Abstract

The absence of evidence in the scholarly literature for a tested long-term relationship between entrepreneurship and economic growth is at odds with the importance attributed to entrepreneurship in the policy arena. The present paper addresses this absence, introducing entrepreneurship using four different and accepted models explaining the total factor productivity of twenty OECD countries with data for the period 1969–2010. Traditionally, entrepreneurship is not addressed in these models. We show that in all models—as well as a joint one—entrepreneurship has a significant influence while the remaining effects largely stay the same. Entrepreneurship is measured as the business ownership rate (number of business owners per workforce) corrected for the level of economic development (GDP per capita).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Explanations of economic growth have been subject to extensive economic analyses. Neoclassical economists (Solow 1956; Swan 1956) focus on labor growth and capital accumulation as drivers of economic growth and treat technological progress as exogenous. Lucas (1988), Romer (1990), Jones (1995) and Young (1998) extend the neoclassical growth model by endogenizing technological change. This is done by interpreting the creation of knowledge as an endogenous process, dependent on the amount of human capital (Lucas 1988) or, more specifically, the amount of human capital allocated to research and development (R&D) activities (Romer 1990; Jones 1995; Young 1998).

Indeed, there is a strong empirical relationship between productivity and R&D (Lichtenberg 1993; Coe and Helpman 1995; Coe et al. 2009; Bassanini et al. 2001; Guellec and Van Pottelsberghe de la Potterie 2004; Khan and Luintel 2006). The usual and obvious critique is that it is not R&D but rather innovation that spurs productivity growth. An important link between R&D and innovation is thought to be organization, and entrepreneurship in particular (Audretsch et al. 2002; Audretsch and Keilbach 2004a, b; Audretsch 2009; Michelacci 2003). Although the impact of entrepreneurship on economic growth and employment has been subject to extensive ad hoc research (Carree and Thurik 2010; Van Praag and Versloot 2007; Prieger et al. 2016), entrepreneurship is practically absent from studies that examine the long-term relationships between economic variables and economic growth or productivity development (Bleaney and Nishiyama 2002).

The lack of studies in the established literature on the long-term relationship between entrepreneurship and economic growth and/or productivity makes the status of entrepreneurship in the policy arena somewhat vulnerable. In fact, the OECD recognizes that despite the clear attention given to entrepreneurship in public policy, its importance for growth is still ambiguous: Researchers argue about the link between entrepreneurship and growth, but everybody wants entrepreneurship, even if the link to growth is not clear (OECD 2006, p. 3). It is precisely this problem that the present paper aims to address.

We can only speculate about the reasons why entrepreneurship is omitted from longitudinal research dealing with the drivers of growth.Footnote 1 One reason could be the lack of high-quality systematic entrepreneurship data. Another could be the complex relationship between entrepreneurship measures and the level of economic development (Carree et al. 2007; Thurik et al. 2008; Prieger et al. 2016; Van Praag and Van Stel 2013). A final reason could be that entrepreneurship, as Schumpeter repeatedly argued, is a disequilibrium phenomenon (Hébert and Link 2006; Audretsch and Link 2012), which is inherently difficult to work into the reduced form set-up of long-run relationships.

Our approach to entrepreneurship makes three assumptions: first, that business ownership can be used as an indicator of entrepreneurship. It is indeed a widely accepted indicator of entrepreneurship at the aggregate level (OECD 2008; Parker 2009; Koellinger and Thurik 2012; Van Praag and Van Stel 2013). Moreover, it is the only entrepreneurship concept for which consistent measurements are available across countries and over time. Moreover, the role of entrepreneurship has changed over the last half century (Wennekers et al. 2010). This last argument leads to two more assumptions, according to which the impact of entrepreneurship is not just time dependent but also country dependent because countries in a certain year are not necessarily at the same stage of economic development (Carree et al. 2002; Prieger et al. 2016). These two heterogeneities are dealt with using a business ownership rate (number of business owners per workforce) corrected for economic development (GDP per capita).

Using the above three assumptions we examine the role of the business ownership rate (in four models) in driving productivity development (Coe and Helpman 1995; Engelbrecht 1997; Griffith et al. 2004; Belorgey et al. 2006). We use one single data set covering a 42-year period (1969–2010) and 20 OECD countries to extend these models. Ultimately, all drivers of the four approaches are specified in an ‘all in the family’ model. We show that, regardless of the specification used to explain total factor productivity, entrepreneurship has a significant positive impact.

The structure of the paper is as follows. Section 2 presents the well-known framework of productivity analysis. Section 3 continues with a discussion of the determinants of productivity from an empirical perspective. Section 4 describes the model, data and variables used in this study. Section 5 presents our empirical results and Sect. 6 concludes.

2 Framework for productivity analysis

The starting point for our framework is the human capital-augmented Solow model as introduced by Mankiw, Romer and Weil (1992):

where Y denotes gross domestic product. K and L denote (physical) capital input and labor (measured in physical units such as hours worked). H represents human capital and A represents the level of (labor augmenting) technological change. Human capital can be distinguished from raw labor. Raw labor encompasses the skills that people naturally possess. Human capital encompasses skills that are acquired through education, training and experience (Romer 2001). From Eq. (1) the following equation for labor productivity can be derived:

or in natural logarithms:

Equations (2) and (3) show that labor productivity depends on the capital–labor ratio (K/L), human capital per unit of labor (H/L) and on a residual term (1 − α − β) ln(A) that captures the level of technology. This residual term represents the level of total factor productivity (TFP), which measures how efficiently the production factors of capital and labor are combined in generating value added.

Country-level data on capital are usually available in internationally comparable statistics. Furthermore, the elasticity of the capital–labor ratio has historically been found to be approximately one-third (Bloom et al. 2002). The impact of human capital, in contrast, is more difficult to quantify: various factors can affect the amount of human capital, such as the average duration of education, the employment rate and the number of hours worked. In this paper, we will not set the impact of these human capital variables a priori but will instead estimate their effects empirically using a broader definition of total factor productivity, TFP, in which the effect of human capital per unit of labor is included as well:

The neoclassical growth theory characteristically treats technological progress (the growth in A) as exogenous. Endogenous growth models have been developed in which technological progress is explained by human capital and/or R&D (Romer 1990; Jones 1995; Young 1998). Although endogenous growth models have been tested by means of calibration (Jones 2002), it is difficult to empirically estimate endogenous growth models developed from a theoretical perspective. One should bear in mind that these models are based on knowledge production functions at the global level, which makes them less useful for application at the country level (Donselaar 2012). The R&D capital approach is used more often in empirical research (Griliches 1998, 2000). In this approach, which has been used since the 1960s (Mansfield 1965; Evenson 1968), the development of TFP is explained using an R&D stock variable.

In Eq. (4) TFP is defined within the framework of a Cobb–Douglas production function: a fixed output elasticity of capital, α, is based on a substitution elasticity of one between capital and labor. Research indicates that this substitution elasticity is actually much lower than one (Chirinko 2008). In that case, a more flexible production function is applicable, such as a Constant Elasticity of Substitution (CES) production function or a translog production function. In such production functions the output elasticity of capital depends inter alia on the capital–labor ratio. Independent of the specific production function, it is possible to impose a varying value on the output elasticity of capital, based on the traditional growth accounting methodology (Solow 1957). Under the neoclassical conditions of perfect competition in product markets and constant returns to scale in the production factors of capital and labor, the marginal products of capital and labor are equal to the return on capital and the wage rate, respectively. It can be derived that, in that case, the output elasticities of capital and labor are equal to the shares of capital income and labor income in total factor income. The annual growth of TFP can then be calculated as follows:

where ω K is the share of capital income in total factor income, or stated differently, the share of capital income in the gross domestic product. This share is the complement of the share of labor income in the gross domestic product and has a value that is approximately one-third (Romer 2001, p. 21). Subsequently, an index of total productivity can be calculated by summing the values of Δln (TFP) relative to a base year, or 1969 in the present paper. The index of TFP can then be calculated as follows:

An advantage of this approach is that a varying output elasticity of capital is taken into account. A limitation is that imperfect competition and deviations from constant returns to scale are not addressed. Whereas both phenomena are realistic at the micro level, it can be derived that the shares of labor income and capital income in the gross domestic product can serve as good approximations of output elasticities if firms do not earn above-normal (monopolistic) profits (Nishimura and Shirai 2000).

3 Determinants of total factor productivity

The present section addresses the drivers of total factor productivity. In addition to entrepreneurship, we limit ourselves to some core determinants, such as R&D capital, technological catch-up, human capital, labor participation, number of working hours and the state of the business cycle.

3.1 R&D capital approach

The R&D capital approach is widely used in empirical studies explaining productivity (Griliches and Lichtenberg 1984; Coe and Helpman 1995; Griliches 1998; Jacobs et al. 2002; Guellec and Van Pottelsberghe de la Potterie 2004). These studies generally find a strong contribution of R&D capital to TFP growth. In the present study we will follow the approach of Coe and Helpman (1995), which discriminates between the impacts of domestic and foreign R&D on productivity growth and relates them to a country’s size and the openness of its national economy.

Coe and Helpman (1995) find that the impact of domestic R&D capital depends positively on country size. Larger economies benefit more than smaller ones from domestic R&D capital. First, the R&D of larger OECD countries constitutes a larger share of worldwide R&D than does the R&D conducted by smaller countries. Second, in larger countries the spillovers of domestic R&D flow to foreign countries to a lesser extent and will be absorbed principally within the home country. Finally, large countries perform R&D across a wide array of possible R&D activities, thereby exploiting complementarities (Coe and Helpman 1995). Coe and Helpman (1995) use a G7 dummy as an interaction term for the domestic R&D capital variable to make a distinction in the output elasticities of domestic R&D capital between G7 and non-G7 countries (G7 = Canada, France, Germany, Italy, Japan, the UK and the US). In the present paper we further differentiate country size by using the share of domestic R&D capital in total global R&D capital (represented by the total R&D capital in our 20 countries) as an interaction term for the domestic R&D capital variable.

In Coe and Helpman’s study, the impact of foreign R&D on domestic productivity depends positively on the import share of a country. The idea is that openness to foreign trade functions as a mechanism that enables the country to benefit from knowledge developed abroad (Romer 1991, 1992; Grossman and Helpman 1991; Barro and Sala-i-Martin 1995). These empirical results indeed show that foreign R&D capital has a stronger effect on domestic productivity when a country is more open to foreign trade. However, Kao et al. (1999) have re-estimated the results of Coe and Helpman and find that when using superior dynamic panel estimation techniques (DOLS), the estimated coefficient of the foreign R&D capital stock is insignificant.

Coe and Helpman (1995) include domestic and foreign business R&D capital in their empirical analysis and abstract from public R&D capital. In our empirical analysis, we abstract from the effect of public R&D on productivity because of its ambiguous results in the literature (Guellec and Van Pottelsberghe de la Potterie 2004; Khan and Luintel 2006; Bassanini et al. 2001; Van Elk et al. 2015).

The domestic R&D capital stock is calculated using the methodology from Guellec and Van Pottelsberghe de la Potterie (2004), which is similar to that of Coe and Helpman (1995): the domestic R&D capital stock (in volume) in period t is equal to new R&D investments (in volume) in period t plus the stock at period t − 1 minus depreciation:

where RD represents the volume of R&D expenditure, S denotes the volume of domestic R&D capital and δ the depreciation rate of R&D capital. The depreciation rate of R&D capital is set at 15 %, based on Griliches (2000, p. 54) who refers to this percentage as the ‘conventional’ 15 percent figure for the depreciation of R&D-capital. Volumes of R&D capital are calculated using a separate R&D deflator. In line with Coe and Helpman (1995, p. 878), nominal R&D expenditure is deflated using the following index for the price of R&D: PR = P 0.5 × W 0.5, where P is the deflator for domestic expenditures and W an index of overall wage development. We assume that half of all R&D expenditure consists of wage costs and that the growth in wages of R&D personnel is in line with the growth in wages in general.

The development of domestic R&D capital in individual countries can be used to construct a variable for the development of foreign capital. Coe and Helpman (1995) use bilateral import shares between countries as weights for domestic R&D capital in individual countries. We follow this approach, calculating a variable for foreign R&D capital in each individual country based on the weighted development of domestic R&D capital in the 19 other countries included in our sample.

3.2 Catching-up

The ‘technology gap’ theory states that countries with low levels of technological development may benefit more from knowledge from abroad than countries that are technological leaders or are close to the technological frontier (Fagerberg 1987; Cameron et al. 1998). The setup of Griffith et al. (2004) relates to both the R&D spillover literature and the convergence literature because it addresses a direct effect of domestic R&D and a separate catch-up effect. In addition to a catch-up effect, Griffith et al. (2004) find evidence for interaction effects of domestic R&D and human capital with respect to catching-up, implying that both domestic R&D and human capital in a country have positive impacts on catch-up potential. This supports the Cohen and Levinthal (1989) idea of ‘absorptive capacity’.

Catching-up is conventionally modeled using the technological distance between countries based on the level of labor productivity per person employed (Dowrick and Rogers 2002; Frantzen 2000) or GDP per capita (Engelbrecht 1997; Fagerberg and Verspagen 2002). In an analysis at the level of manufacturing industries, Griffith et al. (2004) use differences in TFP levels between countries to model their catch-up variable. However, labor productivity and total factor productivity not only reflect the level of technological development but also depend on factors such as hours worked and labor participation. These factors should be taken into account to accurately measure the technological distances between countries. In practice, these adjustments are difficult to make. Therefore, we choose an alternative approach by using a catch-up variable based on patents granted by the USPTO.

Our catch-up variable is constructed by calculating the technological distance of a country’s patent stock (in relation to the labor force) relative to the technological leader.Footnote 2 Although both Japan and Switzerland rank high in terms of their granted USPTO patents, the US is defined as the technological leader. As far as we know, the use of a catch-up mechanism in explaining the development of productivity levels is new. Conventionally, catching-up is modeled in equations explaining the growth rate of productivity. However, we transformed the conventional catching-up mechanism into a mechanism suitable for productivity level estimations.

Our starting point is the catch-up effect on Δln(TFP) t which equals

where PAT denotes the patent stock and LF the labor force as an indicator of the economic scale of a country. A lag of 3 years is assumed between the development of new technological knowledge and the granting of patents. Furthermore, obsolescence of knowledge is taken into account by using a depreciation rate of 15 % on the 1-year lagged patent stock, analogous to our calculation of R&D capital. This means that PAT is not simply the sum of granted patents but is a variable corrected for cumulated depreciation because of the obsolescence of knowledge. A smaller value of the PAT t+3/LF ratio in a country, relative to the US, leads to a larger catching-up effect on Δln(TFP) via a negative value of coefficient λ.

As a next step, we define the cumulative catching-up effect on the level of TFP with 1969 as the base year, \( {\rm ln}\left( {\frac{{TFP_{t} }}{{TFP_{1969} }}} \right)\):

The mathematical term after coefficient λ in Eq. (9) shows the explanatory variable that can be constructed to estimate coefficient λ empirically. This variable will be denoted by CU in the empirical estimates later is this paper. Next to a direct catch-up variable we also use a catch-up variable in which the catch-up effect depends on the R&D capital intensity of a country. The idea behind this second catch-up effect is that the larger the amount of R&D in a country (and the larger its distance from the technological leader), the faster a country can catch up. This is inspired by Cohen and Levinthal’s (1989) idea of ‘absorptive capacity’. By using the R&D capital intensity as an interaction term in the catch-up effect on Δln(TFP) t , the cumulative catching-up effect on the level of TFP relative to 1969 as the base year reads as follows:

where the R&D capital intensity is denoted by S/Y. The main difference with Eq. (9) is that the R&D capital intensity is included as an interaction variable in the part of the equation that models the annual catch-up effects on the growth of TFP. Furthermore, the superscript s is added to coefficient λ, in order to distinguish it from coefficient λ in Eq. (9). The mathematical term after coefficient λ s shows the definition of an explanatory variable that can be used to estimate coefficient λ s empirically. This variable will be symbolized by CU s in the empirical estimates.

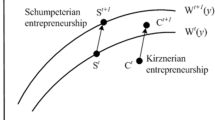

3.3 Entrepreneurship

Investments in knowledge and research alone will not automatically advance productivity because not all developed knowledge is economically relevant (Arrow 1962). Schumpeter (1947) notes that entrepreneurship is an important mechanism for the creation of value added: the inventor creates ideas, the entrepreneur ‘gets things done’. Although several attempts have been made to introduce entrepreneurship into endogenous growth models (Segerstrom et al. 1990; Aghion and Howitt 1998), these attempts miss the essence of the Schumpeterian entrepreneur (Braunerhjelm 2008, p. 475). Inspired by this limitation of endogenous growth theory, Audretsch et al. (2009) and Braunerhjelm et al. (2010) develop different models that introduce a filter between knowledge in general and economically relevant knowledge; they identify entrepreneurship as a mechanism that reduces this so-called ‘knowledge filter’.Footnote 3 Both incumbent and new firms play their roles (Audretsch 2007). Incumbent firms have the capabilities to penetrate the filter (Cohen and Levinthal 1990), and new firms are motivated to do the same to force market entry or capture market share (Kirzner 1997). This implies that entrepreneurship is an important transfer mechanism to facilitate the process of knowledge spillovers (Mueller 2006; Audretsch et al. 2009; Acs et al. 2009; Audretsch and Link 2012; Block et al. 2013; Lafuente et al. 2015). As both incumbent firms and new firms are willing to penetrate the knowledge filter, a ‘stock’ indicator for entrepreneurship – such as the business ownership rate – is more appropriate for our analysis compared to an entrepreneurship variable that merely captures the dynamics of the entrepreneurial process, such as the start-up ratio. Here we follow Parker (2009, p. 10–14) and many others in using the business ownership rateFootnote 4 as a measure of ‘aggregate’ entrepreneurship.

The impact of entrepreneurship on economic growth and employment has been subject to much ad hoc research (Van Stel et al. 2005; Thurik et al. 2008). Audretsch and Keilbach (2004a, b) find an effect of the number of start-ups on German regional growth in terms of labor productivity per employee. Holtz-Eakin and Kao (2003) find evidence of a positive relationship between entrepreneurship (measured by firm birth and death rates) and productivity levels in a cross-section panel of US states. Using a sample of 45 countries, Beck et al. (2005) find no robust cross-sectional relation between the share of the SME sector in manufacturing employment and economic growth. Carree and Thurik (2008) discriminate between the short- and long-run effects of new business creation on productivity growth, but they only find a significant positive effect of entrepreneurship in the short term. Van Praag and Van Stel (2013) and Prieger et al. (2016) find positive relationships.Footnote 5 In his review of the literature, Parker (2009, p. 324–330) hesitates to embrace the notion that entrepreneurship leads to long-term growth. We agree that a real long-term effect is only found in Van Praag and Van Stel (2013) and that studies follow considerable ad hoc reasoning and are seldom embedded in established economic models.

Explaining productivity using entrepreneurship measures is difficult due to the changing role of entrepreneurship in recent decades. Two factors are important for the present study. The first is the well documented, negative relationship between business ownership and economic development (Kuznets 1971; Lucas 1978; Schultz 1990; Yamada 1996; Iyigun and Owen 1998; Wennekers et al. 2010). The growing importance of economies of scale is cited as the explanation (Chandler 1990; Teece 1993). The second factor is the shift, and even reversal, of this trend as first observed by Blau (1987) and Acs et al. (1994). This shift is attributed to technological changes leading to a reduction of the role of economies of scale (Piore and Sabel 1984; Jensen 1993). The role of entrepreneurship has changed with the reversal of this trend, which is sometimes referred to as the switch of the ‘managed’ to the ‘entrepreneurial’ economy (Audretsch and Thurik 2001; Thurik et al. 2013). We follow several recent studies that try to address this changing role by hypothesizing or identifying time varying (U-shape type) influences of entrepreneurship on economic growth (Carree et al. 2002; Wennekers et al. 2010; Prieger et al. 2016). In line with these studies, we do not just introduce a time varying component but also an impact component, which is allowed to vary across countries because all countries in a certain year are not necessarily at the same stage of economic development.

GDP per capita is used to correct for time and country and a U-shape type is used to capture the changing role of entrepreneurship:

where Ê is the ‘standardized’ number of business owners per labor force and Y CAP represents GDP per capita (in thousands of $US, using prices of 1990 and $PPP). Carree et al. (2007) estimate values of δ, β and γ at 0.224, 0.011 and 0.00018 for a panel of 23 OECD countries. See Prieger et al. (2016) for a similar approach. Figure 1 shows the ‘standardized’ business ownership rate (Ê), substituting the estimated coefficients of δ, β and γ in Eq. (11). Each plotted country shows the development of the actual business ownership rate over the period 1970–2010.

Source: EIM Compendia database, Carree et al. (2007)

Business ownership and GDP per capita (US$), 1970–2004

The entrepreneurship variable used in our analyses is the ratio of the actual business ownership rate (e) and the ‘standardized’ business ownership rate (Ê). We expect this ratio to have a positive effect on TFP. The idea is that a level of e in excess of Ê represents additional valorization mechanisms whereas levels below Ê fail to have them. It is also an approach that aims to honor Schumpeter’s disequilibrium role for entrepreneurship (Hébert and Link 2006; Audretsch and Link 2012) in our reduced-form-type model.

3.4 Other variables

The empirical support for a direct effect of human capital (quality improvements in labor due to education and training) on labor productivity used to be limited (Benhabib and Spiegel 1994; Caselli et al. 1996). According to de la Fuente and Doménech (2006), this is due to lack of high-quality data. Using high-quality human capital data (the average education level of the working-age population represented by the average years of education) in a panel analysis for 21 OECD countries over the period 1960–1990, de la Fuente and Doménech (2006) find strong empirical support for the importance of human capital to productivity. Bassanini and Scarpetta (2002) and Arnold et al. (2011) extend the dataset of de la Fuente and Doménech (2006) and find strong results for the effect of average years of education on GDP per capita in panel analyses for OECD countries. The most recent year in the data of Arnold et al. (2011) is 2004. High-quality data covering the time period up to 2010 are available from Barro and Lee (2013) and will be used in this study.

High labor participation is often characterized by increased deployment of less-productive labor, which lowers labor productivity (Pomp 1998; Belorgey et al. 2006; Bourlès and Cette 2007).

In addition to participation levels, the number of hours worked per person employed has implications for the level of labor productivity. Working fewer hours may have a positive impact on productivity if less fatigue occurs among workers or if employees work harder during the shorter number of active hours (Belorgey et al. 2006; Bourlès and Cette 2007). However, a low number of hours worked per person may result from there being a relatively large share of less productive (small) part-time jobs. If the number of hours worked per person is, on average, lower for less productive persons than for persons with higher productivity, this will have an upward effect on the average productivity level of the total work force per hour worked. This then leads to a negative relationship between the number of hours worked per person and labor productivity per hour worked (Donselaar 2012).

Finally, labor and capital endowments are not immediately adjusted to business cycle volatility, but follow after a certain time lag. As a consequence, the short-term development of total factor productivity is partly influenced by fluctuations of the business cycle.

4 Econometrics

In this section we provide an overview of the estimation techniques used. Obtaining spurious results is a serious risk in a panel data analysis that has a long temporal component because the dependent and most independent variables trend over time (Granger and Newbold 1974). Augmented Dickey–Fuller tests show that some of the key variables in our model are non-stationary, which increases the risk of running spurious regressions.

Taking first differences of variables is a safe option to prevent the danger of spurious regression results when estimating relations between trended variables (Wooldridge 2003, p. 615). Unfortunately, this also implies that we lose information about the long-term relationship between the levels of the variables (Greene 2000, p. 790). If non-stationary variables are cointegrated, however, taking first differences is not necessary.Footnote 6 OLS estimates of cointegrated time series converge to their coefficient values much faster than in the case of stationary variables, making these regressions ‘super consistent’ (Stock 1987; Greene 2000, p. 795).

Kao et al. (1999), however, show that normal OLS estimation techniques with non-stationary panel data generate biased results. Therefore, we adopt the more advanced dynamic ordinary least squares estimates (DOLS). DOLS extends the panel cointegrating regression equation with cross-section-specific lags and leads of the differenced independent variables. By including lags and leads, the resulting cointegrating equation error term is orthogonal to the entire history of the stochastic regressor innovations. Our DOLS estimator has the following form:

where y i,t is our dependent variable for country i and year t, \( x_{i,t}^{{\prime }} \) is our matrix of independent variables, β is our cointegration vector, i.e., the long-run cointegrated effect of our set of independent variables on our dependent variable, and υ is the error term. In “Appendix 1”, we show the results of a number of panel cointegration tests, which indicate that the long-term relationships between our variables are cointegrated.

4.1 Endogeneity

With the exception of Belorgey et al. (2006), endogeneity is seldom addressed in studies using our approach. For instance, R&D and TFP are both sensitive to the cycle. Moreover, both TFP and the ratio of the actual and the ‘standardized’ business ownership rate also depend on the level of economic development (per capita income). Although we show in “Appendix 2” that the impact of our entrepreneurship variable on TFP is not predetermined by construction and that there is no self-imposed endogeneity problem, we also formally want to obviate any form of endogeneity that could affect our empirical estimations. Therefore, we use the Arellano–Bond (A–B) estimator (Arellano and Bond 1991) to conduct robustness analyses. The A–B estimator, which is a generalized method of moments (GMM) estimator, addresses two forms of endogeneity. First, A–B allows for the inclusion of a lagged dependent variable within a panel data setting. With the lagged dependent variable, we include the entire history of our independent variables in the model so that any influence is conditioned on this history (Greene 2003). Using standard estimators—such as within, first difference and generalized least squares (GLS)—is inconsistent in this respect, as the lagged dependent variable is correlated with the disturbance term, even if this term itself is not autocorrelated (Cameron and Trivedi 2005). Secondly, the A–B estimator allows for instrumentation of possible endogenous variables. The A–B estimator is identified by means of GMM conditions imposing orthogonality between our instruments and the residuals from our model. The A–B estimator is obtained by minimizing the following quadratic form Q (Cameron and Trivedi 2005, chapter 22):

where l = 1, …, M and k = 1, …, M denote the indices of instruments, i = 1, …, N the index for the countries, t the index for the time period, and T the set of available time periods after differencing regressors and after instrumentation of the endogenous regressors. Additionally, j = 1, …, P denotes the index for the regressors. In addition, z itl denotes the instrument l in period t in country i. Similarly, \( \Delta x_{itj} \) is the differenced regressor j in period t in country i. Finally, w kl denotes the weight given to instruments l and k in the quadratic form. The set of instruments consists of (1) the differenced exogenous regressors, (2) the appropriate A–B instruments, and (3) any other relevant instruments for the endogenous regressors.

5 Data

Table 1 provides an overview of the variables used, including data sources and some descriptive statistics. We use data for a period of 42 years (1969–2010) and twenty countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the UK and the US. The data originate from a number of sources. Variables are expressed in levels and indices (1969 = 1). For the R&D capital variables and TFP it is conventional to use indices. In the case of the R&D capital variables this facilitates interpretation because differences in absolute amounts of domestic and foreign R&D capital do not explain differences in TFP levels between countries. Rather, the development of the R&D capital variables is relevant for explaining the development of TFP in individual countries. For uniformity we also apply the index approach to all other variables. Comparability over time is achieved using constant prices to create 2010 volumes. Data in different national currencies are made comparable across countries by using US dollar purchasing power parities (PPP in US$).

For the construction of TFP levels, GDP data are taken from the OECD Economic Outlook database (as part of OECD.Stat), capital stock data from the AMECO database of the European Commission and the number of hours worked from the Total Economy Database of The Conference Board. The labor participation variable is based on employment data from the OECD Economic Outlook database and population data from the Annual Labor Force Statistics of the OECD (both are part of OECD.Stat), the numbers of hours worked per person employed is from the Total Economy Database. R&D data for the years 1981 onwards are obtained from the OECD Main Science and Technology Indicators (as part of OECD.Stat); for previous years they are retrieved from the publication ‘GERD 1969–1982’ by the OECD (1985). Patent data originate from the U.S. Patent and Trademark Office. The business ownership rate was computed using data from the COMPENDIA Dataset of EIM Business and Policy Research. Data for human capital is based on the average years of schooling from Barro and Lee (2013).

6 Empirical results

A first step is to reproduce the results of the TFP models of Coe and Helpman (1995), Engelbrecht (1997), Griffith et al. (2004) and Belorgey et al. (2006) using DOLS estimation techniques. Next, each model is extended with the entrepreneurship variable. Subsequently, we combine the models into one comprehensive ‘all in the family’ model. We also conduct robustness analyses using GMM estimation techniques.

6.1 Coe and Helpman (1995)

In column (1) of Table 2 we show that estimation results are similar to the original results of Coe and Helpman (1995), although our coefficients are somewhat higher.Footnote 7 In contrast to Kao et al. (1999), who fail to find a significant effect of foreign R&D (c 3 ), all our independent variables have a significant positive effect on TFP.Footnote 8

With respect to the ‘scale effect’ of domestic R&D, c 2 , we prefer to use the share of countries within the total worldwide R&D stock (represented by the total of the 20 countries in our study) as our interaction variable, instead of a G7 dummy. Note that the scale effect related to c 2 and the impact of foreign R&D c 3 are counterparts: larger countries benefit more than small countries from domestic private R&D capital, whereas small countries benefit to a larger extent from foreign private R&D capital.

In column (2) the specification based on Coe and Helpman (1995) is estimated, including our entrepreneurship variable (c 4 ). It shows a significant impact on the development of total factor productivity. Although the results for the other variables in the specification with entrepreneurship do not – across the board – largely differ from the initial results in column (1), adding entrepreneurship to the model does result in a substantial drop from 0.21 to 0.14 in the coefficient related to private domestic R&D capital.

6.2 Engelbrecht (1997)

Following Engelbrecht (1997), in column (3) human capital is incorporated in the ‘Coe and Helpman’ specification. The estimated coefficient for the human capital variable of 0.56 is higher than the output elasticity of 0.14 identified by Engelbrecht (1997, p. 1485). Although we and Engelbrecht both use the same data source, i.e., average years of education computed by Barro and Lee, we use improved data (Barro and Lee 2013) compared to their earlier work from 1993 (Barro and Lee 1993). Adding human capital is at the expense of the ‘scale’ variable, c 2 , which becomes insignificant. This finding is in line with Coe et al. (2009), where the DOLS estimates are almost identical to ours. They also find a significant positive effect of human capital on TFP, ranging between 0.51 and 0.77. This effect is largely in accordance with other empirical results found by Bassanini and Scarpetta (2002) and Arnold et al. (2011).

Column (4) shows the estimation results of the ‘Engelbrecht’ equation including entrepreneurship. Again, entrepreneurship has a significant and strong effect on TFP. Again, the coefficient of domestic R&D (c 1 ) shows a substantial drop in magnitude but remains significant. The other coefficients appear to be fairly stable.

6.3 Griffith et al. (2004)

Column (5) shows the initial results of the ‘Griffith’ equation. As Griffith et al. (2004) estimate a TFP growth model rather than a model explaining development of TFP levels and use data at the level of industries, their coefficients are not directly comparable. Nevertheless, the mechanisms that have a significant impact in their models largely correspond to our DOLS estimates: domestic private R&D, human capital and catching-up all have a significant effect on TFP.

In contrast to Griffith et al. (2004), the coefficient for the direct catching-up variable, c 6 , shows a counter-intuitive positive sign, whereas the catching-up variable interacting with R&D capital intensity does show the expected negative effect. The latter effect implies that domestic R&D capital is important in helping technological laggards to reduce their technological shortfalls vis-à-vis the technological leader. The idea is that catching up with the technological leader is easier for a country if it has a larger research absorptive capacity, in our case measured by R&D capital intensity. Note that our cross-section identifiers have been reduced to 19 instead of 20. The US, as technological leader, is removed from the sample, as DOLS estimates are unable to cope with our catching-up variable (which puts the US at 0 for every year).

In column (6) entrepreneurship is added to the ‘Griffith’ model. As is the case with the ‘Coe and Helpman’ and ‘Engelbrecht’ equations, adding entrepreneurship does not affect the other outcomes substantially and has a significant impact on the development of total factor productivity levels.

6.4 Belorgey et al. (2006)

DOLS estimations of our ‘Belorgey’ specification are not directly comparable to the estimations reported in the original paper, which uses GMM as an estimator. Column (7) shows that hours worked per person employed has a significant and negative effect on the development of TFP levels. Participation levels and the business cycle variable show insignificant effects. When including entrepreneurship in the equation (column (8)), the results ‘improve’ in the sense that they become more in line with those found in the original paper.

As a cross check, we have also conducted GMM estimates of the ‘Belorgey’ model to compare the magnitude of their effects to our own.Footnote 9 Table 3, column (1), shows that the effect of the change in employment (c 8 ) of −0.35 is practically identical to the effect (–0.37) found by Belorgey et al. (2006). The effect of hours worked (c 9 ) on productivity growth is only significant at 10 % and with a magnitude of −0.23, significantly lower than the effect found by Belorgey et al. (2006) of −0.50. If we add the growth of entrepreneurship (c 5 ) to the equation, the direct effect on TFP growth within a GMM setting is positive and significant. Moreover, the coefficients of employment and hours worked are both significant and close to the effects found by Belorgey et al. (2006) (see also Bourlès and Cette 2007). The business cycle effect (c 9 ) is positive and significant but our business cycle variable is different than that used in the original paper, which complicates a direct comparison between the coefficients. Belorgey et al. (2006) use the change in capacity utilization rate as a variable, for which the calculation method is not clear. We developed a business cycle variable in which the deviation of the unemployment rate from a Hodrick–Prescott (HP) filtered trend is used. This is done by dividing 100 minus the unemployment rate (as a percentage of the labor force) by 100 minus the calculated trend value of the unemployment rate. Hence the development of employment relative to the labor force and compared to a trend value is used as a reflection of the business cycle.

6.5 Complete model: ‘all in the family’

In Table 2, column (9), we combine all previously introduced mechanisms into one cohesive model. We only include the catching-up variable that interacts with R&D capital intensity because the direct catching-up variable produces counter-intuitive effects. Domestic private R&D capital (c 1 ), entrepreneurship (c 4 ), human capital (c 5 ), catching-up (c 7 ), employment (c 8 ), hours worked (c 9 ) and business cycle effects (c 10 ) all show significant and expected effects on total factor productivity.

The ‘scale’ variable (c 2 ) and foreign private R&D capital (c 3 ) do not show significant effects but this is most likely due to ‘competition’ from the catching-up variable. Both catching-up and foreign domestic R&D capital are included to capture foreign knowledge spillovers. If we drop our ‘scale’ variable and foreign private R&D capital from the model, every variable continues to show a significant effect (column (10)). If we drop our catching-up variable from our specification (column (11)), foreign private R&D capital again shows the expected effect on TFP and even our ‘scale’ factor shows a positive effect at a 10 % significance level. Most important, foreign knowledge spillover effects are positive and significant. In addition, our entrepreneurship variable shows a stable positive and significant influence on the development of TFP despite the ‘competition’ from the many other drivers of productivity. The weak ‘scale’ effect, however, comes as no surprise and was already addressed when discussing our ‘Engelbrecht’ approach (see Coe et al., 2009).

6.6 Robustness analyses using GMM

In Table 3, we show results of robustness analyses using dynamic GMM panel techniques, which we apply only to our ‘all in the family’ specification of Table 2. In doing so we control for endogeneity by including a lagged dependent variable and by using instrumental variables.

Column (3) in Table 3 shows the GMM re-estimation of column (9) of Table 2. The lagged dependent variable (c 1 ) is negative, which indicates that TFP growth is oscillating over time, but the effect is only significant at 10 % and the magnitude of the coefficient is relatively small. In addition, growth in the R&D variables (c 1 through c 3 ) and hours worked (c 9 ) do not show a significant effect on TFP growth, while entrepreneurship (c 4 ) is only significant at 10 %. All other variables have a significant impact on TFP growth. In short, the initial results are not very promising from a dynamic standpoint. As was the case with our DOLS estimate (column (9) in Table 2), however, combining foreign R&D capital with the catching up term generates inefficient results because both variables are likely to capture the same mechanism: international knowledge spillover effects.

Indeed, if we drop our ‘scale’ variable (c 2 ) and foreign private R&D (c 3 ) from our model, the results in column (4) improve markedly. Growth in private R&D capital (c 2 ), entrepreneurship (c 4 ), human capital (c 6 ), cumulative catching-up (c 7 ) and labor participation (c 8 ) all have a significant impact on TFP growth and show the expected sign. Changes in hours worked (c 9 ) continue to produce an insignificant effect. In addition, the business cycle variable (c 10 ) ceases to have a significant effect.

In column (5) to (7) we also perform three robustness analyses, where we use three different instruments for our entrepreneurship variable. Column (5) uses the lagged level of our entrepreneurship variable, i.e., deviation of the business ownership rate from a ‘standardized’ rate. In column (6) we use the lagged level of the actual business ownership rate as an instrument and in column (7) we use the lagged difference of the business ownership rate. All three estimates generate similar results although the effects of private R&D capital and the business cycle variable become less stable. In any case, entrepreneurship continues to show a robust and significant positive effect on TFP growth.

7 Concluding remarks

The ample attention given to entrepreneurship in public policy (OECD 2006) is not justified by strong scientific evidence despite many research endeavors (Parker 2009). In particular, there is a lack of tested results concerning the long-term relationship between entrepreneurship and productivity growth. Moreover, the persistent productivity slowdown in developed economies has occurred at a time of rapid technological change, increasing participation of firms and countries in global value chains, and rising education levels in the labor force, all of which are generally associated with higher productivity growth (OECD 2016). This disappointing and remarkable development is a major problem for developed economies. Equally disappointing and remarkable is the absence in the public policy debate of the explicit identification and explanation of this development. The present paper contributes to the scientific underpinning of this debate by identifying entrepreneurship as a driver of productivity that is assumed by policy to exist; however, scholars are not yet convinced.

We examine the role of entrepreneurship as a determinant of total factor productivity (TFP) in a series of models based on the R&D capital approach. A panel of annual data of 20 OECD countries is used, spanning the period 1969–2010 (840 data points). Total factor productivity is computed as the ratio between the gross domestic product (volume) and a weighted sum of labor and capital input. Entrepreneurship is computed as the ratio between the actual business ownership rate (number of business owners per workforce) and the ‘standardized’ business ownership rate. This ratio corrects for the influence of per capita income. We argue that this correction is necessary because the importance of entrepreneurship increases with increasing levels of economic development while its own level decreases. We reproduce the outcomes of four strands of the literature explaining productivity, where variables such as private R&D capital, foreign R&D capital, human capital, catching-up to the technological leader, labor participation and hours worked play an important role. In addition, entrepreneurship is taken into account. Ultimately, we combine all variables of the four specifications into one comprehensive ‘all in the family’ model and conduct several robustness tests.

Our empirical results confirm the robustness of the findings of the original models, even with entrepreneurship incorporated in the specifications. With or without entrepreneurship in the specifications, R&D (private domestic and foreign R&D capital), human capital, catching-up, labor participation and the number of hours worked per person employed are all individually significant drivers of the development of total factor productivity. More important, our results prove that entrepreneurship is also a systematic driver of productivity: it has a stable and significant impact on the development of productivity levels and productivity growth, independent of the model design.

In a much earlier version of the present analyses (Erken et al. 2009), a different time period, different estimation techniques and (for most variables) different calculations were used. Also, in this early and largely different approach, entrepreneurship appears as a systematic driver of productivity. We cannot claim that this analysis can be considered a replication of our current results, but it may very well serve as a fair robustness check.

To conclude, our analyses are the first in which entrepreneurship is shown to have a long-term effect on TFP in four different established models, and in a combined model, for a large number of developed countries over a long period (1969–2010).

Notes

An exception is Van Praag and Van Stel (2013).

The cumulated patent stock is based on data for the number of patents granted by the US Patent and Trade Office in relation to the labor force. The number of patents granted to establishments in the US is adjusted for their ‘home advantage’ by selecting patents granted in at least one other country as well. The construction of the patent knowledge stock is based on Furman et al. (2002) and Porter and Stern (2000). In accordance with these studies we assume that patents are granted after a time lag of 3 years. In contrast to these studies we take into account obsolescence of knowledge, by using a depreciation rate of 15 % on cumulated knowledge.

These studies show a positive impact of entrepreneurship on growth and support the view that entrepreneurship serves as a conduit for spillovers of knowledge. It is shown that R&D by itself is neither a growth safeguard nor will resulting growth happen instantaneously. Similarly, entrepreneurship is insufficient for propelling growth: it has to exploit knowledge (R&D) in order to lead to positive growth (Braunerhjelm et al. 2010). This conclusion is also drawn by Michelacci (2003) who considers an endogenous growth model where innovation requires the matching of an entrepreneur with a successful invention.

The business ownership rate is defined as the number of business owners (including all sectors except the agricultural sector) in relation to the labor force. Business owners include unincorporated and incorporated self-employed individuals, but exclude unpaid family workers. See Van Stel (2005) for how this variable is calculated. See Koellinger and Thurik (2012) for an analysis using this variable establishing its interplay with the business cycle and Van Praag and Van Stel (2013) for an analysis on the optimal rate of entrepreneurship and its dependence on tertiary education levels.

Cointegration means that there is a particular linear combination of nonstationary variables which is stationary, i.e., the residuals of the relationship are stationary in the long-run equilibrium. Hence, if series are cointegrated, their long-run equilibrium relationship can be estimated in levels (instead of differences) without running the risk of obtaining spurious results.

These differences are most likely partly due to the fact that Coe and Helpman use a depreciation rate of 5 % to calculate R&D capital, while we use a depreciation rate of 15%. Coe and Helpman also conduct estimations with a 15 % depreciation rate (Coe and Helpman 1995, Table B1) and as a result find higher coefficients for domestic private R&D capital. Similarly, they experiment with time dummies and the possibility of varying coefficients over time and between periods.

One explanation of the deviation of our results from Kao et al. (1999, Table 5, p. 705) could be that they use two leads in their DOLS estimates and we only one. However, re-estimates with one lag and two leads produce equally statistically significant outcomes.

The estimation results of Belorgey et al. (2006) show a short-term elasticity for the effect of the employment rate on gross domestic product per employee of −0.378. Combined with a coefficient of 0.248 for the 1 year lagged endogenous variable, this leads to a long-term elasticity of −0.50 (=−0.378/(1 − 0.248)). For the effect of hours worked per employee on gross domestic product per employee, a short-term elasticity of 0.477 is found, which results in a long-term elasticity of 0.63 (=0.477/(1 − 0.248)). For the effect of hours worked per employee on gross domestic product per hour worked this implies a short-term elasticity of −0.52 (=0.477 − 1) and a long-term elasticity of −0.37 (=0.63 − 1).

References

Acs, Z. J., Audretsch, D. B., Braunerhjelm, P., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Acs, Z. J., Audretsch, D. B., & Evans, D. S. (1994). Why does the self-employment rate vary across countries and over time? London: Centre for Economic Policy Research, CEPR Discussion Paper, no. 871.

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge, MA: The MIT Press.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297.

Arnold, J., Bassanini, A., & Scarpetta, S. (2011). Solow or Lucas? Testing speed of convergence on a panel of OECD countries. Research in Economics, 65(2), 110–123.

Arrow, K. J. (1962). The economic implications of learning by doing. Review of Economic Studies, 29(3), 155–173.

Audretsch, D. B. (2007). Entrepreneurship capital and economic growth. Oxford Review of Economic Policy, 23(1), 63–78.

Audretsch, D. B. (2009). The entrepreneurial society. Journal of Technology Transfer, 34(3), 245–254.

Audretsch, D. B., Aldridge, T., & Oettl, A. (2009). Scientist commercialization and knowledge transfer. In Z. J. Acs, D. B. Audretsch, & R. Strom (Eds.), Entrepreneurship, growth and public policy (pp. 176–201). Cambridge, UK: Cambridge University Press.

Audretsch, D. B., Bozeman, B., Combs, K. L., Feldman, M., Link, A. N., Siegel, D. S., et al. (2002). The economics of science and technology. Journal of Technology Transfer, 27(2), 155–203.

Audretsch, D. B., & Keilbach, M. (2004a). Does entrepreneurship capital matter? Entrepreneurship Theory and Practice, 28(5), 419–429.

Audretsch, D. B., & Keilbach, M. (2004b). Entrepreneurship and regional growth: An evolutionary interpretation. Journal of Evolutionary Economics, 14(5), 605–616.

Audretsch, D. B., & Link, A. N. (2012). Entrepreneurship and innovation: Public policy frameworks. Journal of Technology Transfer, 37(1), 1–17.

Audretsch, D. B., & Thurik, A. R. (2001). What is new about the new economy: Sources of growth in the managed and entrepreneurial economies. Industrial and Corporate Change, 10(1), 267–315.

Barro, R. J., & Lee, J. W. (1993). International comparisons of educational attainment. Journal of Monetary Economics, 32(3), 363–394.

Barro, R. J., & Lee, J. W. (2013). A new data set of educational attainment in the world, 1950–2010. Journal of Development Economics, 104, 184–198.

Barro, R. J., & Sala-i-Martin, X. (1995). Economic growth. New York: McGraw-Hill.

Bassanini, A., & Scarpetta, S. (2002). Does human capital matter for growth in OECD countries? A pooled mean-group approach. Economics Letters, 74(3), 399–407.

Bassanini, A., Scarpetta, S., & Hemmings, P. (2001). Economic growth: The role of policies and institutions. Panel data evidence from OECD countries. Paris: OECD, Economics Department Working Papers, no. 283.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2005). SMEs, growth and poverty: Cross-country evidence. Journal of Economic Growth, 10(3), 199–229.

Belorgey, N., Lecat, R., & Maury, T. P. (2006). Determinants of productivity per employee: An empirical estimation using panel data. Economics Letters, 91(2), 153–157.

Benhabib, J., & Spiegel, M. M. (1994). The role of human capital in economic development: Evidence from aggregate cross-country data. Journal of Monetary Economics, 34(2), 143–173.

Bjørnskov, C., & Foss, N. (2013). How strategic entrepreneurship and the institutional context drive economic growth. Strategic Entrepreneurship Journal, 7(1), 50–69.

Blau, D. M. (1987). A time-series analysis of self-employment in the United States. Journal of Political Economy, 95(3), 445–467.

Bleaney, M., & Nishiyama, A. (2002). Explaining growth: A contest between models. Journal of Economic Growth, 7(1), 43–56.

Block, J., Thurik, A. R., & Zhou, H. (2013). What turns inventions into innovative products? The role of entrepreneurship and knowledge spillovers. Journal of Evolutionary Economics, 23(4), 693–718.

Bloom, D. E., Canning, D., & Sevilla, J. (2002), Technological diffusion, conditional convergence, and economic growth. Cambridge (MA): NBER, NBER Working Paper, no. 8713.

Bourlès, R., & Cette, G. (2007). Trends in “structural” productivity levels in the major industrialized countries. Economics Letters, 95(1), 151–156.

Braunerhjelm, P. (2008). Entrepreneurship, knowledge and economic growth. Foundations and Trends in Entrepreneurship, 4(5), 451–533.

Braunerhjelm, P., Acs, Z. J., Audretsch, D. B., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125.

Braunerhjelm, P., & Borgman, B. (2004). Geographical concentration, entrepreneurship and regional growth: Evidence from regional data in Sweden, 1975–99. Regional Studies, 38(8), 929–947.

Cameron, G., Proudman, J., & Redding, S. (1998). Productivity convergence and international openness. In J. Proudman & S. Redding (Eds.), Openness and growth (pp. 221–260). London: Bank of England.

Cameron, A. C., & Trivedi, P. K. (2005). Microeconometrics: Methods and applications. Cambridge: Cambridge University Press.

Carree, M. A., & Thurik, A. R. (2008). The lag structure of the impact of business ownership on economic performance in OECD countries. Small Business Economics, 30(1), 101–110.

Carree, M. A., & Thurik, A. R. (2010). The impact of entrepreneurship on economic growth. In D. B. Audretsch & Z. J. Acs (Eds.), Handbook of entrepreneurship research (pp. 557–594). Berlin Heidelberg: Springer.

Carree, M. A., Van Stel, A. J., Thurik, A. R., & Wennekers, A. R. M. (2002). Economic development and business ownership: An analysis using data of 23 OECD countries in the period 1976–1996. Small Business Economics, 19(3), 271–290.

Carree, M. A., Van Stel, A. J., Thurik, A. R., & Wennekers, A. R. M. (2007). The relationship between economic development and business ownership revisited. Entrepreneurship and Regional Development, 19(3), 281–291.

Caselli, F., Esquivel, G., & Lefort, F. (1996). Reopening the convergence debate: A new look at cross-country growth empirics. Journal of Economic Growth, 1(3), 363–389.

Chandler, A. D., Jr. (1990). Scale and scope: The dynamics of industrial capitalism. Cambridge, MA: Harvard University Press.

Chirinko, R. S. (2008). The long and short of it. Journal of Macroeconomics, 30(2), 671–686.

Coe, D. T., & Helpman, E. (1995). International R&D spillovers. European Economic Review, 39(5), 859–887.

Coe, D. T., Helpman, E., & Hoffmaister, A. W. (2009). International R&D spillovers and institutions. European Economic Review, 53(7), 723–741.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: the two faces of R&D. Economic Journal, 99(397), 569–596.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Davidson, R., & MacKinnon, J. G. (2004). Econometric theory and methods. Oxford, UK: Oxford University Press.

de la Fuente, A., & Doménech, R. (2006). Human capital in growth regressions: How much difference does data quality make? Journal of European Economic Association, 4(1), 1–36.

Donselaar, P. (2012). Explaining productivity growth, the Solow residual disentangled. In B. de Groot & L. E. Hoeksma (Eds.), ICT, knowledge and the economy 2012 (pp. 252–268). The Hague/Heerlen: Statistics Netherlands.

Dowrick, S., & Rogers, M. (2002). Classical and technological convergence: Beyond the Solow–Swan growth model. Oxford Economic Papers, 54(3), 369–385.

Engelbrecht, H. J. (1997). International R&D spillovers, human capital and productivity in OECD economies: An empirical investigation. European Economic Review, 41(8), 1479–1488.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251–276.

Erken, H. P. G., Donselaar, P., & Thurik, A. R. (2009). Total factor productivity and the role of entrepreneurship. Rotterdam: Erasmus University Rotterdam, Tinbergen Institute Discussion Paper TI 2009-034/3.

Evenson, R. E. (1968). The contribution of agricultural research and extension to agricultural production. Chicago: University of Chicago.

Fagerberg, J. (1987). A technology gap approach to why growth rates differ. Research Policy, 16(2–4), 87–99.

Fagerberg, J., & Verspagen, B. (2002). Technology-gaps, innovation-diffusion and transformation: An evolutionary interpretation. Research Policy, 31(8–9), 1291–1304.

Frantzen, D. (2000). R&D, human capital and international technology spillovers: A cross-country analysis. Scandinavian Journal of Economics, 102(1), 57–75.

Furman, J. L., Porter, M. E., & Stern, S. (2002). The determinants or national innovative capacity. Research Policy, 31(6), 899–933.

Gonzalez-Pernía, J. L., & Peña-Legazkue, I. (2015). Export-oriented entrepreneurship and regional economic growth. Small Business Economics, 45(3), 505–522.

Granger, C. W. J., & Newbold, P. (1974). Spurious regressions in econometrics. Journal of Econometrics, 2(2), 111–120.

Greene, W. H. (2000). Econometric analysis (International edition). New Jersey: Prentice Hall.

Greene, W. H. (2003). Econometric analysis. New Jersey: Prentice Hall.

Griffith, R., Redding, S., & Van Reenen, J. (2004). Mapping the two faces of R&D. Productivity growth in a panel of OECD industries. Review of Economics and Statistics, 86(4), 883–895.

Griliches, Z. (1998). R&D and productivity: The econometric evidence. Chicago: University of Chicago Press.

Griliches, Z. (2000). R&D, education, and productivity. A retrospective. Cambridge (MA): Harvard University Press.

Griliches, Z., & Lichtenberg, F. R. (1984). R&D and productivity growth at the industry level: Is there still a relationship? In Z. Griliches (Ed.), R&D, patents, and productivity (pp. 465–496). Chicago: Chicago University Press and NBER.

Grossman, G. M., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge, MA: MIT Press.

Guellec, D., & Van Pottelsberghe de la Potterie, B. P. (2004). From R&D to productivity growth: Do the institutional settings and the source of funds of R&D matter? Oxford Bulletin of Economics and Statistics, 66(3), 353–378.

Hébert, R. F., & Link, A. N. (2006). The entrepreneur as innovator. Journal of Technology Transfer, 31(5), 589–597.

Holtz-Eakin, D., & Kao, C. (2003). Entrepreneurship and economic growth: the proof is in the productivity. Syracuse: Center for Policy Research Working Papers, no. 50.

Iyigun, M. F., & Owen, A. L. (1998). Risk, entrepreneurship and human capital accumulation. American Economic Review, 88(2), 454–457.

Jacobs, B., Nahuis, R., & Tang, P. J. G. (2002). Sectoral productivity growth and R&D spillovers in the Netherlands. De Economist, 150(2), 181–210.

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48(3), 831–880.

Jones, C. I. (1995). R&D-based models of economic growth. Journal of Political Economy, 103(4), 759–784.

Jones, C. I. (2002). Sources of U.S. economic growth in a world of ideas. American Economic Review, 92(1), 220–239.

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90, 1–44.

Kao, C., Chiang, M.-H., & Chen, B. (1999). International R&D spillovers: An application of estimation and inference in panel cointegration. Oxford Bulletin of Economics and Statistics, 61(s1), 691–709.

Khan, M., & Luintel, K. B. (2006). Sources of knowledge and productivity: How robust is the relationship? Paris: OECD, STI/Working Paper 2006/6.

Kirzner, I. (1997). Entrepreneurial discovery and the competitive market process: An Austrian approach. Journal of Economic Literature, 25(1), 60–85.

Koellinger, P. D., & Thurik, A. R. (2012). Entrepreneurship and the business cycle. Review of Economics and Statistics, 94(4), 1143–1156.

Kuznets, S. (1971). Economic growth of nations, total output and production structure. Cambridge, MA: Harvard University Press/Belknapp Press.

Lafuente, E., Szerb, L., & Acs, Z. J. (2015). Country level efficiency and national systems of entrepreneurship: A data envelopment analysis approach. Journal of Technology Transfer, in press (published online: 17 October 2015).

Lichtenberg, F. R. (1993). R&D investment and international productivity differences. In H. Siebert (Ed.), Economic growth in the world economy (pp. 1483–1491). Tubingen: Mohr.

Lucas, R. E. (1978). On the size distribution of business firms. Bell Journal of Economics, 9(2), 508–523.

Lucas, R. E. (1988). On the mechanisms of economic development. Journal of Monetary Economics, 22(1), 3–42.

Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A contribution to the empirics of economic growth. Quarterly Journal of Economics, 107(2), 407–437.

Mansfield, E. (1965). Rates of return from industrial research and development. American Economic Review, 55(1/2), 310–322.

Michelacci, C. (2003). Low returns in R&D due to the lack of entrepreneurial skills. The Economic Journal, 113(484), 207–225.

Mueller, P. (2006). Exploring the knowledge filter: How entrepreneurship and university–industry relationships drive economic growth. Research Policy, 35(10), 1499–1508.

Nishimura, K. G., & Shirai, M. (2000). Fixed cost, imperfect competition and bias in technology measurement: Japan and the United States. OECD Economics Department Working Papers, no. 273. Paris: OECD.

OECD. (1985). GERD 1969–1982, science and technology indicators, basic statistical series—volume B, gross national expenditure on R&D. Paris: OECD.

OECD. (2006). Understanding entrepreneurship: Developing indicators for international comparisons and assessments. Paris: STD/CSTAT(2006) 9.

OECD. (2008). A framework for addressing and measuring entrepreneurship. Paris: OECD Statistics Working Papers, 2008/2.

OECD. (2016). OECD compendium of productivity indicators 2016. Paris: OECD Publishing.

Parker, S. C. (2009). The economics of entrepreneurship. Cambridge: Cambridge University Press.

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric theory, 20, 597–625.

Piore, M. J., & Sabel, C. F. (1984). The second industrial divide possibilities for prosperity. New York: Basic Books.

Pomp, M. (1998). Labor productivity growth and low-paid work. CPB Report, 1998/1, 34–37.

Porter, M. E., & Stern, S. (2000). Measuring the “ideas” production function: Evidence from international patent output. Cambridge, MA: National Bureau of Economic Research, NBER Working Paper, no. 7891.

Prieger, J. E., Bampoky, C., Blanco, L. R., & Liu, A. (2016). Economic growth and the optimal level of entrepreneurship. World Development, 82, 95–109.

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102.

Romer, P. M. (1991). Increasing returns and new developments in the theory of growth. In Barnett, W. A., Cornet, B., D’Aspremont, C., Gabszewicz, J. J., & Mas-Colell, A. (Eds.) Equilibrium theory and applications: Proceedings of the sixth international symposium in economic theory and econometrics. Cambridge, MA: Cambridge University Press (pp. 83–110).

Romer, P. M. (1992). Increasing returns and new developments in the theory of growth. Cambridge, MA: National Bureau of Economic Research, NBER Working Paper, no. 3098.

Romer, D. (2001). Advanced macroeconomics. New York: McGraw-Hill.

Schultz, T. P. (1990). Women’s changing participation in the labor force: A world perspective. Economic Development and Cultural Change, 38(3), 457–488.

Schumpeter, J. A. (1947). The creative response in economic history. Journal of Economic History, 7(2), 149–159.

Segerstrom, P. S., Anant, T. C. A., & Dinopoulos, E. (1990). A Schumpeterian model of the product life cycle. American Economic Review, 80(5), 1077–1091.

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1), 65–94.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39(3), 312–320.

Stock, J. H. (1987). Asymptotic properties of least squares estimators of cointegrating vectors. Econometrica, 55(5), 1035–1056.

Swan, T. W. (1956). Economic growth and capital accumulation. Economic Record, 32, 334–361.

Teece, D. J. (1993). The dynamics of industrial capitalism: Perspectives on Alfred Chandler’s scale and scope. Journal of Economic Literature, 31(1), 199–225.

Thurik, A. R., Audretsch, D. B., & Stam, E. (2013). The rise of the entrepreneurial economy and the future of dynamic capitalism. Technovation, 33(8–9), 302–310.

Thurik, A. R., Carree, M. A., Van Stel, A. J., & Audretsch, D. B. (2008). Does self-employment reduce unemployment? Journal of Business Venturing, 23(6), 673–686.

Van Elk, R., Verspagen, B., Ter Weel, B., Van der Wiel, K., & Wouterse, B. (2015). A macroeconomic analysis of the returns to public R&D investments. The Hague: CPB Netherlands Bureau for Economic Policy Analysis, CPB Discussion Paper 313.

Van Praag, C. M., & Van Stel, A. (2013). The more business owners, the merrier? The role of tertiary education. Small Business Economics, 41(2), 335–357.

Van Praag, C. M., & Versloot, P. H. (2007). What is the value of entrepreneurship? A review of recent research. Small Business Economics, 29(4), 351–382.

Van Stel, A. J. (2005). COMPENDIA: Harmonizing business ownership data across countries and over time. International Entrepreneurship and Management Journal, 1(1), 105–123.

Van Stel, A. J., Carree, M. A., & Thurik, A. R. (2005). The effect of entrepreneurial activity on national economic growth. Small Business Economics, 24(3), 311–321.

Wennekers, A. R. M., Carree, M. A., Van Stel, A. J., & Thurik, A. R. (2010). The relationship between entrepreneurship and economic development: is it U-shaped? Foundations and Trends in Entrepreneurship, 6(3), 167–237.

Wooldridge, J. M. (2003). Introductory econometrics. A modern approach. Ohio: Thomson/South-Western.

Yamada, G. (1996). Urban informal employment and self-employment in developing countries: Theory and evidence. Economic Development and Cultural Change, 44(2), 289–314.

Young, A. (1998). Growth without scale effects. Journal of Political Economy, 106(1), 41–63.

Acknowledgments

The present paper benefited from many presentations and discussions. In particular, we would like to thank Thomas Astebro, Martin Carree, Isabel Grilo, Philipp Köllinger, Adam Lederer, André Van Stel, Wouter Verbeek and Ronald de Vlaming for their comments on earlier versions. Two anonymous referees provided significant input. The work of Roy Thurik was conducted in cooperation with the research program SCALES, carried out by Panteia BV and financed by the Dutch Ministry of Economic Affairs. The work of Hugo Erken benefited from a stay at the Erasmus School of Economics while he worked at the Ministry of Economic Affairs. The views expressed here are those of the authors and should not be attributed to Rabobank or the Ministry of Economic Affairs.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Testing for cointegration

Engle and Granger (1987) have developed tests to examine whether variables are cointegrated and residuals are I(0). If variables are not cointegrated, then the residuals will be I(1). Pedroni (2004) and Kao (1999) extended the work of Engle and Granger to make the framework applicable for panel data. Both approaches use an augmented Dickey–Fuller (ADF) to test the null hypothesis that variables are not cointegrated. We do not report the Phillips–Perron (PP) test and PP rho test, as it is well known that these tests perform less well in finite samples than ADF tests (Davidson and MacKinnon 2004, p. 623). Table 4 shows the results of the cointegration tests.

The results in Table 4 show that, regardless the number of variables used, the panel cointegration test rejects the null hypothesis of no cointegration. These results imply that we can use dynamic ordinary least squares (DOLS) to estimate long-run relationships.

Appendix 2: Testing for endogeneity

In the regression of ln(TFP) on ln(BOR*) and a set of control variables, the coefficient for ln(BOR*) is positive. In this regression, TFP is total factor productivity and ln(BOR*) = ln(e/Ê), where e is the business ownership rate and Ê the ‘standardized’ business ownership rate. See Carree et al. (2007). Total factor productivity depends upon gross value added per unit of labor (y). The ‘standardized’ business ownership rate depends upon gross domestic product per capita (Y CAP ). Given that y and Y CAP are equal up to a multiplicative constant (employment over population), there might be an endogeneity problem. In this appendix, we show that the sign of \( \frac{d\ln (TFP)}{{d\ln \left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}} \) is not predetermined by construction. Total factor productivity (TFP) depends on gross value added (Y) per unit of labour (L) and the amount of capital (K) per unit of labor. More specifically,

where \( y = \frac{Y}{L} \) and \( k = \frac{K}{L} \).

Ê depends on Y CAP as follows (Carree et al. 2007):

e is defined as the sum of Ê and an estimated error term (μ). That is,

In what follows, we take Y CAP to be equal to y without loss of generality. We know (Carree et al. 2007) that in (14) α > 0 (≈1/3) and that in (15) β > 0 (≈0.011), γ > 0 (≈0.00018) and δ > 0 (≈0.244). We can now rewrite (16) using (15) as follows:

The derivative of e/Ê with respect to y is now given by

Since the denominator of (18) is quadratic, this term is nonnegative by definition. Hence, the sign of \( \frac{{d\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}}{dy} \) is determined by the sign of μ(β − 2γy).

Using (14) we find that

Obviously, by definition, the first term in the last equality cannot be negative. Hence, the sign of (19) is determined by the last term of (19). Now, since the numerical value of the last term, evaluated at a given set of coordinates, is equal to one over the value of \( \frac{{d\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}}{dy} \) evaluated at the same set of coordinates, we have that the sign of \( \frac{dTFP}{{d\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}} \) is equal to the sign of \( \frac{{d\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}}{dy} \), which is in turn determined by the sign of μ(β − 2γy).

Recalling that \( \frac{d\ln (TFP)}{{d\ln \left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}} = \frac{dTFP}{{d\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}} \cdot \frac{{\left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}}{TFP} \) and that e > 0, Ê > 0, TFP > 0, we conclude that

Since y is uncorrelated to μ by the definition of least squares, μ is also uncorrelated to (β − 2γy). By defining z = β − 2γy, this assertion can be proved as follows:

where μ, being the estimated error term, has no predefined sign. Since μ—which we have shown to have no predefined sign—is multiplied with the uncorrelated term (β − 2γy), it follows that \( \frac{d\ln TFP}{{d\ln \left( {{e \mathord{\left/ {\vphantom {e {\hat{E}}}} \right. \kern-0pt} {\hat{E}}}} \right)}} \) has no predefined sign.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Erken, H., Donselaar, P. & Thurik, R. Total factor productivity and the role of entrepreneurship. J Technol Transf 43, 1493–1521 (2018). https://doi.org/10.1007/s10961-016-9504-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-016-9504-5