Abstract

This paper empirically examines the effectiveness of announced government fiscal measures in the context of the COVID-19 pandemic. First, we build a new panel dataset of fiscal announcements by type, such as above-the line, below-the-line, and contingent liabilities for a wide sample of 136 advanced and developing countries between January 2020 and May 2021. Then, using this newly constructed dataset, we show, using both static and dynamic panel analyses, how various types of fiscal announcements affect alternative proxies of economic activity and across different income groups. We also evaluate how these effects vary depending on the country’s initial conditions (degree of public indebtedness or the business cycle positioning). Fiscal announcements also matter in terms of external credibility since they have an effect on government bond spreads. Ultimately, our findings suggest why it might be critical to consider the “news” effect of a fiscal measure by type rather than at the aggregated level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The COVID-19 pandemic cost lives and disrupted economic activity world-wide. Higher rates of illness and death tested the capacities of health systems. Confinement measures to control the spread of the virus disrupted trade between and within countries. The closure of schools and childcare services affected the ability of parents to work. Production and employment consequently fell in most countries. To prevent the spread of the virus, governments-imposed lockdowns with varying degrees of stringency. The general population also sought to reduce exposure to virus through voluntary social distancing. The result was a dramatic contraction in economic activity in 2020 with global GDP estimated to have declined by 3.5 percent (IMF 2021). The rebound in 2021 did not restore the pre-crisis GDP in 2019 in many advanced, emerging and low-income economies. At the same time, debt levels, both private and public, were already at record highs before the Covid-19 pandemic and surged further in 2020. According to IMF (2021) global public debt is projected to have risen by about 19 percentage points of GDP in 2020 among advanced economies. The increase reflects both the rise in deficits due to the automatic stabilizers as economic growth collapsed and the discretionary policy measures undertaken by governments to respond to the health crisis.

Impulse Responses to Fiscal Announcement Shocks, all countries (percent). Note: estimation of Eq. 5 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of the fiscal announcement shock. Solid black lines denote the response to a fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level

Impulse Responses to Fiscal Announcement Shocks by type, all countries. Note: estimation of Eq. 5 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first year of the fiscal announcement shock. Solid black lines denote the response to a fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level

Conditional Impulse Responses to COVID-19 shocks, High vs Low Fiscal Announcements. Note: estimation of Eq. 6 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of COVID-19 shock. Solid black lines denote the response to a COVID-19 shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level. The red line denotes the variable´s unconditional result for comparison purposes

Conditional Impulse Responses to Fiscal Announcements, Good Vs Bad Times. Note: estimation of Eq. 7 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of the fiscal announcement shock. Solid black lines denote the response to a fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level. The red line denotes the variable´s unconditional result for comparison purposes

Conditional Impulse Responses to Fiscal Announcements, High vs Low Fiscal Space. Note: estimation of Eq. 7 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of the fiscal announcement shock. Solid black lines denote the response to a fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level. The red line denotes the variable´s unconditional result for comparison purposes

Impulse Responses on Sovereign Bond Spreads to Fiscal Announcement Shocks, all countries, Advanced and Developing. Note: estimation of Eq. 5 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of the fiscal announcement shock. Solid black lines denote the response to the fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level

In an environment where most countries face increasing interest rates to fight inflationary pressures, fiscal policy retains a crucial role in mitigating the scars of the pandemic´s economic impact. That said, the pressures on government finances were immediate and large as revenue was falling as tax bases contracted and there was an increased need for expenditure to expand the capacity of public health services and to adapt other public services, such as education and aged care, to the need for social distancing. Governments implemented (and some of them still do) measures to mitigate the impact of the pandemic on private sector economic activity. To counter income losses arising from the pandemic, countries took bold steps to help households and firms by implementing discretionary revenue and spending measures. In addition, many governments used below-the-line fiscal measures and contingent liabilities as part of their response to the pandemic.Footnote 1 In other words, they have been providing liquidity support to the economy in the form of equity injections, asset purchases, loans, and credit guarantees.Footnote 2 However, these types of measures also carry with them a risk that large liabilities might be realized at a future point in time. Understanding empirically the economic effects of fiscal measures is therefore important for policymakers, because it allows an assessment of the tradeoffs between measures in terms of both their costs and benefits.

Note however that the fight to the Covid-19 economic consequences was done in tandem with monetary policy.Footnote 3 The synergy between monetary and fiscal policy was essential in effectively addressing the challenges posed by the COVID-19 pandemic (see e.g. Brzoza-Brzezina et al. 2021; Tsatsaronis et al. 2022). First, there is enhanced impact as the combined effects had a more substantial impact on stimulating demand and supporting economic activity. Lower interest rates and QE provided liquidity and support financial markets, while fiscal measures injected money directly into the economy, boosting aggregate demand. Second, coordination was paramount to ensuring that policies do not work at cross-purposes. By aligning their objectives and actions, monetary and fiscal policymakers created a more comprehensive and coherent response to the economic crisis. Thirdly, the issue of targeting canalized each type of policy where the benefit could be maximized. For instance, fiscal policy can focus on specific industries or demographics, while monetary policy can help ensure that the financial system remains stable.

Against this background, this empirical paper estimates reduced-form equations that relate announcements of fiscal measures in the context of the COVID-19 pandemic and several proxies of economic activity. Our premise is to assume the set of announcements made by governments are credible. A key challenge to examine the effect of such fiscal announcements is to identify “fiscal shocks” in the data given the limited time span.Footnote 4 We address this by using daily data on announced fiscal stimulus measures then converted to weekly observations. More specifically, this paper has three goals. First, we build a new panel data of COVID-19 related demand-support fiscal announcements and then quantify their size by country individually and by country´s income group as the pandemic effects unfold. Second, we split these fiscal announcements by type differentiating above and below-the-line fiscal operations, and contingent liabilities. Third, relying on both static and dynamic empirical panel data analyses, we assess how fiscal announcements directly shape the impact of the COVID-19 pandemic alternative proxies for economic activity including the external credibility aspect (using sovereign bond spreads).

Note that a disclaimer is warranted at this point. In this paper we are not looking for a pure “fiscal multiplier” effect even if implicitly some readers could be thinking of this concept. This literature is voluminous in creating or trying to identify an exogenous (non-cyclical) source of fiscal shocks to judge the output effects. Such literature was developed using annual level data and relying on SVARs, natural experiments, forecast errors, etc.Footnote 5 This paper uses instead weekly data rendering inapplicable the list of such previous techniques. Moreover, as the data underlying the analysis was basically largely justified by the COVID-19 pandemic–aggregate demand supporting measures–, this could be thought of being endogenous even if part of those measures were not. That said, and in our defense, we deal with announcements and not ex-post realized values (which can be different).Footnote 6 So, while we are exploring correlational effects of such fiscal news on several economic proxies trying to minimize reverse causality concerns, we make no strict causal statements.Footnote 7

The closest paper to ours is the recent study by Deb et al. (2022). There are, however, three main differences between this and their paper. The first difference is the detailed classification of our data since Deb et al. (2022) used the Yale Covid-19 Financial Response Tracker (CFRT) whereas our study is based on the Oxford Stringency Index. The major difference between the two datasets is that the Oxford dataset has the announcement date and the amount promised, which enabled us to measure the fiscal effects of government support announcement on proxies of economic activity. Secondly, Deb et al. (2022) used a narrative approach and showed the static effects of fiscal announcements. We employ the Local Projection method to illustrate the dynamic effects up to 12 weeks ahead of the different categories of fiscal announcements. Third, Deb et al. (2022) use a sample of 52 countries in their analysis while we have almost 3 times more, 136 countries.

Our main results can be summarized as follows. We find that the dynamic effect of fiscal announcements varies by the types of fiscal measures and on different income groups. We also evaluate whether the effect varies across countries depending on their initial conditions, such as the position in the business cycle and the degree of fiscal indebtedness (which proxies availability of fiscal space or fiscal room for maneuver to battle the COVID-19-led-crisis). Results show that countries with a larger fiscal space tend to boost economic activities more than those who do not have enough fiscal space. Lastly, we analyze to what extent financial markets react to fiscal announcements by inspecting how the pricing of country spreads changes. Our findings suggest that in developing economies (that is, emerging and low-income countries), the impact of fiscal announcement on country spreads is bigger when it involves more direct fiscal support than the supports that require a high level of financial and institutional maturity. Through these results, the paper provides policy guidance on the criteria against which policymakers can assess the appropriateness of fiscal measures. The results demonstrate that a country’s context and fiscal space matter for whether one type of intervention might be preferred to another.

The remainder of this paper is organized as follows. Section 2 reviews the relevant literature. Section 3 develops the empirical framework. Section 5.1 discusses the data and presents some stylized facts. Section 6 discusses the results. The last section concludes and highlights some policy implications.

2 Literature Review

This paper relates to three main strands of literature. The first is the literature on the economic effects of pandemics. The second strand of the literature relates crises and recessions and fiscal variables. The third strand relates to the credibility effect of fiscal policy on economic and financial outcomes.

The first is the literature on the economic effects of pandemics. Studies of the macroeconomic impact of past pandemics and of other major diseases (such as SARS and HIV/AIDs) have typically quantified the resulting short-term loss in output and growth. However, there is little consensus on economic consequences of pandemics. Results critically depend on the models used and on the availability of data (Bell and Lewis 2005). A study by Brainerd and Siegler (2003), one of the few on the economic effects of the Spanish flu, suggested that the 1918/19 pandemic in the US actually increased growth in the 1920s. In contrast, Almond and Mazumber (2005) argued that the Spanish flu had long-term negative effects through its impact on fetal health. Using a theoretical model, Young (2004) argued that the AIDS epidemic in South Africa would increase net future per capita consumption, while Bell et al. (2004) found strong negative effects. Jonung and Roeger (2006) estimated the macroeconomic effects of a pandemic using a quarterly macro-model constructed and calibrated for the EU-25 as a single economic entity. The recent literature on this topic, motivated by the Covid-19 pandemic, provides evidence of large and persistent effects on economic activity (see e.g. Atkeson 2020; Barro et al. 2020; Eichenbaum et al. 2020). In fact, Ma et al. (2020) in an empirical analysis of the economic effects of past pandemics, found that real GDP is 2.6 percent lower on average across 210 countries in the year the outbreak is officially declared and remains 3 percent below pre-shock level five years later. Moreover, according to Jorda et al. (2020), significant macroeconomic after-effects of pandemics persist for decades, with real rates of return substantially depressed. Pandemics induce relative labor scarcity in some areas and/or a shift to greater precautionary savings.

The second strand of the literature relates crises and recessions and fiscal variables (see e.g. European Commission 2009a). Financial crises have induced governments around the globe to take decisive action in terms of sustaining economic activity and preventing the meltdown of the financial sector. These actions had direct and indirect fiscal costs. Direct fiscal costs from actions from financial system rescue packages (such as capital injections, purchases of toxic assets, subsidies, payments of called upon guarantees) resulted in permanent decreases in government´s net worth. Such interventions result in higher public debt, which either show up as an increase in stock flow debt-deficit adjustments or as higher deficits (Attinasi et al. 2010; European Commission 2009b). There also are indirect fiscal costs, i.e., due to the feedback loop from the crisis to economic activity. These involve lower revenues due to falling profits and asset prices, higher expenditure to counter the impact of the crisis, as well as interest rate and exchange rate effects due to market reactions (European Commission 2009b). European Commission (2009b) building on fiscal reaction functions in the spirit of Gali and Perotti (2003) found that the bulk of the effect of crises on debt changes takes place during the first two years. Moreover, the impact of financial crises on debt was larger in emerging market economies than for the EU or other OECD countries. Building on a banking crises dataset by Laeven and Valencia (2008), several empirical studies have investigated the effect of crises on the debt-to-GDP ratio and GDP growth (Furceri and Zdzienicka 2010, 2012; Reinhart and Rogoff 2008, 2009, 2011). Furceri and Zdzienicka (2010) using a panel of 154 countries from 1980–2006 showed that banking crises are associated with a significant and long-lasting increase in government debt and that such increase is a positive function of higher initial indebtedness levels – so initial conditions matter. Employing different modelling techniques, Tagkalakis (2013) found significant econometric evidence that fiscal positions deteriorated during financial crises in 20 OECD countries over the 1990–2010 period. Several other studies investigated the direct fiscal implications of past banking system support schemes (Honohan and Klingebiel 2003), the determinants of fiscal recovery rates (European Commission 2009b), as well as whether costly fiscal interventions reduced output loss (Claessens et al. 2005; Detragiache and Ho 2010).

The third strand relates to the credibility effect of fiscal policy on economic and financial outcomes. The credibility of a fiscal announcement is an important factor to ensure the effectiveness of the announcement. The notion of "credibility" refers to the degree of confidence that the public has in the government authorities. In practice, a government announcement on fiscal measure often does not get taken at its face value. IMF (2021) illustrates that private sector forecasts heavily discount official projections for fiscal adjustments. Private sectors discount more heavily on the announcements of larger adjustments leading to a conclusion that a large fiscal announcement do not necessarily help budget credibility.Footnote 8 End and Hong (forthcoming) develop fiscal credibility measures that quantify the degree to which policy announcements anchor expectations. They analyze why private forecasts for the deficit differ from official projections and shows how strong fiscal frameworks can improve credibility of the announcement. Moreover, credible projection of future budget process can reduce the borrowing cost as shown in IMF (2021).Footnote 9 Credibility of the government announcement is closely related to the “time inconsistency” problem it is facing. A government being “time inconsistent" is describing an attitude that may be desirable under the immediate circumstances but was not perceived as optimal in previous period. To mitigate a time consistency problem and restore credibility of policy announcement, it is necessary to build policy framework, such as long-term targets and policy rules (IMF 2021).

This paper is different as it deals explicitly with the most recent pandemic, the COVID-19 shock while previous studies relied on historical past episodes of similar nature. Moreover, instead of looking at output effects, as we are using weekly data, we have to resort to proxies known to be correlated or associated in some fashion with economic activity. Finally, the effects studied in this paper are those of announcements assumed to be sufficiently credible and not realized ex-post fiscal measures. So, this explores the credibility angle of fiscal news which is an aspect missed in previous papers. So, while the macroeconomic effects of past pandemics have been studied, a deeper and more disaggregated assessment of the degree of fiscal policy relevance, or fiscal news in particular, in the context of the COVID-19 pandemic, conditioned on the type of fiscal announcement, is lacking. This paper aims to bridge this gap.

3 Data and Stylized Facts

3.1 Data

3.1.1 Independent Variables

We assemble a comprehensive database of announced fiscal stimulus measures, economic activity indicators, financial variables, COVID-19 infections (new cases) and degrees of stringency in containment measures. The database is of weekly frequency and covers 136 countries between January 2020 and May 2021. We use fiscal announcements for various types of fiscal measures as our main independent variables. The crude data originally comes from the Oxford COVID-19 Government Response Tracker (“Oxford Stringency”) data. We then create a new data by classifying each fiscal announcement from this data into four categories: “Above-the-line” (ATL) measures, “Below-the-line” (BTL) measures, Contingent Liabilities (CL), and Unknown. For the data classifications of ATL, BTL, and CL, we follow the definitions from the IMF Glossary – see Appendix. Anything else that does not fall into those three categories is classified as Unknown (UNK). When the announcement is mixed with different types of measures, we separate them into different categories. The IMF and Yale University published a similar dataset on fiscal announcement during the Covid pandemic. We cross-checked out classifications with IMF Fiscal Monitor and Yale COVID-19 financial response tracker to increase the accuracy.

Typical examples of ATL measures include unemployment benefits, subsidies, grants, and tax cuts to households and firms. BTL measures include equity injection and loans to the firms. When the government guarantees loans taken out from the banks, this is considered a CL. The obligation does not occur unless a particular event happens. Table 1 shows the examples of each measure from Oxford Stringency data.

Note that it is hard to capture the actual effect of a given fiscal policy announcement on the economy, as there are lags of different nature (design, parliamentary discussion and approval, implementation, verification) that vary country by country and case by case. Our premise is to assume the set of announcements made by governments are credible. Indeed, the ex-ante promised amounts could be different from the ex-post realized amount, but we believe the general direction of fiscal actions coincide with the announcements.Footnote 10

3.1.2 Dependent Variables

We rely on a set of proxies known to be closely related to economic activity (or GDP) as a basis to assess the correlational effectiveness of different types of announced fiscal measures. These variables include measures of travel (e.g. the number of hotel stays) and industrial activity measures (NO2 emissions).Footnote 11

Mobility

Data derived from smartphones on movement and mapping requests are increasingly being used as high frequency measures to nowcast economic activity (e.g., Dong et al. 2017; Sampi Bravo and Jooste 2020). We draw on data provided by Apple that counts the number of map requests in any given week as an estimate of mobility and economic activity in a country. Weekly data on these requests are available for 62 of the 163 countries in our dataset of fiscal measures (for a time series graphical representation by income group see Fig. 10 in the appendix panel a).

Hotel Bookings

The number of hotel room nights demanded in any given week provides an indication of output in the accommodation sector specifically, and the travel sectors more generally. Our hotel data are drawn from STR Hospitality Data and cover 66 countries of the 163 countries in our dataset of fiscal measures (for a time series graphical representation by income group see Fig. 10 in the appendix panel b).

Flights

Our flights data are drawn from the FlightRadar24.com website as the average number of daily domestic flights, international departures, and arrivals by country for each week in our dataset. The number of flights in a country in each week provides an approximation for the combined passenger and cargo air capacity available in that week. Data are available for 160 of the 163 countries in our dataset of fiscal measures (for a time series graphical representation by income group see Fig. 10 in the appendix panel c).

Nitrogen Dioxide Emissions

Nitrogen Dioxide (NO2) has been identified as a correlate with economic activity (Lin and McElroy 2011) and industrial production (Hosny and Pallara 2022). NO2 is mainly emitted from the burning of fossil fuels for transportation and electricity generation and is particularly well-suited to high frequency economic analysis because it has a short lifetime. Data on NO2 emissions are sourced from the Air Quality Open Data Platform of the World Air Quality Index (WAQI) and from the European Space Agency’s Senitnel-5P Precursor satellite. The combination of these datasets covers emissions in 120 of the 163 countries in our dataset of fiscal measures ((for a time series graphical representation by income group see Fig. 10 in the appendix panel d).

3.2 Other Variables

Our key regression analysis will also include as key control variables a proxy for the COVID-19 shock given by the number of new cases (per million inhabitants) in each country and time period (week) and the containment stringency index from the Oxford Coronavirus Government Response Tracker, which is a composite measure based on nine response indicators including school closures, workplace closures, and travel bans, rescaled to a value from 0 to 100 (100 = strictest).Footnote 12 The same indicator was recently employed by Furceri et al. (2021).

Furthermore, to assess how a country´s or income-group characteristics before the pandemic played a role in the effectiveness of the announcement of fiscal measures, we add in some instances some interactive variables based on prevailing macroeconomic and fiscal conditions prior to the COVID-19 shock, namely: (1) the degree of public indebtedness; (2) economic stance proxied by real GDP growth. We select data for the year 2019 which can be found in World Economic Outlook.Footnote 13

3.3 Stylized Facts

Table 2 provides some summary statistics of cumulative fiscal measures during our sample period (January 2020-May 2021) by income group using the World Bank classification. Total/GDP is a sum of ATL, BTL, CL and Unknown from our data. Fiscal measures classified as “unknown” are not included in our analysis. Unsurprisingly, advanced economies (AE) had the highest numbers for accumulated total fiscal measures/GDP, followed by emerging economies (EM) and low-income countries (LIC). This ordering holds for all the fiscal measures (ATL, BTL and CL).

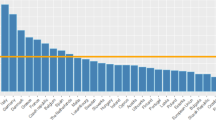

The world map displayed in Fig. 1 shows the regional differences in total accumulated fiscal measures in percent of 2020 GDP between January 2020 and May 2021. The larger the total accumulated fiscal measures, the darker the color of the region. Countries are divided into six groups according to their size of accumulated total fiscal measures. High income countries, such as Japan and United Kingdom, fall into the top group, whereas most of the low-income countries in African continent correspond to the lowest group.

Figures 11, 12 and 13 show the box-whisker plots of cumulative amounts of fiscal announcements over time between January 2020 and May 2021 by income group. Each figure displays three components – ATL, BTL and CL. Lower and upper line of the box represents 25th and 75th percentile, respectively, while the middle line shows the median value. X marks show mean value of each fiscal measure. A number of stylized facts about the fiscal announcement packages are worth noting:

-

1.

AE has the largest fiscal measures for all types (ATL, BTL and CL).

-

2.

In all income groups (AE, EM and LICs), ATL is the one that is the most frequently used.

-

3.

In AE and EM, CL is the second mostly frequently used measure, whereas in LIC, BTL takes that place (though it is still very small).

-

4.

BTL and CL are used in AE, but the usage of BTL and CL in EM and LICs is insignificant (less than 1% of GDP at the best).

-

5.

Mean of BTL and CL in EM and LICs are driven by outliers.

Figure 2 shows that the means of total accumulated fiscal measures is largest in advanced economies, followed by emerging market economies and then low-income countries (a finding in line with Deb et al. 2022). The size of fiscal announcement spiked in March 2020 for all income groups. Additional fiscal support was announced throughout 2020, but this was limited in emerging market economies and low-income countries (Fig. 3).

4 Methodology

4.1 Static Approach

We begin by estimating, in a static manner, the unconditional effect of fiscal shocks on weekly economic indicators. We use an unbalanced sample of 59 countries from January 2020 to May 2021. The first reduced-form equation takes the form:

where \(\Delta {y}_{i,t}\) is the indicator of economic activity—mobility, hotel stays, flights, NO2 emissions. \({TOT}_{i,t}\) denotes the overall size of the total fiscal announcement. \({\alpha }_{i}\) are country fixed effects to account for time-invariant specific characteristics. \({\uppi }_{t}\) are time effects. For EU countries the Next Generation EU (NGEU) common policy response to the Covid-19 challenges was an important move.Footnote 14 Time effects for this group of countries partially take this into account as one cannot empirically explicitly account for this aspect. \({Covid}_{i,t}\) is a proxy for COVID-19 health outcomes, namely new cases per million inhabitants. \(\Delta {string}_{i,t}\) is the Oxford stringency index, rescaled to a value from 0 to 100 (100 = strictest). \({X}_{i,t}\) is a vector of control variables including real GDP per capita, population density, number of hospital beds, median population age and the human development index. \({\upvarepsilon }_{i,t}\) is an i.i.d error term satisfying standard assumptions.

We expand the baseline specification to evaluate whether the impact of announced fiscal measures varies by typology of measure:

where \({ATL}_{i,t}\), \({BTL}_{i,t}\) and \({CL}_{i,t}\) denote above-the-line, below-the-line and contingent liabilities, respectively. All other variables are as in Eq. (1).

Finally, we analyse if the impact of COVID-19 on the different dependent variables varies with the size of the fiscal announcement by augmenting the previous regressions with an interaction term, as follows:

Equation (3) is estimated with OLS with robust standard errors clustered at the country level for the overall fiscal announcement shock and for each category individually.

4.2 Dynamic Approach

To assess the dynamic response of COVID-19 and fiscal announcement shocks on several high frequency dependent variables identified in the previous section, we follow the local projection method proposed by Jordà (2005) to estimate impulse-response functions (IRFs). The first exercise is to dynamically look at the separate effect of the pandemic and fiscal shocks. The second will condition the effect of the pandemic on the amount of the fiscal announcement in an interacting-type regression. This local projection method was advocated by Auerbach and Gorodnichenko (2013) and Romer and Romer (2019) as a flexible alternative to vector autoregression (autoregressive distributed lag) specifications since it does not impose dynamic restrictions.Footnote 15 It is also better suited to estimating nonlinearities in the dynamic response—such as, in our case, interactions between debt surge episodes and the degree of initial indebtedness.

The baseline unconditional specification for the COVID-19 shock takes the following form:

in which y is the dependent variable of interest;\({\beta }_{k}\) denotes the (cumulative) response of the variable of interest in each k week after the COVID-19 shock;\({\alpha }_{i}\), \({\uppi }_{t}\) are country and time fixed effects, respectively; \({Covidshock}_{i,t}\) denotes the COVID-19 shock (the log of the number of new cases per million inhabitants). \({K}_{i,t}\) is a set a of control variables including two lags of the shock and two lags of the dependent variable. \({\mathrm{P}}_{i,t-1}\) is an additional vector of controls akin vector X in Eq. (1).

The baseline unconditional specification for the fiscal announcement shock takes the following form:

in which y is the dependent variable of interest;\({\beta }_{k}\) denotes the (cumulative) response of the variable of interest in each k week after the fiscal announcement shock; \({Fshock}_{i,t}\) denotes the fiscal announcement shock (size of fiscal announcement in percent of GDP). \({L}_{i,t}\) is a set a of control variables including two lags of the shock, two lags of the dependent variable and two lag of the number of COVID-19 cases (in logs). All other variables are as in Eq. (4).

Equations (4–5) are estimated using Ordinary Least Squares (OLS). IRFs are then obtained by plotting the estimated \({\beta }_{k}\) for k = 0,1,..12 (in weeks) with 90 (68) percent confidence bands computed using the standard deviations associated with the estimated coefficients \({\beta }_{k}\)—based on robust standard errors clustered at the country level.Footnote 16 According to Sims and Zha (1999) “the conventional pointwise bands common in the literature should be supplemented with measures of shape uncertainty”. Hence, for characterizing likelihood shape, bands that correspond to 68 percent posterior probability, or one standard deviation shock, provide a more precise estimate of the true coverage probability.Footnote 17

To explore the role of the size of fiscal announcements at the time of COVID-19 shock on several high frequency variables proxying different aspects of economic activity, the dynamic response is now allowed to vary, as follows:

with

in which \({z}_{it}\) is an indicator of the size of the fiscal announcement, normalized to have zero mean and unit variance. The weights assigned to each regime vary between 0 and 1 according to the weighting function \(F\left(.\right)\), so that \(F(z_(i,t))\) can be interpreted as the probability of being in a given state (high fiscal announcement or low fiscal announcement). The coefficients \({\beta }_{k}^{L}\) and \({\beta }_{k}^{H}\) capture the impact of COVID-19 shocks at each horizon k.

As discussed in Auerbach and Gorodnichenko (2013), the local projection approach to estimating non-linear effects is equivalent to the smooth transition autoregressive (STAR) model developed by Granger and Teräsvirta (1993). Here, δ = 1 is used.Footnote 18 The use of the STAR function as an indicator of fiscal policy is not new. In fact, Auerbach and Gorodnichenko (2013) and Abiad et al. (2016) employed similar approaches.

A variant of Eq. 6 is to explore the role of prevailing economic and fiscal space conditions at the time of the fiscal announcement on several high frequency variables proxying different aspects of economic activity, the dynamic response is now allowed to vary, as follows:

in which \({g}_{i,t}\) is an indicator of the phase of the economy (proxied by real GDP growth) or the fiscal space (proxied by government debt in percent of GDP) in the year prior to the COVID-19 started (i.e., 2019). \({I(g}_{i,t})\) is defined in the high (low) state as having country average growth above (below) the sample median growth. For the fiscal space exercise, the high (low) state is one where the country average debt to GDP ratio is below (above) the sample median debt. In this latter case, we have high and low fiscal space respectively. The coefficients \({\beta }_{k}^{L}\) and \({\beta }_{k}^{H}\) capture the impact of fiscal announcement shocks at each horizon k for each state.

5 Empirical Results

5.1 Unconditional

We begin with the estimation of the unconditional regressions depicted by Eqs. (1–4) above. Results excluding and including control variables are displayed in Table 3. We observe that fiscal announcement measures seem to have a positive and significant effect on the number of flights (but the effect lowers in magnitude and significance once other controls are added). Note that we control by an index capturing the degree of stringency with includes travel bans. As expected, the effect of COVID-19 (new cases per million inhabitants) is generally negative and significant on several alternative proxies of economic activity and so is the degree of stringency (the higher the degree of lockdown imposed, the larger the negative impact on the economy). These generally results are in line with previous papers (see e.g. Furceri et al. 2021).

Next, we repeat the estimations splitting the sample by income group. The full set of results are available in Appendix Table 7 while Table 4 below summarizes the key findings in terms of coefficient signs and statistical significance. We observe that the size of announced fiscal measures had negative significant effect in hotel stays in the case of developing economies (that is, emerging and low-income countries) and then positive and significant in NO2 emissions group of countries. Economically, some of these results are difficult to rationalize and for this reason they should be interpreted with care as these static regressions translate a longer-run analysis and the dynamic exercise that will follow aims to instead look at shorter-run effects. The COVID-19 shock generally comes out negative and significant across different dependent variables and income groups.

In Table 5, we split the fiscal announcement by type: ATL, BTL and CL. Overall, BTL measures seem to be the most effective ones (leading to a positive and significant longer run effect in mobility, flights and emissions).

Next, we move to the short to-medium term dynamic analysis by means of the local projection method (Fig. 4). We believe that this part of the analysis is perhaps more informative and closer to the “true” macroeconomic effects of credible fiscal news (announcements).Footnote 19 Following a fiscal announcement, mobility increases and this effect remains statistically different from zero until around 6 weeks after. This could be related to the fact that such announcements incentivize and/or may give the impression of life normalization after a period of lockdown or containment. That said, the effect is not persistent nor permanent. In contrast, the impact on hotel stays, flights and NO2 emissions are more ambiguous (with some tendency for flights to react positively and stay borderline significant).

In Fig. 5, we split the fiscal announcement by type. For mobility, the effectiveness is largest (that is, positive and significant impact) when either ATL or CL are announced (but the magnitude and degree of significance is larger for CL). CL have positive medium-term effects on hotel stays while other types of measures do not significantly impact this variable. CL on tourism and hotel business may help these stay afloat during the “stormy” period and, hence, encourage new reservations down the road. Flights react positively following either BTL or CL fiscal announcement and seem indifferent to ATL measures. Having such measures may prevent the bankruptcy of an airline or its services coming to a halt. Finally, the effect on NO2 emissions is unclear.

5.2 Conditional

Now we turn to the conditional or non-linear effects, that is, estimation of Eq. (6).Footnote 20 The size of the fiscal announcement package matters for the short-term economic response that follows (Fig. 6). In particular, a large (small) fiscal announcement has a positive (negative) and significant effect on mobility. Moreover, if the size of the fiscal announcement is small, then the effect on hotel stays and number of flights is negative and significant. This suggest that indeed ambition in releasing powerful and large fiscal rules seem to payoff whereas timid news may incite fear and have contractionary effects.

Next, we estimate Eq. (7). As discussed, we evaluate two sets of prevailing conditions at the time of the fiscal announcement shock: i) business cycle conditions; ii) fiscal space.

Looking at Fig. 7, we observe that, in the case of mobility, the prevailing business cycle conditions matter for the effect of the fiscal announcement. If the economy is booming, mobility increases and this effect is statistically different from zero. In the remainder of the variables analysed the conditional effect is not statistically different from that of the baseline (unconditional) regression.

In Fig. 8, we inspect whether existence of fiscal space matters. If the fiscal room for manoeuvre is generous, then mobility, hotel stays and flights all increase (at least in the short-run) and above the baseline (unconditional) result.

5.3 Government Credibility Effects

A final exercise is to check how do financial markets that price sovereign bond issuances see the announcement of different types of fiscal measures. The new dependent variable is government bond yields and spreads as measured by 10-year foreign currency-denominated government bond yields and spreads vis-à-vis the U.S. benchmark, which are drawn from Bloomberg.Footnote 21 Note that due to data availability the empirical analysis that follows does not necessarily match the same sample of countries as before. Table 6 shows the unconditional static results of estimating Eq. (1) with the new dependent variable spreads. We observe that the effect on the fiscal announcement is negative and significant, particularly when of the BTL type. This suggests that financial markets reward those announcing big fiscal packages.

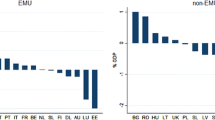

Dynamically, running Eq. (6) on the new dependent variable yields the impulse responses plotted in Fig. 9. We confirm the static results in the sense that spreads go down in the short-run, and more so in the case of developing economies. This may be related to the fact that developing countries are typically characterized by a lower debt level and higher fiscal space for developmental purposes and, hence, when called to act markets find it necessary and reasonable. In advanced economies with typically larger debt and fiscally more constrained, the scrutiny by external investors is larger and hence policies need to be better designed and financially justified not to be perceived as a bad down the road (in terms of fiscal sustainability for instance).

In Fig. 14 we split the type of fiscal announcement and we observe that in the case of AEs it is BTL type of measures that lead to the largest (negative) impact on spreads. In the case of DEV, ATL seem to matter more to reduce spreads (but the effect is only on the margin significant – depends on the CI chosen). More interestingly is the fact that financial markets penalize developing countries that announce BTL or CL type of measures. One reason for this result could be the fact that these countries are often characterized by poorer institutions and weaker public administrations. In the case of DEV, they are rewarded with fiscal announcements that involve more direct support, such as ATL, rather than the announcements that require a high level of financial infrastructure and maturity, such as BTL and CL. Their lower level of financial infrastructure makes it difficult to carry out BTL and CL types of support credibly. Thus, fiscal announcement related to BTL and CL could be seen as “less credible” in DEVs and does not reduce spreads. Also, CL has more uncertainty and exposes the government to fiscal risks that may not be well managed down the line, which could be why spreads are not contracting in response to CL type of fiscal announcements in DEVs.

6 Conclusion

This paper studies the effectiveness of fiscal announcements on economic activities by looking at Covid-19 related fiscal announcements.

Our first contribution is that we build a panel data of fiscal announcements that are Covid-related demand support type. We separate all fiscal announcements between January 2020 and May 2021 into three different categories (ATL, BTL and CL), while keeping track of the date the announcement was made. We also separate each country into different income groups to characterize the cumulative and temporal patterns of fiscal announcements.

Secondly, we show empirically how these fiscal announcements affect the different proxies of economic activities and sovereign spreads. We rely on both static and dynamic panel techniques and in the latter, we also condition on countries’ initial conditions prevailing at the time the COVID-19 shock hit. When looking at static results, the effects of fiscal announcements on high-frequency economic activity variables are generally ambiguous or unclear. As we employ dynamic analysis, however, we find more interesting results as we classify the types of fiscal announcements and income groups. The most interesting results are the following:

-

Fiscal space matters for the effectiveness of fiscal announcements. NO2 is especially sensitive to fiscal space, suggesting economic activity only responds if the announcement is credible.

-

Contingent liability measures (which have little upfront cost) are as or more effective than BTL and ATL measures on most high frequency indicators.

-

Sovereign spreads are sensitive to the type of measures deployed. In advanced economies, the market tends to look favourably on BTL and CL measures, but this is reversed in low-income countries, where markets may be concerned about the capacity of governments to monitor and manage complex instruments.

These results are particularly relevant from a policy perspective. They highlight that the particularly cost-effective role of CL and BTL measures in supporting short-run activity during the pandemic. CL and BTL measures have very low upfront costs and may not lead to any notable increase in public debt in the long run, unlike ATL measures which require immediate spending, often funded through additional borrowing. For AEs, the introduction of CL and BTL measures has a further benefit, as they appear to also reduce sovereign spreads, lowering borrowing costs and supporting confidence. Still, while this combination of low up-front costs, generally positive announcement impact, and lower spreads meant CL and BTL measures were a powerful tool in addressing at least the immediate effects of the pandemic, these measures also carry with them a (sometimes very large) contingent liability that could be realized in the future. Policymakers should be sure to also assess the magnitude and likelihood of risk realization when designing the combination of policy responses to future similar events.

Note, however, that the response of governments to the Covid-19 challenges was influenced many other factors not directly addressed or factored in our analysis. First the general quality and adequacy of health services mattered as countries with strong and well-equipped healthcare systems were generally better prepared to respond to the pandemic. This includes adequate availability of medical supplies, such as personal protective equipment, ventilators, testing kits, and hospital beds. Second, the old-age ratio is likely to have dictated a stronger response from the government to protect vulnerable populations since countries with a higher proportion of elderly citizens were more likely to face a greater burden of severe cases and fatalities. Third, the level of international pressure and cooperation has compelled some governments to respond forcefully to comply with international health regulations, concerns about cross-border transmission, etc. Finally, the relevance of good data and associated credible scientific advice since their quality and credibility influenced the level of action taken by the government.

Notes

One example of a below-the-line measure is a loan. On September 3 2020, the French government announced a new fiscal package to support the recovery of the French economy (“Plan de Relance”), which focused on the ecological transformation of the economy.

Governments saw specific benefits in using below-the-line measures and contingent liabilities in these circumstances. Constraints on the ability to increase spending or accumulate liabilities, for example, made recourse to below-the-line measures and contingent liabilities more palatable. Or there may be characteristics of below-the-line measures and contingent liabilities that make them better suited to respond to the challenges of the pandemic.

We thank an anonymous referee for this point.

For a paper looking at the speed at which fiscal news are reflected in economic forecasts, see Jalles (2015).

Furthermore, it is extremely difficult - in the context of the period under scrutiny marked by the pandemic - to differentiate the exogeneous and endogenous components of those fiscal measures for such a large panel of countries and for this reason we are at most looking for correlational effects, that is, exploring if such pandemic-led-fiscal-measures were successful in terms of raising certain aspects captured by high frequency variables that are in some degree positively related to aggregate GDP. Any leap to a fiscal multiplier discussion could be done but, in all transparency, it is a stretch.

The literature on the political bias in government forecasts is abundant. The persistence of overly optimistic forecasts led to the perception that, as budget forecasts came to occupy a more central role in the political process, the pressure on forecasters to help policy makers avoid hard choices led to forecasting bias. A great deal of literature has analyzed the potential bias the political and institutional process might have on revenue and spending forecasts (Plesko 1988; Feenberg et al. 1989; Auerbach 1995 , 1996; Bruck and Stephan 2006), and the nature and properties of forecast errors within national states (Gentry 1989; Baguestani and McNown 1992; Campbell and Ghysels 1995; Auerbach 1999; Mühleisen et al. 2005).

Relatedly Gupta and Jalles (2018) analyzed the causes and consequences of fiscal consolidation promise gaps, defined as the distance between planned fiscal adjustments and actual consolidations. They found that governments that delivered on their fiscal consolidation plans were rewarded by financial markets and not penalized by voters.

For a more detailed discussion on promised versus realized fiscal actions (not announcements) see Gupta and Jalles (2018).

Other higher frequency economic indicators (such as the number of job advertisements and indicators of purchasing manager sentiment) were also attempted but due to the more unbalanced and incomplete nature of the data, associated results were omitted.

The Oxford Coronavirus Government Response Tracker collects information on government policy responses across several dimensions. The database scores the stringency of each measure ordinally, for example, depending on whether the measure is a recommendation or a requirement and whether it is targeted or nationwide. We normalize each measure to range between 0 and 100 to make them comparable.

Note that as mentioned earlier, the impact of Covid-19 related fiscal measures would not have yielded the intended effects without the complementing effect of monetary policies. In our setting finding proxies for conventional and non-conventional monetary policy shocks is beyond the scope of the paper and a whole literature on its own. Moreover, out of the 59 countries covered in the main analysis, many form the Euro Area and so, for these, fixed effects included in the regressions to a great extent capture the common monetary policy actions.

NGEU mobilised an unprecedented funding volume of up to €807 billion in current prices, the equivalent of 6% of 2020 EU GDP.

Another advantage of the local projection method compared to vector autoregression (autoregressive distributed lag) specifications is that the computation of confidence bands does not require Monte Carlo simulations or asymptotic approximations. One limitation, however, is that confidence bands at longer horizons tend to be wider than those estimated in vector autoregression specifications.

The results do not qualitatively change for different values of δ > 0.

Results for the estimation of Eq. 4 for COVID-19 shocks alone are available upon request. Following the pandemic shock flights and hotel stays go down (and the effect is statistically significant and persistent).

In Appendix Table 11 we conduct a static conditional regression exercise by expanding Eq. 1 with an interaction term of COVID-19 and the fiscal announcement. Results are on average weak and inconclusive with the exception of BTL for the case of NO2 emissions where the combined result (accounting for the significant interacting coefficient) is a negative effect of fiscal announcements the larger the size of the fiscal announcement package.

The list includes the following countries: Albania, Argentina, Austria, Azerbaijan, Bahamas, Bahrain, Belgium, Belize, Benin, Bolivia, Brazil, Bulgaria, Canada, Chile, China, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Côte d'Ivoire, Dominican Republic, Ecuador, Egypt, El Salvador, Finland, France, Ghana, Greece, Guatemala, Hong Kong, Hungary, Indonesia, Ireland, Israel, Italy, Jamaica, Jordan, Kazakhstan, Kenya,Korea, Latvia, Lithuania, Luxembourg, Mexico, Mongolia, Morocco, Mozambique, Netherlands, Nigeria, Oman, Pakistan, Panama, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russian Federation, Rwanda, Saudi Arabia, Senegal, Slovak Republic, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Tajikistan, Republic of, Trinidad and Tobago, Turkey, Ukraine, United Arab Emirates, Uruguay, Uzbekistan, Republic of, Vietnam, Zambia.

References

Abiad A, Furceri D, Topalova P (2016) The macroeconomic effects of public investment: Evidence from advanced economies. J Macroecon 50:224–240

Alesina A, Favero C, Giavazzi F (2015) The output effect of fiscal consolidation plans. J Int Econ 96(S1):S19–S42

Alesina A, Favero C, Giavazzi F (2019) Effects of Austerity: Expenditure- and Tax-based Approaches. J Econ Perspect 33(2):141–162

Almond D, Mazumber B (2005) The 1918 Influenza Pandemic and Subsequent Health Outcomes: an analysis of SIPP data. Am Econ Rev 95(2):258–262

Atkeson A (2020) What Will Be the Economic Impact of COVID-19 in the US? Rough Estimates of Disease Scenarios. NBER WP 26867

Attinasi M, Checherita C, Nickel C (2010) What explains the surge in euro area sovereign spreads during the Financial Crisis 2007–2009? Public Finance and Management 10:595–645

Auerbach AJ (1995) Tax Projections and the Budget: Lessons from the 1980’s. Am Econ Rev 85(165–169):9

Auerbach AJ (1996) Dynamic Revenue Estimation. Journal of Economic Perspectives 10:141–157

Auerbach AJ (1999) On the Performance and Use of Government Revenue Forecasts. Natl Tax J 52:765–782

Auerbach A, Gorodnichenko Y (2013) Fiscal multipliers in recession and expansion. In: Alesina A, Giavazzi F (eds) Fiscal policy after the financial crisis. University of Chicago Press

Bachmann R, Sims ER (2012) Confidence and the transmission of government spending shocks. J Monet Econ 59(3):235–249

Baguestani H, McNown R (1992) Forecasting the Federal Budget with Time series Models. J Forecast 11:127–139

Barro R, Ursua J, Weng J (2020) The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity. NBER WP 26866

Bell C, Lewis M (2005) The economic implications of epidemics old and new. SSRN Electron J

Bell C, Devarajan S, Gersbach H (2004) Thinking About the Long-Run Economic. The Macroeconomics of HIV/AIDS. 96

Blanchard O, Perotti R (2002) An empirical characterization of the dynamic effects of changes in government spending and taxes on output. Q J Econ 117(4):1329–1368

Brainerd E and Siegler M (2003) The economic effects of the 1918 influenza epidemic. CEPR Discussion Papers No. 3791

Bruck T, Stephan A (2006) Do Eurozone Countries Cheat with their Budget Deficit Forecasts. Kyklos 59:3–15

Brzoza-Brzezina M, Kolasa M, Makarski K (2021) Monetary Policy and Covid-19. IMF Working Papers No. 21/274, Washington DC

Campbell B, Ghysels E (1995) Federal Budget Projections: a nonparametric assessment of bias and efficiency. Rev Econ Stat 77:17–31

Claessens S, Klingebiel D, Laeven L (2005) Crisis resolution, policies, and institutions: empirical evidence. In: Honohan P, Laeven L (eds) Systemic financial crises: containment and resolution. Cambridge University Press, pp 169–194

Deb P, Furceri D, Ostry JD et al (2022) The economic effects of COVID-19 containment measures. Open Econ Rev 33:1–32. https://doi.org/10.1007/s11079-021-09638-2

Detragiache M, Ho G (2010) Responding to banking crises: lessons from cross-country evidence. International Monetary Fund

Dong L, Sicong C, Cheng Y, Wu Z, Chao L, Wu H (2017) Measuring economic activity in China with mobile big data. EPJ Data Sci 6(29)

Eichenbaum MS, Rebelo S, Trabandt M (2020) The Macroeconomics of Epidemics. NBER WP 26882

End N, Hong G (forthcoming) Trust What You Hear: Policy Communication and Fiscal Credibility

European Commission (2009a) European Economic Forecast: Autumn, European Commission. Brussels

European Commission (2009b) Public Finances in EMU. European Economy No 3. European Commission: Brussels

Feenberg DR, Gentry W, Gilroy D, Rosen HS (1989) Testing the rationality of State Revenue Forecasts. Rev Econ Stat 71:300–308

Furceri D, Li BG (2017) The macroeconomic (and distributional) effects of public investment in developing economies. IMF Working Papers, No. 17/217, International Monetary Fund

Furceri D, Zdzienicka A (2010) The consequences of banking crisis for public debt. OECD, Working Paper No. 81

Furceri D, Zdzienicka A (2012) How costly are debt crises? J Int Money Financ 31(4):726–742

Furceri D, Loungani P, Ostry J, Pizzuto P (2021) Will COVID-19 have long-lasting effects on inequality? Evidence from past pandemics. IMF Publishing, Washington DC

Furceri D, Loungani P, Ostry JD et al (2022) Will COVID-19 have long-lasting effects on inequality? Evidence from past pandemics. J Econ Inequal 20:811–839

Gali J, Perotti R (2003) Fiscal policy and monetary integration in Europe. Econ Policy 18:533–572

Gentry WM (1989) Do State Revenue Forecasters Utilize Available Information? Natl Tax J 42:429–439

Giordano R, Momigliano S, Neri S, Perotti R (2007) The effects of fiscal policy in Italy: Evidence from a VAR model. Eur J Political Econ 23:707–733

Granger CWJ, Teräsvirta T (1993) Modelling nonlinear economic relationships. Oxford University Press, Oxford

Gupta S, Jalles J (2018) Planned Fiscal Adjustments: do government fulfil their commitments? Euro Union Politics 19(3)

Honohan P, Klingebiel D (2003) The Fiscal Cost Implications of an Accommodating Approach to Banking Crises. J Bank Finance 27(8):1539–1560

Hosny A, Pallara K (2022) Economic activity, fiscal space and types of COVID-19 containment measures. IMF Working Papers 2022/012, International Monetary Fund

IMF (2021) World Economic Outlook - Update, January. IMF Publishing, Washington DC

Jalles J (2015) How Quickly is News Incorporated in Fiscal Forecasts? Economics Bulletin 35(4):2802–2812

Jonung L, Roeger W (2006) The macroeconomic effects of a pandemic in Europe-A model-based assessment. Available at SSRN 920851

Jordà O (2005) Estimation and inference of impulse responses by local projections. American Economic Review 95:161–182

Jordà Ò, Taylor AM (2016) The time for austerity: Estimating the average treatment effect of fiscal policy. Econ J 126(590):219–255

Jorda O, Singh S, Taylor A (2020) Longer-Run Economic Consequences of Pandemics. Covid Econ 1(3) CEPR Press

Laeven L, Valencia F (2008) Systemic Banking Crises: A New Database. International Monetary Fund. IMF Working Papers 08

Lin J-T, McElroy MB (2011) Detection from Space of a Reduction in Anthropogenic Emissions of Nitrogen Oxides During the Chinese Economic Downturn. Atmos Chem Phys 11(15):8171–8188

Ma C, Rogers J, Zhou S (2020) Global Financial Effects. Covid Economics 5:56–78

Mühleisen M, Danninger S, Hauner D, Krajnyáck K, Sutton B (2005) How do Canadian Budget Forecasts Compare with Those of Other Industrial Countries? IMF Working Paper WP/05/66

Plesko GA (1988) The accuracy of government forecasts and budget projections. Natl Tax J 41:483–501

Ramey VA, Shapiro MD (1998) Costly capital reallocation and the effects of government spending. In: Carnegie-Rochester Conference Series on Public Policy, vol 48, no 1, pp 145–194

Reinhart CM, Rogoff KS (2008) This time is different: A panoramic view of eight centuries of financial crises. NBER Working Paper 13882

Reinhart CM, Rogoff K (2009) This Time is Different: Eight Centuries of Financial Folly. Princeton University Press, October, Princeton

Reinhart CM, Rogoff KS (2011) From financial crash to debt crisis. American Economic Review 101(5):1676–1706

Romer C, Romer D (2019) Fiscal Space and the Aftermath of Financial Crises: How It Matters and Why. Brookings Pap Econ Act 239–313

Romer CD, Romer DH (2010) The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks. Am Econ Rev 100(3):763–801

Sampi Bravo JRE, Jooste C (2020) Nowcasting Economic Activity in Times of COVID-19: An Approximation from the Google Community Mobility Report (May 14, 2020). World Bank Policy Research Working Paper No. 9247

Sims CA, Zha T (1999) Error bands for impulse responses. Econometrica 67(5):1113–1155

Tagkalakis A (2013) Audits and tax offenders: Recent evidence from Greece. Econ Lett 118:519–522

Tsatsaronis K, Chui M, Goel T, Mehrotra A (2022) The monetary-fiscal policy nexus in the wake of the pandemic. Working Paper, Bank for International Settlements, BIS Papers No 122

Young A (2004) The Gift of the Dying: The Tragedy of AIDS and the Welfare of Future African Generations. National Bureau of Economic Research. Working Paper No. 10991

Acknowledgements

We thank two anonymous referees for useful comments and suggestions on an earlier version of this paper.

Funding

Open access funding provided by FCT|FCCN (b-on). Open access funding provided by FCT|FCCN (b-on). This work was supported by the FCT (Fundação para a Ciência e a Tecnologia) [grant number UIDB/05069/2020]. The opinions expressed herein are those of the authors and do not necessarily reflect those of the authors’ employers. Any remaining errors are the authors’ sole responsibility.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 IMF Glossary

“Above-the-line” measures Involve revenue raising and government expenditure, which affects the overall fiscal balance and government debt. In summary fiscal statements, these measures are typically recorded above the line of the overall fiscal balance.

“Below-the-line” measures Generally involve the creation of assets or liabilities without affecting fiscal revenues and spending today. Examples include government provision of loans or equity injection in firms. In summary fiscal statements, these are typically recorded as the net acquisition of financial assets, which is below the line of the overall fiscal balance.

Contingent liabilities Obligations that are not explicitly recorded on government balance sheets and that arise only in the event of a particular discrete situation, such as a crisis.

a Apple Map Requests during COVID-19 by Income Grouping. Note: AE = Advanced Economies; EME = Emerging Market Economies; LIC = Low-income Countries following the World Bank income group classification. b Hotel Bookings during COVID-19 by Income Group. Note: AE = Advanced Economies; EME = Emerging Market Economies; LIC = Low-income Countries following the World Bank income group classification. Source: STR Hotel Data and author calculations. c Flights during COVID-19 by Income Group. Note: AE = Advanced Economies; EME = Emerging Market Economies; LIC = Low-income Countries following the World Bank income group classification. Source: FlightRadar24 and author calculations. d Nitrogen Dioxide emissions during COVID-19 by Income Group. Note: AE = Advanced Economies; EM = Emerging Market Economies; LIC = Low-income Countries following the World Bank income group classification. Source: Sentinel-5P (European Commission/ESA/Copernicus) and the Air Quality Open Data Platform of the World Air Quality Index

Impulse Responses on Sovereign Bond Spreads to Fiscal Announcement Shocks, AE vs DEV. Note: estimation of Eq. 5 over a time horizon of k = 12 weeks. Light and dark shaded areas denote confidence bands at the 68 and 90 percent levels. t = 1 is the first week of the fiscal announcement shock. Solid black lines denote the response to the fiscal announcement shock, dark grey area denotes 90 percent confidence bands while light grey area denotes 68 percent confidence bands, based on standard errors clustered at country level

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Jalles, J.T., Battersby, B. & Lee, R. Effectiveness of Fiscal Announcements: Early Evidence from COVID-19. Open Econ Rev 35, 623–658 (2024). https://doi.org/10.1007/s11079-023-09735-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-023-09735-4