Abstract

Conventional parametric stochastic cost frontier models are likely to suffer from biased inferences due to misspecification and the ignorance of allocative efficiency (AE). To fill up the gap in the literature, this article proposes a semiparametric stochastic cost frontier with shadow input prices that combines a parametric portion with a nonparametric portion and that allows for the presence of both technical efficiency (TE) and AE. The introduction of AE and the nonparametric function into the cost function complicates substantially the estimation procedure. We develop a new estimation procedure that leads to consistent estimators and valid TE and AE measures, which are proved by conducting Monte Carlo simulations.

Similar content being viewed by others

Notes

Robinson (1988) showed that the parametric estimators are consistent at the parametric rate of N−1/2, while the nonparametric estimators converge at a slower rate than N−1/2, where N denotes the sample size.

It can be shown that these estimators are consistent and asymptotically normal.

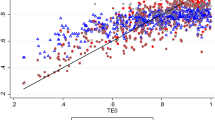

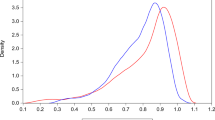

The two-step estimation procedures of Kumbhakar and Lovell (2000) are found to give consistent estimates of AE when the cost function takes the translog form. The TE estimates in general perform not as well as AE estimates, due mainly to the badly performed distribution parameter estimates. Inferences on TE scores using a small sample are doubtful.

Note that the objective function of (3-2) is initially expressed as \( W^{ *} X \) and the choice vector is X. Since parameter b emerges in the constraint of F(·,·), together with X, it is convenient to transform the objective function into \( \left( {W^{ *} /b} \right)bX \). This is equivalent to treat \( W^{ * } /b \) as the new input prices and bX the new choice vector.

Term g t decreases at an increasing rate if γ > 0, increases at an increasing rate if γ < 0, or stays constant if γ = 0.

There is a concern with the referee’s suggestion that equation (3-13) would be plus an extra term \( E(\ln \hat{G}_{nt} |\ln Y_{nt} ) - E(\ln G_{nt} |\ln Y_{nt} ) \), which is non-zero. We can examine how fast it converges to zero as either N or T grows by simulations. The results reveal that the bias measures are small in all of the (N, T) combinations. In addition, the biases decrease as either N or T grows, with the exception of the case of (N, T) = (50, 20). This leads us to conclude that the extra term \( E(\ln \hat{G}_{nt} |\ln Y_{nt} ) - E(\ln G_{nt} |\ln Y_{nt} ) \) does converge rapidly.

To save space, the results for the case of N = 50 are not shown, but available upon request from the authors.

We also check whether the other two regularity conditions are satisfied, that is, a cost function is concave in input prices and the marginal cost should be positive. The model now is specified with an output (y) and two inputs (w1, w2) for simplicity. The result presents that most of the simulated outcomes meet the requirements, although the last condition performs a little worse for smaller sample. We conclude that vast majority of the simulated results satisfy the regularity properties.

We agree with the referee’s opinion that measures of scale economies (SE) and cost elasticity (CE) are important topics particularly in conventional performance analysis. Evidence is found that the simulated estimates of the SE would accurately predict the scope of the true SE and the predictability rises as the sample size increases. Since the CE of outputs is the reciprocal of SE, its measure has very similar performance to the SE. Viewed from this angle, our modeling appears to provide satisfactory results.

References

Aigner DJ, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econom 6:21–37

Akhigbe A, McNulty JE (2003) The profit efficiency of small US commercial banks. J Bank Finance 27:307–325

Altunbas Y, Evans L, Molyneux P (2001) Bank ownership and efficiency. J Money Credit Bank 33:926–954

Atkinson SE, Cornwell C (1993) Estimation of technical efficiency with panel data: A dual approach. J Econom 59:257–262

Atkinson SE, Cornwell C (1994) Parametric estimation of technical and allocative inefficiency with panel data. Int Econ Rev 35:231–243

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data:with application to paddy farmers in India. J Prod Anal 3:153–169

Bauer PW (1990) Recent development in the econometric estimation of frontiers. J Econ 46:39–56

Berger AN, DeYoung R (1997) Problem loans and cost efficiency in commercial banks. J Bank Finance 21:849–870

Berger AN, Mester LJ (1997) Inside the black box: what explains differences in the efficiencies of financial institutions? J Bank Finance 21:895–947

Berger AN, Hancock GA, Humphrey DB (1993) Bank efficiency derived from the profit function. J Bank Finance 17:317–347

Berger AN, Leusner JH, Mingo JJ (1997) The efficiency of bank branches. J Monet Econ 40:141–162

Deng WS, Huang TH (2008) A semiparametric approach to the estimation of the stochastic frontier model with time-variant technical efficiency. Acad Econ Pap 36:167–193

Fan Y, Li Q (1992) The asymptotic expansion of kernel sum of square residuals and its application in hypotheses testing, Discussion paper, University of Windsor, Department of Economics

Fan Y, Li Q, Weersink A (1996) Semiparametric estimation of stochastic production frontier models. J Bus Econ Stat 14:460–468

Ferrier GD, Lovell CAK (1990) Measuring cost efficiency in banking. J Econom 46:229–245

Härdle W (1990) Applied nonparametric regression. Cambridge University Press, Cambridge

Härdle W, Stoker TM (1989) Investigating smooth multiple regression by the method of average derivatives. J Am Stat Assoc 84:986–995

Huang TH (2000) Estimating X-efficiency in Taiwanese banking using a Translog shadow profit function. J Prod Anal 14:225–245

Huang TH, Wang MH (2004) Comparisons of economic inefficiency between output and input measures of technical inefficiency using Fourier flexible cost frontiers. J Prod Anal 22:123–142

Huang TH, Shen CH, Chen KC, Tseng SJ (2011) Measuring technical and allocative efficiencies for banks in the transition countries using the Fourier flexible cost function. J Prod Anal 35:143–157

Kumbhakar SC (1991) The measurement and decomposition of cost inefficiency: The translog cost system. Oxf Econ Pap 43:667–683

Kumbhakar SC (1996a) A parametric approach to efficiency measurement using a flexible profit function. Southern Econ J 63:473–487

Kumbhakar SC (1996b) Efficiency measurement with multiple outputs and multiple inputs. J Prod Anal 7:225–256

Kumbhakar SC (1997) Modeling allocative inefficiency in a translog cost function and cost share equations: an exact relationship. J Econom 76:351–356

Kumbhakar SC, Lovell CAK (2000) Stochastic frontier analysis. Cambridge University Press, Cambridge

Kumbhakar SC, Wang HJ (2006a) Pitfalls in the estimation of a cost function that ignores allocative inefficiency: A Monte Carlo analysis. J Econom 134:317–340

Kumbhakar SC, Wang HJ (2006b) Estimation of technical and allocative inefficiency: a primal system approach. J Econom 134:419–440

Meeusen W, Van Den Broeck J (1977) Efficiency estimation from Cobb-Douglas production functions with composed error. Int Econ Rev 18:435–444

Nadaraya EA (1964) On estimating regression. Theory Prob Appl 10:186–190

Olson JA, Schmidt P, Waldman DM (1980) A Monte Carlo study of estimators of stochastic frontier production. J Econom 13:67–82

Robinson PM (1988) Root-N-Consistent semiparametric regression. Econometrica 56:931–954

Wand MP, Jones MC (1995) Kernel smoothing. Chapman and Hall Press, New York

Watson GS (1964) Smooth regression analysis. Sankhya Series A 26:359–372

Wheelock DC, Wilson PW (2001) New evidence on returns to scale and product mix among US commercial banks. J Monet Econ 47:653–674

Yatchew A (1998) Nonparametric regression techniques in economics. J Econ Literature 36:669–721

Yatchew A (2003) Semiparametric regression for the applied econometrician. Cambridge University Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, TH., Chen, KC., Lin, CH. et al. Consistent estimation of technical and allocative efficiencies for a semiparametric stochastic cost frontier with shadow input prices. J Prod Anal 41, 307–320 (2014). https://doi.org/10.1007/s11123-012-0316-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-012-0316-9

Keywords

- Semiparametric cost frontier

- Monte Carlo simulations

- Shadow prices

- Technical efficiency

- Allocative efficiency