Abstract

In this paper, we use a geoadditve Bayesian stochastic frontier analysis to empirically assess the impact of provincial-level financial development, corruption control, and their interaction on firm efficiency in Vietnam. Using panel data from more than 40,000 Vietnamese firms during 2006-2013, we find that financial development decreases firm efficiency, while corruption control promotes it. Moreover, financial development and corruption control interact positively in affecting firm efficiency. Our results imply that corruption control not only enhances firm efficiency directly by reducing unnecessary regulatory burdens, costs, and delays, but it also offsets potential inefficiencies that arise from increased financial development.

Similar content being viewed by others

1 Introduction

Vietnam has passed through a remarkable path of economic and financial development in the past four decades. The socialist republic was very closed until the 1980s, when high inflation and unsatisfactory results of development plans ran by the government led to the implementation of general reforms (Doi Moi). These reforms allowed greater participation of private and foreign firms in the economy, including the financial sector, and have resulted in a dramatic increase in the number of enterprises operating in the country.Footnote 1

In addition to the proliferation of firms, Vietnam’s economic transformation has been characterized by, among other developments, a rapidly growing financial sectorFootnote 2 and a stubbornly high level of corruption.Footnote 3 Against this background, several studies have examined the effects of financial development (O’Toole and Newman 2017), corruption (Nguyen and Van Dijk 2012; Rand and Tarp 2012) and their interaction (Haschka et al. 2022; Tran et al. 2020) on firm growth in Vietnam. This work complements existing studies by redirecting the focus from firm growth to firm efficiency.

In light of the fact that the aforementioned studies have already documented positive impacts of financial development and corruption control on the growth of firms in Vietnam, this study on the roles of the two factors in promoting the technical efficiency of firms serves three main purposes. First, as growth could arise from factor accumulation and/or enhanced efficiency in the use of existing resources (e.g., Solow 1957), the present study helps to establish if efficiency-enhancement is a fundamental channel which connects financial development and corruption control to the growth of firms. This mirrors the macro-level studies on the impact of financial development on the sources of economic growth (Beck et al. 2000; Rioja and Valev 2004; Arestis et al. 2006). Second, it is known that economic growth driven by factor accumulation is transitory, while growth induced by total factor productivity is sustainable (e.g., Solow 1957). Hence, if financial development and corruption control exert significantly positive effects on firm efficiency, this would highlight the sustainability of the impacts of these factors on firm growth. Third, it is well-documented that factor accumulation is the main source of growth in developing countries, while growth in advanced economies is largely driven by improvements in total factor productivity (Acemoglu et al. 2006; Rioja and Valev 2004). In line with this stylized fact, studies have shown that while financial development enhances technical efficiency in highly efficient countries, this effect becomes smaller or even turns negative in less efficient countries (Rioja and Valev 2004; Arestis et al. 2006). Accordingly, this paper also serves as a micro-level test of the hypothesis that financial development could have a negligible effect on the efficiency of firms in an emerging economy even when the effects on firm growth are significantly positive.

The data for our empirical analysis are taken from the Vietnam Enterprise Survey (VES) and cover more than 40,000 firms for the period 2006–2013. To measure firm efficiency in this context, a standard microeconomic technical efficiency concept is applied under the umbrella of Stochastic Frontier models, where a production function is estimated and a part of the distance between the observed data and the estimated point of efficient production is assumed to be due to inefficiency. Hence, our empirical analysis aims at estimating the effects of financial development, corruption and other firm-specific and regional factors on the estimated inefficiency term.

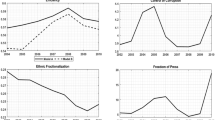

Vietnam is divided into 63 provinces, with large geographic and economic differences among the regions (see, e.g., Fig. 1 in Section 3). The air distance between the capital Hanoi and the biggest city Ho Chi Minh City is more than a thousand kilometers. Regional economic imbalances in Vietnam are substantial and the distribution of firms is particularly striking (see, e.g., the spatial distribution of per capita income in the left hand side panel of Fig. 1). As spillover effects from more dynamic regions, such as Hanoi and Ho Chi Minh City, are more likely to be felt in nearby provinces and not so much in more distant ones, we account for spatial effects by means of the geoadditive stochastic frontier analysis as proposed by Klein et al. (2020).

Our results show that, firstly, a higher level of local financial development is generally associated with a lower degree of firm efficiency in Vietnam. Given that previous studies have consistently documented a positive impact of local financial development on the growth of Vietnamese firms (Haschka et al. 2022; O’Toole and Newman 2017; Tran et al. 2020), we did not expect this result a priori. However, as the negative effect of financial development on firm efficiency could be offset by a positive contribution in raising the volume of resources employed by firms, it is theoretically not impossible that financial development could promote firm growth while exacerbating firm inefficiency. Such considerations are indeed in line with studies which report that financial development enhances technical efficiency in high-efficiency economies, but exerts a much smaller or even negative effect in less-efficient economies (Arestis et al. 2006; Rioja and Valev 2004). However, as growth driven by factor accumulation only is not sustainable (e.g., Solow 1957), the results show how important it is to eliminate potential misallocations of financial resources, for instance, by improving the efficiency of financial suppliers in their screening and monitoring activities, or by removing potential business environment bottlenecks (Haschka et al. 2022; Moretti 2014). Secondly, corruption control substantially enhances the technical efficiency of Vietnamese firms. This is in line with our expectations and much of the existing empirical evidence (Ashyrov and Poltimäe 2022; Haschka et al. 2022; Tran et al. 2020; Tromme 2016). Thirdly, local financial development and corruption control interact positively in affecting firm efficiency. In particular, the adverse effect of financial development on firm efficiency decreases with increasing levels of corruption control, whereas the efficiency-enhancing role of corruption control gets stronger with increasing levels of financial development. In sum, our results provide strong evidence that improving corruption control not only enhances firm efficiency directly, for example, by mitigating unnecessary regulatory burdens, costs, and delays, but it also offsets potential inefficiencies that arise from greater financial development.

An important concern in our estimation is that the employed geoadditive model proceeds under (i) the (restrictive) assumptions of random unobserved firm heterogeneity and (ii) exogeneity of production inputs. Violations of either assumption might potentially lead to endogeneity bias of estimation results. On the one hand, the random effects assumption might be violated if firm-specific effects are correlated with model regressors. On the other hand, if firms have some a priori information on potentially inefficient output generation, it is likely that they adjust their inputs accordingly, leading to correlation between model regressors and stochastic inefficiency (Haschka and Herwartz 2022). To address these concerns, it is worth noticing that the analysis of a large dataset (almost 100,000 observation enter the analysis) suggests modest unobserved correlations, indicating negligible estimation biases. Moreover, to address eventual endogeneity more explicitly, we re-estimate the geoadditive model by means of an endogeneity-robust copula-based estimator for stochastic frontier settings (Tran and Tsionas 2015) that allows factor inputs (i.e. labor and capital) to correlate with the composite model residuals (see also Haschka 2022a, b). Since estimated correlation levels between the composite error term and observable inputs are not larger than 3.01% and lack significance at conventional levels, we are able to fairly conclude that results reported in this paper cannot be attributed to endogeneity biases. The assumption of random effects is thus not expected to lead to significant biases due to unmodeled correlation in the geoadditive model because of the large sample size involved (Wooldridge 2010).

In Section 2, we provide a brief review of the literature on financial development, corruption and firm efficiency. Section 3 describes the Bayesian geoadditive stochastic frontier model used in the paper and discusses the summary statistics of the data. The empirical results are presented and discussed in Section 4. Section 5 concludes. Further information on Bayesian inference, calculation of marginal effects, and results of endogeneity-robust estimation are provided in the Appendices A to C.

2 Local financial development, corruption and firm efficiency: a background

2.1 Financial development and firm efficiency

A large body of theoretical and empirical literature has established that financial development is a crucial determinant of firm performance in both developing and developed countries. Studies have identified at least four channels through which a developed financial system could promote firm growth (Beck and Cull 2014). First, a developed financial sector makes it easier for new firms to enter the market, it promotes new and existing firms to engage in innovative activities, and it allows successful ones to expand (e.g., Aghion et al. 2007; Ayyagari et al. 2011). Second, by helping firms to exploit growth opportunities, financial development enables firms to reach a larger equilibrium size (e.g., Beck et al. 2005; Beck et al. 2006). Third, the level of financial development also matters for the type of asset portfolio that firms hold and for the organizational forms they choose. For instance, Demirguc-Kunt et al. (2006) document that firms are more likely to choose incorporation as an organizational form in countries with a developed financial system, as incorporated firms face fewer bottlenecks in the presence of a developed financial system and stronger legal institutions. Fourth, as large firms are less affected by financial constraints than small firms, financial development disproportionately fosters the growth of small firms, thereby allowing the economy to benefit from the economic outputs of both small and large firms (e.g., Beck and Demirguc-Kunt 2006).

While most of the aforementioned empirical studies examine the association between country-level financial development and firm performance, some studies have also investigated if within-country heterogeneities in financial development affect firm performance. For instance, Guiso et al. (2004) find that regional differences in financial development among Italian regions exert a significant impact on the growth of firms, with local financial development increasing the likelihood of entry of new firms and decreasing the rate of exit of incumbent firms. Taking the discussion to an even finer resolution, Fafchamps and Schündeln (2013) document that commune-level financial development is positively related with the performance of small and medium-sized firms in Morocco. Using a rich firm-level data from Vietnam, O’Toole and Newman (2017) report that financial development alleviates financing constraints faced by firms. In particular, they find that financing constraints are lower in provinces with a higher level of credit to the private sector and are higher in provinces where a larger proportion of finance is directed to state-owned enterprises. A recent study by Tran et al. (2020) confirms earlier findings in O’Toole and Newman (2017) that province-level financial development positively determines firm growth. Moreover, results in Tran et al. (2020) additionally reveal that the growth-promoting effect of local financial development depends negatively on the severity of corruption in the locality. Extending the study of Tran et al. (2020), Haschka et al. (2022) document that financial development interacts positively not only with corruption control but also with the overall business environment in affecting firm growth in Vietnam.

Since the focus in this paper is on the role of local financial development not in overall firm growth but in firm efficiency in particular, we now turn to review the literature that specifically examines the efficiency-enhancing role of financial development. In this respect, it is worth noting that financial development is argued to foster economic development by raising the volume as well as efficiency of investment (Levine 2005; Nourzad 2002; World Bank 1989).

The World Bank summarizes this argument by stating that “efficient financial systems help to grow partly by mobilizing additional financial resources and partly by attracting those resources to their best uses.” (World Bank 1989). In support of this argument, several papers have shown that financial development positively impacts macroeconomic efficiency, as proxied by a country’s Total Factor Productivity growth (e.g., Beck et al. 2000; Rioja and Valev 2004; Arestis et al. 2006). Moreover, as one of the few papers using the SFA methodology to examine the finance-efficiency relationship, Nourzad (2002) document that financial development generally promotes productive efficiency and the effect is larger in developed than in developing countries. While there are several studies supporting this argument at the macro-level, the literature examining if regional differences in financial development could affect technical efficiency of firms is surprisingly scant. As an exception, Moretti (2014) examines if local financial development affects firm efficiency in Italy. Assuming firm productivity as a proxy for firm efficiency and measuring it using the ratio of a firm’s real value added to the number of its employees, Moretti (2014) finds that the positive effects of greater financial depth on productivity are stronger when the socio-institutional environment, such as the duration of civil trials, is sufficiently developed. This paper closely follows Moretti (2014)’s work in examining the impact of provincial heterogeneities in financial development on the technical efficiency of firms. Unlike Moretti (2014), however, we employ a geoadditive Bayesian stochastic frontier analysis and focus on an emerging economy, Vietnam.

2.2 Corruption and firm efficiency

Although there are wide variations in its intensity and economic damage, corruption as a “sale by government officials of government property for personal gain” (Shleifer and Vishny 1993) remains to be a persistent characteristic of modern human societies. Whether corruption is beneficial or detrimental to economic growth has been intensely debated. On the one hand, the “sanders” see corruption as imposing regulatory burden, cost and delay for firms and, hence, view it as a major hindrance to economic growth. The “greasers”, on the other hand, argue that firms operating in a highly bureaucratic environment could utilize corruption to mitigate distortions that emanate from inefficient institutions. As a result, corruption could even promote economic growth.

The existing empirical evidence on the impact of corruption on economic and firm growth is also mixed. For instance, employing three worldwide firm-level surveys, Kaufmann and Wei (1999) show that paying bribes and spending time with government officials increases the cost of doing business and hence hampers firm growth. Similar results supporting the “sanders” are reported in Ehrlich and Lui (1999) and Clarke (2011). Among the country-specific studies, Fisman and Svensson (2007) examine the effects of bribe payments on the growth of firms in Uganda. They find that corruption retards firm growth in Uganda to the extent that its effect is estimated to be three times as detrimental to growth as that of taxation. Moreover, existing studies on the impact of corruption on the performance of Vietnamese firms document overwhelmingly negative effects of corruption on firm growth (e.g., Rand and Tarp 2012; Tran et al. 2020; Tromme 2016).

However, there are also studies which support the view that corruption “greases the wheels” by functioning as a means of overcoming costly bureaucratic delays. For instance, relating the impact of corruption on economic growth to the level of institutional development, Méon and Weill (2010) document that corruption is less detrimental to growth in weak institutional frameworks, and the effect could even turn positive in countries with extremely ineffective institutions. Similarly, Wang and You (2012) document that a high level of corruption has promoted the growth of Chinese firms.

While numerous studies have examined the impact of corruption on several dimensions of firm growth and performance, a few studies have also explicitly focused on corruption’s effect on firm efficiency. It is worth noting that most of the arguments on the positive or negative roles of corruption on firm performance or firm growth are directly applicable to firm efficiency. For instance, on the one hand, the “sanders” may claim that corruption hampers firm efficiency by allowing inefficient firms to survive, and by weakening the competitive pressures that are crucial to efficiency (Hanousek et al. 2019). Corruption could also increase a firm’s inefficiency by diverting managers’ efforts from efficiently allocating the available input volume to increasing input requirements (Dal Bó and Rossi 2007). On the other hand, the “greasers” could also argue that corruption is good for firm efficiency because it provides a means of overcoming institutional deficiencies that might otherwise impede innovation and the introduction of new production processes or technologies.

Empirically, Hanousek et al. (2019) examine if operating in a corrupt environment affects firm efficiency. Using a large dataset of private firms across 14 Central and Eastern European countries over the period 2000 to 2013, the authors document that a corrupt environment has an adverse effect on firm efficiency. Similar negative evidence can also be found in Dal Bó and Rossi (2007) who studied about 80 electric utilities in Latin America for the period 1994-2001. A recent work by Ashyrov and Poltimäe (2022) examines the impact of corruption on the efficiency of firms in the US, Europe and Japan for the period 2002-2010, and shows that corruption significantly hinders overall firm efficiency as well as R&D expenditures and the number of registered patents. Our paper aims to contribute to this line of literature by examining the impact of corruption on the efficiency of firms in Vietnam—a country that has registered remarkable economic growth over the past three decades despite stubbornly high levels of corruption.

2.3 Financial development, corruption and firm efficiency

While a large number of studies continue to investigate the separate effects of financial development and corruption on economic (and firm) growth, a narrow strand of literature has developed over the past few years examining if the two factors could interact in affecting economic (and firm) growth. Based on a detailed review of theoretical predictions from existing studies, Tran et al. (2020) categorize potential avenues of interaction between financial development and corruption into two: The property rights channel and the liquidity channel. Building upon Tran et al. (2020), Haschka et al. (2022) consider the overall business environment—and not just corruption—and add the efficient bureaucracy channel as a third potential avenue through which the business environment could interact with financial development in affecting firm growth. In the following, we discuss which of the three transmission channels is still relevant given that our focus is on firm efficiency rather than the overall firm growth.

The property rights channel: This view is built on the premise that rampant corruption weakens the enforcement of property rights (Acemoglu and Verdier 1998), which in turn discourages investors from fully exploiting the opportunities offered by a developed financial system (Johnson et al. 2002). Hence, this channel predicts that the effect of finance on growth depends negatively on the level of corruption. Corruption could also attenuate the growth-promoting effect of financial development if it affects the banking sector directly to the extent that financial resources are diverted to wasteful projects (Ghirmay 2004; Arcand et al. 2015). However, since this channel is about how firms take advantage of opportunities offered by financial suppliers, it appears to be relevant to factor accumulation and not allocative efficiency as a source of firm growth. Hence, we do not consider this a likely mechanism through which corruption and financial development interact to affect firm efficiency.

The efficient bureaucracy channel: According to Haschka et al. (2022), this channel underscores that business initiatives implemented as a result of improved financial development may not yield the expected benefits if corruption creates regulatory burdens, costs, and delays that impede their efficient implementation. Instead, access to finance could lead to the undesirable consequence of firms accumulating debt. Conversely, while corruption control may improve firm efficiency, it no longer does so in the absence of financial constraints (e.g., Brown et al. 2005). Hence, it is plausible that local financial development and corruption control could interact positively in affecting firm efficiency.

The liquidity channel: Ahlin and Pang (2008) stress the fact that corruption may create a severe liquidity burden for firms if they have to pay a substantial amount of their liquidity reserves as a bribe for bureaucrats. This burden would not get lighter even if firms can pay the bribe after the completion of the project as the timing of the payment is often uncertain. As a result, corruption could curtail firm growth by forcing them to withhold critical internal finance as an insurance against a credible liquidity risk. Accordingly, the positive effect of financial development on firm growth would be felt most when the level of corruption is severe. Conversely, the negative effect of corruption on firm performance gets worse with the decrease in the level of financial development. However, similar to the property rights channel, this channel is mostly about the availability of resources rather than the efficiency of resource allocation. Hence, we believe that this channel is not relevant as a mechanism through which financial development and corruption interact in their effects on firm efficiency.

In sum, the efficient bureaucracy channel seems to be the only plausible mechanism that makes the effect of financial development on firm efficiency conditional on the level of corruption and vice versa. In this study we test if such a dependence is supported by empirical evidence based on data from Vietnamese firms.

3 Methodology and data

3.1 The Bayesian geoadditive stochastic frontier model

3.1.1 Model outline

SFA approaches have gained increasing importance in modeling the production of goods or the provision of services. The model that we use for assessing firm efficiency in Vietnam has been proposed by Klein et al. (2020), and successfully applied in Haschka et al. (2020) and Haschka and Herwartz (2020). The geoadditive model is flexible, since it allows conditioning on (latent) spatial patterns for both the production frontier and scaled deviations from efficiency. A limitation of this approach is, however, that the model outline proceeds under strict exogeneity assumptions. Therefore, practical work with this model requires performing sensitivity checks to ensure that the results of the SFA analysis are not driven by endogeneity biases. While we come back to the scope of endogeneity biases below in the robustness Section 4.4.1, we refer the reader to Klein et al. (2020) for a detailed discussion of the employed SFA model and its positioning within the SFA literature.

Let i = 1, 2, …, N and t = 1, 2, …, Ti, respectively, indicate observations for firms and time instances within an (unbalanced) data panel. Each firm i is characterized by its location in province j, j = 1, 2, …, J, j = j(i). In log-linearized form, the SFA model reads as:

In (1), yit is a (log) measure of firm performance. Individual-specific effects αi account for unobserved heterogeneity and are modeled as random effects, i.e., exhibit a normal distribution with mean zero and constant variance by assumption. The vector xit comprises an intercept and covariate information (typically explicit determinants of firm performance such as labor and capital input). While covariate information in xit (and similarly in zit in (3)) varies across both panel dimensions, some characteristics apply to all firms located in a specific province j (see, e.g., the explicit representation in (6) below), and thereby contribute to observational heterogeneity across provinces. The parameter ψj, j = 1, . . . , J, in (1) capture spatial effects of firm performance that are common to all firms located in province j, but are unobserved (e.g., local subsidies). As outlined in Klein et al. (2020), these effects account for patterns of neighborhood dependence in the form of a Markov random field which serves as a surrogate for unobserved spatial effects.

Composite regression disturbances in (1) read as εit = vit − uit, where vit is a normally distributed idiosyncratic noise term with mean zero and constant variance \({\sigma }_{v}^{2}\). The formalization of the non-negative inefficiency component allows for a dependence on covariate variation by means of scaling techniques, \({u}_{it}={u}_{it}^{* }{h}_{it}\) (see, e.g., Battese and Coelli 1992; Kumbhakar 1988; Wang and Ho 2010; Wang and Schmidt 2002). While \({u}_{it}^{* }\) in (4) exhibits a truncated normal distribution by assumption, the scaling by means of hit allows for time-varying and firm specific profiles of inefficiency. As alternatives, the half-normal, exponential, or gamma distribution have been used in the SFA literature (Kumbhakar and Lovell 2000). While the specification of a one-parameter inefficiency distribution such as the half-normal or exponential might be too restrictive, the two-parameter truncated normal distribution is commonly seen as sufficiently flexible to capture important features of the inefficiency distributions (Kumbhakar et al. 2020). The vector zit comprises covariate information that relates to the efficiency of firm performance.Footnote 4 Contributing to the scaling of inefficiency, the structured spatial effects θj exhibit the same properties as ψj, i.e., inefficiencies of firm performance are subject to (unobserved) spatial effects. Taken together, the scaling function hit allows a structured view on inefficiency in response to observed covariate information and unobserved spatial contributions.

Two remarks are worth making on model flexibility and interpretation, respectively. First, it is evident from the socioeconomic panel literature that the inclusion of random effects αi in (1) risks biased estimation of the model if the right-hand observables correlate with the latent effects. In the present case, moreover, the random effect assumption is of identifying nature, since time-invariant spatial contributions in both the production and scaling function cannot be retrieved within a fixed-effect panel data model. In this regard, the geoadditive spatial approach explains otherwise unobservable heterogeneity to some extent. Intuitively, this particular merit seems to materialize most favorably if a data-based model selection detects spatial correlation in both model components, the production function and the scaling function. We will briefly comment on unmodelled correlation between random effects αi below in the robustness Section 4.3.1. Second, while the coefficient vector β in (1) denotes the marginal effects of the regressors in xit on yit, the model parameters in hit indicate qualitative (i.e., directional) effects. We outline how the marginal effects can be calculated in Appendix B. In case that zit in (3) includes an interaction term, a straightforward calculation of the marginal effects is more complicated (see, Appendix B and Haschka et al. 2022).

3.1.2 Model implementation

We follow the related literature and specify the production function with explicit inputs and time dummy variabels, while all the other covariates are included as scaling factors for inefficiency (Haschka and Herwartz 2020). Owing to the large sample size of almost 100,000 observations (see Section 3.2), we consider both functional forms of covariates as given and focus model selection issues on the specification of the latent spatial profiles within the geoadditive model (i.e., ψj in (1) and θj in (3)). To unravel the most suitable neighborhood structures for shaping the level of (log) production and scaled inefficiencies, we follow suggestions of Klein et al. (2020) and use the Deviance Information Criterion (DIC, Spiegelhalter et al. 2003). Since the SFA model contains latent variables, i.e., unobserved spatial contributions and inefficiency, we also use the DIC3 criterion (Celeux et al. 2006) as an additional guide for model selection.

We approximate firm performance alternatively by means of (i) the log of sales as in Prabowo and Cabanda (2011), and (ii) the log of sales per worker as in Fafchamps and Schündeln (2013) (see also Diaz and Sánchez 2008; Driffield and Munday 2001, for related studies using value added).

The empirical counterpart of the production function in (1) formalizes a Cobb-Douglas technology (with factor inputs lagged by one year). Accordingly, the vector xit includes the following variables: One year lags of the natural logarithm of labor and capital, i.e., \(\ln (labo{r}_{it})\,{{\mbox{and}}}\,\ln (capita{l}_{it})\), and time dummy variables for the years 2007 to 2013 to account for technological change. Specifically, labor denotes the wage bill, and capital is the value of physical assets.Footnote 5 For the empirical counterpart of the inefficiency scaling function in (3) the vector zit comprises a set of twelve firm and province specific variables, i.e.

In (6), private is a dummy variable widely used in the literature on firm efficiency and specially relevant for the context of Vietnam, where a large share of firms are run by the government (Haschka et al. 2022). With similar motivations, heterogeneities in firm performance might emerge from the covariates exported or foreign, which indicate if firms are exporting or fully owned by foreigners, respectively. Firm size (size) is common to explain inefficiency. The inclusion of population density (pop_dens) and squared effects follows the literature about agglomeration effects (e.g. Driffield and Munday 2001; Otsuka et al. 2010; Tsukamoto 2019). Per capita GDP (GDP_pc) accounts for the overall degree of development achieved within a particular province. The inclusion of time dummies is standard and preferred over a linear time trend due to the economic crisis in the middle of the sample period.

The effects of variables measuring the degree of financial development and the local level of corruption are at the core interest of this study. In (6)banks_pc and f_banks_pc denote, respectively, the number of banks and foreign banks per 10,000 inhabitants to indicate the level of financial development as in Fafchamps and Schündeln (2013). To assess the prevalence of corruption, we take an indirect perspective and regard the PCI index for informal charges (lowcorrupt). To interpret this indicator (or its effects) it is important to recall that higher values indicate less informal charges, and, hence, lower levels of corruption (i.e. better business conditions).

The estimation of the geoadditve SFA model builds on Bayesian techniques. All estimations are done using the software BayesX (Belitz et al. 2015). Details on the prior distributions for linear and spatial effects are given in Appendix A, while a detailed description of the Markov chain Monte Carlo (MCMC) sampling algorithm is given in Klein et al. (2020). By means of MCMC techniques, we draw 120,000 samples from the posterior distributions, discard the first 20,000 as ‘burn-in’, and retain each 100th draw to guard against sequential correlation. Although Bayesian inference using Monte Carlo integration would indeed be valid if the samples exhibit serial correlation since the law of large numbers will generally apply, burn-in and thinning ensures that we end up with samples that are close to iid. Convergence of the Markov chains is assessed by means of eyeball inspections, and explicit (average) Gelman-Rubin statistics (Gelman and Rubin 1992). As it turned out Gelman-Rubin convergence statistics were generally below a critical value of 1.3. Hence, we conclude that Markov chains converged to stationary distributions and hence samples can be considered as valid draws from the posterior. Significance can be assessed by constructing posterior credible intervals. A coefficient is considered to be significant at the α% level if (1 − α)% of its posterior samples do not include zero.

3.2 Data

The main data source for this paper is the Vietnam Enterprise Survey (VES), a firm-level dataset from the Ministry of Planning and Investment of Vietnam (Vietnam Ministry of Planning & Investment 2013). This data comes from a survey conducted annually from 2000 to 2015 and it is in the responsibility of the firms to respond to the survey questionnaire. Because of the high rates of response, the sampling bias is reduced. The firms answer questions about own performance and general characteristics, e.g. location, sales, size, age of employees, R&D expenditure, energy consumption, etc. In total the complete survey gives around 900 different indicators. In terms of firm coverage, the VES provides information for more than 100,000 firms in 2005, and for more than 300,000 firms in 2012 and 2013, which amounts to almost 90% of the total number of enterprises in Vietnam.Footnote 6

While all the firm-level data for this paper comes from the VES, the provincial data, such as population, area, population density, and income per capita are drawn from the Statistical Yearbooks of the General Statistics Office of Vietnam (GSO 2005, 2006, 2007b, 2008, 2009, 2010, 2011, 2012b, 2013). The measure used to proxy corruption comes from the Vietnam’s Provincial Competitiveness Index, a collaboration project between the Vietnam Chamber of Commerce and Industry (VCCI) and the United States Agency for International Development (USAID), (VVCI and USAID 2007).

The measure used to proxy corruption comes from the Vietnam’s Provincial Competitiveness Index, a collaboration project between the Vietnam Chamber of Commerce and Industry (VCCI) and the United States Agency for International Development (USAID), (VVCI and USAID 2007). This index summarizes information from ten subindices. From these subindices we use for our analysis the subindex ‘prevalence of informal charges’ that closely reflects corruption and is not subject to other (infra)structural problems of the province.

The measures of financial development are derived again from the Enterprise Survey. We counted the number of banks and financial institutions that responded to the VES questionnaire per province and from that created a measure of the number of financial institutions per capita and per hectare for the respective provinces. A similar aggregation procedure has been used to generate the number of foreign-owned firms, and to compute the total capital of the financial institutions, based on the VES data.

The geographical information, neighborhood map and shapefile are taken from the OCHA’s regional office for Asia and the Pacific, year 2014. The description with all the variables used, sources and measurement units is presented in Table 1. To provide a flavor of the heterogeneous distribution of our core variabels of interest, the medium and right hand side panels of Fig. 1 depict the spatial distribution of corruption control and financial development in 2012, respectively. As two general impressions, we have (i) that corruptions seems to be higher in Northern provinces than in Southern provinces, and (ii) financial development is most advanced in or around the most important metropolitan areas, i.e. Ho Chi Minh City and Hanoi.

As already mentioned the variables were chosen mostly based on data availability, and trying to minimize losses in the number of observations. To be able to keep the panel structure with every firm being interviewed at least two times in the periods as suggested by (Wang and Ho 2010), the observations for 8 provinces are missing and 55 provinces are left. The final number of observations is 96 469, with almost 29 000 distinct firms in all manufacturing sectors.

In Table 1 the description of the variables used in the models and their sources are presented, while descriptive statistics for the most relevant variables are shown in Table 2.

Despite the extensive coverage of the VES dataset, it is important to note that it only covers firms that are (formally registered as) operational in that specific year. Moreover, several firms have been dropped from our sample because of missing data for our dependent variables and explanatory variables of interest. Even then, firms in our sample show substantial movement into and out of our sample (and potentially entry and exit of the market). In particular, out of a total of 96,496 observations, which comprises almost 29,000 unique firms, only 370 of them (1.3%) have been present in all years of the survey under consideration (2006-2013). Almost 28,000 (95%) firms could be considered as new entrants in the sense that they were not covered by the sample in 2006 but nonetheless have appeared twice between 2007 and 2013. Finally, the remaining 630 are firms that were present in 2006 but exited at some point. Therefore, the majority of the firms covered in this study have been entering and /or exiting the sample (and the formal market) during the period under study. The presence of reporting and non-reporting patterns may introduce the econometric challenge of sample selection bias (Heckman 1979). However, we choose not to explicitly model such considerations for two reasons. First, given the large number of market (and survey or sample) entries and exits, it is unlikely that a significant portion of these decisions are related to firm efficiency and hence would contribute to systematic sampling bias. Second, within the SFA model approach, addressing sample selection issues would prevent the exploration of important geographical and firm performance characteristics, which are the focus of the Bayesian model approach proposed by Klein et al. (2020).

4 Financial development, corruption control and firm efficiency in Vietnam: empirical evidence

Contributing to the literature reviewed in Section 2, the empirical results provided in this section shed light on the determinants of firm efficiency in Vietnam. Conditional on standard approximations of socio-economic factors and spatial neighborhood patterns, we discuss, in particular, the effects of province-level financial development and corruption control on the efficiency of Vietnamese firms. Moreover, we address the important issue whether financial development and corruption control are substitutes or complements in their impact on the technical efficiency of firms, using total sales and sales per worker as outcome variables. We first present model diagnostics that show whether our model and estimation strategy can provide reliable empirical inference. We also discuss if control variables exert directional effects that align with a-priori expectations. Subsequently, we discuss our main empirical results on the effects of financial development, corruption control and their interaction on firm efficiency. Finally, we check the robustness of our results by using alternative measures of financial development, firm output and corruption control.Footnote 7

4.1 Model diagnostics

Table 3 documents our baseline results obtained from estimating equation (1) using standardized log sales as an output variable and the number of financial suppliers per 1000 people as a measure of local financial development. Results from four alternative models are reported, depending on the specific spatial structures considered in each specification: (1) structured spatial effect in the scaling inefficiency component (θj); (2) in the production function (ψj); (3) both θj and ψj; (4) no inclusion of spatial effects. According to the selection criteria DIC (Spiegelhalter et al. 2003) and DIC3 (Celeux et al. 2006), the model with structured spatial effects in both the scaling factor and the production function is the most preferred one (with minimum criterion values). The signal-to-noise ratio λ = σu/σv quantifies the variation of inefficiency in comparison with variation due to idiosyncratic noise, while \(\gamma ={\sigma }_{u}^{2}/({\sigma }_{v}^{2}+{\sigma }_{u}^{2})\) indicates the proportion of total variation that is caused by inefficiency. For models explaining the levels of sales and sales per worker (i.e. productivity) variance shares are about 30% and 80%, respectively.Footnote 8 Accordingly, the SFA model provides valuable structural insights into the unexplained part of firm performance in Vietnam.

Another important result in Table 3 is that most parameter estimates consistently carry the expected signs across all the specifications. In particular, private ownership of firms (as opposed to state ownership), participation in export activities, and firm size are positively related to efficiency. Moreover, the number of foreign bank branches per capita is associated with lower efficiency levels. As indicated by the negative coefficient of provincial GDP per capita, firms located in less deprived regions are more efficient, which likely reflects infrastructural advantages. The only effect that differs across specifications is that of agglomeration measures. Conditional on models with spatial effects columns (1)-(3), a high population density has increasingly negative effects on firm efficiency, whereas decreasing effects obtain for the model without spatial effects (4). The latter result on population density could be seen to reflect the confounding effect of spatial patterns, thus underscoring the importance of accounting for spherical correlations. Using the estimator proposed by Jondrow et al. (1982), we further assess estimated efficiency scores among the four models as \(\exp \{-{\hat{u}}_{it}\}\), where \({\hat{u}}_{it}\) denotes estimated inefficiency in (1).Footnote 9 From unreported stylized histograms we find that the unconditional distributions of inefficiency estimates are of quite similar shape. We discuss an explicit landscape of estimated inefficiencies for the most preferable model in Section 4.4 below, where we consider the (conditional) spatial pattern as most convenient to isolate marginal effects of observable covariates on the (in)efficiency of service provision in Vietnamese provinces.

4.2 Baseline results

We now move on to discuss the effects on firm efficiency of our two variables of interest: local financial development and corruption control. One consistent result documented in Table 3 is that financial development (measured by the number of financial suppliers per capita) and low corruption interact negatively in affecting firm inefficiency. Since the coefficients on financial development and low corruption indicate the effects of each variable on firm inefficiency in the empirically irrelevant scenario in which the moderating variable is set to zero, we instead discuss the marginal effects of each variable calculated at the 25th, 50th, and 75th percentiles of the distribution of the moderating variable.

Marginal effect results documented in the second panel of Table 3 reveal two main effects. First, financial development significantly weakens firm efficiency across all the three quartiles of the low corruption distribution. This contrasts with the main thesis of the financial growth literature, which holds that financial development drives economic growth not only by increasing capital accumulation but also, or even primarily, by improving the efficiency with which these resources are allocated (e.g., Beck et al. 2000; King and Levine 1993; Levine 2005). However, these results are in line with studies which report that financial development enhances technical efficiency in high-efficiency economies, but exerts a much smaller or even negative effect in less-efficient economies (Arestis et al. 2006; Rioja and Valev 2004). Second, the efficiency-weakening effect of financial development decreases with decreasing levels of corruption (i.e., with increasing levels of low corruption). This is likely due to the fact that a low corruption environment helps to reduce the likelihood that financial resources are diverted to unproductive or wasteful projects (Arcand et al. 2015; Ghirmay 2004; Tran et al. 2020).

The third panel of Table 3 displays marginal effects of low corruption levels on firm (in)efficiency for levels of financial development at the 25th, 50th and 75th percentile of its empirical distribution. Again, two main patterns emerge from these results. First, low corruption is positively related to firm efficiency across the three levels of financial development. As argued by Shleifer and Vishny (1993), corruption exacerbates a firm’s smooth functioning and causes additional costs. This result is also in line with existing evidence on the detrimental impact of corruption on firm growth in Vietnam (e.g., Haschka et al. 2022; Tran et al. 2020; Tromme 2016). Second, the inefficiency-mitigating role of low corruption gets stronger as the level of financial development increases. This implies that, consistent with the efficient bureaucracy channel outlined in Section 2, low corruption helps to offset the deterioration of firm efficiency caused by local financial development. Therefore, these findings highlight the direct and indirect ways in which corruption control promotes firm efficiency in Vietnam: Directly, by mitigating unnecessary regulatory burdens, costs, and delays; and indirectly, through its role in attenuating inefficiencies that are linked to financial development.

4.3 Spatial structure

As discussed previously, both DIC and DIC3 suggest the model with structured spatial effects in the scalling inefficiency component and the production function. From the comparison of effect estimates retrieved from the preferred spatial model (see columns (3) of Tables 3, 4, and 5), on the one hand, and a stylized SFA model that excludes spatial characteristics (columns (4)), we obtain that spatial confounders are likely to bias effect estimates within the most restrictive model specification considered. For instance, the efficiency-enhancing effect of corruption control that we detect for both models explaining log sales as a measure of firm performance is markedly smaller or even vanishes in the restrictive non-spatial model. Figure 2 shows the structured spatial effects implied by the preferred specification. Most favorable factor productivities obtain for the lead municipalities (Ho Chi Minh City and Hanoi), while, in particular, Northern regions suffer from lowest firm efficiency. Interestingly, efficiency-enhancing spatial patterns are specific to southern Vietnam, particularly Ho Chi Minh City and the Mekong River Delta.

Going beyond issues of point estimation, the MCMC assessment of the spatial model allows to characterize important distributional features of the parameters or effects of interest. For instance, the present analysis might be used to get a sharpened understanding of alternative levels of corruption control on the inefficiency of service provision at the provincial level. Along these lines, Fig. 3 displays posterior quartiles of marginal effects of corruption control on inefficiency evaluated at observation-specific values of the remaining explanatory variables.Footnote 10 First and unsurprisingly, the effects become slightly weaker for higher quartiles, indicating mitigating effects of increasing corruption controls. Differences between alternative quantiles (i.e. panels (a)-(c)) are generally minor and, interestingly, most pronounced in the districts in close neighborhoods of the leading agglomerations, i.e., Hanoi and Ho Chi Minh City. Overall, the posteriori distributions of marginal effects are subject to minor variations. Hence, at the province level the effects of corruption control are accurately estimated. With regard to spatial heterogeneity some noticeable patterns stand out. First, corruption control leads to the highest expected efficiency gains in Hanoi and Ho Chi Minh City. Further, it can be seen that the surrounding regions are also characterized by higher efficiency gains, although the effects are less pronounced. On the contrary, increasing corruption control has no visible effect on firm efficiency in more distant regions in the North- and Southwest. The stronger effects of corruption control in the leading municipalities could be seen to mirror agglomeration effects and respective cost-benefit considerations. At the same time, it is interesting to note that weakest effects show up in poorest regions (in the Northwest) as well as in districts that are more developed (Southwest) and less subject to the treats of economic poverty. Overall, the pronounced spatial profiles of the effects of corruption control might call for a corresponding analysis with sectoral or time dependent resolution that can be straightforwardly performed conditional on the posterior samples.

4.4 Robustness analysis

In this subsection, we examine the robustness of our baseline results regarding deviations from two (crucial) model assumptions and the choice of covariates. Our first concern is that the geoadditive model outline in (1) proceeds under the (restrictive) assumptions of (i) random unobserved firm heterogeneity (αi) and (ii) exogeneity of production inputs, potentially leading to biased estimation results. Against this background, our first robustness check addresses potential endogeneity within the geoadditive SFA and unmodelled correlation between firm-specific effects and model regressors. A second source of concern is that our baseline results are obtained by using (the log of) sales as the only measure of firm performance, and the results might depend on our choice of this specific indicator for firm performance. Hence, as a second group of robustness checks, we employ alternative measures of firm performance as well as alternative indicators of local financial development and corruption control.

4.4.1 Endogeneity bias and random effects

If there exists a correlation between the composite residuals εit and the observable production input factors in (1), ignoring this correlation could lead to endogeneity biases in the Bayesian evaluation of the geoadditive SFA model. As outlined in Section 3.1.2, the SFA is conditional on lagged input variables to better cope with time interdependencies in firm-level production processes and rule out patterns of reverse causality. However, if firms have some (a-priori) knowledge on eventually inefficient output generation, it seems likely that the choice of inputs is adjusted accordingly (Haschka and Herwartz 2022). If this is unobserved by the analyst, estimation results might be misleading because of endogeneity arising from correlation between \(\ln (labo{r}_{it-1})\), \(\ln (capita{l}_{it-1})\) and εit in (1). Endogeneity bias might also occur when firms respond to demand or supply shocks (that are unobserved to the analyst) by adjusting the number of employees (Ehrenfried and Holzner 2019). For instance, global health shocks, energy crises, or political tensions in East Asia might trigger unexpected hiring or investment decisions (Reeb et al. 2012). astly, the presence of omitted variables, such as subsidies that are large enough to have a significant impact on firm growth, can also give rise to endogeneity bias.

Capturing such correlation profiles by means of copulas in a semiparametric manner, Tran and Tsionas (2015) have suggested an endogeneity-robust approach to SFA modeling that does not require any instrumental information. This approach has been successfully adopted in Bayesian geoadditive panel SFA modeling by Haschka and Herwartz (2020). As in Haschka and Herwartz (2020), we first estimate T cross-sectional SFA models without inefficiency scaling with observations for each year using the estimator by Tran and Tsionas (2015) that allows both factor inputs (i.e., labor and capital) to correlate with the composite model residuals. Within this approach, the results are robust to endogeneity in the sense that these are not biased if factor inputs are correlated with idiosyncratic noise or inefficiency (Haschka 2023). We next average these T cross-sectional estimates and use (informative) normal priors to center the coefficients attached to labor and capital in the geoadditive panel SFA model around these averages. A detailed outline of the approach is given in Appendix C. In addition, variance shrinking is employed to ensure that the coefficient estimates in the panel model do not drift because of endogeneity.

Respective estimation results are provided in Appendix C in full analogy to the benchmark results shown in Table 3. In particular, it is noteworthy that, for the preferred and most flexible model specification, estimation results in Appendix C are not statistically different from benchmark results documented in Table 3.Footnote 11 As a particular diagnostic result, the copula-based estimator also provides estimates of the correlation between the composite error and observable inputs. As it turns out, these correlations are not larger than 3.01% and lack significance at conventional levels if spatial effects are present in both the production and the scaling function.Footnote 12 Therefore, we can conclude from these robustness checks that our baseline results are hardly affected by endogeneity biases.

In panel data analysis, the Hausman test (Hausman 1978) has become a common diagnostic tool to distinguish random-effect from fixed-effect model specifications. In the present context, random effects are crucial for the spatial structuring of firm performance and we are not aware of an empirical strategy to implement a fixed effect model as a necessary ingredient of a Hausman-type model diagnostic for the geoadditive SFA. Nevertheless, one conceptual argument supports the use of random effects in the present context. With a focus on mean-squared error loss, Clark and Linzer (2015) underscore that potential losses of unbiased (but largely uncertain) estimation might overweight the adverse outcomes from a (slightly) biased model evaluation. Our analysis of samples that comprise almost 100,000 observations can be expected to yield fairly modest unobserved correlations between firm effects that would give rise to a ‘statistically’ significant Hausman test without signaling the potential for an ‘economically’ sizeable bias. Unsurprisingly, the Hausman test for a stylized (i.e. non-spatial, non-SFA) empirical production model is significant at conventional levels. From this outcome and the bias-uncertainty tradeoff, we conclude that our assumption of random effects within the geoadditive model does not entail significant estimation biases due to unmodelled correlation.

4.4.2 Banks per hectare as a measure of financial development

An alternative means of measuring financial outreach is to divide the total number of financial suppliers in a province by the total area of the province. While the number of banks per capita as a measure of financial development is meant to compensate for congestion—i.e. the banking staff and structure may not fit well with the number of people and, hence, access to credit and other banking services might be more complicated—banks per hectare tries to account for the fact that transaction costs might be lower if there are more bank branches in a given area (Fafchamps and Schündeln 2013).

Table 4 presents results based on the same spatial structures as Table 3, but using banks per hectare and foreign banks per hectare as financial development measures. The results are overall consistent with those documented in Table 3. In particular, financial development as proxied by banks per hectare increases firm inefficiency while low corruption decreases it. Moreover, the two factors interact negatively in affecting firm efficiency. The marginal effect estimates are also consistent with those reported in Table 3. The positive effect of financial development on firm inefficiency decreases as corruption control increases, while the negative effect of corruption control on firm inefficiency increases with increasing financial development. Hence, our results remain qualitatively the same regardless of whether local financial development is measured by the number of banks per capita or per hectare. In the case of Vietnam, however, the number of banks per capita may be preferable to the number of banks per hectare as a measure of financial development because Vietnamese provinces are quite small, with an average size of 5,253 km2. As a result, from now on we will rely on estimates using banks per capita.

4.4.3 Sales per worker as a measure of output

Output per worker is a widely used measure of productivity in the literature, both in the growth literature as well as in the micro-level studies, including the SFA literature (e.g., Fafchamps and Schündeln 2013; Nourzad 2002). The main point of dividing output by the number of workers is to control for scale, approximating it to a productivity measure. Results obtained using sales per capita instead of total sales as an output variable (while measuring financial development by the number of banks per capita) are documented in Table 5.Footnote 13 Once again the preferred spatial specification includes structured effects in the inefficiency component and the production function (column (3)). As in Tables 3 and 4, results documented 5 also show that unlike corruption control, financial development is generally not enhancing firm efficiency. Moreover, financial development and corruption control interact negatively in affecting firm efficiency, i.e., the positive effect of corruption control on firm efficiency gets stronger with the level of financial development, and the negative effect of financial development gets weaker with increasing corruption control.

4.4.4 An alternative measure of corruption control

So far, we have been measuring corruption control using ’informal charges’, which is drawn from the Vietnam Provincial Competitiveness Index. Informal charges is in turn made up of four sub-indices: (1) regularly payment of informal charges, (2) payment of more than 10% of income for informal charges, (3) the prevalence of harassment, and (4) receipt of services after paying informal charges. However, as the fourth sub-index has a markedly weak correlation with the first three sub-indices, some researchers such as Tran et al. (2020) and Haschka et al. (2022), prefer to exclude this sub-index and use the mean of the first three sub-indices as an alternative, ‘refined’ measure of informal charges. Hence, as one robustness check of our baseline results, we re-estimate the results in Table 3 using this refined alternative measure of corruption control. The corresponding results are documented in Table 6 and are qualitatively similar to our baseline results shown in Table 3. There are two notable difference, however. First, the marginal effects of corruption control at a given level of financial development are larger using the ‘refined’ informal charges index (Table 6) than the original informal charges index (Table 3). Second, the interaction effect between corruption control and financial development is also of larger magnitude with the refined index of informal charges to the extent that the effect of local financial development on firm efficiency could turn positive when corruption control is high at the 75th percentile of its distribution. Therefore, this robustness check strongly reinforces our findings from the baseline results that are obtained using the original informal charges index.

5 Conclusion

In this study, we adopt a geoadditive Bayesian stochastic frontier model (Klein et al. 2020) to examine the impact of local financial development, corruption control and their interaction on firm efficiency using panel data of more than 40,000 Vietnamese firms during the period 2006–2013. We obtained three notable results. First, contrary to our initial expectations, higher levels of local financial development are generally associated with lower levels of firm efficiency. Second, corruption control is positively related to firm efficiency, which is consistent with much of the existing empirical evidence for Vietnam and other countries. Third, local financial development and corruption control interact positively in affecting firm efficiency. In other words, corruption control attenuates the unexpected adverse effect of financial development on firm efficiency that we found as our first result. Conversely, corruption control plays a larger efficiency-enhancing role in provinces with higher levels of financial development, apparently because it offsets inefficiencies that are linked to better access to finance.

Since previous studies have well documented the positive role of local financial development on firm growth in Vietnam (Haschka et al. 2022; O’Toole and Newman 2017; Tran et al. 2020, e.g.,), our findings on the negative association between financial development and firm efficiency imply that factor accumulation—and not efficiency-enhancement—is the main channel through which finance is promoting firm growth in Vietnam. This finding is consistent with studies which report that financial development enhances technical efficiency in high-efficiency economies, but exerts a much smaller or even negative effect in less-efficient economies (Arestis et al. 2006; Rioja and Valev 2004). However, as factor accumulation as a source of growth is the less sustainable one and results in large dead weight losses, policymakers should design policies that make financial development to contribute to firm efficiency. This can be done, for instance, by improving the efficiency of financial suppliers in their screening and monitoring activities, or by removing unnecessary business environment bottlenecks (Haschka et al. 2022). Our results on corruption control and on the significant interaction between financial development and corruption control provide strong evidence that improving corruption control not only enhances firm efficiency directly, for example, by mitigating unnecessary regulatory burdens, costs, and delays, but it also offsets potential inefficiencies that arise from greater financial development.

This study also suggests that further research could explore mechanisms that enable the financial sector to contribute to firm growth, not only by providing more finance to firms, but also by increasing their efficiency. For example, this could depend directly on the efficiency of financial institutions themselves, the amount of credit they provide, and the proportion of a firm’s total investment that is covered by debt (which affects the degree of influence that lenders could have on firm efficiency) or the overall business environment. Empirically investigating the most effective mechanism is a topic of immediate interest for future research.

Notes

By the late 1990s, when the first Establishment Census of Vietnam was released, and Vietnam had already re-established relations with the US and China, more than 30,000 firms were created in the country (Library of Congress - Federal Research Division 2005). In 2002, there were more than 2.7 million business establishments in the country, growing to 3.9 million in 2007 and 4.9 million in 2012 (GSO 2007a, 2012a).

As a result of the Doi Moi reforms that started in the 1980s, the Vietnamese financial sector has grown steadily and has reached a level that is considered to be large for a lower middle-income country, with total assets of nearly 200 percent of GDP at the end of 2011 (World Bank 2014).

Vietnam has a central committee to fight corruption, and has signed an anti-corruption law in 2005 and ratified the UN Convention Against Corruption in 2009. Despite these efforts, the country still ranks 117th among 180 countries in the Corruption Perception Index of 2018 (Transparency International 2019), ten positions worse than the year before.

To distinguish the structural inefficiency determinants in zit from the variance \({\sigma }_{u}^{2}\), zit does not contain an intercept.

As in Pross et al. (2018), the measures of (log) input and output are standardized to have mean zero and unit variance to facilitate the comparison of their relative importance.

Although Vietnam is the only emerging economy in Southeast Asia that did not fall into recession in 2009 as a result of the global crisis, its economy was still affected in the sense that the annual GDP growth rate slowed from 8.5% in 2007 to 6.3% in 2008, then to 5.3% in 2009, before recovering to 6.5% in 2010 (Cling et al. 2010). We believe that these muted effects of the global financial crisis are adequately captured by the year dummies we include in the models and therefore do not affect the main results of the paper.

The Bayesian stochastic frontier model under consideration incorporates distinct prior distributions, namely the truncated-normal distribution for inefficiency and a flat prior for regression coefficients. To further ensure the robustness of our findings, we conducted additional analyses, which are not reported. These analyses encompassed an assessment of prior sensitivity and the exploration of alternative inefficiency distributions. Specifically, we employed weakly informative normal priors and used the half-normal distribution, respectively. The outcomes of these analyses revealed only marginal disparities, leading us to conclude that the choice of prior specifications has a minimal impact on the estimation results. Results of these robustness checks are available from the authors upon request.

To explain this difference it is important noticing that we use log-labor in all models as input factor. Hence, it is natural to expect that idiosyncratic noise is smaller in models explaining sales per worker such that \({\sigma }_{u}^{2}\) accounts for a larger share in \({\sigma }_{u}^{2}+{\sigma }_{v}^{2}\).

According to Jensen’s inequality, \(\exp \{-{\hat{u}}_{it}\}\) is a lower bound on the expected efficiency.

For each posterior draw l = 1, …, L, we obtain the coefficient for corruption control (\({\delta }_{7}^{l}\)) and calculate the marginal effect (see Appendix B). This leaves us with L observation-specific marginal effects, which are then averaged over time and firms within provinces, and evaluated at its quartiles. Note that the determination of the corresponding time- and or firm-/sector-specific effects is straightforward conditional on the posteriori draws.

Cross-sectional endogeneity-robust SFA estimates are given in Table 7. To assess if the benchmark results displayed in Table 3 might suffer from endogeneity bias, we calculate the arithmetic means of the T cross-sectional SFA estimates for labor and capital, and test if the panel coefficient estimates for labor and capital differ from these means. Since the respective χ2-statistic reveals a p-value of .2414, we consider it unlikely that the Bayesian geoadditive SFA model suffers from endogeneity due to correlation between model regressors and errors.

Correlations of the composite model residuals and input factors lack significance at conventional levels irrespective of the employed measures of firm performance, financial development and corruption control in our preferred model specification where spatial effects are present in both the production function and the scaling function.

Using per capita sales as an output variable and measuring financial development by the number of banks per hectare yields qualitatively similar results, which are available from the authors upon request.

References

Acemoglu D, Aghion P, Zilibotti F (2006) Distance to frontier, selection, and economic growth. J Eur Econ Assoc 4:37–74

Acemoglu D, Verdier T (1998) Property rights, corruption and the allocation of talent: a general equilibrium approach. Econ J 108:1381–1403

Aghion P, Fally T, Scarpetta S (2007) Credit constraints as a barrier to the entry and post-entry growth of firms. Econ Policy 22:732–779

Ahlin C, Pang J (2008) Are financial development and corruption control substitutes in promoting growth? J Dev Econ 86:414–433

Arcand JL, Berkes E, Panizza U (2015) Too much finance? J Econ Growth 20:105–148

Arestis P, Chortareas G, Desli E (2006) Financial development and productive efficiency in oecd countries: an exploratory analysis. Manch School 74:417–440

Ashyrov G, Poltimäe H (2022) Does corruption hinder firm energy efficiency? evidence from vietnam. Technical Report, Faculty of Economics and Business Administration, University of Tartu, Estonia

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2011) Firm innovation in emerging markets: the role of finance, governance, and competition. J Financial Quant Anal 46:1545–1580

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data: with application to paddy farmers in India. J Prod Anal 3:153–169

Beck T, Cull R (2014) Small-and medium-sized enterprise finance in africa. Global Economy and Development Program. https://www.brookings.edu/wp-content/uploads/2016/06/SME-Finance-in-Africa-Designed_FINAL.pdf

Beck T, Demirguc-Kunt A (2006) Small and medium-size enterprises: access to finance as a growth constraint. J Bank Finance 30:2931–2943

Beck T, Demirgüç-Kunt A, Maksimovic V (2005) Financial and legal constraints to growth: does firm size matter? J Finance 60:137–177

Beck T, Demirgüç-Kunt A, Maksimovic V (2006) The influence of financial and legal institutions on firm size. J Bank Finance 30:2995–3015

Beck T, Levine R, Loayza N (2000) Finance and the sources of growth. J Financial Econ 58:261–300

Becker J-M, Proksch D, Ringle CM (2022) Revisiting Gaussian copulas to handle endogenous regressors. J Acad Market Sci 50:46–66

Belitz C et al. (2015) Bayesx - software for Bayesian inference in structured additive regression models. http://www.bayesx.org. Version 3.0.2

Brown JD, Earle JS, Lup D (2005) What makes small firms grow? Finance, human capital, technical assistance, and the business environment in romania. Econ Dev Cultural Change 54:33–70

Celeux G, Forbes F, Robert C, Titterington D (2006) Deviance information criteria for missing data models. Bayesian Anal 1:651–674

Clark TS, Linzer DA (2015) Should i use fixed or random effects? Polit Sci Res Methods 3:399–408

Cling JP, Chi NH, Razafindrakoto M, Roubaud F (2010) How Deep Was the Impact of the Economic Crisis in Vietnam?: A Focus on the Informal Sector in Hanoi and Ho Chi Minh City. World Bank, Washington, DC. http://hdl.handle.net/10986/27582

Clarke GR (2011) How petty is petty corruption? Evidence from firm surveys in Africa. World Dev 39:1122–1132

Dal Bó E, Rossi MA (2007) Corruption and inefficiency: theory and evidence from electric utilities. J Public Econ 91:939–962

Demirguc-Kunt A, Love I, Maksimovic V (2006) Business environment and the incorporation decision. J Bank Finance 11:2967–2993

Diaz MA, Sánchez R (2008) Firm size and productivity in Spain: a stochastic frontier analysis. Small Business Econ 30:315–323

Driffield N, Munday M (2001) Foreign manufacturing, regional agglomeration and technical efficiency in UK industries: a stochastic production frontier approach. Regional Stud 35:391–399

Ehrenfried F, Holzner C (2019) Dynamics and endogeneity of firms’ recruitment behaviour. Labour Econ 57:63–84

Ehrlich I, Lui FT (1999) Bureaucratic corruption and endogenous economic growth. J Polit Econ 107:S270–S293

Elhorst JP, Elhorst JP (2014) Spatial panel data models. In: Spatial econometrics: From cross-sectional data to spatial panels, 37–93. Springer Berlin, Heidelberg

Fafchamps M, Schündeln M (2013) Local financial development and firm performance: evidence from Morocco. J Dev Econ 103:15–28

Fahrmeir L, Lang S (2001) Bayesian inference for generalized additive mixed models based on markov random field priors. J R Stat Soc Ser C 50:201–220

Fisman R, Svensson J (2007) Are corruption and taxation really harmful to growth? Firm level evidence. J Dev Econ 83:63–75

Gelman A, Rubin DB (1992) Inference from iterative simulation using multiple sequences. Stat Sci 7:457–472

Ghirmay T (2004) Financial development and economic growth in Sub-Saharan African countries: evidence from time series analysis. African Dev Rev 16:415–432

GSO (2005) Statistical Yearbook 2005. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2005) Statistical Yearbook 2006. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2007) Overview on establishments. https://www.gso.gov.vn/default_en.aspx?tabid=487&idmid=&ItemID=8390. Accessed 05 August 2019

GSO (2007) Statistical Yearbook 2007. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2008) Statistical Yearbook 2008. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2009) Statistical Yearbook 2009. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2010) Statistical Yearbook 2010. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2011) Statistical Yearbook 2011. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2012) Results of the 2012 Establishment Census. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2012) Statistical Yearbook 2012. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

GSO (2013) Statistical Yearbook 2013. General Statistics Office of Vietnam, Statistical Publishing House, Ha Noi, Vietnam

Guiso L, Sapienza P, Zingales L (2004) Does local financial development matter? Q J Econ 119:929–969

Hanousek J, Shamshur A, Tresl J (2019) Firm efficiency, foreign ownership and ceo gender in corrupt environments. J Corporate Finance 59:344–360

Haschka RE (2022) Bayesian inference for joint estimation models using copulas to handle endogenous regressors. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4235194

Haschka RE (2022) Handling endogenous regressors using copulas: a generalization to linear panel models with fixed effects and correlated regressors. J Market Res 59:860–881

Haschka, RE (2023) Endogeneity in Stochastic Frontier Models with ‘Wrong’ Skewness: Copula Approach without External Instruments. Available at SSRN: https://ssrn.com/abstract=4337284, https://doi.org/10.2139/ssrn.4337284

Haschka RE, Herwartz H (2020) Innovation efficiency in european high-tech industries: evidence from a Bayesian stochastic frontier approach. Res Policy 49:104054

Haschka RE, Herwartz H (2022) Endogeneity in pharmaceutical knowledge generation: an instrument-free copula approach for Poisson frontier models. J Econ Manag Strat 31:942–960

Haschka RE, Herwartz H, Struthmann P, Tran VT, Walle YM (2022) The joint effects of financial development and the business environment on firm growth: evidence from Vietnam. J Comp Econ 50:486–506

Haschka RE, Schley K, Herwartz H (2020) Provision of health care services and regional diversity in Germany: insights from a Bayesian health frontier analysis with spatial dependencies. Eur J Health Econ 21:55–71

Hausman JA (1978) Specification tests in econometrics. Econometrica 46:1251–1271

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Johnson S, McMillan J, Woodruff C (2002) Property rights and finance. Am Econ Rev 92:1335–1356

Jondrow J, Lovell CK, Materov IS, Schmidt P (1982) On the estimation of technical inefficiency in the stochastic frontier production function model. J Econom 19:233–238

Kaufmann D, Wei S-J (1999) Does “grease money” speed up the wheels of commerce? National Bureau of Economic Research Working Paper Series N. 7093, Cambridge, Massachusetts. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=162974

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108:717–737

Klein N, Herwartz H, Kneib T (2020) Modelling regional patterns of inefficiency: a Bayesian approach to geoadditive panel stochastic frontier analysis with an application to cereal production in England and Wales. J Econom 214:513–539

Kumbhakar SC (1988) On the estimation of technical and allocative inefficiency using stochastic frontier functions: the case of US class 1 railroads. Int Econ Rev 29:727–743

Kumbhakar SC, Lovell C (2000) Stochastic frontier analysis, 1 edn. Cambridge University Press, Cambridge, UK,

Kumbhakar SC, Parmeter CF, Zelenyuk V (2020) Stochastic frontier analysis: foundations and advances i. In: Ray SC, Chambers RG, Kumbhakar SC (eds) Handbook of production economics. Springer, Singapore, SG, 2020, p 331–370

Levine R (2005) Finance and growth: theory and evidence. Handb Econ Growth 1:865–934

United States Library of Congress (2005) Country Profile - Vietnam. Federal Research Division, Library of Congress. Washington, DC. https://lccn.loc.gov/88600482