Abstract

In this paper we first propose a proxy for early stage activity in a country’s exports based on product life cycle theory. Employing a conditional latent class model, we then examine the relationship between this measure and economic growth for 93 countries during the period 1988–2005. We find that the impact of early stage activity differs across three clusters of countries. And we find that GDP levels can predict the cluster and the sign of the coefficient in a non-linear manner. In the richest countries, exporting products that are in an early stage of their product life cycle is associated with higher growth rates. In contrast, we find a cluster of middle income countries with high growth rates that grow faster by exporting more mature products that are in the later stages of their life cycle. Finally, early stage activity has no significant impact on growth in the cluster of the poorest, developing countries. Countries in early stages of development should focus on acquiring market share in mature markets with routine technologies whereas emerging economies face the challenge of at some point switching from copying mature to inventing new products as they approach the global technology frontier. At that frontier they must join the advanced economies who specialise in early stage innovative products to stay ahead of increasing competition from abroad.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ever since Adam Smith linked specialisation and trade to the wealth of nations, trade and competitiveness in international markets has been considered a key driver for development and national well being. For that reason trade has been subject of intense academic and policy interest. Using strategic trade- and industrial policies governments across the world try to push their countries up in the league of nations. It has been found that specialising in the “right” products and markets helps countries move ahead, whereas a focus on the “wrong” export bundle can keep a nation trapped in poverty (e.g. Redding 2002; Bensidoun et al. 2002; Hausmann et al. 2007). But despite the fact that much of the academic literature on this topic stresses the dynamic nature of comparative advantage, to date it fails to consider that “right” and “wrong” are not absolutes. In this paper we argue that the “right” products in emerging countries may well be different from the “right” products in advanced economies. Moreover, the bundle of “right” and “wrong” products will change over time as products mature over their life cycle. It makes quite a difference if you, for example, specialise in video cassette recorders (VCRs) in the early 1980s or in the late 2000s. And it matters a lot also if you do so when you are an emerging economy starting to industrialise or when you are an advanced country at the global technology frontier.

Taking a more dynamic approach to specialisation will go a long way in explaining some of the most salient features of global economic development in recent decades. This point is illustrated using Fig. 1a. It shows that growth in the OECD countries was depressed in the early 90s and 00s and has not reached more than 4% since 1988. The Newly Industrialising Countries (NIC) by contrast show a period of volatile and relatively low growth in the mid 90s and a strong recovery after 2000 with (average) growth rates reaching 7%. Over this period, we also know the NICs, and most notably China, have integrated in global markets and increased their volume and share in global trade (OECD 2005). These developments can be linked to the dynamics in the global pattern of specialisation in general and the composition of exports over product life cycle stages in particular (Audretsch and Sanders 2007). Figure 1b shows how OECD countries have indeed maintained a comparative advantage in young, less mature products, whereas emerging economies rapidly closed the gap over the early 90s but NICs remain specialised in more mature markets, increasingly so since 2000. But the figure does not tell an unambiguous story and the challenge is to find an adequate measure of life cycle maturity at the product level.

The purpose of this paper is to propose such a measure for product maturity and using that measure to investigate the heterogeneous relationships between export maturity and economic growth across a wide range of developing and developed countries. In doing so we make two contributions to the literature.

The first contribution lies in our index that captures the average maturity of a country’s export mix. To date the lack of such a measure has prevented scholars from analysing comparative advantage and specialization patterns over product life cycle stages in global trade. To enable such an analysis, we introduce a product-specific maturity measure using a well established empirical regularity over the product life cycle (e.g. Hirsch 1967; Vernon 1966; Klepper 1996). Over the typical life cycle total sales in the relevant market first increase at an increasing rate, then at a decreasing rate and finally decline. Following Hirsch (1967), Audretsch (1987) and Bos et al. (2013), we therefore proxy for the life cycle stage of a product by the first (growth) and second (growth in growth) moment in its global total export volume. We then calculate an aggregate maturity measure for a country’s export bundle by weighing the product maturity by the shares of these products in a country’s export mix. With this proxy, we are thus able to explore whether and how the maturity of a country’s export bundle matters for its economic performance. Our new measure allows us to build on an older literature that links the product life cycle to trade and growth.Footnote 1

The second contribution of this paper is to employ a conditional latent class model to estimate our growth regression. To the best of our knowledge, this approach is quite new to the trade and growth literature and it brings several advantages over more standard econometric techniques. First, instead of ex ante assuming the number of countries in various growth regimes and then using the data to verify that assumption, we turn the procedure around and let the data tell us how many different regimes best fit our data. All we need to assume in this model is that growth may depend on export maturity and other, more conventional growth determinants. We then show that the level of development, proxied by GDP per capita, has explanatory power predicting in which of the endogenously determined regimes our countries fall. Second, the latent class model allows for parameter heterogeneity. Addressing heterogeneity has become one of the most debated issues in the growth literature (Temple 1999; Durlauf et al. 2005) and in light of this issue, conventional empirical approaches have often been deemed unsatisfactory.Footnote 2 In short, our modelling approach enables us to avoid the pitfalls of imposing a common relationship between export maturity and growth for all countries but yields results that are comparable across countries and time. Our approach is closely related to recent studies that apply conditional latent class (or finite mixture) models to examine the the heterogeneity of growth and convergence patterns across countries.Footnote 3

In our study we apply our method to Statistics Canada’s version of the UN-COMTRADE database that contains the export data on 427 Standard International Trade Classification (SITC) four-digit products for 93 countries over the period 1988–2005. This database gives us the opportunity to zoom in on relatively narrowly defined groups of products and generalise trade patterns across more countries than most studies to date. We thus propose a simple measure of product maturity in the global market and then link the overall average maturity of a country’s export portfolio to their economic growth performance.

Our results are easy to summarise. We find that developed countries (with high GDP per capita) are exporting products in the early stages of their (global) life cycle, whereas the opposite is true for developing countries. In addition, we find evidence for the existence of three quite distinct growth regimes. For the advanced countries’ regime, exporting new and innovate products is associated with higher economic growth, whereas this relationship is insignificant for the developing countries’ (lowest GDP per capita) regime. In stark contrast, we identify an emerging countries’ regime where exporting more mature products appears to be associated with more rapid growth. These findings have important implications for trade and economic development theory and policies. Notably, our results suggests we can look at specialization and dynamic comparative advantage as an advantage in exporting goods and services in a given stage of the life cycle. Advanced economies do not have a comparative advantage in computers or machinery, but in early stage products. Likewise, emerging economies have a comparative advantage in mature products. The early stage products of a decade ago, however, are today’s mature products. And product classes (i.e. telephones) can be rejuvenated through innovation. Taking such an approach to economic development has clear implications for policy. Advanced economies should focus their efforts and resources on shifting out the global technology frontier, whereas emerging economies will prosper by capturing existing, mature markets.

The remainder of the paper proceeds as follows. First we position our paper in the relevant literatures on trade and growth in Sect. 2. In Sect. 3 we present a stylised model of trade and product life cycles to derive our key hypothesis. Note that this paper does not aim to make a theoretical contribution and the model is merely presented to provide a framework in which to interpret our empirical results. In Sect. 4, we develop our maturity proxy and discuss our data and estimation strategies. The empirical results are then presented in Sect. 5. And Sect. 6 discusses the implications of our paper and concludes.

2 Literature review

Our paper builds on recent advances in two long traditions in the literature. The first strand, pioneered by Vernon (1966), applies stylised life cycle models to explain the shift of dynamic comparative advantages and the evolvement of trade patterns over time (Hirsch 1967; Krugman 1979; Jensen and Thursby 1986; Kellman and Landau 1984; Dollar 1986; Flam and Helpman 1987; Grossman and Helpman 1991; Lai 1995). An important prediction in this line of literature is that developing countries will increasingly compete in those products that reach the later stages of the product life cycle, implying that the advanced economies must “run to stand still” (Krugman 1979). A steady flow of new product innovations is necessary to maintain international income differentials. In these models the assumed relative abundance of cheap, unskilled labour in the less developed South is the source of a dynamic comparative advantage in copying mature products and technologies from the more advanced North. If, in such a context, globalisation and trade integration imply that populous developing economies enter global market competition, then advanced economies experience a shift of their comparative advantage towards products that are in the earliest stages of the product life cycle (see e.g. Lai 1995; Audretsch and Sanders 2007).

The second strand of literature relevant to our work extensively documents the effect of trade, and more specifically exports, on economic growth. The vast bulk of the early empirical literature asks: “Do Exports Matter?”.Footnote 4 Most of these studies include either a measure of export (growth) or trade openness in a standard regression framework covering a wide range of countries, time periods and using a variety of estimation techniques. Consistent with the difficulties in establishing robust empirical evidence linking growth to fundamentals in general (Temple 1999; Durlauf et al. 2005), the evidence is rather mixed. Some find a significant positive relationship between export (growth) and per capita GDP growth, while others caution us not to assign the direction of causality (Rodriguez and Rodrik 2001). An interesting contribution by Moschos (1989) hinted at the existence of different regimes in the relationship between exports and growth. A salient feature of this literature is that the measure of export/trade openness is typically broadly defined. As a result, the channels through which international trade influences economic growth remain unclear and possible heterogeneity over different development stages remains hidden.

A number of studies do examine the relationship between the structure of exports and long-term economic performance in more detail and asks: “How do Exports Matter?”.Footnote 5 In particular, this literature has focused on the relationship between export diversification and growth (E.g. de Pineres and Ferrantino 1997). Export diversification is widely seen as a desirable trade objective in promoting economic growth (Herzer and Nowak-Lehnmann 2006). Diversification makes countries less vulnerable to adverse terms of trade shocks. By stabilising export revenues it is then easier to channel positive terms of trade shocks into growth, knowledge spillovers and increasing returns to scale, creating learning opportunities that lead to new forms of comparative advantage.Footnote 6 In a dynamic growth framework, some recent studies have uncovered a non-linear link between export diversification and economic growth (Aditya and Roy 2007; Cadot et al. 2007; Hesse 2008; Xuefeng and Yasar 2016). The main insight is that developing countries benefit from diversifying their exports, whereas developed countries perform better with export specialisation.Footnote 7 What remains unclear from this literature, however, is whether the mix of particular products, diversified or specialised, has any implications for growth.

That raises the question: “Does What We Export Matter?” and our paper is close to a handful of studies that have started to address that question by zooming in on the specific characteristics of exports in relation to economic performance.Footnote 8 The earliest studies distinguish between primary sector and manufacturing exports. Exporting primary products, which suffer from unfavourable price trends and from great price variability, are suspected to associate poor growth performance (Rodriguez and Rodrik 2001), whereas the expansion of manufactured exports has been a vital source of growth for many countries (Cline 1982; Ranis 1985; Martin 1993; Cline 2010). Thanks to the increasing availability of highly disaggregated trade data, first in the OECD and then for other parts of the globe, the research focus has recently shifted to the product characteristics of exports. Dalum et al. (1999) demonstrate that exports with higher levels of technological opportunity and higher income elasticities are associated with better growth prospects among OECD countries. Feenstra and Rose (2000) developed a procedure to order countries according to how soon they export advanced commodities to the US market and find that countries exporting sooner to the United States tend to grow faster. Bensidoun et al. (2002) show that countries specialising in products for which the share in international trade has increased grow faster than those that maintained a comparative advantage in stable or declining products. An and Iyigun (2004) compute the skill content of exports based on the US industry-wide R&D expenditures as a share of gross sales revenue as the benchmark. They show that a higher skill content of exports correlates with a higher growth rate. Lee (2011) adds to the evidence that countries have tended to grow more rapidly when they have increasingly specialised in exporting high-technology as opposed to traditional or low-technology goods and Jarreau and Poncet (2012) shows that export sophistication drives growth also at the regional level in China. Last but not least, a small number of recent papers examines how the network structure of economic output influences a country’s overall wealth and development (Hidalgo et al. 2007; Hidalgo and Hausmann 2009; Hausmann and Hidalgo 2011). For example, Hidalgo et al. (2007) present the network of relatedness between products, i.e. the “product space” and reveal that the types of products a country currently produces determine the probability of that country developing more competitive products in the future. This may help explain the lack of economic convergence of poor countries as they failed to produce more advanced goods.

A seminal study by Hausmann et al. (2007) develops a theoretical model where local cost discovery generates knowledge spillovers to show that a country’s specialisation pattern becomes partly indeterminate in the presence of such externalities. They conclude from this that the mix of goods that a country produces may therefore have important implications for economic growth and construct a product-specific sophistication measure based on the income of the average exporter. They then test their hypothesis and find that exporting more sophisticated products is positively associated with subsequent growth.

Building on these recent studies, we propose not to focus on a static product sophistication measure but rather on a product’s life cycle stage in the global market. This has important implications. With age, a product matures and becomes less sophisticated. In addition, instead of postulating a development strategy for developing countries that should shoot for the stars and export what the developed countries are exporting, we argue this may not be optimal. Developing countries may lack the capability to produce complex products (Indjikian and Siegel 2005).Footnote 9 Therefore, our paper advocates a development strategy that is better tuned to the development stages of countries. But let us first develop our arguments a bit more formally.

3 A simple model adapted from Grossman and Helpman (1991)

Assume we can divide the world in two regions. And advanced “North” and emerging “South”. Consumers in these two regions consume a variety of n goods, indexed by i where utility in both regions is given by:

where U is a utility index, c is consumption and \(\alpha \) is a parameter between 0 and 1. Global demand for good i is then equal to:

where \(p_{i}\) is the price of good i, E is global expenditure on consumption and P is a price index defined as \(P\equiv {\sum _{i=0}^{n}p_{i}^{{\alpha }\over {\alpha -1}}}\). We assume that production follows a simple linear production function in labor only, such that marginal production costs equal wages. Labor is assumed immobile across regions but mobile across firms within a region, such that wages are region specific and given to all firms. Firms produce a single variety i. We assume they own tacit and proprietary knowledge that enables them to do so and consequently they are price setters in their product market. Any product, however, can be imitated at some fixed start-up cost. This implies we have four groups of products. New, \(i \in A_{N,S}\) and mature \(i \in M_{N,S}\) products produced in North and South, respectively. We assume that new products require high skilled labor whereas mature products can also be produced with low skilled labor. The profit maximisation problem for the producer is given by:

where C indexes the regions (N)orth and (S)outh and S the skill levels (H)igh and (L)ow. It is straightforward to show that all firms will set their price equal to:

We assume for simplicity that \({{w_{C}^{L}}\over {\alpha }}<w_{C}^{H}\) such that all producers can set their prices freely.Footnote 10 Let us first solve the model statically, that is, for a given portfolio of goods in the ranges \(A_{N}\), \(M_{N}\), \(A_{S}\) and \(M_{S}\). As costs are equal within these ranges, so are prices and demanded quantities. Labor demand for high and low skilled labor in South and North can be set equal to exogenous supply to yield:

We can now solve for equilibrium wages and express profits in product portfolio ranges, exogenous labor supplies and parameters only.

Such that total profit in the economy adds up to \((1-\alpha )\) times total expenditure. Also note that the profit in any given product range is falling in all product ranges. These profits, however, are also strictly positive and provide an incentive to innovate (create new products) and imitate (switch a product from advanced to mature). In this economy the only long run source of economic growth is this expansion of the goods ranges. We can show that a steady state can only exist when all goods ranges expand at a common growth rate. Note from Eq. 6 that if all goods ranges expand at a common rate, g, we see that profits in an individual firm will fall at a constant rate equal to the growth rate of expenditure minus g. Setting the former to 0 by normalising expenditure to 1 we obtain \(-g\) for the growth rate of profit. The value of a new firm in either goods range will be equal to the discounted profit flow over the expected remaining lifetime of the firm. For mature goods we assume this lifetime to be infinite and the value of a firm producing an mature good in country C is:

For advanced goods it is slightly more complicated, as the profit flow ends when the product is imitated. However, if we assume the expected flow probability of that happening is constant in the steady state at h we can compute the value of a new firm as:

We endogenise innovation and imitation as in e.g. Grossman and Helpman (1991) and Audretsch and Sanders (2007) by assuming R&D firms can employ R&D resources to innovate according to:

where the dot signifies a time derivative and the Cobb–Douglas aggregate of \(A_C\) and \(M_C\) represents the knowledge stock and \(0.5<\gamma <1\) would imply more recent knowledge is given more weight, while \(R_C^R\) is R&D resources allocated to the creation of new products. Likewise we assume imitation takes place according to:

where \(A_{-C}\) is the range of imitable advanced products not in country C and so the relevant knowledge base is a Cobb–Douglas aggregate of domestic and foreign imitable products and \(0.5<\delta <1\) would imply it is easier to imitate from home. We can compute the marginal value product of R&D resources in imitation and innovation by multiplying the derivative of Eqs. (9) and (10) with respect to R&D labor by the value of a new or mature firm in country C in Eqs. (8) and (7), respectively. Substitution for profits using Eq. (6) in both countries and dividing the resulting expressions on each other we obtain:

as R&D arbitrage conditions for North and South respectively. This arbitrage condition allows us to derive some comparative statics on the steady state, in which the left hand side is equal for both regions. We then obtain:

which must hold in the steady state. This equation implies that for \(\alpha -\gamma +2\delta >1\) all powers are positive.Footnote 11 Hence an increase in the left term, a rise in the relative skilled labor abundance in the North, we will see a drop in the relative diversity in the North in the middle and/or a rise in the relative specialisation in early stage products in the North on the right. That is, the North will tend to specialise in advanced products and the South will diversify its production by expanding its mature goods range. In the steady state the North will specialise in advanced, early stage products and services, whereas the South will specialise in imitated, mature products.

This also suggests (but does not yet imply) that out of steady state a more advanced country will have above steady state growth when moving towards a more innovative and advanced output bundle. We argued in Audretsch and Sanders (2007) that the fall of the Berlin wall and market reforms in Latin America and Asia upset the old steady state in the global economy and drew and pushed Europe and the US into a less mature export portfolio. In the model above, the political shocks can be interpreted as an expansion of the Southern labor force, especially in its low skilled labor supply, at least initially. Such a shock shifts the steady state composition of the product ranges and given that a low skilled labor supply shock in the South increases the value of imitation in the South, even from the North, the adjustment to the new steady state will only coincide with positive growth in the North if it can successfully increase its range of advanced products through innovation. Growth in the South, in contrast, will result from imitation and the capture of market share in mature goods and services.

Note that in this slightly adapted setup of Grossman and Helpman (1991) we derived this specialisation pattern endogenously.Footnote 12 We now turn to the empirical evidence in support of our hypothesis.

4 Data and methodology

In this section we first develop a measure of product maturity drawing on the insights from product life cycle theory and then compute the average maturity of our countries’ export portfolios. We then present the estimation strategy, as well as the data before turning to our results in Sect. 5.

4.1 Measuring product maturity

Our measure of product maturity is based on one of the well established empirical regularities found in the product life cycle literature. Total sales of a product in the market first increase at an increasing rate, then at a decreasing rate and finally decline, tracing out an S-shaped diffusion curve (Klepper 1996). We therefore want to develop our measure of maturity at the product level by looking at the dynamics in market volume at the global level. Following Audretsch (1987) and Bos et al. (2013), we characterise the life cycle stage of a product using the first and second moment in its global export volume.

We calculate product maturity for each of the 427 SITC four-digit products over the period 1988–2005 using global-level export data retrieved from the UN-COMTRADE database. The problem with our real trade data is that we do not have the sales volumes for individual products at more disaggregated levels. Instead we have four-digit product classes in which still any number of different products, potentially all in different stages of their respective life cycles, are being added together. However, it is important to note that our product maturity measure captures the average life cycle stage of these product classes. More importantly, our measure can correctly identify the rejuvenation of the product class that is the result of replacing a mature with a new product. We demonstrate these features of our measure through a simulation exercise below. The findings confirm that our measure indeed captures the product life cycle stage in data we have generated ourselves and four-digit product is the right product category for the purpose of this paper.

To this end we generated artificial global sales volumes for 20 products and 20 periods using a standard logistic curve we took from Pan and Kohler (2007):

where \(A_0\) is the lower bound and set to 0, \(A_1\) is the upper bound and set to 100, \(A_2\) sets the inflection point where maximum growth occurs and is set to 0, 5, \(A_3\) is the average growth rate, set to 0, 5 and \(A_4\) is the time at which maximum growth is reached and set to 10. The resulting 20 simulated and S-shaped sales paths are shown in Fig. 2.

It is straightforward to see that fitting a second order polynomial to the simulated data in a window of say 5 periods and obtaining the first and second moment of sales (growth and growth in growth) would be sufficient to characterise the product life cycle stage. Suppose we estimate and compute:

The exact numerical values are not relevant in this case. If we find a positive coefficient \(\gamma _1\) and negative coefficient, \(\gamma _2\) on the quadratic term the product is to the right of the inflection point and might be called mature. If both \(\gamma \)’s are positive the product must be to the left of the inflection point and might be called early stage. Moreover, taking as our measure of maturity the first derivative of the fitted second order polynomial with respect to time (\(\gamma _1+2*\gamma _2*t\)), gives us a continuous measure of maturity, where higher (less negative) values characterise less mature products.

One issue with our real trade data is that we do not have the sales volumes for individual products. Instead we have 4-digit product classes in which still any number of different products at different stages of their respective life cycles are being bundled together. It is clear from Fig. 2 that portfolio’s composed of products in different stages of their life cycle can create quite complex sales dynamics, even if we abstract from all kinds of shocks that can affect sales in addition to the product life cycle. Furthermore, by adding new products and dropping mature ones from existing portfolio’s, the possibility arises that the maturity of a given portfolio actually decreases over time. We can illustrate these cases with our simulated sales data. First we create four portfolio’s of products (artificial product classification codes if you will). One portfolio consists of new products (1–5), one of slightly more mature (6–10), the third of even more mature (11–15) and the fourth of products where there is hardly any growth in sales (16–20). Of course our maturity measure should correctly rank them. Given that we have generated the data we can measure the growth and growth in growth of sales precisely and our maturity index becomes:

where \(dt=1\).Footnote 13 We then obtain the Fig. 3.

One can see that the composed portfolios still retain the imposed S-shaped sales pattern (left panel) and our maturity measure accurately captures the average lifecycle stage of the four portfolios.Footnote 14 In Fig. 4 we show the maturity index for a baseline portfolio (1–10) where in period 4 we took out product 10 (the most mature product) in the “drop 10” simulation and added product 1 (the newest product) in the “add 1” simulation. It is clearly visible in this figure that our maturity index picks up the rejuvenation of the portfolio that is the result of replacing a mature with a new product. But it does so only with a lag. We see that adding a very early stage product (in the near horizontal left part of the S-shape) to replace a product around the inflection point where sales growth is maximised (recall this is around year 10 or for product 10 in year 1 by construction) will “fool” our maturity index and cause it to initially drop below the baseline portfolio score. Still, after only a few periods and faster when products exit closer to the horizontal part on the right, our index will quickly show an increase relative to the baseline. In the real trade data it is most unlikely that products will exit the portfolio at the peak of their global market growth, so we do not expect this “fooling”—effect to be a big problem. Moreover, as many more than 10 product varieties are typically in a single 4-digit product class, it is unlikely for any single product to have a noticeable impact. Still this figure illustrates that over time, if many new products and product varieties enter an existing product class, our proposed maturity index may actually go up, signifying the portfolio of products in that class becomes less mature over time.

Before we can take our index to the data, however, we need to deal with the fact that some changes in global export sales growth (and growth in growth) do not originate from technology and the individual product life cycle, but rather come from the demand side, affecting all product sales (growth rates) at the same time. To control for the global business cycle we therefore estimate the following equation:

where \(ln(exp_{it})\) is the log of global exports of product i at time t in constant dollars; t and \(t^2\) are time (set to 1 at the start of the relevant time window) and time squared, respectively; \(ln(exp_t)\) is the log of global total exports of all products; \(\varepsilon \) is the disturbance term. We can then set our measure of maturity, \(M_{it}\), equal to the effect of an increase in time t on the log of global exports \(ln(exp_{it})\), controlling for global demand shocks. \(M_{it}\) is thus defined as:

where we have taken a 9 year window to estimate the moments of total global exports. Assuming the typical S-shaped pattern of sales over the life cycle we can show that the lower (more negative) \(M_{it}\) is, the more mature a product is. For early stage products both coefficients are typically positive, whereas for more mature products first \(\gamma _{2i}\) and then \(\gamma _{1i}\) will first show up insignificant and than negative in the regression.

We calculated \(M_{it}\) for each of the 427 SITC four-digit products over the period 1988–2005 using global-level export data retrieved from the UN-COMTRADE database.Footnote 15 More specifically, we estimate Eq. (16) taking a rolling window of 9 years, namely 1988–1996, 1989–1997, 1990–1998, 1991–1999, 1992–2000, 1993–2001, 1994–2002, 1995–2003, 1996–2004, 1997–2005 setting the first year to 1 to calculate \(M_{it}\) as in Eq. (17) and taking the average of all \(M_{it}\) over the different sub-samples. This implies that only if we estimate different coefficients per window, the corresponding average maturity for that window will change over time. In this way, we allow for maturity to change over time in a non-linear fashion and movements up and down are allowed.Footnote 16

Four important aspects of our measure \(M_{it}\) are worth pointing out at this stage. First, in contrast to a binary measure to classify industries into either “growing” or “declining” as in Audretsch (1987), our measure is continuous.Footnote 17 This property permits a sensible ranking of products based on maturity level in the global export market.

Second, our measure is time-varying. In other words, we allow products to move from one stage of the life cycle to the next and back. This latter property may seem undesirable, but in fact there are good reasons not to exclude such dynamics by construction. As we have illustrated above, mature product categories can rejuvenate through the upgrading of existing products and/or the introduction of new product varieties in the same product category. Such rejuvenation could set off a new S-shaped pattern in global sales that we want our measure to pick up. In this respect, our measure also differs from Bos et al. (2013) who evaluates Eq. (17) at the mean of t for all industries and does not allow for the changes of product maturity over time.

Third, we based our measure on the global exports of a product. Under the assumption that total global exports correlate with total global production and sales, this will reflect the true product life cycle. Our proxy, however, will also carry some exogenous elements that reflect the growth potential of products in the global market place. As we are interested in the composition of countries’ export bundles, however, it seems only fitting we consider the global market for classifying products as mature or early stage.

Finally, we prefer a product specific measure based on global export volumes over the alternative of country level maturity measures as this measure is less prone to endogeneity problems in the country level growth regressions that follow.Footnote 18 Table 1 provides descriptive statistics on these products, aggregated to the one-digit level.Footnote 19 According to Table 1, we find that manufacturing products account for more than 70% of world total exports. The product maturity exhibits significant variations both across and within one digit categories.

A first check on our maturity measure is to simply look at which products actually get classified as mature and young. Ranking products based on their maturity in the global market yields Tables 8 and 9 in the “Appendix”, which show the maturity and ranking of the 50 products with the lowest and highest maturity values at the end of our sample period (i.e., 2005), respectively. The corresponding rank number at the start of the period (i.e., 1988) is also given. The pairwise correlation between maturity 2005 and maturity 1988 is −0.021, which is not significant at any conventional level. The negative correlation may imply that products classified as mature in 1988 are classified as newer in 2005 and the other way around. The reason is that most products apparently have a (very) negative \(\gamma _2\), such that they start with a very high \(M_{it}\) (low maturity) and end with a very low value (high maturity), whereas the products with a positive \(\gamma _2\) tend to start from a very low \(\gamma _1\). This is consistent with a more or less random distribution over the life cycle stages as early stage products would be expected to have low average growth (captured by a low \(\gamma _1\)) but high growth in growth (captured in a positive \(\gamma _2\)), whereas mature products have low average growth and negative growth in growth. The Spearman rank correlation (0.053), however, shows that the ranking at 1988 and 2005 is independent (p value is 0.254).

The products at the extremes of the ranking, are perhaps not making a very convincing case at first glance. In particular, the list of least mature products includes several raw materials, ores, basic metals and food products that cannot be considered early stage products. Our measure is clearly sensitive to the 90s resource boom. Rising demand for many internationally traded raw materials, ores and energy resources have caused the trade volumes for those commodities to increase faster than the global trade volume for which we correct. Consequently, the boom in commodities trade is interpreted by our measure as a rejuvenation of these commodities, when of course nothing has happened to the product itself. We will leave these products in for now, exactly because this will bias the estimations against finding the results we are most interested in.Footnote 20 Of course we have also excluded these products in robustness tests. The reader should keep in mind, however, that what we measure as maturity is a rough proxy and measurement error is an issue.

The second check is to explore the trend of major products in the global market. Figure 5 shows the maturity of the most important five products (in terms of their size in the global trade) over time. As can be seen from the figure, most manufacturing products are relatively stable and mature. Only petrol oil is moving up and down significantly. Obviously this reflects the peculiarities of global oil markets.

The third check is to explore the volatility of product maturity over time. We want to eliminate those products that exhibit too much volatility over time, e.g. oil. We therefore computed the standard deviation of maturity for each product over the entire sample period. Figure 6 shows the maturity of four products, for which the standard deviation of maturity was above the 99 percentile of the sample. It too suggests that oil products should be treated with caution in our analysis. We keep these “products” in our sample for now, however, to avoid selection bias in our empirical analysis below.

4.2 Measuring the export maturity of countries

The overall maturity associated with a country’s export basket, \(M^{All}_{jt}\), in turn can now be defined as

where \(M^{All}_{jt}\) is a weighted average of product maturity \(M_{it}\) (at the global level) across all products for country j over time t. The weights are the export shares of these products in country j’s total exports.

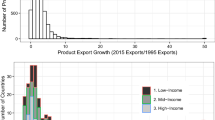

To get a first impression of our export maturity measure \(M^{All}\), Fig. 7a shows that on average, a weak positive relationship exists between export maturity and the level of GDP per capita. High income countries appear to have younger export baskets. Figure 7b plots the export maturity measure against the growth rate of GDP per capita. We do not find a strong association, suggesting that the relationship between export maturity and growth might be heterogeneous across countries.

To check the robustness of our results, we also use four other country-level maturity indices by considering sub-samples of products. To account for the peculiarities of commodities, in particular oil, we compute two measures M1 and M2. M1 excludes the oil-related products, i.e. those for which the first digit product code is 3, whereas M2 includes only the manufacturing products, i.e. those for which the first digit is between 6 and 9.

A handful of studies observe that product quality varies hugely within finely disaggregated products (Schott 2004; Hallak 2006; Khandelwal 2010; Hallak and Schott 2011). To examine whether our results are sensitive to product quality variations across countries, we adopt two other measures M3 and M4 by selecting a sub-sample of products that are more homogenous in quality. Following Sutton and Trefler (2011), we compute M3 using informative products, i.e. products with small quality range across countries. We calculate M4 excluding a category of differentiated products, i.e., products without organised exchange markets or reference prices based on a classification developed by Rauch (1999). Table 2 reports pairwise and ranking correlations of all of our five differently constructed measures. We find that these measures are positively and significantly but certainly not perfectly correlated using both pairwise correlations and ranking correlations.

We conclude from these results that our time varying, continuous measure of export maturity reflects something that is correlated with the alternative measures suggested in the literature, is easy to compute based on conventional trade data and is founded in well established empirical regularities over the product life cycle. The proof of the pudding, however, is in the eating. Our measure picks up something of substance if we can show it has explanatory power in a panel growth regression, to which we turn below. For our purpose, we will use \(M^{All}\) in the main analysis and use the other four maturity measures in our robustness analysis.

4.3 Other variables and data

Economic growth (g), measured as the change of the real GDP per capita is taken from the Penn World Table, version 6.3 (PWT 6.3). To estimate a growth regression we obviously require, in addition to our country level export maturity measure, the standard set of control variables. Levine and Renelt (1992) find that most of the independent variables in standard growth regressions are fragile. Since the effect of export maturity on growth is our primary interest, we minimise the data mining bias for the other variables by closely mimicking the regression in Hausmann et al. (2007). The initial level of GDP per capita \(gdp_0\) (2005 international purchasing power parity (PPP) dollars chain index) is set equal to the start of the different periods.Footnote 21 The capital to labor ratio (KL) is computed as the physical capital stock divided by the total number of workers. We construct the capital stock (K) applying the perpetual inventory method as in Hall and Jones (1999).Footnote 22 Human capital (HC) is measured as the average years of schooling of the population that is at least 25 years old and is obtained from the Barro and Lee (2010) database on educational attainment.Footnote 23 The rule of law index (Law), ranging from 0.5 (low institutional quality) to 6 (high institutional quality) is retrieved from the International Country Risk Guide (ICRG) and our de jure trade openness measure (Jure) is taken from Wacziarg and Welch (2008). It takes a value of one when a country’s trade regime is liberalised, and zero otherwise. In line with Lederman and Maloney (2012), we further add the Hirschman-Herfindahl index as a measure of export concentration, which captures the overall structure of a country’s export using the COMTRADE data. They find that export concentration has important implications for understanding the characteristics of a country’s export basket in relation to growth. The conditioning variable that we rely on to estimate the latent class model is the stage of economic development for which we proxy by using the level of GDP per capita (GDPPC), retrieved from PWT 6.3. Table 3 summarises the definitions, sources and descriptive statistics of country-level variables used in our analysis.

4.4 Empirical methodology

A general investigation of the relationship of export maturity and economic growth starts with the following standard growth regression:

where j denotes country and t denotes time; g is per capita GDP growth; \(M^{All}\) measures the maturity of a country’s export basket; To prevent simultaneity or reverse causality, we take the initial level of the export maturity measure at the beginning of four different time periods (i.e., at 1988, 1993, 1998 and 2003); \(\beta ^\prime \) is a \(1\times n\) parameter vector; Z is a \(n \times 1\) vector of control variables that contains the usual determinants of economic growth described above, including a country’s initial level of GDP per capita (\(gdp_0\)) to capture beta-convergence, the capital to labour ratio (KL), the level of human capital(HC) and rule of law index (Law), a de jure trade openness index (Trade) and a trade concentration index (HHI); finally, \(\varepsilon \) is an i.i.d. error term.

One major drawback of Eq. (19) is that the relationship between the maturity of exports and economic growth is now assumed to be identical across countries. Therefore, the estimated parameters, e.g., \(\beta _1\) and \(\beta ^\prime \) are common to all countries by construction. In practice, it may well be the case that this relationship is not homogeneous and Eq. (19) masks potentially important parameter heterogeneity across countries.

We therefore adopt a flexible modelling framework in which the export maturity-growth relationship is allowed to be heterogeneous across different groups of countries (or growth regimes), depending on the stage of economic development. Two strands of literature motivate our choice of relying on GDP per capita as a proxy of economic development. The first strand has examined the heterogeneity of growth experience of countries in general and has well established the substantial differences in the determinants of growth between developing and developed countries. These studies (e.g., Durlauf and Johnson 1995; Canova 2004; Papageorgiou 2002) typically use the initial level of GDP per capita as a regime splitting variable to examine multiple growth regimes. However, such an ex ante classification is somewhat arbitrary and subject to debate since the appropriate cut-off point is not always clear. In contrast, our approach endogenizes the cut-off points and is thus much more flexible. The second strand has established a non-linear relationship between export structure (specialised vs. diversified) and economic growth (Imbs and Wacziarg 2003; Aditya and Roy 2007; Cadot et al. 2007; Hesse 2008). These papers typically find that the relationship differs by the development stage of countries as proxied by GDP per capita.

We thus treat the stage of development as a latent variable, and use a latent class model to endogenise the sorting of countries into different growth regimes. To model the latent variable, we use a multinomial logit sorting equation, and include the stage of development, proxied by real GDP per capita, to estimate the likelihood of being in a particular growth regime. Our conditional latent class model consists of a system of two equations: an equation to estimate the maturity-growth nexus for each regime, and a multinomial sorting equation where the regime membership is a function of the development stage, i.e. GDP per capita.

To allow for endogenous sorting into regimes \(k(=1,\ldots K)\), we can rewrite Eq. (19) as follows:

where \(k=1,\ldots ,K\) indicates the regime and K refers to the (endogenous) total number of regimes. Each regime has its own parameter vector \(\beta \). In other words, \(\beta _0\), \(\beta _1\), \(\beta ^\prime \) are allowed to differ across regimes.

To estimate Eq. (20), we must first find the suitable number of K. As this is not a parameter to be estimated directly from Eq. (20) Greene (2007) suggests a “test-down” strategy to identify the correct number of regimes. A specification with \(K+1\) regimes is inferior to one with K regimes if the parameters in any two of the \(K+1\) classes are equal (statistically indistinguishable). If the true K is unknown, it is possible to test down from \(K+n\) to K using a log likelihood ratio test.Footnote 24

Our aim is then to sort each observation jt into a discrete regime k. This is done by specifying the contribution of each observation jt to the likelihood function, conditional on its regime membership. The unconditional likelihood for each observation jt is obtained as a weighted average of its regime-specific likelihood using the prior probability of being in regime k as weights. Since we do not observe directly which regime will contain a particular observation jt, the group membership probability \(\theta _{jt}\) must be estimated. In our conditional latent class framework, we make this probability conditional on GDP per capita (GDPPC) and parameterise \(\theta _{jt}\) by means of a multinomial logit model:

where \(\theta _{jt}\) measures the odds of being in regime k, conditional on GDPPC. The likelihood for the entire sample, which is the sum of all unconditional likelihood over all jt resulting from Eqs. (20) and (21), can then be maximised with respect to the parameter vector \(\beta =(\beta _1,\ldots \beta _K)\) and the latent class parameter vector \(\theta =(\theta _1,\ldots \theta _K), \theta _K=0\) using a conventional maximum likelihood estimator, following Greene (2007). With the parameter vector \(\beta \) and \(\theta \) in hand, a posterior estimate of the regime membership probability for each observation jt, can be computed using Bayes’ theorem. Each observation can then be assigned to the regime with the largest posterior probability.

One distinctive feature of our approach is that we allow countries to switch between regimes over time, following e.g. Bos et al. (2010). We do want to avoid countries close to a switching point, however, from switching back and forth between regimes all the time. We therefore split our sample in four time periods and allow countries to only switch regimes between these four periods. Essentially we pooled together the observations from the time periods and treated observations within these periods as independent draws from the same regime. This implies that one country can be allocated to one particular regime k in period 1 (1988–1992) and another one in period 2 (1993–1997), but no switches occur within these periods by construction. This adds flexibility into our modelling framework by avoiding the imposed assumption of persistent regime allocation and provides additional insights into regime switches. We can thus study the dynamics of the maturity-growth relationship as countries move along their development path at different speeds.

To summarise our empirical strategy, we employ a conditional latent class model to examine for the possible non-linear relationship between export maturity and growth in K endogenously determined regimes. The regime membership probabilities are conditional on the stage of economic development.

5 Empirical results

5.1 Main results

We first determine the number of regimes in our data following the suggestion by Greene (2007). The test results in the top row in Table 4 favour a specification with three regimes over the one with two regimes. We refer to these regimes as developing, emerging and advanced for reasons we will explain later. Moreover, the second row shows that the unconditional latent class model must be rejected in favour of the conditional one. Next, we test whether the parameter estimates differ significantly across regimes by means of Wald tests for joint equality. The results indicate that the equality of all parameters should be rejected at the 1% significance level across regimes. Finally, we test whether the effect of export maturity on growth is significantly different across regimes. The Wald tests here reveal that the effects are jointly significantly different across the three regimes, except between the developing and advanced regime.

From this table we conclude that a three regime, conditional latent class specification is most suitable for our purpose. Then we turn to the effect of the maturity of a country’s export portfolio on economic growth across these regimes by looking at the conditional latent class estimation results in Table 5.

First observe in the lower part of the table that the first regime has a low average GDP per capita, the most mature export bundle and the lowest average growth rate. We therefore labeled this regime “developing”. The second “emerging” regime has still low but slightly higher average levels of GDP per capita, a considerably higher average growth rate and an intermediate average maturity. The “advanced” regime has a high average level of GDP per capita, moderate growth rates and the lowest average maturity of exports. Note that we have labelled the regimes after the model classified the observations and we based our labels on these average characteristics, not the other way around.

Most interesting from our perspective, however, is the coefficient of export maturity itself. We uncover a negative coefficient which is significant at 1% for the emerging countries’ regime, suggesting that a higher maturity index, i.e. a less mature export bundle, is associated with lower growth rates. In terms of magnitude, ceteris paribus, a one standard-deviation increase in the export maturity index is associated with a decrease of growth rate by 0.84 percentage points. Compared to the average growth rate of 2.8% for the emerging regime, the effect is economically sizeable. This finding strongly contrasts with the advanced countries’ regime, where a less mature export mix is associated with higher growth rates. Ceteris paribus, a one standard-deviation increase in maturity is associated with an increase in the growth rates of 0.63 percentage points, which is considerable comparing to the average growth rate of 2% for the advanced regime. For the developing countries, the relationship is insignificant, implying that the association between the maturity of the export bundle and growth is less clear-cut. Given that many commodities were classified as young products due to the peculiarities of resource and commodities trade in the 90s, the insignificant effect could perhaps be attributed to the fact that developing countries often find themselves exporting some mature manufactures but also commodities.Footnote 25

The conventional determinants in the growth regressions also show interesting differences over the regimes. The developing country regime exhibits beta-convergence (among developing countries). The importance of human capital and the rule of law for developing countries are also well established and confirmed in our results. In addition, trade openness and export concentration appear to positively relate to growth. In the emerging regime, countries show strong divergence. The negative relationship between the capital-labor ratio and growth reflects the high returns to capital stock such as infrastructure and reliable power supply in these emerging economies. The accumulation of human capital does not appear significant for growth partially, we would argue, because it is not that important in economies that grow based on exporting mature products. For emerging countries, where inflows of foreign direct investment have been shown to be important, the significance of rule of law is as expected. We also find that export concentration carries a growth penalty for emerging countries and this confirms the finding that a more diversified export structure reduces the vulnerability to adverse terms of trade shocks and is growth promoting. For the advanced economies, we do not find strong evidence of the accumulation of physical and human capital as the driver of growth consistent with economies in their steady states. Also improving openness and rule of law have no significant impact as this regime consists of rather homogeneous countries in openness (actually all are open) and rule of law. However, these countries do seem to perform better with export concentration, in line with the earlier non-linear effect of export diversification on growth found in the literature (Aditya and Roy 2007; Cadot et al. 2007; Hesse 2008; Xuefeng and Yasar 2016). We add to this literature by showing that diversifying exports into a wider range of mature products is probably most effective and relevant for developing and emerging countries, whereas concentrating exports on a range of new products has a positive connection to growth for advanced countries.

There are three reasons why we conclude that our latent class specification does not merely sort country-time observations in such a way that these results endogenously emerge. First, the significantly negative coefficient on GDP per capita in the regime membership probability estimation signifies that lower GDP per capita increases the probability of moving from the reference group to the emerging and developing regimes, respectively, where the latter effect is stronger. This implies that countries with high GDP per capita tend to be sorted into the advanced regime, whereas countries with medium GDP per capita sort into the emerging regime and low income countries end up in the developing regime.Footnote 26 In an unconditional latent class specification the three regimes might simply emerge because the model fits the data better if one sorts the observations for which a negative, positive and indeterminate effect applies. The fact that GDP per capita has predictive power in the sorting suggests, however, that there is more to these regimes.

Second, in Table 6 we present the regime classifications over time for selected countries. It can be verified that most of the G7 countries are in the advanced growth regime, most of the time, with an occasional switch to the emerging regime and back. The newly industrialised countries in South East Asia, South Africa and Brazil are classified in most periods into the emerging regime and occasionally move between the developing and emerging regimes (with the exception of Singapore which moves from the advanced to developing regime. Financial services, re-exports and port logistics may well have driven this outlier).Footnote 27 Interestingly, the exports of mature products by China may constitute an important factor to explain the recent rapid growth and strong convergence of the newly industrialised countries. Our classification is not completely in line with our priors (e.g., Japan classified as emerging in 1988–1992 or Brazil as advanced since 1998), but on the whole the classification looks roughly fine, considering that this classification is in no way based on ex ante assumptions and exogenous thresholds or cut-off points.

A final distinctive feature of our model is that a country may change regimes over time. Thus, we can examine the stability of the regime classification by considering regime switches over time. Table 7 presents the regime transition matrix, including the absolute number of regime allocation changes and the frequency between any two time periods.Footnote 28 We can see that the diagonal elements carry the largest percentages, as would be expected. However, there are quite some transitions from emerging to advanced and back. Transitions between the advanced and the developing regime are more rare, as is to be expected. Transitions from developing to emerging and back are much more frequent than between developing and advanced. The emerging regime thus seems to be the stepping stone towards the advanced country growth regime.

The occasional switches from developing to advanced and back can also be due, in part, to the disrupting effects of resource and commodities trading, as was argued above. This, however, requires much more detailed analysis of the transition dynamics in our data. A useful first step in that direction would be to redo our analysis without products that can be classified as primary sector products. We feel, however, that at this stage it is useful to leave these products in the sample. Moreover, one must realise that our classification is endogenously based on the link between growth and trade and therefore sensitive to big shocks in global trade, exchange rates and markets. Our data cover such global trade shocks as the collapse and transition of Russia and the former Eastern Bloc, the Mexican 1994 Peso Crisis, the 1997 Asian Crisis, the Brazilian 1999 Samba Crisis, the collapse of the internet bubble and 9-11. With that in mind the stability of our classification suggests the link between export maturity and growth is indeed different across development stages. Both volatile commodities and global trade stacks the odds against us finding the results we feel are most important to report in this paper. That is, even in the presence of this noise, our maturity measure picks up something of significance, both in the statistical and the economic sense.

If we compare our findings with the existing literature, we can first discuss the any papers that zoom in on specific countries and industries. Chadha (2009) for example demonstrates a positive effect of foreign patent rights on exports for Indian pharmaceutical firms. Our results are in line with their proposition that emerging economies enter the global market at the stage of standardisation and compete on process innovations and cost advantages, but different in a way that we do not specify the source of cost advantages for the emerging economies, which Chadha (2009) argues could arise from labor, capital or technology. A large number of studies have documented extensively the economic success and industrial achievements of the East Asian economies and an interesting strand of literature takes a closer look at the strategies of the firms in these economies (Hobday 1995; Hobday et al. 2004; Choung et al. 2014). In particular, they show that companies in these countries are showing a strong tendency to go beyond exploiting existing technology and competing on mature markets, rather they compete as frontier players with new and innovative products in the global market.Footnote 29 They provide evidence that firms progressed from learning the techniques of manufacturing processes (e.g. strategic partnership, integration in global value chain) and developing competences to eventually engaging in R&D and introducing young and innovative products (Hobday et al. 2004; Pietrobelli and Rabellotti 2011; Choung et al. 2014). Our results corroborate these findings in the literature that emerging economies tend to perform better by exporting mature products but face the challenge of making a transition from copying mature to inventing new products and joining the advanced economies at the frontier. However, these studies do not measure the maturity of the product market directly, nor do they examine the implications of such effects found for the advanced economies. Our paper fills this gap by introducing a novel, macro level measure of product maturity, and assessing the effect of export maturity on country performance instead. With our measure we are thus able to study the relationship between export maturity and growth across a number of countries.

Our results extend and complement recent studies that examine the linkages between the product characteristics of exports and economic growth (Feenstra and Rose 2000; Bensidoun et al. 2002; An and Iyigun 2004; Hausmann et al. 2007; Lee 2011). Table 5 not only shows that export maturity as we have measured it, matters for growth. It also shows that this effect depends on the stage of economic development and is significantly non-linear in the level of GDP per capita. This finding is contrary to the common conclusion that emerges from the literature. In spite of a wide variety of measures, specifications and econometric techniques used, it typically postulates a linear monotonic relationship between specific characteristics of exports and growth. Consistent with the notion that “what you export matters”, however, our findings suggest that the timing of exports in relation to the development process matters as well.

5.2 Robustness analyses

We conducted several robustness checks that show that our results are insensitive to the choice of particular maturity measures. First, to account for the peculiarities of commodities, in particular oil, we consider two alternative export maturity measures: M1 that excludes the oil-related products, and M2, which only includes manufacturing products. We report the specification test results in Tables 11 and 12 in the “Appendix”, respectively. Again, these statistical tests indicate that a three-regime conditional latent class model is preferable. The estimation results are shown in Tables 13 and 14 in the “Appendix”, respectively. The non-linear relationship between export maturity and growth over three development stages is found to be rather similar to those reported in Table 5. We observe a significant positive relationship between a higher maturity index and growth for the advanced countries’ regime and a significant negative one for the emerging countries’ regime, albeit the magnitudes are somewhat smaller.

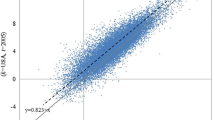

Second, to examine the role of product quality in driving the relationship between maturity and growth, we use two other measures M3 and M4, following Sutton and Trefler (2011) and Rauch (1999), respectively. Sutton and Trefler (2011) develop a model postulating that a country’s wealth and its export mix are simultaneously determined by its capabilities. Thus, economic growth can be achieved either through the shift to a different mix of products or through the improvement in quality/productivity in the existing portfolio of products. Empirically, they demonstrate that the quality range is huge, raising some concerns about the the informativeness of Hausmann et al. (2007)’s measure. As a consequence, they illustrate that changes in the export mix may substantially over-predict economic growth for low-income countries. To define which product is informative, they plot the GDP per capital of the richest exporter against the GDP per capita of the poorest exporter for each product in Fig. 8 in the “Appendix”. Products that lie in the upper right or bottom left part of the figure, i.e. those with small quality range are considered informative.Footnote 30 As can be seen, informative products constitute a small proportion of total products. Based on this definition, we identify 191 informative products (out of 430 in our sample) and calculate M3 using the maturity of these 191 products. Next, we use a classification developed by Rauch (1999) who distinguish products into homogeneous, differentiated and an intermediate categories and calculate M4 by dropping the category of differentiated products. Essentially both M3 and M4 consider a sub-sample of products that are more homogenous in quality, are therefore less prone to quality variations across countries. We expect that the estimated non-linear relationship between maturity and growth to be stronger when using M3 and M4. The specification tests are shown in Tables 15 and 16 in the “Appendix”, respectively. A conditional three-regime latent class model is preferred. The estimation results are presented in Tables 17 and 18, respectively. The results consistently show that the three-regime specification is a very robust feature of our data. The export maturity measure enters with a positive and statistically significant coefficient in the advanced countries’ regime, whereas it appears to be significantly negative in the emerging countries’ regime. The magnitude is considerably larger for the advanced countries, especially using the maturity measure of informative products M3, but it is comparable to that found for emerging countries in Table 5.

Overall, our results therefore do not seem to be driven by the inclusion of commodities in our sample or the product quality variations. Arguably, the endogeneity of export maturity also does not pose a serious problem in our analysis for three reasons. First, since we constructed our product-specific maturity measure using the global data, it is less prone to the endogeneity issue than using country-level data. This approach captures some exogenous product characteristics and does not rely on the product information at the country level. Second, we use lagged export maturity, defined as the level at the beginning of each four periods (i.e. 1988, 1993, 1998, 2003) in our estimations, to alleviate the reverse causality problem. And third, the identification of the negative coefficient between export maturity and growth in the emerging regime suggests that reverse causality cannot be an issue. As countries enjoying higher growth are less likely to export mature products that are in the declining stage, we feel that the causality running from export maturity to growth is far more plausible. Therefore we feel confident that the empirical set-up we adopted ensures the validity of our estimation results. We now turn to our conclusions to discuss the significance of our findings.

6 Conclusions

In this paper, we set out to develop a new measure of product maturity using old knowledge about the product life cycle. A typical product will diffuse in global trade (if at all) approximately following an S-shaped diffusion curve, where total market volume increases fast, than slower and eventually goes into decline. In global markets a product was thus defined as mature when export growth declines. Using this empirical regularity of the product life cycle we developed a continuous maturity measure and showed that our classification of four-digit products in global trade is positively correlated but certainly not equivalent to other classification methods in the literature. As our empirical analysis went on to show, our measure has something sensible and novel to say about countries’ growth performance.

We showed in a conditional latent class growth estimation that countries can find themselves in three distinct growth regimes. That is, the vector of parameters differs significantly between three endogenously determined groups of country-time observations in our data set. In addition, we showed that GDP per capita, as a proxy for the level of development of a country, is a good predictor of class membership and our model distinguishes between low, middle and high income level countries. This too is quite similar to classifications used in the literature, but our classification has the added benefit that we do not impose group membership or have to rely on inherently arbitrary cut-off points.

Finally, we showed that our export maturity measure has a non-linear impact on economic growth over the development stages our countries find themselves in. In the low-income developing stage the maturity of exports is not significantly related to growth and such traditional variables as capital-labor ratio’s and that institutional quality picks up most of the cross-country, within period variation. This implies that for developing countries getting into or out of mature export products is not expected to affect their growth performance in a predictable direction. In part, this may be due to the fact that some resources and commodities were classified as early stage products as a result of the late 1990s resource boom. This would offset the otherwise positive (or negative) impact of manufactured early stage products, but we feel it is more likely we would have found a significant coefficient in either direction if such biases had been strong. For slightly richer emerging countries, in contrast, we found a robust and clearly negative relationship between exporting early stage products and growth. They do better exporting mature (manufactured) products and moving into large but globally saturated or declining markets. This gives them the opportunity to grow fast, capturing market share of others. But, in the advanced country stage, the sign switches and exporting mature products becomes a drag on growth. The challenge here is clearly to grow fast on mature products but simultaneously preparing for the next stage, in which early stage innovative exports take over as the engine of growth.

This is clearly a huge policy challenge. The existence of distinct growth regimes and sign-switches between them imply that policies aimed to support the penetration of mature markets (e.g. lax intellectual property standards, autocratic control over infrastructures, export subsidies and cheap bank credit) promote growth first, but may put a drag on it in the next stage of development. The advanced industrialised countries are currently still making their transition from an industrial, managed society to an entrepreneurial society (Audretsch and Sanders 2007). The challenge for emerging countries like China, India and Brazil is to design policies that are flexible enough to take the country to the next stage of development and then keep it at the frontier. What policies will pass that test is an empirical matter and left for further research.

Another clear limitation of our study is the use of trade data on four-digit product classes, which are aggregated over six-, eight- or even ten-digit classes. If the aggregate sale of a four-digit product class grows, our maturity index would then identify it as less mature. This implies that at least the sales of some underlying products within that class grow faster. Having higher levels of disaggregated data would allow us to more precisely separate the less mature products from those mature ones and to more accurately construct the maturity index. As a result, we expect to find stronger positive effects of exporting early-stage products on growth in advanced countries and stronger positive impacts of exporting mature products on growth in emerging countries, respectively. We leave the verification for future research. In all, the use of highly disaggregated trade data opens up new avenues for identifying the precise nature of products, for reducing measurement errors, and therefore improve our understanding of the relationship between international product life cycles, trade and development stages.

Notes

See Mullor-Sebastian (1983) for an overview of the early empirical literature on the product life cycle in the 60s.

The most common practice is to include regional dummies or country fixed effects in a panel framework. The major drawback of these approaches is that they do not allow for differences in the marginal effect of regressors across regimes. Our conditional latent class model estimates regime-specific parameter vectors. In other words, countries in the same regime share a common parameter vector, but this vector is allowed to differ across regimes.

Specifically, Paap et al. (2005) apply a latent class analysis to sort a number of developing countries according to their average growth rates over the period 1961–2000. Alfo et al. (2008) develop a mixture of cross-sectional growth regression to uncover multiple regimes of per capita income convergence across EU regions for the period 1980–2002. Owen et al. (2009) apply a conditional finite mixture model based on the similarity of the conditional distribution of growth rates for a broad set of countries for the period 1970–2000, and find evidence of two distinct clubs, each with its own distinctive growth dynamics and institutional quality is a good predictor of the club membership. Bos et al. (2010) estimate a latent class production frontier and uncovers three different growth regimes using human capital, openness to trade, financial development, and the primary sector share as regime predictors for a sample of 77 countries during the period 1970–2000. Vaio and Enflo (2011) support that growth patterns were segmented in two worldwide regimes, the one characterised by convergence in per capita income, and the other by divergence based on a sample of 64 countries over a very long horizon 1870–2003. Owen and Videras (2012) use latent class analysis to characterise development experiences of countries by taking into account the quality of growth.

The structure of imports may have direct impact on economic performance as well. Earlier studies show that imports of quality foreign capital goods serves as a means to acquire foreign technology through reverse engineering (Connolly 1999). Lee (1995) and Lewer and Berg (2003) find that capital-importing countries benefit from trade because trade causes the cost of capital to fall, where Schneider (2005) shows that high technology imports matter for growth. However, others do not reveal any significant role for the composition of imports in economic growth (An and Iyigun 2004; Wörz 2005). In line with recent papers that analyse the importance of export structure for better economic performance, this paper focuses on the export side and leave the import side for future research.

This finding is consistent with Imbs and Wacziarg (2003) who find a similar pattern using production and employment data.

See Lederman and Maloney (2012) for an extensive review.

Indjikian and Siegel (2005) provide a comprehensive review on the impact of IT on economic performance in developed and developing countries. They find strong positive correlation between IT and economic performance in developed countries, but not in developing countries. They argue that two deficiencies hinder the use of IT in developing countries are the lack of knowledge of “best practice” and IT-skilled labour force.

One should realise that, since advanced producers in the same or the other region can compete and will produce when their marginal costs are below the market price. This caps the price of mature goods at \(w_{C}^{H}\). We assume here that this constraint is not binding, even for the mature product producers in the North imitating their product from the South. We thus assume: \({{w_{S}^{L}}\over {\alpha }}<>{{w_{N}^{L}}\over {\alpha }}<w_{S}^{H}<>w_{N}^{H} .\)

As for higher \(\alpha \) the price elasticity of demand increases and prices converge on marginal costs a higher \(\alpha \) reflects more intense competition in global markets. Also recall that \(\gamma \) reflects the innovation output elasticity with respect to recent (vs old) knowledge, whereas \(\delta \) reflects the ease of adopting domestic versus foreign advanced technology. As long as \(\alpha \) is above 0.5 and \(\delta >\gamma \) our condition is satisfied.