Abstract

Objectives

This study revisits the relationship between property crime and economic conditions with the latter being represented by a collective economic perception variable in the form of the Index of Consumer Confidence (ICC). The present work takes this application to assess the severity of cross-sectional dependence and nonstationarity, two issues that are deemed pervasive in macro panels but have not been given sufficient consideration in previous research.

Methods

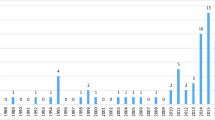

The dataset comprises information for five Canadian regions over a time period of 24 years from 1982 to 2005. The study compares the parameter estimates and residual properties of the commonly used two-way fixed effects (2FE) model and the augmented mean group (AMG) estimator where the latter can accommodate nonstationarity and cross-sectional dependence that potentially arise from unobserved common factors.

Results

In contrast to the 2FE approach, when using the AMG estimator one can reject the null hypothesis that the current ICC has no impact on crime. Some of the effects still hold when an alternative economic indicator, the unemployment rate of young males, is added to the model. Diagnostic tests confirm that the commonly used 2FE estimator yields nonstationary and cross-sectional dependent residuals, whereas the heterogeneous parameter model produces more favorable diagnostic results.

Conclusions

The findings provide evidence supporting the hypothesis that subjective measures of economic conditions are linked to financially-motivated crime rates. Through this application, the study demonstrates the importance of examining underlying data properties and regression residuals in empirical work to ensure the validity of estimates.

Similar content being viewed by others

Notes

Building on extensive Monte Carlo simulations, Bond and Eberhardt (2009) show that the AMG’s performance matches that of the popular Pesaran (2006) common correlated effects (CCE) estimators in terms of bias or RMSE in panels with nonstationary variables (cointegrated or not) and cross-sectional dependence.

The dollar value used to define theft over and under has been changed multiple times in Canadian history. For example, the dollar value was $200 from 1977 to 1984, and then was increased to $1,000 between 1985 and 1994. From 1995 to the present, the dollar value has been $5,000. As the timeframe of the present research is from 1982 to 2005, it is necessary to aggregate the two offences to ensure consistency across time.

Due to data limitations, the percentage of the population that is aboriginal is not available.

Youth incarceration rate is not included due to data limitations.

The first generation panel data unit root tests (Maddala and Wu, 1999) also confirm the nonstationarity.

References

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Baltagi BH, Pesaran HM (2007) Heterogeneity and cross section dependence in panel data models: theory and applications introduction. J Appl Econom 22(2):229–232

Bertrand M, Duflo E, Mullainathan S (2004) How much should we trust differences-in-differences estimates? Q J Econ 119(1):249–275

Blais É, Gagné M-P, Linteau I (2011) L’effet des lois en matière de contrôle des armes à feu sur les homicides au Canada, 1974–2004. Can J Criminol Crim Justice 53(1):27–62

Bond S, Eberhardt M (2009) Cross-section dependence in nonstationary panel models: a novel estimator. MPRA paper 17692, University Library of Munich, presented at the Nordic Econometrics Conference in Lund, Sweden, 2009

Burdett K, Lagos R, Wright R (2003) Crime, inequality, and unemployment. Am Econ Rev 93(5):1764–1777

Bushway S, Reuter P (2001) Labor markets and crime. In: Wilson J, Petersilia J (eds) crime. ICS Press, San Francisco, pp 191–224

Chudik A, Pesaran HM, Tosetti E (2011) Weak and strong cross-section dependence and estimation of large panels. Econom J 14(1):45–90

Coakley J, Fuertes A-M, Smith R (2006) Unobserved heterogeneity in panel time series models. Comput Stat Data Anal 50:2361–2380

Curtin RT (2004) Psychology and macroeconomics: fifty years of the surveys of consumers. In: House JS, Juster FT, Kahn RL, Schuman H, Singer E (eds) A telescope on society: survey research and social science at the University of Michigan and Beyond. University of Michigan Press, Ann Arbor, pp 131–155

De Hoyos RE, Sarafidis V (2006) Testing for cross-sectional dependence in panel-data models. Stata J 6(4):482–496

Eberhardt M, Teal F (2013) No mangoes in the Tundra: spatial heterogeneity in agricultural productivity analysis. Oxf Bull Econ Stat 75(6):914–939

Edmark K (2005) Unemployment and crime: Is there a connection? Scand J Econ 107(2):353–373

Freeman RB (1992) Crime and the employment of disadvantaged youths. In: Peterson G, Vroman W (eds) Urban labor markets and job opportunity. Urban Institute Press, Washington, DC, pp 201–237

Gould ED, Weinberg BA, Mustard DB (2002) Crime rates and local labor market opportunities in the United States: 1979–1997. Rev Econ Stat 84(1):45–61

Greenbaum RT, Tita GE (2004) The impact of violence surges on neighborhood business activity. Urban Stud 41(13):2495–2514

Ihlanfeldt KR (2007) Neighborhood drug crime and young males’ job accessibility. Rev Econ Stat 89(1):151–164

Levitt SD (2001) Alternative strategies for identifying the link between unemployment and crime. J Quant Criminol 17(4):377–390

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61(S1):631–652

Mauser GA, Maki D (2003) An evaluation of the 1977 Canadian firearm legislation: robbery involving a firearm. Appl Econ 35(4):423–436

Mehlum H, Miguel E, Torvik R (2006) Poverty and crime in 19th century Germany. J Urban Econ 59(3):370–388

Mustard DB (2010) How do labor markets affect crime? New evidence on an old puzzle. In: Benson BL, Zimmerman PR (eds) Handbook on the economics of crime. Edward Elgar, Northampton, pp 342–358

Papps K, Winkelmann R (2000) Unemployment and crime: new evidence for an old question. N Z Econ Pap 34(1):53–71

Pesaran HM (2004) General diagnostic tests for cross section dependence in panels. IZA discussion paper No. 1240

Pesaran HM (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Pesaran HM (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Phillips PCB, Moon HR (1999) Linear regression limit theory for nonstationary panel data. Econometrica 67:1057–1111

Piehl AM (1998) Economic conditions, work, and crime. In: Tonry M (ed) Handbook on crime and punishment. Oxford University Press, New York, pp 302–319

Raphael S, Winter-Ebmer R (2001) Identifying the effect of unemployment on crime. J Law Econ 44(1):259–283

Rosenfeld R, Fornango R (2007) The impact of economic conditions on robbery and property crime: the role of consumer sentiment. Criminology 45(4):735–769

Shepherd JM (2002a) Police, prosecutors, criminals, and determinate sentencing: the truth about Truth-in-Sentencing laws. J Law Econ 45(2):509–534

Shepherd JM (2002b) Fear of the first strike: the full deterrent effect of California’s two-and three-strikes legislation. Journal of Legal Studies 31:159–201

Witt R, Clarke A, Fielding N (1999) Crime and economic activity: a panel data approach. Br J Criminol 39(3):391–400

Author information

Authors and Affiliations

Corresponding author

Additional information

While the data collection and part of the data analysis of this work were completed at the Department of Justice Canada, the views expressed in this article are those of the author and do not necessarily represent the views of the Department of Justice Canada.

Rights and permissions

About this article

Cite this article

Zhang, T. Addressing Unobserved Heterogeneity in the Relationship Between Crime and Consumer Confidence. J Quant Criminol 32, 47–59 (2016). https://doi.org/10.1007/s10940-015-9253-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10940-015-9253-x