Abstract

This paper analyses the effects on patent quality of a type of spillovers arising from the disclosure of patent information by firms engaged in competition in a global duopoly. Both firms are involved in producing new technologies and they do not cooperate on joint patents. In this context, we explored whether the disclosure of crucial knowledge in the patents of one of the firms affects the patent quality of its respective competitor. The empirical methodology relies on forward citations as an indicator of quality, and backward citations to the competitor as a measure of spillovers. We estimated several count models with a sample of 7750 patent families (divided into subsamples) owned by two large companies, Airbus and Boeing. Our econometric findings show that, for technologies in which the two firms account for the majority of the global patents, neither of the firms in the duopoly was able to harness spillovers from the rival to improve the quality of its patents. However, knowledge from the competitor becomes relevant, at least for one of the focal firms, in explaining patent quality of other technologies in which the two firms do not exert a dominant position.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Empirical literature has shown a strong relationship between patent quality (e.g., the impact of a patent on subsequent patented inventions) and some indicators of firm performance (Chen & Chang, 2010; Hall & MacGarvie, 2010; Hall et al., 2005; Harrigan et al., 2018; Hirschey & Richardson, 2004; Patel & Ward, 2011). For example, Hirchey and Richarson (2004) found that various measures of patent quality have positive and statistically significant effects on stock prices. According to Hall et al. (2005), if the quality of patents owned by a firm increases, so that on average these patents receive one additional citation, the firm's market value would increase by around 3%. Patent quality is also related to reputation for technological innovation, which in turn correlates with the firm’s competitive advantage (Henard & Dacin, 2010; Höflinger et al., 2018). Furthermore, along with the close link between patent quality and firm value, patent quality promotes innovation by reducing transaction costs and coordinating R&D efforts between rivals (Sag & Rohde, 2007; Thomas, 2002).

These far-reaching consequences of patent quality for the firm have triggered political and academic interest in understanding the factors affecting patent quality. Among other causes, research has found that information disclosed in patents offers opportunities through spillovers to improve the quality of subsequent patented technologies. Although there is a wide variety of well-known channels and sources of spillovers, those produced through patent disclosure from competitors are worth studying for two reasons. First, a high percentage of firms’ researchers read and scrutinize patents for scientific reasons (Ouellette, 2017; Sampat, 2018).Footnote 1 Second, firms may use the knowledge embedded in competitors’ patents to obtain non-infringing patented inventions of better quality. In other words, the use of technological knowledge from a competitor may allow a given firm to achieve results with less research effort than otherwise, undermining the market position of the rival firm that generated the knowledge (Frishammar et al., 2015; Ritala et al., 2018).

While some empirical papers did not break up the sources of the flows of technological knowledge that give rise to spillovers (e.g., Gambardella et al., 2008; Giuliani et al., 2016; Harhoff et al., 2003b; Lee et al., 2007; Tahmooresnejad & Beaudry, 2019), other studies have gone a step further by analysing the origin of spillovers to identify their effect on patent quality across geographical areas (Lee et al., 2012), institutions (Sapsalis et al., 2006), and technological fields (Nemet & Johnson, 2012; Moaniba et al., 2018; Barbieri et al., 2020). However, despite competing firms being important sources of spillovers (Sofka & Grimpe, 2010; Czarnitzki & Kraft, 2012), to our knowledge, no previous work has empirically addressed the role of spillovers from patent disclosure on the subsequent quality of patents owned by firms engaged in duopolistic competition on a global scale. This paper aims to fill this gap by analysing the effect on patent quality of technological knowledge spillovers that occur in markets where there are two main competing firms and where each firm scrutinizes and builds on ideas from the patent information of its respective rival. This could be the case, for example, of Airbus and Boeing in the aircraft industry, Google LLC-Android and Apple in the field of mobile operating systems, and Visa and Mastercard in the financial sector.

Our empirical analysis uses data from two competing firms in the aircraft industry, Airbus and Boeing. Aircraft technology is part of the aerospace sector, which is classified as a multi-technology industry that generates spillovers leading to the development of other advanced technologies with impacts on the whole economy (Kim et al., 2016; Park et al., 2012). Within the aerospace sector, the market for large aircraft is a duopoly (Ibsen, 2009; Bénassy‐Quéré et al., 2011; Schmitt & Gollnick, 2016, p. 158) that matches the purpose of our analysis.

To link the patent quality of one firm with the knowledge disclosed in the competitor’s patents, we estimate some models in which the dependent variable is a measure of quality (forward patent citations), and the main independent variable is the inflow of knowledge stemming from the main competitor (captured by the number of backward patent citations to the competitor). Along with the role of spillovers from the competing firm, our models considered other explanatory factors discussed in studies on patent quality, such as the flows of knowledge from other agents, the characteristics of the technology and the teams involved in producing the patent (e.g. Chang et al., 2018; Gay et al., 2005; Lahiri, 2010; Lanjouw & Schankerman, 2004; Nemet & Johnson, 2012; Popp, 2006; Sapsalis et al., 2006). Our sample consisted of 7750 patent families owned by Airbus and Boeing, which were divided into two subsamples according to the share of the number of patents that the two firms own. One subsample concerns technological classes where Airbus and Boeing account for the majority of the global patents (dominant position in the production of patents). The other subsample contains patents in which the participation of Airbus and Boeing is low, with many other firms contributing to patent production (non-dominant position).

Since the effects of spillovers on patent quality may affect both the recipient and the source of the relevant knowledge, clarifying these effects has important managerial implications; in particular, for those involved in knowledge organization of large firms that compete in the generation of patents. For the recipient, this analysis has relevance because of the close relationship between patent quality and firm value; according to the literature, the firm’s value increases if patent quality increases, resulting in a better position in the market (Hall et al., 2005; Harrigan et al., 2018). For the source, the leakage of knowledge to a rival undermines the original innovator's profit, and weakens its competitive capacity (Easterby-Smith et al., 2008; Frishammar et al., 2015; Green & Scotchmer, 1995). The findings of this paper are also informative for the patent system, in particular in exploring the extent to which it accomplishes the objective of facilitating follow-on inventions in global duopolies.

The remainder of the paper is organized as follows. Section 2 includes two subsections; the first defines patent quality and explains how it is measured, and the second develops the main hypotheses. Section 3 deals with the variables and the model. Section 4 presents the data and a brief descriptive analysis of the Airbus–Boeing technological relationship. The core empirical estimation and robustness are presented in Sect. 5. Section 6 contains a brief discussion and policy implications of our findings, and Sect. 7 concludes and provides some suggestions for future research.

2 Literature review

2.1 Patent quality, meaning and measure

Patent quality is usually defined according to two major criteria (Burke & Reitzig, 2007; Guellec and van Pottelsberghe, 2007, p. 115; Wagner, 2009; Scellato et al., 2011). The first criterion deals with the legal certainty or reliability of a patent as an enforceable property right. For example, a patent is of good quality if the likelihood of it being upheld by the courts is high (Harhoff, 2016). The second criterion concerns the technological and economic aspects of patents, for example the underlying capacity of knowledge embedded in the patent to promote innovation, encourage the diffusion of technology, and affect economic performance. In this paper, the term ‘patent quality’ follows the latter economic and technological approach.Footnote 2 The quality of a patent is defined in this paper as its impact on subsequent patented inventions. In this respect, we follow the definition of Argyres and Silverman (2004), Gay et al. (2005), Popp (2006), Sapsalis et al. (2006), Lahiri (2010), Nemet and Johnson (2012), and Schmid and Fajebe (2019). Thus, a patent that has an impact on many subsequent patents, in the sense that it is used to support other inventions, is considered to have higher quality than another with limited impact. A related concept used in the literature is ‘patent value’, a term linked to the extent to which the impact of the patent correlates with any indicator of firm performance and market value (for discussions see Barberá-Tomás et al., 2011; de Rassenfosse & Jaffe, 2018). There are clear differences between these concepts; however, there is strong evidence in the literature that indicators of technological quality of patents are correlated with their economic value (see references in surveys by Hall & Harhoff, 2012; de Rassenfosse & Jaffe, 2018).

Depending on the objective of the analysis, research has followed different strategies to measure patent quality. Those concerned with patent scope have used the number of claims or the number of patent families as an indicator (Harhoff et al., 2003a, 2003b; Sapsalis et al., 2006). Patent renewal is another well-known indicator when the objective is to estimate the value of patent protection (Bessen, 2008; Grönqvist, 2009; Lanjouw et al., 1998; Lee & Sohn, 2017; Schankerman & Pakes, 1986; Schubert, 2011). Sometimes, complex combinations of indicators were used to measure patent quality (e.g. de Rassenfosse & Jaffe, 2018; Jiang et al., 2019). This study is based on another well-known approach, aiming to measure patent quality by the number of forward patent citations (as in, for example, Lerner, 1994; Hall et al., 2005; Lee et al., 2007; Sapsalis and van Pottelsberghe, 2007; Acosta et al., 2009; Sterzi, 2013; Giuliani et al., 2016).

The logic behind using forward citations to capture the importance of patents is based on the idea that patents that have been cited by subsequent patents in their ‘state of the art’ section (or forward citations), include bits of knowledge on which the underlying inventions rely. Therefore, if a patent is cited in many subsequent patents, this means that this particular patent has had a greater technological impact on future inventions, or it is more important that other patents that are less cited. Forward citations may also capture the economic value, as several validation studies have proved. Validation studies have found correlations between forward citations and different measures of patent value, such as social value (e.g., Trajtenberg, 1990), values that R&D managers and experts give to patents (e.g., Albert et al., 1991; Harhoff et al., 1999), variation in the stock market value of firms (Hall et al., 2005), the decision to pay renewal fees (Bessen, 2008; Harhoff & Wagner, 2009; Thomas, 1999), measures of performance (Moser et al., 2017), and licensing revenue (Abrams et al., 2018). Some studies, however, cast doubt on forward citations as an indicator of economic value because the authors did not find such a clear relationship (e.g., Gambardella et al., 2008; Azagra-Caro et al., 2017). Overall, the use of citations may be justified as a measure of technological impact/value, but with some assumed shortcomings. For example, some authors have warned that predictions may carry significant ‘noise’ (Gambardella et al., 2008; Hall et al., 2005). This noise can arise from several sources related to the role of examiners, self-citations and time truncation. For example, Azagra-Caro and Tur (2018) show that citation patterns vary depending on the nationality of the patent examiner. An analysis of US patents by Moser et al. (2017) indicates that examiner-added citations are typically unrelated to improvements in performance or a follow-on invention. This study suggests, as we do in this paper, that citations by examiners should be excluded from the number of forward citations. By contrast, self-citations have an even more pronounced effect on market value than other citations (Jaffe & Trajtenberg, 2002, p. 16; Hall et al., 2005).

Finally, the truncation problem must be addressed. Citation counts are inherently truncated, as patents continue to be cited over long periods and more recent patents have a lower probability of being cited. A solution proposed in the literature to avoid truncation, and which we also apply in our empirical analysis, is to consider patents with a window of at least five years from their application date (Lahiri, 2010; Lanjouw & Schankerman, 2004; Mariani & Romanelli, 2007).

2.2 The role of competitors’ spillovers on patent quality in a global duopoly: theory and hypotheses

Our analysis focuses on two large companies that manufacture similar technological products and patent in numerous fields. In some specific fields they exert a clear dominance since they own the largest segment of the worldwide production of patents, forming a global duopoly. In this context, to spur on patent quality, firms count on two broad sources of knowledge: internal, which originates within a firm (from the results of their own past research), and is incorporated in its patents, and external, which stems from different sources outside the firm (Lee et al., 2012; Leiponen & Helfat, 2010). To identify the role of the competitor’s knowledge as a source of ideas, the external flow of knowledge can be split into two sources, namely, the main competitor and other sources of technological knowledge.

The knowledge flow from the main competitor occurs when the recipient firm uses ideas from knowledge embedded in the rival firm’s patents. As long as there is no joint venture between the firms to produce collaborative patented inventions, knowledge circulates without compensation. When this happens, it seems reasonable to identify this type of knowledge flow between competitors as knowledge spillovers (Baldwin & Hanel, 2003; McGahan & Silverman, 2006). The second external source of ideas comprises flows of knowledge arising from universities and public institutions, government, laboratories, firms in the same sector (other than competitors), and firms from other sectors.

The disclosure of the patents applied for by each company creates a stock of knowledge which is available to others, but not all of this knowledge is equally accessible to a rival firm. Literature identifies several factors –legal, geographical and technological– that prevent companies from an efficient use of spillovers arising from disclosed patents. First, the mechanisms for a competitor to build on relevant technological spillovers from patents can be hampered by legal hurdles. By ‘legal hurdles’ we mean the ability of the firm (or its attorney), to describe the patented invention in such a way that, without infringing, it creates obstacles to the proper understanding of the details of the invention by a potential competitor. Despite patent laws making it compulsory to disclose details of the patented technology in clear, concise and exact terms, a firm can hinder the access of a rival to its own knowledge in several ways (Seymore, 2009; Hall & Harhoff, 2012; Heger et al., 2019; Baruffaldi & Simeth, 2020). These may include removing some key technical details without infringing the disclosure principle (and hence the patent may not contain information of relevant value to build on); by making the language of the patent somehow unintelligible for a reader; or by formulating ambiguous claims in an effort to expand the patent rights as far as possible. As a consequence, inventors may be discouraged from capturing patent knowledge from a competitor because the blurred language makes it difficult to understand the details. Thus, they may prefer that patent applications are not at stake, avoiding the risk of patent infringement. Experience shows that information disclosed in patents is difficult to understand in some sectors (Chang et al., 2019; Sáiz & Amengual, 2018).

Second, there are technological and geographical barriers that make it difficult for a competitor to absorb the disclosed patented knowledge. The capacity to capture spillovers may be mediated by the proximity between the technological domains of the source and the recipient firms (e.g. Bloom et al., 2013; Marrocu et al., 2013; Quatraro & Usai, 2017); the larger the technological distance, the less is the opportunity for the competitor to take advantage of spillovers. The geographical proximity to the knowledge source is another factor that has been proved to be a key determinant facilitating spillovers (e.g. Aldieri & Vinci, 2016; Audretsch & Feldman, 1996; Cappelli & Montobbio, 2020; Jaffe et al., 1993; Marrocu et al., 2013; Quatraro & Usai, 2017). However, this factor is not relevant for producing spillovers in the case of large firms that operate in globalized markets (Bloom et al., 2013). Finally, firms need to understand the technological details of the rival firm’s patents. In other words, some absorptive capacity is necessary, which means that the extent to which the firm benefits from spillovers depends on its own investment in R&D (Cohen & Levinthal, 1989, 1990).

Not all of the previous factors have the same importance in our setting (two large firms competing in the same technological field). As the two firms work on similar products, the technological distance is close and is not an obstacle to capturing the competitor’s spillovers. Geographical distance cannot prevent the use of a rival’s knowledge since both firms are global; patents can be read and scrutinized in any place, irrespective of the location of the patent’s owner. Both firms possess enough absorptive capacity to understand potential knowledge in their field since the two firms are global companies in the industry. They are supposed to invest heavily in R&D to produce their own patents (as the pioneering works of Cohen & Levinthal, 1989, 1990, suggest, the absorptive capacity is correlated with R&D investments). These similarities imply that, in a global duopoly, the main instrument used by a source firm to prevent leakage of relevant knowledge that might produce spillovers to a competitor will be the use of legal barriers. Then, either of the two firms (or both) could choose to disclose information that could be confusing enough (without infringing the patent) to make such information valueless for improving the patent quality of a competitor.

As an alternative to using blurred language in describing the technical details of the patent, the firm has the option of keeping important inventions secret and patenting only less important inventions. Thus, the firm would apply for patents only for small inventions for which there is no risk of leaking useful knowledge (or for which any knowledge leakages would be worthless for the competitor). Theoretical models point in this direction. For example, Anton and Yao (2004) focus on a firm’s decision about how much of an innovation should be disclosed and how much should be kept secret, which is a major business concern as disclosure would provide competitors with usable information. They find that property rights mean that disclosure incentives are relatively stronger for smaller innovations. As a result, larger and more important innovations are protected more through secrecy as a response to the problem of imitation.

In the context of a global duopoly, in which there are clear differences in the mechanism for facilitating (or hampering) spillovers from patent disclosure between large competitors and other settings, we put forward our hypotheses. We assume a setting of two large dominant firms competing in an industry in which they do not produce joint patents. The flow of knowledge takes place between the two firms when researchers from one firm read and scrutinize a disclosed patent document from the rival, capturing valuable knowledge and ideas upon which they base their innovations. In other words, patents may provide valuable information on which the rival can build to produce other patents of higher quality. Two different scenarios of technological competition are considered. In the first case there is a dominant position in the production of some particular technologies within the duopoly; the two companies account for the largest number of patents globally produced in several specific technological classes. In the second case, there is no such dominance; the two firms generate a relatively small number of patents, and share the production of patents with many other firms. Our hypotheses explore the link between the acquisition of external knowledge captured from information disclosed by a rival company in its patents (spillovers from the main competitor) and the patent quality of the recipient in these two different scenarios.

Our prediction is that, in the first scenario, leaking knowledge through patent disclosure will not affect the quality of the competitor’s patent. The source firm will purposely choose to disclose worthless information by using confusing language or patenting small inventions to prevent the competitor from building on such information. The leaked knowledge should be valueless for the competitor because if both source and recipient work in areas that are at a close technological distance, outgoing spillovers will have a negative effect for the source (the reason is that these spillovers can benefit the recipient through imitation without infringing). The source firm may be reluctant to disclose crucial details in patents because it cannot profit from the cost reductions provided to the main competitor. If such externalities exist, the source may be hurt since the competitor becomes stronger (Frishammar et al., 2015; Ritala et al., 2018; Scotchmer & Green, 1990). The recipient, on the other hand, works at close technological distance to the source, which means that the risk of infringing by capturing the competitor’s knowledge is high. Consequently, the recipient can include knowledge from a rival as background in its patents, but only as a legal requirement, and not because they can or want to build on it. Both the source and the recipient thus have sufficient incentives to avoid flows of knowledge between them that might be useful for improving patent quality. These arguments lead to our first hypothesis:

Hypothesis 1

In a global duopoly where the focal firms have a dominant position in technology production, knowledge spillovers stemming from disclosure of information in patents owned by one firm do not affect the quality of the other firm’s patents.

By contrast, in a second scenario with both firms working in different technological areas and with other companies producing patents in these fields, the decision to avoid disclosure of technological details may not be taken, as long as both companies can reap future benefits by releasing relevant knowledge. The reason for this is that patenting not only involves decisions about the amount of enabling knowledge to be transmitted to one’s competitor; it is also a useful signal to others of the total knowledge that the innovator possesses, which helps to reduce the possibility of being held up by external patent owners (Hall & Ziedonis, 2001; Anton and Yao, 2004). This suggests that when both large competing firms work in the same industry, but in different technological fields, with neither firm dominating and with the presence of additional participants in the fields, both firms will be willing to include relevant technological details in their patents. This voluntary leak of knowledge could favour the patent quality of the main competitor, but the benefits could outweigh this drawback. Such benefits include opening opportunities for potential collaborations and licensing, future reabsorption of recombined knowledge, and an increase in reputation as a leading firm (Bessen & Maskin, 2009; Yang et al., 2010; Belenzon, 2011). It is assumed that these advantages can make up for the drawback of knowledge leakages to the main rival. On this basis, we put forward our second hypothesis.

Hypothesis 2

In a global duopoly where the focal firms do not have a dominant position in technology production, spillovers arising from disclosing information in patents owned by one of the two firms positively affect the patent quality of the other.

The confirmation of our two hypotheses by empirical evidence would suggest that firms could strategically manage their knowledge, releasing or retaining knowledge according to a market strategy. In other words, the spillovers could be intentional.

3 Variables and model

3.1 Dependent variable

Our dependent variable is patent quality, measured by the number of forward citations that a patent receives. The interpretation given to forward citations is basically in terms of technological impact; however, a high number of forward citations also reflects a high economic value. Both technological impact and economic value fit within the objective of determining whether the knowledge from the competitor contributes to strengthening the recipient technologically, which is the key issue tested in this paper.

Considering the previous remarks, the dependent variable in this work is the number of times that a focal patent family was cited as relevant state of the art in subsequent patent families filed within a 5-year time window after the first application for the focal patent family, including self-citations and excluding examiner citations (fpc5years). A patent family comprises all patent documents covering the same invention. More precisely, it can be defined as the set of patents filed in several countries that are related to each other by one or several common priority filings (Zuniga et al., 2009, p. 71; for a detailed discussion, see Martínez, 2010, 2011). One of the main advantages of using patent families is the avoidance of duplication of the information contained in patents that cover the same invention in different countries (de Rassenfosse et al., 2014; Martínez, 2011). Moreover, the calculated citation indicators may differ substantially depending on the procedures of the patent office where the patent application was submitted. Therefore, patent families reveal the most uniform results, and can be used as a comprehensive measure of inventiveness compared to the simple count of patents (Bakker et al., 2016; Tahmooresnejad & Beaudry, 2019; van Raan, 2017). As patent families contain different dates, and we considered a window of five years, it is important to clarify the dates. Following de Rassenfosse et al. (2014), the date of reference is set to the earliest date of publication.

3.2 Independent variables

3.2.1 Variables capturing flows of knowledge

In order to isolate the technological knowledge spillovers stemming from the main competitor’s patents, we divided the total technological knowledge flow into three sources: (i) technological knowledge flows from the main competitor, (ii) from other sources of technological knowledge, and (iii) internal knowledge flows. The knowledge flow between main competitors (spillovers) takes place when one of the two main firms captures relevant knowledge from the rival’s patents. Technological knowledge flows from other sources include knowledge from firms in the same sector (other than the main competitor), from other sectors, and knowledge from institutions (including universities). Finally, the internal knowledge flows are based on each firm’s past research. To link the knowledge from the main competitor to patent quality, it was assumed that backward patent citations capture the knowledge flows, as several validation studies have proved (Corsino et al., 2019; Jaffe et al., 2000; MacGarvie, 2005).Footnote 3 Backward citations are basically an indicator of the extent of reliance on previous technology (Jaffe & de Rassenfosse, 2017). The OECD Patent Statistic Manual (Zuniga et al., 2009, p. 109) defines backward patent citations as follows ‘If a patent B cites patent A, it means that patent A represents a piece of previously existing knowledge upon which patent B builds or to which patent B relates, and over which B cannot have a claim.’ Put simply, the logic behind backward citations for capturing knowledge flows relies on the idea that a patent refers to a piece of knowledge that has been useful in developing a patented invention. The interpretation of backward citations as an indicator of spillovers involves some difficulties. For example, applicants might include citations for different reasons, and many of the citations in patents are added by the examiner rather than the applicant. In these cases, the citations in patents might provide little information about the sources of knowledge (see discussions about the role of the examiner in Alcácer et al., 2009; Azagra-Caro & Tur, 2018). Therefore, it seems reasonable to exclude the citations added by examiners. Several validation studies have clarified the limitations of this measure in capturing knowledge flows (e.g., Roach & Cohen, 2013; Jaffe & de Rassenfosse, 2017; and Corsino et al., 2019). One of the main conclusions of these studies is that patent citations entail ‘noise’ as an indicator of knowledge flow, but they are simultaneously the most widely used measure of spillovers in the economics, management, and policy fields.

Assuming the above-mentioned limitations, the main independent variable in this analysis is:

-

Backward patent citations to the competitor (backcomp). Every patent filed by the focal company (recipient) that includes citations to patents held by its main rival (source) was considered an inter-organizational learning event in which the recipient learned and applied bits of knowledge from the competitor. As stated in our hypotheses, for technologies forming a duopoly between the two large firms, we expect a non-significant coefficient for this variable. However, it should be positive and significant for other patented technologies produced by each company outside the duopoly.

The two other sources of knowledge from which the firm can capture ideas to build patents of better quality are:

-

Other backward patent citations (backothers). As we divided patent citations into three types (from competitor, self-citations and others), it is necessary to account for these other patent citations that make up the total number of backward citations. These include citations to other companies, universities, and research centres, capturing the extent to which a patent relies on previous technological knowledge developed in patents owned by these agents. According to the recent review by Jaffe and de Rassenfosse (2017) the empirical literature is inconclusive; the authors provide several examples in which the extent to which backward citations correlate with patent importance is unclear.

-

Self-citations (backself). Every citation made by the focal firm was considered an intra-organizational learning event in which the firm applied bits of knowledge previously developed. These measure the extent to which the innovators benefit from their own innovations (Dindaroğlu, 2018). Self-citations are also a sign of competitive advantage in a specific technological field (Hall et al., 2005; Popp et al., 2013) and they are usually correlated with patent quality (Bessen, 2008; Popp et al., 2013).

3.2.2 Other determinant variables of patent quality

The type and number of patent quality determinants vary widely across studies. The inclusion of the explanatory factors in models depends on the objective of each empirical study and the availability of data. In this respect, we control for seven determinants of patent quality that were common in previous studies:

-

Scientific citations (npl). The antecedents of a patent include not only citations to other patents (backward citations), but also non-patent citations. Usually known as citation to non-patent literature, this variable encompasses scientific publications, other relevant scientific literature, and firm reports. The rationale for including scientific citations as a determinant of patent quality relies on capturing the complexity and science intensity of the current patent (Cassiman et al., 2008; Squicciarini et al., 2013; van Raan, 2017). The empirical literature draws mixed conclusions about the effect of npl on the number of forward patent citations. For example, the analysis at the patent level by Branstetter (2005) suggests that the incidence of citation of academic science is positively associated with measures of invention quality; in this same paper, he also stresses that citations to academic science are highly concentrated in a small number of technologies. Sorenson and Fleming (2004) found that patents that reference published material, whether peer-reviewed or not, receive more citations. In contrast, Gittelman and Kogut (2003) demonstrate for the biotechnology sector, which presents strong linkages between technological innovation and scientific knowledge, that important scientific papers are negatively associated with high-impact innovations. Cassiman et al. (2008) point out that scientific citations in patents do not significantly explain the forward citations of the patent, and that the linkage to science is more important at the firm level than at the patent level. In other papers, the significance of the coefficient depends on the sector. Harhoff et al., (2003a, 2003b) found a positive effect in pharmaceutical and chemical patents, but not in other technical fields. van Zeebroeck, and van Pottelsberghe (2011) carried out a sensitivity analysis using a large sample of patents and several sectors and countries. They report a positive and significant effect of npl on forward citations in 11 out of 14 industries (two non-significant and one negative), and in 11 out of 17 countries (six non-significant and one negative).

-

Originality (original). Patent originality refers to the breadth of the technology fields on which a patent relies (Squicciarini et al., 2013). In this paper, we use the originality index proposed by Trajtenberg et al. (1997), also detailed in Hall et al. (2001): \(Originality=1-{\sum }_{j}^{{n}_{i}}{s}_{ij}\), where sij is the share of citations made by patent i that belong to patent class j, out of ni patent classes. The index ranges between 0 and 1, and captures whether the patent cites other patents from a wide range of technology classes, or from only a selected group. A large ‘originality’ value (close to 1) indicates broader technological roots of the underlying research (Trajtenberg et al., 1997). In other words, a higher originality index implies that the patent in question is more original since it is not just a continuation of one or a few previous patents. Although it can be expected that more original patents receive on average more citations, this is not always the case. For example, Popp (2006) found that the higher the originality index, the fewer the number of forward citations, whereas Benson and Magee (2015) did not find any effect.Footnote 4

-

Radicalness. (radical). There are several definitions and measures of radicalness (see the review by Dahlin & Behrens, 2005). We follow Shane (2001), Squicciarini et al. (2013), and Egli et al., (2015) in identifying radicalness as an indication of the extent to which a patent relies on previous inventions from fields other than its own. A radical patent develops something new in its field (Shane, 2001; Egli et al., 2015, p. 3). We adopted a simplified version of an index proposed by Rosenkopf and Nerkar (2001) and Shane (2001), consisting of the number of different international patent classification (IPC) classes embedded in the cited patents that are different from those included in the focal patent. As in previous studies (Schoenmakersa and Duysters, 2010; Briggs & Buehler, 2018), radicalness was expected to be correlated with patents presenting a larger number of forward citations.

-

Scope of the patent (scope). The scope of the patent captures its technological breadth. Apparently, the larger the number of technologies embedded in a patent, the greater the opportunities to be cited. However, patent scope can be the response to a strategy designed to achieve the exclusion of competitors (Harhoff & Reitzig, 2004). This means that if the number of fields that a patent can cover is large, then the possibility of infringement rises, which may reduce the subsequent citations of the patent due to the risk of infringement. As in Lerner (1994) and Lanjouw and Schankerman (2004), we measured the scope using the number of distinct 4-digit IPC subclasses of a patent family. The effects of scope to explain patent quality are ambiguous in empirical analyses. Messeni Petruzzelli et al. (2015) found that patents with a broader scope exert a stronger influence (measured by forward patent citations) on the technological developments outside biotechnology. This result resembles other works that used different measures of patent quality. For example, Lerner (1994) showed that patents assigned to more four-digit IPC classes are related to the firm’s value. However, in Harhoff and Reitzig (2004) the coefficient of scope is non-significant in explaining opposition to biotechnology and pharmaceutical patents. Lanjouw and Schankerman (2004) found that the effect of the scope variable (number of different four-digit SIC codes) to explain litigation is negative (‘the narrower patents tend to be litigated more often’).

-

Number of claims (claims). Claims are the list of ‘inventive things’ for which the applicant is claiming exclusive rights. There are two main explanations for the positive correlation between the number of claims and quality. First, the number and content of the claims determine the breadth of the rights conferred by a patent (Lanjouw & Schankerman, 2004). Thus, the number of claims can be considered an alternative to the number of CIP codes to capture the scope of the patent (Marco et al., 2019; Novelli, 2015). There are however differences. Whereas the total number of claims corresponds to the number of variations in the core inventive ideas of the patent, the number of technological classes determines the position of the invention variations in the patent space (Novelli, 2015). The second reason to expect that patents with more claims are of better quality is the cost; the number of claims is one of the factors that determines the total cost of a patent (Zuniga et al., 2009). The number of claims is frequently correlated with patent quality and value (Chang et al., 2018; Gambardella et al., 2008; Moaniba et al., 2018).

-

Number of inventors (inventors). This is a rough variable that may increase both the cost of an invention and the richness of the knowledge involved in the patent, and the access to a wider and more heterogeneous external network (Guellec and van Pottelsberghe, 2001; Singh, 2008; Lee et al., 2007; Sun et al., 2020). Some papers confirm that the number of inventors is positively associated with patent quality when the sample is composed mostly of corporate patents (Guellec and van Pottelsberghe, 2001; Singh, 2008), whereas the coefficient is found to be negative or not significant for academic patents (Sapsalis and van Pottelsberghe, 2007; Sterzi, 2013). As our analysis involves corporate patents, we expect a significant and positive sign for the coefficient of this variable.

-

Family size (fsize). This variable accounts for the number of jurisdictions in which the inventor looks to protect a single invention. Applicants might be willing to accept the additional costs of and delays in extending protection to other countries only if it is worthwhile (Harhoff et al., 2003b; Squicciarini et al., 2013). If applying for protection in each country is costly, the family size should be directly related to the expected value of protecting an innovation (Lanjouw & Schankerman, 2004; de Rassenfosse and Jaffe, 2017). Lanjouw and Schankerman (2004) find that the patent family size is highly and positively correlated with patent quality. Other empirical papers confirm the relationship between family size and patent value (Fischer & Leidinger, 2014; Harhoff et al., 2003b).

3.2.3 Control variables

-

The number of patents included in the family at the United States Patent and Trademark Office (USPTO) (uspto). We include this variable as control because of the localized pattern of citations. In other words, forward citations are more likely to be domestic (e.g. Jaffe et al., 1993). This means that patents applied for at the USPTO have more chance of being cited by subsequent US applicants than by others. This would not be a problem if both EPO and USPTO offices had the same citations policy. However, US patent law stipulates that failures to report known relevant prior art may lead to subsequent revocation of the patent (Cotropia et al., 2013; Jaffe & de Rassenfosse, 2017), which is an incentive to include more citations. This does not happen, for example, at the EPO, where applicants face no ‘duty of candour’ similar to that in the US, leading to a lower number of citations at the EPO (Alcácer et al., 2009; Azagra-Caro & Tur, 2018; Azagra-Caro et al., 2011; Criscuolo & Verspagen, 2008).

-

Finally, the model also accounts for patent fields and time. The fields are captured by ten dummies, each taking the value of 1 if the family includes any of the three-digit codes of the aerospace industry, and 0 otherwise (the IPC codes are those defined by the OECD, 2012, p. 82, as space-based technologies; see the bottom of Table 1). To avoid a truncation problem our dependent variable is the number of subsequent citations in a 5-year span. Moreover, we have included year dummies (from 1998 to 2014).

3.3 Model

To specify and estimate the model, both the count nature of the dependent variable, and the number of zeros that it might contain have to be considered. A Poisson specification is often the starting point for modelling a count variable following the non-linear form:

where ‘i’ is our unit of analysis (patent family). If the data display overdispersion, the standard error of the Poisson model will be biased toward the lower end, resulting in spuriously high values of the t-statistic (Cameron & Trivedi, 1986). The most common formulation for considering overdispersion is the negative binomial (NB) model, as it assumes that the variance is a quadratic function of the mean (for a comprehensive discussion of the estimation procedure, see Cameron & Trivedi, 1998). The proposal of the density function, the logarithmic likelihood function and the first-order conditions, etc., are discussed comprehensively in Cameron and Trivedi (1998). Alternatives when the sample contains many zeros are zero-inflated models (zero-inflated Poisson [ZIP], Lambert, 1992; and zero-inflated negative binomial [ZINB], Heilbron, 1994). In these cases, the zero-inflated distribution can be interpreted as a finite mixture with a distribution whose mass is concentrated at zero. This model contains two sources of overdispersion, one that allows several extra zeros, and another that introduces the individual heterogeneity of the set with positive values. As there are no clear theoretical reasons to think of a mixture of distributions in our data, we have opted to estimate Poisson and NB models. We use zero-inflated models as a robustness check to analyse the sensitivity of the estimated coefficients in other specifications.

4 Data

4.1 Data and sources

Our hypotheses are tested by drawing on a sample of patents owned by the two large firms –Airbus and Boeing– that matches the setup of our assumptions. Airbus SE is a European public company based in Amsterdam, the Netherlands. It is listed in France, Germany and Spain. As there have been several integration and normalization steps in the last few years, following the latest Airbus report (2018), we refer only to Airbus, which includes the company along with its subsidiaries. Airbus has three divisions: Commercial Aircraft, Defence and Space, and Helicopters, the third being the largest in its industry in terms of revenues and turbine helicopter deliveries. The Boeing Company is an American multinational corporation. It has two large divisions: Boeing Commercial Airplanes and Boeing Defense, Space and Security. In 1997 McDonnell Douglas was acquired by Boeing, leaving only Boeing and Airbus to manufacture the largest commercial airplanes, resulting in one of the few global duopolies. As part of the aerospace sector, the aircraft industry is highly concentrated at both the firm and country levels, where there is a duopoly for the major segments of the market. Both firms also produce a variety of technology products, mainly in other fields of the aerospace industry, where there are many competitors.

Our data include information about patent families owned by Airbus and Boeing from 1998 to 2014. We took 1998 as the first year of the sample because the duopoly in the aircraft industry started in this year. The sample ends in 2014 because of the decline in the number of patents afterwards.Footnote 5 We obtained information on patent data using the EPO Worldwide Patent Statistical Database (PATSTAT). The search in PATSTAT was the name of the applicant. There were few problems with Boeing, as almost all its patents contain the harmonized name ‘Boeing Company’. However, Airbus has a substantial number of subsidiaries that applied for patents, and many of them do not have the name of the parent company ‘Airbus’ in their name (e.g. MBDA, ArianeGroup, Premium Aerotec GmbH, Stelia Aerospace, ATR GIE). Thus, the first step was to gather all the names and follow their transformation since the beginning of the sample. The subsidiaries’ names were mainly taken from Airbus annual reports.

To ensure that the patent has a certain quality standard, we retrieved the most important and valuable inventions for both companies, following the criterion of patents applied for at least at USPTO and EPO. In this period, Airbus and Boeing owned 4386 and 3364 patent families, respectively (patent information shows that there is not any joint patent applied for by both companies). Following the OECD (2012), patents were classified in technological fields (patent classes) in two differentiated technological markets. The first consists of family patents that include IPC codes where the two companies have a dominant position in the production of technology. These IPC classes are B64C1, B64C3 and B64C9 (special technologies related to the aircraft technologies), where they account for 58.6%, 61.7% and 64.4% of the world patent families, respectively (Table 2). The second group considers other technologies in which the global number of family patents is shared with many other companies. In this group, Airbus and Boeing do not have a dominant position, and they own up to 20.6% of global patents in technologies of the B64 class (excluding B64C1, B64C3 and B64C9). This share is considerably less in other classes such as signalling and weapons, where they make up around 2% (Table 2).

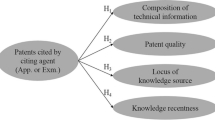

To account for time, family patents were sorted by the priority year (when the first application for the family was filed). Finally, we tracked the forward and the backward-cited patents (excluding citations made by examiners), which allowed us to identify knowledge inflows from the main competitor (citations to the competitor), from other external sources, and the internal knowledge from the company itself (self-citations). Figure 1 includes a patent from our sample classified into several B64 subclasses (aircraft, aviation). The left part of the figure shows all backward citations, which are divided into three parts depending on the source of knowledge. According to the hypotheses put forward in the previous section, our main analysis focuses on whether citations to competitors (in the left part of the figure) affect the number of citations of this patent in subsequent patents (right part of the figure).

4.2 The long-term technological relationship between Airbus and Boeing

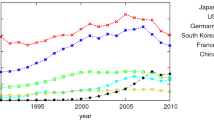

Figure 2 presents the evolution in the number of patents owned by Airbus and Boeing from 1991 to 2014. This figure shows that during the first years, Boeing exhibited a larger number of inventions than Airbus. After the start of the duopoly, both companies increased their patenting output. Nevertheless, since 1998, the data show an improvement in Airbus’s patenting activity: this firm remained leader in the number of patent families per year until 2011. In the following years, Boeing intensified its innovation activity, thus surpassing Airbus (the rest of the analysis focuses on the years after the duopoly, the period 1998–2014).

Table 2 provides more insights into the subclass distribution within the B64 class in which the duopoly holds. The data show that Airbus leads Boeing in the share of patents in all subclasses within B64C, ranging from 58.6% in ‘Fuselages’ to 64.4% in ‘Adjustable control surfaces’. With respect to technologies in which Airbus and Boeing do not dominate, Airbus holds a much larger share of patents in ‘Aircraft, aviation and cosmonautics’ (68% vs 32%). However, Boeing outperforms Airbus in patenting activity in other sectors, with particular superiority in H04 ‘Electronic communication technique’ (61.7% patent families of Boeing vs 38.3% of Airbus) and H01 ‘Basic electric elements’ sector (57.6% patents families by Boeing vs 42.4% of Airbus).

Table 3 presents the data on forward citations for both companies (indicator of quality). On average, patents owned by Boeing received a higher number of citations per patent family than Airbus (1.8 vs 1.0). The upper part of this Table provides a more detailed analysis of forward citations of the subclasses within the sector B64, in which both companies enjoy a dominant position in the production of patented technology. In all these subclasses we observe a higher average of forward citations of Boeing’s patents compared to Airbus’s patents, suggesting Boeing’s patents are of a higher quality. Differences remain across other IPC codes, particularly in ‘Measuring. Testing’ (2.2 average citations per patent for Boeing vs. 0.9 for Airbus) and ‘Signalling’ (2.7 average citations per patent for Boeing vs. 1.1 for Airbus).

Table 4 lists the backward citations of both companies divided into backward citations to the competitor, self-citations and backward citations to others. Three main observations can be drawn from the descriptive data of backward citations. First, the number of citations that each company made to the competitor is relatively small compared to the total backward citations (3% in Airbus’s patents and 1.6% in Boeing’s patents). Second, the relative percentage of citations to the competitor (with respect to the total number of backward citations) is larger in the technologies that make up the duopoly compared with other technologies. Third, Airbus cites more patents of Boeing than Boeing of Airbus (both in absolute and relative terms). This is surprising because the absolute number of Boeing citations is 54% more than those included in Airbus’s patents. Columns (3) and (4) show the number of self-citations of each company and citations to other institutions (for all technologies, around 9% of all backward citations are self-citations, whereas the greatest part are citations to other agents).

5 Results

5.1 Main estimation results

Our dependent variable (patent quality) is the number of forward citations received by each patent family in the five years following the publication of the first application. Table 5 presents the descriptive statistics and the correlation matrix for the dependent and all the explanatory variables. The number of forward citations in each patent ranges between 0 and 42. The average number of forward citations is 1.38, with a standard deviation of 2.53. This is rough evidence of overdispersion that would favour the NB specifications rather than Poisson models.

We estimated Poisson and NB models with all the independent variables described in Sect. 3.2 (summarized in Table 1). The models also account for the office where the patent family was first applied for, technological classes and year dummies. To control for the difference in forward citations between the two companies, we included the dummy variable boeing, which takes value 1 if the patent was applied for by Boeing, and 0 if the patent was applied for by Airbus. To select the best models between Poisson and NB, a likelihood ratio (LR) test of the overdispersion parameter α was performed (see LR chi2 in Table 6). The null hypothesis α = 0 is rejected, providing evidence that the NB models are preferred over Poisson. Thus, we focus on the NB models displayed in Table 6. Models 1 and 2 were estimated with samples in which Airbus and Boeing held a dominant position in the production of technology (those including three patent subclasses in the fields of aircraft and aviation, in which the two companies account for most of the global patents). Models 3 and 4 show the estimations for patented technologies developed by the two companies in fields where there is no such dominance. Models 1 and 3 in Table 6 are the main models to test our two hypotheses. Models 2 and 4 (with interaction terms) in the same Table are used to further analyse different behaviour between the two focal companies.

The first hypothesis stated that in a global duopoly where the focal firms are in a dominant position in technology production, external knowledge embodied in patents released by one of the firms (source), and captured by the other (recipient), does not affect the quality of the recipient’s patented technologies. The key variable to test this hypothesis is backcomp (no. of citations to the competitor). The coefficient of this variable is non-significant in the NB Model 1, providing support to Hypothesis 1. This result suggests that, in a global duopoly, capturing bits of knowledge from the competitor (source) through patent citations would not affect the quality of the technology patented by the recipient.

Hypothesis 2 predicts that, while the firms in the global duopoly with dominant position in the production of specific technologies take considerable precautions in releasing useful knowledge, they would not be so cautious when such dominance does not exist. In other words, there are other companies producing similar technologies, and the technological proximity between the two large companies is not as narrow as in the first case. As explained in Sect. 2.2, the reason for not avoiding the leakage of technological knowledge is simply that the benefits that the firms might obtain by diffusing relevant information to their many competitors may outweigh for the drawbacks. Model 3 shows the estimation results for the factors affecting patent quality in such a situation of non-dominance by the focal firms. Again, the variable backcomp is essential to testing this hypothesis. This variable presents a highly significant coefficient, suggesting that the citation to the main competitor affects the quality of the competitor’s patents. The average marginal effect over backcomp shows that an extra citation to the competitor is associated, on average, with a 0.17 increase in the number of forward citations, setting the other variables at their means. Furthermore, the marginal effect increases according to the number of backward citations to the competitor, ranging from an increase of 0.1 extra forward citation for those patents with just one citation to the competitor to 0.20 forward citations for those with 7 and more citations to the competitor.

Models 2 and 4 are helpful in adding a further discussion about the differences between the two focal companies. In these models we have introduced interaction terms between the regressors and the dummy boeing. In total, the models rely on a set of 48 explanatory variables. Note that we include the three variables in which we broke up backward citations (to competitors, to others, and self-citations), seven traditional determinants on patent quality, the dummy boeing and 12 interaction terms to capture the difference between Boeing and Airbus, and 25 control variables (one dummy to control the US Patent Office, 10 to account for the IPC classes and 14-year dummies).

Given the large number of explanatory variables, one main concern about the reliability of our results arises from the variables that may be correlated between them and—in particular—with our target variable backcomp (citations to the main competitor). However, this variable presents acceptable variation inflation factor (VIF) statistics of 3.05 and 3.24 for the interaction between backcomp and the dummy boeing (values exceeding 5 or 10 are frequently used as indication of problematic multicollinearity). Thus, the VIF of our key variable suggests that multicollinearity is not a concern for the stability of its estimated coefficient. Other regressors (in particular year dummies) present higher VIF values, but this is not an issue since the high VIFs of other variables do not affect the variance of our target variable (see discussion in Allison, 1999). To further identify the consequences of multicollinearity on the main (and other) variables, Models 2 and 4 with the interaction terms can be compared with Models 1 and 3 without interactions. Note that there are no changes in the signs and significance of the main determinants of patent quality with the only exception the coefficient of the variable radical, which maintains a positive sign, but turns significant in Model 4 with respect to Model 3 (without interactions).

The interaction term between Boeing and citation to the competitor (boeing*backcomp) is not significant in Model 2, supporting the result obtained in Model 1 about Hypothesis 1. However, the significant coefficient of the interaction term boeing*backcomp in Model 4 shows that there is a clear difference in the effects of competitor’s citations between Airbus and Boeing. As the effect on Boeing is given by the sum of backcomp and boeing*backcomp, a linear restriction test needs to be performed to identify whether ‘the sum of both coefficients equal zero’ is statistically significant. The result shows that this hypothesis was not rejected (χ2 = 0.02, p = 0.88); in other words, the effect of the competitor’s citations is not relevant in explaining Boeing’s patent quality. This mixed result between a significant effect for Airbus, and no effect in the case of Boeing, suggests that only one of the two large firms (Airbus) harnesses the competitor’s ideas.

5.2 Robustness check

The previous results are based on the estimation of NB models. In this section, we examine how robust the results are to other specifications. Since the number of zeros in the sample was 49.5% (dominant position in the production of technology) and 53.7% (non-dominant position), we estimated zero-inflated Poisson models (ZIP), and zero inflated negative binomial models (ZINB). Table 7 presents the results of ZINB models (according to the Likelihood-ratio tests of alpha = 0, these models are preferred to the ZIP; see LR chi2 in Table 7).

Testing our hypothesis from the results of the ZINB models led to the same conclusions as those obtained from the main models shown in Table 6. In regressions estimated with the dominant-position sample, the variable backcomp (no. of citations to the competitor) is non-significant in Models 5 and 6 (this later model includes the set of interactions, where the interaction between backcomp and boeing is not significant either). These results corroborate the findings of our main models. As for the sample including other technologies in which Airbus and Boeing do not dominate, Table 7 (Models 7 and 8) shows the same results as our main NB models. In other words, only one of the firms takes advantage of the main competitor’s patents.

Further robustness checks were performed by using other versions of the dependent variable. Following the main literature, we have taken a 5-year window (counting the forward citations 5 years after the first publication of the focal patent) as dependent variable in the above estimated models. However, some authors have established a shorter span of three years (e.g., Briggs, 2015; Briggs & Wade, 2014). To analyse whether our hypotheses hold compared to the main models, we have run the NB regressions using the number of citations at three years after the first publication of the patent. The results show some changes in the coefficients, but not in the significance of our main variables.Footnote 6

6 Discussion

Our models provide evidence in favour of Hypothesis 1, that in a global duopoly where two large firms make up the majority of all global patents, there are no leaks of crucial knowledge from which the competitor may benefit to improve their patents. With respect to Hypothesis 2, our results also support the prediction that when the focal firms do not have a dominant position in technology production, spillovers arising from disclosing information in patents owned by one of the two firms positively affect the patent quality of the other. Regarding this later scenario, additional analysis reveals that only one of the two firms benefits from the main competitor’s knowledge when the production of technology is shared by many firms. These outcomes were robust to several specifications and other ways of counting the number of forward citations (using a 3-year instead of a 5-year window).

From a management viewpoint, our results are useful for firms concerned by leakages of knowledge through patent disclosure to a rival. In the first setting of the global duopoly (dominance of the focal firms in the production of technology) our findings indicate that the two firms fully appropriate all their R&D investment. In other words, the knowledge leakages in a situation of duopolistic competition with a dominant position in production of technology are intentional and without value for the rival. Each firm purposely discloses some knowledge in their patents that can support the background of the main competitor’s patents, but without any effect in terms of increasing the quality of the latter’s patents. This symmetric result suggests that both firms behave in a similar manner, preventing the other from obtaining a free ride on ideas embedded in the main competitor’s patents.

The finding of our first hypothesis connects with the theoretical literature triggered by d’Aspremont and Jacquemin (1988) showing that R&D investment and welfare are higher under R&D cooperation than under R&D competition if the spillovers are above a certain threshold, and lower otherwise (see also subsequent papers such as Suetens, 2005, and Cellini & Lambertini, 2009). If we rely on these models, the confirmation of the first hypothesis suggests that the opportunities for collaboration between the two firms in a global duopoly—e.g. Airbus and Boeing—are low, and the spillovers are extremely small (useless for the competitor wishing to produce quality patents). The full appropriability has a negative consequence for the whole industry as the lack of cooperation, and the low level of spillovers, lead to some duplication and prevent both from using competitor spillovers that would contribute to improving patent quality. This discussion suggests that despite spillovers being low, any form of collaboration should be encouraged through the initiative of the companies, and should also be spurred by governments. First, companies could save on R&D, and second, with the active encouragement of the government, benefits in terms of increasing patent quality in the whole industry could be achieved. In this respect, several papers have shown that collaborative patents would not only bring advantages to the sector, but could have a significant impact on subsequent technologies and firm value (Belderbos et al., 2014; Briggs & Wade, 2014; Singh, 2008; Singh & Fleming, 2010). Thus, a direct implication of the confirmation of our first hypothesis is that a movement towards a more proactive means of cooperation between the two large companies should be encouraged in order to strengthen the patent quality of both firms, with positive consequences for the whole sector. This does not mean evolving towards a greater concentration of the market, but rather working together to create new inventions in which there are common interests, particularly in technological fields with widespread social returns (environmentally friendly technologies would be a clear example).

Finally, the control by the two companies over the information that flows out into the pool of publicly available disclosed information in patents also has implications for the patent system. In particular, the difficulty in harnessing disclosed technological knowledge in patents from each competitor in a global duopoly casts some doubt on one of the main objectives of the patent system, which is facilitating follow on inventions and avoiding duplication of R&D efforts. This difficulty suggests that more emphasis should be put on the patent examination procedure when a patent is applied for by firms in global duopolies.

In the second scenario represented by Hypothesis 2, the strain between the two companies is reduced, and their contribution in the production of patent is less significant. Our main empirical results show that in this case of a non-dominant position of the focal firms in the production of technology, spillovers from the competitors affect patent quality. However, additional analysis suggests that only one of the two firms—Airbus—benefits from the rival’s knowledge to improve patent quality. Our intuition is that in fields where the two firms have a moderate level of participation in the generation of patents, the fact that only one company takes advantage of the competitor’s knowledge has to do with the size of the patented inventions. Using the number of claims as a rough indicator of patent size, we observe that Boeing presents 17.3 claims on average, with a maximum of 132, compared to 12.0, and a maximum of 65 for Airbus. Theoretical models support this idea of scarce spillovers from smaller patents. For example, according to the seminal model by Anton and Yao (2004), inventions of smaller size are less prone to spillovers than larger ones. Nevertheless, the fact that spurring patent quality from spillovers embedded in large inventions could be more effective than from small inventions requires further analysis that is worth exploring (and is left for future research).

As for the other variables that we use as determinants of patent quality, there are no surprising results with respect to previous literature. We discuss our main findings in the following paragraphs.

Backward self-citations (backself) affect the quality of patented technology because of the accumulation of knowledge along the inventive path. This holds independently of the level of competition in the technology market. The main regressions (Models 1 and 3) present a positive and highly significant coefficient for this variable, providing strong support for the idea that the more intensive the use of internal knowledge embodied in previous patents captured by backward self-citations, the higher the quality of the patent. Further analysis presented in models with the interaction terms (Models 2 and 4) that identify a possible difference in behaviour for each company, shows a negative significant coefficient of the interaction term boeing*backself in Model 4. As the effect on Boeing is given by the sum of the coefficients of backself and boeing*backself, a linear restriction test needs to be performed to identify whether ‘the sum of both coefficients equals zero’ is statistically significant. The result shows a Chi-squared = 11.79 (p = 0.0006). Thus, the effect of self-citation on patent quality is greater in Airbus (0.196) than in Boeing (0.196–0.136), but positive and significant in both cases. Results of a similar nature concerning the effects of self-citations on patent quality were found by Bessen (2008) and Popp et al. (2013).

The coefficient of the variable patent citations to other agents (backothers) is not significant in any model. Previous studies do not clarify this lack of significance. As indicated above, the review by Jaffe and de Rassenfosse (2017) includes references with mixed findings that do not shed light on the extent to which backward citations correlate with patent quality. Backward citations gather patents from a variety of entities. Thus, our intuition is that breaking down this variable according to the type of source of the backward citation may provide a clearer picture of what type of knowledge source (if any) has a positive impact on patent quality.

The variable capturing non-patent literature (npl) is not significant in our main models. As pointed out by Branstetter (2005) citations to science concentrate on few technological fields. A positive significance seems to be related to fields with strong reliance on science such as pharmaceuticals, chemistry and biotechnology (Arts et al., 2013; Harhoff et al., 2003b). Thus, the lack of significance of the coefficient of npl in our models is not surprising in a sector such as aircraft, which is more grounded in technology than in science.

The index of originality (original), is not relevant in any model, suggesting, as in Benson and Magee (2015), that those patents with broader knowledge incorporated through backward citations are not necessarily the most cited. The scope variable points in the same direction with a non-significant effect, implying that the number of technologies in patents (measured by the number of IPC codes) is not correlated with the number of forward technologies in the aircraft sector. A similar finding was obtained by Messeni Petruzzelli et al. (2015). The variable claims is relevant in almost all models, indicating—as in other papers (Chang et al., 2018; Gambardella et al., 2008; Moaniba et al., 2018)—a significant relationship between the number of claims and quality.

We did not find strong evidence for the effect of an invention radicalness (radical) on patent quality. Only in one of the models estimated with patent classes in which there is not dominance in the production of technology was this variable relevant (and just for one of the focal firms). To our knowledge, only two related studies have identified a relationship between radicalness (with indexes based on patent information) and quality (measured by forward citations), but in a rather different context to that studied in this paper. The first by Schoenmakers and Duysters (2010) found a significant difference between the number of technology classifications embodied in backward citations between patents that received less than 20 forward citations in a five-year time period, and those that received more than that figure. This paper points to the fact that patents with a stronger reliance on recombination of previous knowledge (as an indicator of radicalness) have an greater probability of being cited. The second by Briggs and Buehler (2018) use a large sample of more than five million patents and citations from 1976 to 2017. Estimating several specifications, their findings show that radicalness affects forward citations in an inverted-U shape.

The number of inventors (inventors) is statistically significant in all models. This finding points to the fact that an increase in the number of inventors significantly affects patent quality, in line with other studies on corporate patents such as Sapsalis et al. (2006), Guellec and van Pottelsberghe (2000, 2002), and Singh (2008). These empirical papers suggest that larger teams are associated with strategic research projects with high expected profits, and consequently higher quality. Finally, empirical papers confirm the relationship between family size and patent value (as in, for example, Fischer & Leidinger, 2014; Harhoff et al., 2003b). However, in our models the size of the patent family (fsize) is relevant only in technologies with dominant position of the focal firms. A plausible explanation is that a larger number of patents in a family relates to quality, but only in technological fields that need more protection because leakages of knowledge can be more damaging for the applicant than in other fields with less competitive strain.

7 Conclusions

Spillovers occur through a variety of channels such as publications, patents, technical meetings, conversations with employees of innovating firms, hiring of employees by innovative firms, and reverse engineering. This paper contributes to the literature on spillovers and patent quality by investigating whether disclosed patent information affects patent quality in the context of a global duopoly. To capture spillovers from the main competitor we divided the sources of inflows of knowledge used to produce quality patents into three parts: knowledge from the main competitor, the firm’s own knowledge, and other sources of knowledge. Two main hypotheses were posed. Both related to the role of the external knowledge from the competitor on patent quality in two different scenarios. The first considered a situation in which the two firms dominate the production of patents in specific technological fields. The second examined a scenario with a larger number of firms producing patents, and with considerably lower participation of the two focal firms that form a duopoly (where they do not account for the majority of patents). Our empirical analysis focused on the case of Airbus and Boeing; two large firms that compete in a global duopoly. The two firms—Airbus and Boeing—compete with each other in producing specific patented technologies with a clear dominance in some specific technologies within the aircraft industry. At the same time, they are also involved in producing patents in other fields with more competitors where they do not hold a dominant position. The analysis, built on a sample of 7750 patent families and the estimation of several count models, leads to the conclusions presented in the following paragraphs.

First, the results provide evidence supporting Hypothesis 1. This hypothesis states that the knowledge that each firm captures through patent citations from the main competitor does not affect their patent quality in a global duopoly where the two firms globally dominate the production of patented technology. This finding suggests that the knowledge that one of the firms in the duopoly releases to the competitor when it discloses information in patents is irrelevant in producing patents of better quality. In other words, both firms disclose some knowledge in their patents, but this knowledge is without value to the competitor for increasing patent quality.

Second, when two focal firms do not have a dominant position in producing patented technologies, citations to the main competitor affect patent quality, which supports Hypothesis 2. However, in this latter scenario, further analysis suggests an asymmetric result: one of the firms—Airbus—benefits from the competitor’s patents, whereas the other—Boeing—does not harness the competitor’s knowledge to increase patent quality.

Our findings provide some directions for further empirical research that could widen our knowledge of the effects of spillovers from patent disclosure on patent quality. The first area of interest is whether the use of deliberately blurred written language in patents hampers the efficient use of incoming spillovers to produce patents of better quality. Several strands of literature have developed the notion that firms attempt to manage incoming information flows both by increasing their absorptive capacity and by engaging in some form of cooperation. In our context, however, given that the two firms do not cooperate in producing patents, and that both firms are leaders in the industry with enough absorptive capacity (both invest heavily in R&D), our intuition is that the language in patents is sufficiently confusing to deliberately prevent leakages of knowledge without infringement.

The second area of research involves examining whether incoming spillovers from large patented inventions are more conducive to patent quality than spillovers stemming from small inventions. This analysis requires reliable indicators that go beyond simple approximations of patent size such as the number of claims and patents in a family. The theoretical model by Anton and Yao (2004) (see also a discussion in Hall et al., 2014), suggests that for small patented innovations which are fully disclosed, no imitation occurs. It may be relevant to identify what size of patents are more conducive to spillovers that enhance patent quality. This could help both companies and the whole patent system. Companies could benefit from identifying what types of inventions are less damaging in terms of leakages of knowledge. The patent system could identify if there are failures in the system in terms of its objective of facilitating follow-on innovations through patent disclosure according to the size of the patented inventions.

Notes