Abstract

Energy and industrial networks such as pipeline-based carbon capture and storage infrastructures and (bio)gas infrastructures are designed and developed in the presence of major uncertainties. Conventional design methods are based on deterministic forecasts of most likely scenarios and produce networks that are optimal under those scenarios. However, future design requirements and operational environments are uncertain and networks designed based on deterministic forecasts provide sub-optimal performance. This study introduces a method based on the flexible design approach and the concept of real options to deal with uncertainties during conceptual design of networks. The proposed method uses a graph theoretical network model and Monte Carlo simulations to explore candidate designs, and identify and integrate flexibility enablers to pro-actively deal with uncertainties. Applying the method on a hypothetical network, it is found that integrating flexibility enablers (real options) such as redundant capacity and length can help to enhance the long term performance of networks. When compared to deterministic rigid designs, the flexible design enables cost effective expansions as uncertainty unfolds in the future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Networked energy and industrial infrastructures, such as district heating systems, pipeline-based carbon capture and storage infrastructures and LNG distribution networks, are often characterized by their long life span and huge societal impact as they are intended to provide essential goods and services for society. They transport a commodity (in this case liquid and/or gas) from one or several sources to one or several sinks. In some cases there are several sources and sinks involved and finding a configuration that maximizes value (e.g. lower cost) for developers is very difficult. In addition, during design exploration stage, not all participating sources and sinks nor the capacities they require are fully known. On the other hand, important decisions such as network architecture have to be made at the early stage and the presence of uncertainties makes this task very challenging.

When designing infrastructure networks under uncertain situations, there are two major systems engineering approaches: robust design and flexible design (de Neufville 2004). The robust design approach is a set of design methods intended to improve the consistency of an engineering system function across a wide range of conditions. One of these methods is robust optimization which aims at finding a solution that is robust or insensitive to the uncertainty considered and is thus an efficient solution practice (Mulvey et al. 1995; Ordóñez and Zhao 2007; Chung et al. 2011). The focus of robust optimization is to search for an optimal network that satisfies a fixed set of objectives such as shortest path and minimum cost (Desai and Sen 2010; Roy 2010; Chen et al. 2013; Tarhini and Bish 2015; Li et al. 2011). The method is widely applied to design infrastructure networks such as pipeline networks (Heijnen et al. 2014; van der Broek et al. 2010) and road networks (Szeto et al. 2013; Li et al. 2015). While optimization for cost is a required objective, a solution that is optimized based on fixed requirements is often found to be rigid and does not perform well when uncertainty is high (Goel et al. 2006; Zhao et al. 2015). On one hand, if future uncertainty turns out to be favorable, it will be difficult to easily expand and modify point-optimized solutions, which will amount to a lost opportunity. On the other hand, if the future turns out to be unfavorable, point-optimized solutions cannot easily be reduced in scale, which will amount to a waste of capital.

Another approach that recognizes and embraces the effect of uncertainty is flexible design (de Neufville and Scholtes 2011). Flexible design approach is a design concept that provides an engineering system with the ability to adapt, change and be reconfigured, if needed, in light of uncertainty realizations. The concept could be of help in the design of networks with the capability to pro-actively deal with uncertainties. In such sense, the concept of flexibility is similar to the concept of real options, which is defined as “the right, but not the obligation, to change a project in the face of uncertainty” (de Neufville 2003). Real options are flexibility enablers that provide capabilities to operationalize flexibility. When real options are embedded in the physical design of the network, they enable network developers to adapt the network in the face of uncertainty by utilizing the upside opportunities and minimizing the downside risks (de Neufville et al. 2006; de Neufville and Scholtes 2011). Moreover, (Cardin et al. 2015) real options analysis provides analytical tools to quantitatively assess the value of flexibility by allowing for objective evaluation of design concepts (de Neufville 2003). Therefore, unlike the robust design approach, which de-sensitizes design to future fluctuations and inherently encourages a reactive response, the flexible design approach is characterized by considering a wide range of possible future scenarios and by taking pro-active actions to mitigate and exploit uncertainty. There are several examples on applications of the flexible design approach in large-scale infrastructure systems (Babajide et al. 2009; Buurman et al. 2009; Deng et al. 2013; Lin et al. 2013; Cardin et al. 2015), thus demonstrating that incorporating flexibility considerably improves life cycle performance of engineering systems.

While the flexible design approach using the concept of real options is philosophically appealing and has been applied to various engineering systems, an efficient and effective flexible design generation and evaluation method is not apparent or readily available in the case of energy and industrial infrastructure networks. Networks have a special character in that they develop in stages and grow from simple to complex networks over several years. Therefore, network development is inherently path dependent. To this end, this article presents a method to systematically integrate flexibility in energy and industrial infrastructure networks based on the real options perspective. The method proposed involves three steps: exploratory uncertainty analysis, design flexibility analysis and sensitivity analysis. The three steps are based on simulation of a graph theoretical network model. The proposed method should be able to provide designers and decision makers with insights, early in the conceptual design stage, into how to design better (in economic value) networks in the face of uncertainty.

The rest of the paper is organized as follows. Section 2 discusses the motivation for applying the real options perspective to design flexible networks by reviewing the relevant literature. Section 3 presents the details of the proposed methodology. In section 4 the proposed methodology is demonstrated on a hypothetical pipeline-based network. Section 5 concludes the paper.

2 Literature Review

2.1 The Real Options Framework for Enabling Flexibility

As pointed out in the introduction section, energy and industrial networks have long life time and the future is more uncertain and difficult to forecast in long-term projects. On one hand, forecasts on long-term projects are ‘always wrong’ in that actual design requirements and the future environment will always vary from what has been anticipated (Flyvjberg et al. 2005). On the other hand, development activities that last long time give network developers considerable scope to decide on the size and timing of investments and to thus optimize and increase the targeted value of the project. The real options concept is based on a rationale that when the future is uncertain there is a value in having the “right, but not the obligation” to adapt future changes without making deterministic early commitments (de Neufville 2003). It provides a systematic framework for designers to make rational (though optional) decisions as to which flexible design elements and specific or combined flexibility types can be incorporated into the engineering system. (Zhao and Tseng 2003) apply the real options concept to the size the foundation of a parking garage when future demand is uncertain. The value of the parking garage with extra sizing includes not only its present value, but also the value associated with the option to add the extra floors (Wang 2006) used the real options concept to define the basic elements of flexibility in hydropower design (de Neufville et al. 2008) used the real options framework to increase the value of transportation systems.

Designing for flexibility involves defining a strategy and an enabler in design and management (Cardin 2014). A strategy represents aspects of the design concept that captures flexibility, or how the network is designed to adapt to changing circumstances. An enabler represents what is done to the physical infrastructure design and management to provide and use the flexibility in operations. In the context of engineering systems enablers are the real options. There are two major types of real options (Wang 2006). Options that involve technical design features are referred to as real options ‘in’ engineering systems and options that involve financial decisions on engineering projects are referred to as real options ‘on’ engineering systems (Wang 2006).

2.2 Identifying Valuable Real Options

Multiple sources of flexibilities (real options) exist in the design and management of infrastructure networks. These real options should be integrated into the network at the early stage of the design process to enhance the value of the network. The task of identification and integration of real options requires exploring and evaluating large sets of potential design configurations by generating different scenarios of uncertain variables. Depending on the scenarios, huge number of design alternatives can be generated. In networks, the temporal and spatial dimensions of future scenarios produce a large number of possibilities of designing the network and implementing flexibility decisions. Therefore, a method that enables designers to generate several initial design architectures before the final detailed design is required.

A set of procedures has been proposed in relation to designing and evaluating flexibility from real options perspectives (Ajah and Herder 2005) presented the adoption of the real options approach in the conceptual design stage of energy and industrial infrastructures, and provided a systematic procedure for real options integration. However, the paper does not provide a clear method on how to identify and screen the real options and how to define the added value of flexibility (Hassan and de Neufville 2006) presented a practical procedure for using real options valuation in the design optimization of multi-field offshore oil development under oil price uncertainty. To manage the large number of possible combinations and fine the optimal configuration a Genetic Algorithm is used. However, the procedure results in an optimal design, which tends to be robust for uncertainties and focuses very much on the value (price) of the options to select designs and only a little on how to identify and integrate the options.

A two-step procedure for identifying real options for offshore multi-oilfield development is presented by (Lin 2008). The procedure involves developing a screening model and a simulation model. The screening model is a non-linear programming, low fidelity model for identifying the elements of the system that seem most promising for options. The simulation model tests the candidate designs from runs of the screening model. It is a high fidelity model whose main purpose is to examine candidate designs under technical and economic uncertainties, the robustness and reliability of the designs, and their expected benefits. Both ways of identifying real options are meant simplifying the task of an early search for the most promising flexible design. More pertinent to our work, in terms of their approach for integrating flexibility, are the methods proposed by (Deng et al. 2013) for urban waste management system and for on-shore LNG production design. At the center of the proposed methods by the two papers is a design flexibility analysis procedure to improve the lifecycle performance of the design under uncertainty. However, both works deal with design problems that do not have network characteristics and do not provide enough insight for the kinds of problems that have spatial and temporal characteristics.

A method for addressing the problem of design under uncertainty for energy and industrial networks is presented by (Heijnen et al. 2014). The method proposed is a novel combination of graph theory and concepts of exploratory modelling for the analysis of most likely paths that maximizes the value of network designs. The method conceptualizes the design as a network problem by which the physical infrastructure is abstracted as consisting of nodes (e.g. producers and/or consumers) and links (e.g. pipelines). It takes into account uncertainty about the participants (participating or not), the location of participants and the capacity they require. The most important utility of the method is that it allows easy and fast assessment of low-regret options and quick re-assessment of these options should new information arrive that narrows down or expands these options. However, the method considers deterministic and discrete scenarios of uncertainty parameters and finds an optimal network configuration for each pre-defined scenario. Moreover, the method does not fully address the stochastic and dynamic nature of uncertainties and most importantly does not address the issue of flexibility: i.e. defining flexible strategies and identifying flexibility enablers.

In summary, a systematic methodology to integrate flexibility based on the concept of real options is missing in network design and management. Building on the network model developed by (Heijnen et al. 2014), this paper expands it by adding a more sophisticated uncertainty analysis and a design flexibility analysis procedures. The details of the method are presented in the next section.

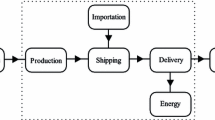

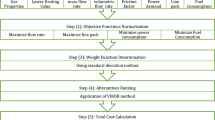

3 Methodology

This paper introduces a method to integrate flexibility in the design of energy and industrial networks. The procedure consists of three concrete steps: exploratory uncertainty analysis, design flexibility analysis and sensitivity analysis. The objective of the proposed method is to enhance the value of networks by identifying and integrating valuable flexibility elements. Figure 1 shows the proposed method.

3.1 Step 1: Exploratory Uncertainty Analysis

This step consists of characterization of major uncertainties, modelling and simulation the network, and design analysis.

3.1.1 Characterization of Major Uncertain Variables

The objective of uncertainty characterization is to model initial distributions and future trajectories of selected uncertain variables. In order to define initial distributions of selected uncertain variables two approaches are often employed: data-driven and an analytical. Data-driven approach requires large quantity of historical data and applies statistical methods (e.g. regression) to fit the empirical model. The analytical approach is more useful in the absence or limitation of full historical data the analytical. It requires making initial estimations on the behavior of uncertain variables (i.e. types of distribution and speed of convergence). The initial estimates are then transformed to a probability distribution, such as a normal distribution, characterized by a vector containing the moments of the distribution (means and variances).

Modelling the future trajectories of uncertain variables requires defining their states over a planning period of the network. The future states can take continuous or discrete behavior. To model continuous behavior, stochastic processes such as Geometric Brownian Motion (GBM) and Wiener processes are often used (Ibe 2013). To model discrete behavior, lattice model can be used (Albanese and Campolieti 2006).

3.1.2 Network Modeling, Simulation and Design Analysis

To generate network design concepts a network model is developed and exploratory simulations of uncertain variables are carried out. In this study a graph theoretical network model (Heijnen et al. 2014) is employed. The model is effective in conceptualizing energy and industrial infrastructures as networks consisting of nodes (e.g. production and/or consumption sites) and links (e.g. pipelines). Monte Carlo simulation of uncertain variables over the network model is carried out to generate multiple network design concepts. The main inputs of the model are the spatial positions of source and sink nodes and flow rate from sources. The outputs of the simulation are minimum-cost tree-shaped network configurations. The resulting network configurations are edge-weighted Steiner minimal tree-shaped networks. An edge-weighted Steiner minimal tree network is a minimum cost network that takes into account the effect on the cost of both the capacity and the length of edges. The details of the graph theoretical network model employed are explained in section 4.2.2.

3.2 Step 2: Design Flexibility Analysis

In this step the concept of flexibility is employed to improve the life cycle performance of network designs selected in step 1. It involves defining flexible strategies, identifying real options to enable these flexible strategies and evaluating designs. Flexible strategies are the actions decision makers can take when a particular path of uncertainties is realized (e.g. expand the capacity of a network if a new participant joins the network in future) (Jablonowski et al. 2011). The actions of decision makers are defined as decisions rules in the network model. The decision rules are triggering mechanisms or “if” statements that specify clearly when flexible strategies will be exercised depending uncertainty realizations (Cardin et al. 2013).

To enable flexible strategies, it is necessary to identify and integrate valuable real options. There are several real options that might lead to flexibility. We listed some of the real options relevant in the context of networks.

-

Option to expand/contract: the option to expand/contract seems useful vis-à-vis the flexibility needs of infrastructure networks as they are often developed in phases. For example, overbuilding the capacity of a large-diameter pipeline in earlier period in order to have the flexibility to accommodate increasing capacity requirements in later period.

-

Option to defer: in the presence of irresolvable uncertainty (at least within the decision time frame) it could be interesting to wait and invest later. This is a typical (wait and see) real option which projects managers exercise often when information about important uncertain variable(s) is not well known.

-

Options to abandon: is it at any point in time possible to abandon the investment? This includes options not to commit further assets.

-

Options to switch: What are the main inputs and outputs of this project? Is it possible to accommodate multiple inputs or outputs so that it is possible to switch later? For example, is the pipeline material able to handle liquid and gas phase substances as required?

The final activity in this step is to evaluate designs with real options. The evaluation helps to determine the cost of implementing real options for the desired flexibility and to decide the appropriate time to exercise the real options. In literature, different kinds of methods are proposed to evaluate real options (de Weck et al. 2004) applied binomial tree approach to obtain the value of real options in stage deployment of communication satellites (Babajide et al. 2009) used decision tree method to evaluate the value of flexibility in oil deployment projects. The binomial approach has limitations in that it assumes path-independency which does not hold in engineering systems and decision tree analysis suffers from intractable computations as the number of decision-making periods and states increases. Recently, simulation based methods are being adopted for valuing flexibility in oil field developments (Lin 2008; Jablonowski et al. 2011), and water management systems (Deng et al. 2013). In this work a simulation approach is adopted as it can be more generally applied, since it has fewer restrictions on the number of time periods and the distribution of uncertainties. Besides, the simulation approach considers decision rules as explicit variables in the modelling framework, so that the model itself can be more easily modified to capture more diverse design configurations.

3.3 Step 3: Sensitivity Analysis

In this step, sensitivity analysis is performed in order to examine how the results obtained following the above steps respond to changes in underlying assumptions. This step can be seen as a way to test the robustness of the design alternatives in response to the variation that may happen to the assumptions. There are standard mathematical (Czitrom 1999), statistical (Saltelli et al. 2000) and graphical (Canon and McKendry 2002) methods to perform sensitivity analysis. These sensitivity analysis methods can be carried out on global or local variables. One-factor-at-a-time method (Czitrom 1999), which addresses the parameter sensitivity relative to the point estimates chosen for the parameters held constant, is used in this work. The one-factor-at-a-time method is more convenient than the other methods because it enables to analyze the effect of one parameter on the dependent variable at a time by keeping other parameters constant.

4 Application

This section demonstrates the proposed simulation framework by applying it on a hypothetical pipeline based network. The hypothetical case is inspired from an initiative to collect carbon from distributed emitters using pipeline network in Rotterdam area, the Netherlands. However, the case could represent any network consisting multiple sources and a single sink such as district heating networks and (bio)gas networks to mention a few.

4.1 Description of the Design Problem

The hypothetical field has three sources S1, S2 and S3 and one sink S0. Figure 2 shows the position of the three sources and the sink on a 60 by 60 Km field. The objective is to build a pipeline network which transports material XFootnote 1 from supply points (sources) to a single demand point (physical sink). The design problem takes the perspective of a private developer whose objective is to make profit by connecting the spatially distributed sources to a sink. During the design exploration phase the future flow rates of existing sources and the capacities they require are uncertain. Moreover, the timing and flow rate of future sources is also uncertain. For example, in carbon capture networks, connected emitters increase their CO2 capture targets with time. Moreover, most carbon capture networks are expected to expand by adding more emitters in the future.

The demonstration tries to answer the following design questions that could be asked by network designers and network developers.

-

1.

What is the most cost-effective strategy for phasing the network to meet increasing flow from existing and future sources?

-

2.

How to strategically design the network to be able to coordinate the capacities of source facilities, pipelines, and the sink as the network expands over time with new sources joining the network?

-

3.

Is overbuilding capacities with large-diameter pipeline early in the design in order to accommodate future flow increase from sources making economic sense?

-

4.

Is it worthy to wait a new source to join the network and for how long?

The objective of this work is then to design networks that provide enhanced value for the investor given the uncertainty in flow rate from existing sources and future new sources.

In order to answer the above questions we specify the design problem scenario such that S2 and S3 are existing sources and S1 will join at some unspecified future time. The economic lifetime of the network is limited to 10 years. The rest of this demonstration is to apply the methodology proposed in the previous section with the aim to design a network that provide enhanced value for the investor given the uncertainty (1) in flow rate from existing sources (i.e. S2 and S3); and (2) timing and flow rate of the future new source (i.e. S1).

4.2 Step 1: Exploratory Uncertainty Analysis

The objective of this step is to model the major uncertainties and explore their effect on the performance of design alternatives. In this study we focus on two major uncertainties: (1) stochastic behavior of flow rate from existing sources, hereafter called flow uncertainty, and (2) the uncertainty in new source(s) that may join the network in the future called participant uncertainty. Flow uncertainty represents flow rate changes from existing sources over the economic lifetime of the network, for example, increase in capture targets from CO2 emission sources. Participant uncertainty represents the uncertainty in the timing of new sources and their flow rates.

4.2.1 Characterization of Major Uncertainties

Flow Uncertainty

Flow uncertainty is due to the stochastic nature of volume flow rates of sources over the life time of the network. An evolutionary path of volume flow rate over time is an external variable that can influence the capacity of the pipe required for connecting a source. It could vary with time given the long life time of such projects. For example, flow from a CO2 producing power plant may increase due to stage-wise increases in emission reduction targets; and flow from a bio-gas producing field could decease due to reduction of substrate. Flow uncertainty model is used to generate possible future trajectories of volume flow rates from sources. First, the flow behavior of the three sources at a given instant in time is modelled using a normal distribution. Initial flow estimates of sources are:

-

S1: mean 100 m3 tone/year and standard deviation 20 m3 tone/year.

-

S2: mean 400 m3 tone/year and standard deviation 100 m3 tone/year.

-

S3: mean 350 m3 tone/year and standard deviation 70 m3 tone/year.

Next, Geometric Brown Motion (GBM) process is used to model the evolution of flow rate from the three sources over an investment period life time of 10 years. Initial values are taken by randomly sampling from the initial. To generate the evolutionary paths the expected drift rate of 1 % and volatility of 30 % are assumed for all the three sources. In each simulation, the GBM model produces future flow evolution volume flow rate values. Figure 3 shows initial flow estimate model of the three sources and one instance of the future flow rates of the three sources over a 10 year time period. The sink is assumed to have significant capacity to absorb all flows from existing as well as future new sources.

Participant Uncertainty

Participant uncertainty represents the uncertainty arising from new source(s) that may join the network in the future. The uncertainty originates from two dimensions: spatial and temporal. Spatially, the new participant could assume any geographical position relative to the existing network. Temporally, the new source could join the network at any time within the technical life time of the network. For designers, both dimensions of participant uncertainty could result in infinite possibilities of network configuration alternatives. As a result, the identification and evaluation of design options is extremely difficult, if not computationally intractable. For simplification, we assume that the new participant will be S1 and this will avoid the spatial uncertainty. With this simplification the uncertainty will be in the time S1 will join the network.

Figure 4 shows 3 instances (years 3, 5 and 7) of the flow evolutionary path of S1. It represents a model of the uncertainty in the year S1 may be connected to the network. The objective is to explore for value maximizing configuration of the network if S1 does not exist at the beginning but appear after sometime within the 10 years period.

4.2.2 Network Modelling

As indicated in the methodology section, in this study we developed a network model based on the concept of graph theory. In a graph theory representation of networks, sources and sinks are nodes (e.g. bio-gas fields and gas consumption sites) and their connections are edges (e.g. pipelines). To determine the investment cost of the network the model uses flow-dependent model, as in (Heijnen et al. 2014). Hence, to generate a minimum-cost edge-weighted Steiner minimal network, the network algorithm uses the following cost function of edges as in.

In Eq. 1, le is the length and \( {q}_e \) is the capacity of an edge e. β is the cost exponent for the capacity with \( 0\le \beta \le 1. \) If \( \beta =0 \), the capacity of the pipelines has no influence on the cost. If \( \beta =1 \), building two pipelines of capacity 1 is just as expensive as building one pipeline of capacity 2. A value of \( \beta =0.6 \) is commonly used (Heijnen et al. 2014), indicating that there are economies of scale to building high-capacity pipelines. Then, the total investment cost \( C(T) \) of a network \( T \) is sum of all connection costs as given in Eq. 2.

where \( E(T) \) is the set of all edges in a network tree \( T \).

In addition to cost, it is also necessary to calculate the expected income of the network. A revenue model that calculates the expected income as a linear function of capacity required by the source is used. The assumption is that the network developer generates income by charging a certain fee per unit capacity. The expected income (\( EI \)) from a network \( T \) is then given as:

In Eq. 3, \( {q}_i \) is the used capacity by a source i in a network \( T \), V(T) is the set of all nodes in the network T, s is the sink and α is the constant coefficient representing, for instance, a constant fee per a unit volume of liquid/gas charged by the network developer. In this demonstration we assumed \( \alpha =1 \) (see section 4.4 for a sensitivity analysis with varying α).

The total income from a given network in its life time is calculated as a summation of discounted yearly income flows over the 10 years period. The interest rate of r = 8 % is used for this demonstration. The sum of the discounted cash flows is the present value of income (\( PVI \)).

The life time performance of a network under a given scenario of an uncertain parameter is evaluated using the Net Present Value (NPV) metric.

4.2.3 Monte Carlo Simulation and Design Analysis

In this section, Monte Carlo simulation of the network model is carried out by varying flow scenarios. Given the low flow rate from S1 at the beginning and the uncertainty in the time it may join the network, the following two design strategies are proposed: committing design strategy (CDS) and abandoning design strategy (ADS). Under the CDS the network will be designed by connecting all the three sources and in the case of ADS the decision is to connect S2 and S3 only by abandoning S1. The inputs of the model are yearly flow rate values from each sources over 10 year period and the spatial position of the sources and the sink. The simulation results in minimum-cost tree-shaped network configurations connecting source nodes to the sink.

Figure 5 (left) and Fig. 6 (left) show density diagrams of 10 network configurations based on a single flow evolutionary path (scenario) under CDS and ADS respectively. Each network configuration is an edge-weighted Steiner tree generated by taking flow rate values at each year of a single flow evolutionary path. The simulation outputs provide designers a better insight into what would be the optimal configuration of the network, not only based on the values of design variables at the time of design but also in multiple future stages.

However, in practice networks are path-dependent, i.e. the state of a given network at later stage is dependent on the decisions made in earlier stage. Network developers will not build one network in year 1 and another network in years after that. Then, the question becomes, how to select the network that provide maximum value over a given scenario?

One way to select the network that maximizes value among several design alternatives is to use a preliminary economic evaluation technique the Present Worth Ratio (PWR), as in (Heijnen et al. 2014). The PWR illustrates the efficiency in the invested capital by taking into account the investment cost and the expected revenue of a network over a fixed period of time.

Figure 5 (right) and Fig. 6 (right) show the network that maximizes value out of the 10 configurations under CDS and ADS respectively. The thickness of edges indicates their capacity. Monte Carlo simulations of the network model results in multiple value maximizing networks and their respective economic performances (i.e. cost and PWR values). 200 different flow path scenarios are simulated resulting 200 optimal networks for each design strategy. Then, the value maximizing network with a highest PWR is selected. This step is used to screen network design alternatives that make economic sense given the future evolution of flow. It serves a preliminary design exploration step by simulating different uncertain scenarios. Exploring multiple design concepts using multiple scenarios provides decision makers with a better insight into the effects of uncertainty compared to a deterministic design based on a single scenario or a few pre-defined scenarios.

Once the networks with the highest PWRs are selected for both design strategies, their life-time economic performances are evaluated over multiple uncertain scenarios. Net Present Value (NPV) metric is used to evaluate the economic performance in this study. 200 Monte Carlo simulation runs were carried out to compare the economic performance of both design strategies. The 200 NPVs of both design strategies are plotted as cumulative distributions, or also known as target curves, see Fig. 7. Moreover, from NPVs of each design strategy, the corresponding expected net present values (ENPVs) are calculated. The ENPV is the most likely NPV (i.e. NPV at 50 % probability in the cumulative distribution curve) calculated by probability-weighting NPVs. The two design strategies are also compared using other economic metrics as shown in Table 1. For the purpose of comparison, the NPVs of the two designs are normalized against the expected net present value (ENPV) of the abandoning design strategy.

From Fig. 7 and Table 1 it is clear to see that the committing design strategy results in a better NPV than the abandoning design strategy. The value enhancement suggests that the revenue obtained from S1under the committing design strategy outweighs the avoided cost of connecting S1 under the abandoning design strategy. Even though abandoning design strategy helps to avoid revenue risk due to the low flow rate of S1 at the early years, it loses the opportunity that may be obtained due to future flow rate increases. However, this conclusion is only valid under flow uncertainty. Under participant uncertainty abandoning design strategy is the only realistic solution of the two strategies. If the network is developed based on abandoning design strategy and a new source wants to join after some years, then the design will not be able to accommodate it. The only possibility is to make a connection directly to the sink. In such a case, the cost will increase and the overall performance of the network will even further decrease.

In addition to NPV (ENPV, minimum NPV and maximum NPV), Capital expenditure (CAPEX) can provide valuable insight during decision making. For example, the NPV of the network under CDS is higher than ADS. However, ADS requires a lower CAPEX than CDS and that can be a factor in decision making.

4.3 Step 2: Flexibility Analysis

The objective of this step is to further enhance the life time performance of the network given the two uncertainties defined in step 1. It involves defining flexible strategies, identifying real options to enable these flexible strategies and evaluation of designs with real options. A stage-wise development of the network with expansion options is defined as a flexible design strategy (FDS).

4.3.1 Identification of Real Options

To enable the flexible design strategy two real options are identified: expansion option to accommodate future flow increases from all sources and an option to delay the connection of S1. The two real options enable the network to pro-actively manage flow and participant uncertainties. If S1 exists but its flow rate remains low in the future delaying its connection could be valuable. If S1 exists and its flow rate increases in the future or if S1 does not exist at the beginning but appear later in the future the expansion option could be valuable. The expansion option is made possible by embedding redundancy in the length and capacity of the network. Having the expansion option may require more initial capital but could give the network manager the right to accommodate future connection of S1 at lower overall cost.

Figure 8 (left) shows 10 different layouts of the network connecting the three source points with the sink. It can be seen that S1 is not connected to the network all the time. The simulation showed that connecting S1 is not worthwhile before year 5 given its low flow rate. One strategy to design the network is to start by connecting S2 and S3 with an option to connect S1 in the future. We call this strategy as the flexible design strategy. Figure 8 (right) shows the layout of the network under the flexible design strategy. A dotted line is used between node S1 and node J1 to represent future connection of S1. Real options are embedded in the network by committing large-size pipes between nodes S0 and J2, i.e. laying out line J1-J2-S2 instead of J2-S2. Both options require extra pipe capacity on line J2-J1 and extra length (i.e. the difference between J2-J1-S2 and J2-S2). Real options can also be considered in line S2-J1 and S3-J2 by having extra capacity to handle future flow rate increases. When the flow from S1 makes an economic benefit the developer can build the pipeline J1- S1. The redundant pipeline capacities and lengths embedded in the network enable the network developer to exercise stage-wise expansion strategy.

4.3.2 Design Evaluation

The performance of the three design strategies is evaluated using flow and participant uncertainty scenarios define in step 1. NPV is used to compare the performance of the three design strategies. 200 Monte Carlo simulations are carried out resulting in 200 NPVs for each design strategy. Then, target curves are plotted based on the 200 NPVs. Moreover, from NPVs of each design strategy, the corresponding expected net present values (ENPVs) are calculated. The ENPV is the most likely NPV (i.e. NPV at 50 % probability in the cumulative distribution curve) calculated by probability-weighting NPVs. In addition to ENPV, decision makers also use capital expenditure (CAPEX) to evaluate design strategies. Table 2 shows ENPV and CAPEX of the three design strategies.

Under Flow Uncertainty

From Fig. 9 and Table 2 it can be seen that the flexible design strategy performs much better than the two rigid design strategies. The sources of improvement in performance are from the flexibility that enabled by the real options built in the edges and lengths of the flexible design strategy. The real options help to reduce down side risks such as commitment to big pipeline capacity when flow from S1 is low. They also help to capitalize on the upside opportunity when the flow from S1 increases. Therefore, the improvement in performance of the flexible design strategy when compared to the other two design strategies can be considered as the value of the real options (\( VoRO \)). The value of the real options is calculated by subtracting the ENPV of the rigid design strategies from the flexible design strategy, see Eq. 7. Appendix shows how cost and revenue are calculated to decide the value of real options.

From Table 2 it can be seen that the flexible design requires a lower initial CAPEX when compared to the committing design strategy but a higher initial CAPEX when compared to the abandoning design strategy. The committing design strategy is the most expensive of the three. Initial CAPEX could be an important factor when evaluating designs and the flexible design strategy reduces costly initial commitments when uncertainty about the future flow evolution of S1 is higher.

The initial CAPEX of ADS is comparatively smaller than the other two design strategies largely due to the fact that there is no connection to S1. Even though, the strategy minimizes investment cost in the early years compared to the CDS and FDS, it loses significant revenue from future increases in flow rate of S1. However, in ADS S1 may join the network when information about S1 is known. However, under such scenario connecting S1 requires building dedicated pipeline directly to sink. As a result of such practice, the network could provide much inferior value when compared to the FDS and the CDS.

Under Participant Uncertainty

The time a new participant could join the network has an effect on the value of the overall network. A comparison is made between the FDS and ADS, as the CDS is not realistic solution, in this case. The analysis is carried out for scenarios on which the new source (S1) joins the network in years 3, 5 and 7. The performance of the two design strategies is shown using cumulative probability distribution of NPV, see Fig. 10.

It can be seen from Fig. 10 that the ENPV of the FDS is higher than the ADS in each of the three scenarios. However, the superiority of FDS over ADS diminishes as the time for connecting S1 is delayed. The curve below P50 (i.e. the lower half of the target curve) shows that the risk of FDS increases faster than the risk of ADS if the connection to S1 is further delayed from Y5 to Y7. In such cases, it does not make economic sense to build a real option that can be exercised only after a long period of time as the value of the option diminishes with time.

In real pipeline network design, decision regarding the time period to consider extra capacity to accommodate future new sources is called ‘no-regrets-period’. The ‘no-regrets-period’ depends on the profitability of the fluid flowing through the network and varies from one case to another. In carbon capture networks, the ‘no-regrets-period’ for having redundant pipe capacity extends up to 10 years based on the current CO2 price (Austell et al. 2011). In natural gas networks, the ‘no-regrets-period’ can extend beyond 15 years.

The analyses of the design strategies under flow uncertainty and participant uncertainty show that there are values to be gained from flexibility. Mainly, there are two flexibility enablers (real options) that can built in the physical design. The first is the extra diameter in edges, required for accommodating future flow rate increases from existing sources and new connections. The second is the extra length that is built in the configuration. These real options anticipate increases in flow rate from existing sources that are not financially feasible to connect at the beginning due to their low flow rate and from new sources that could join in the future. Flexibility would not be possible if designers do not plan and embed those real options at the early stages of the design process.

4.4 Step 3: Sensitivity Analysis

In this step sensitivity analysis is carried out to examine how the three design strategies depend on assumptions. Specifically, the sensitivity of the performance of the three design strategies to the connection fee (α) and the initial flow estimate are considered.

4.4.1 Sensitivity to the Connection Fee

The connection fee value is varied to check its effect on the performance of the flexible design compared to the rigid designs. The connection fee is the amount paid by sources per unit capacity. In other words the connection fee is the price that is charged by the network developer. Figure 11 shows the relative performance (in terms of NPV) of the three design strategies at various connection fee values. The network model is simulated 200 times for each connection fee values. For the purpose of comparison the NPVs of the three designs are normalized against the ENPV of the abandoning design strategy at α = 1.

Figure 11 it is clear to see that the difference between the flexible design strategy and the abandoning design strategy increases when the connection fee increases. The cause of this relationship is mainly due to the increase in revenue as α has a linear relationship with revenue. At low α the difference between the committing design strategy and the abandoning design strategy becomes negative. The negative value implies that, as the connection fee decreases, the abandoning design strategy becomes more valuable than the committing design strategy for the network developer. On the other hand, the flexible design strategy performs better than the abandoning design strategy on all α values. However, as α decreases the difference between the flexible design strategy and the abandoning strategy decreases. Another observation from Fig. 11 is that the difference between the flexible and the committing design strategies decreases when the connection fee increases. The decreasing trend is due to the fact that as α increases its effect on the revenue increases. That means the value of early commitment increases with increasing α.

4.4.2 Sensitivity to Initial Flow Estimate

In this section the effect of initial flow estimates is analyzed. Specifically, the mean value of S1 is varied as S1 is used to make the case for uncertainty analysis in previous steps (low flow rate in case of flow uncertainty and new source in case of participant uncertainty). As the abandoning design strategy does take into account S1, the analysis is focused on the flexible and the committing design strategies. The analysis carried out for flow uncertainty and participant uncertainty.

Figure 12 shows the performance of the flexible and the committing design strategies versus the mean value of S1. It is clear to see that both design strategies increase with increasing mean value of S1. This is due to the linear relation between flow rate and revenue. Up to a mean value of 400 m3 tone/year, the flexible design strategy performs better than the committing design strategy. However, above 400 m3 tone/year the committing design strategy appears to be better than the flexible design strategy. The above observations indicate that at higher mean value of S1 early commitment is valuable than investing on real options.

One the other hand, one can expect that the abandoning design strategy to have constant value since there is no connection to S1. However, the lost opportunity due to a potential increase in flow rate of S1 or avoided risk due to low flow rate from S1 by the abandoning design strategy can be implicitly inferred by comparing it against the other two design strategies. If the mean value of S1 increases, then the opportunity lost by the abandoning design strategy increases. Conversely, if the mean flow of S1 decreases the risk avoided by the abandoning design strategy increases and at much lower mean value, the abandoning strategy can become better than the committing strategy.

The effect of the initial estimate is very strong for the case of participant uncertainty. Figure 13, shows the effect of initial mean value of S1 on the performance of the flexible and the abandoning design strategies. The performance of the flexible strategy compared to the abandoning strategy largely depends on the time S1 is connected. If S1 joins the network early in the investment period, the value of the flexible strategy increases or decreases proportional to the mean value of S1. Conversely, if S1 joins the network later in the investment period, the value of the flexible design strategy diminishes with increasing mean value of S1. For instance, if S1 joined the network in year 7, the flexible strategy provides inferior value compared to the abandoning strategy. The cost of having the real options for flow rate of 500 m3 tone/year is higher than the cost for 100 m3 tone/year. At higher flow rate, the size of extra capacity to accommodate flow increases will be larger. Moreover, as shown in Fig. 10, the value of having the real options would be higher if S1 joins the network at year 3 than at year 7. As a result, the value of the option with higher initial flow rate at year 7 becomes lower than with lower initial flow rate. On the other hand, the performance of the abandoning design strategy is the same as it does not depend on S1. Therefore, at year 7, the difference between the flexible design strategy and the abandoning design strategy decreases with increasing initial flow rate of S1.

5 Conclusions

This paper introduces a method to enhance the value of networks by identifying and integrating flexibility enablers under uncertainty. In the paper, we argued that one way to design flexible networks is to adopt a real options-based design approach. The proposed method uses a graph theoretical network model to carryout out exploratory uncertainty analysis of design alternatives. The aim of the exploratory analysis is to screen out promising design concepts out of several alternatives. Once candidate designs are selected, design flexibility analysis is carried out to improve the life cycle performance of networks by considering uncertainties. The design flexibility analysis uses the concept of real options to enhance the value of the network. The proposed design approach contrasts with the typical design and planning approach which tends to focus on pre-defined requirements and often leads to inflexible and sub-optimal networks.

Using a hypothetical pipeline-based network for demonstration purposes, the method provides valuable insights to designers and decision makers on how to design flexible networks under capacity and participant uncertainty. We found out that building higher pipe capacity is valuable if flow rate increases from existing sources and/or if new sources join the network in the future. Moreover, the proposed method could provide valuable insight into which parts of the network should designers include real options. Results reveal that physically built-in capabilities, such as extra pipe capacities and lengths, provide easy and cost-effective expansion option of the network when compared with a deterministic design approach.

The procedure introduced in this study generally can be applied to most pipeline-based network design problems including natural and bio gas pipeline networks, water distribution networks and district heating networks. However, different networks are subject to distinct costs and benefits and faced with their respective sources of uncertainties; as a result, details of modelling and computation may need to be adjusted to suit the particular network at hand.

Future works in this research include expanding the network model to multiple sources and multiple sinks, cases other than pipelines such as electricity transmission lines which have a different governing physics. Moreover, the utility of the proposed method could be further increased by applying it on real case studies, and by taking into consideration no-go areas such as parks and residential areas.

Notes

By material we mean flowing matter in gas or liquid state.

References

Ajah AN, Herder PM (2005) Addressing flexibility during process and infrastructure systems conceptual design: real options perspective. IEEE, WaiKoloa, pp 3711–3716

Albanese C, Campolieti G (2006) The binomial lattice model. In: Advanced derivatives pricing and risk management: theory, tools and hands-on programming application. Elsevier Academic Press, London, p 337–348

Austell M et al (2011) Development of large scale CCS in The North Sea via Rotterdam as CO2-hub, WP 4.1 Final report, s.l.: EU CO2 Europipe Consortium

Babajide A, de Neufville R, Cardin M-A (2009) Integrated method for designing valuable flexibility in oil development projects. Soc Pet Eng 4:3–12

Buurman J, Zhang S, Babovic V (2009) Reducing risk through real options in systems design: the case of architecting a maritime domain protection system. Risk Anal 29(3):266–379

Canon AJ, McKendry IG (2002) A graphical sensitivity analysis for statistical climate models: application to Indian Monsoon Rainfall prediction by artificial Neural Networks and Multiple Linear Regression. Int J Climatol 22(13):1687–1708

Cardin M-A (2014) Enabling flexibility in engineering systems: a taxonomy of procedures and a design framework. J Mech Des 136(1):1–14

Cardin M-A et al (2013) Emperical evaluation of procedures to generate flexibility in engineering systems and improve lifecycle performance. Res Eng Des 24(3):277–295

Cardin M-A, Ranjbar-Bourani M, de Neufville R (2015) Improving the lifecycle performance of engineering projects with flexible strategies: example of on-shore LNG production design. Syst Eng 18(3):253–268

Chen BY et al (2013) Finding reliable shortest paths in road networks under uncertainty. Netw Spat Econ 13(2):123–148

Chung BD, Yao T, Xie C (2011) Robust optimization model for a dynamic network design problem under demand uncertainty. Netw Spat Econ 11(2):371–389

Czitrom V (1999) One-factor-at-a-time versus designed experiments. Am Stat 53(2):126–131

de Neufville R (2003) Real options: dealing with uncertainty in systems planning and design. Integr Assess 4(1):26–34

de Neufville R (2004) Uncertainty managment for engineering systems planning and design. Monograqph: Engineering System Symposium, MIT, Cambridge

de Neufville R, Scholtes S (2011) Flexibility in engineering design. MIT Press, Cambridge

de Neufville R, Scholtes S, Wang T (2006) Real options by spreadsheet: parking garage case example. J Infrastruct Syst 12(2):107–111

de Neufville R, Hodota K, Sussman J, Scholtes S (2008) Real options to increase the value of intelligent transportation systems. Transp Res Rec 2086:40–47

de Weck O, de Neufville R, Chaize M (2004) Staged deployment of communications satellite constellations in low earth orbit. J Aerosp Comput Inf Commun 1(4):119–136

Deng Y et al (2013) Valuing flexibilities in the design of urban water managment systems. Water Res 47:7162–7174

Desai J, Sen S (2010) A global optimization algorithm for reliable network design. Eur J Oper Res 200:1–8

Flyvjberg M, Holm M, Buhl S (2005) How (in)accurate are demand forecasts in public works projects? The case of transportation. J Am Plann Assoc 71(2):131–146

Goel V, Grossmann IE, El-Bakry AS, Mulkay EL (2006) A novel branch and bound algorithm for optimal development of gas fields under uncertainty in reserves. Comput Chem Eng 30:1076–1092

Hassan R, de Neufville R (2006) Design of engineering systems under uncertainty via real options and heuristic optimization. Real Options Conference, New York

Heijnen PW, Ligtvoet A, Stikkelman RM, Herder PM (2014) Maximising the worth of nascent networks. Netw Spat Econ 14(1):27–46

Ibe OC (2013) Markov processes for stochastic modeling, 2nd edn. Elsevier Inc., London

Jablonowski C, Ramachandran H, Lasdon L (2011) Modeling facility-expansion options under uncertainty. Soc Pet Eng 6(4):239–247

Li M, Gabriel SA, Shim Y, Azarm S (2011) Interval uncertainty-based robust optimization for convex and non-convex quadratic programs with applications in network infrastructure planning. Netw Spat Econ 11(1):159–191

Li T, Wu J, Sun H, Gao Z (2015) Integrated co-evolution model of land use and traffic network design. Netw Spat Econ: 1–25

Lin J (2008) Exploring flexible strategies in engineering systems using screening models. Massachusets Institute of Technology, Cambridge

Lin J, de Weck O, de Neufville R, Yue HK (2013) Enhancing the value of offshore developments with flexible subsea tiebacks. J Pet Sci Eng 102:73–83

Mulvey JM, Vanderbei RJ, Zenois SA (1995) Robust optimization of large scale systems. Oper Res 43(2):264–281

Ordóñez F, Zhao J (2007) Robust capacity expansion of network flows. Networks 50(2):127–180

Roy RK (2010) A primer on the taguchi method, 2nd edn. SME, Dearborn

Saltelli A, Chan K, Scott M (2000) Senstivity analysis: gauging the worth of scientific models, 1st edn. Wiley, New York

Szeto WY, Jiang Y, Wang DZ, Sumalee A (2013) A sustainable road network design problem with land use transportation interaction over time. Netw Spat Econ 15(3):791–822

Tarhini H, Bish DR (2015) Routing strategies under demand uncertainty. Netw Spat Econ: 1–21

van der Broek M et al (2010) Designing a cost-effective CO2 storage infrastructure using a GIS based linear optimization energy model. Environ Model Softw 25:1754–1768

Wang T (2006) Real options “in” projects and systems design: identification of options and solutions to path dependency. Dissertation, Massachusets Institute of Technology: Cambridge

Zhao T, Tseng C-L (2003) Valuing flexibility in infrastructure expansion. J Infrastruct Syst 9(3):89–97

Zhao F et al (2015) Population-driven urban road evolution dynamic model. Netw Spat Econ: 1–22

Acknowledgments

Yeshambel Melese has been awarded an Erasmus Mundus Joint Doctorate Fellowship. The authors would like to express their gratitude towards all partner institutions within the program as well as the European Commission for their support. The authors would also like to thank all the anonymous NETS reviewers whose comments greatly help to improve this work.

Author information

Authors and Affiliations

Corresponding author

Appendix: Cost and Revenue calculations

Appendix: Cost and Revenue calculations

Investment cost and revenue calculation is required for making decisions weather to make a connection to a given source or not.

1.1 Cost Calculation

If a connection to S1 is delayed to year t, the present value of the cost of building the network is the summation of the cost of edges in year 1 and the discounted value of the cost for connecting S1 at year t as shown i’n Eq. A.1.

where y stands for year, \( C{(T)}_{y=1} \) is the summation of the costs of edges in year 1, and \( {C}_{y=t} \) is the cost of pipeline from S1 to junction point j1 at time of connection t. \( C{(T)}_{y=1} \) and \( {C}_{y=t} \) are mathematically expressed as follows:

1.2 Expected Revenue Calculation

Revenues are calculated as the product of the volume flow rate and the price per volume flow rate. The price could also be the service charge (e.g. connection fee) for a unit pipe capacity required for connection. Revenues are calculated every year and discounted to a present value using a discount rate of \( r \). The summation of the discounted revenues from all sources over investment time of the project gives the expected revenue of the network, \( Er \).

where \( {\mathrm{F}}_t \) is the summation of flow rates from all existing sources.

As noted, the decision rule checks if the connection to S1 is worthy by comparing the cost incurred for enabling connection of S1 (summation of cost of the edge from junction point to S1 and the extra cost of pipeline from junction point to the sink to accommodate S1) with the expected revenue from S1. If the expected revenue from S1 is greater than the cost for its connection, then S1 will be connected. However, if the flow is small in early years, a case for differing the connection to S1 may be relevant. This means that the algorithm has to check for delaying and abandoning strategies. In the cases of delaying strategy, the algorithm checks for building real options in the capacity and the length of the pipe. This requires calculating the cost of the options and comparing it against the expected revenue from S1. The cost of taking real options for enabling the network to be flexible for future connections and increases in flow rate is given as:

where \( {C}_{option} \) is the cost of the option.

The expected revenue from S1 (\( {Er}_{s1}\Big) \) is calculated as

where \( {F}_{s1} \) is the flow from S1.

If the expected revenue is greater than the cost of the real option built in, the algorithm results in a network configuration with an option for future expansion. If the delaying strategy is not worthy, the algorithm will choose the abandoning strategy. That means:if \( {C}_{option}>{(Er)}_{s1} \), do not built an option, else if \( {C}_{option}<{(Er)}_{s1} \), build the option.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Melese, Y.G., Heijnen, P.W., Stikkelman, R.M. et al. An Approach for Integrating Valuable Flexibility During Conceptual Design of Networks. Netw Spat Econ 17, 317–341 (2017). https://doi.org/10.1007/s11067-016-9328-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-016-9328-8