Abstract

We analyze the impact of women on corporate boards of directors on product quality. We innovate firstly by integrating the broad but fragmented research on the topic, offering a first simultaneously testing of a larger set of variables identified to be significant in earlier studies. Second, we add alternative indicators of female representation in board of directors as a potential determinant of product quality. Third, we use evaluation scores of goods by the nonprofit foundation “Stiftung Warentest” as a quality indicator, thus adding to a regionally diversified evidence. We find a significant positive effect of female board directors on product quality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Around the world, policymakers, legislators, large institutional investors, and certain stock exchanges have called to diversify boards of directors to increase board independence. Having women on boards sends a positive signal to both internal and external constituents, regarding whether man and women in a firm have similar educational backgrounds and the overall labor market in a particular economy is balanced (Dunn, 2012; Terjesen et al., 2016).

On average, women constituted 30% of corporate boards of directors in Europe’s largest publicly listed companies in 2020 (Gender Statistics Database, 2021), with the highest representation in France (45.1%), Iceland (44.4%), and Norway (40.4%), but other European countries lagged in this regard (e.g., Estonia, 8.8%). Although the female share of boards within European companies has almost tripled since 2010, it remains distant from the European Commission’s recommendation of 40% (Jourova, 2016). The global picture is similar, with females holding only 26.2% of corporate directorships among the Morgan Stanley Capital International World Index companies in 2020, and a declining growth rate in female board positions (Emelianova, 2020). Rohner and Dougan (2012) report that more than 15% of publicly listed companies in the US and Europe still did not have even one female board member appointed, with the gender gap particularly visible in IT, industrial goods, materials, and telecom sectors. The authors find an underrepresentation of women in consumer-related sectors in the European markets and for large-cap stocks. Adams and Kirchmaier (2016) confirm that women are underrepresented in science and engineering professions as well as all academic levels in academia. According to Hillman et al. (2007), only large firms are more inclined to employ a more gender-balanced directors’ cadre to strive for more legitimacy in the corporate hierarchy, as structural barriers still exist for female board candidates, and the actual circumstances are determined by individual firm and industry specific characteristics (Brieger et al., 2019). Young female human capital has overtaken young men in many countries in enrollment and exam passes at schools and universities, but women do not appear to succeed in corporate governance for complex reasons (Walby, 2011). Higher academic achievements are often required for female nominees to be considered for a board nomination. Women also feel that they are more frequently discouraged from aspiring to high-profile positions due to modest self-image, discriminating stereotypes, or lack of networking opportunities among the higher echelons of corporate power. Furthermore, firm size and masculine corporate culture may impede women’s election to governance bodies. In contrast, opportunities for female directors are higher in public and nonprofit enterprises. Greater economic and political empowerment accompanied by countries’ shared cultural values, beliefs, and attitudes has successively helped women overcome the “glass ceiling” of corporate elites (Lewellyn & Muller-Kahle, 2020). However, corporate boardrooms’ gender democratization proceeds slowly, with the first wave of feminization based on political background, the second facilitated by female board candidates’ academic achievements, and the third attributed to exceptional and company-grown female talent (Heemskerk & Fennema, 2014).

Sabatier (2015) confirms that existing quotas have prompted French companies to engage more female directors, which positively impacted companies’ performance, while Comi et al. (2020) elicit mixed results, finding positive effects only on firm labor productivity in Italy, negative effects in France, and an insignificant impact on the profitability of Spanish companies. The Norwegian board of directors’ quota reform of 2003 only applied to publicly listed companies in Norway, which to a larger extent accumulated capital that was financed by debt or a combination of debt and existing capital. The short-run impact of the reform on company performance measured by a return on assets was negligible (Dale-Olsen et al., 2013). Yang et al. (2019a, b) determine that the Norwegian quota adversely affects treated firms’ performance and reduces risk.

Researchers continue to investigate the business case for a higher proportion of female directors on boards, predominantly focusing on financial (e.g., firms’ profitability, market returns, stock prices, liquidity, enterprise value, profits dividends, and risk) or organizational effects (e.g., corporate innovativeness, entrepreneurship, relationships with stakeholders, organizational and team performance, or interdepartmental dynamics and transparency). The scientific evidence for these associations is mixed, as board diversity can become “a double-edged sword,” including a “value-in-diversity” proposition and counterarguments; for instance, regarding social categorization processes that lead to in-group favoritism and out-group discrimination and subsequent team fragmentation and negative behavioral dynamics or group outcomes (Kaczmarek & Nyuur, 2021). Numerous scholars have provided empirical evidence that differences in boards or firms with enhanced female participation may lead to differences in key company figures. Companies with more diversified boards may achieve increased patent activities (Griffin et al., 2021), improved stock liquidity (Ammad & Searat, 2017), better accounting performance (Dang & Nguyen, 2016; Lückerath-Rovers, 2013; Post & Byron, 2015), higher market valuation (Ntim, 2015), larger returns (Duppati et al., 2020; Johnstone-Louis, 2017; Kang et al., 2010), higher share price and earnings per share (van Dunk et al., 2005), a larger price/book value, and a larger average growth (Rohner & Dougan, 2012), particularly firms with a higher market value, as expressed by superior Tobin’s Q performance (Conyon & He, 2017). Rossi et al. (2018) determine that more women on boards of directors increase companies’ indebtedness level, but invested capital is used more efficiently.

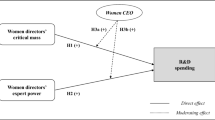

However, the positive impact of female directors could also depend on external circumstances. Dezsö and Ross (2012) suggest that women in executive management improve company performance only if female representation is moderated by high innovation intensity, measured as the ratio of research and development (R&D) expenses to assets from the prior year. Sarhan et al. (2019) determine that the positive impact of diversity on firms’ financial performance is stronger in companies that are better governed and can enhance the pay-for-performance sensitivity. Hsu et al. (2019) used a composite diversity index, including board members’ gender, age, tenure, and professional background, demonstrating that boardroom diversity positively affects operating performance, however firms with larger strategic change tend to present a negative correlation between boardroom diversity and operating performance. The probability of women on a board increases with firm performance, defined as return on assets and family ownership, but diminishes with corporate ownership and firm risk (Martin-Ugedo & Minguez-Vera, 2014). Farrell and Hersch (2005) find that the likelihood of electing a woman to a corporate board negatively depends on the number of females appointed in the past, suggesting that firms may add female directors only as a defensive reaction to outside pressure and scarce female top performers could proactively prefer stronger and better-positioned companies. Turban et al. (2019) rule out this reverse causality, confirming the positive effect of gender diversity (measured using Blau’s index) on firms’ market valuation (e.g., Tobin’s Q or turnover ratio), but only in national contexts where gender diversity is normatively accepted and not in economies where it is regulated (e.g., Western Europe vs. Japan).

Positive evaluations of the greater participation of women on business performance are not without opposition. Other scholars do not find significant effects; for example, on returns (Francoeur et al., 2008; Ramadhania et al., 2021), Tobin’s Q (Rose, 2007), IPO pricing (Mohan & Chen, 2004), or dividend payouts (Arora, 2021; Pucheta-Martinez & Bel-Oms, 2016). Some even reveal negative effects of female directors; for example, on companies’ share price (Ryan & Haslan, 2005), profitability (Shrader, 1997), or firm performance (Dang & Nguyen, 2016; Triana et al., 2013). Ferreira (2015) criticizes research that seeks to prove the positive effects of female directors on firms’ profitability, encouraging focus on female directors’ potential benefits to society.

Since no consensus has emerged regarding the favorable effect of females on boards of directors, this study seeks to make four primary contributions to this controversial topic. First, our study complements the existing spectrum of academic research demonstrating the positive effects of boardroom diversity. We analyze the effect of increased female representation on boards of directors on product quality (PQ),Footnote 1 which we consider to be a socially responsible measure of corporate success and an aspect of sustainable economic development, which is contemporarily deserving of more attention. We examine whether companies with a higher proportion of female directors produce higher quality goods than competitors that are governed by fewer women in boardrooms. Second, we review the relevant literature and methodologies applied to examine the effects of increased female participation in corporate governance. Third, we systematically extend the literature on Product Quality (PQ) in the light of our research. Our study enhances the partially fragmented research on the determinants of PQ (as described in the next section) by conducting the first simultaneous test of a larger set of variables identified to be significant in earlier studies. Finally, we add to research in the economics and management literature regarding the potential effects of gender diversity in leading positions in business enterprises.

2 Background

High PQ is an instrumental component of sustainable corporate policies, as increased quality standards indicate corporations’ high social responsibility, which is a crucial management strategy (Kytle & Ruggie, 2005). Moreover, contemporary firms are expected to manage non-economic business results and fulfill social and ecological responsibilities to stakeholders and clients. Effective corporate social responsibility (CSR) is a tool for successful firm and product differentiation, since internal and external CSR can enhance products’ quality (Calveras & Ganuza, 2016). Social role theory considers women to be more moral, diligent, compassionate, inclusive, and stakeholder oriented. The proportion of females on boards of directors is positively proportional to their influence on CSR decisions (Elstad & Ladegard, 2012). The more highly educated a female senior manager, the more sensitive she is in terms of the quality and commitment of the environment, and the more attention she pays to the community (Yang et al., 2019a, b). A larger proportion of women and female labor representatives at the board level are positively related to CSR and environmental performance (Lopatta et al., 2020), which may subsequently favorably affect PQ.

PQ is also a key consumer decision criterion and has long been a “strategic weapon” in management practice (Garvin, 2001) that can impact several company performance indicators, such as outgoing defect rates and on-time delivery rates (Nagar & Rajan, 2001). Phillips et al. (1983) demonstrate that PQ also has a significant positive influence on return on investment (ROI), particularly for enterprises operating consumer goods non-durables, capital goods, and components businesses. Jacobson & Aacker (1987) observe a highly significant association between quality and product price (for four of six defined business segments), suggesting that buyers are inclined to reward premium goods with higher prices in these markets. Lakhal & Pasin (2008) summarize the literature finding a positive impact of PQ on financial performance, although they do not find a direct significant association linking PQ and financials for a sample of 133 Tunisian companies. Nevertheless, they detect a favorable correlation between PQ and customer satisfaction and internal processes. Table 1 presents the major determinants of PQ studied empirically. For a summary on the evolution of the definition of PQ, see Reeves and Bednar (1994), Golder et al. (2012), and Suchanek et al. (2014).

3 Theoretical framework

Despite substantial empirical literature devoted to the matter, the impact of boardroom diversity on firm performance is not a unanimously held business case. Note that diverging empirical results find their counterparts in diverging theoretical considerations. Three key theories support the positive aspects of greater gender meritocracy on corporate boards, including agency, resource dependence, and stakeholder theories (Ntim, 2015), whereas social identity theory emphasizes a more critical approach (Luis-Carnicer et al., 2008).

Agency theory implies that female directors can more effectively resolve agency problems between shareholders and company managers. Female directors are particularly valued for ex-ante (visionary) strategic company control related to long-term strategy and monitoring of the environment (e.g., benchmarking qualitative indices). They may apply a higher sensitivity to internal compliance policies or acts of discrimination and are considered as more independent board members.

The resource-based perspective argues that firms can develop a competitive advantage by employing a complementary pool of female talent, skills, capabilities, and networks. Corporate boards maintain essential links between companies and their environment. A firm’s effective linkage to its ecosystem, provides an organization with useful information, maintains a channel for communication purposes, is an important step in obtaining commitments of support from important elements of the environment, and helps legitimize organizations (Lückerath-Rovers, 2013). The increased presence of high-profile women in corporate governance could enhance the level of quality assurance, as they may be more responsive to sustainable market trends and technologies. Female leaders can passionately contribute cutting-edge managerial, engineering, and product development skills. They may also be more motivated and determined than their male counterparts to organize and manage publicly transparent internal sustainability and quality reporting, and more proactively network across and beyond corporate hierarchies to anticipate, detect, and navigate quality issues within organization (e.g., product recalls, warranty policy, and customer service).

Stakeholder theory indicates that heterogeneous boards may be more creative, although it may take longer to negotiate and achieve consensus. By recruiting female directors, firms can benefit from links with stakeholders, particularly when determining business purpose and customer orientation, which can become major aspects of the superior PQ of delivered goods. Adams and Ferreira (2004, p. 14) suggest that gender diversity on boards may also have a political dimension, as “companies may care more about diversity when they are concerned about their public image.”

In contrast, Luis-Carnicer et al. (2008, p. 588) examine social identity theory in context, revealing “demographic dissimilarity and these outcomes may vary among negative, neutral and even positive, depending on the extent to which employees’ social identities are built among their demographic characteristics” (Chattopadhyay et al., 2004). Tsui et al. (1992) demonstrate that greater cohesion in homogenous groups results from easier communication and low relational conflict, while higher gender diversity leads to more absences and less organizational commitment for men and more organizational commitment for women (with no effect on absences). These considerations imply that the impact of female directors may depend on the settings and general conditions in the relevant societies and firms. Board gender diversity may primarily affect firm performance positively in countries with high national governance quality (Nguyen et al., 2021), in national contexts where gender diversity is normatively accepted (Turban et al., 2019), and in firms with a high rate of innovation (Dezsö & Ross, 2012). According to social identity theory, male and female management styles differ as well. Women and men in the same organizational roles may behave somewhat differently (Eagly & Johanessen-Schmidt, 2001) and women may be more effective in performing certain tasks over others (Eagly et al., 1995). Although social scientists and organizational scholars argue that gender differences in managerial positions are minimal, they can become impactful when applied in a long-term repetitive mode (Martel et al., 1996). These arguments suggest that gender differences in approach and management of PQ on a strategic company level may result in different PQ outcomes over time.

While diversity fosters change and evolution, the aggregate results of contemporary research in this topic remain inconclusive regarding whether it hinders or improves organizational performance. Fulton (2021) asserts that while social bridging theories argue in favor of diverse organizations, social bonding theories argue against it. The author’s study specifies these concepts as two distinct mechanisms, indicating that both can positively impact organizations, but their respective benefits depend on the task being performed. The study demonstrates that social diversity facilitates performance related to accessing external resources and social interaction facilitates performance related to internal coordination.

4 Literature review and hypothesis development

Koutoupis et al. (2022) systematically scrutinize 140 board diversity studies published from 2015 to 2021, determining that this topic has primarily been empirically investigated in developed countries. The research analyzed predominantly concentrates on the effect of board diversity on firms’ (financial and sustainability) performance; however, no conclusive results have emerged regarding the extent to which diversity facilitates firms’ operations. Nguyen et al. (2020) conducted a comprehensive systematic literature review of the existing research on women on corporate boards and financial and non-financial performance, reviewing 634 mixed, qualitative, quantitative, and theoretical studies conducted in over 100 countries from more than 10 disciplines (e.g., accounting, finance, economics, and governance) from 1981 to 2019 and published in 270 top-ranked journals. The authors find that many existing studies are descriptive and/or draw on single rather than multi-theoretical perspectives and focus on firm-level rather than country-level effects. The observable methodological limitations include a dearth of qualitative, mixed-methods, and cross-cultural/country studies. The study concludes by outlining opportunities for future research regarding women on boards of directors.

The upper echelons theory stipulates that senior management’s quality and traits are reflected in organizations and systematically cascade down the hierarchical ladder to achieve strategic importance (Finkelstein et al., 2008; Hambrick & Mason, 1984; Pfeffer, 1983). The ratio of female directors represents a certain tendency of team (board) composition; hence, gender diversity can be a predictor of board level processes and effectiveness. Amin et al. (2021) indicate that female board presence significantly reduces agency costs (defined as the sum of monitoring expenditures by the principal, bonding expenditures by the agent, and residual losses), hence reduces the principal–agent conflict, particularly when a critical mass of women is achieved. Demographically balanced boards may tend to pursue long-term policies focused on high quality assurance, as female directors holding monitoring roles can mitigate managerial opportunism focused on earnings (Saona et al., 2019). Gyapong et al. (2019) reveal that gender mixed boards may alleviate principal–agent conflicts around the dividend payout in hard times for a company (e.g., during an economic crisis), although they generally favorably affect dividend payouts, particularly when female directors have a critical mass; however, when ownership concentration is high, board gender diversity reduces dividend payments. Corporate funds not spent on dividends could be theoretically invested in advancing a sustainable product portfolio of superior quality. Female directors with financial backgrounds improve earning’s quality more than their female counterparts without relevant financial expertise (Zalata et al., 2021).

We assume that female directors are more effective as PQ agents for companies, staying more vigilant to customer feedback and corporate risks. Oliver (1996) notes that while men tend to measure performance quantitatively in financial terms, women do not hesitate to use either customer service ratings or diverse satisfaction scores. Female directors report higher concerns regarding product risk, supply chain, and reputational issues (Groysberg et al., 2016), mitigate such issues more decisively, and may have less tolerance for ethical lapses (Eagly et al., 2004; Franke et al., 1997; Lunsford, 2000; McCarthy, 2017), which can prevent ambiguous PQ and sustainability hazards. Female directors may monitor internal quality control mechanisms more diligently. They may be more inclined to promote targeted internal quality guidelines and sustainable corporate policies (e.g., product recycling, six sigma programs, and ecologically friendly supply chains). Furthermore, female directors could generally limit firms’ risk performance,Footnote 2 measured by the volatility of equity returns (Zalata et al., 2019 and Yang et al., 2019a, b). Shahab et al. (2020) confirm that CEO’s power to increase the likelihood of stock price crash risk is significantly mitigated when a company’s proportion of female directors is high. Adhikari et al. (2019) determine that female executives have more power to avoid lawsuits, partially by avoiding risky but value-increasing firm policies, such as more aggressive R&D, intensive advertising, and policies inimical to other parties.

Since organizations depend on external resources to survive (Pfeffer & Salancik, 1978), increased female board representation can significantly extend the number of relationships and resources available to a corporation. Because of this, and beyond any soft skills, female directors may be expected to bring a high level of competence to the table (Pesonen et al., 2009, Freeman and Varey, 1997), and new female directors contribute more additional expertise in boardrooms than newly selected male counterparts, on average (Kim & Starks, 2016), frequently advancing capacities for professional achievement (Pace, 2009). Nielsen and Huse (2010, p. 16–17) propose “that it is not the gender per se, but the different values and professional experiences that women may possess that enable them to make a difference to actual board work and influence board decision-making.” The authors conclude that a female board member equivalent with similar (board relevant) professional experiences and different values can enhance board decision-making. The apparent higher quality of female corporate governors may positively affect quality strategy and management of the corporation, as female directors could be more educated, vigilant, and committed to quality management issues.

Board members’ statistics by gender contrast with contemporary research results, confirming that females’ characteristics may complement or ameliorate the input of male directors in multiple business management aspects. Solakoglu and Demir (2016) argue that an increased portion of female directors alters boards’ supervisory behavior. Female managers are less likely to practice “management-by-exception” than males (Burke & Collins, 2002). Women may prefer to engage as transformational and servant leaders (Duff, 2013; Eagly & Carli, 2003). Servant leadership style involves behavioral dimensions, such as empowerment and development, building trust, humility, altruism, authenticity, responsibility, and interpersonal acceptance, and competence in this approach can add significant value to high quality organizations (Su et al., 2020, Amah, 2018; Erdurmazli, 2019). Less tolerance for inconsistent PQ management and high commitment to interdisciplinary teamwork across the organizations could cause more diverse boards to compromise less on the quality of goods and services produced against other factors.

Kochan et al. (2003) and Burgess and Tharenou (2002) describe female managers as consensus seekers who focus on team building, democratic values, and long-term relationships, and Johansen (2007) suggests that female managers tend to prioritize the process by which an outcome is achieved, and are more likely to act as business defenders. Women tend to prefer an inclusive, “power sharing” management style more so than their male counterparts (Burgess & Tharenou, 2002), assuming a more personal approach toward employees and customers (Allen & Truman, 1993). A gender-sensitive board setting may lead to a more transparent information environment (Upadhyay & Zeng, 2014), a higher quality of corporate sustainability reporting (Al-Shaer & Zaman, 2016), and improved adoption of sustainability reporting and external assurance (Girón et al., 2021). However, critical voices suggest that the influence of female directors on the promotion of CSR disclosure practices could be attributable to reputational motivations, and some studies have found mixed results in this regard (Amorelli & Garcia-Sanchez, 2019). Women show more interest in corporate philanthropy (Selma et al., 2020) as well as utilitarian and altruistic endeavors (Mukhtar, 2002; Simmons & Emanuele, 2007). A qualitative management survey by Adams and Funk (2012) finds female directors to be not only more risk-loving but also more benevolent and caring for universalism and stimulation. The authors find that women in the boardroom are less concerned about power, security, conformity, and tradition, which can be beneficial when any problematic status quo in PQ is being questioned. Dobson and White (1995) argue that “feminine firms,” in which soft-skilled persuasion and trust become contractual enforcement mechanisms, establish cooperative environments supporting communal objectives.

Based on the above arguments it can be argued that enterprises with a higher proportion of female directors on the board may be able to pursue a corporate strategy and respectively manage operations to achieve a higher quality output than their competition with fewer women represented in corporate governance.

5 Research design

Since different sets of determinants of PQ have been tested independently of one another, we propose an integrated approach to elicit a comprehensive analysis of the determinants of PQ for investigating the effect of women on boards. We aim to introduce (a) an integrated analysis of the bespoke determinants and (b) a novel approach, adding gender related variables. We apply a three-stage methodology. First, we replicate earlier studies on PQ; second, we estimate models including all the variables identified as significant in earlier studies; third, we add gender-specific variables to test our hypothesis of the favorable impact of women directors on PQ. We find a positive relationship between a higher female board ratio and companies’ PQ scores, which we discuss along with other results.

We use firm-attested PQ as a dependent variable, obtained from the goods’ evaluation scores published regularly by the German nonprofit foundation, Stiftung Warentest (SW). This institution, which tests consumer goods and services from various industry sectors, publishes a monthly journal with a series of tests. All products inspected by the organization are described in the magazine (including price, producer, sample, and other factors), which are evaluated using a reverse point scale per item, from 1 (very good) to 5.5 (very bad).

We also draw on the theoretical considerations of previous studies from the past four decades of related research, including independent determinants that different studies find to have an impact on PQ, which are presented in Table 2.

Phillips et al. (1983) analyze factor correlations of advertising expenditure, sales, general and administrative costs, and R&D expenditure with PQ, finding a positive relationship between all three categories and PQ, particularly in the consumer durables industry sector.Footnote 3 We re-estimate these factors using the variables advertising expenses in percentage of sales (ADDS), sales, general and administrative costs in percentage of sales (SG&A), research and development expenses in percentage of sales (R&D), and a dummy variable for an innovative firm (INNOV) if a company is listed by the Business Week journal as one of the top 50 most innovative companies in the world in respective years. All financial data are sourced from companies’ public annual reports. The advertisment cost ratios are sourced from Schonfeld & Associates (2010).

Jacobson & Acker (1987) use a vector autoregressive model for relative PQ (t) as a dependent variable. The authors’ model equation considers one year lagged ROI, market share, relative product price, relative costs, and relative PQ as independent variables, revealing the positive impact of an established PQ and product price and mixed effects of ROI and costs in consumer durables and non-durables sectors. We use a return on investment ratio as a percentage per anno (ROI), a relative product price levelFootnote 4 of a firm (REL_PRC) to control for companies’ pricing position (expensive or low-cost products), and cost of goods sold as a percentage of sales (COGS) as independent factors possibly impacting PQ. Due to the lack of publicly and readily available information on market share, we are unable to test the exogenous variables of Jacobson & Acker (1987), which are based on a proprietary dataset. Note that market share is not found to be significant in the results for the industry sectors in our study. We alternatively assign two separate dummy parameters; one for corporations active in the consumer durables (IND_CD) sector, and the second for firms in the consumer nondurable (IND_NON_CD) sector, examining them separately in our regressions.

Erdem and Swait (1998) use proprietary questionnaires and ordinary least squares (OLS) regressions to find that brand investments may positively affect a (perceived) quality of goods. We replicate their study by using a BEST BRAND dummy, if a company was ranked among the Global Best Brands in 2010 and in 2009 (Interbrand, 2010).

Cooke (1992) uses ordered probit estimates to investigate the effectiveness of an employee participation program on PQ improvement, determining that investments and a well-established workforce friendly employee participation program positively affect PQ improvement, while downsizing measures significantly deteriorate PQ. Firm size may impact quality endeavors slightly negatively, but the outcome value is rather minimal. Devaro (2008) finds that autonomous production teams can most probably contribute to "a lot higher" than industry average product quality". Likewise, we test capital investments in percentage of sales (CAPEX) as a potential driver of PQ, the numbers for which are taken from the company annual reports (sourced from the corporate investor relations websites). We also deploy the standard test variable of FIRM SIZE based on absolute employee headcount values, supplemented by parameters approximating corporate human resource policies, such as organizational downsizing (DOWNSIZE), if a year-on-year personnel reduction had exceeded 10%, as well as a BEST EMPLOYER dummy variable, if a company was awarded this title in 2010 and/or 2009 by The Great Place to Work Institute(http://www.greatplacetowork.net/).

Finally, we reference Berry and Waldfogel (2010), who use OLS regressions and Tobin’s Q to find a positive impact of market size on PQ in newspaper and restaurant sectors in the US. The authors also demonstrate that markets competing primarily through variable costs (like restaurants) allow for more rapid development of broader market variety, including high-end products, than markets ruled by fixed costs (like newspapers). We use a binary variable indicating whether a company operates within a fixed costs industry (FIX_COST_IND) and consider MARKET SIZE values for Germany, which were taken in absolute numbers from the national value-added tax statistics published by the German Statistical Office (Destatis, 2012).

To test our hypothesis regarding the positive impact of women on boards of directors on PQ, we use several control parameters, such as the number of women on the board of directors (FEMALE DIRECTORS), the size of the board (BOARD SIZE), and the share of female directors (in percentage) per firm (WBOARD). We also include dummy variables for the companies (and years) with a female share of 0%, 1–10%, 11–20%, 21–30%, and 31–50%. Only six of the observations in our data set (N = 142) have more than a 31% female share. The average female directors’ share in our sample increased from 10% in 2009 to 11% in 2010, on average, along with the average female count. In 2010, 26 boards had exclusively male representation, compared to 27 boards in 2009, with a 1% increase of the board size.

SW initially evaluated products from 173 companies in 2009 and 175 firms in 2010, including financial services corporations. We exclude banking and insurance corporations from our analysis due to the effect of the financial crisis on this sector in the respective years; hence, we review 759 product tests for 151 enterprises profiled in 2010 and 682 product tests for 154 firms in 2009 from the SW foundation. We include companies evaluated in two consecutive years reducing our sample to 93 companies evaluated in both years. Finally, we establish our research sample with 71 publicly listed companies for which we are able to obtain consistent financials for our 16 independent variables simultaneously that are consistently reported each year. Therefore, our sample includes a balanced panel data set of 142 observations for which a corresponding set of comprehensive financial details and testing samples is consistently available the two consecutive years of study. Data consistency is a challenging aspect of multi-year quality studies, as the SW foundation’s tested product portfolio changes every year and respective firm financials may vary due to market factors such as mergers and acquisitions, altered reporting structure of business units and accounts, subsidiary business branching, and other changes. The tabulated sample selection process is presented in Table 3.

For the final research sample, we consider a final number of 555 product evaluations in 2010 and 558 in 2009. The included firms reported a cumulative revenue of 2.150 billion US$ in 2010, jointly employing over 5.4 million people worldwide. On average, we collect approximately eight product evaluations per company per year. We calculate PQ (t) approximated by a (log) median product evaluation score per company (MED_PQS) in 2010 and in 2009 as an endogenous variable, based on the product reliability marks achieved per company in the respective year, leading to N = 142. The composition of the data sample in terms of firms’ industry affiliation and geographic origin (including calculated average PQ values) is presented in Table 4.

The reliability of consumer reports is criticized by Hjorth-Andersen (1984), who claims that the mathematical averaging process and some arbitrary product cue weights used for a creation of quality indices could be misleading. However, in an empirical study of consumer reports, Curry and Faulds (1986) come to conflicting conclusions regarding the efficacy of published quality indices. Tellis and Johnson (2007) find product evaluations in the Wall Street Journal to be a reliable source of information that impacts capital markets and increases abnormal returns of product manufacturers’ stock prices for five days from the date of the quality test disclosure Table 4.

We begin by quasi-replicating the previously mentioned PQ studies, study by study. In the next step, we simultaneously test all variables using an OLS regression, referencing Jacobson & Acker (1987).

Equation 1: Regression model for impact of women directors on PQ:

where V is the logarithm of cth firm’s median PQ score in year t. All model variables are indexed by firm c and time period t. X1−p is the set of firm-level control variables described above and the term WBOARD represents the variables related to gender.

For robustness testing, we analyze the same data pool using a robust LS regression function by applying the M-, S-, and MM-estimation methods to mitigate the impact of outliers. We also run stepwise regressions; being aware of the criticisms of the last method (Whittingham et al., 2006, p. 1), we use a “hands-off” approach to test our data selection.

6 Empirical findings

Table 5 presents the re-estimation results of the effects of variables on PQ as individually considered by various studies. We first re-estimate the model of Phillips et al. (1983) in column (1). For consumer durables, we confirm a positive impact of sales force expenditure and company innovative power on PQ. In contrast, we do not find a positive relationship between advertising spending and PQ when using the variable specifications of Phillips et al. (1983).

Column (2) confirms the findings of Jacobson and Aaker (1987), indicating a significant impact of higher relative product prices. Although Jacobson and Aaker (1987) find a significant negative impact of ROI on PQ within nondurable businesses, they generally doubt any larger association between these two parameters. Our results do not find a significant relationship between ROI and PQ. Jacobson and Aaker (1987) find no significant effect of COGS on PQ, which is confirmed in our replication. As the COGS variable is multilinear with industry dummy variables, we only test for COGS.

Column (3) confirms the results of Erdem and Swait (1998) of a positive impact of brand names on the quality of goods, indicating that membership in the global group of “best brand” can favorably impact attested PQ.

Cooke (1992) finds that firms’ size negatively, but marginally, impacts quality, while unionized and nonunionized companies, if empowered with an employee participation program, can improve product reliability. Model (4) shows a significant positive relationship between firm size and PQ but does not reveal any significant positive effects from an employee friendly human resource policy or effective employee participation. In addition, the results do not indicate any significantly negative effect of downsizing measures or capital expenditures on PQ. The author also finds a positive impact of capital investments on PQ, whereas the impacts of these variables are not significantly different from zero in our estimations.

Model (5) quasi-replicates the finding of Berry and Waldfogel (2010) that fixed costs industries may have a significantly positive PQ advantage, but in contrast, we do not find a significant association between market size and PQ.

Finally, Model (6) in Table 5 presents the results of our estimation model including all previously used exogenous determinants. Note that the goodness of fit of our integrated approach is comparatively better. We find that sales, general and administrative expenses, relative product price, firm size, being part of a fixed cost industry, and advertising expenditures significantly impact PQ.

In Table 6, column (1) we simultaneously test all variables significantly associated with PQ in estimation (6) of Table 5. Note that adjusted R2 increases. Variables such as advertising expenses, sales, general and administrative expenditures, product price, firm size, and fixed cost industry remain significant, while company innovativeness and best brand status lose significance. The coefficients of relative price and fixed cost industry increase in value, while other significant factors decrease. In column (2) we add our focus variables featuring the number and the proportion of females on boards of directors and the control parameter of board size. While we find an insignificant impact of board size on PQ, the absolute number of women directors significantly positively affects PQ. Increasing the female director count by one woman (ca. 10%) improves the average PQ score by 2.5%. Accordingly, in column (5) we find a significant positive association of the proportion of females on boards of directors on PQ. Columns (4) and (7) test the quadratic polynomial values of gender-specific variables and remain insignificant. We also confirm that PQ is positively impacted by sales, general and administrative expenses, the relative product price, best brand status, and by being in a fixed cost industry. Conversely, there is an inverse relationship between higher advertising expenses and goods’ quality.

The models in Table 7 adopt the idea of a nonlinear relationship between female participation and PQ due to minimum critical mass (Kanter, 1993; Rosener, 1995; Konrad et al., 2008; Torchia et al., 2011; Elstad & Ladegard, 2012; Joecks et al., 2013; Schwartz-Ziv, 2017; Amorelli & Garcia-Sanchez, 2019; Gyapong et al. 2019, Saggese et al., 2020; Nguyen et al., 2021; Amin et al., 2021). Column (1) of Table 7 indicates that a complete lack of females on a board of directors does not significantly affect the PQ status quo. Column (2) shows that a positive ratio of women directors of 21–30% results in a 3.6% improvement on the PQ score in our log-lev model, also when controlling for time fixed effects. In columns (3–6), we control our model for variable outliers, obtaining similar positive results. The strongest M-estimation model is obtained excluding industry effects. These outcomes suggest that a minimum one-fifth female directors’ ratio generates effective action on PQ.

7 Conclusion

We analyze the determinants of PQ, beginning by a quasi-replication of earlier quantitative studies, simultaneously testing all variables identified to be significant in the past and then adding gender-specific variables. As robustness tests, we leverage M-, S-, and MM- robust LS functions (to control for outliers’ impact) and stepwise regression algorithms.

Our study confirms that optimizing certain determinants of organizational performance is relevant to increasing PQ benchmarks and that gender diversity in corporate governance could be an additional lever for improving the quality of offered goods. Our results also imply that stakeholders should discourage “tokenism” in appointing boards of directors. We confirm the finding of Phillips et al. (1983) that general sales and administrative expenses have a significant and positive effect on PQ. Our results mainly indicate a negative relationship of advertising expenses on PQ, showing a positive association only in one LS robustness test regression (S-Model). This relationship also remains unsettled in the literature. We confirm a positive association between relative product price and product reliability as demonstrated by Jacobson and Aaker’s (1987) research. We also identify an insignificant impact of costs of goods sold and ROI on PQ. Like Erdem and Swait (1998), we find company brand to be a significant determinant of quality performance. Our results suggest that an employee friendly workforce policy and higher capital investments could positively affect PQ, while downsizing measures may decrease it. We find a positive and significant correlation between firm size and PQ. Our models also confirm that being part of a fixed cost industry significantly favors PQ (Berry & Waldfogel, 2010).

Finally, and as a central finding, using different multiple model variants and robustness specifications, we present evidence confirming that female directors can favorably affect PQ. Testing in more detail for further nonlinearities, we find that a critical mass of female board members—beyond a one-fifth proportion—is needed to positively influence PQ scores. Modern and high quality products demand a considerable degree of sustainability (monitoring and governance) and a respective communication style and policy, regarding which female board members appear to have an effective role as PQ agents. Advanced goods tend to already consume less energy and produce less waste and pollution in manufacturing processes. During the product life cycle, such companies usually operate with energy savvy mechanisms, assess low warranty costs, seldom experience product recalls, and maintain a low carbon footprint. Notably, business ethics and sustainability are among the top issues considered by contemporary investors and an overall board gender diversity promotes the implementation of high ethical codes (Koutoupis et al., 2022), which presumably also includes related PQ and sustainability guidance. Ambitious governance best practices and strict monitoring procedures in corporations are company prerequisites for producing reliable and environmentally friendly goods. Diverse boards with more female directors may eventually better facilitate quality friendly policies and business ecosystems. Gender-balanced corporate governance bodies are more likely to implement quality assurance services (Liao et al., 2018). If more companies are motivated through appropriate regulations or research findings such as those found in this study to raise the number of female board appointments, a positive effect to PQ and the sustainability of national economic output could be achieved in the long run. Nongovernmental organizations could have a unique role in favorably affecting the current regulatory status quo of gender participation in corporate governance (Lindberg et al., 2014) and advance board sensitivity to the business implications of high quality goods.

We acknowledge the limitations of our analysis, being aware that researchers’ intervention does not eliminate selection bias (Massaro et al., 2016). As with any empirical study, our results are based on a particular data sample that is specific to the period chosen, geography, and data availability. The regression analysis primarily used in such studies has limitations in assessing the circumstantial aspects of corporate governance. More qualitative and non-parametric analyses or survey approaches could provide adjacent observations in our context. In addition, measuring the proportion of female board members cannot fully capture the deeper traits of female directors’ behavior and management attributes; hence, it only allows for binary modeling of board diversity (Koutoupis et al., 2022). Some authors argue that the proportion of women on the board is not an appropriate measure of diversity, as boards with a large female presence will exhibit a high degree of homogeneity in terms of the gender category (Campbell & Minguez-Vera, 2008). Alternatively, rather than this measure (the proportion of females on boards of directors), the Blau or Shannon index could be used to measure gender diversity, since they are more sensitive to smaller values and may be more appropriate to capture critical mass effects (Humbert & Gunther 2017). We analyze effects of critical mass in Table 7 by setting precise female share intervals. Furthermore, improved access to proprietary and consistently measured of firm characteristics and personnel-related data (e.g., board members’ biographical details, female directors’ experience, or granular key performance indicators on manufacturing shop floors), which are often protected by privacy policies, could presumably uncover further insights into the relationship between board member gender and PQ or other firm performance indicators. Broader data sets from other jurisdictions could consider even more factors, and conducting a similar study for a sample of companies from emerging countries could reveal further results. Notably, with broader resource inequality data that include diverse data on demographic, leadership, and formal personnel and organizational factors, an analysis of gender causality could become overly complex (Cruz-Castro & Sanz-Menendez, 2019; Mazur & Spierings, 2016). Rossignoli et al. (2021) also argue that other aspects of diversity, such as educational background, professional expertise, and other personal information (e.g., marital status, sexual orientation, and other difficult measures that are to model due to a lack of relative disclosures) do not seem to matter for company performance. Considering such caveats, our framework could stimulate further studies, such as in B2B or public domains. Likewise, in sophisticated and transparent markets, where the public is pushing for inclusion, brand equity, and customer loyalty may especially and increasingly depend on a greater representation of female directors, executive officers, and CEOs. In addition, an examination of the impact of women’s representation in the executive ranks of companies operating in markets with rapidly changing market trends, or markets with particularly creative and innovative products, may be of particular interest. We believe that our research could be a good inspiration for academics, practitioners, and policymakers to continuously discuss, pragmatically influence, and possibly further regulate the gender balance of boards of directors.

Notes

For an older rank correlation study on promotional expenses and the quality of diverse consumer goods, see Rotfeld and Rotzoll (1976); for a test on the reverse causality of PQ on advertising expenditure, see Tellis and Fornell (1988); and for an analysis of perceived PQ, see Moorthy and Zhao (2000).

SW documents publish the prices for all reviewed goods and firms, allowing us to calculate the average price of a particular product within each single test sample (e.g., TV sets). We then analyze the price ratio (in percentage) that a particular test item per company (e.g., a TV set unit) has in comparison to the average reference price estimated for this type of product within each test sample. Finally, we determine an average value of the relative product price levels per company in all test samples scrutinized for a particular company.

References

Adams, R. B., & Ferreira, D. (2004). Gender diversity in the boardroom. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.594506

Adams, R. B., & Funk, P. (2012). Beyond the glass ceiling: Does gender matter? Management Science, 58(2), 219–235.

Adams, R. B., & Kirchmaier, T. (2016). Women on boards in finance and STEM industries. American Economic Review: Papers & Proceedings, 106(5), 277–281.

Adhikari, B. K., Agrawal, A., & Malm, J. (2019). Do women managers keep firms out of trouble? Evidence from corporate litigation and policies. Journal of Accounting and Economics, 67(1), 202–25.

Allen, S., & Truman, C. (1993). Women in business. Routledge.

Al-Shaer, H., & Zaman, M. (2016). Board gender diversity and sustainability reporting quality. Journal of Contemporary Accounting & Economics, 12, 210–222.

Amah, O. (2018). Determining the antecedents and outcomes of servant leadership. Journal of General Management, 43(3), 126–138.

Amin, A., Rehman, R.-U., Ali, R., & Ntim, C.-G. (2021). Does gender diversity on the board reduce agency cost? Evidence from Pakistan. Gender in Management: An International Journal, 37(2), 164–181.

Ammad, A., & Serat, A. (2017). Boardroom gender diversity and stock liquidity: Evidence from Australia. Journal of Contemporary Accounting & Economics, 13, 148–165.

Amorelli, M.-F., & Garcia-Sanchez, I.-M. (2019). Critical mass of female directors, human capital, and stakeholder engagement by corporate social reporting. Corporate Social Responsibility and Environmental Management, 27(1), 204–221.

Arora, A. (2021). Gender diversity in boardroom and its impact on firm performance. Journal of Management and Governance, 26, 735.

Bell, A., & Jones, K. (2015). Explaining fixed effects: Random effects modelling of time-series cross-sectional and panel-data. Political Science Research and Methods, 3(1), 133–153.

Berry, S., & Waldfogel, J. (2010). Product quality and market size. The Journal of Industrial Economics, 58(1), 1–31.

Brieger, S. A., Francoeur, C., Welzel, Ch., & Ben-Amar, W. (2019). Empowering women: The role of emancipative forces in board gender diversity. Journal of Business Ethics, 155, 495–511.

Bruna, M. G., Dang, R., Scotto, M.-J., & Ammari, A. (2019). Does board gender diversity affect firm risk-taking? Evidence from the French stock market. Journal of Management and Governance, 23, 915–938.

Burgess, Z., & Tharenou, P. (2002). Women board directors: Characteristics of the few. Journal of Business Ethics, 37(1), 39–49.

Burke, S., & Collins, K. (2002). Gender differences in leadership styles and management skills. Women in Management Review, 16(5), 244–257.

Calveras, A., & Ganuza, J.-J. (2016). Corporate social responsibility and product quality. Journal of Economics & Management Strategy, 27(4), 804–829.

Campbell, K., & Minguez-Vera, A. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics, 83, 435–451.

Chattopadhyay, P., Tluchowska, M., & George, E. (2004). Identifying the ingroup: A closer look at the influence of demographic dissimilarity on employee social identity. Academy of Management Review, 29(2), 180–202.

Comi, S., Grasseni, M., Origo, F., & Pagani, L. (2020). Where women make a difference: Gender quotas and firms’ performance in three European countries. Industrial and Labor Relations Review, 73(3), 768–793.

Conyon, M. J., & He, L. (2017). Firm performance and boardroom gender diversity: A quantile regression approach. Journal of Business Research, 79(4), 198–211.

Cooke, W. N. (1992). Product quality improvement through employee participation: The effects of unionization and joint union-management administration. Industrial and Labor Relations Review, 46(1), 119–134.

Cruz-Castro, L., & Sanz-Menendez, L. (2019). Grant allocation disparities from a gender perspective: Literature review. Synthesis Report. https://doi.org/10.20350/digitalCSIC/10548

Curry, D. J., & Faulds, D. J. (1986). Indexing product quality: Issues, theory, and results. Journal of Consumer Research, 13(1), 134–145.

Dale-Olsen, H., Schone, P., & Verner, M. (2013). Diversity among Norwegian boards of directors: Does a quota for women improve firm performance? Feminist Economics, 19(4), 110–135.

Dang, R., & Nguyen, D. K. (2016). Does board gender diversity make a difference? New evidence from quantile regression analysis. Management International, 20(2), 95–106.

de Luis-Carnicer, P., Martinez-Sanchez, A., Perez-Perez, M., & Vela-Jimenez, M. J. (2008). Gender diversity in management: Curvilinear relationships to reconcile findings. Gender in Management: An International Journal, 23(8), 583–597.

Destatis (2012). Umsatzsteuerstatistik (Voranmeldungen) 2010. Statistisches Bundesamt. Wiesbaden. 28 March 2012.

Devaro, J. (2008). The effects of self-managed and closely managed teams on labor productivity and product quality: An empirical analysis of a cross-section of establishments. Industrial Relations, 47(4), 659–697.

Dezsö, C. L., & Ross, D. G. (2012). Does female representation in top management improve firm performance? Strategic Management Journal, 33, 1072–1089.

Dobson, J., & White, J. (1995). Toward the feminine firm: An extension to Thomas white. Business Ethics Quarterly, 5(3), 463–478.

Duff, A. J. (2013). Performance management coaching: Servant leadership and gender implications. Leadership & Organization Development Journal, 34(3), 204–221.

Dunn, P. (2012). Breaking the boardroom gender barrier: The human capital of female corporate directors. Journal of Management and Governance, 16, 557–570.

Duppati, G., Rao, N. V., Matlani, N., Scrimgeour, F., & Patnaik, D. (2020). Gender diversity and firm performance: Evidence from India and Singapore. Applied Economics, 52(14), 1553–1565.

Eagly, A. H., & Carli, L. L. (2003). The female leadership advantage: An evaluation of the evidence. The Leadership Quarterly, 14(6), 807–834.

Eagly, A. H., Diekman, A., Johannesen-Schmidt, M. C., & Koenig, A. M. (2004). Gender gaps in sociopolitical attitudes: A social psychological analysis. Journal of Personality and Social Psychology, 87, 796–816.

Eagly, A. L., & Johannesen-Schmidt, M. C. (2001). The leadership styles of women and men. Journal of Social Issues, 57(4), 781–797.

Eagly, A. H., Karau, S. J., & Makhijani, M. G. (1995). Gender and the effectiveness of leaders: A meta-analysis. Psychological Bulletin, 117(1), 125–145.

Elstad, B., & Ladegard, G. (2012). Women on corporate boards: Key influencers or tokens? Journal of Management and Governance, 16, 595–615.

Emelianova, O. (2020). Women on Boards—2020 Progress Report. MSCI. https://www.msci.com/documents/10199/9ab8ea98-25fd-e843-c9e9-08f0d179bb85, Retrieved on 5 Jan 2021.

Erdem, T., & Swait, J. (1998). Brand equity as a signaling phenomenon. Journal of Consumer Psychology, 7(2), 131–157.

Erdurmazli, E. (2019). On the servant leadership behaviors perceived in voluntary settings: The influences on volunteers’ motivation and organizational commitment. SAGE Open, 2019, 1–17.

Farrell, K. A., & Hersch, P. L. (2005). Additions to corporate boards: The effect of gender. Journal of Corporate Finance, 11, 85–106.

Ferreira, D. (2015). Board diversity: Should we trust research to inform policy? Corporate Governance: An International Review, 23(2), 108–111.

Finkelstein, S., Hambrick, D. C., & Cannella, A. A. (2008). Strategic leadership: Theory and research on executives, top management teams, and boards. Oxford University Press.

Francoeur, C., Labelle, R., & Sinclair-Desgagne, B. (2008). Gender diversity in corporate governance and top management. Journal of Business Ethics, 81, 83–95.

Franke, G. R., Crown, D. F., & Spake, D. F. (1997). Gender differences in ethical perceptions of business practices: A social role theory perspective. Journal of Applied Psychology, 82, 920–934.

Freeman, S., & Varey, R. (1997). Women communicators in the workplace: Natural born marketers? Marketing Intelligence & Planning, 15(7), 318–324.

Fulton, B. R. (2021). Bridging and bonding: Disentangling two mechanisms underlying the diversity-performance relationship. Nonprofit and Voluntary Sector Quarterly, 50(1), 54–76.

Garvin, D. A. (2001). Product quality: An important strategic weapon. Business Horizons, 27(3), 40–43.

Gender Statistics Database (2021). European Commission. https://eige.europa.eu/gender-statistics/dgs, Retrieved on 5 Jan 2021.

Girón, A., Amirreza, K., Cicchiello, A. F., & Panetti, E. (2021). Sustainability reporting and firms’ economic performance: Evidence from Asia and Africa. Journal of the Knowledge Economy, 12(4), 1741–1759.

Golder, P. N., Mitra, D., & Moorman, C. (2012). What is quality? An integrative framework of processes and states. Journal of Marketing, 76(4), 1–23.

Griffin, D., Li, K., & Xu, T. (2021). Board gender diversity and corporate innovation: International evidence. Journal of Financial and Quantitative Analysis, 56(1), 123–154.

Groysberg, B., Cheng, Y.-J., & Bell, D. (2016). Global board of directors survey (p. 6). SpencerStuart.

Gyapong, E., Ahmed, A., Ntim, G. C., & Nadeem, M. (2019). Board gender diversity and dividend policy in Australian listed firms: The effect of ownership concentration. Asia Pacific Journal of Management, 38, 603–643.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206.

Heemskerk, E. M., & Fennema, M. (2014). Women on board: Female board membership as a form of elite democratization. Enterprise and Society, 15(2), 252–284.

Hill, T. D., Roos, J. M., & Davis, A. P. (2020). Limitations of fixed-effects models for panel data. Sociological Perspectives, 63(3), 357–369.

Hillman, A. J., Shropshire, C., & Cannella, A. A. (2007). Organizational predictors of women on corporate boards. Academy of Management Journal, 50(4), 941–952.

Hjorth-Andersen, C. (1984). The concept of quality and the efficiency of markets for consumer products. Journal of Consumer Research, 11(2), 708–718.

Hsu, C.-S., Lai, W.-H., & Yen, S.-H. (2019). Boardroom diversity and operating performance: The moderating effect of strategic change. Emerging Markets Finance & Trade, 55, 2448–2472.

Humbert, A. L., & Gunther, E. (2017). Gender Diversity Index—preliminary considerations and results cranfield online research data (CORD). Journal Contribution. https://doi.org/10.17862/cranfield.rd.5110978.v1

Interbrand (2010). http: //interbrand.com/best-brands/best-global-brands/2010/ranking/, Retrieved in March 2012.

Iqbal, Z., Sewon, O., & Baek, H. Y. (2006). Are female executives more risk-averse than male executives? Atlantic Economic Journal, 34(1), 63–74.

Jacobson, R., & Aaker, D. A. (1987). The strategic role of product quality. Journal of Marketing, 51(4), 31–44.

Joecks, J., Pull, K., & Vetter, K. (2013). Gender diversity in the boardroom and firm performance: What exactly constitutes a critical mass? Journal of Business Ethics, 118(1), 61–72.

Johansen, M. S. (2007). The effect of female strategic managers on organizational performance. Public Organization Review, 7(3), 269–279.

Johnstone-Louis, M. (2017). Corporate social responsibility and women’s entrepreneurship: Towards a more adequate theory of “work.” Business Ethics Quarterly, 27(4), 569–602.

Jourová, V. (2016). Gender balance on corporate boards. Europe is cracking the glass ceiling. Fact sheet. Directorate-General for Justice and Consumers, European Commission. http://ec.europa.eu/justice/gender-equality/files/gender_balance_decision_making/1607_factsheet_final_wob_data_en.pdf on 07 Sep 2017

Kaczmarek, S., & Nyuur, R. B. (2021). The implications of board nationality and gender diversity: Evidence from a qualitative comparative analysis. Journal of Management and Governance, 26, 707.

Kang, E., Ding, D. K., & Charoenwong, C. (2010). Investor reaction to women directors. Journal of Business Research, 63(8), 888–894.

Kanter, R. (1993). Men and women of the corporation. Basic Books.

Kim, D., & Starks, L. T. (2016). Gender diversity on corporate boards: Do women contribute unique skills? American Economic Review: Papers & Proceedings, 106(5), 267–271.

Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A., Jehn, K., Leonard, J., Levine, D., & Thomas, D. (2003). The effects of diversity on business performance: Report of the diversity research network. Human Resource Management, 42(1), 3–21.

Konrad, A., Erkut, S., & Kramer, V. (2008). Critical mass: The impact of three or more women on corporate boards. Organizational Dynamics, 37(2), 145–164.

Koutoupis, A., Skourti, T., Davidopoulos, L. G., & Kampouris, Ch. G. (2022). Board diversity: Current state and future avenues. Theoretical Economics Letters, 12, 788–813.

Kytle, B., & Ruggie, J. (2005). Corporate social responsibility as risk management. Management of Environmental Quality an International Journal, 20(20), 311–320.

Lakhala, L., & Pasin, F. (2008). The direct and indirect impact of product quality on financial performance: A causal model. Total Quality Management, 19(10), 1087–1099.

Lewellyn, K. B., & Muller-Kahle, M. I. (2020). The corporate board glass ceiling: The role of empowerment and culture in shaping board gender diversity. Journal of Business Ethics, 165, 329–346.

Liao, L., Lin, T. P., & Zhang, Y. (2018). Corporate board and corporate social responsibility assurance: Evidence from China. Journal of Business Ethics, 150, 211–225.

Lindberg, M., Lindgren, M., & Packendorff, J. (2014). Quadruple helix as a way to bridge the gender gap in entrepreneurship: The case of an innovation system project in the Baltic sea region. Journal of the Knowledge Economy, 5(1), 94–113.

Lopatta, K., Böttcher, K., Lodhia, S., & Tideman, S. A. (2020). The relationship between gender diversity and employee representation at board level and non-financial performance—A cross-country study. The International Journal of Accounting. https://doi.org/10.1142/S1094406020500018

Lückerath-Rovers, M. (2013). Women on boards and firm performance. Journal of Management and Governance, 17, 491–509.

Lunsford, D. L. (2000). Ethical judgments—Does gender matter? Teaching Business Ethics, 4(1), 1–22.

Martel, R. F., Lane, D. M., & Emrich, C. (1996). Male-female differences: A computer simulation. American Psychologist, 51, 157–158.

Martin-Ugedo, J. F., & Minguez-Vera, A. (2014). Firm performance and Women on the board: Evidence from Spanish small and medium-sized enterprises. Feminist Economics, 20(3), 136–162.

Massaro, M., Dumay, J., & Guthrie, J. (2016). On the shoulders of giants: Undertaking a structured literature review in accounting. Accounting, Auditing & Accountability Journal, 29, 767–801.

Mazur, A. G., & Spierings, N. (2016). Gender and causal concepts: Implications for comparative theory building. Politics and Gender, 12(3), 1–7.

McCarthy, L. (2017). Empowering women through corporate social responsibility: A feminist foucauldian critique. Business Ethics Quarterly, 27(4), 603–631.

Mohan, N. J., & Chen, C. R. (2004). Are IPOs priced differently based upon gender? The Journal of Behavioral Finance, 5(1), 57–65.

Moorthy, S., & Zhao, H. (2000). Advertising spending and perceived quality. Marketing Letters, 11(3), 221–233.

Mukhtar, S.-M. (2002). Differences in male and female management characteristics: A study of owner-manager businesses. Small Business Economics, 18(4), 289–310.

Nagar, V., & Rajan, M. V. (2001). The revenue implications of financial and operational measures of product quality. The Accounting Review, 76(4), 495–513.

Nguyen, T., Nguyen, A., Nguyen, M., & Truong, T. (2021). Is national governance quality a key moderator of the boardroom gender diversity–firm performance relationship? International evidence from a multi-hierarchical analysis. International Review of Economics & Finance, 73, 370–390.

Nguyen, T., Ntim, C. G., & Malagila, J. K. (2020). Women on corporate boards and corporate financial and non-financial performance: A systematic literature review and future research agenda. International Review of Financial Analysis, 71, 101554.

Nielsen, S., & Huse, M. (2010). The contribution of women on boards of directors: Going beyond the surface. Corporate Governance: An International Review, 18(2), 136–148.

Ntim, C. G. (2015). Board diversity and organizational valuation: Unravelling the effects of ethnicity and gender. Journal of Management & Governance, 19(1), 167–195.

Oliver, J. (1996). Women’s realm. SME, 2, 28–31.

Pace, A. (2009). Roaring all the way to the top. Training and Development, 1, 16–23.

Pesonen, S., Tienari, J., & Vanhala, S. (2009). The boardroom gender paradox. Gender in management, 24(5), 327–345.

Pfeffer, J. (1983). Organizational demography. In L. L. Cummings & B. M. Staw (Eds.), Research in organizational behaviour. JAI Press.

Pfeffer, J., & Salancik, G. R. (1978). Social control of organizations. The external control of organizations: A resource dependence perspective. Harper & Row.

Phillips, L. W., Chang, D. R., & Buzzell, R. D. (1983). Product quality, cost position and business performance: A test of some key hypotheses. Journal of Marketing, 47(2), 26–43.

Post, C., & Byron, K. (2015). Women on boards and firm financial performance: A meta-analysis. Academy of Management Journal, 58(5), 1546–1571.

Pucheta-Martinez, M. C., & Bel-Oms, I. (2016). The board of directors and dividend policy: The effect of gender diversity. Industrial and Corporate Change, 25(3), 523–547.

Ramadhania, S. M., Ahmad, G. N., Zakaria, A., & Witiastuti, R. S. (2021). The effect of gender diversity and the business expertise of female directors on firm performance: Evidence from the Indonesia stock exchange. International Journal of Business, 26(3), 38–52.

Reeves, C. A., & Bednar, D. A. (1994). Defining quality: Alternatives and implications. The Academy of Management Review, 19(3), 419–445.

Rohner, U., & Dougan, B. W. (2012). Gender diversity and corporate performance. Credit Suisse Research Institute. https: //www.credit-suisse.com/newsletter/doc/gender_diversity.pdf, Retrieved on 12 May 2014.

Rose, C. (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), 404–413.

Rosener, J. (1995). America’s competitive secret: Utilizing women as a management strategy. Oxford University Press.

Rossi, F., Cebula, R. J., & Barth, J. R. (2018). Female representation in the boardroom and firm debt: Empirical evidence from Italy. Journal of Economics and Finance, 42, 315–338.

Rossignoli, F., Lionzo, A., & Buchetti, B. (2021). Beyond corporate governance reporting: The usefulness of information on board member profiles. Journal of Management and Governance, 25, 27–60.

Rotfeld, H. J., & Rotzoll, K. B. (1976). Advertising and product quality: Are heavily advertised products better? Journal of Consumer Affairs, 10(1), 33–47.

Ryan, M. K., & Haslam, S. A. (2005). The glass cliff: Evidence that women are over-represented in precarious leadership positions. British Journal of Management, 16(2), 81–90.

Sabatier, M. (2015). A women’s boom in the boardroom: Effects on performance? Applied Economics, 47(26), 2717–2727.

Saggese, S., Sarto, F., & Vigano, R. (2020). Do women directors contribute to R&D? The role of critical mass and expert power. Journal of Management and Governance, 25, 625–626.

Saona, P., Muro, L., San Martin, P., & Baier-Fuentes, H. (2019). Board of director gender diversity and its impact on earnings management: An empirical analysis for selected European firms. Technological and Economic Development of Economy, 25(4), 634–663.

Sarhan, A. A., Ntim, C. G., & Al-Najjar, B. (2019). Board diversity, corporate governance, corporate performance, and executive pay. International Journal of Finance & Economics, 24(2), 761–786. https://doi.org/10.1002/ijfe.1690

Schonfeld & Associates, Inc. (2010). Advertising ratios and budgets.

Schwartz-Ziv, M. (2017). Gender and board activeness: The role of a critical mass. Journal of Financial and Quantitative Analysis, 52(2), 751–780.

Selma, M. B., Yan, W., & Hafsi, T. (2020). Board demographic diversity, institutional context and corporate philanthropic giving. Journal of Management and Governance, 22, 1–29.

Shahab, Y., Ntim, C. G., Ullah, F., Yugang, C., & Ye, Z. (2020). CEO power and stock price crash risk in China: Do female directors’ critical mass and ownership structure matter? International Review of Financial Analysis, 68, 101457.

Shrader, C. B., Blackburn, V. B., & Iles, J. P. (1997). Women in management and firm financial value: An exploratory study. Journal of Managerial Issues, 9(3), 355–372.

Simmons, W. O., & Emanuele, R. (2007). Male-female giving differentials: Are women more altruistic? Journal of Economic Studies, 34(6), 534–550.

Solakoglu, M. N., & Demir, N. (2016). The role of firm characteristics on the relationship between gender diversity and firm performance. Management Decision, 54(6), 1407–1419.

Su, W., Lyu, B., Chen, H., & Zhang, Y. (2020). How does servant leadership influence employees’ service innovative behavior? The roles of intrinsic motivation and identification with the leader. Baltic Journal of Management, 15(4), 571–586.

Suchanek, P., Richter, J., & Kralova, M. (2014). Customer satisfaction, product quality and performance of companies. Review of Economic Perspectives, 14(4), 329–344.

Tellis, G. J., & Fornell, C. (1988). The relationship between advertising and product quality over the product life cycle: A contingency theory. Journal of Marketing Research, 25(1), 64–71.

Tellis, G. J., & Johnson, J. (2007). The value of quality. Marketing Science, 26(6), 758–773.

Terjesen, S., Couto, E. B., & Francisco, P. M. (2016). Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management and Governance, 20, 447–483.

Torchia, M., Calabro, A., & Huse, M. (2011). Women directors on corporate boards: From tokenism to critical mass. Journal of Business Ethics, 102, 299–317.

Triana, M. C., Miller, T. L., & Trzebiatowski, T. M. (2013). The double-edged nature of board gender diversity: Diversity, firm performance, and the power of women directors as predictors of strategic change. Organization Science, 25(2), 609–632.

Tsui, A., Egan, T., & O’Reilly, C. (1992). Being different: Relational demography and organizational commitment. Administrative Science Quarterly, 37, 549–579.

Turban, S., Wu, D., & Zhang, L. (2019). When Gender Diversity Makes Firms More Productive. Harvard Business review (electronic format online), Feb2019, https://hbr.org/2019/02/research-when-gender-diversity-makes-firms-more-productive

Upadhyay, A., & Zeng, H. (2014). Gender and ethnic diversity on boards and corporate information environment. Journal of Business Research, 67(11), 2456–2463.

van Dunk, E. (2005). Diversity and tomorrow’s profits: Women in corporate leadership. International Labour Review, 137(1), 93–102.

Walby, S. (2011). Is the knowledge society gendered? Gender, Work and Organization, 18(1), 1–29.

Whittingham, M. J., Stephens, P. A., Bradbury, R. B., & Freckleton, R. P. (2006). Why do we still use stepwise modelling in ecology and behavior? Journal of Animal Ecology, 75(5), 1182–1189.

Yang, P., Riepe, J., Moser, K., Pull, K., & Terjesen, S. (2019). Women directors, firm performance, and firm risk: A causal perspective. The Leadership Quarterly. https://doi.org/10.1016/j.leaqua.2019.05.004

Yang, W., Yang, J., & Gao, Z. (2019a). Do female board directors promote corporate social responsibility? An empirical study based on the critical mass theory. Emerging Markets Finance & Trade, 55, 3452–3471.

Zalata, A. M., Ntim, C. G., Alsohagy, M. H., & Malagila, J. (2021). Gender diversity and earnings management: The case of female directors with financial background. Review of Quantitative Finance and Accounting, 58, 101–136.

Zalata, A. M., Ntim, C. G., Choudhrya, T., Hassanein, B. C., & Elzaharde, H. (2019). Female directors and managerial opportunism: Monitoring versus advisory female directors. The Leadership Quarterly. https://doi.org/10.1016/j.leaqua.2019.101309

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: robustness and additional analyses

Appendix: robustness and additional analyses

As a further robustness check, we run a robust least squares regression analysis with all variables considered thus far, controlling our model estimates for the impact of outliers (in dependent, independent, and both types of variables) and respectively use the M-, S-, and MM- estimation function. Our outcomes confirm the positive impact of the number and proportion of females in boards of directors on PQ. These results are presented in Table 8.

Additionally, we run a stepwise regression analysis with all variables considered thus far (Table 9).

presenting the best three models determined by the forward stepwise algorithm in columns (1), (2), and (3). The results demonstrate a significant positive effect of relative product price, firm size, general sales, and administrative expenses, being part of a fixed cost industry and a strong corporate brand. Significantly negative effects on PQ are revealed for advertising expenditure. A proportion of female directors of more than 21% significantly improves PQ.

To control for fixed effects, we also calculated models (3) and (6) in Table 6, testing a similar set of variables along with the additional consideration of industry and time fixed effects to control for events that possibly affect all companies (e.g., financial crisis) but are not specific to any company. In this case, female directors on boards and the associated proportion also indicate a positive impact on PQ. We also test our models with company fixed effects, and the results are available upon request. In this setting, all variables, apart from advertising expenditure, are insignificant, potentially indicating a shortcoming of applying the fixed effects models for panel data (Bell & Jones, 2015; Hill et al., 2020). We also test the models in Table 7 with company fixed effects, and the relationship between female share ratios and PQ remains positive (results available upon request). All other variables are insignificant, which points to the above-mentioned controversial aspect of estimation models with (too many) fixed effects.