Abstract

I investigate the impact of voter turnout on top marginal tax rates in OECD countries between 1974 and 2013. I find that higher turnout leads to higher taxes for top earners, a result broadly consistent with the median voter theorem. Using novel survey data, I confirm that individuals in all but the wealthiest income bracket prefer higher taxes on the rich more than they prefer greater government spending in the economy. In line with these preferences, I find that turnout has a significantly negative effect on top income shares but no effect on the size of government or on public welfare expenditure. An instrumental variables approach confirms my findings. Overall, the paper is the first of its kind to link turnout to measures of redistribution that affect top earners and to preferences for redistribution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The right to vote is a basic democratic ideal (Lijphart, 1997). Among other things, both voters and non-voters have “important consequences for who gets elected and for the content of public policies” (Lijphart, 1997). It is unsurprising, therefore, that the consequences of voter turnout on a range of observable political and economic outcomes has been the object of a great deal of academic scholarship. This scholarship includes the effect of turnout on public spending on welfare (Hicks & Swank, 1992), education and health (Lindert, 1996), as well as on the ideological complexion of the ruling party (Pacek & Radcliff, 1995; Van der Eijk & Van Egmond, 2007). Voting has also been linked to measures of redistribution, including poverty reduction (Mahler et al., 2014), Gini coefficients (Kenworthy & Pontusson, 2005) and the size of fiscal transfers (Mahler, 2008).

These studies are, by and large, based on the Meltzer and Richard (1981) model that links voters incomes to preferences for redistribution: the poorer the pivotal voter is, relative to average income, the greater are his or her demands for redistribution. Often, however, the preferences for redistribution are taken to be preferences for greater government spending in the economy on things like welfare, health and education. But what if those with lower incomes prefer measures of redistribution targeted not at themselves but at top earners? Could greater turnout among these voters shape the policies and economic outcomes that affect those at the top of the income distribution and not just at the bottom?

In this paper, I aim at answering these questions. Specifically, I examine the impact of voter turnout on top marginal tax rates in the Organisation for Economic Co-operation and Development (OECD) countries. Across all OECD countries, those that held elections between 2009 and 2013 experienced an average turnout of 67%, 12 percentage points lower than the 1974–1978 average of 79%.Footnote 1 Moreover, empirical studies have shown that the decline in voter turnout is not random: those who vote are systematically different in their social and economic characteristics—and hence their policy preferences—from those who do not vote (Barnes, 2013; Lijphart, 1997). Among other things, voters tend to be richer, better educated and older than non-voters (Larcinese, 2007). Falling rates of voter turnout, therefore, imply that the preferences of wealthy individuals are overrepresented in relation to those of the population in general, which places less pressure on public policy for redistribution (Barnes, 2013; Mahler, 2008). Increasing rates of turnout, by contrast, will produce median voters with lower incomes and stronger preferences for redistribution. Accordingly, I anticipate top marginal tax rates to rise and fall with turnout.

To test this hypothesis, I assemble a panel of data for the OECD countries for the period between 1974 and 2013. I find a positive and statistically significant relationship between voter turnout in a given country and its top marginal tax rate. Results across a number of specifications indicate that a 10-percentage-point increase in voter turnout leads to a 3-percentage-point increase in the top marginal tax rate. If the correlations uncovered in this paper are causal, then the 12-percentage-point decrease in voter turnout in the 40 years to 2013 can explain some 16% of the 22-percentage-point decline in tax rates over the same period. Because both variables are downward-sloping time series, I undertake a number of empirical strategies to regress them against each other in order to determine whether their relationship is, in fact, causal.

As a first step, I control for a number of observable social and economic characteristics of the countries in question, including per capita gross domestic product (GDP), annual growth in GDP, the tertiary education enrollment rate, unemployment, population, the percentage of the population over 65, and a country’s openness to globalization as measured by its trade-to-GDP ratio. In additional tests, I account for a wide range of additional controls, including further demographic characteristics, indices for the strength of political rights and civil liberties, and measures of tax revenue. Controlling for these characteristics does nothing to diminish the effect of voter turnout on top marginal tax rates; the results remain positive, stable and statistically significant at conventional levels. By contrast, the coefficients on the many controls display no clear or consistent patterns, underscoring the important role that voter turnout plays in determining top marginal tax rates.

As a second strategy, I exploit the panel structure of the data by including year dummies and country fixed effects. This is a crucial step as it enables me to study the within-country variation of the variables of interest and account for any unobservable, time-invariant country heterogeneities. It also allows me to control for any additional unobservables that vary over time but that affect all countries in the OECD such as shocks to the global economy, including the Great Recession of 2008/9. Encouragingly, I find that my results remain robust to the inclusion of both year dummies and country fixed effects.

Next, I examine the timing of the effect. I begin by regressing the top marginal tax rate in years \(t + 1\), \(t + 2\) and \(t + 3\) as well as over the election cycle on voter turnout in election year t, and I find significant results, implying that turnout has an impact not just in the election year but throughout the entire term of a given government. I then carry out a placebo test by regressing the average top marginal tax rate from years \(t-1\) to \(t-3\) on turnout in election year t. If turnout is what causes changes in tax rates, then we would not expect to see significant effects of turnout in year t on tax rates in years \(t-n\). Consistent with this thinking, I find that turnout has no explanatory power over top marginal tax rates in the years leading up to an election. Exploring potential mechanisms further, I find, using two different measures of government ideology, that higher levels of turnout are significantly associated with more left-leaning governments assuming power.

As a final step, I employ an instrumental variables (IV) approach in an effort to isolate exogenous variation in voter turnout and to push the causal interpretation of my results. The instrument I use is an indicator variable for whether a country has compulsory voting laws interacted with year dummies, arguing that the introduction of such laws, and the extremely low frequency with which they change, influences the top tax rate only through its impact on turnout. A balance test of country characteristics between nations with and without compulsory voting laws reveals virtually no significant differences in social, economic or political observables, reinforcing the notion that such laws are enacted or repealed independent of economic policy. The IV results largely confirm those generated via ordinary least squares (OLS): the coefficients are of similar magnitude and sign but are estimated with less precision. For this reason, I take the IV results as suggestive. Nonetheless, the set of excluded instruments has a strong first stage and produce precise estimates in two specifications, thus adding some measure of causal validity to my findings.

A crucial assumption of the paper is that voters of lower income—marginal voters in the event of a ceteris paribus increase in turnout—in fact have stronger preferences for redistribution than those higher up on the income distribution. I also assume that this preference expresses itself in a desire to tax the wealthy. While the former assumption has its basis in theoretical models where preferences for redistribution follow from one’s own position in the income distribution, the second is, theoretically and empirically speaking, less clear cut and has received less attention. To lend credence to it, I draw on novel survey data from a representative sample of individuals from a select number of OECD countries. The survey asks respondents, among other things, to choose their preferred rate of income tax for those in the top 1% of the income distribution as well as for those between the 90th and 99th percentiles and those between the 50th and 90th percentiles of the income distribution. It also asks for their preference regarding greater government spending in the economy to foster “equality of opportunity policies,” defined as spending on public education and health. The correlations are unmistakable. Preferences for redistribution are to a large extent influenced by an individuals standing in the income distribution even after conditioning on a range of socioeconomic characteristics and political affiliation. I find that individuals in all but the wealthiest income bracket prefer significantly higher taxes for those at the top of the income distribution. By contrast, income correlates (much) less strongly with preferences for greater public spending in areas intended to boost equality of opportunity including health and education. It also correlates weakly for preferences for greater taxes on those with incomes between the median and the 90th percentile of the income distribution, supporting the view that increases in turnout put pressure on governments for targeted tax increases on top earners and not for greater social spending in the economy.

In light of my findings on preferences, I carry out two exercises to investigate whether and how differential increases in turnout affect the actual distribution of income. First, I obtain the share of national income accruing to those in the top 10% and 1% of the distribution and find that turnout exerts a negative and significant effect on the income share of top earners. As a placebo test, I regress, on turnout, the share of national income accruing to the middle 40% of income distribution and find no effect whatsoever. Together, these results confirm the view that top earners are affected by the electoral participation of those with greater preferences for targeted tax increases. As a second exercise, I collect information on government expenditures in order to test the effect of turnout on the size of government. I find that turnout has no effect on welfare spending and a negative effect on health and education spending. It has, moreover, no explanatory power on the overall size of government, directly in line with my findings on preferences. As a final check, I regress the tax threshold of the top marginal rate on voter turnout and find no relationship, indicating that turnout only increases the top marginal tax rate and not the income level at which that rate becomes relevant.

This study contributes to two interrelated strands of literature. First, it adds to scholarship that documents the effect of voter turnout on the size of government in a cross-country setting. This literature includes studies that examine the impact of turnout on such things as welfare expenditure (Hicks & Swank, 1992) and social spending in non-welfare categories such as education and health (Lindert, 1996). Other studies have looked at the interaction between turnout and income skew (Franzese, 2002) or inequality in voting (Mahler et al., 2014) in explaining government expenditures. Extending these sorts of studies to non-industrialized nations, Larcinese (2007) finds a similar relationship between voter turnout and social and welfare spending holds when considering countries that are not developed democracies. From a methodological perspective, the present study offers two advantages. First, by exploiting the panel structure of the data, I am able to account for unobserved time and country heterogeneity which might confound the analysis, an important step which has not always been taken in previous work. Second, I endeavor to isolate exogenous variation in turnout by employing an instrumental variable which, in the context of a cross-country study, improves the credibility of the point estimates.

Second, the paper relates to the literature highlighting the impact of voter turnout on more direct measures of redistribution such as poverty reduction (Mahler et al., 2014), fiscal transfers and income compression (Mahler, 2008) and Gini coefficients based on household surveys of gross and disposable incomes (Kenworthy & Pontusson, 2005). I build on these studies by estimating the impact of voter turnout on policies of redistribution that affect the top end of the income distribution. Importantly, I shed light on preferences for redistribution and argue that these preferences help explain the patterns in the data. I demonstrate that lower-income voters, compared with higher-income voters, have stronger preferences for targeted tax increases on the rich than they do for social spending, even if that spending is intended to foster greater equality of opportunity. I also show that turnout has significant consequences for the income share of top earners, indicating that governments respond to the preferences for redistribution of the electorate. As such, the paper is, to my knowledge, the first of its kind to relate voter turnout with top marginal tax rates, top income shares and preferences for redistribution.

The rest of this paper is organized as follows. Section 2 discusses the median voter theorem and addresses the question of who votes. Section 3 describes the data while Sects. 4, 5 and 6 outline the empirical specification and present the results. Section 7 concludes.

2 Theoretical motivation

2.1 Voter preferences and the median voter theorem

A tenet of the political science of elections is the median voter theorem. The theorem maintains that politicians have but one objective: to win office. Accordingly, politicians have powerful incentives to align their policy platforms to suit the interests of the majority of their respective electorates. Consequently, the policy platforms of competing parties on a left-right policy spectrum gradually converge toward center ground so as to maximize the number of votes won and to minimize the number of votes lost. As early as 1929, Harold Hotelling, observing the competition between the Republican and Democratic parties in the United States, noted that in order to avoid losing votes, “each party strives to make its platform as much like the other as possible” (Hotelling, 1929).

Elaborating the idea, Downs (1957) suggested that politicians “act solely in order to attain the income, prestige and power which come from being in office...” and that “parties formulate policies in order to win elections, rather than win elections in order to formulate policies.” To win office, therefore, politicians offer policy platforms that increasingly draw nearer to the preferences of the voter whose preferences are located in the median of the preference distribution. Put more precisely, the Downsian model of electoral competition states that, given a one-dimensional policy space and single-peaked voter preferences, the policy preferences of the median voter act as a sort of centripetal force, drawing the policy platforms of various parties towards it.

Meltzer and Richard (1981) build on the Downsian conception of electoral competition to model how governments set tax rates and allocate social spending in response to the preferences of the median voter. Their seminal model indicates that the size of government, taken to be the share of earned income redistributed towards welfare and social services, depends on the relative distance between median and mean income. The lower median income is with respect to mean income, the greater is the demand for redistribution, up to a maximum tax rate. As median income approaches mean income, the preferences of voters for a high tax rate declines. Politicians maximize their electoral chances by offering a tax rate commensurate with the preferences of the median voter for redistribution.

The most basic implication of the theorem is that governments respond to the preferences of the electorate—and in particular to those of the median voter. The model thus has trouble explaining rising inequality, especially of the sort generated by the hyper-concentration of wealth by the top percentiles. After all, such concentration creates median voters with incomes far below the average and with preferences for greater redistribution. If the model holds true, then, we would expect tax rates to rise as wealth becomes increasingly concentrated. Why haven’t they?

2.2 Who votes?

The shortcomings of the median voter theorem have been documented by a number of scholars who, among other things, have questioned the credibility of policy convergence in a two party system with rational voters (Alesina, 1988; Lee et al., 2004) and the assumptions the theorem makes about the preferences of voters and their knowledge of their position in the income distribution (Mahler, 2008). Here, my focus is on the role of turnout. The theorem assumes that everyone in a population votes, in which case the decisive voter is the voter with median level income as suggested by Meltzer and Richard (1981). But what happens when not everyone votes? If voters and non-voters are randomly distributed, it would be difficult to identify significant consequences of falling rates of turnout. A number of studies have shown, however, that those who vote are typically better educated, wealthier and more informed politically than those who abstain. From an empirical point of view, then, the “median voter” is not the one who lies at the median of the income distribution of the population, but rather lies at the median of a much richer subset of it. Larcinese (2007) aptly describes the phenomenon:

Downsian models normally assume that everybody votes...It is, however, clear from available data that non-voters are not randomly distributed across the total population: a substantial body of empirical research has documented that voters and non-voters systematically differ in their socioeconomic and demographic background and, therefore, in their needs and policy preferences...In different countries and elections, empirical research consistently shows that the likelihood of voting is positively correlated with income, age and education level, as well as with being a male citizen. It is quite likely that such characteristics are correlated with policy preference, especially over issues of redistribution.Footnote 2

Given the social, economic and demographic differences between voters and non-voters and the fact that governments respond to the preferences of those who vote, increases and decreases in voter turnout will, theoretically, generate significant effects on public economic policy. Falling rates of turnout will amplify the policy preferences of the wealthy whilst increases in turnout, by generating median voters with lower incomes, will exert pressure on governments for redistribution (Barnes, 2013). I thus anticipate the top marginal tax rate to rise and fall with turnout.Footnote 3

3 Data

The analysis is based on measures of voter turnout and top marginal tax rates in the nations that comprise the OECD for the period between 1974 and 2013. Although the sample covers nearly 40 years, the unit of observation is the country-election, of which there are 349 in total. In this section, I provide details concerning the definition and sources of the main outcome variable, explanatory variable and control variables used in the analysis. In Online Appendix A, I provide summary statistics of these main variables and I also describe the sources and definitions of all the other variables used in the study.

Voter turnout and compulsory voting: Data for voter turnout comes from the International Institute for Democratic and Electoral Assistance (IDEA). IDEA keeps two records for voter turnout: one, turnout, that measures voter participation as a percentage of registered voters, and a second, VAP turnout, that measures voter participation as a fraction of the total voting age population. I choose VAP turnout as the key explanatory variable in the study. Although important conceptual differences exist between the two measures, in practice, they are very similar and the results of the paper are robust to both, as discussed in more detail in Online Appendix B. The database also maintains a dummy variable for whether a nation has compulsory voting laws, which I use to instrument turnout.Footnote 4 Although some countries have compulsory voting laws, turnout in my sample has a maximum value of 95% and a minimum value of 35%, suggesting that even the most strictly enforced compulsory voting laws are unable to induce universal electoral participation.

Top marginal tax rates: Information regarding the top marginal tax rates comes from the OECD, but is compiled by the University of Michigan’s World Tax Database, which can be accessed at https://www.bus.umich.edu/otpr/otpr/default.asp.

Country controls: I use a wide range of socioeconomic characteristics at the country-year level as controls in the analysis. These come, primarily, from two sources. Unemployment and population figures come from the OECD statistical database. I used the World Bank Open Data to collect information on all remaining control variables, including data on GDP per capita as well as annual growth in GDP, the tertiary education enrollment rate,Footnote 5 a country’s openness to globalization as measured by its trade-to-GDP ratio and the percentage of the population over 65. In the Online Appendix, I probe the strength of the baseline relationship by including additional demographic, political and economic controls. Specifically, I include the working age population (defined as the share of the population between 15 and 65), the age dependency ratio (defined as the number of people under 15 and over 65 as a share of those between 15 and 65), and the share of the population residing in rural areas. These data all come from the World Bank. I also include measures of a country’s political rights and civil liberties by including indices prepared by Freedom House and made available by IDEA. I also control for a country’s value-added tax (VAT) rate and its tax revenue and these data are taken from the OECD’s statistical database.

4 Turnout and top tax rates

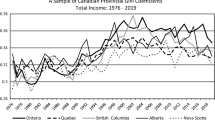

I begin the analysis by plotting the raw data. Figure 1 shows a steady downward trend in both voter turnout and the top marginal tax rates for all the countries in the sample. In Fig. 2, I present two scatter plots: The left panel presents a simple scatter and indicates a strong, positive relationship. In the right panel, I plot the residuals from a regression of top marginal tax rates on year dummies and country fixed effects against the corresponding residuals of turnout. Plotting the residuals enables me to observe variation in the two variables when all country and time heterogeneity have been accounted for. As shown, the relationship remains positive and significant and is not driven by outliers.

Bin scatter plots of tax rates and turnout. Note The left panel presents a simple bin scatter of top marginal tax rates on voter turnout. The right panel plots the residuals of both turnout and top marginal tax rates once year and country fixed effects have been accounted for. Both graphs use bin scatter with 100 bins

For each country i in election year t, I model the relationship between voter turnout and the top marginal tax rate as follows:

where y denotes the top marginal tax rate and \({\textbf {X}}\) contains a vector of country-specific controls, including log of population, GDP per capita and annual growth in GDP, the unemployment rate, the percentage of the population with tertiary education, the percentage of the population over 65 and a country’s trade-to-GDP ratio. I take into account unobserved year- and country-specific heterogeneity through the inclusion of year and country fixed effects, denoted by \(\alpha _{t}\) and \(\delta _i\), respectively. The idiosyncratic disturbance term, \(\mu _{it}\), is clustered at the country level. The parameter of interest is \(\beta\), which estimates the impact of turnout, expressed as a percentage of the voting age population, on top tax rates.Footnote 6

The results are shown in Table 1. Column 1 shows the univariate relationship between turnout and tax rate whilst Column 2 introduces the baseline controls. Neither the coefficient nor its precision is affected in any way through the inclusion of controls. In Column 3 I introduce year fixed effects and in Column 4, the preferred specification, I include country fixed effects. The magnitude of the coefficient decreases by about 40% compared with Column 1 but is precisely estimated and remains economically meaningful. The coefficient suggests that a 1-percentage-point increase in turnout is associated with a 0.3-percentage-point increase in the top marginal tax rate.Footnote 7

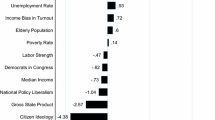

Additional robustness: In Online Appendix D, I probe the strength of the relationship between turnout and tax rates by including a range of additional control variables. These include additional demographic characteristics and political characteristics that measure political freedoms and civil liberties. They also include additional economic controls, including a country’s VAT rate and its tax revenue expressed as a percentage of GDP. The baseline coefficient of turnout on top marginal tax rates is remarkably stable, both in terms of magnitude and precision, across all specifications, increasing confidence that the result is not driven by omitted factors. By contrast, however, the coefficients on the many controls display no clear or consistent pattern, underscoring the important role that voter turnout plays in determining top marginal tax rates.

In Online Appendix D, I also test for the differential effects of turnout on top marginal tax rates before and after 1987. What motivates this analysis are the trends shown in Fig. 1. As shown in that graph, there is a sudden drop in the tax rate in the late 1980s (1987 to be specific). In Column 6 of Table D.1, I find a positive and significant relationship between voter turnout and the top marginal tax rate prior to 1987. I also find that this relationship is not significantly different after 1987; the total marginal effect post-1987 is nearly identical to the baseline and is estimated with as much precision, suggesting that my result is not sensitive to this sudden dip in the tax rate.

4.1 Timing of the effect

The baseline results indicate that voter turnout in election year t has a contemporaneous effect on top marginal tax rates. One may wonder, however, whether governments react that quickly to voter preferences. To increase confidence in the estimates, I regress top marginal tax rates in years \(t + 1\), \(t +2\) and \(t + 3\) on turnout. I also regress the average value of the top marginal tax rate over the entire election cycle for each election in each country on turnout.Footnote 8 Results are shown in Columns 1 to 4 of Table 2. As shown, the coefficient on turnout on the top marginal tax rate in years \(t+1\) to \(t+3\) are positive and precisely estimated, though somewhat smaller than the baseline. However, the coefficient on turnout is similar to the baseline when regressing it on the average tax rate over the entire term of the government, suggesting that the incoming government is indeed responsive to turnout when determining the tax rate for top earners.

As a further check, I carry out a placebo test by regressing the average tax rate in years \(t - 1\) to \(t -3\) on turnout in election year t. The idea is that voter turnout provides a mandate for the tax policies of the incoming government and not the outgoing one; accordingly, I do not expect elections in period t to have an effect on government policies in periods that precede it, that is to say, in period \(t-n\). Results are shown in Columns 5 of Table 2 and show that, as expected, turnout has no explanatory power over tax rates in the years prior to an election.

4.2 Voter turnout and government ideology

In Online Appendix E, I provide additional evidence regarding a potential mechanism that drives the effect. Specifically, I test whether increases in turnout are associated with more left-leaning parties assuming office. For this exercise, I rely on two different measures of government ideology. First, I use the right-left ideological index from the Manifesto Project Database collected by Volkens et al. (2020). Second, I exploit a measure of the ideological gap between the incoming and outgoing government using data from the Comparative Political Database compiled by Armingeon et al. (2021). Using both measures, I find that greater turnout leads governments to adopt more left-leaning positions, a result consistent with previous research (Pacek & Radcliff, 1995; Van der Eijk & Van Egmond, 2007).

4.3 Instrumental variables

In this subsection, I undertake an instrumental variables strategy in an effort to push the causal interpretation of the results. Specifically, I use an indicator variable for whether or not a country has compulsory voting (CV) laws as an instrument for voter turnout. In doing so, I follow Hoffman et al. (2017) who use CV as an instrument to study the impact of turnout on social spending in Austria. The intuition is that CV laws have no effect on tax rates except through voter turnout. Between 1974 and 2013, 10 of the OECD countries had, or continue to have, compulsory voting laws. In Online Appendix F, I detail which countries have CV laws and provide additional discussion on the validity of the exclusion restriction. Importantly, I also provide a balance test along a wide range of country covariates for countries with and without CV laws and find that, with the exception of levels of tertiary education (which I control for in the analysis), there are no statistical differences between these two types of countries.

An empirical challenge with the instrument is that it is time-invariant for all but four countries. This means I rely on variation in four countries to predict exogenous variation in a sample of over 30. To get around this obstacle, and to leverage as much variation as I can, I interact the compulsory voting indicator with year dummies and use this interaction as my instrument. The results are shown in Table 3. In Column 1 I use contemporaneous tax rates as the outcome variable of interest. The coefficient is comparable in magnitude to the corresponding OLS estimate but is indistinguishable from zero. In Column 2, consistent with the thinking that governments need time to react to voter preferences, I use the tax rate in year \(t+1\) as the outcome of interest. Here, the coefficient is around 30% larger than the baseline and is precisely estimated at the 10% level. To the extent that this coefficient reflects the true causal effect of turnout on tax rates, this suggests that the OLS regressions are, if anything, biased downwards. In Column 3, I use the average top tax rate as the outcome of interest. The coefficient is similar to the corresponding OLS regression and estimated with some precision, increasing confidence in the causal interpretation of the result. As shown, the \(F-\)statistic on the excluded instruments from all first-stage regressions is well over 10, signaling a strong set of instruments.Footnote 9 In Column 4, I repeat the placebo test by using the exogenous variation in turnout to predict tax rates in the years prior to a given election. As shown, the coefficients are an order of magnitude smaller and indistinguishable from zero. While I take these findings as suggestive, it is nevertheless encouraging that the 2SLS estimates are comparable in magnitude and sign to those generated using OLS.

5 Individual income and preferences for redistribution

In this section, I lend further credence to the view that lower income citizens—marginal voters in the event of a ceteris paribus increase in turnout—prefer not just higher taxes but higher taxes on the wealthy and that they prefer this policy of redistribution more than a policy of increased government spending to foster equality of opportunity. To do so, I draw on novel, individual survey data from a representative sample of five OECD countries—Sweden, Italy, France, the United States and the United Kingdom. The data are in the form of a cross section of individuals and are taken from Alesina et al. (2018). I use it in order to estimate the parameters of the following model:

where \(y_i\) is one of five outcomes that measure individual i’s preferences for redistribution. The first three outcomes are a respondent’s answer when they are asked to choose the rate of income tax (on a scale between 0 and 100) for people ranked into three income groups: (1) those in the top 1% of the income distribution, (2) those in the next 9% in the distribution and (3) those in the next 40% of the distribution (i.e., between the 50th and 90th percentiles). The fourth outcome is an indicator that is one if the respondent supports increasing government spending in the economy to promote “equality of opportunity policies” (defined as public spending on education and health) and zero if not. The fifth outcome is an indicator that is equal to 1 if the respondent believes the rich are rich because of unfair advantages and zero if (s)he believes their wealth to be the result of hard work and effort.

The model includes region fixed effects, \(\zeta _{r}\), in order to capture fixed differences in preferences for redistribution across people in different regions within a country. Each individual falls into one of four income brackets, \(IB_j\), from poorest (1) to richest (4), and individuals in income bracket 4 serve as the reference category. The coefficient of interest, therefore, is \(\theta _j\) which measures the difference, compared with people in the richest income bracket, of being in income brackets 1 through 3 on various preferences for redistribution.

Finally, the model includes a range of individual controls, denoted \(X_{i}\), including age, gender, employment status, marital status and whether or not the respondent has received a university degree. I also include an individual’s political affiliation in the regression so as to distinguish to what extent distributional preferences run through ideological considerations and how much they run through income considerations alone. Standard errors are clustered at the regional level as shown through \(\mu _r\).

The results are presented in Table 4. As shown, individuals across all three income groups in a given region prefer, in comparison with those in the top income bracket, higher taxes for those in the top 1% of the income distribution. The coefficients become progressively smaller as one works their way up the distribution but remain precisely estimated. Individuals from all three income groups also prefer significantly higher taxes for individuals between the 90th and 99th percentiles of the income distribution, but not as high for those in the top 1%. Interestingly, only individuals in the bottom income bracket prefer more taxes for those between the 50th and 90th percentile of the distribution; those in the middle two brackets have no such preferences. What is more, the correlation between income and preferences for greater government spending in the economy is far less robust. In Column 4, for example, I find that individuals only in the second to last income bracket support more government spending in the economy to foster greater equality of opportunity. The coefficient is two orders of magnitude smaller than it is in Columns 1 and 2 and estimated with less precision. For individuals in the lowest and second highest income brackets, the coefficient is even negative. In Column 5, I test to what extent people perceive wealth to be the fruit of hard work and effort and to what extent it is the result of unfair advantages. Individuals from all three income brackets, when compared with those at the very top, are between 9 and 12 percentage points more likely to believe that the wealth of the rich is due to unfair advantages. Together, these results suggest that taxing the rich is the preferred policy for redistribution for people on the lower ends of the income distribution, rather than having the government intervene with greater public spending in the economy on things like health and education. They might also suggest that voters are satisfied with the level of social spending in the economy but that they would prefer the rich to pay a larger portion of it. Together, these correlations are consistent with the hypothesis put forward in this paper: that greater turnout places more pressure on governments for targeted tax increases for those at the top of the income distribution.

6 Turnout, top earners and government spending

6.1 Turnout and top earners

If more people with stronger preferences for targeted tax increases participate in elections, it is not unreasonable to think that the economic outcomes of top earners would be affected disproportionately more than others. To test this assertion, I obtain the share of national income accruing to those in the top 10% and 1% of the income distribution and regress these on voter turnout. The results are shown in Columns 1 and 2 of Table 5. As shown, the coefficients are negative and precisely estimated, confirming that the economic outcomes of top earners are, in fact, negatively affected by the electoral participation of those with greater preferences for targeted tax increases.Footnote 10

As a placebo test, I regress, in Column 3, the share of national income owned by those between the 50th and 90th percentiles of the income distribution on rates of turnout. The coefficient on turnout switches signs and becomes positive but is indistinguishable from zero, indicating that the increases in top tax rates encouraged by turnout are, in fact, targeted at the top of the income distribution.

In Columns 4 to 6, I repeat the analysis using the set of excluded instruments described in Sect. 4.3 in order to push the causal interpretation of the coefficients. Encouragingly, the signs of all three coefficients for the IV estimates are the same as those for OLS; their magnitudes are slightly larger and they are estimated with as much precision as OLS.

6.2 Turnout and government spending

In Online Appendix G, I investigate the impact of voter turnout on the size of government. To do so, I collect information from the OECD on government expenditures as well as on the tax threshold (expressed as a multiple of the average wage) at which point an individual faces the top rate of tax. I find that turnout has no influence over the threshold at which a person begins to face the top rate of tax and that turnout is unrelated to greater government spending, including spending on social protections, which the OECD defines as benefits “targeted at low-income households, the elderly, disabled, sick, unemployed, or young persons.” These results, together with those on voter preferences presented in the previous subsection, suggest that voters have stronger preferences for taxing the rich than they do for public spending in the economy and that governments respond accordingly.

7 Conclusion

This paper adds to the literature that aims at better understanding the consequences of voter turnout on economic redistribution. For the most part, the literature on turnout has focused on its relationship with government redistribution as measured by public spending on social ends such as health, education and social protections for low-income households. In this paper, I have built on these studies by exploring the relationship between voter turnout and a more direct measure of redistribution at the opposite end of the income distribution: namely, the top marginal tax rate. The theoretical motivation that guided my empirical analysis was the median voter theorem: if governments respond to the preferences of the median voter, a question arises as to what the economic consequences are when voter turnout declines and when that decline is marked along class lines. I have shown that increased participation in elections is associated with a positive and statistically significant impact on top marginal tax rates.

Linking the two, I argue, are voter preferences. I found that all but the wealthiest in society have stronger preferences for taxing the rich than they do for other measures of redistribution, such as greater government expenditure in the economy to foster equality of opportunity. In line with these preferences, I found that voter turnout has a significant negative effect on the economic outcomes of top earners but no effect on the overall size of government. The results of this paper have thus gone a step beyond earlier cross-country work that correlates turnout with the size of government: I have shed light on the nature of the preferences of the electorate as it relates to redistribution and have demonstrated the responsiveness of governments to those preferences. In doing so, I have established the implications of voter turnout for those at the very top—as opposed to the bottom or the middle—of the income distribution.

Of course, a limitation of cross-sectional studies like this is that sharp identification, from which causal inference can be made with greater confidence, is difficult. Nonetheless, I undertook a number of empirical strategies to increase confidence in the causal interpretation of my results. First, I included for a range of social and economic characteristics. I then exploited the panel nature of my data to capture any unobserved country or time heterogeneity. I also accounted for the fact that governments may need time to respond to the mandate given to them by voters. To this end, the results indicate that turnout has a significant impact on tax rates in periods \(t + n\) as well as over the entire electoral cycle but not impact on tax rates in periods preceding an election. And, in an effort to push the causal interpretation of my results, I employed an instrumental variables strategy in order to isolate only the exogenous variation voter turnout. Results across all these specifications point in the same direction: that greater turnout has a positive and significant effect on government policy concerning top earners.

On the whole, then, the results of this paper underscore what may seem to be a self-evident truth: voting matters. Yet, in spite of the veracity of such a seemingly simple claim, fewer and fewer people are turning out to vote. This study shows that doing so is not without consequences.

Data availability

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

Author’s own calculations based on summary statistics of the sample presented in Online Appendix A.

Underscoring this point, Nadeau et al. (2019) show a robust positive relationship between factors like wealth—as distinct from income—education, marital status and age on voter turnout in a sample of 28 democracies.

Aside from the demographic factors that determine who votes and who doesn’t, scholars have highlighted such factors as the costs of registration (things like voter registration laws, information acquisition and time); social and psychological factors (the like of which include habit, marital status, civic duty and social image); and the particular characteristics of a given election (tightness of the race) as predictive of voting (Harder & Krosnick, 2008; DellaVigna et al., 2016).

The IDEA database also includes an indicator for whether a given election was presidential—that is, an election to decide the national presidency of a country or territory—or parliamentary—elections to determine the national legislative body of a country or territory. Because this is a country-specific variable, it is omitted by country fixed effects and hence not used in our main analysis. However, 11 countries in the sample have presidential and parliamentary elections in the same year. In these cases, I chose the more politically relevant election and report which elections from which country I use in Table B.2 in the Online Appendix.

The World Bank data does not have tertiary education information for Japan and so it is dropped from the analysis.

Throughout the analysis, I assume a linear-linear functional form between turnout and tax rates. In Online Appendix C, I plot the distribution of these variables to demonstrate that the linear-linear functional form is appropriate. Moreover, I run the baseline estimating equation using two alternative functional forms—a linear-log and a log-log specification—and demonstrate that the results are very similar to one another, suggesting that the results are not sensitive to functional form.

The standard deviation in turnout stands at 12 points. An equivalent way of interpreting the coefficient is that a one-standard-deviation increase in turnout leads to a 3.6-percentage-point increase in the top marginal tax rate (3.6 \(\approx 12 \times 0.306\)). This represents an approximately 7% increase over the sample mean of 49%.

The total number of elections and the average length of the electoral cycle in each OECD country for the period of the sample are shown in Figures B.2 and B.3 in the Online Appendix.

In Online Appendix F—and specifically in Figure F.1—I plot the distribution of \(t-\)statistics from each of the 30 excluded instruments in the first stage and find that the majority are strong predictors of turnout.

These data are only available for 18 to 26 countries in the sample. Given that I cluster my results at the country level, one may be concerned that the standard errors are inconsistently estimated. To address this concern, I compute p values using a wild bootstrap and report these, as well as the analytical p values in the table. As shown, the null hypothesis that the coefficient equals zero can be rejected at conventional levels even when using wild cluster bootstrapping.

References

Alesina, A. (1988). Credibility and policy convergence in a two-party system with rational voters. American Economic Review, 78(4), 796–805.

Alesina, A., Stantcheva, S., & Teso, E. (2018). Intergenerational mobility and preferences for redistribution. American Economic Review, 108(2), 521–54.

Armingeon, K., Wenger, V., Wiedemeier, F., Isler, C., Knöpfel, L., Weisstanner, D., & Engler, S. (2021). Comparative political dataset 1960–2019. Institute of Political Science, University of Zurich.

Barnes, L. (2013). Does median voter income matter? The effects of inequality and turnout on government spending. Political Studies, 61(1), 82–100.

DellaVigna, S., List, J. A., Malmendier, U., & Rao, G. (2016). Voting to tell others. The Review of Economic Studies, 84(1), 143–181.

Downs, A. (1957). An economic theory of democracy. Harper Brothers.

Franzese, R. J. (2002). Macroeconomic policies of developed democracies. Cambridge University Press.

Harder, J., & Krosnick, J. A. (2008). Why do people vote? A psychological analysis of the causes of voter turnout. Journal of Social Issues, 64(3), 525–549.

Hicks, A. M., & Swank, D. H. (1992). Politics, institutions, and welfare spending in industrialised democracies, 1960–1982. American Political Science Review, 86(3), 658–674.

Hoffman, M., León, G., & Lombardi, M. (2017). Compulsory voting, turnout, and government spending: Evidence from Austria. Journal of Public Economics, 145, 103–115.

Hotelling, H. (1929). Stability in competition. The Economic Journal, 39(153), 41–57.

Kenworthy, L., & Pontusson, J. (2005). Rising inequality and the politics of redistribution in affluent countries. Perspectives on Politics, 3(3), 449–471.

Larcinese, V. (2007). Voting over redistribution and the size of the welfare state: The role of turnout. Political Studies, 55, 568–585.

Lee, D. S., Moretti, E., & Butler, M. J. (2004). Do voters affect or elect policies? Evidence from the US House. Quarterly Journal of Economics, 119(3), 807–859.

Lijphart, A. (1997). Unequal participation: Democracy’s unresolved dilemma presidential address, American Political Science Association, 1996. American Political Science Review, 91(1), 1–14.

Lindert, P. H. (1996). What limits social spending? Explorations in Economic History, 33, 1–34.

Mahler, V. A. (2008). Electoral turnout and income redistribution by the state: A cross-national analysis of the developed democracies. European Journal of Political Research, 47(2), 161–183.

Mahler, V. A., Jesuit, D. K., & Paradowski, P. R. (2014). Electoral turnout and state redistribution: A cross-national study of fourteen developed countries. Political Research Quarterly, 67(2), 361–373.

Meltzer, A. H., & Richard, S. F. (1981). A rational theory of the size of government. The Journal of Political Economy, 89(5), 914–927.

Nadeau, R., Lewis-Beck, M. S., & Foucault, M. (2019). Wealth and voter turnout: Investigating twenty-eight democracies. Polity, 51(2), 261–287.

Pacek, A., & Radcliff, B. (1995). Turnout and the vote for left-of-centre parties: A cross-national analysis. British Journal of Political Science, 25(1), 137–143.

Van der Eijk, C., & Van Egmond, M. (2007). Political effects of low turnout in national and European elections. Electoral Studies, 26(3), 561–573.

Volkens, A., Burst, T., Krause, W., Lehmann, P., Matthieß, T., Merz, N., Regel, S., Weayels, B., & Zehnter, L. (2020). The manifesto data collection. Manifesto Project (MRG/CMP/MARPOR). Version 2020.

Younger, S. (2006). Compulsory voting around the world. The Electoral Commission of the United Kingdom

Acknowledgements

I would like to thank Davide Cantoni, Guido Friebel, Mitch Hoffman, Christoph Winter, Joachim Winter, Andreas Steinmayr and Uwe Sunde as well as seminar participants from the Universities of Munich, Nurnberg and Regensburg for constructive feedback and suggestions.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sabet, N. Turning out for redistribution: the effect of voter turnout on top marginal tax rates. Public Choice 194, 347–367 (2023). https://doi.org/10.1007/s11127-022-01036-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-022-01036-7