Abstract

Using the confined exponential and logistic models of technology diffusion, this paper investigates the roles played by international trade and FDI in explaining productivity growth through both technology transfer and domestic innovation, with the technology transfer also occurring independently. Using panel data on Canadian manufacturing industries, we first find a robust role for the autonomous and international trade embodied technology transfer in explaining TFP growth. Second, international trade and FDI (as well as research and development) all contribute to productivity growth through the rate of innovation. Finally, we find that the exponential and logistic models of technology diffusion may have different implications for the growth dynamics in a technologically lagging country.

Similar content being viewed by others

Notes

The diffusion of technology typically involves both market transactions and externalities. However, many economists believe that most international technology diffusion occurs not through market transactions (such as patenting, licensing and copyrights) but instead through externalities (spillovers). Thus, in this paper we use the terms technology/knowledge transfers and spillovers interchangeably.

Xu (2000) stresses that there exist significant cross-country knowledge spillovers in both disembodied and embodied forms, and that international trade and FDI are considered to be two major channels for embodied knowledge spillovers. Disembodied (or autonomous) spillovers include knowledge and technology flows that do not relate directly to the flow of goods and services between economic agents (Griliches 1992).

Thus, previous studies that specify one channel (such as international trade) may suffer from omitted variable biases and thereby overestimate the importance of this channel in international technology diffusion. For example, Coe and Helpman (1995) estimate an equation with international trade as the sole channel of international R&D spillovers. Keller (1998) finds, however, that the international R&D spillovers identified in Coe and Helpman (1995) are not related to international trade per se, but are a result of various unspecified spillover channels.

It is worth mentioning that this review does not cover all studies addressing trade and/or FDI and productivity linkages, but only those that have explicitly used trade and/or FDI (as a channel of transmission) in constructing measures of foreign technology transfer.

This captures the case that even if some country i imports only from some other country h, for instance, the former might still gain access to technology from countries other than h—if country h has in turn imported from those other countries before.

This functional form for the technology diffusion process was first specified by Nelson and Edmund (1996).

The endogenous growth theory provides a similar formulation. In a closed-economy endogenous growth model, productivity growth is a function of resources devoted to technology innovation, GTFP = g(R), where GTFP denotes TFP growth rate and R denotes R&D intensity. Extended to an open economy, productivity growth can come from both domestic innovation and absorption of foreign technology.

To see how quickly we converge to this steady-state equilibrium relative TFP − \( RTFP^{*} = \ln \left( {{{A_{ij}^{*} } \mathord{\left/ {\vphantom {{A_{ij}^{*} } {A_{Fj}^{*} }}} \right. \kern-\nulldelimiterspace} {A_{Fj}^{*} }}} \right) \), one can use the following general solution to the first-order difference equation for the relative TFP in Eq. (4): \( (RTFP_{t} - RTFP^{*} ) \approx e^{ - \lambda t} (RTFP_{0} - RTFP^{*} ) \), where the subscripts t and 0 denote time and the initial value—for further details on this general solution (see Romer 2006).

The concept of absorptive capacity refers to the ability of countries to understand and adopt foreign technology for use in the domestic market. It is believed that the receiving country’s learning or absorptive capacity depends on its R&D investments—hence the notion of R&D-based absorptive capacity.

The literature on the diffusion of technology across countries involves two broad schools of thought; the first one emphasizes the importance of absorptive capacity and the second one stresses the role of bilateral ties. Thus, by specifying the speed of technology transfer (\( \lambda_{ij} \)) as a function of international trade, FDI, and R&D, we cover both aforementioned views.

Assuming a very simple linear specification where \( \gamma_{ij} = \delta Z_{ijt} \) and \( \lambda_{ij} = \mu Z_{ijt} \) with Z being a single variable, one can specify a diffusion process that nests the logistic and exponential diffusion processes: \( \Updelta \ln A_{ijt} = \left( {\delta + \frac{\mu }{s}} \right)Z_{ijt} - \frac{\mu }{s}Z_{ijt} \left( {\frac{{A_{ijt} }}{{A_{Fjt} }}} \right)^{S} \) with \( s \in [ - 1, \, 1] \). Note that this nested specification collapses to the logistic model when \( s = 1 \), and if s = −1, it collapses to the exponential model. Using a general Bernoulli equation, Benhabib and Spiegel (2003) show that the “the catch-up or convergence condition” for the growth rate of a non-frontier country to converge to the growth rate of the frontier becomes (under logistic model): \( 1 + \frac{\mu }{\delta } > \frac{{Z_{Ft} }}{{Z_{it} }} \). Thus, countries for which this inequality does not hold, will not converge to the frontier's growth rate unless they invest in their economic variable, \( Z_{it} \), to meet this inequality.

In OECD studies, Z measures the degree of competition, while in Griffith et al. (2004) it denotes R&D intensity.

It is noteworthy that in the three OECD studies, the source of productivity growth that is always conclusive is the effect of competition via the speed of technology transfer (i.e., the interaction term coefficient, \( \mu_{1} \)); the effect of competition through innovation (i.e., \( \delta_{1} \)) is often either insignificant or counterintuitive. As for Griffith et al. (2004), they find R&D to be statistically and economically important through both technology transfer and innovation.

Therefore, the catch-up or convergence may be slower when the frontier is either too distant or too close, and is fastest at intermediate distance.

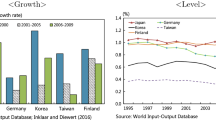

The relative levels of TFP are estimated using the number of employees rather than total hours worked. Although the preferred labour input measure is hours worked, the comparable U.S. hours data at the industry level are not readily available. It is noteworthy that since Canadians work on average about 10 % less hours per person employed in a year than their U.S. counterparts, the Canada–U.S. TFP gaps measured by using the number of employees (as shown in Fig. 1) is about 10 % points higher than the gaps measured using the hours worked.

The inclusion of the business cycle as a control variable is equivalent to including time dummies in the regression analysis. Moreover, all explanatory variables are lagged one period in order to reduce simultaneity problems and direction of causality issues.

Table 3 shows that R&D and trade variables are highly correlated. Note that Bassanini and Ernst (2002) find that R&D activity tends to increase with trade openness. They explain this as firstly evidence of positive knowledge spillovers and secondly, the possibility that by increasing product variety, trade openness may induce greater R&D spending when domestic producers try to imitate the new products.

Note that we include the business cycle variable and cross-section fixed effects (which are not reported) in all regressions throughout the paper.

Regressions in columns (3)–(5) indicate that imports from the U.S. provide a slightly better statistical fit (see R 2), while the magnitude of coefficients on all three import intensities (both the level and interaction terms) are almost equal.

In regressions not reported here, we also included the FDI interaction (technology transfer) term, but it remains statistically insignificant (although positively signed) at conventional critical values, and its inclusion resulted in lower R 2 value.

Capital includes structure and M&E capital. Land and inventory are not included.

References

Acharya, C. R., & Keller, W. (2009). Technology transfer through imports. Canadian Journal of Economics, 42(4), 1411–1448.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2004a). Entry and productivity growth: Evidence from micro-level panel data. Journal of the European Economic Association, 2(2–3), 265–276.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2004b). Firm entry, innovation and growth: Theory and micro evidence. Mimeo: Harvard University.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. Quarterly Journal of Economics, 120(2), 701–728.

Bahk, B. H., & Gort, M. (1993). Decomposing learning by doing in new plants. Journal of Political Economy, 101(4), 561–583.

Barro, R. J., & Sala-i-Martin, X. (1997). Technology diffusion, convergence, and growth. Journal of Economic Growth, 2, 1–26.

Bassanini, A., & Ernst, E. (2002). Labour market institutions, product market regulations and innovation: Cross country evidence. OECD Economics Department working paper no. 316.

Benhabib, J., & Spiegel, M. M. (2003). Human capital and technology diffusion. Development Research Institute working paper series no. 3, New York University.

Bernard, A. B., & Jones, C. I. (1996a). Productivity across industries and countries: Time series theory and evidence. Review of Economics and Statistics, 78(1), 135–146.

Bernard, A. B., & Jones, C. I. (1996b). Comparing apples to oranges: Productivity convergence and measurement across industries and countries. American Economic Review, 86(5), 1216–1238.

Cameron, G., Proudman, J., & Redding, S. (2005). Technological convergence, R&D, trade and productivity growth. European Economic Review, 49, 775–807.

Caves, D., Christensen, L., & Diewert, E. (1982a). The economic theory of index numbers and the measurement of input, output and productivity. Econometrica, 50(6), 1393–1414.

Caves, D., Christensen, L., & Diewert, E. (1982b). Multilateral comparisons of output, input, and productivity using superlative index numbers. Economic Journal, 92, 73–86.

Ciruelos, A., & Wang, M. (2005). International technology diffusion: Effects of trade and FDI. Atlantic Economic Journal, 33, 437–449.

Coe, D. T., & Helpman, E. (1995). International R&D spillovers. European Economic Review, 39(5), 859–887.

Coe, D. T., Helpman, E., & Hoffmaister, A. W. (1997). North–south R&D spillovers. Economic Journal, 107(440), 134–149.

Cohen, W., & Levinthal, D. (1989). Innovation and learning: The two faces of R&D. Economic Journal, 99, 569–596.

Conway, P., De Rosa, D., Nicoletti, G., & Steiner F. (2006). Regulation, competition and productivity convergence. OECD Economics Department working paper no. 509.

Eaton, J., & Kortum, S. (1999). International patenting and technology diffusion. International Economic Review, 40, 537–570.

Griffith, R., Redding, S., & Van Reenen, J. (2004). Mapping the two faces of R&D: Productivity growth in a panel of OECD industries. Review of Economics and Statistics, 86(4), 883–895.

Griliches, Z. (1992). The search for R&D spillovers. Scandinavian Journal of Economics, 94, s29–s47.

Hejazi, W., & Safarian, E. (1999). Trade, foreign direct investment, and R&D spillovers. Journal of International Business Studies, 30, 491–511.

Hoekman, B., & Javorcik, B. S. (2006). Global integration and technology transfer (see Chapter 2 on Lessons from Empirical Research on International Technology Diffusion through Trade and FDI). A Copublication of the World Bank and Palgrave Macmillan.

Keller, W. (1998). Are international R&D spillovers trade-related? Analyzing spillovers among randomly matched trade partners. European Economic Review, 42, 1469–1481.

Keller, W. (2004). International technology diffusion. Journal of Economic Literature, 42, 752–782.

Keller, W., & Yeaple, S. R. (2009). Multinational enterprises, international trade, and productivity growth: Firm-level evidence from the United States. The Review of Economics and Statistics, 91(4), 821–831.

Khan, T. S. (2006). Productivity growth, technological convergence, R&D, trade, and labor markets: Evidence from the French manufacturing sector. IMF working paper no. WP/06/230.

Kraay, A., Soloaga, I., & Tybout, J. (2006). Product quality, productive efficiency, and international technology diffusion: Evidence from plant-level panel data. Chapter 11 in Hoekman, B., and B.S. Javorcik (2006) Global Integration and Technology Transfer.

Lichtenberg, F., & van Pottelsberghe de la Potterie, B. (1996). International R&D spillovers: A reexamination. NBER working paper 5668.

Lichtenberg, F., & van Pottelsberghe de la Potterie, B. (2001). Does foreign direct investment transfer technology across borders? Review of Economics and Statistics, 83, 490–497.

Luh, Y. H., & Stefanou, S. E. (1993). Learning-by-doing and the sources of productivity growth: A dynamic model with application to U.S. agriculture. Journal of Productivity Analysis, 4, 353–370.

Lumenga-Neso, O., Olarreaga, M., & Schiff, M. (2005). On ‘indirect’ trade-related R&D spillovers. European Economic Review, 49(7), 1785–1798.

Nadiri, M. I., & Kim, S. (1996). International R&D spillovers, trade and productivity in major OECD countries. NBER working paper no. 5801.

Nelson, R. R., & Edmund, S. P. (1996). Investment in humans, technological diffusion, and economic growth. American Economic Review, 56, 69–75.

Nicoletti, G., & Scarpetta, S. (2003). Regulation, productivity and growth: OECD evidence. Economic Policy, 36, 11–72.

Rao, S., Tang, J., & Wang, W. (2004). Productivity levels between Canadian and U.S. Industries, mimeo, industry Canada. An abridged version is published in International Productivity Monitor, Fall 2004.

Rao, S., Tang, J., & Wang, W. (2008). What explains the Canada–US labour productivity gap. Canadian Public Policy, 34(2), 163–192.

Romer, D. (2006). Advanced macroeconomics (3rd ed.). New York: McGraw Hill.

Scarpetta, S., & Tressel, T. (2002). Productivity and convergence in a panel of OECD industries: Do regulations and institutions matter? OECD Economics Department working paper no. 342.

Xu, B. (2000). Multinational enterprises, technology diffusion, and host country productivity growth. Journal of Development Economics, 62, 477–493.

Xu, B., & Wang, J. (1999). Capital goods trade and R&D spillovers in the OECD. Canadian Journal of Economics, 32(5), 1258–1274.

Xu, B., & Wang, J. (2000). Trade, FDI, and international technology diffusion. Journal of Economic Integration, 15(4), 585–601.

Zhu, L., & Jeon, B. (2007). International R&D spillovers: Trade, FDI, and information technology as spillover channels. Review of International Economics, 15(5), 955–976.

Acknowledgments

I would like to thank the two anonymous referees for their valuable comments and suggestions. I am also grateful to Eric Ng and Larry Shute for their suggestions and to Weimin Wang for his guidance with the data. The views expressed in this paper are my own and do not reflect in any way those of Industry Canada or the Government of Canada.

Author information

Authors and Affiliations

Corresponding author

Appendix: Variable definitions and data sources

Appendix: Variable definitions and data sources

1.1 GDP and labour (or capital) share of income

The Canada–U.S. GDP ratio is calculated using GDP at factor cost, re-referenced to the year of 1999. GDP at factor cost in 1999 for Canada is obtained from Statistics Canada (STC) CANSIM table 381-0013 and converted into U.S. dollars using the Canada–U.S. bilateral GDP PPP values by industry from Rao et al. (2004). The imputed value for owner-occupied dwellings is not included. The time series of GDP at factor cost in 1999 dollars are estimated using the growth rates of GDP at basic price in 1997 chained-Fisher dollars. The GDP at basic price in 1997 chained-Fisher dollars from 1997 onward come from STC CANSIM table 379-0017, which are extended back to 1987 using the growth rates of GDP at factor cost in 1992 constant dollars from STC CANSIM table 379-0001. The labour (or capital) share of income is calculated using the data from STC CANSIM table 381-0013.

GDP at factor cost in 1999 for the U.S. is calculated using the data from BEA NAICS-based GDP-by-industry tables. The imputed value for owner-occupied dwellings is excluded using BEA NIPA table 7–12. The time series of GDP at factor cost in 1999 dollars are estimated using the chained-Fisher quantity index for GDP at market price from BEA NAICS-based GDP-by-industry tables. The labour (or capital) share of income is calculated using the same source tables.

1.2 Capital stock and employment

The capital stock is the private fixed non-residential geometric end-year net stock.Footnote 22 To calculate Canada–U.S. capital stock ratio, capital stock in Canadian dollars for Canada is converted into U.S. dollars using the Canada–U.S. bilateral total investment PPP values by industry. All the PPP values are obtained from Rao et al. (2008). The capital stock is in chained-Fisher dollars and re-referenced to the year of 1999.

The Canadian data for capital stock by industry are obtained from Statistics Canada (STC) CANSIM table 031-0002. The capital stock data for the U.S. come from the U.S. Bureau of Economic Analysis (BEA) fixed assets tables.

The data used for Canadian employment from 1997 onward is the total number of jobs from STC CANSIM table 383-0010. These data are extended back to 1987 using the growth rates of the total number of jobs from STC CANSIM table 383-0003. The employment data for the U.S. is the number of persons engaged in production. The source for the data from 1998 onward is the BEA NAICS-based GDP-by-industry tables, which are extended back to 1987 using the growth rates of the number of persons engaged in production from the BEA1987 SIC-based GDP-by-industry tables.

1.3 Import intensity

Import intensity is defined as imports to GDP ratio. Data on bilateral trade comes from OECD, STAN Bilateral Trade Database (BTD), 2006. The date covers the values of imports from different countries and regions in thousands of U.S. dollars at current prices over the period of 1980–2004. We used exchange rates for imports (U.S. dollars per national currency) to convert the values in Canadian dollars.

1.4 FDI intensity

FDI intensity is defined as inward FDI stock to GDP ratio. The data by NAICS-based industry from 1999 onward is obtained from Statistics Canada (STC) CANSIM table 376-0052. These data are extended back to 1987 using the growth rates from the SIC-based data provided by DFAIT.

1.5 R&D intensity

R&D intensity is defined as R&D expenditure to GDP ratio. The R&D expenditure data used is the intramural R&D expenditures that are obtained from the Science, Innovation and Electronic Information Division of Statistics Canada. The data from 1994 onward is NAICS-based. It is extended back to 1987 using the growth rates from the SIC-based data.

1.6 Business cycle (a proxy for capacity utilization)

The output fluctuation (i.e., the business cycle) is used as the indicator of capacity utilization because firms will adjust factor inputs accordingly in response to output change. The data used for output is real GDP by industry. The Hodrick–Prescott (H–P) filter is used to decompose GDP into two parts: the long-term trend and the short-term fluctuation. For normalization, the fluctuation is divided by the trend.

Rights and permissions

About this article

Cite this article

Souare, M. Productivity growth, trade and FDI nexus: evidence from the Canadian manufacturing sector. J Technol Transf 38, 675–698 (2013). https://doi.org/10.1007/s10961-012-9259-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-012-9259-6