Abstract

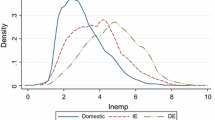

Indirect exporters are defined as firms exporting through a trade intermediary. These firms have received rapidly expanding empirical and theoretical attention recently. I show that in Eastern Europe and Central Asia these firms do, as predicted by the theoretical literature, lie between domestic firms and direct exporters for a range of performance measures. Multi-product firms, despite their generally higher productivity, are shown to be more likely to use intermediaries than single-product firms, suggesting that “mixed exporting strategies” that use intermediaries are important for these firms. Analysis using a small panel subsample of the data suggests the sunk costs of indirect exporting are significantly lower than those for direct exporting, pointing to a role for intermediaries in “greasing the wheel” of entry to export markets.

Similar content being viewed by others

Notes

Ahn et al. (2011) find that intermediaries account for 20% of Chinese exports in 2005. Blum et al. (2010) report that around 35% of imports into Chile from Argentina are mediated through wholesalers, with 6% through retailers. Akerman (2010) shows that in Sweden in 2005, roughly half of firms exporting goods were wholesalers, while these wholesalers accounted for 15% of export volume. Bernard et al. (2010a) show that in Italy, 27% of manufacturing exporters are wholesalers, accounting for 11% of export volume in 2003. Crozet et al. (2010) show that wholesalers account for 20% of French exports in 2010. Felbermayr and Jung (2011) show at industry level for the US that the ratio of exports to intermediaries over exports to foreign affiliates is almost always larger than one, and often by orders of magnitude. Bernard et al. (2010b) show that in the US, “mixed wholesaler-retailers”, i.e. firms with more than 75% of output in those categories, account for two thirds of US exports in 2002.

see Albornoz et al. (2010) for a detailed depiction of how uncertain firms enter export markets.

Garments is found to have the lowest output per worker of all sectors in Table 13. Textiles, on the other hand, exhibits average levels of productivity according to this measure.

Previous literature suggests that firms will use intermediaries more intensively when exporting to markets with higher fixed costs. A lack of data on either the products exported or the destination market prohibits any analysis of this issue in this paper.

References

Abel-Koch J (2011) Firm size and the choice of export mode. Discussion Paper Series 1105, Gutenberg School of Management and Economics

Ahn J, Khandelwal AK, Wei S-J (2011) The role of intermediaries in facilitating trade. J Int Econ 84(1):73–85

Akerman A (2010) A theory on the role of wholesalers in international trade based on economies of scope. Research Papers in Economics 2010:1, Department of Economics, Stockholm University

Albornoz F, Calvo Pardo HF, Corcos G, Ornelas E (2010) Sequential exporting. Discussion Papers 8103, CEPR

Antràs P, Costinot A (2011) Intermediated trade. Q J Econ 126(3):1319–1374

Bernard AB, Grazzi M, Tomasi C (2010a) Wholesalers and retailers in US trade. Am Econ Rev 100(2):408–13

Bernard AB, Jensen JB, Redding SJ, Schott PK (2010b) Intermediaries in international trade: direct versus indirect modes of export. National Bank of Belgium Research Working Paper 199

Blum BS, Claro S, Horstmann I (2009) Intermediation and the nature of trade costs: theory and evidence. Mimeo, University of Toronto, Central Bank of Chile

Blum BS, Claro S, Horstmann I (2010) Facts and figures on intermediated trade. Am Econ Rev 100(2):419–23

Crozet M, Lalane G, Poncet S (2010) Wholesalers in international trade. Working Papers 2010-31, CEPII research center December

EBRD, World Bank (2010) The Business Environment and Enterprise Performance Survey (BEEPS) 2008–2009: a report on methodology and observations. European Bank for Reconstruction and Development and World Bank

Felbermayr G, Jung B (2011) Trade intermediation and the organization of exporters. Rev Int Econ 19(4):634–648

Kruger J (2009) How do firms organize trade? Evidence from Ghana. Working Papers 449, Kiel Institute for the World Economy

Lu J, Lu Y, Tao Z (2010) Exporting behaviour in the presence of intermediaries: theory and evidence. Mimeo, Peking University, National University of Singapore, University of Hong Kong

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Petropoulou D (2011) Information costs, networks and intermediation in international trade. Globalization and Monetary Policy Institute Working Paper 76, Federal Reserve Bank of Dallas

Rauch JE, Watson J (2004) Network intermediaries in international trade. J Econ Manage Strategy 13(1):69–93

Author information

Authors and Affiliations

Corresponding author

Appendix A: Supplementary Tables

Appendix A: Supplementary Tables

Rights and permissions

About this article

Cite this article

McCann, F. Indirect Exporters. J Ind Compet Trade 13, 519–535 (2013). https://doi.org/10.1007/s10842-012-0133-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-012-0133-x