Abstract

Structural change is an important driver of productivity growth at the aggregate level. While previous productivity decompositions account for the contributions of market entry and exit, they overlook continuing firms that switch from one industry to another. We develop an improved productivity decomposition that accounts for both intra-industry and inter-industry switching, is applicable to both static and inter-temporal settings, and ensures consistent aggregation of firm-level productivity to the industry level. The proposed decomposition is applied to Finland’s information and communication technology (ICT) industry in the first two decades of the 21st century. This industry experienced major structural changes due to the rapid downfall of Nokia, the world’s largest mobile phone manufacturer at the beginning of our study period. Our results reveal that the sharp decline of labor productivity was associated with structural changes, whereas the surviving firms that continued in the same industry managed to improve their productivity. Our results indicate that industry switching can dampen or enhance the productivity impacts of structural change, especially during times of crisis and recession.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Schumpeter (1939) coined the term “creative destruction” to describe how market competition leads to the continuous replacement of inefficient producers with more productive ones. He also noted that during recessions, the least productive and least innovative units are more likely to be scrapped, which can help to increase productivity and foster new growth. However, the traditional approach of measuring productivity growth using balanced panel data of continuing firms ignores the impact of structural change through entry and exit on productivity growth (The use of balanced panels of firms in Malmquist productivity decompositions remains common today, with recent examples including Bansal et al. (2022), Laporšek et al. (2022), and Li and Guan (2022), among others).

Baily et al. (1992) and Griliches and Regev (1995) were the first to introduce structural change decompositions of productivity growth that considered not only the continuing firms but also the contributions of firm entry and exit. Following Olley and Pakes (1996), another line of studies distinguishes the contribution of resource reallocation across firms, which is also related to creative destruction. Competition favors highproductivity firms, which tend to grow larger than lowproductivity firms. Note that the market share of a lowproductivity firm may initially shrink and eventually reach zero, resulting in a market exit. Several subsequent studies, such as Maliranta (2003), Böckerman and Maliranta (2007), Diewert and Fox (2009), Hyytinen and Maliranta (2013), Holm (2014), Melitz and Polanec (2015), and Maliranta and Määttänen (2015) have extended the Olley-Pakes productivity decomposition to incorporate entry and exit.

In previous productivity decompositions cited above, firms are classified into mutually exclusive groups of continuing firms, exiting firms, and new entrants. Conventional interpretations often associate market entry with startups and market exit with bankruptcy. However, Bernard et al. (2010) show empirically that continuing firms frequently enter new markets by adding new products to their multiproduct portfolio. Similarly, market exit can occur through the consolidation of production lines. In light of their findings, Kuosmanen and Kuosmanen (2021) argue that pooling continuing firms that introduce a new product (e.g., Apple introducing iPhone) together with genuinely new startups can blur the interpretation of productivity decompositions. Analogously, a multiproduct firm that refocuses its operations on more profitable product lines (e.g., Nokia selling its mobile phone division to Microsoft and focusing on mobile networks) is different from a firm that closes down completely.

The empirical objective of this paper is to examine the impact of structural changes on labor productivity of Finland’s information and communication technology (ICT) industry during the first two decades of the 21st century. This industry went through significant structural changes during our study period, associated with the changing fortunes of Nokia, the flagship of Finland’s ICT sector. Nokia was the world’s largest mobile phone manufacturer in years 1998–2008, but since the introduction of iPhone in 2007, Nokia’s market share started to decline rapidly, which led to the sale of Nokia’s mobile phone division to Microsoft in 2014. The rapid growth and downfall of Nokia had a significant impact on the entire supply chain of subcontractors in Finland (e.g., Simonen et al. 2020), which also influenced the labor markets for software developers, engineers, and other highly skilled professionals. To gain a deeper understanding of the labor productivity development in Finland’s ICT industry, we apply an augmented Olley-Pakes structural change decomposition method to comprehensive firm-level register data of Statistics Finland, which covers virtually all firms in Finland. For the sake of completeness, we consider both ICT manufacturing (NACE division C26) and ICT services (NACE division J62) because the structural changes occurring in the ICT manufacturing caused major spillovers in the ICT service industries as well (e.g., Ali-Yrkkö et al. 2021). As the large-scale manufacturing of mobile phones ended in Finland, many ICT manufacturing firms switched to ICT services.

To meet our empirical objectives, a more granular structural change decomposition of productivity change is needed. Our methodological contribution is to further advance the augmented Olley-Pakes structural change decomposition by Kuosmanen and Kuosmanen (2021) by

-

1.

building a stronger theoretical foundation by connecting the approach more firmly with the dynamic model of Bernard et al. (2010),

-

2.

drawing a sharper distinction between intra-industry and inter-industry switching, and

-

3.

clarifying the specific contributions of firm entry and exit in the intertemporal decomposition of productivity change.

We focus on the decomposition by Kuosmanen and Kuosmanen (2021), which is the only structural change decomposition known in the literature that (a) guarantees consistent aggregation of firm-level productivity measures to the industry level, (b) is applicable to both static and inter-temporal settings, and (c) does not depend on the arbitrary choice of market shares or employment shares as firm weights. Our proposed distinction between intra-industry and inter-industry switching is based on standard industry classifications, such as NACE, used in the European Union (Eurostat 2008) (NACE is similar to the SIC and NAICS systems used in the United Kingdom and North America. In the European NACE industry classification, the first four digits of the classification are the same in all European countries. National implementations may include additional levels, and hence the fifth digit might vary across countries). By intra-industry switching, we refer to a change in a firm’s four-digit or five-digit industry class within the same two-digit industry division. For example, a firm changing NACE class from 2620 to 2630 within division C26 is considered an intra-industry switch. Inter-industry switching, on the other hand, refers to a situation where the firm’s two-digit industry division changes. For example, a firm changing NACE class from 2620 to 6210, thereby changing from division C26 to J62, is considered as an inter-industry switch. This distinction is important because conventional productivity decompositions focusing on a specific two-digit industry division tend to misclassify inter-industry switching as either entry or exit, while intra-industry switching is typically pooled together with the continuing firms.

The rest of the paper is structured as follows. In Section 2, we review theoretical models of firm behavior to motivate intra- and inter-industry switching as specific forms of market entry and exit. In Section 3, we introduce our proposed structural change decomposition. In Section 4, we detail the data used in this study and provide some descriptive statistics. In Section 5, we apply the structural change decomposition to the Finnish ICT industries. Finally, in Section 6, we offer a concluding discussion and suggestions for future research.

2 Industry switching as a form of entry and exit

This section briefly reviews dynamic models of firm behavior to illustrate how market entry and exit are understood in the microeconomic theory. Our purpose is to build a stronger theoretical foundation for the structural change decompositions of productivity to be introduced in Section 3.

Dynamic models of oligopoly that incorporate sunk entry costs, stochastic technological progress, and endogenous exit decision-making have gained significant attention in the literature. These models, first introduced by Jovanovic (1982), Hopenhayn (1992), Ericson and Pakes (1995), and Olley and Pakes (1996) (For recent developments, see Abbring et al. (2018) and references therein), examine how firms maximize their expected net present value of future profits by competing with incumbent firms and potential entrants in the future. The entry and exit decisions made by firms depend on their perceptions of future market structures, which are based on current information. These decisions ultimately shape the future market structures. Ericson and Pakes (1995) established a Markov perfect Nash equilibrium in which firms’ perceptions of the distribution of future market structures align with the objective distribution of market structures generated by the firms’ choices.

Olley and Pakes (1996) describe the endogenous exit rule implied by their dynamic oligopoly model as follows: “a firm compares the sell-off value of its plant to the expected discounted returns of staying in business. If the current state variables indicate continuing in operation is not worthwhile, the firm closes down the plant.” (p. 1273). In other words, market exit occurs as a voluntary liquidation decision as the firm updates its perceptions of future profits. In reality, market exit often occurs involuntarily through bankruptcy. Murto and Terviö (2014) address this possibility by introducing a model that includes forced exit due to liquidity constraints. In this model, firms may be forced to exit the market due to a lack of liquidity, even if it would still be profitable to stay in business. Therefore, the firm must optimally manage its cash reserves to cope with the liquidity constraint. They show that the equilibrium state of the market may result in either too much or too little exit depending on the specific assumptions of the model.

In the context of this study, Bernard et al. (2010) present the most relevant theoretical work, introducing a general equilibrium model that incorporates endogenous entry and exit of firms, and multiproduct firms that can switch products over time. Their model assumes a continuum of products and independent distributions for consumer tastes. The firm’s expected profits across the continuum of products equal the sum of the expected profits from each product, minus the fixed headquarters cost. The general equilibrium of the model includes steady-state product switching, as well as firm entry and exit. In each period, some new firms will incur the sunk entry cost and enter the market if their productivity is above the zero-value cutoff. Firms will exit endogenously if their productivity falls below the zero-value cutoff or exogenously due to force majeure considerations.

In Bernard et al.’s (2010) model, there are two mechanisms that drive continuing firms to switch products (Other plausible reasons for product switching include drastic changes in government regulations (e.g., product bans), taxes and tariffs, transportation costs, and the security of supply concerns. It may also be influenced by factor markets and intermediate inputs, such as affordable energy and the availability of skilled workers). The first mechanism is stochastic shocks to consumer tastes, which can cause fluctuations in the profitability of individual products, leading continuing firms to either discontinue some previously produced products or introduce new ones. The second mechanism is stochastic productivity shocks, which can also result in product switching. An increase in productivity can expand the range of products produced, while a decrease can contract it. Unlike previous dynamic models of endogenous entry and exit, Bernard et al.’s (2010) model allows existing firms to enter new markets and exit existing ones without closing down through liquidation or bankruptcy. The authors suggest that product switching can contribute to the reallocation of resources toward their most efficient use.

In practice, empirical analysis of market entry and exit is typically conducted using comprehensive register data that covers nearly all firms or establishments within a specific industry or sector (In the empirical part of their paper, Bernard et al. (2010) examine the frequency of product switching in the US manufacturing. They found that half of firms change their mix of five-digit SIC products every 5 years, and 28% of firms operate in multiple five-digit classes, while 10% operate in multiple two-digit divisions). Industry classification systems, such as NACE, provide essential information for determining which firms and plants belong to the industry being studied (cf., e.g., the Appendix to Olley and Pakes 1996). In the system of national accounts, all of a firm’s activities are assigned to a single NACE class based on its principal economic activity, even if in reality the firm operates in multiple industries that span different NACE classes or divisions. The firm’s principal economic activity is the activity that contributes most to the firm’s total value added (see Eurostat 2008).

While the firms must report themselves which NACE class is their main economic activity, this does not mean that firms can arbitrarily change their NACE code. In Finland, Statistics Finland is also actively following and updating the industry classification if necessary. For example, Statistics Finland conducted a targeted survey to nearly 300 firms involved in the video games business in 2019 (For further information, see the website: https://www.stat.fi/uutinen/industrial-classification-of-video-game-enterprises-is-reviewed-enterprises-transferred-from-programming-to-publishing). As a result, the industry classification of ~30 software firms was corrected. A majority of these firms were switched from the Computer programming activities (6201) to Publishing of computer games (5821) or Other software publishing (5829).

Product switching and industry switching are closely related but distinct concepts. Product switching can sometimes result in a change in a firm’s industry classification code (such as NACE code). It is important to note that market entry and exit that occurs through switching of a firm’s NACE classification is not always the binary decision described in the theoretical models. In fact, industry switching can occur gradually as a growing production line becomes more significant and overtakes the previous principal economic activity as the main source of value added (To avoid frequent changes that do not reflect a substantial change in the real economy, a stability rule has been established for multiproduct firms (Eurostat 2008). According to this rule, the industry code is changed when the current principal economic activity has accounted for less than 50% of the value added for at least two consecutive years). Paradoxically, a firm can continue to supply the same amount of a product to the market, but the NACE code changes if another product overtakes as the principal economic activity in terms of value added. In this respect, it would be misleading to classify such a firm as a market exit. These observations highlight the need to separate intra-industry and inter-industry switching, both from the continuing firms in the same NACE class and the genuine entry and exit.

3 Structural change productivity decomposition

3.1 Aggregation of firm productivity to industry level

In this paper, we focus on labor productivity, stressing that the proposed decomposition is directly applicable to other productivity measures such as total factor productivity (TFP), green TFP, or carbon productivity. Labor productivity of firm i in period t is defined as the ratio of value added (yit) and labor input (lit), formally,

The industry is simply the aggregate of all Nt firms operating in period t; note that Nt can change over time due to market entry, market exit, and industry switching. Aggregate labor productivity of the industry in period t is defined as

where Yt is the total value added of the industry in period t and Lt is the total labor input of the industry. To link the firm-level and the industry level, it is helpful to restate the labor productivity of the industry as a share-weighted average of firm-level productivity measures, formally,

where \(s_{it} = \frac{{l_{it}}}{{L_t}}\) is the employment share of firm i in year t. Note that the use of employment shares guarantees consistent aggregation of firm-level labor productivity indicators to the industry level (In general, it is not self-evident that firm-level productivity measures can be consistently aggregated to the industry level (e.g., Blackorby and Russell 1999; Zelenyuk 2006; Kuosmanen and Kuosmanen 2021). Clearly, if consistent aggregation is possible, then industrylevel productivity must be a share weighted average of the firm-level productivity measures, as in Eq. (3). Other averages, such as the geometric mean or harmonic mean, would be inconsistent with the summation of the firm-level inputs and outputs to the aggregate level of the industry).

3.2 Static Olley-Pakes decomposition

To quantify the contribution of resource allocation on productivity, Olley and Pakes (1996) reformulate Eq. (3) as

where \(\overline p\) and \(\overline s\) denote the averages of firm productivity and market share, respectively, and \({\Delta}s_{it} = s_{it} - \overline s _t\) and \({\Delta}p_{it} = p_{it} - \overline p _t\) denote the differences from the mean. Since the market shares must sum to one, \(N_t\overline s _t = 1\), and hence Eq. (4) simplifies to

The right-hand side of Eq. (5) decomposes the industrylevel productivity into two components: the first one is the unweighted mean productivity of all firms and the second one represents the allocation of resources across firms. Note that the second component can be equivalently stated as

This representation emphasizes the interpretation of this component as a measure of allocative efficiency. When resources are reallocated from lowproductivity firms to highproductivity firms, the covariance of market shares and productivity increases, resulting in a positive contribution to productivity growth of the industry. Kuosmanen and Kuosmanen (2021) note that the covariance term can be equivalently stated as the difference

This means that it is possible to calculate the allocation component without using the share weights sit because the aggregate productivity Pt can be calculated using Eq. (2) and the average productivity \(\overline p _t\) does not depend on the share weights.

3.3 Static and intertemporal decompositions with entry, exit, and industry switching

The standard approach for measuring the impact of entry and exit on productivity change is to divide the sample of firms into groups of continuing firms, entering firms, and exiting firms, as discussed in previous studies by Baily et al. (1992), Griliches and Regev (1995), and Foster et al. (2001). However, several attempts have been made to reconcile this approach with the Olley-Pakes decomposition, as seen in the works of Maliranta (2003), Böckerman and Maliranta (2007), Diewert and Fox (2009), Hyytinen and Maliranta (2013), Holm (2014), and Maliranta and Määttänen (2015). To ensure consistent aggregation of firm-level productivity measures to the industry level, reduce sensitivity to share weights, and decompose both the level and change of industry productivity, this study utilizes and expands upon the approach proposed by Kuosmanen and Kuosmanen (2021).

Our objective is to measure the contributions of market entry, exit, and industry switching on the level and change of productivity of a specific two-digit industry division (denoted by D) over a chosen study period [t, t + k], where t is the base period t and t + k is the target period. It is important to note that the length of the study period can affect the results; as the study period becomes longer, the shares of entering, exiting, and switching firms will increase. Consequently, the contribution of structural change may appear insignificant in a 1-year period but may become more prominent over a longer period of 5–10 years, as seen in previous studies such as Holm (2014) and Kuosmanen and Kuosmanen (2021).

Recall that the total number of firms in the two-digit industry division D in period t is Nt. The division D can be further divided into multiple three-, four-, or five-digit classes cl = 1,…,CL. Given complete data of all firms operating in the base period t and the target period t + k, we can identify the following subsets of firms in period t:

A(t) = {all firms in industry D in period t}

S(t) = {surviving firms in industry D in period t, existing in period t + k}

E(t) = {enduring firms in industry D in period t, remaining in industry D in period t + k}

C(t) = {continuing firms in industry D in period t, remaining in the same class cl in period t+k}

The time period within the parenthesis indicates the period in which the firm’s membership in division D and class cl is observed. Note that the subsets C(t) = C(t + k) and E(t) = E(t + k) remain constant, as these firms continue to operate within division D of interest. However, the subsets A(t) ≠ A(t + k) due to market entry and exit, and S(t) ≠ S(t + k) due to entry in D and exit from D are associated with inter-industry switching. Note further that these subsets are nested as follows

The same nested structure applies in period t + k. We will utilize this nested structure to measure the contributions of industry switching and exit on the level of productivity in period t.

First, we measure the contribution of intra-industry switching using the following differences in the sub-sample averages

where the subscripts indicate the relevant subset of firms and the time period. The rationale of using unweighted sub-sample means is similar to that of Eq. (7) related to the Olley and Pakes (1996) decomposition. Note that the only difference between the subsets E(t) and C(t) concerns those firms that switch to another five-digit class within the same two-digit industry division of interest between periods t and t + k. Equation (9a) reflects the selection effect before the intra-industry switch has taken place, whereas Eq. (9b) captures the productivity difference after the switches have occurred.

Next, the contribution of inter-industry switching is similarly measured as the following differences in the sub-sample averages

The rationale is directly analogous to that of Eqs. (9a) and (9b). The difference between the subsets S(t) and E(t) concerns those firms observed in division D in period t, which will exit industry D by switching to another industry division by period t + k. Similarly, the difference between the subsets S(t + k) and E(t + k) reflects those firms that entered division D by switching from another division between periods t and t + k.

Finally, the contributions of market entry and exit are measured by the sub-sample averages

The difference between the subsets A(t) and S(t) concerns those firms observed in division D in period t, which will close down completely by period t + k. Similarly, the difference between the subsets A(t + k) and S(t + k) reflects new startups that entered division D between periods t and t + k.

The following proposition demonstrates that the components introduced above add up exactly to productivity at the industry level.

Proposition 1: Productivity of industry D in periods t and t + k is obtained as the sum of the following components:

Note that the allocation effect ALL on the right-hand side of Eq. (12a) and (12b) represents the Olley-Pakes covariance term, which represents the allocation of resources across firms. The sum of the first four components on the right-hand side is equivalent to the unweighted sample average of all firms, similar to the Olley-Pakes Eq. (5). By introducing the additional components, our aim is to differentiate the incremental contributions of intra-industry switching, inter-industry switching, and market entry and exit on productivity.

The static decomposition has an additive structure that reflects the nested structure of the subsets and the fact that any industry is composed of its firms. This additive structure is also present in the Olley-Pakes Eq. (5). However, it is important to note that Eq. (5) is not suitable for log productivity measures, as the use of logarithms would violate the aggregation rules in Eqs. (2) and (3).

The static decomposition of the base period productivity takes into account firms that have exited industry D, whether through inter-industry switching to another division or market exit by period t + k. In contrast, the static decomposition of the target period productivity captures firms that have entered industry D through inter-industry switchers and new startups. The key difference between intra-industry switching and inter-industry switching is that the intra-industry switchers remain within industry D throughout the study period. While the productivity levels of the inter-industry switchers can be computed in both periods t and t + k, we do not attribute their productivity to industry D when they operate in another division according to the industry classification. Productivity cannot be computed for firms that are inactive, such as exiting firms and new entrants.

The static decompositions of the productivity levels in the base period and the target period can be directly extended to the intertemporal decomposition of productivity change as follows:

Proposition 2: Productivity change of industry D from period t to period t + k can be decomposed as:

where

\({\Delta} P = \frac{{ P _{t + k} }}{ P _{t } }\) (productivity change of industry division D),

\({\Delta}\overline p _C = \frac{{\overline p _{C\left( {t + k} \right)}}}{{\overline p _{C\left( t \right)}}}\) (productivity change of continuing firms in the same class),

\({\Delta}INS = \frac{{\overline p _{E\left( {t + k} \right)}}}{{\overline p _{E\left( t \right)}}} - \frac{{\overline p _{C\left( {t + k} \right)}}}{{\overline p _{C\left( t \right)}}}\) (contribution of intra-industry switching),

\({\Delta}INT = \frac{{\overline p _{S\left( {t + k} \right)}}}{{\overline p _{S\left( t \right)}}} - \frac{{\overline p _{E\left( {t + k} \right)}}}{{\overline p _{E\left( t \right)}}}\) (contribution of inter-industry switching),

\({\Delta}ENX = \frac{{\overline p _{A\left( {t + k} \right)}}}{{\overline p _{A\left( t \right)}}} - \frac{{\overline p _{S\left( {t + k} \right)}}}{{\overline p _{S\left( t \right)}}}\) (contribution of market entry and exit),

\({\Delta}ALL = \frac{{P_{t + k}}}{{P_t}} - \frac{{\overline p _{A\left( {t + k} \right)}}}{{\overline p _{A\left( t \right)}}}\) (contribution of reallocation).

The intertemporal decomposition Eq. (13) begins by analyzing the productivity change of firms that continue to operate within the same industry class. The incremental contributions of structural changes are measures using the differences in the growth rates of the subsets of firms. This intertemporal decomposition Eq. (13) relies on the nested structure of subsets, which allows for an additive formulation of the incremental contributions, similar to the static decompositions Eq. (12a) and (12b). This structure allows for a clear and logical representation of the different sources of productivity change over time.

We see decomposition Eq. (13) as a logical way to extend the static Olley-Pakes decomposition of the productivity levels to the intertemporal setting of productivity change over time. Several previous studies cited in the Introduction have tried to bridge this gap, but as Kuosmanen and Kuosmanen (2021) note, most of the previous formulations use log productivity measures, which violates the aggregation rules Eqs. (2) and (3) (We would argue that a minimum requirement for any meaningful decomposition of aggregate productivity is that the individual components systematically add up to the aggregate productivity. Unfortunately, a majority of previous structural change decompositions fail this condition, including highly influential works such as Baily et al. (1992), Griliches and Regev (1995), Foster et al. (2001), Holm (2014), and Melitz and Polanec (2015).

Related to the previous point, Bruhn et al. (2021) criticize the typical practice of using log-transformed productivity measures in productivity decompositions. They argue that the use of logs may lead to inaccurate aggregate growth rates as well. In this respect, we stress that our decomposition (13) does not depend on the use of logarithms, and therefore, we do not need to exclude observations with zero or negative values. This is practically important particularly during times of major crisis in the industry, as firms may experience a decline in demand for their products or services, leading to a decrease in revenue and an increase in costs. This can cause firms to incur losses, and as a result, their value added may be temporarily negative. Note that such negative values are present when the value added of the industry is computed at the aggregate level, so excluding negative values at the firm-level forms a source of aggregation bias.

The key contribution of the decompositions presented in Eqs. (12a), (12b), and (13) beyond Kuosmanen and Kuosmanen (2021) is the distinction between intra-industry switching and inter-industry switching, utilizing the nested structure of industry classification systems such as NACE. Furthermore, we provide more rigorous definitions and formally demonstrate the validity of both static and dynamic decompositions. The proposed decompositions are useful, but not the only possible methods for analyzing structural change components. Other types of firm subsets, such as domestic versus foreign-owned firms or urban versus rural firms, may also benefit from using a similar nested structure. The current study focuses on a single study period [t, t + k], but it may be beneficial to examine multiple overlapping periods, such as using a rolling window. These extensions are left as promising avenues for future research.

Finally, note that component ∆ENX captures the net effect of both entry and exit. To draw a sharper distinction between entry and exit, we can further decompose ∆ENX as follows:

Proposition 3: Intertemporal net contribution of entry and exit (∆ENX) fundamentally depends on the magnitudes of the static entry and exit effects relative to the average productivity change of the continuing firms as

Proposition 3 clarifies the connection between the static entry and exit components Eq. (11a) and (11b) and their net contribution ∆ENX in the intertemporal decomposition. Importantly, ∆ENX measures the incremental contributions of entry and exit relative to the productivity change in the continuing firms. Since the entering firms did not exist in period t and the exiting firms no longer exist in period t + k, such intertemporal notions as “change in entry” or “change in exit” are void of meaning in the present setting. Instead of trying to forcefully separate entry and exit from ∆ENX, one can always complement the intertemporal decomposition by reporting additional information from the static contributions of market entry ENT (t+k) and market exit EXT (t).

4 Application to Finland’s ICT sector

4.1 Data and variables

The analysis of the study uses the Financial Statement Data Panel of Statistics Finland covering the years 2000–2018. The data is collected from corporate financial statements and provides detailed information on the financial accounts and balance sheets. The panel contains yearly financial statement information of essentially all firms in the Finnish business sector. The firms are classified into industries using the Finnish industry classification TOL 2008, which aligns with the European NACE classification for the first four digits (For more details see Statistics Finland, Standard Industrial Classification TOL 2008: https://www2.stat.fi/en/luokitukset/toimiala/toimiala_1_20080101/).

Our analysis focuses on two ICT industries: Manufacture of computer, electronic and optical products (C26) and Computer programming, consultancy and related activities (J62). The ICT sector underwent major structural changes due to the Great Recession and the European debt crisis of 2007–2008. To understand these changes, we analyze productivity over three time periods:

-

1.

2000–2006 (the growth period),

-

2.

2007–2012 (the Great Recession),

-

3.

2013–2018 (the follow-up recession and slow recovery).

The choice of these time periods is justified by three reasons. First, considering longer periods than yearly changes allows us to better capture the productivity impacts of structural changes, such as entry/exit and industry switching (cf., e.g., Holm 2014). Second, major revisions to the Financial Statement Data Panel by Statistics Finland in 2006 and 2013 may impact data comparison across the three subperiods. Third, the second subperiod encompasses the Great Recession (2007–2009), which began with the subprime mortgage crisis in the USA and led to the European Debt Crisis. Further, Finland experienced two recessions according to quarterly real GDP data: the first one from the first quarter of 2008 till the second quarter of 2009, and the second one from the second quarter of 2012 till the first quarter of 2015. These recessions mainly occurred within the second subperiod of our study but also spanned the beginning of our third subperiod.

Labor productivity at the firm-level is calculated using value-added, employment (measured in full-time equivalent units), firm identity, and reporting year. Value added is deflated by the GDP price deflator, and only firms with at least one full-time employee are included. In contrast to the commonly used log-based decompositions, our calculations do not impose any restrictions on value-added, allowing for positive or negative values.

4.2 Intra-industry and inter-industry switching

To understand the frequency of intra-industry and inter-industry switching, we next examine the relative sizes (percentage share of a cohort) of the following five subgroups of firms:

-

1.

Firms that remain in the same five-digit industry class throughout the time period,

-

2.

Firms that switch sub-industry within the same two-digit industry (intra-industry switching),

-

3.

Firms that switch to a different two-digit industry division (inter-industry switching),

-

4.

Firms that close down (exiting firms),

-

5.

New entrants during the time period (entering firms).

Table 1 reports the relative shares of these subgroups calculated for each 6-year period, with the shares reported for the first and last year of the period. The shares of inter- and intra-industry switching firms are presented separately. The shares of the entering and exiting firms were relatively large in all considered periods. In ICT services (J62), over half of the observations in 2006 and roughly half in 2012 were new firms established in the previous 5 years. In contrast, the exit group was larger than the entry group in all periods for ICT manufacturing (C26), while it was the opposite in ICT services (J62). This highlights the broader shift in the Finnish ICT sector from manufacturing to services, as reflected in the number of firms shown in the bottom rows of Table 1.

The shares of firms that switched industries varied across the three periods. The most frequent periods of switching were the first second subperiods. For instance, almost 10% of ICT manufacturing firms in 2007 had switched to another two-digit NACE division by 2012. Although industry switches are less frequent than entry or exit, their impact on productivity can be significant since firms that switch industries tend to be larger than new startups, as illustrated below in Table 2. Notably, the number of inter-industry switches typically surpassed intra-industry switches in both industries across all periods.

Table 2 provides additional information on the number of employees and the age of firms in each subgroup. The median values are presented for each subgroup of firms in the ICT manufacturing and ICT service industries. The median values show that the inter-industry switching firms were generally larger and older than those that remained in the same industry. For example, in 2018, the median firm age of inter-industry switching firms was 20 years for ICT manufacturing firms and 15 years for ICT service firms. These observations further support our argument that the industry switchers should not be pooled together with startups and discontinuing firms.

The last two columns of entering and exiting firms include empty cells to highlight the fact that the entering firms are not observed in the first year of the subperiod, whereas the exiting firms are no longer observed in the last year of the subperiod. Note further that Statistics Finland does not allow us to report median values or averages of subgroups with less than 5 observations. Since the subgroup of intra-industry switchers in period 3 was smaller than this threshold, we use NA in Table 2 to indicate that these statistics could be computed but are not available.

4.3 Productivity levels by subgroup

We proceed to compare the levels of labor productivity among the five subgroups introduced in the preceding subsection. Table 3 presents the average levels of labor productivity, expressed as 1000 euros per worker (in constant prices of 2010), in the first and last years of the three subperiods. The aim of this table is to demonstrate the variations in productivity levels among these subgroups. Recall from Section 3 that the average productivity figures are not directly comparable across the three subperiods due to major revisions of the Financial Statement Data Panel by Statistics Finland in 2006 and 2013, but also the composition of subgroups changes from one period to another due to industry switching, entry and exit.

Consider first the ICT manufacturing industry (NACE division C26). During the initial period 2000–2006, the subgroup of intra-industry switchers within the ICT manufacturing had the highest labor productivity. After the consolidation during the second subperiod, the average labor productivity of continuing firms surpassed that of industry switchers during the last subperiod.

During the crisis period 2007–2012, ICT manufacturing attracted inter-industry switchers from other NACE divisions, who had higher productivity compared to continuing firms in the same industry. However, during the first and the third subperiod, the inter-industry switchers joining from other industry divisions to the ICT manufacturing had notably lower labor productivity than the firms that left the ICT manufacturing and moved to another NACE division. Analogously, the average labor productivity of the genuinely new startups was lower than that of exiting firms in both the first and third periods. Worse yet, the average productivity of entering firms was negative in the latter two periods, supporting our argument that new startups are very different from industry switchers. Note that the conventional productivity decompositions that employ logarithms would have to exclude a large number of startups with negative value added during their first years of operation, which might cause sample selection bias and portray a too rosy picture of the contribution of startups.

Next, consider the ICT service industry (NACE division J62) presented in the bottom part of Table 3. Like the ICT manufacturing, the intra-industry switchers had the highest average productivity in all years, excluding 2007. The inter-industry switchers had lower productivity compared to continuing firms in the first period and the last year of the second period, while they had similar productivity in the last period. Entering firms had higher productivity than exiting firms only in the first period, declining thereafter. In the last period, continuing firms had lower average labor productivity compared to both intra-industry and inter-industry switchers.

5 Productivity decomposition results

5.1 Labor productivity decomposition in levels

While the average labor productivity levels presented in Table 3 exhibit distinct patterns for each subgroup over the study period, to assess the impact of structural changes on the productivity of ICT manufacturing and service industries, we next apply the systematic productivity decomposition developed in Section 3, which also takes into account the Olley-Pakes reallocation effect. Table 4 presents the results of the decomposition of labor productivity levels in the first and last years of the three subperiods, with Panel A displaying the results for ICT manufacturing and Panel B for ICT service industries.

The first five rows of Panel A and B of Table 4 present the components of the labor productivity decomposition in the same order as on the right-hand side of equation (12). The starting point is the average labor productivity of firms that remain in the same industry. The values in the first row of Table 4 match those in Table 3. However, the average labor productivity of this subgroup differs from the ICT manufacturing and service industries’ labor productivity, represented by the left-hand side of equation (12). To account for this difference, the structural effects are shown in rows 2 to 5 of Table 4.

The ICT manufacturing industry experienced a positive impact on labor productivity from intra-industry switching, particularly in the first and second periods, where 3–4 percent of firms switched within the industry. Inter-industry switching had a mixed impact, being negative in 2006 and 2018 when the shares of switching firms were 11 and 6 percent, respectively. The effect of entry and exit was positive only in 2007 and 2012 (during the financial crisis) and negative in the other 4 years. The positive values of the Olley-Pakes covariance term indicate a positive correlation between labor input and productivity, which suggests that resource allocation seems relatively efficient in these industries. Despite the positive impacts of industry switching and resource allocation, the overall labor productivity of the ICT manufacturing industry declined over time.

For the ICT service industry, intra-industry switching had mainly positive impacts, except in 2007. Inter-industry switching had a negative effect in the first two subperiods but turned positive in the last subperiod. Entry and exit had a consistently negative impact, appearing to worsen over time. The Olley-Pakes component had a positive impact throughout the study period, indicating efficient resource allocation. Unlike the ICT manufacturing industry, the labor productivity of continuing firms closely resembles the ICT service industry’s labor productivity, which had a slight increase followed by a decline over time.

5.2 Intertemporal decomposition of labor productivity

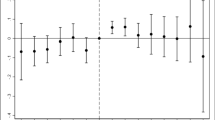

In this section, we apply the intertemporal productivity decomposition developed in Section 3 to examine the average yearly change of labor productivity in the three subperiods. Table 5 summarizes the results of the two ICT industries for the three time periods considered.

The ICT manufacturing industry (NACE class C26) is analyzed in the upper part of Table 5. The first row indicates the average labor productivity growth in the subgroup of continuing firms that remain in the same five-digit industry class. The table indicates that continuing firms experienced a yearly average growth of over 3 percent in the first period, declined during the crisis, and returned to positive growth in the final period. These average productivity figures can be considered as the baseline productivity change in the absence of structural changes.

The impact of intra-industry switching on productivity growth in the ICT manufacturing industry was positive in the first and third periods, but negative in the second. Meanwhile, inter-industry switching had a positive effect on productivity growth during the crisis, but a negative impact before and after it. Inter-industry switching caused a negative contribution of nearly one percentage point in the first period and 1.4 percentage points in the third period. Recall from Table 3 that the average productivity level of firms that switched from ICT manufacturing to other industry divisions was higher than that of firms that joined ICT manufacturing from other industry divisions.

The net impact of entry and exit was negative in the first and third periods but positive in the second period, with a particularly strong negative impact during the last period. Recall from Table 3 that exiting firms had higher average productivity compared to entering firms in the first and third periods. However, the largest factor causing industry level productivity decline was the negative Olley-Pakes reallocation effect in the first two periods, with a further decline during the crisis. This negative effect suggests that Nokia’s crisis had a greater impact on larger firms compared to smaller ones. After the crisis, the reallocation effect turned positive in the last period, reaching an average yearly growth of 7.5 percent per year.

The bottom row of the upper panel of Table 5 shows the average yearly productivity change for the industries, which equals the sum of the preceding sub-components. Despite the productivity growth of the continuing firms in the first and the last periods, the ICT manufacturing industry experienced a decline in productivity due to structural changes already during the first period, reaching a yearly decline of nearly 20 percent during the second period. The resumption of productivity growth in the industry during the third period was largely due to the positive Olley-Pakes reallocation effect.

The lower panel of Table 5 reports the productivity decomposition for the ICT service industry (NACE division J62). The first row shows the average productivity change for continuing firms in the same five-digit industry class. These firms experienced strong growth averaging five percent per year during the first period, but the yearly growth slowed down to 0.16 percent in the last period.

The impact of industry switching on ICT service productivity varied over time. Inter-industry switchers coming from other industry divisions slightly increased the productivity growth of the industry during the second period. Inter-industry switchers had a small positive impact in the first period, which then turned negative. In the third period, both intra-industry and inter-industry switching had negative impacts on the ICT service industry productivity change.

Overall, the net impact of entry and exit was a major factor in the decline of ICT service industry productivity, particularly during the second and third periods. The Olley-Pakes reallocation effect was positive in the first and third periods but became negative during the crisis years of the second period.

The bottom row of the lower panel of Table 5 shows the annual average of the aggregate productivity change of the ICT service industry. The strong positive productivity growth in the first period declined during the second period’s crisis years and did not recover in the third period. In summary, the results of Table 5 demonstrate that industry switching can significantly affect aggregate productivity, especially during crisis periods.

5.3 What if industry switching is omitted?

We noted above that previously structural change decompositions classify firms that switch industries as startups or closed firms. To further demonstrate our contribution beyond previous structural change decompositions, Table 6 presents an alternative productivity decomposition for the same ICT industries as in Table 5, but now disregards industry switching. As a result, the intra-industry switcher subgroup is combined with continuing firms in the same industry, while the inter-industry switcher subgroup is merged with the entering and exiting firms.

One noticeable difference between Tables 5 and 6 is the change in average productivity of continuing ICT services firms (J62) from positive to negative during the third period. Table 5 shows almost 0.2 percent yearly productivity growth for continuing firms in the same industry class, while Table 6 suggests a decline due to the negative impact of intra-industry switching. Pooling the intra-industry switchers with continuing firms in the same industry class can result in a false representation of productivity growth. Intra-industry switching should be viewed as a component of structural change rather than being attributed to the continuing firms in the same industry division.

While inter-industry switching implies exit from one industry division and entry to another, inter-industry switchers are established firms that continue to operate. The decomposition of the Finnish ICT industries reveals that the contribution of inter-industry switching can have a different sign than the genuine entry and exit, which thereby offsets the influence of structural change. Our study demonstrates that it is possible to differentiate inter-industry switchers from genuine entrants and exits, as well as intra-industry switchers from continuing firms within the same industry. This distinction provides a clearer understanding of the effect of structural change on productivity growth.

6 Conclusions

In this paper we have advanced the augmented Olley-Pakes structural change decomposition by Kuosmanen and Kuosmanen (2021) in three directions. First, we built a stronger theoretical foundation by linking the approach with the dynamic model of firm behavior by Bernard et al. (2010). Second, we drew a sharper distinction between intra-industry and inter-industry switching as forms of entry and exit. Third, we clarified the role of the static entry and exit components in the intertemporal decomposition of productivity change.

Our empirical motivation for a more granular structural change decomposition arises from the need to gain a better understanding of how the rapid downfall of Nokia after 2008 affected the productivity dynamics of Finland’s ICT sector. To this end, we applied the proposed augmented Olley-Pakes decomposition to firm-level register data of virtually all Finnish ICT manufacturing and service firms in the years 2000–2018. Our results indicate that structural change had a large negative effect on the productivity growth of these industries during this period. A more granular decomposition provides valuable insights into the complex relationship between structural change and productivity growth and showcases the usefulness of the decomposition technique in capturing the contributions of firms entering and exiting the market, as well as those switching between industries.

This study opens up several interesting avenues for future research. Firstly, the decomposition based on nested subsets of firms could be applied to other types of subgroups of firms or units, for example, the ownership structure (e.g., nested subsets of public, private, domestic, and foreignowned firms). Secondly, the decomposition can be adapted from labor productivity to other relevant productivity measures such as TFP, green TFP, or carbon productivity. Thirdly, the aggregation of firm-level productivity to the industry level could be further extended to cover multiple levels of aggregation from industry classes to industry divisions and further to the entire economy. Multiple level decomposition could also include regional productivity accounts aggregated to the national economy, to examine the reallocation of resources between regions. Finally, the empirical study could be extended to other industries and countries to gain a deeper understanding of the relationship between structural change and productivity growth.

Data availability

The data used in the study were sourced from a server administered by Statistics Finland. The analysis was conducted by utilizing a remote access system to Statistics Finland’s research laboratory (FIONA). For more information on obtaining access to the data, please consult Statistics Finland website (https://www.stat.fi/tup/mikroaineistot/etakaytto_en.html). Access to the data used in this research requires obtaining a license from Statistics Finland, which can be applied for on their website (https://www.tilastokeskus.fi/index_en.html).

References

Abbring JH, Campbell JR, Tilly J, Yang N (2018) Very Simple Markov‐Perfect Industry Dynamics: Theory. Econometrica 86(2):721–735

Ali-Yrkkö J, Cherif R, Hasanov F, Kuosmanen N, Pajarinen M (2021) Knowledge Spillovers From Superstar Tech-Firms: The Case of Nokia. IMF Working Pap 21:258

Baily MN, Hulten C, Campbell D (1992) Productivity dynamics in manufacturing plants. Brookings Pap Econ Act: Microecon 2:187–267

Eurostat (2008) NACE Rev. 2. Statistical classification of economic activities in the European Community. Eurostat Methodologies and Working papers. European Commission, Luxembourg

Bansal P, Mehra A, Kumar S (2022) Dynamic Metafrontier Malmquist–Luenberger Productivity Index in Network DEA: an application to banking data. Comput Econ 59:297–324

Bernard AB, Redding SJ, Schott PK (2010) Multiple-product firms and product switching. Am Econ Rev 100(1):70–97

Blackorby C, Russell RR (1999) Aggregation of efficiency indices. J Product Anal 12:5–20

Böckerman P, Maliranta M (2007) The micro-level dynamics of regional productivity growth: the source of divergence in Finland. Reg Sci Urb Econ 37(2):165–182

Bruhn, S., T. Grebel and L. Nesta (2021) The fallacy in productivity decomposition, Ilmenau Economics Discussion Papers, No. 160.

Diewert WE, Fox KA (2009) On measuring the contribution of entering and exiting firms to aggregate productivity growth. In: Diewert WE, Balk BM, Fixler D, Fox KJ, Nakamura A (eds) Index Number Theory and the Measurement of Prices and Productivity. Trafford Publishing, Victoria, BC, Canada

Ericson R, Pakes A (1995) Markov-perfect industry dynamics: a framework for empirical work. Rev Econ Stud 62(1):53–82

Foster L, Haltiwanger JC, and Krizan CJ (2001) Aggregate productivity growth: Lessons from microeconomic evidence. In: Charles RH, Edwin RD, Michael J (eds). Harper New developments in productivity analysis (pp. 303-372). University of Chicago Press. Chicago, IL, USA

Griliches Z, Regev H (1995) Firm productivity in Israeli industry 1979–1988. J Econom 65(1):175–203

Holm JR (2014) The significance of structural transformation to productivity growth. J Evolut Econ 24(5):1009–1036

Hopenhayn HA (1992) Entry, exit, and firm dynamics in long run equilibrium. Econometrica 60(5):1127–50

Hyytinen A, Maliranta M (2013) Firm lifecycles and evolution of industry productivity. Res Policy 42(5):1080–1098

Jovanovic B (1982) Selection and the Evolution of Industry. Econometrica 50(3):649–70

Kuosmanen T, Kuosmanen N (2021) Structural change decomposition of productivity without share weights. Struct Change Econ Dyn 59:120–127

Laporšek S, Trunk A, Stubelj I (2022) Productivity change in European banks in the post-crisis period. Systems 10(5):186

Li M, Guan S (2022) Does China’s state-owned sector lead industrial transformation and upgrading? J Clean Product 338(1):130412

Maliranta M (2003) Micro Level Dynamics of Productivity Growth: An Empirical Analysis of the Great Leap in Finnish Manufacturing Productivity in 1975–2000. Taloustieto Oy, Helsinki

Maliranta M, Määttänen N (2015) An Augmented Static Olley–Pakes Productivity Decomposition with Entry and Exit: Measurement and Interpretation. Economica 82:1372–1416

Melitz MJ, Polanec S (2015) Dynamic Olley-Pakes productivity decomposition with entry and exit. RAND J Econ 46:362–375

Murto P, Terviö M (2014) Exit options and dividend policy under liquidity constraints. Int Econ Rev 55(1):197–221

Olley S, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64:1263–1298

Schumpeter J (1939) Business cycles: a theoretical, historical, and statistical analysis of the capitalist process. McGraw-Hill, New York

Simonen J, Herala J, Svento R (2020) Creative destruction and creative resilience: restructuring of the Nokia dominated high-tech sector in the Oulu region. Reg Sci Policy Pract 12:931–953

Zelenyuk V (2006) Aggregation of Malmquist productivity indexes. Eur J Operational Res. 174:1076–1086

Acknowledgements

The authors extend their deepest appreciation to the TT Foundation for their generous financial support, without which this research would not have been possible. We would also like to thank Statistics Finland for providing us with the data that was essential for the empirical application presented in this paper.

Funding

Open Access funding provided by University of Turku (including Turku University Central Hospital).

Author information

Authors and Affiliations

Contributions

NK: Conceptualization, Formal analysis, Funding acquisition, Investigation, Software, Writing—original draft, Writing—review & editing. TK: Conceptualization, Formal analysis, Methodology, Writing—original draft, Writing—review & editing.

Corresponding author

Appendix: Proofs of Propositions 1–3

Appendix: Proofs of Propositions 1–3

Proposition 1: Productivity of industry D in periods t and t+k is obtained as the sum of the following components:

Proof: It is easy to confirm using Eqs. (9a)–(11a) that

Similarly, Eqs. (9b)–(11b) confirm that

Inserting these unweighted averages to Eq. (7), we obtain Eqs. (12a) and (12b).

Proposition 2: Productivity change of industry D from period t to t+k can be decomposed as:

where

\({\Delta}P = \frac{{P_{t + k}}}{{P_t}}\) (productivity change of industry division D),

\({\Delta}\overline p _C = \frac{{\overline p _{C\left( {t + k} \right)}}}{{\overline p _{C\left( t \right)}}}\) (productivity change of continuing firms in the same class),

\({\Delta}INS = \frac{{\overline p _{E\left( {t + k} \right)}}}{{\overline p _{E\left( t \right)}}} - \frac{{\overline p _{C\left( {t + k} \right)}}}{{\overline p _{C\left( t \right)}}}\) (contribution of intra-industry switching),

\({\Delta}INT = \frac{{\overline p _{S\left( {t + k} \right)}}}{{\overline p _{S\left( t \right)}}} - \frac{{\overline p _{E\left( {t + k} \right)}}}{{\overline p _{E\left( t \right)}}}\) (contribution of inter-industry switching),

\({\Delta}ENX = \frac{{\overline p _{A\left( {t + k} \right)}}}{{\overline p _{A\left( t \right)}}} - \frac{{\overline p _{S\left( {t + k} \right)}}}{{\overline p _{S\left( t \right)}}}\) (net contribution of market entry and exit),

\({\Delta}ALL = \frac{{P_{t + k}}}{{P_t}} - \frac{{\overline p _{A\left( {t + k} \right)}}}{{\overline p _{A\left( t \right)}}}\) (contribution of reallocation).

Proof: Summing up all components, we immediately see that all the terms with negative signs cancel out, and all that remains is the first subcomponent of the reallocation term ∆ALL, which is the productivity change of the industry.

Proposition 3: Intertemporal net contribution of entry and exit (∆ENX) fundamentally depends on the magnitudes of the static entry and exit effects relative to the average productivity change of the continuing firms as

Proof: In Proposition 2, component ∆ENX is defined as

Recall from Eqs. (11a) and (11b) the static exit and entry components:

Plugging in the static entry and exit terms to the first ratio of the intertemporal ∆ENX, we have

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kuosmanen, N., Kuosmanen, T. Inter-industry and intra-industry switching as sources of productivity growth: structural change of Finland’s ICT industries. J Prod Anal 61, 107–120 (2024). https://doi.org/10.1007/s11123-023-00712-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-023-00712-0