Abstract

By the end of the Second World War, an estimated 20% of the West German housing stock had been destroyed. Building on a theoretical life-cycle model, this paper examines the persistent consequences of the war for individual wealth across generations. As our empirical basis, we link a unique historical dataset on the levels of wartime destruction in 1739 West German cities with micro data on individual wealth at the beginning of the twenty-first century from the German Socio-Economic Panel. Among individuals born in cities or villages that were badly damaged during the Second World War, wealth is still about 10% lower today. Similarly, the destruction of parental birthplace has significant negative implications for the wealth of their descendants. These negative implications are robust after controlling for a rich set of pre-war regional and city-level control variables. In complementary empirical exercises, we study potential channels such as inheritances, health, and education, through which the wartime destruction could have affected wealth accumulation across generations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The war in Ukraine, which began on February 24, 2022, has once again shown the world the immediate consequences of war: Death, life-altering injuries, famine, flight, and displacement; all accompanied by enormous destruction of public infrastructure, businesses, and housing. But are there persistent consequences of war for wealth accumulation in the long term across generations? This paper examines the long-term implications of the Second World War, arguably one of the biggest shocks in European/Western history, for individual wealth—the key determinant of material well-being besides income. More precisely, it investigates whether the bombardments during the Second World War in Germany reverberate, across generations, in individuals’ current wealth at the beginning of the twenty-first century (wealth “today”).

During the Second World War, Allied bombs destroyed about 20% of the housing stock in Germany (The United States Strategic Bombing Survey, 1945). The extent of destruction varied greatly, even across narrow regional entities and entities with similar economic strength. We use this regional variation as well as an instrumental variable approach as means of identification. Our focus is on two generations. The first generation was born between 1931 and 1945, thus having direct experience with war. The second generation are their children, who were indirectly affected by the war’s destruction through their parents.

Destruction during the Second World War may affect current wealth through several channels. As we show in a dynamic model of individual wealth accumulation, a direct channel operates through the initial endowment with wealth including inheritances. For example, if the real estate or company of the parents was destroyed, one might expect that this would reduce parental wealth and, via inheritances, the wealth of their children. Another channel goes through health and education, thus affecting the ability to accumulate wealth over the life course. For example, if the bombardments deteriorate physical or mental health and/or damage educational institutions like schools or universities, then human capital declines and, with it, the opportunities to generate income and accumulate wealth.Footnote 1 Other mechanisms are conceivable, such as changes in fertility,Footnote 2 and mortality as well as resettlement and reconstruction programs.

The data requirements for an analysis of the long-term inter-generational consequences of war on wealth are high. A minimum requirement is the availability of historical data on the extent of bombing at high regional granularity, alongside regionally linkable micro-level data on current wealth and birthplaces. For the historical data, we digitized levels of destruction—the share of destroyed pre-war housing stock—for 1739 municipalities based on Gassdorf and Langhans-Ratzeburg (1950). To our knowledge, this is the most detailed database on Second World War destruction in Germany. We enriched these data with historical indicators of regional-level economic performance to reduce the risk of spurious correlation.Footnote 3 We then linked the historical data with present-day data from the German Socio-Economic Panel (SOEP). The SOEP not only provides wealth portfolios of the population today but it also includes respondents’ and their parents’ birthplaces. Hence, it allows present-day wealth holdings of the first and second generation to be linked with past regional destruction.Footnote 4

Based on the linked dataset, we regress current individual wealth stocks on the level of regional destruction, our treatment indicator, and a set of individual- and regional-level covariates. Additionally, to bypass confounding factors, we use the distance between birth region and London (in logs) as an instrumental variable, following Akbulut-Yuksel (2014) and Vonyó (2012). The wealth stock is captured by three variables: net-of-debt wealth (in euros), our broadest wealth measure, net value of primary residence (in euros), probably the most immediate indicator to assess the direct linkage via inherited real estate, and being the owner of primary residence.Footnote 5

Our results suggest that greater wartime destruction has long-term persistent negative consequences for wealth across generations. Controlling for pre-war regional characteristics, estimates from our preferred OLS model for the first generation at the age of around 60 suggest a loss of about 1000 euros for individual net wealth—or 0.53% of the sample average—per additional percentage point of destruction. Notice that, by research design, our findings are conditional upon survival up to “today,” i.e. the year when wealth for generations one and two is first observed in our data.Footnote 6 For the second generation, losses at around age 40 are of similar magnitude, suggesting rather persistent negative consequences of wartime destruction on wealth across generations and life courses. Analyzing the wealth portfolio in more detail, wartime destruction is most detrimental to real estate wealth. As far as the transmission channels are concerned, it turns out that the education channel explains part of the wealth loss for the first cohort. For the second generation, the implications of destruction are channeled partly through lower education and lower earned income.

Our findings relate to a broader literature on the long-term effects of war. However, there are only two studies that we are aware of that analyze the long-term effects on wealth. Kesternich et al. (2014) study how cross-country differences in combat activity during the Second World War in Europe have changed wealth in the long run. Li & Koulovatianos (2020) explore how in utero combat exposure during the Second Sino-Japanese War (1937–1945) and the Chinese Civil War (1946–1950) affects wealth (and health) in later life.Footnote 7 Our study contributes to these previous literatures in several respects. First, and for the first time, we study the long-term consequences of war within Germany, a large economy in Europe. The long-term is also the focus of Li and Koulovatianos (2020). Yet, the Chinese setting is non-comparable to the European in various dimensions.Footnote 8 Second, to the best of our knowledge, our study is the first to examine the persistent effects of the bombardments on wealth across generations. We think this long-term perspective is necessary to better understand the growth and welfare implications of wars. Third, with the exception of Li & Koulovatianos (2020), our study design is causal: Specifically, it exploits heterogeneities in bombardment intensity across neighboring regions that are not just geographically close but also socio-economically and socio-culturally, meaning that our research design follows the idea of an randomly assigned treatment.Footnote 9 Our analysis also relates to studies on the implications of war for individual’s well-being beyond wealth. In addition to the immediate implications for mortality, physical and psychological injury, and physical capital, the literature explores the short- and long-term implications for income, labor demand and supply, health, education, consumption, tax revenue and government spending, population growth, economic growth and productivity, and/or city size.Footnote 10

The remainder of the article is as follows. Section 2 summarizes the historical context and presents a dynamic model of individual wealth accumulation to explain the long-term implications of bombardments on wealth accumulation over the life cycle. Sections 3 and 4 explain our data and methods. Sections 5 provides our empirical findings. Section 6 concludes.

2 Historical context and theoretical framework

2.1 Historical context

2.1.1 The Allied bombing campaign on German territory

The identification strategy in this article relies on regional differences in the extent of property destruction. The destruction resulted from the Allied bombing campaign, a large-scale military operation that started in September 1939 and intensified in the summer of 1942, when the US Army Air Forces entered the war. The air operations inflicted heavy damage on German cities, infrastructure, and industrial centers, destroying about 20% of the German industrial capital and residential housing stock (Albers, 1989). Ultimately, an estimated 370,000–390,000 German civilians were killed by the airstrikes (Groehler, 1990, p. 320).

The Allied air attacks followed three main goals: (1) to damage specific production sites of crucial industries, such as the ball bearing, oil, and aircraft industry; (2) to weaken the morale of the German population through area bombing of residential districts; and (3) to support and clear the way for Allied ground troops on their way to Berlin (The United States Strategic Bombing Survey, 1945; Hampe, 1963a). In particular, the first two goals affected the broader population.Footnote 11 Starting in 1942, area bombing consisted of sending formations of hundreds of planes to cause broad and heavy damage across populated areas within time spans of a few hours. The invasion of Germany after the liberation of France also brought heavy destruction, especially in West German cities along the border to the Netherlands, Belgium, and France. These different goals, in combination with the imprecision of bombardments, introduced an important element of randomness in terms of the populations and regions that were hit.Footnote 12

Most of the planes carrying out the attacks flew from England and, to a minor degree, from Italy and France after their liberations. There were few aerial attacks on Germany from the East, as the Soviet Red Army used their aircraft mainly in support of ground troops and did not strategically attack German cities or industrial centers (Hampe, 1963a). The result was that northwestern regions of Germany suffered more damage than eastern and southern regions. Following Akbulut-Yuksel (2014), we use the distance of the birthplace to London (in logs) for an instrumental variable estimation strategy explained in more detail in Sect. 4.2.

2.1.2 Post-war policies to mitigate war-induced damages

After the war, the German government faced a severe housing and employment shortage, aggravated by the inflow of millions of German refugees from former Eastern territories.Footnote 13

The government responded with a variety of measures, most importantly, the so-called Lastenausgleich. This law was intended to strike a balance between those who had suffered no loss of assets or income and those who had lost assets or livelihood. Furthermore, new jobs and housing were to be created. The law enacted a wealth tax of 50% on assets held in 1948 for those who had suffered no or little damage. However, since there was the possibility of stretching the payments over 30 years and economic growth was high, the resulting immediate burden for the taxpayers was comparatively small. Beneficiaries were compensated for their losses, but only partly. Compensation rates decreased from 100% for damages up to 6200 Reichsmark (approximately 19.000 euros in 2020) to a minimum rate of 3.5% for damages larger than two million Reichsmark.

Between 1949 and 1959, benefits amounting to around 35.4 billion deutschmarks were granted, around 2000 deutschmarks on average for each of the 18 million claimants. To put the benefit in perspective: Gross domestic product in 1949 amounted to about 1700 deutschmarks per capita. Between 1960 and 1988, a further approximated 100 billion deutschmarks were granted (see Albers, 1989; Deutsche Bundesbank, 2019). We expect that the Lastenausgleich and other measures, e.g., subsidized housing and financial support for the construction of new (rental) homes, have cushioned the long-term effects of destruction on wealth.

2.2 The implications of bombardments in a dynamic model of wealth accumulation

This section presents a dynamic model of individual wealth accumulation, where investments in human capital in the form of education and health, and consumption are choice variables. The model allows for distinction between different channels through which a bombardments’ induced destruction early in life alters wealth holdings later in life: A direct channel going through the destruction of the initial wealth endowment (including inherited wealth), and an indirect channel going through individuals’ human capital (a composite of education and health), thus their ability to generate income and build wealth.Footnote 14

Following standard preferences in growth theory, we assume that individuals have an infinite planning horizon and maximize lifetime utility \( \int _0^\infty e^{-\rho t} \frac{U_t^{1-\frac{1}{\eta }}}{1-\frac{1}{\eta }} dt\) with \(U_t \equiv c_t^\chi \left( 1-l_t-\epsilon _t \right) ^{1-\chi }\). The term \(c_t\) denotes consumption, \(l_t\) working hours, and \(\epsilon _t\) the time invested in education and health at age t. The preference parameters \( \rho >0\), \(\eta >1\), \(0<\chi <1\) are constant.Footnote 15 The individual’s inter-temporal budget constraint is \({\dot{w}}_t = \iota w_t + \Pi _tl_t-c_t\), with \(w_t\) denoting wealth, \(\iota \) the interest rate, and \(\Pi _t>0\) a composite labor-productivity stock variable based on health and human capital. Finally, the labor-productivity stock variable changes over time according to \({\dot{\Pi }}_t = \psi \epsilon _t \Pi _t - \delta \Pi _t\), with \(\psi >0\) denoting the productivity of time investment in education and health, \(\epsilon _t\), and \(\delta >0\) a human-capital depreciation factor.

Appendix A provides the complete solution of the model and numerical examples.Footnote 16 Here we focus on the wealth expansion path. Given \(w_0 \in {\mathbb {R}}, \Pi _0 >0\), \( \lim _{t \rightarrow \infty } \lambda _t w_t = \lim _{t \rightarrow \infty } \mu _t \Pi _t = 0\) with Lagrange multipliers \(\lambda _t\) and \(\mu _t\), the dynamics of individual wealth are then

with \(g_{c}\equiv \frac{{\dot{c}}_{t}}{c_{t}}=\frac{{\dot{\Pi }}_{t}}{\Pi _{t}} =\left( \iota -\rho \right) \frac{1}{1-\left( 1-\frac{1}{\eta }\right) \chi }\), the consumption and the endogenous productivity growth rate (equal in equilibrium), and \(\kappa _{\Pi }\equiv 1-\frac{1}{ \psi }\left( g_{c}+\delta \right) -\frac{1}{1-\chi }\left( 1-\frac{\iota +\delta }{\psi }\right) \). As shown in Appendix A, the product, \( \frac{1}{\psi }\left( g_{c}+\delta \right) \), determines the investment in human capital, \(\epsilon _{t}\). Consumption is \(c_{t}=\frac{\chi }{ 1-\chi }\left( 1-\frac{\iota +\delta }{\psi }\right) \Pi _{t}\), and \(\Pi _{t}=e^{g_{c}t}\Pi _{0}\).

What is the impact of a bombardment early in life on wealth accumulation later in life? A direct channel runs through the initial endowment with wealth: All parameters held constant, if the bombardment reduces \(w_{0}\), e.g. because a property was destroyed, the wealth expansion path is shifted downwards. Similarly, if the bombardment lowers the initial endowment with human capital, \(\Pi _{0}\), e.g. because of destruction of educational infrastructure, human capital, \(\Pi _{t}\), decreases.Footnote 17 Yet, there is another channel through which bombardments affect wealth accumulation: They can have a permanent negative effect on the ability to accumulate health and educational outcomes. In the language of the model, the bombardment can (also) lower \(\psi \) (productivity per unit of time investment) and/or it increases \(\delta \) (the depreciation of human capital). Then a bombardment can have an ambiguous effect on wealth in later life, \(w_{t}\).Footnote 18 This is because individuals then increase working hours and time investments in human capital, \(\epsilon _{t}+l_{t}=\frac{\iota +\delta }{\psi }\). However, compared to the non-bombarded individuals, these extra investments reduce leisure, which lowers lifetime utility.

In summary, due to potentially countervailing channels, the implications of the bombardments on wealth accumulation is theoretically an open (and hence an empirical) question. In our empirical analysis, we consider two generations: the first generation is directly exposed to Second World War bombing. It is to this generation that the model directly refers. However, due to the high intergenerational immobility of wealth and other socio-economic outcomes, the model can also serve as a basis for understanding the channels of impact for the second generation.Footnote 19

3 Data

Our study relies on two data sources. The first source is the historical destruction data for German municipalities provided by Gassdorf & Langhans-Ratzeburg (1950) (GLR), enriched with regional control variables capturing the pre- and post-war phases. The second source is the German Socio-Economic Panel (SOEP), which is one of the largest and longest-running multidisciplinary household surveys worldwide (see Goebel et al., 2019). Since 2002, SOEP provides individuals’ present-day wealth, our main outcome variable, and portfolio composition. It also provides georeferenced birthplaces of the respondents and their parents.

3.1 Historical data

3.1.1 Levels of city destruction

The municipality-level destruction data come from Gassdorf & Langhans-Ratzeburg (1950), hereafter referred to as GLR data. It covers all West German municipalities with more than 3000 inhabitants,Footnote 20 and provides the share of destroyed dwellings in 1945 relative to the total number of dwellings in 1939. A dwelling is classified as destroyed if it was more than 50% damaged.Footnote 21 Unfortunately, GLR does not provide destruction information for municipalities in East Germany and the Saarland.Footnote 22

Taking the weighted average using municipalities’ population sizes in 1939, about 29% of the buildings were destroyed. Figure 1 visualizes how destruction varies across Germany.Footnote 23 Each circle indicates one of the 1739 municipalities, with circles being scaled proportionally to the number of inhabitants.Footnote 24 The color of the circles shows the degree of destruction - from municipalities that were not destroyed (light blue) to municipalities that were at least 50% destroyed (dark red). At any level of city size, there is large variation in destruction, which we exploit in our analyses. Furthermore, destruction increases with city size, which we control for in our estimations.

Source: Gassdorf & Langhans-Ratzeburg (1950); own calculations

Share of destroyed housing stock in 1945 for 1739 municipalities with more than 3000 inhabitants. Municipalities are scaled by their population size in 1939

Despite the strengths of the GLR data, it is not free of (possible) limitations. The first limitation is missing coverage of very small municipalities. According to the classified data in the 1939 census, only about 20% of the West German population lived in municipalities with at most 2000 inhabitants.Footnote 25 In our main analyses, we assume that destruction is zero in non-covered municipalities. Appendix I.3 shows that the results are insensitive to the inclusion or exclusion of these municipalities. The second potential limitation is precision of measurement. First, the comparability of destruction shares across municipalities could be limited, since official guidelines for the data collection by the local authorities were provided only as of July 15, 1944.Footnote 26 Second, municipalities could have a monetary incentive to systematically exaggerate the true level of destruction, because the damage reports were relevant for payments under the financial equalization scheme of the Länder and municipalities, as well as for building material and refugee allocations. However, the incentive to exaggerate the level of destruction in order to receive higher transfers exists in all regions. Overall, Hohn (1991) concludes that the quality of the historical data on “total residential building losses should be considered quite high” (p. 35). For the case of the GLR data, comparability was further improved via the correction of “comparison-disturbing moments” (cf. Kästner, 1949, p. 362).Footnote 27

We assess the quality of the GLR data in two respects. First, we compare the GLR data with two more aggregated data sources: The United States Strategic Bombing Survey (1945) and Albers (1989). These sources estimate that 20% of dwelling units were destroyed or heavily damaged, thus indicating a slightly lower level of destruction than the GLR data. This is not surprising given that the GLR data do not contain very small municipalities, which were, on average, destroyed less than larger urban agglomerations. Second, we compare the GLR data with the destruction data for the largest 199 West German cities provided by Kästner (1949).Footnote 28 For these 199 cities, destruction according to both data sources is very similar and correlating highly at 0.85.Footnote 29 Thus, both cross-validations suggest that the GLR data provide valid information on the levels of destruction of German municipalities.

3.1.2 Additional control variables

We consider three types of regional variables to control for pre-war conditions:

-

1.

Economic performance and wealth. To capture regional differences in pre-war economic performance and wealth (measured in 1938), we use administrative data at the level of tax districts on per-capita tax revenues from (a) income, (b) payroll, (c) wealth, and (d) corporate taxes for 516 tax districts covering West Germany and Berlin.Footnote 30

-

2.

Wealth inequality. If shapes of wealth distributions before bombardments differed across regions, small sample sizes might drive our results even after controlling for average regional wealth. As shown in various studies, the right tail of the wealth distribution is Pareto like. We infer the shape parameter (Pareto’s alpha) using administrative pre-war wealth tax data as provided by the Statistisches Reichsamt (1938) and use it as an additional control in the regressions.Footnote 31

-

3.

Population density. To capture structural differences between rural and urban regions, we use population densities at the level of 571 administrative districts—so-called Stadt- and Landkreise—in 1939 from Statistisches Reichsamt (1944).

3.2 SOEP data

The SOEP is recognized for maintaining the highest standards of data quality and research ethics (Goebel et al., 2019). In 2019, the survey covered about 30,000 adults in 20,000 households. Most importantly for our purposes, SOEP provides detailed information on respondents’ wealth portfolios and biographical data, including respondents’ own and their parents’ birthplace. To cope with panel attrition, over time, several refreshment and boost samples have been included to ensure the cross-sectional representativeness of the target population—households in Germany.

3.2.1 Focal SOEP variables

Our analyses build on two core information from the SOEP: wealth and birthplace.

Wealth is surveyed in the SOEP since 2002 using the questionnaire module “my personal balance sheet.” The module includes net (of debt) wealth in euros, whether (or not) the respondent owns the building she occupies, and, if yes, the net-of-debt value of this real estate.Footnote 32 To cope with item-non response, SOEP provides each portfolio component in imputed form.Footnote 33 A unique feature of the module is that each adult household member provides her/his individual (not household-level) wealth holdings.Footnote 34 This allows for direct linkage of an individual’s wealth today with her birthplace in the past. SOEP has surveyed wealth every fifth year since 2002. We convert all values to constant 2002 euros and use for each respondent the information from the earliest possible year to limit the effects of old-age dissaving.Footnote 35 We winsorize net wealth and the net-of-debt value of residential real estate at the 0.1st and 99.9th percentile to reduce potential biases from outliers.

Geocoded birthplaces are required to construct the first- and second-generation estimation samples. Respondents’ own birthplaces are available since 2012. The parental birthplaces are either reported by the respondents in the 2018 survey or by the parents themselves if they participated in the SOEP. The one-time query in 2018 means that the parental birthplace is available only for respondents who did participate in that wave of the study. In addition, the parental place of birth was not collected in two subsamples.Footnote 36

3.2.2 Linking historical and SOEP data

We link the SOEP data with the historical information using georeferenced places of birth. The linkage is at different regional levels. Destruction is linked at the level of the municipalities; the historical economic performance and wealth inequality indicators are linked through the tax district of the birthplace (Brockmann et al., 2023); the historical population densities are linked through district borders (Max Planck Institute for Demographic Research and Chair for Geodesy and Geoinformatics University of Rostock, 2011).

3.2.3 Construction of estimation samples

We study the implications of Second World War bombardments for two generations. The first generation is born after 1930 and before 1946, and did not spend part of their lives in the German Democratic Republic (GDR). Thus, it was directly exposed to the bombings in childhood, but did not experience an additional wealth shock with the creation of a socialist system. For the first generation, we have 4496 cases with valid wealth information, our gross sample (see Table 1). While wealth has been surveyed in the SOEP since 2002, individual birthplaces were first surveyed in 2012 (and in later years for new subsamples). Due to this time gap, panel attrition implies that the individual’s place of birth is often missing, although individual wealth information is available. In total, we lack birthplaces for 2327 individuals. Another 311 cases were not born in West German cities including Berlin, and for 42 cases we lack historical information. As a result, the first-generation estimation sample includes 1816 respondents.

The second generation is born after the Second World War and their parents were treated. Because the parental birthplaces were collected only once (in 2018), we lack this information for many individuals of the second generation. In addition, the information provided by the 2018 respondents is not always complete and they were more often only able/willing to name the place of birth of one parent. For this reason, we construct two second-generation samples. The second-generation sample with paternal treatment consists of SOEP respondents with valid information about the father’s birthplace. Analogously, the second-generation sample with maternal treatment consists of SOEP respondents with valid information about the mother’s birthplace. For each of the two second-generation samples, gross-sample size is about 8100 cases. We apply analogous sample selection criteria as for the first-generation sample. This leaves us with about 1200 cases in each of the two second-generation samples. Figure 2 depicts the temporal sequence of birth, bombing exposure, and wealth surveying for the samples of the first and second generation.Footnote 37

Source: Gassdorf & Langhans-Ratzeburg (1950); own calculations. In panel a, municipalities are scaled by their population size in 1939. In panels b–d, municipalities are scaled by the numbers of respondents in the respective sample

Share of destroyed housing stock in 1945 for municipalities with more than 3000 inhabitants

3.2.4 Descriptive evidence, coverage and selectivity

The differences in case numbers between gross and estimation samples raises the question of sample selectivity. In this regard, there are three important requirements for the generalizability of our findings: that the estimation samples cover (a) all West-German regions, (b) all community sizes, and (c) all levels of destruction.

The four maps in Fig. 3 compare the full set of GLR municipalities with the municipalities covered by our first- and second-generation samples. Panel (a) is identical to Fig. 1, with circles scaled proportionally to population size in 1939. In panels (b–d), the scaling is proportional to the sample-specific numbers of respondents. The panels (b–d) are visually very similar to panel (a), indicating that all subsamples meet the three requirements.

Another important aspect is selectivity. Are the cases excluded from the three gross samples systematically different from the estimation samples? To answer this question, the top panel of Table 2 provides comparisons of today’s characteristics for the estimation samples and the excluded individuals. The first three rows provide the means of the dependent variables in in the regression exercises: net-of-debt wealth, net value of primary residence, and being the owner of primary residence (dummy variable). For all samples, no systematic differences are found between the estimation sample and the excluded individuals. For the first generation, the average net wealth is around 185k euros for the estimation sample and 194k euros for the excluded individuals. In the second generation, in contrast, the excluded cases have somewhat lower average wealth. In both cases, the differences between included and excluded individuals are not significantly different. Furthermore, Appendix C shows that the shapes of the cumulated densities of wealth are very similar for the included and excluded cases. There is also no evidence of stronger selectivities in the other two wealth outcome variables. In addition, Table 2 provides comparisons for individual-level control variables: age at the time of measuring wealth (survey year), birth year, and survey year. Columns 3, 6, and 9 contain Student t-tests with the null hypothesis that the means are the same in the estimation and excluded samples. Although some tests indicate significant differences, especially for birth year and survey year, all differences are quantitatively very small.

The bottom panel of Table 2 provides information on the historical regional information that we use in the regressions. Since the exclusion of SOEP observations results from missing information on their birthplaces, comparisons between the estimation sample and the excluded SOEP respondents are unfeasible. The extent of destruction is about 19% on average for the first-generation sample and slightly lower for the two second-generation samples, at about 18 and 17%, respectively. Thus, after including the small communities whose destruction is set to zero by assumption, the average destruction rates in our samples are very close to the estimates in The United States Strategic Bombing Survey (1945) and Albers (1989).Footnote 38

As shown earlier in this subsection, the estimation samples cover all community size classes very well. Among the first generation, about 21% come from places with fewer than 3000 residents, about 40% from places with 3000–50,000 residents, about six percent from places with 50,000 to 100,000 residents, and another 32% from places with at least 100,000 residents. The distribution for parental birthplaces in the two second-generation samples is very similar. As far as economic performance and regional wealth inequality prior the Second World War are concerned, there are no marked differences between the three estimation samples. For interested readers, Table 11 shows supplementary descriptive statistics on all the historical variables.

4 Methods

By exploiting the variation in destruction, we quantify the persistent implications of the bombardments in the past on wealth accumulation across generations. To do this, we rely on OLS regressions and IV estimations.

4.1 Regression of wealth today on destruction in the past

For the first-generation sample, the basic OLS regression model takes the form,

with \(y_{itm}\) denoting the wealth stock of a respondent i in year t, born in municipality m, in region r. Because the wealth data is multiply imputed, we use Rubin’s rule (Rubin, 1987) in all estimations.

The independent variable, \(D_{m}\), is the percentage share of the destroyed housing stock in a person’s birthplace, m. The proposed coefficient of interest is \(\beta _1.\) If higher destruction in the past implies lower wealth today, \(\beta _1\) will be negative. \(X_i\) is a set of individual-level control variables. One specification includes age and age squared to capture the age-wealth profile, while another specification additionally includes the federal state where the respondent was born to control for regional heterogeneities resulting from, e.g., different developments in real-estate markets. \(D_t\) is a dummy variable indicating the earliest year \(t\in \left( 2002,2007,2012,2017\right) \) when a respondent i’s wealth was surveyed. A potentially important confounding factor is the past economic development of a region that both made bombardment more likely and also affects wealth stocks today. Allied forces indeed targeted specific industries, important infrastructures, and larger cities in general, and it is possible that these factors correlate with post-war growth, affecting income and wealth levels up to the present. To mitigate such effects, we include \( V^{hist}\), a set of variables capturing the pre-war characteristics of the birth region of i: economic performance, economic wealth, wealth inequality, population density, and the municipality size. Finally, \(e_{itm}\) is a random, idiosyncratic error term, clustered at the level of GLR municipalities to account for correlations in wealth between individuals born in the same municipality.

Source: SOEP v37, Brockmann et al. (2023), own calculations

Pre-war wealth and destruction. The figure shows the per-capita wealth tax revenues in 1938 and the average level of destruction for each of the 388 tax districts that are used in the estimations of the first-generation sample. Because a tax district may contain various municipalities with destruction data, the weighted average of destruction is shown, with the weight being the municipality-level population in 1939

To assess the consequences of destruction of the parental birthplace on individual i’s wealth, we build an adapted version of model (1), taking the form,

with p denoting either the maternal or paternal parent. The treatment now is \(D_{m_p}\), the destruction of the paternal or maternal birthplace. Hence, if higher destruction of the paternal (maternal) birthplace in the past implies lower wealth today, \(\beta _1^f\) (\(\beta _1^m\)) will be negative. \(V^{hist}_{m_p}\) captures the pre-war economic development (as defined above) of the birth region of parent p of i. A regression model that incorporates destruction of both the paternal and the maternal simultaneously would be desirable, but comes with a rather low sample size. Table 18 in the Appendix shows that such a model supports the results of model (2).

Although we control for regional differences in pre-war wealth (via wealth tax revenue), its correlation with destruction is of interest for interpreting the OLS results as causal. This correlation is 0.427.Footnote 39 The scatter plot in Fig. 4 shows that this positive correlation results primarily from some districts that remained virtually undestroyed and where tax revenues were very low. Against this background, we complement the OLS with instrumental variables estimations.

Destruction and distance from London (\(1{\text {st}}\) stage of IV). The figure shows all Gassdorf & Langhans-Ratzeburg (1950) municipalities and the zero-imputed municipalities for the first-generation estimation sample. Population-weighted average destruction is calculated using a municipality’s number of inhabitants in 1939 as weight. Source: Gassdorf & Langhans-Ratzeburg (1950); own calculations

4.2 Instrumental variables estimation

Most of the bombing during the Second World War was carried out by planes taking off from England. Following Vonyó (2012) and Akbulut-Yuksel (2014), we use the log of the distance in kilometers between a municipality and London as an instrumental variable.Footnote 40

Figure 5 shows a scatter plot of the distance to London and the degree of destruction. Consistent with the historical sources, it shows a negative correlation (value of − 0.324).Footnote 41 There are several historical reasons why more distant municipalities were bombed less. First, the range of aircraft types was limited, particularly in the early years of the war,Footnote 42 Second, as argued by Hampe (1963b), most regions in Germany offered valuable targets and, from a simple cost-benefit perspective, it was more convenient to attack nearby regions. Third, the course of the war led to British and Americans troops invading from the West, escorted by heavy bombardments that destroyed several municipalities near the western German border.

As regards exogeneity of the instrument, our main concern is that the distance variable picks up peculiarities of German economic geography. For example, the federal state of Bavaria is in one of the richest areas of Germany and is also far from London. To ensure that our estimates are robust to such unintended links, we repeat all estimations in the robustness section excluding specific states.

Regarding the credibility of the exclusion restriction, we want to emphasize that while distance to London is a natural instrument for bombing, it is also been used as a predictor for industrialization.Footnote 43 If the same logic applies for Germany, distance to London also predicts industrialization and development. With the pre-war controls we seek to control this direct channel on development. Furthermore, distance to London is correlated with distance to sea ports in Germany like Hamburg, Bremerhaven, or Kiel, that, in turn, is a proxy for international trade. However, proximity to sea ports would drive up wealth in proximity to London rather than depress it, as bombardments do.Footnote 44

5 The long-run implications of war destruction on wealth holdings

5.1 Estimation results

Results from OLS Table 3 summarizes the results from OLS regressions for the first-generation sample and the two second-generation samples as well as for each of our three dependent variables: net wealth, net value of primary residence, and being a homeowner. It shows results from two specifications differing in the set of control variables contained in X, as detailed in Sect. 4.1. To keep the presentation concise, we show only the estimates of the destruction parameter, \(\beta _1\). Output tables with the complete sets of regression coefficients are found in Appendix E. These show that the other explanatory variables, with the exception of age and the number of inhabitants of the birthplace, have little explanatory power.

For the first generation, all six \({\hat{\beta }}_1\)s in columns (1) and (2) are significant and negative, suggesting that the experience of bombing during childhood lowers wealth holdings in later life. For all three outcomes, the coefficient is economically relevant. For net wealth, a 1 percentage point increase in the proportion of destroyed residential buildings in the place of birth reduces net wealth later in life by about 1270 euros, according to specification (2). This equals approximately 0.53% of the average net wealth in the sample. The detrimental effect of destruction operates strongly through real estate holdings: According to the estimates of specification (2), a marginal increase in destruction reduces the net value of the primary residence by 720 euros and the probability of being a homeowner by about 0.18 percentage points.

The detrimental implications of war transmit intergenerationally. As for the first-generation sample, all six \({\hat{\beta }}^p_1\)s are significant and negative for the second-generation sample with paternal treatment. A 1 percentage point increase in the proportion of destroyed residential buildings in the paternal place of birth reduces net wealth later in life by about 900 euros, the net value of the primary residence by 330 euros, and the probability of being a homeowner by about 0.27 percentage points, according to specification (2). For the second-generation sample with maternal treatment, the coefficients are of similar magnitude but levels of significance are lower.

In addition, Table 18 in the Appendix shows the results for a sample with simultaneous paternal and maternal treatment. For reasons outlined above, the sample size is relatively small. Nevertheless, the results suggest that the degree of destruction of the paternal birthplace is more important for wealth today than the destruction of the maternal birthplace. The fact that the coefficients on paternal and maternal birthplace destruction partially cancel each other out is maybe explained by the fact that the extent of destruction of the two places is highly correlated at 0.497.

Results from IV Table 4 summarizes the IV results. It has the same structure as Table 3, but, in the upper panel, it also shows the results for the first stage. Like for the OLS estimation, output tables with the complete results are found in the Appendix (see Appendix F). The coefficient for the log distance to London on destruction is negative and highly significant for both the first and the second generations: The greater the distance from London, the less the local destruction. The relevance of the instrument is indicated by the F-statistics: Depending on the sample of interest, these range between 21.0 and 26.3 for specification (1) and are lower for specification (2).Footnote 45 F-statistics are not higher because we take a conservative approach by clustering on the level of GLR municipalities and there is, by construction, no variation in the instrument and the destruction variable within clusters. Abstaining from clustering increases the F-statistics to values between 112.1 and 212.5 for the first specification and 21.8 to 51.9 for the second specification.

The IV estimations confirm the negative implications of the bombings during the Second World War on wealth holdings today. Quantitatively, the coefficients are larger in absolute terms but also estimated with less precision compared to OLS. In sum, the estimates for the first-generation sample support the idea that war destruction has a long-lasting detrimental effect on net wealth and also for the net value of the primary residence. For homeownership, the coefficients point in the expected direction but are insignificant. For the second-generation sample with paternal treatment, the regression indicates negative implications of the war destructions on all three outcome variables. For the second-generation sample with maternal treatment, the regression results point in the same direction as for the sample with paternal treatment, but are not statistically different from zero for homeownership.

The finding of quantitatively stronger results in most of the IV estimations compared to OLS complies with the findings for education in Akbulut-Yuksel (2014). Note, however, that IV and OLS estimates are not immediately comparable: IV is estimating the local average treatment effect (ATE), while OLS is estimating the ATE over the entire population.

A candidate explanation for smaller effect sizes in OLS are omitted variables. One might, for example, think that omitting the municipality-level population density biases the OLS results downwards if wealthier people lived in denser municipalities and these municipalities were attacked more heavily. Both assumptions may be true given that population density should correlate positively with property prices and economic development. Moreover, Allied forces might have attacked denser cities more heavily due to their strategy of bombing to break the morale of the German population or other strategic considerations. Another candidate explanation is measurement error: If some people were born in a hospital in a bombarded municipality but raised in another less bombarded municipality, this would introduce measurement error in the treatment variable, downward bias OLS coefficients, and be a reason for larger IV coefficients. Conversely, it may also be that the IV estimators are, in absolute terms, upward biased. In our setting, this may be the case if, for example, municipalities far away from London grew more and generated more income and wealth after the war than municipalities nearer to London. For this reason, we present results for additional estimations in the robustness section, in which we exclude certain regions from the sample, and show that the general results are robust.

Quantification exercise What is the impact of yesterday’s destruction on average wealth today? The basic idea of our answer is to compare the empirically observed wealth with a counterfactual hypothetical value: the observed wealth corrected for the negative consequences of destruction. The correction factor is the product of the extent of regional destruction and the absolute value of the estimated destruction coefficients. Table 5 shows the results for net wealth (top panel) and net value of primary residence (bottom panel). The results for the shock-adjusted values rely on the coefficients of specification (2) detailed in Tables 3 and 4. The tables show that the assets are significantly higher after the shock-adjustment. This is true for all three samples and for both wealth concepts.

As regards net wealth for the first generation, the actual average is about 185k euros (column “Observed”). Using the OLS estimates, the shock adjustment increases the value by about 24k euros (column “Difference”) to about 209k euros (column “Hypothetical”). In relative terms, this is an increase of about 13%. For the second generation, the nominal changes are of similar magnitude: about 16k euros after adjustment for the destruction of the paternal and about 14k euros after adjustment for the destruction of the maternal birthplace. However, since the second generation is much younger than the first, its wealth is markedly lower and the resulting percentage increases very similar: about 17% after adjustment for the destruction of the paternal birthplace and 13 percent after adjustment for the destruction of the maternal birthplace. The IV-based changes are larger, at about 74% for the first generation and 59% (35%) for the second-generation maternal (paternal) sample.

As regards net value of primary residence according to the OLS estimates for the first-generation sample, the shock-adjusted value of about 111k euros is about 14k euros higher than the observed actual value. In relative terms this is an increase of about 14 percent. For the second-generation sample with paternal (maternal) treatment, the shock adjusted value is about 51k euros (57k euros), thus about 6k euros (7k euros) higher than the observed value, an increase of about 14% (13%). The results from IV suggest increases of about 54% of the first generation and 137% (110%) for the second generation with paternal (maternal) treatment.

What is the magnitude of the quantified impact of the bombardments on today’s wealth to the value of destroyed real estate in the past? Nieschlag (1947) provides estimates on the war-related damage to real estate of the German Empire evaluated in 1946. Based on these historical numbers, destruction and damaging of buildings lowered German real estate wealth by about 22% (23−25 billion Reichsmark). And how significant are the losses in terms of total private wealth today? The 1931−1945 birth cohorts born in western Germany account for around 14% of the total adult population in 2002. Their share of wealth amounts to around 27%, with average wealth in Germany equivalent to around 88,000 euros per adult. Assuming all other variables to be constant for the sake of simplicity, today’s total German wealth could have been \(14\% \times 27\% = 3.08\%\) higher if West Germany had not been bombed.Footnote 46

Section I in the Appendix presents the results of five robustness checks, which confirm the validity of the previous estimates. First, we examine whether the heavy right tail of the wealth distribution is the main driver of our estimated effects by (a) winsorizing the wealth data, and (b) by replacing wealth by wealth ranks as outcome variable. Like in our main specifications, destruction has a negative effect. Second, we check that it is not observations from a particular federal state that drive our results by repeatedly re-running the main regressions leaving out one state at a time. The regressions produce estimates similar to those of the main analysis, suggesting that state-specific factors do not confound our estimations. Third, we exclude observations from small municipalities for which we had to assume zero destruction because they were missing in the GLR data. In these restriced samples, the estimated effects of destruction are statistically significant and their magnitudes are similar to those of the main analysis, emphasizing that the estimated effects are not brought about by the replacement of missing values with zero. Fourth, we re-run the main regressions on extended samples that include individuals who spent parts of their lives in the GDR. The addition of the about 100 individuals of the first generation and about 50 per sample of the second generation does not alter our main estimates. Fifth, the division of Germany after the Second World War decreased market access for municipalities close to the inner German border, reducing economic activity and plausibly wealth accumulation in those cities (Redding & Sturm, 2008). Hence, it could be that two municipalities have a similar distance to London but one is closer to the new border and wealth accumulation is lower. For this reason, we included distance to the inner German border as an additional control variable in the regressions. Its inclusion does not alter our main estimates.

5.2 Empirical exploration of the mechanisms

According to our theoretical model in Sect. 2.2, bombardments impact wealth accumulation through the direct channel of destroying initial wealth endowments as well as through the indirect channels of health and education, which again determine lifetime income and the propensity to accumulate wealth.

A first possible channel runs through inheritances. The bombardments imply a reduction of the wealth stock at the time of the bombardment and later in life. This also reduces the ability of the parental generations to transfer wealth to next generation. This applies to transfers of wealth from generation zero to generation one, as well as from generation one to generation two. Lower inheritances could explain part of the observed long-term reductions in wealth. However, the heirs could also adjust their behavior in response to lower expected values of inheritance, possibly through consumption and labor supply (see Elinder et al., 2018; Joulfaian & Wilhelm, 1994). To assess the inheritance channel, we construct a dummy variable that indicates whether a person has received an inheritance or gift inter vivos prior to the measurement of the person’s wealth stock. Depending on the availability of data and measurement time point of wealth, the dummy is derived by one of three variables: individual inheritances over the lifetime up to the year 2001; individual inheritances from 2002 to 2017; or individual inheritances over the life course up to 2019.

A second possible channel runs through education. Several studies show the detrimental effect of war and wartime destruction on educational outcomes. According to Akbulut-Yuksel (2014), Second World War destruction in Germany reduced the years of school attendance at that time; Waldinger (2016) shows that many German universities lost their scientific staff and buildings, both of which possibly constrained the supply of higher education (see Table 8 in the Appendix for further literatures). As higher education, an important component of human capital, implies higher lifetime income and, thus, a higher propensity to save and accumulate wealth (Card, 1999), we expect education to be an important mechanism that explains part of the total reduction of wealth. In particular, when interpreting the results for the first generation, it should be noted that different birth cohorts were differently affected by the policies of the Nazis (e.g., evacuation from children to the countryside). As a measure for education, we use a person’s highest educational degree classified according to the International Standard Classification of Education (ISCED 97) [UNESCO (2006)] to construct a higher-education dummy. This dummy takes the value zero for the bottom three and value one for the top three ISCED categories.

A third possible channel runs through health. Health is another important part of human capital and presumably operates in a similar way to education. Several studies find that war-related treatments have long-lasting detrimental effects on health outcomes (see Table 8 in the Appendix). Hence, we expect that health, like education, explains part of the total reduction of wealth. As a measure of health, we use a person’s current satisfaction with their health, self-rated on a 0–10 scale.Footnote 47

A fourth possible channel runs through lifetime labor market outcomes. For the vast majority of people, work is a central determinant of material well-being. Labor market outcomes may pick up potential effects of destruction on regional economic development, both in regions where individuals were born as well as in regions to which they moved later in life. For example, the results of Brakman et al. (2004) and Bosker et al. (2008) indicate that the Second World War bombings in Germany reduced city-level population growth up to 50 years after the war, which might have affected regional economic development in various ways. We use three indicators of labor market success: (1) The age at which a person had her first job, to test whether labor market entrance decisions were affected by destruction; (2) The years of total labor market experience to measure lifetime labor supplyFootnote 48; (3) An indicator of lifetime income.

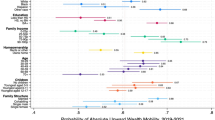

To study the role of each of the mechanisms, we proceed in three steps. First, we re-estimate Eqs.(1) and (2), but use the potential mechanism (e.g., inheritances or education) as the dependent variable in lieu of wealth (row a. in Table 6). That is, we test whether differences in the local level of wartime destruction affect the respective mechanism. Second, we test whether the mechanism is correlated with wealth (row b). For a causal pathway to exist, we would expect that wartime destruction directly impacts the mechanism, which in turn is correlated with wealth. Third, we quantify the importance of the mechanism by re-estimating Eqs. (1) and (2) with the mechanism as an additional control variable. The explained part of the wealth-reduction by the mechanism then is the difference between the estimated coefficient on destruction and the total implications of destruction for wealth. We report the explained part of the wealth-reduction by the mechanism in row d, whereas row c reports the total long-term implications of destruction on wealth as a reference.Footnote 49

Table 6 summarizes the results of the mediation exercise. Inheritances cannot explain the long-term consequences of destruction on wealth: Although wealth is positively associated with inheritances in all three samples (row b.), the probability of receiving an inheritance does not correlate with the extent of destruction. This result may not be in line with the expectation that inheritances are an essential channel through which families pass on wealth to their children. However, as explained above, inheritors may respond to expected inheritances by adjusting their behavior. Furthermore, we suspect that measurement error in the inheritance indicator is an issue.

Education can explain part of the long-term consequences of destruction on wealth: In all three samples, wealth is positively correlated with higher education and, at the same time, higher education is negatively correlated with the level of destruction. Quantitatively, for the first generation sample, the education channel explains 241 €/1270 €\(\ = 19\)% of the long-term consequences of war. For the second-generation sample with paternal (maternal) treatment, the education channel explains \(193/917=21\)% (\(151/820=18\)%). Health cannot explain the long-term consequences of destruction on wealth. For the first-generation sample, wealth is positively correlated with health satisfaction and, at the same time, health satisfaction is negatively correlated with the extent of destruction. However, the second correlation is insignificant. One possible explanation lies in survivor bias: It can be assumed that those individuals of the first generation, whose health was particularly severely damaged by the bombings, died before the 2000s. This mechanism also has no explanatory power for the second-generation samples. Lifetime labor market outcomes only explain the long-term consequences of the destruction for the second-generation sample with paternal treatment. For this sample, individuals from more severely destroyed municipalities cluster at the bottom of the age-specific income distribution and accumulate less wealth. This channel explains \(159/903=\) 18% of the long-term consequences of war. There are several possible explanations why the mechanism does not seem to play a role for the first generation: the survivor bias discussed above; the insurance function of the pension system (war-disabled pensions; damaged-person pensions; survivor pensions); and contribution limits that cap pensions.

Overall, the results point to education as an important mechanism in the first-generation sample, explaining about one fifth of the destruction-induced wealth loss. For the second-generation samples, the education and the labor-market channel matter. Nevertheless, a considerable share of the wealth losses is not explained by the aforementioned mechanisms. Other conceivable mechanisms are testable with our data: Table 19 in the Appendix contains additional results for the role of the regional share of expellees in the regional population in 1961, the death of father and mother, the number of siblings, being retired, and the log distance between the current residence and place of birth. Empirically, none of these mechanisms can explain much of the negative consequences of the bombardments on wealth today. Other potential mechanisms exist that we could not test because of data limitations. For example, Second World War destruction triggered large-scale rebuilding programs and important government interventions into the real estate market that may have had long-lasting effects on individual investment behavior and household portfolios. Further, while we considered lifetime labor market outcomes, it is also possible that implications of destruction were mediated through the capital market. Affected individuals potentially had less assets for investment or as collateral for mortgages, such that post-war wealth differences were perpetuated over decades.

6 Conclusion

Motivated by a formal life-cycle model of individual wealth accumulation, this paper studies the long-term implications of arguably one of the biggest shocks in West-European history, the Second World War, on individual wealth formation. To do so, we link, for the case of Germany, micro data on wealth holdings today with historical data including the municipality-level destruction of housing stocks during the Second World War.

Looking back in history appears to be important for understanding wealth today. Even some 60 years after the Second World War, the consequences of the bombardments are still measurable, leaving its mark on the level of private wealth today: People who were exposed to particularly heavy bombing during the war still have less valuable assets: For the generation born between 1931 and 1945, our estimations indicate that the long-term reduction of wealth by the bombings amounts to about 13% in our most-preferred model. This also carries over to the descendants generation: the bombardments of the paternal birthplace reduce its wealth today by about 17%. For the earlier born generation, the detrimental long-run repercussions of the bombardments can be partly attributed to lower education. For their descendants, the education channel and participation in the labor market are relevant.

In sum, our study suggests that the bombardments of the Second World War have persistent implications for wealth accumulation across generations. This adds to the notion that wealth formation does not just depend on individual effort, but also the circumstances individuals grow up in. Most importantly, our analysis provides evidence for the long-term welfare costs of wars, highlighting the importance of peaceful resolutions of current and future conflicts.

The paper lacks an assessment of the persistent quantitative impacts of bombardments for generation zero—the parents of our first generation. Generation zero was directly affected by the bombings at young adulthood, and may have been particularly hard hit by the bombings in terms of their later economic opportunities and also health. Unfortunately, exploring the implications of the bombings for generation zero (wealth losses, injuries, health setbacks, etc.) is not feasible with our data. Knowing about these implications would invite for more sophisticated modeling and for more thorough investigations on mechanisms and transmission channels of the bombardment to future-generation wealth accumulation. Empirically, establishing such persistent effects in a country like Germany (a developed, industrialized economy), would motivate further research on what policymakers should do in order to alleviate the effects of bombardments in the long run.

Another relevant question for future research is to explore whether the link between destruction and wealth is mitigated or reinforced by mortality and fertility.Footnote 50 Theoretically, the direction is unclear. As an example, assume that the bombings were more mortal for low-wealth individuals.Footnote 51 Combined with the high intergenerational persistence of wealth, this higher mortality risk should mitigate the measured long-term implications of the bombings on average wealth. As another example, assume that bombardment-induced economic losses and uncertainties lowered fertilityFootnote 52 and that low-wealth individuals reduced their fertility more because their budget constraint is tighter and their access to credit markets is restricted. Then the share of non-wealthy households in generations one and two declines, and the total sum of inheritances is distributed among fewer individuals. As this should be particularly the case in regions that experienced heavy bombardment, fertility should mitigate the long-term implications for wealth. But a reinforcing effect is also conceivable. This is the case when higher economic instability encourages people to have more children as a form of economic security.Footnote 53

Notes

Such disadvantages could be reduced in the long run if, for example, the loss of homeownership made people more mobile and able to find better-paying jobs, allowing them to catch-up over time. The same is true if parents decide to put more focus on their children’s education because of the loss of wealth (if they can still afford it at that point).

This is not only about the number of children. The timing of births may also change (Kesternich et al., 2020) and with it, education and labor supply decisions, wealth accumulation, as well as intergenerational transfers (including human capital). Abu-Musa et al. (2008) reviews the literature on the effects of war on fertility.

For example, not only did workers in the industrial areas have low wealth and relatively low education, they were also likely to be hit by air attacks. At the beginning of the twenty-first century, we still observe lower wealth stocks in these areas, but these might be observed due to lower pre-war wealth rather than bombardments.

Unfortunately, we lack information on bombardment impacts for the parents of our first generation (e.g., permanent injuries or loss of individual real-estate). However, this data limitation does not prevent us from assessing the persistent wealth-accumulation effects for generations 1 and 2.

We use this dichotomous variable in addition because real estate wealth is highly skewed and the estimates for the mean may be sensitive to outliers.

Another study by Lee (2005) investigates the short-term consequences of war on wealth by studying how serving in a military company that underwent more dangerous military missions changes wealth accumulation.

Amongst others, China is a communist country with a mix of market and non-market allocation of resources. Furthermore, China lacked a general medical safety net until 2004 and the communist party imposed wealth equality between 1950 and 1978. These differences, as Li and Koulovatianos (2020) also suggest, imply that their results are unlikely to generalize to other countries.

The quantifications of the war-wealth nexus of Kesternich et al. (2014), for example, rely on a cross-country design, correlating individual wealth holdings in several European countries with country-level indicators of Second World War involvement after controlling for year-of birth and country dummies. As the authors mention, “there are issues of possible selection effects … that may have biased our estimates” (p. 113).

See Appendix B for an overview.

For the protection of civilians, a main Nazi German policy response was to increase anti-air defense capabilities, provide air-raid shelters, and relocate civilians to rural sites. However, during the course of the war, Allied forces increasingly gained control of German air space and achieved technological superiority, rendering many defensive systems ineffective. Moreover, in the final years of the war, German policy prioritized the protection of strategic industries over the safety of civilians (Groehler, 1990).

The United States Strategic Bombing Survey (1945) states “only about 20% of the bombs aimed at precision targets fell within [the] target area”, the target area being “a circle having a radius of 1000 feet [305 m] around the aiming point of attack”.

By 1953, the number of refugees in West Germany had reached 8.3 million people from former Eastern territories and 2 million from the Soviet Occupation Zone (Albers, 1989).

Benhabib et al. (2011) instead assume that human capital is exogeneous.

We use individual and household as synonyms assuming well-defined household preference orderings and ignoring the possibility of conflicting preferences of individuals within a household.

An OLG model where inheritances are normal goods (in the sense that whenever resources increase, inheritances increase, too), will qualitatively behave in the same way as our infinitely-lived-dynasty model (see Michel et al. (2006) and the references on the extensive related literature therein). This is because an infinitely-lived setting can be interpreted implicitly a sequence of finitely-lived generations.

This result holds under the reasonable assumption that \(\kappa _{\Pi }>0\), as long as \(g_{c}\ne \iota \), since \(\frac{e^{\iota t}-e^{g_{c}t}}{\iota -g_{c}} =e^{\iota t}\frac{1-e^{-\left( \iota -g_{c}\right) t}}{\iota -g_{c}}\), which is strictly positive for all \(g_{c}\ne \iota \).

This channel of war effects on parameters \(\psi \) and \(\delta \) is corroborated by studies documenting a direct long-term effect of war shocks to the health of people since childhood (see, e.g., Li and Koulovatianos (2020), and references therein).

We use the terms “city” and “municipality” interchangeably.

An exception are cities from the state of Bavaria. Here, only completely destroyed dwellings were classified as destroyed. For robustness, we conduct our main analysis excluding Bavarian cities.

For the first generation, the GLR data lack destruction information for 26 municipalities; about the same number is missing in each of the two second-generation samples.

To create this Figure, we georeferenced the GLR data using the Geonames database. See http://www.geonames.org. Last accessed in October 2020. For each municipality we assigned the geo-coordinates of its center. Some of the municipalities were disbanded after 1939 and merged with neighboring cities, but they continue to exist as districts under their old name. In these cases, we assigned the geo-coordinates of the district center.

The scaling of the circles is such that the circular area equals \(c \times \sqrt{population}\), where c is a positive constant.

Unfortunately, we lack information to refine the classification.

Guidelines for the Statistics and Presentation of Damage in Destroyed Cities (Arbeitsstab Wiederaufbauplanung zerstörter Städte, 1944).

The quotes were translated from German by the authors.

Differences are largest for some cities in the state of North Rhine-Westphalia, for which the average destruction in Kästner (1949) is 6.5 percentage points higher. A footnote in Kästner (1949, p. 368) states that their figures for North Rhine-Westphalia contain not only “completely destroyed” but also “heavily destroyed” dwellings, pointing to the possibility that the authors had to use a different definition of destruction for North Rhine-Westphalia than for the other states and a different one than used in the GLR data.

For a digitized version of the data, see Brockmann et al. (2023).

The Pareto distribution has two parameters, shape parameter \(\alpha >1\) and a lower-bound \(\underline{y}\). Applying Van der Wijk’s law, the shape parameter determines the so-called average-to-base index, \(B \equiv \frac{\alpha }{\alpha -1}\). It gives the average wealth beyond a certain wealth threshold, \(y_b > \underline{y}\), relative to the base, \(\underline{y}\). For the Pareto, the average-to-base index is inversely related to the Gini index, defined as \(\frac{1}{2\alpha -1}\). We infer the regional indices interpreting the tax allowance as \(\underline{y}\) and average wealth above the threshold as reported in the administrative wealth tax data from 1935 (the year with available data closest to the start of the Second World War).

The value is only known if the respondent owns the residential property. For non-owners, we use a value of zero.

The statistical method used in the SOEP is multiple imputation by chained equations (MICE). MICE is a standard method of addressing missing data. As detailed in White et al. (2011), the central idea of MICE is to rely on the distribution of the observed data to estimate a set of plausible values for the missing data and to consider random components in the estimates to reflect their uncertainty. As detailed in Grabka & Westermeier (2015), SOEP provides five fully imputed datasets for each wealth item.

The module asks about respondents’ portfolios in a three-stage procedure: The first stage asks if the respondent holds a particular asset, the second stage asks about the asset’s market value, and the third asks what share the respondent owns.

Old-age dissaving likely attenuates wealth differences between the wealthy and the poor as well as between those whose real estate was destroyed and those whose real estate was left intact. Similarly, selective deaths within the population also potentially affect our analysis. If poorer individuals pass away at younger ages, they are less likely to be surveyed. Thus, selective death also leads to an underestimation of potential effects.

This concerns the SOEP subsamples L2 and L3, which mainly comprises young families with low income. These two subsamples constitute about 16.7% of all SOEP individuals in 2012. For the first-generation sample, the non-includability of L2 and L3 is not a concern: Persons born 1945 and earlier make up only around 0.5% of the two samples. However, for the second generation a selectivity issue possibly arises.

Of course, it would be informative if the database were sufficiently large to examine more narrowly defined cohorts including those being in school age during the years of bombardment. As an example, if schooling was more often interrupted during the last months of the war, these closures presumably affected mostly the cohorts born in the early 1930s.

Compared to the population share in villages below 2000 inhabitants according to the census 1939 (see Sect. 3.1.1), the share in our sample is lower. Notice, however, that these shares are not 1:1 comparable. Most importantly, the share from the census considers all residents regardless of age, whereas the share from our sample is restricted to the youngest cohorts of that time. Differences in regional age structures or birth rates are potential reasons for the observed differences.

The correlation is weighted by the population size of the tax districts in 1938.

Miguel & Roland (2011) use distance between Vietnamese regions and the 17th parallel north in their study on bombing during the Vietnam War.

As we show in Sect. 5, the instrument is relevant. The null hypothesis that the instrument is weak can be rejected at high levels of significance.

Although bombers had sufficient range to penetrate deep into German territory, the limited range of accompanying fighter aircraft posed a major problem for Allied forces. An important technical innovation was the introduction of the P-47D Thunderbolt and P-51 Mustang long-range fighters in 1943, which made it possible to escort bombers deeper into the German territory (The United States Strategic Bombing Survey 1945, p. 6; Hampe, 1963a, p. 125).

See, for example, Franck & Galor (2021).

We would like to thank an anonymous reviewer for these comments regarding on the credibility of the exclusion restriction.

These are Kleibergen-Paap rk Wald F-statistics for a test of weak instruments for the two-stage least squares estimator as reported by Stata’s ivreg2 command (Baum et al., 2002). A test of the null hypothesis of weak instruments is that the Wald test size is more than 15%, which corresponds to a critical F-statistic of 8.96. Except for specification (2) for the second-generation samples, all of our IV regressions surpass this critical value.

To calculate the population share, we retrieved the share of the 1931–1945 birth cohorts in all adult Germans in 2002 (21.4%) from Statistisches Bundesamt (Destatis) (2023). This share we multiplied with the share of persons in these cohorts that were born in West Germany (including Berlin, excluding Saarland) obtained from the SOEP data (64.6%). The wealth share and average wealth are also obtained from the SOEP data.

Unfortunately, the data do not contain information on health during childhood or a person’s medical history.

Experience includes periods of full- and part-time employment and unemployment spells.

As mentioned in the introduction, our findings are conditional upon survival up to the year in which wealth is observed. The mediating effect of the number of siblings on the long-term link between bombardments and wealth is explored in Appendix H.

This would be supported by the fact that the Beletage, the “beautiful level” or main floor of the building, where aristocratic or upper-middle-class people typically resided, was the second floor. The floors above the Beletage are likely to have been more severely damaged by bombardment, and thus, the risk of death among residents of these floors is higher. Similarly, the better construction of upper-middle-class residential buildings is likely to reduce the risk of mortality.

An integrating factor is a function that is chosen to facilitate the solving a differential equation.

The result is comparable if depreciation of human capital increases.

Unfortunately, we are not aware of a documentation of the amounts that North Rhine-Westphalia or other federal states received from the Marshall Plan. However, Grünbacher (2004) argues that substantial funds were channeled to the Ruhr region so as to reconstruct, for example, miners’ housing.

References

Abu-Musa, A. A., Kobeissi, L., Hannoun, A. B., & Inhorn, M. C. (2008). Effect of war on fertility: a review of the literature. Reproductive Biomedicine Online, 17(1), 43–53.

Akbulut-Yuksel, M. (2014). Children of war: The long-run effects of large-scale physical destruction and warfare on children. Journal of Human Resources, 49(3), 634–662.

Akbulut-Yuksel, M. (2017). War during childhood: The long run effects of warfare on health. Journal of Health Economics, 53, 117–130.

Akbulut-Yuksel, M., & Yuksel, M. (2017). Heterogeneity in the long term health effects of warfare. Economics & Human Biology, 27(Part A), 126–136.

Albers, W. (1989). Der Lastenausgleich Rückblick und Beurteilung. FinanzArchiv/Public Finance Analysis, 47(2), 272–298.

Arbeitsstab Wiederaufbauplanung zerstörter Städte. (1944). Richtlinien für die Statistik und Darstellung der Schäden in den zerstörten Städten. Reichsministerium für Rüstung und Kriegsproduktion, Berlin: Technical report.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2002). IVREG2: Stata module for extended instrumental variable/2SLS and GMM estimation. Statistical Software Components, S425401, B.

Becker, G. S. (1960). An economic analysis of fertility. In U.-N.B. Committee & E. Research (Eds.), Demographic and economic change in developed countries (pp. 209–240). Columbia University Press.