Abstract

We examine the strategic use of corporate social responsibility (CSR) in Cournot competition between two firms that differ in their marginal costs of production. The level of CSR determines the weight a firm puts on consumer surplus in its objective function before it decides upon supply. We show that the more efficient firm chooses a higher CSR level, reinforcing its dominant position. If there are sufficiently large fixed costs of CSR, only the more efficient firm will engage in CSR.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Corporate social responsibility (CSR) refers to all social and environmentally friendly activities of a firm beyond its legal requirements (Kitzmueller and Shimshack 2012). In the past decades, CSR has increasingly become a concern for many firms, particularly large- and mid-cap companies (Benn and Bolton 2011; KPMG 2017). Among the various motives for CSR, its strategic use in markets with imperfect competition plays an important role (Garriga and Melé 2004; Bénabou and Tirole 2010). The basic idea is that even pure profit-maximizing firms engage in CSR because it may serve as a commitment device for their strategy choices.

Although overall empirical evidence on the relation between firms’ CSR activities and their financial performance is mixed, meta-analyses such as Aguinis and Glavas (2012) confirm a small positive relation. Indeed, many recent studies find a positive correlation (Jo and Harjoto 2011; Eccles et al. 2014; Flammer 2015). This raises the question about causality: does CSR boost profits or can more profitable firms afford more CSR?

We address this question within a simple model of Cournot competition between two firms that differ in their marginal costs of production. The level of CSR determines the weight a firm puts on consumer surplus in its objective function before it decides upon supply. We find a mutual causality: the more efficient firm chooses a higher CSR level, reinforcing its dominant position. If there are sufficiently large fixed costs of CSR, an equilibrium will arise in which only the more efficient firm chooses a positive level of CSR.

2 The Model

We consider Cournot competition between two profit-maximizing firms on the market for some homogeneous good with (normalized) linear inverse demandFootnote 1p = 1 − (q1 + q2), where p denotes the price of the good and qi denotes the output of firm i ∈{1,2}. Marginal costs of production are assumed to be constant with c1 = 0 (normalization) and c2 = c, where 0 ≤ c ≤ 1, i.e., firm 1 is (possibly) more efficient than firm 2.

Competition between firms is modeled as a two-stage game. In the first stage of the game, the firms simultaneously choose their level of CSR. The CSR level of firm i ∈{1,2} is understood as the weight 𝜃i ≥ 0 on consumer surplus CS in addition to profits πi in its objective function:Footnote 2

where Ki represents a quasi-fixed cost of CSR, i.e., Ki = 0 if 𝜃i = 0 and Ki = Z ≥ 0 if 𝜃i > 0.Footnote 3 Such a commitment to an objective function can be thought of as signing an appropriate corporate charter or hiring a manager known to have appropriate preferences. Our framework may thus also be interpreted as a model of strategic delegation (Vickers 1985; Fershtman and Judd 1987; Sklivas 1987).

In the second stage of the game, firms decide simultaneously on their output levels qi ≥ 0 in order to maximize their objective functions Vi.

3 Analysis

In this section, we abstract from costs of CSR (Z = 0) and solve the game by backward induction for its subgame perfect equilibria (SPE). We focus on potential SPE in which 𝜃i ∈ [0,1] for i ∈{1,2}, i.e., no firm puts more weight on consumer surplus than on profits.

At the second stage of the game, the first-order conditions ∂Vi/∂qi = 0 imply the reaction functions

and thus, the second stage quantity choices as functions of the CSR levels:

At the first stage, the firms anticipate these choices and maximize their respective profits

by the choice of their CSR levels. The first-order conditions ∂πi/∂𝜃i = 0 imply

It is straightforward to show that 0 ≤ 𝜃1(𝜃2) < 1 for all 0 < c < 1 and all 𝜃2 ∈ [0,1] as well as 𝜃2(𝜃1) < 1 for all 0 < c < 1 and all 𝜃1 ∈ [0,1]. Moreover, 0 < 𝜃2(𝜃1) for 0 < c < 1 and 𝜃1 ∈ [0,1] if and only if

Consequently, for all 0 < c < 1 and 𝜃1,𝜃2 ∈ [0,1], the first stage best responses of the firms are given by the reaction functions r1(𝜃2) := 𝜃1(𝜃2) and \(r_{2}(\theta _{1}):=\max \limits \{\theta _{2}(\theta _{1}),0\}\), where 𝜃1(𝜃2) and 𝜃2(𝜃1) are defined by Eqs. 5 and 6, respectively.

Figure 1 illustrates the equilibrium CSR levels depicting the reaction functions r1 and r2 for the cost differentials c = 0, c = 1/4, and c = 1/3, respectively. Lemma 1 in the Appendix provides the comparative statics properties of the reaction functions. In particular, it shows that an increase in c increases r1 and decreases r2 wherever positive. For c = 1/3, we have r1(0) = 𝜃1(0) = 1/2 and r2(1/2) = 𝜃2(1/2) = 0 according to Eqs. 5 and 6, and thus, r1 and r2 intersect at (𝜃1,𝜃2) = (1/2,0). Lemma 1 then implies that, for any c ≥ 1/3, we always have 𝜃2 = 0 where r1 and r2 intersect. If 𝜃2 = 0, however, Eq. 5 implies the best response 𝜃1 = (1 + c)/(3 − c), and thus, q2 < 0 for all c > 1/3 by Eq. 2, i.e., the non-negativity constraint on the quantity of firm 2 will be violated. This proves

Proposition 1

If c ≥ 1/3, the less efficient firm will leave the market.

Notice that, without the strategic use of CSR (𝜃1 = 𝜃2 = 0), the threshold marginal cost above which the less efficient firm leaves the market is larger (c = 1/2). Strategic CSR may thus increase the market power of more efficient firms and foster market consolidation as well as the adaption of new technologies.

For smaller marginal costs, the intersection of the reaction functions r1 and r2 constitutes a SPE. We asterisk the corresponding equilibrium values.

Proposition 2

For all c ∈ (0,1/3), the two-stage game with strategic CSR and Cournot competition between two asymmetric firms has a SPE in which

-

(a)

The firm with the lower marginal costs chooses a higher CSR level, produces more output, and earns higher profits, i.e., \(\theta ^{*}_{1} > \theta ^{*}_{2} > 0\), \(q^{*}_{1}>q^{*}_{2} > 0\), and \(\pi ^{*}_{1}>\pi ^{*}_{2} > 0\) for all 0 < c < 1/3.

-

(b)

An increase in the cost differential increases the CSR level of the advantaged firm and decreases the CSR level of the disadvantaged firm, i.e., \(d\theta ^{*}_{1}/dc > 0\) and \(d\theta ^{*}_{2}/dc < 0\) for all c ∈ (0,1/3).

The proof can be found in the Appendix. For the intuition behind these results, note that in this model a higher CSR level (i.e., more weight on consumer surplus) represents a strategic commitment to a higher output. Since the more efficient firm faces lower costs of production, increasing its output is less costly for this firm. Therefore, it has stronger incentives to use this commitment device.Footnote 4 The model thus applies particularly well to environments in which CSR measures aim at a high market coverage, e.g., in the provision of pharmaceuticals in developing countries.

Proposition 2 is in line with several findings in the recent literature on strategic delegation. Straume (2006) and Fanti and Meccheri (2017) also find that the more efficient firm chooses a higher weight on the additional objective if managers maximize a weighted combination of profits and sales. For revenues as additional objective, Delbono et al. (2016) show that the more efficient firm earns higher equilibrium profits.Footnote 5 Moreover, Colombo (2019) finds that for sufficiently high cost differences the more efficient firm may even earn higher profits in the delegation equilibrium than if both firms abstained from delegation.

4 Inclusion of Fixed Costs for CSR

Fixed costs for CSR may induce firms to shy away from its strategic use. Based on numerical computations, we demonstrate that, depending on the level of fixed costs Z, different types of equilibria may exist: as Fig. 2 illustrates (for c = 0.02), we may find not only interior solutions, I, in which both firms choose positive CSR levels, but also right (left) corner solutions, R (L), in which only the more (less) efficient firm chooses a positive CSR level, or an equilibrium, O, in which neither firm engages in CSR.

Figure 3 depicts which equilibria may occur for different combinations of asymmetric marginal costs of production, c, and symmetric quasi-fixed costs of CSR, Z. Using Eqs. 3 through 6, we compute the threshold values for Z for each given c in the following way:

Intuitively, if the costs of CSR are sufficiently small (below Z1), it may pay off for both firms to choose positive CSR levels resulting in an interior solution (I). By contrast, if the costs of CSR are prohibitively large (above Z4), both firms will abandon CSR in equilibrium (O). In the range of intermediate costs of CSR (above Z0 and below Z4), corner solutions may arise: investing these costs and choosing a sufficiently high level of CSR, one firm can “take the lead” and commit to a quantity that makes such a costly commitment unprofitable for the other firm. Since a commitment to a larger quantity is less attractive for the less efficient firm (and the less so the higher its production costs c), the range of parameters for a left corner solution (L), where only the less efficient firm engages in CSR, is restricted to the area above Z2 and below Z3. By contrast, in the whole area between Z0 and Z4, there always exists a right corner solution (R), where only the more efficient firm engages in CSR.

Including fixed costs for CSR, our model thus provides an explanation why firms with and without CSR engagement may coexist.

5 Conclusion

We have examined the strategic use of corporate social responsibility (CSR) in Cournot competition between two firms that differ in their marginal costs of production. The level of CSR determines the weight a firm puts on consumer surplus in its objective function before it decides upon supply. The results demonstrate that the strategic use of CSR complements cost advantages and reinforces differences in market power. Moreover, (symmetric) fixed costs of CSR provide an explanation for the coexistence of (highly profitable) firms that engage in CSR and (less profitable) firms that abstain from CSR. In the long-run, strategic CSR may thus foster market consolidation and accelerate the adoption of superior technologies.

The lessons for policymakers are twofold: First, the observation of differing CSR levels may convey information on differing costs of production. On markets with imperfect competition, a firm’s CSR level may also be an indicator of market power. Thus, such information may be useful for regulatory purposes. Second, if politics can control the fixed costs of CSR, e.g., by establishing an official CSR label, it may be able to influence the (type of) market equilibrium and outcome. We find both cases in which the government can increase consumer surplus by reducing the fixed costs of CSR and cases in which it can do so by raising them.Footnote 6

A comprehensive welfare analysis is, however, beyond the scope of this short paper.

Notes

In the present framework, a large class of more general demand functions yields the same strategic incentives (Planer-Friedrich and Sahm 2020).

Incorporating consumer surplus into the firm’s objective function is a standard way of modeling CSR (e.g., Goering 2008; Kopel et al. 2014; Wang 2016; Fanti and Buccella 2017; Zennyo 2017; Nakamura 2018; Planner-Friedrich and Sahm 2020; Leal et al. 2019). An alternative approach considers CSR as a means of vertical product differentiation (e.g., Arora and Gangopadhyay 1995; Cremer and Thisse 1999; García-Gallego and Georgantzís 2009; Manasakis et al. 2013; Manasakis et al. 2014; Liu et al. 2015).

In this model, firms choose their CSR level strategically to commit to a higher output. For this, firms need to believably signal their commitment. Thus, fixed costs of CSR may arise, e.g., due to efforts to obtain a CSR label or the preparation of a CSR report (Sharma 2018).

Intuitively, the same reasoning also applies to Cournot competition with differentiated products. On markets with price (Bertrand) competition, however, the strategic use of CSR as a commitment to increase output is of no avail: it would be understood as a commitment to lower prices where instead some commitment to higher prices would be needed (Fershtman and Judd 1987). Planer-Friedrich and Sahm (2020) offer a formal treatment of these issues in a framework with symmetric firms.

This result also holds for sufficiently high cost differences in the analysis of Fanti and Meccheri (2017).

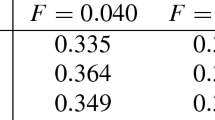

For the example from above with c = 0.02, the table below displays the consumer surplus and the firms’ profits in the different equilibria (rounded to four decimals). Starting from a corner solution or an equilibrium without CSR, the government may enforce an interior solution and increase consumer surplus by reducing the fixed costs of CSR (below Z0; see Fig. 3). If such a reduction is not feasible, the government may still be able to reach an improvement: starting from a left corner solution, raising the fixed costs (above Z3; see Fig. 3) leads to a right corner solution and increases consumer surplus.

CS

π1

π2

I

0.2988

0.0925 − Z

0.0757 − Z

R

0.2775

0.1301 − Z

0.0552

L

0.2738

0.0676

0.1152 − Z

O

0.2178

0.1156

0.1024

References

Aguinis H, Glavas A (2012) What we know and don’t know about corporate social responsibility: a review and research agenda. J Manag 38(4):932–968

Arora S, Gangopadhyay S (1995) Toward a theoretical model of voluntary overcompliance. J Econ Behav Organ 28(3):289–309

Bénabou R, Tirole J (2010) Individual and corporate social responsibility. Economica 77(305):1–19

Benn S, Bolton D (2011) Key concepts in corporate social responsibility. SAGE Key Concepts series. SAGE London

Colombo S (2019) Strategic delegation under cost asymmetry revised. Oper Res Lett 47(6):527–529

Cremer H, Thisse J-F (1999) On the taxation of polluting products in a differentiated industry. Eur Econ Rev 43(3):575–594

Delbono F, Lambertini L, Marattin L (2016) Strategic delegation under cost asymmetry. Oper Res Lett 44(4):443–445

Eccles RG, Ioannou I, Serafeim G (2014) The impact of corporate sustainability on organizational processes and performance. Manage Sci 60(11):2835–2857

Fanti L, Buccella D (2017) Corporate social responsibility, profits and welfare with managerial firms. Int Rev Econ 64(4):341–356

Fanti L, Meccheri N (2017) A note on managerial delegation with asymmetric and convex costs. Manage Decis Econ 38(3):279–284

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77(5):927–940

Flammer C (2015) Does corporate social responsibility lead to superior financial performance? a regression discontinuity approach. Manage Sci 61(11):2549–2568

García-Gallego A, Georgantzís N (2009) Market effects of changes in consumers’ social responsibility. J Econ Manag Strategy 18(1):235–262

Garriga E, Melé D (2004) Corporate social responsibility theories: mapping the territory. J Bus Ethics 53(1-2):51–71

Goering GE (2008) Socially concerned firms and the provision of durable goods. Econ Model 25(3):575–583

Jo H, Harjoto MA (2011) Corporate governance and firm value: the impact of corporate social responsibility. J Bus Ethics 103(3):351–383

Kitzmueller M, Shimshack J (2012) Economic perspectives on corporate social responsibility. J Econ Lit 50(1):51–84

Kopel M, Lamantia F, Szidarovszky F (2014) Evolutionary competition in a mixed market with socially concerned firms. J Econ Dyn Control 48:394–409

KPMG (2017) The road ahead: the KPMG Survey of Corporate Responsibility Reporting 2017

Leal M, García A, Lee S-H (2019) Effects of integration with a consumer-friendly firm in a cournot duopoly. Journal of Industry, Competition and Trade, forthcoming

Liu C-C, Wang LFS, Lee S (2015) Strategic environmental corporate social responsibility in a differentiated duopoly market. Econ Lett 129:108–111

Manasakis C, Mitrokostas E, Petrakis E (2013) Certification of corporate social responsibility activities in oligopolistic markets. Can J Econ 46(1):282–309

Manasakis C, Mitrokostas E, Petrakis E (2014) Strategic corporate social responsibility activities and corporate governance in imperfectly competitive markets. Manag Decis Econ 35(7):460–473

Nakamura Y (2018) Endogenous market structures in the presence of a socially responsible firm. Journal of Industry, Competition and Trade 18(3):319–348

Planer-Friedrich L, Sahm M (2020) Strategic corporate social responsibility, imperfect competition, and market concentration. Journal of Economics 129(1):79–101

Sharma A (2018) A note on stackelberg equilibrium in duopoly: strategic use of corporate social responsibility. Econ Bull 38(4):1720–1726

Sklivas SD (1987) The strategic choice of managerial incentives. The RAND Journal of Economics 18(3):452–458

Straume OR (2006) Managerial delegation and merger incentives with asymmetric costs. J Inst Theor Econ 162(3):450–469

Vickers J (1985) Delegation and the theory of the firm. The Economic Journal 95(Supplement: Conference Papers):138–147

Wang Y-C (2016) R&D policy involving consumer-friendly strategy: cooperative and non-cooperative R&D. Journal of Industry, Competition and Trade 16(2):257–272

Zennyo Y (2017) Asymmetric payoffs and spatial competition. Journal of industry, Competition and Trade 17(1):29–41

Acknowledgments

We thank the editor and an anonymous referee. Open Access funding provided by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Proof of Proposition 2

Appendix: Proof of Proposition 2

In order to prove part (a) of Proposition 2, first notice that for c = 0, a (unique) SPE exists (Planer-Friedrich and Sahm 2020) and is symmetric with \(\theta ^{*}_{1}=\theta _{2}^{*}=(5-\sqrt {17})/4\) according to Eqs. 5 and 6. Now, suppose that an SPE with \(\theta ^{*}_{i} \in [0,1]\) for i ∈{1, 2} exists for all 0 < c < 1 and has the properties stated in part (b) of Proposition 2. Then these properties imply \(\theta ^{*}_{1} > \theta ^{*}_{2}\) for all 0 < c < 1, which, in turn, implies \(q^{*}_{1}>q^{*}_{2}\) according to Eqs. 1 and 2, and, consequently, \(\pi ^{*}_{1}>\pi ^{*}_{2}\).

It remains to show that an SPE with \(\theta ^{*}_{i} \in [0,1]\) for i ∈{1, 2} exists for all 0 < c < 1 and has the properties stated in part (b). Notice that r1(1) = r2(1) = 0 and r1(0) > 0 for all 0 < c < 1. For c = 1/3, we have r1(0) = 𝜃1(0) = 1/2 and r2(1/2) = 𝜃2(1/2) = 0 according to Eqs. 5 and 6, and thus, \(\theta ^{*}_{1}=1/2\) and \(\theta _{2}^{*}=0\) constitute an SPE. The existence of an SPE for all 0 < c < 1 in which \(\theta ^{*}_{i} \in [0,1]\) for i ∈{1, 2} and the respective comparative statics \(d\theta ^{*}_{1}/dc > 0\) for all c ∈ (0, 1) and \(d\theta ^{*}_{2}/dc < 0\) for all c ∈ (0, 1/3) as well as \(\theta ^{*}_{2}=0\) for all c ∈ [1/3, 1) now result from the following:

Lemma 1

For all 0 < c < 1 and 𝜃1,𝜃2 ∈ [0, 1], the reaction function

-

(a)

r1 strictly decreases in 𝜃2, i.e., ∂r1/∂𝜃2 < 0,

-

(b)

r2 strictly decreases in 𝜃1, i.e., ∂r2/∂𝜃1 < 0, wherever positive.

-

(c)

r1 shifts strictly upward in c, i.e., ∂r1/∂c > 0, for all 𝜃2 ∈ [0, 1)

-

(d)

r2 shifts strictly downward in c, i.e., ∂r2/∂c < 0, for all 𝜃1 ∈ [0, 1) wherever positive.

Proof

-

(a)

Using Eq. 5, it is straightforward to show that ∂r1/∂𝜃2 = ∂𝜃1(𝜃2)/∂𝜃2 < 0 is equivalent to

$$ -5+c^{2}-2c\theta_{2}+6\theta_{2}-{\theta_{2}^{2}} < 0. $$For 𝜃2 = 1, the expression on the left-hand side (LHS) of this inequality is obviously negative for all 0 ≤ c ≤ 1. As a function of c, the LHS is convex and takes its minimum at c = 𝜃2 ∈ [0, 1]. Consequently, depending on 𝜃2, the LHS takes its maximum either at c = 0 or at c = 1. For 0 ≤ 𝜃2 ≤ 1/2 the LHS has a maximum of \(-4+4\theta _{2}-{\theta _{2}^{2}}<0\) at c = 1, and for 1/2 < 𝜃2 < 1 the LHS has a maximum of \(-5+6\theta _{2}-{\theta _{2}^{2}}<0\) at c = 0. The maximum of the LHS is thus always negative and, a fortiori, the inequality is correct for all 0 < c < 1 and 𝜃2 ∈ [0, 1].

-

(b)

Wherever r2 is positive, r2(𝜃1) = 𝜃2(𝜃1). Using Eq. 6, it is straightforward to show that ∂𝜃2(𝜃1)/∂𝜃1 < 0 is equivalent to

$$ (6-10c+4c^{2})\theta_{1}-(1-c)^{2}{\theta_{1}^{2}} < 5-10c+4c^{2}. $$(8)The expression on the left-hand side (LHS) of inequality (8) strictly increases in 𝜃1, because straightforward calculations show that

$$ \frac{6-10c+4c^{2}}{2(1-c)} > 1 \geq \theta_{1} $$for all 0 < c < 1 and 𝜃1 ∈ [0, 1]. According to inequality (7), 𝜃1 < (1 − 2c)/(1 − c) wherever r2 positive. Consequently, wherever r2 positive, the LHS of inequality Eq. 8 is smaller than

$$ (6-10c^{2}+4c^{2}) \cdot \frac{1-2c}{1-c}-(1-c)^{2} \cdot \left( \frac{1-2c}{1-c}\right)^{2} = 5-12c+4c^{2} $$and thus obviously smaller than the right-hand side of inequality (8) for all 0 < c < 1.

-

(c)

Using Eq. 5, it is straightforward to show that ∂r1/∂c = ∂𝜃1(𝜃2)/∂c > 0 is equivalent to

$$ 2-3\theta_{2}+{\theta_{2}^{2}} > 0, $$which is obviously true for all 𝜃2 ∈ [0, 1) as the expression on the left-hand side of this inequality strictly decreases for all 𝜃2 ∈ [0, 1] and thus takes its minimum 0 at the corner 𝜃2 = 1.

-

(d)

Wherever r2 is positive, r2(𝜃1) = 𝜃2(𝜃1). Using Eq. 6, straightforward calculations show that ∂𝜃2(𝜃1)/∂c < 0 for all 𝜃1 ∈ [0, 1).

□

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Planer-Friedrich, L., Sahm, M. Strategic CSR in Asymmetric Cournot Duopoly. J Ind Compet Trade 21, 33–42 (2021). https://doi.org/10.1007/s10842-020-00335-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-020-00335-3