Abstract

It has long been recognized that voters bring their political behaviors in line with economic assessments. Recent work, however, suggests that citizens also engage in economic behaviors that align with their confidence—or lack thereof—in the political system. This alignment can happen consciously or, as we suggest, unconsciously, in the same way that positivity carries over to other behaviors on a micro-level. Using monthly time series data from 1978 to 2008, we contribute further evidence of this relationship by demonstrating that political confidence affects consumer behavior at the aggregate level over time. Our analyses employ measures more closely tied to the theoretical concepts of interest while simultaneously accounting for the complex relationships between subjective and objective economic indicators, economic behavior, political attitudes, and the media. Our results suggest that approval of the president not only increases the electorate’s willingness to spend money, but also affects the volatility of this spending. These findings suggest that the economy is influenced by politics beyond elections, and gives the “Chief Economist” another avenue by which they can affect the behavior of the electorate.

Similar content being viewed by others

Notes

Ironically, as Kellstedt et al. (2015) point out, Katona argued that income and assets measure ability to spend and proposed the attitudinal ICS specifically as a measure of willingness (i.e., motivation). Yet four of the five questions focus on objective realities and ability (e.g., “would you say that you are better off or worse off financially than you were a year ago”); the one question closest to ascertaining motivation and willingness asks “do you think now is a good or bad time for people to buy major household items” rather than “do you plan” or “are people interested in buying” these items.

Enns and Anderson (2009) examined whether mood could explain the observed changes in consumer behavior, and found no significant change in happiness after the election. However, they do not test whether happiness directly predicts spending and, in any case, the question is quite broad (i.e., “I’m very happy with my life as it is”) and does not speak to confidence in the political system.

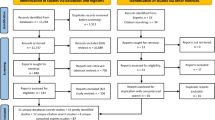

The complexity of the relationships described in Fig. 1 also raise concerns about endogeneity, a question we address in a later section.

The data on total personal consumption expenditures were gathered from the Bureau of Economic Analysis’ “National Income and Product Accounts” (2009), publicly available online at http://www.bea.gov/national/. Measured in billions of dollars and seasonally adjusted, the data have also been adjusted for inflation to constant 2008 dollars.

We nonetheless re-ran the model with the two business conditions questions (e.g., Kellstedt et al. 2015) and personal prospections (see footnote 1) one at a time in lieu of the index. The components exhibited unique relationships with spending, but in each case the results of interest were substantively and statistically unaffected. We thus use the index; results using the components are available from the authors upon request.

These interventions were identified by examining the ARFIMA residuals. Only the most extreme events were included to avoid overfitting.

This system has been used by other scholars and institutions as an indicator of media sentiment. Most prominently, beginning in the fall of 2007, the Annenberg National Election Study included daily summary data generated by Lydia to capture information about each presidential candidate and relevant issues, providing a snapshot of the campaign for the day respondents completed the survey. Studies of the system’s internal validity can be found in a variety of sources. An overview of the technical aspects of the process can be found in Bautin et al. (2010). For details about the aggregation process, see Bautin et al. (2009). For a discussion of the sentiment analysis, see Bautin et al. (2008) and Godbole et al. (2007). A technical discussion of the spatial analysis can be found in Bautin et al. (2010). Readers may also see Online Appendix A for a general discussion of the Lydia system.

The media coverage variables also act as micro-event detectors, picking up events—political and otherwise—that relate to the president. This allows us to include changes in the political environment in a more parsimonious fashion, reducing the number of interventions in an already complex model.

See Online Appendix B for integration tests and the values of d used to difference each series.

Likewise, specifying the lag structure a priori requires assumptions about the behavior of the political and economic variables that are difficult to justify theoretically.

Multicollinearity is certainly a concern for time series data, as variables may share a common trend over time. Although this is true when variables are included as regressors in their level form, differencing the data removes any time trend, thus limiting the correlation between variables (Gujarati 2004, p. 367).

The model has a Durbin-Watson statistic of 2.07, indicating no significant autocorrelation remaining. The residuals are also white noise, with a Ljung-Box Q statistic of 14.6 at a lag of 20. The results for the models run using first differences instead fractional differencing techniques are presented in Online Appendix D. The results remain substantively unchanged.

A table of cointegration tests can be found in Online Appendix C. We follow the procedures discussed in Grant and Lebo (2016) and Lebo and Grant (2016) to test for cointegration. The fractional differencing parameter for the FECM is 0.61. Although PCE and RDI do not meet traditional standards of cointegration in our data, they are treated as cointegrated in the economics literature and are included in our FECM (e.g., Davidson et al. 1978; Lettau and Ludvigson 2001). PCE and approval do not show evidence of cointegration and, as such, approval has been excluded from the FECM.

To test for weak exogeneity, models were first specified for the marginal processes (e.g. consumer sentiment). These models were then estimated including an error correction mechanism (ECM) from the PCE model. If the marginal process is weakly exogenous to PCE, the ECM should be statistically insignificant. The next step is to include the residuals from the marginal process equation (estimated without the ECM) into the PCE model. A statistically insignificant coefficient for the residuals fails to reject the null hypothesis of weak exogeneity. Although not a component of the FECM, we included presidential approval in our weak exogeneity testing as a robustness check of our exclusion of this variable from the FECM. For a formal discussion of weak exogeneity, see Online Appendix E.

The results for the models run using first differences instead fractional differencing techniques are presented in Online Appendix F.

References

Aisen, A., & Veiga, F. J. (2006). Does political instability lead to higher inflation? A panel data analysis. Journal of Money, Credit, and Banking, 38, 1379–1389.

Alesina, A., Lodregan, J., & Rosenthal, H. (1993). A model of the political economy of the United States. American Political Science Review, 87(1), 12–33.

Alesina, A., Özler, S., Roubini, N., & Swagel, P. (1996). Political instability and economic growth. Journal of Economic Growth, 1, 189–211.

Bautin, M., Vijayarenu, L., & Skiena, S. S. (2008). International sentiment analysis for news and blogs. Paper presented at 2nd international conference on weblogs and social media (ICWSM 2008).

Bautin, M., Ward, C. B., Patil, A., & Skiena, S. S. (2010). Access: News and blog analysis for the social sciences. Paper presented at 19th Int. World Wide Web conference (WWW 2010).

Bautin, M., Ward, C. B., & Skiena, S. S. (2009). A high-performance architecture for historical news analysis. Paper presented at 2nd Hadoop Summit.

Blinder, A. S. (1981). Inventories and sticky prices: More on the microfoundations of macroeconomics. Working Paper, National Bureau of Economic Research.

Brader, T. (2005). Striking a responsive chord: How political ads motivate and persuade voters by appealing to emotions. American Journal of Political Science, 49(2), 388–405.

Brody, R. A. (1991). Assessing the president: The media, elite opinion, and public support. Stanford, CA: Stanford University Press.

Canes-Wrone, B., & Park, J.-K. (2012). Electoral business cycles in OECD countries. American Political Science Review, 106(1), 103–122.

Carroll, C. D. (1992). The buffer-stock theory of saving: Some macroeconomic evidence. Brookings Papers on Economic Activity, 2, 61–156.

Carroll, C., Fuhrer, J., & Wilcox, D. (1994). Does consumer sentiment forecast household spending? If so, why? The American Economic Review, 84(5), 1397–1408.

Charemza, W., & Deadman, D. (1997). New directions in econometric practice: General to specific modelling, cointegration, and vector autoregression. Lyme: Edward Elgar.

Chong, J., Halcoussis, D., & Phillips, M. (2011). Does market volatility impact presidential approval? Journal of Public Affairs, 11, 387–394.

Christiansen, C., Schmeling, M., & Schrimpf, A. (2012). A comprehensive look at financial volatility prediction by economic variables. Journal of Applied Econometrics, 27, 956–977.

Chung, M. (2013). Two out of five americans cut spending amid government shutdown. Bloomberg Business. 15 October. http://www.bloomberg.com/news/articles/2013-10-15/two-out-of-five-americans-cut-spending-amid-government-shutdown.

Cryder, C. E., Lerner, J. S., Gross, J. J., & Dahl, R. E. (2008). Misery is not miserly sad and self-focused individuals spend more. Psychological Science, 19, 525–530.

Cukierman, A., Edwards, S., & Tabellini, G. (1992). Seigniorage and political instability. The American Economic Review, 82(3), 537–555.

Davidson, J. E., Hendry, D. F., Srba, F., & Yeo, S. (1978). Econometric modelling of the aggregate time-series relationship between consumers’ expenditure and income in the United Kingdom. The Economic Journal, 88, 661–692.

De Boef, S., & Kellstedt, P. (2004). The political (and economic) origins of consumer confidence. American Journal of Political Science, 48(4), 633–649.

Dhawan, R., & Jeske, K. (2006). How resilient is the modern economy to energy price shocks? Economic Review-Federal Reserve Bank of Atlanta, 91, 21.

Dynan, K. E., Elmendorf, D. W., & Sichel, D. E. (2006). Can financial innovation help to explain the reduced volatility of economic activity? Journal of Monetary Economics, 53(1), 123–150.

Engle, R. F. (2003). Risk and volatility: econometric models and financial practice. Nobel lecture. Stockholm: Nobel Foundation.

Engle, R. F., Hendry, D. F., & Richard, J.-F. (1983). Exogeneity. Econometrica, 51(2), 277–304.

Engle, R. F., Lilien, D. M., & Robins, R. P. (1987). Estimating the time varying risk premia in the term structure: The ARCH-M model. Econometrica, 55(2), 391–407.

Enns, P. K., & C. J. Anderson. (2009). The American voter goes shopping: micro-foundations of the partisan economy. APSA 2009 Toronto Meeting Paper.

Ericsson, N. R., & Irons, J. S. (1995). Testing exogeneity. NewYork: Oxford University Press.

Erikson, R., MacKuen, M., & Stimson, J. (2002). The macro polity. New York: Cambridge University Press.

Evans, G., & Pickup, M. (2010). Reversing the causal arrow: The political conditioning of economic perceptions in the 2000–2004 U.S. presidential election cycle. Journal of Politics, 72(4), 1236–1251.

Fiorina, M. (1978). Economic retrospective voting in american national elections: A micro-analysis. American Journal of Political Science, 22, 426–443.

Fiorina, M. (1981). Retrospective voting in american national elections. New Haven: Yale University Press.

Garner, A. (1991). Forecasting consumer spending: Should economists pay attention to consumer confidence surveys? Federal Reserve Bank of Kansas City Economic Review, 76, 57–71.

Gelper, S., Lemmens, A., & Croux, C. (2007). Consumer sentiment and consumer spending: Decomposing the granger causal relationship in the time domain. Applied Economics, 39(1), 1–11.

Gerber, A. S., & Huber, G. (2009). Partisanship and economic behavior: Do partisan differences in economic forecasts predict real economic behavior? American Political Science Review, 103(3), 407–426.

Gerber, A. S., & Huber, G. (2010). Partisanship, political control, and economic assessments. American Journal of Political Science, 54(1), 153–173.

Godbole, N., Srinivasaiah, M., & Skiena, S. (2007). Large-scale sentiment analysis for news and blogs. In Proceedings of the international conference on weblogs and social media, pp. 219–222.

Granger, C. W. (1980). Long-memory relationships and the aggregation of dynamic models. Journal of Econometrics, 14(2), 227–238.

Grant, T., & Lebo, M. J. (2016). Error correction methods with political time series. Political Analysis, 24, 3–30.

Green, D., Palmquist, B., & Schickler, E. (2002). Partisan hearts and minds: Political parties and the social identities of voters. New Haven, CT: Yale University Press.

Greene, S. (2004). Social identity theory and party identification. Social Science Quarterly, 85, 136–153.

Gronke, P., & Brehm, J. (2002). History, heterogeneity, and presidential approval. Electoral Studies, 21, 425–452.

Gujarati, D. N. (2004). Basic econometrics (4th ed.). New York: McGraw Hill.

Han, S., Lerner, J. S., & Keltner, D. (2007). Feelings and consumer decision making: The appraisal-tendency framework. Journal of consumer psychology, 17, 158–168.

Katona, G. (1968). Consumer behavior: Theory and findings on expectations and aspirations. American Economic Review, 58(2), 19–30.

Kellstedt, P. M., Linn, S., & Lee Hannah, A. (2015). The usefulness of consumer sentiment: Assessing construct and measurement. Public Opinion Quarterly, 79, 181–203.

Kernell, S. (1978). Explaining presidential popularity. American Political Science Review, 72(2), 506–522.

Keynes, J. M. (1936). The general theory of employment, interest, and money. New York: Harcourt, Brace, and World, Inc.

Kiewiet, D. R. (1983). Macroeconomics and micropolitics: The electoral effects of economic issues. Chicago: University of Chicago Press.

Kinder, D. R., & Kiewiet, D. R. (1979). Economic discontent and political behavior: The role of personal grievances and collective economic judgments in congressional voting. American Journal of Political Science, 23, 495–527.

Kinder, D. R., & Kiewiet, D. R. (1981). Sociotropic politics: The American case. British Journal of Political Science, 11, 129–141.

Kramer, G. H. (1983). The ecological fallacy revisited: Aggregate- verses individual-level findings on economic and elections, and sociotropic voting. American Political Science Review, 77(1), 92–111.

Kriner, D., & Schwartz, L. (2009). Partisan dynamics and the volatility of presidential approval. British Journal of Political Science, 39(3), 609–631.

Ladner, M., & Wlezien, C. (2007). Partisan preferences, electoral prospects, and economic expectations. Comparative Political Studies, 40, 571–596.

Lebo, M. J., & Grant, T. (2016). Equation balance and dynamic political modeling. Political Analysis, 24, 69–82.

Lerner, J. S., Small, D. A., & Loewenstein, G. (2004). Heart strings and purse strings: Carryover effects of emotions on economic decisions. Psychological Science, 15(5), 337–341.

Lettau, M., & Ludvigson, S. (2001). Consumption, aggregate wealth, and expected stock returns. The Journal of Finance, 56(3), 815–849.

Lockerbie, B. (1989). Change in party identification: The role of prospective economic evaluations. American Politics Research, 17(3), 291–311.

Loewenstein, G., & Lerner, J. S. (2003). The role of affect in decision making. In R. Davidson, H. Goldsmith, & K. Scherer (Eds.), Handbook of affective science (pp. 619–642). New York: Oxford University Press.

Ludvigson, S. (2004). Consumer confidence and consumer spending. Journal of Economic Perspectives, 18(2), 29–50.

MacKuen, M. B., Erikson, R. S., & Stimson, J. A. (1989). Macropartisanship. American Political Science Review, 83(4), 1125–1142.

MacKuen, M. B., Erikson, R. S., & Stimson, J. A. (1992). Peasants or bankers? The American electorate and the U.S. Economy. American Political Science Review, 6(3), 597–611.

Marcus, G., & MacKuen, M. (1993). Anxiety, enthusiasm, and the vote: The emotional underpinnings of learning and involvement during presidential campaigns. American Political Science Review, 87(3), 672–685.

Mobarak, A. M. (2005). Democracy, volatility, and economic development. Review of Economics and Statistics, 87, 348–361.

Nadeau, R., Niemi, R., Fan, D., & Amato, Timothy. (1999). Elite economic forecasts, economic news, mass economic judgments, and presidential approval. Journal of Politics, 61, 109–135.

National Income and Product Account. (2009). Personal Consumption Expenditures. National Income and Product Account.

Ozler, S., & Tabellini,G. (1991). External debt and political instability. No. w3772. National Bureau of Economic Research.

Poterba, J., & Samwick, A. (1995). Stock ownership patterns, stock market fluctuations, and consumption. Brookings Papers on Economic Activity, pp. 295–372.

Rick, S. I., Cryder, C. E., & Loewenstein, G. (2008). Tightwads and spendthrifts. Journal of Consumer Research, 34, 767–782.

Romer, C. (1990). The great crash and the onset of the great depression. Quarterly Journal of Economics, 105, 597–624.

Schwartz, J., Hoover, S., & Schwartz, A. (2008). The political advantage of a volatile market: The relationship between presidential popularity and the ‘Investor Fear Gauge’. Journal of Public Affairs, 8, 195–207.

Soroka, S. N., Stecula, D. A., & Wlezien, C. (2015). It’s (change in) the (future) economy, stupid: Economic indicators, the media, and public opinion. American Journal of Political Science, 59(2), 457–474.

Starr, M. (2008). Consumption, sentiment, and economic news. AU Department of Economics Working Paper Series, 2008–16.

Tullock, G. (1976). The vote motive: An essay in the economics of politics, with applications to the British Economy. London: Institute of Economic Affairs.

Vuchelen, J. (2004). Consumer sentiment and macroeconomic forecasts. Journal of Economic Psychology, 25, 493–506.

Acknowledgements

We would like to thank Matthew Lebo, Janet Box-Steffensmeier, Jeffrey Segal, and Helmut Norpoth for their invaluable assistance with this project. Also, participants in the PRISM time series course and the four anonymous reviewers offered helpful comments that greatly improved the paper. The data and replication code can be found at https://dataverse.harvard.edu/dataverse/Key.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Key, E.M., Donovan, K.M. The Political Economy: Political Attitudes and Economic Behavior. Polit Behav 39, 763–786 (2017). https://doi.org/10.1007/s11109-016-9378-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11109-016-9378-0