Abstract

In recent American elections political candidates have actively emphasized features of their fundraising profiles when campaigning. Yet, surprisingly, we know comparatively little about how financial information affects vote choice specifically, whether effects differ across types of election, and how robust any effects are to other relevant political signals. Using a series of conjoint experiment designs, I compare the effects of campaigns’ financial profiles on vote choice across direct democratic and representative elections, randomizing subjects’ exposure to additional political cues. I find that while the financial profile of candidates can affect vote choice, these effects are drowned out by non-financial signals. In ballot initiative races, the explicit policy focus of the election appears to swamp any effect of financial information. This paper is the first to explore the comparative effects of financial disclosure across election type, contributing to our understanding of how different heuristics interact across electoral contexts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

In recent US elections, candidates have actively publicized aspects of their campaign finance profiles including the average size of donations, the proportion of small donations, and the local nature of their financial support. For example, in 2016, Bernie Sanders repeatedly campaigned on the fact his average donation was $27 (Bump, 2016). In the early stages of the 2020 presidential race, Elizabeth Warren tweeted “I won’t take a dime of PAC money in this campaign”,Footnote 1 and both President Trump and Kamala Harris highlighted that over 98% of their campaign funds came from small contributions (Rizzo, 2019).

That candidates emphasize their own campaign finance profiles suggests they believe this information matters to voters. Yet, surprisingly, we know little about how voters actually react to information about candidates’ campaign finance profiles. While theoretical works argue financial transparency is a Pareto improving feature of electoral systems that grants citizens greater information over their vote choice (Coate, 2004; Ashworth, 2006), in practice, findings on the impacts of disclosure are mixed. While voters’ perceptions of candidates are not immune to the effects of disclosure (Wood, 2019; Spencer & Theodoridis, 2020), the marginal informational benefits may be limited (Primo, 2013).

Several fundamental aspects of the effect of financial cues on voters’ behavior remain understudied. First, few studies have examined how disclosure affects vote choice, particularly in contexts that resemble the discrete choice voters face at the ballot box (Dowling & Wichowsky, 2013). Instead, studies typically focus on separate assessments of each candidate (Ridout et al., 2015; Rhodes et al., 2019; Dowling & Wichowsky, 2015), perceptions of the substantive positions of candidates or interest groups (Sances, 2013; Primo, 2013), or perceptions of corruption (Spencer & Theodoridis, 2020). However, financial signals may shift voters’ perceptions about candidates without inducing changes in vote choice, which has substantial implications for the practical utility of the regulation.

Second, it is unclear how the effects of financial information are themselves impacted by other relevant features of the electoral context. Do financial cues affect vote choice once other highly relevant information like partisanship and political experience are revealed? While some studies explicitly control for these cues (Dowling & Wichowsky, 2015; Dowling & Miller, 2016; Rhodes et al., 2019), we know little about how other signals mediate the effect of campaign finance information.

Third, previous experiments focus primarily on candidate elections, but the effects of financial information may differ in other democratic races that lack explicit partisan or valence signals. Given the policy implications of direct democratic outcomes, voters may infer useful information about a policy’s likely beneficiaries from campaign finance information by inferring the interests of donors (Boudreau & MacKenzie, 2021). This issue is particularly important given the prominence of ballot initiative policymaking in the United States (Bowler & Donovan, 2000), and the vast sums of money now spent for and against propositions each electoral cycle (Stratmann, 2010). This paper, to the best of my knowledge, provides the first test of the comparative effects of financial information on vote choice across representative and direct democratic elections.

In this paper, I develop a simple theoretical account of how financial cues affect vote choice given the broader informational context. In the absence of other signals, cues taken from financial disclosure can lead to meaningful shifts in the estimation of a voter’s utility, and thus substantive shifts in vote choice. However, in the presence of other political signals, these financial cues may be “swamped" yielding negligible changes in vote choice. This mechanism also translates to direct democratic elections: the explicit policy focus of referendums and ballot initiatives may overwhelm informative cues gleaned from a campaign’s financial profile.

The primary empirical contributions of this paper are to establish whether financial signals can affect voters’ choices, and how robust these potential effects are across different contexts. Using a series of conjoint designs, I test the efficacy of financial signals across two types of election—gubernatorial and ballot initiative races. I also vary the presence of other politically-relevant signals by randomising the number of conjoint attributes displayed to respondents (Sen, 2017). Half of all subjects receive additional information about candidates’ ideology, partisanship and political experience. Random assignment across conditions allows for an unconfounded analysis of whether the marginal effects of financial cues are robust to the presence of other political signals prevalent in contemporary electoral contexts.

I find that campaign finance information can have an effect on vote choice, but that these effects are swamped by other political signals.Footnote 2 When subjects are only presented with financial cues they are less likely to choose candidates with high average donations, a majority of donations from out of the state, and relatively concentrated groups of donors. However, when candidates’ ideology, partisanship, and experience are known, these effects are indistinguishable from zero—with the exception of the geographic origin of donations. Disclosure also does not appear to affect vote choice in initiative elections either. Subjects appear to have relatively fixed political views on policy issues, rendering disclosure ineffective. The results therefore provide little evidence that campaign finance information has a distinct impact on vote choice conditional on other highly-salient cues. In Sect. 4 I discuss the policy implications of these results.

The Informational Benefit of Disclosure

In First National Bank of Boston v. Bellotti (1978), which struck down expenditure limits in ballot initiative races, the Supreme Court argued that disclosure allows voters to evaluate the arguments presented for and against proposed legislation, and thus bolster their ability to make informed decisions in elections—what is known as the “informational benefit” of disclosure (Jiang, 2019). More recently, in Citizens United v. FEC (2010) , the Court opined that, since contributions are effectively a form of speech, voters should have the right to know who is speaking because this knowledge informs voting behavior.Footnote 3

Research on political advertisements demonstrates that disclosure can affect voter decisionmaking, specifically by inferring different intentions by different donor sources (Dowling & Wichowsky, 2013; Sances, 2013; Dowling & Wichowsky, 2015). At the aggregate campaign-level, voters appear to value transparent profiles (Wood, 2019), with disclosure influencing voters’ perceptions of candidate corruption (Spencer & Theodoridis, 2020). Other work, however, finds that the marginal benefit of disclosure to voters’ knowledge of interest group positions is negligible (Primo, 2013).

These studies on voter perceptions are important but leave open the question as to whether changes in perceptions translate to changes in voting behavior. Only one paper (to the best of my knowledge) directly assesses the effect of aggregate disclosure on the likelihood of voting for a candidate, finding moderate support that this information alters vote choice even in the presence of partisan cues (Dowling & Miller, 2016).

In this section, I present a simplified theoretical motivation for how disclosure might affect vote choice by refining individuals’ perceptions of the utility gain from choosing one candidate over another. I discuss several financial features of campaigns that may influence vote choice. I then show how the presence of other politically relevant signals, and the type of electoral race, may “swamp” the effects of these cues.

Financial Disclosure as a Heuristic

Assume, in the most abstract terms, that a voter must make a choice between two candidates with the goal of maximising their own utility. Assume further that the problem the voter faces is about estimation—given a set of signals can voters adequately estimate which candidate will make them better off?

Researching candidates and campaigns is taxing (Primo, 2013). Moreover, some factors such as competence, trustworthiness, and viability are hard to observe directly. Candidates and campaigns may even suppress information or qualities that are deemed harmful to their electoral prospects. To overcome these overly-taxing cognitive demands, individuals use information signals that enable less costly estimates of the position or valence of a campaign. These heuristics, “efficient cognitive processes ...that ignore part of the information” (Gigerenzer & Gaissmaier, 2011, p.451), often provide useful shortcuts for evaluating campaigns and political choices (Lupia, 1994).

Campaign finance information, particularly when simplified, may play the role of a heuristic device. Voters may prefer campaigns with higher total donations, for example, because it signals something about hard to observe characteristics like political viability (Wood, 2019). The “informational benefit" of disclosure, therefore, is the extent to which this information enables voters to refine (i.e. reduce uncertainty about) their estimates of candidates and campaigns along the relevant dimensions.

Suppose that, in the absence of any information, the voter is completely uncertain over which candidate will make them better off. Figure 1 captures this intuition graphically, by plotting a probability distribution of a voter’s utility when choosing one candidate over another. Without informative signals, the probability of the difference in utility from choosing Candidate B over Candidate A is centred around zero (represented by the dashed probability mass in Fig. 1).

Now suppose that the voter receives effective additional cues from campaign finance disclosure (labelled D in Fig. 1). The effect of this financial information is to refine the individual’s evaluations of the two candidates, shifting the probability mass towards Candidate B. The red-shaded area indicates the increase in probability mass in favour of Candidate B as a result of the disclosure signal. In other words, the financial information makes it easier for the voter to discern which candidate is the optimal choice. In this hypothetical example, the change is substantial, making it much more likely that the individual will vote for Candidate B.

Relevant Facets of Disclosure

There are various facets of financial disclosure that may act to shift a voter’s utility distribution in favour of one candidate (Prat et al., 2010). Here, I focus on five aggregate aspects of a campaign’s financial profile—the total dollar-amount of donations, the average donation size, the proportion of funds from the largest donor, the type of largest donor, and the origin of donations. These facets may activate different heuristic mechanisms, and affect voters’ behavior in different ways.

Total Donations The total size of donations is an indication of a campaign’s scale. A relatively under-funded campaign, for example, is more restricted in its ability to carry out the political functions often seen as necessary for electoral success—for example, opinion research, advertising, and get-out-the-vote operations. The total amount of funding (holding constant its composition) may indicate to voters the campaign’s viability. Voters may use the size of the campaign as a signal of how donors, who may be more politically informed, have “pre-screened” campaigns to choose those they think are most likely to succeed.

Alternatively, voters may be distrustful of campaigns with very large donation totals (again, holding constant the composition of the campaign). Voters may (rightly or wrongly) perceive that large amounts of money mean a campaign has as an unfair electoral advantage, and react by tempering their support for it. Theoretically, therefore, it is not clear which of these dynamics (if any) will affect voters’ decisionmaking.

Average Donation Where the total size of donations gives voters an indication of a campaign’s viability and/or electoral capacity, the average donation seems likely to tell voters more about the breadth of support for a campaign. Those with a low average donation can tout this as an indicator of broader political support (holding constant the total donations), or at least that the typical donor comes from comparatively limited means. Conversely, a very high average donation might indicate that narrow but well-funded interests are the predominant supporters of a campaign. It seems unlikely that the opposite effect would be true, namely that the typical voter infers some positive quality from candidates whose average donation is very high.

Type of Largest Donor The type of donor may separately signal information about what sectors of society a campaign is aligned with, and potentially valence information about the campaign. Donations may predominantly come from individuals, corporations, labor unions, or other political advocacy groups. Corporation and labor union support likely signal pro-business and pro-employee alignment, respectively. The effect of these donor types likely therefore depends on voters’ political leanings. Without these ideological cues, however, knowing a campaign is funded by a political advocacy group may indicate a high level of political organisation and support from policy elites and leaders, suggesting an effective or experienced campaign.

Separately, a growing concern in the US system is the ability of certain donors to obscure their contributions through nonprofit “501(c)(4)” entities that, as charitable organisations, are not obliged to reveal their donors (Wood, 2018; Rhodes et al., 2019; Oklobdzija, 2019). Dark money vehicles are useful primarily to exceptionally wealthy individuals and groups who wish to obscure their involvement in the political process. This obscurity makes it very difficult to highlight these donors to voters through disclosure. While a 501(c)(4) organisation will be named, it will typically be uninformative—for instance, “Americans for Prosperity". If voters are unable to infer the source of donations—because the name is withheld or nondescript—they may shift their support away from that campaign. Or, as perhaps these groups hope, the name’s obscurity cancels out any potential cue to voters based on name recognition.

Proportion of Funds by Largest Donor Alongside the largest donor’s identity, the proportion of a campaign’s funds that are donated by a single donor may reflect the degree of “capture" by a particular donor or interest. Separate from the average donation, this feature explicitly encapsulates the concentration of financial support, rather than providing a signal about the base of that support. Intuitively, if voters use this cue, they may be averse to campaigns where the largest donor is responsible for a high proportion of funding, since this likely signals a campaign is beholden to a narrow set of donor interests.

Geographic Origin of Donations Finally, voters may care about where financial support comes from. Given the federal structure of the United States, voters may be concerned about whether campaigns are funded locally or not (especially for state-level races). When a majority of donations come from outside the state in question this may signal “capture" by external interests. In other words, large numbers of donations from out-of-state actors could suggest interference in a state’s affairs and thus may diminish voters’ willingness to support a campaign or candidate. It may also be a signal of whether candidates care about the concerns of their constituents.

Effects of Financial Cues in the Presence of Other Signals

Even if the hypothesised heuristics hold, it is not guaranteed that this information will, in real electoral contexts, affect vote choice. The scenario in Sect. 1.1 assumes that, without financial information, the voter is equally torn between the two candidates. Therefore even relatively small shifts in the distribution yield large changes in the probability one candidate makes the voter better off. During political campaigns, however, individuals may use other heuristics to inform their vote choice. In turn, these additional signals may alter the utility distribution and thus impact the marginal effect of campaign finance cues.

Figure 2 illustrates this idea. If other political signals are strong, the marginal effect of financial information on vote choice may approach zero. In this scenario, the cumulative effect of other political signals (labelled P) is much stronger than those from campaign finance information. Consequently, the same signals gleaned from the campaigns’ financial profiles now results in a much smaller change in the probability that some voter would prefer candidate B over A—the increase in probability mass in favour of Candidate B (the red shaded area) is minuscule. Importantly, this occurs even though the rightward shift of the distribution as a result of disclosure is of the same size as in Fig. 1. The effect of financial information on vote choice is much smaller because the relative importance of these signals on voters’ utility is less than that of other politically-relevant cues. In other words, they “swamp” the effects of a campaigns’ financial profile on vote choice.

The potential for campaign finance effects to be swamped is important given the wider context in which this information is revealed. In candidate campaigns, voters receive political signals about both the experience of candidates (plus other valence characteristics) as well as the ideology and/or partisanship of that candidate. If, as we would expect, these signals weigh heavily on the decisions made by voters, then the informational benefit gleaned from disclosure may not translate into changes in voter behavior. It is not that financial cues are uninformative, but that in the presence of other electorally-relevant information, inferences based on these cues are simply less efficacious on vote choice itself.

Effects of Financial Signals Across Types of Electoral Campaign

The type of electoral contest may also impact the efficacy of financial disclosure. Ballot initiative elections are an important form of policymaking, in which citizens can draft and submit legislation directly to the ballot. If other political signals like partisanship swamp the effects of disclosure, then perhaps in contexts typically devoid of these cues the effects of financial information will be greater (Garrett & Smith, 2005; Briffault, 2010; Primo, 2013).Footnote 4 Boudreau and MacKenzie (2021), for example, find that campaign finance information has substantial effects on initiative support, although this effect is confined to high-knowledge voters. To the best of my knowledge, the comparative aspect of disclosure (between election types) has not been tested empirically before.

Voters may use financial disclosure to assess the valence of initiative campaigns. Since these elections ask voters to endorse or reject an item of legislation, voters may want to estimate the likelihood that the bill will achieve its stated aim. They might also be concerned that the legislation is anticompetitive, or favours out-of-state interests, even if they are supportive of the policy in general. Voters may also want to estimate the compatibility of the proposal with their existing political beliefs. Absent explicit ideological, partisan, and valence signals typically present in candidate elections, divulging information about the supporters of these policymaking efforts may be particularly informative to voters.

Conversely, while initiative campaigns typically lack overt partisan signals, the specific policy focus of the election—for example, whether to increase the minimum wage, lower prescription drug prices, or curtail state governments’ taxation powers—could, in fact, override other cues in a similar way to how political signals may swamp the effects of disclosure in candidate elections. If voters’ utility functions prioritise the policy content, disclosure is unlikely to make a difference.

Conjoint Experiment to Assess Impacts of Disclosure on Vote Choice

To assess the causal effects of these various financial heuristics, across electoral venues and varying the presence of other information signals, I expose subjects to a series of conjoint experiments examining vote choice. Across all experiments, subjects are presented with a forced choice between two campaigns—either two candidates or the support and opposition groups for an initiative proposal.

Conjoint survey experiments are an efficient way to test the extent to which multiple attributes affect subjects’ choices (Hainmueller et al., 2014). Since these designs typically ask respondents to choose between two profiles, this discrete choice task is a natural analogue for the sorts of decisions voters make in American elections. This is useful even for ballot initiative elections where each voter makes a binary decision over whether to endorse a policy proposal. Initiative elections typically have separate “Yes” and “No” campaigns. Opposition groups raise their own funding and play a prominent role in advocating for the status quo (Gerber, 1999) and so, given this involvement, there is good reason to inspect how their financial profiles affect vote choice too.

Randomizing the Number of Attributes

Conjoint designs randomly vary the content of a fixed number of attributes. This allows researchers to estimate the marginal effects of different features on respondents’ choices within the experiment. The causal interpretation of these effects is defined with respect to the experimental context. That is, claims about the causal effect of any attribute only hold in situations where subjects are exposed to the same signals (and only those signals).

Claims about generalisability of any causal effect beyond the experimental context, however, require more stringent assumptions. Among other things, researchers must assume that the given set of attributes fully describe the pertinent features over which respondents make a choice. The observed causal effects may not hold up in contexts where some feature not included in the conjoint experiment also acts on individuals’ behavior.

To test for differences in the effects of campaign finance information across different informational environments, I randomly assign subjects to one of two candidate conjoint experiments (Sen, 2017). Half of subjects are exposed to disclosure attributes only. The other half also see other relevant political cues: partisanship, ideology, and previous experience. Randomization across these two conditions at the subject-level ensures unconfoundedness between those presented the full set of conjoint attributes, and those presented only the disclosure cues. Comparing the estimated marginal effects for the common set of attributes shared across both groups therefore helps illustrate how robust any effects of campaign finance information are to the inclusion of other relevant signals.

Experimental Protocol

All participants completed two separate conjoint experiments—one choosing candidates in a hypothetical state gubernatorial election (either with or without additional attributes), and one asking subjects to consider four initiative policy proposals. In both experiments, subjects were presented with randomized information (levels) for each facet of disclosure (attributes).

Table 1 provides details of the conjoint attribute-levels across the two experiments. The large differences in dollar-amounts are intended to clearly distinguish campaign finance profiles and provoke stronger differences in subjects’ behavior. These donation totals are nevertheless broadly plausible: Beto O’Rourke’s 2018 senate campaign had receipts in excess of $70 million, and Proposition 61 (2016) in California saw opposition donations exceed $100 million. It is worth noting, however, that legal contribution limits to gubernatorial candidates vary across states (no such limits exist for initiative campaigns).Footnote 5 This variance limits the external validity of these findings—a large average donation will be implausible given some states’ contribution limits, but this should not affect the internal validity of the experiment.

The experiments also used abstract descriptors for the largest donor type since, without increasing the number of attribute levels, subjects would regularly be presented with rounds in which the two campaigns have the same, named largest donor. While this is not statistically problematic, nor theoretically impossible, it might be cognitively dissonant within the experiment—particularly if it happens multiple times.Footnote 6 With abstract descriptors, displaying the same attribute-level for both profiles can conceivably be rationalised as different entities of the same type. Moreover, abstract labels are a more direct test of the type of donor. While a ‘Political Advocacy Group’ could be either left- or right-leaning (or neither), it nevertheless signals an organised political entity focused on advancing the electoral prospects of campaigns.Footnote 7 Since I also include ideologically-aligned groups (labor unions and corporations), this label tests whether voters infer anything from the type of donor separable from its alignment with a sector of society.

Candidate Conjoint Respondents (\(n=390\)) were presented with the funding profiles of two candidates running for gubernatorial office, with half seeing three politically relevant signals in addition to the financial cues. The exact same funding attributes and attribute-levels were used across the two candidate scenarios. Figure 3 displays an example vignette from the candidate conjoint experiment.Footnote 8

The experiment’s focus on hypothetical candidates and its simple design likely increases subjects’ attention on the financial cues. In neither condition are voters aware of the candidates’ gender, their policy priorities, or other contextual features that might distract from the financial signals. What matters for testing the theory of this paper is whether disclosure can have an effect on vote choice (which a simple design is likely going to be more sensitive to) and then how robust those effects are to a small number of politically relevant, non-financial signals. The candidate scenario without additional information is designed to assess the possible effects of disclosure, rather than the actual effect of these cues in real elections. The introduction of additional cues is a controlled way of assessing the resilience of these effects in a noisier information context.

Initiative Conjoint All participants also voted on four initiative topics, which were chosen to reflect the sorts of salient issues considered on the ballot in recent electoral cycles. The text for each initiative is shown in Table 2. These topics are, with the exception of the bond issuance initiative, reasonably ideologically clear-cut. While this is in part a consequence of choosing salient topics, this clarity also aids comparisons with the candidate conjoint where ideological cues are included. We might expect to observe larger effects for those issues that are less salient, less ideologically-aligned, or with more confusing ballot language (Lupia, 1994). The inclusion of the bond initiative provides some leverage over this dimension, but I also return to this point in the discussion.

Alongside the initiative title and a brief description of the proposed policy, participants were presented with the same funding table as in the candidate conjoint, showing both the support and opposition campaigns. Participants were asked to consider this information and choose whether they would vote ‘for’ or ‘against’ the proposed policy. Each participant made a total of four choices within the initiative experiment—one per issue.

Randomization Procedure The order in which the candidate and initiative conjoint experiments were presented to each subject was randomized, as was assignment to the two candidate conditions. For the initiative component, the order of the issues was randomized for each subject. Finally, across all experiments, attributes were randomized with minimal restrictions to prevent implausible attribute-level combinations.Footnote 9

Sample The conjoint experiments were conducted using an online subject pool of adults resident in the United States operated by the Centre for Experimental Social Science, at Nuffield College, University of Oxford. Further information on this subject pool is presented in Section A of the Supplementary Materials. Individuals were invited to participate if they were resident in a state which used the initiative process and therefore were likely to be familiar with the process. The first round of invitations was sent to those resident in California, Washington, Oregon, Arizona, Ohio, Florida, Colorado, and Massachusetts - all states with relatively high usage of the initiative process. Further invitations were then sent to those resident in the other 17 states where some form of initiative policymaking is used. In total, 390 eligible participants completed the experiment.

Table A1 in the Supplementary Materials describes the demographic composition of this sample, which is reasonably balanced in terms of gender and age. 46% of respondents identified (post-experiment) as Democrats, 30% as independents, and 15% as Republicans. The imbalance in party identification is to be expected given West Coast states (where initiative elections are most common) were over-sampled in the first round of invitations and these states are broadly Democratic-leaning. To further assess the plausibility of the partisan distribution in the sample I take the average of the difference in party affiliations at the state level,Footnote 10 weighted by the proportion of respondents per state in the experimental sample. While the lean in the experimental sample is larger, the expected lean towards the Democrats is nevertheless substantial (7 percentage points) suggesting that Democratic bias is to be expected. Given this study tests for the causal effects of disclosure, rather than its generalisability, this Democratic lean does not affect the validity of the inference.

Since every subject completes multiple rounds of the experiment, the effective sample size is larger than the number of subjects. Post hoc tests of the experimental power demonstrate that, given the size of coefficients observed in the candidate conjoint, the experiments are sufficiently powered for us to attribute declines in effects across conditions to the presence of additional cues. Section H of the Supplementary Materials provides a detailed discussion of this simulation and the results. The sample size does, however, limit the conclusions that can be drawn from subgroup analyses where the number of observations in each group is smaller. In particular, with relatively few Republican respondents, comparisons of behavior between partisan identities should be treated as indicative, rather than conclusive, evidence. I discuss this further in Sect. 3.4.

Causal Assumptions For conjoint models to have a causal interpretation, several design assumptions must be met (Hainmueller et al., 2014). Section E of the Supplementary Materials provides a detailed discussion of these criteria, and presents analyses that verify the stability of effects, no profile-order effects, effective randomization, and balanced profiles.

Results

The Effects of Financial Cues

The first candidate conjoint presented only financial attributes to voters. To recover the marginal effect of each attribute-level, I estimate a linear probability model (LPM) that contains indicator variables for each attribute-level (excluding reference categories). The resultant coefficients reflect the average marginal component effect (AMCE) of an attribute-level on the probability of selecting a candidate, relative to the corresponding reference category. All standard errors are clustered at the individual-level since subjects (from which we take multiple observations) are sampled from a much wider population of interest.Footnote 11

In this low-information environment, financial attributes do have clear effects on vote choice. Figure 4 plots the AMCEs for each attribute-level. Subjects are less likely to vote for candidates who receive a large proportion of their funds from a single donor, or where the average donation amount is high. Donations mainly from within the state, labor union donors, and lower average donation amounts all have a positive effect on the probability of a candidate being chosen.

Candidate conjoint results without additional cues (\(N = 2068\)). Coefficient estimates for each attribute-level are shown with 95% confidence intervals, clustered by participant. Reference categories are included as coefficients with values of zero. Stars above coefficients indicate significance at *\(p < 0.05\), **\(p < 0.01\), and ***\(p < 0.001\) respectively

These results show that aggregate disclosure can influence voter decisionmaking. In the absence of other cues, subjects are averse to instances where candidates appear to be captured by a particular interest or group. In particular, voters appear to care about political capture rather than the scale of a campaign itself. This feature is reflected in the relative importance of the geographic, average donation, and proportion attributes.

The substantively large and positive effect of the largest donor being a labor union (and the negative effect of corporations) is perhaps telling of the Democratic bias in the sample. It is nevertheless noteworthy that voters adjust their vote choice when presented with this information. The neutral “political advocacy group” label did not affect vote choice, which perhaps suggests that voters do not infer valence information about campaigns funded by organised political entities separately from those groups’ ideological alignment.

Moreover, the effect of the “identity not disclosed" level is statistically insignificant (relative to individual donors). This null result suggests that voters are not immediately deterred from voting for a campaign if identifying information is withheld. This may be because financial disclosures typically preserve the anonymity of individual donors if their contributions are below a certain limit. Respondents may therefore not consider the simple lack of disclosure problematic. I return to this point in the Discussion.

It is also possible that voters make inferences on the basis of multiple attributes in combination, which the present model specification would not detect.Footnote 12 The absence of modelled interaction effects would be problematic if we observed only null effects, since null results could mask significant interaction effects. However, the results demonstrate that individuals can and do parse the financial attributes separately. For four of the five attributes, there are substantial and statistically significant independent effects of the financial information. In the following section, therefore, I test whether these independent effects drop out in the presence of other political signals.

Priming Subjects’ Perceptions of Candidates’ Ideology and Valence

Elections are rarely fought on campaigns’ financial profiles alone. Indeed, voters typically receive signals about candidates’ ideology, partisanship and valence characteristics. The first set of results demonstrate the ability of disclosure mechanisms to affect vote choice. But do financial cues have an independent effect once we control for other relevant political signals?

For those subjects randomly exposed to additional political signals, I include additional parameters for partisanship, ideology, and previous office-holding in the LPM. We should expect differential effects dependent on subjects’ own partisan affiliation for these attributes. I therefore compare the revealed partisanship of the candidate to that of the subject, coding whether the partisanship is the “same” or “different”. Similarly, for ideology, I project the ideological factor levels evenly between (0–10) and measure the absolute difference in ideology between candidate and subject.

Figure 5 displays the results of this model. The independent effects of all but one feature of disclosure are indistinguishable from zero once subjects’ political priors are primed: only the positive effect of a majority of within-state donors has a significant effect on vote choice. Moreover, all previously significant coefficients in Fig. 4 are statistically significantly different from those in Fig. 5 (\(p < 0.05\)), except for the $1m average donation coefficient.Footnote 13

Candidate conjoint results with partisan, ideological and previous experience attributes included (\(N = 2089\)). Coefficient estimates for each attribute-level are shown with 95% confidence intervals, clustered by participant. Stars above coefficients indicate significance at *\(p < 0.05\), **\(p < 0.01\), and ***\(p < 0.001\) respectively

The political controls in this model, however, have substantial effects. Voters unsurprisingly are averse to voting for candidates of a different party to themselves. Similarly, as the ideological distance between candidate and subject increases, this decreases the probability of voting for that candidate. The previous experience attribute does not exhibit significant differences between the attribute levels.Footnote 14

These null results are noteworthy because, without additional political signals, financial attributes had statistically significant and substantial effects on vote choice. For example, the AMCE of the labor union attribute-level is approximately one-tenth its original size. Even the strongest financial signal—having a majority of donors within the state—is reduced to a third of its size once political signals are included.

Since respondents were randomly assigned across conditions, the reduction in efficacy of the financial attributes can be attributed to the presence of other political signals. Taken together, the results suggest that while financial cues can affect vote choice, they are relatively inert once other political signals are present. I explore one tentative reason for this drop in efficacy in Sect. 3.4.

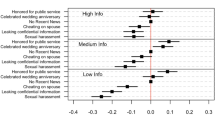

Financial Cues in Initiative Elections

Figure 6 displays the estimated AMCEs from a LPM on the pooled observations across the four initiative topics, with issue fixed effects to control for the underlying support for each policy. The only statistically significant disclosure attribute is, again, the geographic origin of donations.Footnote 15 This attribute’s effect is notably strong across all three conjoint experiments in this study. Subjects again favour those campaigns that are funded predominantly by donors within their own state. For all other attributes, however, the financial cues did not have a marginal impact on subjects’ vote choice.Footnote 16

Pooled initiative conjoint results (\(N = 3003\)). All responses across the four issues are pooled with issue fixed effects. Coefficients are shown with 95% confidence intervals, clustered by participant. Stars above coefficients indicate significance at *\(p < 0.05\), **\(p < 0.01\), and ***\(p < 0.001\) respectively

It is plausible, however, that voters use financial disclosures in different ways when considering different policy issues. To check this possibility, I estimate separate models for each initiative question. Figure 7 plots the estimated coefficients. Large campaign finance totals and a low average donation are statistically significant, positive predictors of support for the sewage bond issue. No attribute level is significant for either the marijuana legalisation or environmental taxation issues, and only the majority of within-state donations attribute is statistically significant for the minimum wage issue. These results suggest (but by no means confirm) that, for less salient issues where we might expect voters’ issue preferences to be less strongly held, financial information can impact vote choice.

Initiative conjoint results by issue area. \(N = \) 752 (bond issuance), 750 (carbon emissions tax), 755 (marijuana legalisation), and 746 (minimum wage increase). All coefficients are shown with 95% confidence intervals, clustered by participant. Stars above coefficients indicate significance at *\(p < 0.05\), **\(p < 0.01\), and ***\(p < 0.001\) respectively

Figure F7 in the Supplementary Materials reports the differences in marginal means for the attributes between issues. On the whole, differences across the four issues are insignificant. The marginal mean of an anonymous largest donor is significantly larger for the comparison between minimum wage and bond initiatives, and labor unions significantly lower for the comparisons between minimum wage and bond initiatives as well as between marijuana and bond initiatives. All other attributes are statistically indistinguishable from zero at conventional levels of significance. These comparisons provide further evidence that, at least with the power available in this study, voters do not exhibit clear differences in how they act on disclosure information across issues.

Partisan Differences

Financial cues may act differently dependent on individuals’ own stance. For example, Republicans’ trust in business leaders is much higher than for Democrats (Rainie et al., 2019), with corporate donors tending to be Republicans themselves (Francia et al., 2005). Having a corporate entity as a largest donor may therefore be a positive signal for Republican voters but a negative signal for Democrats. Absent explicit cues, as is the case in the first candidate conjoint experiment, the financial cues may act as “informational equivalences" that voters use as proxies for other relevant information (Dafoe et al., 2018).

To assess this possible mechanism, I estimate LPMs on separate subsets of the data for Democrats, Republicans, and independents respectively. Figure 8 displays the coefficients for each of these three models. The typical caveats regarding subgroup analyses apply here—smaller sample sizes (particularly for Republican subjects) increase the uncertainty around the coefficient estimates.

Comparison of estimated AMCEs across respondents’ partisan identities for the candidate conjoint experiment without other political signals.\(N=\) 1070 (Democrats), 349 (Republicans), and 718 (independents). All coefficients are shown with 95% confidence intervals, clustered by participant. Stars above coefficients indicate significance at *\(p < 0.05\), **\(p < 0.01\), and ***\(p < 0.001\) respectively

The results do not suggest substantial differences in the size or direction of effects across partisan identities.Footnote 17 All three groups have positive, significant and substantially large effects of within-state donations, positively signed coefficients for the 10% largest donor proportion, and negatively signed or essentially zero AMCEs for the 90% donor proportion. Interestingly, for the labor union attribute-level, arguably the most overtly partisan signal, all three groups have positive AMCEs (strongly statistically significant for both Democrats and independents). There is some suggestion that the effect of labor union donations on Republicans is smaller, although with a large variance it is hard to draw concrete conclusions.

Z-scores for the differences between coefficients across models confirm the similarity suggested in Fig. 8.Footnote 18 The only group-level difference that meets conventional levels of significance is that between Republicans and Democrats on the “Proportion donated by the largest donor: 90%" attribute-level (\(p<0.05\)).

Figure F8 and Table F2 in the Supplementary Materials present similar results for the initiative conjoint. While there are some differences in the sign of coefficients across groups, the generally small effect sizes and lack of statistical significance for all but one coefficient preclude any definitive conclusions.

Discussion

In the absence of other relevant information, campaigns’ financial profiles influence vote choice. Voters appear concerned about campaigns captured by narrow interests or out-of-state actors. This finding accords with appeals made by political candidates to their low average donation amounts in elections. Crucially, however, once subjects are (randomly) primed with other ubiquitous political cues these effects all but disappear. Disclosure appears to be ineffective in ballot initiative campaigns too.

One exception is the positive effect of having a majority of within-state donations, which is robust across experiments and across partisan identities. Voters appear averse to the influence of actors outside their state, even in the presence of partisan and policy signals. The resilience of this cue is notable and more research is needed on why this effect is so robust when other disclosure cues are not.

Subjects in the experiments did not appear to balk at campaigns for whom they cannot attribute a donor’s identity. The “identity not disclosed" label used in this study is a comparatively weak cue, and future work should explore whether framing non-disclosure as deliberate is more impactful. More generally, this experiment cannot distinguish the effect of donating from taking a public stance on an issue or candidate. It remains to be explored whether voters have differential reactions to financial cues based on whether these donors also take visible positions on the issues or candidates in an election. Moreover, these dynamics may also depend on the number of groups or individuals taking public stances.

Financial cues may also be more influential for lower salience elections, races where the political differences between candidates are more limited, or where the consequences of initiative legislation are less clear. Consistent with the theory of this paper, general elections may be a tough environment for financial cues to impact vote choice precisely because campaigns may differ starkly on other important political dimensions. Future work may, therefore, want to consider whether the impact of disclosure differs in other contexts like school board races or nonpartisan judicial elections, or where the complexity of the initiative wording is such that ideological implications of voters’ decisions are less clear-cut. Of particular relevance to American elections, might disclosure cues have a stronger impact in primary elections where candidates share partisan labels?

From a policy perspective, ensuring transparency has become the modus operandi of campaign finance regulation, upheld by courts and encouraged by good government organizations. Evidence that voters react strongly against out-of-state donors suggests regulators may wish to pursue policies that emphasise this feature in elections. More generally, however, these findings question the merit of focusing on transparency as a mechanism for limiting the influence of money in elections. While this evidence does not preclude ex ante benefits of transparency—for example, by perturbing unethical behavior—it does challenge the assumption that the influence of donors in elections can be counterbalanced by informing voters of that influence. If policymakers cannot rely on voters using financial transparency information to alter their vote choice, prioritising transparency in reform efforts may not be worth the effort. Those in favour of reform may instead wish to pursue proactive measures that limit the extent to which donors can be involved, for example through public or matched funding tied to restricted fundraising activity or much tighter limits on non-profit electioneering groups’ donations.

Data availability

All material related to this project, including experimental data and replication code, is available at https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/ZQDC1D.

Notes

Replication data for this study is available at: https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/ZQDC1D.

Section B of the Supplementary Materials discusses the implications of this decision in more detail.

Parties can support/oppose initiatives, but initiatives are not labelled as ‘Democrat’ or ‘Republican’ and many issues are not explicitly supported by either party.

Section C in the Supplementary Materials lists these limits.

With complete random assignment, 20% of vignettes would include the same donor label, occurring approximately 1.2 times per subject.

I opted for “political advocacy" rather than “special interest" because it plausibly describes a broader set of groups.

Figures D1 and D2 in the Supplementary Materials, respectively, show screenshots of the candidate conjoint with additional attributes and the initiative conjoint.

For instance, a campaign raising $100,000-200,000 could not have an average donation of $1 million.

Data taken from Gallup’s 2017 summary of state party affiliation, available at https://news.gallup.com/poll/226643/2017-party-affiliation-state.aspx.

These results are robust to using logistic rather than linear regression models. All replication code is available on Dataverse.

Adding interaction terms would require a substantially larger sample given the number of attribute-levels.

See Sect. H.1 in the Supplementary Materials for more details on this test.

Figures F3–F5 in the Supplementary Materials present further results estimating separate models for each partisan/ideological identity.

Figure F6 in the Supplementary Materials demonstrates that these results are unaffected when controlling for respondents’ partisanship.

See Sect. G in the Supplementary Materials for further analysis of subjects’ support for these issues.

In Supplementary Fig. F2 I find very similar results subsetting by ideology rather than partisanship.

See Table F1 in the Supplementary Materials.

References

Ashworth, S. (2006). Campaign finance and voter welfare with entrenched incumbents. American Political Science Review, 100(1), 55–68.

Boudreau, C., & MacKenzie, S. A. (2021). Following the Money? How donor information affects public opinion about initiatives. Political Research Quarterly. https://doi.org/10.1177/1065912921990744.

Bowler, S., & Donovan, T. (2000). Demanding choices: Opinion, voting, and direct democracy. Michigan: University of Michigan Press.

Briffault, R. (2010). Campaign finance disclosure 2.0. Election Law Journal: Rules, Politics, and Policy, 9(4), 273–303.

Bump, P. (2016). Bernie Sanders keeps saying his average donation is \$27, but his own numbers contradict that. The Washington Post . https://www.washingtonpost.com/news/the-fix/wp/2016/04/18/bernie-sanders-keeps-saying-his-average-donation-is-27-but-it-really-isnt/

Citizens United v. Federal Election Commission, 558 U.S. 310. (2010).

Coate, S. (2004). Pareto-improving campaign finance policy. The American Economic Review, 94(3), 628–655.

Dafoe, A., Zhang, B., & Caughey, D. (2018). Information equivalence in survey experiments. Political Analysis, 26(04), 399–416.

Dowling, C. M., & Miller, M. G. (2016). Experimental evidence on the relationship between candidate funding sources and voter evaluations. Journal of Experimental Political Science, 3(02), 152–163.

Dowling, C. M., & Wichowsky, A. (2013). Does it matter who’s behind the curtain? Anonymity in political advertising and the effects of campaign finance disclosure. American Politics Research, 41(6), 965–996.

Dowling, C. M., & Wichowsky, A. (2015). Attacks without consequence? Candidates, parties, groups, and the changing face of negative advertising: The changing face of negative advertising. American Journal of Political Science, 59(1), 19–36.

First National Bank of Boston v. Bellotti, 435 U.S. 765. (1978).

Francia, Peter L., Green, John C., Herrnson, Paul S., Powell, Lynda W., & Wilcox, Clyde. (2005). Limousine liberals and corporate conservatives: The financial constituencies of the democratic and republican parties*. Social Science Quarterly, 86(4), 761–778.

Garrett, Elizabeth, & Smith, Daniel A. (2005). Veiled political actors and campaign disclosure laws in direct democracy. Election Law Journal: Rules, Politics, and Policy, 4(4), 295–328.

Gerber, E. R. (1999). The populist paradox: Interest group influence and the promise of direct legislation. Princeton: Princeton University Press.

Gigerenzer, G., & Gaissmaier, W. (2011). Heuristic decision making. Annual Review of Psychology, 62(1), 451–482.

Hainmueller, J., Hopkins, D. J., & Yamamoto, T. (2014). Causal inference in conjoint analysis: Understanding multidimensional choices via stated preference experiments. Political Analysis, 22(01), 1–30.

Jiang, L. (2019). Disclosure’s last stand? The Need to clarify the “informational interest’’ advanced by campaign finance disclosure. Columbia Law Review, 119(2), 487–526.

Lupia, A. (1994). Shortcuts versus encyclopedias: Information and voting behavior in California insurance reform elections. The American Political Science Review, 88(1), 63–76.

Oklobdzija, S. (2019). Public positions, private giving: Dark money and political donors in the digital age. Research and Politics, 6(1), 1–8.

Prat, A., Puglisi, R., & Snyder, J. M., Jr. (2010). Is private campaign finance a good thing? Estimates of the potential informational benefits. Quarterly Journal of Political Science, 5(3), 291–318.

Primo, D. M. (2013). Information at the margin: Campaign finance disclosure laws, ballot issues, and voter knowledge. Election Law Journal: Rules, Politics, and Policy, 12(2), 114–129.

Rainie, L., Keeter, S., & Perrin, A. (2019). Trust and distrust in America. Technical report Pew Research Centre.

Rhodes, S. C., Franz, M. M., Fowler, E. F., & Ridout, T. N. (2019). The role of dark money disclosure on candidate evaluations and viability. Election Law Journal: Rules, Politics, and Policy, 18(2), 175–190.

Ridout, T. N., Franz, M. M., & Fowler, E. F. (2015). Sponsorship, disclosure, and donors: Limiting the impact of outside group ads. Political Research Quarterly, 68(1), 154–166.

Rizzo, S. (2019). The Trump and Harris campaigns’ sketchy boasts about small-dollar contributions. The Washington Post. https://www.washingtonpost.com/politics/2019/04/17/trump-harris-campaigns-sketchy-boasts-about-small-dollar-contributions/

Sances, M. W. (2013). Is money in politics harming trust in government? Evidence from two survey experiments. Election Law Journal: Rules, Politics, and Policy, 12(1), 53–73.

Sen, M. (2017). How political signals affect public support for judicial nominations: Evidence from a conjoint experiment. Political Research Quarterly, 70(2), 374–393.

Spencer, D. M., & Theodoridis, A. G. (2020). The “Appearance of Corruption’’ linking public opinion and campaign finance reform. Election Law Journal. https://doi.org/10.1089/elj.2019.0590.

Stratmann, T. (2010). Campaign spending and ballot measures. In K. G. Lutz & S. Hug (Eds.), Financing referendum campaigns. London: Palgrave Macmillan UK.

Wood, A. K. (2018). Campaign finance disclosure. Annual Review of Law and Social Science, 14(1), 11–27.

Wood, A. K. (2019). Show me the money: Candidate selection based on campaign finance transparency. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3029095.

Acknowledgements

I would like to thank Andy Eggers, Raymond Duch, Jan Stuckatz, Nelson Ruiz, Sönke Ehret, and attendees of the 2019 LSE-Oxford Postgraduate conference for their insightful comments. A previous version of this paper was circulated under the title “Knowledge or Ignorance? Assessing the Causal Effects of Campaign Finance Disclosure on Vote Choice.”

Funding

This project was funded by an ESRC (Grand Union DTP) research training support grant and studentship. The experiments in this paper were conducted in collaboration with the Centre for Experimental Social Sciences (CESS) at Nuffield College, University of Oxford.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There are no conflicts of interest.

Ethical approval

All experiments in this paper received ethical clearance from the DepartmentalResearch Ethics Committee at theUniversity of Oxford (SSH DPIR C1A 19 012) and the CESS Ethics Committee (OE 0027).

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Robinson, T.S. When Do Voters Respond to Campaign Finance Disclosure? Evidence from Multiple Election Types. Polit Behav 45, 1309–1332 (2023). https://doi.org/10.1007/s11109-021-09766-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11109-021-09766-y