Abstract

A competitive firm is considered to be inefficient when its observed profit falls short of the maximum possible profit at the applicable prices of inputs and outputs. Two alternative measures of performance of the firm are the ratio of the actual to the maximum profit and the difference between the maximum and the actual profit. The ratio measures its profit efficiency and is naturally bounded between 0 and 1 so long as the actual profit is strictly positive. However, the possibility of negative actual profit and zero profit at the maximum has prompted many researchers to opt for the difference measure of profit inefficiency, which is necessarily non-negative. For a meaningful comparison of performance across firms, however, the difference needs to be appropriately normalized to take account of differences in the scale of operation of firms. Three common variables used for normalization are the observed cost, the observed revenue, and the sum of revenue and cost. It is a common practice to measure the separate contributions of technical and allocative efficiencies to the overall profit efficiency of the firm. When the firm is not operating on the frontier of the production possibility set, there are many ways to project it on to the frontier. This leads to different decomposition of profit efficiency into technical and allocative components. In this paper, we consider McFadden’s gauge function and an endogenous projection based on the overall efficiency of the firm along with the usual input- or output-oriented distance functions, the graph hyperbolic distance function, and a slack-based Pareto Koopmans efficiency measure for technical efficiency. We show that in a multiplicative decomposition of profit efficiency, the technical efficiency component of profit efficiency is independent of input-output prices only from the projection based on the gauge function. Also, an empirical application using data from Indian banks shows that the alternative normalized difference measures of inefficiency generate different performance ranking of the firms. Thus, comparative evaluation of performance of firms depends on the analyst’s preference for a specific type of normalization.

Similar content being viewed by others

Notes

CCF (1998) describes this as the size of the firm.

Aparicio, Zofío and Pastor (2023) consider alternative measures of profit (in)efficiency and their additive and multiplicative decomposition. However, they require that the technically efficient projection of any inefficient unit should lie in the strongly efficient subset of the frontier. This often excludes radial projections. Besides, they select the profit-efficient bundle itself as the technically efficient projection of an inefficient input-output bundle. This leads to their claim that all profit inefficiency is either technical or allocative.

Although with free exit long-run profit will be non-negative, the actual profit may be negative in a specific case.

We address this point again in Section 5.2 again

By contrast, (ray) average productivity increases when outputs are radially scaled up or inputs are radially scaled down.

Thus, \(H\left( {x,\,y} \right) = \gamma = \frac{1}{{1 + \beta }}\).

This amounts to explicitly imposing a non-negativity restriction on βy. But if θ exceeds 1, βx in (22) can still be negative.

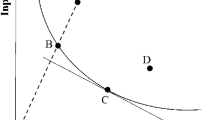

The endogenous efficient projection cannot be shown directly in the same diagram. Also, in the 1-input 1-output example, there is no input or output slack in this diagram and every point on the frontier is Pareto Koopmans efficient.

FHLZ (2019) provides a multiplicative decomposition of their output-oriented profit efficiency into three separate components that relate to potential for a radial expansion of the observed output vector y0 without any change in the input x0, allocative efficiency component of the revenue efficiency of \(R_0 = p^\prime y_0\) from input x0, and a residual factor. Their output-oriented profit efficiency (PEo) is different from the ratio measure profit efficiency considered above and more like a difference measure normalized by the actual revenue of the firm.

This example is not an in-depth study of the performance of Indian banks, which is beyond the scope of this paper.

We aim to distinguish technical efficiency and technical inefficiency in this table. Unlike other measures, DDF Pure Technical Inefficiency (TIE_n) and Endogenous DDF Pure Technical Inefficiency (TIE_r) quantify the level of inefficiency. Therefore, in contrast with other measures, a bigger number of technical inefficiency indicates lower efficiency.

Note that when the DDF takes the value 0, all the difference between the maximum and the actual profit is ascribed to allocative inefficiency.

It has lower Nerlovian inefficiency than 7 banks. When the difference is normalized by either actual revenue or actual cost, it is found to perform better than 11 banks.

\(1 - \frac{{\pi _0}}{{\pi ^ \ast }} = \frac{{\pi ^ \ast - \pi _0}}{{\pi ^ \ast }} = \frac{{\Delta}}{{\pi ^ \ast }}\).

References

Aparicio J, Zofío JL, Pastor JT (2023) Decomposing economic efficiency into technical and allocative components: an essential property. Journal of Optimization Theory and Applications 197:98–129

Aparicio J, Pastor JT, Ray SC (2013) An overall measure of technical inefficiency at the firm and at the industry level: the ‘lost profit on outlay’. European Journal of Operation Research 226(1):154–162

Banker RD (1984) Estimating the most productive scale size using data envelopment analysis. European Journal of Operational Research 17(1 (Jul)):35–44

Banker RD, Maindiratta A (1988) Nonparametric analysis of technical and allocative efficiencies in production. Econometrica 56(5):1315–1332

Briec W (1997) A graph-type extension of Farrell technical efficiency measure. Journal of Productivity Analysis 8(1):95–110

Chambers RG (2022) Overall Inefficiency Measures: A Different Perspective. University of Maryland Working Papers, https://www.rgchambers3.com/_files/ugd/43ea9a_d97783e20cd842f9bba487c68b3331ba.pdf

Chambers RG, Chung Y, Färe R (1996) Benefit and distance functions. Journal of Economic Theory 70:407–419

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions, and Nerlovian efficiency. Journal of Optimization Theory and Applications 98:351–364

Färe R, Grosskopf S, Lovell CAK (1985) The Measurement of Efficiency of Production. Kluwer-Nijhoff, Boston

Färe R, Grosskopf S, Lovell CAK (1994) Production Frontiers. Cambridge University Press, Cambridge

Fare R, Grosskopf S, Ray SC, Miller SM, Mukherjee K (2000) “Difference Measures of Profit Inefficiency: An Application to U.S. Banks”; Paper presented at a Conference on Banking and Finance held at Miguel Hernandez University, Elche, Spain in May 2000

Färe R, Grosskopf S, Whittaker W (2013) Directional output distance functions: endogenous directions based on exogenous normalization constraints. Journal of Productivity Analysis 40:267–269

Färe R, He X, Li S, Zelenyuk V (2019) A unifying framework for Farrell profit efficiency measurement. Operations Research 67:183–197

Farrell MJ (1957) The measurement of technical efficiency. Journal of Royal Statistical Society Series A (General) 120(Part 3):253–290

Luenberger DG (1992) Benefit functions and duality. Journal of Mathematical Economics 21:461–481

McFadden D (1978) Cost, Revenue, and Profit Functions. In: Fuss M, McFadden D (Eds) Production Economics: A Dual Approach to Theory and Applications, vol 1. Amsterdam, North-Holland, p 110

Pastor JT, Ruiz JL, Sirvent I (1999) An enhanced DEA Russell graph efficiency measure. European Journal of Operation Research 115(3):596–607

Portela MCS, Thanassoulis E (2007) Developing a decomposable measure of profit efficiency using DEA. The Journal of the Operational Research Society 58(4):481–490

Ray SC (2007) Shadow profit maximization and a measure of overall inefficiency. Journal of Productivity Analysis 27:231–236

Reserve Bank of India (RBI). DATABASE OF INDIAN ECONOMY (2022) Retrieved March 29, 2023, from https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!4

Sengupta JK (2003) New Efficiency Theory with Applications of Data Envelopment Analysis (Springer)

Shephard RW (1953) Cost and Production Functions. Princeton University Press, Princeton

Shephard RW (1970) The Theory of Cost and Production Functions. Princeton University Press, Princeton

Tone K (2001) A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research 130(3):498–509

Zofio JL, Pastor JT, Aparicio J (2013) The directional profit efficiency measure: on why profit efficiency is either technical or allocative. Journal of Productivity Analysis 40:257–266

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Ethics approval and consent to participate

Not applicable.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ray, S.C., Yang, L. Measurement and decomposition of profit efficiency under alternative definitions in nonparametric models. J Prod Anal (2024). https://doi.org/10.1007/s11123-024-00720-8

Accepted:

Published:

DOI: https://doi.org/10.1007/s11123-024-00720-8