Abstract

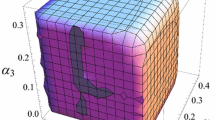

In this paper, we study the pricing decisions stability when a retailer adopts bundling strategy for complementary products. We firstly explore whether or not the decision maker will adopt bundling strategy, finding that bundling strategy benefits retailer’s profit by improving sales of both products. Considering demand uncertainty, we focus on a bounded rational decision maker adjusting decisions in each period, build a dynamic pricing system and study its stability based on chaos theory. According to different pricing strategies for the bundling products, we propose two game models, i.e., simultaneous and sequential game, and compare the performance on the bundling strategy and system stability. The results show that both game models can reach the same optimal decisions, but sequential game has a better performance in keeping system stable. We also show the joint influence of parameters on the system stability and find that the retailer can control a chaos system caused by uncertain demand by slowing down the speed of decision adjustment. This paper’s theoretic contribution is to compare the performance of two or more systems’ stabilities based on Jury criteria.

Similar content being viewed by others

References

Nambisan, S.: Complementary product integration by high-technology new ventures: the role of initial technology strategy. Manag. Sci. 48(3), 382–398 (2002)

Elrod, T., Russell, G.J., Shocker, A.D., Andrews, R.L., Bacon, L., Bayus, B.L., Carroll, J.D., Johnson, R.M., Kamakura, W.A., Lenk, P.: Inferring market structure from customer response to competing and complementary products. Mark. Lett. 13(3), 221–232 (2002)

Bhaskaran, S.R., Gilbert, S.M.: Selling and leasing strategies for durable goods with complementary products. Manag. Sci. 51(8), 1278–1290 (2005)

Wei, J., Zhao, J., Li, Y.: Pricing decisions for complementary products with firms’ different market powers. Eur. J. Oper. Res. 224(3), 507–519 (2013)

Xia, Y., Xiao, T., Zhang, G.P.: Distribution channel strategies for a manufacturer with complementary products. Decis. Sci. 44(1), 39–56 (2013)

He, Y., Yin, S.: Joint selling of complementary components under brand and retail competition. Manuf. Serv. Oper. Manag. 17(4), 470–479 (2015)

Taleizadeh, A.A., Charmchi, M.: Optimal advertising and pricing decisions for complementary products. J. Ind. Eng. Int. 11(1), 111–117 (2015)

Wang, L., Song, H., Wang, Y.: Pricing and service decisions of complementary products in a dual-channel supply chain. Comput. Ind. Eng. 107, 223–233 (2017)

Venkatesh, R., Kamakura, W.: Optimal bundling and pricing under a monopoly: contrasting complements and substitutes from independently valued products. J. Bus. 76(2), 211–231 (2003)

Bhargava, H.K.: Mixed bundling of two independently valued goods. Manag. Sci. 59(9), 2170–2185 (2013)

Estelami, H.: Consumer savings in complementary product bundles. J. Mark. Theory Pract. 7(3), 107–114 (1999)

Yue, X., Mukhopadhyay, S.K., Zhu, X.: A Bertrand model of pricing of complementary goods under information asymmetry. J. Bus. Res. 59(10), 1182–1192 (2006)

McCardle, K.F., Rajaram, K., Tang, C.S.: Bundling retail products: models and analysis. Eur. J. Oper. Res. 177(2), 1197–1217 (2007)

Yang, B., Ng, C.T.: Pricing problem in wireless telecommunication product and service bundling. Eur. J. Oper. Res. 207(1), 473–480 (2010)

Ferrer, J., Mora, H., Olivares, F.: On pricing of multiple bundles of products and services. Eur. J. Oper. Res. 206(1), 197–208 (2010)

Yan, R., Bandyopadhyay, S.: The profit benefits of bundle pricing of complementary products. J. Retail. Consum. Serv. 18(4), 355–361 (2011)

Yan, R., Myers, C., Wang, J., Ghose, S.: Bundling products to success: the influence of complementarity and advertising. J. Retail. Consum. Serv. 21(1), 48–53 (2014)

Danaher, B., Huang, Y., Smith, M.D., et al.: An empirical analysis of digital music bundling strategies. Manag. Sci. 60(6), 1413–1433 (2014)

Honhon, D., Pan, X.A.: Improving profit by bundling vertically differentiated products. Prod. Oper. Manag. 26, 1481–1497 (2017)

Kyrtsou, C., Labys, W.C.: Evidence for chaotic dependence between US inflation and commodity prices. J. Macroecon. 28(1), 256–266 (2006)

Wilding, R.D.: Chaos theory: implications for supply chain management. Int. J. Logist. Manag. 9(1), 43–56 (1998)

Hwarng, H.B., Xie, N.: Understanding supply chain dynamics: a chaos perspective. Eur. J. Oper. Res. 184(3), 1163–1178 (2008)

Chaudhry, M.I., Miranda, M.J.: Complex price dynamics in vertically linked cobweb markets. Econ. Model. 72, 363–378 (2018)

Jiang, Y., Liu, Y., Shang, J., et al.: Optimizing online recurring promotions for dual-channel retailers: segmented markets with multiple objectives. Eur. J. Oper. Res. 267(2), 612–627 (2018)

Zhang, F., Wang, C.: Dynamic pricing strategy and coordination in a dual-channel supply chain considering service value. Appl. Math. Model. 54, 722–742 (2017)

Guo, Y., Ma, J.: Research on game model and complexity of retailer collecting and selling in closed-loop supply chain. Appl. Math. Model. 37(7), 5047–5058 (2013)

Ma, J., Wang, H.: Complexity analysis of dynamic noncooperative game models for closed-loop supply chain with product recovery. Appl. Math. Model. 38(23), 5562–5572 (2014)

Gupta, S., Loulou, R.: Process innovation, product differentiation, and channel structure: strategic incentives in a duopoly. Mark. Sci. 17(4), 301–316 (1998)

Hu, X., Su, P.: The newsvendor’s joint procurement and pricing problem under price-sensitive stochastic demand and purchase price uncertainty. Omega 79, 81–90 (2017). https://doi.org/10.1016/j.omega.2017.08.002

Bischi, G.I., Naimzada, A.: Global Analysis of a Dynamic Duopoly Game with Bounded Rationality. Advances in Dynamic Games and Applications, pp. 361–385. Birkhäuser, Boston (2000)

Puu, T., Panchuk, A.: Oligopoly and stability. Chaos Solitons Fractals 41(5), 2505–2516 (2009)

Li, T., Ma, J.: Complexity analysis of dual-channel game model with different managers’ business objectives. Commun. Nonlinear Sci. Numer. Simul. 20(1), 199–208 (2015)

Acknowledgements

The research was supported by China Scholarship Council (CSC) and the National Natural Science Foundation of China (Grant No. 71571131), Doctoral Fund of Ministry of Education of China (Grant No. 20130032110073).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ma, J., Xie, L. The stability analysis of the dynamic pricing strategy for bundling goods: a comparison between simultaneous and sequential pricing mechanism. Nonlinear Dyn 95, 1147–1164 (2019). https://doi.org/10.1007/s11071-018-4621-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-018-4621-3