Abstract

We explore the relationship between social mobility and economic development. First, we map the geography of intergenerational mobility in education for 52 Latin American regions, and examine its evolution over time. Then, through a new weighting procedure considering the level of participation of various cohorts in the economy in each year, we estimate the association between changes in mobility and regional economic indicators, such as income per capita, inequality, poverty, labor formality, and luminosity. Our findings show that increasing social mobility is consistently associated with economic development and growth in Latin America.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Equality of opportunity and social mobility are values shared by many and are very important policy objectives rooted in the constitution of most countries. From an empirical perspective, it remains an open question whether higher social mobility is also beneficial for economic performance. Establishing the existence of a positive effect of improved social mobility on economic indicators would provide an even greater justification for targeting it as a policy objective, beyond the usual equity argument.

From a theoretical point of view, in a world in which abilities are transmitted perfectly from parents to children, and income inequality is merely the result of returns to individual ability, redistributing opportunities to the children of less able (and hence less affluent) parents at the expense of the children of more able ones might induce distortions causing considerable efficiency loss. However, abilities are not perfectly transmitted across generations, and other factors play an important role in the distribution of income (e.g. Bowles and Gintis, 2002; Black et al., 2020; Sacerdote, 2011). Under these conditions, creating better opportunities for the less affluent, and thus increasing social intergenerational mobility, should lead to a more efficient accumulation of human capital, reduce the misallocation of talent, and eventually improve the performance of the economy (e.g. Galor and Tsiddon, 1997; Galor and Moav, 2004; Mincer, 1984). Our aim in this study is to test these predictions, analyzing the role of intergenerational mobility for economic development.Footnote 1

Our paper makes a contribution to the literature that studies how inequality in access to resources and in opportunities may affect economic performance (e.g. Galor and Zeira, 1993; Banerjee and Duflo, 2003; Voitchovsky, 2005; Brueckner et al., 2018; Van der Weide and Milanovic, 2018; Marrero and Rodríguez, 2013; Ferreira et al., 2018) providing the first large-scale study on the role of social mobility for economic efficiency. Recent descriptive studies suggest a positive correlation between mobility and economic performance indicators across countries and within single countries across geographical areas (e.g. Chetty et al., 2014; Güell et al., 2018; Neidhöfer et al., 2018; Aghion et al., 2019; Aydemir and Yazici, 2019). In this study, we go one step further by providing estimates based on subnational region-level panel data for multiple countries. Our laboratory of analysis is Latin America, a region with interesting historical similarities and, at the same time, ample heterogeneity in economic development, income inequality, and social mobility trends. For instance, while in most Latin American countries, such as Argentina, Brazil, Chile, and Mexico, educational upward mobility increased substantially from 1940 to 1990, cohorts born in the 1980 s in Guatemala and Nicaragua still experience relatively low levels of upward mobility (Neidhöfer et al., 2018). At the same time, Guatemala and Nicaragua show substantially lower GDP per capita levels and trends from 1990 to today compared to the other countries (World Bank: World Development Indicators). To test the relationship between these two phenomena, we construct a unique data set of (sub-national) region-year observations for 10 Latin American countries.The dataset includes information about the intergenerational mobility of education for people born between 1940–1989, and several development indicators, such as average income, poverty rates, labor formality, and luminosity information from satellite data, covering the period from 1981 to 2018. To link social mobility and economic development, we implement a new methodology that connects cohort- and year-level observations by weighting the degree of mobility of a cohort based on its contribution to the overall economic performance of the respective country in each year.

Our results show that intergenerational mobility is consistently associated with economic development. We document strong variation in terms of social mobility and the level of economic development across and within Latin American countries and find that higher intergenerational mobility is associated with rising income per capita, income growth, and other development indicators. These results are robust to different social mobility measures, hold when controlling for unobserved cross-regional heterogeneity and spillover effects, and do not depend on factors related to migration, educational expansions, and initial conditions. Results are also robust to the inclusion of contemporaneous income inequality, meaning that even when controlling for this factor, intergenerational mobility remains relevant for explaining economic development. An interesting picture also emerges when observing the interaction of cross-sectional income inequality and intergenerational mobility: Holding social mobility constant, the association between inequality and economic development is positive. However, the interaction between the two can be particularly detrimental to development when inequality is high and, at the same time, social mobility is low.

These findings have important policy implications. They suggest that there is no equity-efficiency trade-off regarding social mobility. Instead, our results show that improving the opportunities of disadvantaged individuals creates positive economic returns. Hence, even if interventions aimed at improving intergenerational mobility may cause inefficiencies in the short-run, cost-benefit analyzes should also take their positive long-run impact on the economy into account, which may still justify their use.

This paper is organized as follows: Sect. 2 provides an intuitive conceptual framework about the role of opportunities and social mobility for economic development and reviews the theoretical and empirical literature. Section 3 explains the estimation strategy. Section 4 describes the data, as well as the measurement of social intergenerational mobility and economic development. Section 5 maps the geography of intergenerational mobility in Latin America. Section 6 estimates the impact of social mobility on economic development. Section 7 concludes.

2 Social mobility and economic development: conceptual framework and literature review

Economic reasoning suggests that human capital promotes development. Hence, improving the opportunities to invest in human capital should enhance its accumulation and allocation, eventually supporting the process of economic development (e.g. Galor and Zeira, 1993; Galor and Tsiddon, 1997; Galor and Moav, 2004; Hassler and Rodriguez Mora, 2000; Maoz and Moav, 1999; Owen and Weil, 1998). In turn, inequality of opportunities harms the accumulation and allocation of human capital and reduces social mobility. In modern economics, the works by Becker and Tomes (1979), Becker and Tomes (1986), Loury (1981), Solon (1992), among others, set the theoretical and conceptual basis of the literature on social intergenerational mobility, modeling the mechanisms and transmission channels that explain the persistence of economic outcomes of families between generations. In these models, intergenerational mobility depends primarily on the inheritance of abilities from parents to children, as well as on private and public investments in human capital.Footnote 2 Thus, the persistence of inequality between family lineages over time is an indicator of the opportunities for individuals to achieve economic well-being through their own efforts, independent of circumstances beyond their control, such as the family environment they were born into (Roemer, 1998). Generally, the more equally distributed opportunities for human capital formation are, the higher is intergenerational mobility. These opportunities are directly influenced by under-investments that may exist due to budget constraints, credit market imperfections, or informational asymmetries, among other factors (Heckman & Mosso, 2014).

Social intergenerational mobility is, thus, a measure of how likely it is for people to realize their full potential and make the most of their intrinsic talents and abilities, regardless of the family background they were born into.Footnote 3 If the innate abilities of children and their parents are not perfectly correlated, and the distribution of talent in the population has an idiosyncratic component, unequal opportunities to invest in human capital cause talent to be misallocated. Improving social mobility implies that people have better opportunities to take advantage of their potential. This has, in turn, positive repercussions on the accumulation and allocation of human capital, increases the pool of talent in the labor force, and eventually improves economic performance.

Empirical studies at the micro-level find support for the positive relationship between individual opportunities for economic success and economic performance. Bell et al. (2019) highlight the role played by the childhood-environment for innovation and progress. Bandiera et al. (2017) evaluate an intervention that enabled poor women by reducing barriers to taking on better work opportunities and find that the program contributed to sustainable poverty reduction among beneficiaries while not making ineligible households to be worse off. Hsieh et al. (2019) show that improving occupational opportunities for disadvantaged groups causes a better allocation of talent and higher aggregate productivity. Hereby, barriers to forming human capital, such as credit constraints (e.g. Galor & Zeira, 1993) or under-nutrition (e.g. Dasgupta & Ray, 1986), have been argued to be particularly important. Another factor limiting individual opportunities and, hence, harming economic development are inefficiently low aspirations (e.g. Genicot & Ray, 2017; La Ferrara, 2019). Individuals belonging to poor households may have lower aspirations than rich individuals because they anticipate unfair chances in their future. This anticipation can push the poor to choose lower levels of human capital investment, thus perpetuating their economic disadvantage. The resulting non-optimal investment decisions are detrimental to economic performance. All this evidence is consistent with the hypothesis that inequality of opportunity is harmful for growth and that higher social mobility has a positive impact on economic development.

Focusing on the inequality of opportunity, rather than inequality of outcomes, may also shed some light on the so far contrasting findings on the inequality-growth nexus (see e.g. Barro, 2000; Panizza, 2002; Banerjee & Duflo, 2003; Voitchovsky, 2005; Neves & Silva, 2014; Neves et al., 2016; Berg et al., 2018; Brueckner et al., 2018; Van der Weide and Milanovic, 2018). This shift of focus to opportunities, which was already proposed by Rawls (1971), Sen (1980), and Roemer (1998), among others, is materialized in the central message of the World Development Report 2006 (Bourguignon et al., 2007). Still, the empirical literature on the topic is rather scant. Ferreira et al. (2018), one of the few studies testing the opportunities-growth relationship, finds evidence that suggests a negative association between inequality of opportunity and growth in a cross-country analysis, though the findings are not robust. Likewise, Marrero and Rodríguez (2013) decompose the level of total inequality at the state-level in the US into inequality due to effort, and inequality due to opportunities. They consistently find that economic growth is positively related to the former, and negatively linked to the latter. Choosing social intergenerational mobility as an indicator of opportunity, some recent studies have shown a positive correlation between mobility and economic indicators, both between countries (e.g. Neidhöfer et al., 2018; Aiyar & Ebeke, 2020) and within countries across geographical areas (e.g. Chetty et al., 2014; Fan et al., 2015; Bradbury & Triest, 2016; Güell et al., 2018; Aghion et al., 2019; Aydemir & Yazici, 2019). In this study, we are the first to exhaustively analyze the relationship between social mobility and economic performance going beyond merely describing geographical correlations. We complement the existing evidence by exploiting within-country (and within-region) variation based on a unique panel of Latin American regions, introducing a novel way of linking the intergenerational mobility of cohorts to year-level indicators of economic development.

3 Estimation strategy

3.1 Social mobility and economic development

To test the association between intergenerational mobility and economic development, we translate the conceptual framework discussed in Sect. 2 into a linear panel regression. Hereby, the units of analysis are the subnational regions and the time dimension is in years:

In equation (1) Y is the level of economic development, measured for instance by log income per capita, of region j, which is located within the borders of country c, in year t. M is our main variable of interest, which displays the degree of intergenerational mobility. This variable is measured as a weighted average of the degree of intergenerational mobility of people born from 1940 to 1989 living in region j, taking into account their participation in the economy in year t given their age. The exact weighting procedure is explained more exhaustively below in Sect. 3.2. X is a vector of control variables for regional characteristics in t, including controls for economic conditions, and average characteristics of the cohorts used to estimate social mobility. The model further includes one lag of the dependent variable, fixed effects for regions (\(\upsilon\)), and country-specific trends (\(\tau\)), while \(\epsilon\) is the error term. In Sect. 4 we describe the measurement and data sources for each variable more in detail. In different estimations, described and discussed in Sect. 6, the control variables, fixed effects, and the lag of the dependent variable are included gradually, such that in some estimations their coefficients are restricted to be equal to zero.

3.2 Weighting procedure

One fundamental challenge of linking social mobility to economic development is the temporal association of the two phenomena: while aggregate economic indicators are measured in particular years, an insightful indicator for intergenerational mobility should be measured at the birth cohort level. When the aim is to measure the impact of aggregate indicators—such as growth, income inequality, or public expenditures—on intergenerational mobility, one possible way is to estimate the association between the level of these aggregate outcomes that individuals experienced during their childhood and their future degree of intergenerational mobility (e.g. Mayer & Lopoo, 2008; Neidhöfer, 2019). However, this method is not feasible when the aim is to estimate the reverse, namely the impact of intergenerational mobility on aggregate economic outcomes. Indeed, most of the empirical literature overcomes this problem by taking averages of both measures across geographical areas, thus omitting the temporal dimension.

To go one step further in the direction of a proper measurement of the effect of social mobility on economic indicators, the aim is to find a strategy that accounts for the fact that, for reasons related to the life cycle, individuals born in different cohorts are at different stages of their individual contribution to the economy in each year. Neidhöfer et al. (2018) address this issue by arbitrarily choosing time lags of 30, 40, and 50 years to measure economic development when the individuals of each birth cohort were old enough to contribute substantially to the economic activity of the country. In this paper, we develop a novel weighting procedure that enables us to obtain more accurate estimates. The procedure associates the intergenerational mobility of individuals belonging to certain birth cohorts to the economic development of their region of residence by weighting their contribution to the economy in that particular year. This contribution is defined by the wage, experience, and labor market participation associated with the individual’s stage of life in a given year.

We compute the weights by estimating cohort-participation profiles for each country in each year. The cohort-weights are constructed such that they sum up to one in every year. The cohort with the highest weight is the one with the highest contribution to the economy in that particular year, while cohorts with a weight equal to zero are not participating in the labor market because they are either too young or too old. In our main specification, these cohort-participation profiles represent the share of total wages earned by all individuals belonging to the respective birth cohort; i.e. \(w_{bct}=\frac{\Omega _{bct}}{\sum _{b=1}^{B}\Omega _{bct}}\) where \(\Omega\) is the sum of wages in year t of individuals residing in country c belonging to cohort b. To avoid potential correlation between the degree of intergenerational mobility of cohorts and their labor market participation affecting the construction of the weights, we define the participation profiles at the national level, rather than at the regional level, and normalize the weights to sum up to one in each year. Reassuringly, we do not observe any consistent pattern of correlation between the degree of mobility of a cohort and its weight across regions and over time.

For illustrative purposes, Fig. 1 shows these participation profiles for all countries in three different years. To test the robustness of our results, we also compute the weights based on other definitions of cohort-participation rates: i) measured by the average wages of the cohorts w.r.t. the average national wages in each year; ii) defining a minimum share of 10% of contribution to total wages to get a non-zero weight and dividing the weights equally for every cohort satisfying this requirement; iii) defining a minimum share of 10% of contribution to total employment to get a non-zero weight and, again, dividing the weights equally for every cohort satisfying this requirement. Results of these additional exercises are included in the Online Appendix.Footnote 4 We observe that most cohorts show an active contribution to the economy in each year, while younger and older individuals have the lowest weights.

Following the procedure, M in equation (1) results in a weighted average of the intergenerational mobility of people born from 1940 to 1989:

Here, \(m_{bcj}\) is the degree of intergenerational mobility of individuals residing in j and belonging to cohort b. \(w_{bct}\) is the weight measuring cohort b’s participation in the economy in t. The variation across years and regions in our estimations is then given by the interaction between the degree of intergenerational mobility and the cohort-participation weight. To measure intergenerational mobility we adopt several indicators, which we describe below in Sect. 4.2.

4 Data and measurement

4.1 Data

To obtain our estimates of social mobility and economic development, we rely on 44 nationally representative household surveys from ten Latin American countries (Argentina, Brazil, Chile, Colombia, Ecuador, Guatemala, Mexico, Nicaragua, Panama, and Peru). Hereby, our selection criteria to include a country in our sample is the availability of at least one representative survey with retrospective questions on parental education and a sufficiently large sample size to enable a subdivision of the country into subnational regions. Using these surveys, we measure intergenerational mobility of people born from 1940 to 1989.

Then, we retrieve the surveys with the highest available quality for each country in our sample–usually deriving from national statistical offices and not necessarily the same surveys used before to measure intergenerational mobility–to estimate different measures of economic development for the subnational regions of these countries from 1981 to 2018. We complement our analysis with, firstly, additional information on alternative local development indicators, such as night-time luminosity information from satellite data and, secondly, regional control variables on demographic characteristics. Thirdly, we incorporate historical data on GDP per capita, population size, and weather conditions retrieved from different data sources.

In what follows, we briefly describe the measurement of the two main variables studied in this analysis, social intergenerational mobility and economic development, and of the control variables, as well as the data employed to obtain the estimates. A more detailed description of the data sources for each country is included in the Online Appendix.

4.2 Social mobility

The idea behind the measurement of social intergenerational mobility is to capture the likelihood of changes in the lifetime socioeconomic status of children with respect to their parents.Footnote 5 Measuring socioeconomic status through appropriate proxy measures, such as permanent income, can be challenging, mainly because of data availability (Black et al., 2011; Jäntti & Jenkins, 2015).Footnote 6 Instead, information on the completed level of education of parents and children is, firstly, more likely to be available in households surveys, secondly, highly correlated with other measures using income or occupation (Blanden, 2013), and, thirdly, less affected by measurement error (Hertz, 2008). Hence, in our analysis, we focus on the education of individuals and their parents to measure intergenerational associations.

To measure m in equation (2), we estimate four different intergenerational mobility indicators: first, the slope coefficient of a linear regression of children’s years of education on the years of education of their parents; second, a standardized measure of educational persistence; third, the probability of educational upward mobility; fourth, the relative risk of high school completion. We estimate these measures separately for individuals residing in different subnational regions and who were born in different birth cohorts, spanning 10-year intervals.Footnote 7

The slope coefficient is the most widely used mobility index in the intergenerational mobility literature. In our application, we regress the years of education y of an individual i on the years of education of the parent with the highest educational qualification \(y^{p}\)Footnote 8:

x is a set of control variables for age and sex, and \(\varepsilon\) the error term. The regression coefficient \(\beta\), the estimated value of which usually lies between zero and one, measures the degree of regression to the population mean between two generations. The higher is \(\beta\), the stronger the association between parents’ and children’s education, and, hence, the lower is intergenerational mobility.

This measure of intergenerational mobility has the advantage of comparability between countries, regions, and over time. However, it does not account for changes in the marginal distribution of years of education. To consider this, we estimate an indicator for the standardized persistence of education from parents to children:

Here, \(\sigma\) and \(\sigma ^{^{p}}\) are the standard deviations of children’s and parents’ years of education, respectively.Footnote 9 Intuitively, both are indicators of relative mobility. While \(\beta\) mirrors the degree of association of one year of parental education with the education of their children, \(\rho\) measures this association in terms of one standard deviation.

We complement the analysis with two other indicators of social intergenerational mobility that instead of accounting for the entire distribution of years of education focus on an important threshold, namely high school completion. The first indicator, which we define as the probability of upward mobility, measures the likelihood of disadvantaged individuals - i.e. individuals whose parents both did not complete secondary education - to complete high school:

Here, y and \(y^{p}\) are defined as in the equations above and s is the number of regular years of education attached to the completion of secondary schooling. The higher this likelihood, the higher (absolute) intergenerational mobility.

Building on the probability of upward mobility we estimate also our last indicator for intergenerational mobility, namely the relative risk of high school completion:

The relative risk of high school completion indicates how much more likely it is for the children of high-educated parents (i.e. parents with a completed secondary qualification or more) to complete high school compared to their peers with low-educated parents. The higher RR, the lower intergenerational mobility.

As mentioned before, to avoid co-residency bias we estimate all indicators using surveys that include retrospective information about parental education for each respondent (see Emran et al., 2018).Footnote 10 Furthermore, since our aim is to only include individuals who are no longer enrolled in the education system, we restrict the sample to respondents that are older than 22.

Although the inclusion of retrospective questions is not common across Latin American household surveys, and we need enough large sample sizes to subdivide the sample within representative subnational regions and birth cohorts, we were able to obtain suitable data sets for 10 countries: Argentina, Brazil, Chile, Colombia, Ecuador, Guatemala, Mexico, Nicaragua, Panama, and Peru. Pooling all available survey waves we are able to estimate intergenerational mobility for five birth cohorts (1940–49, 1950–59, 1960–69, 1970–79, and 1980–89) in 52 regions. By using similar variable definitions and consistent data processing methods, the resulting statistics are comparable not only across countries and regions but also over time. Our final sample, including all countries and cohorts, comprises almost 1.2 million individuals.Footnote 11 In all of our micro-level estimations of intergenerational mobility, we weight each observation by the inverse probability of selection provided by the survey, normalizing the weights over the different survey waves.

4.3 Regional development

We collect data that enables us to estimate the level of economic development Y for each of the subnational regions in our sample. For the final analysis, we were able to construct an unbalanced panel of 52 regions for the period 1981–2018. National household surveys are our main data source for retrieving our estimates. When measuring economic development we are not forced to use household surveys that include retrospective questions about parental education. Hence, we use all available sub-nationally representative household surveys for the ten countries in our mobility sample. Since these surveys are not necessarily uniform in terms of geographical coverage and questionnaires across countries and over time, we process the surveys in order to harmonize the variable definitions, the subdivision in subnational units, and the measurement of economic development; i.e. we make the surveys comparable across countries and regions, and over time.Footnote 12

In our baseline specification, the main indicator for the level of regional development is the average of household per capita income measured in purchase power parity (PPP). We estimate this aggregate measure with the household surveys mentioned above, adding up all individual labor and non-labor incomes reported during the last month within a household and dividing by the number of household members. Our second indicator of economic development is the population-weighted night-time luminosity of regions measured with satellite data. This indicator has been shown to be a consistent proxy for economic growth (Henderson et al., 2012). We retrieve this data from Hodler and Raschky (2014). We also test our findings on a battery of further indicators for economic development: poverty, overall employment, labor formality, and access to water and electricity. All these indicators and their sources are described more exhaustively in the Online Appendix, Section B.

4.4 Control variables

The vector X in equation (1) includes a set of control variables such that the uncovered patterns of association between social mobility and economic development are not spurious. The set of controls can be subdivided into three groups: (i) year-level controls; (ii) cohort-level controls; and (iii) cohort-specific initial conditions.

4.4.1 Year-level controls

The first group of covariates includes income inequality in region j and year t, measured by the Gini index of disposable household per capita income, total regional population (polynomial of the second degree), and the urban share of the population. We estimate the first from household survey data and retrieve the two other from census data (their sources are described in the Online Appendix, Section C).

4.4.2 Cohort-level controls

The second group of covariates includes the cohort’s average years of education and its variance, as well as the share of migrants. The average years of education are included to control for different levels of human capital accumulation, while its variance is used to control for differences in its allocation. These measures also control for the overall geographic sorting by skill level across regions (Diamond, 2016; Moretti, 2012). The share of migrants is included to control for migration from low mobility regions to high mobility regions that may bias our estimates (e.g. Ward, 2022). Including migrants could lead to upward bias of the estimates because of the positive selection of migrants (who, on average, have higher degrees of social intergenerational mobility) into regions with higher levels of economic development. Controlling for the weighted share of migrants in the cohort should correct for this bias. Furthermore, we test the robustness of our results by excluding migrants when estimating our mobility measures and obtain consistent results.Footnote 13 All variables are obtained from the surveys that we use to estimate intergenerational mobility, estimated at the cohort level, and weighted by the cohort-participation rate; exactly as the variable m in equation (2).

4.4.3 Cohort-specific initial conditions

The inclusion of the last group of controls aims to abstract from the potential effect of so-called initial conditions, i.e. the past development level of the economy that could have had both, an effect on social mobility, as well as on subsequent economic development (e.g. Johnson & Papageorgiou, 2020). In our empirical set-up, we are mostly interested in controlling for the conditions of the economy in the years when the individuals in our social mobility sample were born and grew up. Since historical data on economic conditions is not available at the regional level for Latin America, we approximate the initial conditions for the cohorts measured in each region (i.e. between 1940 and 1989 which are the years of birth of the individuals for whom we estimate social mobility) with five different indicators.

The first indicator is an estimate for regional GDP per capita from 1940 to 1989 that we obtain following three steps: First, using the first available household survey for each country we compute the share of regional income over total national income for each sub-national region. Then, we retrieve country-level data on historical per capita GDP from the Maddison Project database (Bolt & van Zanden, 2020). Finally, assuming that the regional shares computed in the first step are constant over time, we multiply these shares with the historical country-level values for per capita GDP.

The second indicator for initial conditions is the child mortality rate around the year of birth of individuals. This variable controls for both, parental investments in children and the environment in which these investments take place. The idea behind this is inspired by the so-called quantity-quality model of fertility; i.e. the characterization of the trade-off in the choice between the number of children and the amount invested in the education of each child (Becker & Lewis, 1973). Under consideration of the quantity-quality trade-off, the degree of infant mortality mirrors the probability that individuals grow up in households with more or less children, and thus, ceteris paribus, their chances of receiving a higher or lower amount of investment in education. Negative shocks to infant mortality, for instance, due to medical and pharmaceutical advances, could thus lead to an increased number of children per family, and result in a lower investment in the education of each child. Additionally, high levels of infant mortality could also reflect adverse environmental conditions experienced while in-utero or in early childhood, such as natural catastrophes or epidemics, that may have a direct effect on mortality, future health, and cognitive capacities of survivors and, thus, on economic growth (e.g. Almond, 2006; Caruso & Miller, 2015).

The regional population from 1940 to 1989 is our third indicator. The inclusion of this variable is motivated by the literature relating population growth to economic growth (e.g. Headey & Hodge, 2009). The fourth and fifth indicators capture the regional weather conditions from 1940 to 1989 retrieved from National Oceanic and Atmospheric Administration, measured by the average air temperature and the average precipitation. As has been shown by past research, early-life weather conditions may have a persistent effect on future health, schooling, and socioeconomic outcomes (e.g. Maccini & Yang, 2009) as well as on economic development (e.g. Dell et al., 2012). Since all these variables are measured in the years associated with the birth cohorts, the same weighting procedure explained in Sect. 3 is applied to them. To account for non-linear interactions, the variables for population, temperature, and precipitation are included as a polynomial of the second degree.

5 Geography of intergenerational mobility in Latin America

In this section, we characterize the variation of intergenerational social mobility across the 52 sub-national regions we constructed for Latin America. Our goal in this section is to provide a first detailed spatial picture of the extent to which children’s education is related to their parental educational background. This analysis is relevant since it allows to identify regions with less social progress,Footnote 14

As a first approach, Fig. 2 maps the geography of social intergenerational mobility in Latin America for three cohorts. Interestingly, two main spatial patterns emerge: First, social mobility varies significantly across countries. The high levels of social mobility found in the south of South America (primarily Chile and Argentina) contrast with lower levels in the Northern part of the region, including Mexico and Central American countries. Second, there is also a substantial variation within countries. For instance, the south of Chile presents low upward mobility compared to the north of the country. In turn, the northern regions of Brazil shows considerably lower levels of mobility relative to the south. These findings complement previous country-level studies which show that intergenerational mobility is rising in Latin America (e.g. Neidhöfer et al., 2018). We provide evidence suggesting that this trend reached almost every sub-national region, but with a high degree of heterogeneity between and within countries.Footnote 15

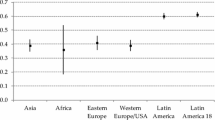

To emphasize the relevance of within-country variation, Fig. 3 shows the distribution of different measures of social mobility for each country and its regions. The country-level values can reasonably give a general picture of social mobility in Latin America. However, most of the country-levels estimates are not a sufficient summary of the heterogeneity within countries. For instance, Ecuador, Nicaragua, and Panama have levels of intergenerational persistence above the Latin American average (i.e., lower social mobility), while many of their sub-regions reach substantially lower levels, comparable to the most socially mobile countries (Argentina and Chile). This heterogeneity is also visible in Fig. 4, which shows the 10% regions with the highest and lowest levels of intergenerational mobility.

Figure 5 plots the evolution of social mobility measures for regional level (grey) and country-level (black) estimates by comparing individuals belonging to the first two cohorts of our analysis (1940–1949) with people born in the last two (1980–1989). As is evident, Latin Americans benefited differently from the development of social mobility over time, even considering areas within the same country. Estimates over the 45-degree line imply that intergenerational mobility did not change over the time period considered here. On the other hand, estimates reveal improvements in social mobility when they are on the right of the 45-degree line for intergenerational persistence, standardized persistence, and risk ratio, and on the left for the probability of upward mobility. In general, intergenerational mobility is rising in our sample of Latin American countries at both the regional and national level. For instance, while in all countries the chance of upward mobility for people born in 1940-49 with low-educated parents is less than 50%, the chances of people born in 1980-89 in many regions are significantly higher. However, substantial heterogeneity remains regarding both the degree of mobility as well as its evolution over time. In particular, the dispersion of social mobility across regions for younger cohorts is much less prominent than it was in past.

6 Social mobility and economic development

In this section we report the results of our empirical analysis testing the relationship between social mobility and economic development.Footnote 16 First, in 6.1, we present the results on the relationship between social mobility and economic development measured by regional income per capita in levels. Then, in 6.2, we show the estimates obtained by including lags of the dependent variable, which indicate the relationship between social mobility and economic growth. In 6.3 we then investigate the association between social mobility and other indicators of economic development, such as nighttime luminosity and poverty rates. We discuss the strengths and limitations of our results in 6.4. Finally, we provide additional evidence on the accumulation vs. allocation of human capital hypothesis in 6.5, and on the mobility-inequality nexus in 6.6.

6.1 Economic development

As a first approximation, Fig. 6 plots the averages over the entire time period of all four measures of social intergenerational mobility described in Sect. 4.2 and log average household per capita income. This first stylized analysis shows a clear and robust positive (negative) correlation between intergenerational mobility (persistence) and economic development, both across countries as well as across regions.

Table 1 presents the results of estimating equation (1) using the slope coefficient to measure intergenerational mobility (M) and average household per capita income as indicator of economic development (Y). So far, these estimates are obtained without including lags of the dependent variable. Recall that the slope coefficient is a measure of persistence; it shows the degree of association of one year of parental schooling with the years of schooling of their children. The higher this coefficient, the lower intergenerational mobility. Hence, a negative regression coefficient of M in Table 1 indicates higher intergenerational persistence (i.e. lower intergenerational mobility) is associated with lower average per capita income.Footnote 17 To allow a more straightforward interpretation of the coefficients, all variables are included as logarithms in the estimations. Robust standard errors are obtained by clustering at the country-year level to account for serial correlation of the error term within countries.Footnote 18 The significance of the point estimates is consistent with the main analysis if we cluster standard errors by countries, or regions.

We gradually include the control variables described in Sect. 4.4. In column (3) we first include the year-level covariates mentioned in Sect. 4.4.1 and in column (4) the cohort-level variables described in Sect. 4.4.2, which are aimed to abstract from contemporaneous and past characteristics related to social mobility that could influence economic development. Among these, the second set of controls includes information on migration and human capital accumulation, measured by the share of migrants in the cohort and the average and variance of years of schooling of the cohort. In column (5), results are obtained controlling for cohort-specific initial conditions, i.e. the economic conditions during the formative childhood years of individuals in our social mobility sample. These controls are necessary as said conditions could have had an effect on both social mobility as well as subsequent economic development. These include past GDP per capita, child mortality, population, temperature and precipitation from 1940 to 1989 (see Sect. 4.4.3). All variables at the cohort-level are weighted adopting the cohort-participation profiles explained in Sect. 3.2. Models including lags of the dependent variable are reported and discussed in Sect. 6.2.

The results show that in all estimations the coefficient of M, measured by the slope coefficient, is negative and highly significant. Hence, social mobility is consistently associated with economic development. These findings hold when controlling for (i) unobserved heterogeneity by including region and time fixed effects, (ii) potential mediators (cross-sectional inequality, share of migrants, average education, and cohort-specific initial conditions), (iii) spillover effects between regions in the same country, and (iv) country-specific time trends (country-by-time fixed effects).Footnote 19 On average, a 10% increase in intergenerational mobility, measured by the slope coefficient, is associated with a rise in per capita income by 17%.Footnote 20 To give benchmarks for this estimate, intergenerational mobility in education measured by the slope coefficient rose in Latin America, on average, by 4% from one four-year-cohort to the next between 1940 and 1991, and by 12% for people born at the end of the 70 s with respect to people born at the beginning of the 60 s.Footnote 21

Among the covariates included in the models, income inequality deserves a special mention. Its coefficient in most specifications shows that, controlling for the degree of intergenerational mobility, inequality is positively associated with economic development. However, the interaction between social mobility and cross-sectional income inequality in column (8) has a negative sign, meaning that low social mobility is particularly detrimental when income inequality is high. We will analyze the relationship between social mobility and inequality separately in Sect. 6.6.

6.2 Economic growth

We also analyze the relationship between social mobility and economic growth, rather than economic development measured in income levels. Equation (1) can be reformulated as a growth equation

where \(GY_{jct}=Y_{jct}-Y_{jct-1}\) is the logarithmic growth rate of regional income per capita. The only difference between (7) and the baseline equation (1) is the interpretation of the coefficient of the lagged dependent variable, \(\tilde{\theta }=\theta -1\) (Durlauf et al., 2005). With this in mind, we estimate equation (1) including one lag of regional income per capita among the set of covariates. Table 2 shows the results of the estimations.

Column (1) of Table 2 shows the estimates obtained by OLS regressions omitting the fixed effects \(\upsilon _{jc}\) and \(\tau _{tc}\). The coefficient of M is negative and significantly different from zero, suggesting that social mobility is positively associated with economic growth. Also, the requirement for conditional convergence is fulfilled, which is \(\tilde{\theta }<0\) or, respectively, \(\theta <1\). However, this OLS estimate may be biased because of the potential correlation between lagged income and the error term. Hence, in the next columns, we gradually include fixed effects in the model. Column (2) includes region fixed effects, column (3) region and year fixed effects, and column (4) region and country-by-year fixed effects. In these models, equivalently to most specifications in Table 1, the variation in the degree of social mobility within-regions explains the variation in economic growth. In all fixed effects estimations, the coefficient of M is consistently negative and significant, while conditional convergence still holds.

As shown by Nickell (1981), within-group estimates of dynamic panel data models such as equation (1) and (7) relying on a low number of observations over time (small T) may be seriously biased. If the number of observations over time included in our panel can be considered to be relatively high (T = 28 on average across regions, with a maximum of 36 time periods), the fixed-effects model that we estimate should provide consistent results (Roodman, 2009). However, following Marrero and Rodríguez (2013), among others, we also account for region-specific dynamics by estimating the models using dynamic panel data methods, and implement a system GMM-estimator (Arellano & Bover, 1995; Blundell & Bond, 1998). This approach is based on the use of lagged levels of the regressors as instruments. We employ the one-step system GMM estimator and consider robust standard errors. We use all available lags of income per capita \(>t-2\) and limit the number of instruments by collapsing the instrument set (Roodman, 2009). The results of this application are shown in columns (5) to (8) of Table 2. For transparency, we show the estimates for the same specifications as in columns (1)–(4). Below the estimates in these columns, we also report the p-value of the Hansen test of over-identifying restrictions, and the two Arellano-Bond tests of autocorrelation. A significant Hansen statistics suggests that the set of instruments is not valid, while absence of autocorrelation in the Arellano-Bond test requires that the AR(1) test rejects the null hypothesis (p \(<0.1\)) while the AR(2) test does not (p\(>0.1\)).

Generally, the results are consistent with the main analysis: Social mobility is negatively associated with economic growth when considering region-specific dynamics. The coefficients obtained by applying System-GMM, shown in columns (5)–(8) of Table 2, are in the same order of magnitude and are not significantly different from the OLS estimates, shown in columns (1)–(4) of the same table. Likewise, the coefficient of the income lag consistently points at conditional convergence. In column (5), which is the specification that does not include fixed effects, the validity of the instruments is not rejected by the Hansen test and the coefficient of M is negative, but not statistically significant. In columns (6) and (7), the coefficient of M is negative and significant, but the Hansen test suggests that the set of instruments is not valid. Finally, in column (8), which is our preferred specification because it properly controls for country-specific heterogeneity in income trends, the coefficient of M is statistically significant and the p-value of the Hansen test suggests that the set of instruments is valid. Altogether, the estimates suggest that social mobility is positively associated with future economic growth.Footnote 22

6.3 Different dimensions of development

We test whether the positive association between social mobility, income per capita and economic growth also extends to other dimensions of economic development. Table 3 presents the estimated coefficient of social mobility M in equation (1) for different variables as indicators of economic development Y. These estimations include the full set of control variables described in Sect. 4.4, region and country-by-time fixed effects, and spillover effects. The results show that the positive relationship between social mobility and economic development is robust to considering different indicators, namely the log of average nighttime lights per pixel (i.e. luminosity), poverty (headcount ratio at 1USD a day), total employment, labor formality, and houses with access to water and electricity. A 10% decrease in the slope coefficient (i.e. an increase in social intergenerational mobility) is associated with a 8% stronger luminosity, 25% less poverty, 8% more employment, 5% more labor formality, and 8% and 2% higher share of houses with access to water and electricity, respectively.Footnote 23

6.4 Discussion of the results

Although the exact identification of the effect of improving social mobility on economic performance is empirically challenging, and we cannot completely exclude that other sources of unobserved heterogeneity not considered here may bias our results, these new estimates allow us to make an important step toward understanding the relationship between social mobility and economic development.

First, the results presented above show that the positive and significant association between social mobility and economic development (and growth) is not explained by confounding factors such as migration, human capital accumulation, contemporaneous income inequality, and the initial conditions of the economy; i.e. the persistent effect of regional economic development in the past (1940–1989—which represents the circumstances faced during the formative years of the individuals in our sample) on present economic development.

Second, we perform the analysis within subnational regions over time. The inclusion of region and time fixed effects, and even country-specific time trends in some estimations, warrants that our estimates account for unobserved heterogeneity that could drive the results, for instance due to the role of culture and institutions as drivers of economic development. In addition, we also take into account region-specific dynamics affecting growth and development by estimating dynamic panel data models, which provide results that are consistent with the main analysis.

Third, given the structure of our data and the construction of our variable for social mobility through the weighting procedure explained in Sect. 3, the association that we measure relates past mobility with future economic development. Due to the applied cohort-participation profiles methodology, at the point in time when economic development is measured the individuals for whom mobility is estimated have already completed their educational careers. Further, we control for the past level of development–i.e. the cohort-specific initial conditions of the economy (including past GDP per capita, child mortality, population, temperature and precipitation in the period 1940–1989–which assures that the uncovered relationship between social mobility and economic development is not spuriously driven by the past level of development that is correlated with both, social mobility and future development. Hence, the estimated correlation is not affected by a feedback effect resulting in reverse causality.

Finally, all results hold when considering different dimensions of economic development, and the significance of the correlation is robust to the consideration of different measures of intergenerational mobility, when measuring the degree of intergenerational mobility of men and women separately, and to the exclusion of migrants (see Additional Results in the Online Appendix).Footnote 24

We conclude that these findings allow us to make a step forward toward understanding the relationship between social mobility and economic development. As mentioned in Sect. 2, the theoretical mechanism behind this relationship is that higher social mobility results in a better allocation of talent, thus, improving the overall productivity of the population in the labor force. Less inequality of opportunity in the process of human capital formation enables individuals from households in the lower end of the income distribution to translate their talent and abilities into human capital. As a consequence, assuming a constant distribution of innate abilities, the pool of talent in the labor force increases, and the allocation of individuals to occupations depends more on individual’s skills than on socioeconomic background. With low levels of social mobility, economic development is negatively affected by the misallocation of talent which is prevalent in the society. Since the frequency of our data is annual, the estimates obtained by including region fixed effects show that in a year when social mobility (i.e. the weighted average social mobility across all cohorts) is higher than average, economic development indicators show a higher-than-average performance. Hence, the positive association between mobility and development is mainly driven by cohorts of individuals that had better opportunities to develop their talent entering the labor market or gaining more experience and lower employment shares among cohorts of individuals that faced lower equality of opportunity and a stronger misallocation of talent.

6.5 Accumulation versus allocation

After having shown that social mobility is consistently and positively associated with economic development, and that this relationship is robust, we further test whether the main driver of this relationship is the accumulation of human capital or its allocation. Generally, a stronger accumulation of human capital and lower social mobility could coexist, for instance when it is mostly the children of high-educated parents who benefit from educational expansions. In the regressions presented thus far, we controlled for the average years of education to avoid bias in our estimates capturing the “trickle-down-effect” of this type of accumulation (at the top of the distribution) on economic development, instead of the impact of social mobility and equality of opportunity. Furthermore, the fact that also measures of relative mobility–such as the standardized persistence and the relative risk of high school completion–yield consistent results on the positive relationship between social mobility and economic development provides suggestive evidence in favor of the allocation-hypothesis. In this section, we further test this assumption including both the degree of upward mobility from the bottom, and the degree of persistence at the top. The results of this exercise are shown in Table 4.

The regression estimates in column (1) of Table 4 are obtained including the full set of control variables with the exception of average years of education. The coefficient of upward mobility, i.e. the likelihood of completing secondary education for the children of low-educated parents, is positively and significantly associated with economic development. The same applies to the degree of top persistence, i.e. the likelihood of completing secondary education for the children of high-educated parents, which is highly correlated with the degree of upward mobility from the bottom since secondary school expansions benefited most of the population in Latin American countries. However, when including the degree of upward mobility in column (4) and (5), the coefficient of top persistence becomes very small in size and statistically indistinguishable from zero. In contrast, the level of upward mobility is consistently, significantly, and substantially associated with economic development.

These estimates confirm that it is not only the overall accumulation of human capital that positively affects economic development, but also in which part of the distribution this accumulation takes place is important. Reduced inequality of opportunity implies a higher level of human capital accumulation for children from disadvantaged families leading to a more efficient allocation of talent, and, hence, to improved aggregate economic performance. A higher level of accumulation that only benefits advantaged families may have no direct effect on development.

6.6 Mobility and inequality

As a final exercise, we estimate the relationship between social mobility and income inequality. This relationship has attracted special attention by researchers and policy makers since descriptive evidence suggests that countries with high levels of income inequality also have low degrees of intergenerational mobility. A graph showing this relationship became very famous under the name Great Gatsby Curve (Corak, 2013).

Economic theory, indeed, suggests the existence of a negative correlation between inequality and social mobility (e.g. Becker & Tomes, 1979; Loury, 1981; Galor & Zeira, 1993; Owen & Weil, 1998; Maoz & Moav, 1999; Hassler et al., 2007). The main mechanism hypothesized to be behind this relationship is inequality in investment in human capital: since parents invest one part of their income in the human capital of their children, a higher degree of income inequality leads to a higher dispersion of parental investments. Hence, the human capital of children from families in the upper part of the distribution rises at a higher rate than the human capital of children from families with less resources and, as a consequence, social mobility decreases. Neidhöfer (2019) tests this side of the relationship and finds that, indeed, higher levels of inequality experienced during childhood and adolescence by children of low-educated parents are associated with lower levels of mobility measured in adulthood. Our data allows us to investigate the other side of the relationship, namely the effect of intergenerational mobility on future cross-sectional income inequality. The proposed mechanism driving this relationship is straightforward: higher inequality of opportunity to invest in human capital, which mirrors a lower degree of social mobility, leads to higher levels of income inequality in the future.

We follow the same approach as before and estimate the partial correlation between social mobility in year t, obtained by weighting the mobility of each cohort by their cohort-participation profile, and income inequality in t. Figure 7 plots the unconditional relationship between our four indicators for social mobility and income inequality (i.e. the Great Gatsby Curve), measured by the Gini coefficient of disposable household income per capita. Table 5 shows estimates obtained via linear regressions subsequently including the control variables described above. All results are consistent with the hypothesis that lower levels of social mobility, and hence higher inequality of opportunity, are associated with higher levels of future income inequality.

7 Conclusions

In this paper, we explored the relationship between social intergenerational mobility and economic development constructing a new panel data set including 52 regions of 10 Latin American countries. For these regions, we estimate the degree of intergenerational mobility of people born between 1940 and 1989, and aggregate measures of economic development from 1981 to 2018. These are linked using a new weighting procedure that we develop to account for the relative participation of the cohorts in the economy in each year. Our results show a positive, significant, and robust association between increasing social mobility and the economic development of Latin American regions.

To the best of our knowledge, this paper represents the first large scale study on the role of social mobility on economic development and contributes to our understanding of the nexus between inequality and economic growth. Our findings suggest the non-existence of the equity-efficiency trade-off regarding social mobility. Conversely, they suggest that improving equality of opportunity generates positive economic returns. Our analysis provides evidence for the robustness of this positive association and shows that it is not driven by confounders such as migration, human capital accumulation, and initial development conditions. Although a clear causal identification of the relationship is challenging, our empirical set-up makes a decisive step forward. In addition, the cohort-participation profiles methodology that we propose should also be suitable for a more thorough evaluation of the relationship between human capital, measured by education, and growth. This new methodology represents a valuable contribution to this branch of the literature, which thus far has mainly focused on contemporary (or lagged) relationships between the average education of the working age population and economic growth.

Our findings are also relevant for the evaluation of the effectiveness of market interventions. Arguably, interventions aimed at improving equality of opportunity may create distortions and thus lead to inefficiency in the short-run. However, if these interventions are indeed able to contribute to better opportunities and less misallocation of talent, they should simultaneously contribute to increased efficiency in the long run. Consequently, both effects could possibly outweigh each other and change the terms of the trade-off. For the sake of sustainable policy decisions, these long-run considerations should be taken into account to evaluate the effectiveness of policy measures in the future.

Finally, our analysis also contributes to the literature on the geography of intergenerational mobility (e.g. Alesina et al., 2021; Chetty et al., 2014; Corak, 2020; Güell et al., 2018) by providing the first geographical trends for 52 sub-national regions in Latin America. Our findings show that there is considerable variation among sub-national regions in both intergenerational mobility and economic development, even within countries. Since previous country-level estimations showed that Latin America is a region with strong intergenerational persistence (e.g. Torche, 2014; Neidhöfer et al., 2018), these new findings contribute to the overall understanding that country-wide patterns obscure within-country heterogeneity.

Notes

The essay “The Misallocation of Talent” by Rodríguez Mora (2009) motivates the importance of the subject: “A society with low intergenerational mobility is not only unfair, it is inefficient. There is no trade-off between fairness and efficiency when increasing mobility: the more there is, the fairer and more efficient society. (...) It is hard to think about fairness, since what is fair for some is unfair for others. Efficiency is a much more powerful concept; if an allocation is inefficient, it is so for everybody. Society (as a whole) could do better.”

Analyzing the mechanisms affecting social mobility—such as territorial segregation across neighborhoods, early childhood policies, educational systems, informational barriers etc—and their relative effectiveness in improving equality of opportunity goes beyond the scope of this work. For a review of the causal evidence on the topic, see Stuhler (2018).

To further prove the consistency of our proposed method we also run a series of placebo tests where we use weighting schemes that do not relate at all to the cohort-participation profile in each year. The results of these placebo tests (included in the Online Appendix, Section E.8) show, reassuringly, no clear pattern of association between social mobility and economic development across specifications.

Intergenerational mobility measures give meaningful insights on the stratification of societies and are closely related to the notion of equality of opportunity; both empirically and conceptually (Brunori et al., 2013).

For instance, measures of income mobility may suffer from so-called life cycle bias if measured on few income spells for parents and children (e.g. Nybom & Stuhler, 2017).

The correlation between these four measures for social intergenerational mobility is high but not perfect (see Section A.2 of the Online Appendix). Hence, each captures different aspects of social mobility.

Following the so-called “dominance principle”, in all mobility measures we define parental education as the education of the parent in the household with the highest qualification. For individuals that indicated only the education of one parent, we use the available information.

When no control variables are included in equation (3), \(\rho\) is equivalent to Pearson’s correlation coefficient between y and \(y^{p}\).

Neidhöfer et al. (2018) discuss potential selectivity issues that derive from non-responses to questions on parental education in household surveys. The analysis shows that although non-response (which is between 2 and 22% of respondents depending on the survey) might be systematic, i.e. respondents with lower education are slightly less likely to report their parents education, this does not affect significantly the sample mean and variance of years of education. Selective non-response could, if substantial, lead to upwardly biased intergenerational mobility estimates. However, the pattern is found to be the same in all countries, such that cross-country comparisons should keep their validity. For more information, see Neidhöfer et al. (2018), Supplemental Material, Section 1.3.

The surveys that we use for nine of the ten countries are nationally representative for urban and rural areas. The survey that we use to measure intergenerational mobility in Argentina only includes urban areas (defined as localities with more than 2,000 inhabitants) covering 91.1% of the total Argentinian population (see Piovani & Salvia, 2018) More information on the employed surveys is included in Section A of the Online Appendix.

We follow the methodology of the Socioeconomic Database for Latin America and the Caribbean (SEDLAC), a project jointly developed by CEDLAS at the Universidad Nacional de La Plata and the World Bank. For more information, see the https://www.cedlas.econo.unlp.edu.ar/wp/en/estadisticas/sedlac/.

For the purposes of this paper, an individual is considered a migrant if he or she was born in a different geographic area from his or her geographic area of residence (see Online Appendix, Section D). Chetty and Hendren (2018) evaluate the impacts of neighborhoods on intergenerational mobility and find heterogeneous effects depending on the age of children at the time of migration. However, we do not have information on the age of migration, which would allow us to consider this aspect in our analysis. The results excluding migrants, included in the Online Appendix, show the pure, but downward biased, local level effect of social mobility on development and can, thus, be considered a lower bound estimate.

Munoz (2021) estimates intergenerational mobility of education across Latin American provinces using cohabitation samples from census data. Since the estimates are relying on parents and children cohabiting in the same household, and hence a sample of older individuals is likely to suffer from co-residency bias (Emran et al., 2018) the analysis mostly focuses on the probability to complete primary education of younger individuals, following Alesina et al. (2021). This dimension is, actually, important for older cohorts of Latin American residents, but less relevant for younger cohorts because of the expansion of secondary education in recent decades (e.g. Levy & Schady, 2013). Indeed, changes in returns to education just above and below high school completion are closely related to the changes in inequality experienced in the region (López-Calva & Lustig, 2010).

Note that these estimates are merely descriptive and do not consider, so far, the role of migration in shaping intergenerational mobility patterns. The level of intergenerational mobility of a region is measured on a sample including all residents of that region. Since the intention of this part of the analysis is to give a descriptive overall picture on the geography of intergenerational mobility in Latin America we abstain from excluding migrants here. However, when measuring the impact of intergenerational mobility on economic development in the next sections we do take this important dimension into account, including appropriate control variables and testing the robustness of our results.

Throughout this section, we present the results weighting social mobility measures using the aggregated cohort-participation profiles. All the results presented here are robust to the utilization of the other alternatives of cohort weights described in Sect. 3. These additional results are shown in Section E of the Online Appendix.

The same applies for the standardized persistence (\(\rho\)) and the relative risk of high school completion (RR). For the probability of upward mobility (UM) a positive coefficient indicates that higher mobility is associated with economic development.

Results with bootstrapped standard errors are included in the Online Appendix.

Spillover effects are controlled by including the average degree of intergenerational persistence in year t of all other regions \(-j\) in the country (i.e. region j is excluded to estimate this average).

The results obtained using the other measures of mobility described in Sect. 4.2 confirm these findings. The average effect over all mobility measures is around 12%. In terms of standard deviations, the effect size is also similar across specifications and mobility indicators: a one standard deviation increase in mobility is associated with an income per capita increase of around 0.5–1 standard deviations. All additional results tables, including several robustness checks, can be found in the Online Appendix, Section E.

These estimates are obtained from the Mobility-Latam Data at https://mobilitylatam.website (see Neidhöfer et al., 2018).

The results we obtain with the other social mobility measures are mainly consistent with the baseline analysis, although the statistical significance of the coefficients and the validity of the instrument set sometime varies. However, qualitatively, all estimates suggest the same pattern: social mobility is positively associated with economic development and growth. The additional System GMM estimates obtained with the other indicators are included in the Online Appendix, Section E.

The coefficient of the last parameter is not statistically significant.

Generally, the intergenerational mobility of men and women, and of migrants and non-migrants, are highly correlated across regions and cohorts. The mobility of each population subgroup is likely to be influenced by the shared overall equality of opportunity-enhancing environment and, since all subgroups participate to the economy, we do not expect substantial differences in the estimated relationship between each subgroup level of mobility and economic development. Interestingly, the point estimates showing the association between the social mobility of men and economic development are stronger then the estimates for women. This is in line with a lower labor market participation–both at the extensive and intensive margin–of women in most Latin American countries.

References

Aghion, P., Akcigit, U., Bergeaud, A., Blundell, R., & Hémous, D. (2019). Innovation and top income inequality. The Review of Economic Studies, 86, 1–45.

Aiyar, S., & Ebeke, C. (2020). Inequality of opportunity, inequality of income and economic growth. World Development, 136, 105115.

Alesina, A., Hohmann, S., Michalopoulos, S., & Papaioannou, E. (2021). Intergenerational mobility in Africa. Econometrica, 89, 1–35.

Almond, D. (1918). Is the influenza pandemic over? Long-term effects of in utero influenza exposure in the post-1940 US population. Journal of Political Economy, 114(2006), 672–712.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68, 29–51.

Aydemir, A. B., & Yazici, H. (2019). Intergenerational education mobility and the level of development. European Economic Review, 116, 160–185.

Bandiera, O., Burgess, R., Das, N., Gulesci, S., Rasul, I., & Sulaiman, M. (2017). Labor Markets and Poverty in Village Economies*. The Quarterly Journal of Economics, 132, 811–870.

Banerjee, A. V., & Duflo, E. (2003). Inequality and growth: What can the data say? Journal of Economic Growth, 8, 267–299.

Barro, R. J. (2000). Inequality and growth in a panel of countries. Journal of economic growth, 5, 5–32.

Becker, G. S., & Lewis, H. G. (1973). On the interaction between the quantity and quality of children. Journal of political Economy, 81, S279–S288.

Becker, G. S., & Tomes, N. (1979). An equilibrium theory of the distribution of income and intergenerational mobility. Journal of political Economy, 87, 1153–1189.

Becker, G. S., & Tomes, N. (1986). Human capital and the rise and fall of families. Journal of labor economics, 4, S1–S39.

Bell, A., Chetty, R., Jaravel, X., Petkova, N., & Van Reenen, J. (2019). Who becomes an inventor in America? The importance of exposure to innovation. The Quarterly Journal of Economics, 134, 647–713.

Berg, A., Ostry, J. D., Tsangarides, C. G., & Yakhshilikov, Y. (2018). Redistribution, inequality, and growth: New evidence. Journal of Economic Growth, 23, 259–305.

Black, S. E., Devereux, P. J., Lundborg, P., & Majlesi, K. (2020). Poor little rich kids? The role of nature versus nurture in wealth and other economic outcomes and behaviours. The Review of Economic Studies, 87, 1683–1725.

Black, S. E., Devereux, P. J., & Salvanes, K. G. (2011). Older and wiser? Birth order and IQ of young men. CESifo Economic Studies, 57, 103–120.

Blanden, J. (2013). Cross-country rankings in intergenerational mobility: A comparison of approaches from economics and sociology. Journal of Economic Surveys, 27, 38–73.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of econometrics, 87, 115–143.

Bolt, J., & van Zanden, J. L. (2020). Maddison style estimates of the evolution of the world economy. A New 2020 Update. University of Groningen, Groningen Growth and Development Centre, Maddison Project Working Paper.

Bourguignon, F., Ferreira, F. H., & Walton, M. (2007). Equity, efficiency and inequality traps: A research agenda. The Journal of Economic Inequality, 5, 235–256.

Bowles, S., & Gintis, H. (2002). The inheritance of inequality. Journal of economic Perspectives, 16, 3–30.

Bradbury, K., & Triest, R. K. (2016). Inequality of opportunity and aggregate economic performance. RSF The Russell Sage Foundation Journal of the Social Sciences, 2, 178–201.

Brueckner, M., Lederman, D., et al. (2018). Inequality and economic growth: The role of initial income. Journal of Economic Growth, 23, 341–366.

Brunori, P., Ferreira, F. H., & Peragine, V. (2013) Inequality of opportunity, income inequality and economic mobility: Some international comparisons. In: Getting Development Right: Structural Transformation, Inclusion, and Sustainability in the Post-Crisis Era (vol. 85), Palgrave Macmillan.

Caruso, G., & Miller, S. (1970). Long run effects and intergenerational transmission of natural disasters: A case study on the, Ancash Earthquake. Journal of development economics, 117(2015), 134–150.

Chetty, R., & Hendren, N. (2018). The impacts of neighborhoods on intergenerational mobility I: Childhood exposure effects. The Quarterly Journal of Economics, 133, 1107–1162.

Chetty, R., Hendren, N., Kline, P., & Saez, E. (2014). Where is the land of opportunity? The geography of intergenerational mobility in the United States. The Quarterly Journal of Economics, 129, 1553–1623.

Corak, M. (2013). Income inequality, equality of opportunity, and intergenerational mobility. Journal of Economic Perspectives, 27, 79–102.

Corak, M. (2020). The Canadian geography of intergenerational income mobility. The Economic Journal, 130, 2134–2174.

Dasgupta, P., & Ray, D. (1986). Inequality as a determinant of malnutrition and unemployment: Theory. The Economic Journal, 96, 1011–1034.

Dell, M., Jones, B. F., & Olken, B. A. (2012). Temperature shocks and economic growth: Evidence from the last half century. American Economic Journal: Macroeconomics, 4, 66–95.

Diamond, R. (2016). The determinants and welfare implications of US workers’ diverging location choices by skill: 1980–2000. American Economic Review, 106, 479–524.

Durlauf, S. N., Johnson, P. A., & Temple, J. R. (2005). Growth econometrics. Handbook of economic growth, 1, 555–677.

Emran, M. S., Greene, W., & Shilpi, F. (2018). When measure matters coresidency, truncation bias, and intergenerational mobility in developing countries. Journal of Human Resources, 53, 589–607.

Fan, Y., Yi, J., & Zhang, J. (2015). The great gatsby curve in China: Cross-sectional inequality and intergenerational mobility. Technical Report, Working Paper, CUHK, Hongkong

Ferreira, F. H., Lakner, C., Lugo, M. A., & Özler, B. (2018). Inequality of opportunity and economic growth: how much can cross-country regressions really tell us? Review of Income and Wealth, 64, 800–827.

Galor, O., & Moav, O. (2004). From physical to human capital accumulation: Inequality and the process of development. The Review of Economic Studies, 71, 1001–1026.

Galor, O., & Tsiddon, D. (1997). The distribution of human capital and economic growth. Journal of Economic Growth, 2, 93–124.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The review of economic studies, 60, 35–52.

Genicot, G., & Ray, D. (2017). Aspirations and inequality. Econometrica, 85, 489–519.

Güell, M., Pellizzari, M., Pica, G., & Rodríguez Mora, J. V. (2018). Correlating social mobility and economic outcomes. The Economic Journal, 128, F353–F403.

Hassler, J., & Rodriguez Mora, J. V. (2000). Intelligence, social mobility, and growth. American Economic Review, 90, 888–908.

Hassler, J., Rodríguez Mora, J. V., & Zeira, J. (2007). Inequality and mobility. Journal of Economic Growth, 12, 235–259.