her competitor buys anything (one piece or two). Therefore, given the price pair, only one client will buy from both sellers and the other client buys nothing.

From a seller’s point of view, suppose \(P_{1}>P_{2}\), if firm 2 wants to lower its price so that it can sell two pieces, its maximal price is \(\pi _{i}^{ij}-\pi _{0}^{ij}\). When \(2(\pi _{i}^{ij}-\pi _{0}^{ij})<\pi _{j}^{0}-\pi _{0}^{0}\), this is not profitable. Therefore, no firm will deviate. □

Lemma 7

When \(\pi _{ij}^{ij}-\pi _{i}^{ij}<\pi _{i}^{ij}-\pi _{0}^{ij}\), any price pair that satisfies the following conditions can be achieved in the Nash equilibrium, where only one client buys from both sellers and the other client buys from one seller:

Proof

The logic of the proof follows that of Lemma 5, and the proof is straightforward. The set of conditions in the Lemma ensures that neither the sellers nor the clients will deviate. □

Lemma 8

When \(\pi _{ij}^{ij}-\pi _{i}^{ij}>\pi _{i}^{ij}-\pi _{0}^{ij}\), any price pair that satisfies the following conditions can be achieved in the Nash equilibrium, where both clients buy two pieces from each seller:

Proof

The proof follows directly from that of Proposition 4. In such an asymmetric equilibrium, both clients will buy from both sellers and no seller will raise the price. □

Proof of Result 2

This corresponds to the equilibrium in proposition 2. Expanding the equilibrium conditions, we have:

The first inequality suggests that the quality of information is moderately high, and the second inequality suggests that the buyer competition is strong. □

Proof of Result 3

Under complements, the duopolist sellers’ profits, denoted \(\Pi ^{d}\), are:

Comparing \(\Pi ^{m}\) and \(\Pi ^{d}\) provides:

Since complementarity requires low q, the duopoly profit is higher than monopoly profit only when q is low and a is high.

Under substitutes, from Lemma 1 and 2 the duopolists’ profits can be rewritten as:

It can be checked that when the duopolists use exclusive contracts, their profits are always lower than that of a monopolist. With non-exclusive contracts, however, the profit comparisons between the duopolists and the monopolist yield:

The two inequalities constitute the triangle area above the complementarity threshold in Fig. 5. □

Rights and permissions

About this article

Cite this article

Xiang, Y., Sarvary, M. Buying and selling information under competition. Quant Mark Econ 11, 321–351 (2013). https://doi.org/10.1007/s11129-013-9135-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-013-9135-1