Abstract

Income comparisons are important for individual well-being. We examine the shape of the relationship between relative income and life satisfaction, and test empirically if the features of the value function of prospect theory carry over to experienced utility. We draw on a unique panel dataset for a middle-income country that allows us to work with an endogenous reference income, which differs for individuals with the same observable characteristics depending on the perception error about their relative position in the distribution. We find the value function for experienced utility to be concave for both positive and, at odds with prospect theory, also negative relative income. Loss aversion holds only for incomes that are sufficiently distant from the reference income. Our heterogeneity analysis shows that the slope of the value function is contingent on people’s personality, social beliefs, and how much they care about income comparisons.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We know from happiness economics that relative income matters. As convincingly argued by an increasing number of economists, this influences individual behaviour (Frank, 1985), causes welfare losses (Frank, 2005), and it is also relevant for public policy, such as optimal taxation (Boskin & Sheshinski, 1978; Oswald, 1983; Kanbur & Tuomala, 2013). Own income relative to the average income of a social reference group has been found to have a sizable effect on individual well-being: Ferrer-i-Carbonell (2005), for instance, finds relative income to be as important as absolute income. Furthermore, as suggested by Duesenberry’s 1949 relative income hypothesis, relative income matters more for people with relative deprivation (lower income than the group’s average) than for those with relative affluence. With very few notable exceptions, pioneered by Vendrik and Woltjer (2007), the relationship between relative income and subjective well-being has been assumed to be log-linear. Despite this usual (but unfounded) practice in empirical work, this functional form may not be the best choice to capture the true relationship between relative income and experienced utility.

Even though Prospect Theory was originally put forth to explain risky choices, Tversky and Kahneman (1991) convincingly argue that Prospect Theory is also relevant to examine riskless choices, and Vendrik and Woltjer (2007) examine whether the salient features of the value function, which we outline in the next paragraph, help us understand individual’s income concerns relative to a reference group.

The prospect theory developed by Kahneman and Tversky (1979) contends that when agents make decisions based on a value function that reflects their expected utility, they value the options with respect to a reference point. This function has several features, which distinguish it from conventional decision making models: (a) reference dependence, which postulates that the well-being depends more on income relative to a reference point than on its level in absolute terms; (b) the asymmetric valuation between gains and losses, which states that the intensity of the valuation of losses and gains of equal magnitude are different; (c) the principle of diminishing sensitivity, which implies that the value function may be convex in the area of losses and concave in gains; (d) reflection effect, which postulates equal degree of concavity and convexity; (e) loss aversion, which implies that the value function is steeper in losses than in gains; and (f) subjective probability assessments, that states that under uncertainty people weight their options based on subjective distribution functions (Kahneman & Tversky, 1979, 2000).

These fundamental characteristics of the utility function of prospect theory have been extensively examined in the lab using expected utility, the utility concept for which prospect theory was originally conceived. As outlined above, the empirical literature that uses self-reported life satisfaction as an empirical measure of experienced utility has long corroborated the pertinence of relative income as a benchmark to assess the value of own income. The question that arises, then, is whether the features that characterize the value function of expected utility are also useful to characterize the utility function with experienced utility.

This paper addresses this question using a panel dataset for a middle-income country (Uruguay), which includes information on personality traits and individual beliefs.Footnote 1 We examine whether the basic properties of the value function of prospect theory carry over to experienced utility by allowing the value function to be non-linear. In the only paper that estimates a flexible non-linear relationship between experienced utility and income relative to the average income of a reference group, Vendrik and Woltjer (2007) confirm, using data for Germany, asymmetric effects for positive and negative relative income. They also find life satisfaction to be concave in positive relative income, but in contrast to prospect theory, also in negative relative income, which in turn implies loss aversion, in a wide sense. However, when the reference point is taken to be last year’s income plus the average income growth from last year across the sample—instead of the average income of a reference group–, Kanninen & Mahler (2017) find evidence of diminishing sensitivity and loss aversion, using the same data for Germany as Vendrik and Woltjer (2007) and a flexible non-linear specification of the relative income term.

Vendrik and Woltjer (2007) suggest that the contradiction between their findings and prospect theory could be due to their exogenous definition of reference income, which assumes that individuals with similar observable characteristics have the same reference group. We improve the definition of reference income in two ways. First, in line with Van Praag and Ferrer-i-Carbonell (2008), which suggest that individuals assign much weight to individuals from their reference group who are nearby socially speaking, we use neighbourhoods, that is, very small geographical areas, to define reference groups. Second, we also take into account that reference group selection may be a source of bias in the individual assessment of their own income (Kapteyn et al., 1978; Cruces et al., 2013), and assume that those biases are related to the difference between the reference income of an exogenously defined group and the true reference income of the individual. This introduces heterogeneity in the reference income among individuals with similar observable characteristics.

Our estimates corroborate that income comparisons are not symmetric. They are more important for relative deprivation than for relative affluence. In line with the findings of Vendrik and Woltjer (2007) for Germany, we also find the relationship between relative income and life satisfaction in Uruguay to be concave both for relative affluence and relative deprivation, which is at odds with the principle of diminishing sensitivity (c) of prospect theory. Finally, loss aversion holds only for incomes that are sufficiently distant from the reference income.

These findings apply on average to the whole sample. However, there are many reasons to believe that different population subgroups may have different value functions. We shall explore three factors: (i) intensity of comparisons, as not everyone gives the same importance to income comparisons (Clark & Senik, 2010; ii) personality traits, as they have been found to mediate in the relationship between relative income and life satisfaction (Proto & Rustichini, 2015; Budria & Ferrer-i-Carbonell, 2019); and (iii) social beliefs, as people’s beliefs about how society works are important drivers of individuals’ preferences and behaviour (Bénabou and Tirole, 2006). Heterogeneity does not change the shape of the value function, which is always found concave for the full support of relative incomes, but affects the slopes of the value function of the different groups.

Our paper contributes to the literature in several ways. It is the first study to provide evidence on the prospect theory hypotheses with experienced utility for a middle-income country, and one of the few studies addressing the relevance of relative income for life satisfaction from a prospect theory perspective. Furthermore, our estimates are obtained from fixed-effects models that control for unobserved heterogeneity, a key issue in life-satisfaction regression analysis (Ferrer-i-Carbonell & Frijters, 2004), which is nevertheless not standard practice in the Latin America region due to lack of longitudinal data. The only evidence we have so far on the shape of the value function for experienced utility is for a developed country, Germany. Since the concavity of the value function for negative relative incomes suggests increasing marginal costs of social participation with relative deprivation (Vendrik & Woltjer, 2007), our novel evidence on the larger concavity of the value function in Uruguay than in Germany points to larger marginal costs of social participation in countries with higher inequality and poverty. We also improve the definition of reference income in two ways: we endogenize reference income and reference groups are comprised of individuals who are socially nearby the individual. Finally, we examine heterogeneous effects for the first time. Our heterogeneity analysis also shows that such costs are not homogeneous across the board, but are higher for internal individuals, those with high empowerment and high self-esteem. Consistent with an incipient literature showing that personality traits and beliefs help us understand heterogeneous social preferences (Almlund et al., 2011; Becker et al., 2013), we find that envy effects are lower and pride effects are larger amongst external individuals, those with less self-esteem, and those who perceive larger discrimination in society.

The rest of the paper is organized as follows. Section 2 motivates and describes the hypotheses we are taking to the data. Section 3 presents our empirical strategy to take the prospect theory hypotheses to the data, describes the endogenous reference groups, and discusses the salient features of our data, the “Multidimensional Well-being Trajectories in Childhood” survey. Section 4 presents our main results for the whole sample and provides heterogeneity analysis by comparison intensity, personality traits, and social beliefs. Finally, Sect. 5 provides arguments to explain the estimated concavity of the value function, discusses the implications of such concavity, and concludes.

2 Hypotheses

We test four basic assumptions about the functional form of relative concern used in the value function proposed by prospect theory.

Hypothesis HI: (Asymmetry of comparisons). The valuations with respect to relative income are asymmetric.

This first hypothesis presupposes reference dependence—i.e. that relative income and hence reference groups are relevant– and suggests that the same relative distance to the reference income has a differential effect on satisfaction depending on what side of the reference income individuals are located, that is, on whether relative income is positive or negative. The hypothesis is thus related to the asymmetric valuation between gains and losses, which is hypothesis (b) from prospect theory. Empirical evidence in support for this hypothesis was first provided by Ferrer-i-Carbonell (2005), drawing on data from the German SOEP and using a log-linear specification for relative income. Vendrik and Woltjer (2007) corroborate such asymmetry of comparisons with a power function specification and the same German SOEP data.

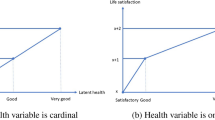

Hypothesis HII: (Diminishing sensitivity). The marginal sensitivity of the utility function to relative income has an asymmetric shape, being convex for individuals with relative deprivation and concave for those with a positive relative income.

The second hypothesis is the equivalent to the diminishing sensitivity hypothesis in prospect theory, which postulates convexity in losses and concavity in gains—that is, that people are more sensitive to changes near their reference point than to changes far from their status quo. To the best of our knowledge, there is no evidence in support of diminishing sensitivity with respect to the reference income of a relevant reference group. Vendrik and Woltjer (2007) is the only paper we know of that tests this hypothesis in the context of experienced utility and social comparisons and find concavity both in positive as well as negative relative incomes.

Hypothesis HIII: (Equal degree of convexity and concavity). The degree of convexity for individuals with relative deprivation is the same as the degree of concavity for individuals with positive relative income.

The third hypothesis is equivalent to the reflection effect in prospect theory, which postulates equal degree of convexity in losses and concavity in gains. Such symmetry results from assuming that “people focus on the numbers indicating a scale’s value without concern for the unit or physical meaning of the scale” (Wakker et al., 2007), that is, from the so-called numerosity effect. Studies on decision utility find evidence in support of the reflection effect (Kahneman, 2003).

Economists assume decreasing marginal utility of income, which reinforces the concavity in gains but reduces the convexity in losses, making it closer to linearity. Put together, the general psychological perceptions determined by the nominal value of money and the economic assumption determined by the intrinsic value of money, predict a larger degree of concavity in gains than convexity in losses. Wakker et al. (2010) call it partial reflection. As noted above, there is no evidence for experienced utility consistent with diminishing sensitivity, when the reference point is the average income of a reference group. Notwithstanding this, Vendrik and Woltjer (2007) find larger degrees of concavity for positive relative income than for negative relative income. This could be interpreted as the economic intrinsic effect of money outweighing the psychological numerosity effect.

Hypothesis HIV: (Loss aversion). Changes in relative income have a greater impact for those who face relative deprivation than for those who have a positive relative income.

The fourth hypothesis informs about the relative size of the effect of comparisons. In particular, it postulates that the negative effect on satisfaction of negative relative income for poorer individuals is larger than the effect of positive relative income of richer individuals. In the context of prospect theory, it is similar to loss aversion. Again, Ferrer-i-Carbonell (2005) and Vendrik and Woltjer (2007), among others, find evidence consistent with this hypothesis.Footnote 2

3 Empirical Strategy

3.1 Empirical Model

We use a life satisfaction variable, LSS, as a proxy measure of utility. The validity of satisfaction variables has been discussed in Kahneman and Krueger (2006), Clark et al. (2008), and Ferrer-i-Carbonell (2011). The empirical literature usually estimates the following model to examine the relationship between relative income and life satisfaction:

where y is income, \(y^{rg}\) is the average income of the reference group, the vector X includes relevant controls and the Greek letters are parameters to be estimated. This model distinguishes the absolute income effect, captured by \(\tilde{\beta }\), from the relative income effect, quantified by \(\gamma\). Parameters \(\tilde{\beta }\) and \(\gamma\) are expected to be non-negative. Equation (1) can be written as:

where \(\beta =(\tilde{\beta }-\gamma )\). Thus, \(\beta <0\) if \(\tilde{\beta }<\gamma\). Now, the overall marginal effect of income as given by the sum of the absolute and relative income effects is \((\beta +\gamma )\). Following Ferrer-i-Carbonell (2005), to study the possible asymmetric effect of relative income, parameter \(\gamma\) is allowed to take two different values, depending on whether own income is larger or smaller than reference group average income, thus obtaining the following model:

where I is an indicator function, which equals 1 when \((y-y^{rg})\ge 0\) and 0 when \((y-y^{rg})<0\). Now \(\gamma _{+}\) and \(\gamma _{-}\) capture the effect of relative income for incomes larger and smaller than reference’s group average income level, respectively. Thus, \(\gamma _{+}\) and \(\gamma _{-}\) are expected to be non-negative.

Since we want to test the importance and shape of relative income effects at either side of a reference income level, our baseline model relaxes the logarithmic functional form of relative income of equations (1) to (3), and uses instead a more flexible parametric power function, \(h(\cdot )\), to capture relative income effects on satisfaction. To avoid possible multicollinearity problems, which may bias our estimate of the absolute income effect, we continue using the logarithmic function to model the absolute effects of income, as it is customary in the literature. We report in Sect. 4.1 the results with an alternative power function specification for the absolute income effect and show relative income effects to be robust to the specification of absolute income effects.

Gains and losses are defined in absolute terms in prospect theory, i.e. \((y-y^{rg})\) (Tversky & Kahneman, 1991). However, as Vendrik and Woltjer (2007) argue, relative distances to the reference value seem more relevant determinants of satisfaction than absolute gains and losses. We therefore define income relative to the reference’s group average income level, \(y^{rg}\), in percentage terms, and thus define \(G^{+}=((y-y^{rg})/y^{rg})>0\) for incomes larger than reference’s group average income level and \(G^{-}=((y-y^{rg})/y^{rg})<0\) for incomes smaller than reference’s group average income level. Our baseline model can be then expressed as:

This specification falls within the models that Hopkins (2008) classifies as “mean dependence”, which assume that utility increases with income in absolute terms, but also with respect to income relative to a reference point. Some studies employ income ranks to model relative concern—see, for instance, Clark et al. (2009). This is however not a good option for us, as we want to study how satisfaction responds to variations in the size of the relative income gap.

Previous empirical studies typically find a positive relationship between relative income and life satisfaction. Since we define \(G^{+}\) to be positive and \(G^{-}\) to be negative, we expect both \(\gamma _{+}\) and \(\gamma _{-}\) to be non-negative.

The power functions of relative incomes, \(h(G^{+},\rho _{+})\), and \(h(G^{-},\rho _{-})\) take the following form:

Since we have defined \(G^{-}\) and \(G^{+}\) the same way, that is, equal to \(((y-y^{rg})/y^{rg})\), the power function specifications in (5) and (6) are convenient as they permit using \(\rho _{+}\) and \(\rho _{-}\)—which equal Pratt’s measure of risk aversion, a commonly used index to describe the curvature of utility– to test the degree of concavity and convexity of the value function (i.e. Hypothesis HIII). Using the above definitions of the relative income gaps, \(G^{-}\) and \(G^{+}\), also allows a direct comparison of our estimates with those obtained by Vendrik and Woltjer (2007) for Germany. However, a drawback of the above definitions of \(G^{-}\) and \(G^{+}\) is that they are asymmetric in \((1+G^{-})\) and \((1+G^{+})\), which makes a test of Hypothesis HIII of equal degrees of convexity in \(G^{-}\) and concavity in \(G^{+}\) as implied by the reflection effect in prospect theory less adequate.Footnote 3 To make sure that this asymmetry does not drive our results when testing Hypothesis HIII, we also estimate our baseline model (4, 5, 6) with an alternative definition of \(G^{-}\), as the opposite “mirror image” of \(G^{+}\). We thus define \(G^{-}_{\bowtie }=((y^{rg}-y)/y^{rg})>0\). Note, however, that with the alternative definition of relative income for the region of losses, \(G^{-}_{\bowtie }\), \(\rho _{-}\) does not equal any longer Pratt’s measure of risk aversion and thus cannot be used to test the degree of concavity in losses and convexity in gains together with \(\rho _{+}\). We will build on the advantage of every approach and use both \(G^{-}\) and \(G^{-}_{\bowtie }\) to test Hypotheses HII and HIII, in Sect. 4.

3.2 Specification Tests for our Hypotheses

The four hypotheses outlined in sect. 2 have implications on the parameters of interest in equations (4, 5, 6), which can be tested. The asymmetry of comparisons hypothesis (HI) implies the value of parameters \(\gamma _{+}\) and \(\gamma _{-}\) or the value of parameters \(\rho _{+}\) and \(\rho _{-}\) in equation 4 to differ: \((\gamma _{+} \ne \gamma _{-}\) or \(\rho _{+} \ne \rho _{-})\).Footnote 4 Of course, HI also holds if the two sets of parameters differ, i.e. \(\gamma _{+} \ne \gamma _{-}\) and \(\rho _{+} \ne \rho _{-}\).

The following two hypotheses address the possible non-linearity of relative income effects. Diminishing sensitivity (HII) implies convexity for individuals facing relative deprivation and concavity for individuals with positive relative income. Convexity in relative deprivation requires \(\rho _{-}<0\) while concavity in relative affluence requires \(\rho _{+}>0\).

Hypothesis HIII requires measuring the degree of concavity and convexity. Given our power function specification, we use \(\rho _{+}\) and \(\rho _{-}\) for that purpose, which resembles Pratt’s measure of relative risk aversion. Then equal degree of concavity for relative deprivation and convexity for relative advantage implies \(\left| \rho _{+}\right| =\left| \rho _{-}\right|\).

Finally, loss aversion (HIV) may be tested in two different ways. One first (and more global) strategy is to check whether the slope is steeper for relative deprivation than for relative advantage, for the same gap, i.e. \(G^{+}=\left| G^{-}\right|\). A second, more local, strategy is to check whether there is a kink in the slope of the value function at the reference level, i.e. \(G^{+}=G^{-}=0\), with a steeper slope for relative deprivation (Kahneman et al., 1991; Köbberling & Wakker, 2005).

The first strategy concerns parameters \(\gamma _{+}\) and \(\gamma _{-}\), but also \(\rho _{+}\) and \(\rho _{-}\), since \(\partial S/\partial G^{+}=\gamma _{+}\left( 1+G^{+}\right) ^{-\rho _{+}}\) and \(\partial S/\partial G^{-}=\gamma _{-}\left( 1+G^{-}\right) ^{-\rho _{-}}\). Loss aversion is satisfied if the value function is concave and the slope does not present any discontinuity in both \(G^{-}\) and \(G^{+}\), i.e. if \(\gamma _{-} \ge \gamma _{+}\), \(\rho _{+}>0\) and \(\rho _{-}>0\), for all positive values of \(G^{+}=\left| G^{-}\right|\), as in Vendrik and Woltjer (2007). If \(\rho _{+}>0\) and \(\rho _{-}>0\), i.e. concave value function, but \(\gamma _{-} < \gamma _{+}\), then loss aversion depends on the particular values of \(\gamma _{+}\) and \(\rho _{+}\) relative to \(\gamma _{-}\) and \(\rho _{-}\), and of \(G^{+}=\left| G^{-}\right|\) in a complex way. This, of course, means that hypothesis HII does not hold. If hypothesis HII holds, however, and the value function is convex for relative deprivation, loss aversion also depends on the particular values of \(\gamma _{+}\) and \(\rho _{+}\) relative to \(\gamma _{-}\) and \(\rho _{-}\), and of \(G^{+}=\left| G^{-}\right|\) in a complex way. Since the second strategy evaluates the slope of the value function at \(G^{+}=G^{-}=0\), it simply implies \((\left| \gamma _{-}\right| >\left| \gamma _{+}\right| )\). Previous evidence suggest that relative income is not relevant for individuals with relative advantage (Ferrer-i-Carbonell, 2005). Thus, we will also test whether \(\gamma _{+}=0\).

3.3 Endogenous Reference Groups

The above model assumes that the researcher knows the income of the reference group Y\(^{rg}\). However, determining the reference income is the most problematic aspect of prospect theory (de Meza & Webb, 2007). The literature is inconclusive about how reference groups are formed and generally assumes that individuals compare themselves with other individuals who share observable characteristics (Ferrer-i-Carbonell, 2011; Vendrik & Woltjer, 2007), thus assuming that individuals with similar observable characteristics have the same reference group. However, aspects such as individual social mobility, social interactions, the presence of information problems, copying strategies, or misperceptions about one’s relative position may also explain individual’s choice of reference group and thus of reference point (Falk & Knell, 2004; Stutzer, 2004; Clark & D’Angelo, 2013). If so, the standard practice of using basic socio-economic observable characteristics to define reference groups would not provide an accurate estimate of each individual’s reference income, casting thus doubt on our findings about the validity of the assumptions of prospect theory.

We address this issue by using a definition of reference income that depends on individuals’ own perception of outcomes. This introduces heterogeneity in the reference income among individuals with similar observable characteristics. We explore the idea that individuals assess their own situation by comparing it with the perceived distribution of outcomes (Kapteyn et al., 1978). To this end, we first assume that the reference group based on observable characteristics (\(y_{i}^{rg-observed})\) provides relevant, but insufficient information, as it may differ from what each individual really considers when making their valuations (\(y_{i}^{rg-true}\)). We also assume that the difference between \(y_{i}^{rg-observed}\) and \(y_{i}^{rg-true}\) is related to the biases in individuals’ evaluations of their own relative position in the overall income distribution.

Let the perception error of an individual’s i own relative position in the income distribution, \((e_{i})\), be the difference between her perceived position \((P_{i}{}^{P})\) and the true position \((P_{i}{}^{T}\)) in the income distribution, \(e^{p}_{i}=P_{i}{}^{P}-P_{i}{}^{T}\). Following the evidence provided in Kapteyn et al. (1978) and Cruces et al. (2013), we assume that biased perceptions of own relative position depend on the reference group and the resulting income taken as a reference. The richer the true reference group, and thus the higher the reference income, the more individuals underestimate their relative position in the overall income distribution. Table 7 provides empirical support to this assumption for the MWTC data.

We then use an increasing function of \(e_{i}\), \(\psi (e_{i})\), to adjust the observed reference group income, as follows:

The function \(\psi (e_{i})\), which solely depends on the individual’s perception error, can be generally defined as

where \(\psi (e_{i})>0\), \(\psi (0)=1\), and \(\psi '(e_{i})>0\). That is, individuals’ reference income is adjusted only if their perceptions about their own position in the income distribution are not correct. Overestimating one’s position, i.e. \((P_{i}^{P}>P_{i}^{T})\), leads to a downward adjustment in own reference income, while the opposite happens when one’s position is underestimated. For the empirical analysis we use the following functional form of \(\psi (e_{i})\):

where both perceived and true positions, P\(_{i}\) \(^{P}\) and P\(_{i}\) \(^{T}\), are measured in deciles and take values from 0.1 to 1.

However, results are robust to other functional forms of \(\psi (e_{i})\), such as the square root of the error, which gives less importance to greater perception errors, or to different definitions of the perception error, such as the ratio between true income and that of the decile where individuals perceive themselves to be. Results are also robust to assuming that perception errors are not relevant, i.e. \(\psi (e_{i})=1\).Footnote 5

Adjusted reference group income, \(y_{i}^{rg-adj}\), changes over time (we omit time subscripts for simplicity) as both \(y_{i}^{rg-observed}\), which are neighbourhood specific in our empirical analysis (see Sect. 3.4 for further details), and perception errors, which define \(\psi (e_{i})\), may not be time-invariant. In our empirical analysis, however, we have to assume \(e_{i}\) constant as perception of own position in the distribution, \(P_{i}^{P}\), is only reported in the last of the two time periods. The positive side of this assumption is that it wipes out endogeneity concerns that would arise if we were to use time-varying subjective perception errors to adjust reference incomes, as we would be introducing subjective aspects among the regressors.

3.4 Data

Our data comes from the “Multidimensional Well-being Trajectories in Childhood” (MWTC), a unique panel data set in Latin America, which includes a wide set of individual socioeconomic characteristics, as well as individual perceptions and opinions, which are important for our analysis and are not usually found in surveys that are representative of large populations. The MWTC is representative of the households residing in the metropolitan area with children attending the first year at a public primary school in 2004.Footnote 6 Public school coverage is close to 90% among first-year school children in Uruguay.Footnote 7

We use data from the last two waves of the survey, corresponding to the years 2006 and 2011, as the first wave does not include information on life satisfaction, our dependent variable. Our sample includes 1626 individuals, of which 1278 are respondents of the 2006 wave and 1070 come from the 2011 wave. The panel component includes 722 individuals who provided answers in both waves. This is the sample we use for the panel data analysis. To check if our sample is a self-selected sample, we check whether the mean values of the main variables are different across the cross-section and longitudinal samples. The difference-in-means tests reported in Table 8 in Appendix A.I show that only 5 out of 24 comparisons are statistically significantly different.Footnote 8 We therefore conclude that self-selection is not a big threat. The description and source of each variable is provided in Table 6 in Appendix A.I. Given the nature of the MWTC data, our sample does not include either very young or elder individuals. However, it is difficult to tell whether and in what direction this sample selection has any effect on our results, as to the best of our knowledge, there is no study that estimates non-linear relative income effects using flexible functional forms, as we do, by age groups.

Our dependent variable is reported individual life satisfaction, S, which following Vendrik and Woltjer (2007) we interpret as a measure of experienced utility.Footnote 9 The income variable measures per capita real annual disposable household income, which includes labour and capital income net of taxes and transfers.Footnote 10

As explained in sect. 3.3, reference income is the income of a relevant reference group, adjusted by individual’s own perception error about her position in the income distribution. Unlike previous studies, instead of using broad regions to define reference groups, we use much finer geographical areas, namely neighbourhood of residency, which we believe define more relevant reference groups.Footnote 11 Due to small cell sizes, we do not use other observables typically used in previous studies to define reference groups, such as education, age or gender. Lack of relevant information also prevents us from using colleagues, friends, or relatives to define reference groups— (Clark & Senik, 2010) and Dumludag et al. (2018) use these groups in the context of relative income concerns.

To estimate the reference income of the groups we use the whole cross-section sample of the MWTC, which is larger than the panel sample. To adjust individuals’ income by own perception error about their position in the income distribution, we use information on perceptions on own position, \(P_{i}^{P}\), and actual position, \(P_{i}^{T}\), in the income distribution. Information on individual’s perception comes from the following question: “Suppose a ladder that goes from 1 to 10, where poor people are located at 1 and rich people are located at 10. Where would you place yourself on this ladder?” (and then the integer numbers from 1 to 10 are shown). Answers to this question are compared to the actual position they have in the income distribution, which we estimate from the CHS, and express in deciles.Footnote 12 We use the CHS to estimate income deciles for two reasons. First, since the perception question refers to the income distribution of the whole of Uruguay, we use a dataset, the CHS, that is representative of the whole population—recall that the MWTC data is representative of the households residing in the metropolitan area with children attending the first year at a public primary school in 2004. Having said this, estimated income deciles are robust to using the MWTC data instead of the CHS data. Second, the sample size in the CHS data is much larger, which yields more precise estimates.

Our set of controls is standard and includes age, hours worked, and number of adults in the household, all in logarithms, and marital status, number of children, labour market status, number of active household members, as categorical variables, a dummy for the capital city Montevideo, and year fixed effects.Footnote 13 Time-invariant variables such as sex, education, cognitive, and non-cognitive skills are subsumed in the individual fixed effect. Table 6 shows the precise definition of all variables.

3.5 Estimation Procedure

In accordance to a substantial part of the empirical literature, we do not use ordinal models (Ferrer-i-Carbonell & Frijters, 2004), but non-linear least squares with individual fixed effects. This assumes interpersonal comparability and cardinality,Footnote 14 but provides a simpler interpretation of the coefficients of interest—i.e. those associated with relative concern. Furthermore, fixed effects control for unobserved time-invariant heterogeneity, which is key when modelling self-reported satisfaction levels (Ferrer-i-Carbonell & Frijters, 2004). Standard errors of parameter estimates are individual-level clustered to correct for heteroskedasticity and within-person correlation.

As outlined above, a source of simultaneity and bias lies in the choice of the reference group (Falk & Knell, 2004; Heffetz & Frank, 2011). On the one hand, the reference group may be relevant in deciding how much income is necessary to obtain a certain level of economic satisfaction, but on the other hand, individuals may choose the reference group endogenously in order to maximize economic satisfaction—see (Falk & Knell, 2004), Senik (2009), and (Clark & Senik, 2010) for evidence on the endogenous determination of reference groups. Notwithstanding this, reference groups are usually assumed exogenous in the empirical literature Clark et al. (2008). As explained in Sect. 3.3 and 3.4, to address this issue, we introduce two novelties: we use neighbourhood of residency to define the reference groups and use individual perceptions about own relative position in the income distribution to correct the reference income from endogeneity biases (Kapteyn et al., 1978; Cruces et al., 2013)

4 Testing the Assumptions of Prospect Theory

Section 4.1 reports and discusses our main findings on the four basic assumptions about the functional form of relative concern used in the value function proposed by prospect theory and presented in Sect. 2, while Sect. 4.2 explores to what extent individual attributes and characteristics introduce heterogeneity in the functional form of relative concern.

4.1 Main Results

Table 1 reports estimates of the main parameter of interest from specifications (1) to (3). The first specification of table 1 is the base equation in which only own income is included. The regression indicates a positive (and precisely estimated) coefficient. Including the average income of the reference group in the model (specification 2), does not significantly change the coefficient of own income, \(\tilde{\beta }\),Footnote 15 while the average income of the reference group shows the expected negative (and precisely estimated) relation with satisfaction (i.e. \(\hat{\gamma }>0\)). In contrast with the literature in Europe and the US, the effect of the average income of the reference group is much larger (6 times) than the effect of absolute own income.Footnote 16 This means that equally distributed income growth would reduce individuals’ satisfaction.Footnote 17Footnote 18 This drives the negative estimate of \(\beta\) in equation 2 (third specification in Table 1), which models relative income as the log difference between own and reference’s group average income, and the subsequent negative estimates of \(\beta\) in the rest of the Tables in the paper.Footnote 19 Finally, when the relative income effect is allowed to be asymmetric, point estimates suggest that negative relative incomes have a larger effect than positive ones, as \(\hat{\gamma }_{-}>\hat{\gamma }_{+}\). However, the estimated coefficients \(\hat{\gamma }_{-}\) and \(\hat{\gamma }_{+}\) are not statistically significantly different. This could be seen as preliminary evidence not in favour of the asymmetry of comparisons hypothesis (HI). However, this apparent lack of asymmetry of comparisons is likely to be the result of the rigid log-linear functional form imposed in equation (3). When we allow a more flexible functional form, in equations (4, 5, 6), the data suggests that comparisons are indeed asymmetric.

Table 2 reports estimates of the main parameter of interest from our flexible model outlined in equations (4, 5, 6), which allow us to test empirically hypothesis HI to HIV. The full set of estimates of model (4, 5, 6) is reported in Table 10. The estimates of \(\gamma _{+}\), \(\gamma _{-}\), \(\rho _{+}\) and \(\rho _{-}\) corroborate that income comparisons are not symmetric, as \(\hat{\gamma }_{+} \ne \hat{\gamma }_{-}\) and \(\hat{\rho }_{+} \ne \hat{\rho }_{-}\).Footnote 20 The positive estimate of \(\gamma _{-}\) corroborates previous findings about upward comparisons reducing individuals’ satisfaction, consistent with envy effects. The positive estimate of \(\gamma _{+}\) suggests a satisfaction-enhancing impact of downward comparisons, consistent with pride or status effects (Fehr & Schmidt, 1999).

Our findings do not give support to the diminishing sensitivity hypothesis (HII). This hypothesis postulates a convex relationship between relative income and satisfaction for individuals with relative deprivation but a concave relationship for individuals with positive relative income. Convexity in relative deprivation requires parameter \(\rho _{-}\) to be negative while concavity in relative affluence is satisfied when parameter \(\rho _{+}\) is positive. Our parameter estimates of both \(\rho _{-}\) and \(\rho _{+}\) are positive, implying concavity for positive relative income, as suggested by HII, but, contrary to HII, also for relative deprivation. When we use \(G^{-}_{\bowtie }\) instead of \(G^{-}\), to avoid the asymmetry issues discussed in Sect. 3.1, we obtain the same result of concavity on both sides of the reference income.Footnote 21

The equal degree of convexity and concavity hypothesis (HIII) is clearly rejected, as we find no support for the hypothesis of diminishing sensitivity. Nonetheless, we can check whether the degree of concavity differs at both sides of the reference income level.Footnote 22 The larger estimate of \(\rho _{+} = 2.26 > 1.06 = \rho _{-}\) suggests concavity to be larger for relative affluence than relative deprivation. A Wald test on \(H_{0}:\rho _{+} = \rho _{-}\) rejects the hypothesis at 1% level. As we discuss in Sect. 5, the degree of concavity of the value function has implications for individual behaviour. Because of this, it is important to notice that our measures of concavity, \(\rho _{-}\) and \(\rho _{+}\), are statistically significantly larger than one−two tests on \(H_{0}:\rho _{-} = 1\) and on \(H_{0}:\rho _{+} = 1\) reject the hypotheses at 1% level. This also implies that the data does not support the log-linear specification for relative income.

Loss aversion (HIV) is only satisfied for incomes that are sufficiently distant from the reference income. Loss aversion required steeper slope for losses than for gains. Since \(\gamma _{-} < \gamma _{+}\), to check whether loss aversion holds we do a Wald test on the slope condition \(\partial S/\partial G^{-} (-G)=\gamma _{-}\left( 1+G^{-}\right) ^{-\rho _{-}} > \partial S/\partial G^{+} (G)=\gamma _{+}\left( 1+G^{+}\right) ^{-\rho _{+}}\) for fixed values of \(G=\left| G^{-}\right| =G^{+}\). This test suggests that the slope condition is significant for incomes 16% lower or larger than the reference income, i.e. for \(G \ge 0.16\). In our sample, this means that loss aversion holds for about 79.5% of individuals.

The more local strategy to test for loss aversion, consisting of evaluating the slope of the value function at \(G^{-}=G^{+}=0\), indicates that there is a jump at this point and corroborates the lack of loss aversion for incomes close to the reference income, as \((1.73=\hat{\gamma }_{+}>\hat{\gamma }_{-}=0.79)\).

In sum, our findings for Uruguay, a middle-income country, are in line with those of Vendrik and Woltjer (2007) for Germany, a high-income country: Satisfaction is concave in positive as well as negative relative income—thus rejecting the diminishing sensitivity as well as the equal degree of convexity and concavity hypotheses–, concavity being larger for positive relative income, and loss aversion is only satisfied for incomes that are sufficiently distant from the reference income. We find this relative income gap of 16% to be similar for Uruguay than the gap for Germany, reported by Vendrik and Woltjer (2007).

Using the more flexible power-function specifications to model relative income does not change the sign of the absolute income parameter estimate, \(\hat{\beta }\), relative to the parameter estimate coming from equation (3), that models positive and negative relative incomes in logs—see the last two columns of Table 1. Notice that the size of the overall marginal effect of income as given by the sum of the absolute and relative income effects is now negligible.Footnote 23 To check the robustness of this result, we introduce more flexibility in the absolute income term and estimate equation (4) with the power function \(\beta \left( y^{1-\rho }-1\right) /\left( 1-\rho \right)\), \(\rho \ne 1\), instead of the log-linear specification \(\beta ln(y)\). This strategy, however, faces two possible problems. First, given our limited sample size, simultaneously estimating non-linear power functions for the absolute income effect and the positive relative income effect may demand too much from the data, and second, there might be multicollinearity of the absolute and positive relative income terms (Vendrik & Woltjer, 2007). The estimates from this new specification (\(\hat{\beta }=-0.3\) and \(\hat{\rho }=0.91\), both statistically significant) corroborate the results obtained with the log-linear specification. This latter result is similar to that obtained by Vendrik and Woltjer (2007).

4.2 Heterogeneity

Do the above conclusions, which apply on average to the whole sample, also characterize the value function of relevant population subgroups? The literature has not devoted much work to examine the heterogeneous effects of relative income on life satisfaction. The existing limited evidence suggests that non-cognitive traits have a relevant influence on the relative income (comparisons) effect on life satisfaction (Budria & Ferrer-i-Carbonell, 2019).Footnote 24 This section provides further and novel evidence on how individual heterogeneity shapes the value function. We will explore differences that arise from the importance given by individuals to income comparisons, from personality or non-cognitive traits, and from fairness beliefs.

A common finding arises from all the heterogeneity analyses we undertake: the value function is always found to be concave, as we have documented for the sample as a whole. Thus, in what follows we are discussing mainly the differences in slopes of the various heterogeneous groups.

4.2.1 Importance of Income Comparisons

Comparing one’s income with that of relevant others has been proven to be important. Using data for European countries, (Clark & Senik, 2010) show that self-reported intensity on the relevance of comparisons matter for individuals’ life satisfaction. In particular, they find a negative relationship between own happiness and intensity of comparisons. That is, those who deem relevant comparing their income are less happy.

On average, the results reported in Sect. 4.1 suggest that life satisfaction decreases at an increasing rate as individuals income is increasingly lower than reference income, while it increases at a decreasing rate as individuals income is increasingly higher than reference income. Does the value function of individuals who report that income comparisons are important to them differ from those who feel that income comparisons are not important? And if so, do individuals who report income comparisons to be important experience larger or smaller changes in life satisfaction as their income moves away from the reference income?

To examine whether the value function differs for individuals who care about income comparisons, we use the answers to the following question: “How important is it for you to compare your income with other people’s incomes?” Individuals answered using a showcard, where 1 corresponds to “Not at all important”, and 5 is labeled “Very important”. Since only one fourth of the mass reports values greater than one, we collapse the five-point scale original variable into a dichotomous variable indicating high intensity, which takes value 1 if individuals answer 2 to 5 in the original five-point scale, and zero otherwise. Table 9 shows the distribution of answers to the original question. Since this question was only included in 2011, we have to assume that income comparisons are time-invariant within a short time period.

To allow individuals with different income comparison intensity to have different value functions, we interact the power functions of relative incomes \(h(G^{+},\rho _{+})(\text {I})\) and \(h(G^{-},\rho _{-})(1-\text {I})\) with the indicator variable H, and estimate the following specificationFootnote 25:

where now, with a slight abuse of notation, parameters \(\gamma _{+}\) and \(\gamma _{-}\) capture the effect of individuals for whom comparisons are not important, while parameters \(\gamma _{+}^{H}\) and \(\gamma _{-}^{H}\) indicate the differential effect of individuals for whom comparisons are important. The overall effect for the latter individuals is obtained from adding both parameters \(\gamma _{+}\) and \(\gamma _{+}^{H}\) (or \(\gamma _{-}\) and \(\gamma _{-}^{H}\)), as usual.Footnote 26 All indicator variables used to explore heterogeneous effects in Sect. 4.2 are time-invariant, and their direct effect on life-satisfaction is thus subsumed into the time-invariant individual-specific fixed effect.

Table 3 shows that the value function of individuals who care for income comparisons differs from those who do not, as both \(\gamma _{+}^{H}\) and \(\gamma _{-}^{H}\) are significantly different from zero. The estimates show a flatter value function in income losses and a steeper function in income gains for individuals who deem income comparisons important. The flatter value function in income losses means that negative relative income has a smaller effect on life satisfaction of individuals who care for income comparisons. One interpretation of this result is that the envy effect dominates the information effect for negative relative income, but less so for individuals who report that comparisons are important. For some reason these individuals believe there is more to be learned from others’ good fortune than those who report comparisons not to be important. A related interpretation of the smaller negative effect of relative deprivation for individuals who deem income comparisons important is that self-enhancement motives—which lead to choosing reference groups that make themselves feel better– dominate self-improvement aspects—which entail choosing reference groups that help them improve their performance. This in turn could result from these individuals being less ambitious or more complacent.

The larger (positive) effect of positive relative income of individuals who find income comparisons important, relative to those who do not find them important can be interpreted as status or self-enhancing effects being larger for individuals who compare.

The different slope of the value function between those who compare and those who do not implies that the difference in life satisfaction between these two types of individuals increases as relative income increases. This is to the best of our knowledge novel evidence.Footnote 27

Our findings of a steeper slope of the value function for gains for Uruguayan individuals who report comparisons to be important are consistent with previous evidence for Turkish immigrants in the Netherlands. Dumludag et al. (2018) find the positive life satisfaction effect of positive relative income to be larger for individuals who consider income comparisons with other immigrants very important relative to those who consider those comparisons not very important, in a sample of Turkish immigrants in the Netherlands. In contrast to this evidence, other studies find no heterogeneous effects of relative income on life satisfaction across groups that attach different importance to income comparisons for German data (Mayraz et al., 2009, and Goerke and Pannenberg, 2013)

4.2.2 Personality Traits

In this section we report heterogeneity by three personality traits, locus of control, empowerment, and self-esteem, which are indicators of a common construct termed ’core self-evaluations’ (Judge et al., 2002).Footnote 28 Almlund et al. (2011) define positive self-evaluation as indicating “a generally positive and proactive view of oneself and one’s relationship to the world”.

Locus of control measures the extent to which individuals perceive that the control of their life is external (depends on others, luck, etc.) or internal (the course of own life depends on own decisions and effort); self-esteem is usually conceived of as the perception that individuals have about their own ability; while empowerment captures the belief that one can act effectively to bring about desired results.

Out of these three personality traits, locus of control is the non-cognitive skill which has captured most attention amongst economists. A rapidly increasing stock of literature examines the extent to which locus of control, which is rather stable for adults (Cobb-Clark & Schurer, 2013), provides helpful insights in our understanding of relevant economic outcomes and behaviours, such as education attainment (Almlund et al., 2011), labour market outcomes (Cobb-Clark, 2015), health status (Cobb-Clark et al., 2014), savings behaviour (Cobb-Clark et al., 2016), individual’s well-being (Verme, 2009), poverty (Bernheim et al., 2015), social behaviour (Heckman et al., 2006), and economic preferences (Becker et al., 2012). There is more paucity of studies using either self-esteem or empowerment. Still, self-esteem has been also found to be relevant for labour market outcomes, notably earnings (Drago, 2011), education (de Araujo & Lagos, 2013), and health Trzesniewski et al. (2006), while empowerment correlates positively with educational attainment (Behncke, 2009), risk attitudes (Krueger & Dickson, 1994), and pro-social behaviour (Caprara et al., 2010)

We measure locus of control with the Internality, Powerful Others, and Chance (IPC) scale Levenson (1981).Footnote 29. Our external locus of control indicator combines the answers to two questions. In the first one respondents choose their position in a 5-point scale, where 1 is “everything is determined by destiny or external forces” and 5 “we make our own destiny”, while in the second one individuals report about their perceived power today, five years ago, and about the power of their neighbours, in a 9-point scale.Footnote 30

The indicator variable for high empowerment was originally proposed by Alsop et al. (2006) and takes value 1 if individuals answer that they are responsible for changes in their live when asked “who will contribute more to a change in your live?”, while takes value 0 when answering either of the other six options, including their family, the State, God, local government, other groups of people or another person.Footnote 31

We use two different indicator variables for self-esteem that measure low self-esteem. Following Harder and Zalma (1990), the first one takes value 1 if individuals report having very often at least one of the following feelings: stupid, ridicule, ashamed, or humiliated, while it takes value 0 otherwise, while the second one, suggested by Zavaleta (2007), takes value 1 if individuals report having very often at least one of the following feelings: was treated unfairly, was humiliated, was treated disrespectfully, being sickening, while it takes value 0 otherwise—Table 6 shows the exact wording of the questions and the possible answers.

As Table 4 shows, the value function is flatter for external individuals, in the range of relative deprivation, but steeper in the range of relative advantage. In other words, income losses affect externals less than internals, but the former derive higher satisfaction from income gains. This result is consistent with recent findings about external individuals obtaining larger life satisfaction gains from having higher income ranks (Budria & Ferrer-i-Carbonell, 2019).

The results for the other two core self-evaluation variables, shown in columns 2 to 4 of Table 4, are very consistent with those of locus of control. The results from columns 3 and 4 also suggest that individuals with high self-esteem obtain larger satisfaction gains from increasing relative negative income. As for locus of control, self-esteem is also relevant for individuals with positive relative income. Now, high self-esteem individuals show a flatter value function. Our findings also suggest that internality and high self-esteem have asymmetric effects on both sides of the reference income: The fall in satisfaction from a relative income decrease when the individual is relatively deprived is smaller than the increase in satisfaction from an income increase of the same relative size when her relative income is positive. Finally, consistent with the previous findings for the other two personality traits, the point estimates for empowerment suggest that highly empowered individuals face a steeper slope when in relative deprivation, but a flatter one when in relative affluence. The large standard errors of such point estimates, however, suggest that empowerment may have no significant effects on the slope of the value function.

4.2.3 Social Beliefs

People’s beliefs about how society works are important drivers of individuals’ preferences and behaviour. In this section we focus on fairness beliefs and exploit answers to two questions on beliefs about there being discrimination in society. To interpret the role of fairness beliefs we draw on the concept of “Belief in a just world” (BJW), where people generally get what they deserve, introduced by (Lerner, 1965, 1980) in psychology.Footnote 32 Believing in a just world serves to combat the idea that one’s fate is largely random and provides a feeling of self-determination and control over one’s destiny. It is then no surprise that BJW has been shown to correlate with locus of control (Furnham, 2003), and to enhance mental health and self-esteem (Dalbert, 1999). The belief in self-reliance or self-sufficiency that is related to BJW may imply that those individuals who perceive less or no discrimination have a steeper value function than those who do. In other words, people who see their relative income improve get a satisfaction premium that may result from believing that they are mostly responsible for such improvement. Analogously, the extra depression in satisfaction experienced by those who see their relative income decrease may be due to their belief that the income reduction is mostly due to their actions.

To examine the extent to which fairness beliefs affect individuals’ value function, we use two dummy variables that measure whether individuals perceive that society discriminates either by social origin or by ethnic origin. Social discrimination by social (ethnic) origin takes value one if respondents agree that social (ethnic) origin hinders at least one of the following: the chance of getting a job, access to services, access to education, getting a contract with the government, and it takes value 0 otherwise.

Consistent with the concept of BJW and the ensuing self-determination beliefs, the estimates of Table 5 show a flatter value function in negative relative income for individuals who perceive social discrimination either by social or ethnic origin. As expected, these results are in line with our previous findings by locus of control. For positive relative incomes, however, the value function of those who perceive no or little discrimination is only steeper for one of the indicator variables used.

5 Discussion and Conclusions

This paper contributes new evidence to the literature on how individuals value their situation in relation to a reference group, evaluating the validity of the basic assumptions of prospect theory, for a middle-income country. In line with previous evidence, our findings suggest that income comparisons within a relevant social group matter and are more important for people with negative relative income than for individuals whose income is larger than the reference income. A substantial body of evidence imposes a log-linear function for relative incomes and finds a nil effect of relative income for downward comparisons (e.g. Ferrer-i-Carbonell, 2005).Footnote 33 Contrary to this evidence, when we allow for more flexible non-linearities by means of a power function, the effect of downward comparisons turns to be positive, suggesting that the nil effect may be induced by the log-linear specification of previous studies.

The value function describing the relationship between relative income and life satisfaction is found to be concave for positive relative incomes, and contrary to the principle of diminishing sensitivity of prospect theory, as well for negative relative incomes. Loss aversion, which requires steeper slope of the value function for negative relative incomes than for positive ones, is only satisfied for incomes that are sufficiently distant from the reference income (i.e. at least 16% higher or lower).

The importance given by individuals to income comparisons, their personality traits and social beliefs affect the slope of the value function, mostly for negative relative incomes. Individuals reporting income comparisons not to be important show a steeper value function. Different arguments may explain this finding: the envy effect dominates the information effect, or self-enhancing motives dominate self-improvement aspects. Internal locus of control, high empowerment, and high self-esteem—traits that indicate a positive and proactive view of oneself and one’s relationship to the world– also show steeper value functions. This satisfaction premium to income increases may result from their belief in them being responsible for their economic success. Moreover, these three personality traits have asymmetric effects on both sides of the reference income: The fall in satisfaction from a relative income decrease when the individual is relatively deprived is smaller than the increase in satisfaction from a relative income increase of the same size when her relative income is positive. Finally, and consistent with the concept of “Belief in a just world” (Lerner, 1965, 1980), individuals who do not perceive social discrimination also show a steeper value function.

The value function for experienced utility in Uruguay shares basic characteristics with that in Germany: Comparisons are asymmetric, the value function is concave, and loss aversion holds for incomes not too close to the reference income. However, concavity of the value function is larger in Uruguay, both for negative and positive relative incomes. As outlined below, this has implications for effort decisions and aggregate economic mobility.

The concave value function for relative deprivation, which conforms with standard economic theory, can be explained by increasing marginal costs of social participation as the relative gap between own income and reference income widens up (Vendrik & Woltjer, 2007). According to this interpretation, then, the more concave value function in Uruguay implies that the marginal costs of social participation increase more rapidly in Uruguay than in Germany. Our heterogeneity analysis also shows that such costs are not homogeneous across the board, but are higher for internal individuals, those with high empowerment and high self-esteem.

Our finding of a concave, as opposed to convex, value function for relative deprivation may also be due to a mistaken choice of reference group for each individual. Reference groups are endogenously chosen by individuals in a non-trivial way, for self-enhancing or self-improvement purposes, for instance. We have tried to minimize the error when estimating reference incomes by exploiting endogenous residential choices and the perception error of an individual’s own relative position in the income distribution, which introduces heterogeneity within groups of individuals who share the same observable characteristics. Notwithstanding this, as Vendrik and Woltjer (2007) argue, if we were still estimating upwardly biased reference incomes, we would obtain a concave relationship between life satisfaction and relative income, even when the true relationship were convex, as predicted by prospect theory. Substantial further work in defining the correct reference group and estimating the correct reference income is clearly needed if we want to be entirely certain that these issues do not affect the estimated shape of the value function.

The concavity or convexity of life satisfaction in relative concern has important economic implications, as it influences individuals’ behaviour (Clark & Oswald, 1998) and effort decisions (Leites & Ramos, 2019; Goette et al., 2004). In order to understand the importance of reference groups on intergenerational mobility, Leites and Ramos (2019) model effort decisions of rational agents from different social origins, who choose the level of effort that maximizes their expected utility. They show that when facing sufficiently large relative deprivation people get discouraged and respond by reducing their effort, if relative concern is convex. However, if the value function is concave, sufficiently large relative deprivation encourages individuals to increase their effort. The former reaction enhances intergenerational persistence, while the latter reduces intergenerational poverty traps and contributes to increased mobility.Footnote 34 In an earlier modelling of individual behaviour when relative concerns matter, (Clark & Oswald, 1998) show that the concavity or convexity of the utility function in relative concern is key to understand people’s following or deviant behaviour. Applied to relative deprivation and effort decisions, the concavity of the life satisfaction function found for Uruguay—with \(\rho _{+}\) and \(\rho _{-}\) larger than 1– implies that reference groups will induce people to increase their effort. Our findings also indicate that such increase would not be homogeneous across personality traits and social beliefs: effort would increase to a lower extent for external individuals, those with less self-esteem, and those who perceive larger discrimination in society.

Notes

Recently Uruguay was classified as a high-income country, but the analysis covers a period in which Uruguay was classified as middle-income country.

Some papers test this hypothesis with respect to own income gains and losses over time, finding mixed evidence. For instance, while Di Tella et al. (2010), Boyce et al. (2016), and Kanninen & Mahler (2017) find evidence in support for loss aversion for Germany and the UK, Fang Niimi (2015) findings for Japan do not support loss aversion for own income gains and losses over time. Notwithstanding this, the latter reports evidence in line with loss aversion with respect to a reference income.

For equal absolute gaps, i.e. when \(\left| G^{-}\right| =G^{+}\), the value of the base in the power function is different, i.e. \((1+G^{-}) \ne (1+G^{+})\), and this will influence the estimates of \(\rho _{-}\) and \(\rho _{+}\).

We also use the estimates of \(\gamma _{+}\) and \(\gamma _{-}\) from equation 3 to provide preliminary evidence about this hypothesis.

In spite of this, we prefer presenting the results where observed income is adjusted by \(\psi (e_{i})\) as defined in equation (8) because we believe it is conceptually more sound. The estimates that use observed, rather than adjusted income are available from the authors upon request.

The metropolitan area includes Montevideo and Canelones, and accounts for 54% of the entire population.

The data and the questionnaires are available from http://fcea.edu.uy/estudio-del-bienestar-multidimensional-en-uruguay/108-departamentos/departamento-de-economia/proyectosiecon/estudio-longitudinal-de-bienestar-en-uruguay/928-lanzamiento-de-la-cuarta-ronda-del-estudio-longitudinal-de-bienestar-en-uruguay.html. Original sample sizes are 1327 in 2006, and 1084 in 2011. It is worth noting that top income households are underrepresented in the MWTC sample. See Burstin et al. (2010) for further details about the MWTC data.

We find small differences in sex and hours worked for the first wave and years of education, age and sex for the second wave.

The MWTC provides information on an extensive set of income sources. Our income variable is the sum of all income sources, and it is strictly positive for all households in our sample. Moreover, the average of our income variable is consistent with the larger and representative Continuous Household Survey (CHS), which is run by the National Institute of Statistics of Uruguay. This consistency is obtained because the set of questions on income sources used in the MWTC is analogous to that of the CHS. We use per capita income in our main analysis, which assumes no economies of scale within households. It is worth noting that this assumption does not condition our main conclusions, as our results are robust to using an equivalent income measure, where the equivalent scale is the square root of household size.

People tend to compare themselves to similar others (Falk & Knell, 2004), and we argue that residential choice also captures unobserved individual characteristics that are relevant to define the group of similar others. Moreover, the behaviour, haves, and have-nots of neighbours is more readily observed and thus more likely to exert a larger influence than that of individuals that one never comes across but are nevertheless living in the same administrative region.

The definition of income we use to estimate the deciles is the same as we use for our income variable, i.e. per capita real annual disposable household income.

Our results remain unchanged when we use these variables without logs or when we use a quadratic in age.

See Ferrer-i-Carbonell and Frijters (2004) for the implications of these assumptions.

The size of our \(\tilde{\beta }\) estimate is similar to estimates from previous studies. For instance, using a similar specification and a fixed-effect estimator, Ferrer-i-Carbonell and Frijters (2004) report a \(\tilde{\beta }\) of 0.11 with German data. Note that the LS variable used in Ferrer-i-Carbonell and Frijters (2004) ranges from 0 to 10 while our ranges from 1 to 5.

Kingdon and Knight (2007) also find relative income to have a larger impact on life satisfaction than own income in South Africa.

Equally distributed income growth means that everyone gets the same amount of income. Thus, average income increases by this same amount. The partial derivative tells us how life satisfaction changes when (reference) income increases marginally. This partial derivative can be expressed as \(((\tilde{\beta } {/} y)-(\gamma / y^{rg}))\). Using the estimates obtained in Table 1 for \(\tilde{\beta }\) and \(\gamma\), and making the derivative equal to zero, we obtain that the increase in life satisfaction is going to be zero when \(y=(16)y^{rg}\). Therefore, (a marginal) equally distributed income growth will decrease life satisfaction when own income is larger than one-sixth of reference group’s income.

Equally distributed income growth reduces relative inequality. Our results, thus, suggest a positive relationship between inequality and life satisfaction. As Hopkins (2008) shows, such positive relationship may arise when individuals derive high utility from having greater income than the poor (a.k.a downward envy) or when individuals care about their relative position in the income distribution. If income ranks are inferred from individuals’ position in the distribution of visible consumption, they will compete in conspicuous consumption in order to improve their apparent rank. However, in equilibrium these efforts cancel themselves out and each maintains the same relative position. The amount of conspicuous consumption chosen by each individual depends on the income distribution in society, as in more equal situations, it is easier to overtake others in consumption. This induces increased competition in consumption, which reduces life satisfaction.

Recall that \(\beta =(\tilde{\beta }-\gamma )\)

The differences are statistically significant with a p-value<0.0001.

Since now \(G^{-}_{\bowtie }\)>0, convexity for losses requires parameters \(\gamma _{-}\) and \(\rho _{-}\) of opposite sign. However, we obtain \(\gamma _{-}<0\) and \(\rho _{-}<0\), which imply concavity for negative relative income.

Note that the hypothesis of diminishing sensitivity is rejected both when we use \(G^{-}\) and \(G^{-}_{\bowtie }\). Now, recall that since \(\rho _{-}\) is not equivalent to \(\rho _{+}\) when the negative income gap is defined according to \(G^{-}_{\bowtie }\), to check the degree of concavity we use \(G^{-}\).

The partial derivative of life satisfaction with respect to income in equation 4 is:

$$\begin{aligned} \frac{\partial S}{\partial y}={\left\{ \begin{array}{ll} \begin{array}{cc} \frac{\beta }{y}+\gamma _{+} \frac{(1+G^{+})^{-\rho _{+}}}{y^{rg}} &{} if\, y>y^{rg}\\ \frac{\beta }{y}+\gamma _{-} \frac{(1+G^{-})^{-\rho _{-}}}{y^{rg}} &{} if\, y<y^{rg} \end{array}\end{array}\right. } \end{aligned}$$(9)The average value of this partial derivative for negative relative incomes is as small as \(1.5\cdot 10^{-6}\) and not statistically significant (t-value\(=0.45\)), while for positive relative incomes it is also small (\(7.1\cdot 10^{-6}\)) and statistically significant t-value\(=15\)).

Much the same has been found for loss aversion (Boyce et al., 2016).

Because of our limited sample size, in our estimations we restrict the curvature, captured by \(\rho _{+}\) and \(\rho _{-}\), to be homogeneous across different groups. Our attempts to estimate a different \(\rho\) parameter per group yield unstable and unreliable estimates.

Note that the hypothesis \(H_{0} = \gamma _{+} = \gamma _{+}^{H} = \gamma _{-} = \gamma _{-}^{H} = 0\) is rejected for all models in Sect. 4.2. Likewise, hypotheses \(H_{0} = \rho _{+} = \rho _{-} = 0\) and \(H_{0} = \rho _{+} = \rho _{-} = 1\) are also rejected by the data. This rejects the linear and the log-linear specification of the relative income terms.

Clark & Senik (2010) , for instance, use an empirical strategy that only allows them to identify the effect of relative income at the average relative income level.

The direct effect of these time-invariant personality traits on life satisfaction is subsumed in the fixed effect.

Levenson’s scale has been previously used in economics, e.g. Tanguy et al. (2014), and builds on earlier work by Rotter (1966), which is the scale many economists have employed and which can be found in large data sets, such as the German SOEP or the Australian HILDA. Unlike Rotter’s, however, Levenson’s scale considers more than one dimension, which has been argued to better capture beliefs about control (Lefcourt, 1991)

The variable we use in the analysis is the union of two indicator variables, which capture externality/chance and low power, respectively. Externality/chance takes value 1 if the average answer of individuals over the two waves is less than four, while low power takes value 1 if if the average answer of individuals over the three questions (own power today, own power five years ago, and neighbour’s power) is less than five.

This variable has been previously used in economics, e.g. Solava and Alkire (2007).

See Vendrik and Woltjer (2007) for a notable exception.

A caveat here is that Leites and Ramos (2019) define relative income in absolute terms.

References

Alesina, A., & Angeletos, G. M. (2005). Fairness and Redistribution. American Economic Review, 95(4), 960–80.

Alesina, A., Cozzi, G., & Mantovan, N. (2012). The Evolution of Ideology, Fairness and Redistribution. Economic Journal, 122, 1244–1261.

Almlund, M., Duckworth, A. L., Heckman, J., & Kautz, T. (2011). Personality Psychology and Economics. In E. A. Hanushek, S. J. Machin, & L. Woessmann (Eds.), Handbook of the Economics of Education, Volume 4, Chapter 1 (pp. 1–158). Elsevier B.V., Amsterdam: North-Holland.

Alsop, R., Bertelsen, M. & Holland, J., (2006) Empowerment in Practice: From Analysis to Implementation, The World Bank Group.

Becker, A., Deckers, T., Dohmen, T., Falk, A., & Kosse, F. (2012). The Relationship Between Economic Preferences and Psychological Personality Measures. Annual Review of Economics, 4, 453–478.

Behncke, S. (2009). How Do Shocks to Non-Cognitive Skills Affect Test Scores?, IZA Discussion Paper No. 4222.

Bénabou, R., & Tirole, J. (2006). Beliefs in a Just World and Redistributive Politics. Quarterly Journal of Economics, 121(2), 699–746.

Bernheim, B. D., Ray, D., & Yeltekin, S. (2015). Poverty and Self-Control. Econometrica, 83(5), 1877–1911.

Boyce, C. J., Wood, A. M., & Ferguson, E. (2016). Individual Differences in Loss Aversion Conscientiousness Predicts How Life Satisfaction Responds to Losses Versus Gains in Income. Personality and Social Psychology Bulletin, 42(4), 471–484.

Boskin, M. J., & Sheshinski, E. (1978). Individual Welfare Depends upon Relative Income. Quarterly Journal of Economics, 92, 589–601.

Budria, S., & Ferrer-i-Carbonell, A. (2019). Life Satisfaction. Review of Income and Wealth: Income Comparisons and Individual Traits. 65: 337-357

Burstin, V., Fascioli, A., Modzelewski, H., Reyes, A., Pereira, G., Salas, G., & Vigorito, A. (2010). Preferencias Adaptativas: entre Deseos, Frustración y Logros. Fin de Siglo: Montevideo.

Caprara, G. V., Alessandri, G., Di Giunta, L., Panerai, L., & Eisenberg, N. (2010). The Contribution of Agreeableness and Self-efficacy Beliefs to Prosociality. European Journal of Personality, 24, 36–55.

Clark, A., & D’Angelo, E. (2013). Upward Social Mobility, Well-being and Political P: Evidence from the BHPS, CEP Discussion Papers dp1252. LSE: Centre for Economic Performance.

Clark, A., Frijters, P., & Shields, M. (2008). Relative Income, Happiness, and Utility: an Explanation for the Easterlin Paradox and Other Puzzles. Journal of Economic Literature, 46(1), 95–144.

Clark, A., Kristensen, N., & Westergård-Nielsen, N. (2009). Economic Satisfaction and Income Rank in Small Neighbourhoods. Journal of the European Economic Association, 7(2–3), 519–527.

Clark, A. E., & Oswald, A. J. (1998). Comparison-concave Utility and Following Behavior in Social and Economic Settings. Journal of Public Economics, 70, 133–155.

Clark, A., & Senik, C. (2010). Who Compares to Whom? The Anatomy of Income Comparisons in Europe, The Economic Journal, 120(544), 573–94.

Cobb-Clark, D. A. (2015). Locus of Control and the Labor Market. IZA Journal of Labor Economics, 4, 3–19.

Cobb-Clark, D. A., Kassenboehmer, S. C., & Schurer, S. (2014). Healthy Habits: The Connection between Diet, Exercise, and Locus of Control. Journal of Economic Behavior and Organization, 98, 1–28.

Cobb-Clark, D. A., Kassenboehmer, S. C., & Sinning, M. (2016). Locus of Control and Savings. Journal of Banking and Finance, 73, 113–130.

Cobb-Clark, D., & Schurer, S. (2013). Two Economists’ Musings on the Stability of Locus of Control. The Economic Journal, 123, F358–F400.

Cruces, G., Perez-Truglia, R., & Tetaz, M. (2013). Biased Perceptions of Income Distribution and Preferences for Redistribution: Evidence from a Survey Experiment. Journal of Public Economics, 98, 100–112.

Dalbert, C. (1999). The World is More Just for Me Than Generally. Social Justice Research, 12, 79–98.

de Araujo, P., & Lagos, S. (2013). Self-esteem, Education, and Wages Revisited. Journal of Economic Psychology, 34(3), 120–132.

Deci, E. L., & Ryan, R. M. (1985). Intrinsic Motivation and Self-Determination in Human Behavior. New York: Plenum.

de Meza, D., & Webb, D. C. (2007). Incentive Design under Loss Aversion. Journal of the European Economic Association, 5(1), 66–92.

Di Tella, R., Haisken-De New, J., & MacCulloch, R. (2010). Happiness Adaptation to Income and to Status in an Individual Panel. Journal of Economic Behavior and Organization, 76(3), 834–852.

Drago, F. (2011). Self-Esteem and Earnings. Journal of Economic Psychology, 32(3), 480–488.

Duesenberry, J. S. (1949). Income. Cambridge: Saving and the Theory of Consumer Behavior, Harvard University Press.

Dumludag, D., Gokdemir, O. & Vendrik, M. (2018). Relative Income and Life Satisfaction of Turkish Immigrants: The Impact of a Collectivistic Culture?, Working paper, Economics Department, SBE, Maastricht University.

Falk, A., & Knell, M. (2004). Choosing the Joneses: Endogenous Goals and Reference Standards. Scandinavian Journal of Economics, 106, 417–35.