Abstract

The present study identifies the most influential industries in Ecuador according to the Input–Output Table for 2019. For this purpose, four weighted centrality indices are used from Social Network Analysis: Degree Centrality, Closeness Centrality, Betweenness Centrality, and Alpha Centrality. The results suggest that wholesale and retail trade, transportation, and professional activities are the most influential in the Ecuadorian economy due to their high centrality in commercial relationships. According to Chenery and Watanabe's methodology, all are base sectors, that is, they mainly are supply-driven. So, these centrality measures highlight the relevance of sectors based on their forward linkages. This result is not surprising. The theory of shock diffusion suggests that productive shocks on high centrality sectors can spread cascading effects downstream and generate aggregate fluctuations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The input–output model proposed by Leontief (1951) is possibly the first approximation to network theory in firms’ economy. This model allows one to analyze the interdependence of industries, considering how the production of one industry is demanded by others as inputs. Based on this work, Hirschman (1958), Rasmussen (1958) and Chenery and Watanabe (1958) extend the IO analysis by incorporating the forward–backward linkages of a production network. Since then, a large number of studies have applied input–output models. A deep literature review about them is provided by Bon (2018).

From these contributions, the analysis of Input–output networks has been expanded gradually incorporating its topological characteristics with the support of the Social Network Analysis (SNA). This field integrates quantitative techniques from the graph theory, which was applied for the first time by Campbell (1975) and later used to explore social structures and the role of agents and their relationships (Fu et al. 2017; Scott 2017; Aroche Reyes 2019; Galety et al. 2022). Here, we can remark upon one of the biggest topics: Centrality.

Centrality is one of the main features analyzed in Input–output networks.Footnote 1 The relevance of the role played by sectors in the input–output linkages has been used to quantify their resilience in the study of diverse economic issues. Technological progress, financial development, productivity dynamics, and foreign trade are some examples of economic phenomena that have been empirically analyzed using network theory. For instance, Shih and Chang (2009) and Huang et al. (2011) investigate the structure of international technology diffusion and the innovative capacity by measuring its centralities. Andrieş et al. (2022) and Borochin and Rush (2022) estimate the degree of interconnectedness and quantify the linkages between global financial systems and other institutions. Blöchl et al. (2011), Xu and Liang (2019) and Costa et al. (2022) rank sectors’ centrality within trade network in order to understand the structure of world economies. de Santana Ribeiro et al. (2022) analyze the productive interdependence using I-O tables at the regional level and obtained that the interconnectedness across regions allows their recovery in the case of a shock.

A sector’s centrality has gained importance in the study of intersectoral relationships, but also in the field of shock’s diffusion. Acemoglu et al. (2012) and Carvalho (2014) argue that productivity shocks can spread in the business system and generate macroeconomic fluctuations. On the one hand, commercial relationships propagate shocks from one sector to its neighbors (i.e. first-order connections) and extend these effects to other interrelated sectors (i.e. higher-order connections) in the production network throughout high central industries. On the other hand, if the role of sectors as input suppliers is highly heterogeneous such that the power law holds, shocks have a large effect on macroeconomic fluctuations. According to the authors, both characteristics enable shocks to diffuse from buyer to buyer in a network, generating the so called “downstream” cascading effects (i.e. shocks propagate from buyer to buyer). Several investigations about diffusion in input–output networks share this theoretical approach, remarking the importance of sectors’ centrality and its power law distribution (e.g. Stella 2015; Bigio and La’O 2016; Carvalho et al. 2016; Atalay 2017; Grassi 2017; Baqaee 2018).

The main objective of this paper is to identify the most influential industries in Ecuador's Input–Output network in 2019, using four weighted centrality indices from Social Network Analysis: Degree Centrality, Closeness Centrality, Betweenness Centrality, and Alpha Centrality. To do so, we analyze the Ecuadorian Input–output network at the sectoral level in 2019, through the use of these four centrality indices for weighted graphs. The identification of the most influential sectors through their centrality in an economy is very relevant for policy considerations since it indicates their importance in the production network.

Ecuador is a developing country located in South America whose economy has been characterized as being undiversified, with a high concentration in the production of primary goods and low incorporation of added value. Extraction of crude oil represents 31.48%, and traditional products such as bananas, cocoa, coffee, and shrimp, represent 27.91% of total exports, for the year 2019 (Central Bank of Ecuador 2019b). Thus, the Ecuadorian economy depends to a large extent on these sectors, which constitutes a problem due to the price volatility and therefore, the vulnerability of the economy. In this sense, it is important to know whether these sectors are relevant in centrality terms, which would indicate their interconnectivity with other sectors and in turn, their influence on macroeconomic aggregates. The high dependence on agro-exports has been a discussion topic among policy makers. Consequently, in 2012, a project of Ecuadorian Productive Matrix Change was proposed. In this study, apart from the main analysis of centrality of sectors, the prioritized sectors in the framework of this project are analyzed in terms of their centrality. The results shed light on the relevance of these sectors and their changes between 2007 and 2019.

In this context, the main hypothesis of the present study is that the Key sectors in the Ecuadorian input–output network, according to the methodology of Chenery and Watanabe's (CW), are not necessarily the sectors with high centrality. The results show that the industries of wholesale and retail trade, transport and professional activities are the most relevant and influential sectors in the Ecuadorian economy, because they stand out in the four centrality indices analyzed. Answering our hypothesis, these sectors are not the Key sectors determined by the CW methodology, but rather Base sectors. Therefore, weighted centrality measures provide insights into sectors that possess strong forward linkages, which can amplify the impact of external shocks and public policies, when characteristics such as transactionality, proximity, and betweenness of IO network are considered.

The production network depends to a large extent on these three sectors over time, as it does not present significant structural changes with respect to base year 2007. At the same time, the distribution of the productive sectors according to the centrality measures follow a power law. Therefore, we can expect, as literature establishes, that productivity shocks on the aforementioned sectors could give rise to cascade effects and generate variations of macroeconomic aggregates.

This paper contributes to the growing empirical literature that applies SNA on input–output networks to analyze the sectors’ ability to propagate economic shocks and generate cascade effects (e.g. Xu and Liang 2019; Villamar and Guananga 2019; Giammetti et al. 2020; Lavassani and Movahedi 2021; Costa et al. 2022). In addition, this research adds to the few studies done in the region (Contreras 2019; de Santana et al. 2022) by going further with the application of the alpha centrality (Ghosh and Lerman 2011), weighted closeness and weighted betweenness centrality (Opsahl et al. 2010) on an input–output network. Frequently, only weighted degree and alpha centralities have been used to analyze the importance of productive sectors in commercial relationships, however no researches have applied weighted closeness and betweenness centralities to our knowledge. These types of measures take into account the number of commercial relationships in which an industry participates directly or indirectly in the input–output network (as conventional closeness and betweenness non weight centralities), but also the buying-selling amount of these relationships. So, the relevance of a sector can be further explored in the value chains considering both intersectoral linkages and their economic exchange.

This study is structured as follows: Section 2 synthesizes the main theoretical and empirical investigations; Section 3 discusses the different tools used; Section 4 exposits the preliminary analysis of the Ecuadorian input–output network; Section 5 presents the main results; finally, Section 6 presents the main conclusions of the study and the possible recommendations to be implemented in future research.

2 Methodology

The main feature to describe in this study, as mentioned in the theory of shock diffusion, is the sector’s centrality. To this purpose, the Ecuador Input–Output Table for the year 2019 is used. This matrix shows the intersectoral commercial relationships between 70 productive sectors, divided according to the National Accounts Industry Classification (NAIC). This information was obtained from the System of National Accounts elaborated by the Central Bank of Ecuador.Footnote 2 The identification number of the sectors in this matrix, as well as their classification according to the Chenery and Watanabe methodology (CW classification), is shown in Appendix A.

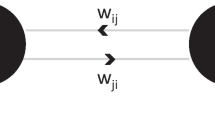

In order to explain the methodology, the Ecuadorian input–output network will be represented as a directed and weighted graph \(G=\left(N, A\right)\), where \(N=\left\{1,\dots ,n\right\}\) is the set of productive sectors (i.e. vertices) and \(A={\left\{{a}_{ij}\right\}}_{n\times n}\) is the adjacency matrix of the input–output network (i.e. edges). Here, \({a}_{ij} \epsilon \left\{\mathrm{0,1}\right\}\) represents the commercial relationship between the sector \(i\) and the sector \(j\). If \({a}_{ij}=1\), then the sector \(i\) sells to the sector \(j\); otherwise, if \({a}_{ij}=0\), the sector \(i\) does not sell to the sector \(j\). Let \(w:A\to {\mathbb{R}}_{+}\) be the weighting function that assigns to each intersectoral link \({a}_{ij}\) the amount \({w}_{ij}=w\left({a}_{ij}\right)\) that the sector \(i\) sells to the sector \(j\).

The weighted centrality indices that will be applied on the Ecuadorian input–output network are: degree centrality, closeness centrality, betweenness centrality (Opsahl et al. 2010) and alpha centrality (Ghosh and Lerman 2011). The weighted degree centrality displays the economic relevance of industries in their industry-specific input–output network (i.e., their immediate buyers and sellers) meanwhile the weighted closeness centrality, betweenness centrality and alpha centrality are systemic measures that are calculated on the entire input–output network. The weighted closeness centrality gives an idea of how close a supplier is to the buyers through productive linkages between industries. The weighted betweenness centrality indicates the industry’s importance on any value chain formed in the production network. The weighted alpha centrality shows how far an exogenous sectorial shock can be propagated forward.

2.1 Weighted Degree Centrality

The weighted degree centrality \({C}_{i}^{d}\left(G\right)\) measures the total amount of direct commercial relationships that a vertex \(i\) makes with others. This index is calculated as follows:

where \(n\) is the total number of vertices in the network. If this centrality index has a high value, the amount of direct commercial relationships for an economic sector is high, and therefore it is more central in the input–output network.

2.2 Weighted Closeness Centrality

The weighted closeness centrality \({C}_{i}^{c }\left(G\right)\) measures the inverse of farness, which in turn, is the sum of distances of vertex \(i\) to all other nodes. Here, the distance is determined by the inverse of commercial relationships. This index is calculated as follows:

where \({d}_{ij}^{\alpha }\) is the length of the shortest path between vertex \(i\) and vertex \(j\), based on the inverse of the commercial relationships. This length is measured as:

where \({\Phi }_{ij}\) are all possible paths between vertex \(i\) and vertex \(j\), \((r, s)\) is an edge that belongs to the path \(\phi\) and \(\alpha\) is a synchronization parameter. This parameter is equal to 1 to exclusively consider the amounts of the commercial relationships in network for the calculation of the index.

A high closeness centrality indicates than an economic sector maintains a close relationship with the rest of the sectors in the input–output network, due to the high commercial amounts. Its reciprocal value could give an idea of the average number of commercial relationships between one sector with their final buyers.

2.3 Weighted Betweenness Centrality

The weighted betweenness centrality \({C}_{i}^{b }\left(G\right)\) shows how well a vertex \(i\) is located, according to the geodesic paths between all vertices in the input–output network, using Dijkstra's algorithm (1959). This index is calculated as follows:

where \({p}_{ij}^{\alpha }\) is the number of geodesic paths between vertices \(i\) and \(j\), and \({p}_{ij}^{\alpha }\left(k\right)\) is the number of geodesic paths between vertices \(i\) and \(j\) passing exclusively through vertex \(k\) \(\left({p}_{ij}^{\alpha }\left(k\right)<{p}_{ij}^{\alpha }\right)\). In order to identify these geodesic paths, the distance is measured as:

where \({\Phi }_{ij}\left(k\right)\) are all possible paths between vertex \(i\) and vertex \(j\) with an intermediate vertex \(k\notin \left\{i,j\right\}\), \((r, s)\) is an edge that belongs to the path \(\phi\) and \(\alpha\) is the synchronization parameter. This parameter is equal to 1 when considering the amounts of the commercial relationships in network.

When the weighted centrality index of betweenness takes high values, an economic sector appears more frequently in the geodesic paths that connects all pairs of sectors in the input–output network.

2.4 Weighted Alpha Centrality

The weighted alpha centrality \({C}^{a}\left(G\right)\) determines the influence of vertex \(i\) towards its neighbors and the neighbors of its neighbors, through exogenous shocks in the network. This influence is measured by adding the amounts of purchases and sales that vertices \(i\) conduct with other sectors. Therefore, the alpha index is proportional to the sum of the amounts of the vertices to which it is connected. This index is calculated vectorially as follows:

where \({W}^{T}\) is the transpose of the weighted adjacency matrix \(W={\left\{{w}_{ij}\right\}}_{n\times n}\), \(\omega\) is a parameter that reflects the relative importance of endogenous factors in determining the centrality, \(e\) is a vector of exogenous perturbationsFootnote 3 and \(I\) is the identity matrix.

If the value of the alpha index is high, then the sector is central because its neighboring sectors have high commercial exchange. This index is analogous to the dispersion sensitivity index proposed by Rasmussen (1958), which measures how important a sector is in the forward linkage of a input–output network through exogenous economic shocks.Footnote 4 Also, Acemoglu et al. (2012) finds that the power law distribution of this index helps to explain the aggregate volatility of the economic system.

2.5 Clustering Analysis

Once the centrality measures are calculated, a clustering analysis using the k-means method is conducted. This method consists in constructing clusters focusing on the intra-class and inter-class similarity. The k-means algorithm starts with k non-empty subsets. After that, the centroids of the clusters are calculated and based on that, the algorithm assigns each sector to the cluster with the nearest centroid. Finally, it stops until the assignment is stable (Han et al. 2011).

3 Preliminary Statistics of Ecuadorian Input–Output Network

In the Ecuadorian input–output network, there are few big sectors that are suppliers and buyers of the majority of other sectors. This generates a star/like pattern of intersectoral relations, as shown in Fig. 1. The industries with the highest level of commercial exchange are construction (number 53 in figure), wholesale and retail (54), transport (58) and professional services (64).

Graph of the Ecuadorian input–output network. Source: Central Bank of Ecuador (2019b). Note: This graph shows the Ecuadorian cross-sectoral network according to the input-output matrix 2019. Vertices represent the 70 productive sectors of the economy, and their size shows their added value, classified according to the Appendix B. The NAIC identification number of these sectors is shown in the Appendix A. This figure is obtained by the Fruchterman-Reingold algorithm that accounts for the weight of the vertices; vertices inside (outside) the network have a higher (lower) commercial exchange. On the other hand, edges represent the amount of buying and selling transactions; and its size indicates the amount of the transaction made between two sectors. For graphic purposes, only the 15% largest commercial relationships are considered

This is consistent with the center-periphery model of Everett and Borgatti (1999), where a group of sectors with strong links are found in the center of the network, while weakly connected sectors are relegated to peripheral positions. Given this structure, we can expect that microeconomic shocks on central sectors could diffuse through the network and generate macroeconomic fluctuations, as proposed by Acemoglu et al. (2012) for "star networks".

In Table 1, the main characteristics of the Ecuadorian input–output network are shown. The number of edges show that most of the 70 sectors (number of vertices) are related to each other through 4,510 buying and selling transactions. If all sectors were related to each other, 4,830 (70*69) edges would be possible. In the Ecuadorian case, 93% (network density) of the possible commercial relationships take place. This high density indicates that most sectors are directly related to each other (Coleman and Moré 1983). The diameter indicates that a maximum of 2 intersectoral relationships are required to be able to reach from one sector to another, considering the shortest.

As Table 1 shows, the length of the average path between sectors is 1.04 commercial relationships; that is, for one sector to be related to another it must perform at least 1 transaction approximately. The total non-weighted degree indicates that a sector records an average of 129 sale-purchase relationships. The average amount of these commercial relationships is USD$ 1,581.36 million (total weighted degree). In addition, one sector maintains business relationships with approximately 65 buyers (in-degree) and 65 suppliers (out-degree). The sectors of extraction of crude oil (12), manufacturing industries (50), transport and storage (58) and private teaching services (66) are buyers with the highest number of connections (66 in-degree), while postal and mail activities (59) have the lowest quantity of relationships, corresponding to 54. On the other hand, suppliers maintain a maximum of 70 (non-weighted out-degree) direct transactions on the network, however, manufacturing of tobacco products (32), public education services (non-market) (67) and health and social services (non-market) (69) have 0 out-degree connections.

Considering the total demand and supply, the Ecuadorian input–output network records an amount of USD$ 62,935 million. The total demand from the economic sectors is shown in Fig. 2. It is evident that the demand is concentrated in few sectors and that the gap between the first demanding sector and the next sectors is quite large. The construction sector records the highest demand for inputs, with USD$ 6,691 million, representing 10.63% of the total intermediate consumption at basic prices. The next sectors with the highest input demand are the wholesale and retail trade (54) and oil and natural gas extraction (12), with USD$ 4,081 million (6.80%) and USD$ 3,650 million (6.08%), respectively. The rest of the sectors (67 sectors) demand USD$ 23,239 million, despite that most of the sectors are interconnected (high density of 93%), few of them are highly interconnected because of their demand.

Demand by economic sectors, 2019. Source: Central Bank of Ecuador (2019b). Note: The bar chart represents the total intermediate consumption by sector of the Ecuadorian economy. The horizontal axis indicates the demand for each sector in millions of dollars, while the vertical axis indicates the 15 sectors with the highest demand in the country. In addition, the color of the bars shows the intensity of consumption in the sectors. The more tomato (blue) this color is, the higher (lower) its consumption

The supply of economic sectors is shown in Fig. 3. The distribution of the supply is highly concentrated in few sectors but to a lesser extent than the demand. The first three supply sectors record shares around 10% each one. The sector with the highest supply corresponds to professional, technical, and administrative activities (64), which sells USD$ 9,823 million (15.61% of total production). It is very interesting that this sector is the main supplier to other sectors because it means that other sectors are performing based on training and technical assistance. In particular, this sector mainly provides services to itself (9.67%), to the wholesale and retail sector (54) with 8.64%, to the communications and information sector (60) with 8.17% and to transport and storage (58) with 8.04% of its total production. The second and third most important supply sectors are wholesale and retail, and transportation, which supply a total of USD$ 6,769 million and $USD 6,023 million (10.75% and 9.57%, respectively).

Supply by economic sectors, 2019. Source: Central Bank of Ecuador (2019b). Note: The bar chart represents the total production by sector of the Ecuadorian economy. The horizontal axis indicates the production of each sector in thousands of dollars, while the vertical axis indicates the 15 sectors with the highest production in the country. In addition, the color of the bars shows the intensity of the production of the sectors. The more tomato (blue) this color is, the higher (lower) its production

4 Results

This section identifies the sectors with the greatest centrality in the Ecuadorian economy according to the four measures proposed: Weighted Degree Centrality, Closeness Centrality, Betweenness Centrality and Alpha Centrality. Furthermore, a clustering analysis is conducted to determine similarities in terms of centrality between sectors. Finally, the centrality of prioritized sectors within the Productive Matrix Change Project is analyzed.

4.1 Centrality Analysis

Table 2 shows the descriptive statistics regarding the weighted centrality indices of degree, closeness, betweennessFootnote 5 and alpha centrality for the 70 industries in the Ecuadorian network, using the Input–Output Matrix 2019. In order to visualize them, each of the centrality indices are plotted in the panels of Fig. 4, using a color scale for the nodes: if the node is red (yelow), its centrality index is high (low).

Graphs of Weighted Centrality Indices. Note: The Figure shows the indexes centrality of degree, closeness, betweenness and alpha in the Ecuadorian input–output network. The vertices represent the 70 productive sectors. The NAIC identification number of these sectors is shown in the Appendix A. The color of the vertices is related to the weighted centrality indices; that is, if the node is redder (more yellow), its centrality index is higher (lower). In addition, edges represent the amount of buying and selling transactions; and its size indicates the amount of the transaction made between two sectors. For graphic purposes, only the 15% largest commercial relationships are considered

According to the degree-weighted centrality index (Fig. 4 - Panel A), commercial relationships of the productive sectors in Ecuador show high variability. The mean of the degree-weighted centrality is USD$ 1,798.14 million. There are 20 sectors that are above the mean and 50 sectors below the mean. There are 4 sectors that trade amounts greater than 7 billion dollars. The sectors that most boost the economy, by recording high level first-order relationships with suppliers and buyers, are professional activities (64), wholesale and retail (54), transportation (58) and construction (53). The sectors that record low levels of first-order relationships are: manufacture of tobacco products (32), manufacture of rubber products (41) and manufacture of farinaceous products (24).

The closeness index (Fig. 4 - Panel B) shows a great number of sectors that have a high proximity. These sectors are suppliers that rapidly interact with various industries in the network. This aspect facilitates quick access to inputs by suppliers and to carry out their production process. The mean of this index is 0.0329 and there are 31 sectors above the mean and 39 below it. The sectors that are closer to others are: professional activities (64), transportation (58), manufacture of refined petroleum products (38) and wholesale and retail (54). These sectors are close to others because they are direct providers in the input–output network. This relationship promotes commercial interaction, without the need for many intermediaries, which makes the exchange more dynamic in the input–output network. The sectors that are far away from suppliers and that need many intermediaries to carry out their production process are: manufacture of tobacco products (32), public (non-market) education services (67) and non-market health and social services (69).

The betweenness centrality index (Fig. 4 - Panel C) shows a polarized network, with only four sectors (circles 54, 58, 57 and 64) that actively participate intermediating between sectors and the rest of the sectors (66 sectors) participate to a lower extent intermediating transaction like manufacture of tobacco products (32), public (non-market) education services (67) and non-market health and social services (69). The mean of the betweenness-weighted centrality is 188 intersectoral relationships, and there are 10 sectors that are above the mean and 60 sectors below it. The high intermediary sectors are transportation (58), wholesale and retail (54), food service (57) and professional activities (64). These sectors are in strategic positions in the network since they channel transactions more efficiently in the economy. By contrast, the rest of sectors depend on those strategic sectors, so that a shock in the strategic sectors would affect them.

The alpha centrality index (Fig. 4 - Panel D) shows few sectors of high importance in commercial exchange, considering the relationship with other industries that also trade high amounts. However, it presents a more balanced image than that shown in the betweenness index. The mean of the alpha-weighted centrality is 1.60, and there are 18 sectors that are above the mean and 52 sectors below it. Among the most central sectors, there are professional activities (64), wholesale and retail (54), transportation (58) and oilseed and industrial crops (5), where a negative shock will probably affect the client-industries of these sectors. In contrast, the sectors recording the lowest alpha centrality are manufacture of tobacco products (32), public (non-market) education services (67) and non-market health and social services (69). This means that they are slightly connected downward in the input–output network.

For more information, Appendix C shows the top 7 industries (that is, 10% of economic sectors) with the greatest centrality in each of the four indices.

Input–output networks are characterized by high heterogeneity of the sectors’ centrality in commercial relationships, regularly characterized in literature through a power law distribution (Carvalho 2014; Gabaix 2016). The power law distribution of the centrality indices was verified through the Kolmogorov–Smirnov goodness-of-fit test and Likelihood ratio test, which suggested that the distribution of the four centrality indices follow a power law, indicating the presence of few highly central sectors and a large concentration of sectors that have low centrality indices (Acemoglu et al. 2012). The tests performed for each centrality index can be seen in Appendix D (Tables 7, 8 and 9).

4.2 Clustering According to the Centrality Indices

Based on the four centrality indices, a clustering analysis is conducted to determine similarities in terms of centrality between sectors. In Fig. 5, Dimension 1 is explained by the degree, betweenness and alpha centrality indices in a 77.2%, while dimension 2 is explained by the closeness centrality index in a 12.5%.

Clustering K-means according to centrality indices. Source: Central Bank of Ecuador (2019b). Note: The variables that explain most of dimension 1 are the indexes of degree centrality, betweenness and alpha, meanwhile the index of closeness explains dimension 2. The NAIC identification number of the sectors is shown in Appendix A

As seen in Table 3, Cluster A records the lowest mean value of all four indices, simultaneously cluster E records the highest mean value in the four indices. The average centrality of each of these indices is increasing across clusters, starting with cluster A, and then heading to cluster E. The list of sectors within these clusters can be seen in Appendix E.

Sectors with high centrality are grouped in Clusters D and E. They have a high capacity to diffuse productivity shocks, to generate cascade effects and to generate macroeconomic fluctuations. Among them, according to the CW classification, there are six base sectors, one motor sector, one island sector and one key sector. In other words, it can be argued that the CW classification loses sight of sectors that are relevant in terms of their transactionality, proximity, betweenness and linkages. With the CW classification, only one sector (Extraction of crude oil and natural gas) is identified as key sector that promotes production, by demanding and offering large amounts of inputs to the rest of the sectors (Table 4).

The three sectors of cluster E represent 22.71% of the GDP and these are: wholesale and retail (54), professional activities (64) and transportation (58). These three sectors correspond, according to the CW classification, to base sectors; that is, they mostly generate forward linkages. These results are consistent with other economies in the world. For instance, Wholesale Trade has been pointed out as one of the most central sectors in Mexico (Contreras 2019), Brazil (de Santana Ribeiro et al. 2022) and Greece (Tsekeris 2017) using SNA. Professional, scientific and technical activities have also been identified as central in Brazil and Greece, based on the application of a non-weighted betweenness centrality.

The professional, technical, and administrative activities (64), as shown in Table 4, commercialize the highest amount of purchase-sale relationship, corresponding to USD$ 11,973.8 million and participate in 1,351 transactions out of a total of 4,510 (29.96%). This sector can reach its final buyers with around 12 commercial relationships (1/closeness = 1/0.0785). In addition, the professional, technical, and administrative activities increase their production by USD$ 7.81 for each additional dollar in intermediate consumption in this sector.

Wholesale and retail trade (54) is part of 2,524 transactions (55.96%) and trades directly with other sectors around USD$ 11,213.3 million, providing a great amount of inputs to the rest of the sectors. In addition, for each additional dollar in intermediate consumption in the wholesale and retail sectors, the production of this sector increases by USD$ 5.76 towards other activities. It takes approximately 14 (1/closeness = 1/0.068) commercial relationships in the input–output network to attain its final buyers.

The transportation and storage sector (58) trades around USD$ 9,768.6 million dollars and it is part of 2,910 intersectoral relationships (64.52%) in the production network. This sector is in charge of accelerating the Ecuadorian economy, because it promotes economic growth and development (Fernández 2017). This sector can reach its final buyers with around 13 (1/closeness = 1 / 0.0733) transactions. For each additional dollar in intermediate consumption of transportation and storage, its production increases by USD$ 4.32 towards other activities.

Cluster D is made up of 7 sectors that represent 27.83% of GDP. These sectors are mainly services, real estate activities and oil-related activities. The construction sector (53) stands out in the degree centrality, while financial services activities (61) with manufacture of refined petroleum (38) stand out in closeness centrality. Food, and beverage services (57) predominate in the betweenness centrality, while financial services activities (61) stand out in the alpha centrality.

Clusters A, B and C are mostly made up of primary activities, intensive in labor, belonging to informal sectors like agriculture, farming of cattle, fishing, and forestry. Given that Ecuador is a primary-exporter economy, it is striking that these sectors are among these clusters and not in clusters D and E with greater centrality. These primary sectors consolidate the productive matrix by generating high foreign exchange earnings and, therefore, a high share of GDP. This phenomenon is due to the fact that exports continue to be commodities with low added value, which is why they generate low local transactionality. Therefore, the fact that these sectors are not highly central could be considered as a good thing, since a shock to these sectors would not affect the rest of the input–output network.

To capture possible changes over time in the production network, the centrality measures are analyzed for 2007 and 2019. Table 5 indicates the results of a transition matrix of sectors considering their deciles between 2007 and 2019 and the rank correlation of centrality measures between 2007 and 2019. The different rank correlation measures show that rank positions of sectors are positively and highly correlated between 2007 and 2019, which means that if a sector had a high (low) position in the ranking in 2007, it is very likely that it also has a high (low) position in 2019. The Ecuadorian production network does not present significant structural changes.

For all centrality measures, except for the degree centrality (44%), more than 65% of sectors keep their position in a given decile. The remaining percentage of sectors increase or decrease their centrality measures. As for the degree centrality, 33% of sectors decreased their position in degree centrality from 2007 to 2019. Regarding the closeness centrality, 13% of sectors dropped position between 2007 and 2019. For the betweenness and alpha centrality, around 17.5% of sectors decreased their rank over time. For more information, Appendix F shows the position changes in the four weighted centrality indices for the year 2007 and 2019.

Among the sectors that do not change to another the decile, we have the Wholesale Trade (54), Transportation (58) and Professional Activities (64), which were the most influential sectors in both 2007 and 2019. These sectors remain among the first positions in all centrality measures over time. It is worth noting that Professional activities changed its betweenness from the 6th position in 2007 to the 4th position in 2019. For the other measures, this sector was ranked in first place in both years.

4.3 Centrality of Prioritized Sectors of the Project of the Change of Ecuadorian Productive Matrix

The project of Change of Ecuadorian Productive Matrix (CEPM) proposed in 2012, aimed to diversify the country's supply, stimulate exports of non-oil goods, encourage innovation and development, and strengthen labor productivity. The prioritized sectors within this project, with their corresponding aggregate activities according to NAIC, are shown in Table 6.

Among all prioritized sectors, the aggregate sectors of Transportation and storage (58), Construction (53) and Oilseed and industrial cultivation (5) ranked in the first quartile of centrality in the Ecuadorian economy. Communications and information (60), Production of wood and wood products (36), Manufacture of base metals (45) and Manufacture of other chemicals (40) ranked in the second quartile of centrality. The rest of prioritized sectors ranked in the third quartile of centrality and no prioritized sector rank in the fourth quartile. To analyze whether these sectors increase in their relevance after their prioritization in the framework of the Change of the productive matrix,Footnote 6 a temporal analysis of their centrality measures is conducted (Appendix G). Four of them have increased their centrality position in the production network between 2007 and 2019: Manufacture of basic chemicals, fertilizers and primary plastics (39), Manufacturing of base metals (45), Communications and information (60) and Manufacture of other chemical products (40).

The Manufacture of basic chemicals, fertilizers and primary plastics (39) changed in average its centrality from the 44th position in 2007 to the 37th position in 2019 and it’s the only sector that has improved its 4 centrality indices analyzed. Therefore, it has increased its commercialized purchase and sale amounts (ranking up 10 positions), it has become closer to its final buyers (ranking up 10 positions), more efficient in intermediating transactions between sectors (ranking up 5 positions) and has expanded its production for other economic activities (ranking up 2 positions).

In 2007, Manufacturing of base metals (45) changed in average its centrality from 23th position to the 20th position in 2019, due to an increase of 5 positions in degree and alpha centralities, meaning that its ability to trade high amounts has improved and its production has expanded for other economic activities. In the same sense, it has increased its betweenness centrality, thereby improving its strategic position by being more efficient in network transactions (ranking up 3 positions). Its ability to relate to its end buyers was slightly affected, decreasing 2 positions according to closeness centrality.

The average centrality for Communications and information (60) in 2007 to 2019, changed from 21st position into the 19th position, principally to the greatest growth in the betweenness index, climbing 22 positions, which is why it has gained importance in this period analyzed by improving its strategic position as intermediary in the production network. Additionally, the degree centrality has a positive but small impact, since it has only increased by one position. However, the closeness and alpha indices have decreased by 5 and 9 positions respectively, which means that it has distanced itself from its final consumers and has decreased its production for other economic activities.

The average centrality of Manufacture of other chemical products (40) has increased its position from 2007 to 2019, from 26th position into 25th position, due to greater amounts traded with other productive sectors, as well as its relationship with final consumers, therefore, increasing 5 and 3 positions in the degree and closeness centralities, respectively. On the other hand, its ability to influence the production of other sectors decreased, as well as its role as an intermediary to facilitate the transactions between the productive sectors.

5 Conclusions

The objective of this study was to analyze at the sectoral level the Ecuadorian input–output network using indicators based on Social Network Analysis. Its main contribution is to provide details on the role played by sectors, through centrality indices. Theoretically, these features are mainly important to identify the most influential sectors for the diffusion of productivity shocks, the propagation of cascade effects and the generation of macroeconomic fluctuations.

According to the results, the sectors of wholesale and retail trade (54), transport (58), and professional activities (64) are the most influential in the Ecuadorian economy, because they prevail in the four centrality indices. Therefore, these sectors are capable of commercializing high amounts of purchases and sales (degree), have a strategic place to carry out efficient transactions (betweenness), increase their production for other economic activities (alpha), and are closer to their final consumers (closeness). The importance of these sectors is structural as they were also ranked in the first positions of all centrality measures in 2007. However, they are not key sectors according to Chenery and Watanabe's methodology, all are base sectors. In this sense, the weight centrality measures used in this paper highlight the relevance of sectors as they participate significantly in commercial relationships in the production network.

Overall, the production network does not change significantly since most of sectors remain in their same rank between 2007 and 2019. Furthermore, due to power law holds for centrality measures, these sectors can significantly predetermine the activity of the entire input–output network, so a productive shock on them could spread cascading effects downstream and generate aggregate fluctuations, as argued by Acemoglu et al. (2012) and Carvalho (2014). Regarding the prioritized sectors within the project of the Change of the Productive Matrix, our results show that 7 out of 12 prioritized sectors, are highly central in the Ecuadorian economy. This result indicates that their economic linkage impact would be positive as benefits directed to these central sectors very likely diffuse to other sectors in their network. From a public policy point of view, to change the productive matrix based on products with low value added towards a productive matrix with higher value added, it is important to promote sectors with linkages generation potential such as those sectors in cluster D (Construction, Extraction of crude oil and natural gas, Financial services activities, Food and beverage service, Real estate activities and Manufacture of refined petroleum and other products), considering the key role of most central sectors in cluster E (Professional and administrative activities, Wholesale and retail and Transport and storage). Policy implications of centrality on important phenomena such as employment and distribution are out of our scope since it needs an econometric estimation, for instance.

This analysis shows the empirical importance of SNA’s tools, as they allow us to identify the most important industries in the commercial relationships of the Ecuadorian production network. It could be complemented with other indexes to measure interindustry linkages under Leontief-based methodologies, such as hypothetical extraction (Dietzenbacher et al. 2019), average propagation length (Dietzenbacher et al. 2005) and structural path analysis (Xie et al. 2020). It should be noted that centralities indexes provide descriptive statistics of the most resilient and influential sectors in the IO system so they could give some ideas about the possible effects of an economic shock or public policy. However, they do not provide a counterfactual analysis in a general equilibrium setting. In this sense, extensive economy-wide models could be required in order to formulate public policy adequately or prevent exogenous shocks. In addition, to improve public policy actions to change the productive matrix, an analytic comparison with other economies producing products and services with high value added is needed.

Some possible recommendations are presented for a possible extension of this analysis. Econometric models can be used to quantify upstream and downstream cascading effects caused by a shock or public policy to a core industry. Another alternative is the dynamic analysis which measures the significance and the effect of variables such as employment, taxes, technology, and intermediate consumption in the total added value of the sectors. Applied general equilibrium models can also be used to evaluate ex-ante supply-side policies related to the most influential industries on employment, income distribution, government revenue, the trade balance, among others. Likewise, other policies such as financing strategies (i.e., taxation, private financing, and international loans) could be evaluated. The detection of communities in the input–output network is an analysis that provides information on patterns that are not so visible, such as, detecting highly connected communities that do not allow the dissemination of a productive shock, but that affects only that community. Finally, spatial analysis is one of the alternatives that can allow us to know the integration between the central, regional, and local levels, with the aim of improving the productivity of the economic system.

Availability of Data and Material

All relevant data are within the manuscript and in Ecuador Input-Output Matrix for the year 2019 at: https://www.bce.fin.ec/index.php/informacioneconomica/sector-real.

Notes

In theoretical terms, centrality allows identifying the most “influential” sectors in an economy, depending on (i) how connected one sector is to another, (ii) the ease of one sector to reach others, (iii) how important a sector is in terms of connecting other sectors and (iv) how central a sector is according to the centrality of its neighboring sectors (Jackson 2010).

The Input–Output Table (IOT) is constructed by the Central Bank of Ecuador, based on the international standards of the System of National Accounts. A production function with fixed coefficients is used: \(a_{ij}=A_{ij}/X_j\) with \(X=a_{ij}X+DF\) and \(X=\left(I-a_{ij}\right)^{-1} DF\) where X is the production matrix, A is the intermediate demand matrix and DF is the final demand. This tool allows quantifying not only the direct but also the indirect effects that industries have on the economy. The input-output tables of industries have a fixed structure and are based on the fixed structure of sales of products, which represent the distribution of the demand of products. For the fixed structure of industries is assumed that economic agents demand the same combination of products from a given industry.

In the present study, the exogenous factor \(e\) is a vector of 1, because only the structure of the productive network is analyzed.

In fact, the alpha centrality index is equivalent to the row-wise sum of the Leontief matrix, while the dispersion sensitivity index is equivalent to the row-wise mean of this matrix divided by the total mean.

The synchronization parameter α used in the closeness and intermediation centrality index was set to 1 to consider only the amounts of transactions between sectors.

This analysis cannot be considered an impact assessment, as it requires the application of ex-ante evaluation tools or the use of econometric techniques to establish a completer and more rigorous counterfactual scenario. It is essential to consider that, during this period, other significant events occurred, such as the crisis in the value of the barrel of oil in 2014, the devastating earthquake in Pedernales in 2016, and various tax reforms. Therefore, the observed effect in the ranking according to their centralities in the productive matrix cannot be attributed exclusively to this factor.

References

Acemoglu D, Carvalho M, Vasco AO, Tahbaz-Salehi A (2012) The network origins of aggregate fluctuations. Econometrica 80(5):1977–2016. https://doi.org/10.3982/ECTA9623

Andrieş AM, Ongena S, Sprincean N, Tunaru R (2022) Risk spillovers and interconnectedness between systemically important institutions. J Financial Stab 58. https://doi.org/10.1016/j.jfs.2021.100963

Aroche Reyes F (2019) Estructura productiva y crecimiento económico en México: una perspectiva multisectorial. Investigación Económica 78(309):3. https://doi.org/10.22201/fe.01851667p.2019.309.70117

Atalay E (2017) How important are sectoral shocks? Am Econ J Macroecon 9(4):254–280. https://doi.org/10.1257/mac.20160353

Baqaee DR (2018) Cascading failures in production networks. Econometrica 86(5):1819–1838. https://doi.org/10.3982/ECTA15280

Bigio S, La’O J (2016) Financial frictions in production networks. Working paper

Blöchl F, Theis FJ, Vega-Redondo F, Fisher EON (2011) Vertex centralities in input-output networks reveal the structure of modern economies. Phys Rev E Stat Nonlinear Soft Matter Phys 83(4):1–8. https://doi.org/10.1103/PhysRevE.83.046127

Borochin P, Rush S (2022) Information networks in the financial sector and systemic risk. J Bank Financ 134:106327. https://doi.org/10.1016/j.jbankfin.2021.106327

Campbell J (1975) Application of graph theoretic analysis to interindustry relationships. Reg Sci Urban Econ 5(1):91–106. https://doi.org/10.1016/0166-0462(75)90015-0

Carvalho VM (2014) From micro to macro via production networks. J Econ Perspect 28(4):23–48. https://doi.org/10.1257/jep.28.4.23

Carvalho VM, Nirei M, Saito YU, Tahbaz-Salehi A (2016) Supply chain disruptions: Evidence from the great east Japan earthquake. SSRN Electron J. https://doi.org/10.2139/ssrn.2883800

Central Bank of Ecuador (2019a) Input-Output Matrix

Central Bank of Ecuador (2019b) System of National Accounts

Chenery HB, Watanabe T (1958) International comparisons of the structure of production. Econometrica 26(4):487. https://doi.org/10.2307/1907514

Coleman TF, Moré JJ (1983) Estimation of sparse Jacobian matrices and graph coloring blems. SIAM J Numer Anal 20(1):187–209. https://doi.org/10.1137/0720013

Contreras A, Martha G (2019) Detecting diffusion properties of sectors in the mexican economy, 2012. Investigación Económica 79(311):110. https://doi.org/10.22201/fe.01851667p.2020.311.72438

Costa S, Sallusti F, Vicarelli C (2022) Trade networks and shock transmission capacity: A new taxonomy of Italian industries. J Ind Bus Econ 49(1):133–53. Springer International Publishing. https://doi.org/10.1007/s40812-022-00208-2

de Santana Ribeiro LC, Pereira EJ, Perobelli FS, Pereira HB (2022) Sectoral interdependence, network analysis, and regional resilience in Brazil. Lat Am Bus Rev 1–29. Routledge. https://doi.org/10.1080/10978526.2022.2074441

Dietzenbacher E, Luna IR, Bosma NS (2005) Using average propagation lengths to identify production chains in the Andalusian economy. Estud Econ Apl 23(2):405–422

Dietzenbacher E, van Burken B, Kondo Y (2019) Hypothetical dxtractions from a global perspective. Econ Syst Res 31(4):505–19. Routledge. https://doi.org/10.1080/09535314.2018.1564135

Dijkstra EW (1959) A note on two problems in connexion with graphs. Numer Math 1(1):269–271. https://doi.org/10.1007/BF01386390

Everett MG, Borgatti SP (1999) The centrality of groups and classes. J Math Sociol 23(3):181–201. https://doi.org/10.1080/0022250X.1999.9990219

Fernández M (2017) No Title El Transporte Público Terrestre y La Accesibilidad, Instrumentos Para El Análisis Funcional Del Sistema de Asentamientos: El Caso de Ecuador. Secretaría Nacional de Planificación y Desarrollo

Fu X, Luo JD, Boos M (2017) Social network analysis: Interdisciplinary approaches and case studies. https://doi.org/10.1201/9781315369594

Gabaix X (2016) Power laws in economics: an introduction. J Econ Perspect 30(1):185–206. https://doi.org/10.1257/jep.30.1.185

Galety MG, Al Atroshi C, Balabantaray B, Mohanty SN (2022) Social network analysis. theory and applications. https://www.wiley.com/en-us/Social+Network+Analysis%3A+Theory+and+Applications-p-9781119836735

Ghosh R, Lerman K (2011) Parameterized centrality metric for network analysis. Phys Rev E Stat Nonlinear Soft Matter Phys 83(6):1–10. https://doi.org/10.1103/PhysRevE.83.066118

Giammetti R, Russo A, Gallegati M (2020) Key sectors in input-output production networks: An application to brexit. World Economy 43(4):840–870. https://doi.org/10.1111/twec.12920

Grassi B (2017) IO in I-O: Size, industrial organization, and the input–output network make a firm structurally important. Working paper

Han J, Kamber M, Pei J (2011) Data mining: Concepts and technique. Morgan Kaufmann Publishers, United States of America

Hirschman AO (1958) The strategy of economic development. Yale University Press, New Haven

Huang HC, Shih HY, Wu YC (2011) Contagion effects of national innovative capacity: Comparing structural equivalence and cohesion models. Technol Forecast Soc Change 78(2):244–55. Elsevier Inc. https://doi.org/10.1016/j.techfore.2010.07.017

Jackson MO (2010) Social and economic networks. Soc Econ Netw 1–504. https://doi.org/10.1093/acprof:oso/9780199591756.003.0019

Lavassani KM, Movahedi B (2021) Firm-level analysis of global supply chain network: Role of centrality on firm’s performance. Int J Global Bus Competitive 16(2):86–103. Springer Singapore. https://doi.org/10.1007/s42943-021-00026-8

Leontief WW (1951) Input-output economics. Sci Am 185(4):15–21. Scientific American, a division of Nature America, Inc. http://www.jstor.org/stable/24945285

Opsahl T, Agneessens F, Skvoretz J (2010) Node centrality in weighted networks: Generalizing degree and shortest paths. Soc Netw 32(3):245–251. https://doi.org/10.1016/j.socnet.2010.03.006

Ranko B (2018) Economic structure and maturity collected papers in input–output modelling and applications

Rasmussen P (1958) Studies in inter-sectorial relations. Ámsterdam, North- Holland PC

Scott J (2017) Social network analysis

Shih HY, Chang TL (2009) International diffusion of embodied and disembodied technology: A network analysis approach. Technol Forecast Soc Change 76(6):821–34. Elsevier Inc. https://doi.org/10.1016/j.techfore.2008.09.001

Stella A (2015) Firm dynamics and the origins of aggregate fluctuations. J Econ Dyn Control 55(1133):71–88. https://doi.org/10.1016/j.jedc.2015.03.009

Tsekeris T (2017) Network analysis of inter-sectoral relationships and key sectors in the greek economy. J Econ Interact Coord 12(2):413–435. Springer Berlin Heidelberg. https://doi.org/10.1007/s11403-015-0171-7

Villamar A, Guananga S (2019) Análisis de La Participación Del Sector Terciario En La Economía Del Ecuador, Periodo 2014–2018

Xie R, Zhao Y, Chen L (2020) Structural path analysis and its applications: literature review. Nat Account Rev 2(1):83–94. https://doi.org/10.3934/nar.2020005

Xu M, Liang S (2019) Input–output networks offer new insights of economic structure. Physica A Stat Mech Appl 527:121178. Elsevier B.V. https://doi.org/10.1016/j.physa.2019.121178

Funding

The paper was elaborated in the non-funded research project PII-DEC-2020-01 of Escuela Politécnica Nacional.

Author information

Authors and Affiliations

Contributions

Introduction, Literature Review: José Ramírez-Álvarez, Vanessa Chungandro-Carranco, Nathaly Montenegro-Rosero Data process: Vanessa Chungandro-Carranco, Nathaly Montenegro-Rosero Formal analysis: José Ramírez-Álvarez, Vanessa Chungandro-Carranco, Nathaly Montenegro-Rosero, Carolina Guevara-Rosero Funding acquisition: José Ramírez-Álvarez Methodology: José Ramírez-Álvarez, Carolina Guevara-Rosero Project administration: José Ramírez-Álvarez Resources: José Ramírez-Álvarez Supervision: José Ramírez-Álvarez, Carolina Guevara-Rosero Validation: José Ramírez-Álvarez, Carolina Guevara-Rosero Visualization: Vanessa Chungandro-Carranco, Nathaly Montenegro-Rosero Writing - original draft: Vanessa Chungandro-Carranco, Nathaly Montenegro-Rosero Writing - review & editing: José Ramírez-Álvarez, Carolina Guevara-Rosero.

Corresponding author

Ethics declarations

Ethics Approval and Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Appendix A. List of the Productive Sectors With the Identifier and Chenery and Watanabe Categorization

NAIC id | Sector | CW categorization |

|---|---|---|

1 | Growing of banana, coffee, and cocoa | Base |

2 | Growing of cereal | Base |

3 | Growing of flowers | Isle |

4 | Growing of vegetables, melons, fruits and tubers | Isle |

5 | Growing of oleaginous and industrial crops | Base |

6 | Support activities for crop production | Isle |

7 | Raising cattle, other animals; animal products; and support activities | Key |

8 | Silviculture, timber extraction and other forestry activities | Isle |

9 | Aquaculture and shrimp fishing | Key |

10 | Fishing (except shrimp) | Isle |

11 | Aquaculture (except shrimp) | Motor |

12 | Extraction of crude petroleum and natural gas | Key |

13 | Support activities for petroleum and natural gas extraction | Isle |

14 | Mining of metal ores | Isle |

15 | Mining of non-metallic ores and support activities for other mining and quarrying | Isle |

16 | Processing and preserving of meat | Motor |

17 | Processing and preserving of shrimp | Motor |

18 | Processing of fish and other processed aquatic products | Motor |

19 | Conservation of aquatic species | Motor |

20 | Manufacture of vegetable and animal oils and fats | Motor |

21 | Manufacture of dairy products | Motor |

22 | Manufacture of grain mill products | Isle |

23 | Manufacture of bakery products | Motor |

24 | Manufacture of noodles and similar farinaceous products | Motor |

25 | Manufacture and refining of sugar | Motor |

26 | Manufacture of cocoa, chocolate and sugar confectionery | Motor |

27 | Manufacture of prepared animal feeds | Isle |

28 | Manufacture of coffee | Motor |

29 | Manufacture of other food products | Motor |

30 | Manufacture of alcoholic beverages | Isle |

31 | Manufacture of non-alcoholic beverages | Motor |

32 | Manufacture of tobacco products | Isle |

33 | Manufacture of threads, yarns; fabrics and clothing | Key |

34 | Manufacture of wearing apparel | Motor |

35 | Manufacture of leather, leather products and footwear | Motor |

36 | Manufacture of wood and of products of wood | Key |

37 | Manufacture of paper and paper products | Base |

38 | Manufacture of refined petroleum and other products | Base |

39 | Manufacture of basic chemicals, fertilizers, and primary plastics | Isle |

40 | Manufacture of other chemicals | Isle |

41 | Manufacture of rubber products | Isle |

42 | Manufacture of plastic products | Base |

43 | Manufacture of glass, refractory products, and ceramics | Isle |

44 | Manufacture of cement, articles of concrete and stone | Motor |

45 | Manufacture of basic metals | Key |

46 | Manufacture of fabricated metal products, except machinery and equipment | Isle |

47 | Manufacture of machinery and equipment | Motor |

48 | Manufacture of transport equipment | Isle |

49 | Manufacture of furniture | Motor |

50 | Manufacturing industries n.e.c | Base |

51 | Electric power generation, transmission, and distribution | Key |

52 | Water collection, treatment, and supply | Isle |

53 | Construction of buildings | Isle |

54 | Wholesale and Retail; including trade of motor vehicles and motorcycles | Base |

55 | Maintenance and repair of motor vehicles | Isle |

56 | Accommodation | Motor |

57 | Food and beverage service activities | Motor |

58 | Transport and warehouse | Base |

59 | Postal and courier activities | Motor |

60 | Information and communication | Motor |

61 | Financial service activities | Base |

62 | Insurance plans, except social security | Key |

63 | Real estate activities | Base |

64 | Professional, technical, and administrative activities | Base |

65 | Public administration, defence; compulsory social security | Isle |

66 | Private teaching services | Isle |

67 | Public (non-market) education services | Isle |

68 | Private health and social services | Isle |

69 | Non-market health and social services | Isle |

70 | Association services; entertainment; cultural and sport activities | Isle |

1.2 Appendix B. Node Size Ranking By Amount Traded

Groups | N° Sectors | Maximum Value Added | Average Value Added | Minimum Value Added |

|---|---|---|---|---|

1 | 5 | $ 12.087 | $ 8.096 | $ 5.387 |

2 | 6 | $ 4.864 | $ 3.429 | $ 2.435 |

3 | 11 | $ 1.925 | $ 1.399 | $ 1.020 |

4 | 17 | $ 992 | $ 701 | $ 525 |

5 | 27 | $ 466 | $ 292 | $ 100 |

6 | 4 | $ 94 | $ 73 | $ 53 |

1.3 Appendix C. The Top 7 Industries With the Greatest Centrality

A) Degree Centrality (millions of dollars) | ||||

|---|---|---|---|---|

Id | Sector | Index | Categorization CW | Clustering by centrality |

64 | Professional and administrative activities | $ 11,973.8 | Base | E |

54 | Wholesale and retail | $ 11,213.3 | Base | E |

58 | Transport and storage | $ 9,768.6 | Base | E |

53 | Construction | $ 7,847.6 | Isle | D |

12 | Extraction of crude oil and natural gas | $ 4,970.7 | Key | |

61 | Financial services activities | $ 4,715.9 | Base | D |

51 | Generation, capture and distribution of electrical energy | $ 4,642.1 | Key | C |

B) Closeness Centrality | ||||

|---|---|---|---|---|

Id | Sector | Index | Categorization CW | Clustering by centrality |

64 | Professional and administrative activities | 0.0785 | Base | E |

58 | Transport and storage | 0.0733 | Base | E |

38 | Manufacture of refined petroleum and other products | 0.0685 | Base | D |

54 | Wholesale and retail | 0.0680 | Base | E |

61 | Financial services activities | 0.0669 | Base | D |

12 | Extraction of crude oil and natural gas | 0.0645 | Key | D |

13 | Activities that support oil and natural gas extraction | 0.0630 | Isle | C |

C) Betweenness Centrality | ||||

|---|---|---|---|---|

Id | Sector | Index | Categorization CW | Clustering by centrality |

58 | Transport and storage | 2910 | Base | E |

54 | Wholesale and retail | 2524 | Base | E |

57 | Food and beverage service | 1523 | Motor | D |

64 | Professional and administrative activities | 1351 | Base | |

63 | Real estate activities | 653 | Base | D |

38 | Manufacture of refined petroleum and other products | 645 | Base | D |

12 | Extraction of crude oil and natural gas | 642 | Key | D |

D) Alpha Centrality | ||||

|---|---|---|---|---|

Id | Sector | Index | Categorization CW | Clustering by centrality |

64 | Professional and administrative activities | 7.8151 | Base | E |

54 | Wholesale and retail | 5.7642 | Base | E |

58 | Transport and storage | 4.3239 | Base | E |

5 | Oilseed and industrial crops | 3.2113 | Base | C |

61 | Financial services activities | 2.9428 | Base | D |

51 | Generation, capture and distribution of electrical energy | 2.5866 | Key | C |

38 | Manufacture of refined petroleum and other products | 2.3488 | Base | D |

1.4 Appendix D. Power Law Distributions of Weighted Centrality Indices

1.5 Appendix E. Clusters According to the Centrality Indices

1.6 Appendix F. The Centrality Compared to the Base Year

1.7 Appendix G. Rank Position Changes in 2007–2019 for the Prioritized Sectors of the Project of CEPM

Prioritized sector according to CEPM | Sector according to NAIC | Rank position | Rank position | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

2007 | 2019 | ||||||||||

Degree | Closeness | Betweenness | Alpha | Average | Degree | Closeness | Betweenness | Alpha | Average | ||

Petrochemistry | Manufacture of basic chemicals. fertilizers and primary plastics (39) | 52 | 42 | 49 | 31 | 43.5 | 42 | 32 | 44 | 29 | 36.8 |

(+10) | (+10) | (+5) | (+2) | (+6.8) | |||||||

Metalworking | Manufacture of base metals (45) | 29 | 21 | 21 | 19 | 22.5 | 24 | 23 | 18 | 14 | 19.8 |

(+5) | (-2) | (+3) | (+5) | (+2.8) | |||||||

Technology. software. hardware and computer services | Communications and information (60) | 15 | 15 | 39 | 16 | 21.3 | 14 | 20 | 17 | 25 | 19.0 |

(+1) | (-5) | (+22) | (-9) | (+2.3) | |||||||

Biotechnology | Manufacture of other chemicals (40) | 27 | 28 | 27 | 21 | 25.8 | 22 | 25 | 32 | 22 | 25.3 |

(+5) | (+3) | (-5) | (-1) | (+0.5) | |||||||

Clothing and footwear | Manufacture of threads. yarns; fabrics and clothing (33) | 35 | 54 | 36 | 18 | 35.8 | 39 | 53 | 34 | 17 | 35.8 |

(-4) | (+1) | (+2) | (+1) | (0.0) | |||||||

Transport and logistics | Transportation and storage (58) | 2 | 2 | 1 | 3 | 2.0 | 3 | 2 | 1 | 3 | 2.3 |

(-1) | (0) | (0) | (0) | (-0.3) | |||||||

Fresh and processed foods | Oilseed and industrial cultivation (5) | 16 | 29 | 14 | 5 | 16.0 | 18 | 28 | 16 | 4 | 16.5 |

(-2) | (+1) | (-2) | (+1) | (-0.5) | |||||||

Construction | Construction (53) | 5 | 10 | 7 | 28 | 12.5 | 4 | 10 | 8 | 31 | 13.3 |

(+1) | (0) | (-1) | (-3) | (-0.8) | |||||||

Tourism | Accommodation (56) | 49 | 33 | 21 | 51 | 38.5 | 52 | 35 | 20 | 52 | 39.8 |

(-3) | (-2) | (-1) | (-1) | (-1.3) | |||||||

Wood forest products | Production of wood and wood products (36) | 13 | 14 | 29 | 15 | 17.8 | 16 | 13 | 28 | 20 | 19.3 |

(-3) | (+1) | (+1) | (-5) | (-1.5) | |||||||

Vehicles, motor vehicles, and parts | Manufacturing of transportation equipment (48) | 39 | 31 | 21 | 43 | 33.5 | 55 | 30 | 19 | 43 | 36.8 |

(-16) | (+1) | (+2) | (0) | (-3.3) | |||||||

Environmental services | Water collection, purification and distribution; sanitation (52) | 45 | 23 | 39 | 36 | 35.8 | 51 | 37 | 47 | 36 | 42.8 |

(-6) | (-14) | (-8) | (0) | (-7.0) | |||||||

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ramírez-Álvarez, J., Chungandro-Carranco, V., Montenegro-Rosero, N. et al. Central Industries in the Ecuadorian Input–Output Network. An Application of Social Network Analysis. Netw Spat Econ 24, 131–164 (2024). https://doi.org/10.1007/s11067-023-09605-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-023-09605-z