Abstract

We develop a theoretical model that focuses on the effects of international knowledge spillovers on the country’s horizontal (variety expansion) and vertical (quality-improving) R&D efforts in less developed countries (LDC). The novelty of the approach is that it studies the effect of cross-country knowledge spillovers in the framework of a second-generation endogenous growth model without scale effect. The structure of the market, the level of R&D expenditures, and the rate of economic growth are endogenously determined by the level of knowledge spillovers. The effect of cross-country knowledge spillovers on the return to R&D is ambiguous. It depends on the relative dominance of market interaction versus technological interaction among firms in LDC. The R&D expenditures by the firms in the developed countries may reduce incentives to vertical innovations in LDC; however, our results emphasize the importance of developing domestic R&D projects and improving the efficiency of those projects for LDC rather than relying on foreign knowledge spillovers. In the presence of sunk costs, nonetheless, running efficient R&D projects is justified only when the country is relatively large in size.

Similar content being viewed by others

Notes

See, for example, Berger and Martin (2011).

Under the assumption of zero costs of entry number of firms in the industry jumps to its steady-state value, which eliminates dynamic adjustment process in number of firms.

See Peretto (1996).

Introducing leader-follower interaction through the imitation channel is beyond the scope of this paper and can serve as a possible extension of the current work.

The more integrated countries become, at least in terms of their levels of technology, the closer the values of β and γ ∗ are expected to be. To capture this phenomenon, we will be required to introduce the evolution process for both parameters, β and γ∗, as a function of technological gap Z/Z∗, which, however, will render the model intractable.

Acemoglu and Zilbotti (2001) specifically emphasize the importance of tacit knowledge in accounting for cross-country differences in output per worker.

Peretto (1996) identifies these effects and discusses in more details how these effects operate. Here, we present only brief summary of the impacts of the gross-profit and the business-stealing effects for the clarity of presentation.

Peretto (1996) shows that simultaneous solution to the equivalent equations in the closed economy framework characterizes Nash Equilibrium with free entry and exit for the model.

Here, we explicitly impose equalization of the growth rates consistent with the stable income distribution across countries (Acemoglu and Ventura 2002). Maddison (2001) demonstrates data on growth rates of different regions across the world over thousand years. The evidence shows that Africa’s growth rate diverges from the growth rate of the other regions in the world, making our assumption on growth rate equalization between developed and developing country restrictive. However, in the context of LDC engaged in vertical and horizontal innovations, the assumption can be thought to be less restrictive.

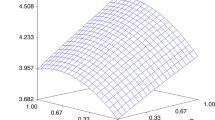

Once we imposed the restrictions, we change the values of the remaining parameters in (30) to understand the behavior of the function. We used desmos graphing calculator for this analysis.

Note that competitive market structure is reached at \({N}_{\max }^{*}\) where R&D expenditures equal zero, and the zero profit condition holds.

Source: World Development Indicators, last updated 11/14/2018 https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS.

Most of the results of the comparative static are consistent with Peretto (1996).

References

Acemoglu D, Zilibotti F (2001) Profuctivity differences. Q J Econ 116 (2):563–606

Acemoglu D, Ventura J (2002) The world income distribution. Q J Econ 117:659–694

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Alvaredo F, Chancel L, Piketty T, Saez E, Zucman G (2018) The elephant curve of global inequality and growth. AEA Papers and Proceedings 108:103–08

Backus D, Kehoe P, Kehoe T (1992) In search of scale effects in trade and growth. J Econ Theory 58:377–409

Berger B, Martin RE (2011) The growth of Chinese exports: an examination of the detailed trade data, International finance discussion Pape 1033r board of governors of the federal reserve system

Bond-Smith S, McCann P, Oxley L (2018) A regional model of endogenous growth without scale assumptions. Spat Econ Anal 13(1):5–35

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39:850–887

Coe DT, Helpman E, Hoffmaister AW (2008) International R&D spillovers and institutions, NBER working paper 14069

Connolly M (2003) The dual nature of trade: its impact on imitation and growth. J Dev Econ 72:31–55

Dinopoulos E, Thompson P (1998) Schumpeterian growth without scale effects. J Econ Growth 3:313–35

Eaton J, Kortum S (1996) Trade in ideas: parenting and productivity in the OECD. J Int Econ 40:251–278

Grossman G, Helpman E (1991) Innovation and growth in the global economy. MIT Press, Cambridge

Howitt P (1999) Steady endogenous growth with population and R&D inputs growing. J Polit Econ 107:715–730

Jaffe AB, Tratjenberg M, Henderson R (1993) Geographic localization of knowledge spillovers as evidenced by patent citations. Q J Econ 108(3):577–598

Jones IC (1995) Time series tests of endogenous growth models. Q J Econ 110 (2):495–525

Laincz A, Peretto P (2006) Scale effects in endogenous growth theory an error of aggregation not specification. J Econ Growth 11:263–288

Lakner C, Milanovic B (2016) Global income distribution from the fall of the berlin wall to the great recession. World Bank Econ Rev 30(2):203–232

Maddison A (2001) The world economy: a millennial perspective. Paris: Development Centre Studies, OECD

Mattoo A, Globalization A (2009) Subramanian criss-crossing uphill flows of skill-intensive goods and foreign direct investment, Working paper series, Peterson institute of international economics

Orlando MJ (2000) On the importance of geographic and technological proximity for R&D spillovers: an empirical investigation, Research working paper, Federal reserve bank of kansas city

Parente SL, Prescott E (2000) Barriers to riches. MIT Press, Cambridge

Peretto P (1996) Sunk costs, market structure and growth. Int Econ Rev 37 (4):895–923

Peretto P (1998) Technological change, market rivalry, and the evolution of the capitalist engine of growth. J Econ Growth 3(1):53–80

Peretto P (1999) Cost reduction, entry, and the interdependence of market structure and economic growth. J Monet Econ 43:173–195

Peretto P (2003) Endogenous market structure and the growth and welfare effects of economic integration. J Int Econ 60(1):177–201

Rivera-Batiz LA, Romer P (1991) Economic integration and endogenous growth. Q J Econ 106:531–555

Romer P (1990) Endogenous technological change. J Polit Econ 98(5):71–102

Schumpeter JA (1942) Capitalism, socialism and democracy. Harper and Brothers, New York

Sutton J (1991) Sunk costs and market structure: price competition, advertising, and the evolution of concentration. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kondyan, S., Yenokyan, K. Cross-country Knowledge Spillovers and Innovations in Less Developed Countries in the Context of the Schumpeterian Growth Model. J Ind Compet Trade 19, 479–500 (2019). https://doi.org/10.1007/s10842-019-00302-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-019-00302-7

Keywords

- Technological diffusion

- Knowledge accumulation

- Knowledge spillovers

- Endogenous growth

- Economic integration