Abstract

Entrepreneurship is one of the main pillars of growth in any economy. Achieving a high rate of entrepreneurship in a region has become the priority objective of governments and firms. However, in many cases, new firm creation is conditioned by relations or collaboration in innovation with agents from other countries. Previous literature has analyzed the mechanisms that foster entrepreneurship. This paper attempts to shed light on the influence of international patent collaboration (IPC) on entrepreneurial activity at country level taking into account the timing of this relationship. An empirical study is proposed to verify whether IPC leads to greater entrepreneurship and to analyze the gestation period between international patenting actions and firm creation. Using the Generalized Method of Moments, the two hypotheses proposed were tested in a data panel of 30 countries for the period 2005–2017. Results show the influence of IPC in promoting entrepreneurship in the same year, but especially in the following year. The study offers implications for entrepreneurs and public agents. IPC affects the integration and interaction of international agents in a country, favors the production of new knowledge, and increases positive externalities in a territory. All this facilitates the creation of new companies with a high innovative component.

Resumen

El emprendimiento es uno de los principales pilares del crecimiento de cualquier economía. Lograr una alta tasa de creación de empresas en una región se ha convertido en el objetivo prioritario de los gobiernos y las empresas. Sin embargo, en muchos casos la creación de nuevas empresas está condicionada por las relaciones o colaboraciones en materia de innovación con agentes de otros países. Trabajos previos han analizado los mecanismos que fomentan el emprendimiento. En el presente documento se intenta arrojar luz sobre la influencia de la colaboración internacional en materia de patentes (IPC) en el emprendimiento a nivel de país teniendo en cuenta el momento en que se establece esa relación. Se propone un estudio empírico para verificar si la IPC conduce a un mayor emprendimiento y analizar el período de materialización entre el desarrollo de la patente y la creación de una nueva empresa. Utilizando el método generalizado de los momentos (GMM), las dos hipótesis propuestas se probaron en un panel de datos de 30 países para el período 2005–2017. Los resultados muestran la influencia de la IPC sobre el emprendimiento en el mismo año, pero especialmente en el año siguiente. El estudio ofrece diferentes implicaciones para los empresarios y los agentes públicos. La IPC afecta a la integración e interacción de los agentes internacionales en cada país, favorecen la producción de nuevos conocimientos y aumentan las externalidades positivas en el territorio. Todo ello hace posible la creación de nuevas empresas con un alto componente innovador.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Contributions: This paper attempts to shed light on the influence of international patent collaboration (IPC) on entrepreneurial activity at country level, taking into account the timing of this relationship. This study contributes to entrepreneurship literature in two main aspects. Firstly, patents have already been related with entrepreneurship but, as far as we know, there is only one international empirical study on this relation (Goel et al. 2016). This previous paper focuses on comparing the effects of knowledge flows on the formal and informal sectors and determining multilateral spatial spillovers of innovation, but it does not analyze the timing of the relationship. In another paper, the same authors’ study time lags in the patent-entrepreneurship nexus but their scope is not international. This study aims to fill this gap in the literature by focusing on timing and also adopting an international scope. Secondly, using the two-step difference GMM, we study this relationship using panel data at country level for a period of 12 years.

Research questions and purpose: Previous literature suggests indirect relationships between innovation, patents, and entrepreneurship. This paper attempts to shed light on the influence of IPC on entrepreneurial activity at country level taking into account the timing of this relationship. To address this gap in the literature, we propose one main question: Does international patent collaboration have an effect on entrepreneurship? Also, another secondary question is included: How much time it takes to materialize?

Basic research methodology and information: To address the research questions of this paper, we analyze a panel data of 30 countries over the period between 2005 and 2017. Since we use a panel data structure, in case of causality problems, we adopt the two-step difference GMM (Generalized Method of Moments) as our estimation method.

Database/Information: We obtain information from four different databases: Global Entrepreneurship Monitor Database, EPO’s Worldwide Statistical Patent Database, Global Competitiveness Report, and Corruption Perceptions Index Database.

Results/findings: Our results confirm the positive relationship of a 1-year increment in IPC on entrepreneurship in the same period of analysis. This influence is higher when we consider a 1-year increment in the dependent variable TEA and greater when we analyze the impact of IPC on the entrepreneurship rates of period t + 1. In addition, when we analyzed the effect of unidirectional patents collaboration on entrepreneurship, we observe that they behave differently. While patents invented abroad exert a negative and significant influence on TEAt+1, patents invented by foreign researchers have a positive and significant influence on TEAt+1. According to these results, we can confirm that patents developed in a country, in collaboration with other countries or developed by foreign researchers, contribute to increased entrepreneurship rates in that country in the same year but achieve a particular advantage 1 year later. Conversely, the fact that national researchers develop patents in other countries may contribute to reduced entrepreneurship rates in their home country in subsequent years.

Limitations and future research directions: The main limitation of this study is the lack of less developed countries in the sample. IPC may differ between developed and developing countries, so we cannot extrapolate our findings to all countries. Moreover, this type of collaboration may imply mobility, but we do not know the characteristics of mobility. Future lines of research might cover IPC in less developed countries since the level of development explains why the level of entrepreneurial activity is different among countries. It would also be of interest to analyze the type of collaboration and the type of industry and industrial agents involved in collaboration (firm to firm, public sector to public sector, firm to public sector, etc.).

Practical implications and recommendations: The study offers implications for entrepreneurs and policymakers. IPC affects the integration and interaction of international agents in a country, favors the production of new knowledge, and increases positive externalities in the territory. All this facilitates the creation of new companies with a high innovative component. Policymakers can establish innovative programs to enhance entrepreneurship rates.

Introduction

Entrepreneurship is essential for generating social, technological, and economic growth (Romer 1986; Audretsch and Acs 1994; Ács and Varga 2005; Acs 2006; Hafer 2013). Governments and firms today are worried about low levels of entrepreneurship and are investing resources to promote it and take up market niches (Bishop and Thompson 1992; Eschenbach and Hoekman 2006; Lo 2009). However, their resources are scarce so they have to select the most efficient methods (North 2005)

Innovation is generally believed to enhance entrepreneurship (Helmers and Rogers 2011; Drucker 2014) and is often a crucial ingredient in new venture success (Ireland and Webb 2007; Baron and Tang 2011), but intellectual property rights like the ones conferred by patents and trademarks can stifle competition (Goel and Saunoris 2017). In this context, international patent collaboration or IPC (i.e., agreements among agents in different countries to jointly develop technological innovations) has become a common phenomenon, receiving increasing attention from scholars in a variety of fields (Montobbio and Sterzi 2013; Belderbos et al. 2014; Nepelski and De Prato 2015; Giuliani et al. 2016; Alonso-Martínez 2018). Knowledge spillovers from such collaboration are essential for improving creativity, efficiency, and productivity, enhancing a country’s ability to develop technological innovations (Mariani 2004; Lee and Bozeman 2005) and new firms (Goel et al. 2016).

Intellectual property rights may enhance entrepreneurial actions through direct and indirect channels, as illustrated by Goel and Saunoris (2017, p. 701). Directly, patents may induce entrepreneurship by creating spin-offs, with the actors involved becoming entrepreneurs themselves or choosing to cash in on their inventions by licensing production to others (Somaya and Teece 2008; Son et al. 2019). Indirectly, knowledge embedded in patents may spill over to other entrepreneurs (Mansfield 1985; Griliches 1992; Goel and Saunoris 2017). Some leading worldwide companies have increased cooperation by sharing their intellectual property assets so that new ventures can be launched. For example, Galvani Bioelectronics is a new company created in 2016 between GlaxoSmithKline PLC, a UK-based pharmaceutical multi-company, and Verily Life Sciences LLC (formerly Google Life Sciences), an Alphabet company based in the USA, for the development of bioelectronics medicine (a branch of medicine using miniaturized implantable devices).

Another key aspect is the gestation period between international patenting actions and firm creation. New technology characteristics, industry factors, and institutional contexts determine the speed at which IPC can enhance entrepreneurial activity. In some cases, entrepreneurial entry may occur fairly soon after patenting but, in others, long production gestation periods, regulatory requirements, or cross-licensing obligations may delay entry for patent holders (Goel and Saunoris 2017).

This paper attempts to shed light on the influence of international patent collaboration (IPC) on entrepreneurial activity at country level, taking into account the timing of this relationship. We attempt to contribute to the literature in two main aspects. Firstly, patents have already been related with entrepreneurship but, as far as we know, there is only one international empirical study on this relation (Goel et al. 2016). This previous paper focuses on comparing the effects of knowledge flows on the formal and informal sectors and determining multilateral spatial spillovers of innovation, but it does not analyze the timing of the relationship. In another paper, the same authors’ study time lags in the patent-entrepreneurship nexus but their scope is not international. So we aim to fill this gap in the literature by focusing on timing and also adopting an international scope.

Moreover, it is particularly relevant to analyze recent trends, so we study this relationship using panel data at country level for a period of 12 years. We use the two-step difference GMM model drawn up for dynamic panel data models by Arellano and Bond (1991) as our estimation method. Previous literature suggests there may be a reverse causality link in the innovation-entrepreneurship relationship since it highlights the role of entrepreneurship in reinforcing innovative activity (Miller 1983; Lumpkin and Dess 1996; Wong et al. 2005). The use of GMM models allows us to control for endogeneity problems caused by this possible bidirectionality.

This paper is structured as follows. First, we review the existing literature on the relationship between IPC and entrepreneurship. Based on previous literature, we then develop our research hypotheses, describe the research methodology, and present and discuss our findings. Finally, we provide the main conclusions, implications, and limitations of this paper and suggest avenues for future work.

Theoretical framework

International technological collaboration and international patent collaboration

Countries today are investing resources in international collaboration in order to obtain new knowledge, improve economic and technological growth, increase quality of life, and foster entrepreneurship (Hamel 1991; Leiblein and Reuer 2004; Reuer 2006; Inkpen 2008; Montobbio and Sterzi 2013; Belderbos et al. 2014; Nepelski and De Prato 2015; Giuliani et al. 2016). One of the most common types of international collaboration is technological collaboration (Belderbos et al. 2014; Milanov and Fernhaber 2014), that is, agreements between agents in different countries to jointly develop technological innovation, focusing on R&D investment and patents. It has been described as a “key constituent of the globalization of trade and business, with potentially major impacts on patterns of economic development and public policies worldwide” (Meyer-Krahmer and Reger 1999, p. 752).

The open-innovation paradigm considers innovation as an open system in which companies can take advantage of different collaborative activities with external knowledge partners (Chesbrough 2003, 2006). Several authors stress the benefits of inter-organizational R&D collaboration (i.e., Kleinknecht and Reijnen 1992; Fritsch and Lukas 2001; Tether 2002; Laursen and Salter 2006; Cassiman and Veugelers 2006; Belderbos et al. 2014), which facilitates the synergistic blending of external and internal ideas into new products, processes, and systems (Belderbos et al. 2014).

Specifically, IPC at country level is a type of technological collaboration that involves two or more countries and results in a patent (Alonso-Martínez 2018). IPC is considered particularly fruitful since it implies that highly qualified personnel and significant resources will be involved and that strong relationships among agents in partner countries will be developed (Battistoni et al. 2016; Fernández-Esquinas et al. 2016). Whereas previous works highlight some drawbacks of co-patenting (Hagedoorn 2003; Belderbos et al. 2010; Bergek and Bruzelius 2010), co-ownership of intellectual property remains an empirically relevant strategy for companies developing technology jointly (Belderbos et al. 2014).

International patent collaboration and entrepreneurship

Although there is no clear definition of entrepreneurship (Shane 2012), the majority of studies treat it as the creation of new enterprises (Low and MacMillan 1988) and “the discovery, evaluation, and exploitation of opportunities” (Shane and Venkataraman 2000, p. 218). According to this paradigm and in line with Packard (2017, p. 537), who states “entrepreneurship can only occur through trade, and thus requires the existence of some social ‘reality’,” entrepreneurship can be understood as the discovery of new business opportunities. According to Schumpeter (1934), the function of the entrepreneur is to innovate, to “carry out new combinations,” but the entrepreneur is not the inventor. Rather, the entrepreneur exploits the invention to bring innovation to the market (Somaya and Teece 2008).

The benefits for entrepreneurship of all types of innovation are well-known. Innovation allows firms to discover technological opportunities that are essential to entrepreneurship, but these depend increasingly upon market information and especially, in the era of globalization, on interaction among market participants (Kirzner 1997; Hayek 2005). At country level, investment in innovation amounts to greater knowledge and improved conditions in the institutional environment, which improve prospects for the development of new business ideas (Cohen 2010; Hall et al. 2014). In the context of the patenting-entrepreneurship nexus, at firm level, previous research has examined whether patents foster the raising of finance for new ventures and affect the overall success of firms (Helmers and Rogers 2011; Audretsch et al. 2012; Hsu and Ziedonis 2013; Gaulé 2018). Innovations developed by IPC provide an optimal instrument for the creation of new businesses. They also provide extra value because they facilitate technology transfer and knowledge spillovers (implicit and explicit knowledge), allow new knowledge to be obtained, establish long-term relationships, and facilitate new agreements in other areas (Acs et al. 2008; Grimaldi et al. 2011; Plummer and Acs 2014).

The literature has identified at least two mechanisms through which technological alliances may enhance organizational growth in general and entrepreneurship in particular. First, IPC enables firms and entrepreneurs to acquire complementary assets and local knowledge. For entrepreneurial firms, this means that firms may be able to enter into a market before rivalry dissipates rents (Mitchell et al. 1994). Prior studies have shown that younger ventures are able to offset their lack of — or limited — firm-level experiential learning with learning through either the prior experiences of the top management team or through inter-organizational relationships (Bruneel et al. 2010). So, IPC can both exploit firms’ innovativeness and result in improved access to financial resources and partners’ complementary resources, allowing existing firms to expand or new ones to be created in international markets.

Knowledge acquired during international collaboration helps firms to overcome resource constraints (e.g., Contractor and Lorange 1988; Hara and Kanai 1994); to acquire country, partner, or task-specific knowledge (e.g., Khanna et al. 1998); to improve their strategic positioning (e.g., Harrigan 1988); and to achieve flexibility in uncertain environments (Kogut 1991; Larson 1991). They also obtain new knowledge, technology, and tools, and their institutional relations are facilitated, among other benefits (Knight and Cavusgil 1996). The knowledge obtained from IPC is essential for promoting entrepreneurship because it provides the advantages of innovation output and of collaboration with foreign agents and also generates innovative environments. The growing number of new firms having an international perspective is positively associated with high innovative skills, including the ability to access effective R&D, as well as distribution channels, often in partnerships characterized by close international collaboration and involving frequent, intense, and integrated efforts across nations (Knight and Cavusgil 1996; Madsen and Servais 1997). Many national and international programs promote IPC and entrepreneurship such as Small Business Innovation Research (SBIR), Small Business Technology Transfer (STTR), Science Enterprise Challenge, and the “Law on innovation and research to promote the creation of innovative technology companies” (Mustar and Wright 2010; European Commission 2016).

The second mechanism views alliances as transitional investments in learning that open doors for future expansion opportunities (Reuer and Koza 2000). International collaboration provides greater value than national or regional collaboration because the scope is larger and more agents are connected, which improves a country’s capacity for innovation and, therefore, its conditions for entrepreneurship. Previous studies on entrepreneurship and technological innovation emphasize that entrepreneurial opportunities are created in the process of technological innovation because of the exchange of knowledge between different agents (Roberts 1988; Utterback 1994). Entrepreneurs have an important role to play in finding information which will allow them to “capitalize upon the opportunities because the new combination of assets will result in profits” (Soh 2003, p. 730). In addition, there are indications that if two or more partners obtain a patent as a result of international collaboration, they may continue working together in the future, creating more intensive ties that may take the form of new firms.

In addition, new firms often arise as a result of international collaboration which allows for the creation of hybrid structures such as network partners and joint ventures (Madsen and Servais 1997; Crick and Jones 2000). New firms often rely on supplementary competencies, which are sourced from other firms and expand their distribution channels. Many new ventures have been observed to internationalize as part of a network (Coviello and Munro 1997; Coviello 2006) in which strategic alliances play a prominent role.

Therefore, IPC creates direct ties that contribute significantly to the exchange of resources and information between partnering agents (Arora and Gambardella 1990; Shan 1990; Larson 1991; Hamel 1991; Barley et al. 1992; Eisenhardt and Schoonhoven 1996; Guan and Liu 2016). Moreover, according to Soh (2003), an individual may learn and discover opportunities from innovations developed by international collaboration and go on to create a firm. However, the benefits of IPC in a focal country in terms of entrepreneurship can be expected to vary depending on whether entrepreneurial activities derived from patent collaboration are fostered in the home or host country. Owing to the characteristics of our sample, we focus on the benefits in the home country. On the basis of the above arguments, we formulate the following hypothesis:

-

H1. At country level, IPC in year t is positively related to entrepreneurship in the same year

While delays between R&D and patenting have been extensively examined in the literature (for example, Hall et al. 1986; Czarnitzki et al. 2009; Parra 2019), we find only one paper that considers the lag structure of patents with regard to entrepreneurship (Goel and Saunoris 2017). However, it does not adopt an international perspective. Entrepreneurs require time to exploit patents due to their complexity and novelty, and the effects of IPC are not immediate and might involve a time lag. In some cases, “new business entry might occur rather quickly after patenting, whether due to the nature of the product/service or if the patent holder starts doing the ground work for market entry before the patent is granted (as many pharmaceutical firms introduce new drugs even before the patent is granted). On the other hand, long production gestation periods, regulatory requirements, or cross-licensing compulsions might delay actual market entry for patent holders” (Goel and Saunoris 2017, p.702). Based on these arguments, our next hypothesis is:

-

H2. At country level, IPC in year t is positively related to entrepreneurship in yeart+1.

Research design

Sample

We analyzed data from four databases: (1) “EPO’s Worldwide Statistical Patent Database,” which is especially appropriate for this analysis because indicators based on patent families improve international comparability and the quality of patent indicators (overcoming the drawbacks of traditional patent-based indicators (European Patent Office 2020)); (2) Global Entrepreneurship Monitor Database (http://www.gemconsortium.org/), one of the most relevant worldwide databases in the field of entrepreneurship (Global Entrepreneurship Monitor 2020) as evidenced by previous studies (Kwon and Arenius 2010; Estrin et al. 2013b; Davidsson 2015); (3) “Global Competitiveness Report,” drawn up by the World Economic Forum, which collected information on public–private international cooperation by countries (World Economic Forum 2020) and is one of the most relevant databases in this area as many previous studies show (Estrin et al. 2013a; Walter and Block 2016); and (4) Corruption Perceptions Index Database drawn up by International Transparency in line with previous studies (Aidis et al. 2008; Ács et al. 2014; International Transparency 2020).

Our data panel contains information on 30 countries (Table 1) — Australia, Belgium, Brazil, Canada, China, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Norway, Portugal, Russia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, the Netherlands, Turkey, the UK, and the USA — and covers the period from 2005 to 2017. We restricted our sample to countries with information for four consecutive years. The initial data panel contained 269 country-year observations. After lagging all independent and control variables, the final panel comprised 239 country-year observations.

Measurement of variables

Dependent variable (TEA)

Total Entrepreneurial Activity (TEA) as constructed by the GEM Project is the dependent variable used in this study (Global Entrepreneurship Monitor 2020). This indicator includes individuals in the process of starting a venture and those running a new business less than 3½ years old (expressed as a percentage of the adult population aged 18 to 64). It covers all entrepreneurial activities (social and commercial activities), including self-employment if the entrepreneur has some of the capital. In addition to this variable, we also consider the annual variation in TEA between t and t + 1, and variable TEA in period t + 1. In this study, we use TEA for the period 2005–2017. It is a consistent measure with the pattern of intentions to start a venture and is widely accepted in the literature (Urbano and Alvarez 2014; Aparicio et al. 2016).

Independent variable (international patent collaboration)

International patent collaboration involves several agents from different countries. Ownership of such patents may be shared among all these agents. We measure IPC as the proportion of a country’s patents that are developed in collaboration with one or more other countries from the start of the inventive process. This type of international collaboration is characterized by the fact that it does not always imply mobility, and ownership is always shared. For the analysis, we consider the difference (increase or decrease) between period t + 1 and t. We obtained the data on these patents covered by the Patent Co-operation Treaty (PCT) from the EPO’s Worldwide Statistical Patent Database (PATSTAT 2020). We consider the period between 2005 and 2017. Previous literature shows the relevance of this measure for capturing IPC (Montobbio and Sterzi 2013; Belderbos et al. 2014; Nepelski and De Prato 2015; Giuliani et al. 2016; Ervits and Zmuda 2018; Montobbio and Sterzi 2013).

Control variables

We consider five control variables based on previous literature on entrepreneurship. Firstly, we consider other types of IPC that involve fewer agents than pure co-patents. Secondly, we control for the level of corruption. There are many studies indicating a positive influence (the effect of greasing the wheels), while most of the literature argues that corruption is harmful. Thirdly, social capital amounts to an important informal source of knowledge that promotes the creation of new firms. Finally, we also analyze the influence of GDP. Traditionally, entrepreneurship rates are associated with a greater economic outcome. For the analysis, we consider the difference (increase or decrease) between period t + 1 and t. The details of the variables are shown below:

-

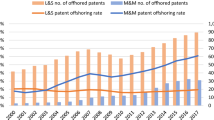

Patents invented abroad (PIA): This type of patent reflects international flows of knowledge from the inventor country to the applicant countries and international flows of funds for research. We use the variable “Domestic ownership of inventions made abroad” defined as the “number of patents owned by resident(s) of country x (applicant) that have been invented by at least one foreign resident (inventor)” (OECD 2015). This measure collects patents invented by national researchers in foreign countries. Specifically, we include the percentage of patents invented abroad: the share of the above indicator in total patents owned by resident(s) of country x (applicant). For the analysis, we consider the difference (increase or decrease) between period t + 1 and t. We obtained the data of these patents covered by the PCT from the EPO’s Worldwide Statistical Patent Database (PATSTAT 2020). We consider the period between 2005 and 2017. Previous literature shows the relevance of this measure for capturing IPC (Nepelski and De Prato 2015;Guellec and van Pottelsberghe de la Potterie 2001).

-

Patents invented by foreign researchers (PIF): This variable is defined as “Foreign ownership of domestic inventions: number of patents invented by resident(s) of country x (inventor) that are owned by at least one foreign resident (applicant)” (OECD 2015). Specifically, we include the percentage of patents owned by foreign residents: share of above indicator in total patents filed by resident(s) of country x (inventor). For the analysis, we consider the difference (increase or decrease) between period t + 1 and t. We obtained the data of these patents covered by the PCT from the EPO’s Worldwide Statistical Patent Database (PATSTAT 2020). We consider the period between 2005 and 2017. Previous literature shows the relevance of this measure for capturing IPC (Nepelski and De Prato 2015;Guellec and van Pottelsberghe de la Potterie 2001).

-

Corruption: Previous literature shows the need for control of the level of corruption by country (Anokhin and Schulze 2009; Wiseman 2015). Sometimes, corruption facilitates entrepreneurship but, more usually, it complicates the creation of new firms (de Vaal and Ebben 2011). The literature covers three indicators of corruption: the Corruption Perception Index drawn up by International Transparency, the World Bank indicator, and the World Economic Forum indicator (Judge et al. 2011). We decided to use the first, which is the most widely used of these three. The Corruption Perception Index measures the control of corruption by country (on a scale from 0 to 100). It was constructed from other variables and indicators and is based on interviews with experts and firms (International Transparency 2020). Specifically, we collected data for the period between 2005 and 2017 by country and year.

-

Social capital: Previous literature shows that social capital influences entrepreneurship rates (Dodd and Patra 2002; Kwon and Arenius 2010). We use the same indicator as these papers, namely, the measure of “Trustworthiness and confidence” reported in the “Global Competitiveness Report” drawn up by the World Economic Forum for the period between 2005 and 2017 (World Economic Forum 2020).

-

Gross domestic product (GDP): This is especially important for entrepreneurship; the economic growth of countries is one of the main drivers of entrepreneurship. Specifically, GDP is the standard measure of the value added that is created through the production of goods and services in a country during a certain period. It also measures the income earned from that production, or the total amount spent on final goods and services (minus imports). We collected data from the “Global Competitiveness Report,” drawn up by the World Economic Forum for the period between 2005 and 2017 by country and year (World Economic Forum 2020).

Estimation method

Panel data estimations seem to be the most suitable method of capturing variations over time in the entrepreneurship rate, since they allow us to control for country-specific heterogeneity as well as changes over time in countries’ operating environments (Montobbio and Sterzi 2013; Giuliani et al. 2016). To test the hypotheses proposed in the theoretical background section, we used the STATA15 program. Additionally, due to concerns regarding endogeneity between the dependent variable (TEA) and the independent variable (IPC) and taking into account the panel structure of the data, we use GMM and instrumental variables. These are the most frequently considered approaches to solve this problem when the dependent variable is continuous due to the characteristics of the estimators (Arellano and Bond 1991; Blundell and Bond 1998). This methodology allows us to avoid potential problems caused by a possible correlation between non-observable country characteristics and individual variables, as it mitigates any unobservable country heterogeneity (Hausman and Taylor 1981). Unobservable heterogeneity might result in spurious correlations with the dependent variable, which would bias the coefficients obtained.

In particular, the GMM estimator uses internal instruments, specifically, instruments that are based on lagged values of the right-hand-side explanatory variables that may present problems of endogeneity (in this study, we instrument all independent and control variables). To check the validity of the model specification when using GMM, the Hansen statistic of over-identifying restrictions is used to test for the absence of correlations between the instruments and the error term; M2 statistics are used to verify the lack of second-order serial correlation in the first-difference residuals; and Wald tests analyze the joint significance of the reported coefficients. In contrast, the traditional estimator of instrumental variables (although consistent) is inefficient in the presence of heteroscedasticity (Baum et al. 2003). Furthermore, there is the problem of identifying the appropriate instruments. Thus, the principal limitation of the instrumental variables approach is the choice of external instruments that are not correlated with the error term and that contain sufficient information about the explanatory variables in the model that are not strictly exogenous (Pindado and Requejo 2015). For this reason, this study uses the GMM approach. Table 2 provides descriptive statistics for all the variables included in our study.

Results

Table 3 shows the results of the GMM analysis. Before estimating the model proposed and in order to detect any problems of multicollinearity, a variance inflation factor (VIF) analysis was performed (Table 4). According to the empirical rule of Kleinbaum et al. (2013), there were apparently no such problems because in no case was the VIF greater than 10.

The three GMM models obtained cover the influence exerted by IPC, control variables and annual cycle variables on three different dependent variables related with entrepreneurship rates in different periods. Firstly, we consider entrepreneurship (TEA) in period t. The specification tests (joint and individual) confirm the validity of the model proposed. On the one hand, we confirm the positive and significant influence of our independent variable IPC (β = 0.001, p < 0.1). This result allows us to confirm Hypothesis 1 regarding the positive relationship of a 1-year increment in international patent collaboration on entrepreneurship in the same period of analysis. This influence is higher when we consider a 1-year increment in the dependent variable TEA (β = 0.004, p < 0.05) and greater when we analyze the impact of IPC on the entrepreneurship rates of period t + 1 (β = 0.021, p < 0.05) according to our Hypothesis 2.

Moreover, our results also confirm the significant influence of four of the control variables proposed (PIA, PIF, Corruption, and GDP). Also, both unidirectional IPC variables seem to exert an effect on entrepreneurship. However, although we find some similarities, we observe that they behave differently. The main similarity is that they only exert a significant influence on entrepreneurship when a lag is considered. This could be explained because such collaboration requires more time to materialize. Specifically, while PIA exert a negative and significant influence (β = − 0.064, p < 0.01) on TEAt+1, and PIF have a positive and significant influence (β = 0.023, p < 0.05) on TEAt+1. According to these results, we can confirm that patents developed in a country, in collaboration with other countries or developed by foreign researchers, contribute to increased entrepreneurship rates in that country in the same year but achieve a particular advantage 1 year later. Conversely, the fact that national researchers develop patents in other countries may contribute to reduced entrepreneurship rates in their home country in subsequent years.

In addition, we can also confirm the positive and significant relationship between corruption (level or absence of corruption in a country) and entrepreneurship. Like the independent variable, greater control of corruption levels contributes to increased entrepreneurship rates 1 year later. Similarly, GDP also seems to exert a positive and significant influence on entrepreneurship rates 1 year later. However, using GMM1, we did not find the positive and significant influence of GDP on entrepreneurship in the same year that we had expected.

Conclusions

Our results seem to indicate that IPC helps detect new business opportunities, increases acquisition of precise knowledge, and creates stronger networks that favor the appearance of new ventures with a global strategy. Entrepreneurship is essential for country development (Acs 2006; Hafer 2013). The literature has analyzed it from different perspectives such as environmental and individual conditions, the process and procedures required to create a firm, and its impact on society. Most authors agree that the concepts of “entrepreneurship” and “innovation” are strongly related and cannot be considered separately (Wong et al. 2005; Ireland and Webb 2007; Baron and Tang 2011; Helmers and Rogers 2011; Drucker 2014). Moreover, the recent growth in IPC due to globalization and its effects have attracted the attention of many scholars (Fu et al. 2011; Guan and Chen 2012; Montobbio and Sterzi 2013; Giuliani et al. 2016). As we showed in the theoretical part and have confirmed empirically, there is a positive relationship between technological innovation endeavors such as IPC and entrepreneurship.

In particular, our findings point out the capacity of countries (our sample includes both developing and developed countries) to benefit from international collaboration. As Giuliani et al. (2016) argue, “countries show outstanding capacity to internationalize production activities, and to invest abroad to acquire knowledge and other strategic assets not available in their home countries” (Giuliani et al. 2016, p. 200). Moreover, the structural variables of countries favor integration and interaction with foreign agents in the focal country (or national agents in foreign countries) and therefore improve entrepreneurship based on this type of IPC. Intense collaboration relationships between countries are relevant because they may result in patents, may lead to more relationships in the future, and may therefore increase the level of social capital of the countries involved (Alonso-Martínez 2018). Also, IPC may lead to the creation of new firms based on a previous successful relationship that provides the initial framework (Somaya and Teece 2008; Goel and Saunoris 2017; Son et al. 2019). In addition, as a consequence of the patents generated, sometimes, the new ventures focus on high-technology industries (Helmers and Rogers 2011), which are particularly relevant for countries’ wealth and for improving their environmental conditions.

Our research contributes to the policy debate about the effects of IPC on entrepreneurship. We have shown how new mechanisms can enhance entrepreneurship and strengthen international relationships, which may be of use for policy-makers. In addition, our results have several implications for managers. Co-patents offer new direct and useful knowledge that they can incorporate into their organizations, and the spillovers it generates may favor the appearance of new entrepreneurs. Such knowledge is especially relevant because of the patents’ value and because they involve at least two countries. International production provides relevant and useful knowledge from all the countries involved which might be impossible to obtain in isolation. The major presence of this type of patents and the economic difficulties faced by all countries require investments to be efficient at generating entrepreneurship. In addition, governments and policy-makers should promote IPC because it helps improve a country’s technological and social conditions. Moreover, IPC determines the knowledge obtained, the networks established, and, in the end, the type of entrepreneurship generated (Etemad and Lee 2003; Dickson et al. 2006). Sometimes, the type of patents obtained and the partners involved create a special, strong link that enhances environmental conditions in their countries, and such close relationships may also generate spillovers that favor entrepreneurship.

Another important conclusion of this research is that unidirectional IPC may exert both a positive and a negative influence on entrepreneurship. These results provide important implications for managers and policy-makers. Researchers that obtain a patent in a foreign country may be motivated to continue working abroad, leading entrepreneurship rates in their home countries to decrease. Conversely, if foreign researchers are motivated to patent in a host country, this may increase its level of entrepreneurship as they may continue working there, providing more knowledge and spillovers, or they may find an opportunity to start a new business.

We also recommend that policy-makers should work to create environments with low levels of corruption. Although some researchers support the theory of “greasing wheels” whereby corruption facilitates the creation of new firms, our results show the opposite effect, namely, that better-established, non-corrupt countries favor the creation of new firms.

This research has some limitations, the main one being that it does not include less developed countries. IPC differs between developed and developing countries, so we cannot extrapolate our findings to all countries. Moreover, this type of collaboration may imply mobility, but we do not know if the mobility is between developed and developed, developed and developing, or developing and developing countries. Future lines of research might cover IPC in less developed countries since the level of development explains why the level of entrepreneurial activity is different among countries (Abdesselam et al. 2018). It would also be of interest to analyze the type of collaboration and the type of industry and industrial agents involved in collaboration (firm to firm, public sector to public sector, firm to public sector, etc.), taking into account also that IPC can favor entrepreneurship in either the host and or the home country. Such analyses might provide more specific information about which public policies in terms of IPC would be most effective for promoting entrepreneurship. We consider that a useful line of future research would therefore be to explore IPC mechanisms such as the new knowledge generated, spillovers and impact on entrepreneurship in both home and host countries.

Change history

11 November 2021

Springer Nature’s version of this paper was updated due to the following: An Open Access funding note was added.

References

Abdesselam R, Bonnet J, Renou-Maissant P, Aubry M (2018) Entrepreneurship, economic development, and institutional environment: evidence from OECD countries. J Int Entrep 16:504–546. https://doi.org/10.1007/s10843-017-0214-3

Acs Z (2006) How is entrepreneurship good for economic growth? Innov Technol Gov Glob 1:97–107. https://doi.org/10.1162/itgg.2006.1.1.97

Ács ZJ, Autio E, Szerb L (2014) National systems of entrepreneurship: measurement issues and policy implications. Res Policy 43:476–494. https://doi.org/10.1016/J.RESPOL.2013.08.016

Acs ZJ, Desai S, Klapper LF (2008) What does “entrepreneurship” data really show? Small Bus Econ 31:265–281. https://doi.org/10.1007/s11187-008-9137-7

Ács ZJ, Varga A (2005) Entrepreneurship, agglomeration and technological change. Small Bus Econ 24:323–334. https://doi.org/10.1007/s11187-005-1998-4

Aidis R, Estrin S, Mickiewicz T (2008) Institutions and entrepreneurship development in Russia: a comparative perspective. J Bus Ventur 23:656–672. https://doi.org/10.1016/J.JBUSVENT.2008.01.005

Alonso-Martínez D (2018) Social progress and international patent collaboration. Technol For Soc Chang 134:169–177. https://doi.org/10.1016/J.TECHFORE.2018.06.001

Anokhin S, Schulze WS (2009) Entrepreneurship, innovation, and corruption. J Bus Ventur 24:465–476. https://doi.org/10.1016/J.JBUSVENT.2008.06.001

Aparicio S, Urbano D, Audretsch D (2016) Institutional factors, opportunity entrepreneurship and economic growth: panel data evidence. Technol For Soc Chang 102:45–61. https://doi.org/10.1016/J.TECHFORE.2015.04.006

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297. https://doi.org/10.2307/2297968

Arora A, Gambardella A (1990) Complementarity and external linkages: the strategies of the large firms in biotechnology. J Ind Econ 38:361–379. https://doi.org/10.2307/2098345

Audretsch DB, Acs ZJ (1994) New-firm startups, technology, and macroeconomic fluctuations. Small Bus Econ 6:439–449. https://doi.org/10.1007/BF01064858

Audretsch DB, Bönte W, Mahagaonkar P (2012) Financial signaling by innovative nascent ventures: the relevance of patents and prototypes. Res Policy 41:1407–1421. https://doi.org/10.1016/J.RESPOL.2012.02.003

Barley SR, Freeman J, Hybels RC (1992) Strategic alliances in commercial biotechnology. Networks Organ Struct Form Action 31:1–347

Baron RA, Tang J (2011) The role of entrepreneurs in firm-level innovation: joint effects of positive affect, creativity, and environmental dynamism. J Bus Ventur 26:49–60. https://doi.org/10.1016/J.JBUSVENT.2009.06.002

Battistoni G, Genco M, Marsilio M et al (2016) Cost–benefit analysis of applied research infrastructure. Evidence from health care. Technol For Soc Chang 112:79–91. https://doi.org/10.1016/J.TECHFORE.2016.04.001

Baum CF, Schaffer ME, Stillman S (2003) Instrumental variables and GMM: estimation and testing. Stata J 3:1–31. https://doi.org/10.1177/1536867X0300300101

Belderbos R, Cassiman B, Faems D et al (2014) Co-ownership of intellectual property: exploring the value-appropriation and value-creation implications of co-patenting with different partners. Res Policy 43:841–852. https://doi.org/10.1016/J.RESPOL.2013.08.013

Belderbos R, Faems D, Leten B, Van LB (2010) Technological activities and their impact on the financial performance of the firm: exploitation and exploration within and between Firms*. J Prod Innov Manag 27:869–882. https://doi.org/10.1111/j.1540-5885.2010.00757.x

Bergek A, Bruzelius M (2010) Are patents with multiple inventors from different countries a good indicator of international R&D collaboration? The case of ABB. Res Policy 39:1321–1334. https://doi.org/10.1016/J.RESPOL.2010.08.002

Bishop M, Thompson D (1992) Regulatory reform and productivity growth in the UK’s public utilities. Appl Econ 24:1181–1190. https://doi.org/10.1080/00036849200000127

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bruneel J, Yli-Renko H, Clarysse B (2010) Learning from experience and learning from others: how congenital and interorganizational learning substitute for experiential learning in young firm internationalization. Strateg Entrep J 4:164–182. https://doi.org/10.1002/sej.89

Cassiman B, Veugelers R (2006) In search of complementarity in innovation strategy: internal R&D and external knowledge acquisition. Manage Sci 52:68–82. https://doi.org/10.1287/1050.04700

Chesbrough H (2003) The era of open innovation. MIT Sloan Manag Rev 44:35–41

Chesbrough, H.W. (2006) Open Business Models: How to Thrive in the New Innovation Landscape, Boston, MA, Harvard Business School Press

Cohen WM (2010) Fifty years of empirical studies of innovative activity and performance. Handb Econ Innov 1:129–213. https://doi.org/10.1016/S0169-7218(10)01004-X

Contractor FJ, Lorange P (1988) Why should firms cooperate? The strategy and economics basis for cooperative ventures. In: Contractor FJ, Lorange P (eds) Cooperative Strategies in International Business - Joint Venture and Technology Partnerships between Firms. Lexington Books, Lexington (MA), pp 3–30

Coviello N, Munro H (1997) Network relationships and the internationalisation process of small software firms. Int Bus Rev 6:361–386. https://doi.org/10.1016/S0969-5931(97)00010-3

Coviello NE (2006) The network dynamics of international new ventures. J Int Bus Stud 37:713–731

Crick D, Jones MV (2000) Small high-technology firms and international high-technology markets. J Int Mark 8:63–85. https://doi.org/10.1509/jimk.8.2.63.19623

Czarnitzki D, Kraft K, Thorwarth S (2009) The knowledge production of ‘R’ and ‘D’. Econ Lett 105:141–143. https://doi.org/10.1016/J.ECONLET.2009.06.020

Davidsson P (2015) Entrepreneurial opportunities and the entrepreneurship nexus: a re-conceptualization. J Bus Ventur 30:674–695. https://doi.org/10.1016/J.JBUSVENT.2015.01.002

de Vaal A, Ebben W (2011) Institutions and the relation between corruption and economic growth. Rev Dev Econ 15:108–123. https://doi.org/10.1111/j.1467-9361.2010.00596.x

Dickson PH, Weaver KM, Hoy F (2006) Opportunism in the R&D alliances of SMES: the roles of the institutional environment and SME size. J Bus Ventur 21:487–513. https://doi.org/10.1016/J.JBUSVENT.2005.02.003

Dodd SD, Patra E (2002) National differences in entrepreneurial networking. Entrep Reg Dev 14:117–134. https://doi.org/10.1080/08985620110111304

Drucker P (2014) Innovation and entrepreneurship. Routledge, New York, NY, US

Eisenhardt KM, Schoonhoven CB (1996) Resource-based view of strategic alliance formation: strategic and social effects in entrepreneurial firms. Organ Sci 7:136–150. https://doi.org/10.12691/jfe-2-5-9

Ervits I, Zmuda M (2018) A cross-country comparison of the effects of institutions on internationally oriented innovation. J Int Entrep 16:486–503. https://doi.org/10.1007/s10843-018-0225-8

Eschenbach F, Hoekman B (2006) Services policy reform and economic growth in transition economies. Rev World Econ 142:746–764. https://doi.org/10.1007/s10290-006-0091-7

Estrin S, Korosteleva J, Mickiewicz T (2013a) Which institutions encourage entrepreneurial growth aspirations? J Bus Ventur 28:564–580. https://doi.org/10.1016/J.JBUSVENT.2012.05.001

Estrin S, Mickiewicz T, Stephan U (2013b) Entrepreneurship, social capital, and institutions: social and commercial entrepreneurship across nations. Entrep Theory Pract 37:479–504. https://doi.org/10.1111/etap.12019

Etemad H, Lee Y (2003) The knowledge network of international entrepreneurship: theory and evidence. Small Bus Econ 20:5–23. https://doi.org/10.1023/A:1020240303332

European Commission (2016) ProTon Europe. https://cordis.europa.eu/project/id/IPS-2000-1104/es. Accessed 10 Apr 2019

European Patent Office (2020) EPO’s Worldwide Statistical Patent Database. https://www.epo.org/searching-for-patents/business/patstat.html#tab-1. Accessed 10 Apr 2019

Fernández-Esquinas M, Pinto H, Yruela MP, Pereira TS (2016) Tracing the flows of knowledge transfer: latent dimensions and determinants of university–industry interactions in peripheral innovation systems. Technol For Soc Chang 113:266–279. https://doi.org/10.1016/J.TECHFORE.2015.07.013

Fritsch M, Lukas R (2001) Who cooperates on R&D? Res Policy 30:297–312. https://doi.org/10.1016/S0048-7333(99)00115-8

Fu X, PietroBelli C, Soete L (2011) The role of foreign technology and indigenous innovation in the emerging economies: technological change and catching-up. World Dev 39:1204–1212. https://doi.org/10.1016/J.WORLDDEV.2010.05.009

Gaulé P (2018) Patents and the success of venture-capital backed startups: using examiner assignment to estimate causal effects. J Ind Econ 66:350–376. https://doi.org/10.1111/joie.12168

Giuliani E, Martinelli A, Rabellotti R (2016) Is co-invention expediting technological catch up? A study of collaboration between emerging country firms and EU inventors. World Dev 77:192–205. https://doi.org/10.1016/J.WORLDDEV.2015.08.019

Global Entrepreneurship Monitor (2020) Global reports. https://www.gemconsortium.org/data/key-aps. Accessed 10 Apr 2019

Goel RK, Saunoris JW (2017) Dynamics of knowledge spillovers from patents to entrepreneurship: evidence across entrepreneurship types. Contemp Econ Policy 35:700–715. https://doi.org/10.1111/coep.12224

Goel RK, Saunoris JW, Zhang X (2016) Intranational and international knowledge flows: effects on the formal and informal sectors. Contemp Econ Policy 34:297–311. https://doi.org/10.1111/coep.12112

Griliches Z (1992) The search for R&D spillovers. Scand J Econ 94:S29–S47. https://doi.org/10.2307/3440244

Grimaldi R, Kenney M, Siegel DS, Wright M (2011) 30 years after Bayh-Dole: reassessing academic entrepreneurship. Res Policy 40:1045–1057

Guan J, Chen K (2012) Modeling the relative efficiency of national innovation systems. Res Policy 41:102–115. https://doi.org/10.1016/J.RESPOL.2011.07.001

Guan J, Liu N (2016) Exploitative and exploratory innovations in knowledge network and collaboration network: a patent analysis in the technological field of nano-energy. Res Policy 45:97–112. https://doi.org/10.1016/J.RESPOL.2015.08.002

Guellec D, Van Pottelsberghe De La Potterie B (2001) The internationalisation of technology analysed with patent data. Res. Policy 30 (8), 1253–1266. https://doi.org/10.1016/S0048-7333(00)00149-9

Hafer RW (2013) Entrepreneurship and state economic growth. J Entrep Public Policy 2:67–79. https://doi.org/10.1108/20452101311318684

Hagedoorn J (2003) Sharing intellectual property rights—an exploratory study of joint patenting amongst companies. Ind Corp Chang 12:1035–1050. https://doi.org/10.1093/icc/12.5.1035

Hall BH, Griliches Z, Hausman JA (1986) Patents and R and D: is there a lag? Int Econ Rev (philadelphia) 27:265–283. https://doi.org/10.2307/2526504

Hall J, Matos SV, Martin MJ (2014) Innovation pathways at the base of the pyramid: establishing technological legitimacy through social attributes. Technovation 34:284–294. https://doi.org/10.1016/j.technovation.2013.12.003

Hamel G (1991) Competition for competence and interpartner learning within international strategic alliances. Strateg Manag J 12:83–103. https://doi.org/10.1002/smj.4250120908

Hara G, Kanai T (1994) Entrepreneurial networks across oceans to promote international strategic alliances for small businesses. J Bus Ventur 9:489–507. https://doi.org/10.1016/0883-9026(94)90018-3

Harrigan KR (1988) Joint ventures and competitive strategy. Strateg Manag J 9:141–158

Hausman J, Taylor W (1981) Panel data and unobservable individual effects. J Econ 16:155. https://doi.org/10.1016/0304-4076(81)90085-3

Hayek FA (2005) The use of knowledge in society. World Scientific Book Chapters, in: Guang-Zhen S (ed.) Readings in the economics of the division of labor the classical tradition, World Scientific Publishing, chapter 25, pp 279-284

Helmers C, Rogers M (2011) Does patenting help high-tech start-ups? Res Policy 40:1016–1027. https://doi.org/10.1016/J.RESPOL.2011.05.003

Hsu DH, Ziedonis RH (2013) Resources as dual sources of advantage: implications for valuing entrepreneurial-firm patents. Strateg Manag J 34:761–781. https://doi.org/10.1002/smj.2037

Inkpen AC (2008) Managing knowledge transfer in international alliances. Thunderbird Int Bus Rev 50:77–90. https://doi.org/10.1002/tie.20180

International Transparency (2020) Corruption perception index. https://www.transparency.org/. Accessed 10 Apr 2019

Ireland DR, Webb JW (2007) Strategic entrepreneurship: creating competitive advantage through streams of innovation. Bus Horiz 50:49–59. https://doi.org/10.1016/J.BUSHOR.2006.06.002

Judge WQ, McNatt DB, Xu W (2011) The antecedents and effects of national corruption: a meta-analysis. J World Bus 46:93–103. https://doi.org/10.1016/J.JWB.2010.05.021

Khanna T, Gulati R, Nohria N (1998) The dynamics of learning alliances: competition, cooperation, and relative scope. Strateg Manag J 19:193–210. https://doi.org/10.1002/(SICI)1097-0266(199803)19:3<193::AID-SMJ949>3.0.CO;2-C

Kirzner IM (1997) Entrepreneurial discovery and the competitive market process: an Austrian approach. J Econ Lit 35:60–85

Kleinbaum DG, Kupper LL, Nizam A, Rosenberg ES (2013) Applied regression analysis and other multivariable methods. Fifth edition. Cengage Learning

Kleinknecht A, Reijnen JON (1992) Why do firms cooperate on R&D? An empirical study. Res Policy 21:347–360. https://doi.org/10.1016/0048-7333(92)90033-Z

Knight G, Cavusgil S (1996) The born global firm: a challenge to traditional internationalization theory. Adv Int Mark 8:11–26

Kogut B (1991) Joint ventures and the option to expand and acquire. Manage Sci 37:19–33. https://doi.org/10.1287/mnsc.37.1.19

Kwon S-W, Arenius P (2010) Nations of entrepreneurs: a social capital perspective. J Bus Ventur 25:315–330. https://doi.org/10.1016/J.JBUSVENT.2008.10.008

Larson A (1991) Partner networks: leveraging external ties to improve entrepreneurial performance. J Bus Ventur 6:173–188. https://doi.org/10.1016/0883-9026(91)90008-2

Laursen K, Salter A (2006) Open for innovation: the role of openness in explaining innovation performance among U.K. manufacturing firms. Strateg Manag J 27:131–150. https://doi.org/10.1002/smj.507

Lee S, Bozeman B (2005) The impact of research collaboration on scientific productivity. Soc Stud Sci 35:673–702. https://doi.org/10.1177/0306312705052359

Leiblein MJ, Reuer JJ (2004) Building a foreign sales base: the roles of capabilities and alliances for entrepreneurial firms. J Bus Ventur 19:285–307. https://doi.org/10.1016/S0883-9026(03)00031-4

Lo AW (2009) Regulatory reform in the wake of the financial crisis of 2007–2008. J Financ Econ Policy 1:4–43. https://doi.org/10.1108/17576380910962376

Low MB, MacMillan IC (1988) Entrepreneurship: past research and future challenges. J Manage 14:139–161. https://doi.org/10.1177/014920638801400202

Lumpkin GT, Dess GG (1996) Clarifying the entrepreneurial orientation construct and linking it to performance. Acad Manag Rev 21:135–172. https://doi.org/10.2307/258632

Madsen TK, Servais P (1997) The internationalization of Born Globals: an evolutionary process? Int Bus Rev 6:561–583. https://doi.org/10.1016/S0969-5931(97)00032-2

Mansfield E (1985) How rapidly does new industrial technology leak out? J Ind Econ 34:217–223. https://doi.org/10.2307/2098683

Mariani M (2004) What determines technological hits?: Geography versus firm competencies. Res Policy 33:1565–1582. https://doi.org/10.1016/J.RESPOL.2004.08.004

Meyer-Krahmer F, Reger G (1999) New perspectives on the innovation strategies of multinational enterprises: lessons for technology policy in Europe. Res Policy 28:751–776. https://doi.org/10.1016/S0048-7333(99)00019-0

Milanov H, Fernhaber SA (2014) When do domestic alliances help ventures abroad? Direct and moderating effects from a learning perspective. J Bus Ventur 29:377–391. https://doi.org/10.1016/J.JBUSVENT.2013.05.004

Miller D (1983) The correlates of entrepreneurship in three types of firms. Manage Sci 29:770–791. https://doi.org/10.1287/mnsc.29.7.770

Mitchell W, Shaver JM, Yeung B (1994) Foreign entrant survival and foreign market share: Canadian companies’ experience in United States medical sector markets. Strateg Manag J 15:555–567. https://doi.org/10.1002/smj.4250150705

Montobbio F, Sterzi V (2013) The globalization of technology in emerging markets: a gravity model on the determinants of international patent collaborations. World Dev 44:281–299. https://doi.org/10.1016/J.WORLDDEV.2012.11.017

Mustar P, Wright M (2010) Convergence or path dependency in policies to foster the creation of university spin-off firms? A comparison of France and the United Kingdom. J Technol Transf 35:42–65. https://doi.org/10.1007/s10961-009-9113-7

Nepelski D, De Prato G (2015) International technology sourcing between a developing country and the rest of the world. A Case Study of China. Technovation 35:12–21. https://doi.org/10.1016/J.TECHNOVATION.2014.07.007

North DC (2005) Understanding the process of economic change. In Miller, M (Ed): Worlds of Capitalism. Routledge, pp 107–120

OECD (2015) Science, technology and industry scoreboard. In: Main Science and Technology Indicators. http://www.oecd.org/sti/scoreboard.htm. Accessed 10 Apr 2019

Packard MD (2017) Where did interpretivism go in the theory of entrepreneurship? J Bus Ventur 32:536–549. https://doi.org/10.1016/J.JBUSVENT.2017.05.004

Parra Á (2019) Sequential innovation, patent policy, and the dynamics of the replacement effect. RAND J Econ 50:568–590. https://doi.org/10.1111/1756-2171.12287

PATSTAT (2020) EPO’s Worldwide Statistical Patent Database. https://stats.oecd.org/Index.aspx?DataSetCode=PATS_REGION. Accessed 10 Apr 2019

Pindado J, Requejo I (2015) Family business performance from a governance perspective: a review of empirical research. Int J Manag Rev 17:279–311. https://doi.org/10.1111/ijmr.12040

Plummer LA, Acs ZJ (2014) Localized competition in the knowledge spillover theory of entrepreneurship. J Bus Ventur 29:121–136. https://doi.org/10.1016/J.JBUSVENT.2012.10.003

Reuer JJ (2006) Entrepreneurship and strategic alliances. J Bus Ventur 21:401–404. https://doi.org/10.1016/J.JBUSVENT.2005.03.001

Reuer JJ, Koza MP (2000) Asymmetric information and joint venture performance: theory and evidence for domestic and international joint ventures. Strateg Manag J 21:81–88

Roberts EB (1988) What we’ve learned: managing invention and innovation. Res Manag 31:11–29. https://doi.org/10.1080/08956308.1988.11670497

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037

Schumpeter JA (1934) Theorie der wirtschaftlichen Entwicklung. The theory of economic development. An inquiry into profits, capital, credit, interest, and the business cycle. New Brunswick (USA) and London (UK), Transaction Publishers

Shan W (1990) An empirical analysis of organizational strategies by entrepreneurial high-technology firms. Strateg Manag J 11:129–139

Shane S (2012) Reflections on the 2010 AMR Decade Award: delivering on the promise of entrepreneurship as a field of research. Acad Manag Rev 37:10–20. https://doi.org/10.5465/amr.2011.0078

Shane S, Venkataraman S (2000) The promise of entrepreneurship as a field of research. Acad Manag Rev 25:217–226. https://doi.org/10.2307/259271

Soh P-H (2003) The role of networking alliances in information acquisition and its implications for new product performance. J Bus Ventur 18:727–744. https://doi.org/10.1016/S0883-9026(03)00026-0

Somaya D, Teece DJ (2008) Patents, licensing, and entrepreneurship: effectuating innovation in multi-invention contexts. In Teece, DJ (Ed): The transfer and licensing of know-how and intellectual property. World Scientific, chapter 14, pp 123–150

Son H, Chung Y, Hwang H (2019) Do technology entrepreneurship and external relationships always promote technology transfer? Evidence from Korean public research organizations. Technovation 82–83:1–15. https://doi.org/10.1016/J.TECHNOVATION.2019.02.005

Tether BS (2002) Who co-operates for innovation, and why: an empirical analysis. Res Policy 31:947–967. https://doi.org/10.1016/S0048-7333(01)00172-X

Urbano D, Alvarez C (2014) Institutional dimensions and entrepreneurial activity: an international study. Small Bus Econ 42:703–716. https://doi.org/10.1007/s11187-013-9523-7

Utterback J (1994) Mastering the dynamics of innovation: how companies can seize opportunities in the face of technological change. Harvard Business School Press, Boston, MA, USA

Walter SG, Block JH (2016) Outcomes of entrepreneurship education: an institutional perspective. J Bus Ventur 31:216–233. https://doi.org/10.1016/J.JBUSVENT.2015.10.003

Wiseman T (2015) Entrepreneurship, corruption, and the size of US underground economies. J Entrep Public Policy 4:313–330. https://doi.org/10.1108/JEPP-04-2014-0018

Wong PK, Ho YP, Autio E (2005) Entrepreneurship, innovation and economic growth: evidence from GEM data. Small Bus Econ 24:335–350. https://doi.org/10.1007/s11187-005-2000-1

World Economic Forum (2020) Global Competitiveness Report. http://www.weforum.org/reports/global-competitiveness-report. Accessed 10 Apr 2019

Acknowledgements

In addition, we would like to recognize the work of the three anonymous reviewers and Editor for their advices. Theoretical framework, and specifically, the second hypothesis of this paper, was created based on their reviewers’ recommendations. Also, the empirical section and the methodology used to estimate the results was improved based on these advices. Finally, we want to recognize the work of the Editor providing useful comments of how to remark the contribution of our paper.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. This work was supported by the Spanish Ministry of Science and Innovation under grant PID2019-105140RB-I00.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alonso-Martínez, D., González-Álvarez, N. & Nieto, M. Does international patent collaboration have an effect on entrepreneurship?. J Int Entrep 19, 539–559 (2021). https://doi.org/10.1007/s10843-021-00302-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10843-021-00302-x