Abstract

We investigate whether and the extent to which buyer’s characteristics affect housing transaction prices. Using the transaction data of existing apartments from 2014 to 2017 in Guangzhou, China, our results show that buyer’s locality, motivation and financial ability affect the transaction prices. Non-local buyers pay a premium. First-time buyers gain a discount. Experienced repeat buyers for upgrading pay a premium. We also find that buyer’s financial ability affects purchasing power and transaction prices. The buyers paying the acquisition with mortgage gain a higher discount or pay a lower premium than their counterparts paying in cash. Internet use itself won’t affect transaction price. When it is combined with buyer’s other characteristics, the buyers using the internet to obtain the property information have an information advantage over the ones using the traditional method and gain a higher discount or pay a lower premium than their counterparts using the traditional method, especially for the non-local. This finding is important for market participants and regulators to improve market efficiency and transparency by improving the accuracy of the information disclosed on the Internet.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper studies whether and to what extent homebuyer characteristics affect the transaction price in the housing market. Especially, the study applies to the particular case of Guangzhou, China. The theoretical framework applied to the analysis is the information asymmetry or search cost model. We hypothesize that the degree of information asymmetry or search cost varies with the characteristics of house buyers.

The property market is not completely efficient. The degree of inefficiency is fundamentally a consequence of the heterogeneity of properties, and the other causes. Infrequent trading, geographically segmented, and asymmetric information are regarded as major characteristics of property markets. Therefore, when, buyers have to search for the properties, their search cost incurs The final prices paid depend on negotiation power between buyer and seller which is affected to a great extent by the information each party possesses.

House buyers are also heterogonous in locality, prior experience and knowledge of the local market, motivation of buying a house, bargaining power, financial ability, and search method. Therefore, the buyer’s characteristics can have an impact on the prices paid because of the existence of information asymmetry. For example, the buyers who have more information about the local market or more experience than the others, say, local buyers or repeat buyers may pay less for the same kind of houses than less-informed or less experienced buyers if the market is not efficient.

Additionally, prior experience and the motivation of the buyers can be different. Some people buy the properties for their own occupation, i.e. buyer/occupant; others buy the properties for investment, i.e. buyer/investor. The buyers/investors are more experienced in or more informed of the housing market than the buyers purchasing for their own occupation, therefore, they may pay less for houses than buyers/occupiers as they can either identify the underpriced properties or can take advantage of the information asymmetry to negotiate a lower price than buyers/occupiers. Thus, the buyer’s motivation may matter to the prices paid (e.g. Kessens et al. 2006).

Financial constraints faced by the buyers have an influence on the bargaining power of buyers and transaction prices. For example, higher-income buyers are expected to search less as their opportunity cost of searching is high. Thus, they are less likely to spend a longer time searching for their desirable properties and are willing to pay a premium (Song, 1998). The different socio-economic status of different types of house buyers may affect the search costs and the prices paid.

Application of the technology, i.e. internet in the search process may be able to reduce the search cost as potential buyers can view more properties at one time than otherwise; therefore, affects the price discount/premium. Internet use could improve market efficiency.

This paper hypothesizes that the price premium/discount could be caused by the heterogeneity of the buyer’s characteristics. We extend the previous studies of local versus non-local buyers and price premiums by including more buyer’s characteristics such as prior market experience, acquisition motivation, financial constraints and searching method. We also empirically study a comprehensive set of data of housing transactions in Guangzhou city, the capital of Guangdong province, China from January 2014 to April 2017. Guangzhou is one of four first-tierFootnote 1 cities in China. In our sample, 34% of the buyers are out-of-province buyer and 62% are first-time buyer. At the same time, Internet use as a tool to search for properties on sale in the transaction process is not widespread in China. In our sample, only 31% of potential buyers use the Internet to search the properties on the housing market. Therefore, the diversity of buyer’s types provides a good laboratory to assess the impact of buyer’s characteristics on the transaction price.

The information asymmetry or search cost model is employed to examine whether and to what extent a house buyer’s characteristics could influence the price distribution of the existing commodity apartments in Guangzhou city. Search costs include the cost of commuting to visit and inspect different properties on market for sale and research of the local area and community. It is costly because the houses being on market for sale in different areas are heterogeneous, a potential buyer has to collect the information on the property for sale. Hence, the optimal search is a trade-off between getting a lower price by searching one more time against the cost of the continued search. Search costs vary with the buyer’s characteristics. We categorize the types of the buyer based on Hukuo residence, the ID registration card (i.e. local versus non-local buyer), prior market experience, (i.e. first-time buyer versus repeat buyer), acquisition motivation (buyer/occupier or buyer/investor), financial constraints (i.e. buyer paying the acquisition with mortgage versus buyer paying in cash), search method employed (i.e. Internet use or traditional method). By separating the buyers into different types based on their characteristics, we can examine whether a buyer’s characteristics are related to paying a premium/discount for a given property with the same housing characteristics.

The findings of the research have an implication for other cities in China or other countries. As people migrate from less economically developed cities or towns to wealthy and economically developed cities like Guangzhou, it is crucial to help non-local migrants to break down the information asymmetry in the housing market by establishing a transparent market. The internet is regarded as an effective search tool. To encourage more home buyers to use the Internet, the information disclosed on the Internet should be full and accurate. This issue should cause the attention of professionals and policymakers.

The paper is structured as follows. Section 2 is the literature review on buyer’s characteristics and price differentials. Section 3 outlines the empirical specifications and Sect. 4 describes the data. The results are discussed in Sect. 5 before we draw the conclusions in Sect. 6.

2 Literature review

Four streams of interrelated literature are reviewed here. They are information asymmetry or search cost and the locality of buyer, i.e. local versus non-local buyer; buyer’s experience and motivation, i.e. inexperienced first-time buyer versus experienced repeat buyer or buyer/occupier versus buyer/investor, and financial strength. The search method, i.e. internet use may reduce information asymmetry or search cost compared to a traditional method such as advisement in the newspaper, word of mouth, house show, or real estate agent. All these factors are identified empirically to affect information asymmetry and search cost; therefore, they are interrelated with each other.

The existing literature focuses on the relation of local or non-local buyers and price premiums/ discounts paid by the different buyer groups. The theoretical framework is information asymmetry or search cost among different house buyer types. The theory emphasizes consumer ignorance in that some less informed buyers would be charged by the seller a high price that could not be justified by the true quality of the product (Tellis & Wernerfelt, 1987).

The housing market is inefficient as a result of the unique features of the house. The features include immobility, durability, high transaction costs, supply restrictions, and price inelasticity (Maclennan, 1982). Consequently, the relevant information of the property is difficult to obtain. So potential buyers have to spend time and effort to search the properties on sale. The search cost varies with different buyer types. Local buyers have an information advantage in the local housing market over non-local buyers, so they tend to pay a lower price for the house. This has been proved empirically by previous studies.

The earlier studies of the non-local buyer and price premium have mixed results. For example, Turnbull & Sirmans (1993) studied whether the non-local house buyers paid a premium in Baton Rouge, Louisiana with 151 single-family house transactions in one year. They failed to find a significant price difference between local buyer versus non-local buyer and between first-time buyer versus repeat buyer. Watkins (1998) undertook similar research of Glasgow in the United Kingdom to that of Turnbull and Sirmans. This study has a larger sample size (544 observations with 138 non-local residents) and the variables of property features included in the test. The results show that there is no significant difference in price between intra-market movers and in-migrants, mirroring those obtained by Turnbull and Sirmans.

The recent studies increased the sample size and found there is a difference in the prices paid by different types of buyers. For instance, Lambson et al., (2004) found that out-of-state buyers pay 5.5% more for the property than their in-state counterparts in the Phoenix metropolitan area from 1990 to 2002. Their study covers 2,854 apartment building transactions. Ihlanfeldt & Mayock (2012) studied 6,666 single-family home transactions from the state of Florida and yielded similar results as Lambson et al., (2004), that is non-local buyers tend to pay a premium for the property compared to their local counterparts. This premium could be explained by time constraints, high search costs, and/or an anchoring effect.

The studies of the relation between the locality of house buyers and housing prices in Asian markets include Neo et al., (2008) studying the Singapore market and Zhou et al., (2015) studying the Chengdu housing market, China. Their findings are broadly similar to the literature mentioned above, that is non-local buyers pay a premium for the houses than their local counterparts. Qiu et al., (2020) studied how homebuyers’ heterogeneity affects their searching cost and bargaining power in Tianjin, China. Apart from the locality of the buyers, their study also includes homebuyers’ demographic characteristics such as age, education, income, and type of occupation. Their findings suggest that information asymmetry and the anchoring effect exists in the housing market of Tianjin, China. The buyers with higher education and income tend to have lower bargaining power and pay more for a given house.

The explanations for non-local buyers paying a premium are, first, they have a higher search cost and time constraints. Secondly, non-local buyers have less knowledge or information about the local housing market and do not have first-hand experience observing unique local market conditions (Turnbull & Sirmans, 1993). Thirdly, it is the “anchoring” effect that refers to that the buyers from the places where house values are high or low relative to local prices may also have biased expectations of property values.

These studies focused on the behaviour of local versus non-local buyers, which may be insufficient to understand the factors contributing to housing price premium/discount. There is strong evidence that buyer’s characteristics matters and influences the asset price in the real estate market. For example, a buyer’s experience may affect the price he/she pays for a property (e.g. Turnbull & Sirmans 1993; Watkins, 1998; Song, 1998; Chinloy et al., 2013). However, there is no consensus on the relationship between buyer experience and price. Usually, first-time buyers are regarded as being less experienced than repeat buyers, but they do not necessarily pay more than experienced repeat buyers (e.g.Turnbull & Sirmans 1993; Watkins, 1998). Wilhelmsson (2008) did not find that the price paid by first-time buyers is significantly higher than other buyers in the Stockholm housing market. However, there are studies supporting the notion that first-time buyers paid less than other buyers (Song, 1998; Harding et al.2003a; Kestens et al., 2006 and Chinloy et al., 2013). The explanations are that first-time buyers search much longer than experienced house buyers (Baryla & Zumpano, 1995) and get a better price by “waiting longer to close a deal” (Kestens et al., 2006).

Lately, Shui & Murthy (2019) studied whether first-time house buyers pay more for their homes and found that first-time house buyers tend to buy smaller and cheaper houses and pay a premium of 1.04% on average compared to their more experienced counterparts. Their explanations for the price premium paid by first-time buyers are that the first-time buyers pay rent in addition to the search cost paid by all buyers in each search period; therefore, they tend to spend less time on searching and buy hastily at higher prices.

Repeat buyers for upgrading have to sell their houses before purchasing new ones. If they could not find their desirable houses in time, they have to rent, which will increase the total costs. The repeat buyers for upgrading may have a shorter time horizon, and the premium may be explained by the buyer’s haste. Another explanation is that repeat buyers pay a premium intending to “fulfill social homogeneity” (Kestens et al., 2006) and secure a property in their desirable neighborhood. Larsen (2010) compared prices of single-family houses purchased by investors with those purchased by owner-occupants and found that the more experienced buyer/investor paid a significantly lower price. Neo et al., (2008) have the same finding that buyer/investor is positively related to the prices paid in the Singapore housing market. However, the prior literature does not investigate whether the information asymmetry affects the different buyer groups uniformly.

To better understand the relationship between heterogeneous characteristics of the house buyer and transaction prices, some studies include the social-economic status of the buyers such as age, education and income in a hedonic framework to investigate how the characteristics of house buyers affect their bargaining power and house prices (e.g. Harding et al., 2003a; Colwell & Munneke, 2006, Qiu et al., 2020). The main results suggest that household age and wealth have a negative effect on bargaining power and transaction prices; the bargaining power varies among different types of buyers (Harding et al., 2003a, b; Ortalo-Magné & Rady, 2006; Kestens et al., 2006; Wilhelmsson, 2008; Steegmansa & Hassinka, 2017). Qiu et al., (2020) studied the Tianjin housing market, China with the transaction data combined with the Housing Provident Fund (HPF) home loan data. They find that homebuyer’s age is positively related to the bargaining power, but negatively related to the prices paid. They also find that higher income household has weaker bargaining power. One of the explanations for the negative relationship between buyer’s income and price paid is that the opportunity cost of searching for high-income buyers is high, indicating they are less likely to invest more time and effort in searching and bargaining, therefore, are likely to pay more.

The relative financial position of the buyer can also be proxied by payment methods used by the house buyer, i.e. mortgage or cash. House buyers who purchase the house with a mortgage have a higher overall cost of the property which may affect the price a buyer is able to pay (Turnbull & Sirmans, 1993). In sum, the buyer’s financial positions affect the prices and explain part of price differences in the transaction prices (e.g. Harding et al., 2003a and b; Kestens et al., 2006, Qiu et al., 2020). However, these studies do not examine whether the financial position affects the different buyer groups differently.

Internet as one of the search tools in the transaction process should increase efficiency in housing markets by providing information for house buyers and reducing information asymmetry. Internet use increases the buyer’s search duration and intensity. Young potential buyers are found to use the Internet more than their older counterparts (Larsen et al., 2008; Zumpano et al., 2003) used the survey data to investigate whether the use of the Internet can increase the market efficiency in the US. and found that the search costs are reduced and search intensity is increased, the efficiency can be enhanced. Their findings are supported by a similar reach by Richardson & Zumpano (2012). However, the authors also raised an issue about market efficiency. They argued that if Internet search could not reduce search time or help to find a lower price house, that is, a buyer searching on the Internet was not compensated, this would be inefficient. But these studies do not address this research question. Ling et al., (2018) studied the transaction prices and local buyers in the US commercial real estate market. Though they did not explicitly investigate the impact of the use of the Internet on the transaction price, they found that the use of a real estate broker increases the acquisition prices of buyers.

In summary, the existing literature finds that information asymmetry exists in the housing market. There is a price premium/discount paid by different buyer groups. A buyer’s financial status affects the price he/she pays for the property. Internet as a search tool could improve search efficiency and reduce information asymmetry, but no significant impact of it on housing prices is found.

3 Data and methodology

The standard hedonic model is employed to estimate the effect of house buyer’s characteristics on housing transaction prices.

Our model builds on prior search models such as Lambson et al., (2004), Ihlanfeldt & Mayock (2012) and Chinloy et al., (2013). We modify prior models by including more buyer’s characteristics such as residence, prior market experience and acquisition motivation, financial ability and search method to account for trade-off between buyer’s characteristics and their impact on transaction prices. The hedonic model is constructed as follows.

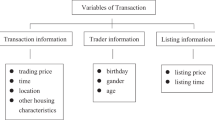

P is the sale price per sq. m taking the nature logarithm form. X are building attributes with parameter β including location attributes and submarket controls. H are the buyer’s characteristics and γ is the parameter. The house buyer’s characteristics are buyer’s residence to isolate local and non-local buyers; experience and motivation, i.e. less experienced first time buyer and more experienced repeat buyer for upgrading, buyer/investor; buyer’s demographic factors such as age and financial strength proxied by paying the acquisition with mortgage or cash and single or joint buyer and the search methods, i.e. internet use or traditional method. It is anticipated that non-local buyers pay a premium in acquisition price; less experienced first-time buyers may not pay a premium, as they are less wealthy and may search longer. Experienced repeat buyers for upgrading may pay more in order to secure their desired property in a short time horizon. Experienced buyer/ investor may pay less for the houses. The financial constraints negatively affect the bargaining power and transaction price.

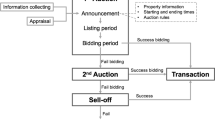

4 Data description

The data are provided by a real estate agency in Guangzhou. The study period is from January 2014 to March 2017. The dataset contains the information of sale date, sale price and a number of physical attributes of housing unit, locational factors and buyer’s characteristics. The physical attributes are the interior size (Size), lift (Lift), the housing unit at the top level (Top) or at the ground level (Ground). Top floor or ground floor indicates the location of the housing unit in a building which may contribute to the price difference. The empirical studies of the price premium of top floor or/and ground floor are inconclusive (Shimizu et al., 2010; Wong et al., 2011), arguing the top floor is quiet and has a higher ceiling, it may command a price premium. but less accessible if the building has no lift, indicating a negative effect on housing prices for the buildings without lifts. The ground floor is more accessible and may have a storage room or garden, though it could have pollution issue. So its impact on price could be positive or negative. Based on these inconclusive findings there are no expected signs of the variables.

The location factors include distance in meters to CBD, primary school (PSCH), middle school (MSCH), metro station (Metro) and the environmental amenities such as the distance to city’s Landmarks, i.e. Pear River (River), Baiyun Mountain Park and other parks (Park). The natural of immobility of houses indicates the existence of spatial heterogeneity exists which contributes to the price variation (Anselin, 2003; Hanink et al. 2012; Wen et al., 2017; Chica-Olmo & Cano-Guervos, 2020). Therefore, we control the issue of spatial heterogeneity by including 10 binary variables concerning 12 submarketsFootnote 2 in Guangzhou. Transaction prices are influenced by the housing market; therefore, we also control the housing market by including quarterly housing price index (HP) for existing apartment in Guangzhou during the study period.

The data record the ID (Hukou) registration place of the homebuyers and the information of buyer’s characteristics, which allows us to identify the status of the buyer (local versus non-local), age, acquisition motivation (owner-occupier versus investor), market experience (first-time buyer versus repeat buyer for upgrading), financial strength (the acquisition is paid with mortgage versus in cash and single buyer versus joint buyer ) and search method (internet versus tradition methods such as real estate agent, word of mouth, advisement in the paper, etc.).

The buyers whose Hukuo, the registration card, is not in Guangdong province are categorized as non-local buyer (Non-local). The reason for such categorization is that Guangdong province has a unique spoken language and indigenous Lingnan culture. It would take time and effort for the people from outside Guangdong provinces to understand these unique local features, which could further increase information asymmetry for non-local buyers. We expect that non-local buyers pay a price premium, as they have an information disadvantage over their local counterparts. Not only do they have to search more intensively, having a higher search cost, but also they may be less knowledgeable of the subtlety of the unique Lingnan culture and custom.

First-time buyer (FTB) is defined as a person who has never purchased a house before. First-time buyers are different from repeat buyers in many aspects. They are younger and have lower income and lower credit scores. The properties they purchase are usually less costly than the properties purchased by repeat buyers (Patrabansh, 2013). Experienced buyers are repeat buyers (RB). They are a former house owner and buy the house for upgrading the size, neighbourhood and accessibility to amenities such as CBD, schools, City’s landmarks such as Pear River, Baiyun Mountain park, and other parks. They are more informed and experienced of the local housing market and have stronger financial power than first time buyer. But they may not necessarily pay less as they usually have a chain, that is, they have to sell their houses to purchase new ones. Especially if they could not find their desirable houses in time, they have to rent a place, which will increase their total costs. So they may be more likely to pay a premium.

The motivation for buyer/occupier is different from buyer/investor (INVE), which may explain the price difference paid. Buyer/investor is an experienced and informative buyer and may be able to identify the underpriced property and pay less than owner/occupier (Larsen et al., 2008 and Neo et al.2008)

Demographic variables are buyer’s age and financial power. Buyer’s age (Age) is identified as one of the demographic factors affecting the price (e.g. Harding et al., 2003b; Ling et al. 2013 and Qiu et al., 2020). Age is calculated as the difference between the transaction year and the buyer’s birth year and takes the natural log form in the test. The buyer’s financial power is proxied by paying the acquisition with a mortgage or one-time cash and single buyer or joint buyer as we don’t have the information of the buyer’s income. It is assumed that buyer who has weak financial power has weaker bargaining power, they will be more likely to shop around and negotiate to find a home they can afford, so they are likely to get a discount. Financial power influences price premium/discount (Harding et al., 2003a, b; Kestens et al., 2006). We expect that the buyer paying the acquisition with a mortgage or a single buyer is more likely to pay a discount.

Method of searching is defined as whether the buyers find the property information on the Internet or via telephone, advertisement in newspaper, house show, word of mouth, branch visit, the traditional methods. The Internet can increase search intensity, therefore reducing information asymmetry. We argue that Internet use can explain price differentials to a certain extent.

Our empirical study focuses on the existing commodity apartment buildings. Affordable houses, self-constructed houses, and privatized houses through the housing reform are excluded from the sample to minimise the bias noise. We discard the observations with missing or abnormal value. There are 13,848 transactions with complete information. Table 1 presents the summary of the variable description and its expected sign.

Sample means for the variables used in our empirical model are reported in Table 2. Column 1 is a full sample. Column 2 is the local buyer and Column 3 is the non-local buyer. The average size of the full sample is 93.24 sq. m. The average size for the local buyer is 90.49 sq. m; while the average size for the non-local buyer is 98.86 sq. m. The unit price for the full sample is RMB 20,734 per sq. m. The unit price paid by local buyer is RMB 20,579 per sq. m, lower than the price paid by the non-local buyer who paid RMB 21,053 per sq. m. The non-local buyers tend to buy bigger houses and pay higher prices than their local counterparts.

In Guangzhou, the buildings built before 1993 have no lift, so the lift variable is used as a proxy of building age. 65% of the buildings in the sample have lifts, indicating they are built after 1993. The differences in the locational attributes are more pronounced between local and non-local buyers. Local buyers tend to buy properties that are closer to CBD, schools, metro stations, and amenities such as Pear River and parks than non-local buyers who chose more distant locations from these amenities.

33% of the house buyers are out-of-province buyers. The average age of house buyers in the full sample is 35.3 years old. The average age is 35.59 years for the local buyer and 34.70 year, for the non-local buyer.

60% of the buyers are first-time buyers (FTB), 60% of local buyers are first-time buyers as shown in column 2; while 61% of non-local buyers are first-time buyers as seen in column 3. This ratio is comparable to some studies of US city such as Reno (Song, 1995) and European city such as Stockholm (Wilhelmsson, 2008). The repeat buyers for upgrading (RB) or investment (INVE) represent 29% or 11% respectively in the full sample. The proportions of local repeat buyer and investors are 29% and 7%. 29% of non-local buyers are repeat buyers and 6% are investors.

70% of buyers paid their acquisitions with a mortgage. 69% of local buyers purchased the houses with a mortgage, compared to 73% non-local buyers as shown in columns 2 and 3. 35% of buyers are joint buyers, so is it for local buyers as shown in column 2. 34% of nonlocal buyer are a joint buyer as shown in column 3.

Internet use for house buyers in the searching process is not as widespread as in some developed western countries like the UK and the USA. For example, according to the 2009 National Association of Realtors (NAR) Profile of Home Buyers and Sellers in the USA, 90% of home buyers used the Internet to search for houses. Traditional methods such as real estate agency, words of mouth, house shows, advertisements in the newspaper, branch visits, etc. are still the major channels to disseminate the information of the properties on sale in China. In our sample, only 31% of buyers used the Internet to search houses on sale. This ratio is the same for the local buyer (31%). More non-local buyers (33%) use the Internet to search for the houses on the market.

Table 3 reports a descriptive summary of the study variables of different buyer groups. Column 1 reports first-time buyer (FTB), column 2 is repeat buyer for upgrading (RB) and column 3 is buyer/investor (INVE). It can be seen that there are systematic differences in the observables of the different buyer groups. FTB selects the most distant locations to CBD, schools, metro stations, and amenities, pays the lowest unit price (RMB 18,902 per sq. m). They are the youngest (33.25 years old) and have the weakest financial strength proxied by Jbuyer (20%) and mortgage (78%). It is the group that is more likely to use the Internet (33%).

Repeat buyer (RB) in Column 2 tends to buy the largest house (114.07 sq. m), pay the highest price (RMB 24,589.86 per sq. m), chose the location closer to the amenities than FTB. They are older (38.92 years old) and have stronger financial strength than FTB proxied by Jbuyer (11%) and mortgage (59%). 31% of RB uses the Internet to search for property in the market.

INVE tends to pay less than repeat buyer, buy the smallest house (66.56 sq. m), choose the locations closest to CBD, schools, metro stations, and environmental amenities such as Pear River and parks; They tend to be the oldest (39 years old) and has strongest financial power as shown in Colum 3. 2% of INVE are Jbuyer and only 39% of the purchase with a mortgage. 26% of them use the Internet to search for the property, less than the other two buyer groups.

Tables 2 and 3 show that there are marked differences in buyer’s characteristics among different buyer groups. These differences highlight the importance to examine the relationship between buyer’s characteristics and the transaction prices and the extent to which the price premium/discount observed could be explained by these characteristics.

5 Empirical results

Our study aims to investigate whether and the extent to which house buyer’s characteristics affect housing transaction prices. We control for average by including submarkets and time of sale by fixed effects. The variables of the existing housing price index of Guangzhou, building attributes, location attributes, submarket dummies, and year dummies are controlled but not reported here.

Table 4 reports the regression test results of the impact of the buyer’s characteristics on the housing transaction price. The test results with all control variables are reported in Appendix. There are three model specifications. In each of the specifications, the natural logarithm of the sale price per sq. m is expressed as a function of the test variables identified to affect the house sale prices. Specification 1 is the base model; the control variable is non-local buyer. In specification 2, the variables of different buyer groups, i.e. first-time buyer (FTB), repeat buyer for upgrading (RB,) and buyer/investor (INVE) are included for the test. Specification 3 reports the results of non-local FTB, non-local RB, and non-local INVE to test the effect of locality on different buyer groups. The primary focus of the paper is whether the different types of buyers pay the same price for a given property.

The estimated coefficients of the non-local variable in Specification 1 and 2 are positive and statistically significant at a 1% level, suggesting that non-local buyers pay a 1.2% premium for identical housing. This finding is in accord with the theory and other research findings that the locality of house buyers affects the transaction prices (e.g. Lambson et al., 2004; Ihlanfeldt & Mayock, 2012; Neo et al., 2008; and Zhou et al., 2015) as they have information disadvantage over their local counterparts about the local housing market.

In Specification 2, the coefficient of FTB is negative and statistically significant, indicating the first time buyer pays significantly less than other groups of buyers. The coefficient of RB is positive and statistically significant, suggesting that repeat buyers who upgrade the size, neighbourhood or location pay a price premium. The coefficient of INVE is negative but insignificant.

Specification 3 includes the non-local FTB, non-local RB and non-local INVE. The coefficient of non-local FTB is negative, but becomes statistically insignificant now when the locality is considered. The coefficients of non-local RB and INVE are positive and statistically significant, indicating both of them pay a premium, higher than the average ones paid by RB and INVE as shown in Specification 2. The finding provides further evidence that the locality of buyers matters and its impact varies with different non-local buyer groups, as not all non-local buyer groups pay a premium. The locality factor seems to affect the prices paid by repeat buyer and buyer/investor more significantly than a non-local first-time buyer.

Next, we explore whether and the extent to which the influence of buyer demographics and search method on the price discount/premium by different buyer groups. Buyer’s demographic characteristics are age and financial strength proxied by mortgage or cash and single buyer or joint buyer.

Table 5 reports the regression test results. The buyer’s purchase power is subject to their financial status and ability measured by paying the acquisition with mortgage or cash and single buyer or joint buyer. If the house is purchased by joint buyer, the financial strength of buyers may be relatively stronger than by a single buyer. Therefore, the variable of joint buyer is included as a proxy of the buyer’s financial strength. The buyers paying with a mortgage or single buyer should have relatively weaker purchase power than the ones paying in cash or joint buyer, therefore they may pay less for a property than their counterparts paying in cash or joint buyer.

Specification 1 in Table 5 is the base model, showing the results of the impact of age, financial strength proxied by mortgage and joint buyer and Internet use on the transaction price. The coefficient of the non-local buyer remains positive and statistically significant, the same as the ones in Specification 1 and 2, Table 4. The coefficient of mortgage is negative and statistically significant; indicating the house buyer paying the purchase with mortgage pay a significantly lower price than the one paying in cash. The coefficient of Jbuyer is positive but insignificant. The coefficient of Age is positive but insignificant. The coefficient of the Internet is negative and insignificant, indicating that Internet use itself has no significant impact on the prices.

Specification 2 in Table 5 reports the test results of the interaction terms of the mortgage and different buyer groups, i.e. FTBxMor, RBxMor and INVExMor to test the contribution of financial strength to the differences of price discount/premium paid by different buyer groups. The coefficient of FTBxMor is negative and statistically significant. The coefficients of RBxMor and INVExMor are positive and statistically significant. Compared with the results in Specification 2, Table 4, the coefficient of FTBxMor, -0.013 is greater than the one of FTB, -0.008, indicating the increase of the discount paid by FTB with a mortgage. The coefficient of RBxMor,0.013 is smaller than RB, 0.021 as a whole indicating the reduction of the premium paid by RB with a mortgage. The coefficient of INVExMor is positive and significant, indicating the increase in premium. The motivation of buyer/investor is different from buyer/occupier; the role the gear plays in the acquisition is different. Buyer/investor uses gearing to boost their purchase and investment return. The results indicate that financial strength affects the bargaining power of different types of buyers and can increase price discounts or reduce premiums.

Specification 3 in Table 5 reports the test results of the interaction terms of the mortgage and different non-local buyer groups, i.e. Non-local FTBxMor, Non-local RBxMor and Non-local INVExMor. Interestingly, the coefficient of non-local FTBxMor is negative and becomes statistically significant now, compared with the result in Specification 3, Table 4 that the coefficient of non-local FTB is insignificant, indicating that financial strength causes a significant increase in price discount to the non-local FTB. The coefficients of non-local RBxMor and non-local INVExMor are positive and statistically significant. Compared with the results in Specifications 3, Table 4, the non-local RBxMor pay a premium of 1.9%, smaller than the non-local RB’s average one of 2.7%. However, the premium paid by non-local INVExMor is 3.8%, higher than the non-local INVE’s average one of 2.2%, indicating the strong impact of financial strength on the differences of price premium paid by two different buyer groups.

If the mortgage is used as the proxy of buyer’s financial ability, the first-time buyers or repeat buyers who paid the acquisition with a mortgage would get a higher discount or pay a lower premium than their counterparts paying in cash respectively, especially for non-local FTB with a mortgage who pays a price discount than otherwise. The investors are an exception. The investors, regardless of their locality, would gear up their financial strength through mortgage and pay a higher price for their desirable property. Thus, the test results provide strong evidence that financial strength affects the different buyer groups differently and could explain the variation in the discount/premium.

Specification 4 reports the test results of the interaction terms of different non-local buyer groups with a mortgage and using the Internet, i.e. Non-local FTBMorxInt, Non-local RBMorxInt and Non-local INVEMorxInt to test whether the search method could further contribute to the differentials of discount/premium paid by different non-local buyer groups and reduce the information asymmetry for non-local buyers after controlling the financial constraints. The coefficient of Non-local FTBMorxInte is negative and statistically significant. The coefficient of Non-local RBMorxInte is positive and statistically significant. Comparing with the results in Specification 3, Table 5, we can see that the discount paid by non-local FTB with a mortgage and using the Internet is increased; while the premium paid by non-local RB with a mortgage and using the Internet is reduced. The results provide the evidence that Internet use itself could not have a significant effect on the transaction price, but combined with the variables of financial constraints, the effect of the Internet use on the differentials of price discount/premium paid is significant, indicating Internet use can reduce information asymmetry for non-local buyers and can improve the market efficiency.

VIFs of all independent variables are less than 10, but are not reported here. Thus, these statistical results indicate that all independent variables are independent relatively and the multicollinearity issue does not affect our estimations.

Robustness Test

Following Ong et al., (2006), Samaha & Kamakura (2008), it is assumed that a buyer has a reservation price, P* for a housing unit i, which is determined by a bundle of housing attributes and locational characteristics. The actual transaction price paid by a buyer could be expressed as.

Where ε is the residual value. The hedonic model captures the value of housing attributes and locational characteristics, but not the buyer’s characteristics which may be fetched by the error term and contribute to the housing price variation. Therefore, the residual value could include the price discount/premium determined by a buyer’s characteristics. The binary variable is designed in the probit model that has the value of 1 if the property has a premium and 0 otherwise. The test results are reported in Table 6.

Probit regression results are consistent with the ones in Tables 3 and 4, reinforcing the traditional hedonic regression test results above.

6 Conclusion

The empirical results show that house buyer’s characteristics affect the transaction prices in the residential market in Guangzhou, China and information asymmetry exists. The market efficiency can be improved by encouraging the use of the Internet to search for property in the market, especially for information disadvantageous non-local buyers. Once we controlled for observed and unobserved house heterogeneity, locational features, and housing market, non-local buyers pay a premium. Generally, less experienced first-time buyer gains a discount. The explanation for this is first-time buyers may search longer and have financial constraints, so they pay lower prices.

Secondly, we find that the motivation of acquisition plays an important role in price differentials. Experienced repeat buyers for upgrading tend to pay a premium, irrelevant of their locality. The repeat buyers are older and have stronger financial power than first-time buyers. They may have higher search costs and a short time horizon. Thus, they tend to purchase in haste or in their desired neighbourhood. Since upgrading the size or neighbourhood is the motivation of the acquisition, the house buyers for upgrading buy larger houses than the first-time buyer and buyer/investor and purchase the properties relatively in proximity to CBD, schools, metro stations and environmental amenities.

We also find mortgage as a proxy of the financial strength of house buyers plays a significant role in price differentials. The buyers financing the acquisition with a mortgage have strong bargaining power and pay a significantly lower price than the buyers paying in cash regardless of the locality except for non-local buyer/investor who seems to behave differently. The price effect of a mortgage is more pronounced for the non-local first-time buyer who pays a discount, compared with their counterpart paying in cash. This finding confirms that the financial constraints contribute to the differentials of price discount/premium paid.

Internet use itself is not found to have a significant impact on the price. When combined with the factors of locality and financial strength among different buyer groups, it is found that Internet use could increase the discount paid or reduce the premium for a non-local first-time buyer or non-local repeat buyer, indicating Internet use can reduce information asymmetry for the non-local buyers, especially the non-local buyers with financial constraints. This finding is important to improve the market efficiency in China as at the moment, the Internet as a search tool in the process of housing transaction is not widely used in the housing market in China. One of the reasons is the accuracy of the housing information disclosed on the Internet, as the seller could list his/her property on the Internet without having to accurately disclose the information of the property. This could discourage some house buyers from searching the properties on the Internet. Therefore, it’s necessary to establish a system or a generally accepted practice to regulate information disclosure on the Internet and increase the credibility of the information disclosed. This will attract more people to use the Internet as a search tool and improve market transparency. Improving real estate agent’s capability to understand e-business process and establish pivotal websites that are user friendly and without restrictions on area covered or/and listing duration also could help improve market efficiency.

Notes

Beijing, Shanghai, Guangzhou, and Shenzhen are China’s Tier 1 cities. These four cities boast China’s most developed economies and biggest transport infrastructure. These cities have a major political and cultural influence in the country.

3 small-sized submarkets are grouped in one submarket.

References

Anselin, L. (2003). Spatial externalities, spatial multipliers and spatial econometrics. International Regional Science Review, 26, 153–166

Baryla, E., & Zumpano, L. (1995). Buyer search duration in the residential real estate market: the role of the real estate agent. The Journal of Real Estate Research, 10(1), 1–13

Chica-Olmo, J., & Cano-Guervos, R. (2020). Does my house have a premium or discount in relation to my neighbors? A regression-kriging approach. Socio-Economic Planning Sciences, 72, 100914

Chinloy, P., Hardin, W., & Wu, W. (2013). Price, place, people, and local experience. Journal of Real Estate Research, 35(4), 477–505

Colwell, P. F., & Munneke, H. J. (2006). Bargaining strength and property class in the office markets. Journal of Real Estate Finance and Economics, 33, 197–213

Hanink, D. M., Cromley, R. G., & Ebenstein, A. Y. (2012). Spatial variation in the determinants of house prices and apartment rents in China. Journal of Real Estate Finance and Economics, 45, 347–363. https://doi.org/10.1007/s11146-010-9262-3

Harding, P., Rosenthal, S. S., & Sirmans, C. F. (2003a). Estimating bargaining power in the market for existing homes. Review of Economics and Statistics, 85(1), 78–88

Harding, P., Knight, J., & Sirmans, C. F. (2003b). Estimating bargaining effects in hedonic models: evidence from the housing market. Real Estate Economics, 31(4), 601–622

Ihlanfeldt, K., & Mayock, T. (2012). Information, search, and house prices: revisited. Journal of Real Estate Finance and Economics, 44, 90–115

Kestens, Y., Thériault, M., & Des Rosiers, F. (2006). Heterogeneity in hedonic modelling of house prices: looking at buyers’ household profiles. Journal of Geographical System, 8, 61–96

Lambson, V., McQueen, G., & Slade, B. (2004). Do out-of-state buyers pay more for real estate? An examination of anchoring-induced bias and search costs. Real Estate Economics, 32(1), 85–126

Larsen, J. E. (2010). The impact of buyer-type on house price: some evidence from the USA. International Journal of Housing Markets and Analysis, 3(1), 60–68.

Larsen, J., Coleman, J., & Gulas, C. (2008). Using public perception to investigate real estate brokerage promotional outlet effectiveness. Journal of Real Estate Practice and Education, 11(2), 159–177

Ling, D., Naranjo, A., & Petrova, M. (2018). Search costs, behavioral biases, and information intermediary effects. Journal of Real Estate Finance and Economics, 57, 114–151. DOI https://doi.org/10.1007/s11146-016-9582-z

Maclennan, D. (1982). Housing Economics: An Applied Approach. London: Longman

Neo, P., Ong, S., & Tu, Y. (2008). Buyer exuberance and price premium. Urban Studies, 45(2), 331–345

Ong, S. E., Neo, P. H., & Spieler, A. C. (2006). Price premium and foreclosure risk. Real Estate Economics, 34(2), 211–242

Ortalo-Magné, F., & Rady, S. (2006). Housing market dynamics: on the contribution of income shocks and credit constraints. The Review of Economic Studies, 73(2), 459–485. https://doi.org/10.1111/j.1467-937X.2006.383_1.x

Patrabansh, S. (2013). A study of first-time homebuyers. Washington, DC: Mortgage Market Note 13 – 1, Federal Housing Finance Agency

Qiu, L., Tu, Y., & Zhao, D. (2020). Information asymmetry and anchoring in the housing market: a stochastic frontier approach. Journal of Housing and the Built Environment, 35, 573–591. https://doi.org/10.1007/s10901-019-09701-y

Richardson, H., & Zumpano, L. V. (2012). Further assessment of the efficiency effects of Internet use in home search. Journal of Real Estate Research, 34(4), 515–548

Samaha, S. A., & Kamakura, W. A. (2008). Assessing the market value of real estate property with a geogaphically weighted stochastic frontier model. Real Estate Economics, 4, 717–751

Shimizu, C., Takatsuji, H., & Ono, H. (2010). Structural and temporal changes in the housing

market and hedonic housing price indices.International Journal of Housing Markets and Analysis3 (4),351–368

Shui, J., & Murthy, S. (2019). Under what circumstances of first-time homebuyers overpay? Journal of Real Estate Research, 411 (1), 107–145.Song, S. (1995). Determinants of bargaining outcome in single-family housing transaction: an empirical examination. Urban Studies, 32 (3), 605–614

Song, H. (1998). Homebuyers’ characteristics and selling prices. Applier Economics Letters, 1, 11–14

Steegmansa, J., & Hassinka, W. (2017). Financial position and house price determination: an empirical study of income and wealth effects. Journal of Housing Economics, 36(June), 8–24

Tellis, G. J., & Wernerfelt, B. (1987). Competitive price and quality under asymmetric information. Marketing Science, 6, 240–253

Turnbull, G. K., & Sirmans, C. F. (1993). Information, search, and house prices. Regional Science and Urban Economics, 23, 545–557

Watkins, C. (1998). Are new entrants to the residential property market informationally disadvantaged? Journal of Property Research, 15, 57–70

Wen, H., Jin, Y., & Zhang, L. (2017). Spatial heterogeneity in implicit housing prices: evidence from Hangzhou, China. International Journal of Strategic Property Management, 21(1), 15–28. doi:https://doi.org/10.3846/1648715X.2016.1247021

Wilhelmsson, M. (2008). Evidence of buyer bargaining power in the Stockholm. Real Estate Research, 30(4), 475–498

Wong, S. K., Chau, K. W., & Yau, Y. (2011). Property price gradients:The vertical dimension

Journal of Housing and the Built Environment, 26, 33–45

Zhou, X., Gibler, K., & Zahirovic-Herbert, V. (2015). Asymmetric buyer information influence on price in a homogeneous housing market. Urban Studies, 52(5), 891–905

Zumpano, L. V., Johnson, K. H., & Anderson, A. (2003). Internet use and real estate brokerage market intermediation. Journal of Housing Economics, 12(2), 134–150

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

We confirm thereby that. • The research has not received any funding. • There is no disclosure of potential conflicts of interest. • The research is not involving Human Participants and/or Animals. • Informed consent is not applicable.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Jia, S., Ke, Q. Heterogonous buyers and housing transaction prices: a case study of Guangzhou, China. J Hous and the Built Environ 38, 1099–1118 (2023). https://doi.org/10.1007/s10901-022-09974-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-022-09974-w