Abstract

Numerous cities around the world have tried to internalize externality costs from road traffic by instituting charges for entering their city centers. The revenues collected from these charges are often redistributed to improve conditions for motorists, cyclists, pedestrians, and public transport. At the same time, many schemes allow for exemption of cleaner vehicles, which potentially reduces revenue collection. This paper assesses the effect of exempting electric vehicles from urban toll ring charges on the charge that is levied on conventional car drivers. Using panel data of Norwegian cities that have urban toll rings, I exploit regional variation in electric car adaption and find that owners of conventional cars pay 3.3 NOK (0.36 USD) more per passage due to the exemption. Moreover, I find that local governments that are fragmented or have a left-wing majority increase toll charges more due to the loss in revenue. As the majority of electric vehicle owners have above-average incomes, the exemption implies a distributional effect in which low-income groups pay the largest portion of the increased toll price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Increasing air pollution and congestion from road traffic are challenges that are faced by many cities. These challenges have led to the development of a variety of schemes that aim at curbing private vehicle usage, where a main motivation has been alleviating congestion externalities (Pigou, 2017; Vickrey, 1963). For example, in some cities, such as Stockholm, London, Singapore, and Milan, commuters must pay to enter a predefined congestion area. Another common approach for addressing increasing local air pollution is to incentivize the purchase and use of cleaner vehicles. This can be realized by offering tax credits, providing access to high-occupancy vehicle lanes, or exempting less-polluting vehicles from congestion charging, which is the focus of this paper.

Congestion charges are a well-established strategy for limiting the exhaust of harmful pollutants; however, the combination of charging for driving in city areas and exempting some vehicles from this charge is not entirely consistent. While toll charges are a means of raising funds for road construction and public transport, exempting electric vehicles from the charges reduces the potential revenues.

Many Norwegian cities have introduced urban toll rings as a means of raising revenue to improve local roads and public transport. However, a dramatic improvement in electric vehicle design and technology created a sudden surge in the number of electric vehicles, which are nationally exempt from toll payments. This has led to many of the municipalities’ road projects being underfinanced. Thus, local governments are left with two possible outcomes. Either they must increase the toll price for paying, non-electric vehicles, which is unfavorable as it increases the day-to-day commuting cost of many voters, or they have to reduce road infrastructure investments, which entails cancelling already promised projects.

The first option is particularly interesting. Because toll prices are a type of poll tax, raising the price has negative distributional effects. These are exacerbated by the fact that owners of electric vehicles are shown to have above-average income and belong to two-car households, whereas owners of conventional vehicles to a larger extent are spread across the whole income distribution (Institute of Transport Economics, 2016). Thus, local governments may be hesitant to raise the toll price to compensate for the revenue loss. This is especially true as the public opinion of road tolls has become increasingly divisive. An example of rising opposition to road tolls is the single-issue party People’s Action No to More Road Tolls (Folkeaksjonen nei til mer bompenger), which was founded in 2014 and was elected with three (out of 67) representatives in the Stavanger municipal council the following year.

The aim of this paper is to assess whether local governments raise urban toll ring charges to compensate for an increase in the number of exempted electric vehicles. In addition to being the first paper studying the effects of the exemption policy on the charge for conventional motorists, it also explores how political fragmentation or ideology can affect the charging policy.

The Norwegian setting provides an interesting study for a variety of reasons. A number of cities in Norway have implemented “city packages,” which are projects that aim at improving roads and public transport, funded by revenues from urban toll rings. Moreover, throughout the past decade, there has been a substantial rise in the use of electric cars in many countries. This rise has arguably been most rapid in Norway, which is reported to have the world’s highest share of electric vehicles per capita (World Economic Forum, 2019). For example, the electric vehicle share grew from 1% to one third of new car sales between 2011 and 2018. The presence of several toll rings and a nontrivial increase in the share of electric vehicles allows for a study that covers multiple settings within a country over time.

Moreover, the urban toll price is determined at the local government level, where partisanship and political fragmentation may influence the toll pricing decisions. For example, the left-wing parties in Norway have been more positive towards the use of toll charges to finance road construction. However, an increase in toll charges to compensate for the exemption of high-income electric vehicle owners would be at the expense of middle-income and low-income households. Thus, an extension of the analysis will explore how different political compositions can produce heterogeneous responses to reductions in toll revenue.

I utilize data on the number of electric and conventional vehicles in cities with urban toll rings and their adjacent municipalities from 2010 to 2017, which is a period that coincided with increased electric car ownership. A challenge to the causal interpretation is that higher toll charges and other policies that are included in the city packages may affect the uptake of electric vehicles. To address this, I employ an instrumental variable strategy where I use the electric vehicle share in other locations as a source of exogenous variation. This variation will reflect underlying factors that drive electric vehicle uptake, net of local factors that affect the local electric vehicle uptake.

The baseline instrumental variable estimate implies that a one-percentage-point larger electric vehicle share leads to a toll charge increase of 2.9%. A back-of-the-envelope calculation based on estimates in this paper suggests that in 2017, a conventional vehicle owner paid 3.3 NOK (0.36 USD) more every time she crossed an urban toll ring compared with the counterfactual case in which electric vehicles were not exempted from the charge. Due to the income characteristics of the different vehicle types, the increased toll price is a burden that is shifted mostly onto low-income, non-electric vehicle owners.

Moreover, I find that the changes in toll price are subject to the discretion of the municipal council. In line with previous findings, such as Roubini and Sachs (1989), the results also imply that local governments that are politically fragmented increase prices more than governments with a few, strong parties. Furthermore, left-wing majority governments will increase toll prices more than right-wing majority governments. Although aligning with Norwegian left-wing parties’ positive attitude towards the use of toll rings, it contradicts the traditional views that parties to the left act in the interest of the poor by advocating for progressive taxes (Hibbs, 1977).

The remainder of the paper is organized as follows. In Sects. 2 and 3, I present the related literature and the institutional background. Sections 4 and 5 present the data and the empirical approach. Section 6 presents the main findings. In Sects. 7 and 8, I analyze political heterogeneity and distributional effects, respectively. In Sect. 9, I conclude the paper.

2 Related literature

Road pricing schemes can be regarded as serving two objectives. First, they align the cost of private vehicle use in congested areas with the social cost of using the road. Second, they provide funding for transport infrastructure improvements. Indeed, researchers have found that tolls improve air quality, reduce congestion and, consequently, encourage labor supply, in addition to increasing traffic safety (Fu & Gu, 2017; Gibson & Carnovale, 2015; Green et al., 2016; Hymel, 2009). However, other economists have raised concerns regarding the negative effects that road pricing mechanisms can have on economic activities. Examples include discouraging labor force participation, adding congestion to areas in which no charge is levied, and reducing retail real estate prices (Agarwal et al., 2015; Parry & Bento, 2001, 2002).

The experience from several pricing schemes is that the number of exempt vehicles dramatically increases after the implementation of urban toll rings. This has led to a partial offsetting of the decrease in congestion and a reduction in collected revenues (Börjesson et al., 2012; Leape, 2006; Rotaris et al., 2010). Furthermore, Green et al. (2020) find that NO2 emissions increased after the London congestion charge was imposed, which was presumably due to a shift towards exempt diesel vehicles.

This paper, in addition to studying how local governments in general respond to revenue shortfalls, explores how the political composition of local governments can produce heterogeneous outcomes in the toll pricing policy. The existing literature implies that two factors in particular can influence the pricing policy, namely political strength and partisanship. Early examples of studies of the relationship between political strength and policy include Roubini and Sachs (1989), Poterba (1994), and Alt and Lowry (1994), finding that politically fragmented coalitions tend to result in poor fiscal outcomes. A more recent example by Artés and Jurado (2018) confirms that single-party majorities are better at raising revenue and produce larger surpluses than coalitions. Despite the weak relationship between party ideology and local economic policy found in the United States [see for example Reed (2006) or Potrafke (2017)], Pettersson-Lidbom (2008) notes that higher shares of left-wing representatives in Swedish local councils lead to both greater spending and higher taxation.

For this paper, it is particularly relevant to review the evidence on the relationship between municipal council composition and public policy in Norway. In general, both political fragmentation and ideology are found to be important for tax levels and spending. For example, Borge (1995) notes that less fragmented local governments decreased the size of the local public sector, and that an increase in left-wing politicians has the opposite effect. These findings are supported in studies on the determinants of property taxation by Borge and Rattsø (2004) and Fiva and Rattsø (2007). The authors find that political fragmentation and higher socialist shares in the municipal council increase the probability of introducing municipal property tax. More generally, Fiva et al. (2018) find that increased left-wing influence leads to more property taxation, but also higher spending on care for children and elderly.

The existing literature therefore implies that toll prices are potentially higher in municipalities where the left-wing share is larger. An additional factor that supports this perception is that left-wing parties in Norway are more positive towards the use of toll charges to finance road construction. This includes the Labour Party, which is the largest party in Norway.Footnote 1 The largest right-wing party, namely the Conservative Party, has a stated objective of reducing the share of road construction that is financed by toll road revenue, whereas the second-largest right-wing and third-largest party in Norway, the Progress Party, is strongly against toll rings.

Nevertheless, the literature provides little evidence on how different municipalities will determine their pricing policies when faced with a revenue loss. It is not given that left-wing majority municipalities are more likely to increase toll prices when faced with declining revenues. In fact, municipalities with an initially high toll price may be reluctant to further increase toll prices. This paper contributes to our knowledge regarding the interaction between road charging polices and policies that aim at increasing the demand for cleaner vehicles. Moreover, it adds to the extensive literature on incidence and heterogeneous policy outcomes.

3 Institutional background

3.1 Electric vehicle policy in Norway

Norway has a long history with electric vehicles. From the 1970s onward, there was a strong desire to establish Norwegian electric vehicle production, and attempts at commercialization were conducted. In the 1990s, an electric vehicle association was established, of which the lobbying activities focused on removing barriers to electric vehicle adoption (Figenbaum et al., 2015). These activities resulted in many benefits being implemented in the late 1990s and early 2000s that remain in place today. Table 1 presents an overview of all the policies and when they were implemented. For instance, drivers who buy electric vehicles are exempt from registration and value-added tax (VAT), have a reduced annual road tax, can recharge and park in public parking spaces for free, have access to public transport lanes and, critically for this paper, can pass through road tolls free of charge.Footnote 2

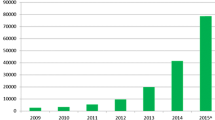

Nevertheless, the ownership of electric vehicles did not change substantially after the implementation of these incentives. Figure 1 provides an overview of the shares of electric vehicles in cities that were within commuting distance of a toll ring in Norway, between 2010 and 2017. The share of electric vehicles was essentially zero until 2010, when ownership started to grow at an exponential rate. Figenbaum et al. (2015) explain this growth in terms of increased international focus on greenhouse gas mitigation and improved battery technology. In addition, from 2010 onwards, many of the large international car companies introduced their electric vehicles into the Norwegian market. The vast increase in availability of electric cars led to a rapid expansion in sales and increased price competition among manufacturers, which further fueled the acquisition of electric vehicles.Footnote 3 According to the Norwegian Road Federation, 5% of the car fleet was battery-only by the end of 2017, and by August 2018, almost 30% of new car sales consisted of electric vehicles.

All electric vehicles have a registration number that starts with the letters EL or EK, which offers a convenient way of differentiating between toll-paying conventional cars and free-passing electric cars. When driving through a toll, the vehicle’s registration number is automatically photographed. Every month, the local toll company sends an invoice to the vehicle’s registration address, where the number of passes, toll price, and rebates are summed.

3.2 Urban toll rings

The first urban toll ring in Norway opened at the end of the 1980s, and the number of rings has been increasing steadily ever since. Initially, the objective of urban toll rings was not to reduce traffic flows or pollution but to finance new road projects and to improve established roads to handle growing traffic flows (Ramjerdi et al., 2004). This was manifested in low toll rates and little or no variation in rates according to the degree of congestion or the time of day.

Today, urban toll rings still serve as a mechanism for raising revenue for road infrastructure investments, some of which operate similarly to a congestion charge with rush-hour charges. There are several rationales for municipalities using this strategy for raising revenue. First, the city infrastructure is improved at a faster rate than if municipalities were to wait for national government funding. Second, there is a principle of fairness that is based on a user-pay concept. The driving population in and around the city pays the road tolls, but they also benefit from the revenue in the form of investment in the local road infrastructure. Third, municipalities often arrange a revenue-matching scheme with the central government. The revenue that is raised in each toll ring is matched with an equal amount of government funding, which provides additional incentives for local governments to implement toll rings (Larsen & Østmoe, 2001).

The process of instituting an urban toll ring begins with the affected municipalities and counties initiating a project. The objectives of the project could be to enhance a road or the public transport system, to improve safety for cyclists and pedestrians, and to finance the project by using toll road revenue. Thus, tolls are situated around the city centers, so that the payers of the tax in the next step can benefit from the revenues. If a majority among the representatives of the local government councils is obtained, an independent public company is established. The company’s responsibility is to manage the finances, which includes obtaining loans that are related to the planned projects, administering the toll collection, and managing revenue. After paying for operating costs, the profits are limited to the expenditures on the predefined projects.

The initial toll charge is computed based on the predicted costs of the planned projects and the expected revenues over the collection period. The typical factors considered when selecting the toll charge include the financial contribution of the central government, the number of paying cars in the focal urban area, and the duration of the collection period (which cannot exceed 15 years). Two types of price increases are possible during the urban toll ring’s operation period. The first type is price adjustment changes. For example, charges are raised to adjust for increases in the general price level. The second type of price change is politically determined, and often involves larger price changes. Municipalities consider increasing the toll price when additional revenue is needed either to add projects to the city package or if the planned projects are underfinanced. These changes must win the local government majority’s vote for the price change to be implemented. Consequently, the political composition of the parties and their attitude towards the use of urban toll rings for financing are likely to be important factors that determine to what extent toll prices are changed.

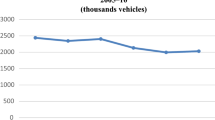

By 2018, 11 cities in Norway had urban toll rings, and this number is expected to double over the next decade.Footnote 4 An overview of the cities with toll rings, the years of implementation, prices, and population is presented in Table 2. The prices that are listed in columns two and three are 24-hour averages, which are stated in 2017 prices. Averaging is conducted to ensure that any changes in the ring operation hours or rush-hour charges are reflected in the price. The real prices have increased most prominently in the largest cities, whereas smaller and more recently opened rings have experienced moderate price increases.

Ever since the urban toll rings opened, toll companies have offered subscriptions to toll ring passers. The discounts were implemented to incentivize prepayment, and to give the perception that toll ring costs were maintained at reasonable levels for frequent passers, which likely contributed to lower public resistance (Larsen & Østmoe, 2001). The discount schemes have varied between cities and over time. The discounts range between 10 and 50% per passage, and approximately 80% of crossings are conducted by vehicles with a subscription (The Norwegian Public Roads Administration, 2018). This has at least three implications: First, most vehicle owners face a lower price in practice than the stated prices. Thus, the incentive for switching to an electric vehicle or an alternative transport mode is reduced. Second, in some cases, the toll companies reduced the maximum discount instead of increasing the toll price. Such changes will not be reflected in the stated prices, whereas most commuters experienced a price increase in practice. Third, the discounted price represents the true income of the toll companies. Therefore, the rebated prices are a more accurate measure of the revenue than the stated prices. Thus, I estimate the effect of the electric vehicle share on the urban toll ring price under the assumption that the price commuters face is the price that corresponds to the maximal discount.

4 Data

The data used in this paper come from several sources. First, I retrieve information on toll prices between 2010 and 2017 from all toll companies in Norway. Second, I draw data from Statistics Norway on the number of registered cars in all 419 Norwegian municipalities by fuel type.Footnote 5 The available statistic distinguishes between petrol, diesel, gas, electric, and other fuel types, where “other” includes hybrid cars. I also collect data on population, share of urban population, income, unemployment, and education. Since the data are provided on an annual basis, the prices of the toll rings are weighted annual averages, where the weights are the numbers of days for which the corresponding prices are in operation. This is done to capture price changes that occur during a calendar year. Table 3 provides summary statistics for the included data.

During the sample period there are eight cities with toll rings, which suggests that only eight municipalities should be included in the analysis. However, it is possible that the most frequent toll passers in Oslo, for example, are not people who live in Oslo. People who live in the adjacent municipalities and commute to Oslo for work are more likely to face the toll charge. This emphasizes the importance of including nearby municipalities in the analysis. Consequently, I include municipalities that have strong proximity and economic and labor market attachments to the municipality where the toll ring is located. For example, if a city has an urban toll ring, the inhabitants of neighboring municipalities will be assumed to face the same price as the inhabitants of the ring city.Footnote 6 This increases the sample to include 61 municipalities.

The summary statistics for the municipalities with or adjacent to a toll ring are presented in Table 4.

5 Empirical approach

I explore whether the rapid increase of electric vehicles in the Norwegian car market contributes to increasing the price in the toll rings. I estimate the following equation:

where ln(realprice)it is the natural logarithm of the inflation-adjusted price of a toll ring in municipality i in year t, and ShareEVit is the number of electric vehicles divided by all vehicle types in municipality i at time t.

An alternative approach would be to have the total number instead of electric vehicle share as the main variable of interest. However, an increase in the number of electric vehicles might be due to an increase in the total number of cars, keeping the share of electric vehicles unchanged. An increase in the total number of cars may increase the need for road repairs, which could increase the toll prices. Thus, the dependent variable is the share of electric vehicles.

I also control for several observed covariates, including population level, share of urban population, average income, unemployment rate, and educational level for municipality i at time t. αi denotes unobserved time-constant effects in municipality i, and εit denotes the time-varying idiosyncratic errors. The key parameter of interest is α1, which provides an estimate of the effect of an increase in the share of electric vehicles on the price of the toll ring.

One clarification related to the setup and timing of the variables is needed. The number of vehicles in the data is recorded at the end of a year (31st of December). However, the prices are averages over a year. For this to make sense, the data are aligned such that the number of electric vehicles in year 2010 is matched with the average prices in 2011. Thus, the share of electric vehicles variable is implicitly lagged so that politicians observe the number of electric vehicles at the end of last year before deciding to change the road toll price.

Several econometric challenges arise when identifying the effect of the electric vehicle share on the toll rates. First, the main explanatory variable is the number of registered vehicles and is therefore a proxy for the actual usage of a specified vehicle type. Newer vehicles may be more frequently used than older vehicles due to improvements in fuel efficiency, safety, and appearance. This is a source of measurement error, which implies that the true effect of the electric vehicle share on toll charges may be underestimated when using the number of registered vehicles. Thus, there is a chance that the result in this paper is somewhat more conservative than the true effect.

The alternative would be to use the number of toll ring crossings. However, this is a more responsive and potentially noisy variable. There are myriad factors that might impact the day-to-day decision to drive, such as weather or traffic conditions, that are hard to pick up using annual data. Moreover, not controlling properly for these conditions would introduce an omitted variable bias to the model and produce inconsistent estimates. This is considered a more serious problem than the potential measurement error which produces estimates that are skewed towards zero. Additionally, to be able to study distributional effects of the exemption policy later, the ownership of the cars is of most interest in this paper. Therefore, I use the number of registered cars as the main variable of interest in the analysis.

An additional challenge is that the number of planned projects and, thus, the cost of the projects will vary among city packages. Moreover, the topography and car culture may influence car use, toll cordon placement, and the number of cordons that are required for the formation of a ring around the city. These time-invariant variables affect both the share of electric vehicles and the toll price. Failing to control for the time-fixed variables will thus result in a biased estimate of α1. To address this concern, all regressions are estimated with municipality fixed effects. In addition, several time-varying variables, including population size, share of urban population, average income, and unemployment levels, are included in the model.

Finally, one might expect higher toll prices to incentivize consumers to buy electric vehicles, since passing the tolls with an electric vehicle is free of charge. If this is the case, we have a situation with reverse causality, which might lead to the fixed-effects estimates overstating the true impact of electric vehicles on the toll price. To overcome the potential reverse causality problem and causally identify the effect of a rising electric vehicle share on the toll price, I instrument the electric vehicle share in one area by the average share of electric vehicles in other Norwegian areas.Footnote 7

Figure 2 is a graphical illustration of the instrumental variable strategy. The municipalities marked with black are municipalities with toll rings. The municipalities in green are the adjacent municipalities, that is, municipalities that share a border with the toll ring municipalities. The gray municipalities indicate the labor marked region of the toll ring city. They are defined following the structure suggested by Bhuller (2009), where all municipalities are divided into 46 labor market regions, where commuting patterns are the main sorting criteria. The municipalities in white are considered distant to all urban toll rings, and thus should not react to changes in or influence the toll rings in any city. To put the distances in perspectives, it is approximately 2500 km from the northernmost point to the southernmost point in Norway. Moreover, the distances between the northernmost toll ring (Namsos) and the ring on the southeast (Kristiansand) is 1000 km, or a 15-hour drive.

Thus, the instrument for the electric vehicle share in Kristiansand and its adjacent municipalities is the share of electric vehicles in all other municipalities except for the municipalities adjacent to or belonging to the commuting zone of Kristiansand. This leave-one-out strategy is then repeated for all toll ring areas. The approach should be in line with the exclusion criteria because the share of electric vehicles in the distant municipalities does not influence the toll ring prices in the focal city. In an alternative instrumental variable strategy, I only use the municipalities categorized as distant as an instrument.

On the other hand, the government’s electric vehicle policy, as well as the supply and the technological progress of electric vehicles, is homogeneous within the country. Consequently, changes to any of these components will cause analogous effects across the country. For example, an extended range due to improved battery technology will have a positive effect on electric vehicle demand irrespective of where one lives. This satisfies the relevance criteria, and allows the electric vehicle shares in distant municipalities to be exploited as instruments for the endogenous electric vehicle share around a given city.

In summary, the identifying assumption that underlies this strategy is that other regions’ electric vehicle uptake should not be a function of the focal city’s tolls. Moreover, area-specific market conditions will provide independent variations across regions. The empirical specification is as follows:

where

where \(\overline{{ShareEV_{it} }}\) is the average electric vehicle share in all municipalities except for municipality i and its adjacent municipalities. In discussing the results, I consider potential threats to identification such as learning effects across urban toll ring areas and the choice of the cluster level of the standard errors, and seek to address these. Importantly, I show that the key results are robust to a range of exercises that seek to address these concerns.

6 Results

I start this section by estimating the relationship between electric vehicle share and urban toll ring prices with a fixed-effects approach. In all regressions, the standard errors are clustered at the municipal level, which is motivated by the concern that the error terms might be correlated within municipalities across years.Footnote 8 In columns (1) and (2) in Table 5, I present a model that is estimated with ordinary least squares (OLS) and fixed effects, respectively. The difference between these two columns demonstrates a slight upward bias in the OLS estimates. The estimate from the fixed-effects model suggests that an increase in the share of electric vehicles of one percentage point, for example from 10 to 11%, will increase the toll ring price by approximately 4.2%. Thus, a toll charge of 20 NOK (2.35 USD) will increase to 20.84 NOK (2.45 USD). Controlling for population growth, increased urbanization, income level, unemployment rate, and education level in column (3) reduces the point estimate somewhat but does not substantially affect the coefficient of interest.

Next, I move on to disentangle the distinct effects of electric vehicles and conventional vehicles on the toll ring price. I estimate a model in which electric and conventional cars enter as separate variables, which is presented in column (4). The baseline category is “other” cars, including gas and hybrids. Separating the variables suggests that having more electric vehicles increases the toll prices, whereas having more paying conventional vehicles has a negative effect on the toll price, keeping all else constant. More specifically, an increase of 1000 electric cars will increase the price by 0.46%, whereas an increase of 1000 conventional vehicles will decrease the price by 0.2%. This asymmetry suggests that toll prices are more readily increased in the case of lost income than decreased in the case of increased income. In column (5), I re-estimate the main model and add year dummies to control for national factors that change each year and may affect toll prices. The coefficient for the electric vehicle share increases somewhat compared with column (3) and is less precisely estimated. However, the estimate remains statistically significant at the 5% level.

To examine whether the result is sensitive to estimation method, I estimate the model using a first-difference approach, which is presented in column (6). Virtually no change is observed in the estimated coefficient.Footnote 9

So far, I have assumed a semi-elastic relationship between the share of electric vehicles and the toll price, where the electric vehicle share enters linearly in the equation [re-estimated column (1) in Table 6]. It is however possible that the effect of electric vehicle share on the toll price is nonlinear. For example, a 10-percentage-point increase from a 10% and 50% electric vehicle share, respectively, might have different effects on the toll ring price. Specifically, if the share of electric vehicles approaches 100, one would expect nonlinear effects on the toll price.

I explore whether this is the case by including the squared share of electric vehicles in the model. The result is presented in column (2). The point estimate of the squared variable is negative, which implies a concave relationship between electric vehicle share and toll price. This suggests that the increase in prices decreases as the share of electric vehicles increases. Consequently, controlling for the squared electric vehicle share also increases the point estimate and increases the significance of the main variable of interest. However, the squared term is relatively small and not statistically significant.

I go on to explore the empirical model further. The dependent variable, the share of electric vehicles, is defined as the number of electric vehicles divided by the total number of cars. One would expect that if the total number of cars increases, while controlling for the share of electric vehicles, the potential revenue of the toll ring is larger and the toll price should be lower. On the other hand, an increase in the number of vehicles overall increases congestion and road wear and tear, which in turn implies a positive effect on the urban toll ring prices. I explore empirically how the total number of cars affects the toll price by including the sum of vehicles explicitly in the model. The result is presented in column (3) and shows that controlling for the total number of cars changes neither the coefficient size nor the significance of the main variable of interest.

In summary, I find that neither the squared share of electric vehicles nor the total number of cars is statistically significant when included separately in the model. In column (4), I estimate a model where I include both variables simultaneously. Again, neither of the two variables is statistically significant, and an F-test of 1.46 (not reported) suggests that the variables are also jointly not statistically significant. This result has some possible explanations. First, because the share of electric vehicles and total number of cars are accumulative variables, they are relatively slow-moving, and there are no “sudden shocks” or large variations within one municipality that provide enough variation to fit a quadratic functional form. Second, because all models are estimated using fixed effects, these slow-changing variables are largely accounted for in the baseline estimate.

Due to the potential reverse causality problem in the paper, which is discussed subsequently, there is a need for an instrument for the share of electric vehicles. Leaving the total number of cars or the squared electric vehicle in the model would mean that I have more than one endogenous variable, which thus would require more than one instrument. Since neither the squared electric vehicle share nor the sum of vehicles is statistically significant, my preferred estimate is the model in column (1).

The prior analysis suggests that a one-percentage-point higher electric vehicle share increases the price in urban toll rings by approximately 3%. However, a fundamental concern is that an increase in the toll price may itself lead to an increase in the share of electric vehicles, representing a reverse causality and potentially producing inconsistent estimates. The instrumental variable strategy, which is outlined in Sect. 4, identifies the component of electric vehicle take-up that is due to overall reduced usage costs and improved technology, thereby circumventing the potential bias that is caused by reverse causality in the fixed-effects estimates.

Table 7 presents the estimates of the relationship between the electric vehicle share and the toll price obtained by using an instrumental variable approach. In the top part of the table, the first-stage estimates from the model in column (1) are presented. The coefficient suggests that the electric vehicle share increases by 2.5 percentage points when other municipalities have an increase of one percentage point in their shares of electric vehicles. This implies that the increase in the overall electric vehicle share in Norway is somewhat slower than in cities with toll rings. Moreover, the coefficient is statistically significant at the 1% level. An F-statistic above 10 is obtained, and thus, following Staiger and Stock (1997), the instrument passes the standard thresholds for detecting weak instruments.

The estimates in column (1) are the IV counterpart of the fully specified fixed-effects model in column (3) in Table 5. The coefficient is slightly reduced compared with the fixed-effects estimate but remains statistically significant at the 1% level. The relatively small change in the point estimate of the coefficient estimated with the instrumental variable approach has one important implication. It suggests that the reverse causality problem, where increases in toll price increase the electric vehicle share, is not that substantial. Indeed, because the estimates do drop somewhat, the toll price has a positive effect on the electric vehicle share. However, it does also imply that toll price is just a small portion of the totality of drivers of the electric vehicle uptake, such as technological progress, charging possibilities, and other relevant policies.

There is a concern that macroeconomic cycles and infrastructure development might affect both toll prices and electric vehicle adoption. Economic downturns might cause stagnant toll prices or affect electric vehicle adoption. In addition, improvements in the charging station infrastructure in an area might not only increase the electric vehicle share in that area, but also possibly lead to spillover effects that increase the demand in other areas. If that increase in electric vehicles raises the toll price in the other areas, then the exclusion assumption for a valid instrument is violated. I approach this concern by estimating a model that includes both year fixed effects and toll-ring-specific time trends. The results are presented in column (2). The coefficient of interest increases substantially compared with column (1) and is statistically significant at the 1% level. The instrument loses some explanatory power but still passes the standard threshold for a valid instrument. However, in controlling for the macroeconomic variables, I also take out the underlying factors that affect national electric vehicle take-up, which is a crucial deflator in the instrumental variable approach. Thus, knowing that the model is robust to accounting for broad macroeconomic effects, the model presented in column (1) is my preferred IV estimate.

An additional cause of concern is that a learning effect might occur between cities with urban toll rings. Imagine a shock that affects the number of electric vehicles in one area. Other areas can observe the consequences of this shock and, in turn, alter the prices in their toll rings to prepare for a similar shock. This learning effect, if present, can only occur between areas where an urban toll ring has been established. To determine the extent to which a learning effect is present, I construct a second instrument, which includes only the average share of electric vehicles in areas without urban toll rings (the municipalities marked in white in Fig. 2).

The result obtained using the alternative instrument is presented in column (3). The negligible changes in the estimated coefficients relative to the results in column (1) suggest that a learning effect is not present in the data. Moreover, because this approach removes the effects of other tolls overall, it serves as a robustness test of the initial instrument. Note however that the Hausman test of endogeneity suggests that the share of electric vehicles is no longer endogenous. While Hausman tests are useful in many cases for determining between IV and OLS models, it is sensitive to the instrument being used. The fact that the Hausman test was rejected in the previous two models but not in this one suggests that using only the distant municipalities as an instrument is not to be preferred. This is likely due to the lack of sufficient variation in the electric vehicle share when excluding all other areas with toll rings. Thus, the leave-one-out approach is the preferred instrument.

7 Political heterogeneity

The main result suggests that when the share of toll-exempt vehicles increases, the toll charge increases. However, raising the toll charge is at the discretion of the municipal council. For example, some municipalities indeed respond to a loss in revenue by increasing the toll charge. Others might be more reluctant to increase tolls and instead seek funding elsewhere or drop planned projects. As discussed in subsection 3.2, price setting and price changes depend heavily on the incumbent parties in local governments. In this section, I explore how political fragmentation and ideology effect the toll charging policy.Footnote 10

The strength of political parties is operationalized using the effective number of parties (the inverted Herfindahl index). This index, developed by Laakso and Taagepera (1979), represents a measure of political fragmentation in the local municipal council. A higher effective number of parties (ENoP) represents less political strength and is expected to increase the toll price. I re-estimate the main model and include an interaction term between the share of electric vehicles and ENoP. I use observations only for 2010, 2012, and 2016, which are the first full years following an election.Footnote 11

The result is presented in column (1) in Table 8. The baseline effect of an increase in electric vehicle share is marginally lower than what the results in the main analysis suggested and is statistically significant at the 5% level. Moreover, the interaction term between electric vehicle shares and the effective number of parties is positive and statistically significant. This implies that more fragmented municipalities tend to increase toll prices, which indeed is in line with previous findings reviewed in Sect. 2.

I move on to explore the effect of partisanship on toll pricing policy. I re-estimate the main regression and interact the share of electric vehicles with left-wing and right-wing majority.Footnote 12 The result is presented in column (2) in Table 8. Note that the multiparty system in Norway implies that a municipality can be governed without any left-wing or right-wing majority but can consist of coalitions across the political spectrum. Therefore, the baseline estimate can implicitly be interpreted as politically fragmented municipalities, as they are governed without a clear majority.

The baseline effect suggests that in cases where municipalities are governed by coalitions, the effect of electric vehicles on toll price is much stronger compared with the main estimates. When there is a left-wing majority in the municipal council, the effect is drastically reduced. Thus, political strength reduces the price increase effect, which is also in line with previous literature. Moreover, the reduction of the price increase is stronger under a right-wing majority. In fact, in councils with a right-wing majority, the effect of an increase in electric vehicle share on the real toll price is close to zero. This might imply that right-wing governments, because of reduced toll revenues, reduce road expenditure instead of increasing the toll charge.

Thus, the results in column (2) suggest that governments with left-wing majorities are more prone to increasing the toll price than right-wing majorities, which is in line with the stated ideology of left-wing parties. More specifically, left-wing governments react to a loss in revenue by increasing toll charges, presumably to avoid a reduction in transportation spending. Right-wing majority governments are more likely to accept the revenue loss and reduce transportation spending or search for alternative funding. Although these results align with Norwegian left-wing parties’ positive attitude towards the use of toll rings, they contradict the traditional view that parties to the left act in the interest of low-income individuals. It should be noted, however, that the increase in toll prices by left-wing majorities is lower than the price increases performed by governments with no majority.

8 Distributional effects

As a final point I consider the distributional consequences of the electric vehicle exemption policy. I approach this exercise by first presenting a back-of-the-envelope calculation of the counterfactual toll price if there were no exemption policy. Second, I explore how the ownership of electric and conventional vehicles varies by income group to assess whether some income groups receive a net benefit from the policy.

How much more is a conventional vehicle owner paying per urban toll ring passage as a consequence of the larger electric vehicle share? In 2017, the mean electric vehicle share in municipalities that were adjacent to a toll ring was 6.7%. The average toll ring price was 23 NOK (2.5 USD). The result that was obtained in the main analysis suggests that the toll price increases by approximately 3% per percentage-point increase in the electric vehicle share. Suppose instead that every electric car is a paying vehicle, all other things being equal. The average price of the toll rings would be 19.17 NOK (2.09 USD).Footnote 13 This naïve calculation suggests that a conventional vehicle owner pays 3.3 NOK (0.36 USD) more per toll ring crossing today than in the counterfactual scenario in which there is no exemption policy.

Next, I divide the ownership shares of the vehicle types by three income groups.Footnote 14 By the end of 2017 there were approximately 95,000 electric vehicles in and around municipalities with toll rings, whereas 1.07 million cars were running on conventional fuel types. Assuming that all cars pass a toll ring every day for a year, and using the mean toll ring price for 2017 (2.5 USD), the lost revenue that is attributable to electric cars is 87 million dollars.Footnote 15 Dividing this loss by the number of conventional vehicles yields an increase of 0.2 dollars in excess payment in 2017.

Table 9 provides an overview of vehicle type ownership according to income group. The first row in section A suggests that the above-average income group owns the majority of electric vehicles, whereas the below-average and average income groups constitute 25% of electric vehicle owners. In the second row, I calculate the value of the exemption (87 million dollars) according to the ownership share in each income group. In section B, I calculate the value of the excess payment by the conventional car owner to bridge the toll company’s revenue gap according to income group. In section C, the values of the exempted tolls and excess tolls by income group are summed to obtain the net cost of the policy according to income group. Table 9 reveals that individuals who earn less than average have a net cost of approximately 11 million dollars in 2017 due to the electric vehicle exemption policy. Furthermore, individuals who belong to the average income group have a net cost of 7 million dollars, whereas the above-average earners receive a net benefit of 19 million dollars.

This analysis identifies nontrivial differences in the net cost among income groups as a consequence of the exemption policy. The increased toll price is a burden that is shifted mostly onto low-income non-electric vehicle owners, thereby resulting in an inverse relationship between cost and income. This suggests that the policy is regressive and implies an unfavorable distributional effect.

However, as described in Parry and Bento (2001) and Parry and Bento (2002), the total welfare effect of general road pricing depends on the revenue recycling effect. Left-wing majority governments might increase toll charges to keep revenue at a constant and to avoid reducing public transport investments. Even though increasing toll charges for conventional vehicles might appear to have a negative distributional effect, the total welfare effect depends on whether the revenue is recycled to improve or subsidize public transport supply. This is especially true if low-income groups utilize public transport to a higher degree than other income groups.

9 Concluding remarks

The development of measures for addressing increasing traffic levels in urban areas has become increasingly important for policymakers. Several road pricing mechanisms have been implemented to restrict traffic growth. Charging motorists to enter city centers can reduce congestion and, thus, reduce air pollution, improve road safety, and serve as a mechanism for revenue collection. However, many schemes exempt less-polluting vehicles from charge to obtain a cleaner car fleet, which might offset some of these effects and may have implications for social welfare.

This paper explores how toll charges, set by local governments, are affected when selected vehicle types are exempt from the charges. By analyzing the prices in several urban toll rings in Norway over time, I find that an increase in the share of electric vehicles increases the toll price. Moreover, I find that the changes in toll price are at the discretion of the municipal council. Local governments that are politically fragmented increase toll prices more than governments with a few, strong parties. Also, left-wing majority governments will increase toll prices more than right-wing majority governments.

The policy raises the question of whether the combination of congestion charging and electric vehicle exemptions have unintended consequences for social welfare, where the tax that is collected from conventional motorists is used to subsidize well-off electric vehicle owners. I find that the increase in toll charges is shifted onto the below-average income group, implying a negative distributional effect. This distributional effect is found to be driven by left-wing governments. However, the total welfare effect of the exemption of electric vehicles from toll charges is uncertain. If the revenue from urban toll charging is recycled so that it benefits the lower-income groups more, such as investment in public transportation, this will have a positive effect on the total welfare. Therefore, the net effects of electric vehicle exemption on society and heterogeneous groups should be explored in future research.

Notes

An exception is the Red Electoral Alliance, which is the smallest and leftmost party, that argues that toll roads are inequitable.

In the later years, some municipalities began charging a full or reduced price for parking for electric vehicles compared to conventional cars due to overcrowding of electric vehicles.

The price competition that followed the entry of international car companies into the Norwegian market led to the end of Norwegian electric vehicle production.

The cities that had toll rings in 2017 are Bergen, Bodø, Bærum/Oslo, Førde, Haugesund area, Harstad, Namsos, Kristiansand, Trondheim, Skien/Porsgrunn, and Stavanger area. I am excluding the toll rings in Bodø, Førde, Harstad, and Skien/Porsgrunn from the analysis because they all opened late in the observation period (2015). Thus, these toll companies have more information about the relationship between the toll price and the electric vehicle share and can set a high initial price to prepare for a large electric vehicle share. However, I do include the toll ring in Tønsberg, which closed in 2016 because the collection period ended.

There were 426 municipalities in 2017. There have been several splits and mergers of municipalities during the last decade in Norway, and the seven missing municipalities from my data are a consequence of this.

Two additional groupings have been applied in the analysis. One follows the structure of Statistics Norway’s economic regions, which are based on labor and commodity market flows and on population levels. The other follows the proposed groups of Bhuller (2009), where the main grouping criterion is the commuting patterns in the municipality. Neither of the two alternative groupings yielded any significant differences in the results. Therefore, they are excluded from the paper but available on request.

The selection of the cluster level is not straightforward in this case. One could argue that standard errors should be clustered at the urban toll ring level, namely including all municipalities that commute through a selected toll ring, or at the county level. However, there are only eight toll rings and 13 counties in the analysis, and clustering in low numbers is advised against (Cameron & Miller, 2015). An alternative is to cluster at lower levels, for instance municipalities, where a greater number of clusters are available. Several different clustering levels have been applied (not included in the paper), which negligibly altered the results.

In unreported estimates I also used a one-step Arellano–Bond estimator, with two lags on the dependent real price variable and the share of electric vehicles. There was no substantive change in either the significance or magnitude of the effect of electric vehicles on toll prices.

The data on local government elections are provided by Fiva, J. H., Halse, A. H., and Natvik, G. J., (2017): Local Government Dataset.

The first relevant election occurred in September 2007. However, since I do not have data for 2008, I use the first available year, namely 2010.

The left-wing parties are the Red Electoral Alliance, the Socialist Left Party, the Labour Party, and the joint lists of left-wing parties. Right-wing parties include the Liberal Party, the Centre Party, the Christian Democrats, the Conservative Party, the Progress Party, and the joint lists of the right-wing parties.

The following formula is applied: PEV = (1 + α·ShareEV1)PC, where PEV and ShareEV1 are the current toll ring price and electric vehicle share, respectively, α is the coefficient that was obtained in the main analysis, and PC is the counterfactual price.

The statistics on ownership shares and income are derived from the National Travel Survey from 2013/2014 (Institute of Transport Economics, 2016), and include subjects driving to work five times a week with cars as the main mode of transportation. The income statistic is only available in nine intervals.

Although it is inaccurate to assume that car owners drive to work every day, it is likely that, when accounting for trips undertaken during leisure time, the average number of toll crossings over a year approach one per day.

References

Agarwal, S., Koo, K. M., & Sing, T. F. (2015). Impact of electronic road pricing on real estate prices in Singapore. Journal of Urban Economics, 90, 50–59. https://doi.org/10.1016/J.JUE.2015.09.004

Alt, J. E., & Lowry, R. C. (1994). Divided government, fiscal institutions, and budget deficits: Evidence from the states. American Political Science Review, 88(4), 811–828. https://doi.org/10.2307/2082709

Artés, J., & Jurado, I. (2018). Government fragmentation and fiscal deficits: A regression discontinuity approach. Public Choice, 175, 367–391. https://doi.org/10.1007/S11127-018-0548-Y/TABLES/8

Autor, D. H., Dorn, D., & Hanson, G. H. (2013). The China syndrome: Local labor market effects of import competition in the United States. American Economic Review, 103(6), 2121–2168. https://doi.org/10.1257/aer.103.6.2121

Bhuller, M. S. (2009). Inndeling av Norge i arbeidsmarkedsregioner (Tech. Rep.). Oslo: Statistics Norway.

Borge, L. E. (1995). Economic and political determinants of fee income in Norwegian local governments. Public Choice, 83(3), 353–373. https://doi.org/10.1007/BF01047752

Borge, L. E., & Rattsø, J. (2004). Income distribution and tax structure: Empirical test of the Meltzer - Richard hypothesis. European Economic Review, 48(4), 805–826. https://doi.org/10.1016/j.euroecorev.2003.09.003

Börjesson, M., Eliasson, J., Hugosson, M. B., & Brundell-Freij, K. (2012). The Stockholm congestion charges—5 years on. Effects, acceptability and lessons learnt. Transport Policy, 20, 1–12. https://doi.org/10.1016/J.TRANPOL.2011.11.001

Cameron, C. A., & Miller, D. L. (2015). A practitioner’s guide to cluster-robust inference. Journal of Human Resources, 50(2), 317–372. https://doi.org/10.3368/jhr.50.2.317

Figenbaum, E., Assum, T., & Kolbenstvedt, M. (2015). Electromobility in Norway: Experiences and opportunities. Research in Transportation Economics, 50, 29–38. https://doi.org/10.1016/j.retrec.2015.06.004

Fiva, J. H., Folke, O., & Sørensen, R. J. (2018). The power of parties: Evidence from close municipal elections in Norway. The Scandinavian Journal of Economics, 120(1), 3–30. https://doi.org/10.1111/SJOE.12229

Fiva, J. H., & Rattsø, J. (2007). Local choice of property taxation: Evidence from Norway. Public Choice, 132(3–4), 457–470. https://doi.org/10.1007/s11127-007-9171-z

Fu, S., & Gu, Y. (2017). Highway toll and air pollution: Evidence from Chinese cities. Journal of Environmental Economics and Management, 83, 32–49. https://doi.org/10.1016/J.JEEM.2016.11.007

Gibson, M., & Carnovale, M. (2015). The effects of road pricing on driver behavior and air pollution. Journal of Urban Economics, 89, 62–73. https://doi.org/10.1016/J.JUE.2015.06.005

Green, C. P., Heywood, J., & Navarro, M. (2020). Did the London congestion charge reduce pollution? Regional Science and Urban Economics. https://doi.org/10.1016/j.regsciurbeco.2020.103573

Green, C. P., Heywood, J. S., & Navarro, M. (2016). Traffic accidents and the London congestion charge. Journal of Public Economics, 133, 11–22. https://doi.org/10.1016/J.JPUBECO.2015.10.005

Hausman, J., Leonard, G., & Zona, D. (1994). Competitive analysis with differenciated products. Annales D’economie Et De Statistique, 34, 159. https://doi.org/10.2307/20075951

Hausman, J., & Ros, A. (2013). An econometric assessment of telecommunications prices and consumer surplus in Mexico using panel data. Journal of Regulatory Economics, 43(3), 284–304. https://doi.org/10.1007/s11149-013-9212-0

Hibbs, D. A. (1977). Political parties and macroeconomic policy. American Political Science Review, 71(4), 1467–1487. https://doi.org/10.2307/1961490

Hymel, K. (2009). Does traffic congestion reduce employment growth? Journal of Urban Economics, 65(2), 127–135. https://doi.org/10.1016/j.jue.2008.11.002

Institute of Transport Economics. (2016). Norwegian National Travel Survey 2013/2014 (Tech. Rep.). Bergen: Institute of Transport Economics.

Laakso, M., & Taagepera, R. (1979). ”Effective” number of parties. A measure with application to West Europe. Comparative Political Studies, 12(1), 3–27.

Larsen, O. I., & Østmoe, K. (2001). The experience of urban toll cordons in Norway: Lessons for the future. Journal of Transport Economics and Policy, 35(3), 457–471.

Leape, J. (2006). The London congestion charge. Journal of Economic Perspectives, 20(4), 157–176. https://doi.org/10.1257/jep.20.4.157

Nevo, A. (2001). Measuring market power in the ready-to-eat cereal industry. Econometrica, 69(2), 307–342.

Parry, I. W. H., & Bento, A. (2001). Revenue recycling and the welfare effects of road pricing. Scandinavian Journal of Economics, 103(4), 645–671. https://doi.org/10.1111/1467-9442.00264

Parry, I. W. H., & Bento, A. (2002). Estimating the welfare effect of congestion taxes: The critical importance of other distortions within the transport system. Journal of Urban Economics, 51(2), 339–365. https://doi.org/10.1006/juec.2001.2248

Pettersson-Lidbom, P. (2008). Do parties matter for economic outcomes? A regressiondiscontinuity approach. Journal of the European Economic Association, 6(5), 1037–1056. https://doi.org/10.1162/JEEA.2008.6.5.1037

Pigou, A. (2017). The economics of welfare. Routledge. https://doi.org/10.4324/9781351304368

Poterba, J. M. (1994). State responses to fiscal crises: The effects of budgetary institutions and politics. Journal of Political ECONOMY, 102(4), 799–821. https://doi.org/10.1086/261955

Potrafke, N. (2017). Government ideology and economic policy-making in the United States—a survey. Public Choice, 174(1), 145–207. https://doi.org/10.1007/S11127-017-0491-3

Ramjerdi, F., Minken, H., & Østmoe, K. (2004). Norwegian Urban Tolls. In G. Santos (Ed.), Road pricing: Theory and evidence (9th ed., pp. 237–249). Elsevier Ltd.

Reed, W. R. (2006). Democrats, republicans, and taxes: Evidence that political parties matter. Journal of Public Economics, 90(4–5), 725–750. https://doi.org/10.1016/J.JPUBECO.2004.12.008

Rotaris, L., Danielis, R., Marcucci, E., & Massiani, J. (2010). The urban road pricing scheme to curb pollution in Milan, Italy: Description, impacts and preliminary cost–benefit analysis assessment. Transportation Research Part a: Policy and Practice, 44(5), 359–375. https://doi.org/10.1016/J.TRA.2010.03.008

Roubini, N., & Sachs, J. D. (1989). Political and economic determinants of budget deficits in the industrial democracies. European Economic Review, 33(5), 903–933. https://doi.org/10.1016/0014-2921(89)90002-0

Staiger, D., & Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica, 65(3), 557. https://doi.org/10.2307/2171753

The Norwegian Public Roads Administration. (2018). Bompengeselskapenes drift i 2016 (Tech. Rep.). Oslo: The Norwegian Public Roads Administration.

Vickrey, W. S. (1963). Pricing in urban and suburban transport. The American Economic Review, 53(2), 452–465.

World Economic Forum. (2019). These countries have the highest share of electric vehicles. Retrieved from https://www.weforum.org/agenda/2019/03/chart-of-the-day-half-of-new-cars-sold-in-norway-are-electric-or-hybrid/.

Acknowledgements

I thank Maria Bratt Börjesson, Colin Green, Jørn Rattsø and the anonymous reviewers for comments that substantially improved this paper. I also benefited from comments that were made by participants at the 2019 Annual Meeting of the Norwegian Association of Economists and the Scottish Economic Society Annual Conference in April 2019. Finally, I am grateful for data on toll prices from Ferde, Fjellinjen, Nye Kristiansand Bompengeselskap and Vegamot.

Funding

Open access funding provided by NTNU Norwegian University of Science and Technology (incl St. Olavs Hospital - Trondheim University Hospital).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Krehic, L. How do increases in electric vehicle use affect urban toll ring prices?. Public Choice 193, 187–209 (2022). https://doi.org/10.1007/s11127-022-01008-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-022-01008-x