Abstract

The effect of the COVID-19 pandemic on price convergence in the housing market is largely unknown. This paper aims to assess the impact of the pandemic on the convergence of sales and rental housing prices. The residential markets in Polish voivodeship capitals were chosen as a case study. The convergence evaluation was based on a local linear version of the log t regression test, which allowed the estimation of a time-varying convergence speed parameter. The causal effect of the pandemic on convergence was examined using a Bayesian structural time series model. The study results revealed that the pandemic led to divergence in the primary sales housing market, growth convergence in the secondary sales housing market, and a weakening growth convergence in the rental housing market. Finally, this paper provides the R function logt that enables running the local linear and dummy variable log t regression tests.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The outbreak of the COVID-19 pandemic launched one of the biggest health crises in recent years, leading to more than 6.5 million deaths worldwide by the end of 2022. The emergence of the coronavirus also caused a significant economic shock, resulting in recession in many countries. The housing market has also been affected by the COVID-19 outbreak. Research to date indicates that the pandemic led to a fall in rental housing prices and changes in residential preferences and processes shaping housing sub-markets. Very little is known, however, of the extent to which the pandemic affected house price convergence. In its simplest sense, the latter refers to the process of house prices in the study locations moving towards a common price in the long term (Kim & Rous, 2012). House price divergence, on the other hand, means that differences in house prices between locations increase steadily over time (Abbott & De Vita, 2013). House price convergence may occur mainly through the ripple effect, which implies the transfer of price shocks between spatially separated markets due to the mobility of capital, labour and population. On the contrary, the heterogeneity and non-mobility of housing, as well as the local character of residential markets, are factors supporting price divergence. The pandemic significantly reduced the mobility of the population (Yang et al., 2022; You, 2022), which supports the intensification of price divergence in the housing market. Additionally, it tweaked specific housing preferences, such as the desire to own a flat with a balcony or garden located outside city centres and in small apartment buildings (Gür, 2022). These indications, in turn, suggest that the pandemic could increase the desire to relocate one’s home for a significant proportion of citizens, which might have magnified price convergence. It is also likely that the impact of the pandemic on house price convergence varied across different types of housing markets. Existing research suggests that the rental housing market was more strongly affected by the outbreak than the sales market (Trojanek et al., 2021). Moreover, different reactions to coronavirus emerged in the primary and secondary housing markets (Szczepek, 2021). The former refers to the market of newly built housing, while the latter refers to second-hand housing for sale or rent.

Given all of the above, this paper aims to assess the impact of the COVID-19 pandemic on the convergence of sales and rental house prices. Residential markets in Polish voivodship capitals were chosen as a case study due to the availability of data, as well as the widely documented impact of the pandemic on all segments of the residential market in Poland. This study contributes to the current literature in several ways. First, it is the first study to examine the impact of the pandemic on the convergence of sales and rental housing prices. Second, the local linear log t regression test is used to investigate the convergence hypothesis, which has a number of advantages over alternative methods, and allows the speed of convergence to be measured in each time period studied. Third, the causal impact of the pandemic on house price convergence is evaluated using a robust statistical technique, i.e. a Bayesian structural time series (BSTS) model. Fourth, this paper provides the R function logt estimating the local linear and dummy variable log t regressions.

2 Literature review

The pandemic has had a different impact across different segments of the housing market. In the primary sales market in Warsaw, during the first quarter after the outbreak of the pandemic, i.e. in the second quarter of 2020, Augustyniak et al. (2021) observed only a slight correction in prices and the number of transactions. In the next quarter, however, housing demand and supply considerably dropped and this decrease was larger than the forecasts based on the macroeconomic data. The authors attribute these declines to a sense of uncertainty among households, as well as real estate developers, about the future economic situation. Examining the housing markets in Warsaw, Cracow, Gdansk and Poznan, Bełej (2021) and Szczepek (2021) confirmed that the pandemic did not significantly affect prices in the primary sales housing market, and only noted a substantial decrease in supply as a result of stalled construction. Similarly, Załęczna and Antczak-Stępniak (2022) noted that immediately after the pandemic outbreak, i.e. in April and May 2020, the number of residential construction projects decreased as a result of the lockdown introduced in Poland. In contrast, in the following months, this number returned to its pre-pandemic dynamics. A decline in activity in the primary sales housing market was also documented by Ahsan and Sadak (2021) in Turkey, where the transaction volume in 2019q4–2020q2 decreased by as much as 62%.

The pandemic also changed the functioning of the secondary sales housing market. Szczepek (2021) concluded that one year after the pandemic outbreak, the number of residential sales listings in Cracow doubled, while at the same time the average area of flats on offer decreased by 15 m2. This effect was the result of a significant change in housing preferences, involving the desire to move to a larger flat with a garden or balcony (Marona & Tomal, 2020). This was the direct outcome of the increased time spent at home caused by the pandemic restrictions introduced. Similar findings were noted in the housing market in Wuhan (China), where between December 2019 and April 2020 the area of residential transactions fell by 50% (Zeng & Yi, 2022). The authors also observed a decrease in the volume of transactions in the secondary residential market. These results were confirmed by Ahsan and Sadak (2021) in Turkey, where the number of transactions in 2019q4–2020q2 dropped by as much as 55%. In contrast, the researchers did not find an overall significant fall in prices in the secondary sales housing market due to the pandemic outbreak (Cheung et al., 2021). Contat and Rogers (2022) attribute the occurrence of reduced liquidity in the housing market during the pandemic to the general uncertainty of the period as well as the unwillingness of homeowners to reduce prices due to the low-interest rates at the time and the long-term increase in property values. Duca et al. (2021) detail additional reasons for the resilience of house prices during the pandemic such as government transfers to businesses and households, the sentiment that housing is a good investment in the long term, even at the beginning of the pandemic and the anchoring of the asking price among sellers to the price paid at purchase.

Research results to date indicate that the shock of the pandemic had the strongest impact on the functioning of the rental housing market. First, it caused a significant drop in rental prices. For example, Tomal and Marona (2021) demonstrated that rents in Cracow fell by 6–7% as a result of the first wave of the pandemic, and by an additional 6.25% due to the second. Trojanek et al. (2021) confirmed these findings for Warsaw. They also noted that the decline was mainly caused by an influx of new housing supply from short-term rentals, a fact also pointed out by Kadi et al. (2020) studying the rental housing market in Austria. Similarly, the decline in long-term rental prices is argued by Duca et al. (2021), who points out that the pandemic caused a significant drop in the occupancy rate of short-term rentals in many European cities, which forced many landlords to enter the long-term rental market. As in the sales market, the pandemic also altered housing preferences in the rental market. According to a study by Tomal and Helbich (2022) conducted in Cracow, these changes consisted mainly of an aversion to living in large apartment buildings and a reduction in the importance of locations closer to the city centre. Results from studies in other countries, however, are not as clear-cut as those conducted in Poland. For example, Junga et al. (2022) and Subaşı and Baycan (2022) proved that rental prices in the Czech Republic and Turkey respectively, increased during the pandemic.

This paper aims to assess the impact of the pandemic on house price convergence. However, this topic has not often been addressed in previous research. To the best of the author's knowledge, only two relevant works have been produced so far and both focused on the Polish housing market. In the first, Gnat (2022) examined the α- and β-convergence of sales prices among five localities of the Szczecin agglomeration in the West Pomeranian voivodeship. The study showed that the price convergence process between 2015–2019 (prior to the pandemic) and 2020–2021 (during the pandemic) did not change. Convergence was tested using a simple trend regression, but no statistical method was used to assess the difference in the intensity of the convergence process between the two periods. The second study was carried out by Weremczuk et al. (2021) and looked at the capital cities of Polish voivodeships. This analysis, however, was not based on any formal convergence test but only on a descriptive comparison of house price indexes in selected quarters of the 2018–2021 period.

In conclusion, the impact of the COVID-19 pandemic on house price convergence has been poorly studied in the scientific literature to date. The drawbacks of earlier analyses on this matter are either that they are very narrow in scope or that the research methods used are inadequate for both measuring the convergence process itself and investigating the causal impact of the pandemic on its behaviour. This paper fills this research gap with a robust methodology that allows the identification of level convergence, growth convergence or divergence in each analysed time period, followed by an evaluation of the causal impact of the pandemic on house price convergence.

3 Methodology

3.1 Data and study area

Data on house prices were obtained from the National Bank of Poland (NBP) (https://www.nbp.pl/). NBP present quarterly average nominal transactional prices of flats for the primary and secondary sales markets, as well as for the secondary rental market. The database relates to the period 2006q3–2022q2 and is the longest such time series of house prices available publicly in Poland. This study uses a time series ending a quarter earlier, i.e. in 2022q1, in order to avoid the impact of the outbreak of war in Ukraine on the research results.

The database covers residential markets operating in the capital cities of Polish voivodeships and, additionally, in the city of Gdynia, which together with Gdansk and Sopot form the metropolitan area called Tricity, which is inhabited by almost 1.5 million people. The database is, however, incomplete for the rental market, where deficiencies exist for ten cities. In this context, it should also be noted that the database is concerned with long-term rentals on the secondary market only, as the primary residential rental market is almost non-existent in Poland.

Table 1 presents basic descriptive statistics of flat prices in the studied cities. By far the highest mean of average house prices in the period 2006q3–2022q1 is found in Warsaw regardless of the residential market segment. In turn, the lowest prices can be observed in Zielona Gora, which is one of the least populous voivodeship cities in Poland. The highest increase in sales prices can be observed in Gdansk for the primary sales market and in Gdynia for the secondary sales market. In turn, rental prices increased most prominently in Cracow, i.e. by almost 150%.

Figure 1 shows the pre-processing of the collected data. As the assessment of the convergence of housing prices aims at observing their development over a long period of time, cyclical and seasonal fluctuations need to be removed from the examined time series. These were extracted using the automated procedure X-13ARIMA-SEATS (https://www.census.gov/data/software/x13as.html). Cyclical fluctuations were removed using the boosted Hodrick–Prescott (bHP) filter developed by Phillips and Shi (2021). The bHP smoothing technique addresses the problem of selecting the tuning parameter in the standard Hodrick–Prescott (HP) filter (1997). If the tuning parameter is too large, the HP fitted trend creates a residual trend, which pollutes the cyclical component. To the contrary, if the tuning parameter is too small the fitted trend is too flexible and imitates short-term fluctuations (Tomal 2021). The bHP filter solves this problem by checking whether the cyclical component of the time series contains trend elements after applying the standard HP filter. If so, the HP filter is applied once again to remove any trend residuals. The whole process is repeated until the trend components are completely removed.

Time series filtering using the HP technique is also exposed to end-point bias, which refers to the excessive influence of the last observation in a time series on the trend. The remedy for this problem is to forecast several observations for the time series under study, then applying the HP filter and finally removing the filtered forecasted observations. In this study, an autoregressive integrated moving average (ARIMA) model was used for the forecasting, the detailed specifics of which were chosen based on the Hyndman and Khandakar (2008) algorithm. Following Fritsche and Kuzin (2011), a forecast of six observations was made, which almost entirely eliminates end-point bias in the context of the convergence approach used in this study.

3.2 Methods

3.2.1 Convergence measurement

The local linear log t regression test developed by Johnson (2020) was used to assess house price convergence in this study. This method is based on the log t regression by Phillips and Sul (2007), which is an ordinary least squares (OLS) regression of the form:

where \(\mathrm{log}{y}_{it}\) is a log variable of interest, \({H}_{t}\) denotes the cross-sectional variance, \(b\) is the convergence speed parameter, and \(r\) is a parameter designed to remove a certain number of initial observations in order to increase attention to the rest of the sample. Phillips and Sul (2007) proved that for small (\(T\le 50\)) and large samples (\(T\ge 100\)), the best choices are \(r=0.3\) and \(r=0.2\) respectively. A one-sided t-test, using \(\widehat{b}\) and a heteroskedasticity and autocorrelation-consistent (HAC) standard error, is employed to test the convergence hypothesis. This is rejected at 5% if \({t}_{\widehat{b}}<-1.65\). Conversely, \(2>\widehat{b}\ge 0\) denotes convergence in growth rates, whereas \(\widehat{b}\ge 2\) implies convergence in levels. The log t regression test has a number of advantages over competing methods for assessing convergence (Panopoulou & Pantelidis, 2009). First, it is based on a non-linear time-varying factor model, which allows for heterogeneity across panel units, as well as across time. Second, this approach does not make any assumptions regarding trend stationarity or stochastic non-stationarity of times series in the panel. Third, this method is robust to structural breaks in time series (Antonakakis et al., 2017).

The standard log t regression test, however, does not provide information on the intensity of convergence/divergence for each period analysed, but only for the entire period studied. The local linear log t regression test by Johnson (2020) relaxes this constraint by modifying Eq. (1) as follows:

where \(m(\mathrm{log}\left(t\right))\) is a smooth function. Within this framework at time \(t\), \(2>m{\prime}\left(\mathrm{log}\left(t\right)\right)\ge 0\) denotes convergence in growth rates while \(m{\prime}\left(\mathrm{log}\left(t\right)\right)\ge 2\) denotes convergence in levels, where \(m{\prime}\left(\mathrm{log}\left(t\right)\right)\) is the first derivative of \(m\left(\mathrm{log}\left(t\right)\right)\). Expressing Eq. (2) as \({z}=m\left({x}\right)+\varepsilon\), \(m(x)\) is approximated as \(m\left(x\right)\approx c+d\left(x-{x}_{0}\right)\) for \(x\) in the neighbourhood of \({x}_{0}\). The estimation of \(d\) is performed via weighted least squares as follows:

where \({\overline{x} }_{w}={\sum }_{i=1}^{n}{w}_{i}\left(x\right){x}_{i}/{\sum }_{i=1}^{n}{w}_{i}\left(x\right)\) and \({w}_{i}\left(x\right)=K({x}_{i}-x)/h(x)\). \(K(x)\) is a kernel function and \(h(x)\) is the bandwidth. This means that while estimating \(c\) and \(d\) for a fitting point \(x\), only observations in the interval \((x-h\left(x\right),x+h\left(x\right))\) are used. \(K(x)\) ensures that observations closer to \(x\) have a greater weight. Loader (1999) indicates that \(\widehat{d}\) is the local slope and appropriate estimator of \(m{\prime}(x)\).

Johnson (2020) also proposed a non-overlapping block bootstrap method to construct confidence intervals for \(m{\prime}\left(\mathrm{log}\left(t\right)\right)\) due to high persistence in the residuals from Eq. (2). This method involves dividing the residuals into several non-overlapping blocks, and then replacing them with sampling blocks to create a new vector of residuals. These are added to the fitted values from Eq. (2), creating a new dependent variable, after which Eq. (2) is estimated anew. This procedure is repeated 1,000 times and a 95% confidence interval for \(m{\prime}\left(\mathrm{log}\left(t\right)\right)\) is constructed for each time point by taking the 25 smallest and 25 largest values of the local slopes across all replications.

The estimation results of Eq. (2) can vary depending on the chosen kernel and bandwidth. In this study, tricube, bisquare and gaussian kernels were tested for bandwidths of 0.1, 0.2, 0.3, 0.4 and 0.5. The following proprietary algorithm was used to select the optimal kernel and bandwidth for each residential market segment studied:

Step 1. Estimation of the log t regression by Arestis et al. (2017):

where \({D}_{\tau ,t}\) is the time dummy variable for year \(\tau\) and \({D}_{\tau ,t}\mathrm{log}\left(t\right)\) is the corresponding interaction term. Within this framework, the estimate \(\widehat{b}+{\widehat{\alpha }}_{\tau }\) refers to the speed of convergence in year \(\tau\). Testing for convergence consists of checking if \(\widehat{b}+{\widehat{\alpha }}_{\tau }\ge 0\) using a one-sided t-test with a HAC standard error. This approach does not allow the measurement of convergence in each quarter due to limitations on the number of predictors in the OLS regression.

Step 2. Estimation of local linear log t regressions assuming different kernels and bandwidths and, in each case, calculation of \({\widehat{d}}_{\tau }\) for successive annual intervals by averaging the values of the local slopes obtained for the quarters.

Step 3. Calculation of the absolute difference \({|\widehat{d}}_{\tau }-(\widehat{b}+{\widehat{\alpha }}_{\tau })|\) for each annual interval and then the sum of these differences \({\sum }_{\tau }{|\widehat{d}}_{\tau }-(\widehat{b}+{\widehat{\alpha }}_{\tau })|\). This step is repeated for each kernel and bandwidth: the lower the value of the sum above, the better the consistency of the estimates between the approaches of Arestis et al. (2017) and Johnson (2020).

Step 4. Selection of the optimal kernel and bandwidth for which the sum from Step 3 is the lowest.

3.2.2 Identification of the impact of the pandemic on house price convergence

A Bayesian structural time series (BSTS) model developed by Scott and Varian (2014) was used to assess the causal impact of the pandemic on house price convergence. This method is widely used to evaluate the effect of an intervention on a targeted time series. In this case, the intervention is a pandemic outbreak, which occurred in Poland in 2020q1. The idea behind this approach is first to estimate the model in the pre-intervention period and then predict the value of the dependent variable for the post-intervention period using the actual values of the explanatory variables. The causality of the intervention is assessed by comparing the predicted and actual values of the dependent variable in the post-intervention period (Trojanek and Głuszak, 2022). The BSTS approach has so far been widely used to assess the impact of the pandemic on various economic phenomena (Takyi & Bentum-Ennin, 2021).

The following BSTS model was used in this study:

where \({y}_{t}\) is the value of local slope \(d\) (from Eq. (3)) at time \(t\), the error terms \({\epsilon }_{t}\), \({\omega }_{t}\) and \({v}_{t}\) are normal, independent and identically distributed, \({\mu }_{t}\) is the local linear trend component, and \({\beta }_{1}\) and \({\beta }_{2}\) are parameters for control variables. These include two variables, namely the average wage level (\({w}_{t}\)) and the new housing supply (new flats put into use) (\({nhs}_{t}\)). Therefore, the first control variable is related to housing demand and the second to supply. These variables may affect the convergence of housing prices, while the available studies indicate that the pandemic did not significantly affect their behaviour (Rokicki et al., 2022; Siemińska, 2021). In addition, for consistency, \({w}_{t}\) and \({nhs}_{t}\) were logarithmised, cyclical and seasonally adjusted prior to the estimation of the model (5).

In order to apply the BSTS model, the time series \({y}_{t}\) was divided into two sub-periods. The first, covering the period 2006q1–2020q1, refers to the time prior to the pandemic. Officially, in Poland, the first case of the pandemic was recorded in March 2020, but any impact of the pandemic on the housing market could not have taken place until the next quarter. The second period, from 2020q2 to 2022q1, refers to the time of the pandemic. In Poland, pandemic restrictions were lifted in 2022q2, but this quarter was omitted due to the outbreak of war in Ukraine in February 2022. This omission, however, should not have a significant impact on the results due to the fact that in 2022q2 there were hardly any pandemic-related restrictions in effect in Poland.

3.3 Software

The local linear log t regression test by Johnson (2020) is not available in any statistical software. Therefore, this paper uses the R function logt to perform this test. The above function takes the following parameters: data—a data frame object; start_p—a start date, end_p—an end date, fr—a data frequency, col_d—TRUE if the first column of data contains information on dates, FALSE if otherwise; seas_a—TRUE if data should be seasonally adjusted, FALSE if otherwise; fil—TRUE if a trend component should be extracted from the data, FALSE if otherwise. The function uses the boosted HP filter for smoothing. In addition, the end-point bias is eliminated using the procedure developed in Fritsche and Kuzin (2011); met—"PS" if the standard Phillips-Sul approach is to be applied, "AR" implements the dummy variable log t regression test described in Arestis et al. (2017), "JO" implements the local linear log t regression test described in Johnson (2020); a—If "JO" a means the bandwidth in %, e.g. 0.2; k—If "JO" k means the kernel, e.g. "tcub", "gauss" (see the locfit package for details). This function for calculating HAC standard errors uses an adaptive quadratic spectral bandwidth for the truncation of the quadratic spectral kernel. An example of the use of the logt function is as follows: logt(data = rents, start_p = c(2006, 3), end_p = c(2022,1), fr = 4, col_d = TRUE, seas_a = TRUE, fil = TRUE, met = "JO", a = 0.2, k = "tcub"). In this case, the data has a quarterly character, starts in 2006q3 and ends in 2022q1. The log t regression test is performed using the procedure outlined by Johnson (2020) assuming bandwidth equal to 20% and a tricube kernel. Prior to applying the test, the data were seasonally adjusted and a trend component was extracted from the time series. The function logt is available at https://figshare.com/articles/software/logt/22133012.

In order to estimate the causal impact of the pandemic on house price convergence with the BSTS model, the R package CausalImpact was used.

4 Results and discussion

The empirical study first determined the optimal kernel and bandwidth for local linear log t regressions. For this purpose, the algorithm presented in Sect. 3.2.1 was used. The starting point was the estimation of dummy variable log t regressions for all housing market segments studied (see Table 2). Local linear log t regressions were then estimated assuming a tricube, bisquare or gaussian kernel and a bandwidth equal to 0.1, 0.2, 0.3, 0.4 or 0.5 (all local slopes are shown in Tables 6, 7, and 8). The average values of the local slopes, which are also convergence speed parameters, were then calculated for the annual intervals. Next, the consistency of estimates between dummy variable log t regressions and local linear log t regressions was examined by assessing the values of \({\sum }_{\tau }{|\widehat{d}}_{\tau }-(\widehat{b}+{\widehat{\alpha }}_{\tau })|\). The results in Table 3 indicate that for the primary and secondary sales markets, as well as for the rental market, the bandwidth when estimating the local linear log t regression should be 0.1 for which the values of \({\sum }_{\tau }{|\widehat{d}}_{\tau }-(\widehat{b}+{\widehat{\alpha }}_{\tau })|\)) are the lowest. The choice of this bandwidth is also confirmed by Mallows' Cp criterion, whose values are the smallest of all the possibilities analysed. Interestingly, it was observed that the wider the bandwidth, the worse the performance of local linear regressions. Regarding the kernel function, the best choice for the primary sales market was the tricube shape, while for the rest of the markets this was the bisquare. In the case of the analysed kernels, however, there was not as much difference between them as in the case of bandwidth.

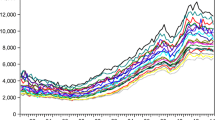

Figure 2 shows the convergence speed parameters estimated using local linear log t regressions in the selected specifications. The results cover the period from 2010q4 onwards, as the first 17 observations were truncated, according to the general assumptions of the log t regression test. More specifically, the value of the truncation parameter \(r\) was set to 0.274 by interpolating between 0.2 and 0.3. Interpolation was necessary because the analysed database consisted of 63 observations, and so the standard values of \(r\) determined by Phillips and Sul (2007) could not be adopted.

The estimated local linear log t regressions indicate that from 2010 to 2018/2019 there was price divergence in all segments of the Polish residential market (the values of the local slopes with 95% confidence intervals are available in Table 10). These results are fully consistent with studies by Tomal (2021), Trojanek et al. (2022) and Tomal (2021) relating to the same research area, as well as to both the sales and rental markets. Interestingly, the maximum intensity of divergence was present in 2015/2016, which is also in line with the above-mentioned research. This fact is related to the general dynamics of the Polish housing market during the analysed period. Namely, until 2015/2016, the market was in a phase of crisis and stagnation followed by a period of recovery and boom supporting the conditions for price convergence (Głuszak & Belniak, 2020a, 2020b). It can also be inferred from Fig. 2 that the convergence speed parameters between 2010 and 2018/2019 for all housing market segments were characterised by co-movement. This is due to the fact that there are strong positive and negative interdependencies between different segments of the Polish regional housing markets, as confirmed by Drachal (2018) and Brzezicka et al. (2019), among others, with Tomal (2020) pointing out that the primary sales market plays a key role in shaping the entire Polish housing market.

When analysing the change in convergence speed parameters (see Fig. 2) in the aftermath of the pandemic, it can be seen that each segment of the housing market reacted differently to this shock. Initially, prices in the primary sales market started to diverge very strongly, i.e. individual regional primary markets reacted differently to the coronavirus outbreak. This may be due to the fact that property developers respond heterogeneously to economic shocks depending on their financial condition. In particular, small real estate developers were forced to reduce prices slightly in order to maintain financial liquidity. Larger developers, conversely, chose not to discount prices, deciding to wait out the difficult time by reducing the housing supply (Zańko-Gulczyński, 2021).

A diametrically opposed situation was observed in the secondary sales market, where very strong convergence processes took place, which finally in 2021q4 and 2022q2 led to level convergence, i.e. prices among regional markets started to move towards a fixed level in the long term. Such strong convergence processes may have been caused by a change in and, to some extent, unification of housing preferences. The population started to switch from smaller to larger flats with access to a balcony or terrace, additionally located away from the city centre. The secondary sales market, unlike the primary market, quickly adapted to the new housing preferences. This is confirmed by an analysis by Szczepek (2021), indicating that one year after the outbreak of the pandemic, the number of sale offers of flats in Cracow doubled, while at the same time the average floor area of the dwellings on offer decreased by 15 m2.

The least impact of the pandemic on price convergence was observed in the rental market, where a decline in the convergence speed parameter was noted. This, however, still indicates growth convergence, namely that rental price growth rates among regional markets will converge in the long term. This result is unexpected, as the literature review presented in Sect. 2 indicated a strong impact of the pandemic on this segment of the housing market. Such influences, however, may shape the convergence processes differently. On the one hand, the rental market in Poland has seen some adjustment due to the different housing preferences as a result of the pandemic (Tomal & Helbich, 2022). On the other hand, there has been an influx of supply from the short-term rental market into the long-term one leading to a decline in prices (Trojanek et al., 2021). This inflow, however, only occurred in the largest regional markets, which may have exacerbated price divergence between the larger and smaller rental markets in Poland.

In order to assess the causal impact of the pandemic on house price convergence in the markets under study formally, BSTS models were estimated. The estimates presented in Table 4 fully confirm the conclusions drawn from the analysis of Fig. 2. For the primary sales market, the BSTS model, in the absence of the pandemic, predicted a mean value of the convergence speed parameter equal to 0.99, which would indicate the occurrence of growth convergence. In contrast, the pandemic caused the average actual value of this parameter to be –0.49, suggesting a price divergence process. The opposite occurred in the secondary sales market, where the BSTS model anticipated the emergence of price divergence, while in fact, during the pandemic, on average, the convergence speed parameter was equal to 1.02, pointing to growth convergence. In the case of the rental market, the pandemic caused a weakening of convergence. In the absence of a pandemic shock, the BSTS model anticipated level convergence, while the pandemic contributed to the stabilisation of growth convergence with a tendency to weaken it. Based on Fig. 2 and the results in Table 4, Table 5 synthesises the impact of the pandemic on the convergence process in each analysed housing market segment in Poland.

5 Conclusion

This study examined the impact of the COVID-19 pandemic on the convergence of sales and rental house prices in Poland. The analysis was performed for housing markets operating in Polish provincial cities. The study results revealed the heterogeneous impact of the pandemic on house price convergence across different segments of the housing market. In the primary sales market, the pandemic led to price divergence, while in the secondary sales market to growth convergence and, finally, to level convergence. The least impact of the pandemic on house price convergence was seen in the rental market, where growth convergence was weakened.

This study has several limitations. First, it only investigated the prices of flats excluding other types of residential properties. Second, due to data shortages, the analysis of rental price convergence was only based on seven regional housing markets. Third, only two control variables were included in the BSTS models because of the difficulty of accessing quarterly data that would further satisfy the condition of no change in their dynamics following the outbreak of the pandemic. Future research should focus on examining the impact of the pandemic on price convergence for other types of residential properties. Further, the geographical area of study could be extended to include smaller housing markets. In addition, it would be interesting to see whether convergence clubs existed during periods of price divergence and, if so, whether the pandemic altered their structure or size. Finally, further research should investigate the impact of the pandemic on house price convergence in markets in other countries. This is because the pandemic has affected house price dynamics in a heterogeneous way in different countries (Bas, 2022; Głuszak & Belniak, 2020a, 2020b) due to the various specificities of housing markets and the diverse anti-pandemic policies applied around the world (Malpezzi, 2023).

This study also has several practical implications. In Poland, a single unified housing policy to support the development of new residential construction projects may not be effective, as the conducted research indicated that in the primary sales market, housing developers react differently to economic shocks, leading to price discrepancies among regional markets. Second, real estate developers creating a new stock of residential properties should take into account the latest housing preferences that resulted from the pandemic. Finally, housing policies should vary across housing market segments because, despite their strong interdependence, they respond differently to unexpected events.

Data vailability

The data that support the findings of this study are available upon reasonable request.

Code availability

The code is available at https://figshare.com/articles/software/logt/22133012.

References

Abbott, A., & De Vita, G. (2013). Testing for long-run convergence across regional house prices in the UK: A pairwise approach. Applied Economics, 45(10), 1227–1238. https://doi.org/10.1080/00036846.2011.613800

Ahsan, M. M., & Sadak, C. (2021). Exploring housing market and urban densification during COVID-19 in Turkey. Journal of Urban Management, 10(3), 218–229. https://doi.org/10.1016/j.jum.2021.06.002

Antonakakis, N., Christou, C., Cunado, J., & Gupta, R. (2017). Convergence patterns in sovereign bond yield spreads: Evidence from the Euro Area. Journal of International Financial Markets, Institutions and Money, 49, 129–139. https://doi.org/10.1016/j.intfin.2017.03.002

Arestis, P., Fontana, G., & Phelps, P. (2017). Regional financialisation and financial systems convergence: Evidence from Italy. Environment and Planning a: Economy and Space, 49(1), 141–167. https://doi.org/10.1177/0308518X16664192

Augustyniak, H., Łaszek, J., Olszewski, K., & Joanna, W. (2021). Why has the COVID-19 pandemic had a limited impact on the primary housing market in Poland? Critical Housing Analysis, 8(2), 1–15. https://doi.org/10.13060/23362839.2021.8.2.534

Bas, M. (2022). The impact of the COVID-19 pandemic on the residential real estate market on the example of Szczecin, Poland. Procedia Computer Science, 207, 2048–2058. https://doi.org/10.1016/j.procs.2022.09.264

Bełej, M. (2021). Housing price forecasting in selected Polish cities during the COVID-19 pandemic. Geomatics and Environmental Engineering, 15(4), 59–80. https://doi.org/10.7494/geom.2021.15.4.59

Brzezicka, J., Łaszek, J., Olszewski, K., & Waszczuk, J. (2019). Analysis of the filtering process and the ripple effect on the primary and secondary housing market in Warsaw. Poland. Land Use Policy, 88, 104098. https://doi.org/10.1016/j.landusepol.2019.104098

Cheung, K. S., Yiu, C. Y., & Xiong, C. (2021). Housing market in the time of pandemic: A price gradient analysis from the COVID-19 epicentre in China. Journal of Risk and Financial Management, 14(3), 108. https://doi.org/10.3390/jrfm14030108

Contat, J., & Rogers, M. (2022). Housing supply and liquidity in the COVID-19 era. Cityscape, 24(3), 123–152.

Drachal, K. (2018). Causality in the polish housing market: Evidence from biggest cities. Financial Assets and Investing, 9(1), 5–20. https://doi.org/10.5817/FAI2018-1-1

Duca, J. V., Hoesli, M., & Montezuma, J. (2021). The resilience and realignment of house prices in the era of Covid-19. Journal of European Real Estate Research, 14(3), 421–431. https://doi.org/10.1108/JERER-11-2020-0055

Fritsche, U., & Kuzin, V. (2011). Analysing convergence in Europe using the non-linear single factor model. Empirical Economics, 41(2), 343–369. https://doi.org/10.1007/s00181-010-0385-4

Głuszak, M., & Belniak, S. (2020a). Rynek nieruchomości po kryzysie. Centrum Polityk Publicznych. Retrieved from https://politykipubliczne.pl/wp-content/uploads/2020/11/08-Rynek_nieruchomosci-08.09.2020-last.pdf

Głuszak, M., & Belniak, S. (2020b). The COVID-19 pandemic and housing markets in selected European Countries: Lessons learnt and policy implications. Zarządzanie Publiczne/public Governance, 3(53), 48–59. https://doi.org/10.15678/ZP.2020.53.3.04

Gnat, S. (2022). Convergence of residential property prices in the Szczecin agglomeration in the context of the COVID-19 pandemic. Procedia Computer Science, 207, 2039–2047. https://doi.org/10.1016/j.procs.2022.09.263

Gür, M. (2022). Post-pandemic lifestyle changes and their interaction with resident behavior in housing and neighborhoods: Bursa, Turkey. Journal of Housing and the Built Environment, 37(2), 823–862. https://doi.org/10.1007/s10901-021-09897-y

Hodrick, R. J., & Prescott, E. C. (1997). Postwar US business cycles: An empirical investigation. Journal of Money, Credit, and Banking, 29(1), 1–16.

Hyndman, R. J., & Khandakar, Y. (2008). Automatic time series forecasting: The forecast package for R. Journal of Statistical Software, 27, 1–22. https://doi.org/10.18637/jss.v027.i03

Johnson, P. A. (2020). Parameter variation in the “log t” convergence test. Applied Economics Letters, 27(9), 736–739. https://doi.org/10.1080/13504851.2019.1644436

Junga, P., Smolinská, R., Krulický, T., & Machová, V. (2022). Evaluation of impact of the Covid-19 pandemic on rental housing prices in the city of Brno between 2020 and 2021. In SHS web of conferences (vol. 132, p. 01024). EDP Sciences. https://doi.org/10.1051/shsconf/202213201024

Kadi, J., Schneider, A., & Seidl, R. (2020). Short-term rentals, housing markets and COVID-19: Theoretical considerations and empirical evidence from four Austrian cities. Critical Housing Analysis, 7(2), 47–57. https://doi.org/10.13060/23362839.2020.7.2.514

Kim, Y. S., & Rous, J. J. (2012). House price convergence: Evidence from US state and metropolitan area panels. Journal of Housing Economics, 21(2), 169–186. https://doi.org/10.1016/j.jhe.2012.01.002

Loader, C. (1999). Local regression and likelihood. New York: Springer.

Marona, B., & Tomal, M. (2020). The COVID-19 pandemic impact upon housing brokers’ workflow and their clients’ attitude: Real estate market in Krakow. Entrepreneurial Business and Economics Review, 8(4), 221–232. https://doi.org/10.15678/EBER.2020.080412

Malpezzi, S. (2023). Housing affordability and responses during times of stress: A preliminary look during the COVID-19 pandemic. Contemporary Economic Policy, 41(1), 9–40. https://doi.org/10.1111/coep.12563

Panopoulou, E., & Pantelidis, T. (2009). Club convergence in carbon dioxide emissions. Environmental and Resource Economics, 44(1), 47–70. https://doi.org/10.1007/s10640-008-9260-6

Phillips, P. C. B., & Sul, D. (2007). Transition modeling and econometric convergence tests. Econometrica, 75(6), 1771–1855. https://doi.org/10.1111/j.1468-0262.2007.00811.x

Phillips, P. C., & Shi, Z. (2021). Boosting: Why you can use the HP filter. International Economic Review, 62(2), 521–570. https://doi.org/10.1111/iere.12495

Rokicki, T., Bórawski, P., Bełdycka-Bórawska, A., Szeberényi, A., & Perkowska, A. (2022). Changes in logistics activities in poland as a result of the COVID-19 pandemic. Sustainability, 14(16), 10303. https://doi.org/10.3390/su141610303

Scott, S. L., & Varian, H. R. (2014). Predicting the present with Bayesian structural time series. International Journal of Mathematical Modelling and Numerical Optimisation, 5(1–2), 4–23. https://doi.org/10.1504/IJMMNO.2014.059942

Siemińska, E. (2021). The residential property market during a pandemic period in Poland. World of Real Estate Journal, 4(118), 21–45. https://doi.org/10.14659/WOREJ.2021.118.02

Subaşı, S. Ö., & Baycan, T. (2022). Impacts of the COVID-19 pandemic on private rental housing prices in Turkey. Asia-Pacific Journal of Regional Science, 6(3), 1177–1193. https://doi.org/10.1007/s41685-022-00262-7

Szczepek, M. (2021). Changes in the housing market in Cracow during COVID-19 Pandemics. Świat Nieruchomości, 115(1), 20–47. https://doi.org/10.14659/WOREJ.2021.115.02

Takyi, P. O., & Bentum-Ennin, I. (2021). The impact of COVID-19 on stock market performance in Africa: A Bayesian structural time series approach. Journal of Economics and Business, 115, 105968. https://doi.org/10.1016/j.jeconbus.2020.105968

Tomal, M. (2019). House price convergence on the primary and secondary markets: Evidence from polish provincial capitals. Real Estate Management and Valuation, 27(4), 62–73. https://doi.org/10.2478/remav-2019-0036

Tomal, M. (2020). Spillovers across house price convergence clubs: Evidence from the polish housing market. Real Estate Management and Valuation, 28(2), 13–20. https://doi.org/10.1515/remav-2020-0012

Tomal, M. (2021). Testing for overall and cluster convergence of housing rents using robust methodology: Evidence from Polish provincial capitals. Empirical Economics, 62, 2023–2055. https://doi.org/10.1007/s00181-021-02080-w

Tomal, M., & Helbich, M. (2022). The private rental housing market before and during the COVID-19 pandemic: A submarket analysis in Cracow, Poland. Environment and Planning B: Urban Analytics and City Science, 49(6), 1646–1662. https://doi.org/10.1177/23998083211062907

Tomal, M., & Marona, B. (2021). The impact of the covid-19 pandemic on the private rental housing market in Poland: What do experts say and what do actual data show? Critical Housing Analysis, 8(1), 24–35. https://doi.org/10.13060/23362839.2021.8.1.520

Trojanek, R., & Gluszak, M. (2022). Short-run impact of the Ukrainian refugee crisis on the housing market in Poland. Finance Research Letters, 50, 103236. https://doi.org/10.1016/j.frl.2022.103236

Trojanek, R., Gluszak, M., Hebdzynski, M., & Tanas, J. (2021). The COVID-19 pandemic, Airbnb and housing market dynamics in Warsaw. Critical Housing Analysis, 8(1), 72–84. https://doi.org/10.13060/23362839.2021.8.1.524

Trojanek, R., Gluszak, M., Kufel, P., Tanas, J., & Trojanek, M. (2022). Pre and post-financial crisis convergence of metropolitan housing markets in Poland. Journal of Housing and the Built Environment. https://doi.org/10.1007/s10901-022-09953-1

Weremczuk, A., Wielechowski, M., & Wrzesińska-Kowal, J. (2021). Developments and convergence of real housing prices in Poland during the COVID-19 pandemic: focus on voivodeship capitals. Turystyka i Rozwój Regionalny, 16, 111–124. https://doi.org/10.22630/TIRR.2021.16.24

Yang, L., Liang, Y., He, B., Lu, Y., & Gou, Z. (2022). COVID-19 effects on property markets: The pandemic decreases the implicit price of metro accessibility. Tunnelling and Underground Space Technology, 125, 104528. https://doi.org/10.1016/j.tust.2022.104528

You, G. (2022). The disturbance of urban mobility in the context of COVID-19 pandemic. Cities, 128, 103821. https://doi.org/10.1016/j.cities.2022.103821

Załęczna, M., & Antczak-Stępniak, A. (2022). Is the impact of COVID-19 on housing construction activity inside and outside a large city evident? The example of Łódź (Poland). Bulletin of Geography. Socio-Economic Series, 55, 35–48. https://doi.org/10.12775/bgss-2022-0003

Zańko-Gulczyński, P. (2021). Pandemia zmienia rynek mieszkaniowy. Droższa budowa, zadłużone firmy i inne oczekiwania klientów. regioDom. Retrieved from https://regiodom.pl/pandemia-zmienia-rynek-mieszkaniowy-drozsza-budowa-zadluzone-firmy-i-inne-oczekiwania-klientow/ar/c9-15517197.

Zeng, S., & Yi, C. (2022). Impact of the COVID-19 pandemic on the housing market at the epicenter of the outbreak in China. SN Business & Economics, 2(6), 1–20. https://doi.org/10.1007/s43546-022-00225-2

Acknowledgements

Not applicable.

Funding

The publication presents the results of the Project financed from the subsidy granted to the Krakow University of Economics – Project nr 018/EEN/2023/POT.

Author information

Authors and Affiliations

Contributions

Not applicable.

Corresponding author

Ethics declarations

Competing interests

The author has no conflicts of interest to declare.

Ethics approval

Not applicable.

Consent

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables

6,

7,

8,

9 and

10.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Tomal, M. The COVID-19 pandemic and house price convergence in Poland. J Hous and the Built Environ (2023). https://doi.org/10.1007/s10901-023-10090-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10901-023-10090-6