Abstract

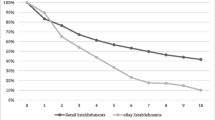

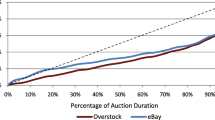

On the basis of the bidding history of a panel of new eBay bidders, we examine the impact of different types of experiences on bidding behavior evolution. Accounting for unobserved bidder heterogeneity, the results indicate that losing experiences make the bidders’ bidding behavior evolve toward the normative predictions of auction theory, in that they submit fewer bids and bid later. Winning experiences, however, do not have such an effect. Moreover, the experience effect pertains to the bidder’s entire previous bidding experience regardless of product categories. We also assess the potential bias introduced by using feedback ratings (compared with actual participation) as experience measures.

Similar content being viewed by others

Notes

In private-value auctions, bidders’ valuations are assumed to be independent. In contrast, a common component affects all bidders’ valuations (e.g., Wilson 1977) in common value auctions. Reasons for such a common component include “some prestige value of owning and might be admired by others, or items that may be resold later at an unknown price” (Milgrom and Weber 1982, p. 1095; Wilcox 2000, p. 369).

If an auction did not end with a sale, the tracked bidder is considered to have lost the auction because he or she did not win.

Because the highest valuation of the product is not revealed, due to auction rules, we cannot expect it to influence bidders’ behavior in general. We use the winning price instead, because it is observable to bidders (Park and Bradlow 2005).

We do not include the number of bids together with the number of unique bidders, because they are highly correlated (Pearson r = 0.768, p = 0.000).

We caution that such coding is based on a simple heuristic, following the precedent in previous literature and our judgment. Private- and common-value need not necessarily be dichotomous, and an affiliated-value framework would include both paradigms (e.g., Laffont and Vuong 1996). Klemperer (1998) shows that small asymmetries among bidders in common value auctions may lead to auctions with almost common values. We thank an anonymous reviewer for pointing this out.

Because we use Bayesian estimation, the parameter estimates appear in distributional form. We report the means, standard deviations, and 2.5–97.5% confidence intervals (CI) for each parameter, unless otherwise noted. A parameter is statistically significant at 5% if the 2.5–97.5% CI falls completely in the positive or negative domain and does not include 0.

We thank an anonymous reviewer for this suggestion.

References

Allison, P. D. (1999). Logistic regression using the SAS system. Cary: SAS Institute.

Ariely, D., & Simonson, I. (2003). Buying, bidding, playing or competing? Value assessment and decision dynamics in online auctions. Journal of Consumer Psychology, 13(1–2), 113–123. doi:10.1207/S15327663JCP13-1&2_10.

Bajari, P., & Hortascu, A. (2003). The winner’s curse, reserve prices, and endogenous entry: empirical insights from eBay auctions. The Rand Journal of Economics, 34(2), 329–355. doi:10.2307/1593721.

Beck, N. (1991). Comparing dynamic specifications: the case of presidential approval. Political Analysis, 3(1), 51–87. doi:10.1093/pan/3.1.51.

Borle, S., Boatwright, P., & Kadane, J. (2006). The timing of bid placement and extent of multiple bidding. Statistical Science, 21(2), 194–205. doi:10.1214/088342306000000123.

Box, G. E. P., & Pierce, D. A. (1970). Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. Journal of the American Statistical Association, 65(332), 1509–1526. doi:10.2307/2284333.

Bradlow, E. T., & Park, Y.-H. (2007). Bayesian estimation of bid sequences in internet auctions using a generalized record breaking model. Marketing Science, 26, 218–229, March–April. doi:10.1287/mksc.1060.0225.

Darr, E., Argote, L., & Epple, D. (1995). The acquisition, transfer, and depreciation of knowledge in service organizations: productivity in franchises. Management Science, 41(11), 1750–1762.

Greene, W. (1997). Econometric analysis (3rd ed.). Englewood Cliffs: Prentice Hall.

Herriott, S. R., Levinthal, D., & March, J. G. (1985). Learning from experience in organizations. The American Economic Review, 75(2), 298–302.

Hoeffler, S., Ariely, D., & West, P. (2006). Path dependent preferences: the role of early experience and biased search in preference development. Organizational Behavior and Human Decision Processes, 101(2), 215–229. doi:10.1016/j.obhdp.2006.04.002.

Kamins, M. A., Drèze, X., & Folkes, V. S. (2004). Effects of seller-supplied prices on buyers’ product evaluations: reference prices in an internet auction context. The Journal of Consumer Research, 30(1), 622–628. doi:10.1086/380294.

Klemperer, P. (1998). Auctions with almost common values. European Economic Review, 42, 757–769. doi:10.1016/S0014-2921(97)00123-2.

Laffont, J.-J., & Vuong, Q. (1996). Structural analysis of auction data. The American Economic Review, 86(2), 414–420.

Lant, T. K., & Montgomery, D. B. (1987). Learning from strategic success and failure. Journal of Business Research, 15, 501–517. doi:10.1016/0148-2963(87)90035-X.

Melnik, M. I., & Alm, J. (2002). Does a seller’s E-Commerce reputation evidence from eBay auctions. The Journal of Industrial Economics, 50(3), 337–350.

Milgrom, P. R., & Weber, R. J. (1982). A theory of auctions and competitive bidding. Econometrica, 50(5), 1089–1122. doi:10.2307/1911865.

Nunes, J. C., & Boatwright, P. (2004). Incidental prices and their effect on willingness to pay. JMR, Journal of Marketing Research, 41, 457–466, November. doi:10.1509/jmkr.41.4.457.47014.

Ocaña, C., & Zemel, E. (1996). Learning from mistakes: a note on just-in-time systems. Operations Research, 44(1), 206–214.

Ockenfels, A., & Roth, A. E. (2006). Late and multiple bidding in second-price internet auctions: theory and evidence concerning different rules for ending an auction. Games and Economic Behavior, 55, 297–320. doi:10.1016/j.geb.2005.02.010.

Park, Y.-H., & Bradlow, E. T. (2005). An integrated model for bidding behavior in internet auction: whether, who, when and how much. JMR, Journal of Marketing Research, 42, 470–482, November. doi:10.1509/jmkr.2005.42.4.470.

Roth, A. E., & Ockenfels, A. (2002). Last-minute bidding and the rules for ending second-price auctions: evidence from eBay and Amazon auctions on the internet. The American Economic Review, 92(4), 1093–1103. doi:10.1257/00028280260344632.

Wang, X., Montgomery, A., Srinivasan, K. (2008). When auction meets fixed price: a theoretical and empirical examination of buy-it-now auctions. Quantitative Marketing and Economics, 6(4), 339–370. doi:10.1007/s11129-008-9041-0.

Wilcox, R. T. (2000). Experts and amateurs: the role of experience in internet auctions. Marketing Letters, 11(4), 363–374. doi:10.1023/A:1008141313927.

Wilson, R. (1977). A bidding model of perfect competition. The Review of Economic Studies, 44(3), 511–518. doi:10.2307/2296904.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, X., Hu, Y. The effect of experience on Internet auction bidding dynamics. Mark Lett 20, 245–261 (2009). https://doi.org/10.1007/s11002-009-9068-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11002-009-9068-3