Abstract

The literature on aid and growth has not found a convincing instrumental variable to identify the causal effects of aid. This paper exploits an instrumental variable based on the fact that, since 1987, eligibility for aid from the International Development Association (IDA) has been based partly on whether or not a country is below a certain threshold of per capita income. The paper finds evidence that other donors tend to reinforce rather than compensate for reductions in IDA aid following threshold crossings. Overall, aid as a share of gross national income (GNI) drops about 59 % on average after countries cross the threshold. Focusing on the 35 countries that have crossed the income threshold from below between 1987 and 2010, a positive, statistically significant, and economically sizable effect of aid on growth is found. A 1 percentage point increase in the aid to GNI ratio from the sample mean raises annual real per capita growth in gross domestic product by approximately 0.35 percentage points.

Similar content being viewed by others

Notes

This assertion applies to countries crossing from below, but perhaps not to the smaller set of countries crossing the threshold from above; at least they display systematic negative growth rates. Moreover, IDA policies are premised on the expectation of growth and eventual graduation, and instances of crossing the threshold from above are dealt with in a more ad hoc fashion. In such cases, IDA has often been “reluctant to accept renewed claims on its scarce concessional resources, especially if this would reward poor performance” (Kapur et al. 1997). Crossing from above and from below may therefore have highly asymmetric effects on aid, and in turn on subsequent growth. In particular, crossing from above would likely be a weaker instrument for aid, and its effects would be less precisely estimated due to the smaller sample of relevant countries. We therefore focus only on the countries that cross the IDA threshold from below.

Regressing the average growth rate over a long period of time on the average aid in that period does not identify the long-term effect of aid on economic growth, even if aid were exogenous in that equation.

http://databank.worldbank.org/ddp/home.do?Step=12&id=4&CNO=2, accessed and extracted in August, 2012. The WDI dataset is usually updated 4 times a year, and sometimes revises historical data on national income and other variables. Most of the revisions are minor.

Data are from DAC Table 2a, available at http://stats.oecd.org/Index.aspx?DatasetCode=TABLE2A, accessed in August, 2012.

Both aid and GNI are measured in nominal terms, as is the IDA income threshold.

Sao Tome and Principe crossed the threshold in 2009. It has only two periods of data in the sample and is thus automatically dropped from the analysis and hence also from the sample.

Many recent panel studies group years in 4- or 5-year periods. Temple and Van de Sijpe (2014) use 3-year periods. As Clemens et al. (2012, p.594) observe, “The question of when to test for growth impacts plagues the entire growth literature, not just aid-growth research. Empirical research on the determinants of growth cannot escape the selection of a fixed observation period,” but there is no consensus regarding the time intervals over which to study growth.

The SDR (“Special Drawing Rights,” the unit of account for the International Monetary Fund) deflator is a weighted average of the GDP deflators for the U.S., Japan, the U.K. and the euro area. As shown in Fig. 1, the threshold declined slightly for several years between 1998 and 2002, because the SDR deflator was negative.

We follow the convention of the majority of the literature and measure both GNI and ODA in current US dollars, the same units IDA uses to define its income threshold. A minority of studies, such as Boone (1996), use GNI in purchasing power parity terms, however.

In Online Appendix Table C we report the results of including \(Crossing_{i,s-1}, Crossing_{i,s-2}\), and \(Crossing_{i,s-3}\) in the model while otherwise retaining the specification of Eq. 1. Column 1 presents the results. Coefficients associated with all three variables are negative and statistically significant. However, the one associated with \(Crossing_{i,s-2}\) has the largest test statistic. Reduced-form results are in column 2 of Online Appendix Table C.

For sample countries with per capita GNI always above the false threshold, the crossing dummy is replaced with 0.

Our aid and growth variables both have some measure of national income in their denominators. By controlling for both income (per capita) and population and measuring them (and aid/GNI) in logs, we minimize the possibility of spurious correlation due to regressing two variables with the same denominator (Kronmal 1993).

Notice that, by construction, \(y_{is-1} \) is not mechanically correlated with the dependent variable. Some studies in the literature use per capita real GDP in purchasing power parity terms to measure income level and to calculate growth (e.g., Boone 1996). Real per capita GDP based on current exchange rates (in constant dollar terms, and using the Atlas method) and real per capita GDP in PPP terms are highly correlated (at over .95) across countries in our sample. Growth rates constructed from the two versions are essentially the same. We use per capita GDP based on current exchange rates (in constant dollars) because there are fewer missing observations in the WDI database than for the PPP measure. Using instead the PPP measure we obtain almost identical results for our basic specifications in Table 3.

For further justification of why we use the log form, see Appendix B. In addition, the results are essentially unchanged when \(Aid_{is-1} \) is measured as the ODA share of GDP.

When the panel is long, \(\ddot{\varepsilon }\) is less correlated with the error term from a particular period, and the bias will be small. To get a sense of the potential bias in the 2SLS fixed effect model due to the mechanical correlation between the instrument and the demeaned error term, we conduct a Monte Carlo simulation. We assume the error term is i.i.d. We use the predicted values from the OLS FE model and add an i.i.d. error to simulate the outcome variable \((g_{is}^{sim} )\). We reconstruct our instrument as \({Crossing_{is-2}^{sim}} = \mathbf 1 \left\{ {y_{is-3} +g_{is}^{sim} \ge {\bar{y}}_{s-2} } \right\} \), where \({\bar{y}}_{s} \) is the IDA threshold in the second year of period s. In the FE model, the instrument is thus mechanically correlated with the demeaned error term. We then estimate the 2SLS FE model using \({Crossing_{is-2}^{sim}}\) as the instrumental variable for aid and gauge the magnitude of the bias. We repeat this procedure 1,000 times, take the mean of 2SLS FE estimate and compare it with the OLS FE estimate (the true parameter). We estimate a negligible bias of less than 2 % of the true parameter value.

Since both our sample and the extended dataset are unbalanced panels, for each of the 35 countries in our sample we use only a balanced panel of available donors.

This algorithm is in the spirit of the synthetic control approach in Abadie et al. (2010).

Using the predicted crossing as the instrumental variable introduces sampling error not accounted for in the synthetic control step, which leads to bias in the estimation of the standard error. Usually this is adjusted by bootstrapping the whole procedure. We did not do this because bootstrap fails for the K-nearest neighbor matching (Abadie and Imbens 2008). The intuition is that in the K-nearest neighbor matching the number of matches does not increase smoothly with the sample size. Synthetic matching does allow the number of matches to rise as the sample size increases, but the increase is not smooth everywhere because we restrict the weights to be bounded between 0 and 1. More sophisticated bootstrap procedures may recover the correct inference, but we are not aware of a widely accepted method (also see Imbens and Wooldridge 2009 for a discussion of this issue).

A large F-statistic suggests a strong first stage, alleviating the concern of potential severe bias due to weak instruments. For linear models with only one endogenous variable, Stock and Yogo (2005) suggest a rule-of-thumb cutoff for a first stage F-Statistic of about 10. This heuristic criterion does not apply straightforwardly to more complicated specifications presented below.

Column 3 of Online Appendix Table C presents the estimates of the same specification as in Column 3 of Table 3, but using \(Crossing_{is-1}, Crossing_{is-2}\), and \(Crossing_{is-3}\) as instrumental variables. The point estimate of the effect of aid on growth remains very similar, but the first stage is weaker than in our baseline specification.

If we re-estimate the model in column 3 of Table 3 while including quadratic and cubic terms of \(y_{is-1}\), the results remain similar (as shown in Online Appendix Table H).

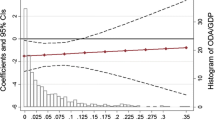

We report the robust first-stage F statistic for the overall strength of the first stage (Kleibergen-Paap rank Wald F statistic) for specifications in Table 4. With multiple endogenous variables, the first stage F statistic is less informative than the case of one instrument. We thus construct 95 % Anderson-Rubin confidence intervals for the coefficients associated with endogenous variables that are robust to weak instruments (Finlay and Magnusson 2009). With two endogenous variables, the confidence interval of a particular coefficient depends on the value of the coefficient associated with the other endogenous variable. Thus the confidence interval for both endogenous variables will be a two-dimensional figure. We report these graphs for specifications in Table 4 in Online Appendix Figure A. Overall, the 95 % confidence intervals for the aid coefficient lie entirely to the right of zero (except for Column 4 in which we obtain significance only at the 10 % level, and we show the plot for the 90 % confidence interval).

We rely on first differenced models in this exercise because changing the number of periods also affects the estimation of the country fixed effects, and we want to hold everything constant except for the signal to noise ratio in aid.

Needless to say, as discussed extensively through the paper, this is not the only source of potential endogeneity in aid. Furthermore, we note that the discussion above is based on the assumption of a homogeneous effect of log aid. Relaxing this assumption, the results found in Table 5 would also be consistent with the presence of heterogeneous effects where aid has the largest effect around the IDA threshold (instead of when countries were poorer).

Results are also robust to other specifications in Table 3.

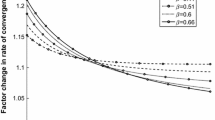

Even under a linear technology such as the AK model, the effect of aid on growth could be strictly concave since, for instance, the effect of aid on physical investment might be decreasing in aid. Moreover, the aggregate technology could be non-linear as suggested by the robust finding of conditional convergence in the empirical growth literature.

Note that this figure is also consistent with standard growth accounting assumptions. Assuming capital per capita depreciation rate of 10 percent per year, and an investment rate of 25 percent of GDP per year, a country with a capital-output ratio of 2 would grow, in per capita terms, at 2.5 percent per year, which is consistent with the figures in our sample.

Admittedly, the back-of-the-envelope calculation changes somewhat when alternative growth models are used. Using the A-K model with per capital output function \(y=Ak^{\alpha }\), when \(\alpha =0.49\), directly estimated from our sample, and \(K/Y=2\) , investment accounts for a smaller, but still substantial \(37~\% (= 0.49 \times 0.5 \times 0.54/0.35)\) of the total effect on growth.

References

Abadie, A., Diamond, A., & Hainmueller, J. (2010). Synthetic control methods for comparative case study: Estimating the effect of California’s tobacco control program. Journal of the American Statistical Association, 105(490), 493–505.

Abadie, A., & Imbens, G. W. (2008). On the failure of the bootstrap for matching estimators. Econometrica, 76(6), 1537–1557.

Acemoglu, D., Johnson, S., & Robinson, J. A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401.

Alesina, A., & Dollar, D. (2000). Who gives foreign aid to whom and why? Journal of Economic Growth, 5, 33–64.

Angrist, J., Imbens, G. W., & Rubin, D. B. (1996). Identification of causal effects using instrumental variables. Journal of the American Statistical Association, 91(434), 444–455.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Arndt, C., Jones, S., & Tarp, F. (2010). Aid, growth and development: have we come full circle? Journal of Globalization and Development, 1(2), 5.

Arndt, C., Jones, S. & Tarp, F. (2015). ‘What is the aggregate economic rate of return to foreign aid? World Bank Economic Review.

Bazzi, S., & Clemens, M. (2013). Blunt instruments: Avoiding common pitfalls in identifying the causes of economic growth. American Economic Journal: Macroeconomics, 5(2), 152–186.

Boone, P. (1996). Politics and the effectiveness of foreign aid. European Economic Review, 40(2), 289–329.

Bruckner, M. (2013). On the simultaneity problem in the aid and growth debate. Journal of Applied Econometrics, 28(1), 126–150.

Burnside, C., & Dollar, D. (2000). Aid, policies, and growth. American Economic Review, 90(4), 847–868.

Bun, M. J. G., & Windmeijer, F. (2010). The weak instrument problem of the system GMM estimator in dynamic panel data models. Econometrics Journal, 13(1), 95–126.

Cameron, A. C., Gelbach, J., & Miller, D. (2008). Bootstrap-based improvement for inference with clustered errors. Review of Economics and Statistics, 90(3), 414–427.

Chong, A., & Gradstein, M. (2008). What determines foreign aid: The donors’ perspective. Journal of Development Economics, 87, 1–13.

Clemens, M. A., Radelet, S., Bhavnani, R. R., & Bazzi, S. (2012). Counting chickens when they hatch: The short-term effect of aid on growth. Economic Journal, 122(561), 590–617.

Dreher, A., Eichenauer, V. & Gehring, K. (2016). Geopolitics, aid and growth: The impact of UN security council membership on the effectiveness of aid. World Bank Economic Review. doi:10.1093/wber/lhw037

Dreher, A. & Langlotz, S. (2015). Aid and growth: New evidence using an excludable instrument. CESifo Working Paper No. 5515.

Easterly, W., Levine, R., & Roodman, D. (2004). Aid, policies, and growth: Comment. American Economic Review, 94(3), 774–780.

Finlay, K., & Magnusson, L. M. (2009). Implementing weak-instrument robust tests for a general class of instrumental-variables models. Stata Journal, 9(3), 398–421.

Frot, E., & Santiso, J. (2011). Herding in aid allocation. Kyklos, 64(1), 54–74.

Hansen, H., & Tarp, F. (2001). Aid and growth regressions. Journal of Development Economics, 64(2), 547–570.

Headey, D. (2008). Geopolitics and the effect of foreign aid on economic growth: 1970–2001. Journal of International Development, 20, 161–180.

Imbens, G. W., & Wooldridge, J. M. (2009). Recent developments in the econometrics of program evaluation. Journal of Economic Literature, 47(1), 5–86.

Jerven, M. (2013). Comparability of GDP estimates in sub-saharan Africa: The effect of revisions in sources and methods since structural adjustment. Review of Income and Wealth, 59, S16–S36.

Kapur, D., Lewis, J. P., & Webb, R. C. (1997). IDA: The bank as a dispenser of concessional aid. In D. Kapur, J. P. Lewis, & R. C. Webb (Eds.), The World Bank: Its First Half Century, Chapter 17 (Vol. 1, pp. 1119–1159). Washington, DC: Brookings Institution Press.

Kraay, A. (2012). How large is the government spending multiplier? Evidence from world bank lending. Quarterly Journal of Economics, 127, 829–887.

Kronmal, R. A. (1993). Spurious correlation and the fallacy of the ratio standard revisited. Journal of the Royal Statistical Society., 156(3), 379–392.

McCrary, J. (2008). Manipulation of the running variable in the regression discontinuity design: A density test. Journal of Econometrics, 142(2), 698–714.

Mekasha, T. J., & Tarp, F. (2013). Aid and growth: What meta-analysis reveals. Journal of Development Studies, 49(4), 564–583.

Moss, T. & Majerowicz, S. (2012). No Longer Poor: Ghana’s New Income Status and Implications of Graduation from IDA. Center for Global Development Working Paper 300, Washington, D.C.

Nunn, N., & Qian, N. (2014). U.S. food aid and civil conflict. American Economic Review, 104(6), 1630–1666.

OECD (2012). Statistics on resource flows to developing countries. http://www.oecd.org/dac/aidstatistics/statisticsonresourceflowstodevelopingcountries.htm.

Qian, N. (2015). Making progress on foreign aid. Annual Review of Economics, 7(1), 277–308.

Rajan, R., & Subramanian, A. (2008). Aid and growth: What does the cross-country evidence really show? Review of Economics and Statistics, 90(4), 643–665.

Rodrik, D. (1996). Understanding economic policy reform. Journal of Economic Literature, 34(1), 9–41.

Roodman, D. (2007). The Anarchy of numbers: Aid, development, and cross-country empirics. World Bank Economic Review, 21(2), 255–277.

Roodman, D. (2009a). How to to xtabond2: An introduction to difference and system GMM in stata. Stata Journal, 9(1), 86–136.

Roodman, D. (2009b). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158.

Stock, J. H. & Yogo, M. (2005). Testing for weak instruments in linearIV regression. Identification and inference for econometric models: Essaysin honor of Thomas Rothenberg.

Temple, J. (2010). Aid and conditionality. Handbook of Development Economics, 5, 4415–4523.

Temple, J. & Van de Sijpe, N. (2014). Foreign aid and domestic absorption. CESifo Working Paper No. 5029.

Werker, E., Ahmed, F. Z., & Cohen, C. (2009). How is foreign aid spent? Evidence from a natural experiment. American Economic Journal: Microeconomics, 1(2), 225–244.

World Bank (1989). IDA eligibility. IDA 9 Discussion Paper No. 3. March. Washington, DC: The World Bank.

World Bank (2010). A review of IDA’s long term financial capacity and financial instruments (IDA16 Replenishment Report). Washington, DC: The World Bank.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful for valuable comments by several anonymous referees, George Clarke, Michael Clemens, Yingyao Hu, Aart Kraay, Martin Ravallion, and seminar participants at the 2013 Southern Economics Association Annual Meeting, the University of Toronto, Xiamen University, and the Center for Global Development.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A: standard errors

We first report robust standard errors clustered at the country level, which allow for arbitrary within-country correlation. There are 35 countries in our sample. Standard asymptotic tests might over-reject the null hypothesis under the presence of few clusters. Although 35 clusters is not a small number, for robustness we also report the standard errors from the clustered wild bootstrap procedure following Cameron et al. (2008). recommends the clustered wild bootstrap-t procedure for better asymptotic properties, as the t statistic is “pivotal”. However, in order to compare with the clustered standard errors, we report the standard errors from the clustered wild bootstrap procedure. Inference based on the bootstrap-t procedure is quantitatively similar to that based on bootstrapped standard errors. Either approach yields very similar statistical inferences. Throughout the paper, we report both sets of standard errors. For brevity, we focus our discussion on the clustered standard errors, and in tables, we mark asterisks after these standard errors to indicate conventional levels of statistical significance.

Appendix B: the functional form of aid

Our measure of aid is slightly different from most of the literature, which often uses the aid to GDP or GNI ratio as the main explanatory variable. We take the log of aid since the previous body of evidence suggests that the marginal effect of aid on growth is decreasing. The logarithmic form is a parsimonious way to introduce concavity while preserving our ability to identify aid’s causal impact with only one exogenous binary instrumental variable. However, note that instrumented aid still takes on a large number of values on its domain, since each country’s aid is shifted by the instrument starting from different values (over time). The logarithmic specification is admittedly less flexible than a quadratic specification; in particular, it does not allow the marginal effect of aid to change its sign. Clemens et al. (2012), however, find that the effect of aid on growth does not turn negative until aid exceeds roughly 15 % of GDP. In our sample, over 90 % of the observations are below 11 % of GDP. Thus, a logarithmic specification provides a good approximation over the range of observed values on aid. Additionally, we report as a robustness test in Table G results from using \(Aid_{is-1}^*=\Big (\sum _{k=3}^5 \frac{ODA_{it-k} }{GNI_{it-k} }\Big )/3\) (i.e. not logged) as the measure for aid. \(Aid_{is-1}^*\) has a positive, quantitatively large, and marginally significant coefficient, despite a lower first stage F statistic. We find that a 1 percentage point increase in the aid to GNI ratio raises annual per capita GDP growth by 0.57 percentage point at the sample mean of the aid to GNI ratio. This estimate is even larger than our baseline result, reported later in Sect. 5.

Rights and permissions

About this article

Cite this article

Galiani, S., Knack, S., Xu, L.C. et al. The effect of aid on growth: evidence from a Quasi-experiment. J Econ Growth 22, 1–33 (2017). https://doi.org/10.1007/s10887-016-9137-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-016-9137-4