Abstract

This study investigates the relationship between international inventor teams and the technological variety of multinational enterprises. We frame this relationship conceptually by considering two possible attributes of diversity in international inventor teams: cultural differences and heterogeneous knowledge. We employ a dataset for 454 multinational enterprises with 71,126 subsidiaries across 185 countries that applied for 139,066 priority patents during the period 2007–2014. Fixed-effects panel estimations indicate that international inventor teams are positively associated with both related and unrelated technological variety at the level of the MNE. Such relationships display diminishing marginal returns, pointing to management and coordination costs reducing the benefits from international inventor teams. In addition, we find that MNEs with higher technological innovation capability deal with the additional complexity from managing and coordinating international inventor teams by consolidating technological variety.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Variety in the knowledge base is essential for innovation, since it determines the range of possible reconfigurations of knowledge (Arthur, 2007; Basalla, 1988; Nelson & Winter, 1982; Schumpeter, 1934). Weitzman (1998) concludes that ‘… the ultimate limits to growth may not lie so much in our abilities to generate new ideas, as in our abilities to process to fruition an ever-increasing abundance of potentially fruitful ideas’ (p. 359). Choices regarding variety play an important role in economics and innovation management, but often remain implicit (Van den Bergh, 2008).

Previous research dealt with strategies of multinational enterprises (MNEs) to maintain variety through diversification of technology drawing on evolutionary concepts such as path dependency and technological accumulation (see for example Cantwell, 1995; Piscitello, 2000; Cantwell & Piscitello, 2014) and the capability-based view of the firm (Granstrand, 1998; Teece et al., 1997). This line of thought suggests that firms diversify primarily into ‘related’ technological assets to retain patterns of corporate coherence (Breschi et al., 2003; Piscitello, 2004; Teece & Pisano, 1994; Teece et al., 1994). In terms of cognitive proximity, some degree of relatedness is required to recombine existing pieces of knowledge for incremental innovation by the firm. However, firms also diversify into unrelated technologies, thereby combining previously unconnected knowledge domains. While such recombination is more likely to fail, resulting innovations, when successful, are more likely to be of a radical nature (Fleming, 2001).

This study is one of the first to analyse determinants of the creation of technological variety within firms. While there is evidence that technological variety increases innovation in firms (Fleming, 2002; Garcia-Vega, 2006; Miller et al., 2007; Nesta & Saviotti, 2005; Quintana-Garcia & Benavides-Velasco, 2008) through access to a broader set of recombination paths, we find very little research on the determinants of and mechanisms for the creation of technological variety by firms (see Nerkar & Paruchuri, 2005; Cecere & Ozman, 2014).

Our analysis focuses on international inventor teams as a source of technological variety in MNEs. Recent studies emphasise that intra-firm knowledge transfer and integration ultimately depend upon the actions and interactions of individuals, such as inventors, sharing knowledge within the MNE (Castellani et al., 2022). Structural characteristics of individual inventors affect not only dissemination but also the recombination of knowledge throughout the organisation (Nerkar & Paruchuri, 2005; Paruchuri & Awate, 2017).

This study moves beyond individual inventor characteristics by inquiring whether and, if so, how international inventor teams create technological variety in MNEs. We posit that international inventor teams create novelty through the recombination of knowledge. Drawing from organisation research, we argue that novelty emerges from cultural differences and heterogeneous knowledge embedded in international inventor teams. Cultural differences create value by drawing from diverse perspectives (DiStefano & Maznevski, 2000; Lane et al., 2009), deemed particularly beneficial for conceptual and creative tasks (Hoever et al., 2012; Marino & Quatraro, 2022; McLeod et al., 1996). The second attribute, heterogeneous knowledge, reflects differences in know-how and expertise. We reason that this attribute is more prevalent in international inventor teams compared to domestic ones, since differences in technological specialisations are larger across than within countries (Archibugi & Pianta, 1992; Cantwell & Vertova, 2004; Picci & Savorelli, 2013).

However, diversity is a ‘double-edged sword’ (Milliken & Martins, 1996, p. 403). Excessive levels of diversity may also cause disparate mental models and interpersonal tensions, which might hinder the team’s ability to develop creative outcomes (Bassett-Jones, 2005; Khedhaouria & Jamal, 2015). Cultural differences within teams may inhibit their ability to develop a task strategy, resolve conflicts, and build cohesion (Anderson, 1983; Kirchmeyer & Cohen, 1992; Kirkman & Shapiro, 2005; Watson et al., 1993, 2002). Knowledge heterogeneity can be counterproductive due to a lack of coordination among otherwise homogenous groups (Cegarra-Navarroa et al., 2021; Zhang & Li, 2016). Thus, we propose a non-linear relationship: International inventor teams increase the possibility for knowledge recombination within and across technological domains, which, in turn, would be a source for related and unrelated technological variety at the level of the MNE. However, we expect that coordination and management costs associated with the integration of knowledge from inventor teams spreading over too many countries reduce the benefits from international inventor team diversity upon technological variety. We suggest that MNEs’ technological innovation capability could mitigate potentially negative effects from diversity in international inventor teams related to cultural differences and heterogeneous knowledge.

We tested these conjectures empirically, using a patent-firm-level dataset for a sample of MNEs headquartered in EU15Footnote 1 countries. We analysed data for 454 MNEs with 71,126 subsidiaries across 185 countries with 139,066 priority patent applications during the observation period 2007–2014. Fixed-effects panel estimations on variety measures computed on MNE patent portfolios indicate that international inventor teams are positively associated with both related and unrelated technological variety. However, such relationships display diminishing marginal returns, pointing to management and coordination costs reducing the benefits of cultural diversity and heterogeneous knowledge in international inventor teams. In addition, we find that multinational enterprises with higher technological innovation capability deal with the additional complexity of managing and coordinating international inventor teams by consolidating technological variety in the firm.

Section 2 provides a conceptual framework and develops three hypotheses on the relation between international inventor teams and technological variety in MNEs. Section 3 introduces data and descriptive statistics, as well as the measures and methods. In Sect. 4, we present the findings from the analysis and Sect. 5 concludes with a discussion.

2 Conceptual framework

2.1 Related and unrelated technological variety

Greater diversity in knowledge inputs means a greater potential for creative combinations (Weitzman, 1998; Van den Bergh, 2008). To produce new knowledge, firms use external sources in conjunction with internal R&D, which has been framed as an open innovation model (Almirall & Casadesus-Masanell, 2010; Benkler, 2006; Chesbrough, 2003; Dahlander & Gann, 2010; von Hippel, 2001, 2005). Searching broadly enhances firms’ knowledge through variation and novelty of the knowledge employed by the external source (Laursen & Salter, 2006; Teodoridis et al., 2019). Technological recombination requires language and interface commonality to be able to enter and be diffused within an organization (Forman & van Zeebroeck, 2019; Savino et al., 2017; Trantopoulos et al., 2017; Vaccaro et al., 2009). Today, there is a broad consensus that the probability of a firm, region, or country launching new and specific activities is a function of the number of the related activities they are specialised in (see for example, Frenken et al., 2007; Boschma & Iammarino, 2009; Neffke et al., 2011; Boschma et al., 2015; Hidalgo et al., 2018).

From a technological point of view, relatedness refers to the fact that although no two technologies are identical, they often share commonalities (Nooteboom, 2000). Proximity, commonality, and complementarity of knowledge are factors that might help to explain why firms diversify predominantly into related technologies (Breschi et al., 2003). Knowledge proximity refers to firms’ learning processes via unintended spillovers (Griliches, 1979; Henderson & Cockburn, 1996), as well as intended learning by focusing on technological domains that present similarities in problem-solving and knowledge bases (Dosi, 1997; Nelson & Winter, 1982). Knowledge commonality implies that the same type of knowledge is used in various technologies, whereas knowledge complementarity arises from the need to use technologies jointly (Milgrom & Roberts, 1990; Pavitt, 1998; Scott, 1993). Decision-makers may have limited cognitive capabilities to identify potentially fruitful combinations of pieces of knowledge unrelated to their existing knowledge bases and/or to each other (Nightingale, 1998; Nooteboom, 2000). While recombination of previously unconnected knowledge domains is more likely to fail, resulting innovations, when successful, are often of a radical nature as recombination across unrelated technologies can lead to completely new operational principles, functionalities and applications (Fleming, 2001).

Extant literature offers insights into the extent to which related and unrelated technological variety increases firms’ innovation through the recombination of knowledge (Aarstad et al., 2016; Fleming, 2002; Fornahl et al., 2011; Garcia-Vega, 2006; Miller et al., 2007; Nesta & Saviotti, 2005; Quintana-Garcia & Benavides-Velasco, 2008; Solheim et al., 2020). However, research on the determinants of and mechanisms for changes in related and unrelated technological variety is much more limited (Juhacz et al., 2020; Menzel, 2015).

2.2 Capabilities-based view on technological diversification in the MNE

The capabilities-based approach distinguishes the theory of the MNE from a mere special case of the theory of the firm, based on the specificities of the dynamic and continuous cross-border interaction of MNEs (Cantwell, 2014). To innovate, MNEs build synergistic or complementary portfolios of capabilities drawn from different locational contexts, which involve multidirectional knowledge transfer (Cantwell, 2009). The capabilities-based approach explaines the process of corporate technological diversification as an outcome of more closely integrated MNE networks and their internationalisation (Cantwell & Piscitello, 2000, 2014; Castellani & Zanfei, 2006; Rahko, 2016).

Over the decades, we gained important insights into MNE strategies to maintain variety through the diversification of technology. Firstly, technological competencies are multi-field as they include technological fields outside firms’ distinctive cores (Patel & Pavitt, 1997). Technological diversification is usually greater than product diversification and often anticipates product and market diversification (Pavitt, 1998). Operating within environments of converging or increasingly interrelated technologies, large firms develop and maintain a broad technological base, thereby becoming multi-technology corporations (Granstrand, 1998; Granstrand & Sjölander, 1992; Granstrand et al., 1997; Patel & Pavitt, 1997). Secondly, firms’ technological diversification changes only slowly because of the inertia of specialisation and incremental changes in knowledge production (Cantwell & Andersen, 1996; Fai & von Tunzelmann, 2001), as well as sunk costs of R&D (Narula, 2014). Thirdly, while specialisation results in economies of scale associated with the learning process and knowledge transfer between the core technologies of the firm (Breschi et al., 2003; Garcia-Vega, 2006), diversification generates economies of scale and scope due to cross-fertilisation between core and peripheral technologies (e.g., Granstrand, 1998; Granstrand & Sjölander, 1992; Granstrand et al., 1997; Piscitello, 2000; Suzuki & Kodama, 2004).

2.3 Role of inventors for variety in MNEs

Knowledge transfer and integration are highly dependent on the actions and interactions of individuals, such as inventors, sharing knowledge within the MNE (Castellani et al., 2022). When it comes to the circulation of technological knowledge, inventors are the key characters to observe (Fleming, 2001; Miguelez & Morrison, 2023), since they carry out the actual knowledge-creation processes (Allen & Cohen, 1969). Yet not all inventors are equally effective knowledge creators. For example, cross-border mobility of inventors within an MNE enables the temporary co-location of mobile inventors and, in turn, wider dissemination of their knowledge within the organisation (Castellani et al., 2022). Organisation research also hints at a relation between individual inventors’ structural characteristics, especially the centrality of inventors and the spanning of structural holes, and the processes of recombination of knowledge (Nerkar & Paruchuri, 2005). Inventors who span many structural holes are aware of and have access to organizational knowledge that is distributed in diverse pockets of the organization (Paruchuri & Awate, 2017). When such inventors generate innovations by recombining organisational knowledge, they gain a wider reach in the intra-organizational inventor network. Similarly, there is evidence of a positive relationship between the strength of intra-firm inventors’ ties and technological variety (Cecere & Ozman, 2014). However, if inventors are excessively embedded in networks, they become more like each other, which reduces opportunities for novel combinations of knowledge (ibid).

2.4 Hypothesis development

Moving beyond individual inventor characteristics, this paper looks at international inventor teams as a possible source for technological variety in MNEs. Previous research argued that multinational breadth, in terms of the dispersion of subsidiaries across countries, correlates positively with investments in R&D (Castellani et al., 2017) and also diversifies an MNE’s knowledge base, which increases the likelihood of discovering new and valuable combinations of ideas (Kafouros et al., 2012). MNEs undertake international R&D via strategic alliances (Almeida et al., 2002), acquisition of external R&D facilities (Awate et al., 2015), knowledge acquisition from local suppliers (Li et al., 2010), collaboration with foreign universities (Belderbos et al., 2020, 2021; Ivarsson et al., 2017), or ‘listening posts’ (Gassmann & von Zedtwitz, 1999; Monteiro & Birkinshaw, 2017). All these modes can involve a team of international inventors that appropriates the returns from R&D in the form of a cross-country patent application with inventors residing in different countries (Alkemade et al., 2015; Frost & Zhou, 2005; Laurens et al., 2015). Thus, ‘international inventor teams’ reflect not only the outcome of joint R&D (collaboration in a strict sense) but also the results of R&D contracts (acquisition) and R&D advice (services) (Bergek & Bruzelius, 2010). We already know that MNEs use international teams to coordinate dispersed but interdependent R&D activities (Ambos & Schlegelmilch, 2004). Furthermore, the value of innovative work by international inventor teams can exceed the returns from purely domestic inventor teams of the same MNE (Kerr & Kerr, 2018). This study investigates whether and, if so, how diversity associated with international inventor teams shapes technological variety in MNEs.

2.4.1 Diversity as a driver of variety within international inventor teams

Team diversity favours the search for innovative solutions by introducing more heterogeneous sources of knowledge (March, 1991). Cognitive diversity is often associated with the generation of ideas and creativity (Farr et al., 2003). Diversity as a team characteristic denotes the extent to which members differ with regard to a given attribute (Joshi & Roh, 2009; van Knippenberg & Schippers, 2007). This view focuses upon underlying differences in perspectives on a task as the more proximal indicator of a team’s increased cognitive resources (Harrison & Klein, 2007; van Knippenberg et al., 2004). Regarding international inventor teams, our argument focuses on two possible attributes: cultural differences and heterogeneous knowledge.

International inventor teams with members representing two or more cultures leverage creativity for product and service innovation more effectively than single-culture teams (e.g. Bouncken et al., 2015; DiStefano & Maznevski, 2000; Hoever et al., 2012; Jang, 2017; Lane et al., 2009). Diversity in cultural background is particularly salient (Stahl et al., 2010) because it affects the team members' beliefs, attitudes, and mindsets (van Knippenberg et al., 2013). Although ‘domestic’ teams can also be multi-cultural, international inventor teams are so by definition.

The second attribute, heterogeneous knowledge, reflects differences in terms of technological knowledge and expertise rather than differences in perspectives. We also find heterogeneous knowledge in exclusively domestic inventor teams. However, we expect this attribute to be more extensive in international inventor teams, since differences in technological specialisations are larger across than within countries (Archibugi & Pianta, 1992; Cantwell & Vertova, 2004; Picci & Savorelli, 2013). This provides a higher potential for knowledge complementarities in international inventor teams compared to purely domestic ones. Team members can acquire knowledge from one another to make further abstractions and analogies between problems and, thus, use experience-based skills to solve new problems (Zhuge et al., 1997).

Given that MNEs locate foreign R&D predominantly in host countries with a technological specialisation, to exploit an already existing technological advantage at home (Laurens et al., 2015; Le Bas & Sierra, 2002), international inventor teams in such R&D projects are likely to focus on technological domains that present high similarities in problem-solving and knowledge bases. In this case, collaboration within international inventor teams facilitates the effective exchange of proximate knowledge to work on incremental innovations. This collaboration often requires face-to-face communication and personal feedback to overcome the ambiguities of tacit knowledge (Teece, 1981). Knowledge proximity lowers the cost of combining knowledge and enables systematic and creative work, which is likely to foster related technological variety within the MNE.

Since competence-exploitation and competence-creation strategies are often employed simultaneously, MNEs also use foreign R&D to explore and search beyond existing technological specialisations at home (Cantwell & Mudambi, 2005, 2011; De Beule & Van Beveren, 2019). In this case, we would expect the diversity of knowledge within international inventor teams to be relevant, since it offers the opportunity to develop a broader set of recombination paths. These are essential for more radical innovations (Fleming, 2002), which are rare but usually come from a recombination of already existing knowledge (Hargadon, 2003), often based on the combination of mature and emerging technologies (Schoenmakers & Duysters, 2010). International inventor teams could be a way to access emerging technologies developing abroad for integration with existing technologies of the MNE. Thus, international teams could be a mechanism to attain greater unrelated technological variety within an MNE. Against this background, we hypothesise:

H1

Other things equal, the presence of international inventor teams is associated with greater technological variety of the MNE.

2.4.2 Coordination and management costs of international inventor teams

Diversity favours the opportunity for creativity, while at the same time increasing the likelihood that some team members will feel dissatisfied and detached from the group (Bassett-Jones, 2005; Milliken & Martins, 1996). Organisation research confirms that an excessive level of diversity may cause disparate mental models and interpersonal tensions, which hinder a team's ability to develop creative outcomes (Khedhaouria & Jamal, 2015). Cultural differences within a team may inhibit the team’s ability to develop a task strategy, resolve conflicts, build cohesion, and foster effective interaction among team members (Anderson, 1983; DiStefano & Maznevski, 2000; Kirchmeyer & Cohen, 1992; Kirkman & Shapiro, 2005; Watson et al., 1993, 2002). Negative social interaction and group incohesiveness are also likely to reduce the benefits from heterogeneous knowledge in international inventor teams in the effective creation of technological variety (Huang, 2009; Nissen et al., 2014). Maintaining regular international knowledge exchange, in turn, is costly, and spreading MNE networks across a larger number of countries increases organisational complexity (Castellani et al., 2017).

Knowledge heterogeneity of international inventor teams itself could be counterproductive if coordination is lacking among otherwise homogenous groups (Cegarra-Navarroa et al., 2021; Zhang & Li, 2016). MNE research team geographic diversity has a curvilinear relationship with the team’s innovation performance (Seo et al., 2020), which implies that some degree of homogeneity in collaborative research teams is beneficial (Coad et al., 2017). We would, therefore, expect that coordination and management costs associated with integrating knowledge from multinational inventor teams reduces the benefits from diversity upon technological variety at the level of the MNE. Thus, we hypothesise:

H2

Other things equal, there are diminishing marginal returns from the breadth of knowledge sourcing via international inventor teams upon an MNE’s technological variety.

2.4.3 Technological innovation capability as a moderator

Arguably, some MNEs are better than others at managing international knowledge flows to create technological variety. Many studies in innovation performance focus on R&D investments (e.g., Ahuja & Katila, 2001; Castellani et al., 2017; Mairesse & Mohnen, 2005). Others emphasize non-R&D inputs. For example, Bell (2009) refers more broadly to firms’ ‘capability to create new configurations of product and process technology and to implement changes and improvements to technologies already in use’ (p. 11). Such innovation capability consists of various assets related to physical capital, knowledge capital, human capital, and organisational capital (ibid.). The latter has been recognised as an important element in firms’ searches for innovative inputs from external sources (e.g., Katila & Ahuja, 2002; Laursen & Salter, 2006).

We expect that MNEs with higher innovation capability are better positioned to identify and integrate knowledge flows from international inventor teams, so that stronger positive effects upon technological variety can materialise. This, for example, could be facilitated by access to superior R&D equipment, staff experienced in international R&D collaborations, or a larger stock of previous knowledge within the MNE. Such technological innovation capability would then mitigate the potentially negative effects from diversity in international inventor teams related to cultural differences and heterogeneous knowledge. Therefore, we hypothesise:

H3

Other things equal, technological innovation capability positively moderates the relation between the presence of international inventor teams and an MNE’s technological variety.

3 Data, measurement and method

3.1 Data

Extant research used firm-level databases with information on patent applicants to measure R&D internationalisation and/or to approximate the incidence of foreign R&D (Alkemade et al., 2015; Dernis et al., 2015; Laurens et al., 2015). We extend this approach by accounting for affiliates’ entries into and exits from MNEs groups over time to relax the restrictive assumption of static MNE ownership structures (see for example Dernis et al., 2015 for a discussion of this limitation). This increases precision in the allocation of patents to the actual patent owners over time. We employ a dataset for 454 MNEs headquartered in the EU15 for the observation period 2007–2014.

Our data source is the BvD ORBIS database. We started by extracting data on active enterprises headquartered in an EU15 country, with at least 100 employees, being active and not dissolved, classified as an industrial company, having manufacturing as a primary activity (NACE Rev. 2 Section code C) and having at least one foreign subsidiary in 2014. Based on individual ownership links, we derived an historical ownership hierarchy for each MNE for each year of the observation period.Footnote 2 We excluded individuals or financial entities as global ultimate owners (GUOs) and instead selected the next industrial entity in the hierarchy as GUO. Then, we extracted all patent documents available in the patent section of ORBIS for all MNEs and their subsidiaries. The identified patent documents were matched with PATSTAT (Version 2019a) through the application number and the corresponding identification number of the entity.Footnote 3 This enabled us to identify priority patent applications, their associated International Patent Classification (IPC) codes, and the countries of residence of their inventors. Using priority applicationsFootnote 4 reduces country bias and enables a more accurate representation of inventor locations (De Rassenfosse et al., 2013). In line with existing research (see for example Picci & Savorelli, 2013; Laurens et al., 2015; Alkemade et al., 2015), we inferred the inventors’ location from the addresses of residence of the inventors, as indicated in the priority patent application.

This process yielded our final sample, which includes 454 MNEs with 71,126 subsidiaries across 185 countries and 139,066 priority patent applications. The average MNE was observed in the sample for 4.5 years and accounted for about 68 priority applications per year (see Appendix Table 3). Nearly all patent applications were made by inventor teams (only 0.2% report a single inventor). Inventors whose listed address is not in their MNE’s headquarters country constitute a relevant phenomenon: about 1 of every 5 inventors are foreign (i.e. 19.2%, 12.1% residing in the EU15 and 7.1% outside it) and about 1 of every 4 (i.e. 26.1%) patent teams are international, i.e. include a foreign inventor (see Appendix Tables 4, 5). Aggregated across the parent and subsidiaries, we found that 78% of MNE-year observations had patent applications with more than one IPC code and about 48% had inventors from more than one country (see Appendix Table 6).

3.2 Measurements and methods

Earlier studies also used patents as proxies for codified technological knowledge and used patent classifications to measure various aspects of technological relatedness and coherence at the level of the firm (e.g., Breschi et al., 2003; Colombelli et al., 2014; Nesta & Saviotti, 2005). Technological proximity can be estimated in several ways (Juhacz et al., 2020). We applied a hierarchical technological classification scheme as an ex-ante imposed structure that defines relatedness and unrelatedness. We computed entropy measures using the hierarchical structure of 610 IPC subclasses that fall exclusively under one of the IPC’s eight sections.Footnote 5 Formally, in the equations that follow, k denotes IPC subclasses, j IPC sections and \({S}_{j}\) the set of IPC subclasses belonging to section j. We first computed the IPC subclass shares \({p}_{i,t,k}\) as the sum of the full count of patent applications of MNE group i falling in IPC subclass k in year t.Footnote 6 Then, we computed the IPC section share \({P}_{i, t,j}\) by summing the IPC subclass shares \({p}_{i,t,k}\) of MNE group i falling in IPC section j in year t. Unrelated technological variety \({UV}_{i,t}\) of MNE i in year t is then given by:

and related technological variety \({RV}_{i,t}\) by:

Thus, to account for cognitive proximity between technologies in an MNE’s patent portfolio, unrelated variety measures the extent of technological diversity across the eight broad IPC sections. MNE groups that patent in more sections have a higher index value for unrelated technological variety. Related variety, in turn, measures the extent of technological diversity within each IPC section across IPC subclasses and is larger for MNEs whose patents are distributed across more IPC subclasses within a single IPC section.

To test our first hypothesis (H1), we regressed our technological variety measures on variables based on the location of the corresponding inventors and other MNE characteristics. We applied a fixed-effect panel regression specified by:

\({TV}_{i,t}\) indicates the respective technological variety measure for MNE group i (i = 1, …, 454) at year t (t = 2008, …, 2014); \({\beta }_{1}\) is the parameter of \({MNInv}_{i, t}\), a dummy that indicates whether one or more patents applied by MNE i in year t includes a team of inventors with different countries of residenceFootnote 7; \({\beta }_{2}\) is the parameter of \({NCInv}_{i,t}\), which is the number of the countries of residence of the inventors in the pool of patent applications made by MNE i in year t (‘breadth of international knowledge sourcing’); \({\delta }^{\mathrm{^{\prime}}}\) is a vector of parameters associated to a vector of time-varying MNE-specific controls \({Z}_{i, t-1}\); \({d}_{t}\) denotes year fixed effects; \({u}_{i}\) is an MNE-specific time-invariant fixed effect; and \({\varepsilon }_{r,t}\) is the error term.Footnote 8 The vector \({Z}_{i, t-1}\) includes the number of patent applications (\({{\text{NPat}}}_{i, t-1}\), in log) made by MNE i, the number of subsidiaries (in log), the share of foreign subsidiaries to take into account MNE’s internationalisation of production, the number of employees and the value of intangible assets (both in logs) as well as measures for MNE related and unrelated variety across industries. All control variables are lagged by one year in order to minimise the impact of simultaneity between MNE’s attributes and technological variety.

Appendix Table 8 shows descriptive statistics of the variables entering the regression analysis.Footnote 9 MNEs in the sample are large (about 20,000 employees on average) and highly innovative (with intangible assets and yearly R&D expenditures of about 1,750 and 289 million Euro, respectively, on average). They have a broad geographical presence, with 105 foreign subsidiaries spanning 23.6 countries, on average. They file an average of about 69 patents every year, about half of which involve international inventors spanning five countries of residence.

To test for decreasing marginal returns from the breadth of knowledge sourcing via international inventor teams on technological variety (H2), Eq. (4) introduces an additive quadratic term of the number of countries of residence of inventors (\({NCInv}_{i,t}\)):

Finally, we tested for the role of innovation capability in moderating the effects of international knowledge sourcing on technological variety (H3) by augmenting Eq. (5) with an interaction term: the product of the number of countries of residence of inventors (\({NCInv}_{it}\)) and the number of patent applicationsFootnote 10\(({{\text{NPat}}}_{i, t-1}\)):

Regression parameters’ of models (3)–(5) may suffer from endogeneity issues that our fixed effects panel estimators can not address, and should therefore be interpreted as correlates of technological variety. While sources of potential endogeneity with an inventor team’s composition and diversity look hard to identify, the relationship between technological variety and technological capacity at the core of H3 seems trickier. In fact, time-varying omitted shocks that are specific to certain countries, industries or technological fields, induced for instance by national policies encouraging innovation in specific domains, the upsurge of technological breakthroughs, and market dynamics entailing changes in the demand for products, might influence both the number of patents and the variation of MNEs patenting across fields. In order to attenuate biases coming from such potential confounders, we also considered models’ specifications that include a time-varying measure of the technological specializationFootnote 11 of the MNE’s headquarters country, as well as year-specific controls for MNE industry and headquarters country. The inclusion of these additional controls left the parameters of interest unaltered, so we opted to exclude them from our baseline specification for the sake of parsimony.

4 Findings

Table 1 shows the estimation results of fixed effects regression models for related and unrelated variety. It reports the results of four specifications for each variety measure. All models include a dummy for the presence of international inventors and the number of inventor countries of residence,Footnote 12 which we expected to be positively associated with the variety measures. Models (2) and (6) introduce a quadratic term of the number of inventor countries of residence to test potential diminishing marginal returns. Models (3) and (7) introduce an interaction term between the number of inventor countries and the number of patent applications.

Models (4) and (8) include all variables, i.e. the quadratic specification of the number of inventor countries and its interaction with the number of patents.

In line with H1, the dummy indicating the presence of international inventor teams is positive and significant across all specifications. Thus, the presence of international inventor teams is positively associated with both related and unrelated technological variety. The same applies to the number of inventor countries of residence. However, the quadratic term introduced in models (2), (4), (6) and (8) is negative, though not significantly different from zero when the interaction between the number of inventors’ countries and the number of patents is also introduced in the model (models (4) and (8)). The result indicates the presence of positive correlations between variety measures and the number of inventor countries (breadth of knowledge sourcing). However, these positive correlations fall slightly as the number of inventor countries increases.

Models (3) and (4), which include the interaction term between the number of inventor countries and the number of patents, show negative and significant estimates for related variety. The sign is negative also for unrelated variety, but the estimate becomes statistically non-significant in model (8), which also includes the quadratic term of the number of inventors’ countries.

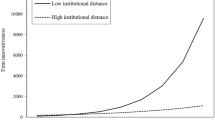

In order to better assess the relationships between international inventor teams and technological variety in the models that include the quadratic and interaction terms, Fig. 1 plots the average marginal effects (AMEs) of the number of inventor countries on technological variety. Figure 1 indicates that the AMEs fall for both related and unrelated variety as the number of inventor countries itself and the number of patents increase. Statistically significant positive effects are present for low numbers of inventor countries and patent applications, but are not statistically different from zero at high values. Figure 1 also indicates that point estimates become increasingly imprecise as the number of inventor countries increases, with the confidence interval getting larger as the number of data points decreases. Yet, this feature of the specifications does not affect the qualitative pattern of the focal relationships. In line with H2, the results provide evidence for decreasing marginal returns as the breadth of international inventor teams across countries becomes increasingly broad.

Average marginal effects of the number of inventor countries on technological variety. Notes: Average marginal effects’ (AMEs) are derived using the sample mean of all explanatory variables other than the number of inventors’ countries and the number of patents. The vertical lines indicate the means of the number of inventors’ countries and the number of patents. The graphs for related variety use model (4)’s estimates (Table 1), while the graphs for unrelated variety use model (8)’s estimates. The grey area indicates 95% confidence intervals

As for the moderating role of innovation capability, we find, in contrast with H3’s expectation, that higher innovation capability is associated with a lower correlation between multinational inventor teams and MNE’s technological variety. As for the other explanatory variables, the direct effect of innovation capability is positive and significant for related variety, and not statistically different from zero at standard confidence levels for unrelated variety. Thus, diversification into related technologies increases with higher innovation capability; diversification into unrelated technologies does not. Most of the coefficients of other explanatory variables, shown in Appendix Table 9, are not statistically significant.Footnote 13

The results of the analysis are robust to a series of robustness checks shown in Table 2, which reports estimates of baseline (models (4) and (8) of Table 1) and alternative fixed effects models.Footnote 14 First, we use fractional rather than full counting for the patents with multiple applicants in the construction of variety measures.Footnote 15 Estimates of models (2) and (8) in Table 2 are nearly unchanged with respect to the relevant baseline.

Second, we replicate the analysis using only MNEs-years observations with more than 5 patents.Footnote 16 Variety measures show quite large variation, also for MNEs with one or few patents because most patents (78%, see Appendix Table 6) are associated to multiple IPC classes. This enables us to test that results are not driven by MNEs with few patents. Also, in this case, estimates of models (3) and (9) in Table 2 are very similar to the relevant baseline as the estimated coefficients display the same sign and significance. With respect to the baseline, we notice a larger positive association between innovation capabilities and related variety.

Third, we estimated a model that also includes R&D expenditure (in log and lagged by one year). R&D expenditures are an important input for an MNE’s innovative activities and could influence variety measures. While we do not use R&D expenditures in the baseline models due to a high number of missing values in the sample (25%), models (4) and (10) in Table 2 indicate that, once innovation capability and international knowledge sourcing are controlled for, R&D expenditures are not associated with an MNE’s technological variety. In brief, the results of the baseline models do not change when R&D expenditures are included.

In addition, we tested the robustness of our baseline models by excluding countries that could bias our findings. Models (5) and (11) in Table 2 exclude Germany, which is the most-represented country in the sample, accounting for about 31% of MNEs (see Appendix Table 3). While the the dummy variable indicating the presence of international inventor teams becomes statistically non-significant due to an increase of the associated standard error leading the p-value to 0.103, at the edge of statistical significance at the 90% level in the case of related variety, the findings of the baseline analysis are substantially confirmed for both related and unrelated variety. We also report estimates of models excluding MNEs from the UK, which account for about 17% of MNEs in the sample but show comparatively low patent intensity (on average, 11 patents per year versus 68 by the average MNE).Footnote 17 All results are very similar to those of baseline models (see models (6) and (12) in Table 2).

Results are also confirmed by further robustness checks that we do not report for the sake of brevity.Footnote 18 In order to test how the financial crisis may have influenced our estimates, we augment the baseline specification, which simply controls for common year effects, with country- and industry-specific business-cycle variables. In particular, results do not change when we include unemployment rates in MNE headquarter-countries and industry-specific (at the NACE Rev. 2 Section level) GDP levels and growth rates. Models’ results are also robust to the inclusion of a time-varying measure of the technological specialization of the MNE headquarters country (computed over alternative time windows to smooth potential volatility in patenting activities across technological fields, especially for smaller countries), as well as of year-specific dummies for the industry and MNE headquarter-countries. Finally, in order to test the extent to which our results change when using lag structures that allow for more time for a patent to be generated, we lagged control variables by two and three years, re-estimated all models, and find no substantial difference with the findings obtained in the baseline using a one-year lag.

5 Discussion

5.1 Main findings and contributions

This research builds upon the capability-based view that international integration of MNE networks facilitates the diversification of corporate technology (Cantwell, 2009; Cantwell & Piscitello, 2000, 2014; Castellani & Zanfei, 2006; Rahko, 2016). We advance the state-of-the-art in two ways. Firstly, this is one of the first studies to focus on the determinants rather than on the consequences of variety by using the related and unrelated technological variety of MNEs as dependent variables. Secondly, we focus on international inventor teams as creators of technological variety in firms. Conceptually, we frame this relationship by considering two possible attributes of diversity in international inventor teams: cultural difference and heterogeneous knowledge.

Our econometric results indicate that international inventor teams might enhance both related and unrelated technological variety of MNEs. This suggests that, in principle, MNEs can overcome the need for spatial proximity in the creation of related variety, which has been postulated in the literature on evolutionary economic geography (Boschma & Iammarino, 2009; Frenken et al., 2007). Our results also suggest that international inventor teams enhance an MNE’s ability to create unrelated variety, which might reflect their quest to combine previously unconnected knowledge domains, which in turn are key to rare radical or breakthrough innovations (Castaldi et al., 2015; Fleming, 2001; Solheim et al., 2020). This finding challenges the conclusion from previous research that ‘…firms go abroad for augmenting or exploiting their home base, not for acquiring new bits of knowledge outside the technologies they master at home’ (Laurens et al., 2015, p. 773).

In line with H1, our econometric results document that the breadth of MNEs inventor countries increases technological variety. However, in line with H2, increases in variety flatten as the number of inventor countries increases. These diminishing marginal returns could be explained by cognitive limits to knowledge identification (Noteboom, 2000), disparity between originating ideas (Olsson & Frey, 2002), inhibited social interaction and group cohesion due to cultural differences within international teams (DiStefano & Maznevski, 2000; Kirkman & Shapiro, 2005; Lane et al., 2009) – all resulting in increasing costs for coordination and management of knowledge transfer and integration from international R&D (Castellani et al., 2017; Narula, 2014). Our finding of diminishing marginal returns supports the view that team diversity might both provide opportunities for creativity and hinder a team's ability to develop creative outcomes (Bassett-Jones, 2005; Khedhaouria & Jamal, 2015; Milliken & Martins, 1996).

We also find that an MNE’s technological innovation capability, approximated by the number of previous patents, is an important direct predictor of related variety. Unrelated variety, by contrast, shows similar values for MNEs with patent portfolios of varying sizes. Thus, diversification into related technologies gains in importance as an MNE’s innovation capability increases. This finding supports the view that technological diversification is characterised by expansion into related assets to establish patterns of corporate coherence (Breschi et al., 2003; Piscitello, 2004; Teece & Pisano, 1994; Teece et al., 1994). Our results also indicate that international knowledge sourcing via multinational inventor teams for MNEs with lower innovation capability might complement strategies that aim to create unrelated rather than related technological variety. This can be associated with the argument that it is possible for MNEs to ‘jump’ stages of technological evolution via international knowledge sourcing (see, for example, Enderwick & Buckley, 2021).

Finally, in contrast to H3, our results show that the positive contribution of international inventor teams upon technological variety declines as an MNE’s innovation capability increases. This finding could suggest that MNEs with higher technological innovation capability deal with the higher complexity of managing and coordinating heterogeneous inventors from different countries by reducing technological diversity more than MNEs with a lower technological innovation capability. In other words, it is likely that MNEs with higher technological innovation capability engage in international knowledge sourcing in ways that reflect consolidation towards their technological core, rather than diversification into related or unrelated variety—given that they already operate at a higher level of variety than MNEs with lower technological innovation capability.

5.2 Limitations

This study exploits a firm-patent level dataset that is not exempt from limitations. First, even though control variables are introduced in the empirical analysis with a one-year lag to minimise the impact of the potential simultaneity between MNEs' attributes and technological variety, the results should be interpreted as descriptive of the variety of an MNE’s patent portfolio, without any presumption of causality.

Second, the observation period is restricted to eight years.Footnote 19 This is relatively short in comparison to studies of long-term patterns of firm-level technological change (e.g., Cantwell & Vertova, 2004), though it compares well to most studies on technological variety at the firm level (e.g., Aarstad et al., 2016; Capozza et al., 2020; Solheim et al., 2020). In addition, our observation period includes the global financial crisis, which may distort the relationships of interest due to firms having scaled back their R&D (OECD, 2009). Yet, due to sunk and opportunity costs, firms may have reduced R&D less than other expenditures for other functions such as sales, marketing and post-sales activities during the crisis (Rafferty, 2003). Moreover, during the crisis, the existence of an internal R&D department, as well as strategies aimed at exploring new markets and new product developments, proved to be important determinants of the persistence of innovation (Archibugi et al., 2013).

Finally, our approach exploits patents to measure firms’ technological knowledge, which have limitations well known and extensively discussed in previous studies (e.g. Griliches, 1990; Hall et al., 2014; Hussinger, 2006; Pavitt, 1988). However, previous studies highlighted the usefulness of patents as measures of the discovery of new knowledge. In particular, a firm’s patent portfolio is a reliable measure of technological knowledge and innovation usable for production, especially as compared to innovation measures based on surveys (Acs et al., 2002).

5.3 Future research

In this study, we do not differentiate intra-organisational vs. inter-organisational MNE networks in the production of technological variety. MNEs might rely primarily on internal networks between international inventors to create related variety but might shift to external networks to diversify towards unrelated variety. This aspect might also be important, since organisational research has argued that institutional diversity hampers effective knowledge sharing and negatively affects innovation outcomes of international R&D teams (Brunetta et al., 2020). Differentiating between MNE’s inventor teams involving internal and external networks was beyond the scope of this study but could be accomplished empirically by analysing patent citations (Frost, 2001). Future research could also investigate whether the mode of entry helps to explain the diminishing marginal returns from international inventor teams on technological variety, since the cost of coordination and organisational complexity could be higher in case of acquired MNE units vs. greenfield projects.

Finally, future research could question how the presence of international inventor teams moderates the relationship between technological variety and the innovative performance of MNEs. This would integrate previous research in evolutionary economic geography that considers the effect of unrelated and related variety on innovation performance depending on firm location (see for example, Solheim et al., 2020) with research that looks at the effect of foreign knowledge networks on MNEs’ radical vs. incremental innovation (see for example, Berry, 2018). While we focused on the ‘international’ dimension of knowledge sourcing, future research could employ a research design that allows for within-country variation in the international search for technological variety.

Notes

Member states of the European Union (EU) as of 2014: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, and United Kingdom.

We calculated the combined ownership from any entity connected to another, either directly or through a path of subsidiaries, with ownership exceeding 25%. For example, an MNE directly owns an 80% equity stake in a subsidiary. If the subsidiary in turn owns a 50% equity stake in another subsidiary, the total ownership that the MNE holds over the latter subsidiary is calculated to 40% (80%*50%). By establishing hierarchical ownership structures, we can track ownership changes for each subsidiary, on an annual basis. In case of missing information, we identified gaps and, when possible, imputed missing data through interpolation.

BvD matches entities to patents with the OECD Harmonised Applicants’ Names Database (see Thoma et al., 2010).

A priority filing (or priority patent) is the first patent application filed to protect an invention. It represents the total number of patent families, regardless of their spatial protection scope.

Human necessities, performing operations and transporting, chemistry and metallurgy, textiles and paper, fixed constructions, mechanical engineering, physics, and electricity.

We replicated the analysis using the sum of the fractional count (rather than the full one) of patent applications to compute the IPC subclass shares \({p}_{i,t,k}\). As shown in Table 2, the results of the analysis do not change.

We follow an approach introduced by the European Commission's Joint Research Centre and the OECD, which exploits information on the location of the inventors of corporate patents to approximate ‘international knowledge sourcing’ (Dernis et al., 2015) and/or the incidence of ‘foreign R&D’ (Laurens et al., 2015). In our case, ‘MNE patents’ refer to all priority patents applied for by the GUO of the MNE, as well as those applied for by any domestic or any foreign subsidiary of the focal MNE in the respective year.

Notice we link an input – international knowledge measured through the location country of inventors – and an output – technological variety in the corresponding pool of patents – in the MNE innovation process. Innovation activities in general, and technological ones in particular, are uncertain and typically time-consuming, giving rise to a volatile and erratic output path. Thus, we measure the input and the output of the innovation process using the same pool of patents in order to avoid capturing spurious volatility rather than meaningful time changes in the relationship of interest. Control variables, by contrast, enter the model with one year lag in order to minimize potential simultaneity issues.

Appendix Table 7 reports the definition of all variables used in the analysis.

Patent applications belong to firms’ intangible assets, which in turn, constitute one type of capital that constitute ‘innovation capability’ as defined by Bell (2009).

Following Miguelez and Moreno (2015), we computed the following measure of technological specialization:

$$Patent\,specialisation\,inde{x}_{it}=\frac{1}{2}{\sum }_{j}\left|\frac{pa{t}_{it}^{j}}{pa{t}_{it}}-\frac{pa{t}_{t}^{j}}{pa{t}_{t}}\right|$$where \(pa{t}_{it}^{j}\) is the number of patents (filed under the Patent Cooperation Treaty) in country i, time t and technology j, \(pa{t}_{it}\) is the number of patents in country i and time t in all technologies, \(pa{t}_{t}^{j}\) is the number of world patents in time t and technology j, and \(pa{t}_{t}\) is the number of world patents in time t in all technologies. We considered 35 technology classes as defined by Schmoch (2008).

All models also control for the number of patent applications (in log), as well as time-varying MNE-specific characteristics and year common effects.

Most of the control variables, in particular the number of subsidiaries, employees as well as the value of intangible assets, show limited variance within MNEs across years (see Appendix Table 8), so their effects are likely to be captured by the time-invariant MNE -specific fixed effects.

Full models of all robustness checks are found in Appendix Table 10.

The sample includes 1,799 patents with multiple applicants belonging to 10% (203) of MNEs-years observation.

MNEs-years observations with 5 or less patents represent 43% of the sample (see Appendix Table 6).

While the issues of coverage and data availability are known limitations of ORBIS, these are by far outweighed by its advantage of offering a comprehensive cross-country micro-level dataset for scientific research purposes (e.g. Gal, 2013). See Appendix Tables 3 and 6 for a detailed distribution of MNEs and patents across countries.

Tables available upon request from the authors.

A historical expansion of the firm-level dataset is limited by the fact that the online Orbis version offers ownership data (and other firm level data) for only 9 years backward. The time lag in the registration patent applications (about 3 years) limits a forward expansion much beyond 2018 at the time we conducted our study.

References

Aarstad, J., Jakobsen, S.-E., & Kvitastein, O. A. (2016). Related and unrelated variety as regional drivers of enterprise productivity and innovation: A multilevel study. Research Policy, 45(4), 844–856. https://doi.org/10.1016/j.respol.2016.01.013

Acs, Z. J., Anselin, L., & Varga, A. (2002). Patents and innovation counts as measures of regional production of new knowledge. Research Policy, 31, 1069–1085. https://doi.org/10.1016/S0048-7333(01)00184-6

Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strategic Management Journal, 22(3), 197–220. https://doi.org/10.1002/smj.157

Alkemade, F., Heimriks, G., Schoen, A., Villard, L., & Laurens, P. (2015). Tracking the internationalization of multinational corporate inventive activity: National and sectoral characteristics. Research Policy, 44(9), 1763–1772. https://doi.org/10.1016/j.respol.2015.01.007

Allen, T. J., & Cohen, S. I. (1969). Information flow in research and development laboratories. Administrative Science Quarterly, 14(1), 12–19. https://doi.org/10.2307/2391357

Almeida, P., Song, J., & Grant, R. (2002). Are firms superior to alliances and markets? An empirical test of cross-border knowledge building. Organization Science, 13(2), 109–122. https://doi.org/10.1287/orsc.13.2.147.534

Almirall, E., & Casadesus-Masanell, R. (2010). Open versus closed innovation: A model of discovery and divergence. The Academy of Management Review, 35(1), 27–47.

Ambos, B., & Schlegelmilch, B. (2004). The use of international R&D teams: An empirical investigation of selected contingency factors. Journal of World Business, 39, 37–48. https://doi.org/10.1016/j.jwb.2003.08.004

Anderson, L. R. (1983). Management of the mixed-cultural work group. Organizational Behavior and Human Performance, 31(3), 303–330. https://doi.org/10.1016/0030-5073(83)90128-9

Archibugi, D., Filippetti, A., & Frenz, M. (2013). Economic crisis and innovation: Is destruction prevailing over accumulation? Research Policy, 42(2), 303–314. https://doi.org/10.1016/j.respol.2012.07.002

Archibugi, D., & Pianta, M. (1992). Specialization and size of technological activities in industrial countries: The analysis of patent data. Research Policy, 21(1), 79–93. https://doi.org/10.1016/0048-7333(92)90028-3

Arthur, W. B. (2007). The structure of invention. Research Policy, 36(2), 274–287. https://doi.org/10.1016/j.respol.2006.11.005

Awate, S., Larsen, M. M., & Mudambi, R. (2015). Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46, 63–86. https://doi.org/10.1057/jibs.2014.46

Basalla, G. (1988). The evolution of technology. Cambridge University Press.

Bassett-Jones, N. (2005). The paradox of diversity management, creativity and innovation. Creativity and Innovation Management, 14(2), 169–175. https://doi.org/10.1111/j.1467-8691.00337.x

Belderbos, R., Grabowska, M., Kelchtermans, S., Leten, B., Jacob, J., & Miccaboni, M. (2021). Whither geographic proximity? Bypassing local R&D units in foreign university collaboration. Journal of International Business Studies, 52, 1302–1330. https://doi.org/10.1057/s41267-021-00413-6

Belderbos, R., Lokshin, B., Boone, C., & Jacob, J. (2020). Top management team international diversity and the performance of international R&D. Global Strategy Journal, 12, 108–133. https://doi.org/10.1002/gsj.1395

Bell, M. (2009). Innovation capabilities and directions of development, STEPS Working Paper 33, Brighton: STEPS Centre

Benkler, Y. (2006). The wealth of networks: How social production transforms markets and freedom. Yale University Press.

Bergek, A., & Bruzelius, M. (2010). Are patents with multiple inventors from different countries a good indicator of international R&D collaboration? The Case of ABB. Research Policy, 39(2010), 1321–1334. https://doi.org/10.1016/j.respol.2010.08.002

Berry, H. (2018). The influence of multiple knowledge networks on innovation in foreign operations. Organization Science, 29(5), 855–872. https://doi.org/10.1287/orsc.2018.1203

Boschma, R., Balland, P. A., & Kogler, D. F. (2015). Relatedness and technological change in cities: The rise and fall of technological knowledge in US metropolitan areas from 1981 to 2010. Industrial and Corporate Change, 24(1), 223–250. https://doi.org/10.1093/icc/dtu012

Boschma, R., & Iammarino, S. (2009). Related variety, trade linkages, and regional growth in Italy. Economic Geography, 85(3), 289–311.

Bouncken, R., Brem, A., & Kraus, S. (2015). Multi-cultural teams as sources for creativity and innovation: The role of cultural diversity on team performance. International Journal of Innovation Management. https://doi.org/10.1142/S1363919616500122

Breschi, S., Lissoni, F., & Malerba, F. (2003). Knowledge-relatedness in firm technological diversification. Research Policy, 32(1), 69–87. https://doi.org/10.1016/S0048-7333(02)00004-5

Brunetta, F., Marchegiani, L., & Peruffo, E. (2020). When birds of a feather don’t flock together: Diversity and innovation outcomes in international R&D collaborations. Journal of Business Research, 114(2020), 436–445. https://doi.org/10.1016/j.jbusres.2019.08.033

Cantwell, J. (1995). The globalisation of technology: What remains of the product cycle model? Cambridge Journal of Economics, 19(1), 155–174. https://doi.org/10.1093/oxfordjournals.cje.a035301

Cantwell, J. (2009). Location and the multinational enterprise. Journal of International Business Studies, 40(1), 35–41. https://doi.org/10.1057/jibs.2008.82

Cantwell, J. (2014). Revisiting international business theory: A capabilities-based theory of the MNE. Journal of International Business Studies, 45(1), 1–7. https://doi.org/10.1057/jibs.2013.61

Cantwell, J., & Andersen, B. (1996). A statistical analysis of corporate technological leadership historically. Economics of Innovation and New Technologies, 4(3), 211–234. https://doi.org/10.1080/10438599600000010

Cantwell, J., & Mudambi, R. (2005). MNE competence-creating subsidiary mandates. Strategic Management Journal, 26(12), 1109–1128. https://doi.org/10.1002/smj.497

Cantwell, J., & Mudambi, R. (2011). Physical attraction and the geography of knowledge sourcing in multinational enterprises. Global Strategy Journal, 1(3–4), 206–232. https://doi.org/10.1002/gsj.24

Cantwell, J., & Piscitello, L. (2000). Accumulating technological competence: Its changing impact on corporate diversification and internationalization. Industrial and Corporate Change, 9(1), 21–51. https://doi.org/10.1093/icc/9.1.21

Cantwell, J., & Piscitello, L. (2014). Historical changes in the determinants of the composition of innovative activity in MNC subunits. Industrial and Corporate Change, 23(3), 633–660. https://doi.org/10.1093/icc/dtt047

Cantwell, J., & Vertova, G. (2004). Historical evolution of technological diversification. Research Policy, 33(3), 511–529. https://doi.org/10.1016/j.respol.2003.10.003

Capozza, C., Salomone, S., & Somma, E. (2020). Micro-econometric analysis of innovative start-ups: The role of firm-specific factors and industry context in innovation propensity. Industrial and Corporate Change, 29(4), 935–957. https://doi.org/10.1093/icc/dtaa006

Castaldi, C., Frenken, K., & Los, B. (2015). Related variety, unrelated variety and technological breakthroughs: An analysis of US state-level patenting. Regional Studies, 49(5), 767–781. https://doi.org/10.1080/00343404.2014.940305

Castellani, D., Montresor, S., Schubert, T., & Vezzani, A. (2017). Multinationality, R&D and productivity: Evidence from the top R&D investors worldwide. International Business Review, 26(3), 405–416. https://doi.org/10.1016/j.ibusrev.2016.10.003

Castellani, D., Perri, A., & Scalera, V. G. (2022). Knowledge integration in multinational enterprises: The role of inventors crossing national and organizational boundaries. Journal of World Business, 57, 101290. https://doi.org/10.1016/j.jwb.2021.101290

Castellani, D., & Zanfei, A. (2006). Multinational firms, innovation and productivity. Edward Elgar.

Cecere, G., & Ozman, M. (2014). Technological diversity and inventor networks. Economics of Innovation and New Technology, 23(2), 161–178. https://doi.org/10.1080/10438599.2013.815473

Cegarra-Navarroa, G., Ruiz, F. J. A., Martínez-Caroc, E., & Garcia-Perez, A. (2021). Turning heterogeneity into improved research outputs in international R&D teams. Journal of Business Research, 128, 770–778. https://doi.org/10.1016/j.jbusres.2019.05.023

Chesbrough, H. W. (2003). Open Innovation: The new imperative for creating and profiting from technology. Harvard Business School Press.

Coad, A., Amoroso, S., & Grassano, N. (2017). Diversity in one dimension alongside greater similarity in others: Evidence from FP7 cooperative research teams. Journal of Technology Transfer, 42, 1170–1183.

Colombelli, A., Krafft, J., & Quatraro, F. (2014). High-growth firms and technological knowledge: Do gazelles follow exploration or exploitation strategies? Industrial and Corporate Change, 23(1), 261–291. https://doi.org/10.1093/icc/dtt053

Dahlander, L., & Gann, D. M. (2010). How open is innovation. Research Policy, 39, 699–709.

De Beule, F., & Van Beveren, I. (2019). Sources of open innovation in foreign subsidiaries: An enriched typology. International Business Review, 28, 135–147. https://doi.org/10.1016/j.ibusrev.2018.08.005

De Rassenfosse, D., Dernis, G., Guellec, H., Picci, D. L., & De La Potterie, B. V. P. (2013). The worldwide count of priority patents: A new indicator of inventive activity. Research Policy, 42(3), 720–737. https://doi.org/10.1016/j.respol.2012.11.002

Dernis, H., Dosso, M., Hervás, F., Millot, V., Squicciarini, M., & Vezzani, A. (2015). World Corporate Top R&D Investors: Innovation and IP bundles. A JRC and OECD common report. Luxembourg: Publications Office of the European Union. https://doi.org/10.2791/741349

DiStefano, J. J., & Maznevski, M. L. (2000). Creating value with diverse teams in global management. Organizational Dynamics, 29(1), 45–63. https://doi.org/10.1016/S0090-2616(00)00012-7

Dosi, G. (1997). Opportunities, incentives and the collective patterns of technological change. Economic Journal, 107, 1530–1547. https://doi.org/10.1111/j.1468-0297.1997.tb00064.x

Enderwick, P., & Buckley, P. J. (2021). The role of springboarding in economic catch-up: A theoretical perspective. Journal of International Management. https://doi.org/10.1016/j.intman.2021.100832

Fai, F., & von Tunzelmann, G. N. (2001). Industry-specific competences and converging technological systems: Evidence from patents. Structural Change and Economic Dynamics, 12(2), 141–170. https://doi.org/10.1016/S0954-349X(00)00035-7

Farr, J. L., Sin, H. P., & Tesluk, P. E. (2003). Knowledge management processes and work group innovation. In L. V. Shavinina (Ed.), International handbook on Innovation (pp. 574–586). Elsevier Science.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132. https://doi.org/10.1287/mnsc.47.1.117.10671

Fleming, L. (2002). Finding the organizational sources of technological breakthroughs: The story of Hewlett–Packard’s thermal ink-jet. Industrial and Corporate Change, 11(5), 1059–1084. https://doi.org/10.1093/icc/11.5.1059

Forman, C., & van Zeebroeck, N. (2019). Digital technology adoption and knowledge flows within firms: Can the Internet overcome geo-graphic and technological distance? Research Policy, 48(8), 103697.

Fornahl, D., Broekel, T., & Boschma, T. (2011). What drives patent performance of German biotech firms? The impact of R&D subsidies, knowledge networks and their location. Papers in Regional Science, 90(2), 395–418. https://doi.org/10.1111/j.1435-5957.2011.00361.x

Frenken, K., van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41(5), 685–697. https://doi.org/10.1016/j.respol.2016.01.013

Frost, T. S. (2001). The geographic sources of foreign subsidiaries’ innovation. Strategic Management Journal, 22(2), 101–123. https://doi.org/10.1002/1097-0266(200101)22:2%3c101::AID-SMJ155%3e3.0.CO;2-G

Frost, T. S., & Zhou, C. (2005). R&D co-practice and ‘reverse’ knowledge integration in multinational firms. Journal of International Business Studies, 36(6), 676–687. https://doi.org/10.1057/palgrave.jibs.8400168

Gal, P. N. (2013). Measuring total factor productivity at the firm level using OECD-ORBIS. OECD Economics Department Working Papers, No. 1049, OECD Publishing, Paris.

Garcia-Vega, M. (2006). Does technological diversification promote innovation? An empirical analysis for European firms. Research Policy, 35(2), 230–246. https://doi.org/10.1016/j.respol.2005.09.006

Gassmann, O., & von Zedtwitz, M. (1999). New concepts and trends in international R&D organization. Research Policy, 28, 231–250. https://doi.org/10.1016/S0048-7333(98)00114-0

Granstrand, O. (1998). Towards a theory of the technology-based firm. Research Policy, 25(5), 467–491. https://doi.org/10.1016/S0048-7333(98)00067-5

Granstrand, O., Patel, P., & Pavitt, K. (1997). Multitechnology corporations: Why they have ‘distributed’ rather than ‘distinctive core’ competencies. California Management Review, 39(4), 8–25. https://doi.org/10.2307/41165908

Granstrand, O., & Sjölander, S. (1992). Internationalisation and diversification of multi-technology corporations. In O. Granstrand, L. Hakanson, & S. Sjölander (Eds.), Technology Management and International Business: Internationalisation of R&D and Technology (pp. 181–207). Wiley.

Griliches, Z. (1979). Issues in assessing the contribution of research and development to productivity growth. Bell Journal Economics, 10(1), 92–116.

Griliches, Z. (1990). Patent statistics as economic indicators: A survey. Journal of Economic Literature, 38, 1661–1707.

Hall, B., Helmers, C., Rogers, M., & Sena, V. (2014). The choice between formal and informal intellectual property: A review. Journal of Economic Literature, 52(2), 375–423. https://doi.org/10.1257/jel.52.2.375

Hargadon, A. (2003). How Breakthroughs Happen. Harvard Business School Press.

Harrison, D. A., & Klein, K. J. (2007). What’s the difference? Diversity constructs as separation, variety, or disparity in organizations. Academy of Management Review, 32(4), 1199–1228. https://doi.org/10.5465/amr.2007.26586096

Henderson, R., & Cockburn, I. (1996). Scale, Scope, and Spillovers: The determinants of research productivity in drug discovery. RAND Journal Economics, 27(1), 32–59. https://doi.org/10.2307/2555791

Hidalgo, C. A., Balland, P.-A., Boschma, R., Delgado, M., Feldman, M., Frenken, K., & Zhu, S. (2018). The principle of relatedness. International conference on complex systems (pp. 451–457). Springer.

Hoever, I. J., Van Knippenberg, D., Van Ginkel, W. P., & Barkema, H. G. (2012). Fostering team creativity: perspective taking as key to unlocking diversity’s potential. Journal of Applied Psychology, 97(5), 982–996. https://doi.org/10.1037/a0029159

Huang, C. C. (2009). Knowledge sharing and group cohesiveness on performance: An empirical study of technology R&D teams in Taiwan. Technovation, 29(11), 786–797. https://doi.org/10.1016/j.technovation.2009.04.003

Hussinger, K. (2006). Is silence golden? Patents versus secrecy at the firm level. Economics of Innovation and New Technology, 15(8), 735–752.

Ivarsson, I., Alvstam, C., & Vahlne, J.-E. (2017). Global technology development by colocating R&D and manufacturing: The case of Swedish manufacturing MNCs. Industrial and Corporate Change, 26(1), 149–168. https://doi.org/10.1093/icc/dtw018

Jang, S. (2017). Cultural brokerage and creative performance in multicultural teams. Organization Science, 28(6), 993–1009. https://doi.org/10.1287/orsc.2017.1162

Joshi, A., & Roh, H. (2009). The role of context in work team diversity research: A meta-analytic review. Academy of Management Journal, 52, 599–627. https://doi.org/10.5465/AMJ.2009.41331491

Juhacz, S., Broekel, T., & Boschma, R. (2020). Explaining the dynamics of relatedness: The role of co-location and complexity. Papers in Regional Science. https://doi.org/10.1111/pirs.12567

Kafouros, M. I., Buckley, P. J., & Clegg, J. (2012). The effects of global knowledge reservoirs on the productivity of multinational enterprises: The role of international depth and breadth. Research Policy, 41(5), 848–861.

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. The Academy of Management Journal, 45(6), 1183–1194. https://doi.org/10.2307/3069433

Kerr, S. P., & Kerr, W. (2018). Global collaborative patents. The Economic Journal, 128(612), 235–272. https://doi.org/10.1111/ecoj.12369

Khedhaouria, A., & Jamal, A. (2015). Sourcing knowledge for innovation: Knowledge reuse and creation in project teams. Journal of Knowledge Management., 19(5), 932–948. https://doi.org/10.1108/JKM-01-2015-0039

Kirchmeyer, C., & Cohen, A. (1992). Multicultural groups: Their performance and reactions with constructive conflict. Group & Organization Management, 17(2), 153–170. https://doi.org/10.1177/1059601192172004

Kirkman, B. L., & Shapiro, D. L. (2005). The impact of cultural value diversity on multicultural team performance. In D. L. Shapiro, M. A. Von Glinow, & J. L. Cheng (Eds.), Advances in international management (Vol. 18, pp. 33–67). London.

Lane, H. W., Maznevski, M. L, DiStefano, J. J., Dietz, J., 2009. International management behavior: Leading with a global mindset (6th ed.), Oxford: Blackwell.

Laurens, P., Le Bas, C., Schoen, A., Villard, L., & Laredo, P. (2015). The rate and motives of the internationalization of large firm R&D: Toward a turning point? Research Policy, 44(3), 765–776. https://doi.org/10.1016/j.respol.2014.11.001

Laursen, K., & Salter, A. (2006). Open for Innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strategic Management Journal, 27(2), 131–150. https://doi.org/10.1002/smj.507

Le Bas, C., & Sierra, C. (2002). Location versus home country advantages in R&D activities: Some further results on multinationals’ locational strategies. Research Policy, 31(4), 589–609. https://doi.org/10.1016/S0048-7333(01)00128-7

Li, J. L., Poppo, J., & Zheng Zhou, K. (2010). Relational mechanisms, formal contract, and local knowledge acquisitions by international subsidiaries. Strategic Management Journal, 31, 349–370. https://doi.org/10.1002/smj.813

Mairesse, J., & Mohnen, P. (2005). The Importance of R&D for innovation: A reassessment using French survey data. Journal of Technology Transfer, 30(1/2), 183–197. https://doi.org/10.1007/s10961-004-4365-8

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87.

Marino, A., & Quatraro, F. (2022). Leveraging global recombinant capabilities for green technologies: The role of ethnic diversity in MNEs’ dynamics. Journal of Technology Transfer. https://doi.org/10.1007/s10961-022-09975-5

McLeod, P. L., Lobel, S. A., & Cox, T. H., Jr. (1996). Ethnic diversity and creativity in small groups. Small Group Research, 27, 248–264. https://doi.org/10.1177/1046496496272003

Menzel, M. P. (2015). Interrelating dynamic proximities by bridging, reducing and producing distances. Regional Studies, 49(11), 1892–1907. https://doi.org/10.1080/00343404.2013.848978

Miguelez, E., & Moreno, R. (2015). Knowledge flows and the absorptive capacity of regions. Research Policy, 44(4), 833–848. https://doi.org/10.1016/j.respol.2015.01.016

Miguelez, E., & Morrison, A. (2023). Migrant inventors as agents of technological change. Journal of Technology Transfer, 48, 669–692. https://doi.org/10.1007/s10961-022-09927-z

Milgrom, P., & Roberts, J. (1990). The economics of modern manufacturing: Technology, strategy and organization. American Economic Review, 80(3), 511–528.

Miller, D. J., Fern, M. J., & Cardinal, L. B. (2007). The use of knowledge for technological innovation within diversified firms. Academy of Management Journal, 50(2), 308–326.

Milliken, F. J., & Martins, L. L. (1996). Searching for common threads: Understanding the multiple effects of diversity in organizational groups. Academy of Management Review, 21(2), 402–433.

Monteiro, F., & Birkinshaw, J. (2017). The external knowledge sourcing process in multinational corporations. Strategic Management Journal, 38, 342–362. https://doi.org/10.1002/smj.2487

Narula, R. (2014). Exploring the paradox of competence-creating subsidiaries: Balancing bandwidth and dispersion in MNEs. Long Range Planning, 47(1), 4–15. https://doi.org/10.1016/j.lrp.2013.10.006

Neffke, F., Henning, M., & Boschma, R. (2011). How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Economic Geography, 87(3), 237–265. https://doi.org/10.1111/j.1944-8287.2011.01121.x

Nelson, R. R., & Winter, S. G. (1982). An Evolutionary Theory of Economic Change. Harvard University Press.

Nerkar, A., & Paruchuri, S. (2005). Evolution of R&D Capabilities: The Role of Knowledge Networks within a Firm. Management Science, 51(5), 771–785.

Nesta, L., & Saviotti, P. P. (2005). Coherence of the knowledge base and the firm’s innovative performance: Evidence from the US pharmaceutical industry. Journal of Industrial Economics, 53(1), 123–142. https://doi.org/10.1111/j.0022-1821.2005.00248.x

Nightingale, P. (1998). A cognitive theory of innovation. Research Policy, 27(7), 689–709. https://doi.org/10.1016/S0048-7333(98)00078-X

Nissen, H. A., Evald, M. R., & Clarke, A. H. (2014). Knowledge sharing in heterogeneous teams through collaboration and cooperation: Exemplified through public-private-innovation partnerships. Industrial Marketing Management, 43(3), 473–482. https://doi.org/10.1016/j.indmarman.2013.12.015

Nooteboom, B. (2000). Learning and innovation in organizations and economies. Oxford University Press.

OECD. (2009). Policy responses to the economic crisis: investing in innovation for long-term growth. Organisation for Economic Cooperation and Development.

Olsson, O., & Frey, B. S. (2002). Entrepreneurship as recombinant growth. Small Business Economics, 19, 69–80. https://doi.org/10.1023/A:1016261420372

Paruchuri, S., & Awate, S. (2017). Organizational knowledge networks and local search: The role of intra-organisational inventor networks. Strategic Management Journal, 38, 657–675. https://doi.org/10.1002/smj.2516

Patel, P., & Pavitt, K. (1997). The technological competences of the world’s largest firms: Complex, path-dependent but not much variety. Research Policy, 26(2), 141–156. https://doi.org/10.1016/S0048-7333(97)00005-X

Pavitt, K. (1988). Uses and abuses of patent statistics. In A. F. J. van Raan (Ed.), Handbook of quantitative studies of science and technology. Elsevier Science Publishers.