Abstract

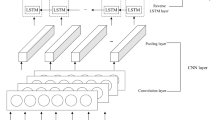

Stock price forecasting is a crucial area of research that demands a thorough comprehension of market dynamics and sophisticated analytical methods. Deep neural networks have recently demonstrated considerable potential for enabling academics to create extremely precise models for foretelling financial patterns. Another quickly developing technology is Natural language processing (NLP), which is increasingly used to evaluate financial data, notably news, and social media sentiment, and forecast the course of the market. An innovative deep learning-based stock market prediction model is created in this research paper. The historic stock market data and news feed as the information source. The acquired raw data (news data) are pre-processed using lowercase text conversion, punctuation removal, stop word removal, tokenization of sentences, normalization, and a bag of words technique. Then, from the pre-processed news data, the features such as Parts of Speech (PoS), Term Frequency-Inverse Document Frequency (TF-IDF), and N-gram-based features are extracted. In addition, the Moving Average Convergence/Divergence oscillator (MACD), and Relative Strength Index (RSI) based features are extracted from the historic stock market data. The extracted features from the historic stock market data and news feeds are fused. The optimal features are then chosen from the fused features using a new hybrid optimization model called Exchange Market Emperor Pigeon Optimization (EMEPO). The proposed EMEPO model is a combination of the standard Exchange Market Algorithm (EMA) and Emperor Pigeon Optimization (EPO). A new three-phase classifier is introduced in this research work, for accurate stock price forecasting. The proposed three-phase classifier includes Convolutional neural networks (CNN), Bidirectional long short-term memories (Bi-LSTM), and Autoencoder. The three-phase classifier is trained using the selected EMEPO-based features. The projected outcome from the three-phase classifier portrays the stock market prices. In all three feature selection events, the suggested method produces positive outcomes. In Case 1 (Open/Close), the Mean Absolute Error (MAE) value is 0.051582, suggesting a minimal average difference between the anticipated and actual values. The accuracy of the model in forecasting percentage errors is shown by the Mean Absolute Percentage Error (MAPE), which is 11.28154%. Similar results are obtained by the model in Case 2 (High/Low/Close), with an MAE of 0.056408 and a MAPE of 12.0081%. These results show how well the suggested strategy works for anticipating stock prices with accuracy.

Similar content being viewed by others

Data availability

Not Applicable

References

Wang WJ, Tang Y, Xiong J, Zhang YC (2021) Stock market index prediction based on reservoir computing models. Expert Syst Appl 178:115022

Ingle V, Deshmukh S (2021) Ensemble deep learning framework for stock market data prediction (EDLF-DP). Global Transit Proc 2(1):47–66

Akhtar MM, Zamani AS, Khan S, Shatat ASA, Dilshad S, Samdani F (2022) Stock market prediction based on statistical data using machine learning algorithms. J King Saud Univ Sci 34(4):101940

de Almeida RL, Neves RF (2022) Stock market prediction and portfolio composition using a hybrid approach combined with self-adaptive evolutionary algorithm. Expert Syst Appl 204:117478

Chen X, Ma X, Wang H, Li X, Zhang C (2022) A hierarchical attention network for stock prediction based on attentive multi-view news learning. Neurocomputing 504:1–15

Zhao Y, Yang G (2023) Deep Learning-based Integrated Framework for stock price movement prediction. Appl Soft Comput 133:109921

Ma Y, Mao R, Lin Q, Wu P, Cambria E (2023) Multi-source aggregated classification for stock price movement prediction. Inform Fusion 91:515–528

Wang C, Chen Y, Zhang S, Zhang Q (2022) Stock market index prediction using deep Transformer model. Expert Syst Appl 208:118128

Xiong K, Ding X, Du L, Liu T, Qin B (2021) Heterogeneous graph knowledge enhanced stock market prediction. AI Open 2:168–174

Polamuri SR, Srinivas K, Mohan AK (2022) Multi-model generative adversarial network hybrid prediction algorithm (MMGAN-HPA) for stock market prices prediction. J King Saud University-Comput Inform Sci 34(9):7433–7444

Gao R, Cui S, Xiao H, Fan W, Zhang H, Wang Y (2022) Integrating the sentiments of multiple news providers for stock market index movement prediction: A deep learning approach based on evidential reasoning rule. Inf Sci 615:529–556

Wang C, Liang H, Wang B, Cui X, Xu Y (2022) MG-Conv: A spatiotemporal multi-graph convolutional neural network for stock market index trend prediction. Comput Electr Eng 103:108285

Liu X, Guo J, Wang H, Zhang F (2022) Prediction of stock market index based on ISSA-BP neural network. Expert Syst Appl 204:117604

Almalis I, Kouloumpris E, Vlahavas I (2022) Sector-level sentiment analysis with deep learning. Knowl-Based Syst 258:109954

Paramanik RN, Singhal V (2020) Sentiment analysis of Indian stock market volatility. Procedia Comput Sci 176:330–338

Chen J, Wen Y, Nanehkaran YA, Suzauddola MD, Chen W, Zhang D (2023) Machine learning techniques for stock price prediction and graphic signal recognition. Eng Appl Artif Intell 121:106038

Yang J, Zhang W, Zhang X, Zhou J, Zhang P (2023) Enhancing stock movement prediction with market index and curriculum learning. Expert Syst Appl 213:118800

Yan WL (2023) Stock index futures price prediction using feature selection and deep learning. North Am J Econ Finance 64:101867

Liu T, Ma X, Li S, Li X, Zhang C (2022) A stock price prediction method based on meta-learning and variational mode decomposition. Knowl-Based Syst 252:109324

Chaudhari K, Thakkar A (2023) Neural network systems with an integrated coefficient of variation-based feature selection for stock price and trend prediction. Expert Systems with Applications, 119527

Teng X, Zhang X, Luo Z (2022) Multi-scale local cues and hierarchical attention-based LSTM for stock price trend prediction. Neurocomputing 505:92–100

Kanwal A, Lau MF, Ng SP, Sim KY, Chandrasekaran S (2022) BiCuDNNLSTM-1dCNN—A hybrid deep learning-based predictive model for stock price prediction. Expert Syst Appl 202:117123

Zhang D, Lou S (2021) The application research of neural network and BP algorithm in stock price pattern classification and prediction. Futur Gener Comput Syst 115:872–879

Jafari A, Haratizadeh S (2022) GCNET: graph-based prediction of stock price movement using graph convolutional network. Eng Appl Artif Intell 116:105452

Yun KK, Yoon SW, Won D (2021) Prediction of stock price direction using a hybrid GA-XGBoost algorithm with a three-stage feature engineering process. Expert Syst Appl 186:115716

Ahmad A, Akbar S, Khan S, Hayat M, Ali F, Ahmed A, Tahir M (2021) Deep-AntiFP: Prediction of antifungal peptides using distanct multi-informative features incorporating with deep neural networks. Chemom Intell Lab Syst 208:104214

Akbar S, Khan S, Ali F, Hayat M, Qasim M, Gul S (2020) iHBP-DeepPSSM: Identifying hormone binding proteins using PsePSSM based evolutionary features and deep learning approach. Chemom Intell Lab Syst 204:104103

Akbar S, Hayat M, Tahir M, Khan S, Alarfaj FK (2022) cACP-DeepGram: classification of anticancer peptides via deep neural network and skip-gram-based word embedding model. Artif Intell Med 131:102349

Dataset1 taken from: “https://datahub.io/collections/stock-market-data”, dated 08/03/2023.

Dataset2 taken from: “https://www.kaggle.com/datasets/jainilcoder/netflix-stock-price-prediction”, dated 14/07/2023.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Dixit, S., Soni, N. Enhancing stock market prediction using three-phase classifier and EM-EPO optimization with news feeds and historical data. Multimed Tools Appl 83, 37859–37887 (2024). https://doi.org/10.1007/s11042-023-17184-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11042-023-17184-x