Abstract

The incentives to conduct basic or applied research play a central role for economic growth. How does increasing early innovation appropriability affect basic research, applied research, innovation and growth? In a common law system an explicitly dynamic macroeconomic analysis is appropriate. This paper analyzes the macroeconomic effects of patent protection by incorporating a two-stage cumulative innovation structure into a quality-ladder growth model with endogenous skill acquisition. We focus on two issues: (a) the over-protection versus the under-protection of intellectual property rights in basic research; (b) the evolution of jurisprudence shaping the bargaining power of the upstream innovators. We show that the dynamic general equilibrium interactions may seriously mislead the empirical assessment of the growth effects of IPR policy: stronger protection of upstream innovation always looks bad in the short- and possibly medium-run. We also provide a simple “rule of thumb” indicator of the basic researcher bargaining power.

Similar content being viewed by others

Notes

\(^{1}\)Heller and Eisenberg (1998) suggested the existence of a tragedy of the anticommons, i.e. a proliferation of upstream intellectual property rights which greatly amplify the transaction costs of downstream research and development, thus hampering downstream research for biomedical advance.

Our framework somewhat complements Eicher and García-Peñalosa (2008), that envisages endogenous IPR based on firm choice, instead of on jurisprudence evolution.

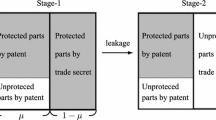

Including the Stevenson-Wydler act of 1980 and the Bayh–Dole act, of 1980, which amended the patent law to facilitate the commercialization of inventions obtained thanks to government funding, especially by universities. The pro-early innovation cultural change is also reflected in the increasing protection of trade-secrets—starting in the 80s with the Uniform Trade Secret Act and culminating with the Economic Espionage Act of 1996 (Cozzi 2001)—as well as in the increasingly positive attitude towards software patents (Hunt 2001; Hall 2009), culminating in the Final Computer Related Examination Guidelines issued by the USPTO in 1996.

In our case, it is important to recall Janice Mueller’s (2004) account of the common law development of a narrow experimental use exemption from patent infringement liability: with special reference to the discussion of the change in the doctrine from 1976s Pitcairn v. United States, through 1984s Federal Circuit decision of Roche Products, Inc. v. Bolar Pharmaceutical Co., all the way to Madey v. Duke University in 2002.

Another important source of change in sharpening IPRs can be driven by special interests, as studied by Chu (2008).

We will endogenize skill acquisition in Sect. 5.

As in (Grossman and Helpman (1991b), pp. 88–91).

The second equality builds on the Cobb–Douglas property that minimum total cost is \(\left[ \left( \tfrac{1-\alpha }{\alpha }\right) ^{-(1-\alpha )}+\left( \tfrac{\alpha }{1-\alpha }\right) ^{-\alpha }\right] w_{s}(t)^{\alpha }w_{u}(t)^{1-\alpha }X\left( \omega ,t\right) ^{\alpha }L\left( \omega ,t\right) ^{1-\alpha }\). Notice that profit is \(\left( \gamma -1\right) \) times total costs because unit costs are constant due to the assumed constant returns to scale (CRS) technology. Using Eq. (8) and simplifying gives the result.

Population density favours innovation at the local level (see Carlino and Hunt 2001): according to this solution to the strong scale effect, the dilution of R&D is not related to population density, but with the overall size of the economy.

Provided the initial Lebesgue mass of each was positive.

For basic research in the presence of non-pecuniary rewards, see Cozzi and Galli (2009).

O’Donoghue and Zweimüller (2004) and Chu (2009) are indirectly related, as they capture the role of patent claims in molding the bargaining between current and future innovators: their concepts of patentability requirement and leading breadth could be re-adapted here to accomodate the blocking power of the upstream patent holder.

Assuming that basic and applied innovators match and target applied innovator-specific innovations, we could re-read this strategic interaction as Aghion and Tirole’s (1994a, b) research unit (RU) and customer (C). Then our case would clearly correspond to when RU’s effort is important (\( \tilde{U}_{C}>U_{C}\)), which implies that “the property right is allocated to RU” (Aghion and Tirole 1994b, p. 1191). In this light, our \(\beta (t)\) generalizes Aghion and Tirole’s (1994a, b) equal split assumption.

In the more realistic case that basic research results have multiple applications, this would increase the blocker’s outside option and its equilibrium share of the final patent value.

According to Fon and Parisi (2006), such a case evolution could also appear in a civil law system.

Notice that \(n_{b}\) does not affect the aggregate innovation rate \(n_{A}\) in the industry, which is determined by the free-entry condition (14c). Moreover \(n_{b}>n_{A}\) would not be individually rational, generating negative expected profits. Hence in equilibrium the basic research patent holder will invest up to \(n_{b}\le n_{A}\) and free entrant applied researchers will invest the remaining \(n_{A}-n_{b}\).

See Cozzi (2007) for further discussion on the role of free entry into applied research.

Dinopoulos and Segerstrom (1999) have first developed the overlapping generations education framework followed here. Boucekkine et al. (2002); Boucekkine et al. (2007) recently studied population and human capital dynamics in continuous time and off steady states and numerically calibrated in a way methodologically more similar to ours.

We here restrict to the share of technician workers in manufacturing in the late 80s, as indicated by Berman et al. (1994). We are ignoring other white collars, though our simulations are quite robust to alternative specifications.

We have also checked that the equilibrium values of the endogenous variables change continuously by undertaking numerical simulations.

Hence it does no harm to abstract from R&D sequentiality and imagine both activities to be taken simultaneously. This is also facilitated by the zero-interest rate assumption of this simpler model—which (along with the steady state) was indeed assumed by Hosios (1990) original paper.

They correspond to \(\alpha \) and \(1-\alpha \) of Ellison et al. (2013).

Ellison et al.’s (2013) Corollary 1 also requires an additional technical condition (Eq. 27), which in our framework becomes \(\frac{a}{1-a}< \frac{\lambda _{1}}{\lambda _{0}}\). It will be valid as long as the congestion parameter is not too high and the productivity parameter of applied R&D is not too low relative to that of the basic research.

Based on National Science Foundation (2013), Table 3 (“U.S. applied research expenditures”, “All Sources”) and Table 4 (“U.S. applied research expenditures”, “All Sources”), in million constant 2005 dollars: 1953–2011.

Which reopened the door to the research exemption doctrine at least for the pharmaceutical sector.

That is, if publicly-funded basic research is not so huge to completely crowd the private R&D out of the market, so that Eq. (14a) is still valid.

Alternatively, we could assume that a given level of public expenditure \(G\) is planned, with its actual amount per-sector \(n_{B}^{gov}=\frac{G}{ m(A_{0})w_{H}}\) being determined endogenously. As long as \(n_{B}^{gov}\) does not exceed the level of \(n_{B}\) which satisfies free entry condition (14a), our equilibrium will be unchanged.

Of course, in so doing we are assuming that the government funded R&D is equally productive and that government agencies wish to derive the deserved income share \(\beta \) of the value of the private profits generated by their innovations. This is certainly possible after 1980 Bayh-Dole and Stevenson–Wydler acts. Moreover, the Reagan administration strongly encouraged the patentability of research outcomes obtained by the use of public funds as a vehicle to find new sources of government revenues alternative to taxation. Our zero-profit conditions clearly allow this public R&D to self-finance itself.

The profit of the blocking monopolist is always the same, \(\pi \), regardless of the progressively lower relative quality of its good. This is a consequence of our assumed Cobb–Douglas preference structure, characterized by unit elasticity of substitution across varieties. If the elasticity of substitution was higher (lower) than \(1\) the profits would gradually decline (increase). A more complete model, beyond the scope of this paper, would also consider a realistic finite patent life.

This is an old problem in the history of patents. As reported by (Scotchmer (2004), p. 14), “James Watt (d. 1819) used his patents to block high-pressure improvements...Watt’s refusal to license competitors froze steam-engine technology for two decades.” Fortunately, patent legal life was not as long as assumed in our model.

We have also simulated how the dynamic behavior changes if \(\beta \) immediately jumps to the new steady state level, either expected or unexpected. The basic message of this section is robust to these variants.

To save space in the main text, we have relegated the analytics of the dynamics of the college students to College population section in Appendix.

These variables are: \(v_{B}\), \(n_{B}\), \(n_{A}\), \(v_{L}^{0}\), \(v_{L}^{1}\), \(w\) , and the variables simultaneously linked to them, i.e. “Basic Research”, “Applied R&D”, and \(x\).

Even though this is not always clearly visible given the small units in Fig. 1. For example, “Basic Patent Value” has a fast increase in the period 41, and then its evolution becomes gradual, but this is hardly discernible by the eye. Similarly for “Basic Research”.

As will be the case of Fig. 7.

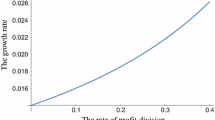

We remind the reader that with these parameters—already used in Fig. 3—the growth-maximizing level of \(\bar{\beta }\) is 0.5490.

See Eq. (10).

The files used to generate them are available to the interested readers.

Remember that we have previously proved that \(n_{B}\) and \(\frac{n_{B}}{n_{A}} \) are increasing functions of \(n_{A}\) and \(\beta \).

References

Acemoglu, D. (1998). Why do new technologies complement skills? Directed technical change and wage inequality. Quarterly Journal of Economics, 113(4), 1055–1058.

Acemoglu, D. (2002). Directed technical change. The Review of Economic Studies, 69(4), 781–809.

Akcigit, U., Hanley, D., & Serrano-Velarde, N. (2012). Back to basics: Basic research spillovers, innovation policy and growth. Manuscript, University of Pennsylvania.

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351.

Aghion, P., & Howitt, P. (1996). Research and development in the growth process. Journal of Economic Growth, 1, 13–25.

Aghion, P., & Tirole, J. (1994a). Opening the black box of innovation. European Economic Review, 38(3–4), 701–710.

Aghion, P., & Tirole, J. (1994b). The management of innovation. Quarterly Journal of Economics, 109(4), 1185–1209.

Berman, E., Bound, J., & Griliches, Z. (1994). Changes in the demand for skilled labor within U.S. manufacturing: Evidence from the annual survey of manufacturers. The Quarterly Journal of Economics, 109(2), 367–397.

Bessen, J., & Maskin, E. (2009). Sequential innovation, patents, and imitation. RAND Journal of Economics, 40(4), 611–635.

Boucekkine, R., de la Croix, D., & Licandro, O. (2002). Vintage human capital, demographic trends, and endogenous growth. Journal of Economic Theory, 104(2), 340–375.

Boucekkine, R., de la Croix, D., & Peeters, D. (2007). Early literacy achievements, population density, and the transition to modern growth. Journal of the European Economic Association, 5(1), 183–226.

Carlino, C., & Hunt, R. M. (2001). Knowledge spillovers and the new economy of cities. Working Paper, FED of Philadelphia, pp. 1–14.

Chu, A. (2008). Special interest politics and intellectual property rights: An economic analysis of strengthening patent protection in the pharmaceutical Industry. Economics and Politics, 20(2), 185–215.

Chu, A. (2009). Effects of blocking patents on R &D: A quantitative DGE analysis. Journal of Economic Growth, 14(1), 55–78.

Chu, A. (2010). Effects of patent policy on income and consumption inequality in a R &D growth model. Southern Economic Journal, 77(2), 336–350.

Chu, A. (2010). The welfare cost of one-size-fits-all patent protection. Journal of Economic Dynamics and Control, 35(6), 876–890.

Chu, A., Cozzi, G., & Galli, S. (2012). Does intellectual monopoly stimulate or stifle innovation? European Economic Review, 56(4), 727–746.

Cozzi, G. (2001). Inventing or spying? Implications for growth. Journal of Economic Growth, 6(1), 55–77.

Cozzi, G. (2007). The Arrow effect under competitive R &D. The B.E. Journal of Macroeconomics, 7(1), 1–20.

Cozzi, G., & Galli, S. (2009). Science-based R &D in Schumpeterian growth. Scottish Journal of Political Economy, 56–4(September), 474–491.

Dinopoulos, E., & Segerstrom, P. S. (1999). A Schumpeterian model of protection and relative wages. American Economic Review, 89(3), 450–472.

Dinopoulos, E., & Thompson, P. S. (1998). Schumpeterian growth without scale effects. Journal of Economic Growth, 3, 313–335.

Dinopoulos, E., & Thompson, P. S. (1999). Scale effects in Neo-Schumpeterian models of economic growth. Journal of Evolutionary Economics, 9(2), 157–186.

Eicher, T., & García-Peñalosa, C. (2008). Endogenous strength of intellectual property rights: Implications for economic development and growth. European Economic Review, 52(2), 237–258.

Ellison, M., Keller, G., Roberts, K., & Stevens, M. (2013). Unemployment and market size. The Economic Journal. doi:10.1111/ecoj.12043.

Fon, V., & Parisi, F. (2006). Judicial precedents in civil law systems: A dynamic analysis. International Review of Law and Economics, 26, 519–535.

Furukawa, Y. (2007). The protection of intellectual property rights and endogenous growth: Is stronger always better? Journal of Economic Dynamics and Control, 31(11), 3644–3670.

Galasso, A., & Schankerman, M. (2013). Patents and cumulative innovation: Causal evidence from the courts. CEPR Discussion Paper 9458.

Gallini, N. (2002). The economics of patents: Lessons from recent U.S. Patent reform. Journal of Economic Perspectives, 2, 131–154.

Galor, O., & Moav, O. (2000). Ability-biased technological transition, wage inequality, and economic growth. The Quarterly Journal of Economics, 115(2), 469–497.

Gennaioli, N., & Shleifer, A. (2007a). The evolution of common law. Journal of Political Economy, 115, 43–68.

Gennaioli, N., & Shleifer, A. (2007b). Overruling and the instability of law. Journal of Comparative Economics, 35(2), 309–328.

Gersbach, H., Schneider, M., & Schneller, O. (2010). Optimal mix of applied and basic research, distance to frontier, and openness. CEPR Discussion Papers 7795. Discussion Papers, C.E.P.R.

Gersbach, H., & Schneider, M. (2012). Basic research, openness, and convergence. Journal of Economic Growth, 18(1), 33–68.

Green, J., & Scotchmer, S. (1995). On the division of profit in sequential innovations. The Rand Journal of Economics, 26, 20–33.

Grossman, G. M., & Helpman, E. (1991a). Quality ladders in the theory of growth. Review of Economic Studies, 58, 43–61.

Grossman, G. M., & Helpman, E. (1991b). Innovation and growth in the global economy. Cambridge, MA: MIT Press.

Grossman, G. M., & Shapiro, C. (1987). Dynamic R &D competition. The Economic Journal, 97, 372–387.

Ha, J., & Howitt, P. (2007). Accounting for trends in productivity and R &D: A Schumpeterian critique of semi-endogenous growth theory. Journal of Money, Credit, and Banking, 39(4), 74–733.

Hall, H. B. (2009). Business and financial method patents: Innovation and policy. Scottish Journal of Political Economy, 56(s1), 443–473.

Heller, M. A., & Eisenberg, R. S. (1998). Can patents deter innovation? The anticommons in biomedical research. Science, 280(5364), 698–701.

Hosios, A. J. (1990). On the efficiency of matching and related models of search and unemployment. Review of Economic Studies, 57, 279–98.

Howitt, P. (1999). Steady endogenous growth with population and R &D inputs growing. Journal of Political Economy, 107(4), 715–730.

Hunt, R. M. (2001). You can patent that? Are patents on computer programs and business methods good for the new economy? Federal of Philadelphia Business Review, Q1, 5–15.

Jones, C. (2005). Growth in a world of ideas. In P. Aghion & S. Durlauf (Eds.), Handbook of economic growth. Amsterdam: North-Holland.

Jones, C., & Williams, J. (1998). Measuring the social return to R &D. Quarterly Journal of Economics, 113, 1119–1135.

Jones, C., & Williams, J. (2000). Too much of a good thing? The economics of investment in R &D. Journal of Economic Growth, 5(1), 65–85.

Kiley, M. (1999). The supply of skilled labour and skill-biased technological progress. Economic Journal, 109(458), 708–724.

Madsen, J. B. (2008). Semi-endogenous versus Schumpeterian growth models: Testing the knowledge production function using international data. Journal of Economic Growth, 3(1), 1–26.

Martins, J., & Scarpetta, S. (1996). Markup pricing. Market structure and the business cycle. OECD Economic Studies, 27, 71–105.

Maurer, S. M., & Scotchmer, S. (2004). A primer for nonlawyers on intellectual property. In S. Scotchmer (Ed.), Innovation and incentives. Cambridge, MA: MIT Press.

Mueller, J. M. (2001). No ‘Dilettante Affair”’: Rethinking the experimental use exception to patent infringement for biomedical research tools. 76 Wash. L. Rev., 1, 22–27.

Mueller, J. M. (2004). The evanescent experimental use exemption from United States patent infringement liability: Implications for university and nonprofit research and development. Baylor Law Review, 56, 917.

National Science Foundation. (2013). National Patterns of R &D Resources: 2010–2011 Data Update.

O’Donoghue, T., & Zweimüller, J. (2004). Patents in a model of endogenous growth. Journal of Economic Growth, 9(1), 81–123.

Peretto, P. (1998). Technological change and population growth. Journal of Economic Growth, 3, 283–311.

Peretto, P. (1999). Cost reduction, entry, and the interdependence of market structure and economic growth. Journal of Monetary Economics, 43(1), 95–173.

Roeger, W. (1995). Can imperfect competition explain the difference between primal and dual productivity measures? Estimates for US manufacturing. Journal of Political Economy, 103(2), 316–330.

Scotchmer, S. (2004). Innovation and incentives. Cambridge, MA: MIT Press.

Segerstrom, P. (1998). Endogenous growth without scale effects. American Economic Review, 88(5), 1290–1310.

Segerstrom, P., Anant, T., & Dinopoulos, E. (1990). A Schumpeterian model of the product life cycle. American Economic Review, 80(5), 1077–1091.

Smulders, S., & van de Klundert, T. (1995). Imperfect competition, concentration and growth with firm-specific R & D. European Economic Review, 39(1), 139–160.

Spinesi, L. (2007). IPR for public and private innovations, and growth. Discussion Paper 2007-15, Catholic University of, Louvain-la-Neuve.

Spinesi, L. (2012). Heterogeneous academic-industry knowledge linkage, heterogeneous IPR, and growth. Journal of Public Economic Theory, 14(1), 67–98.

Young, A. (1998). Growth without scale effects. Journal of Political Economy, 106, 41–63.

Acknowledgments

We thank three anonymous Referees and an Associate Editor for their extremely helpful comments and generous suggestions. We are also grateful to Reiko Aoki, Raouf Boucekkine, Robert Hunt, and seminar participants at the University of Glasgow, Stockholm School of Economics, Hitostubashi University, RIETI centre in Tokyo, University of Durham, University of Mainz, University of Konstanz, University of St. Gallen, SKEMA Business School, University of Zurich, and ETH Zurich for very useful feedback.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 1

From Eqs. (22a) and (22c), we have

which implies that \(n_{B}\) is an increasing function of \(n_{A}\) and \(\beta \) , as is \(\frac{n_{B}}{n_{A}}\).

Let us rewrite Eq. (11) as \(\pi =\frac{1-\gamma }{1-\alpha }l\). Moreover, since \(l=\theta _{0}\), Eq. (6) can be rewritten as \(w_{H}=\frac{B}{l-\Gamma } \), where \(B\) is a constant.

After solving for \(v_{L}^{0}\) using Eqs. (22d) and (22e), and in light of the above-mentioned results, we can rewrite Eq. (22c) as:

Equations (53) and (54) imply, by the implicit function theorem, that \(l\) is a function of \(l\left( n_{A},n_{B},\beta \right) \) increasing in all its three arguments.

From \(l=\theta _{0}\), we can rewrite Eqs. (22a, 22b, 22c, 22d, 22e) as

where \(Q\) is a constant. Notice that \(h^{\prime }(l)>0\) in the relevant range, because in equilibrium \(l>\Gamma \). Equations (23) and (24) imply that:

Notice that the right hand side of Eq. (55) is decreasing in \(l\), and therefore decreasing in \(n_{A}\), \(n_{B}\), and \(\beta \). Instead, the left hand side of Eq. (55) is increasing in \(n_{A}\) and \(\beta \).Footnote 44 Therefore, by the implicit function theorem, \(n_{A}\) will be an increasing function of \(\beta \). \(\square \)

Proof of Proposition 1

From Eqs. (68) and (25) follows that the steady state level of human capital per-capita is an increasing function of the skilled premium \(w_{H}\), which we can write as \( \overline{h}(w_{H})\).

Plugging Eq. (40) into the skilled labour market clearing condition (11) yields:

with \(\Psi ^{\prime } (w_{H})>0\). Inserting Eqs. (42) into (56) we obtain:

Plugging (39) and Eq. (41) into Eqs. (14a) and (40) we obtain:

From the definition of profits and the steady state mass of unskilled labour, we know that \(\pi =\pi (w_{H})\), with \(\pi ^{\prime }(w_{H})<0\). Dividing the last two equations side by side implies:

Plugging (59) into (57) gives:

where \(\Phi ^{\prime }(w_{H})>0\). Therefore there exists a unique steady state level of the skill premium obtained as the solution to Eq. (60). It is important to notice that, in this example, the steady state skill premium is independent of \(\beta \).

The steady state innovation rate can be rewritten, after using (59), as:

The numerator does not change with \(\beta \) as previously proved. The innovation rate is maximized when the denominator is minimized. Hence we need to find a value of \(\beta \) such that \(\left( \frac{1}{\lambda _{0}} \right) ^{\frac{1}{a}}\left( \frac{1}{\beta }\right) ^{\frac{1-a}{a}}+\left( \frac{1}{\lambda _{1}}\right) ^{\frac{1}{a}}\left( \frac{1}{1-\beta }\right) ^{\frac{1-a}{a}}\) is minimized, which implies expression (43 ).\(\square \).

1.1 Labour supply and education dynamics

1.1.1 Unskilled labor supply

As previously shown, individuals born at \(t\) with ability \(\theta (t)\in [0,\theta _{0}(t)]\) optimally choose not to educate themselves, thereby immediately joining the unskilled labour force. Hence a fraction \( \theta _{0}(t)\) of cohort \(t\) remains unskilled their whole life. Summing up over all the older unskilled who are still alive—hence born in the time interval \([t-D,t]\)—we obtain the total stock of unskilled labour as of time \(t\):

where \(b\) is the birth rate, \(N(s)\) is the population at time \(s\).

To stationarize variables, we divide by current (time \(t\)) population \(e^{gs}\), obtaining:

Its steady state level is:

The change in the stock of the population-adjusted stock of unskilled labour is obtained by derivating \(l(t)\) with respect to time:

As in Boucekkine et al. (2002) and Boucekkine et al. (2007) we obtain a crucial role for delayed differential equations.

1.1.2 College population

The individuals born in \(t\) with ability \(\theta (t)\in [\theta _{0}(t),1]\) optimally choose to educate themselves, thereby becoming college students for a training period of duration \(Tr\). Hence summing up over all the previous cohorts who are still in college—hence born in the time interval \([t-Tr,t]\)—we obtain the total stock of college population as of time \(t\):

In per-capita terms:

In a steady state:

Taking the derivative of Eq. (64) with respect to time we obtain:

1.1.3 Human capital

The stock of skilled workers will coincide with those students who have completed their education and are still alive, born in \([t-D,t-Tr]\):

The total workforce (including students) in equilibrium equals total population, hence:

Due to heterogeneous learning abilities, in order to obtain the aggregate skilled labour supply, we need to multiply each skilled worker by the average amount of human capital that she can supply, given by the average skill of her cohort net of dispersion parameter \(\Gamma \):

Therefore the aggregate amount of skilled labour in efficiency units (skilled labor supply) is:

Dividing by time \(t\) population, we can express per-capita human capital as:

The steady state value is:

The dynamics of human capital can be studied by derivating both sides of Eq. (67) with respect to time:

1.2 Transitional properties of educational choice

The study of the transition dynamics of this model is complicated by the skilled/unskilled labour dynamics and by the endogenous education choice under perfect foresight. Key to the solution is the transformation of the integral equation for the ability threshold level for education into a set of differential equations.

Defining the present value of the unskilled wage incomes as \( W_{U}(t)=\int _{t}^{t+D}e^{-\int _{t}^{s}i(\tau )d\tau }ds\) and the present value of the skilled wage income as \(W_{S}(t)=\int _{t+Tr}^{t+D}e^{- \int _{t}^{s}i(\tau )d\tau }w_{H}(s)ds\), we know from (24) that

Defining

we can write:

Differentiating Eqs. (71)–(72) with respect to time we obtain:

These equations allow us to cast our model in a framework that can be studied in terms of delayed differential equations.

1.3 Expenditure and manufacturing dynamics

From Eq. (10) follows:

Log-differentiating with respect to time, using Euler equation (3) and the unskilled law of motion (63) yield:

that—since \(r(t)=i(t)-g\)—can be rewritten as

In the steady state: \(r(t)=\rho \).

Rights and permissions

About this article

Cite this article

Cozzi, G., Galli, S. Sequential R&D and blocking patents in the dynamics of growth. J Econ Growth 19, 183–219 (2014). https://doi.org/10.1007/s10887-013-9101-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-013-9101-5