Abstract

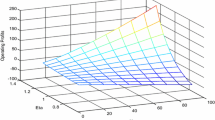

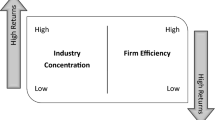

In this paper, we investigate the role of firm efficiency in asset pricing using a sample of US publicly listed companies for the period 1988–2007. We employ non-parametric data envelopment analysis (DEA) on various input/output combinations, focusing on sales and market value as output measures in the construction of the frontier technologies. Using these performance measures, we examine whether efficient firms perform differently from inefficient firms following standard financial analysis procedures. First, we employ performance attribution regressions, by forming portfolios based on efficiency scores and tracking the performance of the various portfolios over time. Second, we perform cross-sectional/panel regressions to determine whether firm efficiency indeed has explanatory power for the cross-section of stock returns. Our results suggest that firm efficiency plays an important role in asset pricing and that efficient firms significantly outperform inefficient firms even after controlling for known risk factors.

Similar content being viewed by others

Notes

Distress risk is one way to link firm efficiency to the return on equity; efficiency affects the riskiness of the firm’s cash flows that in turn affect equity returns (see Nguyen and Swanson 2009).

When we estimate the model empirically we use the average output and the average input to define the directional vectors g y and g x .

See http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html for more details on the construction of these factors.

We observe a slight inverted U-shape pattern in β M . This pattern will be explained when we address the 3-factor model.

We also observe a slight inverted U-shape in these coefficients, which can explain the invert U-shape previously observed in CAPM beta’s. This suggests that the middle deciles are more dominated by small caps than the most and least efficient deciles.

Results for the CAPM and Fama-French 3-factor model have not been reported for the sake of brevity, but are available from the authors on request.

Results for the CAPM and Fama-French 3-factor model have not been reported for the sake of brevity, but are available from the authors on request.

References

Alam I, Sickles R (1998) The relationship between stock market returns and technical efficiency innovations: evidence from the US airline industry. J Prod Anal 9:35–51

Banz R (1981) The relationship between return and market value of common stocks. J Financ Econ 9:3–18

Black F (1972) Capital market equilibrium with restricted borrowing. J Bus 45:444–455

Carhart M (1997) On the persistence in mutual fund performance. J Finance 52:57–82

Chambers R, Chung Y, Färe R (1996) Benefit and distance functions. J Econ Theory 70:407–419

Demerjian P, Lev B, McVay S (2009) Quantifying managerial ability: a new measure and validity tests. Working paper

Easley D, Hvidkjaer S, O’Hara M (2002) Is information risk a determinant of asset returns? J Finance 57:2185–2221

Fama E, French K (1992) The cross-section of expected stock returns. J Finance 47:427–465

Fama E, French K (1993) Common risk factors in the returns on stocks and bonds. J Finance Econ 33:3–56

Habib M, Ljungqvist A (2005) Firm value and managerial incentives: a stochastic frontier approach. J Bus 78:2053–2093

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Finance 48:65–91

Leverty JT, Qian Y (2009) Do efficient firms make better acquisitions? Working paper

Lintner J (1965) The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Rev Econ Stat 47:13–37

Markowitz H (1952) Portfolio selection. J Finance 7:77–91

Newey W, West K (1987) A simple positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55:703–708

Nguyen G, Swanson P (2009) Firm characteristics, relative efficiency, and equity returns. J Financ Quant Anal 44:213–236

Pàstor L, Stambaugh R (2003) Liquidity risk and expected stock returns. J Polit Econ 111:642–685

Petersen M (2009) Estimating standard errors in finance panel data sets: comparing appraoches. Rev Financ Stud 22:435–480

Rosenberg B, Reid K, Lanstein R (1985) Persuasive evidence of market inefficiency. J Portfolio Manag 11:9–17

Sharpe W (1964) Capital asset prices: a theory of market equilibrium under conditions of risk. J Finance 19:425–442

Stattman D (1980) Book values and stock returns. Chic MBA J Sel Pap 4:25–45

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Frijns, B., Margaritis, D. & Psillaki, M. Firm efficiency and stock returns. J Prod Anal 37, 295–306 (2012). https://doi.org/10.1007/s11123-011-0246-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-011-0246-y