Abstract

How does an increase in group size affect individual welfare in the presence of Olson’s group size paradox? Under the standard approaches to modeling the group size paradox, individual welfare declines as the size of the group expands. However, this may not be true if we apply the group size paradox to politics. In particular, if a smaller group attempts to extract a fixed income transfer from a larger group, the welfare of individuals in the larger group is increasing monotonically in the size of their group under a standard contest success function. Even though the probability of the transfer taking place is rising monotonically in the size of the group, the expected transfer per member shrinks because more members share the burden of financing the transfer. A similar result is obtained if the transfer is modeled as a fixed entitlement to be received by each member of the smaller group. By contrast, if the transfer imposes a fixed cost per member of the larger group, the result that individual welfare in the larger group is falling monotonically in its own group size is restored.

Similar content being viewed by others

Notes

Alternatively, a strong form of the group size paradox may be said to occur when a large group is unable to provide itself with any of the public good (See Sandler 1992, pp 8–9).

When I say I take the existence of the group size paradox as given, I mean that I make technological assumptions within the model such that the paradox will occur.

Appelbaum and Katz (1986) model a game in which the rent received by the winner of a contest is financed by payments from losers of the contest. In this setting, the recipient of the transfer and the identities of those who finance the transfer are determined by the outcome of the contest itself. Also see Hillman and Riley (1989). Neither of these papers considers rent seeking in groups and so do not address the issues analyzed in my paper. In my model, I will take as given the identity of the potential recipient and the potential payer of the transfer.

The stakes in our contest will generally be asymmetric. See, among others, Nti (1999).

This allows us to contemplate an increase in the size of one group without implying a decrease in the size of the other group.

For a book-length treatment of contests, see Konrad (2009).

In a balanced two-person contest, participation constraints always hold for r ≤ 2. However, our contest potentially is unbalanced because we may have a 1 and R 1 R 2. In an unbalanced contest the participation constraint of 1 of the two parties may be violated for values of r between 1 and 2.

As pertains to asymmetric equilibria, our analysis shows what happens to the welfare of an “average” member of the group.

The analysis does not depend in any way on whether the entitlement created should be considered socially desirable.

In order for the sugar policy story to match the model exactly we would need a constant opportunity cost of production combined with a production quota set by the government at the quantity demanded associated with the support price. Note that protection of US sugar producers has at times involved both support prices and domestic production quotas. See Krueger (1990) for details.

References

Appelbaum, E., & Katz, E. (1986). Transfer seeking and avoidance: on the full social cost of rent seeking. Public Choice, 48, 175–181.

Baik, K. H. (1993). Effort levels in contests: the public good prize case. Economics Letters, 41, 363–367.

Baik, K. H., & Lee, S. (2007). Collective rent seeking when sharing rules are private information. European Journal of Political Economy, 23, 768–776.

Bergstrom, T., Blume, L., & Varian, H. (1986). On the private provision of public goods. Journal of Public Economics, 29, 25–49.

Brennan, G. (2015). Olson and imperceptible differences. Public Choice, 164, 235–250.

Buchanan, J. M. (1965). An economic theory of clubs. Economica, 32, 1–14.

Chamberlin, J. (1974). Provision of public goods as a function of group size. American Political Science Review, 68, 707–716.

Cheikbossian, G. (2008). Heterogeneous groups and rent-seeking for public goods. European Journal of Political Economy, 24, 133–150.

Cheikbossian, G. (2012). The collective action problem: within group cooperation and between group competition in a repeated rent-seeking game. Games and Economic Behavior, 74, 68–82.

Congleton, R. D. (2015). The logic of collective action and beyond. Public Choice, 164, 217–234.

Cornes, R., & Hartley, R. (2003). Risk aversion, heterogeneity and contests. Public Choice, 117, 1–25.

Cornes, R., & Hartley, R. (2012). Risk aversion in symmetric and asymmetric contests. Economic Theory, 51, 247–275.

Cornes, R., & Sandler, T. (1984). Easy riders, joint production, and public goods. Economic Journal, 94, 580–598.

Cornes, R., & Sandler, T. (1985). The simple analytics of pure public good provision. Economica, 52, 103–116.

Cornes, R., & Sandler, T. (1996). The theory of externalities, public goods, and club goods (2nd ed.). Cambridge: Cambridge University Press.

Epstein, G. S., & Nitzan, S. (2002). Stakes and welfare in rent-seeking contests. Public Choice, 112, 137–142.

Esteban, J., & Ray, D. (2001). Collective action and the group-size paradox. American Political Science Review, 95, 663–672.

Gradstein, M. (1993). Rent seeking and the provision of public goods. Economic Journal, 103, 1236–1243.

Hillman, A. L., & Katz, E. (1984). Risk averse rent seekers and the social cost of monopoly power. Economic Journal, 94, 104–110.

Hillman, A. L., & Riley, J. G. (1989). Politically contestable rents and transfers. Economics and Politics, 1, 17–39.

Jindapon, P., & Whaley, C. A. (2015). Risk lovers and the rent over-investment puzzle. Public Choice, 164, 87–102.

Katz, E., Nitzan, S., & Rosenberg, J. (1990). Rent seeking for pure public goods. Public Choice, 65, 49–60.

Kolmar, M., & Wagener, A. (2012). Contests and the private provision of public goods. Southern Economic Journal, 79, 161–179.

Konrad, K., & Schlesinger, H. (1997). Risk aversion in rent-seeking and rent-augmenting games. Economic Journal, 107, 1671–1683.

Konrad, K. A. (2009). Strategy and Dynamics in Contests. Oxford: Oxford University Press.

Krueger, A. O. (1990). The political economy of controls: American sugar. In M. Scott & D. Lal (Eds.), Public policy and economic development (pp. 170–216). Oxford: Clarendon Press.

Lee, S. (1993). Inter-group competition for a pure private rent. Quarterly Review of Economics and Finance, 33, 261–266.

McGuire, M. C. (1974). Group size, group homogeneity, and the aggregate provision of a pure public good under Cournot behavior. Public Choice, 18, 107–126.

Nitzan, S. (1991). Collective rent dissipation. Economic Journal, 101, 1522–1534.

Nitzan, S., & Ueda, K. (2009). Collective contests for commons and club goods. Journal of Public Economics, 93, 48–55.

Nitzan, S., & Ueda, K. (2011). Prize sharing in collective contests. European Economic Review, 55, 678–687.

Nti, K. O. (1999). Rent seeking with asymmetric valuations. Public Choice, 98, 415–430.

Olson, M. (1965). The logic of collective action. Cambridge: Harvard University Press.

Ostrom, E. (2003). How types of goods and property rights jointly affect collective action. Journal of Theoretical Politics, 15, 239–270.

Pecorino, P. (2015). Olson’s logic of collective active at fifty. Public Choice, 162, 243–262.

Riaz, K., Shogren, J. F., & Johnson, S. R. (1995). A general model of rent seeking for public goods. Public Choice, 82, 243–259.

Sandler, T. (1992). Collective action. Ann Arbor: University of Michigan Press.

Sandler, T. (2015). Collective action: fifty years later. Public Choice, 164, 195–216.

Treich, N. (2010). Risk aversion and prudence in rent-seeking games. Public Choice, 145, 339–349.

Tullock, G. (1980). Efficient rent seeking. In J. M. Buchanan, R. D. Tollison, & G. Tullock (Eds.), Toward a theory of the rent-seeking society (pp. 97–112). College Station: Texas A&M University Press.

Acknowledgments

I would like to thank William F. Shughart II, seminar participants at Samford University and participants at the Public Choice Society Meeting for providing helpful comments on this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

In “Group size and welfare with a rival, but nonexcludable good” section in Appendix, I will briefly develop a model in which a single group attempts to provide itself with a fully rival, but nonexcludable good. In this setting, the group size paradox will hold and individual welfare is decreasing in group size. Similarly, in “Group size and welfare in a contest for a positive rent” section in Appendix, I will show that when two groups compete for a fully rival positive rent that the welfare of both groups is decreasing in the size of their own group and increasing in the size of the other group. This establishes for some standard models that, when the group size paradox holds, individual welfare is decreasing in own group size. This contrasts with Results 1 and 2 of the paper. In “The derivatives for Result 1, A derivative for Result 2 and The derivatives for Result 3” sections in Appendix, I provide the some of the comparative statics underlying Results 1–3.

Group size and welfare with a rival, but nonexcludable good

Pure public goods are nonrival and nonexcludable, but obtaining the group size paradox generally requires that the good in question be rivalrous, which is the assumption employed here. There are n > 1 identical agents. Person i’s consumption of the private good is x i and her contribution towards the public good is s i where x i + s i = w. The parameter w is an exogenously given level of income. Provision of the rival and nonexcludable good is \(g = (1/n)\sum\limits_{i = 1}^{n} {s_{i} }\). Utility is given by U(x i, g), where there is a diminishing marginal rate of substitution between g and x i. The first order condition at an interior equilibrium implies

Since agents are identical, a symmetric Nash equilibrium exists in which s i = s, i. We thus have g = ns/n = s. Using the budget constraint and the result g = s, (13) may be expressed as follows:

Because of a diminishing marginal rate of substitution, it must be the case that as n increases, s = g decreases, i.e., dg/dn < 0. Thus, individual consumption of g is decreasing in group size; in this setting we have a strong form of the group size paradox.

If we differentiate the utility function we obtain \(dU = U_{{x_{i} }} dx_{i} + U_{g} dg\). From (13) \(U_{{x_{i} }} = (1/n)U_{g}\) and from the budget constraint, dx i = −ds. Since s = g, we have ds = dg. Combining these we can write

Recall that dg/dn < 0. Individual utility is decreasing in the size of the group. This contrasts with Results 1 and 2 of this paper.

Group size and welfare in a contest for a positive rent

The main body of the paper lays out a rent seeking contest in which group 2 seeks a positive transfer from group 1. Thus, while group 1 seeks a positive rent, group 2 seeks to avoid a possible loss. This is the key to the result that the welfare of members of group 2 is increasing in group 2’s size. The only difference with the analysis in the main body of the paper is that now group 2 also is competing for a positive rent R with each member receiving R/m 2 if the group is successful in obtaining the rent. The problem for group 1 remains as in (3a) with R 1 = R/m 1. The problem for person j in group 2 becomes

It can be shown that the solutions to the problems in (3a) and (15) imply the same values of X 1 , X 2 and p as found in (4a–4c) with the substitutions R 1 = R/m 1 and R 2 = R/m 2. Substituting these values into \(w_{2}^{j}\) we have the following:

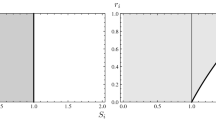

By inspection we can see that welfare of an individual in group 2 is increasing in the size of group 1. The derivative of the welfare function of individual j with respect to the size of group 2 may be expressed as follows:

Because r ≤ 1 and m 2 ≥ 2, we know that the term in the large parentheses is positive, making the entire expression negative. Thus, in a standard model of rent seeking, the welfare of members of group 2 is increasing in the size of group 1 and decreasing in the size of group 2. The results for group 1 are found from the analysis in the main body of the paper: welfare is decreasing in m 1 and increasing in m 2. These results correspond to the standard intuition that if one belongs to a group subject to the group size paradox and that group’s size expands, individuals in that group will be made worse off. For group 2, this conclusion stands in contrast to Results 1 and 2.

The derivatives for Result 1

Taking the derivative of (10a), we have the following:

Since r ≤ 1 and m 1 ≥ 2, we know the term in the large parentheses is positive, making the derivative overall negative. Thus, the welfare of members of group 1 is decreasing in own group size.

Next, consider the effect of an increase in the size of group 1 on the welfare of an individual in group 2. From (10b) we obtain the following:

The term in brackets inside the second parentheses is less than 1 in absolute value. As a result, the expression inside the second parentheses is positive, implying that \(dw_{2}^{j} /dm_{ 1} > 0\). Thus, the welfare of group 2 is increasing in the size of group 1.

Next, in determining the sign of \(dw_{2}^{j} /dm_{ 2}\) note from (10b) that \(w_{2}^{j}\) may be expressed as follows:

where

Since there is a negative sign out front, if the product of A times B falls when m 2 rises, and \(w_{2}^{j}\) will increase. By inspection, it is clear that B is decreasing in m 2. Taking the derivative of A with respect to m 2 yields,

Since A and B both decrease in m 2, welfare is increasing in m 2.

A derivative for Result 2

Taking the derivative of (11a) yields the following:

We are able to sign the term in brackets, because r ≤ 1 and m 1 ≥ 2. Once again, the welfare of members of group 1 is decreasing in the size of group 1.

The derivatives for Result 3

Notice that the solution for \(w_{1}^{i}\) from (12a) is m 2 times the solution for \(w_{1}^{i}\) from (10a). Thus, the derivative of welfare with respect to m 1 is m 2 times the expression in (18), which is negative. As before, the welfare of group 1 is decreasing in own group size.

Next we turn to \(w_{2}^{j}\). Note that the solution in (12b) is m 2 times the solution in (10b).Thus when we take the derivative of \(w_{2}^{j}\) in (12b) with respect to m 1, it is simply m 2 times the derivative in (19), which is positive. The welfare of group 2 is increasing in the size of group 1. Taking the derivative of (12b) with respect to m 2, we have

Because m 2 > 2 > 1 + r, we know that the term in the big brackets is positive, making the entire expression negative. In contrast with Results 1 and 2, the welfare of group 2 is decreasing in its own group size.

Rights and permissions

About this article

Cite this article

Pecorino, P. Individual welfare and the group size paradox. Public Choice 168, 137–152 (2016). https://doi.org/10.1007/s11127-016-0353-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-016-0353-4