Abstract

This paper examines financial spillovers between the four largest equity markets (by market capitalization) in the GCC region using a VAR-GARCH (1,1) framework that sheds light on interdependence as well as the effects of the 2014 oil crisis. Since the UAE is a federation including two stock exchanges (Abu Dhabi and Dubai), it is possible to test whether being part of a federal union matters more than market size in terms of financial integration. Our results suggest that the latter is more important, since we could not find evidence of stronger linkages between the Abu Dhabi and Dubai markets compared to those between other markets in the region. By contrast, there are significant spillover effects, both in the mean and in the volatility, from the largest market of Saudi Arabia to Qatar and the two markets in the UAE, which confirms that market capitalization is a more important determinant of financial integration than belonging to a federal union. Further, spillovers from the larger markets have become stronger as a result of the 2014 oil crisis. Finally, there is also evidence of spillovers from the smaller to the larger markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent decades the October 1987 stock market crash in the US, the 1992 European Exchange Rate mechanism (ERM) crisis, the 1997 East Asia crisis and the 2008 global financial crisis have generated renewed interest among academics, policy makers and practitioners in understanding the transmission of shocks across financial markets, both developed and emerging. Following the seminal paper by King and Wadhwani (1990), one strand of the literature has used conditional correlation analysis to test for shifts in the linkages between financial markets during crisis periods; those are defined as contagion, whilst the term interdependence is normally used to refer to linkages that do not change over time. However, the validity of such tests is affected by key features of the data generating process such as heteroscedasticity and endogeneity, and also by the existence of common factors (King et al. 1994; Forbes and Rigobon 2002; Corsetti et al. 2005; Caporale et al. 2005). Dungey et al. (2002, 2003) adopted a different approach and estimated dynamic latent factor models to test for contagion in bond and stock markets during crisis episodes. Bekaert et al. (2005) used an alternative factor model that allows for time-varying integration with global markets, and identified contagion as “excess correlation” , that is, cross-country correlations between the model residuals during crisis periods.

Several episodes of turbulence in developed financial markets in the first decade of this century are the motivation for recent studies analysing spillover effects from those markets to the emerging ones; in particular, Beirne et al. (2013) test for changes in the transmission mechanism (contagion) during turbulent periods in mature markets, and provide evidence of shifts in the volatility spillovers from mature to emerging markets at such times; further, they find that the conditional variance increases in most emerging markets during these episodes, but there is only limited evidence of shifts in the conditional correlations between mature and emerging markets.

This paper focuses on the linkages between the four largest stock markets in the Gulf Cooperation Council (GCC) region, namely Abu Dhabi, Dubai, Saudi Arabia and Qatar. Specifically, it estimates a VAR-GARCH (1,1) model allowing for spillovers in both the first and the second moments (i.e. mean and variance) at the daily frequency. The adopted framework is suitable to test for both interdependence (the existence of spillover effects) and contagion (shifts in the corresponding parameters as a result of a crisis, in this case the 2014 oil crisis) between all four stock markets. Unlike the present one, most previous studies had only considered unidirectional spillovers from the larger (Saudi Arabia) to the smaller stock markets in the region (Suliman 2011), overlooking the possibility of spillovers in the opposite direction. Two notable exceptions are Khalifa et al. (2014) and Al-Maadid et al. (2018). The former, using a Multi-Chain Markov Switching (MCMS) model, examine volatility transmission between six GCC stock markets and three global markets (S&P 500 index, Oil-WTI prices and MSCI- world); the latter investigate the effects of the recent political tension in the Arabian peninsula on the linkages between the stock markets of the leading GCC countries.

Average annual GDP per capita ($69,166) in the GCC region is substantially higher than the world average ($16,961) as reported by the World Bank (2017). Its members have benefited from being oil and gas producers, although they have still been affected by the worldwide slowdown caused by the 2007-08 global financial crisis. Market capitalisation in 2017 was USD451bn in Saudi Arabia, USD132bn in Abu Dhabi, USD130bn in Qatar, USD104bn in Dubai, USD90bn in Kuwait (and slightly lower in Bahrain and Oman). The GCC has recently launched a series of common economic projects to promote integration.

It is noteworthy that Dubai and Abu Dhabi are both part of the United Arab Emirates (UAE). This is therefore a rather unique case of a country, namely the UAE, including more than one stock exchange, the only well-known precedent being that of the regional US exchanges in the 1960s. Given the limited size of the UEA, the existence of more than a single stock exchange is likely to affect the liquidity and trading volumes of those markets; the presence of separate regulatory authorities (the Securities and Commodities Authority for Abu Dhabi and the Financial Services Authority for Dubai) is another important factor to take into account. The two markets have in fact pursued different strategies, with Abu Dhabi focusing on internal growth and Dubai aiming to mirror developments in the main international financial markets. The possibly negative consequences of market fragmentation in the UAE and the potentially beneficial network effects of consolidation have been recently debated. Differences in their governance and business models, as well as the possibility of hierarchies resulting from consolidation, are the main arguments that have been used against a merger (for further details, see Paltrinieri2015).

The current set-up offers an interesting opportunity to test whether the “large country effect” or being part of a federal state is a more important factor for financial integration, in this case whether or not the linkages between the stock markets of Abu Dhabi and Dubai, that belong to the same country, are stronger than those with the largest markets in the region, namely Qatar, and Saudi Arabia; our modelling approach is particularly suitable for addressing such issues.

The layout of the paper is as follows. Section 2 outlines the econometric modelling approach. Section 3 describes the data and presents the empirical findings. Section 4 summarises the main findings and offers some concluding remarks.

2 The Model

We represent the first and second moments of the GCC stock market returns using a VAR-GARCH(1,1) process. In its most general specification the model takes the following form:

where \(\mathbf {x}_{t}=\left (SaudiArabia_{t},Dubai_{t},Qatar_{t},Abu-Dhabi_{t}\right ) \) and xt− 1 is the corresponding vector of lagged variables. The residual vector \(\mathbf {u}_{t}=\left (u_{1,t},u_{2,t},u_{3,t},u_{4,t}\right ) \) is four-variate and normally distributed \(\mathbf {u}_{t}\mid I_{t-1}\sim (\mathbf {0},H_{t})\), its conditional variance covariance matrix being given by:

The parameter vector of the mean return (1) includes the constant \(\mathbf {\alpha }=\left (\alpha _{1},\alpha _{2},\alpha _{3},\alpha _{4}\right ) \), and \(\mathbf {\beta }=\left (\beta _{11},\beta _{12},\beta _{13},\beta _{14}\mid \beta _{21},\beta _{22},\beta _{23},\beta _{24}\mid \beta _{31},\beta _{32},\beta _{33},\right .\)\(\left .\beta _{34}\mid \beta _{41},\beta _{42},\beta _{43},\beta _{44}\right ) ,\) the autoregressive term, which measures the cross country linkages between stock market returns. Furthermore, we control for global market and oil shocks using the VIX (as a proxy for global uncertainty) and the change in crude oil prices respectively. The parameter matrices for the variance (2) are C (which is restricted to be upper triangular), and A and G. Therefore, the second moment takes the following form:Footnote 1

where

Equation 3 models the dynamic process of Ht as a linear function of its own past values Ht− 1 and the past values of the squared innovations \(\left (u_{1,t-1}^{2},u_{2,t-1}^{2},u_{3,t-1}^{2},u_{4,t-1}^{2}\right ) \). The parameters of Eq. 3 are given by C, which is restricted to be upper triangular, and the two matrices A and G. The BEKK representation guarantees by construction that the covariance matrix in the system is positive definite. In order to account for the possible effects of the recent oil price downturn, we also include a dummy variable (denoted by *) with a switch on 14 November 2014 (which is the day prices started to fall dramatically). Given a sample of T observations, a vector of unknown parameters 𝜃 and a 4 × 1 vector of variables xt, the conditional density function for model (1) is:

The log-likelihood function is:

where 𝜃 is the vector of unknown parameters. The standard errors are calculated using the quasi-maximum likelihood method of Bollerslev and Wooldridge (1992), which is robust to the distribution of the underlying residuals.

3 Empirical Analysis

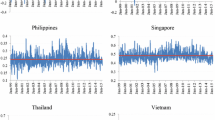

We use daily data (from Bloomberg) on the stock market indexes for the largest GCC markets (by market capitalization) namely Abu Dhabi, Dubai, Qatar and Saudi Arabia; the sample period goes from 01/9/2010 to 30/4/2017, for a total of 1640 observations; daily returns are defined as the logarithmic differences of the four stock market indices which are shown in Fig. 1. The data for the Brent crude oil prices and VIX are also collected from Bloomberg.

In order to test the adequacy of the estimated models, Ljung - Box portmanteau tests were performed on the standardized and squared standardized residuals. Overall, the results indicate that the VAR-GARCH(1,1) specification is data congruent and captures satisfactorily the persistence of stock returns and of their volatility. The estimated parameters of the VAR-GARCH(1,1) model with the associated robust p-values and likelihood function values are presented in Table 1. We select the optimal lag length of the mean equation using the Schwarz information criterion. The estimated mean of daily returns is positive for all four stock markets, the highest mean return being 0.103 in the case of Dubai.

The results suggest that there are significant dynamic linkages in both the first and the second moments. In particular, we find positive and significant (bi-directional) mean spillovers at the standard 5% significance level in most cases, Abu Dhabi being the only market that does not affect the others. The largest spillovers appear to run from the Saudi to the Dubai market \(\left (\beta _{21}=0.157\right )\) and from the Qatari to the Dubai one \(\left (\beta _{23}=0.105\right )\). The VIX index, which controls for global financial uncertainty, does not affect the four indices, whilst the change in crude oil prices has a significant impact, especially in the cases of Qatar and Dubai, with the spillovers becoming stronger after the beginning of the oil crisis in November 2014.

Causality effectsFootnote 2 in the conditional variance vary in magnitude across countries (note that the signs on cross-market volatilities cannot be determined). It appears that Qatar and Saudi Arabia share bidirectional spillover effects \(\left (a_{13}=0.087 \text { and }a_{31}=0.171\right )\). The Abu Dhabi stock market has an impact on those of Saudi Arabia \(\left (a_{14}=0.144\right ) \), Qatar \(\left (a_{34}=0.257\right ) \) and Dubai \(\left (a_{24}=0.063\right ) \) whereas there is evidence of volatility spillovers running from the market in Dubai to those of Saudi Arabia \(\left (a_{12}=0.165\right ) \) and Qatar \(\left (a_{32}=0.197\right ) \) for the whole sample. Furthermore, the 2014 oil crisis appears to have affected the causality-in-variance dynamics. In particular, in the period following the crisis volatility in the Abu Dhabi market started being effected quite severely by that in the markets of Saudi Arabia \(\left (a_{41}^{\ast }=-0.392\right ) ,\) Dubai \(\left (a_{42}^{\ast }=0.427\right ) \) and Qatar \(\left (a_{43}^{\ast }=-0.256\right ) \). The strongest post-2014 volatility effects are found to be running from the Saudi market to the Dubai market \(\left (a_{21}^{\ast }=0.517\right ) \). Finally, the Saudi Arabia was affected by those of Dubai \(\left (a_{12}^{\ast }=-0.370\right ) ,\) and Abu Dhabi \(\left (a_{13}^{\ast }=-0.207\right ) \).

4 Conclusions

This paper has examined financial spillovers between the four largest equity markets (by market capitalization) in the GCC region using a VAR-GARCH (1,1) framework that sheds light on interdependence as well as the effects of the 2014 oil crisis. The GCC countries are a particularly interesting case because one of them, namely the UAE, is a federation including two stock exchanges (Abu Dhabi and Dubai); therefore it is possible to test whether being part of a federal union matters more than market size in terms of financial integration.

Our results suggest that the latter is more important, since we could not find evidence of stronger linkages between the Abu Dhabi and Dubai markets compared to those between other markets in the region, even though both of them have only UAE companies listed. By contrast, there are significant spillover effects, both in the mean and the volatility, from the largest market of Saudi Arabia to Qatar and the two markets in the UAE, which confirms that market capitalization is a more important determinant of financial integration than belonging to a federal union. Further, spillovers from the larger markets have become stronger as a result of the 2014 oil crisis. Finally, there is also evidence of spillovers from the smaller to the larger markets, which indicates that other economic factors and financial market characteristics also affect the financial transmission mechanisms; future work will investigate more thoroughly such issues as well as considering all GCC countries.

Our findings have some important policy implications. In particular, they raise the issue of consolidation for relatively small markets in terms of market capitalization and trading value such as those in the UAE. Mergers have already occurred in the case of other emerging markets such as Singapore where the benefits from economies of scale have been apparent. Creating a single UAE stock market could also strengthen it as an international finance hub as well as improve its corporate governance and should be given serious consideration by the UAE authorities.

Notes

The parameters \(\left (a_{21}\right ) \) and \(\left (a_{31}\right )\) in Eq. 3 measure the volatility spillovers running from Saudi Arabia to Dubai and Qatar respectively. The possible effect of the downturn trend in oil prices on those linkages is captured by \(\left (a_{21}+a_{21}^{\ast }\right ) \) and \(\left (a_{31}+a_{31}^{\ast }\right ) \).

Please note that the term causality refers to Granger causality and therefore a structural interpretation is not appropriate.

References

Al-Maadid A, Caporale GM, Spagnolo F, Spagnolo N (2018) Political tension and stock markets in the arabian peninsula, CESifo Working Paper 7341

Beirne J, Caporale GM, Schulze-Ghattas M, Spagnolo N (2013) Volatility spillovers and contagion from mature to emerging stock markets. Rev Int Econ 2:1060–1075

Bekaert G, Campbell RH, Lundbladd C (2005) Does financial liberalization spur growth?. Journal of Financial Economics 77:3–55

Bollerslev TP, Wooldridge JM (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econ Rev 11:143–172

Caporale GM, Cipollini A, Spagnolo N (2005) Testing for contagion: a conditional correlation analysis. J Empir Financ 12:476–89

Corsetti G, Pericoli M, Sbracia M (2005) Some contagion, some interdependence: more pitfalls in tests of financial contagion. J Int Money Financ 24:1177–99

Dungey M, Fry R, González-Hermosillo B, Vance M (2002) International contagion from the russian crisis and the LTCM collapse, IMF working paper 02/74

Dungey M, Fry RA, Martin VL (2003) Equity transmission mechanisms from Asia to Australia: interdependence or contagion?. Aust J Manage 28(2):157–182

Forbes KJ, Rigobon R (2002) No contagion, only interdependence: measuring stock market co-movements. J Financ 57:2223–61

Khalifa A, Hammoudeh S, Otranto E (2014) Patterns of volatility transmissions within regime switching across GCC and Global markets. Int Rev Econ Financ 29:512–524

King M, Wadhwani S (1990) Transmission of volatility between stock markets. Re-view of Financial Studies 3:5–33

King M, Sentana E, Wadhwani S (1994) Volatility and links between national stock markets. Econometrica 62:901–33

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

Paltrinieri A (2015) Stock exchange industry in UAE: an assessment of potential merger between Dubai financial market and Abu Dhabi securities exchange. Int J Emerg Mark 10(3):362–382

Suliman O (2011) The large country effect, contagion and spillover effects in the GCC. Appl Econ Lett 18:285–29

The World Bank, Annual Report (2017). https://www.worldbank.org/en/about/annual-report

Acknowledgments

We would like to thank the Editor and two anonimous referees for very helpful comments and suggestions, and also Zayed University for financial support, RIF grant R16045.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Arin, K.P., Caporale, G.M., Kyriacou, K. et al. Financial Integration in the GCC Region: Market Size Versus National Effects. Open Econ Rev 31, 309–316 (2020). https://doi.org/10.1007/s11079-019-09554-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-019-09554-6