Abstract

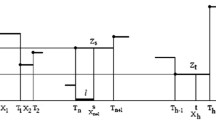

In this paper we show how it is possible to construct an efficient Migration models in the study of credit risk problems presented in Jarrow et al. (Rev Financ Stud 10:481–523, 1997) with Markov environment. Recently it was introduced the semi-Markov process in the migration models (D’Amico et al. Decis Econ Finan 28:79–93, 2005a). The introduction of semi-Markov processes permits to overtake some of the Markov constraints given by the dependence of transition probabilities on the duration into a rating category. In this paper, it is shown how it is possible to take into account simultaneously backward and forward processes at beginning and at the end of the time in which the credit risk model is observed. With such a generalization, it is possible to consider what happens inside the time after the first transition and before the last transition where the problem is studied. This paper generalizes other papers presented before. The model is presented in a discrete time environment.

Similar content being viewed by others

References

Altman EI (1999) The importance and subtlety of credit rating migration. J Bank Financ 22:1231–1247

Berthault A, Gupton G, Hamilton DT (2001) Default and recovery rates of corporate bond issuers: 2000. Moody’s Investors Service special comment

Blasi A, Janssen J, Manca R (2004) Numerical treatment of homogeneous and non-homogeneous semi-Markov reliability models. Commun Stat Theory Methods 33:697–714

Bluhm C, Overbeck L, Wagner C (2002) An introduction to credit risk modeling. Chapman & Hall, London

Carty L, Fons J (1994) Measuring changes in corporate credit quality. J Fixed Income 4:27–41

D’Amico G, Janssen J, Manca R (2005a) Homogeneous discrete time semi-Markov reliability models for credit risk management. Decis Econ Finan 28:79–93

D’Amico G, Janssen J, Manca R (2005b) Non-homogeneous backward semi-Markov reliability approach to downward migration credit risk problem. In: Proceedings of 8th Italian Spanish meeting on financial mathematics

D’Amico G, Janssen J, Manca R (2007) Valuing credit default swap in a non-homogeneous semi-markovian rating based models. Comput Econ 29:119–138

D’Amico G, Janssen J, Manca R (2009) The dynamic behaviour of single-unireducible non-homogeneous Markov and semi-Markov chains. In: Networks: topology and dynamics. Lecture notes in economic and mathematical systems, Springer, Berlin

Duffie D, Singleton K (2003) Credit risk. Princeton University Press, Princeton

Hamilton DT, Cantor R (2004) Rating transitions and defaults conditional on watchlist, outlook and rating history. Moody’s Investor Service Special Comment

Janssen J, Manca R (2006) Applied semi-Markov processes. Springer, New York

Jarrow AJ, Lando D, Turnbull SM (1997) A markov model for the term structure of credit risk spreads. Rev Financ Stud 10:481–523

Kavvathas D (2001) Estimating credit rating transition probabilities for corporate bonds. Working Papers University of Chicago

Lando D, Skodeberg TM (2002) Analyzing rating transitions and rating drift with continuous observations. J Bank Financ 26:423–444

Nickell P, Perraudin W, Varotto S (2000) Stability of rating transitions. J Bank Financ 24:203–227

Vasileiou A, Vassiliou P-CG (2006) An inhomogeneous semi-Markov model for the term structure of credit risk spreads. Adv Apll Probab 38:171–198

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

D’Amico, G., Janssen, J. & Manca, R. Initial and Final Backward and Forward Discrete Time Non-homogeneous Semi-Markov Credit Risk Models. Methodol Comput Appl Probab 12, 215–225 (2010). https://doi.org/10.1007/s11009-009-9142-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-009-9142-6