Abstract

This paper offers a critical assessment of the value added intellectual coefficient (VAIC) through the analysis of the coherence of the definitions of and semantic relationships among the theoretical constructs at the heart of the model. Some of the criticisms detected here refer to inconsistencies of the VAIC with the most consolidated concepts developed by the Intellectual Capital (IC) literature as well as to the constructs internal to the model and generated by the misalignment of Pulic’s theoretical assumptions with the way they have been translated into the mathematical model. Other criticisms derive from the time mismatch in the relationship among the variables constituting the three ratios and from the ambiguous meanings of human capital efficiency and structural capital efficiency. Implications for both researchers and managers are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The value added intellectual coefficient (VAIC) is a measure of intellectual capital efficiency proposed by Pulic (1998; 2000a; b; 2004a; b; 2008) that is entirely consistent with the knowledge-based economy and a more objective alternative to traditional measures, such as EBITDA.

The VAIC concerns the efficiency of three types of capital: human capital (HC), measured by the cost of employees; structural capital (SC), equal to the difference between the value added generated by the firm and human capital; and physical and financial capital employed (CE), i.e., the amount of financial capital available to the firm.

The VAIC is the result of the sum of three efficiency ratios, all obtained through the combination of the value added (VA) with the three types of capital mentioned above:

-

Human capital efficiency (\(HCE=VA/HC\));

-

Structural capital efficiency (\(SCE=SC/VA= \left(VA-HC\right)/VA\)), and

-

Capital employed efficiency (\(CEE=VA/CE\)).

According to Pulic, an increase in the VAIC signals an improvement in the efficiency of a firm’s resources in general and employees’ knowledge in particular and thus the ability of the firm to create new economic value.

The postulated relationships among the VAIC, performance, and (market) value of a firm have stimulated a broad interest in the model, boosted by the fact that the VAIC model is easy to handle. In fact, it is based on accounting information that is publicly available (Tan et al. 2007) and audited (Young et al. 2009), does not require a benchmark for comparison (Laing et al. 2010), and can be calculated for the whole firm or even for single business units (Pulic 1998, 2004b).

Over time, however, two streams of criticism have been directed towards the VAIC, as some scholars have detected some theoretical inconsistencies in the model and others have reported unexpected results from analyses testing the association between the VAIC and firm performance.

For instance, Andriessen (2004) argues that the VAIC confuses stocks with flows and expenses with assets, does not consider synergies among the three types of capital and is not supported by any causal link with value creation. Iazzolino and Laise (2013) disagree with some of Andriessen’s remarks but note that Pulic uses some terms in his own way and very differently from the IC literature. Ståhle et al. (2011) highlight some criticisms relating to the calculation of value added and to the inconsistency of the VAIC with some consolidated concepts in the IC literature.

Empirical analyses of the VAIC (Ståhle et al. 2011; Marzo and Bonnini 2018) produce some surprising results, as a positive and sometimes significant association is in general, but not always, found between market value (and other financial metrics, such as return on assets and return on equity) and human capital efficiency and financial capital efficiency, while the association with the VAIC as a whole and with structural capital efficiency is, however, found to be weak or non-significant.

Aiming at achieving better empirical performance, some researchers have tried to overcome some of these criticisms through modifications of or extensions to the original VAIC model (Nazari and Herremans 2007; Vishnu and Kumar 2014; Pietrantonio and Iazzolino 2014; Ulum et al. 2014 Nimtrakoon 2015; Nadeem et al. 2018; Bayraktaroglu et al. 2019; Singla 2020).

The “struggle for correlation” has, however, led researchers to modify the original model or to add new components without complete awareness of the theoretical pitfalls of the VAIC, with the risk that the modifications made have replicated Pulic’s reasoning at the foundation of the VAIC, thereby generating in their new models the same issues that have drawn the criticisms above.

Others have instead decided to continue using the VAIC for their studies while simply alerting readers to criticisms of the model but without renouncing the advantages of its use and therefore without offering an educated assessment of the net value generated by the VAIC’s pros against its cons.

These considerations call for an in-depth analysis of the theoretical pitfalls of the VAIC, which could clarify all the inconsistencies and ambiguities affecting the model and their implications for the work of IC researchers and managers willing to rely on the VAIC.

The paper begins with some considerations on the most suitable criteria for evaluating the acceptability of a theory or a theoretical model and focuses on the importance of the coherence of the definitions and semantic relationships of the theoretical constructs at the heart of the model (Suddaby, 2010) to investigate the theoretical acceptability of the VAIC in detail. Some of the criticisms detected here refer to the inconsistencies of the VAIC with the most consolidated concepts developed by the IC literature as well as to the concepts internal to the model and generated by the misalignment of Pulic’s theoretical assumptions with their translation into the mathematical model. Other criticisms derive from the time mismatch in the relationships among the variables constituting HCE and from the ambiguity existing in the formulas for HCE and SCE and in their relationship.

This paper contributes to the literature on IC accounting and decision-making in three ways.

First, the paper offers a comprehensive analysis of the VAIC, collecting the criticisms already raised by scholars but at the same time rebalancing some of them and adding some new ones. Second, the paper highlights the role of the governance system within the value and the determination of HCE and points out that the overlap between the production and distribution approaches to value added in the constitution of HCE causes ambiguity in its meaning. Finally, the paper highlights some implications deriving from the drawbacks investigated, which serve as warnings for researchers in their empirical tests using the VAIC and for managers using VAIC as a tool for decision-making.

The outline of the paper is as follows. Section 2 presents the methodology employed for the theoretical assessment of the VAIC. Section 3 discusses the relevant literature on the VAIC. Section 4 focuses on the inconsistencies of the VAIC in light of the IC literature, and Sect. 5 discusses the internal inconsistencies between Pulic’s assumptions and the way they have been translated into the VAIC calculation. Section 6 offers some new insights into the problem of time mismatch in the VAIC variables. Sections 7 and 8 focus on the ambiguous meaning of HCE and its relationship with SCE. Section 9 summarises the main findings of the paper. Section 10 concludes.

2 Focus and methodology of the paper

There is an extensive and long-standing debate on which criteria are the most suitable for evaluating the acceptability of a theory or a theoretical model. In very general terms, a theory can be defined as a statement of relationships between constructs (Nagel 1961; Dubin 1969; Cohen 1980). Constructs are conceptual abstractions of phenomena and cannot be directly observed (MacCorquodale and Meehl 1948; Kerlinger 1973). Consequently, an operationalisation phase occurs when a theory is empirically tested (Dubin 1976). As Sutton and Staw (1995) clarify, data per se are not theory, nor are lists of variables or constructs. Theory is, instead, about why the empirical patterns to which data refer are observed or are expected to be observed (Kaplan 1964). Therefore, relying on the significance of empirical tests does not result in good theory. Theory, in fact, is about why and how something happens (Gioia and Pitre 1990), and using empirical tests, even if significant, as a substitute for theory is brute empiricism (Sutton and Staw 1995).

However, “a theoretical model is not simply a statement of hypothesis” (Dubin 1976, p. 26). A theory is a system of constructs and variables operationalising constructs, relating them through propositions and hypotheses (Bacharach 1989). While constructs are terms that cannot be observable (Kaplan 1964), variables are instead observable entities capable of assuming two or more values (Schwab 1980). Variables are therefore the operational translation of constructs.

The main goal of a theory is to organise concepts, to answer the questions of how, when and why, and to communicate these answers (Bacharach 1989). The clarity of constructs is essential, and the adequacy of their interrelationships is fundamental (Bacharach 1989). Clarity comprises four elements: definitions, scope conditions, semantic relationships to other constructs, and coherence or logical consistency.

A good definition should capture the essential characteristics of the phenomenon under study, avoid tautology or circularity (Priem and Butler 2001; Priem et al. 2008) and be parsimonious. However, a clear definition of a construct is not easy to obtain, as even the most commonly used constructs contain a complex inner grammar (Suddaby 2010) that can generate ambiguity in interpretation.

The scope conditions refer to space, time and value conditions to which the theory is restricted (Bacharach 1989). Constructs could apply differently in different types of organisations or levels of analysis. In addition, constructs may have historical validity, and changes in time can hinder the validity of constructs. Finally, constructs are constrained by values, i.e., the worldview of the researcher.

The semantic relationship with other constructs can be fostered by demonstrating the historical lineage of a new construct, thereby positioning it in a field of already existing constructs. Even brand new constructs are interrelated with other older constructs, and, as such, they are the results of a “semantic network” (Suddaby 2010). An improvement to the clarity of constructs then derives from making this network explicit and evident.

Finally, definitions, scope conditions and semantic relationships must be coherent. Coherence is the “intuitive assessment of whether the various attributes of a phenomenon are adequately contained within a construct”, and it is essential to theorising (Suddaby 2010, p. 352). However, constructs gain coherence both internally, referring to the consistency between their definition, scope conditions and semantic relationships, and externally, through their relationships with the other constructs that are part of the same theory. Therefore, proper constructs are necessary for good theory, but a good theory is necessary to arrive at proper constructs (Kaplan 1964).

This paper draws on the four elements that define the clarity of theoretical constructs and their operationalisation to carry out an in-depth analysis of the VAIC. The matters of consistency among definitions and relationships among constructs will be carefully analysed. For the sake of simplicity, the paper does not deal with space conditions. The VAIC model is, in fact, proposed to hold independently of any space conditions, such as industries and firm size.

An evident characteristic of the VAIC model is that it presents conceptual constructs (such as the IC efficiency, the employee knowledge, the human and the structural capitals) firmly intertwined with their variables. Therefore the theoretical model already offers its operationalisation. As for any operationalisation phase, the validity or the consistency of the operational variables with the theoretical constructs is a matter of investigation. In the case of the VAIC, the three variables measuring the efficiency of capital have a specific feature: they complement the definitions of constructs more than operationalising them. For instance, the definition of SCE is provided by its operational variable and is not treated from the conceptual point of view. The analysis of the clarity of the constructs therefore extends to the variables in the model.

To carry out the analysis, first, a review of the literature was performed to collect the critical reviews of the VAIC model. Second, the papers written by Pulic were investigated in-depth with the purpose of identifying the conceptual constructs employed in the model and the operational variables proposed and assessing their clarity and consistency. It is worth noting that the internal consistency among the elements defining the clarity of a construct as well as the external consistency among that construct and the others that constitute the theory can only be assessed on an “intuitive” basis (Suddaby 2010). Such an intuitive assessment has been made as explicit as possible by combining the in-depth analysis of Pulic’s paper with the findings of the literature review. This way, the comprehensive analysis of the VAIC has addressed numerous criticisms that could hinder its use by scholars and managers. At the same time, some of the criticisms highlighted in the literature have to be recalibrated.

3 Literature review

Since its first appearance, the VAIC has received both praise and criticism from IC scholars. On the one hand, it has been applauded for its ease of calculation (Pulic 1998, 2004b), deriving from the fact that the value added at the core of the model is based on data originating in the market (Pulic 2000b) and that all the other figures essential to its calculation can be drawn from publicly available financial statements (Tan et al. 2007), which can be even more reliable sources when audited (Young et al. 2009). Moreover, the VAIC does not require managers to adopt a benchmark external to the company to assess the efficiency of the company’s types of capital, as it is a pure measure (Laing et al. 2010). Finally, the VAIC is flexible in its use, as it can be calculated for the whole firm, for each business unit or even for particular processes and activities (Pulic 2000b). In addition, Pulic (2000b) largely supports the association of the VAIC with the firm’s financial and market performance, which should lead to managers basing their decision-making on the VAIC.

Despite all these advantages, however, many scholars have raised relevant concerns regarding the significance and consistency of the VAIC from a theoretical point of view as well as the purported relationship between the VAIC and the financial and market performance of the firm.

Andriessen (2004) is one of the first to address the criticisms of the VAIC. First, he argues, the VAIC does not separate expenses from assets, as labour expenses may include expenses that could generate future benefit. Second, the VAIC treats labour expenses as stocks (the value of human capital) even if they are flows. Third, the three component ratios do not provide information about the contribution of each type of capital to value creation, as a causal link is missing. Finally, he writes, the VAIC does not consider synergies among the three types of capital.

Ståhle et al. (2011) begin their analysis by considering that the way VA is calculated (Pulic 2005)—that is, as the sum of operating profit, personnel costs, depreciation and amortisation—reflects earnings management policies and similar decisions. Additionally, they highlight that the VAIC does not measure IC, as the model relies on pure financial figures that are not necessarily linked to IC, therefore turning one of the pros of the model into a weakness. Finally, they detect that the entire model is based on labour and physical investments, resulting in a weak measure of IC. In sum, they conclude that the VAIC suffers from conceptual vagueness.

Iazzolino and Laise (2013) highlight that Pulic uses the terms of his model, HC and SC, in a brand new way and attribute to this novelty some of the misunderstandings raised in the literature, particularly the conceptual vagueness in Ståhle et al. (2011). Additionally, they reject the criticisms raised by Andriessen (2004) on the confusion of flows and stocks and expenses and investments. They further explore the relationship between HCE and SCE, identifying that the VAIC formula generates a null value of ICE for HCE = 0.618. Furthermore, Iazzolino and Laise (2016) and Iazzolino et al. (2019) praise the VAIC for supplying a measure, namely, HCE, consistent with the importance of creativity in today’s economies and with the continuous increase in the productivity of knowledge work.

Building on Ståhle et al. (2011), Bassetti et al. (2019) decompose the VAIC in a perfectly competitive setting and find that it is a function of the elasticity coefficient of human capital, the elasticity coefficient of physical capital, and the interest rate; the authors highlight the theoretical inconsistency of the VAIC as a measure of IC and advise scholars to control for the interest rate in empirical analyses of the VAIC.

In addition to the critical remarks mentioned above, other criticisms of the VAIC refer to the results of its empirical association with firm financial performance and market value.

Some of the analyses that Pulic (2005) presents to support his model are obscure in statistical terms (Ståhle et al. 2011). In general, the empirical analyses return puzzling results, as a positive and sometimes significant association has indeed been found between market value (and other financial metrics, such as return on assets or return on equity) and two of the components of the VAIC: human capital efficiency and financial capital efficiency. The association of market value with the VAIC as a whole and with structural capital efficiency is, however, sometimes found to be weak or non-significant (Ståhle et al. 2011). A recent survey of 68 papers addressing the empirical analysis of the VAIC confirms that the results are often ambiguous, and in particular, the regression coefficient of SCE is often non-significant (Marzo and Bonnini 2018).

With the aim of overcoming all of these concerns, some scholars have developed extensions of the original model through the inclusion of relational, customer and innovation capital or have modified the way VA and SCE are calculated (Nazari and Herremans 2007; Vishnu and Kumar 2014; Pietrantonio and Iazzolino 2014; Ulum et al. 2014 Nimtrakoon 2015; Nadeem et al. 2018; Bayraktaroglu et al. 2019; Singla 2020).

However, the struggle to attribute empirical significance to the model can lead to brute empiricism (Sutton and Staw 1995) with no understanding of why and how something happens (Gioia and Pitre 1990). Empirical validity is in fact pointless without a consistent theoretical framework that makes explicit the relationships among the variables involved (Greenland et al. 2016).

4 The inconsistency of the VAIC with the IC literature

4.1 The definition of IC and the types of capital within the VAIC

The VAIC draws on new and sometimes misleading definitions of established concepts, which can generate confusion and lead to misinterpretation. In particular, the VAIC deals not with IC but rather with its efficiency in value creation. Pulic (2008, p. 707) states that the goal of the VAIC is “… providing necessary information on IC performance, which is the Achilles’ heel of modern companies.” More than a “semantic shift”, as stated by Iazzolino and Laise (2013), a “focus shift” lies at the core of the VAIC, which is not universally understood by researchers. Indeed, an analysis of 68 papers published between 2013 and 2017 addressing the empirical association of the VAIC with firms’ market or financial performance reveals that 38 papers (65.5%) refer to the VAIC as a measure of intellectual capital, while only 17 (29.3%) correctly refer to it as a measure of IC efficiency (Marzo and Bonnini 2018).

The reference to the efficiency of IC and other resources testify to Pulic’s belief that efficiency, particularly the efficient use of the company’s knowledge, is the most important goal for companies (Pulic 1998). This is the reason why, “… the value added is related to the resources, capital employed, human and structural capital, in order to receive their value creation efficiency” (Pulic 2000b, 706). As in Pulic’s view, the value added is the right metric for measuring the success of a company in the knowledge-based economy and the value the firm generates (Pulic 1998), its use in the formulas for the efficiency ratios is not surprising. However, combining the definition of the human and structural capital makes it clear that the value added is, at the same time, the value generated and the value of IC itself. In fact, following Edvinsson, Pulic (2000a) maintains that structural capital is intellectual capital minus human capital. As human capital is measured by HC and structural capital by VA-HC, it is easy to derive that VA = IC.

Pulic (1998), then, defines IC as the value added of a firm. This definition has, of course, nothing to do with the one at the core of IC research. It is an operational definition arising from Pulic’s attempt to translate IC into monetary value, a form of metonymy in which Pulic replaces cause (intellectual capital) with effect (its value). He would have avoided considerable misunderstanding by coining a new term for the concept of IC at the core of his model. His choice has costs since the absence of any explicit conceptualisation of IC, together with the modification of the meaning of established terms, generates ambiguities in the use of the VAIC and introduces new definitions without grounding them in theoretical arguments (see, in a similar vein, Ståhle et al. (2011)).

Moreover, the double identity of VA, as the value generated by IC and the IC itself, generates an ambiguous circularity in the model at the expense of the clarity of the construct.

The proposal of new meanings and concepts in this implicit fashion does not facilitate the in-depth understanding of the model. Researchers using the VAIC in their analyses are then warned that if interested in IC, according to the model, they should use VA and not the VAIC; otherwise, their focus should move to the analysis of the efficiency of IC.

4.2 Missing relational capital

Despite the many existing definitions of IC in the literature (Kaufmann and Schneider 2004; Choong 2008) and in practice (Corbella et al. 2019), in general, IC is decomposed into three components—human capital, structural capital, and relational capital (Bontis 1996, 1998; Bontis et al. 2000; Edvinsson and Malone 1997; Edvinsson and Sullivan 1996; Roos et al. 1998; Saint-Onge 1996; Stewart 1991, 1997; Sveiby 1997)—although some ambiguities exist in all three terms (Kaufmann and Schneider 2004). The VAIC, instead, considers only human and structural capital, the latter being conceptually different from the construct at the core of the IC tradition (Iazzolino and Laise 2013) (See Sect. 4.3).

Value added is at the core of the VAIC, as “value added indicates the power of companies in wealth creation” (Pulic 2008, p. 7). Focusing on value added is, however, not without consequences. Value added in fact traces a sharp divide between what is “inside” and what is “outside” the firm. It therefore indirectly reflects relational capital, as this type of capital affects both sales and external costs, and relational capital is thus inextricably intertwined with human capital in the analysis of HCE, with structural capital in the analysis of SCE and, finally, with financial and physical capital in the analysis of CEE. In sum, all the ratios that compose the VAIC have a more extensive meaning than the one outlined by Pulic. None of them, in fact, can be employed to focus on the efficiency of a specific form of capital.

Some authors have tried to redefine the role of relational or customer capital by decomposing SCE into components, one of them being relational capital (Nazari and Heremans 2007; Anoifowose et al. 2018), or by adding a new ratio at the same level of SCE (Ulum et al. 2014; Vishnu and Gupta 2014; Bayraktaroglu et al. 2019). However, none of the authors has considered the impacts of relationships on the in-brought costs already included in value added.

Researchers should therefore consider that the model proposed by Pulic does not explicitly take into account relational capital even if it implicitly influences the value of revenues and incoming costs, that is, the two components of VA. Researchers can consider relational capital to be included in SCE, inheriting the same opposite role to HCE that SCE has in the model (see Sect. 7), or risk their analysis being incomplete if a ratio for relational capital is not introduced into the model.

4.3 Missing structural capital

Employee knowledge plays a primary role in Pulic’s approach. Pulic maintains, in fact, that “business success depends … on the ability and efficiency of using company knowledge” (Pulic 1998, p. 3) and that “the intellectual potential (IP) of each company is represented by all of its employees” (Pulic 1998, p. 7). However, relying only on employee knowledge could be detrimental to the long-term success of a business when employees leave (Joe et al. 2013). Such considerations are usually at the foundation of the role assigned to structural capital, which supports human capital while being independent of it (Bontis et al. 2000; Bontis and Fitz Enz 2002) and remaining under the control of the firm (Edvinsson 1997). Accordingly, structural capital can be used to manipulate and extract human capital (Gogana et al. 2015). However, in Pulic’s approach, individual knowledge (i.e., employee knowledge) and structural capital are seen as opposing forces.

As Iazzolino and Laise (2013) contend, structural capital has a very different meaning to Pulic than the one it has in the IC literature; therefore, structural capital as traditionally understood is, together with relational capital, also missing from the VAIC, as SCE is conceptualised in terms of HCE and has an advantage that is essentially opposed to that of HCE.

This remark leads to implications that are useful for researchers in the IC field. First, as structural capital does not exist in the VAIC, researchers should not rely on SCE if they are interested in the analysis of the role of structural capital. Second, SCE is nothing other than a counterbalance of HCE and a source of non-linearity hidden in the VAIC model, and it has never been considered in empirical analyses until now (Sect. 8). Finally, the modified versions of the VAIC should be reframed in light of this consideration, as researchers often maintain that Pulic’s SC refers to structural capital as conceptualised in IC research, while it is instead a concept that is difficult to grasp, as it lacks theoretical consistency.

4.4 Missing interactions among the types of capital

The VAIC does not take into account the interaction of employee knowledge with structural and physical resources (Andriessen 2004). The existence of synergies arising from the interactions of different forms of capital appears, however, to be quite a reasonable assumption (Dosi, 1994; Teece et al. 1997). According to this view, employee knowledge generates value added but does so together with other forms of capital. Pulic, indeed, affirms that the intellectual potential of each company includes the abilities of employees to create value “by efficiently using the company’s infrastructure as well as in intensive relation with their environment, the market” Pulic (1998, p. 7). Nevertheless, the role of a company’s infrastructure is touched on only briefly, and relationships with other forms of capital are unexplored.

Considering the role of interactions among different forms of capital would modify the analysis that Pulic performs based on the VAIC. Let us assume that an increase in VA that is higher than the increase in the contribution that employee knowledge can account for is recorded. Pulic would always read such a phenomenon as demonstrating a higher efficiency of HC, whereas in fact, in this case, it would be the result of more substantial efficiency deriving from HC’s interaction with structural and financial capital.

Some scholars have tried to overcome this problem through the introduction of interaction terms in their regression models (Nazari and Herremans 2007; Veltri and Silvestri 2011; Silvestri and Veltri 2014; Bayraktaroglu et al. 2019). However, when the interaction term is devoted to exploring the interrelation between human and structural capital, its meaning changes as a consequence of SCE being a function of HCE. In fact, considering that:\(HCE\times SCE=HCE\times \left(1-\frac{1}{HCE}\right)=HCE-1\), the interaction term disappears, and therefore, the analysis does not truly consider the role of the interaction among the two types of capital.

5 The inconsistency of the VAIC formula with Pulic’s basic assumptions about the role of employee knowledge

5.1 The VAIC as an underspecified multi-attribute model

The three efficiency ratios in the VAIC are displayed with the same coefficient (or weight), which means that despite the relevance that Pulic assigns to human capital as the primary driver of firm success, all three types of capital have the same importance in the generation of economic value; therefore, decision-makers are not led to invest in human capital to increase the company’s performance (for a discussion of the role of SCE as opposed to HCE, see Sect. 8).

If the empirical analyses carried out until now had offered consistent and significant results, the regression coefficients of the three components could have been employed as “empirical” weights for the calculation of the VAIC. However, those analyses have, as mentioned above, returned ambiguous results.

In addition to the puzzling results highlighted by many authors, empirical analyses of the VAIC also suffer from non-linearity between firm performance and HCE, which arises because SCE is a function of the inverse of HCE (see Sect. 8).

5.2 The self-serving analysis by Pulic

The analyses that Pulic uses to demonstrate the role of the VAIC in value creation are prone to the fictitious independence of the three types of capital and to the predominance of HCE over the others and therefore derive from Pulic’s view of the world.

For instance, Pulic (2000b) presents the following Table 1.

He comments, “This example demonstrates the significance of HC in value creation: although both companies have almost identical CE, the second company creates almost double the value of company 1 with slightly more HC” (Pulic 2000b, p. 707).

However, in the situation depicted, deciding that the increase in VA derives from either HC or CE is a matter of faith. Indeed, if one were to magnify the role of CE over HC, she could quickly reverse the analysis: “This example demonstrates the significance of CE in value creation: although both companies have almost identical HC, the second company creates almost double the value of company 1 with slightly more CE”.

The situation just described leads to two remarks. First, different values of the measures that compose the VAIC can result in the same value of the VAIC. In particular, the most important role in the determination of the VAIC can be assigned to CEE rather than HCE. The positive association that many researchers have obtained between CEE and firm financial performance and market value supports the validity of this new interpretation of the VAIC.

Second, and consequently, the lack of an explicit theoretical model that distinguishes among increases in the VAIC that are generated by different forms of capital makes the analysis of the VAIC ambiguous. Such ambiguity lessens the power of the VAIC as a management tool. Indeed, since different drivers can determine a change in the VAIC according to relationships that the model does not establish, managers would do well to follow their gut feelings with regard to relying on the model. Again, the alleged objectivity of the VAIC is put under strain.

5.3 The definition of value added

Pulic (2003) begins his analysis with a calculation of VA, seen as objective in the sense that its components, revenues and incoming costs are determined in markets and therefore do not suffer from the subjectivity of the analysts.

Ståhle et al. (2011), however, highlight that value added as defined by Pulic (2005) suffers from being exposed to earnings management and the decisions of companies. Starting from the definition of VA,

they argue that operating profit (P), depreciation (D) and amortisation (A), “…are strongly affected by company strategies and decision making, D and A are antecedents of prior investments, and P is determined by present investments” (Ståhle et al. 2011, p.534).

This criticism is, however, unfounded, as the calculation of VA adopted by Pulic (2005) only follows the indirect method, which consists of starting from a final result (in this case, operating profit) and adding all components that have been previously subtracted from the target figure, in this case, value added. Starting from the formula that calculates the operating profit of a company,

it is easy to verify that the VA can be determined either in the direct way by comparing revenues (OUT) to in-brought costs (IN) or in the indirect way discussed by Ståhle et al. (2011):

Therefore, VA is always determined as OUT – IN, independently of how it is calculated, and the criticism highlighted by Ståhle et al. (2011) is unfounded.

6 The time inconsistency of HCE

Pulic assumes that all costs related to employees are investments in employee knowledge. This proposal has misled some authors (e.g., Andriessen 2004) into thinking that Pulic confounds expenses with assets. Pulic (2008 p. 5) indeed maintains that “today we invest in employees, who are the main value creators of contemporary economy”. Iazzolino and Laise (2013) argue that Pulic’s approach does not intend to consider labour expenses from the accounting point of view but only to identify the incremental contribution that employees make to the generation of value added. As Iazzolino and Laise (2013) note, “Salaries and wages are investments because the firm would expect a return from this expenditure. Firm cannot grow up if investment in knowledge workers does not create VA” (Iazzolino and Laise 2013, p. 556). As Iazzolino and Laise (2018) further explain, investment in human resources is living knowledge, as only people are able to create new knowledge and therefore produce VA in such a way as to justify the investment.

Both Andriessen’s (2004) and Iazzolino and Laise’s (2013 and 2018) views shed some light on the meaning of HCE.

It is worth noting, drawing on Andriessen (2004), that some labour-related expenses that are constitutive of employees’ future knowledge (such as training expenses) influence the future production of value added (such as labour on R&D) and therefore loosen the relationship between value added generated at time t and the cost of employees (the measure of human capital, HC) at time t. Indeed, if part of \({HC}_{t}\) is an “investment”, one would expect its effects to be generated not only in t but also in future periods.

In other words, considering that some labour-related expenses are investments in employee knowledge reveals that the stock of knowledge available at a specific time \(t\) and that has generated \({VA}_{t}\) is the result of expenses sustained in the past. Therefore, the numerator and the denominator of the HCE ratio are not time-consistent. Combining investments and costs related to human capital thus artificially deflates its efficiency at a time when those expenses are incurred and artificially inflates it in subsequent years.

The fact that the relationship between \({VA}_{t}\) and \({HC}_{t}\) extends over time complicates the analysis of the variation in HCE from one period to another. In fact, a reduction in HCE could be determined by the fact that some labour-related expenses do not generate their results during the same period in which they have been incurred. The simple example shown in Table 2 clarifies why the usual analysis of the VAIC leads to inaccurate results.

The data in the table present a situation in which, after a reduction from year t to year t + 1, HCE increases in year t + 2. An analysis of the VAIC performed without considering the remarks above would detect that firm performance varied during the three years examined. However, knowing that in year t + 1, the company spent €4 on training to obtain higher efficiency the following year (therefore in year t + 2), the analysis changes entirely. Table 3 shows the same data as Table 2 after the training expenses are moved to the year they are expected to be fruitful (year t + 2).

The analysis of Table 3 gives a different perspective on firm performance. In fact, HCE has remained stable over the entire period, as the apparent variation was merely the result of a failure to separate investments from costs.

The situation depicted above is common to all accounting-based measures,Footnote 1 but in the case of the VAIC, it is even more relevant due to the paramount importance of HCE. In fact, since the experience curve (Deimler et al. 2012) was introduced by BCC in the late 1960s, it has been taken for granted that people can continuously improve their ability and, in addition, that they can generate new knowledge. Therefore, the temporal mismatch between the costs of employees and the generation of VA is even more pronounced and could be derived from the criticism of Andriessen (2004); consequently, HCE remains easy to calculate but flawed in meaning.

By neglecting this fact, both researchers and managers can commit serious mistakes. Researchers might carry out empirical analyses whose results would be influenced by a mistaken displacement of human capital costs over time. A mistaken accounting of HCE could similarly impair managers’ decision-making, as managers might not be able to correctly place in time the investments they have made in employee knowledge.

7 The ambiguity in the meaning of HCE between the generation and distribution of value added and the neglected role of the governance system

Another criticism of human capital efficiency is that the ratio \(HCE=VA/HC\) leads to ambiguous interpretations. First, HCE can be interpreted as a measure of the value added generated by human capital, as in the VAIC model and leaving aside all the remarks presented in the previous section. According to this view, HCE is a productivity measure. Second, it can be interpreted as the (inverse of the) share of value added distributed to firm employees in the form of salaries and wages, as HC is the cost of firm employees. According to this second perspective, HCE identifies the amount of value added used to cover the cost of employees, and it is therefore a metric of the distribution of value added to employees, consistent with the metrics generally used in social reporting (Pohmer and Kroenlein 1970; Morley 1978; Gabrovec Mei 1984; American Accounting Association 1991; Shimizu et al. 1991; Kim et al. 1996; Haller and Stolowy 1998; Van Staden 1998; Riahi-Belkaoui 1999).

Therefore, there is an overlap in the ratio between two different approaches, namely, the generation and the distribution of value added. Pulic’s scheme focuses on the meaning of the ratio only from the perspective of generation. The two perspectives, however, are closely linked, as one justifies the other: value added is to be distributed among the internal stakeholders who have generated it.

Nevertheless, mixing the distribution and generation schemes produces ambiguities in the meaning of HCE. Indeed, depending on the approach one adopts, \(VA/HC\) takes on a different interpretation: higher HCE could be determined by a higher productivity of human capital, which translates into greater value added (as assumed by Pulic), by a lower share of value added distributed to firm employees, or, finally, by a combination of both.

The ratio appears consistent with Pulic’s aim to put human capital at the core of his analysis only under some specific conditions. Iazzolino and Laise (2018) argue the HCE ratio finds a meaning consistent with Pulic’s approach when one considers that, given the difficulty in measuring the quantity of employees’ knowledge, the use of HC can be accepted as a proxy, as “… the expense in knowledge-based human resources (HC) is positively correlated to the quantity of knowledge incorporated in the human resources” (Iazzolino and Laise 2018, p.352). However, the use of HC as a proxy for the knowledge of employees cannot be taken for granted unless labour markets are efficient.

Even in this case, it is difficult to understand how VA can increase more than HC without considering that the increase in HC might be constrained for some reason. The reason for this constraint could relate only to the contractual arrangements between the firm and its employees and consequently to the governance system of the firm. Therefore, despite Pulic’s focus on employee knowledge, the ratio he proposes is strictly dependent on the governance system of the firm, and the analysis of the meaning of the ratio should be carried out through the insights that different views of the firm can offer once firm governance and its relationships with factor markets are taken into account (Lajili, 2015).

From a neoclassical perspective, Bassetti et al. (2019) consider the following Cobb–Douglas production function:

where Y is total output, A is the state of technology, H is the stock of human capital, K is the stock of physical capital, I is the flow of the intermediate good, and α, β, and γ are the elasticity coefficients of human capital, physical capital, and an intermediate good, respectively \(\left(\alpha , \beta , \gamma >0\right)\). Bassetti et al. (2019) demonstrate that in a perfectly competitive long-run equilibrium, the VAIC is a function of the elasticity coefficient of human capital (α), the elasticity coefficient of physical capital (β), and the interest rate (r). The HCE, in particular, has the following formula:

It is easy to verify than in the long-run neoclassical equilibrium, the efficiency of human capital is therefore dependent on technology (here represented by α and β) and is not modifiable by the firm or its employees.

Neoclassical agency theory (Jensen and Meckling 1976) leads us to consider labour contracts as being valued according to the knowledge each employee has (Marzo 2014). Indeed, according to this theory, the firm is nothing more than a nexus of contracts, a partition of the market, and all contracts except those concerning principals (i.e., shareholders) are signed at their fair value. In this case, however, an increase in the productivity of knowledge is already arranged in the comprehensive contracts (Hart 1995; Zingales 2000) that individuals have signed, thus keeping HCE constant over time.

If one moves away from perfect markets and comprehensive contracts to the incomplete contract setting, the meaning of HCE changes dramatically. According to residual control rights theory (Grossman and Hart 1986; Hart and Moore 1990; Hart 1995), even highly skilled employees can be impeded in their access to other forms of capital, limiting their possibilities for work and, consequently, for gain. In this case, therefore, part of the higher value generated by employees flows instead to the “boss”, depending on how much power she has.

If this were the case, the value of wages would not identify the value of employee knowledge, as the power of the boss will constrain HC. The ratio will therefore express a combination of the productivity of employee knowledge and the governance structure of the company (i.e., the power of the boss).

Only by adopting the perspective of strategic factor markets (Barney 1986) can one maintain that certain strategic resources can be acquired at a price lower than their value due to imperfections in the market. In this case, one could experience an increase in HCE determined by the real value of human capital being higher than its cost. Therefore, unexpectedly, the only reason to rely on the market values of wages and salaries is simply that strategic factor market values are flawed.

The relationship between HCE and the VAIC therefore depends on both the productivity of human capital (setting aside the roles of all other forms of capital) and the way the governance of the firm influences the distribution of value added among stakeholders, particularly through the cost of human capital (HC).

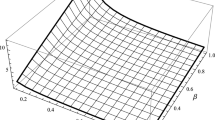

As depicted in Fig. 1, a set of cases can be formally analysed to show different combinations of productivity and distribution regimes. For the sake of simplicity, three different relationships between VA and the level of employee knowledge (K) are presented, assuming increasing, constant and decreasing returns (i.e., VA increases with K in a more than proportional, less than proportional and proportional way). Column 2 shows the essential characteristics of VA as a function of K through the signs of \(\frac{dVA}{dK}\) and \(\frac{{d}^{2}VA}{{dK}^{2}}\).

HC can increase, decrease or remain constant as K increases depending on the bargaining power of the employees and the firm as a governance system. The analysis is focused on two main cases, considering a positive and a constant relationship between HC and K, the first of which is further analysed considering that the relationship between HC and K can be more than proportional, less than proportional or proportional, depending on the power of the firm over its employees. For example, a more than proportional relationship accounts for situations in which employee power is so high that employees are compensated more than what would be consistent with the increase in the level of their knowledge (K). In the second case, where HC remains constant with respect to K, an increase in employee knowledge does not modify their compensation, and the cost of their labour remains at the same level independently of the increase in K, as the firm can expropriate the additional value that their greater knowledge generates.

When the cases presented above are combined, they yield a 3 × 4 matrix of twelve combined situations, all graphically depicted in Fig. 1. For some cases, different instances are labelled with letters from a to c, which derive from the different slope that the HC function can have. A level \(K={K}^{*}\), shown in some cases, corresponds to situations in which the two functions (VA and HC) intersect. Before or beyond this point, the comparative importance of the generation and distribution schemes is different. Depending on which of the two functions lies above the other, HCE increases or decreases when K increases. All twenty cases can be grouped into four categories:

-

HCE always increases when K increases (cases 1a, 6a, 10a, 11a);

-

HCE always decreases when K increases (cases 1b, 2b, 6b, 11b);

-

HCE always increases when K increases and \(K>{K}^{*}\) (cases 2a, 3, 4, 7, 8, 9, 10c, 11c, 12); and

-

HCE always decreases when K increases and \(K<{K}^{*}\) (cases 1c, 5, 10b).

The graphical analysis makes it clear that only in some cases does HCE increase with the increased productivity of K. However, even in these cases, the governance system is responsible for the pace of the increase. In all other cases, an increased productivity of K has an impact on HCE in combination with the power of the governance system (i.e., the rules for the distribution of VA).

The ambiguity detected here has significant implications for both researchers and managers, as it means they cannot use HCE as a sharp metric for the productivity of employee knowledge.

8 A further analysis of the relationships between HCE and SCE

Drawing on Iazzolino and Laise (2013), the analysis of the formulas at the core of the VAIC can help restore the role of SCE. Given that \(ICE=VA/HC+SC/VA\) and, consequently,

ICE is null when \(HCE=\pm \left(\sqrt{5}-2\right)/2\approx \pm 0.618\) and positive if \(-0.618<HCE<0\) and for \(HCE>+0.618\). In other words, there are situations in which a positive ICE results even when the value added is so low that it cannot cover the costs of employees and other workers, of depreciation and amortisation, and of financial capital.

A more in-depth study of the function reveals the following:

As \(\frac{dICE}{dHC}\) is always positive, ICE increases with the increase in HCE. However, since \(\frac{{d}^{2}ICE}{d{HC}^{2}}\) is always negative, ICE increases at an ever lower rate. If one translates this analysis into economic terms, progressive increases in HCE translate into less-than-proportional increases in ICE and, with CEE remaining constant, in the VAIC.

Considering HCE separately from SCE helps us to understand why this happens.

As

and

both \(\frac{dHCE}{dHCE}\) and \(\frac{dSCE}{dHCE}\) are positive, but \(\frac{{d}^{2}SCE}{d{HCE}^{2}}\) is always negative (with \(VA,HC>0\)). Therefore, an increase in HCE has a less-than-proportional impact on SCE. In contrast, a decrease in HCE influences SCE in a more-than-proportional way.

As Pulic states, “HC and SC are in a reverse proportion” (Pulic 2000b, p. 707). The translation of this “reverse proportion” into the ICE formula determines the magnitudes of variation of the two addends that compose ICE. The ICE formula is a source of critical managerial implications, as it could have asymmetrical impacts on managers’ behaviour. As a decrease in the efficiency of human capital (HCE) determines a more considerable decrease in ICE and the VAIC, managers are pushed to counteract the decrease in HCE by investing in maintaining at least the current level of efficiency.

However, as an increase in HCE has a progressively lower effect regarding the entire ICE (and the VAIC, holding CEE constant), managers are encouraged to reduce investment in HCE due to the lower marginal return that they can expect. Therefore, managers risk becoming stuck in a VAIC trap.

Moreover, the relationship between HCE and SCE lying at the core of the VAIC transforms the linear relationship between the VAIC components and the dependent variable (DV) into a non-linear association that challenges the conventional approach to the empirical analysis of the VAIC (Marzo and Bonnini 2018). The linear regression model commonly used

can in fact be written as

which returns a non-linear association between \({DV}_{t}\) and \({HCE}_{t}\). The slope of the relationships between the DV and HCE, therefore, is not \({\beta }_{1}\), but \({\beta }_{1}-{\beta }_{2}\frac{1}{{{\mathrm{HCE}}_{t}}^{2}}\).

The relationship between the dependent variable and HCE depends on the sign and the magnitude of both \({\beta }_{1}\) and \({\beta }_{2}\), and it is contingent on the value of HCE. This means that if \({\beta }_{2}\) is not significant, the association between the dependent variable and HCE is linear, while if \({\beta }_{2}\) is significant, the relation is non-linear and dependent on the sign and the value of both \({\beta }_{1}\) and \({\beta }_{2}\).

This remark should advise researchers to test the VAIC in full consciousness of the reality that the role of HCE is partly hidden in the common method of empirically testing the VAIC and that the non-linear relationship highlighted above should receive appropriate attention.

9 Discussion

The main findings of the research are mentioned below, together with the implications for scholars and managers.

First, the VAIC focuses on the efficiency of intellectual capital. However, many researchers have ignored this point and used the VAIC as a measure of IC, disregarding the fact that in the VAIC model, IC is measured by VA. The new definitions that Pulic gives to established labels and concepts are probably responsible for this misunderstanding (Iazzolino and Laise 2013). Researchers using the VAIC in their analyses should therefore consider its focus on the efficiency of IC and dismiss it if the main topic of their investigation is the role of intellectual capital.

Second, in the VAIC model, value added traces a sharp divide between what is “inside” and what is “outside” the firm, and in doing so, it indirectly reflects relational capital, which is neglected by the model. However, researchers and managers should be aware that the missing relational capital is indirectly taken into account, as the two components of VA, i.e., revenues and in-brought costs, are influenced by that capital, and they should decide whether relational capital is already included in SCE or a new component should be added in the VAIC (Nazari and Heremans 2007; Anoifowose et al. 2018; Ulum et al. 2014; Vishnu and Gupta 2014; Bayraktaroglu et al. 2019.

Third, as Iazzolino and Laise (2013) argue, the structural capital at the core of the VAIC is not the one that IC researchers have used before. An in-depth analysis reveals, in fact, that SC is simply a function of the inverse of HCE, whose role is clear from a mathematical point of view but fuzzy and mysterious from a theoretical perspective, as it simply counterbalances the positive impact of HCE on the VAIC. Therefore, researchers should avoid referring to SCE as a measure for traditional structural capital (efficiency); they would do better to treat it as a counterweight of HCE or a non-linear term in the empirical analysis.

Fourth, the model completely neglects the interactions among the different kinds of capital. Interaction terms have sometimes been included in the equation used in the empirical analysis to overcome the problem. However, the interaction term between HCE and SCE returns \(\left(\mathrm{HCE}-1\right)\), which means that the interaction term is not truly an interaction term.

The lack of any consideration of those interactions also influences managers’ decision-making. Investing only in employee knowledge, as recommended by the VAIC, could return results that are lower than expected if the higher productivity from employee knowledge is linked to and depends on other forms of capital.

Fifth, as the reasons that have pushed Pulic to assign equal weight to the three components of the VAIC are unclear, researchers should decide whether to adopt the model while intentionally ignoring the problem or, otherwise, to supplement it with different weights, which unfortunately cannot derive from the empirical analyses carried out previously due to the ambiguous results they yielded. Even managers are stunned when confronted with this situation, as they are advised to invest in human capital, but the model does not clarify why. This paper, in fact, demonstrates that the reasoning that Pulic offers to support the role of HCE as the most critical measure to focus upon is flawed, as it can be easily reversed to assign the same importance to any of the types of capital involved. Therefore, managers using the VAIC as a tool to lead their companies should be conscious of the limitations of the results it generates.

Sixth, there is a time mismatch between the incurrence of labour costs and the generation of value added, which makes HCE time-inconsistent. While similar arguments could be addressed to many accounting-based measures, this is largely detrimental for a model that is based precisely on that ratio. Therefore, researchers attempting to test the empirical validity of the VAIC should pay careful attention when gathering figures from financial statements. Managers who have access to internal and private information could be in a better position to modify the calculation of HC according to the criticism just highlighted, but they should be conscious of the accounting flaw at the heart of HCE.

Seventh, human capital efficiency suffers from having at least two different interpretations that make its meaning different from that assigned by Pulic. Indeed, HCE confuses issues concerning the productivity and efficiency of work with those concerning the role of the governance system of the firm (i.e., the contracting power of different stakeholders). As shown in the various cases analysed in this paper, there is no possibility to use the HCE ratio for the purpose that Pulic intends, as both productivity from employee knowledge and the governance mechanism of the firm jointly determine the value of HCE. Both practitioners and scholars should recognise, therefore, that the VAIC cannot lead to an analysis focused on the efficiency of the human capital and, consequently, that analyses based on HCE should be performed more cautiously than Pulic’s papers suggest.

Finally, the relationship between HCE and SCE is open to criticism, as it generates ambiguities regarding the role of HCE. For instance, a decrease in HCE determines a more considerable decrease in ICE and the VAIC, whereas an increase in the efficiency of human capital has a progressively smaller effect on the entire ICE and the VAIC. Consequently, managers are encouraged to counteract the decrease in HCE by investing in maintaining at least the current level of efficiency, but at the same time, they are encouraged to reduce investment in improving the efficiency of human capital due to the lower marginal return they can expect. Again, situations can arise in which the value added is so low that it is unable to cover both the cost of employees and the cost of financial capital, even though the calculation produces a positive VAIC. Managers’ decision-making could be impaired, therefore, by the mechanics of the VAIC.

Moreover, a non-linear association centred on HCE is concealed within the VAIC model, which requires a complete modification of the interpretation of the results researchers have obtained from their empirical analyses. Researchers are therefore advised on the different tests they should run to investigate the empirical significance of the association of the VAIC with the financial performance or market value of firms.

10 Conclusions

Pulic presents the VAIC model as a sound measure for valuing the efficiency of IC (Pulic 1998). He asserts that the VAIC is positively associated with a firm’s profitability and its market value (Pulic 2000a) and, therefore, that managers can improve their decision-making by using the VAIC as a management tool (Pulic 2000b). Using the VAIC, he argues, makes it possible not only to achieve greater efficiency in the deployment of physical capital and intellectual potential by orienting all of the activities of the company towards the performance of employees but also to identify internal inefficiencies and to offer a warning if the firm obtains poor results.

Moreover, it is possible to calculate the VAIC and the ratios that compose it for both the firm as a whole and for each business unit (Pulic 2008). Software based on the VAIC can customise the application of the model to each business and break down its processes and activities (Pulic 2000b, p. 711). Furthermore, the VAIC is easy to calculate, as all the figures are accounting-based and come from the financial statements of the firm (Tan et al. 2007), and as such, they are also reliable when audited (Young et al. 2009).

These much-touted strengths of the model have attracted the interest of IC researchers. Indeed, some have begun using the VAIC as a measure of IC or its efficiency, regressing it against market value and other business profitability measures to check its empirical validity. As the studies carried out have returned only ambiguous and sometimes inconsistent results, some modifications to the original model have been proposed to obtain higher empirical significance (Nazari and Herremans 2007; Vishnu and Kumar 2014; Pietrantonio and Iazzolino 2014; Ulum et al. 2014 Nimtrakoon 2015; Nadeem et al. 2018; Bayraktaroglu et al. 2019; Singla 2020).

Focusing on the empirical issues of the VAIC, however, has moved attention away from the theoretical side of the model and from the fact that at its basis, the thin theory is responsible for the drawbacks identified by many sides.

This paper performed an in-depth analysis of the VAIC with the aim of identifying the theoretical ambiguities and inconsistencies of the model to offer IC researchers and managers another opportunity to reflect on the usefulness of the VAIC as a tool for research and decision-making. The analysis carried out here was based upon the assessment of the consistency in the definitions, scope conditions and semantic relationships of the theoretical constructs of the VAIC (Suddaby 2010).

All the findings explored above lead to the conclusive answer that the VAIC is theoretically inconsistent, and it is very far from being a suitable measure of IC. In fact, the analysis found a relevant circularity in the role of value added, which is simultaneously the value generated by IC components and the value of IC itself.

The VAIC also lacks a semantic relationship with the literature on IC, as it defines IC and the structural capital in a very different way that is not supported by any theoretical argumentation. In addition, the definition of structural capital is only offered by difference as a residual to the definition of HC, which leads to the conclusion that the clarity of the construct is very low. Finally, the VAIC does not consider relational capital, a well-established component of IC.

The VAIC is also exposed to the specific time constraint related to the fact that the investment included in the cost of labour is compared to the VA for the same period, while they should be compared with the VA generated in the future. Moreover, the role of efficiency in the knowledge-based economies and the way Pulic attributes to HCE the main effect on value generation are the results of the researcher’s view of the world and are therefore value constrained.

Finally, many inconsistencies plague the VAIC model, such as those referring to the IC components included in the model, the ambiguous meaning of HCE and the relationship between HCE and SCE.

This paper contributes to the literature on IC accounting and decision-making in three ways.

First, the paper offers a comprehensive analysis of the VAIC, collecting the criticisms already raised by scholars while rebalancing some of them and adding some new ones at the same time. In particular, the paper highlights that the missing relational capital, which some authors have already found as a limitation of the model (Nazari and Heremans 2007; Anoifowose et al. 2018;Ulum et al. 2014; Vishnu and Gupta 2014; Bayraktaroglu et al. 2019), has more profound implications than initially understood, as that capital is explicitly missing but implicitly included in the effect it generates on the components of value added, which is therefore the result of the combination of relational capital together with human and structural capital. Moreover, structural capital as intended by Pulic is a simple function of HCE that offsets the power of HCE, albeit without a clear meaning. Furthermore, the paper clarifies that neglecting the interactions among the types of capital cannot be recovered through the use of an interaction term between HCE and SCE, as that term would reduce to HCE-1 due to the formulas of the two ratios. At the same time, Ståhle et al.’s (2011) criticism of the influence of firms’ decisions and policies in the calculation of VA is deemed unfounded.

Second, the paper positions the role of the governance system at the core of the VAIC and discusses how the overlapping of the production and distribution perspectives on value added generates ambiguity in the meaning of HCE. The role of corporate governance for the effective management of IC has been widely recognised (Volontè and Gantenbein 2016; Williams et al. 2018; Zambon et al. 2019), but the VAIC considers it as a residual to be confined to the definition of the only structural capital. The analysis carried out here demonstrates, instead, that even human capital efficiency depends on the governance structure of the firm and the power the firm has in bargaining with its employees. The discussion has made clear that it is difficult to accept HCE as a measure of employee knowledge, as the value of the ratio is strongly influenced by the governance system of the firm, with the result that two firms with identical levels of knowledge productivity could display different values of HCE. Therefore, the authors of studies focusing on HCE as a measure of human capital efficiency (Iazzolino and Laise 2016; Iazzolino et al. 2019) are alerted to the need to consider the issue.

Third, even though the focus of this paper is theoretical in nature, the implications that some theoretical inconsistencies have for empirical analyses have been investigated, offering warnings to scholars who rely on the VAIC for their empirical tests. In particular, the paper focuses on the already-cited problem with the interaction term between HCE and SCE, which reduces to HCE when introduced in the analysis, as well as the non-linearity that arises in the empirical analysis, given that SCE is a function of the inverse of HCE.

The analysis carried out in this paper reiterates the lack of inconsistency of the VAIC and the ambiguity hidden in its mechanics and should lead researchers to decide whether to continuously amend the VAIC or reject it despite its ease of calculation and prompt availability. Future research could be performed along this line. For instance, it could be investigated whether the proposed modified or extended versions of the VAIC (Nazari and Herremans 2007; Vishnu and Kumar 2014; Pietrantonio and Iazzolino 2014; Ulum et al. 2014 Nimtrakoon 2015; Nadeem et al. 2018; Bayraktaroglu et al. 2019; Singla 2020) can overcome the theoretical pitfalls of their ancestor or will instead perpetuate the same criticisms under different formulas. Clearly, the analysis proposed here should not be carried out only on the empirical validity of those models, as the struggle for correlation can quickly morph into brute empiricism (Sutton and Staw 1995).

Moreover, the attempt recently made (Bassetti et al. 2019) to include the interest rate in the empirical analysis of the VAIC introduces a novelty to be valued against the theoretical drawbacks discussed here. In fact, even if authors confirm that the VAIC can be tested only by adding the interest rate in the analysis, the concerns with the validity of the VAIC remain unchanged.

To conclude, it is worth recognising that criticising a model or an idea is much easier than building a new one. However, any justified critique is a step forward in the growth of knowledge, as it clarifies the limitations of the proposal and consequently makes it possible to decide between rejecting it or more consciously applying it, suggesting refinements to the idea or possible directions to build new ones. In the case of the VAIC, all the criticisms analysed here can help managers and researchers decide whether to abandon, modify or use the model and to understand, if they do decide to use it, what precautions they must take.

Notes

I am indebted to one of the reviewers for pointing out this commonality.

References

American Accounting Association. (1991). Committee on Accounting and Auditing Measurement, Report 1989–1990. Accounting Horizons., 5(3), 81–105.

Andriessen, D. (2004). Making Sense of Intellectual Capital: Designing a Method for the Valuation of Intangibles. Burlington, MA: Elsevier Butterworth-Heinemann.

Anifowose, M., Abdul Rashid, H. M., Annuar, H. A., & Ibrahim, H. (2018). Intellectual capital efficiency and corporate book value: evidence from Nigerian economy. Journal of Intellectual Capital, 19(3), 644–668.

Bacharach, S. B. (1989). Organisational theories: Some criteria for evaluation. Academy of Management Review, 14(4), 496–515.

Barney, J. B. (1986). Strategic Factor Markets: Expectations, Luck, and Business Strategy. Management Science, 32(10), 1231–1241.

Bassetti, T., Dal Maso, L., & Liberatore, G. (2019). A critical validation of the value added intellectual coefficient: use in empirical research and comparison with alternative measures of intellectual capital. Journal of Management and Governance. Ahead-of-print.

Bayraktaroglu, A. E., Calisir, F., & Baskak, M. (2019). Intellectual capital and firm performance: an extended VAIC model. Journal of Intellectual Capital, 20(3), 406–425.

Bontis, N. (1996). There’s a price on your head: managing intellectual capital strategically. Business Quarterly, 60(4), 40–47.

Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision., 36(2), 63–76.

Bontis, N., & Fitz Enz, J. (2002). Intellectual Capital ROI: A Causal Map of Human Capital Antecedents and Consequences. Journal of Intellectual Capital., 3(3), 223–247.

Bontis, N., Keow, C. C., & W., & Richardson, S. . (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital., 1(1), 85–100.

Choong, K. K. (2008). Intellectual capital: definitions, categorisation and reporting models. Journal of Intellectual Capital, 9(4), 609–638.

Cohen, B. (1980). Developing sociological knowledge. Theory and method. Englewood Cliffs, NJ: Prentice Hall.

Corbella, S., Florio, C., Sproviero, A. F., & Stacchezzini, R. (2019). Integrated reporting and the performativity of intellectual capital. Journal of Management and Governance, 23(2), 459–483.

Deimler, M., Lesser, R., Rhodes, D., & Sinha, J. (2012). Own the Future: 50 Ways to Win from the Boston Consulting Group. Hoboken, NJ: John Wiley & Sons Inc.

Dosi, G. (1994). Firm, boundaries of the. in G. M. Hodgson, W. J. Samuels and M. R. Tool (Eds), The Elgar Companion to Institutional and Evolutionary Economics, Edward Elgar, Aldershot. 1, 229–237.

Dubin, R. (1969). Theory building. New York: Free Press.

Dubin, R. (1976). Theory building in applied areas. In M. D. Dunnette (Ed.), Handbook of Industrial and Organizational Psychology (pp. 17–40). Chicago: Rand McNally.

Edvinsson, L. (1997). Developing intellectual capital at Skandia. Long Range Planning, 30(3), 366–373.

Edvinsson, L., & Malone, M. S. (1997). Intellectual Capital: Realising Your Company’s True Value by Finding its Hidden Brainpower. New York, NY: HarperBusiness.

Edvinsson, L., & Sullivan, P. (1996). Developing a model for management intellectual capital. European Management Journal., 14(4), 187–199.

Gioia, D. A., & Pitre, E. (1990). Multiparadigm perspectives on theory building. Academy of Management Review., 15(4), 584–602.

Gogana, L. M., Duran, D. C., & Draghicia, A. (2015). Structural capital - A proposed measurement model. Procedia Economics and Finance., 23(8), 1139–1146.

Grabrovec Mei, O. (1984). Il valore aggiunto dell’impresa. Trieste: Libreria Goliardica.

Greenland, S., Senn, S. J., Rothman, K. J., Carlin, J. B., Poole, C., Goodman, S. N., & Altman, D. G. (2016). Statistical tests, P values, confidence intervals, and power: a guide to misinterpretations. European Journal of Epidemiology., 31(4), 337–350.

Grossman, S., & Hart, O. (1986). The costs and benefits of ownership: a theory of vertical and lateral integration. Journal of Political Economy., 94(4), 691–719.

Haller, A., & Stolowy, H. (1998). Value added in financial accounting: a comparative study of Germany and France. Advances in International Accounting., 11, 23–51.

Hart, O. (1995). Firms, contracts, and financial structure. Oxford: Clarendon Press.

Hart, O., & Moore, J. (1990). Property rights and the nature of the firm. Journal of Political Economy., 98(6), 1119–1158.

Iazzolino, G., & Laise, D. (2016). Value Creation and Sustainability in Knowledge-based Strategies. Journal of Intellectual Capital., 17(3), 457–470.

Iazzolino G., Laise D., & Pulic A. (2019) 20 years of VAIC Value Added Intellectual Coefficient. In Schiuma G., Demartini P., Yan M.R. (Eds), Knowledge Ecosystems and Growth, Proceedings of 14th IFKAD 2019, Matera, Italy, June 5–7, 951–965.

Iazzolino, G., & Laise, D. (2013). Value added intellectual coefficient (VAIC): A methodological and critical review. Journal of Intellectual Capital., 14(4), 547–563.

Iazzolino, G., & Laise, D. (2018). Knowledge worker productivity: is it really impossible to measure it? Measuring Business Excellence, 22(4), 346–361.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics., 3(4), 305–360.

Joe, C., Yoong, P., & Patel, K. (2013). Knowledge loss when older experts leave knowledge-intensive organisations. Journal of Knowledge Management., 17(6), 913–927.

Kaplan, A. (1964). The Conduct of Inquiry. New York: Harper & Row.

Kaufmann, L., & Schneider, Y. (2004). Intangibles: a synthesis of current research. Journal of Intellectual Capital., 5(3), 366–388.

Kerlinger, F. N. (1973). Foundations of behavioral research: Educational, psychological and sociological inquiry. New York: Holt Rinehart and Winston.

Kim, J. H., Ki, J. I., & Choi, F. D. S. (1996). The information content of productivity measures: an international comparison. Journal of International Financial Management and Accounting., 7(3), 167–190.

Laing, G., Dunn, J., & Hughes-Lucas, S. (2010). Applying the VAIC model to Australian hotels. Journal of Intellectual Capital., 11(3), 269–283.

Lajili, K. (2015). Embedding human capital into governance design: a conceptual framework. Journal of Management & Governance., 19(4), 741–762.

MacCorquodale, K., & Meehl, P. E. (1948). On a distinction between hypothetical constructs and intervening variables. Psychological Review., 55(2), 95–107.

Marzo, G. (2014). Improving internal consistency in IC research and practice: IC and the theory of the firm. Journal of Intellectual Capital., 15(1), 38–64.

Marzo, G., & Bonnini, S. (2018). On the association between VAIC and firms’ market value and financial performance. Paper presented at The 14th Interdisciplinary Conference on Intangibles and Intellectual Capital, Munich, Germany September 20–21, 2018.

Morley, M. F. (1978). The value added statement: a British innovation. The Chartered Accounting Magazine., 12(2), 31–34.

Nadeem, M., Dumay, J., & Massaro, M. (2018). If you can measure it, you can manage it: A case of intellectual capital. Australian Accounting Review, 29(4), 590–615.

Nagel, E. (1961). The Structure of Science: Problems in the Logic of Scientific Explanation. New York: Harcourt, Brace and World.

Nazari, J. A., & Herremans, I. M. (2007). Extended VAIC model: measuring intellectual capital components. Journal of Intellectual Capital., 8(4), 595–609.

Nimtrakoon, S. (2015). The relationship between intellectual capital, firms’ market value and financial performance: Empirical evidence from the ASEAN. Journal of Intellectual Capital., 16(3), 587–618.

Pietrantonio, R., & Iazzolino, G. (2014). Intellectual capital and business performances in Italian firms: An empirical investigation. International Journal of Knowledge Management Studies., 5(3–4), 211–243.

Pohmer, D., & Kroenlein, G. (1970). Wertschopfungsrechnung, betriebliche. in E. Kosiol (Ed). Handworterbuch des Rechnungswesens. Stuttgart: Poeschel Verlag.

Priem, R. L., & Butler, J. E. (2001). Is the resource-based “view” a useful perspective for strategic management research? Academy of Management Review, 26(1), 22–40.

Priem, R. L., Butler, J. E., & Priem, R. L. (2008). in the Resource-Based View Tautology and the Implications of Externally Determined Resource Value. Further., 26(1), 57–66.

Pulic, A. (1998). Measuring the performance of intellectual potential in the knowledge economy. Paper presented at The 2nd McMaster Word Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential.

Pulic, A. (2000a). MVA and VAIC analysis of randomly selected companies from FTSE 250. Online] Www. Vaicon. Net- April.

Pulic, A. (2000b). VAIC - an accounting tool for IC management. International Journal of Technology Management., 20(5–8), 702–714.

Pulic, A. (2004). Do we know if we create or destroy value? International Journal of Entrepreneurship and Innovation Management., 4(4), 349–359.

Pulic, A. (2004). Intellectual capital – does it create or destroy value? Measuring Business Excellence., 8(1), 62–68.

Pulic, A. (2005). Value creation efficiency at national and regional levels: Case study – Croatia and the European Union. In A. Bounfour, & L. Edvinsson (Eds.), Intellectual capital for communities. Oxford: Elsevier.

Pulic, A. (2008). The Principles of Intellectual Capital Efficiency. Croatian Intellectual Capital Center, Zagreb: A Brief Description. Mimeo.

Riahi-Belkaoui, A. (1999). Value Added Reporting and Research. Westport, CT: Greenwood Publishing.

Roos, J., Roos, G., Dragonetti, N. C., & Edvinsson, L. (1998). Intellectual Capital: Navigating in the New Business Landscape. New York, NY: New York University Press.

Saint-Onge, H. (1996). Tacit knowledge: the key to the strategic alignment of intellectual capital. Strategy & Leadership., 24(2), 10–14.

Schwab, D. P. (1980). Construct validity in organisational behavior. In B. M. Staw & L. L. Cummings (Eds.), Research in Organizational Behavior (Vol. 2, pp. 3–43). Greenwich, CT: JAI Press.

Shimizu, M., Kiyoshi, W., & Nagai, K. (1991). Value Added Productivity Measurement and Practical Approach to Management Improvement. Tokyo: Asian Productivity Organization.

Silvestri, A., & Veltri, S. (2014). Overcoming the additive property of value added intellectual capital (VAICTM) methodology. International Journal of Learning and Intellectual Capital., 11(3), 222–243.

Singla, H. K. (2020). Does VAIC affect the profitability and value of real estate and infrastructure firms in India? A panel data investigation. Journal of Intellectual Capital, 21(3), 309–331.

Ståhle, P., Ståhle, S., & Aho, S. (2011). Value added intellectual coefficient (VAIC): a critical analysis. Journal of Intellectual Capital., 12(4), 531–551.