Abstract

The U.S. Geological Survey National Minerals Information Center (NMIC) is the U.S. Government agency tasked with the collection, analysis, and dissemination of information on the production, consumption, import, export, and other measures of the flows of non-fuel mineral commodities of importance to the U.S. economy and national security. The NMIC and its agency predecessors have maintained a database of this information, collected and published annually, dating back to the beginning of the twentieth century. Time series analysis of annual information from the NMIC provides the opportunity to identify trends in the supply chains of the minerals and metals which are increasingly in demand for advanced technologies. The identification of trends in data for net import reliance, country concentration of production, global demand, price volatility, and other measures, when combined with world governance indicators, can be used to focus attention on individual mineral commodities where supply chain restrictions may develop. Specific examples for U.S. net import reliance, global tantalum primary mining, and mineral criticality screening are presented to illustrate the utility of time series analysis of trends in mineral commodity supply and demand, the types of data required, and the limitations of currently available information.

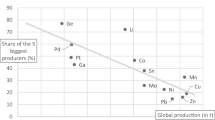

Modified from U.S. Geological Survey (2017)

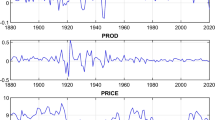

Modified from (Bleiwas et al. 2015)

Similar content being viewed by others

References

Abraham, D. (2015). The elements of power: Gadgets, guns, and the struggle for a sustainable future in the rare metal age. New Haven: Yale University Press.

Bleiwas, D. I., Papp, J. F., & Yager, T. R. (2015). Shift in global tantalum mine production, 2000–2014. U.S. Geological Survey Fact Sheet 2015–3079. doi:10.3133/fs20153079.

Brininstool, M. (2014). Copper. In Mineral commodity summaries 2014 (pp. 48–49). Washington: U.S. Geological Survey. https://minerals.usgs.gov/minerals/pubs/mcs/2014/mcs2014.pdf.

Brininstool, M. (2017). Copper. In Mineral commodity summaries 2017 (pp. 54–55). doi:10.3133/70180197.

Chasan, E. (2015). “Conflict minerals” prove hard to trace. The Wall Street Journal. 4 August (p. B4).

Erdmann, L., & Graedel, T. E. (2011). Criticality of non-fuel minerals: A review of major approaches and analyses. Environmental Science and Technology, 45, 7620–7630.

Fortier, S. M., De Young, J. H., Sangine, E. S., & Schnebele, E. K. (2015). Comparison of U.S. net import reliance for nonfuel mineral commodities—A 60-year retrospective (1954–1984–2014). U.S. Geological Survey Fact Sheet 2015–3082. doi:10.3133/fs20153082.

Gambogi, J. (2017a). Rare earths. In Mineral commodity summaries 2017 (pp. 134–135). doi:10.3133/70180197.

Gambogi, J. (2017b). Scandium. In Mineral commodity summaries 2017 (pp. 146–147). doi: 10.3133/70180197.

Graedel, T. E., & Reck, B. K. (2015). Six years of criticality assessments: What have we learned so far? Journal of Industrial Ecology, 20, 692–699.

Jaskula, B. W. (2017). Gallium. In Mineral commodity summaries 2017 (pp. 64–65). Washington: U.S. Geological Survey. https://minerals.usgs.gov/minerals/pubs/mcs/2017/mcs2017.pdf.

Kelly, T. D., & Matos, G. R. (2014). Historical statistics for mineral and material commodities in the United States. U.S. Geological Survey Data Series 140. https://minerals.usgs.gov/minerals/pubs/historical-statistics/.

Kharas, H., & Gertz, G. (2010). The new global middle class: a crossover from west to east. In C. Li (Ed.), China’s emerging middle class: Beyond economic transformation (pp. 32–54). Washington, DC: The Brookings Institution.

Marscheider-Weidemann, F., Lankau, S., Hummen, T., Erdmann, L., Angerer, G., Marwede, M., & Benecke, S. (2016). Summary: Raw materials for emerging technologies 2016. Berlin: DERA Rohstoffinformationen 28.

Meinert, L. D., Robinson, G. R., Jr., & Nassar, N. T. (2016). Mineral resources: Reserves, peak production and the future. Resources, 5(1), 14. doi:10.3390/resources5010014.

National Research Council. (2008). Minerals, critical minerals, and the U.S. economy. Washington, DC: The National Academies Press.

Olson, D. (2017). Graphite (natural). In Mineral commodity summaries 2017 (pp. 74–75). Washington: U.S. Geological Survey. https://minerals.usgs.gov/minerals/pubs/mcs/2017/mcs2017.pdf.

Papp, J. F. (2014). Conflict minerals from the Democratic Republic of the Congo—Global tantalum processing plants, a critical part of the tantalum supply chain. U.S. geological survey fact sheet 2014–3122. https://pubs.usgs.gov/fs/2014/3122/.

Polyak, D. (2017). Molybdenum. In Mineral commodity summaries 2017 (pp. 112–113). doi:10.3133/70180197.

Subcommittee of Critical and Strategic Mineral Supply Chains. (2016). Assessment of critical minerals: Screening Methodology and Initial Application. U.S. Office or Science and Technology Policy, Executive Office of the President. https://www.whitehouse.gov/sites/whitehouse.gov/files/images/CSMSC%20Assessment%20of%20Critical%20Minerals%20Report%202016-03-16%20FINAL.pdf.

Subcommittee of Critical and Strategic Mineral Supply Chains. (2017). Assessment of critical minerals: Updated application of the screening methodology. U.S. Office or Science and Technology Policy, Executive Office of the President (in review).

The World Bank Group. (2017). The worldwide governance indicators (WGI) project. http://info.worldbank.org/governance/wgi/index.aspx#home. Accessed February 8, 2017.

U.S. Department of State. (2015). About the great lakes region. http://www.state.gov/s/greatlakes_drc/191417.htm. Accessed February 8, 2017.

U.S. Geological Survey. (2017). Mineral commodity summaries 2017. Washington: U.S. Geological Survey. https://minerals.usgs.gov/minerals/pubs/mcs/2017/mcs2017.pdf.

U.S. Securities and Exchange Commission. (2012). SEC adopts rule for disclosing use of conflict minerals. U.S. Securities and Exchange Commission press release. August 22, 2012. http://www.sec.gov/news/press/2012/2012-163.htm. Accessed February 8, 2017.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fortier, S.M., Thomas, C.L., McCullough, E.A. et al. Global Trends in Mineral Commodities for Advanced Technologies. Nat Resour Res 27, 191–200 (2018). https://doi.org/10.1007/s11053-017-9340-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-017-9340-9