Abstract

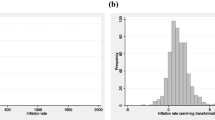

We propose a new explanation for the decoupling of official and perceived inflation based on relative consumption concerns. In presence of high inequality, when the consumers’ reference point of consumption is more distant to reach, a tight budget constraint is likely to be misperceived as a currency’s loss of purchasing power. Using data from a set of 15 European countries in the period 1990-2008, we estimate the effect of inequality on inflation perception. Our research design exploits the exogenous variation in inequality induced by the reduction in social expenditure that accompanied the implementation of the convergence criteria set up by the Maastricht treaty, in the years preceding the Euro changeover. Our results confirm that an increase in inequality significantly affects the deviation of inflation perceptions from actual inflation.

Similar content being viewed by others

Notes

See also King et al. (2001).

Results are not reported but are available upon request.

References

Adriani, F., Marini, G., Scaramozzino, P.: The inflationary consequences of a currency changeover on the catering sector: Evidence from the michelin red guide. Oxf. Bull. Econ. Stat. 71(1), 111–133 (2009)

Agnello, L., Sousa, R.M.: How do Banking Crises Impact on Income Inequality? Review of Income and Wealth (2013)

Alesina, A., Di Tella, R., MacCulloch, R.: Inequality and happiness: are Europeans and Americans different? J. Public Econ. 88(9-10), 2009–2042 (2004)

Andersson, M., Masuch, K., Schiffbauer, M.: Determinants of inflation and price level differentials across the euro area countries. Working Paper Series 1129, European Central Bank (2009)

Angelini, P., Lippi, F.: Did prices really soar after the euro cash changeover? Evidence from ATM withdrawals. In: Del Giovane, P., Sabbatini, R. (eds.) The Euro, Inflation and Consumers’ Perceptions, Springer, pp 109–124 (2008)

Atkinson, A.B., Piketty, T., Saez, E.: Top incomes in the long run of history. J. Econ. Lit. 49(1), 3–71 (2011)

Ball, L.M., Furceri, D., Leigh, D., Loungani, P.: The Distributional Effects of Fiscal Consolidation. IMF Working Papers 13/151, International Monetary Fund (2013)

Barro, R., Lee, J.-W.: A new data set of educational attainment in the world, 1950-2010. J. Dev. Econ. 104, 184–198 (2010)

Becker, S.O., Woessmann, L.: Was weber wrong? a human capital theory of protestant economic history. Q. J. Econ. 124(2), 531–596 (2009)

Bertola, G.: Inequality, integration, and policy: issues and evidence from emu. J. Econ. Inequal. 8(3), 345–365 (2010)

Biau, O., Dieden, H., Ferrucci, G., Friz, R., Lindén, S.: Consumers Quantitative Inflation Perceptions and Expectations in the Euro Area: an Evaluation. Tech. rep., Mimeo (2010)

Blanchflower, D.G., Kelly, R.: Macroeconomic literacy, numeracy and the implications for monetary policy (2008)

Bogliacino, F., Maestri, V. Changing Inequalities in Rich Countries: Analytical and Comparative Perspectives. In: Salverda, W., Nolan, B., Checchi, D., Marx, I., McKnight, A., Tóth, I.G., van de Werfhorst, H. (eds.) : Increasing Economic Inequalities? pp 14–48. Oxford University Press, Oxford (2014)

Bogliacino, F., Ortoleva, P.: The Behavior of Other as a Reference Point. DOCUMENTOS DE TRABAJO - ESCUELA DE ECONOMA 013611, UN - RCE - CID (2015)

Bouvet, F.: Emu and the dynamics of regional per capita income inequality in europe. J. Econ. Inequal. 8(3), 323–344 (2010)

Bowdler, C., Nunziata, L.: Trade openness and inflation episodes in the OECD. J. Money, Credit, Bank. 38(2), 553–563 (2006)

Bowdler, C., Nunziata, L.: Inflation adjustment and labour market structures: Evidence from a multi-country study. Scand. J. Econ. 109(3), 619–642 (2007a)

Bowdler, C., Nunziata, L.: Trade union density and inflation performance: Evidence from OECD panel data. Economica 74(293), 135–159 (2007b)

Brickman, P., Campbell, D.T.: Hedonic relativism and planning the good society. In: Apley, M.H. (ed.) Adaptation-level theory: A symposium, pp 287–305. Academic Press, Michigan (1971)

Bruni, L.: Civil Happiness: Economics and Human Flourishing in Historical Perspective. Routledge (2009)

Caporale, G.M., Kontonikas, A.: The euro and inflation uncertainty in the european monetary union. J. Int. Money Financ. 28(6), 954–971 (2009)

Cestari, V., Del Giovane, P., Rossi-Arnaud, C.: Memory for prices and the euro cash changeover: an analysis for cinema prices in Italy. In: Del Giovane, P., Sabbatini, R. (eds.) The Euro, Inflation and Consumers’ Perceptions, Springer, pp 125–156 (2008)

Del Giovane, P., Fabiani, S., Sabbatini, R.: What’s behind ’inflation perceptions’? A survey-based analysis of Italian consumers. In: Del Giovane, P., Sabbatini, R. (eds.) The Euro, Inflation and Consumers’ Perceptions, Springer, pp 13–49 (2008)

Del Giovane, P., Sabbatini, R.: Perceived and measured inflation after the launch of the euro: explaining the gap in Italy. In: Del Giovane, P., Sabbatini, R. (eds.) The Euro, Inflation and Consumers’ Perceptions, Springer, pp 13–49 (2008)

Di Tella, R., Haisken-De New, J., MacCulloch, R.: Happiness adaptation to income and to status in an individual panel. J. Econ. Behav. Organ. 76(3), 834–852 (2010)

Duesenberry, J.S.: Income saving and the Theory of Consumer Behaviour. Harvard University Press, Cambridge (1949)

EC: Joint EU Harmonised Programme of Business and Consumer Surveys. User guide, European Commission (2014)

Ehrmann, M.: Rational inattention, inflation developments and perceptions after the euro cash changeover. Working Paper Series 588, European Central Bank (2006)

Ferrer-i Carbonell, A.: Income and well-being: an empirical analysis of the comparison income effect. J. Public Econ. 89(5-6), 997–1019 (2005)

Fluch, M., Stix, H.: Perceived inflation in austria extent, explanations, effects. Monetary Policy & the Economy, (3), 2247 (2005)

Frank, R.H., Levine, A.S., Dijk, O.: Expenditure cascades. Review of Behavioral Economics 1(12), 55–73 (2014)

Gaiotti, E., Lippi, F.: Pricing behavior and the introduction of the euro: Evidence from a panel of restaurants in italy. Giornale degli Economisti 63(3-4), 491–526 (2004)

Genicot, G., Ray, D.: Aspirations and inequality. Econometrica 85(2), 489–519 (2017)

Heckman, J.J.: Causal parameters and policy analysis in economics: a twentieth century retrospective. Q. J. Econ. 115(1), 45–97 (2000)

Herfindahl, O.C.: Concentration in the Steel Industry. Ph.D. thesis, Columbia University (1950)

Hirsch, F.: Social Limits to Growth. Harvard University Press, Cambridge (1976)

Hirschman, A.O.: The paternity of an index. Am. Econ. Rev. 54, 761–762 (1964)

Kahneman, D., Krueger, A.B., Schkade, D.A., Schwarz, N., Stone, A.A.: A survey method for characterizing daily life experience: The day reconstruction method. Science 306(5702), 1776–1780 (2004)

King, G., Honaker, J., Joseph, A., Scheve, K.: Analyzing incomplete political science data: an alternative algorithm for multiple imputation. Am. Polit. Sci. Rev. 95 (1), 49–69 (2001)

Lindén, S.: Quantified Perceived and Expected Inflation in the Euro Area–How Incentives Improve Consumers Inflation Forecasts. In: Joint European Commission-OECD Workshop on International Development of Business and Consumer Tendency Surveys, Brussels (2005)

Malgarini, M.: Quantitative inflation perceptions and expectations of italian consumers. Giornale degli Economisti 68(1), 53–80 (2009)

Marini, G., Piergallini, A., Scaramozzino, P.: Inflation bias after the euro: evidence from the uk and italy. Appl. Econ. 39(4), 461–470 (2007)

Mezulis, A.H., Abramson, L.Y., Hyde, J.S., Hankin, B.L.: Is there a universal positivity bias in attributions? a meta-analytic review of individual, developmental, and cultural differences in the self-serving attributional bias. Psychol. Bull. 130(5), 711–747 (2004)

Moon, Y.: Dont blame the computer: When self-disclosure moderates the self-serving bias. J. Consum. Psychol. 13(12), 125–137 (2003)

Niehues, J.: Social Spending Generosity and Income Inequality: A Dynamic Panel Approach. IZA Discussion Papers 5178, Institute for the Study of Labor (IZA) (2010)

Oster, E.: Unobservable selection and coefficient stability. Theory and evidence. Journal of Business & Economic Statistics, forthcoming (2016)

Piketty, T., Saez, E.: Income inequality in the united states, 1913-1998. Q. J. Econ. 118(1), 1–39 (2003)

Rubin, D.: Multiple Imputation for Nonresponse in Surveys. Wiley, New York (1987)

Solt, F.: Standardizing the world income inequality database*. Soc. Sci. Q. 90 (2), 231–242 (2009)

Staiger, D., Stock, J.H.: Instrumental variables regression with weak instruments. Econometrica 65(3), 557–586 (1997)

Stiglitz, J.E.: Of the 1%, by the 1%, for the 1%. Vanity Fair (2011)

Stolper, W.F., Samuelson, P.A.: Protection and real wages. Rev. Econ. Stud. 9(1), 58–73 (1941)

Stutzer, A.: The role of income aspirations in individual happiness. J. Econ. Behav. Organ. 54(1), 89–109 (2004)

Tóth, I.G.: Rivisiting Grand Narratives of Growing Inequalities: Lessons from 30 Country Studies. In: Salverda, W., Nolan, B., Checchi, D., Marx, I., McKnight, A., Tóth, I.G., van de Werfhorst, H. (eds.) Changing Inequalities and Societal Impacts in Rich Countries: Thirty Countries’ Experiences, pp 11–47. Oxford University Press, Oxford (2014)

Veblen, T.: The Theory of the Leisure Class: An Economic Study of Institutions. MacMillan (1899)

Woo, J., Bova, E., Kinda, T., Zhang, Y.S.: Distributional Consequences of Fiscal Consolidation and the Role of Fiscal Policy: What Do the Data Say? IMF Working Papers 13/195, International Monetary Fund (2013)

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Multiply imputed data estimations

The SWIID data on inequality is unique in providing information on inequality in different countries, calculated upon a uniform set of assumptions and definitions on harmonized microdata. The data construction is subject to a trade-off between comparability across countries and coverage of country/years cells, resolved through a multiple-imputation procedure (Solt 2009). Such procedure introduces some noise in the inequality data, but one of the advantages of the SWIID dataset is that the researcher can appreciate the extent of such noise through the availability of 100 different imputed time series for inequality in each country. As a consequence, we can perform our analysis on SWIID data using two different approaches. The uncertainty introduced by multiple imputation can be resolved by simply averaging the 100 inequality series available for each country, as done in the tables above. Alternatively, we also estimated all models using Rubin (1987)’s approach, i.e. by estimating one separate model on each of the 100 inequality series, through multiple Monte Carlo simulations, and then pooling our set of 100 estimates by averaging the outcomes.Footnote 1 Our findings are strongly consistent under the two approaches, and we do not find any appreciable difference in our estimates. If anything, the estimates obtained though Monte Carlo simulations tend to deliver larger point estimates and t-statistics. The F-statistics of weak instruments tend instead to be slightly smaller, but well above the threshold of 10 indicated by Staiger and Stock (1997) as the criterion for testing for instrument weakness when the parameters are just identified.Footnote 2

Appendix B: Additional tables

Rights and permissions

About this article

Cite this article

Filippin, A., Nunziata, L. Monetary effects of inequality: lessons from the euro experiment. J Econ Inequal 17, 99–124 (2019). https://doi.org/10.1007/s10888-018-9395-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10888-018-9395-9