Abstract

China is preparing to develop and implement an emissions trading system in its 13th five-year plan. Allowance allocation is one of the key issues to settle during the establishment of this system. This study applies the China Energy and Environmental Policy Analysis model to assess how the allowances should be allocated. Simulation results show that, while impacts on China’s economic development vary according to how allowances are allocated, the negative impacts cannot be mitigated completely, which are between −0.5 and −0.1 % when 5 % of carbon emissions are reduced. In terms of the impacts on the macroeconomy, sectoral output, and capital revenue, results suggest that auctioning the allowances and recycling the revenue to reduce the indirect tax will perform best in alleviating the negative impacts. Meanwhile, impacts of carbon mitigation on international competitiveness can be reduced most in the approach where only key energy- and trade-intensive sectors are able to receive free allowances. However, if citizens’ welfare and quality of life is prioritized, auctioning the allowance and transferring the revenue to households in proportion to their occupation will be the most effective approach; in this case, the negative impacts on rural households’ disposable incomes and welfare will be reduced, and the income gap between rural and urban households will be narrowed.

Similar content being viewed by others

References

Chinese Monetary Society (2008) Chinese monetary yearbook (2008). Chinese Monetary Society Editorial Office, Beijing

Cho GL, Kim HS, Kim YD (2010) Allocation and banking in Korean permits trading. Resour Policy 35:36–46

Cong RG, Wei YM (2010) Potential impact of carbon emissions trading (CET) on China’s power sector: a perspective from different allowance allocation options. Energy 35:3921–3931

Cramton P, Kerr S (2002) Tradeable carbon permit auctions How and why to auction not grandfather. Energy Policy 30:333–345

Department of National Account (2009) Input–output table of China (2007). China Statistics Press, Beijing

Dinan T (2007) Trade-offs in allocating allowances for CO2 emissions, economic and budget issue brief. Congressional Budget Office, Washington, DC

Edwards TH, Hutton JP (2001) Allocation of carbon permits within a country: a general equilibrium analysis of the United Kingdom. Energy Econ 23:371–386

Ekins P, Barker T (2001) Carbon taxes and carbon emissions trading. J Econ Surv 15:325–376

Ellerman AD (2003) Are cap-and-trade programs more environmentally effective than conventional regulation. Joint Program on the Science and Policy of Global Change, Massachusetts Institute of Technology, Cambridge. http://tisiphone.mit.edu/RePEc/mee/wpaper/2003-015.pdf. Accessed 19 May 2012

Fischer C, Fox A (2004) Output-based allocations of emissions permits: efficiency and distributional effects in a general equilibrium setting with taxes and trade. Resources for the Future, Washington, DC. http://www.rff.org/files/sharepoint/WorkImages/Download/RFF-DP-04-37.pdf. Accessed 19 Dec 2015

General Administration of Customs of the People’s Republic of China (2008) China Customs Statistics Yearbook (2007) Customs Statistics editorial office of General Administration of Customs of the People’s Republic of China, Beijing

Glomsrød S, Wei T (2005) Coal cleaning: a viable strategy for reduced carbon emissions and improved environment in China? Energy Policy 33:525–542

Goulder LH, Hafstead MC, Dworsky M (2010) Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. J Environ Econ Manag 60:161–181

Hahn RW, Stavins RN (2011) The effect of allowance allocations on cap-and-trade system performance. J Law Econ 54:S267–S294

He ZD (2005) China’s tax system. Tsinghua University Press, Beijing

Heilmayr R, Bradbury JA (2011) Effective, efficient or equitable: using allowance allocations to mitigate emissions leakage. Clim Policy 11:1113–1130

IPCC (2006) Prepared by the National Greenhouse Gas Inventories Programme. In: Eggleston HS, Buendia L, Miwa K, Ngara T, Tanabe K (eds) 2006 IPCC Guidelines for National Greenhouse Gas Inventories. IGES, Japan

Jensen J, Rasmussen TN (2000) Allocation of CO emissions permits: a general equilibrium analysis of policy instruments. J Environ Econ Manag 40:111–136

Li S, Huang T (2003) A multi-objectives decision model of primary emission permits allocation. Chin J Manag Sci 11:40–44

Liang Q-M, Wei Y-M (2012) Distributional impacts of taxing carbon in China: results from the CEEPA model. Appl Energy 92:545–551

Liang Q-M, Fan Y, Wei Y-M (2007) Carbon taxation policy in China: How to protect energy- and trade-intensive sectors? J Policy Model 29:311–333

Liang Q-M, Fan Y, Wei Y-M (2009) The effect of energy end-use efficiency improvement on China’s energy use and CO2 emissions: a CGE model-based analysis. Energy Effic 2:243–262

Liang Q-M, Wang Q, Wei Y-M (2013) Assessing the distributional impacts of carbon tax among households across different income groups: the case of China. Energy Environ 24:1323–1346

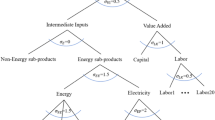

Liang Q-M, Yao Y-F, Zhao L-T et al (2014) Platform for China energy environmental policy analysis: a general design and its application. Environ Model Softw 51:195–206

Loisel R (2010) Quota allocation rules in Romania assessed by a dynamic CGE model. Clim Policy 10:87–102

Lu W, Cui L-Q (2003) Analysis of allocation model of tradable permits right. China Environ Manag 22:8–9

Ministry of Finance People’s Republic of China (2008) China finance yearbook (2008). China Finance Journal Office, Beijing

National Bureau of Statistics (2008a) China energy statistical yearbook (2008). China Statistics Press, Beijing

National Bureau of Statistics (2008b) China statistical yearbook (2008). China Statistics Press, Beijing

National Bureau of Statistics (2009) China statistical yearbook (2009). China Statistics Press, Beijing

Paltsev S, Reilly J, Jacoby HD, Gurgel AC et al (2007) Assessment of U.S. cap-and-trade proposals. Joint Program on the Science and Policy of Global Change, Massachusetts Institute of Technology, Cambridge. http://tisiphone.mit.edu/RePEc/mee/wpaper/2007-005.pdf. Accessed 19 Dec 2015

Parry IWH, Lii RCW, Goulder LH (1999) When can carbon abatement policies increase welfare? The fundamental role of distorted factor markets. J Environ Econ Manag 37:52–84

Peace J, Juliani T (2009) The coming carbon market and its impact on the American economy. Policy Soc 27:305–316

Quirion P (2009) Historic versus output-based allocation of GHG tradable allowances: a comparison. Clim Policy 9:575–592

Stavins RN (2008) Addressing climate change with a comprehensive US cap-and-trade system. Oxf Rev Econ Policy 24:298–321

The State Council (2010) Decision of the state council on accelerating the fostering and development of strategic emerging industries. The State Council, Beijing

The State Council (2011) The outline of National twelfth five-year plan. The State Council, Beijing

Wang C (2003) Climate change policy simulation and uncertainty analysis: a dynamic CGE model of China. Tsinghua University, Beijing

Wang Q, Liang Q-M (2015) Will a carbon tax hinder China’s efforts to improve its primary income distribution status? Mitig Adapt Strateg Glob Change 20:1407–1436

Wei Y-M, Liu L-C, Wu G, Zou L-L (2010) Energy economics: CO2 emissions in China. Springer, Berlin

Wittneben BBF (2009) Exxon is right: let us re-examine our choice for a cap-and-trade system over a carbon tax. Energy Policy 37:2462–2464

Wu Y-J, Xuan X-W (2002) The economic theory of environmental tax and its application in China. Economic Science Press, Beijing

Xue X-M (1998) Calculation and comparison study of CO2 emission from China’s energy consumption. Environ Prog 4:27–28

Yao Y-F, Liang Q-M, Yang D-W, Liao H, Wei Y-M (2014) How China’s current energy pricing mechanisms will impact its marginal carbon abatement costs. Mitig Adapt Strateg Glob Change. doi:10.1007/s11027-014-9623-y

Yi W-J, Zou L-L, Guo J, Wang K, Wei Y-M (2011) How can China reach its CO2 intensity reduction targets by 202? A regional allocation based on equity and development. Energy Policy 39:2407–2415

Zhang Z-X (1999) Should the rules of allocating emissions permits be harmonised? Ecol Econ 31:11–18

Zhang H (2009) Comparison of carbon permits allocation methods. Environ Prot Circ Econ 12:16–18

Zhang K-Z, Yang F-L (2009) international practice and experience of carbon tax. Tax Res 4:88–90

Zhao F, Yang J (2009) The comparative analysis of allowance allocation methods of emission trading. Environ Pollut Control 31:76–78

Acknowledgments

The authors gratefully acknowledge financial support from the National Natural Science Foundation of China under Grant Nos. 71422011, 71461137006, and 71521002; the Programme for New Century Excellent Talents in University under Grant No. NCET-12-0039. We also would like to thank the anonymous referees for their helpful suggestions and corrections on the earlier draft of our paper.

Author information

Authors and Affiliations

Corresponding author

Appendix: Abbreviations

Rights and permissions

About this article

Cite this article

Yao, YF., Liang, QM. Approaches to carbon allowance allocation in China: a computable general equilibrium analysis. Nat Hazards 84 (Suppl 1), 333–351 (2016). https://doi.org/10.1007/s11069-016-2352-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-016-2352-7