Abstract

The objective of this case-based study is to provide insights into the advisory role of non-family board members in a family firm attempting strategic renewal. By studying the non-family board members of a family firm in a Nordic country, we suggest that non-family board members’ advisory role evolves in a dynamic way. We show at the micro-level how the role, content, intensity, and locus of advice change and how it can be both inertia- and stress-inducing. This facilitates the renewal and hence a firm’s capacity to improve its alignment with changing external demands. We highlight the collaborative nature of the advisory role and the importance of the non-family member chair in ensuring effective board processes. Through our research we contribute to the understanding on the contextual nature of the board roles and tasks and on family firm renewals. We provide insights into how the family firm owners and the chair of the board can enhance the prospects that the non-family board members create value through their advisory role.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, the combination of often unpredictable economic and political changes as well as the introduction of new technologies has changed the environment in which companies operate (Porter and Heppelmann 2014; Schmitt et al. 2016). There is a need to close the gap between the evolving basis of competitive advantage and a firm’s core competencies. The top management of firms must promote, accommodate and utilise new knowledge and behaviours to bring about change in the firm’s core competencies and/or market positioning (Floyd and Lane 2000). Recognising and competing in new environmental conditions may call for new and different business skills (Castanias and Helfat 2001; Huff et al. 1992). However, attracting new talent into an organisation on a timely basis can be challenging. Hence a firm’s internal knowledge base can fall short in the midst of a rapid change. The extant literature on the role of boards has recognised that board members provide advice for the CEO and other top management team (‘TMT’) members (e.g. Fiegener et al. 2000; Johnson et al. 1996; Hillman et al. 2000; Finkelstein and Mooney 2003; van Ees et al. 2008; Zahra and Pearce 1989). Despite of this both research and public debate has long focused on the board’s control and monitoring role. However, recent years have witnessed a growing interest in the topic of the board’s advisory role (see for example Åberg et al. 2019; Adams et al. 2010; Bankewitz 2016, 2018; Krause et al. 2013; Machold and Farquhar 2013) as well as board processes in general (see for example in this journal Derdowski et al. 2018; Huse et al. 2011; McNulty et al. 2011). Yet we still have a limited understanding of what board members actually do when they enact this role. As Bankewitz (2018) observes, it is necessary to gain insight into what takes place in reality inside and outside the boardroom (Finkelstein and Mooney 2003) This can be done by applying an approach that recognises both the contextual setting and the importance of processes (Pettigrew 1992). Half a century after Mace (1971) challenged the mythical concept of board members’ roles vis-à-vis their real activities, we still have work to do in clarifying what the board members actually do when they fulfil their duties.

Chua et al. (1999, 25) defines a family firm as ‘a business governed and/or managed with the intention to shape and pursue the vision of the business held by a dominant coalition controlled by members of the same family or a small number of families in a manner that is potentially sustainable across generations or families’. Strong mental models, the importance of tradition and a long-term perspective (Jensen 2003; Le Breton-Miller and Miller 2006; Miller and Le Breton-Miller 2005) can cultivate inertia in family firms. This can inhibit change and renewal that requires the promotion and utilisation of new knowledge and innovative behaviour (Floyd and Lane 2000; Huff et al. 1992). The research on family firm governance provides evidence that, in a similar way to non-family firms, the family firm board’s advisory role can extend the knowledge base of the company. Board members who belong to the family may have extensive firm-specific knowledge. On the other hand, non-family board members, who we define as individuals who do not belong to the family and who are not part of the management team, i.e. who are also non-executive directors, can also play an important role. They can bring to the firm important general business knowledge and external contacts (Bammens et al. 2011; Bettinelli 2011; Gabrielsson and Huse 2005). However, while many scholars agree on the potential benefits of the non-family board members’ advisory role, the question of how the non-family board members play this role at the micro-level has been overlooked in family firm research. Given this, as well as the economic importance yet high failure rate of mature family firms (Beckhard and Dyer 1983; Hiebl 2015), we argue that it is important to explore the advisory role of non-family board members. It can form a potential source of improving a firm’s capacity to enhance its alignment with changing external demands and thus to achieve long-term sustainability.

The context of our study is the strategic renewal of a family firm in a rapidly changing environment. The target of the research is the content, process and influence of the advisory role implemented by non-family board members. Our case is a 96-year-old Finnish firm that is owned by the fourth generation of family members who no longer hold operational roles in the firm but participate as board members. With our results we contribute both to theory and practice. We deepen the conversation at the nexus of discussion on the contextual nature of the board roles and tasks (e.g. Carpenter and Westphal 2001; Huse 1998, 2005; Huse and Zattoni 2008; Krause et al. 2013; Lynall et al. 2003; Machold and Farquhar 2013; Minichilli and Hansen 2007; Pye and Pettigrew 2005) as well as on case-based research on family firm renewals (e.g. Bégin et al. 2010; Canterino et al. 2013; Cater and Schwab 2008; Salvato et al. 2010; Sievinen et al. 2019). While the role of the outside CEO in family firm renewals has been highlighted by scholars (Canterino et al. 2013; Salvato et al. 2010), we provide evidence of how non-family board members can also support the CEO and the family firm owners in rejuvenating the firm’s strategies. We adopt the framework by Huff et al. (1992) that conceptualises the renewal through a model of stress and inertia that exist simultaneously in any organisation. Within this framework we show how the content, intensity and the locus of the advisory role can evolve dynamically over time. We propose that the non-family board members’ advisory role can be both inertia- and stress-inducing. This depends on whether the advice given is within the boundaries of the current strategy or aimed to extend its boundaries, as is the case when a firm attempts a strategic renewal. We identify several advisory tasks that non-family board members can take up at different stages of the renewal in order to facilitate change. The extant literature acknowledges that board roles are carried out not only inside the boardroom but also outside it (e.g. Huse 1998, 2005, 2007; Huse and Zattoni 2008). We build on this as we highlight the role of spatial separation and advice inside and outside the board and distinguish between the different advisory tasks. By doing this we contribute to the findings of Machold and Farquhar (2013) that recognise the temporal separation of different board tasks.

2 Theoretical framework—non-family board members as advice providers in a family firm’s strategic renewal

The theoretical plurality of governance research has provided fertile ground for board studies. In this section we identify three key tensions that are by no means exhaustive or fully capture the past achievements of board studies but nevertheless which are at the heart of the board research relevant to our study. We explore these tensions that arise from different research objectives, the demarcation of different board roles and the assumptions, and position of our own approach with regard to these questions. In addition, we discuss the case-based studies of family firm renewals and present our chosen analytical framework, the model of cumulative stress and inertia by Huff et al. (1992).

2.1 Objective of research on boards

The first tension deals with a fundamental question concerning the objective of the research on boards of directors and is reflected in the research in this field which has largely focused on two different streams (Machold and Farquhar 2013; Pugliese et al. 2009). First, there is research that aims to define what the boards are expected to do and how the board characteristics impact the firm’s performance (Zahra and Pearce 1989). This approach has yielded limited results and has been repeatedly criticised for being largely based on archive data of large US companies with dispersed ownership, as well as dismissing factors such as board processes and behavioural aspects (e.g. Bammens et al. 2011; Bankewitz 2018; Gabrielsson and Huse 2005; Huse 1998, 2000; Huse et al. 2011; Zattoni et al. 2015). Consequently, the second stream has responded by applying multi-theoretical, processual and/or behavioural, social and cognitive approaches so as to understand the missing links between the governance of a firm, board efficiency and firm performance (e.g. Bankewitz 2018; Finkelstein and Mooney 2003; Forbes and Milliken 1999; Huse et al. 2011). For example, Huse (2007), Huse et al. (2011) and van Ees et al. (2009) have suggested the adoption of the behavioural theory of boards. This recognises the limitations to rational decision-making, satisficing behaviour, political bargaining and the role of routines (Cyert and March 1963; Simon 1947) in explaining decision-makers’ behaviour as well as the importance of the deployment of knowledge concerning the control of managerial behaviour as a source of value created by boards. By focusing on actual board behaviour and the evolution and consequences of informal and formal structures, it provides new insights into the potential of the boards and boards as open systems. By studying the advisory role and its potential value not as theoretical constructs but as a real-life phenomenon in a highly contextual setting, our research has traction with this approach.

2.2 Labelling board’s advisory role and content of advisory related tasks

The second tension we recognise relates to the challenges to reach consensus on labelling the board’s advisory role and its content. While the control role of the board is strongly rooted in agency theory (Fama and Jensen 1983; Jensen and Meckling 1976), the advisory role has multi-theoretic foundations (Bammens et al. 2011). It can be viewed through dominant governance theories such as agency theory (Fama and Jensen 1983; Jensen and Meckling 1976), resource dependence theory (e.g. Pfeffer and Salancik 1978), the resource-based view (e.g. Ireland et al. 2003; Sirmon et al. 2007), stewardship theory (Donaldson and Davis 1991; Davis et al. 1997) and stakeholder theory (Donaldson and Preston 1995).

The theoretical plurality on the rationale of the board’s advisory role is reflected in the differences in labelling the advisory role, and in particular in the use of the terms ‘strategy’, ‘advice’ and ‘service’. In their seminal paper, Zahra and Pearce (1989) define three critical board roles: service, strategy and control. The strategy role includes the board’s involvement in strategy formulation and supporting its execution by providing expertise, while the service role refers to the board members’ role in representing the firm in the community and providing legitimacy. Since Zahra and Pearce’s study, most scholars have referred to the agency theory-based monitoring/control role of the board in similar terms, but for the other board roles (which Zahra and Pearce categorised as strategy and service) whose theoretical basis is more diverse, various labels have been applied (Machold and Farquhar 2013; van den Heuvel et al. 2006). While some scholars use the term ‘advice’ (e.g. Bammens et al. 2011; Finkelstein and Mooney 2003; Gabrielsson and Huse 2005; Johannisson and Huse 2000), the roles containing elements relating to advice provision have also been labelled strategy, resource or service roles (e.g. Johnson et al. 1996; Fiegener et al. 2000; Hillman et al. 2000; van den Heuvel et al. 2006).

In addition to the lack of consensus in labelling the advisory role, there is also a wide variance in what is considered to be the content of these activities. While enacting the advisory role in general is defined as giving counsel to and acting as a sounding board for the CEO and other top management (Johnson et al. 1996; Hillman et al. 2000; Fiegener et al. 2000; Gabrielsson and Huse 2005), it may contain many tasks. It can capture strategic issues (Zahra and Pearce 1989; van den Heuvel et al. 2006; Machold and Farquhar 2013) including strategic analyses (van Ees et al. 2008; Bankewitz 2016), proposing alternatives and providing information on the competition (Hillman et al. 2000) or be focused on networking, building the organisational reputation, providing legitimacy, or connecting the firm to external resources (Hillman and Dal 2003; Pfeffer and Salancik 1978). It can also include advising the CEO and top management on administrative and other managerial issues (Johnson et al. 1996; Bankewitz 2016), while in the family firm context some scholars also propose tasks such as mitigation and resolution of conflicts (Bammens et al. 2011; Siebels and Knyphausen-Aufsess 2012) as a form of advice. As Åberg et al. (2019) observe, many of these tasks can also be categorised as ‘service’ tasks as proposed by Johnson et al. (1996). More recently, scholars focused on actual board behaviour have offered new insights to further conceptual clarity. Bankewitz (2016, 2018) calls for a higher granularity of tasks. He suggests differentiating between functional advice that refers to advice on general management as well as financial and legal questions and firm-specific advice that includes board members’ advice on matters that relate to functional production, information management and marketing. On the other hand, Machold and Farquhar (2013) question the discrete categorisation of the board tasks based on various theoretical backgrounds. Instead, they suggest that the board tasks are temporal and contextual, and as such, the intensity of the particular task evolves and adapts in response to the changing strategic context.

In our research, we include all the above tasks related to service, strategy and providing counsel in what we label as belonging to the advisory role. We consider the board members’ advisory role to include board members individually or the board as a coalition sharing their insights or making recommendations to the CEO, other TMT members or shareholders on a decision or action to take in a particular situation. Åberg et al. (2019) also observe that terms such as ‘board tasks’, ‘roles’, ‘activities’ and ‘functions’ are often used interchangeably. When we discuss the specific activities taken up as a part of the process of providing advice, we refer to them as ‘tasks’. When we discuss a wider concept that also includes social constructs such as identities and perceptions that relate to non-family board members’ actual or expected performance of these tasks, we refer to it as the ‘advisory role’.

2.3 The advisory role of non-family board members

The dominance of cross-sectional research approaches has to some extent hidden contextual and dynamic aspects that inherently relate to board roles (Gabrielsson and Huse 2004; Machold and Farquhar 2013). Still, several contextual factors such as firm resources, size, ownership structure, life cycle, dominant ideology, leadership, location and industry (Huse 2005; Johannisson and Huse 2000) can influence the governance of a firm. For example, Gabrielsson and Huse (2005) observe that family firms typically have small boards composed of a few family managers in addition to the owner-manager. However, in later-generation family firms, the board structure often changes (Gersick et al. 1997) and as the ownership of the firm becomes more dispersed, the need for more formal governance increases and non-family board members are appointed more frequently.

In the context of studies focusing on the role of non-family board members, we recognise the third important tension that reflects the difference between scholars posing a question whether non-family board members can add value and if so, in what role, as opposed to asking how the non-family board members can add value. Early studies on the role of non-family board members in family firms were based mostly on agency theory. They emphasised non-family board members’ roles in terms of control or monitoring the varying interests of different shareholder groups (Andersson and Reeb 2004) and the pressure of non-family shareholders was seen the primary reason for appointing non-family board members (Fiegener et al. 2000). Schwartz and Barnes (1991) however, recognise that non-family board members are well positioned to support the firm not only in monitoring but also in terms of providing contacts and a long-term perspective. Johannisson and Huse (2000) in turn suggest that introducing non-family board members to the board of a small family firm is influenced by and influences the prevailing management ideologies, but an active board with non-family board members can help to exploit the tensions between competing ideologies in a fruitful way.

As Gabrielsson et al. (2016) observe global competition and growingly complex governance environments have accelerated an interest among family firms in how the boards can create value. Research interest in the advisory role has also increased. For example, van den Heuvel et al. (2006) observed that in Belgian family SMEs, CEOs perceive the board’s advisory role to be more important than its control role and suggest that a well-functioning board that includes non-family board members can add value through its advice. Jones et al. (2008) focus on affiliate directors and show that in family firms their sharing of knowledge and expertise reduce diversification risks as perceived by the family managers and hence stimulate growth strategies. Brunninge et al. (2007) provide evidence on Swedish SMEs, suggesting that they exhibit less strategic change than firms with widespread ownership, but that having board members who are not family members or not working in the firm on a daily basis or extending the size of the TMT can help to achieve strategic change. Voordeckers et al. (2007) in turn propose that a family firm board structure reflects family goals and characteristics. They argue that while a strong focus on family goals may obscure family members from seeing the value that non-family board members add, their advice on topics such as succession can be highly valuable. On the other hand, Bankewitz (2018) points out that in smaller companies with a more concentrated ownership, the board may be needed not only as a resource. It can also be in a better position to enact its advisory role, as there is less need for the board members to balance diverse shareholder interests that are typical of larger public companies.

Over time, the debate about whether non-family board members can add value has been increasingly replaced by suggestions that the structure of the board or attributes of individual board members alone do not ensure value creation but that mediating factors such as board processes, play a major role (e.g. Bettinelli 2011; Gabrielsson and Winlund 2000). Gabrielsson and Winlund (2000) show a positive relationship between the use of knowledge, board members’ preparations for meetings and the board’s formal routine, and how well the board perform what they define as its’ service role. Overall, the board’s involvement and routines, such as the board agenda, protocols and division of work between the board members are shown to be important for the board’s ability to perform its tasks effectively. Bettinelli (2011) studied the impact that non-family board members have on board efficiency in Italian family firms. She argues that a greater proportion of non-family board members improve effort norms and board cohesion in family firms with active boards. Bettinelli (2011) also suggests that the beneficial effect that non-family board members can increase as the firm becomes more mature. Zattoni et al. (2015) studied family involvement and board processes. They suggest that while board processes in general have a positive impact on board task performance, family involvement has a negative influence on cognitive conflicts but a positive one on effort norms and the use of knowledge and skills. Bankewitz (2016) in turn distinguishes between the types of advice and highlights the importance of the chair of the board in terms of how the board utilises its advisory capacity. In a study of Norwegian SMEs, Bankewitz (2018) applies effectiveness concepts (Forbes and Milliken 1999) to analyse the effect that the board members’ knowledge base and diversity has on two types of advice: firm-specific advice and functional advice. Bankewitz’s (2018) findings emphasise the importance of differentiating between the types of advice as well as the board members’ general business knowledge and organisational knowledge. He proposes that general business knowledge (largely based on the board members’ previous board experience) does not contribute to the boardroom culture where the board members actively make use of their knowledge or board task performance, whereas organisational, firm-specific knowledge has a positive relationship with the use of knowledge.

Gabrielsson et al. (2016) offer an integrated approach to the board’s value adding role in family firms by combining resource-based perspectives and a value chain analysis (e.g. Porter 1985) with team production theory (Alchian and Demsetz 1972; Kaufmann and Englander 2005; Blair and Stout 1999) into extended team production approach. Team production theory suggests that valuable resources can be contributed by several stakeholders and that the value distribution should be made so that it benefits all the stakeholders who contribute resources. Gabrielsson et al. (2016) observe that in family firms the concept of value goes beyond what is generally recognised as value in the corporate literature. They propose that the board of a family firm can contribute to the value chain by taking up different board tasks, including advisory tasks, and stewarding the key value-adding stakeholders. They suggest that these tasks are supported by board competences as well as by board culture, leadership provided by the chair, structures and developmental activities (Huse 2007).

These and several other studies have reduced the doubts on the potential value of non-family board members. These concerns included for example whether a family firm’s real decision-making occurs outside the boardroom (Gersick et al. 1997), or that outside directors in general may not have the required time to contribute as they are involved with multiple boards and interact as a coalition only infrequently (Forbes and Milliken 1999), or that they lack access to or do not have the required knowledge of the firm and its environment (Ford 1988). These are viewed now more as process and behavioural issues (which also underlines our research focus) than fundamental doubts on whether non-family board members have the potential to add value.

2.4 The advisory role in the context of family firm strategic renewal

2.4.1 Empirical evidence on the board’s advisory role in the context of family firm strategic renewal

Strategic renewal is a prominent yet elusive concept in the literature on organisations and management. Different theoretical backgrounds have led to a lack of consensus about what strategic renewal consists of, and Schmitt et al. (2016) and Agarwal and Helfat (2009) have called for increased conceptual clarity. In our research we adopt the definition by Schmitt et al. (2016, 5) of strategic renewal in that: ‘strategic renewal describes the process that allows organizations to alter their path dependence by transforming their strategic intent and capabilities’.

Several scholars have provided evidence that a firm’s life cycle influences the board’s roles and tasks. Huse (1998) shows that the interactions between the board and internal and external stakeholders have an influence on board roles. He notes that the advisory role of the board is particularly prominent in a firm that is facing market reorganisation, whereas in a distressed firm with a need to raise financing, the board focuses on a monitoring role. In a firm that is recovering from bankruptcy, the legitimation role becomes prominent. Focusing on the influence of trust between the internal actors, board members and external stakeholders, Huse and Zattoni (2008) in turn show, in a slightly different setting of firm life cycles than Huse (1998), that the advisory role of the board is dominant when a firm is in a growth phase, while in a start-up phase, legitimation was found to be the main board role. Similarly to Huse (1998), Huse and Zattoni (2008) suggest that if a firm is facing a crisis, the board’s focus is on control- and monitoring-related roles. However, while an organisational crisis may elevate the importance of the board’s control role, the role of advice and the board’s ability to provide it cannot be dismissed in such situations. Minichilli and Hansen (2007) provide evidence that board diversity becomes particularly relevant in these situations. This suggests that diversity generates a variety of views and alternatives that can help to overcome difficult situations and strategic inertia.

While family firms and other SMEs may share characteristics such as their size and focused ownership, family ownership may play a particularly important role when a firm is attempting a strategic renewal (Canterino et al. 2013; Cater and Schwab 2008). A family firm’s characteristics, such as the importance of tradition, a long-term perspective and strong mental models (Jensen 2003; Le Breton-Miller and Miller 2006; Miller and Le Breton-Miller 2005) can influence the renewal process, even when the owners are highly committed to necessary changes (Sievinen et al. 2019). Research on the role of boards in the strategic renewal of family firms is scarce. In their case study of two US-based family firms attempting a turnaround, Cater and Schwab (2008) recognise the role of the board as a key decision-making body. Canterino et al. (2013) discuss the changing of a family member dominated board into a board composed of non-family board members as a tool to combat the cultural inertia of the firm and the family. The advisory role of the board is also highlighted in a study of an Italian family entrepreneurs’ exit from the founder’s business, and subsequent entrepreneurial renewal by Salvato et al. (2010). In this research, a family member considered the well-functioning board to have improved the quality of strategic decisions. Sievinen et al. (2019) in turn have shown that in an attempted family firm strategic renewal, owners that serve on the board play a key role in triggering and facilitating the change both inside and outside the boardroom. However, based on our review of the relevant literature, we argue that the role of non-family board members in the strategic renewal of family firms is still mostly uncharted in strategic renewal research.

2.5 The model of cumulative stress and inertia—our analytical framework

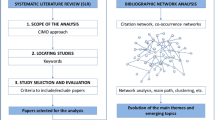

When analysing and making sense of our data, we reviewed the data and emerging concepts through several theoretical frameworks to find a relevant analytical framework. Our decision to use the model by Huff et al. (1992) that depicts renewal through a model of cumulative stress and inertia, was driven by several of reasons. First, the concepts of inertia and stress fit well with the dynamics revealed by our data. Second, the extant research on family firms discusses inertia as a key force in family firms (Jensen 2003; Le Breton-Miller and Miller 2006; Miller and Le Breton-Miller 2005) and hence is of interest when studying change in family firms; and third, the ability of the model by Huff et al. (1992) to operate at several of analytical levels (individual, group, firm) is helpful when analysing highly detailed and complex case data such as ours. Figure 1 illustrates the key concepts of the model by Huff et al. (1992).

Key concepts of the model by Huff et al. (1992)

The model by Huff et al. (1992) draws on the concepts of satisfying behaviour and cognitive boundaries (Cyert and March 1963; Simon 1947), innovation adaptation (see, e.g., Rogers 1962; Lave and March 1975; Abrahamson 1991) and schema theories. The key concepts, inertia and stress, that regulate the balance of the organisation between the status quo and change are viewed to exist simultaneously. Inertia is defined as the level of commitment to the current strategy and resistance to renewal outside its boundaries (Huff et al. 1992). The organisation remains at the status quo (state I) as long as the current strategy delivers satisfactory results as it is or by making only minor changes to it. As time goes by, organisational inertia grows as there is an increasing economic and psychological commitment to the current strategy (Huff et al. 1992). However, the passage of time also sows seeds for change. Changes in the environment put pressure on the chosen strategy or the management may not succeed in executing the strategy properly, even if it were suited to the external and internal conditions. As dissatisfaction with the current strategy grows, i.e. stress, the organisation faces a decision about whether or not to consider a radical change in strategy (state II). If the organisation decides to consider a radical change, it moves on to state III to develop and evaluate renewal alternatives. The risks of a possible new strategy are assessed, and if the benefits are expected to exceed them, the organisation is ready to enter state IV. In this state the early excitement about the new strategy, the ‘honeymoon’, is followed by the first observable results. Huff et al. (1992) suggest that if the results fulfil the expectations adequately and start to accumulate, the commitment to the new strategy, i.e. inertia, starts to grow again, and the organisation again enters status quo.

3 Methods and materials

3.1 Methodology

Our decision to choose a qualitative approach and to focus on a single case and study it in depth was driven by the formulation of our initial research question. As Ahrens and Khalifa (2013, 24) observe, the qualitative research approach is ‘an important alternative to treating the various components and processes of corporate governance as black boxes whose key elements are assumed to be somehow “standard” and thereby known without context-specific inquiry’. Given our interest in the micro-level processes of the board of a family firm, we opted for a single case study to ensure access to highly detailed data As for example Huse et al. (2005) have shown, a qualitative single-case study can provide a good way to acquire in-depth knowledge about boardroom dynamics and behaviour. We chose our case using a purposive method (Eisenhardt 1989), as the key driver for the selection of the case company was our knowledge of its ongoing attempts to carry out a strategic renewal and the access that the owners granted us to the members of the board, top management and the company archives.

To a large extent we subscribe to the interpretivist view, which views reality as socially constructed and sees the aim of case-based research to develop insights into the phenomenon studied in all its uniqueness, contextuality and complexity (Leppäaho et al. 2016). However, we differ from a strictly interpretivist approach in two important ways. First, in line with the critical realist approach, we accept reality to exist independently of ourselves and believe that our data grasps it only imperfectly (Sayer 1992). This means that we accept using data and source triangulation in our attempt to develop a plausible view of events, for example, if interviewees do not recall the sequence of some past events. Second, similarly to Gioia et al. (2013), we do not consider our findings to be fully idiosyncratic and hence inapplicable to other domains but assume that we can recognise concepts and processes that can be structurally similar (Morgeson and Hofmann 1999) between cases. However, we recognise that while the concepts proposed by us can also be applicable to other mature family firms that have both owners and non-family board members serving on their boards, our approach does not enable us to present prescriptions on how all family firms, or even family firms of this size and at a similar development stage to our case company, should aim to compose their board or organise their board processes. Contexts such as cultural differences, differences between the sectors as well as individual preferences and behavioural models affect these needs.

3.1.1 Data collection

We started the data collection with a meeting with one of the owners who provided information on the company and the process it was going through. We then conducted 12 semi-structured interviews over 5 months to collect our primary data. The interviews that were recorded and transcribed were scheduled to last between 60 and 90 min. We interviewed all the board members; two owners (one of whom serves as vice chair of the board), an outside chair of the board, and three other outside board members. We also interviewed several other people that had participated in the board meetings in some other capacity than as board member: an ex-CEO, the current CEO and three other TMT members, including the CFO of the firm who served as the secretary of the board but also as acting CEO in 2016 between a CEO leaving and the new one joining. Access both to the board members as well as the CEO and other TMT members was important for us to achieve a full view of the board’s role, tasks and behaviours. We worked hard to ensure that the questions in our semi-structured interviews were not leading, yet we allowed earlier interviews to influence the following ones as we gained more information. Secondary data including board agendas, board minutes and board presentation materials provided us with important information in terms of timing, decisions and reported actions, and other available market information provided us with an in-depth understanding of the firm, its background and the industry (Table 1).

3.1.2 Data analysis

To ensure the transparency of our methods, we chose to apply the Gioa method (e.g. Gioia et al. 2013; Nag and Gioia 2012) to support our data analysis and theory building. The data collection and data analysis were conducted in an iterative manner. Based on our primary and secondary data, we first worked to create a plausible view of the events that we used as an initial data organisation tool (Langley 1999). This provided us with a processual lens to view the data. To support the identification of 43 data-driven categories, we used the N-Vivo software package. We wrote a description for each code and named them after representative quotes so as to create the first-level data structure.

In our second-level analysis, we complemented the data-driven codes with theory-based codes derived from the relevant literature on corporate governance and strategic renewals. Our case-based approach enabled us to link the data both to content and process aspects provided by the extant literature on strategic renewal and governance (e.g. Bammens et al. 2011; Cater and Schwab 2008; Canterino et al. 2013; Grinyer et al. 1988; Greiner et al. 2003; Huff et al. 1992; Pfeffer and Salancik 1978; Schoenberg et al. 2013; Stopford and Baden-Fuller 1990; Schweizer and Nienhaus 2017). When doing this, we identified several topics that related to the distinctive role, tasks and behaviours of the non-family board members and the owners. We then decided to focus on these two topics separately in two different papers in order to ensure an adequate focus on both themes.

The theory building stage was characterised by an iteration between the data and the relevant literature in an attempt to reveal the relationships between the key concepts relating to the background of the renewal, renewal strategies and the role of the non-family board members. While the existing theories and frameworks of the board roles and family firm renewals helped us to define the phenomenon—the non-family board members’ advisory role in a strategic renewal—we felt that the existing literature fell short of studying it empirically at the micro-level and addressing the questions necessary to understand the essence and the evolution of this role.

When interpreting a socially complex phenomenon, it is important to remain open to perspectives and theories in order to create enhanced understandings (Nordqvist et al. 2009). As we worked in an iterative way, we added new informants to our initial list of interviewees and also went back after the interviews to clarify some of the answers or to gain new information, to ensure that we had adequate data for analysing board member behaviour and to gain data to confirm or reject our initial interpretations. This was particularly important when assessing the intensity of the enactment of the advisory role and its content at different stages of renewal, as we had to rely on the informants’ descriptions of their past behaviour. For this analysis the board minutes offered only limited support, as they recorded only what had been decided inside the boardroom in the board meeting.

At this stage, we also reassessed our decision to focus on the owners’ and the non-family board members’ roles in separate papers in order to ensure that no key dependencies were lost because of this approach. Gradually, we reached a stage where we felt that we no longer received new data that was within the scope of our study, no new themes emerged, and that we had adequate clarity to finalise our framework which revealed the relationships between the key concepts and to conceptualise our findings. During the drafting of our framework, we were privileged not only to receive member-checking on the course of the events but also high-quality feedback on the interpretation of the data. We met with the board of directors of the case company for a group discussion in addition to requesting individual feedback from each of them. We also met with a group of seasoned practitioners who provided us with valuable feedback.

3.2 The case company and governance context

In 2016 the case company, which focuses on lighting controls and lighting components, had a turnover of EUR 76 million and employed 260 people. Over 97% of the sales were generated outside Finland; in other parts of Europe and Asia. The company was founded in 1921 and has gone through several transformations, shifting its focus first from radio assembly to its own manufactured radios, then in the late 1940s and early 1950s to lighting components and TV sets. During the 1970s, the company focused its operations on lighting components only. In 1990 the company acquired full control of a leading lighting control company in the UK. The company has a strong balance sheet but has experienced a decline in sales.

Owned by the same family since 1921, the company is controlled by a group of six cousins, two of whom are current board members of the company (‘the owners’). In our case study we have focused on the period between 2015 and 2017, when the family and the board of directors of the company triggered a renewal process to rejuvenate the firm’s strategies after several years of lacklustre sales development. While one of the owners had headed the company in the 1990s, during the period we studied, none of the family members were involved in the daily operations of the company. Hence, the company can be described as family-owned but not family-managed (Chua et al. 1999) and, according to the typology of Gersick et al. (1997), as a mature business in the cousin consortium stage.

Between 2014 and 2017 the board was composed of two family members, one of whom served as vice chair of the board, and four non-family board members, including the chair of the board. All board members were non-executive directors and the non-family board members are independent from the company also by not having any close business ties with it or owning any stakes in it. The changes to the board composition between 2014 and 2017 included an appointment of a new non-family member chair as well as two other non-family board members replacing the previous non-family chair and a non-family board member who resigned.

The Finnish governance system is based on civil law and has three key decision-making bodies: the shareholders’ meeting, the board of directors and the managing director (‘CEO’). The board is accountable to the shareholders and is responsible for the organisation of the company’s operations. The board usually consists of members who are non-executives and the corporate governance code for listed companies recommends separating the roles of chair and CEO. The CEO is appointed by the board and he or she is responsible for the day-to-day operations of the company. Finnish corporate governance also recognises a supervisory board, but it is not recommended for listed companies and is usually found in no other than state-owned companies.

While Finland lacks the strong traditions of SMEs and family firm governance research found in the neighbouring countries of Norway and Sweden and hence its governance system is less known among the governance scholars, the three Nordic countries share similarities with active boards, the separation of the CEO and chair roles (legally enforced in Norway and Sweden for listed companies, and as noted above, part of the recommended corporate governance code for listed companies Finland) and clearly articulated separate roles for the board and CEO/executive team. As proposed by Sinani et al. (2008), the Scandinavian countries (Denmark, Norway and Sweden) share many similarities between their informal governance mechanisms, so aspects such as trust, information diffusion and reputation mechanisms play a significant role. We argue that Finland shares these ‘small world’ (Sinani et al. 2008, 27) characteristics.

4 Analysis and discussion—the non-family board members’ advisory role in the strategic renewal of a family firm

In this section we reflect the non-family board members’ advisory role in our case company within the strategic renewal frame by Huff et al. (1992). In line with Huff et al. (1992), we define advice that relates to the existing strategy without challenging it or which proposes only minor modifications to it as inertia-preserving advice and advice that relates to proposing or promoting a new strategic directions as stress-inducing advice.

4.1 Strategic renewal state I and state II—from the status quo to considering a radical change in strategy

While the first decade of the 21st century had been characterised by a successful turnaround of the component business, by around 2014 it was starting to become evident to the owners of the case company that the pace of external change was exceeding the change capabilities of the firm. The CEO (‘CEO 1’) and the incumbent chair of the board, both non-family members yet loyal and trusted by the owners, had been working together for 11 years. Both were approaching retirement age. The company’s core Finnish-based business, lighting components, was being outperformed by the largely UK-based lighting control operations, a business viewed as non-core by the management. The owners had been strong in their belief in the synergies between the two businesses but proving those benefits had been challenging. While many of the employees appreciated the security provided by working for a company that took pride in being a good long-term employer, attracting new talent was not easy due to the location of the sites and the limited means to compete with larger technology companies. Yet the balance sheet was strong and difficult decisions were easy to postpone.

Although the non-family board members and management did not propose major changes, the owners and the family members not involved in the governance of the firm were starting to feel increasingly uneasy about the future prospects of the company. The owners felt that the non-family board members would not take the initiative in triggering the change unless the owners clearly communicated their appetite for radical changes.

If the non-family board members think that we [owners] are very satisfied, they will not drive the change […] they may think that the firm could do twice as well as it does now, but if they think the family is happy and they want this management, few will challenge the owners […] [the non-family board members] or question things [the direction of the firm], and usually only after the problems have become large. (Owner, member of the board)

In many ways, the situation of the company reflected state I in that management had little incentive to propose changes to its strategy as it would be cumbersome and time-consuming to explore alternative ways of working (Huff et al. 1992). Furthermore, the non-family board members’ advisory role in state I was carried out largely within the boundaries of the existing strategy and did not initiate any radical changes. The extant literature offers several possible interpretations for this. Sievinen et al. (2019) suggest that non-family board members may not know the owners’ true expectations. Consequently, the outside advisors may compare a firm’s performance against redundant benchmarks. On the other hand, power and authority may also play a role. The non-family board members may have a sense of obligation to support those who have favoured their appointment and avoid challenging these decision-makers (Bettinelli 2011; Daily and Dalton 1995; Wade et al. 1990; Zattoni et al. 2015) or risk the owners’ sensitivity to ‘outsiders’ criticism of their firm (Gomez-Mejia et al. 2011), which in turn causes the non-family board members not to express their views freely.

In order to trigger change, the owners signalled their appetite for change by starting a search for a new chair of the board. The process followed the well-tested practice of the owners for looking for new non-family board member candidates that typically were appointed for a four-year period.

When we know where we are heading to, we review what [competences] we have in the management team, and what we have in the board. And what we need more of, what less and how complementary the skills sets and the backgrounds are. Then we start the search [for non-family board member candidates] with the help of head-hunters. (Owner, vice chair of the board).

The requirements for the new chair were carefully drafted as the owners recognised that the profile of the new chair could be based on the firm’s immediate needs but that it must reflect the needs to reach the desired state. First, the person had to fully appreciate and understand the importance of the increasing pace of change in the industry. Second, the optimal candidate had to have experience of carrying out a large-scale transformation. Third, the owners wanted to find someone who could comfortably hold a dialogue at all levels of the organisation. The search was triggered with a help of a professional head-hunter who had been used by the owners in the past. While modest in his demeanour, the winning candidate had extensive first-hand experience in leading a global business that had witnessed value migration from the hardware to the software layer.

While the owners had played a key role so far in triggering the change, the non-family board members’ role in supporting the renewal process began to grow as the new chair was appointed. The new chair helped the owners to make their expectations clear for the company performance and to make appetite for the change known both to the non-family board members and the management. Marking the start of considering a radical renewal, state II (Huff et al. 1992), the new chair launched a stringent strategy process that revealed a lack of market and competitor data. In this process the non-family board members advised on best practices and standards for professional ways of working and hence challenged the existing organisational processes. This played an important role in facilitating the change as while the established decision-making routines promote efficiency and stability (Cyert and March 1963; van Ees et al. 2009), they can also form an important barrier to contemplating change and recognising changes in the operating environment (Huff et al. 1992).

[We were in] such a niche market that you just can’t go and buy objective market data… this led to a situation where we had no metrics and we had no capability to take a view of how the market was developing apart from very general views […] it all becomes fluffy, there are lots of slides and everything is very general. The direction may be right, but it is very difficult to evaluate [the results] and have a precise action plan as you can’t measure whether you are on the right track or not. (Chair of the board)

Apart from improving the processes, the new chair of the board took a key role in helping the owners and the board to assess the situation from an outside-in perspective. The owners, who had followed the industry very closely for many decades, knew that the component business would not help the company to grow but found it difficult to grasp what was happening in the rapidly developing lighting control market. The varied background of the non-family board members in technology, sales and marketing enabled them to contribute from several different perspectives to form a view of what was going on in the industry. After several iterative rounds of strategy work, the initial assessment was clear: the company’s core business was at risk as its competitive advantage in basic components was being eroded and at the same time the company lacked direction and the necessary software competencies to tap into new opportunities in the lighting control business.

The advisory task of the non-family board members was related to assessing the external landscape and was largely enacted inside the boardroom. The new chair of the board promoted an open discussion between board members and between the board and the management. In addition, the new chair facilitated frank dialogue between the board members by reserving ‘board only’ time at the end of each board meeting. During these sessions the CEO or other TMT members were not present, and no minutes were kept.

While the first strategy review process was felt to generate important market insights that the firm had lacked and the implementation of this task raised the level of the board task performance (Forbes and Milliken 1999), some directors felt that there was too much analysis at the expense of the actual conclusions. Our data suggests that the board or individual board members did not address this issue with CEO 1. We interpret this is as the board’s focus having moved from an advisory to control role as the board started to assess the performance of the current CEO.

However, although the result of the initial strategy assessment fell short of the expectations of providing a clear plan of how to renew the company, it enabled the board to grasp the drivers of the industry turbulence and the scope of the necessary change, as well as to take a view of the new competencies required. Hence, in the late summer of 2016, the board felt some satisfaction in having gained an increased understanding of what was going on in the industry. It had also proved that the owners’ suspicions were right; while the long-serving CEO was an expert in the volume manufacturing of lighting components, he was not equipped with the skills necessary to ensure future growth. The process of searching for a new CEO was initiated. Finding candidates with the right skills set was not easy. While all candidates went through a transparent search process led by a professional head-hunter and the owners exercised influence over the process, it was the contacts of the chair of the board that facilitated the identification of the best candidates. At the end of the process, the new CEO (‘CEO 2’), a seasoned tech executive, joined the company and was tasked immediately with preparing a plan for the new strategic direction.

Luckily, the new CEO was not alone. After the initial strategic assessment, the board had concluded that if the firm was to be successful in the new environment, not only a change of CEO was necessary but also other new resources were needed.

It [the initial strategic assessment] led to the conclusion that as a large share of the firm value was attributable to the lighting control business, we must think about attracting new competencies…as one moves from embedded architecture to a layered one, as it was clear that would happen [in the lighting control industry], it was normal that we did not have such resources in-house… (Chair of the board)

The chair played a key role in supporting the CEOs outside the boardroom by providing access to resources who could lead and support the renewal in these recruitments. For example, the head of research and digital, the head of strategy and the head of human resources shared the same corporate background as the chair of the board.

[The new chair of the board] hired, more or less, or recommended [the new chief digital officer and director of research] to be hired. (Non-family board member)

The data suggests that individual board members were active outside the boardroom advising also on more operational issues related to resourcing, such as moving headquarters from a quiet country town to the capital region to ensure better access to software engineering resources and providing benchmarks from other companies. A non-family board member, for example, invited the TMT members to visit the high-end R&D premises of his own company to provide an example of a modern R&D site. This and other efforts supported the decision-making to move the company headquarters from a quiet country town to the capital region just before CEO 2 joined.

And I was one of the loudest ones I think on that front [promoting the move of the headquarters to the capital region], as far as I know because of the experiences on the software hiring that we [in the company headed by a non-family board member] had and how much we struggled to hire software [engineers even] in downtown Helsinki… I invited…management team members as my guests to our [the company headed by a non-family board member] office in Helsinki showing them a modern software setup. (A non-family board member)

We consider these efforts to be important tools for non-family board members to widen the horizons of management. This shows that while the role of the board is a cognitive one (e.g. Huse 2007), enacting advisory role can require highly concrete actions that take the actors outside the walls of the boardroom.

4.2 Strategic renewal states III and IV—envisioning renewal alternatives and adopting the new strategy

Tasked with formulating a detailed plan on the strategic direction of the firm, CEO 2 conducted a series of interviews with the employees and external stakeholders. As the plan was being drafted, both the non-family board members and the owners were actively contributing to it. We observed three behaviours in the discussions between the non-family board members and the CEO. First, those non-family board members who initiated discussions outside the board meetings focused either on the topics that they felt they were experts in or discussed the business situation and the renewal options in more general terms.

I think we all [non-family board members] had extended offline meetings with [the CEO] and we all had our own sort of interest areas or areas that we thought that he should know about. […] I talked with the chair of the board offline and then again I went and talked with [head of research and digital]. I had some discussions with [one of the owners], e-mail–based… (A non-family board member)

[I talked with the CEO] about people, members of the management team, reductions in the headcount, and a lot about what we do with the [component business]… we talked about things like this when drinking morning coffee; it wasn’t based on any [formal] agenda. (A non-family board member)

I think my biggest contribution as a board member is actually provided between board meetings, when I can act as a sounding board in my own area of expertise. (A non-family board member)

Second, there is a difference between how CEO 2 assessed the board members’ advice on strategic issues outside the boardroom and how the board members interpreted it. CEO 2 recalls how he initiated one-to-one meetings with all the board members:

In other [ownership] structures I would have likely just gone into the board meetings and presented things to everybody equally. I think the whole one-to-one approach I actually invented, because I wanted [a representative of the owners, vice chair of the board] to be in the loop before [the board meetings where key strategic decisions were discussed], and then not to single him out, I decided to do one-to-ones with all of them. (CEO 2)

We interpret the data to mean that while the board members viewed the one-to-one meetings with CEO 2 as an opportunity to provide advice to the CEO, CEO 2 took them as an opportunity to ‘bring them [the board members] on the journey’ and ‘do the pre-selling’, and gain early support for the proposals he planned to make in the board meeting. This suggests that the process of board members providing advice on the key strategic issues for the CEO is not without its complications: The CEO may be wary of referring to these discussions as advice so as not to appear weak or indecisive. Furthermore, while not dismissing the advice of the board members, CEO 2 felt that the non-family board members were distant from the company’s businesses, while the owners’ accumulated experience of the businesses reflected the firm’s past rather than its future. The non-executive directors’ lack of in-depth knowledge of the business is an efficiency issue recognised by the general governance literature (e.g. Ford 1988), while the latter concern of CEO 2 can be associated with the strong mental models of family firm owners (Jensen 2003).

The data shows that the non-family board members’ advisory role was intensive in advising on alternative renewal strategies in state III. The interaction took place both in and outside the boardroom between the individual board members and the CEO and other TMT members. The data also shows that there was interaction between the individual non-family board members and the owners outside the board meetings. While the owners’ influence on the proposals of a family firm CEO can be significant (Sievinen et al. 2019), the data suggests that the non-family board members can play a role in supporting the CEO helping to ensure that the decision-making is not narrowed down too early to too few and obvious alternatives. For example, while the CEO was preparing a proposal on the R&D site strategy between the UK and Finland, the non-family board members with extensive experience in research, product development and multi-site strategies played a key role in facilitating a thorough analysis prior to the plan being presented at the board meeting. Additionally, the data suggests that through their experience from other firms, the non-family board members supported the TMT in evaluating the costs and benefits of the alternatives. By enacting these tasks, the non-family board members helped to ensure a thorough analysis of alternatives yet facilitated arriving at conclusions in a timely manner in spite of the high uncertainty surrounding the alternative options. We also recognise that the non-family board members had been appointed to provide specific knowledge and hence were predisposed to actively provide advice. We suggest that this helps to ensure that the non-family board members’ skills complement the CEO and other TMT members’ competencies, and we suggest that this legitimises the non-family board member’s role in informal interaction between the other board members, the CEO and other TMT members outside board meetings.

During the board meeting in December 2016, the new CEO was ready to present his proposal for the new strategy. The lack of synergy between the two businesses was a fact, he explained. The components business was a high-volume, low-margin business with increasing price pressures. The company had no real competitive differentiator in this business, and investments to secure a full-scale portfolio were not supported by the margins that the business generated. Consequently, the components business was preventing the company from focusing fully on the lighting control business, where intelligent solutions promised future growth. The proposal was that the company should define itself as a lighting intelligence business, while the component business would play an important role as a cashflow generator. The decision to refocus called for immediate decisions about the site strategy. Although the headquarters were in Finland, most operations related to the new strategic core resided in the UK. After intensive discussions, a decision was reached. While it had initially looked obvious to some that the company would need to focus on one site only, the final decision acknowledged the importance of both sites but with more clearly defined roles. In this way, the company could tap into the software resources available in Finland while retaining the core of the lighting control development knowledge in the UK. The decision on the new direction meant radical changes to both businesses and would call for a significant reshuffling of resources.

Throughout the decision-making, an owner, who was the vice chair of the board, wanted to make sure that the non-family board members felt comfortable about expressing their true opinions. Owners expressing their strong opinions on matters early on may put a damper on debate, he felt.

I am trying to learn that when it is about the owners’ directions, I talk late enough […] But yes, as an owner you need to be careful that you do not kill the discussion prematurely. Because it very easily happens that when the CEO proposes something and the chair seems to have [the same] opinion… and if then the owner agrees, it is very difficult for the [non-family board members] to be critical or consider alternatives. (Owner, vice chair of the board)

An exception to not talking first was made, however, when it was estimated that up to a quarter of the workforce would have to be made redundant. At this point, the owners expressed their support for the CEO’s proposal early in the board meeting so as to show that the owners were prepared for radical changes in order to ensure the sustainability of the firm. However, they requested that all redundancies were to be made in a respectful manner. Finally, after weeks of extensive preparations and then thorough discussions in the board meeting, the board approved the plan proposed by the CEO without hesitation.

In early spring 2017 the board felt satisfied. Only a few months previously, there had been a profound concern that the company lacked a strategic direction. Now the board members felt that the uncertainty had been replaced by a clear vision and an action plan. After an intensive period of evaluating the alternatives, the company was in the execution phase, state IV, characterised by early excitement and then assessment of the first observable results.

However, just when everything was looking good, unexpected news came. The new CEO had accepted an attractive offer to become the CEO of a large, high prestige company in his home country. After the initial shock, the board had no other alternative other than to focus on keeping up the momentum of change; the resignation of the CEO would not be allowed to jeopardise the effectively progressing renewal.

Again, a new CEO (‘CEO 3’) was found through the network of the chair of the board. Now the board members felt that as the company had a clear strategy and the restructuring was done, a new CEO with strong credentials in sales and people management could focus on the execution and development of a high-performing top management team to ensure that the renewal process would be successfully completed. As Huff et al. (1992) observed, a significant transformation takes time and many of its details remain to be worked out even after the renewal is announced. The non-family board members were ready to support the new CEO with this. The data suggests that CEO 3 perceived the dyadic interaction between him and the board members more as an opportunity to tap into the expertise of the non-family board members and was more active in initiating such discussions with individual board members than CEO 2.

[As I started, I wanted to know] if they [the non-family board members] are available for sparring, like for example [a non-family board member] who is very experienced in marketing and sales, [another non-family board member] who has a very different viewpoint as a CEO of a start-up and [another non-family board member] who [is experienced] in R&D. (CEO 3)

[Soon after having started] I had ideas with regard the road mapping process and tested them with [two non-family board members] and it worked well, both of them had something to offer, so that was good. (CEO 3)

We argue that this could be attributed to two factors. As there was no change in the composition of the board between the CEO appointments, and CEO 2 and CEO 3’s backgrounds were not vastly different, this could reflect the differences between the preferences and working styles of the two CEOs. On the other hand, CEO 3 joined the firm after the new strategy had been announced in state IV. This suggests that a CEO may consider inertia-inducing advice, advice that relates to the current strategy, to be less intimidating than stress-inducing advice that would challenge the current strategy.

At this stage, the board felt that the management could also benefit from mentoring, which we define as investing the resources and time of more experienced people to improve another person’s technical competence and/or understanding of objectives, circumstances and values, for example (adapted from Hendry 2002). The direct hierarchy between the CEO and the individual board members who represent the board that evaluates the CEO’s performance and which have the authority to dismiss him or her does not necessarily provide fertile ground for a mentoring-type relationship. In acknowledging these challenges and wanting to support CEO 3, the board took a decision to suggest an external coach for CEO 3 at the early stage of his tenure. While this can be interpreted from the evolutionary perspective on the CEO-board relationship which emphasises the importance of focusing on CEO leadership development in early phases of the CEO’s tenure (Shen 2003), the ongoing renewal process also played a role. As the benefits of the new direction are often not immediately observable in state IV (Huff et al. 1992), and despite the fact that the organisation yearned for convincing and visible promoters of the new strategy (Bibeault 1982), there was a high degree of pressure on the CEO. While the owners could effectively help an outside CEO to build commitment to a new strategy in the family firm’s strategic renewal (Sievinen et al. 2019), dealing with high pressure also may require external support.

Our data also provides evidence of non-family board members acting as mentors for a TMT member. This task was enacted at the individual level and activated when CEO 2 announced his resignation.

I agreed with [CEO 2] that outside the boardroom I act as a mentor for [the head of digital and research]. It worked quite well. But it is more one-to-one mentoring than board work. (A non-family board member]

We associate this with the need to encourage behaviour which may be necessary to develop the new skills needed to renew the firm (Barr et al. 1992). However, a non-family board member acknowledged the challenges related to the mentoring relationship. There were topics that he was familiar with but could not bring up in the discussions with a TMT member. In addition, he was sensitive about not wanting to interfere in the relationship between the TMT member and CEO 2, who was still engaged with the company although he was leaving. Similar to the board’s task of supporting the CEO in talent acquisition, we consider the board mentoring of TMT members to be a task that extends beyond the customary tasks of the board and which is activated by the context of the renewal (as new knowledge was needed) and the case-specific circumstance of the CEO’s resignation leading to a leadership gap.

5 Key findings

We believe that our findings have implications both for research and practice as we focus on how the board’s advisory role can evolve over time. We conceptualise the contextual nature of the non-family board members’ advisory role by depicting our findings within the framework of Huff et al. (1992). With the help of this framework we show that in our case the non-family board members’ advisory role can evolve as the organisation moves from state I, status quo, to state IV (of the framework) where the new strategic direction is adopted, and the status quo is again established (Fig. 2). We identify several advisory tasks that the non-family board members can carry out inside and outside the boardroom to create value through their knowledge and provide access to resources. Our case shows that these advisory tasks can evolve as the renewal proceeds, reflecting the stage of the renewal process and resource configuration of the firm.

Non-family board members’ advisory role in the strategic renewal of a family firm. Definitions of states I–IV based on Huff et al. (1992)

5.1 The collaborative nature of the advisory role

With our focus on the strategic renewal of a family firm, we build on the extant knowledge on the contextual nature of board roles (e.g. Carpenter and Westphal 2001; Huse 1998, 2005; Huse and Zattoni 2008; Krause et al. 2013; Lynall et al. 2003; Machold and Farquhar 2013; Minichilli and Hansen 2007; Pye and Pettigrew 2005) as well as on the case-based literature on family firm renewals (e.g. Bégin et al. 2010; Canterino et al. 2013; Cater and Schwab 2008; Salvato et al. 2010; Sievinen et al. 2019). While the literature on family firm renewals recognises the role of non-family CEOs in executing disruptive managerial actions (Canterino et al. 2013; Salvato et al. 2010), we show that non-family board members can play an important role in supporting the CEO as well as the owners in bringing about the change. We argue that this can be especially so when the firm is facing a need to rejuvenate its strategies because of radical changes in the environment, and there is pressure to complement firm-specific knowledge (Kets de Vries 1993) with complementary experience and skills (Bammens et al. 2011; Gabrielsson and Huse 2005; Jones et al. 2008). We propose that effective collaboration between the management, the owners and the non-family board members facilitates the non-family board members to enact their advisory role and helps to build the firm’s capacity to respond to external demands. While several scholars have highlighted the importance of the chair in terms of board performance (e.g. Huse 2007; Gabrielsson et al. 2007), we argue that in the context of a family firm’s strategic renewal, the chair can play a key role not only in ensuring that the board makes the decisions needed to push the firm from one renewal stage to the next, but also in enabling successful collaboration between the owners, the non-family board members and the TMT through effective board processes.

The owners can support the chair in this role. In our case company, the owners appointed non-family board members based on their competencies, had them outnumber the owners on the board, and appointed a non-family board member as a chair of the board. A ‘revolving door of expertise’ (Krause et al. 2013) was kept moving by the owners’ practice of limiting each non-family board members’ tenure to 4 years. Through these practices the owners signalled that they wanted a radical change and ensured that the firm had an objective and knowledgeable board that was not expected merely to ratify management decisions or bend to the owner’s will.

5.2 Content and influence of the advisory role and tasks

We suggest that the non-family board members’ advisory role in a strategic renewal can be both inertia- and stress-inducing, depending on whether the advice given is within the boundaries of the selected strategy or whether it aims to extend its boundaries. By doing this, we build on the findings of Sievinen et al. (2019), who studied the family firm owners’ role in the same context. Within the framework by Huff et al. (1992) we show that at state I of the framework the non-family board members can contribute to preserving inertia. In such a situation, the non-family board members’ advice remains within the boundaries of the current strategy and the advisory role can be expected to be primarily enacted inside the boardroom. However, our data suggests that once the owners trigger the change by making their goals known and appointing a new chair, the intensity of the non-family board members’ advisory role can grow. In the case studied here, the non-family board members took up stress-inducing advisory tasks that supported renewal as the firm entered state II of the framework. To facilitate the focus on changes in the environment (Barr et al. 1992), the non-family board members made efforts through the strategy process to refocus the management’s attention beyond the current strategy and ways of working. More professional processes were introduced to analyse the business and the industry and there was support for identifying and facilitating access to the necessary resources.

As many scholars (see e.g. Daily and Dalton 1995; Grinyer et al. 1988; Huff et al. 1992; Stopford and Baden-Fuller 1990) have observed, the introduction of renewal often requires a major reorientation that can call for changes in senior management. In line with this, resourcing played a key role in state II of the framework in our case. As the board, and the chair in particular, were not only active in CEO appointments and enacting their controlling role to hire (and fire) the CEO (see for example Johnson et al. 1996) but also in other TMT searches, we propose that the board can also take responsibility for supporting the wider group of key recruitments by actively evaluating the key competencies needed in the firm and supporting their acquisition. While all board members can provide support for resource acquisition, we propose that the chair of the board can be particularly well positioned to do this for two reasons. First, in the CEO appointments the chair plays a more critical role than the other board members, given his or her leadership function on the board. Second, in other TMT appointments the chair’s more direct channel to and frequent communications with the CEO enables the chair to advise the CEO effectively on the appointments.

We also observe that state II provided evidence of the role interrelation (Åberg et al. 2019) as the initial strategy review revealed the competence gap and hence prepared the board to enact its control role and consider changing the CEO. The two roles were interwoven, yet the actions that they triggered were executed sequentially. In this way carrying out advisory role related tasks can provide the board members with necessary information to also enact their control role. This, we argue, is important when a firm is attempting a strategic renewal that by its very essence is a high-risk endeavour and calls for diligent monitoring by the board.

The data suggests that the outside advisors’ stress-inducing advisory role reached its peak in state III of the framework while the firm was envisioning renewal alternatives. We interpret this to indicate that at this point the non-family board members played a key role in ensuring that strong mental models (Barr et al. 1992; Hall 1984) and satisficing behaviour (Cyert and March 1963; Simon 1947) of those who have a higher vested interest in the current strategy by being closer to business either operationally (management) or through their long tenure with the firm (family firm owners) did not lead to overlooking changes in the environment or prematurely narrowing down the alternatives evaluated. The data shows that each non-family board member effectively focused on their areas of expertise and expected the other non-family board members to do the same both inside and outside the boardroom. When the new direction was announced and the implementation started in state IV of the framework, the board members’ focus shifted from inducing stress to creating commitment for the new strategic direction. In this way, the inertia that had previously delayed the necessary change became an important tool in ensuring the successful execution of the new strategy.

5.3 Intensity of the advisory role