Abstract

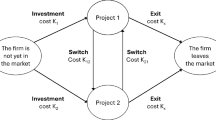

In this paper, we study the optimal research and development (R &D) investment problem under the framework of real options in a regime-switching environment. We assume that the firm has an R &D project whose input process with technical uncertainty is affected by different regimes. By the method of dynamic programming, we have obtained the related Hamilton–Jacobi–Bellman (HJB) equation and solved it in three different cases. Then, the optimal solution for our model is constructed and the related verification theorem is also provided. Finally, some numerical examples are given to investigate the properties of our model.

Similar content being viewed by others

Notes

If \(n=1\) represents the ’unfrindly’ regime and \(n=2\) represents the ’friendly’ regime, the result is similar. Thus, we omit the discussion here, similarly hereinafter.

References

Bensoussan, A., Hoe, S.R., Yan, Z.F., Yin, G.: Real options with competition and regime switching. Math. Financ. 27, 224–250 (2017)

Bensoussan, A., Yan, Z.F., Yin, G.: Threshold-type policies for real options using regime-switching models. SIAM J. Financ. Math. 3, 667–689 (2012)

Bizan, O.: The determinants of success of R &D projects: evidence from American-Israeli research alliances. Res. Policy 32, 1619–1640 (2003)

Choi, J.P.: Cooperative R &D with product market competition. Int. J. Ind. Organ. 11, 553–571 (1993)

Chronopoulos, M., Lumbreras, S.: Optimal regime switching under risk aversion and uncertainty. Eur. J. Oper. Res. 256, 543–555 (2017)

Cohen, W., Levin, R., Mowery, D.: Firm size and R &D intensity: a re-examination. J. Ind. Econ. 35, 543–565 (1987)

Cooper, R.G.: An empirically derived new product project selection model. IEEE Trans. Eng. Manag. 28, 54–61 (1981)

Dai, M., Zhang, Q., Zhu, J.: Trend following trading under a regime switching model. SIAM J. Financ. Math. 1, 780–810 (2010)

Dasgupta, P., Stiglitz, J.: Industrial structure and the nature of innovative activity. Econ. J. 90, 266–293 (1980)

Elliott, R.J., Siu, T.K.: On risk minimizing portfolios under a Markovian regime-switching Black–Scholes economy. Ann. Oper. Res. 176, 271–291 (2010)

Hairer, E., Nørsett, S.P., Wanner, G.: Solving Ordinary Differential Equations I: Nonstiff Problems. Springer, New York (1993)

Huchzermeier, A., Loch, C.H.: Project management under risk: using the real options approach to evaluate flexibility in R &D. Manage. Sci. 47, 85–101 (2001)

Kort, P.M.: Optimal R &D investment of the firm. OR Spektrum 20, 155–164 (1998)

Koussis, N., Martzoukos, S.H., Trigeorgis, L.: Real R &D options with time-to-learn and learning-by-doing. Ann. Oper. Res. 151, 29–55 (2007)

Lin, D.: Accelerability vs. scalability: R &D investment under financial constraints and competition. Manag. Sci. 69, 4078–4107 (2023)

Moawia, A.: A note on the theory of the firm under multiple uncertainties. Eur. J. Oper. Res. 251, 341–343 (2016)

Nishihara, M.: Valuation of R &D investment under technological, market, and rival preemption uncertainty. Manag. Decis. Econ. 39, 200–212 (2018)

Nishihara, M.: Closed-form solution to a real option problem with regime switching. Oper. Res. Lett. 48, 703–707 (2020)

Osmolovskii, N.P., Maurer, H.: Applications to Regular and Bang-Bang Control. Society for Industrial and Applied Mathematics, Philadelphia, PA (2012)

Pennings, E., Sereno, L.: Evaluating pharmaceutical R &D under technical and economic uncertainty. Eur. J. Oper. Res. 212, 374–385 (2011)

Pindyck, R.S.: Investments of uncertain cost. J. Financ. Econ. 34, 53–76 (1993)

Sendstad, L.H., Chronopoulos, M.: Strategic technology switching under risk aversion and uncertainty. J. Econ. Dyn. Control 126, 103918 (2021)

Sotomayor, L., Cadenillas, A.: Explicit solutions of consumption investment problems in financial markets with regime switching. Math. Financ. 19, 251–279 (2009)

Teschl, G.: Ordinary Differential Equations and Dynamical Systems. American Mathematical Society, Providence (2012)

Villani, G., Biancardi, M.: An evolutionary game approach in international environmental agreements with R &D investments. Comput. Econ. 54, 1027–1042 (2019)

Wang, M.H., Huang, N.J., O’Regan, D.: Optimal product release time for a new high-tech startup firm under technical uncertainty. J. Ind. Manag. Optim. 19, 321–337 (2023)

Wang, M.H., Huang, N.J.: Robust optimal R &D investment under technical uncertainty in a regime-switching environment. Optimization 71, 1557–1578 (2022)

Whalley, A.E.: Optimal R &D investment for a risk-averse entrepreneur. J. Econ. Dyn. Control 35, 413–429 (2011)

Yu, X.N., Lan, Y.F., Zhao, R.Q.: Cooperation royalty contract design in research and development alliances: Help vs. knowledge-sharing. Eur. J. Oper. Res. 268, 740–754 (2018)

Acknowledgements

The authors would like to express deep gratitude to the reviewers and the editor for their very helpful suggestions and comments, which have helped us to substantially improve the presentation and quality of this manuscript.

Funding

This work was supported in part by the Fundamental Research Funds for the Central Universities (JBK2101005), in part by the National Natural Science of Foundation of China (11801462, 12171339).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential Conflict of interest was reported by the authors.

Additional information

Communicated by Kok Lay Teo.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, Mh., Yue, J. & Huang, Nj. Optimal R &D Investment Problem with Regime-Switching. J Optim Theory Appl (2024). https://doi.org/10.1007/s10957-024-02451-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10957-024-02451-0