Abstract

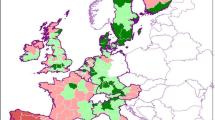

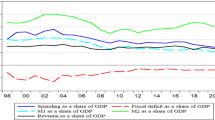

The European Monetary Union (EMU) is the only Union that allows its members to conduct their own fiscal policy, which has to be consistent with the Maastricht treaty. This paper attempts to shed light on business cycles determinants focusing on fiscal variables in EU economies, in the time period 1996–2013, using quarterly data fully capturing the on-going recession. In this context, it also acknowledges the significant role of the Quality of Institutions and of the Elections in a Political Business cycles framework. Additionally, based on the business cycles characteristics of the EU economies it explores the potential formation of clusters in the EU economy. To this end, a number of relevant econometric techniques are employed such as: HP filtering, LLC tests; Ljung-Box tests; Fourier analysis; Rolling windows; Dynamic Panel Data analysis; Toda-Yamamoto causality test, Panel Seemingly Unrelated Regressions (SUR) and k-means clustering. Our findings suggest that Social Benefits, Social Transfers and Gross Debt are the most significant policy variables with a counter-cyclical character, while taxation was found to have a destabilizing effect. In addition, Elections and the Quality of Institutions were found to significantly affect the key fiscal variables examined. Meanwhile, most peripheral countries lie in one cluster suggesting that the recent crisis has led a number of small(-er) peripheral economies to cluster together.

Similar content being viewed by others

Notes

Other relevant approaches for assessing the role of fiscal policy on business cycle stabilization would be to estimate the response of fiscal variables to the cycle or to assess the impact of fiscal policy on output volatility. We would like to thank an anonymous referee for pointing this out.

Alternatively, IV or biased correct LSVD estimators have been used but the results did not change significantly.

Also, several other important factors, such as Private Investment, Corruption, Openness, Political orientation of the Government, Trade relations and Labour forms, have been considered as determinants of the key fiscal variables. Nevertheless, none of them had statistically significant effects and were, thus, dropped from all three equations.

In addition we use OECD quarterly data regarding the GDP of the UK, Sweden and Denmark, in 2005 prices in billions of dollars.

Given that some of the data were not available, following Pesaran et al. (2004), we intra-polated the missing observations.

References

Abbott A, Jones P (2013) Procyclical government spending: a public choice analysis. Public Choice 154:243–258

Acemoglu D, Robinson J, Thaicharoen Y (2003) Institutional causes, macroeconomic symptoms: volatility, crises and growth. J Monet Econ 50(1):49–123

Aidt TS, Veiga FS (2011) Election results and oppotunistic policices: a new test of the rational political business cycles model. Public Choice 148:21–44

Aizenman J, Jinjarak Y, Park D (2013) Capital flows and economic growth in the Era of financial integration and crisis 1990–2010. Open Econ Rev 24:371–396

Alegre GJ (2012) An evaluation of EU regional policy. Do structural actions crowd out public spending? Public Choice 151:1–21

Ales L, Maziero P, Yared P (2014) A theory of political and economic cycles. J Econ Theory 153(C):224–251

Alesina A, Campante F, Tabellini G (2008) Why is fiscal policy often procyclical? J Eur Econ Assoc 6(5):1006–1036

Aloui R (2013) Deep habbits and the macoreconomic effects of government debt. J Macroecon Dynam 17:1659–1686

Amemiya, T (1985) Advanced econometrics. Harvard University Press

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297, Wiley Blackwell

Artis M, Zhang W (1997) International business cycle and the ERM: is there a European business cycle? Int J Finance Econ 2:1–16

Artis M, Zhang W (1998) Core and periphery in EMU: a cluster analysis. EUI Working Paper RSC No. 98/37

Artis M, Zhang W (1998) Membership of EMU: A fuzzy clustering analysis of alternative criteria. EUI Working Paper RSC No. 98/52

Barlevy G (2004) The costs of business cycles under endogenous growth. Am Econ Rev 94(4):964–990

Battaglini M, Coate S (2008) A dynamic theory of public spending, taxation, and debt. Am Econ Rev 98(1):201–236

Bayoumi T, Eichengreen B (1993) Shocking aspects of European monetary integration. In: Torres F, Giavazzi F (eds) Adjustment and growth in the European monetary union. Cambridge University Press, Cambridge

Bayoumi T, Eichengreen B (1997a) Ever closer to heaven? An optimum-currency-area index for European countries. Eur Econ Rev 41:761–770

Bayoumi T, Eichengreen B (1997b) Optimum currency areas and exchange rate volatility; theory and evidence compared. In international trade and finance: New frontiers for research. In: Cohen B (ed) Essays in Honour of Peter Kenen. Cambridge University Press, Cambridge

Bergman MU (2004) How similar are the European business cycles? Economic Policy Research Unit Working Paper series, 2004–13

Bozdogan H (1993) Choosing the number of component clusters in the mixture model using a new informational complexity criterion of the inverse Fisher information matrix. In: Opitz O, Lausen B, Klar R (eds) Information and classification. Springer, Berlin, pp 40–54

Calinski T, Harabasz J (1974) A dendrite method for cluster analysis. Commun Stat 3(1):1–27

Camacho M, Perez-Quiros G, Saiz L (2006) Are European business cycle close enough to be just one? CEPR Discussion Papers No. 4824

Canova F, Pappa E (2011) Fiscal policy, pricing frictions and monetary accommodation. Econ Policy 26(68):555–598

Canzoneri M, Valles J, Vinals J (1996) Do exchange rates move to address international macroeconomic imbalances?”, CERP Discussion Papers, No.1948

Castro V (2011) The impact of the European union fiscal rules on economic growth. J Macroecon 33(2):313–326

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887

Concaria LA, Soares MJ (2009) Business cycle synchronization across the Euro area: a wavelet analysis. NIPE Working Papers

Crowley P, Christi C (2003) European Union Studies Association (EUSA), Biennial Conference, (8th), March 27–29

Crowley P, Lee J (2005) Decomposing the co-movement of the business cycle: a time-frequency analysis of growth cycles in the euro area. Bank of Finland Discussion Papers 12/2005

De Haan J, Jong-A-Pin R, Mierau JO (2013) Do budgetary institutions mitigate the common pool problem? New Empirical Evidence for the EU. Public Choice 156:423–441

Dees S, Zorell N (2012) Business cycles synchronization: disentangling trade and financial linkages. Open Econ Rev 23:623–643

Dickerson A, Gibson H, Tsakalotos E (1998) Business cycle correspondence in the European Union. Economica 25:51–77

Easterly W, Islam R, Stiglitz J (2001) Shaken and stirred: explaining growth volatility. In: Pleskovic B, Stern N (eds) Annual world bank conference on development economics

Efthyvoulou G (2011) Political cycles under external economic constraints: evidence from Cyprus. J Econ Bus 63(6):638–662

Efthyvoulou G (2012) Political budget cycles in the European Union and impact of political pressures. Public Choice 153:295–327

European Central Bank (2012) Competitiveness and external imbalances in the Euro area. ECB Occasional Paper No. 139

Fatás A, Mihov I (2003) The case for restricting fiscal policy discretion. Q J Econ 118(4):1419–1447

Frankel J, Rose A (1998) The endogeneity of the optimum currency area criteria. Econ J 108:1009–1025

Furceri D, Karras G (2007) Country size and business cycle volatility: scale really matters. J Jpn Int Econ 21(4):424–434

Furceri D, Zdzienicka A (2011) Financial integration and fiscal policy. Open Econ Rev 23:805–822

Galli J, Perotti R (2003) Fiscal policy and monetary integration in Europe. Econ Policy 18(37):533–572

Gavin M, Hausmann R (1998) Growth with equity: the volatility connection. In: Birdsall N, Graham C, Sabot RH (eds) Beyond tradeoffs: market reforms and equitable growth in Latin America. Inter-American Development Bank and the Brookings Institution, Washington, DC, pp 91–109

Giannone D, Michele L, Reichlin L (2009) Business cycles in the Euro area. CEPR Discussion Papers 7124, C.E.P.R. Discussion Papers

Giovanni J, Levchenko A (2008) Putting the parts together: trade, vertical linkages, and business cycle comovement. Working Papers 580, Research Seminar in International Economics, University of Michigan

Gouveia S, Correia L (2008) Business cycle synchronization in the Euro area: the case of small countries. IEEP 5(1):103–121

Hakura D (2009) Output volatility in emerging market and developing countries: what explains the “great moderation” of 1970-2003? Czech J Econ Financ 59(3):229–254

Hartigan JA, Wong MA (1978) Algorithm AS 136: a K-means clustering algorithm. Appl Stat 28:100–108

Hausman J, McFadden D (1984) Specication tests for the multinomial logit model. Econometrica 52(5):1219–1240

Kalemli-Ozcan S, Sorensen B, Yosha O (2001) Regional integration, industrial specialization and the asymmetry of shocks across regions. J Int Econ 55:107–137

Katsimi M, Sarantides V (2011) Do elections affect the composition of fiscal policy in developed, established democracies. Public Choice 151(1):325–362

Kenen PB (1969) The theory of optimum currency areas: an eclectic view. In: Mundell RA, Swoboda AK (eds) Monetary problems of the international economy. University of Chicago Press, Chicago, pp 41–60

Kishor KN (2012) A note on time variation in a forward looking monetary policy rule: evidence from European countries. J Macroecon Dynam 16:422–437

Kose A, Prasad E, Terrones M (2003) Financial integration and macroeconomic volatility. IMF Staff Pap 50(Special Issue):119–141

Kose MA, Otrok C, Prasad ES (2012) Global business cycles: convergence or decoupling. Int Econ Rev 53:511–538

Krugman P (1991) Geography and trade. MIT Press, Cambridge

Kydland FE, Prescott EC (1990) Business cycles: real facts and a monetary myth. Fed Reserve Bank Minneap Q Rev 14:3–18

Lane P (2003) The cyclicality of fiscal policy: evidence from the OECD. J Public Econ 87(12):2661–2675

Laursen T, Mahajan S (2005) Volatility, income distribution, and poverty. In: Aizenman J, Pinto B (eds) Managing economic volatility and crises: a practitioner’s guide. Cambridge University Press, New York, pp 101–136

Levin A, Lin CF, Chu C-SJ (2002) Unit root tests in panel data: asymptotic and finite sample properties. J Econ 108:1–22

Ljung G, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

Lucas RE, Jr (1977) Understanding business cycles. In: Karl Brunner K, Meltzer A (eds.), Stabilization of the domestic and international economy. Amsterdam: North Holland.

Magud NE (2008) On asymmetric business cycles and the effectiveness of counter-cyclical fiscal policies. J Macroecon 30(3):885–905

Malik A, Temple J (2006) The geography of output volatility. CEPR Discussion Paper 5516

Massmann M, Mitchell J (2004) Reconsidering the evidence: are Eurozone business cycles converging? J Bus Cycle Meas Anal 1:275–307

McKinnon R (1963) Optimum currency areas. Am Econ Rev 53(4):717–725

Mechtel M, Potrafke N (2013) Electoral cycles in active labour market policies. Public Choice 156:181–194

Montoya LA, De Haan J (2008) Regional business cycle synchronization in Europe? IEEP 5(1):123–137

Mundell RA (1961) A theory of optimum currency areas. Am Econ Rev 51(4):657–665

Nordhaus W (1975) The political business cycle. Rev Econ Stud 42:169–190

Pallage S, Robe M (2003) On the welfare cost of economic fluctuations in developing countries. Int Econ Rev 44(2):677–698

Persson T, Tabellini G (1990) Macroeconomic policy, credibility and politics. Harwood Academic Publishers, Chur

Pesaran MH, Schuermann T, Weiner SM (2004) Modeling regional interdependencies using a global error-correcting macro-econometric model. J Bus Econ Stat 22(2):129–162

Potrafke N (2012) Political cycles and economic performance in OECD countries: empirical evidence 1951–2006. Public Choice 150:155–179

Ramey G, Ramey V (1995) Cross-country evidence on the link between volatility and growth. Am Econ Rev 85(5):1138–1151

Ravn M, Uhlig H (2001) On adjusting the HP-filter for the frequency of observations. CESifo Working Paper Series 479, CESifo Group Munich

Razin A, Rose A (1994) Capital mobility: the impact on consumption, investment, and growth. In: Leiderman L, Razin A (eds) Capital mobility: the impact on consumption, investment, and growth. Cambridge University Press, Cambridge, pp 48–76

Rogoff K (1990) Equilibrium political budget cycles. Am Econ Rev 80:21–36

Rogoff K, Sibert A (1988) Elections and macroeconomic policy cycles. Rev Econ Stud 55:1–16

Tavlas GS (1993) The ‘New’ theory of optimum currency areas. World Econ 16:663–686

Taylor C (1995) EMU 2000? Prospects for European Monetary Union. Chatham House Papers. The Royal Institute of International Affairs

Timm N (2002) Applied multivariate analysis. Springer texts in statistics

Toda HY, Phillips PC (1993) Vector autoregressions and causality. Econometrica 61(6):1367–1393

Toda HY, Yamamoto (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66:225–250

Trichet J (2001) The euro after two years. J Common Mark Stud 39:1–13

West Κ (1987) A specification test for speculative bubbles. Q J Econ 102:553–580

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT Press, London

Zivot E, Wang J (2006) Modeling financial time series with s-plus. Springer, NY

Acknowledgments

The second (T.P.) and third (P.G.M.) authors would like to thank Margarita Katsimi, Athens University of Economics and Business, for helpful comments on other versions of this manuscript. Finally, the second author (T.P.) kindly acknowledges the financial support provided by the IKY Postdoctoral Scholarship (Siemens programme).

Author information

Authors and Affiliations

Corresponding author

Additional information

We are indebted to the Editor, George Tavlas, and the anonymous Referees of this Journal for their constructive comments that have helped to us improve the quality of the paper significantly.

Rights and permissions

About this article

Cite this article

Konstantakis, K.N., Papageorgiou, T., Michaelides, P.G. et al. Economic Fluctuations and Fiscal Policy in Europe: A Political Business Cycles Approach Using Panel Data and Clustering (1996–2013). Open Econ Rev 26, 971–998 (2015). https://doi.org/10.1007/s11079-015-9345-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-015-9345-0