Abstract

A development imperative emphasising the economic benefits of mineral extraction has led researchers to speculate about whether minerals inflate citizens’ economic expectations and, due to an upward shift in aspirations, cause a degree of dissatisfaction. Using survey data from 18 Latin American countries, this study finds evidence of the ‘euphoric effect’ of minerals materialising among household expectations concerning future changes in the economic situation of their country. Similarly, it also finds a positive and significant relationship with expectations concerning future changes in respondents’ personal economic situation. However, it does not detect a significant relationship between minerals and citizens’ life satisfaction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The extractive sector has played a significant role in Latin America’s economic history. The global increase in energy and commodity demand has seen Chile, Peru, and Bolivia become leading exporters of raw materials (such as copper and tin), while Venezuela, Brazil, Mexico, and Colombia have also turned into major players in the global oil market. Consequently, much attention now surrounds an extractive-based development imperative in the region. This imperative emphasises the potential economic benefits the extractive industries may bring to the region’s modern economies (Arsel et al., 2016). The arguments put forward by this extractive-based development imperative are also very compelling for many. One iconic example even shows Mexican cartoonists depicting the oil sector as a descending guardian angel and a new Virgin of Guadalupe (Grayson, 1981). However, a contemporary stream of thinking now further points towards the influence this economic rhetoric may have on citizens’ economic expectations (Collier, 2017; Cust & Mihalyi, 2017; Frynas et al., 2017; Toews, 2015). In particular, Collier (2017) suggests the ‘psychological effects’ of countries’ extractive activities have inflated many citizens’ expectations and Toews (2015) also theorises a link between increased mineral rents, heightened expectations, and citizen dissatisfaction.

Limited empirical evidence currently exists verifying these relationships (Toews, 2015; Cust & Mensah, 2020). Hence, evaluating public opinion data collected over 16 years from individuals across 18 Latin American countries (namely, Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Peru, Uruguay, and Venezuela), this study further explores the relationship between the mineral sector and citizens’ economic expectations and satisfaction. First this study looks at the relationship between the mineral sector and both respondents’ reported expectations about changes in their country’s economic situation and their expectations about changes in their own economic situation. The distinction between the two types of expectations is important in this research because individuals may expect that minerals can improve the economic prospects of the country, on average, but not necessarily their own prospects if the benefits accrue to a small minority/the elite. If accurate, this might provide some explanation towards understanding the clamour for public consumption of mineral revenues and the breakdown in state-society relations seen in many resource-rich countries (Collier, 2017).

Second, this study examines the relationship between the mineral sector and citizens’ life satisfaction. This primarily builds on Toews’ (2015) exposition on the potential link between mineral wealth, expectations, and citizen satisfaction. However, it also contributes to the burgeoning literature probing into the determinants of citizen satisfaction. This includes a large literature examining the purported positive relationship between income and satisfaction (Zee Ma & Zhang, 2014), as well other economic factors such as inflation (Di Tella et al., 2003), unemployment (Blanchflower et al., 2014), and international trade (Bjørnskov et al., 2008). While much ambiguity exists regarding the precise relationship between these factors and satisfaction, many of the intricacies of these issues are discussed in further detail in reviews of the field (e.g. see Clark, 2018). The controversies caused by the so-called Easterlin paradox, for instance, suggests the positive effects of income on satisfaction may diminish at sufficiently high levels of income (Easterlin, 2015). Otherwise, studies in this literature also regularly explore the explanatory power of individuals characteristics such as age, gender and education on satisfaction (further discussed below) (Oshio, 2017).

In this vein, this study contributes to a new strain of this literature on the determinants of satisfaction related to a paradox dubbed the ‘Happiness Resource Curse’ (Ali et al., 2020). Here recent cross-country research indicates a negative correlation exists with mineral rents when comparing average satisfaction levels between countries (see Ali et al., 2020; Mignamissi & Kuete, 2021). However, from these studies, it is difficult to discern the degree that these correlations could be susceptible to the various statistical fallacies aggregated (averaged) data are prone to (Aitkin & Longford, 1986; Woodhouse & Goldstein, 1988; Zee Ma & Zhang, 2014).Footnote 1 This study benefits from access to a rich database of individual-level data to examine satisfaction outcomes. It is very much in the same ilk of studies as the vintage piece by Di Tella et al. (2003) on ‘the Macroeconomics of Happiness’.

Overall, this study finds evidence of a mineral-induced ‘euphoric effect’ materialising among citizens expectations concerning changes in the economic situation of their country and changes in their personal economic situation. However, it does not detect a corresponding significant relationship between minerals and citizens’ life satisfaction hypothesised by either Toews’ (2015) or the broader literature on the Happiness Resource Curse. This paper continues in Sect. 2 with a review of synergies linking minerals with economic expectations and satisfaction. Section 3 then provides more details of the study’s methodology and Sect. 4 presents the results of the empirical analysis. Finally, Section 5 summarises the study’s findings and provides concluding remarks with respect to future research.

2 Minerals, Economic Expectations, and Satisfaction: Literature Review

Many economic arguments now consider the revenues derived from the extraction of minerals can constitute a major shock to national wealth (spurring economic activity). This includes numerous well-known growth models that emphasise these revenues may provide economies with the investible funds needed to improve local infrastructure and public services, as well as the capital to industrialise or develop infant industries (e.g. Balassa, 1980; Hartwick, 1977; Rostow, 1960). A related argument, based on the Harrod-Domar model, also suggests these revenues may help to plug the financing gap in many developing economies and start a self-sustaining process of capital accumulation and economic growth (Easterly, 1999). Ali et al. (2020) further describe that, in principle, this means mineral rents may be positively related to satisfaction where they can be used to invest in welfare-enhancing activities.

However, the economic opportunities related to the extraction of minerals are increasingly leading scholars to believe that these ideals may be inflating citizens’ economic expectations (Frynas et al., 2017). Some consider the potential implications of these issues. For example, Collier (2017) describes that exaggerated expectations among citizens may build appetites for increased spending. Others highlight inflated expectations may explain a common predisposition among citizens towards ‘Mineral Populism’ (encouraging voters to elect politicians who make overly ambitious promises about mineral revenues, e.g. see Stolan et al., 2017). It is also thought these issues may incite contestations of power (which can affect state functioning and trust in public governance, e.g. see discussions by Tyce, 2020, and Fenton Villar, 2020). Alternatively, Toews (2015) suggests these heightened expectations may cause an upward shift in individuals’ aspirations, thus precluding them from deriving a degree of economic satisfaction.

Despite increasing speculation concerning the relationship between mineral extraction and expectations, it is not necessarily the case that a country’s mineral wealth does inflate citizens expectations. The literature dedicated to an empirical phenomenon widely known as the Resource Curse further reports on the relative economic underperformance of many mineral-dependent economies (Gilberthorpe & Papyrakis, 2015). In this respect, the literature dedicated to the resource curse also describes some of the difficult realities economies dependent on mineral extraction can face in terms of increased political conflict, corruption, economic volatility, de-industrialisation, environmental degradation and fitful fiscal spending (see Papyrakis & Pellegrini, 2019).

These same issues point to the many reasons citizens may become dissatisfied with economic activity related to the mining sector (Ali et al., 2020). For instance, there is often public apprehension concerning local communities’ potential vulnerability to the environmental and health liabilities associated with mineral extraction. For example, considerable environmental concerns arose surrounding deep-water oil activity in Brazil’s Foz do Amazonas Basin due to its environmentally sensitive ecosystems and nearby coral reefs. Environmentalists in the region highlighted that leaked oil could devastate local environments in Brazil’s northern state Amapá (which is home to the world’s largest belt of mangroves and thousands of square miles of rainforest, see Nogueira, 2017). Recent environmental studies from Latin America have also highlighted some of the livelihood issues arising from extensive contamination of soil and vegetation due to mineral extraction (e.g. see Barraza et al., 2018). Such problems may weigh down on individuals’ satisfaction as they create a cause for concern for their environment. For some, these concerns are so compelling that it even spills over into mass protests and violent conflict (e.g. see Haselip, 2011).

However, quantitative evidence examining the ‘euphoric effects’ of minerals on citizens’ economic expectations or its relationship with citizen satisfaction remains limited (and none yet focused on Latin America). Of the evidence available, Toews (2015) first examined the effects of world oil prices on household income satisfaction in Kazakhstan between 2001 and 2005 theorising a link between expectations, aspirations, and satisfaction with income. He found that households located closer to an oil field report a significantly lower level of income satisfaction following oil price increases.Footnote 2 Since this analysis, cross-country studies have also shown a negative correlation exists with mineral rents when comparing average satisfaction levels between countries (see Ali et al., 2020; Mignamissi & Kuete, 2021).

Further to this, the results of a recent lab-in-the-field experiment in Mozambique by Armand et al. (2020) have shown that disseminating information about mineral wealth increased citizens’ optimism about the future. Cust and Mensah (2020) have also studied the effects of oil discoveries on citizens’ expectations in Africa. Assuming oil discovery announcements and households reported expectations are not subject to calendar effects, their findings indicate expectations concerning changes in the economy and their living conditions increased in the months following a discovery. Meanwhile, Paler et al. (2020) reports expectations concerning the future benefits of oil are higher among voters in oil constituencies in swing states in Uganda. However, they caution the data is observational and cross-sectional and as such does not capture the causal effects of oil.

3 Methodology

This study contributes to this literature a novel empirical analysis examining the euphoric effects of the extractive sector on citizens’ economic expectations and its relationship with life satisfaction in Latin America. This section provides details of the study’s estimation strategy and data and the next section presents the results of the analysis.

3.1 Identifying the Effects of the Mineral Sector

Despite decades of research, questions concerning the effects of the extractive sector on social, political, and economic outcomes largely remain unresolved (Gilberthorpe & Papyrakis, 2015). Much of the disagreement owes to the difficulty identifying some degree of exogenous variation in countries mineral wealth to consistently identify the effects of the extractive sector (Cassidy, 2019). Here it is important to understand that mineral exploration and production are determined by various endogenous, unobserved, and hard to measure factors. For instance, David and Wright (1997) describe the competitive advantage some economies, such as the U.S., have in the extractive sector due to its technological superiority and high institutional quality. Brunnschweiler and Poelhekke (2019) also highlight the importance of legal factors and ownership structure. More broadly, van der Ploeg and Poelhekke (2017) generalise these issues and refer to a multitude of factors, from changing political and institutional regimes to fluctuating economic factors, which may be correlated with both the size of an extractive sector and socio-economic outcomes. They explain that inevitably estimates of the effects of the extractive sector suffer from bias caused by omitted and confounding variables.

To resolve this estimation problem, some studies have recently explored a promising approach which instruments countries’ mineral rents with their endowment of sedimentary land (e.g. see Cassidy, 2019 and Mahdavi et al., 2020). To add context here, Cassidy (2019) explains that a geological pre-requisite for the formation of oil reservoirs includes source rocks (a sedimentary rock deposited by algae and zooplankton millions of years ago) which form in sedimentary basins. It is also the case that sedimentary basins are home to numerous other deposits. For example, nearly all of the world’s coal is found in sedimentary rock and many metal ores can also be located in them (Cathles, 2019; Kyser, 2007; Wright, 1985). Sedimentary basins are, therefore, a time-invariant geological factor that determines countries’ prospective mineral endowments.Footnote 3

However, using sedimentary basins as an instrument in this instrumental variable (IV) approach is based on the assumption that sedimentary basins only affect an outcome variable indirectly (through mineral rents). This is known as the exclusion restriction. Several concerns exist with this IV approach in this context. One important issue is that the extractive sector’s activity in sedimentary basins may influence expectations other than through the rents they generate. For instance, extractive companies’ activity securing and locating prospective mineral endowments in sedimentary basins can directly provoke public attention towards the sector and this often coincides with the early onset of mineral-related political rhetoric and public debate (Arezki et al., 2017; Cust & Mihalyi, 2017; and Mihalyi, 2020). Haselip (2011) further provides an example here describing the community consultation process for developing oil in the Peruvian Amazonia. It emphasises that public interest in the extractive sector’s activity in sedimentary basins can occur a long time before either the extraction or formal exploration for minerals even starts.

Methodologically, this study poses a novel way of building on and adapting Cassidy’s (2019) explanations about the relevance of sedimentary basins to the mineral sector to assess the effects of its activity. This approach contrasts with previous studies, such as Cassidy (2019) and Mahdavi et al. (2020), which assumes the sector’s activity in sedimentary basins only affect outcomes through minerals rents (i.e. at the point of production). It is forged on the understanding that the mineral-focused rhetoric in Latin American societies, which potentially affects individuals’ expectations and satisfaction, is jointly determined by both rents from mineral extraction and countries’ endowment of land in a sedimentary basin determining their prospective mineral resources. This also reflects explanations, such as those by Reiss (1990), that the extractive sectors economic interests (e.g. capital expenditure) extend beyond activities related to immediate production and also encompass exploration for prospective mineral endowments.

Further to this, here it is hypothesised that these factors may interact to some degree. In other words, the effects of mineral rents on expectations and satisfaction may vary according to countries’ endowment of land in sedimentary basins (and vice versa). One reason explaining why these factors may interact includes that the added interest arising from commercial activity related to prospective mineral endowments in sedimentary basins could help to reinforce economic expectations concerning current rents. For example, as highlighted by Haselip’s (2011) case study, public interactions on future developments may also influence the publics experience and expectations of existing extractive activity. Alternatively, looking at this another way, the extractive sector may hold more political clout in economies that are more dependent on its rents. This political clout might allow extractive companies to push their commercial interests higher up the public agenda (causing greater interest in their activity developing prospective mineral endowments in sedimentary basins, ceteris paribus).

Given this hypothesis, the econometric specification used in this study involves regressing measures of individual expectations and satisfaction on the interaction between a measure of a country’s mineral rents and a measure of its land in sedimentary basins. While mineral rents are considered to be endogenous (see above), after controlling for country fixed effects, the sedimentary basin variable is exogenous. This interaction term is potentially very interesting here because the coefficient of an interaction term between an endogenous variable and an exogenous variable is consistent, as long as the endogenous variable is controlled for in the regression (e.g. see Bun & Harrison, 2019). Hence, this interaction term may provide us with important insights into a degree of variation in the outcomes which are caused by the time-varying effects of countries prospective mineral endowments. The effects caused by prospective mineral endowments have seen a notable increase in attention in recent years but it remains an issue we know little about (Mihalyi, 2020).

Beyond this, this interaction effect also provides estimates from which we may speculate about the direction of the sectors overall effect. No research in this context is infallible (with all studies holding some limitation or untestable assumption, e.g. about exclusion restrictions etc., to justify their claims about the estimated effects of minerals) and looking only at the interaction term limits what we might infer about the magnitude of the full marginal effect of the extractive sector.Footnote 4 However, speculating about the sign of overall effects from the variation caused by the interaction term appears relatively reasonable given the discussion above justifying the interaction term. It suggests the interaction term is expected to increase the extent of the rhetoric towards the extractive sector and magnify the effects the sector has on outcomes. To summarise this point, while we may not be able to detect the full magnitude of the effects of the extractive sector from this approach, this is not that important for the sake of interpreting the interaction term (which also provides us with important insights into the effects of the sector).

3.2 Data

This study collates data on expectations from a repeated cross-section public opinion survey covering individuals from 18 countries in Latin America. The survey, conducted by national polling firms, compiles nationally representative data from between 1000 and 1200 respondents per country per year and has been centralised by the Latinobarómetro database since 1996. This analysis focuses on collating and analysing survey responses between 2001 and 2017 due to the availability of expectations variable data described below. Our particular focus on Latin America is driven by the region’s prominent public debates concerning the role of mineral extraction in development (e.g. see Pellegrini, 2018). The region’s pervasive public interest and political rhetoric towards the extractive sector make it an ideal testing ground to explore the relationship between mineral extraction and ordinary citizens’ expectations. However, another reason justifying our interest in this dataset reflects that, compared to other public surveys (including those compiled outside of Latin America–such as other geographic regions’ Barometer datasets), the frequency of this (almost) annual survey provides a rich dataset from which we may also examine how expectations evolve with time.Footnote 5

Using the data available from the Latinobarómetro database, this study examines two outcome variables directly related to respondents’ economic expectations. The survey questions these variables derive from ask respondents whether they expect changes to; i) the economic situation of their country in the coming 12 months (Country Exp.) and ii) their own personal economic situation in the coming 12 months (Personal Exp.). Scaled between 1 and 5, the original ordering of the survey responses are reversed so that larger values indicate a more optimistic outlook. Hence the values 1, 2, 3, 4, and 5 indicate that one expects the economic situation to get “much worse”, “a little worse”, “stay about the same”, “little better”, and “much better”, respectively. Table 1 further reports descriptive statistics for these indicators and Appendix 1 provides further details for each variable.

Beyond looking at individuals expectations, this study also aims to provide some empirical insights into the potential relationship between the extractive sector and respondents’ reported life satisfaction. This builds on recent findings by Ali et al. (2020) and Mignamissi and Kuete (2021) that the sector may have a detrimental effect on citizen’s satisfaction, as well as Toews’ (2015) exposition on the link between minerals, citizens’ aspirations, and their degree of satisfaction. The outcome variable here derives from a survey question in the Latinobarómetro asking whether respondents are satisfied with their life (Life Sat.). Scaled between 1 and 4, the original ordering of respondents’ responses are again reversed so that larger values indicate a higher degree of life satisfaction. The values 1, 2, 3, and 4, indicate that they are “not satisfied at all”, “not very satisfied”, “fairly satisfied”, and “very satisfied” with their life.

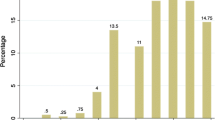

The econometric specification used in this study involves regressing measures of individual expectations on the interaction between a measure of a country’s mineral rents and a measure of its land in sedimentary basins. This study uses data from Cassidy (2019) on the fraction of each country’s land that resides in a sedimentary basin (Basin).Footnote 6 Figure 1 presents information on each country’s sedimentary endowment. This study interacts each country’s sedimentary basin endowment with data from the World Development Indicator database on their mineral rent dependency (measured as the sum of the fraction of mineral, coal, oil and natural gas rents in GDP) (MR Dependence). The interacted value between these two variables is multiplied by 100 to prevent the coefficient from appearing misleadingly large in the regression models reported below. For comparative purposes, further specifications also consider interacting the sedimentary basin variable with a dependence variable focused specifically on oil rents (reflecting the approach taken by Cassidy, 2019 and Mahdavi et al. 2020 to instrument oil wealth with sedimentary basins).

Data Source: Cassidy (2019) supplementary data file

Graph on each country’s land in a sedimentary basin.

Since the seminal work by Brunnschweiler and Bulte (2008), it is also customary to distinguish between measures of mineral dependence and mineral abundance. The latter uses as a measure the log value of mineral rents per capita. Studies often found that mineral dependence relates more strongly with resource curse phenomena since it captures the relative importance of the extractive sector relative to other economic activities. In principle, mineral-abundant economies can reduce their mineral dependence by diversifying their economies (as in the case of Norway) (Papyrakis et al., 2017). This infers that, in diversified economies, the extractive sector may not receive the same level of public interest or hold the same degree of political clout required to cause the expected interaction effect. This may weaken the relationship between mineral abundance and the outcome variables. To do justice to this stream of the literature, this study explores this using an interaction term between sedimentary basins and a measure of mineral abundance (mineral rents per capita). The data on mineral rents per capita derives from the World Development Indicator database (multiplying real GDP per capita by the fraction of mineral rents in GDP) (MR per capita).Footnote 7

This study also includes data on several control variables determining respondents’ reported outcomes. The control variables include the respondent’s age, education, gender, civil-status, and socioeconomic status. The inclusion of these characteristics reflects the findings of similar studies which find, for example, that age corresponds with a more pessimistic economic outlook but that the change in pessimism decreases as people age (in other words the coefficient for age is negative and the coefficient of age squared is positive). They also show individuals with secondary and higher education report more optimistic expectations, as do males and those with a higher socioeconomic status. For example, these factors may also relate with job prospects and social access to economic opportunities (Graham & Sukhtankar, 2004 and Clark & D’Ambrosio, 2018).

Similarly, the literature on life satisfaction largely indicates that higher socioeconomic status, education, and marriage are positively associated with life satisfaction. It also indicates that age is negatively correlated with life satisfaction and that its squared term is positively correlated. The relationship between gender and life satisfaction is rather complex and, unlike the literature on expectations, historically women have generally reported relatively more positive outcomes; suggesting they are more satisfied with their lives. However, the literature also shows the relationship between gender and life satisfaction is mediated by several societal factors such as income disparities, gender discrimination, and other gendered social inequalities (Bjørnskov et al., 2008; Graham & Lora, 2009). Furthermore, numerous discussions point towards the continued decline in the state of female happiness globally. They indicate data from the past couple of decades now suggests it is not any more likely a woman reports greater life satisfaction than a man. Rather, in many contexts, the opposite is more likely (e.g. see Stevenson & Wolfers, 2009).

Finally, further country-level time-varying control variables are also included in the data for some additional analysis. These variables are inspired by common macroeconomic variables appearing in the literature on satisfaction discussed in the introduction. The variables include the log of GDP per capita, GDP per capita growth (%), the unemployment rate (% of total labor force), trade openness (i.e. international trade % of GDP) and inflation (captured using the annual % GDP deflator). For basic intuition, we might notionally consider that generally higher levels of GDP, GDP growth, and trade are positive economic factors for a country’s economic outlook and security (thus potentially promoting life satisfaction) while unemployment and inflation are negative economic factors often causing insecurity and higher costs to basic living. However, as mentioned previously, there is a great deal of debate and ambiguity about these variables expected relationship with citizens expectations and life satisfaction. Again, all of the control variable statistics are presented in Table 1 and further descriptive details are available in Appendix 1.

3.3 Estimation Strategy

In this study we examine an ordered logit regression model estimating the likelihood that individual i in year t reports expectation ℓ {1, 2,…,ℒ}.Footnote 8 Note the description of this framework outlined below is generalisable enough, so we may also simply substitute the term expectations with satisfaction when applicable. The regression model estimating the probability respondent i reports expectation ℓ takes the following form:

The variable \(MR{ }\) denotes mineral rents in country j at time t and \(Basin\) the endowment of land in a sedimentary basin in country j. The interaction term between the MR and \(Basin\) variable is the term intended to identify the effects of the extractive sector on expectations. One might expect both components of the interaction term to appear in this model. However, the \(Basin\) variable is time-invariant and is, therefore, captured by the model’s fixed-effects (discussed below). X is the vector of control variables.

The parameters \(\beta_{1} , \beta_{2}\) and \(\beta_{3}\) are the variables’ coefficients and the parameters \(\tau_{t}\) and \({ }\lambda_{j}\) are the fixed components of the error term. \(\tau_{t}\) captures year specific aggregate factors correlated with the outcome variable. Meanwhile, \(\lambda_{j}\) captures the country-specific fixed-effects. For instance, the country-specific fixed-effects may capture innate and difficult to measure time-invariant factors. This includes countries’ cultural and societal histories (which may affect individuals’ psychological disposition or outlook), as well as other geological processes correlated with the formation of sedimentary basins. \(\varepsilon_{ijt}\) is the variable component of the error term.

In this regression, while the interaction term’s coefficient (\(\beta_{2}\)) is consistent, the coefficient of the main term for the endogenous variable (MR) is inconsistent (i.e. \(\beta_{1}\) is inconsistent) (e.g. see Bun and Harrison, 2018). The inclusion of the endogenous variable in this model is necessary to ensure the consistency of \(\beta_{2}\) but the results inferred from the value of \(\beta_{1}\) are erroneous.Footnote 9 While this limits what we might infer about the magnitude of the full marginal effect of the extractive sector, as discussed above, this interaction effect provides an important indicator from which we may speculate about the direction of its overall effect. In this respect, this might also be considered a lower-bound estimate of the effects of the extractive sector’s economic activity (i.e. where \(\beta_{1} = 0\)). The interaction term in itself is also interesting here because it provides insights into the variation in outcomes caused by the extractive sector from the time-varying effects of prospective mineral endowments.

4 Results

We now examine the findings from this empirical analysis. First, Table 2 presents the results from the regressions on respondents’ expectations concerning the future economic situation of their country. The first column in Table 2 reports a parsimonious specification including the mineral rent dependence variable, its interaction with the sedimentary basin variable, and exogenous control variables for age, the square of age divided by 100, and the binary male variable. The models reported in Columns 2, 3 and 4 in Table 2 build on this, providing richer specifications that add the control variables for respondents’ civil status, education level, and socioeconomic status. Despite providing intuitive results to compare with the parsimonious specification, it is important to note that these richer specifications should be interpreted with caution. These additional control variables are not necessarily exogenous and the inclusion of endogenous control variables may bias the coefficient of the interaction term between the mineral rent and sedimentary basin variable. The coefficients reported in the table refer to the estimated odds ratio (OR), where a coefficient value greater than 1 indicates that the relative likelihood of respondents reporting more optimistic expectations increases and a value less than 1 that the likelihood decreases.

Overall, the results in Table 2 consistently show the estimated coefficient for the interaction term between the mineral dependence and sedimentary basin variable is both statistically significant and greater than 1. This implies that a positive relationship exists between the interaction term and respondents’ expectations concerning the future economic situation of their country. The significant interaction effect estimated in column 1 (OR = 1.128) indicates that a 1-unit increase in the interaction term increases the odds of respondents reporting a more optimistic outlook by approximately 12.8%. The magnitude of the coefficients from the models using the richer specifications reported in columns 2 to 4 are largely similar.

Considering the magnitude of these coefficients further, conventional benchmarks established by Cohen (1988) suggest that OR’s above 1.437, 2.476, and 4.27 might constitute small, medium, and large effects respectively.Footnote 10 However, these benchmarks were only based on intuitive examples from the biological world (mainly using the visible differences in the body heights of men and women). Cohen (1988) warns that such benchmarks might not apply to all fields and there exists a severe risk of their overuse. Some ambiguity also exists whether these values should be minimum cutoffs or may even be centroids. More recent research examining effects observed in applied psychology and the social sciences shows that more reasonable benchmarks could be less than half of those previously approximated by Cohen (1988) in standard deviations (e.g. see Hill et al., 2008; Bosco et al., 2015). Half of the small, medium and large effects reported above in terms of OR equivalents is 1.199, 1.5737, and 2.066. Even by these yardsticks, however, the magnitude of the interaction term’s ORs still appear reasonably small.

Nevertheless, it is important to consider two further points when interpreting the magnitude of these coefficients. First, the full effects of mineral rents might be larger as this estimate might only be considered a lower-bound estimate of the magnitude of the effects of the extractive sector on expectations. Second, a one-unit increase in the interaction term is not very large. The difference between the smallest and largest value is more than 15 units (see Table 1). The coefficient reported in column 1 of Table 2 infers that a 15-unit increase in the value of the interaction term corresponds with an OR of approximately 6.545.Footnote 11 It is also not uncommon to see even annual changes in mineral rent dependency that cause a change larger than 1 in the interaction term’s value. For example, during the commodity market’s recovery from the global financial crisis, Venezuela witnessed a 5.675 point increase in the interaction term’s value. This was due to an approximately 11.5 percentage point increase in its level of mineral dependence. Simulating an increase of this magnitude corresponds with an OR of 1.981, which implies that respondents are almost twice as likely to report a more optimistic expectation. Considered together, these arguments suggest that the magnitude of the extractive sector's influence on ordinary citizens’ outlook about their country’s future economic prospects may indeed be significant.

Before moving on, we briefly inspect the estimated effects of some of the other control variables in Table 2. The results show that respondents become increasingly more likely to report a more pessimistic outlook about their country’s economic situation as they age (coefficients significantly smaller than 1).Footnote 12 The coefficient of the quadratic (age) term is significant and above 1. In line with previous evidence, this indicates that the negative change occurs at a decreasing rate (e.g. see Clark & D’Ambrosio, 2018). On average, males are also significantly more likely to report a more optimistic outlook than females, as are respondents that are single rather than married. The findings that males are more optimistic than females in this sample is not particularly surprising. This may reflect that the societies being examined here have been historically very gendered and continue to lag behind many other parts of the world in this respect, such as Europe and North America.Footnote 13 We also see that respondents who belong to a more privileged socioeconomic group are significantly more likely to report higher expectations. Education levels, meanwhile, only seem to have a very small positive effect on expectations (if they are significant).

Next, Table 3 reports the results from the regressions on respondents’ expectations concerning their personal economic situation. The estimated coefficient of the interaction term between the mineral dependence and sedimentary basin variable is, again, both statistically significant and greater than 1. The coefficients of the other variables in Table 3 are also largely in line with the results of the previous regressions on respondents’ expectations about the country’s economic situation. Again, ageing relates with a greater likelihood of reporting a more pessimistic outlook (but the rate of change declines with age as indicated by the quadratic term). Males are also significantly more likely to be more optimistic about changes in their personal economic situation, as are those from a higher socioeconomic group. In this instance, though, secondary and higher education is a significant determinant of expectations. The coefficients indicate that respondents with secondary and higher education are likely to be more optimistic about changes in their future economic situation. Respondents that are separated are also less likely to report a more optimistic outlook than married respondents.

Now, concerning the interaction term between the mineral dependence and sedimentary basin variable, the results in Table 3 show that it is positively related to respondents’ expectations concerning their personal economic situation. As might be expected, compared to the coefficients in the regressions on expectations concerning changes in the respondent’s country’s economic situation (Table 2), the interaction term’s coefficients are slightly more conservative. This becomes more apparent when examining the results of the intuitive simulation discussed above (based on Venezuela’s empirical experience). The interaction term’s coefficient from Column 1 in Table 3 (1.090) infers, given a 5.675 point increase in the value of the interaction term, the estimated OR is 1.631. Compared to the OR simulated from the results in Table 2 (1.981) this does appear smaller. However, given the coefficients’ standard errors, the difference in the magnitude of these coefficients is not significant.

Table 4 shows the results of the regressions on respondents’ life satisfaction. It provides limited evidence in support of a relationship between life satisfaction and the extractive sector's activity. The coefficients are consistently small across the various specifications presented and largely insignificant (except for column (3)). Although, the discussion above has also clearly outlined that this study provides conservative (lower-bound) estimates of the true effects of the extractive sector. This means it may also be susceptible to type II errors (i.e. concluding there is not a significant effect when there is one) where the strength of the relationship is modest.

The regressions presented so far interact a measure of mineral dependence (the proportion of the total value of mineral rents in GDP) with the sedimentary basin variable. Table 5 reports the regressions replicating the analysis with an interaction between the log value of mineral income per capita (i.e. mineral abundance) and the sedimentary basin variable. For brevity, we present the results of the preferred parsimonious specifications without the potential endogenous control variables. The interaction term’s coefficient is statistically insignificant across the various specifications using the different outcome variables in Table 5. The results provide the same qualitative conclusions even when the additional control variables are included in the regression model. These findings are in line with previous evidence on the resource curse which finds that mineral abundance is not correlated with societal outcomes per se (e.g. see Brunnschweiler & Bulte, 2008). It corresponds with the expectation that in diversified economies the extractive sector may not observe the same public and political leverage provoking significant attention towards its economic interests in sedimentary basins.

Further to this, this analysis also looked at the results of using interaction terms featuring oil dependence and oil abundance variables (see Appendix 2 and 3). The results of the exercise did not qualitatively change the conclusions of the main analysis. Perhaps, the only notable difference is that the magnitude of the difference between the interaction terms coefficients for regressions on respondents’ expectations concerning changes in the economic situation of their country and their own economic situation is slightly larger. This may also reflect that petroleum often tends to be more geographically concentrated than other minerals (which makes its accrued rents more easily controlled and appropriable) and the high oil prices seen across much of the study period increased the incentive to rent-seek (Papyrakis et al., 2017).

Another exercise replicated the main analysis having excluded countries with rather small extractive industries. The restricted sample excluded observations from El Salvador, Paraguay, Panama, and Honduras. These are countries that earned very little income from the extractive industries during the study period (below $100 per annum per capita). The results are shown in Appendix 4 and 5 and, again, the conclusions of the exercise are qualitatively in line with the main results presented above. Other specifications also experimented with adding several additional country-level control variables to the regressions, including logged GDP per capita, % GDP growth, trade openness, unemployment and inflation. Appendix 6 and 7 present some of these results. It is again important to note that these richer specifications should be interpreted with caution as these additional control variables are not necessarily exogenous. Nevertheless, the conclusions concerning the interaction term are approximately the same as our main results, albeit the size of the significant coefficients shrinks slightly.

Finally, this analysis uses individual survey data. Another common approach uses aggregated (averaged) country-level outcome data (e.g. see Ali et al, 2020; Mignamissi & Kuete, 2021). This is common where the survey data is not easily accessible from its source or restricted access applies but country summary information is presented by survey firms. While aggregate level data is often more readily available, various studies show statistical estimates based on aggregate data should be approached with caution (e.g. see Zee Ma & Zhang, 2014).Footnote 14 Nevertheless, for purposes of comparison, Appendix 8 presents a summary of the main results using a country-year fixed effects regression after having averaged and logged the survey responses for each country and year. In this instance, the sign and significance of the coefficients of the interaction term between the mineral rent and sedimentary basin variables remain largely the same as presented in the main analysis above on the individual-level data.

5 Conclusion

In recent years the growth of the extractive-based development imperative within Latin America has led scholars to speculate about the possible effects this may have on citizens’ expectations and, in turn, their satisfaction. This study examines this relationship using public opinion data collected between 2001 and 2017 from 18 countries in Latin America. From the variation determined by the interaction between the sedimentary basin and mineral rent dependence variable, this study’s results indicate a ‘euphoric’ relationship does exist between the extractive sector and expectations. The results also show that this relationship is not trivial either, particularly given larger episodes of changes in extractive activity and mineral dependence. For example, our simulations show an 11.5 percentage point increase in Venezuela's mineral rents dependence (which is equivalent to the annual increase observed during the oil market’s recovery from the global financial crisis) would almost double the likelihood of respondents reporting more optimistic expectations about changes in their country’s economic situation. It would also increase the probability of reporting more optimistic expectations about changes in their own economic situation by approximately 63%.

Some suggest that citizens may feel they do not directly benefit from mineral extraction and that its benefits may be concentrated in the broader economy. Looking at the difference in the estimated effects for the different types of expectations examined, this study’s results indicate that expectations about changes in the country’s economic situation do appear more sensitive to increases in the interaction terms value than expectations about citizens expectations concerning their personal economic situation. However, the differences are not statistically significant and, so, we cannot confidently corroborate this hypothesis.

Finally, this study does not detect a corresponding significant relationship between minerals and citizens’ life satisfaction hypothesised by either Toews’ (2015) or the broader literature on the Happiness Resource Curse. However, this study poses only an initial line of enquiry into these issues and further research is needed to better understand these relationships. A potential limitation of the estimation strategy’s is that the analysis may only provide lower-bound estimates of the effects of the sector. Further to this, future research should consider that this analysis only examines relatively short-term expectations. Understanding whether the relationship with long-term expectations differs would pose an interesting extension, as well as examining the relationship with aspirations (which we do not have data on in this instance).

Data Availability

In line with user data agreements, interested readers should seek data from the original source. The data used in this analysis is free and publicly available from the repositories cited in the text.

Change history

20 November 2021

A Correction to this paper has been published: https://doi.org/10.1007/s10902-021-00458-2

Notes

Simpson’s paradox provides one good example here (Simpson, 1951). Recall that Simpson's Paradox is a situation where the relationship between two variables is reversed in comparisons using aggregated (averaged) data. Of course, in practice, the relationship is not always completely reversed (e.g. significant relationship may simply become insignificant or the sign and significance may not change at all).

Some other studies have also used geological layers as a means of identification. For example, more recently Bazillier and Girard (2020) have used the geoglogical layer determined by the Birimian volcano-sedimentary basin in Burkina Faso to capture the effects of informal (unregistered) gold mines. Alternatively, Fernihough and O’Rourk (2014) present a natural experiment using the proximity of European cities to rock strata from the Carboniferous era to examine the population effects of coal-fields between 1750 and 1900.

Although, if the total effects of the sector is determined by activity related to both production and prospective endowments in sedimentary basins, this limitation is no different to any study that etsimates the effects of rents (could they consistently estimates the effects with some exogenous degree of variation).

The dataset contains gaps for years where the survey was not conducted or a survey question was not asked. The gaps that exist within this dataset are relatively minor (with data absent only for a few years of the entire study period). The frequency and consistency of the data makes the Latinobarómetro an extremely advantageous data source in the sense that, compared to other datasets with expectations data available from cross-national surveys (inc. other regions Barometer datasets – which are typically available every 3–4 years), the frequency of this data provides a much greater degree of variation from which we may examine how responses evolve over-time. This is suited to our methodological approach using country-fixed effects. This approach limits the degree of variation used to infer estimated effects but controls for time-invariant unobserved factors (such as innate cultural history and geographic and geological factors) which would otherwise confound our analysis and are very difficult to accurately measure or completely capture in a regression model.

Note this analysis does not use the precise sedimentary basin variable reported in Cassidy (2019); which is the log of the sovereign area (in square kilometers) per 1,000 inhabitant. Population size may be endogenously determined and existing discussions (such as those in Bellemare et al. 2017) have explained at some length why lagged explanatory variables should not be used to ‘exogenise’ variables for identification purposes. Alternatively, using absolute values (i.e. not per capita values) will overvalue the relative endowments of larger countries. Given that the estimation strategy is dependent on the exogeneity of the basin variable, we prefer the fraction variable presented in an earlier version of Cassidy’s results (which is conditionally exogenous and impartial to a country’s size). One further point might be added to this, even if we were to use the population based variable equivalent to Cassidy’s (2019) definition, the results would indicate there is not a statistically significant relationship between the sedimentary basin and mineral rents interaction term (discussed in the estimation strategy) and any of the three outcome variables. Hence it is thought in this instance that the fraction variable may also best capture the relationship we wish to explore. The fraction variable used here is available in Cassidy’s (2019) dataset published online.

Note that here it is not necessary to multiply the value of the interaction term by 100.

This estimation approach uses a maximum likelihood estimator, the details of which can be found in many common econometric texts (such as Wooldridge, 2012).

Bun and Harrison (2018) provide expansive proofs of this condition for an OLS regression. The results here are robust to the use of both maximum likelihood (presented in text) and OLS estimators.

To estimate the interaction terms OR for changes of different magnitudes, start by calculating the coefficients estimate in terms of log odds. The log odds model has the convenient property of being linear. Here log odds = ln(odds ratio). Next, we multiply the value of the change interaction term by the log odds coefficient estimate. We and then convert back to an odds ratio (e log odds = odds ratio).

To compare the magnitude of coefficients that are less than 1 to those that are greater than 1 we may simply take their reciprocal values (i.e. divide 1 by the reported odds ratio). E.g. the reciprocal value of the age coefficient (0.966) is 1.035.

E.g. see the World Economic Forums Global Gender Gap Report. Available here: http://www3.weforum.org/docs/WEF_GGGR_2020.pdf.

References

Aitkin, M., & Longford, N. (1986). Statistical modelling issues in school effectiveness studies. Journal of the Royal Statistical Society, 149(1), 1–43.

Ali, S., Mansoob Murshed, S., & Papyrakis, E. (2020). Happiness and the Resource Curse. Journal of Happiness Studies, 21, 437–464.

Arezki, R., Ramey, V., & Sheng, L. (2017). News Shocks in Open Economies: Evidence from Giant Oil Discoveries. The Quarterly Journal of Economics, 132(1), 103–155.

Armand, A., Coutts, A., Vicente, P. C., & Vilela, I. (2020). Does information break the political resource curse? Experimental evidence from Mozambique. American Economic Review, 110(11), 3431–3453.

Arsel, M., Hogenboom, B., & Pellegrini, L. (2016). The extractive imperative in Latin America. The Extractive Industries and Society, 3(4), 880–887.

Balassa, B. (1980). The Process of Industrial Development and Alternative Development Strategies. Princeton University.

Barraza, F., Maurice, L., Uzu, G., Becerra, S., López, F., Ochoa-Herrera, V., Ruales, J., & Schreck, E. (2018). Distribution, contents and health risk assessment of metal(loid)s in small-scale farms in the Ecuadorian Amazon: An insight into impacts of oil activities. Science of the Total Environment, 622, 431–449.

Bazillier, R., & Girard, V. (2020). The gold digger and the machine Evidence on the distributive effect of theartisanal and industrial gold rushes in Burkina Faso. Journal of Development Economics, 143, 102411.

Bjørnskov, C., Dreher, A., & Fischer, J. A. V. (2008). Cross-country determinants of life satisfaction: Exploring different determinants across groups in society. Social Choice and Welfare, 30, 119–173.

Blanchflower, D., Bell, D., Montagnoli, A., & Moro, M. (2014). The happiness trade-off between unemployment and inflation. Journal of Money, Credit and Banking, 46(S2), 117–141.

Borenstein, M., Hedges, L., Higgins, J., & Rothstein, H. (2009). Introduction to Meta-Analysis. Wiley.

Bosco, F., Aguinis, H., Singh, K., & Field, J. (2015). Correlational Effect Size Benchmarks. American Psychological Association, 100(2), 431–449.

Brunnschweiler, C. & Poelhekke, S. (2019). Pushing One’s Luck: Petroleum ownership and discoveries. OxCarre Research Paper 219.

Brunnschweiler, C., & Bulte, E. H. (2008). The resource curse revisited and revised: A tale of paradoxes and red herrings. Journal of Environmental Economics and Management, 55(3), 248–264.

Bun, M., & Harrison, T. (2019). OLS and IV estimation of regression models including endogenous interaction terms. Econometric Reviews, 38(7), 814–827.

Cassidy, T. (2019). The Long-Run Effects of Oil Wealth on Development: Evidence from Petroleum Geology. The Economic Journal, 129(623), 2745–2778.

Cathles, L. (2019). On the processes that produce hydrocarbon and mineral resources in sedimentary basins. Geosciences, 9, 520.

Clark, A. E. & D’Ambrosio, C. (2018). Economic inequality and subjective well-being across the world. WIDER Working Paper 170.

Clark, A. E. (2018). Four decades of the economics of happiness: Where next? The Review of Income and Wealth, 64(2), 245–269.

Cohen, J. (1988). Statistical power analysis for the behavioral sciences (2nd ed.). Lawrence Erlbaum.

Collier, P. (2017). The institutional and psychological foundations of natural resource policies. The Journal of Development Studies, 53(2), 217–228.

Cust, J. F. & Mihalyi, D. (2017). Evidence for a presource curse? oil discoveries, elevated expectations, and growth disappointments. World Bank Policy Research Working Paper 8140.

Cust, J & Mensah, J. (2020). Natural Resource Discoveries, Citizen Expectations and Household Decisions. World Bank Policy Research Working Paper 9372.

David, P. A., & Wright, G. (1997). Increasing returns and the genesis of American resource abundance. Industrial and Corporate Change, 6(2), 203–245.

Di Tella, R., MacCulloch, R. J., & Oswald, A. J. (2003). The Macroeconomics of Happiness. The Review of Economics and Statistics., 85(4), 809–827.

Easterlin, R. A. (2015). Happiness and economic growth: The evidence. In W. Glatzer, L. Camfield, V. Møller, & M. Rojas (Eds.), Global handbook of quality of life. Springer.

Easterly, W. (1999). The ghost of financing gap: Testing the growth model used in the international financial institutions. Journal of Development Economics, 60(2), 423–438.

Fenton Villar, P. (2020). The extractive industries transparency initiative (EITI) and trust in politicians. Resources Policy, 68, 101713.

Fernihough, A & O’Rourk, K. (2014). Coal and the European Industrial Revolution. NBER Working Paper No. 19802.

Frynas, J. G., Wood, G., & Hinks, T. (2017). The resource curse without natural resources: Expectations of resource booms and their impact. African Affairs, 116(463), 223–260.

Gilberthorpe, E., & Papyrakis, E. (2015). The extractive industries and development: The resource curse at the micro, meso and macro levels. The Extractive Industries and Society, 2, 381–390.

Girard, V., Kudebayeva, A. & Toews, G. (2020). Inflated Expectations and Commodity Prices: Evidence from Kazakhstan. GLO Discussion Paper, No. 469.

Graham, C., & Lora, E. (2009). Paradox and perception: Measuring quality of life in Latin America. The Brookings Institution Press.

Graham, C., & Sukhtankar, S. (2004). Does economic crisis reduce support for markets and democracy in latin america? some evidence from surveys of public opinion and well being. Journal of Latin American Studies, 34(2), 349–377.

Grayson, G. (1981). The Mexican Oil Boom. Proceedings of the Academy of Political Science, 34(1), 146–157.

Hartwick, J. (1977). Intergenerational equity and the investing of rents from exhaustible resources. The American Economic Review, 67(5), 972–974.

Haselip, J. (2011). Transparency, consultation and conflict: Assessing the micro-level risks surrounding the drive to develop Peru’s Amazonian oil and gas resources. Natural Resources Forum, 35(4), 283–292.

Hill, C., Bloom, H., Black, A., & Lipsey, M. (2008). Empirical benchmarks for interpreting effect sizes in research. Child Development Perspectives, 2(3), 172–177.

Kyser, T. (2007). Fluids, basin analysis, and mineral deposits. Geofluids, 7, 238–257.

Mahdavi et al. (2020). Why Do Governments Tax or Subsidize Fossil Fuels?. CGD Working Paper 541.

Mignamissi, D., & Kuete, Y. (2021). Resource rents and happiness on a global perspective: The resource curse revisited. Resources Policy, 71, 101994.

Mihalyi, D. (2020). The Long Road to First Oil. Munich Personal RePEc Archive Paper 103855.

Nogueira, M. (2017). Total's plans for Brazil's new oil frontier snagged on Amazon reef. Reuters News. [Online]. Available at: https://de.reuters.com/article/us-brazil-oil-amazon/totals-plans-for-brazils-new-oil-frontier-snagged-on-amazon-reef-idUKKBN1880L3.

Oshio, T. (2017). Which is More Relevant for Perceived Happiness, Individual-Level or Area-Level Social Capital? A Multilevel Mediation Analysis. Journal of Happiness Studies, 18, 765–783.

Paler, L., Springman, J., Grossman, G. & Pierskalla, J. (2020). Oil Discoveries and Political Windfalls: Evidence on Presidential Support in Uganda. Working Paper. [Online]. Available at: https://laurapaler.files.wordpress.com/2020/06/oil_uganda_main.pdf.

Papyrakis, E., & Pellegrini, L. (2019). The Resource Curse in Latin America. In Oxford Research Encyclopedia of Politics. Oxford University Press.

Papyrakis, E., Rieger, M., & Gilberthorpe, E. (2017). Corruption and the extractive industries transparency initiative. The Journal of Development Studies, 53, 295–309.

Reiss, P. C. (1990). Economic and financial determinants of oil and gas exploration activity. In G. Hubbard (Ed.), Asymmetric information, corporate finance, and investment (pp. 181–206). University of Chicago Press.

Rostow, W. (1960). The stages of growth: A non-communist manifesto. Cambridge University Press.

Stevenson, B & Wolfers, J. (2009). The paradox of declining female happiness. NBER Working Paper Series, 14969.

Stolan, A., Engebretsen, B., Berge, L., Somville, V., Jahari, C., & Dupay, K. (2017). Petroleum populism: How new resource endowments shape voter choices. Chr. Michelsen Institute Brief, 16(11), 1–4.

Toews, G. (2015). Inflated expectations and natural resource booms: Evidence from Kazakhstan. OxCarre Research Paper 109.

Tyce, M. (2020). Unrealistic expectations, frustrated progress and an uncertain future? The political economy of oil in Kenya. The Extractive Industries and Society, 7(2), 729–737.

van der Ploeg, F., & Poelhekke, S. (2017). The impact of natural resources: survey of recent quantitative evidence. The Journal of Development Studies, 53(2), 205–216.

Woodhouse, G., & Goldstein, H. (1988). Educational performance indicators and LEA league Tables. Oxford Review of Education, 14(3), 301–320.

Wooldridge, J. M. (2012). Introductory econometrics: A modern approach. Cengage Learning.

Wright, J. (1985). Geology and mineral resources of West Africa. Allen and Unwin.

Zee Ma, Y., & Zhang, Y. (2014). Resolution of the happiness-income paradox. Social Indicators Research, 119, 705–721.

Acknowledgements

This work has been supported by the Economic and Social Research Council (ESRC) award to the University of East Anglia [Grant No. 1948727—ES/P00072X/1]. I am grateful for this support and I would also like to thank Dr Edward Anderson and Dr Elissaios Papyrakis who provided constructive comments on this research.

Funding

This work has been funded by the Economic and Social Research Council (ESRC) award to the University of East Anglia [Grant No. 1948727—ES/P00072X/1].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: In the original publication, Appendix tables were published incorrectly with the labels Table 6, Table 7, … and Table 13. These labels are now corrected as Appendix 1, Appendix 2, … and Appendix 8.

Appendix

Appendix

See Appendices 1, 2, 3, 4, 5, 6, 7, 8.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fenton Villar, P. Is there a Mineral-Induced ‘Economic Euphoria’?: Evidence from Latin America. J Happiness Stud 23, 1403–1430 (2022). https://doi.org/10.1007/s10902-021-00455-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10902-021-00455-5