Abstract

In this paper we study an endogenous growth model where investments are (generically) distributed over multi-period flexible projects leading to new capital once completed. Recently developed techniques in dynamic programming are adapted and used to unveil the global dynamics of this model. Based on this analytical ground, several numerical exercises are performed to show the quantitative relevance of the analytical findings with an emphasis on the relation between project features and economic growth and speed of convergence toward the balanced growth path.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Motivation: The notion of investment project has been often used in the economic growth literature [e.g., Asea and Zak (1999), Bambi (2008) and Bambi et al. (2012)] and in the real business cycle literature [e.g., by Kydland and Prescott (1982)] to introduce gestation lags in the production of capital goods. In these contributions, a project has always three features. First, it requires several stages before its completion and, once completed, leads to new productive capital; therefore, an (exogenously given) lag of several periods exists between the beginning of a project and the formation of new productive capital. Secondly, the amount of resources allocated to a project, as well as its objective, are decided at its beginning and cannot be adjusted afterward. For this reason, we refer to this kind of projects as fixed projects.Footnote 1 Lastly, the investment distribution over the fixed projects is exogenously given and, furthermore, not generic. More precisely, it is often assumed that the investment is either spread evenly over all the projects independently on their degree of completion (uniform distribution), or concentrated on the project at its earliest stage (i.e., pure investment lag case).Footnote 2

While the first feature is confirmed by several empirical evidences [e.g., Koeva (2000)], the other two features are less convincing and are often introduced to make the model more analytically tractable. The assumption of fixed projects seems even more restrictive when capital is constructed broadly “to encompass human capital, knowledge, public infrastructure, and so on” [see Barro and Sala-i Martin (2004)] as it is usually the case with endogenous growth models having linear technology.

In fact, several empirical evidences point to projects with a certain degree of flexibility. Among them, those on public infrastructures are probably the most popular. In the UK, the government started in 2009, as a consequence of the recession, a public spending review which comprehended 217 projects, totaling 34 billion pounds (The Independent June 17, 2010); following the review, several of these projects were reduced or even axed as the building of new schools for around 5 billion pounds (Guardian, 6 July 2010), or the building of new hospitals for more than 2.5 billion pounds (The Telegraph, March 3, 2009).Footnote 3

The third feature is also not confirmed by several recent contributions pointing out to alternative distributions over the projects. In a model with projects lasting four quarters, Altug (1989) estimates that 70 percent of the resources are allocated in the first two quarters and strongly reject the hypothesis of uniform distribution in favor of a decreasing exponential distribution. Similar results are found by Park (1984) when the projects take three quarters to be completed. On the other hand, some authors [e.g., Christiano and Todd (1996) or Del Boca et al. (2008)] have found evidences in support of an increasing exponential distribution according to which a close to zero proportion of resources is allocated in the first stage of the project (planning) and increasingly higher in the other stages (construction). Other distributions identified by the literature are a U-shaped distribution [e.g., Zhou (2000) and Peeters (1998)] and a hump-shaped distribution [e.g., Altug (1989)]. Interestingly, there is also evidence that the heterogeneity in the distributions can be country specific [e.g., Peeters (1998)].

The heterogeneity in the project’s characteristics (i.e., investment distribution and project’s length) seems even more compelling when we consider not only physical capital but also human capital, public infrastructure, etc. For example, the realization of public infrastructures projects varies significantly across countries with some reporting significant delays in their completion.Footnote 4 Of course, the heterogeneity in the project’s features becomes even more evident when we compare the developed with developing countries as emerges from a quite large literature on construction projects showing that the actual project’s length is, on average, longer in developing countries where it can arrive to be twice the estimated project duration.Footnote 5

Therefore, the aim of this paper was to develop an endogenous growth model characterized by generically distributed investment over flexible multi-period projects to account for the empirical evidences just described and to investigate how much the growth rate and transitional dynamics can be affected both qualitatively and quantitatively by differences in the project’s characteristics. In this extent, we depart from the standard assumptions used in the literature by modifying the second and third features of the investment projects.

Description of the Model: The engine of growth in our economy is the presence of constant returns to scale in the capital stock which is the only accumulating factor of production. A linear technology is a useful assumption for several reasons. First, because capital is then defined in a broader sense, and our results can be related to the empirical evidences on investments in public infrastructures, human capital formation, and construction mentioned before; second, because it lets us investigate the global rather than the local dynamics of the economy, the welfare analysis can be done without the usual problems related to the approximation errors.

Our analysis focuses on the centralized version of the model where a benevolent social planner decides, as usual, how much to consume and save in each period; however, the aggregate net investment contributes to the development of all the projects not yet completed (flexibility), each of them leading to new capital at different dates in the future. Then new capital is obtained as the weighted (Riemann) sum of all the investments undertaken over a given (finite) time interval, and as its limit when we move to continuous time. The other departure from the existing literature is to allow for a generic distribution of the investment over the (flexible) projects by keeping generic, but still exogenous as in Kydland and Prescott, the weights in the previously mentioned (Riemann) sum.

Before moving to our results, we stress that a project in our model is defined as flexible not because the generic investment distributions is endogenous but rather because the resources to be invested for its advancement or completion are not predetermined as in the fixed case explained at the beginning of this introduction.

Main Results: The paper contributes to the existing literature in three ways. First, it provides a full analytical characterization of the global dynamics of an endogenous growth model with investment generically distributed over flexible multi-period projects; this is done in the core part of the paper where we use a dynamic programming approach to unveil the closed-form optimal path of all the aggregate variables. This result is important also because constitutes the solid ground where the quantitative analysis is built on.

Secondly, the dynamic programming approach used in this paper represents a methodological contribution to the existing theoretical literature since it provides, for the first time, a strategy to solve optimal control models where the state equation is an integral delay differential equation (IDDE hereafter). Most importantly, our approach allows to find the optimal path of the aggregate macroeconomic variables explicitly, something not achievable using the existing results on the Pontryagin maximum principle. Moreover, the strategy developed in this paper can be easily adapted and applied to other interesting economic problems such as those on optimal dynamic advertising whose solutions have been always obtained for specific distributions of the forgetting time (see section Related Literature).

Thirdly, our analysis shows that economies with same interest rate, preference discount factor, depreciation rate, and elasticity of intertemporal substitution but different projects’ characteristics may grow at different rates and that the heterogeneity in the projects’ characteristics may imply quantitatively relevant differences in output growth. For example, we show in one of our first quantitative exercise that the income gap after 100 years between two economies, which are similar but their investment’s distributions, is 9.4 % when in both economies the length of a project, d, is 2 years, but the richest is characterized by time-to-plan (i.e., increasing exponential distribution), while the poorest by a uniform distribution of the investment over the projects. The income gap changes to 37.02 % when the poorest is characterized by pure investment lags in production (i.e., Dirac’s Delta in \(-d\)). Even larger differentials are observed if the project length changes from 2 to 3, 4, and 5 years. In the latter, the income gap after 100 years is 109.6 % when the poorest has pure investment lags in production, while there is time-to-plan in the richest. Crucially, the effect of different investment distributions on economic growth has not been investigated before; in fact, previous contributions have always focused on the effect of the project’s length on economic growth for an exogenously given but specific distribution which assumed all the resource to be invested at the beginning of a project [see Bambi et al. (2012)]. Based on our analytical findings we have also performed some numerical exercises which show two interesting things: First, it is possible to rank the investment distributions in term of their negative effect on economic growth if we exclude the hump-shaped distribution; second, the effects of this distribution on economic growth becomes, as expected, more and more negative as the length of the project increases but such change is milder than that implied by other distribution (such as the uniform) for some choices of the project’s length (see Table 2).

Lastly, we show how different projects’ features modify the transitional dynamics of the standard AK model; again, this analysis generalizes existing results, such as Bambi et al. (2012), which have always focused on the role of the project’s length in a pure gestation lag environment (i.e., the investment distribution is a Dirac delta \(\delta _{-d}\)). In fact, our analysis unveils how different choices of the project’s length and of the investment distribution may affect the growth rate and the transitional dynamics of an economy. Furthermore, we propose several quantitative exercises to assess how different projects features affect the average and maximum absolute deviation of the optimal output path from the balanced growth path as well as its speed of convergence. Most importantly, we find that economies with projects’ features more detrimental for economic growth are also characterized by a slower convergence to the balanced growth path. The speed of convergence differentials can be quantitative relevant, ranging from 24 to 106 % for different investment distributions, assuming a project’s length of 2 years; such figures change to 56 and 252 % when the project’s length is 5 years.

The rest of the paper is organized as follows. Sect. 2 presents the related theoretical literature; Sect. 3 explains the model setup with emphasis on the definition of the flexible multi-period investment projects and the investment distributions. In Sect. 4, we state the problem formally as an optimal control problem, and we prove some important preliminary results. In Sect. 5 we explain the methodological procedure to deal with this kind of problems and we prove the main theoretical result of the paper. In Sect. 6 we use the results of Sect. 5 to describe the balanced growth paths, while in Sect. 7, we study the transitional dynamics of the economy. Finally Sect. 8 assesses numerically the quantitative implications of our model in term of economic growth and transitional dynamics with an emphasis on the speed of convergence and welfare analysis. All proofs are in “Appendix,” while in the supplementary material the interesting reader may find the complete procedure used to solve the optimal control problem.

2 Related literature

Classical economists, such as Jevons (1871, Ch. VII) and Bohn Bawerk von Böhm-Bawerk (1890), argued that the time required to build new capital is a relevant dimension to be investigated to understand its role on the accumulation of capital and, therefore, on the growth rate and business cycle of an economy. Since then a quite large literature has followed.

Several contributions on economic growth and endogenous fluctuations [see, among others Kalecki (1935) and Benhabib and Rustichini (1991), example 7, page 332, Asea and Zak (1999), Ferrara et al. (2014), Bambi (2008) and Bambi et al. (2014)] have studied analytically the dynamics of economies with pure investment lags and fixed projects. In a stochastic general equilibrium framework, Kydland and Prescott (1982) showed that time-to-build may enhance the persistence of fluctuations emerging from exogenous random productivity shocks. As explained in the introduction, our paper differs from this existing literature because we study an endogenous (deterministic) growth model where the investments are generically distributed over flexible projects.

Interestingly, Lucas (1981) is the contribution which probably shares more similarities with our paper. In fact, Lucas (1981) studies, in a partial equilibrium framework, the optimal investment policy for a single firm whose objective is to maximize the discounted flow of profits by choosing the number of projects to initiate taking into account that the limit of the weighted (Riemann) sum of all the initiated projects undertaken over a given (finite) time interval generates new capital stock. Therefore, the capital’s formation equation is an IDDE, closely resembling ours.Footnote 6 However, there are three crucial differences with respect to his contribution. The first concerns the ownership right of capital; in our model, the firms rent capital at each date from the households and then their profit maximization problem is static, while the households’ problem is dynamic and their saving/investment is spread over the not yet completed projects. The second difference is the aim of the analysis, since we are interested in understanding how different distributions and lengths of the projects may affect the growth rate and transitional dynamics of the economy. The last difference is that the main analytical results in Lucas (see Lucas (1981), page 43) are obtained by restricting the analysis to those distributions which allow the author to convert the original complicated problem to a classical problem in the calculus of variations. On the other hand, our approach does not require restrictions on the distributions of the investment over the projects. In this extent, we contribute also from a methodological viewpoint by providing an approach which can be used to solve a broader class of problems.

Similarly, our paper is related to the stream of literature on optimal dynamic advertising. In their seminal contribution, Nerlove and Arrow (1962) study the optimal decision of a monopolistic firm which has to decide the stock of advertising goodwill which maximizes the discounted flow of profits taking into account that advertising is a costly activity, and it has a positive, but decreasing over time, effect on the revenue. As documented by the survey of Feichtinger et al. (1994), several contributions have generalized the Arrow and Nerlove’s model to account for two effects: the lag between the investment in advertising and the corresponding increase in goodwill, and the distribution of the forgetting time [for more details, Feichtinger et al. (1994), page 200]. The resulting law of motion of the stock of advertising goodwill is similar to the capital’s formation used in our model. Also in this case, our paper is different in the assumption on the ownership of the stock variable and on the scope of the analysis. Moreover, all these contributions [e.g., Pauwels (1977) and Hartl (1984)] characterize analytically the optimal investment decision for specific distributions using a modification of the maximum principle, while in our paper we apply dynamic programming techniques to find the optimal plan of the economy without imposing any restriction on the distribution of the investment over the projects.

Finally, this paper belongs to the class of optimal control problems where the state equation is a functional differential equation. Vintage capital models are, clearly, an economic example of such problems [see among others Boucekkine et al. (1997) and Feichtinger et al. (2006), and the survey on this literature by Boucekkine et al. (2011)]. From a methodological viewpoint, most of the papers dealing with this kind of problems use maximum principle techniques. Recently, starting from Fabbri and Gozzi (2008), new techniques in dynamic programming have been developed to solve such problems more explicitly; in particular it is possible to find the closed-loop policy function and unveiling economic mechanisms which were otherwise hidden [e.g., see Bambi et al. (2012) and Boucekkine et al. (2010)]. Optimal control of functional integro-differential equations has been also tackled in a partial equilibrium framework by Hritonenko and Yatsenko (1996) and Hritonenko and Yatsenko (2005). The novelty of their contributions is to consider economic problems with no distributed lags but with the delay parameter (in our case, the gestation lag) to be endogenously determined.Footnote 7

3 Model setup

3.1 Description of the flexible multi-period projects

We start with a description of the flexible multi-period projects, or investment plans, when time is discrete, and then we move to its continuous counterpart.Footnote 8 Let \(s_{j,t}\) indicate a project at time t, j stages from completion.Footnote 9 Once completed a project generates new capital:

no project requires more than d periods to be completed, \(s_{d+1,t}=0\), and the initial capital stock, \(k_0\), is exogenously given.

Flexibility is introduced by assuming that aggregate investment at time t is allocated over a menu of d projects:

so that each project completed after j periods, receives an (exogenous) share, \(a_j\), of the aggregate investments, \(i_t\). Formally, an investment distribution is so defined:

Definition 1

(Investment’s Distribution) Given the (maximal) project’s length \(d\in \mathbb N\), an investment distribution over the projects is a vector

where, for every j and t, \(a_ji_t\) is the share of the investment \(i_t\) over the projects j periods from completion.Footnote 10

Therefore, the dynamics of the projects is described by the following equation:

Clearly a project of period length d and started at date t can be modified at any date in the interval \((t,t+d)\). Therefore, all the resources added to a project, even those at the very last stage, increase the capital stock generated by completing it: This is the reason why the project is said to be flexible. Flexibility implies also that the total resources needed to complete a project are not determined at its beginning but only at the end because a project can be modified at each stage. Therefore, any investment decision taken at \(t=0\) influences, according to Eq. 2, all the projects not yet completed at that date. On the other hand, flexibility does not mean that the planner may decide how much to invest in each single project since total net investments are distributed over the existing projects according to the exogenously given distribution, \(a(\cdot )\). It is also worth noting that in the continuous-time counterpart, a completed project leads instantaneously to new capital, and therefore, the investment decision at that date may modify its magnitude. Flexibility as just described is fully specified as long as the initial history of the investment \(i_t\) with \(t\in [-d,0)\) and the initial capital stock \(k_0\) are exogenously given; in fact, this information is essential to characterize the projects to be completed in the interval [0, d).Footnote 11

3.2 The social planner problem

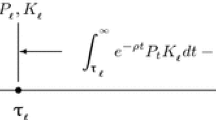

We begin this section embedding the project’s structure just described in the centralized version of an AK model. The social planner solves the following problem:Footnote 12

subject toFootnote 13

Observe that \(A \mathop {=}\limits ^{\mathrm{{def}}}R-\delta >0\) is the interest rate (i.e., the rental rate of capital, R, minus the depreciation rate, \(\delta \)). The other two parameters introduced, namely \(\sigma \), and \(\rho \), indicate the inverse of the elasticity of substitution and the preference discount rate, respectively. Also the resource constraint indicates that output is used for consumption and net investment. Net investment does not lead immediately to new capital but contributes to the development of projects as described by the state equation. In the problem above, k is the state variable and i the control variable. The constraint (c1) is a constraint on the state variable imposing the nonnegativity of capital, while the constraint (c2) is a mixed state-control constraint imposing that net investment cannot exceed the capital income. We note that in 3, \(i_0(s)\) must be assigned for a.e. \(s\in [-d,0)\) and it is an initial datum together with \(k_0\).Footnote 14

The fact that the initial datum is a real number \(k_0\) together with a function \(i_0\) illustrates that the nature of the problem is infinite dimensional. Differently from Bambi et al. (2012), the state Eq. 3 is a IDDE in the control variable and investment are reversible, meaning that net investment can be also negative.

4 The control problem: preliminary analysis

In this section, we briefly describe the notation on functional spaces used throughout the paper and then we give a formal statement of the optimal control problem. A sufficient condition for the finiteness of the value function is also found; this preliminary result is crucial to solve the problem using the dynamic programming approach.Footnote 15

4.1 Notation

We adopt the notation proposed by Brezis (2011). \(L^2([-d,0];{\mathbb {R}})\) denotes the space of all functions from \([-d,0]\) to \(\mathbb {R}\) that are Lebesgue measurable and square integrable. \(L^2_{\mathrm {loc}}(\mathbb {R}_+; \mathbb {R})\) denotes the space of all functions from \(\mathbb {R}_+\) to \(\mathbb {R}\) that are Lebesgue measurable and square integrable on all bounded intervals.Footnote 16 \(W^{1,2}([-d,0]; \mathbb {R})\) (resp. \(W^{1,2}_{loc}(\mathbb {R}_+; \mathbb {R})\)) denotes the space of the functions in \(L^2([-d,0];{\mathbb {R}})\) whose weak first derivative exists and belongs to \(L^2([-d,0];{\mathbb {R}})\) (\(L^2_{\mathrm {loc}}(\mathbb {R}_+; \mathbb {R})\) resp.) too. \(C^0 (\mathbb {R}_+; \mathbb {R})\) and \(C^1(\mathbb {R}_+; \mathbb {R})\) denote, respectively, the space of continuous and of continuously differentiable functions from \(\mathbb {R}_+\) to \(\mathbb {R}\). Similar definitions are given when \(\mathbb {R}\) is replaced by \(\mathbb {R}_+\): simply, in this case, the functions take values in \(\mathbb {R}_+\).Footnote 17

4.2 Formal statement of the control problem

Consistently with the Definition 1 of investment distribution, we assume, from now on, the following.

Assumption 1

The share of investment \(a(\cdot )\) is a function in \(L^2([-d,0];\mathbb {R}_+)\) with \(\int _{-d}^0 a( r)\mathrm{{d}}r=1\).

We now begin to rewrite our optimal control problem. First of all, we write more formally the state Eq. 3: Given a control strategy \({i}_{0}\in L^2([-d,0];{\mathbb {R}})\) and \(i \in L^2_{\mathrm {loc}}(\mathbb {R}_+; \mathbb {R})\), we denote by \(\tilde{\imath }: [-d,+\infty ) \rightarrow \mathbb {R}\) the function in \(L^2_{\mathrm {loc}}([-d,+\infty ); \mathbb {R})\) defined as follows.

For every \(i_0\in L^2([-d,0];{\mathbb {R}})\), \(k_0\in \mathbb {R}\) and \(i \in L^2_{\mathrm {loc}}(\mathbb {R}_+; \mathbb {R})\), there exists a unique continuously differentiable solution to 3, i.e., a function of class \(C^1(\mathbb {R}_+;\mathbb {R})\), which will be denoted by \(k_{(k_{0},i_{0}), i},\) verifying pointwise 3 for each \(t\ge 0\). Using 5, this solution can be explicitly written in integral form

The fact that \(k_{(k_{0},i_{0}), i}\in C^1(\mathbb {R}_+;\mathbb {R})\) is due to the continuity of the function \(s\mapsto \int _{-d}^{0} a( r) \tilde{\imath }(s+ r)\mathrm{{d}}r\).

The functional to maximize is

under the set

We call (P) the problem of finding an optimal investment strategy \(i^{*} \in \mathcal {I}_{(k_{0},i_{0}) } \) such that

where V is the value function. Define now the Hilbert space \(H\mathop {=}\limits ^{\mathrm{{def}}}\mathbb {R}\times L^2([-d,0];\mathbb {R})\). The variable \((k_0,i_0)\) belongs to one of the following two subsets of H:

where the initial capital, \(k_0\), is always positive while the initial investment, \(i_0\), can be reversible (\(H^{+}\)), or irreversible (\(H^{++}\)).Footnote 18 Nevertheless, it will be convenient to solve the problem at first assuming \((k_0,i_0)\in H\) and only later restricting its domain of existence to \(H^+\) or \(H^{++}\).

The condition for the value function to be finite depends on the maximal growth rate of the capital stock at infinity. For this reason we first focus on the maximal growth rate of capital in the next subsection and on the finiteness of V in Sect. 4.4.

4.3 Maximal growth rate of capital

In this section we prove that the admissible state trajectories (capital paths) admit an upper bound, denoted by \(k^{M}_{(k_0,i_0)}\), where the asymptotic growth rate of capital is maximum. To prove the existence of this upper bound, some preliminary results are necessary.

Equation 6, Assumption 1 and the structure of \(\mathcal {I}_{(k_0, i_0)}\) suggest that the highest accumulation of capital, k, is when consumption is zero and output is fully reinvested at each date, i.e., \(i(t)=Ak(t)\) for all \(t\ge 0\) (which implies that the constraint (c2) in 4 is binding). Substituting this constraint into the state Eq. 3, we get the corresponding closed-loop IDDE

We notice that in 10 the delay is now in the state variable.Footnote 19

Proposition 2

-

1.

For every \((k_0,i_0)\in H\), the IDDE 10 has a unique continuously differentiable solution denoted by \(k^{M}_{(k_0,i_0)}\).

-

2.

Let \((k_{0},i_{0} )\in H\), \(i\in \mathcal {I}_{(k_{0}, i_0) } \). Then \(k_{(k_{0},i_{0}),i}(t)\le k^{M}_{(k_0,i_0)}(t)\) for every \(t\ge 0\).

-

3.

If \(k^{M}_{(k_0,i_0)}(t)> 0\) for every \(t\ge 0\), then \(\mathcal {I}_{(k_0,i_0)}\ne \emptyset \).

Now we want to study the IDDE 10, which becomes, for \(t\ge d\),

The characteristic equation of (11) is the transcendental equation

The characteristic equation associated to a linear IDDE have generically an infinite number of complex conjugate roots [e.g., Diekmann et al. (1995, Ch. 1)]. In the next proposition we study the properties of the spectrum of roots of (12).

Proposition 3

-

1.

There exists a unique real root \(\xi \) of (12). It is simple and belongs to the interval (0, A).

-

2.

If \(\lambda =\mu +i\nu \) is a complex root of (12) (with \(\nu > 0\)) then also the complex conjugate \(\bar{\lambda }=\mu - i \nu \) is a root of (12). The following inequalities also hold

$$\begin{aligned} -Ae^{-\mu d}< \mu < \xi , \qquad \frac{\xi }{d}< \nu < A \left( 1 \vee e^{-\mu d} \right) \end{aligned}$$(13)In particular, the real part of all the complex roots is strictly smaller than \(\xi \). The real number \(\xi \) is, therefore, called the maximal root associated to (12).

-

3.

There exists a decreasing real sequence \(\{\mu _j\}\) and a positive real sequence \(\{\nu _j\}\) such that all the complex and non-real roots of (12) are given by the set

$$\begin{aligned} \{\lambda _j=\mu _j +i \nu _j, \ \bar{\lambda }_j=\mu _j -i \nu _j\}_{j\in \mathbb {N}}. \end{aligned}$$ -

4.

Let \(a_1\) and \(a_2\) be two functions in \(L^2([-d,0];\mathbb {R}_+)\) satisfying Assumption 1 and let \(\xi _1\) and \(\xi _2\) be the corresponding maximal roots; then we have that

$$\begin{aligned} \int _{-d}^s a_1( r )\mathrm{{d}}r \le \int _{-d}^s a_2( r )\mathrm{{d}}r, \quad \forall s \in [-d,0] \quad \Longrightarrow \quad \xi _1 \ge \xi _2. \end{aligned}$$Since \(\int _{-d}^0 a_1( r )\mathrm{{d}}r =\int _{-d}^0 a_2( r )\mathrm{{d}}r=1\), this is true in particular if \(a_1\) is increasing and \(a_2\) is decreasing.

-

5.

Let \(\{a(\cdot ,d)\}_{d> 0}\) be a family of distributions, indexed by \(d>0\), satisfying Assumption 1 for each \(d> 0\), and such that \(a(\cdot ,\cdot )\in C^1(T;\mathbb {R})\) where

$$\begin{aligned} T:=\{(x,y)\in \mathbb {R}^2 : \ -y\le x<0\}; \end{aligned}$$let \(\xi (d)\) be the unique real root to the characteristic Eq. 11 associated with the distribution \(a(\cdot ,d)\). Then there exists \(\frac{\partial \xi }{\partial d}(d)\) for every \(d>0\) and

$$\begin{aligned} \frac{\partial \xi }{\partial d}(d)=\frac{A\left( \int ^0_{-d}\frac{\partial a(r,d)}{\partial d}e^{r\xi (d)}\mathrm{{d}}r-a(-d,d)e^{-d\xi (d)}\right) }{1-A\int ^0_{-d}a(r,d)re^{r\xi (d)80}\mathrm{{d}}r}. \end{aligned}$$(14)

The real root \(\xi \) is the maximal long-run growth rate of capital, i.e., the growth rate of \(k^{M}_{(k_0,i_0)}\). This is formalized in the next proposition.

Proposition 4

(Maximal Growth of Capital) Assume \((k_{0},i_{0} )\in H\). Then for every \(\varepsilon >0\), we have that the upper bound of all the admissible state trajectories is

where \(\xi \) is the maximal long-run growth rate of capital, \(\alpha _0\) is a coefficient depending on \((k_0,i_{0})\) and \(\lim _{t\rightarrow +\infty }\left| \frac{o(e^{(\xi -\varepsilon ) t})}{e^{(\xi -\varepsilon ) t}}\right| =0.\)

Some considerations on Proposition 4.3 and 4.4 are in order. First, the existence of an infinite number of complex roots, besides the real root \(\xi \), strictly depends on the presence of the gestation lag parameter, d. As it will result clear later, their existence will be crucial for the raising of fluctuations in capital, investment and output. Second, the root with largest real part, i.e., \(\xi \), is always positive as long as the interest rate, A, remains strictly positive. Moreover, the maximal growth rate coincides with the interest rate, i.e., \(\xi =A\), when the gestation lag parameter, d goes to zero; this confirms what happens in the standard AK model without delays. Intuitively, the maximal growth rate of capital becomes \(\xi <A\) when the projects take time to be completed because a certain amount of resources remains unproductive till the project is completed. As a consequence the accumulation of capital will be slower as well as the maximal growth rate of capital. Moreover, Proposition 4.3 property 4 reveals that the distribution of the investment over the not yet completed projects plays a crucial role in the determination of the maximal growth rate of capital. In particular, those investment distributions characterized by a large allocation of resources in the early stages of the project (e.g., pure investment lag in production or decreasing exponential distribution) and very few, if any, in the latest stages imply a lower maximal growth rate of capital than the one obtained when the resources are mainly invested in the latest stages of the project (e.g., time to plan). The intuition behind this result is that in the first case a larger amount of resources remains unproductive for a longer period of time. More generally, given two investment distributions and the associated maximal growth rates of capital, Proposition 4 property 4 proves that the economy characterized by the investment distribution with a larger area behind \(a(\cdot )\) in any interval of time \([-d,s]\) and \(s\in [-d,0]\), will have the lower maximal growth rate of capital. This is indeed true when we compare, for example, an increasing exponential distribution with a decreasing exponential. It can be also shown numerically that projects of length \(d=3\) years and characterized by time to plan such that between a 75 and 95 % of the investment is concentrated in the last 2 years before being completed have a maximal growth rate of capital higher than in the case of a uniform distribution since property 4 of Proposition 4.3 is indeed respected. This is shown in Fig. 1 where on the left-hand side the distributions are drawn while in the right-hand side we control numerically if the area behind the increasing exponential distributions (i.e., time to plan) remains always lower than the area below the uniform distribution as s changes from \(-d\) to 0. As it emerges clearly from the figure, this is indeed the case, and therefore, property 4 of Proposition 4.3 holds.Footnote 20 Assuming an interest rate, A, to be equal to 0.077, the maximal growth rate of capital can be computed and it is equal to 0.031 and 0.0304 for the increasing exponential distributions and to 0.0301 for the uniform distribution.Footnote 21

Proposition 3—Property 4 at work looking at different investment’s distributions

Finally, some considerations need to be done on property 5 of Proposition 4.3. First of all, the sign of \(\frac{\partial \xi }{\partial d}\) depends on the sign of the numerator in 14, since the denominator is always positive because \(h(r)=a(r)re^{r\xi }\le 0\) for any \(r\in [-d,0]\). Therefore, the maximal growth rate of capital can be positively or negatively affected by an increase in the length of the projects, d, depending on the specification of the family of investment’s distributions \(\{a(\cdot ,d)\}_{d>0}\) and on its effect on the sign of the numerator of the expression in 14. However, the most commonly used families of used investment’s distributions are characterized by \(\frac{\partial \xi }{\partial d}<0\). In particular, it can be proved that the maximal growth is negatively affected when the family of investment distributions is uniform \(a(r,d)= \hbox {Unif}_{d}(r)\equiv \frac{1}{d}\mathbf {1}_{[-d,0](r)}\) (see Sect. 8), since in this caseFootnote 22

Similarly, one can show that \(\frac{\partial \xi }{\partial d}\) is negative when the family investment’s distributions is exponential, i.e., \(a(r,d)=\hbox {Exp}_{\mu ,d}(r,d):=\left( \frac{\mu }{1-e^{-\mu d}}\right) e^{\mu r}\) (see again Sect. 8). In fact, in this case

independently on specifying an increasing exponential distribution (\(\mu >0\), time to plan) or a decreasing exponential distribution \((\mu <0\)). The intuition behind this result is that shorter projects imply a faster accumulation of capital and therefore a higher \(\xi \).

All these considerations on the role of the project’s length, d, and the investment’s distribution, \(a(\cdot )\), in the determination of the maximal growth rate of capital, \(\xi \), will be crucial later because the growth rate of the economy, g, will be proved to depend on the maximal growth rate of capital.

4.4 Finiteness and properties of the value function

We may now proceed to study the finiteness and properties of the value function, V. By convention, we have that \(V(k_{0},i_{0})=-\infty \) if \(\mathcal {I}_{ (k_{0},i_{0} )}=\emptyset \).

Clearly, any choice of \(k_0\le 0\) implies that the set of admissible strategies is trivially empty, so \(V=-\infty \) when \((k_0,i_0)\in H-H^+\). On the other hand, we will see that \(V>-\infty \) in \(H^{++}\). Hence, letting

we have that

The following results are proved.

Proposition 5

(Finiteness and homogeneity of the value function V)

-

1.

\(V(k_{0},i_{0})<+\infty \) for every \((k_0,i_0)\in H\) and \(V(k_{0},i_{0})>-\infty \) for every \((k_{0},i_{0})\in H^{++}\). In particular \(\hbox {dom}(V)\supset H^{++}\) and

-

a)

if \(\sigma \in (0,1)\) and \(\xi (1-\sigma )<\rho \), then \(0\le V(k_{0},i_{0}) <+\infty \) for every \((k_0,i_0)\in H^{++}\);

-

b)

If \(\sigma >1\), then \(-\infty <V(k_{0},i_{0})\le 0\) for every \((k_0,i_0)\in H^{++}\).

-

a)

-

2.

\(\hbox {dom}(V)\) is a cone of H and V is homogeneous of degree \((1-\sigma )\) therein:

$$\begin{aligned} V\left( \lambda (k_0,i_0)\right) =\lambda ^{1-\sigma }V(k_0,i_0),\ \ \ \ \ \forall \lambda >0. \end{aligned}$$ -

3.

V is concave on \(\hbox {dom}(V)\).

Therefore, the value function is finite as long as the following assumption, which will be a standing assumption from here on, holds true.

Assumption 6

The parameters are set such as \(\rho > \xi (1-\sigma )\) when \(\sigma \in (0,1)\).

Another significant assumption, to be made to guarantee a positive economic growth rate, i.e., \(g>0\), is the following.

Assumption 7

The parameters are set such as \(\xi >\rho \).

It is worth to be noticed that when both Assumptions 7 and 6 hold, this means that we are considering the case \(\xi \in (\rho ,\frac{\rho }{1-\sigma })\), when \(\sigma \in (0,1)\), or the case \(\xi \in (\rho ,+\infty )\), when \(\sigma \in (1,+\infty )\). Interestingly, these two restrictions have a counterpart in the standard AK model. In fact, in the case without delay we have \(\xi ={A}\) and then Assumption 6 leads to the usual condition for bounded utility \(A<\frac{\rho }{1-\sigma }\), while Assumption 7 becomes \(A>\rho \), which is the usual condition for the interest rate to be higher than the intertemporal discount factor and, therefore, to have a positive economic growth. Differently from the standard AK model, \(A>\rho \) is no more a sufficient condition to guarantee positive growth because now the length of the projects, d, and the investment distribution, \(a(\cdot )\) create a wedge between the maximal growth rate of capital, \(\xi \), and the interest rate, A. In particular, Proposition 4.3 shows that \(A>\xi \) implying that any form of time to build is, not surprisingly, detrimental for the economic growth.

5 Solution of the optimal control problem

5.1 Methodology

Our problem (P) is an optimal control problem with state constraints where the state Eq. 3 is an integral differential distributed lags equation (IDDE). This kind of problems is usually difficult to solve for two reasons. First, they are intrinsically infinite dimensional due to the fact that the solution of the state equation (such as Eq. 3) can be found only specifying an initial condition which is not a point in \(\mathbb {R}^n\) but a function, in our case, the initial capital stock and the past history of the investment. Second, there are state/control inequality constraints, in our case (c1) and (c2) in the social planner problem 4.

The dynamic programming approach can be used successfully to solve these problems if a “regular” (i.e., differentiable in a suitable sense) solution of the associated Hamilton–Jacobi–Bellman (HJB) equation can be found and if such solution is indeed the value function V for, at least, a subset of initial data. The first contribution in the economic literature which successfully dealt with an infinite dimensional optimal control problem with state constraint was Fabbri and Gozzi (2008), while other more recent contributions are Bambi et al. (2012) and Boucekkine et al. (2010).

Remark 1

The presence of a generic delay structure in the state equation and the absence of the irreversibility constraint make our problem much more difficult than those faced in previous contributions. The main problem does not concern the solution of the HJB equation in infinite dimension (which can be obtained similarly to the aforementioned references), but rather the proof of the admissibility of closed-loop candidate optimal controls. Such a problem is solved by finding a suitable good “natural” class of initial data (the set \(\mathbf {S}\) defined below)—new in the literature—and through a series of highly technical and not trivial results, which are the real new contribution of this paper from a mathematical viewpoint. We are referring to the results contained in Subsections A and B.6 in the Supplementary Material.

For the reasons described in the remark above, we have developed a specific strategy to solve problem (P) which is fully described in “Appendix B” of the supplementary materials. This strategy can be summarized in the following steps:

-

1.

We rewrite (P) as an equivalent infinite dimensional problem \(\mathbf{(P^H)}\) (with value function \(V^H\)) in order to apply the dynamic programming approach. This is done in Section B.2 of online supplementary material.

-

2.

We write the HJB equation associated to \(\mathbf{(P^H)}\) and we find an explicit solution, v. This is done in Section B.3 of online supplementary material.

-

3.

We show that the explicit solution, v, is defined on a larger set of initial data than the one of \(V^H\) and, through a verification theorem, that v is equal to the value function \(\tilde{V}^H\) of another control problem (that we call \(({\tilde{\mathbf{P}}}^\mathbf{H})\)) which is easier to solve. This is addressed in Section B.4 of online supplementary material.

-

4.

We perform the inverse path with respect to item 1 of the present list and define a problem \(({\tilde{\mathbf{P}}})\) which is the optimal control problem with delay (in dimension one) equivalent to \(({\tilde{\mathbf{P}}}^\mathbf{H})\). Then we derive its solution through the one found for \(({\tilde{\mathbf{P}}}^\mathbf{H})\). Section B.5 of online supplementary material is dedicated to this, in particular Proposition 19.

-

5.

We show, through a delicate analysis of the asymptotic behavior of admissible trajectories that it exists an open set of initial data, \(\mathbf {S}\), where problem \(\mathbf{( P)}\) and \((\tilde{\mathbf{P}})\) are equivalent. Section B.5 of online supplementary material is devoted to prove this, while Theorem 8 in the main text uses such result to prove the main analytical findings of the paper.

Most importantly, these steps can be applied to solve not only our problem but also other relevant economic problems such as those on growth or optimal advertising mentioned in the review of the literature when the state equation is an IDDE.

Interestingly enough, the dynamic programming approach is used instead of a more “familiar” Pontryagin maximum principle for two reasons: first, there is no result in the literature on the maximum principle which can be directly applied to our problem; second, even in similar cases where some results exist [see, e.g., Boucekkine et al. (2005)], it is not possible to find explicitly the optimal strategies, e.g., the value of \({C}^0_{(k_0,i_0)}\) in (18).

In the next subsection we present the main result of our optimal control problem which will be used later to study the properties of the optimal paths.

5.2 The main result

We want to address the question of solving \(({\mathbf {P}})\) at least on the following subset of initial data (i.e., initial stock of capital and initial history of the investment):

where

and

Observe that \(\nu >0\) by Assumption 6 and \(g>0\) if Assumption 7 holds. The set \(\mathbf {S}\), for which we will be able to fully solve the problem, is non-empty as long as \(g>0\)—see Proposition 9—hence as long as Assumption 7 holds. For this reason, such an assumption will hold from now on. It is also worth noting that \(\mathbf {S}\) is not, a priori, the largest set of initial data where it is possible to solve the model: We are only claiming that we are able to do it for this (quite meaningful) set of initial data. Furthermore, we notice that taking the initial data in this set excludes an initial history of disinvestments; on the other hand, the possibility of reversible (negative) investment is not precluded for \(t>0\). As matter of fact, however, the optimal investment starting from \(\mathbf {S}\) will be proved to remain always positive.

We have the following explicit expression of the value function and complete characterization of optimal paths when the initial data belong to \(\mathbf {S}\).

Theorem 8

(Value function and optimal paths) Let \((k_0,i_0)\in \mathbf {S}\). Then

Moreover, the optimal paths of the main aggregate variables are characterized as follows.

-

1.

The optimal capital path, \(k^*_{(k_0,i_0)} \), is the unique continuously differentiable solution of the IDDE:

$$\begin{aligned} \left\{ \begin{array}{lll} &{}k' (t) =\int _{-d}^{(-d)\vee (-t)} a( r) i_0(t+ r)\mathrm{{d}}r\\ &{}\ \ \ \ \ \ \ \ \ +A\int _{(-d)\vee (-t)}^{0}a( r)\big (k(t+ r)-{C}^0_{(k_0,i_0)}e^{g(t+r)}\big )\mathrm{{d}}r, \ \ \ t\ge 0,\\ &{}k(0)=k_{0}, \ \ \ \ i_{0}(s), \ \ s \in [-d,0). \end{array} \right. \end{aligned}$$(20) -

2.

The optimal investment path, \(i^*_{(k_0,i_0)}\), is the unique continuously differentiable solution of the IDDEFootnote 23

$$\begin{aligned} \left\{ \begin{array}{ll} i'(t)=A\int _{-d}^0 a( r)i(t+ r)\mathrm{{d}}r-g {C}^0_{(k_0,i_0)} e^{gt}, \ \ \ \ t\ge 0\\ i(0)=Ak_0-{C}^0_{(k_0,i_0)}, \ \ \ \ i(s)=i_0(s), \ \ s\in [-d, 0). \end{array} \right. \end{aligned}$$(21) -

3.

The optimal consumption path, \(c^*_{(k_0,i_0)}\), is purely exponential:

$$\begin{aligned} c^*_{(k_0,i_0)}(t) =Ak^*_{(k_0,i_0)}(t)-i^*_{(k_0,i_0)}(t)= {C}^0_{(k_0,i_0)} e^{gt}, \ \ \ t\ge 0. \end{aligned}$$(22)

Some considerations are useful before moving to the next section. First, optimal detrended consumption is always constant independently on the choice of the project’s structure and of the initial conditions. However, when the projects takes time to be completed, optimal detrended capital and investment will not remain constant for any initial datum as in the standard AK model.

Moreover, considering a family \(\{a(\cdot ,d)\}_{d>0}\) of investment’s distributions as in Proposition 3 (property 5) and indicating by \(C_{(k_0,i_0)}^0(d)\) the associated optimal initial consumption rate and by \(\xi (d)\) the associated real root of the characteristic Eq. 11, we may consider the dependence of the variation of the latter with respect to d, that is \(\frac{\partial C_{(k_0,i_0)}^0}{\partial d}(d)\). Indeed,

Considering a uniform investment’s distribution, \(a(r,d)= \hbox {Unif}_{d}(r)\equiv \frac{1}{d}\mathbf {1}_{[-d,0](r)}\) (see Sect. 8), the latter reduces to

Hence, if \((k_0,i_0)\in \mathbf {S}\) (thus, \(i_0\ge 0\)), from 4.3 we get \(\frac{\partial C_{(k_0,i_0)}^0}{\partial d}(d)<0\). Similarly, when we consider exponential investment’s distributions, i.e., \(a(r,d)=\hbox {Exp}_{\mu ,d}(r,d):=\left( \frac{\mu }{1-e^{-\mu d}}\right) e^{\mu r}\), from 23 to 15, we get \(\frac{\partial C_{(k_0,i_0)}^0}{\partial d}(d)<0\); this result holds for both the decreasing exponential distribution (\(\mu <0\)) and for the increasing exponential (\(\mu >0\)).

Therefore, in these cases, the initial consumption will decrease when the project length decreases and the investment’s distribution is one of those commonly used (e.g., uniform distribution, exponential distribution, etc.) because we have shown after Proposition 4.3 that the maximal growth rate of capital will increase. Intuitively, the decrease in the project length makes the investment in the projects more attractive because the return on an investment today will be paid earlier; therefore, the representative agent has an incentive to invest more; since output is predetermined, this can be achieved only with a reduction in his initial consumption.

In the next two sections we will provide conditions under which the economy is either immediately on a balanced growth path or is characterized by transitional dynamics.

6 Balanced growth paths

A balanced growth path (BGP) is any optimal path such that \(k^*,i^*,c^*\) are purely exponential functions with the same growth rate. In this section we show that the set of initial conditions consistent with a BGP solution is not empty. To do that, consider the couple of initial data \(\mathbf {E}_b\) defined as follows:

where \(b>0\) is an exogenously given constant, describing the past history of investments of exponential form, with \(i_0(0^-)=b\). In the next proposition, we prove that the initial data \(\mathbf {E}_b\), where \(b>0\), belong to \(\mathbf {S}\) under the restriction on parameters imposed in Assumption 7.

Proposition 9

\(\mathbf {E}_b\in \mathbf {S} \) for every \(b>0\).

Moreover, the following result can be proved.

Proposition 10

The optimal capital, investment, and consumption paths are purely exponential if and only if \((k_0,i_0)=\mathbf {E}_b\) for some \(b>0\). More precisely we have

where \({C}^0_{(k_0,i_0)}\) is the positive constant given in (18), which in the present case becomes

The growth rate of the economy, g, was indeed found to be equal to \(\frac{\xi -\rho }{\sigma }\). Therefore, a change in the project features modifies it indirectly through the maximal growth rate \(\xi \). Therefore, all the findings about the mechanisms which may affect \(\xi \) discussed in Sect. 4.3 can be now used. In particular, it is immediate to observe that \(\frac{\partial g}{\partial d} \) and \(\frac{\partial \xi }{\partial d}\) have the same sign; furthermore, a change in the investment distribution \(a(\cdot )\) consistent with Proposition 4.3, property 4, (see also Fig. 1) implies a change of \(\xi \) and therefore of g.

As we have seen, the optimal consumption policy is always exponential. We may compare how a change in the specification of the investment’s distribution over the projects affects the initial optimal consumption rate when the initial paths lie in \(\mathbf {E}_b\). Indeed, by 26, in this case we have

In the case of exponential distributions, \(\hbox {Exp}_{\mu ,d}(r):=\left( \frac{\mu }{1-e^{-\mu d}}\right) e^{\mu r}\), straightforward computations and Proposition 3, Property 4, yield that the corresponding initial consumption \({C}^0_{(k_0,i_0)}(\mu )\) is increasing in \(\mu \).

This result is illustrated in Fig. 2, where a decreasing and increasing exponential distributions are compared. By moving from the decreasing to the increasing exponential distribution, the economy experiences a lower initial consumption, but a faster economic growth. Intuitively, this result depends on the fact that investments on a time-to-plan project is seen more attractive, since the amount of resources are unused for a shorter period of time once invested into a time-to-plan project.

From decreasing to increasing exponential distributions (left) and associated consumption optimal paths (right; expressed in \(\log \)) along balanced growth paths (see Sect. 6)

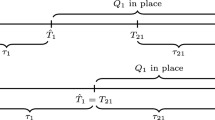

Moreover, Proposition 10 tells us that the economy is on a BGP from the very beginning, i.e., from \(t\ge 0\), if and only if the initial history of the investment has already a purely exponential form \(i_0(s)= be^{gs}\), where \(s\in [-d,0)\), and the initial capital \(k_0\) is exactly \(\frac{b}{g} \int _{-d}^0 a(s)e^{gs}\mathrm{{d}}s\). Differently from the AK model with \(d=0\), the economy is on a BGP only for a very specific choice of the initial condition of the state variable. In fact, an economy with a past history of the investment \(i_0(s)= be^{gs}\), but with a capital stock different from \(\frac{b}{g}\int ^0_{-d}a(s)e^{gs}\mathrm{{d}}s\) and still in the feasible set of initial condition \(\mathbf {S}\), will not be on a BGP from \(t=0\) on. Under these initial conditions, the optimal path of investment and capital are no more purely exponential and converge over time to the balanced growth path. Therefore, the economy displays transitional dynamics. The next section is dedicated to find the explicit form of these optimal paths and to prove that an economy which, generically, is not on a BGP from \(t=0\) on, meaning that the initial conditions are in \(\mathbf {S}\) but are not \(\mathbf {E}_b\), will converge to it over time by damping fluctuations.

7 Transitional dynamics

In this section we characterize optimal trajectories besides the balanced growth paths just studied. From now on we assume the following:

Assumption 11

All the complex roots of the characteristic Eq. 12

-

(i)

have real part smaller than g and

-

(ii)

are simple.

It is indeed theoretically viable to provide restrictions on parameters and on the distribution \(a(\cdot )\) such that (i) and (ii) hold. However, we do not address this issue analytically but rather numerically by checking Assumption 11—case by case—in Sect. 8. Also, (ii) occurs generically and, while not essential, it is useful to simplify the proof of Proposition 12. Taking into account Theorem 5.2, we can now prove the following result.

Proposition 12

Consider an initial datum \((k_0,i_0)\in \mathbf {S}\). Then the optimal paths are:

where \(\alpha _\xi >0\) is the real constant in 48, \(p_j\) is the eigenvector associated with the eigenvalue \(\lambda _j\) while \(a_j\) and \(b_j\) are the complex numbers

and

Moreover, defining for \(t\ge 0\) the optimal detrended paths as \(x^*_{(k_0,i_0),g}(t)\mathop {=}\limits ^{\mathrm{{def}}}e^{-gt}x^*_{(k_0,i_0)}(t)\) with \(x=k,i,c\),

we have that the optimal detrended consumption path is constant and equal to \({C}^0_{(k_0,i_0)}\) for (27), while detrended capital and investment converges by damping oscillations respectively to the positive constants

Several consideration can be done. First, unless the initial conditions \((k_0,i_0)\in \mathbf {E}_b\), the economy will not be on the BGP till the very beginning. In fact, some of the aggregate variables are now characterized by transitional dynamics: Detrended capital, investment, and output will indeed converge over time to a BGP by damping fluctuations since \(g>\lambda _j\) for any \(j>1\) by Assumption 7.1 (i). On the other hand, detrended consumption remains always constant even during the transition of the other variables. Of course, this result is coherent with the assumption of risk adverse agents (i.e., concavity in the utility function) who prefer smooth consumption profile to profile alternating periods of high and low consumption. Interestingly, the agents are able in our model to smooth perfectly consumption over time (i.e., detrended consumption remains constant) by offsetting any deviation from the BGP with changes in their investment decision. This result holds for any specification of the projects’ features. Furthermore, the perfect consumption smoothing can be found also in other models with time to build where the technology is not necessarily linear as shown by Bambi and Gori (2014), Proposition 2. Perfect consumption smoothing emerges independently of the projects features. This does not mean welfare equalization across different investment distributions and/or projects’ lengths. In fact, these two features affect non-trivially the welfare by modifying \(\xi \), g, \(c^*(0)\) and therefore the economies will converge to different BGPs. Furthermore, we have already appreciated in Sect. 6 and Fig. 2 that \(\xi \) and g may go down while \(c^*(0)\) may go up when we modify d and \(a(\cdot )\). These opposite variations in the growth rate and the initial optimal consumption level make the welfare evaluation worth to be studied.Footnote 24

Second, the amplitude and length of the fluctuations strictly depend on the projects’ features. In particular, the project’s length, d, and the investment’s distribution, \(a(\cdot )\), play a crucial role in the shape of the spectrum of roots of the characteristic Eq. (12). Therefore, the value of the roots \(\lambda _j\) and of the associated eigenvectors, \(p_j\), with \(j\in (1,\infty )\) depend on them. It is analytically very difficult to provide any insight into this relation, and for this reason, we have used Fig. 3 to illustrate how different is the shape of the damping fluctuations when we consider economies which are exactly identical but the investment distributions over the projects. In particular, the figure on the left show the different optimal output path while the figure on the right is simply a zoom to emphasize the differences in the damping fluctuations. To compare more effectively the differences in the transitional dynamics, we have translated the optimal paths such that all of them converge to the same constant \(y_L\). Further quantitative considerations on the functional form of the investment distributions used to draw such a figure as well as on the deviations from the BGP and on the speed of convergence are postponed in the next Section.

Optimal detrended paths (on the right: zoom on the vertical axis of the left figure) for different distributions with \(d=5\) (see Sect. 8)

From this proposition and from Fig. 3, it clearly emerges that economies with the same past history of investment and initial stock of capital behave very differently if they differ in the projects’ structure. In fact, different investment distributions over the projects and different projects’ length across economies determine different asymptotic growth rates, different balance growth paths and different transitional dynamics.

Finally, we conclude this section with a comment on the stability of the optimal paths. This feature is not easy to address in its full generality; in fact, our analysis describes the dynamic behavior of solutions starting from the set \(\mathbf {S}\), which is not a nice set in the our framework Hilbert space H of Subsection B.2 (indeed, it has empty interior part). Nevertheless, we can assert that starting from close points \((k_0,i_0), (\overline{k_0}, \overline{i_0})\) of the set \(\mathbf {S}\) (in the sense that \(\mathcal {Q}({k_0}, {i_0})\) is close to \(\mathcal {Q}(\overline{k_0}, \overline{i_0})\) with respect to the norm of the space H, see Subsection B.2), the (detrended) associated optimal paths remain close. This is not difficult to see by using the explicit expressions of Proposition 12.

8 Quantitative analysis

In this section, we perform two numerical exercises. The first evaluates how much the growth rate, g, is affected by different assumptions on the projects’ structure while keeping all the other parameters unchanged. In fact, the projects may be different in length and in term of the investment distributions as defined in (the continuous-time counterpart of) Definition 1; the relevance of these two features in affecting the maximal growth rate of capital, \(\xi \), and therefore the growth rate, g, was indeed proved analytically in Propositions 3 and 17, but their quantitative relevance is assessed in this first exercise.

The second numerical exercise consists in studying how the transitional dynamics are affected by different choices of the projects’ length and of the investment’s distribution over the projects when the initial condition \((k_0,i_0)\in \mathbf {S}\) but different from \(\mathbf {E}_b\), i.e., the economy does not begin on its BGP. To do this assessment, we specify the parameters as in the first numerical exercise, but we also add an initial exogenous shock which makes the economy deviate from its BGP by reducing the initial capital stock of ten percentage points. As observed in Proposition 12 the economy converges to the BGP by damping fluctuations; therefore, our objective is to quantitatively evaluate the speed of convergence as well as the average and maximum absolute deviation of output from the BGP.

Both the numerical exercises are performed looking at a range of values for d, between 2 and 5 years and considering the following investment’s distributions over the projects:

-

1.

Dirac’s Delta concentrated at \(-d\), i.e., pure gestation lag in investment; when \(d=0\) this corresponds to no time to build. In this case d is the only parameter to choose.

-

2.

Uniform distribution [e.g., Kydland and Prescott (1982), among others], i.e., \(a(\cdot )= \hbox {Unif}_{d}(\cdot )\equiv \frac{1}{d}\mathbf {1}_{[-d,0]}\). Also here the only parameter is d.

-

3.

Exponential distribution, i.e., \(a(\cdot )\!=\!\hbox {Exp}_{\mu ,d}(\cdot )\), where \(\hbox {Exp}_{\mu ,d}(r)\!:=\!\left( \frac{\mu }{1-e^{-\mu d}}\right) e^{\mu r}\), \(r\in [-d,0]\). Then we have a decreasing exponential distribution [e.g., Peeters (1998)] or an increasing exponential distribution [e.g., Koeva (2000)] when \(\mu <0\) or \(\mu >0\) respectively. Clearly there are now two parameters to be chosen: \(\mu \) and d. In all these cases we have properly set the parameter \(\mu \) to reproduce a specific investment distribution over the projects: for example, in the case of a decreasing exponential distribution, \(\mu \) was set equal to either \(-0.3466\) or \(-1.197\) to have, respectively, a 75 and 95 % of the investment concentrated on the projects which need more than 2 years to be completed when the full length of a project is 3 years. Similarly, when the increasing exponential distribution has been chosen, we have set \(\mu \) equal to either 0.3466 or 1.197 to have, respectively, a 75 and 95 % of the investment concentrated on the projects which need \(<\)2 years to be completed when the full length of a project is 3 years. Moreover, we have adjusted accordingly the distribution of the investment over the projects when the projects’ lengths is different from 3 years, in the sense that whenever the projects’ lengths is different from 3 years, we move up or down the considered distribution such that Assumption 1 still holds.

-

4.

U-shaped [e.g., Peeters (1998) and Zhou (2000)] and hump-shaped [e.g., Altug (1989) and Palm et al. (1994)] are modeled in this continuous-time context using a parabola: \(a(\cdot )=P_{\alpha ,\beta ,d}(\cdot )\), where \(P_{\alpha ,\beta ,d}(r)=\alpha r^2+\beta r+\gamma \), with \(r\in [-d,0]\). Here the parameters are \(\alpha ,\beta ,\gamma \) and d. The U shape or the hump shape is obtained, respectively, for \(\alpha >0\) and \(\alpha <0\), while \(\gamma \) has been chosen in order to satisfy the constraint \(\int _{-d}^0 P_{\alpha ,\beta ,d}(r)\mathrm{{d}}r=1\). In the U-shaped distribution the parameters have been set to have 50 % of the investment allocated to the projects which need more than 40 % of the period to be completed. In the hump-shaped distribution the parameters have been set to have 70 % of the investment concentrated on the projects requiring \(<\)40 % of the period to be completed. The values of these parameters are reported in Table 1.Footnote 25

Finally, all the numerical computations have been done using MATLAB; the section on output volatility has been performed using DDE-BIFTOOL, a MATLAB package developed by Engelborghs and Roose (1999).

8.1 Long-Run Economic Growth

The parameters to be decided to perform the first numerical exercise are A, \(\rho \), \(\sigma \), and those in the investment’s distribution. All these parameters enter in the characteristic Eq. 12 and then are relevant to determine the growth rate of the economy, g, as proved in Propositions 3 and 17. We start considering an economy without time to build—\(a(\cdot )\) is a Dirac’s Delta in 0—and we set \(\rho =0.017\) and \(\frac{1}{\sigma }=0.5\) which are quite standard and non-controversial values for the preference discount rate and the instantaneous intertemporal elasticity of substitution. Within this setting (no time-to-build), a choice of the interest rate equal to \(R-\delta =0.077\) with \(\delta =0.10\) implies an annual growth rate \(g=0.03\). Then, we consider how much the growth rate is affected by different choices of the delay parameter, d, and of the investment’s distribution, \(a(\cdot )\) while keeping unchanged all the other parameters. These values of the growth rates for the different specifications of the projects’ features are reported in Table 2.

The maximum growth rate differentials are observed when we compare an economy with pure investment lags in production—\(a(\cdot )\) is a Dirac’s Delta in \(-d\)—with another economy characterized by time-to-plan—\(a(\cdot )\) is increasing exponential distribution with \(\mu =1.197\).Footnote 26 According to our computations the growth differential, due to the different resource distributions over the projects, is around 12.5 % when the length of the project is 2 years. Moreover, such differential enlarges to 21.45 % when the project’s length changes to 3 years. This sharp increase in the growth differential can be immediately explained: The growth rate of the economy characterized by time-to-plan is not affected significantly (just around \(-0.03\) percentage points) by the increase in the length of the project because the largest amount of the resources are concentrated on the last stages; on the other hand, in the pure investment lag case all the resources are concentrated at the beginning of the project and, therefore, a larger amount of resources remains “unproductive” for a longer period of time when the length, d, increases, with a larger negative effect on the growth rate of the economy (around \(-0.2\) percentage points). The growth differentials for the case of \(d=4\) and \(d=5\) years are also computed, and they are respectively the 28.6 % and the 36.3 %.

Interestingly enough, a comparison of the growth rates when the investment’s distribution is hump shaped and when it is uniform, reveals that the first distribution pins down higher growth rates only when the projects’ length is lower or equal than 3 years. Keeping aside this case, a ranking of the distributions in term of the growth rates can be done: Given A, \(\rho \), \(\sigma \), and d, the increasing exponential distribution is characterized by the highest growth rates, followed by the U-shaped distribution, the uniform distribution and the hump-shaped distribution to end with the decreasing exponentials and the Dirac’s delta in \(-d\), the latter characterized by the lowest growth rate. The robustness of this ranking has been checked for different choices of the parameters \(\sigma \), \(\rho \), and r.

8.1.1 Transitional Dynamics

To study the transitional dynamics from a quantitative viewpoint we proceed as follows. We consider economies which are identical but the project characteristics. Each of them is assumed to be on its respective balanced growth path, meaning that the initial conditions are exactly \(\mathbf {E}_b\) where \(b=1\) without loss of generality. At \(t=0\), we introduce an exogenous shock which makes each economy deviate from its balanced growth path by destroying the 10 % of the initial capital. Under our parametrization the past history of the investment and the capital stock after the negative shock are still in the set \(\mathbf {S}\) and therefore we know from Proposition 12 that each economy will converge by damping fluctuations to its balanced growth path. The output dynamics is described quatitatively by computing the maximum and average absolute deviation from the BGP and the speed of convergence.Footnote 27 These three indicators have been computed by looking respectively at the following quantitiesFootnote 28

These three indicators have been computed for different investment’s distributions \(a(\cdot )\), and projects’ length, d, and reported in Table 3 (the maximum and average absolute deviation from the BGP) and Table 4 (speed of convergence). In Table 3, the values outside (inside) the parenthesis refer to the average (maximum) deviation. Output fluctuations are significant if characterized by a high maximum and absolute deviation and a low speed of convergence. Keeping aside the U-shaped and the hump-shaped distributions, we observe that the economy with the projects’ investment distribution leading to higher growth rates are also those with more pronounced deviations from the balanced growth path. In particular, the same ranking on the investment distributions proposed for the growth rates, holds when we rank the economies from those with lowest to those with highest output volatility.

Most importantly, large differences in the speed of convergence to the BGP can be appreciated looking at Table 4. Comparing the speed of convergence between two economies with different distributions, it emerges that those characterized by project features which are detrimental for the economic growth are also characterized by a slower speed of convergence to the BGP. Therefore, not only these economies will asymptotically grow at a lower rate but will experience longer transitional dynamics.

9 Conclusion

In this paper we have used a dynamic programming approach to assess how the investment project’s features may affect the growth rate and transitional dynamics of an endogenous growth model. The analytical results are used in the quantitative analysis to evaluate the changes in output growth and output dynamics due to different choices of the project’s length and of the investment distributions over the projects. Relatively small differences in these features may induce significant differences in output growth and in the speed of convergence toward the balanced growth path even when all the other parameters of the economy are kept the same.

Notes

It is worth noting that a project already started is fixed not because the investment is irreversible but because the resources necessary to complete it are predetermined or committed at its beginning. This difference will result plainly clear in Section 2.1 where we will formally define the projects.

Kydland and Prescott propose a model setup with a generic distribution, but the equilibrium path is numerically computed by assuming the two previously described distributions (i.e., uniform distribution or pure investment lag).

Evidences of opposite sign can be also found in the literature. Recently Flyvbjerg et al. (2002) and Flyvbjerg et al. (2003) have estimated that additional resources were required to complete around 90 % of a sample of 258 public transportation infrastructure projects in the USA and that the additional resources added over time amount for the 20–40 % of the initially planned investment. Modifications to public works are also contemplated and regulated by law in some European Countries as shown, for example, by the Italian Law 109 approved in 1994.

A typical example is the list of the incomplete public projects recently published by the Italian Public Infrastructure and Transport Ministry (see “Elenco Anagrafe Opere Incompiute,” Ministero per le Infrastrutture e Transporti).

Koushki et al. (2005) shows that the estimated residential construction project duration in Kuwait is on average 8.3 months (planning) plus 9.4 months (construction), while the actual is 8.3 plus 18.2 months. Similar results are found in studies focusing on other developing countries such as Nigeria (Mansfield et al. 1994) and Jordan (Al-Momani 2000).

Application to functional differential equation in an OLG framework has been also investigated by d’Albis and Augeraud-Veron (2007).

The choice of continuous time has no relevant implications on the results found in this paper; we have decided to study the problem in continuous time because it makes the analytical part more tractable.

It is worth noting that there is no relevant change in the analytical derivations and interpretation of the results if \(s_{j,t}\) indicates the group of projects at time t, j-stages from completion.

Observe that the investment distribution can be read as a probabilistic distribution with \(a_j\) the probability of investing in a project j stages from completion. Also \(\mathbb N\) indicates as usual the set of all natural numbers and \(\mathbb R_+\) the set of all nonnegative real numbers.

The interested reader is referred to the “Appendix” for a comparison with the case of fixed projects as used, for example, by Kydland and Prescott.

It is worth noting that the case of logarithmic utility can be treated as well.

A property holds almost everywhere (a.e.) means, as usual in Measure Theory, that it holds out of a set of null Lebesgue measure.

In this paper we have used “initial datum,” “initial condition” and “past history” as synonymous.

This preliminary part would be also necessary to solve this problem using the maximum principle approach.

We recall that, loosely speaking, two functions in \(L^2([-d,0];{\mathbb {R}})\) or in \(L^2_{\mathrm {loc}}(\mathbb {R}_+; \mathbb {R})\) are equal if they coincide almost everywhere (a.e.) with respect to the Lebesgue measure.

We recall that functions in \(W^{1,2}_{loc}(\mathbb {R}_+; \mathbb {R})\) admit a (unique) continuous representative.

Observe that the inner product in H is defined, given two elements \(x=(x^0,x^1)\) and \(y=({{y}^0}, {{y}^1})\in H\), as \(\langle x,y\rangle _H \mathop {=}\limits ^{\mathrm{{def}}}{{x}^0} {y}^0 + \langle {{x}^1}, {{y}^1} \rangle _{L^2([-d,0];\mathbb {R})}\).

Recall that given two real numbers a and b, by \(a \vee b\) (respectively \(a\wedge b\)) we mean \(\max \{a,b\}\) (respectively \(\min \{a,b\}\)).

The reader can find more details on the functional form of the distributions in Sect. 8.

The small difference in the growth rates is because the increasing exponential distribution is quite “close” to the uniform distribution for the selected parameters. Of course, the difference in the growth rates become more substantial when we consider different choices of the parameters as reported in Table 2.

Remember that the sign of a real number, x, is defined as \(\hbox {sgn}(x)\) and it is equal to \(-1, 0,\) or 1 when x is lower, equal, or greater than zero, respectively.

The existence and uniqueness of solutions to such DDE follows from Theorem 2.12 in Diekmann et al. (1995).

A similar consideration has been recently done by Boucekkine et al. (2015).

Intuitively the increasing exponential distribution is the distribution “closest” to the Dirac’s Delta in 0 (i.e., no time-to-build case), and it indeed converges to it as the resources tends to be concentrated in the last stage of the project. This is the reason why the highest growth rate differential is observed when we compare the time-to-plan economy with a pure investment lag economy.

Consistently with Ortigueira and Santos (1997) and Bambi et al. (2012) the speed of convergence has been measured as the absolute value of the difference between the growth rate of the economy and the complex eigenvalue having the highest real part. In fact, this is the term which drives the convergence as clearly emerges from the proof of Proposition 12.

The first two values are computed in MATLAB, so their values in Table 3 are in truth finite approximations, i.e., a max over a finite period [0, T] instead of a \(\sup \) over \([0,+\infty )\) and a finite sum instead of an integral.

References

Al-Momani, A.H.: Construction delay: a quantitative analysis. Int. J. Proj. Manag. 18, 51–59 (2000)

Altug, S.: Time-to-build and aggregate fluctuations: some new evidence. Int. Econ. Rev. 30, 889–920 (1989)

Asea, P.K., Zak, P.J.: Time-to-build and cycles. J. Econ. Dyn. Control 23, 1155–1175 (1999)

Bambi, M.: Endogenous growth and time to build: the AK case. J. Econ. Dyn. Control 32(4), 1015–1040 (2008)

Bambi, M., Fabbri, G., Gozzi, F.: Optimal policy and consumption smoothing effects in the time-to-build AK model. Econ. Theory 50, 635–669 (2012)

Bambi, M., Gori, F.: Unifying time-to-build theory. Macroecon. Dyn. 18, 1713–1725 (2014)

Bambi, M., Gozzi, F., Licandro, O.: Endogenous growth and wave-like business fluctuations. J. Econ. Theory 154, 68–111 (2014)

Barro, R., Sala-i Martin, X.: Economic Growth, 2nd edn. MIT Press, Cambridge (2004)

Benhabib, J., Rustichini, A.: Vintage capital, investment, and growth. J. Econ. Theory 55, 323–339 (1991)

Boucekkine, R., de la Croix, D., Licandro, O.: Vintage capital growth theory: three breakthroughs. Front. Econ. Growth Dev. 20(1), 14–27 (2011)

Boucekkine, R., Fabbri, G., Gozzi, F.: Maintenance and investment: complements or substitutes? a reappraisal. J. Econ. Dyn. Control 34, 2420–2439 (2010)

Boucekkine, R., Fabbri, G., Pintus, P.: Short-run Pain, Long-run gain: The Conditional Welfare Gains from International Financial Integration the Conditional Welfare Gains from International Financial Integration. AMSE Working Papers 1202 (2015)

Boucekkine, R., Germain, M., Licandro, O.: Replacement echoes in the vintage capital growth model. J. Econ. Theory 74, 333–348 (1997)

Boucekkine, R., Licandro, O., Puch, L., del Rio, F.: Vintage capital and the dynamics of the AK model. J. Econ. Theory 120, 39–72 (2005)

Brezis, H.: Functional Analysis, Sobolev Spaces and Partial Differential Equations. Universitext, Springer, New York (2011)

Christiano, L.J., Todd, R.M.: Time to plan and aggregate fluctuations. Fed. Res. Bank Minneap. Q. Rev. 20, 14–27 (1996)

Del Boca, A., Galeotti, M., Himmelberg, C.P., Rota, P.: Investment and time to plan and build: a comparison of structures vs. equipment in a panel of italian firms. J. Eur. Econ. Assoc. 6, 864–889 (2008)

d’Albis, H., Augeraud-Veron, E.: Balanced cycles in an olg model with a continuum of finitely-lived individuals. Econ. Theory 30(1), 181–186 (2007)

Diekmann, O., Van Gils, S.A., Lunel, S.M.V., Walther, H.O.: Delay Equations. Springer, Berlin (1995)

Engelborghs, K., Roose, D.: Numerical computation of stability and detection of Hopf bifurcations of steady state solutions of delay differential equations. Adv. Comput. Math. 10(3/4), 271–289 (1999)

Fabbri, G., Gozzi, F.: Solving optimal growth models with vintage capital: the dynamic programming approach. J. Econ. Theory 143(1), 331–373 (2008)

Federico, S., Goldys, B., Gozzi, F.: HJB equations for the optimal control of differential equations with delays and state constraints, i: regularity of viscosity solutions. SIAM J. Control Optim. 48(8), 4821–5653 (2009)