Abstract

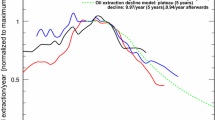

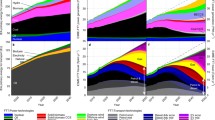

The role of unconventional oil is increasing in global energy markets. Although conventional oil is being depleted, unconventional oil might manage or eliminate supply constraints in meeting the demand for oil without large positive step changes in the prices. In this study, we use the ACEGES model, which is agent-based, to explore the potential impact of unconventional oil on the evolution of the oil markets, focusing on four important oil-producing countries. We also use quantile sheets to summarize the simulation results. Given the estimated potential of conventional and unconventional resources, the results suggest that the production profiles will change tremendously. Although countries rich in conventional oil, such as Saudi Arabia and Iran, will still occupy the global oil markets for approximately the first half of this century, oil production in countries with rich unconventional resources, such as Canada and Venezuela, will be higher in production than Saudi Arabia and Iran from 2050 to 2060. This change in production means that the market power in the global oil markets will shift from Middle Eastern countries to Canada and Venezuela in this century.

Similar content being viewed by others

Notes

Brandt (2010) also reviews several types of modeling approaches for analyzing future oil production, including top-down and bottom-up models.

The Walrasian Auctioneer aggregates the demands and supplies submitted by agents wishing to trade their assets in a market and then announces the first potential trading price (Bauwens and Giot 2001).

It is not clearly stated in Voudouris et al. (2011), and only figures are shown.

Note that it does not mean that the rate of exploiting the resources is stable, but it can depend on the amount of the remaining resources, and on technological, economic, political, and/or geological conditions.

See also the depletion analysis by Höök (2014), which shows that peak of production is usually less than 50 % of the EUR.

On the other hand, Tverberg (2012) discusses that the high oil price reduces oil demand and may cause a recession.

De Castro et al. (2009) assume that the variation of GDP depends on the variation in oil demand.

References

Aguilera, R. F. (2014). Production cost of global conventional and unconventional petroleum. Energy Policy, 64, 134–140.

Aguilera, R. F., Eggert, R. G., Lagos, G. C. C., & Tilton, J. E. (2009). Depletion and the future availability of petroleum resources. Energy Journal, 30, 141–174.

American Petroleum Institute. (1971). Petroleum facts and figures (1971st ed.). Baltimore: Port City Press.

Bauwens, L., & Giot, P. (2001). Econometric modelling of stock market intraday activity. Boston: Kluwer Academic.

Brandt, A. R. (2008). Converting oil shale to liquid fuels: Energy inputs and greenhouse gas emissions of the shell in situ conversion process. Environmental Science and Technology, 42, 7489–7495.

Brandt, A. R. (2009). Converting oil shale to liquid fuels with the Alberta Taciuk processor: Energy inputs and greenhouse gas emissions. Energy and Fuels, 23, 6253–6258.

Brandt, A. R. (2010). Review of mathematical models of future oil supply: Historical overview and synthesizing critique. Energy, 35, 3958–3974.

Bundesanstalt für Geowissenschaften und Rohstoffe (BGR). (2008). Reserves, resources and availability of energy resources 2007. Annual Report.

Bundesanstalt für Geowissenschaften und Rohstoffe (BGR). (2011). Reserves, resources and availability of energy resources 2011. Annual Report.

Caithamer, P. (2008). Regression and time series analysis of the world oil peak of production: Another look. Mathematical Geosciences, 40, 653–670.

Campbell, C. (1996). The status of world oil depletion at the end of 1995. Energy Exploration and Exploitation, 14, 63–81.

Campbell, C., & Heapes, S. (2008). An atlas of oil and gas depletion. West Yorkshire: Jeremy Mills.

Campbell, C., & Laherrére, J. (1998). The end of cheap oil. Scientific American, 278(3), 78–83.

Canadian Association of Petroleum Producers (CAPP). (2013). Statistical handbook. http://www.capp.ca/library/statistics/handbook/Pages/default.aspx. Accessed 13 April 2013.

Cleveland, C. J., & O’Connor, P. A. (2011). Energy return on investment (EROI) of oil shale. Sustainability, 3, 2307–2322.

De Castro, C., Miguel, L. J., & Mediavilla, M. (2009). The role of non conventional oil in the attenuation of peak oil. Energy Policy, 37, 1825–1833.

DeGolyer and MacNaughton. (2006). 20th century petroleum statistics, 2005. Technical Report.

DuMoulin, H., & Eyre, J. (1979). Energy scenarios: A learning process. Energy Economics, 1, 76–86.

Energy Information Administration (EIA). (2012). International energy statistics. http://www.eia.gov/countries/data.cfm. Accessed 25 February 2012.

Energy Information Administration (EIA). (2014). Glossary. http://www.eia.gov/tools/glossary/. Accessed 21 April 2014.

Epstein, J. (2007). Generative social science: studies in agent-based computational modeling. Oxfordshire: Princeton University Press.

Fantazzini, D., Höök, M., & Angelantoni, A. (2011). Global oil risks in the early 21st century. Energy Policy, 39, 7865–7873.

Guseo, R. (2011). Worldwide cheap and heavy oil productions: A long-term energy model. Energy Policy, 39(9), 5572–5577.

Guseo, R., & Guidolin, M. (2008). Cellular automata and Riccati equation models for diffusion of innovations. Statistical Methods and Applications, 17(3), 291–308.

Guseo, R., & Guidolin, M. (2009). Modelling a dynamic market potential: A class of automata networks for diffusion of innovations. Technological Forecasting and Social Change, 76(6), 806–820.

Guseo, R., & Guidolin, M. (2010). Cellular automata with network incubation in information technology diffusion. Physica A, 389, 2422–2433.

Guseo, R., & Guidolin, M. (2011). Market potential dynamics in innovation diffusion: Modelling the synergy between two driving forces. Technological Forecasting and Social Change, 78, 13–24.

Guseo, R., & Guidolin, M. (2014). Heterogeneity in diffusion of innovations modelling: A few fundamental types. Technological Forecasting and Social Change,. doi:10.1016/j.techfore.2014.02.023.

Guseo, R., & Mortarino, C. (2012). Sequential market entries and competition modelling in multi-innovation diffusions. European Journal of Operational Research, 216, 658–667.

Hallock, J. L., Tharakan, P., Hall, C. A. S., Jefferson, M., & Wei, W. (2004). Forecasting the limits to the availability and diversity of global conventional oil supply. Energy, 29, 1673–1696.

Hallock, J. L., Wei, W., Hall, C. A. S., & Jefferson, M. (2014). Forecasting the limits to the availability and diversity of global conventional oil supply: Validation. Energy, 64, 130–153.

Höök, M. (2014). Depletion rate analysis of fields and regions: A methodological foundation. Fuel, 121, 95–108.

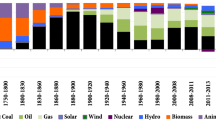

Höök, M., Li, J., Johansson, K., & Snowden, S. (2012). Growth rates of global energy systems and future outlooks. Natural Resources Research, 21, 23–41.

Höök, M., Li, J., Oba, N., & Snowden, S. (2011). Descriptive and predictive growth curves in energy system analysis. Natural Resources Research, 20, 103–116.

International Energy Agency (IEA). (2012). World energy outlook 2012. Paris: OECD/IEA.

Jakobsson, K., Bentley, R., Söderbergh, B., & Aleklett, K. (2012). The end of cheap oil: bottom-up economic and geologic modeling of aggregate oil production curves. Energy Policy, 41, 860–870.

Jakobsson, K., Söderbergh, B., Snowden, S., & Aleklett, K. (2014). Bottom-up modeling of oil production: A review of approaches. Energy Policy, 64, 113–123.

Jefferson, M. (2012). Shell scenarios: what really happened in the 1970s and what may be learned for current world prospects. Technological Forecasting and Social Change, 79, 186–197.

Jefferson, M. & Voudouris, V. (2011). Oil scenarios for long-term business planning: Royal Dutch Shell and generative explanation, 1960–2010. USAEE/IAEE Working Paper, 11-087.

Lutz, C., Lehr, U., & Wiebe, K. S. (2012). Economic effects of peak oil. Energy Policy, 48, 829–834.

Masui, T., Matsumoto, K., Hijioka, Y., Kinoshita, T., Nozawa, T., Ishiwatari, S., et al. (2011). An emission pathway for stabilization at 6 Wm−2 radiative forcing. Climatic Change, 109, 59–76.

Matsumoto, K., Tachiiri, K., Kawamiya, M. (2014a). Socioeconomic analysis of various emission pathways considering the uncertainties of earth system models. USAEE/IAEE Working Paper Series, 14–158.

Matsumoto, K., Voudouris, V., Andriosopoulos, K. (2014b). Unconventional oil: Will it satisfy future global oil demand? USAEE/IAEE Working Paper Series, 14–156.

Matsumoto, K., Voudouris, V., Stasinopoulos, D., Rigby, R., & Di Maio, C. (2012). Exploring crude oil production and export capacity of the OPEC Middle East countries. Energy Policy, 48, 820–828.

Mohr, S. (2010). Projection of world fossil fuel production with supply and demand interactions. PhD Thesis, The University of Newcastle, Australia.

Mohr, S., & Evans, G. (2007). Mathematical model forecasts year conventional oil will peak. Oil and Gas Journal, 105(17), 45–46, 48–50.

Mohr, S., & Evans, G. (2008). Peak oil: Testing Hubbert’s curve via theoretical modeling. Natural Resources Research, 17(1), 1–11.

Mohr, S., & Evans, G. (2009). An empirical method to make oil production models tolerant to anomalies. Natural Resources Research, 18(1), 1–5.

Mohr, S., & Evans, G. (2010a). Combined generalized Hubbert-Bass model approach to include disruptions when predicting future oil production. Natural Resources, 1, 28–33.

Mohr, S., & Evans, G. (2010b). Long term prediction of unconventional oil production. Energy Policy, 38, 265–276.

Nashawi, I. S., Malallah, A., & Al-Bisharah, M. (2010). Forecasting world crude oil production using multicyclic Hubbert model. Energy and Fuels, 24, 1788–1800.

Okagawa, A., Masui, T., Akashi, O., Hijioka, Y., Matsumoto, K., & Kainuma, M. (2012). Assessment of GHG emission reduction pathways in a society without carbon capture and nuclear technologies. Energy Economics, 34, 391–398.

Remme, U., Blesl, M., Fahl, U. (2007). Global resources and energy trade: an overview for coal, natural gas, oil and uranium. Forschungsberichte des Instituts für Energiewirtschaft und Rationelle Energieanwendung, 101.

Reynolds, D. B., & Baek, J. (2012). Much ado about Hotelling: Beware the ides of Hubbert. Energy Economics, 34, 162–170.

Schnabel, S. K., & Paul, E. H. C. (2013). Simultaneous estimation of quantile curves using quantile sheets. Advances in Statistical Analysis, 97(1), 77–87.

Tesfatsion, L. (2006). Agent-based computational economics: A constructive approach to economic theory. In L. Tesfatsion & K. L. Judd (Eds.), Handbook of computational economics (Vol. 2, pp. 831–880)., Agent-based computational economics Amsterdam: Elsevier.

Tverberg, G. E. (2012). Oil supply limits and the continuing financial crisis. Energy, 37, 27–34.

Voudouris, V. (2011). Towards a conceptual synthesis of dynamic and geospatial models: Fusing the agent-based and object-field models. Environment and Planning B, 38(1), 95–114.

Voudouris, V. & Di Maio, C. (2010). ACEGES 1.0 documentation: simulated scenarios of conventional oil production. CIBS Working Paper Series, 12.

Voudouris, V., Matsumoto, K., Sedgwick, J., Rigby, R., Stasinopoulos, D., & Jefferson, M. (2014). Exploring the production of natural gas through the lenses of the ACEGES model. Energy Policy, 64, 124–133.

Voudouris, V., Stasinopoulos, D., Rigby, R., & Di Maio, C. (2011). The ACEGES laboratory for energy policy: Exploring the production of crude oil. Energy Policy, 39(9), 5480–5489.

Acknowledgments

We would like to thank the Japan Society for the Promotion of Science (JSPS) for partial financial support with JSPS KAKENHI 24710046.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Matsumoto, K., Voudouris, V. Potential Impact of Unconventional Oil Resources on Major Oil-Producing Countries: Scenario Analysis with the ACEGES Model. Nat Resour Res 24, 107–119 (2015). https://doi.org/10.1007/s11053-014-9246-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-014-9246-8