Abstract

Conventional models of data envelopment analysis (DEA) are based on the constant and variable returns-to-scale production technologies. Any optimal input and output weights of the multiplier DEA models based on these technologies are interpreted as being the most favorable for the decision making unit (DMU) under the assessment when the latter is benchmarked against the set of all observed DMUs. In this paper we consider a very large class of DEA models based on arbitrary polyhedral technologies, which includes almost all known convex DEA models. We highlight the fact that the conventional interpretation of the optimal input and output weights in such models is generally incorrect, which raises a question about the meaning of multiplier models. We address this question and prove that the optimal solutions of such models show the DMU under the assessment in the best light in comparison to the entire technology, but not necessarily in comparison to the set of observed DMUs. This result allows a clear and meaningful interpretation of the optimal solutions of multiplier models, including known models with a complex constraint structure whose interpretation has been problematic and left unaddressed in the existing literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The two conventional models of data envelopment analysis (DEA) are based on the assumption that the production technology is characterized by either constant or variable returns to scale (CRS and VRS), respectively. The CRS and VRS DEA models of Charnes et al. (1978) and Banker et al. (1984), whose earlier statements were introduced in the production theory literature by Afriat (1972), Shephard (1974) and Färe et al. (1983), are linear programs that can be stated in two mutually dual envelopment and multiplier forms.

The interpretation of the CRS and VRS models is well-established and depends on whether they are solved in the input or output orientation (Førsund 2018). The optimal value of these programs is interpreted as, respectively, the input or output radial efficiency of the decision making unit (DMU) under the assessment, denoted DMUo. From the envelopment perspective, the input or output radial efficiency of DMUo represents the utmost factor by which the input or output vector of DMUo can be improved in the given technology.

The dual multiplier CRS model is stated in terms of the input and output weights. As shown by Charnes et al. (1978), any optimal weights of this model (often also referred to as the input and output shadow prices) maximize the ratio of the total weighted output to the total weighted input of DMUo, under the condition that similar ratios calculated for all observed DMUs do not exceed the value of 1. Following this interpretation, the optimal input and output weights are regarded as the most favorable for DMUo (represent DMUo in the best light) when it is benchmarked against the set of all observed DMUs.

A similar interpretation is used for the optimal weights of the multiplier VRS model. This model also includes an additional dual variable corresponding to the normalizing equality (convexity constraint) in the envelopment model. Banker and Thrall (1992) show that the range of optimal values of this variable defines the type of returns to scale exhibited by the projection of DMUo on the boundary of the VRS technology. The dual characterization of the CRS and VRS production technologies and optimal solutions of the multiplier models based on them have been extensively studied in the literature – see, e.g., Briec and Leleu (2003), Färe and Primont (1995), Olesen and Petersen (1996, 2015) and Zelenyuk (2013).

In recent years, a number of new DEA models have been developed based on various assumptions about the production technology. Most of these technologies are modeled as polyhedral sets and are referred to as polyhedral technologies (Podinovski et al. 2016). The class of polyhedral technologies including the standard CRS and VRS technologies of Charnes et al. (1978) and Banker et al. (1984), the non-increasing and non-decreasing returns-to-scale technologies (Färe et al. 1983, Seiford and Thrall 1990), and their extensions by production trade-offs which are dual terms to weight restrictions (Podinovski 2004b). Further examples include the hybrid returns-to-scale technology based on the idea of selective proportionality between certain subsets of inputs and outputs (Podinovski 2004a), technologies with multiple component processes, including those with joint or shared inputs and outputs (Cherchye et al. 2013, Podinovski et al. 2018), and models based on (selective) weak disposability of inputs and outputs (Mehdiloo and Podinovski 2019). Finally, the underlying technologies of various network DEA models (Färe and Grosskopf 2000) are also polyhedral.

Similar to the conventional CRS and VRS models, DEA models employing any polyhedral technology can be stated in two mutually dual envelopment and multiplier forms. While the interpretation of the envelopment models is usually straightforward and similar to the case of the CRS and VRS models, the interpretation of the multiplier models and their optimal solutions (vectors of shadow prices) is often problematic. Of course, duality theory and standard interpretation of shadow prices apply to all such models and their optimal solutions. However, typically, such solutions include not only the vectors of input and output weights but also a number of other variables dual to the often complex constraints of the envelopment model. What the constraints of the multiplier models mean, whether the optimal input and output weights (and the optimal values of any other dual variables) are the most favorable for the DMUo and, if so, then exactly in what sense, is often unclear.

One example of polyhedral technology that illustrates the described difficulty is the standard CRS or VRS technology expanded by the specification of production trade-offs (dual to weight restrictions in the multiplier models). Such trade-offs represent permissible substitutions between certain input and output quantities, and their specification expands the production technology (Podinovski 2004b). Based on the earlier example of Podinovski and Athanassopoulos (1998), in a further development, Podinovski (2016) shows that the optimal input and output weights of such models may not necessarily be the most favorable for DMUo among all nonnegative weights when it is benchmarked against the observed DMUs. Therefore, the conventional interpretation of the optimal weights does not apply to models based on such polyhedral technologies.Footnote 1

In this paper we give a further example based on the non-increasing returns-to-scale technology in which the traditional interpretation of optimal solutions of the multiplier model is clearly incorrect. These examples show that we do not have a general meaningful explanation of the multiplier models for arbitrary polyhedral technologies, except for the CRS and VRS models and a few other models for which alternative bespoke interpretations, that apply only to a particular model, have been developed in the literature (see, e.g., Cherchye et al. 2013, Podinovski et al. 2018).Footnote 2

A new way to interpret optimal solutions of the multiplier model was recently suggested in a special case of polyhedral technology, namely, for the VRS and CRS technologies expanded by production trade-offs. Podinovski (2016) proved that the optimal input and output weights of the corresponding multiplier models are the most favorable for DMUo among all nonnegative weights, in comparison not to the set of observed DMUs (as already shown by Podinovski and Athanassopoulos (1998)) but in comparison to the infinite set of all DMUs in the technology expanded by the trade-offs.

In this paper we generalize this result to the whole class of polyhedral technologies and obtain a unifying interpretation of the multiplier models based on them. We also reinterpret optimal solutions of multiplier models in terms of profit maximization, and show that the optimal input and output weights of the multiplier model based on any polyhedral technology maximize the profit efficiency of DMUo in comparison to all DMUs in the technology.

To achieve this, we first develop a transformation of the multiplier model based on any polyhedral technology to a different linear model whose structure is transparent and amenable to interpretation. We further suggest two additional transformations to the linear fractional and maximin models in which the efficiency of DMUo is measured by the ratio of its weighted output and input combinations. Using these restated models, we prove that, irrespective of the often complex structure of the original multiplier model, its optimal solutions are the most favorable for DMUo both in the conventional sense explored by Charnes et al. (1978) and Banker et al. (1984), and in the sense of profit maximization, but with the caveat that DMUo is benchmarked against the entire technology and not against the set of observed DMUs. For example, for any polyhedral cone technology, the optimal input and output weights (which are generally only a part of the longer vector representing an optimal solution) maximize the ratio of the total weighted output to the total weighted input of DMUo and, alternatively, the profit of DMUo, in comparison to all DMUs in the technology, but not necessarily in comparison to the set of observed DMUs as would be the case for the conventional CRS model.

The new interpretation of optimal solutions obtained in this paper applies to any polyhedral technology and does not contradict the established interpretations for the CRS and VRS models. The optimal weights of the CRS and VRS multiplier models are the most favorable for the DMUo under the assessment if it is benchmarked against the finite set of observed DMUs (as in the standard interpretation) and also against the entire CRS or VRS technology (as in the new interpretation obtained in this paper).

We proceed as follows. In Section 2, we consider a motivational example based on the HRS technology of Podinovski (2004a). We show that the optimal solutions of the standard multiplier model based on this technology do not allow a straightforward interpretation. In the subsequent sections, we obtain their interpretation, and the interpretation in the case of any other polyhedral technology, by restating the standard linear multiplier models in three new forms.

We obtain this new universal interpretation not for an individual technology, but for the whole class of polyhedral technologies, examples of which were highlighted above, in one unifying development. To enable this new development, in Section 3, we first introduce a general statement of polyhedral technology and the envelopment and multiplier models based on it. In Section 4, we develop a universal transformation that restates the multiplier model based on an arbitrary polyhedral technology in a transparent linear form. In section 5, we discuss the hierarchy of three forms of the multiplier model in the standard case of VRS technology, which clarifies the direction of further theoretical investigation. In Section 6, we obtain transformations of the multiplier model to the linear fractional and maximin forms. All these transformed models allow us to prove that any optimal input and output weights (which are often only a part a full optimal solution of the original multiplier model) are the most favorable for DMUo when the latter is benchmarked against all DMUs in the entire technology. In Section 7, we prove that optimal solutions of the multiplier CRS and VRS models of Charnes et al. (1978) and Banker et al. (1984) can be interpreted in two ways, as being the most favorable for DMUo if it is benchmarked against the set of observed DMUs and also if it is benchmarked against the entire technology generated by such DMUs. In Section 8, we consider a numerical example that illustrates the theoretical results of this paper. In Section 9, we present a concluding summary of the main results. All mathematical proofs are given in Appendix A. In Appendix B, we show the usefulness of our results for the interpretation of multiplier models based on three different polyhedral technologies.

2 Motivational example

The hybrid returns-to-scale (HRS) technology was introduced and axiomatically defined by Podinovski (2004a) as a generalization of the standard CRS technology of Charnes et al. (1978) based on the concept of selective proportionality. The HRS technology models a situation in which only a subset of outputs and a subset of inputs are assumed to be mutually proportional (scalable), while the other inputs and outputs are not a part of this proportion.

Let \(({X}_{j},{Y}_{j})\in {{\mathbb{R}}}_{+}^{m+s}\) be the observed DMUs, where j = 1, …, n. The input and output vectors Xj and Yj, j = 1, …, n, are the columns of the input and output matrices \(\overline{X}\) and \(\overline{Y}\) whose dimensions are m × n and s × n, respectively.

We now consider the rows of matrices \(\overline{X}\) and \(\overline{Y}\) corresponding to the nonproportional inputs and outputs, and replace them by zero rows. Denote the resulting m × n and s × n matrices \(\tilde{X}\) and \(\tilde{Y}\), respectively. The columns \({\tilde{X}}_{j}\) and \({\tilde{Y}}_{j}\), j = 1, …, n, of these matrices are the corresponding input and output vectors Xj and Yj whose nonproportional components are replaced by zeros.

As proved by Podinovski (2004a), technology \({{\mathcal{T}}}_{{\rm{HRS}}}\) is the set of all DMUs \((X,Y)\in {{\mathbb{R}}}_{+}^{m+s}\) for which there exist vectors \(\lambda ,\mu ,\nu \in {{\mathbb{R}}}^{n}\) and slack vectors \({S}_{X}\in {{\mathbb{R}}}^{m}\), \({S}_{Y}\in {{\mathbb{R}}}^{s}\) and \({S}_{\lambda }\in {{\mathbb{R}}}^{n}\), such that

In conditions (1), the components of vector μ allow the selected inputs and outputs of the observed DMUs represented by the columns of matrices \(\tilde{X}\) and \(\tilde{Y}\) to be scaled up. Similarly, the components of vector ν allow such inputs and outputs to be scaled down. (As shown by Podinovski (2004a), in the latter scenario we need to replace the matrix \(\tilde{Y}\) by \(\overline{Y}\) which appears in the term \(\overline{Y}\nu\) on the left-hand side of conditions (1b).) Conditions (1c) allow contraction of the selected inputs and outputs (assumed proportional) as long as the difference λj − νj remains nonnegative for all j = 1, …, n, which in turn guarantees that the resulting inputs and outputs of the selectively contracted DMUs remain nonnegative.

Consider assessing the input radial efficiency of DMU (Xo, Yo) in the HRS technology. Specifying the input-oriented envelopment model is straightforward. This requires replacing DMU (X, Y) in conditions (1a) and (1b) by DMU (θXo, Yo), where θ is a sign-free variable, and minimizing θ subject to the resulting constraints.

Let \(v\in {{\mathbb{R}}}^{m}\), \(u\in {{\mathbb{R}}}^{s}\), \(\sigma \in {{\mathbb{R}}}^{n}\) and \(\rho \in {\mathbb{R}}\) be dual to the constraints of the envelopment HRS model. The input-oriented multiplier HRS models can then be stated as follows:

The constraints of program (2) have a complex structure, and direct interpretation of its optimal solutions (u, v, σ, ρ) is a challenging task. It may be argued that we should obtain the interpretation of this program by restating it in the linear fractional form, similar to the interpretation of the CRS model by Charnes et al. (1978):

It is clear that the restatement of program (2) in the linear fractional form (3) has not made the interpretation any easier.Footnote 3

Note that it would be erroneous to simply state that the optimal solutions to the multiplier models (2) and (3) represent DMU (Xo, Yo) in the best light compared to the set of observed DMUs, for several reasons. First, the constraints of these programs are stated not only for the observed DMUs (Xj, Yj) but also for the DMU-like structures \(({\tilde{X}}_{j},{\tilde{Y}}_{j})\) and \(({\tilde{X}}_{j},{Y}_{j})\) as seen in the conditions of program (3). These DMU-like structures are not observed DMUs but can be seen as parts of them. Second, the optimal solutions include vector σ and scalar ρ whose role is unclear.

Third, it is known that the input and output weights that are the most favorable for DMU (Xo, Yo) in relation to the observed DMUs are those obtained from the standard multiplier CRS or VRS models. (The meaning of this statement is slightly different in the two models.Footnote 4) Optimal solutions of the HRS model (2) are not generally optimal in the CRS or VRS models, and for this reason cannot be the most favorable for DMU (Xo, Yo) in the same sense.

In summary, the standard HRS multiplier model (2) does not allow a clear interpretation of its optimal solutions, and the question arises: what is the meaning of such optimal solutions?

The described difficulties with the HRS technology are not unique and arise in the case of many other technologies, especially those whose statements involve complex conditions. We consider additional examples of such technologies in Appendix B.

In this paper, we address the noted difficulties and explain the meaning of optimal solutions of the multiplier models. We do this in a single development, by considering a general statement of technology as a polyhedral set. We then prove that, regardless of the specific conditions and complexity of their statements, the optimal solutions of the multiplier model based on any polyhedral technology, including the HRS technology, are the most favorable for DMU (Xo, Yo) when it is compared not to the finite set of observed DMUs but to the infinite set of all DMUs in the technology. (We further illustrate the difference between the two interpretations using an example in Section 8.) This new universal interpretation cannot be observed from the standard multiplier model such as (2), and we need to develop alternative multiplier statements that make this new interpretation clear.

3 DEA models for polyhedral technologies

3.1 Polyhedral technologies

Consider production technology \({\mathcal{T}}\subset {{\mathbb{R}}}_{+}^{m+s}\) with m inputs and s outputs. To be specific, we assume that \({\mathcal{T}}\) satisfies the assumption of free (strong) disposability of all inputs and outputs (see, e.g., Färe et al. 1985). The case in which not all inputs and outputs are freely disposable is similar and is not discussed.

Most of the convex production technologies developed in the DEA literature are polyhedral sets. Examples of such technologies were highlighted in Section 1. Using the general form of polyhedral technologies suggested by Podinovski et al. (2016), any freely disposable technology \({\mathcal{T}}\) is stated as the set of all DMUs \((X,Y)\in {{\mathbb{R}}}_{+}^{m+s}\) for which there exist a vector \(\hat{\lambda }\in {{\mathbb{R}}}^{q}\) and vectors of input and output slacks \({S}_{X}\in {{\mathbb{R}}}^{m}\) and \({S}_{Y}\in {{\mathbb{R}}}^{s}\) such that:

In the above statement, \(\hat{X}\), \(\hat{Y}\) and \(\hat{U}\) are matrices of dimensions m × q, s × q, and p × q, respectively, and Uo is a constant vector of dimension p. The conditions (4c) are optional and are not always specified. Below we refer to them as the parameter conditions. These conditions are homogeneous if Uo is a zero vector and nonhomogeneous otherwise.

Conditions (4) identify a general form in which any freely disposable polyhedral technology can be stated. In each special case of a particular technology, the matrices \(\hat{X}\), \(\hat{Y}\) and \(\hat{U}\), vector Uo and the dimensions p and q are different. As an illustration, consider the following examples.

Let \({\mathcal{T}}\) be the conventional VRS technology of Banker et al. (1984). In this case, the columns of matrices \(\hat{X}\) and \(\hat{Y}\) are the input and output vectors of the observed DMUs, respectively. The parameter condition (4c) is the single equality \({1}^{\top }\hat{\lambda }=1\), i.e., \(\hat{U}\) is a vector row of ones of dimension n, and Uo is a scalar equal to 1. In the case of the CRS technology of Charnes et al. (1978), the equality (4c) is not used.

For many other polyhedral technologies, the structure of matrices \(\hat{X}\), \(\hat{Y}\) and \(\hat{U}\) used in conditions (4) is more complex. Consider, for example, the HRS technology defined by conditions (1). This technology is a polyhedral technology and its statement (1) is a special case of (4).

Indeed, we can view the combined vector \(\left(\lambda ,\mu ,\nu ,{S}_{\lambda }\right)\) in (1) as the vector \(\hat{\lambda }\) in (4). We now restate equalities (1a) and (1b) as follows:

where \({\overline{O}}_{X}\) and \({\overline{O}}_{Y}\) are zero m × n and s × n matrices, respectively. It is now clear that equality (1a) corresponds to equality (4a) in which \(\hat{X}\) is the combined matrix \([\overline{X},\tilde{X},-\tilde{X},{\overline{O}}_{X}]\) of dimension m × q, where q = 4n. Similarly, condition (1b) corresponds to condition (4b) in which \(\hat{Y}\) is the combined matrix \([\overline{Y},\tilde{Y},-\overline{Y},{\overline{O}}_{Y}]\) of dimension s × q. The equalities (1c) and (1d) are parameter conditions (4c) in which the vector Uo is of dimension n + 1. Its first n components are equal to zero, and its last component is equal to 1.Footnote 5

Two further examples of polyhedral technologies with a complex structure are considered in Appendix B.

Remark 1

Throughout the paper, we distinguish between the matrices \(\hat{X}\) and \(\hat{Y}\) used in the general statement (4) of a polyhedral technology, and the matrices \(\overline{X}\) and \(\overline{Y}\) formed by the input and output vectors of the n observed DMUs, as in the statement (1) of the HRS technology. We also distinguish between the intensity vector λ used to combine observed DMUs (i.e., the columns of matrices \(\overline{X}\) and \(\overline{Y}\)) and the generally longer vector \(\hat{\lambda }\) used to combine the columns of matrices \(\hat{X}\) and \(\hat{Y}\) in (4).

As shown by the case of HRS technology, \(\overline{X}\) and \(\overline{Y}\) are generally only submatrices of \(\hat{X}\) and \(\hat{Y}\), although they coincide with the latter in the case of standard VRS and CRS technologies. As another example, in models with weight restrictions, the matrices \(\hat{X}\) and \(\hat{Y}\) incorporate columns representing the input and output vectors of the observed DMUs as well as the vectors representing production trade-offs dual to the weight restrictions (Podinovski 2004b).

3.2 Envelopment and multiplier DEA models

To be specific, consider assessing the input radial efficiency of DMU\({}_{o}\in {\mathcal{T}}\), whose input and output vectors are Xo ≠ 0 and Yo ≠ 0, respectively. The case of output radial efficiency is similar and is not discussed.

The input radial efficiency of DMUo is the optimal value θ* of the envelopment model

Using (4), we restate this envelopment program as follows:

Because of the arbitrary nature of technology \({\mathcal{T}}\), we have to assume specifically that the optimal value of program (5) is finite (and therefore is attained) and that θ* > 0. Under this assumption, which should be valid in any meaningful application, all inputs and outputs of the input radial projection (θ*Xo, Yo) are nonnegative and satisfy conditions (4), together with any optimal solution \({\hat{\lambda }}^{* }\), \({S}_{X}^{* }\) and \({S}_{Y}^{* }\) of program (5). Therefore, \(({\theta }^{* }{X}_{o},{Y}_{o})\in {\mathcal{T}}\).

The dual to program (5) is the following multiplier model:

In model (6), the vectors \(v\in {{\mathbb{R}}}_{+}^{m}\) and \(u\in {{\mathbb{R}}}_{+}^{s}\) and the vector of sign-free variables \(w\in {{\mathbb{R}}}^{p}\) are dual to constraints (5b), (5c) and (5d), respectively. If the parameter condition (5d) is not specified, its dual vector w and the corresponding terms in model (6) are omitted.

It is worth noting that the structure of the multiplier model (6) may be sufficiently complex and make its interpretation problematic. An example is the multiplier HRS model (2) which is a special case of model (6). As highlighted in Section 2, the interpretation of the multiplier HRS model is unclear.

In the next sections, we overcome the problem with the interpretation of model (6) by restating it in several more transparent forms.

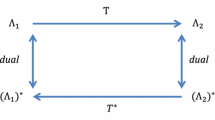

4 Restated linear program

In this and the next sections we explore the interpretation of optimal solutions of the linear multiplier model (6) by transforming it to the three new useful forms: linear, linear fractional and maximin models. In contrast to the standard multiplier model (6), all three new models have intuitively clear feasible regions which allows straightforward interpretation of their optimal solutions. This series of transformations extends the earlier idea developed by Podinovski et al. (2016) for the special case of CRS and VRS technologies expanded by production trade-offs, to the general case of an arbitrary polyhedral technology.

4.1 The general case

Consider the input-oriented multiplier model (6) based on any polyhedral technology \({\mathcal{T}}\). To facilitate the interpretation of its optimal solutions, we introduce the following program which has an infinite number of linear constraints:

To establish a relationship between the standard multiplier program (6) and the above program (7), let \(\left(u,v,w\right)\) be any feasible solution to the multiplier model (6). Define the scalar

We now generalize the result obtained by Podinovski et al. (2016) for the special case of the VRS technology expanded by production trade-offs to the case of an arbitrary polyhedral technology \({\mathcal{T}}\):

Theorem 1

If solution \(\left(u,v,w\right)\) is feasible in program (6), then solution \(\left(u,v,{u}_{0}\right)\) is feasible in program (7). Furthermore, if \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in (6), then \(\left({u}^{* },{v}^{* },{u}_{0}^{* }\right)\) is optimal in (7). The maximum in program (7) is attained, and we have \({\theta }^{* }={\varphi }_{1}^{* }\).

It is worth highlighting the differences between the original multiplier program (6) with a finite number of constraints and its restatement (7) with the infinite number of constraints. The former program is stated in terms of the output and input weights (u, v) and the vector w dual to the parameter conditions (5d). Because the constraints of program (6) often have a complex structure, a direct interpretation of this program and its optimal solutions may be problematic.

In contrast, the structure of program (7) is much more transparent. The complex statement (4) of technology \({\mathcal{T}}\) explicitly incorporated by the standard multiplier model (6) is employed implicitly in program (7) through the intuitively clear (but not really operational) condition \((X,Y)\in {\mathcal{T}}\) of constraints (7c). Also note that the structure of program (7) is similar to the structure of the standard VRS model of Banker et al. (1984). The only difference is that, in the latter, the full technology \({\mathcal{T}}\) in constraints (7c) is replaced by the set of observed DMUs.

Remark 2

It may seem surprising that the matrices \(\hat{X}\), \(\hat{Y}\) and \(\hat{U}\), and the vector Uo that define technology \({\mathcal{T}}\) by conditions (4) and are used in the standard multiplier model (6) apparently “disappear” in program (7). As already noted, these conditions are still incorporated in program (7), via the condition \((X,Y)\in {\mathcal{T}}\) in the inequalities (7c).

To give an intuitive explanation of such transformation, suppose that we sample a very large number n of DMUs (Xj, Yj) from the polyhedral technology \({\mathcal{T}}\) stated as in (4). We can consider the standard VRS technology generated by this large number of sampled DMUs as a suitable approximation of technology \({\mathcal{T}}\). Instead of assessing the input radial efficiency of DMUo in technology \({\mathcal{T}}\) by solving program (6), we assess it in the approximate technology, by solving the standard input-oriented VRS multiplier program. It is similar to program (7), except for conditions (7c) which are replaced by the standard VRS conditions:

Because n is very large, we can think of these last conditions as an approximation of condition (7c) stated for every DMU \((X,Y)\in {\mathcal{T}}\). We now see that, regardless of the complexity of the statement (4) of technology \({\mathcal{T}}\), program (7) always has the same simple structure similar to the standard VRS model. The statement of technology \({\mathcal{T}}\) is now incorporated in the conditions \((X,Y)\in {\mathcal{T}}\) of program (7).

In loose words, we can say that solving the multiplier program (6) based on any polyhedral technology \({\mathcal{T}}\) simultaneously solves the multiplier model (7) based on the VRS technology generated by the infinite number of all DMUs in technology \({\mathcal{T}}\).

Of course, the given explanation is not rigorous and does not substitute the precise statement of Theorem 1 and its formal proof. In fact, from the given intuitive explanation it may appear that programs (6) and (7) are equivalent and that their sets of feasible and optimal solutions are the same after the transformation (8) is applied. This is not so, and Theorem 1 only states that any feasible and optimal solution of program (6) is, after the transformation (8), feasible and optimal in program (7), respectively. The fact that the converse is generally not true was demonstrated by Podinovski (2015, Example 2) in the case of CRS technology expanded by production trade-offs.

The optimal value θ* of both envelopment and multiplier programs (5) and (6) is interpretable as the input radial efficiency of DMUo in technology \({\mathcal{T}}\). Theorem 1 suggests an alternative interpretation of any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) of program (6) in terms of profit maximization, consistent with the economics literature (see, e.g., Färe and Grosskopf 2004).

Let u and v be regarded as the output and input prices. Then the difference Y⊤u − X⊤v is the profit generated by DMU (X, Y). At optimality, at least one constraint in (7c) is satisfied as equality, as otherwise we could increase the optimal output prices u or the scalar u0, and the value of the objective function (7a), which contradicts the assumption of optimality. Therefore, the negated sign-free term −u0 represents the maximum profit across all DMUs in technology \({\mathcal{T}}\) (and not only observed DMUs).

Taking into account (7b), we restate the objective function in (7a) as \(1-[(-{u}_{0})-({Y}_{o}^{\top }u-{X}_{o}^{\top }v)]\). Maximizing this function is equivalent to minimizing the difference between the maximum profit −u0 and the actual profit \({Y}_{o}^{\top }u-{X}_{o}^{\top }v\) generated by DMUo. By Theorem 1, the weights u* and v* in any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) of program (6) maximize the profit of DMUo in comparison to the maximum profit of all DMUs in technology \({\mathcal{T}}\), equal to \(-{u}_{0}^{* }=-{U}_{o}^{\top }{w}^{* }\), subject to the cost-normalizing condition \({X}_{o}^{\top }v=1\).

Furthermore, the difference

is equal to the shortfall of the profit of DMUo compared to the maximum profit \(-{u}_{0}^{* }\). DMUo is profit efficient if 1 − θ* = 0, i.e., θ* = 1. Therefore, the weights u* and v* are the most favorable for the profit efficiency of DMUo when it is benchmarked against all DMUs in \({\mathcal{T}}\). The example given in Section 8 shows that this is different from the conventional interpretation according to which DMUo is benchmarked against the observed DMUs only, and that the conventional interpretation is generally incorrect in the case of an arbitrary polyhedral technology.

Remark 3

As a variant of the given interpretation, we can also view the optimal value θ* of programs (5) and (6) as the exact upper bound representing the attainable profit efficiency of DMUo if information about the actual input and output prices becomes available.Footnote 6 Indeed, suppose that all DMUs face the same known prices \(v^{\prime}\) and \(u^{\prime}\) normalized by condition (7b). Denote \(-{u}_{0}^{\prime}={\max }_{(X,Y)\in {\mathcal{T}}}\{{Y}^{\top }u^{\prime} -{X}^{\top }v^{\prime} \}\), the maximum profit across all DMUs in technology \({\mathcal{T}}\) for such prices. Then the triplet \((u^{\prime} ,v^{\prime} ,{u}_{0}^{\prime})\) satisfies inequalities (7c) and is a feasible solution of program (7). By Theorem 1, we have \({\theta }^{* }={\varphi }_{1}^{* }\). Because the latter is the optimal value of program (7), it follows that \({\theta }^{* }\ge {Y}_{o}^{\top }u^{\prime} +{u}_{0}^{\prime}\). Therefore, θ* is an upper bound on the profit indicator \({Y}_{o}^{\top }u+{u}_{0}\) that can in principle be achieved by DMUo, taking into account all possible input and output prices normalized by condition (7b). This upper bound θ* is exact and is attained at the prices u* and v* taken from any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) of program (6).

Furthermore, as follows from (9), the difference 1 − θ* is interpretable as the optimal (lowest) shortfall of the profit of DMUo compared to the maximum profit achieved across all DMUs in technology \({\mathcal{T}}\), considering all possible (normalized) input and output prices. Therefore, 1 − θ* represents the exact lower bound on the actual shortfall of the profit of DMUo if the information about the actual prices becomes available. For any actual normalized prices, the shortfall of the profit of DMUo can never be smaller than 1 − θ*. This lower bound is attained for any optimal prices u* and v* of program (6).

The following result generalizes the known fact established by Banker et al. (1984) for the VRS technology, to an arbitrary polyhedral technology. It shows that any optimal solution of program (6) defines a supporting hyperplane to technology \({\mathcal{T}}\) at the input radial projection (θ*Xo, Yo) of the DMU (Xo, Yo). Note the nontrivial way in which the intercept \({u}_{0}^{* }\) of this hyperplane is calculated.

Proposition 1

Let \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) be any optimal solution of program (6). In accordance with (8), define \({u}_{0}^{* }={U}_{o}^{\top }{w}^{* }\). (Alternatively, and more generally, let \(\left({u}^{* },{v}^{* },{u}_{0}^{* }\right)\) be any optimal solution of program (7).Footnote 7) Then the set of all pairs \((X,Y)\in {{\mathbb{R}}}^{m+s}\) that satisfy the equation

is a supporting hyperplane to technology \({\mathcal{T}}\) at the input radial projection (θ*Xo, Yo). The vector (u*, − v*) is the normal vector of this supporting hyperplane, and \({u}_{0}^{* }\) is a constant scalar. For any DMU \((X,Y)\in {\mathcal{T}}\), we have \({Y}^{\top }{u}^{* }-{X}^{\top }{v}^{* }+{u}_{0}^{* }\,\le\, 0\). For the input radial projection \((X,Y)=({\theta }^{* }{X}_{o},{Y}_{o})\in {\mathcal{T}}\), this last inequality is satisfied as equality.

Remark 4

If \({\mathcal{T}}\) is the VRS technology of Banker et al. (1984), the vector Uo in the parameter condition (4c) has a single component equal to 1 and, by formula (8), we have \({u}_{0}^{* }={w}^{* }\). As follows from Banker and Thrall (1992) (see also Førsund and Hjalmarsson 2004), the range of optimal values of u0 determines the type of returns to scale (RTS) exhibited by the projection (θ*Xo, Yo). Podinovski et al. (2016) generalize this result and prove that the range of optimal values of the scalar \({u}_{0}^{* }={U}_{o}^{\top }{w}^{* }\) defines the type of RTS in an arbitrary polyhedral technology. However, why this relatively unintuitive formula is responsible for the RTS characterization has so far remained unclear. Proposition 1 resolves this issue by demonstrating that \({u}_{0}^{* }\) is the constant (intercept) of the supporting hyperplane to the technology evaluated at the projected DMU, the role of which in the VRS technology has already been demonstrated by Banker and Thrall (1992).

Let us consider this in greater detail. As follows from the general result of Podinovski et al. (2016, Endnote 14), if DMUo is both input and output radial efficientFootnote 8 in technology \({\mathcal{T}}\), the range of optimal values of \({u}_{0}^{* }={U}_{o}^{\top }{w}^{* }\) defines the left-hand and right-hand scale elasticities ε−(Xo, Yo) and ε+(Xo, Yo) evaluated at DMUo and, therefore, its RTS characterization.

More precisely, let \({u}_{0}^{\min }\) and \({u}_{0}^{\max }\) be, respectively, the minimum and maximum values of the term \({U}_{o}^{\top }w\) taken over the set of all optimal solutions to the multiplier model (6). (Identifying \({u}_{0}^{\min }\) and \({u}_{0}^{\max }\) requires solving two linear programs.) Then

The above formulae allow infinite values of ε+(Xo, Yo) and ε−(Xo, Yo), obtained when their denominators are equal to zero. Theorem 1 in Podinovski et al. (2016) and its application to the evaluation of scale elasticity discussed in Section 3.3 of the same paper show that, in an arbitrary polyhedral technology \({\mathcal{T}}\), these cases occur if and only if any marginal proportional increase or, respectively, reduction of the input vector Xo of the DMUo leads outside the technology. For this reason, the corresponding one-sided scale elasticity is undefined. If technology \({\mathcal{T}}\) is freely disposable (which is assumed in the current paper), the right-hand scale elasticity ε+(Xo, Yo) is always finite and cannot be negative.

This result is similar to the expressions obtained for the standard VRS technology by Banker and Thrall (1992). The difference is that, in the case of VRS, the terms \({u}_{0}^{\min }\) and \({u}_{0}^{\max }\) are the extreme values of the actual component u0 of the optimal solution to the multiplier VRS model which is dual to the normalizing (convexity) constraint of the envelopment VRS model. For an arbitrary polyhedral technology, \({u}_{0}^{\min }\) and \({u}_{0}^{\max }\) are the extreme values of the term \({U}_{o}^{\top }w\), where w is the vector of dual variables to the parameter conditions (4c). This term is reduced to the single dual variable u0 in the VRS model.

4.2 Cone technologies

Assume that the parameter conditions (4c) are either homogeneous or are not specified. In the former case, the vector Uo is a zero vector, and conditions (4c) are replaced by the equality

In both cases it is straightforward to verify that technology \({\mathcal{T}}\) is a polyhedral cone. Examples of polyhedral cone technologies whose statements do not include the parameter condition (4c) are the standard CRS technology of Charnes et al. (1978) and its extension by production trade-offs developed by Podinovski (2004b). An example of polyhedral cone technology with complex homogeneous parameter conditions (4c) is the cone extension of the technology with multiple component processes (Podinovski et al. 2018, p. 287).

Under the stated assumptions, the multiplier model (6) takes on the following form:

Taking into account (8), we have u0 = 0 and restate program (7) as follows:

The following results is a straightforward restatement of Theorem 1 for the cone technologies under the consideration:

Theorem 2

If solution \(\left(u,v,w\right)\) is feasible in program (13), then \(\left(u,v\right)\) is feasible in program (14). Furthermore, if \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in (13), then \(\left({u}^{* },{v}^{* }\right)\) is optimal in (14). The maximum in program (14) is attained, and we have \({\theta }^{* }={\psi }_{1}^{* }\).

We are now in a position to provide interpretation of program (13), which is close to the interpretation of the more general program (6). Namely, let u and v be the output and input prices and the difference Y⊤u − X⊤v be the profit of DMU (X, Y). We first consider program (14). According to constraints (14c), no DMU \((X,Y)\in {\mathcal{T}}\) is allowed to have a positive profit. Furthermore, for any optimal prices u and v of this program, at least one inequality in (14c) is satisfied as equality. (Otherwise, we would be able to increase the vector of optimal output prices u and the objective function (14a), which contradicts the assumption of optimality.) This implies that, at optimality, the maximum profit over all DMUs in the entire technology \({\mathcal{T}}\) is equal to zero, which is consistent with the assumption of CRS.

Using (14b), we can restate the objective function in (14a) as \(({Y}_{o}^{\top }u-{X}_{o}^{\top }v)+1\). Maximizing this function is equivalent to maximizing the profit \({Y}_{o}^{\top }u-{X}_{o}^{\top }v\) of DMUo.

Let \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) be any optimal solution of program (13). By Theorem 2, the solution \(\left({u}^{* },{v}^{* }\right)\) is optimal in (14). Therefore, the vectors of prices u* and v* maximize the profit of DMUo subject to the condition that all DMUs in the entire technology \({\mathcal{T}}\) have a nonpositive profit and that the cost of the input bundle is normalized by the equality \({X}_{o}^{\top }v=1\).

Note that program (14) requires that the profit of all DMUs in technology \({\mathcal{T}}\) be nonpositive. For example, the CRS technology of Charnes et al. (1978) expanded by production trade-offs (Podinovski (2004b) is a cone technology. It includes all DMUs in the CRS technology and their modifications obtained by the application of trade-offs in different proportions. It would generally be incorrect to say that the optimal prices u and v in the corresponding multiplier model maximize the profit of DMUo under the condition that the profit of all observed DMUs is nonpositive. For this interpretation to be correct, we need the profit of all DMUs (including observed DMUs and their modifications by trade-offs) to be nonpositive.

We can also restate Proposition 1 for the technologies considered in this section as follows:

Proposition 2

Let \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) be any optimal solution of program (13). (More generally, let \(\left({u}^{* },{v}^{* }\right)\) be any optimal solution of program (14).) Then the set of all pairs \((X,Y)\in {{\mathbb{R}}}^{m+s}\) that satisfy the equation

is a supporting hyperplane to technology \({\mathcal{T}}\) at the input radial projection (θ*Xo, Yo). The vector (u*, − v*) is the normal vector of this supporting hyperplane. For any DMU \((X,Y)\in {\mathcal{T}}\), we have Y⊤u* − X⊤v*≤0. For the input radial projection \((X,Y)=({\theta }^{* }{X}_{o},{Y}_{o})\in {\mathcal{T}}\), this last inequality is satisfied as equality.

5 The hierarchy of multiplier DEA models

In the previous section, we discussed the interpretation of the linear multiplier program (6) by restating it in the alternative linear form (7), and their variants (13) and (14) for cone technologies. Our next step is to obtain additional interpretation by restating programs (7) and (14) in two further forms, referred to as the linear fractional and maximin models. To add intuition to this development, in this section we provide preliminary discussion that clarifies the relationship between these three forms of the multiplier model, using the standard VRS technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) of Banker et al. (1984) as an example.Footnote 9

Let \(({X}_{j},{Y}_{j})\in {{\mathbb{R}}}_{+}^{m+s}\), j = 1, …, n, be the observed DMUs. To evaluate the input radial efficiency of DMU \(({X}_{o},{Y}_{o})\in {{\mathcal{T}}}_{{\rm{VRS}}}\), we solve the standard linear multiplier VRS program

Also consider the linear fractional program (Banker et al. 1984, program (21)):

and the maximin program analogous to the maximin model (stated for the case of CRS) of Cooper et al. (1996) and Podinovski and Athanassopoulos (1998):

Let us show that the three programs (15), (16) and (17) are closely related and form a hierarchy in which program (15) is a normalized variant of program (16), which in turn is a normalized variant of program (17).

Program (17) maximizes the efficiency ratio \(({Y}_{o}^{\top }u+{u}_{0})/{X}_{o}^{\top }v\) of DMUo in relation to the maximum of similar ratios of all observed DMUs, under the single condition u, v ≥ 0. Any optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of this program is the most favorable for DMUo (in the sense of maximizing its efficiency ratio) among all solutions (u, v, u0) with nonnegative vectors u and v and sign-free scalar u0, when DMUo is benchmarked against the set of observed DMUs.

We now note that, if \((u^{\prime} ,v^{\prime} ,{u}_{0}^{\prime})\) is a feasible or optimal solution of program (17), then, for any α > 0 and β > 0, the solution \((\alpha u^{\prime} ,\beta v^{\prime} ,\alpha {u}_{0}^{\prime})\) is also feasible or, respectively, optimal in (17), because the multipliers α and β simultaneously appear in the numerator and denominator of the objective function of this program and cancel out. The value of the objective function for this parametric family of solutions remains the same.

By varying α and β, we can make the efficiency ratios \(({Y}_{j}^{\top }\alpha u^{\prime} +\alpha {u}_{0}^{\prime})/({X}_{j}^{\top }\beta v^{\prime} )\) of all DMUs as small (close to zero) or as large as we want. (For example, these ratios become very large as β tends to zero.) Because the objective function of program (17) is the same for all solutions \((\alpha u^{\prime} ,\beta v^{\prime} ,\alpha {u}_{0}^{\prime})\), we can limit its maximization to the subset of the feasible region obtained by the incorporation of the normalizing condition stating that the efficiency ratio \(({Y}_{j}^{\top }u+{u}_{0})/{X}_{j}^{\top }v\) of all observed DMUs does not exceed 1 (in which case the maximum of all such ratios is equal to 1). Under this normalizing condition, the denominator in the first line of program (17) becomes equal to 1, and program (17) is restated as (16). The optimal values of the linear fractional and maximin programs (16) and (17) are equal, and any optimal solution of the former program is optimal in the latter. The converse is true only for the optimal solutions of (17) (members of the parametric family of solutions \((\alpha u^{\prime} ,\beta v^{\prime} ,\alpha {u}_{0}^{\prime})\) discussed above) for which the maximum of all efficiency ratios \(({Y}_{j}^{\top }u+{u}_{0})/{X}_{j}^{\top }v\) across all observed DMUs is equal to 1.

Now consider any feasible or optimal solution \((u^{\prime} ,v^{\prime} ,{u}_{0}^{\prime})\) of program (16). For any α > 0, the solution \((\alpha u^{\prime} ,\alpha v^{\prime} ,\alpha {u}_{0}^{\prime})\) is also feasible and, respectively, optimal in (16). The parametric family of such solutions is an open ray from the origin through the solution \((u^{\prime} ,v^{\prime} ,{u}_{0}^{\prime})\). The objective function of program (16) remains constant along this ray. We next note that, on each such ray of feasible or optimal solutions, there exists one representative which satisfies the normalizing equality \({X}_{o}^{\top }v=1\). Therefore, we can limit the maximization of the objective function of program (16) over its entire feasible region by its maximization over the set of such representatives only. This results in program (15). The linear fractional objective function of program (16) becomes a linear objective function of program (15).

The optimal values of the linear and linear fractional programs (15) and (16) are equal, and any optimal solution of the former program is optimal in the latter. The converse is true only for the optimal solutions of program (16) that satisfy the normalizing condition \({X}_{o}^{\top }v=1\). Such solution obviously exists in each parametric family of optimal solutions \((\alpha u^{\prime} ,\alpha v^{\prime} ,\alpha {u}_{0}^{\prime})\) of program (16).

In summary, we have shown that programs (15) and (16) can be viewed as progressively normalized variants of the maximin program (17). Any optimal solution of program (15) is also optimal in program (16), and any optimal solution of the latter is also optimal in program (17). The fact that the maximin program (17) is not normalized and maximizes the efficiency ratio of DMUo against all observed DMUs subject to the single constraint u, v ≥ 0 makes the interpretation of its optimal solutions, as well as optimal solutions of programs (15) and (16) that are also optimal in (17), straightforward.

In the next section, we show that the discussed hierarchy of multiplier models can be adapted to the modified multiplier model (7) with the infinite number of constraints. It turns out that the latter model also allows the linear fractional and maximin statements useful for interpretation of its optimal solutions.

6 Further interpretations

Below, we continue the transformation of the multiplier model (6) started in Section 4, to two further alternative statements, and consider the interpretation of optimal solutions arising from them. The relation between these models is similar to the hierarchy of the three multiplier VRS models discussed in Section 5.

6.1 The linear fractional model: the general case

Similar to the standard VRS model discussed in Section 5, we can restate program (7) in the linear fractional form. The resulting program has an infinite number of constraints:

Theorem 3

If solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in program (6), then \(\left({u}^{* },{v}^{* },{u}_{0}^{* }\right)\) is optimal in program (18), where \({u}_{0}^{* }\) is found by formula (8). The maximum in program (18) is attained, and we have \({\theta }^{* }={\varphi }_{2}^{* }\).

The following statement is a useful analog of Proposition 1.

Proposition 3

For the projected DMU \(({\theta }^{* }{X}_{o},{Y}_{o})\in {\mathcal{T}}\) and for any optimal solution \(\left({u}^{* },{v}^{* },{u}_{0}^{* }\right)\) of program (18), the inequality (18b) is satisfied as equality, i.e.,

By Theorem 3, any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) to the multiplier model (6) maximizes the efficiency ratio \(({Y}_{o}^{\top }u+{u}_{0})/{X}_{o}^{\top }v\) of DMUo, where the scalar u0 is calculated by formula (8), with respect to the efficiency ratios of all DMUs in technology \({\mathcal{T}}\), under the condition that no such ratio exceeds the value of 1. Furthermore, according to Proposition 3, the latter condition can be replaced by the condition that the maximum of all efficiency ratios across all DMUs in the technology is equal to 1. This maximum is attained at the input radial projection \(\left({\theta }^{* }{X}_{o},{Y}_{o}\right)\in {\mathcal{T}}\).

The above interpretation is different from the traditional interpretation of optimal solutions in the conventional multiplier VRS model stated in the linear fractional form (16). In the latter model, the inequalities (18b) are required only for the finite number of observed DMUs, and not for all DMUs in the technology.

To see the economic meaning of Theorem 3, let u and v be interpreted as the output and input prices. Because at optimality at least one of the constraints (18b) is satisfied as equality, the negated sign-free term − u0 is interpretable as the maximum profit across all DMUs in the technology. Restate the objective function in (18a) as follows:

The second term in (19) is the Nerlovian profit indicator of DMUo normalized by the input combination \({X}_{o}^{\top }v\) (Chambers et al. 1998, Färe and Grosskopf 2004). According to Theorem 3, the optimal prices u* and v* in any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) of program (6) minimize this profit indicator, i.e., maximize the profit efficiency of DMUo in comparison to all DMUs in technology \({\mathcal{T}}\). For these optimal prices, the maximum profit across all DMUs in \({\mathcal{T}}\) is equal to \(-{u}_{0}^{* }=-{U}_{o}^{\top }{w}^{* }\).

6.2 The maximin model: the general case

The efficiency ratios of all DMUs in program (18) are bounded above by 1. It may be argued that this condition complicates the interpretation of its optimal solutions. Below we remove this condition by restating program (18) in the maximin form:

Note that, in contrast to the linear fractional model (18), program (20) does not specify any upper bounds on the efficiency ratios of the DMUs.

Theorem 4

If solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in program (6), then \(\left({u}^{* },{v}^{* },{u}_{0}^{* }\right)\) is optimal in program (20), where \({u}_{0}^{* }\) is found by formula (8). The maximum in program (20) is attained, and we have \({\theta }^{* }={\varphi }_{3}^{* }\).

Theorem 4 allows us to give an interpretation of any optimal solution of program (6) in terms that are independent of the normalizing conditions of the linear and linear fractional programs (7) and (18). Namely, any optimal solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) to the multiplier model (6) maximizes the efficiency ratio of DMUo in comparison to the maximum of the efficiency ratios of all DMUs in technology \({\mathcal{T}}\), under the single condition u, v ≥ 0, without the upper bounds on such ratios specified in the linear fractional model (18) and without the additional input-normalizing condition \({X}_{o}^{\top }v=1\) of the linear model (7).

6.3 Interpretations for cone technologies

Consider a special case in which \({\mathcal{T}}\) is a cone technology for which the parameter condition (4c) is either not specified or is the homogeneous condition (12). This allows us to restate the results obtained for the general technology in a simpler form.

Taking into account formula (8) in which Uo is a zero vector, we restate the general linear fractional program (18) as follows:

Theorem 5

If solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in program (13), then \(\left({u}^{* },{v}^{* }\right)\) is optimal in program (21). The maximum in program (21) is attained, and we have \({\theta }^{* }={\psi }_{2}^{* }\).

The following statement is a useful analog of Proposition 2.

Proposition 4

For the projected DMU \(({\theta }^{* }{X}_{o},{Y}_{o})\in {\mathcal{T}}\) and for any optimal weights \(\left({u}^{* },{v}^{* }\right)\) of program (21), the inequality (21b) is satisfied as equality, i.e.,

Program (14) can also be restated as the maximin program which does not specify an upper bound on the efficiency ratios:

Theorem 6

If solution \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) is optimal in program (13), then \(\left({u}^{* },{v}^{* }\right)\) is optimal in program (22). The maximum in program (22) is attained, and we have \({\theta }^{* }={\psi }_{3}^{* }\).

Let \(\left({u}^{* },{v}^{* },{w}^{* }\right)\) be any optimal solution of program (13). As follows from Theorems 5 and 6, the optimal weights (u*, v*) in this solution maximize the efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\) of DMUo compared to the maximum of such ratios of all DMUs in technology \({\mathcal{T}}\).Footnote 10 This statement is valid if the efficiency ratios are bounded above by 1 as in the linear fractional program (21), or if no such bounds are specified as in the maximin program (22). In this sense, the optimal weights (u*, v*) are the most favorable for DMUo when it is benchmarked against all DMUs in the technology.Footnote 11

The above interpretation is different from the conventional interpretation of the linear fractional CRS model (Charnes et al. 1978) according to which the efficiency ratio of DMUo is explicitly maximized only in comparison to the observed DMUs.

7 The special case of VRS and CRS technologies

In this section, we formally show that, for the multiplier VRS and CRS models, both the traditional and new interpretations of their optimal solutions are correct.

7.1 The VRS technology

Let \({{\mathcal{T}}}_{{\rm{VRS}}}\) be the standard VRS technology of Banker et al. (1984). As shown in Section 5, any optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the standard multiplier VRS program (15) is optimal in the corresponding linear fractional program (16) and is, in turn, optimal in the maximin program (17). This last program maximizes the efficiency ratio \(({Y}_{o}^{\top }u+{u}_{0})/{X}_{o}^{\top }v\) of DMUo when it is benchmarked against the set of observed DMUs. Therefore, any optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the standard multiplier VRS model (15) is the most favorable for DMUo when it is compared to the set of observed DMUs only.

It is interesting to note that, although the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) is identified by program (15) under the two normalizing conditions discussed in Section 5 (the efficiency ratio of all DMUs is bounded above by 1 and the input weights are normalized by the equality \({X}_{o}^{\top }v=1\)), this solution is also optimal in the maximin program (17) which does not have any such conditions. Therefore, the solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) is the most favorable for benchmarking DMUo against the set of observed DMUs among all triplets (u, v, u0) under the only condition that u ≥ 0 and v ≥ 0.

Now consider the statement of Theorem 4. For the VRS technology, the vector Uo in the statement (4) is the scalar equal to 1, and we have \({u}_{0}^{* }={w}^{* }\). According to Theorem 4, the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the standard multiplier VRS model (15) is also optimal in program (20) and is therefore the most favorable for DMUo when it is benchmarked against all DMUs in technology \({{\mathcal{T}}}_{{\rm{VRS}}}\). It is worth pointing out that, although the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) satisfies the normalizing conditions of program (15) mentioned above, it is the best solution among all triplets (u, v, u0) such that u, v ≥ 0, which is the only condition of the maximin program (20).

In summary, we have shown that any optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the standard multiplier VRS program (15) is simultaneously the most favorable for DMUo when it is benchmarked against the observed DMUs only and also against all DMUs in the VRS technology generated by these DMUs.

Remark 5

Benchmarking DMUo against the set of observed DMUs (in the sense of maximizing its efficiency ratio \(({Y}_{o}^{\top }u+{u}_{0})/{X}_{o}^{\top }v\)) does not depend on the specification of technology \({\mathcal{T}}\) and requires solving the maximin program (17) whose statement does not refer to any technology. In contrast, benchmarking DMUo against the entire technology \({\mathcal{T}}\) requires solving the maximin program (20) which depends on \({\mathcal{T}}\). For \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{VRS}}}\), program (20) is equivalent to (17). Indeed, as shown in Section 5, solving the maximin program (17) is equivalent to solving the linear multiplier VRS model (15) (with a caveat that solving the latter model identifies only the normalized solutions among the multiple optimal solutions of the maximin model). Taking into account that \({u}_{0}^{* }={w}^{* }\), by Theorem 4, this is in turn equivalent to solving the maximin program (20) with \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{VRS}}}\).

This observation puts the VRS technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) in a unique position in that it allows the two interpretations discussed above. Namely, benchmarking DMUo against the set of observed DMUs is equivalent to benchmarking DMUo against the technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) generated by such observed DMUs.

7.2 The CRS technology

The case of CRS technology is similar. Let \({{\mathcal{T}}}_{{\rm{CRS}}}\) be the standard CRS technology of Charnes et al. (1978). As mentioned in Footnote 9, similar to the multiplier VRS model, the linear multiplier CRS model can also be stated in the linear fractional and maximin forms. These three forms are models (15), (16) and (17) from which we remove the sign-free variable u0.

Suppose that the solution (u*, v*) is optimal in the linear CRS model (model (15) with u0 removed). Then (u*, v*) is optimal in the other two forms, including the maximin model obtained from program (17) by removing variable u0. The meaning of the last program is clear: the optimal solution (u*, v*) maximizes the efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\) of DMUo when it is benchmarked against the set of observed DMUs. Because the solution (u*, v*) is optimal in the maximin model, the weights u and v are the best for DMUo among all nonnegative weights, and not only among the normalized feasible solutions of the linear multiplier program.

Similarly, by Theorem 6, the solution (u*, v*) is also optimal in the maximin program (22) where \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{CRS}}}\). This means that it maximizes the efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\) of DMUo when this DMU is benchmarked against the entire technology \({{\mathcal{T}}}_{{\rm{CRS}}}\).

We have shown that, for any optimal solution (u*, v*) of the standard multiplier CRS program, both interpretations are correct. Namely, any such solution is the most favorable for DMUo (in the sense of maximization of the efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\)) when it is benchmarked against the set of observed DMUs and against the entire CRS technology generated by these DMUs.

We conclude by making a similar observation to Remark 5. Benchmarking DMUo against the set of observed DMUs (in the sense of maximizing its efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\)) does not depend on the assumed technology \({\mathcal{T}}\) and requires solving the appropriately specified maximin program (program (17) with u0 removed). In contrast, benchmarking DMUo in the same sense against the whole technology leads to the maximin program (22) stated with \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{CRS}}}\). Similar to the case of VRS discussed in Remark 5, it is straightforward to show that these two maximin programs are equivalent. This puts the CRS technology in a unique position in that benchmarking DMUo against the set of observed DMUs (in the sense of maximizing the efficiency ratio \({Y}_{o}^{\top }u/{X}_{o}^{\top }v\)) is equivalent to benchmarking DMUo against the technology \({{\mathcal{T}}}_{{\rm{CRS}}}\) generated by such observed DMUs.

8 Clarifying example

This example illustrates the difference between the maximization of the efficiency ratio \(({Y}_{o}^{\top }u+{u}_{0})/{X}_{o}^{\top }v\) of the DMUo with respect to the maximum of such ratios taken over all DMUs in the entire technology \({\mathcal{T}}\) and, alternatively, over the set of observed DMUs only.Footnote 12 It also illustrates a similar difference in the evaluation of profit efficiency of DMUo.

8.1 Technology

Consider the non-increasing returns-to-scale (NIRS) technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) with a single input and a single output generated by the three observed DMUs A, B and C shown in Table 1. (The additional DMU D in this table is not considered observed but is used in the discussion below.) For reference, we also consider the standard VRS technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) generated by the same three observed DMUs.

To keep consistency with the general statement of polyhedral technology (4), we state technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) as the set of all DMUs \((X,Y)\in {{\mathbb{R}}}_{+}^{m+s}\) for which there exist an intensity vector \({({\lambda }_{A},{\lambda }_{B},{\lambda }_{C})}^{\top }\) and the scalar slacks SX, SY and Sλ such that

It is clear that (23) is a special case of (4). Indeed, vector \(\hat{\lambda }\) in (4) corresponds to the extended vector \(\hat{\lambda }={({\lambda }_{A},{\lambda }_{B},{\lambda }_{C},{S}_{\lambda })}^{\top }\) in (23). The scalar Uo is equal to 1 and the three matrices \(\hat{X}\), \(\hat{Y}\) and \(\hat{U}\) have a single row and 4 columns, and are defined as follows:

Technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) is shown in Fig. 1 as the shaded area below its boundary OBW. The smaller VRS technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) generated by the same observed DMUs is shown in darker shading.

8.2 The multiplier models and their solutions

Consider assessing the input radial efficiency of DMU C in the specified technologies. For technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\), the input-oriented multiplier model is stated as follows:

For technology \({{\mathcal{T}}}_{{\rm{VRS}}}\), we use the statement (24) from which we remove the condition u0 ≤ 0, i.e., declare u0 a sign-free variable.

Program (24) is a special case of the general statement (6) of the multiplier model based on an arbitrary polyhedral technology \({\mathcal{T}}\). Note that, in line with the statement of program (6), we should be using notation w for the dual variable to the primal equality (23c) and distinguish it from the variable u0 defined by the transformation (8) as \({u}_{0}={U}_{o}^{\top }w\). However, because in this example the scalar Uo = 1, we have w = u0. To simplify discussion, we use the same notation u0 in all models in this example. (Note that the condition u0 ≤ 0 of program (24) is dual to the primal variable Sλ in equality (23c).)

The input radial efficiency of DMU C in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) is equal to 0.5, and its input projection is F. The multiplier program (24) has the unique optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })=(0.25,0.25,0)\). In line with Proposition 1, it defines the supporting hyperplane \({{\mathcal{H}}}_{{\rm{NIRS}}}\) to technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) at the input projection F. This hyperplane satisfies the equation 0.25Y − 0.25X = 0 and includes the line OB as a subset. All DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) are located to one side of \({{\mathcal{H}}}_{{\rm{NIRS}}}\), more precisely, for any DMU \((X,Y)\in {{\mathcal{T}}}_{{\rm{NIRS}}}\), we have 0.25Y − 0.25X ≤ 0.

Similarly, the input radial efficiency of DMU C in technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) is equal to 0.625. The multiplier VRS model for this DMU has the unique optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})=(0.125,0.25,0.375)\) which defines the supporting hyperplane \({{\mathcal{H}}}_{{\rm{VRS}}}\) to technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) at the input projection G. This hyperplane satisfies the equation 0.125Y − 0.25X + 0.375 = 0 and includes the line segment AB as a subset. All DMUs in technology \({{\mathcal{T}}}_{{\rm{VRS}}}\) are located to one side of the hyperplane \({{\mathcal{H}}}_{{\rm{VRS}}}\), i.e., for any DMU \((X,Y)\in {{\mathcal{T}}}_{{\rm{VRS}}}\), we have 0.125Y − 0.25X + 0.375 ≤ 0.

8.3 Benchmarking efficiency ratio against the observed DMUs only

Consider the following question: what are the best input and output weights v ≥ 0 and u ≥ 0, and the sign-free constant u0 that maximize the efficiency ratio (Y⊤u + u0)/X⊤v of DMUo = C in relation to the maximum of such ratios of all observed DMUs? Note that this question does not refer to any technology. We are simply interested in the triplet (u, v, u0), where u ≥ 0 and v ≥ 0, which is the most favorable for DMU C in comparison to the observed DMUs. This question does not require that we assume any production technology.

Note that the above question is in line with the original motivation of the CRS model by Charnes et al. (1978). This model is first introduced in the linear fractional multiplier form, without a reference to any particular technology. It is presented as a model that maximizes the efficiency ratio Y⊤u/X⊤v of DMUo when it is benchmarked against the finite set of observed DMUs.

For ease of reference, Table 2 shows the efficiency ratios (Y⊤u + u0)/X⊤v of different DMUs (including the unobserved DMU D) evaluated at the optimal solutions \(({u}^{* },{v}^{* },{u}_{0}^{* })\) and \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the NIRS and VRS multiplier models that assess the input radial efficiency of DMU C.

As noted in Remark 5, the answer to the above question is obtained by solving the standard input-oriented multiplier VRS model. In our example, this is model (24) in which the condition u0 ≤ 0 is removed and the variable u0 is declared sign free. The solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) optimal in the VRS model shows DMU C in the best light in comparison the set of observed DMUs only. As seen from Table 2, for this solution, the ratio of the efficiency ratio of DMU C to the maximum of such ratios of all observed DMUs A, B and C (but not D) is equal to \(0.625/\max \{1,1,0.625\}=0.625\).

Note that the solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) obtained in the NIRS model is worse in this respect because \(0.5/\max \{0.5,1,0.5\}=0.5\,<\,0.625\). Therefore, the optimal solution of the NIRS model is not the most favorable for DMU C when it is benchmarked against the set of observed DMUs. Note that the solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) is also feasible in the VRS model, but this is not required and is unrelated to the stated question.

8.4 Benchmarking efficiency ratio against the NIRS technology

We now consider a question the answer to which depends on the assumed technology: what is the most favorable triplet (u, v, u0), where v ≥ 0, u ≥ 0 and u0 is sign-free, that maximize the efficiency ratio (Y⊤u + u0)/X⊤v of DMUo = C in relation to the maximum of such ratios of all DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\)?

In contrast to the question answered in Section 8.3, we now have to compare the efficiency ratio of DMUo with the efficiency ratios of all DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\). For example, this includes DMU D which is not observed but belongs to the technology by the assumption of NIRS. However, exactly as in Section 8.3, the only condition on the vectors v and u is that they should be nonnegative. In particular, the triplet (u, v, u0) is not required to satisfy any other conditions of the multiplier NIRS program (24), which is simply a normalized form of the corresponding maximin program (20)—see a related discussion in Section 5.

It is clear that any most favorable triplet (u, v, u0) in the described setting is an optimal solution of the maximin program (20), stated for DMUo = C, where we take \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{NIRS}}}\). By Theorem 4, and because in our example \({u}_{0}^{* }={w}^{* }\), the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the standard multiplier NIRS program (24) is also optimal in the maximin program (20). Therefore, \(({u}^{* },{v}^{* },{u}_{0}^{* })\) is the most favorable triplet for DMU C when it is benchmarked against the entire technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\).

Furthermore, by Theorem 4, the optimal value θ* = 0.5 of program (24) is equal to the optimal value \({\varphi }_{3}^{* }\) of the corresponding program (20) and represents the maximal ratio of the efficiency ratio of DMU C to the maximum of similar efficiency ratios calculated for all DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\).

Now consider the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier model. It is clear that this solution is feasible in the maximin program (20) stated for DMUo = C, with \({\mathcal{T}}={{\mathcal{T}}}_{{\rm{NIRS}}}\). However, it is not its optimal solution and is, therefore, not the most favorable for DMU C when it is compared to the entire technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\), in the sense of maximizing its efficiency ratio. Indeed, to see this, it suffices to find a DMU \((X^{\prime} ,Y^{\prime} )\) in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) such that the ratio of the efficiency ratios of DMUs C and \((X^{\prime} ,Y^{\prime} )\), calculated for \((\hat{u},\hat{v},{\hat{u}}_{0})\), is strictly less than 0.5.

As an example of the required DMU \((X^{\prime} ,Y^{\prime} )\), consider DMU D. As shown in Table 2, for the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier model, the efficiency ratio of DMU C is equal to 0.625, and the same ratio of DMU D is equal to 2. The ratio of these efficiency ratios is equal to 0.625/2 = 0.3125, which is lower than the optimal value 0.5 achieved at the solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\). Therefore, the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier model is not the most favorable for DMU C when it is compared to all DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\).

Remark 6

It may be noted that the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier model, as shown in Table 2, does not satisfy the constraints of the multiplier NIRS model (24), for example, because \({\hat{u}}_{0}=0.375> 0\). It is also clear from Fig. 1 that the corresponding supporting hyperplane \({{\mathcal{H}}}_{{\rm{VRS}}}\) to the VRS technology is not a supporting hyperplane to the NIRS technology. However, these observations are unrelated to the question asked at the beginning of this section. The only condition imposed by the question is the nonnegativity of the weights u and v. Therefore, any triplet (u, v, u0) that satisfies this condition is an eligible candidate for the maximization of the efficiency ratio of DMU C by the maximin program (20). The optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier program is feasible in the maximin program (20) but, as shown, is not optimal. In contrast, by Theorem 4, the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the multiplier NIRS program (24) is also optimal in program (20), and provides the answer to the stated question.

8.5 Benchmarking profit efficiency against the NIRS technology

Let us reinterpret the same example in terms of profit efficiency. Let v ≥ 0 and u ≥ 0 represent the input and output prices. The second column of Table 3 shows the profit of the observed DMUs A, B and C, and the unobserved DMU D, calculated for the input and output prices v* = u* = 0.25 taken from the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the multiplier NIRS model (24). For example, the profit of DMU C is equal to 2 × 0.25 − 4 × 0.25 = − 0.5. The last column shows the profit of these DMUs calculated for the prices \(\hat{v}=0.25\) and \(\hat{u}=0.125\) taken from the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS multiplier model.

Consider the following question: what input and output prices v and u minimize the difference between the maximum profit across all (observed and unobserved) DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) and the profit of DMU C, under the normalizing condition that the cost of the input bundle of DMU C is equal to 1 (i.e., 4v = 1 in our example)? In other words, what input and output prices are the most favorable for DMU C in the sense of profit efficiency evaluated in comparison to the entire technology?

The general answer to this question was obtained in Section 4.1. In the context of our example, such most favorable prices v* and u* are taken from the optimal solution \(({u}^{* },{v}^{* },{u}_{0}^{* })\) of the multiplier NIRS program (24), i.e., v* = u* = 0.25. As shown in Section 4.1, for these prices, the maximum profit achievable across all DMUs in technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\) is equal to \(-{u}_{0}^{* }=0\). (Note that this maximum is consistent with the profits of all four DMUs shown in the second column of Table 3, although of course these DMUs do not represent the whole technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\).) The difference between this maximum profit and the profit of DMU C is calculated as 0 −(−0.5) = 0.5.

It is easy to show that the input and output prices \(\hat{v}=0.25\) and \(\hat{u}=0.125\) taken from the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS model do not maximize the profit efficiency of DMU C benchmarked against the entire technology \({{\mathcal{T}}}_{{\rm{NIRS}}}\). (Note that such prices satisfy the conditions stated in the question about profit efficiency maximization: both prices are positive and the cost of the input bundle of DMU C is equal to 1.) Indeed, it suffices to identify a DMU \((X^{\prime} ,Y^{\prime} )\in {{\mathcal{T}}}_{{\rm{NIRS}}}\) such that the difference between the profits of DMUs \((X^{\prime} ,Y^{\prime} )\) and C for the prices \(\hat{v}\) and \(\hat{u}\) is greater than 0.5.

As an example of DMU \((X^{\prime} ,Y^{\prime} )\), consider DMU D. As follows from the last column of Table 3, the difference between the profits of DMUs D and C is equal to −0.125 − (−0.75) = 0.625 > 0.5. Therefore, the optimal prices \(\hat{v}\) and \(\hat{u}\) of the multiplier VRS model do not maximize the profit efficiency of DMU C when it is benchmarked against the entire technology.

8.6 Benchmarking profit efficiency against the observed DMUs

Now suppose that we want to identify the input and output prices that maximize the profit of DMU C in comparison to the maximum profit among the three observed DMUs only. Similar to the question considered in Section 8.3, the answer to this new question does not depend on the assumed technology.

The prices that answer the stated question are the ones given by the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\) of the VRS model. (To prove this, we need to repeat the discussion of profit maximization in Section 4.1, with the technology \({\mathcal{T}}\) replaced by the set of observed DMUs (Xj, Yj), j = 1, …, n, and program (7) replaced by program (15).) For the optimal solution \((\hat{u},\hat{v},{\hat{u}}_{0})\), the difference between the maximum profit and the profit of DMU C is equal to −0.375 − (−0.75) = 0.375. This represents a smaller shortfall compared to the shortfall of 0.5 in the case of benchmarking DMUo against the entire NIRS technology considered in Section 8.5.

Note that, if we used the prices v* = u* = 0.25 identified by the multiplier NIRS program (24), the profit of DMU C would be equal to −0.5 and the maximum profit among the observed DMUs would be equal to 0 (the profit of DMU B), with the difference equal to 0 − (−0.5) = 0.5, which is greater than the difference 0.375 achieved at the optimal prices in the VRS model. Therefore, the optimal prices obtained by solving the multiplier NIRS program (24) do not maximize the profit efficiency of DMUo when it is benchmarked against the observed DMUs only.

8.7 Summary and discussion