Abstract

Financial well-being is a desirable state as it benefits individuals, families, organizations, and society, and these benefits reach beyond the financial domain. We assessed financial well-being as two components (current financial stress and expected future financial security) and used data from a representative sample of adults in the United Kingdom (n = 411). Our study provides novel insights based on preregistered hypotheses, method, and analysis plan on the Open Science Framework. We hypothesized that both executive functioning and financial self-efficacy are positively related to financial well-being via positive financial behaviors. We also hypothesized that executive functioning moderated the indirect relation of financial self-efficacy with financial well-being, and that financial self-efficacy moderated the indirect relation of executive functioning with financial well-being. As predicted, results showed that financial self-efficacy was strongly positively related to financial well-being via positive financial behaviors. Our results did not show that executive functioning was related to financial well-being via positive financial behaviors, nor that executive functioning or financial self-efficacy operated as moderators. This study provides possible strategies for financial practitioners and service providers, among others, to help individuals and families better their financial behaviors and their financial well-being.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Financial well-being is an important research topic, as its benefits are far-reaching, and extend beyond the financial domain. At the individual and family level, financial well-being is related to various ingredients of general well-being, such as physical and mental health, relationship quality, and happiness (Brüggen et al., 2017; Netemeyer et al., 2018). At the organizational level, financial well-being of employees benefits organizations through engagement, loyalty, and productivity, and thereby profitability (Krekel et al., 2019; Netemeyer et al., 2018). And, at the societal level, financial well-being is associated with more welfare because it leads to more spending capacity and less reliance on social security (Brüggen et al., 2017).

Individuals who engage in positive financial behaviors (behaviors that lead to effective financial decisions), likely have more control over their money to meet their current and future financial obligations. Consequently, they have less stress about their current financial state and higher expectations regarding their future financial state, thus experiencing greater financial well-being. Several studies support this reasoning, showing that positive behaviors are a powerful predictor of financial well-being (Brüggen et al., 2017; Gutter & Copur, 2011; Riitsalu & Murakas, 2019; Riitsalu & Van Raaij, 2020). However, not all individuals express said behaviors to the same degree and in the same way, so it is important to identify the individual factors that can influence these behaviors and, through these behaviors, also financial well-being.

We argue that individuals need executive functions (cognitive skills that enable higher-order thinking) to engage in positive financial behaviors supportive of financial well-being. Prior studies have not empirically addressed the proposed indirect relation but, at the same time, related work has yielded mixed results (Drever et al., 2015; Strömbäck et al., 2020). The present study adds to the literature by shedding more light on the relation between executive functions, on the one hand, and positive financial behaviors and financial well-being, on the other. We also argue that individuals need financial self-efficacy (strong beliefs in their capacity to successfully complete a task or achieve a goal) to perform positive financial behaviors that contribute to financial well-being. Also here, there is no empirical evidence on the suggested indirect relation, yet related work has found supportive results (Farrell et al., 2016; Forbes & Kara, 2010; Serido & Shim, 2017; Vosloo et al., 2014). The present study broadens available work by establishing that the relation between financial self-efficacy and financial well-being occurs via positive financial behaviors. Furthermore, the impact of financial confidence on financial well-being through financial behaviors has been studied before, but such an examination is lacking for financial self-efficacy (Kempson et al., 2017). Confidence refers to having a strong belief, but this belief may concern something positive or negative (e.g., strong belief that one is able or unable to accomplish something), whereas self-efficacy entails having a strong, positive belief that one has the ability to achieve a task or goal (Bandura, 1977, 1997). Thus, we think that focusing on self-efficacy may help us better understand the association between positive financial behaviors and financial well-being.

We moreover argue that, combined, executive functions and financial self-efficacy enable individuals to think and act effectively, leading them to identify more savvy financial behaviors and act upon them to advance their financial well-being. That is, the relation between financial self-efficacy and positive financial behaviors may depend on the level of executive functioning. For example, the higher individuals’ level of executive functions (e.g., self-control), the better they can use their beliefs in their abilities to successfully meet financial goals, thereby helping them to identify appropriate positive behaviors. Similarly, the impact of executive functioning on positive financial behaviors may depend on the level of financial self-efficacy. The stronger individuals’ beliefs in their capacities, the more their executive function skills can guide them to engage in positive behaviors. In both cases, said behaviors may increase financial well-being. To our knowledge, no studies have investigated the moderating influence of executive functions and/or financial self-efficacy on financial well-being via positive financial behaviors. Yet, some studies have examined the moderating role of executive functions or financial self-efficacy for the two constructs separately, that is, for positive financial behaviors and financial well-being. For example, Drever et al. (2015) indicated that executive functions moderate the relation of environmental factors (e.g., poverty, stress) with both positive financial behaviors and financial well-being. Financial self-efficacy has been found to moderate the association between money attitudes and financial literacy, on the one hand, and positive financial behaviors, on the other (Bari et al., 2020; Qamar et al., 2016), as well as between credit card literacy and satisfaction with remuneration, on the one hand, and financial well-being, on the other (Limbu & Sato, 2019; Vosloo et al., 2014). The just-described moderating effects of executive functions and financial self-efficacy on either positive financial behaviors or financial well-being, together with the finding that positive financial behaviors and financial well-being are associated, testify to the possible moderating roles of executive functioning and financial self-efficacy in predicting financial well-being via positive financial behaviors.

Overall, the present study fits with the recommendation for further research on individual factors that predict financial well-being (Wilmarth, 2020). Findings from this study could provide financial practitioners and service providers, among others, with insights to help individuals and families improve their financial behaviors and their financial well-being by increasing executive functioning and financial self-efficacy.

Literature Review

Financial Well-Being

The current literature lacks generally accepted definitions and measurements of financial well-being. Research on financial well-being can be classified into three categories: (a) both objective and subjective elements, (b) objective elements only, and (c) subjective elements only (Brüggen et al., 2017). Objective elements concern individuals’ actual financial condition, such as income, assets, and debt. Subjective elements involve how individuals assess their own financial condition, such as their satisfaction with their standard of living or financial status. Individuals with an identical objective financial well-being can have very different levels of subjective financial well-being. As an illustrative example, two individuals have a similar income of £2,000 per month. However, one individual overspends and ends up frustrated due to excessive debt, while the other individual spends responsibly and saves, thereby enjoying life. Consequently, although both individuals enjoy the same objective financial well-being, the latter will likely report greater subjective financial well-being than the former. Hence, in the current study, we opted for a subjective measure, because it implies a broader, intangible interpretation of the concept of financial well-being, whereas an objective approach provides a more limited, tangible interpretation (see e.g., Peterson & Bush, 2013).

With respect to subjective financial well-being specifically, there seems to be agreement on two dimensions in the literature, namely current financial stress and expected future financial security (CFPB, 2015; Netemeyer et al., 2018). Current financial stress encompasses having insufficient financial resources and lacking control over one’s present financial situation. Expected future financial security refers to being able to meet one’s distant financial goals. The Consumer Financial Protection Bureau (CFPB, 2015) was among the first to develop a single measure for both dimensions. This measure, however, focused more on the current dimension than the future one. Hence, recent research recommends using two measures, to enable an equal assessment of the two dimensions (Netemeyer et al., 2018).

Determinants of Financial Well-Being

The CFPB (2015) carried out extensive qualitative research to develop a conceptual framework of the determinants of financial well-being. In this framework, positive financial behaviors (e.g., budgeting, saving, investing, working toward financial goals) were identified as the most powerful determinant of financial well-being and these behaviors, in turn, were found to be affected by individual factors. Among these factors, executive functions and financial self-efficacy were marked as important, which is particularly relevant for the current study. According to the CFPB, executive functions help individuals to plan ahead, control impulses, and think creatively to handle unanticipated challenges, and financial self-efficacy help individuals to believe in their ability to influence financial outcomes. The CFPB framework provides a good theoretical foundation, but is limited because the identified relationships were not empirically tested.

Subsequent studies used similar elements as this framework and showed that several individual factors, such as knowledge, skills, attitudes, and psychological traits, were related to financial well-being via positive financial behaviors (Iramani & Lutfi, 2021; Kempson et al., 2017; Selvia et al., 2020). However, to our knowledge, none of these studies empirically examined the role of executive functions and financial self-efficacy in predicting positive financial behaviors and, in turn, financial well-being. Thus, the current study fills this gap and provides possible strategies for financial practitioners and service providers, among others, to help individuals and families better their financial behaviors and financial well-being. In the following, we discuss the path of executive functions and financial self-efficacy to financial well-being via positive financial behaviors.

Executive Functioning, Positive Financial Behaviors, and Financial Well-Being

Executive functioning consists of a set of mental processes or cognitive abilities or skills necessary for goal-directed behavior (Diamond, 2013; Van der Elst et al., 2012). In the literature, there is agreement on at least three core executive functions: (a) attention, (b) self-control and self-monitoring, and (c) planning and initiative. Attention involves holding (verbal and nonverbal) information in mind and working on it, thereby seeing connections between what happened earlier and what comes later. Self-control and self-monitoring regard controlling one’s behavior to resist dysfunctional habits and temptations. Planning and initiative build on the previous two executive functions because these enable one to change perspectives by deactivating previous perspectives (self-control and self-monitoring) and activating new perspectives (attention). Together, these three core executive functions allow for higher-order thinking, such as reasoning and problem solving (Collins & Koechlin, 2012). These executive function skills can help individuals engage in positive financial behaviors. To illustrate, establishing financial goals and remaining focused on them might prevent the use of overdrafts and promote paying bills on time. Similarly, overriding urges and impulses that push away from financial goals enables responsible spending and tracking expenses. Likewise, being able to plan and organize how to achieve financial goals can instigate active saving and investing. All these positive financial behaviors, in turn, may increase financial well-being.

Studies have shown that executive functioning is an important contributor to several well-being outcomes, such as mental health (Fairchild et al., 2009), physical health (Miller et al., 2011), and quality of life (Brown & Landgraf, 2010). In the current study, we argue that this relation is also present in the financial domain. Specifically, as illustrated earlier, we posit that executive functioning supports positive financial behaviors which, in turn, contribute to financial well-being. To date, no studies have empirically tested this indirect relationship. There is evidence on both the relationship between executive functioning and positive financial behaviors, and between executive functioning and financial well-being (Drever et al., 2015; Strömbäck et al., 2020), but this evidence is limited and mixed. Whereas some studies showed positive relations between aforementioned three variables (Drever et al., 2015), other studies found no significant relations (Strömbäck et al., 2020). Thus, the empirical question remains of whether executive functioning can contribute to financial well-being via its association with positive financial behaviors.

Financial Self-Efficacy, Positive Financial Behaviors, and Financial Well-Being

Self-efficacy, a concept originally proposed by Bandura (1977, 1997), refers to individuals’ beliefs in their own capacity to successfully complete a task or meet a goal. Self-efficacious individuals generally consider complex tasks as challenges to overcome, establish a deep interest in their tasks, set challenging goals and remain committed to meeting them, and recover rapidly from problems and disappointments. The concept of financial self-efficacy is related to Bandura’s self-efficacy theory, involving the perceived ability to complete financial tasks and meet financial goals (Lapp, 2010). The higher individuals’ financial self-efficacy, the more motivated they are to master financial challenges. This, subsequently, can promote positive financial behaviors, like working toward financial goals, and, in turn, increase financial well-being.

It is well documented that self-efficacy predicts successful well-being outcomes, such as mental health (Tahmassian & Moghadam, 2011), physical health (Rimal & Moon, 2009), and quality of life (Banik et al., 2018). In the current study, we argue that this relation is also present in the financial sphere. Specifically, as described earlier, we posit that financial self-efficacy supports positive financial behaviors which, in turn, contribute to financial well-being. So far, there are no studies that have empirically addressed this indirect relation. Related previous work has shown that financial self-efficacy is positively associated with positive financial behaviors, such as investing and (retirement) saving (CFPB, 2018; Farrell et al., 2016; Forbes & Kara, 2010). Some studies also showed that financial self-efficacy is positively related to financial well-being (Sabri et al., 2020; Vosloo et al., 2014). Again here, however, the empirical question remains of whether financial self-efficacy can contribute to financial well-being through its connection to positive financial behaviors.

Conceptual Framework of the Present Study

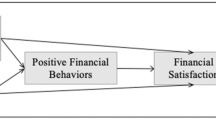

The preceding literature review provides a solid foundation to develop the conceptual framework of the present study. We postulated that executive functions and financial self-efficacy, separately and in combination, predict positive financial behaviors, which, in turn, predict financial well-being. Figure 1 presents our conceptual framework.

We hypothesized that executive functions are positively related to financial well-being via positive financial behaviors (H1 in Fig. 1). We also hypothesized that financial self-efficacy is positively related to financial well-being via positive financial behaviors (H2 in Fig. 1). Furthermore, we hypothesized that the relationship as described in Hypothesis 1 is stronger with increasing levels of financial self-efficacy (H3a in Fig. 1). And we hypothesized that the relationship as described in Hypothesis 2 is stronger with increasing levels of executive functioning (H3b in Fig. 1). We treated all demographic factors as control variables.

Method

Participants and Study Design

Using the software program G*Power, we approximated the power of the coefficient tests with an Ordinary Least Squares (OLS) power analysis to calculate the required sample size for the present study. The power analysis suggested a sample of 406 respondents. However, because our pilot study (including 20 respondents randomly sampled) revealed that 20% of the respondents were not responsible (personally or jointly) for their households’ day-to-day financial decisions, one of our requirements for participation in the present study, we decided to recruit a larger sample of 488 respondents.

The aim was to obtain 0.90 power to detect a small effect size of Cohen’s d 0.05 given the standard 0.05 alpha error probability. Respondents were selected to obtain a representative sample of the UK population and they completed the survey during 10–12 December 2020. We collected the data through the online platform Prolific (www.prolific.com). According to the guidelines of this platform, we paid each respondent £1.25 for 10 min to complete the survey. The representative sample was stratified across age, gender, and ethnicity. To improve the quality of our data, we considered the following aspects: (a) requesting respondents to manually indicate their unique Prolific ID and the unique survey completion code, (b) including a captcha, (c) preventing ballot box stuffing, and (d) manually approving the data to check whether the time spent on completing the survey was not unreasonably fast.

From the collected sample of 488 respondents, only data from respondents who lived in the UK, who were a native English speaker, and who were responsible (personally or jointly) for their households’ day-to-day financial decisions were included in the present study. This resulted in a sample of 411 respondents between the ages of 18 and 88 years (Mage = 48 years, SD = 14.62; 48.4% male and 51.6% female).Footnote 1 Among the sample, 25.3% had less than upper secondary education, 16.3% had upper secondary education, 8.8% had higher professional education, 33.8% had undergraduate university education, and 15.8% had postgraduate university education. More than one-third of the sample (37.5%) was employed full-time, 15.3% were employed part-time, 8.5% were self-employed, 6.1% were unemployed, 19.5% were (semi-)retired, and 13.1% were not employed for other reasons (e.g., students, disabled, and caretakers). The mean effective monthly household income was £2,023 (SD = 1399), and the mean subjective socioeconomic status score was 5.51 (SD = 1.55). The Psychology Research Ethics Committee of Leiden University approved the study (V1–2513, December 2020). All hypotheses, measures, and analyses for this study were preregistered at Open Science Framework (OSF, https://osf.io/pfz8k/).

Measures

Subjective Financial Well-Being

We measured two components of subjective financial well-being: (a) current financial stress and (b) expected future financial security.

For current financial stress, we used the 5-item version of the Psychological Inventory of Financial Scarcity (PIFS) Scale (Van Dijk et al., 2021; see Table 1, for the 5 items), which has a strong internal consistency (Cronbach’s α = 0.92–0.95) and a strong construct validity based on five large-scale survey-based samples (N = 1122–4901). The PIFS assesses the subjective experience of financial scarcity and covers stress appraisals (i.e., insufficient financial resources and lack of control over one’s financial situation) and stress responses (i.e., financial rumination and worry, and a short-term focus). Answers were provided on a 7-point Likert scale ranging from 1 (does not describe me at all) to 7 (describes me completely). An exploratory factor analysis using maximum likelihood extraction and promax rotation with Kaiser normalization yielded one factor, explaining 70% of the variance (Eigenvalue = 3.5) with factor loadings from 0.698 to 0.895. Thus, we computed factor scores for current financial stress using all 5 items based on regression coefficients (Cronbach’s α = 0.89).

For expectations regarding one’s future financial security, we used the 5-item expected future financial security subscale of the Perceived Financial Well-Being Scale (Netemeyer et al., 2018; see Table 1, for the five items), which has a strong internal consistency (Cronbach’s α = 0.90–0.93) and a strong construct validity based on three large-scale survey-based samples (N = 3000–6000). Answers were provided on a 7-point Likert scale ranging from 1 (does not describe me at all) to 7 (describes me completely). An exploratory factor analysis using maximum likelihood extraction and promax rotation with Kaiser normalization yielded one factor, explaining 77% of the variance (Eigenvalue = 3.9) with factor loadings from 0.729 to 0.952. Thus, we computed factor scores for expected future financial security using all 5 items based on regression coefficients (Cronbach’s α = 0.93).Footnote 2,Footnote 3

Positive Financial Behaviors

We used 17 positive financial behaviors, covering several topics, namely paying bills on time, paying credit card bills in full, paying mortgage or rent, having emergency funds, and having investments, as proposed by Wagner & Walstad (2018); tracking expenses, staying within budget plan, shopping around, paying loans above minimum, and saving without goals from the Financial Management Behavior Scale (FMBS) developed by Dew & Xiao (2011); and reviewing credit report, saving for long-term goals, working toward financial goals, figuring out retirement saving, saving for retirement, responsible spending, and using overdrafts responsibly as presented by Kim et al. (2019) (see Table 2, for all assessed items). Answers were provided on a 7-point Likert scale ranging from 1 (never) to 7 (always). Initial exploratory factor analysis using maximum likelihood extraction and promax rotation with Kaiser normalization yielded five factors (Eigenvalue of the first factor = 5.2, Eigenvalue of the other four factors = 1.5, 1.2, 1.1, and 1.0, respectively). Because we observed a large drop-off between the first factor (Eigenvalue = 5.2) and the second factor (Eigenvalue = 1.5), a distinction between different factors is not needed and, therefore, we proceeded with one factor. This factor explained 33% of the variance with the highest factor loading being 0.827, 13 items with factor loadings greater than 0.300, and only 2 items with factor loadings below 0.250. Only item 8 (shopping around) had a very low factor loading of 0.023, so we decided to exclude it. Thus, we performed an additional exploratory factor analysis using maximum likelihood extraction in which we restricted the number of factors to one, and computed factor scores for positive financial behaviors using the remaining 16 items based on regression coefficients (Cronbach’s α = 0.85).Footnote 4

Executive Functioning

We used the 13-item Amsterdam Executive Function Inventory (AEFI; Van der Elst et al., 2012; see Table 3, for the 13 items). The AEFI measures the three core executive functions: (a) attention (three items), (b) self-control and self-monitoring (five items), and (c) planning and initiative (five items). Answers were provided on a 7-point Likert scale ranging from 1 (strongly disagree) to 7 (strongly agree). Initial exploratory factor analysis using maximum likelihood extraction and promax rotation with Kaiser normalization yielded two factors (the first factor with a large Eigenvalue of 5.1, the second factor with a small Eigenvalue of 2.0). The factor loadings method, however, revealed that only items 12 and 13 explained the second factor. For this reason, we removed these two items and continued with one factor. This factor explained 45% of the variance with factor loadings from 0.372 to 914. Thus, we performed an additional exploratory factor analysis using maximum likelihood extraction in which we restricted the number of factors to one, and computed factor scores for executive functioning using the remaining 11 items based on regression coefficients (Cronbach’s α = 0.88).

Financial Self-Efficacy

We used the 5-item Financial Self-Efficacy Scale (Montford & Goldsmith, 2016; see Table 4, for the 5 items). Answers were provided on a 7-point Likert scale ranging from 1 (strongly disagree) to 7 (strongly agree). An exploratory factor analysis using maximum likelihood extraction and promax rotation with Kaiser normalization yielded one factor, explaining 73% of the variance (Eigenvalue = 3.7) with factor loadings from 0.700 to 0.949. Thus, we computed factor scores for financial self-efficacy using all 5 items based on regression coefficients (Cronbach’s α = 0.90).

Demographic Control Variables

We used gender (female and male), age (continuous: ranging from 18 to 88 years old), education (five categories: less than upper secondary education, upper secondary education, higher professional education, undergraduate university education, and postgraduate university education), occupation (six categories: employed part-time, [semi-] retired, self-employed, unemployed, not employed for other reasons, and employed full-time), effective incomeFootnote 5 (continuous: ranging from £66 to £9,374), and subjective socioeconomic status (continuous: ranging from 1 to 9) as the demographic control variables (see Table 5). Previous research has shown that said variables were related to positive financial behaviors and/or financial well-being (see e.g., Kempson & Poppe, 2018). We used the last category of education and occupation as the reference group.

Data Analysis

Missing Values

Between 0.2% (financial self-efficacy) and 35% (positive financial behaviors) of the data were missing. As shown by Little’s (1988) test, χ2 = 6,644.37, df = 6,386, p = 0.012, the data were not missing completely at random. Following the approach of Von Hippel (2018), we used multiple imputations with twenty-six plausible datasetsFootnote 6 based on a Markov Chain Monte Carlo (MCMC) method known as fully conditional specification (FCS).

Path Analysis

We used the path module of the open-source jamovi statistical platform (Gallucci, 2019; The jamovi project, 2021), based on the lavaan R package (Rosseel, 2012), for our path analyses. This method enabled us to test the compatibility of our conceptual moderated mediation model (see Fig. 1) with our dataset. Results consisted of indirect, direct, and total effects (Jeon, 2015). Indirect effects were the relations between the independent and the dependent variables that operated via the intermediate variable. Direct effects were the relations between the independent and the dependent variables, ceteris paribus. Total effects were the sum of direct and indirect effects. All effects were standardized coefficients estimated through maximum likelihood.

We developed a path analysis using executive functioning and financial self-efficacy as the independent variables, positive financial behaviors as the intermediate variable, and current financial stress and expected future financial security as the dependent variables, and tested Hypothesis 1 and Hypothesis 2. This path analysis also included subjective socioeconomic status, age, effective income, and occupation together as the control variables. Subsequently, we incorporated the interaction of executive functioning and financial self-efficacy in the path analysis, and tested Hypothesis 3a and Hypothesis 3b. The pathj module enabled us to include both constructs of subjective financial well-being together in the path analysis.

Results

Correlation Results

Table 6 depicts the correlation coefficients of all study variables. A correlation analysis revealed that almost all individual variables (i.e., executive functioning, financial self-efficacy, subjective socioeconomic status, age, education, effective income, and occupation) were significantly related to current financial stress, expected future financial security, and/or positive financial behaviors (p < 0.05), except for gender (r = 0.09, p = 0.063, r = − 0.08, p = 0.095, and r = − 0.09, p = 0.072, respectively). Among the independent variables, the analysis also showed that no multicollinearity problems were present (see e.g., Landau & Everitt, 2004).Footnote 7

Path Analysis Results

Because the interaction of executive functioning and financial self-efficacy did not have a significant contribution on positive financial behaviors (β = − 0.05, z = 1.33, p = 0.182) and financial well-being (current financial stress: β = − 0.00, z = 0.09, p = 0.930 and expected future financial security: β = 0.01, z = 0.25, p = 0.799), we excluded it. Hence, we only report the results for executive functioning and financial self-efficacy as separate predictors of financial well-being below.

Tables 7 and 8 report the standardized coefficients obtained from the path analysis when controlling for demographic variables (i.e., subjective socioeconomic status, age, effective income, and occupation).

Executive Functioning and Financial Self-Efficacy as Predictors of Current Financial Stress

Indirect Effects on Current Financial Stress

Results showed that there was no significant indirect relation found for executive functioning (β = − 0.03, z = 1.23, p = 0.218; see Table 7). Conversely, financial self-efficacy had a negative indirect relation with current financial stress via positive financial behaviors (β = − 0.14, z = 5.66, p < 0.001). A subsequent analysis of the component effects showed that financial self-efficacy had a positive association with positive financial behaviors (β = 0.29, z = 6.42, p < 0.001), which, in turn, had a negative relationship with current financial stress (β = − 0.49, z = 12.47, p < 0.001; see Table 8). These results provide no support for Hypothesis 1, but do support Hypothesis 2.

Direct Effects on Current Financial Stress

Results showed that both executive functioning (β = − 0.12, z = 3.18, p = 0.001) and financial self-efficacy (β = − 0.13, z = 3.60, p = < 0.001) had direct negative relations with current financial stress (see Table 7).

Total (indirect plus direct) Effects on Current Financial Stress

Results showed that executive functioning was a less strong predictor of current financial stress (β = − 0.15, z = 3.42, p < 0.001) than financial self-efficacy (β = − 0.27, z = 6.84, p < 0.001; see Table 7).

Among the demographic control variables, subjective socioeconomic status (β = − 0.29, z = 5.83, p < 0.001) and effective income (β = − 0.09, z = 2.09, p = 0.037) were negatively related to current financial stress (see Table 7). Regarding occupation, unemployed respondents reported less current financial stress than those who were employed full-time (β = − 0.15, z = 2.77, p = 0.006).

Executive Functioning and Financial Self-Efficacy as Predictors of Expected Future Financial Security

Indirect Effects on Expected Future Financial Security

Results showed no significant indirect relation for executive functioning (β = 0.02, z = 1.23, p = 0.218; see Table 7). Conversely, financial self-efficacy had a positive indirect relation with expected future financial security via positive financial behaviors (β = 0.12, z = 5.22, p < 0.001). A subsequent analysis of the component effects showed that financial self-efficacy had a positive association with positive financial behaviors (β = 0.29, z = 6.42, p < 0.001), which, in turn, had a positive relationship with expected future financial security (β = 0.42, z = 9.51, p < 0.001; see Table 8). Again, these results provide no support for Hypothesis 1, but do support Hypothesis 2.

Direct Effects on Expected Future Financial Security

Results showed that both executive functioning (β = 0.09, z = 2.27, p = 0.023) and financial self-efficacy (β = 0.12, z = 2.79, p = 0.005) had direct positive relations with expected future financial security (see Table 7).

Total (indirect plus direct) Effects on Expected Future Financial Security

Results showed that executive functioning was a less strong predictor of expected future financial security (β = 0.11, z = 2.59, p = 0.010) than financial self-efficacy (β = 0.24, z = 5.81, p < 0.001; see Table 7).

Among the demographic control variables, subjective socioeconomic status (β = 0.32, z = 6.38, p < 0.001) and effective income (β = 0.11, z = 2.34, p = 0.019) were positively related to expected future financial security (see Table 7). Regarding occupation, unemployed respondents reported more expected future financial security than those who were employed full-time (β = 0.19, z = 3.62, p < 0.001).

Discussion

In the present, preregistered, study using a representative sample of the UK population, we tested the hypotheses that both executive functioning (Hypothesis 1) and financial self-efficacy (Hypothesis 2) are associated with financial well-being (current financial stress and expected future financial security) via positive financial behaviors. We also hypothesized that financial self-efficacy moderated the indirect relation of executive functioning with financial well-being (Hypothesis 3a) and that executive functioning moderated the indirect relation of financial self-efficacy with financial well-being (Hypothesis 3b). Below, we discuss the main results, contributions, implications, and limitations of this study.

Summary of Results and Contributions

We found that executive functioning did not predict current financial stress and expected future financial security via positive financial behaviors, thereby not supporting Hypothesis 1. This finding corroborates previous work that showed no relation of executive functioning with positive financial behaviors (Strömbäck et al., 2020), but contradicts studies that found a positive relation between the two variables (Drever et al., 2015). Conversely, we found that executive functioning was directly related to both current financial stress and expected future financial security. This result echoes existing work that used an overall measure of financial well-being (Drever et al., 2015; Sabri et al., 2020) and extends it by showing that the direct relation applied to both dimensions of financial well-being.

We furthermore obtained support for Hypothesis 2, as we found that financial self-efficacy predicted both current financial stress and expected future financial security via positive financial behaviors. Additionally, we found that financial self-efficacy was directly related to both current financial stress and expected future financial security. These findings are in line with research that demonstrated a positive association of financial self-efficacy with both positive financial behaviors (Farrell et al., 2016) and financial well-being (Sabri et al., 2020). Also here, we extend current literature (Drever et al., 2015; Sabri et al., 2020) by showing that the direct relation of financial self-efficacy is applicable to both dimensions of financial well-being. Based on a comprehensive qualitative research, CFPB (2015) expressed that executive functioning and financial self-efficacy are important ingredients to better financial behaviors and, through these behaviors, support financial well-being. Our results add to the literature by empirically confirming this path for financial self-efficacy, but not for executive functioning. In addition, Kempson et al. (2017) claimed that financial confidence plays an important role in predicting financial well-being. Our results add to the literature by showing that this is also the case for financial self-efficacy, which is a concept related but not similar to confidence.

It should be noted, however, that perceived self-efficacy was assessed within a financial context, whereas executive functioning was measured in relation to a broader, more general context. One might argue that the obtained difference in predictive power between self-efficacy and executive functioning reflects this difference in specificity, whereby more specific factors are stronger predictors of more specific behaviors (see e.g., Xiao et al., 2008). Future research could address this issue by including a more specific assessment of executive functions. The difference in predictive power between executive functioning and financial self-efficacy may also be related to our UK sample. Future research might expand our findings by testing the studied relations within other socioeconomic and cultural contexts.

Our results did not show that executive functioning and financial self-efficacy interacted to predict financial well-being, thus providing no support for Hypothesis 3a and Hypothesis 3b. Perhaps it reflects that the roles of these two factors in relation to both financial behavior and financial well-being are independent from each other. This suggestion may stimulate more research on this topic, for example, to assess whether the result depends on the socioeconomic context in question.

In addition to the observed relationships discussed above, more exploratory analyses showed that subjective socioeconomic status, effective income, and unemployment were negatively related to current financial stress, but positively related to expected future financial security. Intuitively, the higher the effective income of individuals, the easier they can meet their short-term financial obligations (e.g., rent, food) and save to meet their distant financial goals (e.g., house, car). As a result, they may experience less current financial stress and expect more future financial security. Similarly, the better off individuals perceive themselves in material terms compared to their peers, the less they will worry about their current financial state and the more they will work toward achieving a good future financial state. This may lead to less current financial stress and more expected future financial security. Although the result for unemployment might seem surprising, it probably reflects the fact that the UK offers a social security benefits system to unemployed individuals, which ensures that their living expenses are covered, leading them to experience less current financial stress and expect more future financial security.

Implications for Financial Practitioners and Service Providers

Overall, financial self-efficacy strongly contributes to financial well-being, and does so both directly and through positive financial behaviors. Executive functioning, on the other hand, has no indirect relation with financial well-being via positive financial behaviors, but only a moderate direct relation with financial well-being. Because financial self-efficacy and executive functioning have unequal associations with financial well-being, financial practitioners should take this into account when incorporating these factors in their interventions and practices. For example, it is well advised to assign a greater role to financial self-efficacy than executive functions. Also, when testing the effectiveness of financial self-efficacy, practitioners can assess whether individuals are experiencing more financial well-being, but also whether they are engaging in better financial behaviors. When testing the effectiveness of executive functions, it is recommended to assess directly whether individuals are experiencing more financial well-being.

Based on Bandura’s four sources of self-efficacy (Bandura, 1997), there are several ways how financial practitioners and service providers can help individuals and families build or better their financial self-efficacy. The first source—performance accomplishment—regards how individuals and families learn from their successes and failures when engaging in a task or striving to meet a goal. For example, if individuals have tried to stick to a budget several times and failed to do so, they might quit performing this positive behavior. Financial practitioners can help these clients by creating a budget together with them and monitoring their behavior during the subsequent weeks. Service providers can also offer tools, such as budget apps, in this case. The second source—vicarious experience—concerns how individuals and families replicate the behaviors of those around them, whom they view as their role models. Financial practitioners can facilitate their clients’ financial behavior by posting about actual financial experiences and lessons learned via social media channels. And service providers can present their clients with actual anonymous client cases to help them understand the pros and cons of financial products and services. The third source—verbal persuasion—refers to how individuals and families are motivated by others. Financial practitioners may wish to monitor their clients on a consistent basis to motivate them to continue performing a positive behavior that they have been lacking. Likewise, service providers can incentivize their clients to purchase financial products or services that are a better fit for their unique situation. The last source—emotional arousal—involves how individuals and families’ emotions influence how they perform a task or strive to achieve a goal. Financial practitioners can help their clients realize that they should avoid making financial decisions when they are emotional. Similarly, service providers should advise their clients to avoid purchasing financial products and services when they are emotional. These strategies are supported by prior research explaining that Bandura’s sources are all effective ways to improve financial self-efficacy (Tharp, 2018).

There are also various ways how financial practitioners and service providers can help individuals and families develop or strengthen their executive functions. Financial practitioners can start by helping individuals identify the specific goals they need to accomplish to achieve financial well-being. We indicate ‘specific’ goals because these depend on the unique circumstances of the clients. The goals can subsequently be numbered and outlined on a chart to offer visual support to the clients (perhaps also adding a picture per goal). Each goal must have an accompanied checklist with reasonable expectations regarding the time, resources, and steps to complete them. Practitioners can guide individuals to select the first goal to focus on and monitor their progress on a frequent basis (e.g., weekly, monthly). Once the first goal has been achieved, individuals can move onto the next goal. Service providers can create digital tools, such as personalized nudges, to remind individuals about the steps on the checklist in a timely manner (see e.g., Raveendran et al., 2021, for further details). As underscored by previous work (Pychyl, 2013), when implementing strategies that contribute to executive functions, it is important to be daily committed to one task at the time.

Limitations and Suggestions for Future Research

The present study comes with some limitations. First, as our study design has a correlational nature, we cannot confirm causal relationships. For instance, it could be that executive functions and financial self-efficacy increase financial well-being, but it could also be that the causal relationship is in the opposite direction. For example, previous research has indicated that financial scarcity impedes executive functions (Mani et al., 2013). Moreover, it could be that the relationships of executive functioning and financial efficacy with financial well-being are bi-directional and reinforce each other. For instance, high financial self-efficacy may lead to greater financial well-being, which, in turn, heightens financial self-efficacy, leading to a further increase in financial well-being. Future research could examine the possible causal relationships between executive functions, financial self-efficacy, and financial well-being by conducting, for example, longitudinal studies (e.g., Downward et al., 2020).

Second, in the present study executive functioning was assessed with a self-rating scale. In future studies, executive functioning might be assessed using a cognitive performance task, such as the hearts and flowers task, which measures working memory, inhibitory control, and cognitive flexibility (Diamond et al., 2007). Additionally, in the current research, we measured executive functions more generally, and not related to a specific domain. It would be interesting to examine whether the relationship between executive functions and financial well-being is stronger, when these cognitive abilities are measured specifically within the financial domain. For example, one could replace the item “It takes a lot of effort for me to remember things” with “It takes a lot of effort for me to remember things regarding my finances”.

Third, the assessed positive financial behaviors were self-reported. Future research could assess actual financial behaviors, for example, by monitoring individuals’ budgeting, spending, saving, and investing behaviors per week, month, or year (e.g., Ameriks et al., 2004). Researchers, however, should be aware that collecting such data could be a challenge because (a) individuals may find it cumbersome to keep track of their financial habits, especially if they are not used to it, and (b) individuals may argue that this information is personal and confidential and, therefore, not participate in the study.

Conclusions

Financial well-being has positive implications for individuals, families, organizations, and the society and these implications are not limited to the financial realm. Therefore, financial practitioners and service providers, among others, must know what factors determine financial well-being, to develop strategies to help individuals and families achieve and maintain it. Our study contributes to the current literature by providing new insights on how executive functioning and financial self-efficacy predict subjective financial well-being.

Practitioners are recommended to assign an important role to financial self-efficacy in their interventions and practices (insofar this has not been done yet), as it seems to be a key factor to better both financial behaviors and financial well-being. Given the moderate contribution of executive functioning, practitioners are advised to draw attention to this factor if they notice that their clients lack higher-order thinking. Service providers are encouraged to collaborate with practitioners and offer a supporting role in this process, as described earlier. We suggest testing the effectiveness of these potential avenues for interventions and practices as soon as possible. This will enable practitioners to continue improving their strategies, to ensure that individuals and families enjoy the highest financial well-being possible.

Data Availability

Both the raw and transformed data are available online at https://osf.io/4aqkr/.

Notes

Because only three respondents identified themselves as other genders (1% of the sample), we treated these answers as missing.

We used the expected future financial security subscale of the Perceived Financial Well-Being Scale, because all items consistently represented aspects regarding one’s financial future. We did not use the current financial stress subscale of the aforementioned scale, because it captures items related to lack of money and lack of control over one’s financial situation only (i.e., stress appraisals). Instead, we used the PIFS, because the latter covers both stress appraisals and stress responses (e.g., financial rumination and worry).

To assess that item 1 of expected future financial security (the revised item) did not impact our estimates, we conducted a robustness check by performing a path analysis that included expected future financial security without the aforementioned item. Results were practically equivalent in both cases, thereby indicating that the financially secure item did not affect our estimates. As the results did not differ, we decided to use the expected future financial security scale including all items, as described in the main text. The path analysis with the expected future financial security variable excluding the aforementioned item is available online at: https://osf.io/4aqkr/.

To assess whether the inclusion of the items 15 and 16 impacted our results, we ran a robustness check in which we conducted a path analysis with and without these items in the positive financial behaviors variable. Results were practically equivalent in both cases, thereby indicating that the two retirement items did not affect our estimates. As the results did not differ, we decided to use the positive financial behaviors variable, as described in the main text. The path analysis with the positive financial behaviors variable excluding the aforementioned items is available online at: https://osf.io/4aqkr/.

The number of imputations was calculated as follows: \(M=1+\frac{1}{2}{\left(\frac{FMI}{CV\left(SE\right)}\right)}^{2}\), where \(FMI\) is the fraction of missing information and \(CV\left(SE\right)\) is the percentage that the standard error estimate is allowed to change if the data were imputed again. In the present study, \(FMI\) = 35% and \(CV\left(SE\right)\) = 5%, resulting in \(M\) = 25 or 26.

This result was verified by the Variance Inflation Factors (VIF) below 2.

References

Ameriks, J., Caplin, A., & Leahy, J. (2004). The absent-minded consumer (NBER Working Paper No. 10216). Retrieved from National Bureau of Economic Research website: https://www.nber.org/system/files/working_papers/w10216/w10216.pdf. Accessed 10 May 2020.

Bandura, A. (1977). Self-efficacy: Toward a unifying theory of behavioral change. Psychological Review, 84(2), 191–215. https://doi.org/10.1037/0033-295X.84.2.191

Bandura, A. (1997). Self-efficacy: The exercise of control. Freeman.

Banik, A., Schwarzer, R., Knoll, N., Czekierda, K., & Luszczynska, A. (2018). Self-efficacy and quality of life among people with cardiovascular diseases: A meta-analysis. Rehabilitation Psychology, 63(2), 295–312. https://doi.org/10.1037/rep0000199

Bari, A. F., Yunanto, A., & Shaferi, I. (2020). The role of financial self efficacy in moderating relationships financial literacy and financial management behavior. International Sustainable Competitiveness Advantage, 10(1), 51–60.

Brown, T. E., & Landgraf, J. M. (2010). Improvements in executive function correlate with enhanced performance and functioning and health-related quality of life: Evidence from 2 large, double-blind, randomized, placebo-controlled trials in ADHD. Postgraduate Medicine, 122(5), 42–51.

Brüggen, E., Hogreve, J., Holmlund, M., Kabadayi, S., & Lofgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237. https://doi.org/10.1016/j.jbusres.2017.03.013

Buhmann, B., Rainwater, L., Schmaus, G., & Smeeding, T. M. (1988). Equivalence scales, well-being, inequality, and poverty: Sensitivity estimates across ten countries using the Luxembourg income study (LIS) database. Review of Income and Wealth, 34, 115–142. https://doi.org/10.1111/j.1475-4991.1988.tb00564.x

CFPB (Consumer Financial Protection Bureau). (2015). Financial well-being: The goal of financial education (Research Report). Retrieved from CFPB website: https://files.consumerfinance.gov/f/201501_cfpb_report_financial-well-being.pdf. Accessed 10 May 2020.

CFPB (Consumer Financial Protection Bureau). (2018). Pathways to financial well-being: The role of financial capability (Research Report). Retrieved from CFPB website: https://files.consumerfinance.gov/f/documents/bcfp_financial-well-being_pathways-role-financial-capability_research-brief.pdf. Accessed 10 May 2020.

Collins, A., & Koechlin, E. (2012). Reasoning, learning, and creativity: Frontal lobe function and human decision-making. PLoS Biology, 10(3), 1–16. https://doi.org/10.1371/journal.pbio.1001293

Dew, J., & Xiao, J. J. (2011). The financial management behavior scale: Development and validation. Journal of Financial Counseling and Planning, 22(1), 43–59.

Diamond, A. (2013). Executive functions. Annual Review of Psychology, 64, 135–168. https://doi.org/10.1146/annurev-psych-113011-143750

Diamond, A., Barnett, S., Thomas, J., & Munro, S. (2007). Preschool program improves cognitive control. Science, 318, 1387–1388. https://doi.org/10.1126/science.1151148

Downward, P., Rasciute, S., & Kumar, H. (2020). Health, subjective financial situation and well-being: A longitudinal observational study. Health and Qualily of Life Outcomes, 18(203), 1–9. https://doi.org/10.1186/s12955-020-01456-3

Drever, A. I., Odders-White, E., Kalish, C. W., Else-Quest, N. M., Hoagland, E. M., & Nelms, E. N. (2015). Foundations of financial well-being: Insights into the role of executive function, financial socialization, and experience-based learning in childhood and youth. Journal of Consumer Affairs, 49, 13–38. https://doi.org/10.1111/joca.12068

Fairchild, G., Van Goozen, S. H. M., Calder, A. J., Stollery, S. J., & Goodyer, I. M. (2009). Deficits in facial expression recognition in male adolescents with early-onset or adolescence-onset conduct disorder. Journal of Child Psychology and Psychiatry, 50, 627–636. https://doi.org/10.1111/j.1469-7610.2008.02020.x

Farrell, L., Fry, T. R. L., & Risse, L. (2016). The significance of financial self-efficacy in explaining women’s personal finance behaviour. Journal of Economic Psychology, 54, 85–99. https://doi.org/10.1016/j.joep.2015.07.001

Forbes, J., & Kara, S. M. (2010). Confidence mediates how investment knowledge influences investing self-efficacy. Journal of Economic Psychology, 31(3), 435–443. https://doi.org/10.1016/j.joep.2010.01.012

Gallucci, M. (2019). jAMM: jamovi advanced mediation models [Computer software]. Retrieved from https://jamovi-amm.github.io/. Accessed 20 Aug 2020.

Gutter, M., & Copur, Z. (2011). Financial behaviors and financial well-being of college students: Evidence from a national survey. Journal of Family and Economic Issues, 32, 699–714. https://doi.org/10.1007/s10834-011-9255-2

Iramani, R., & Lutfi, L. (2021). An integrated model of financial well-being: The role of financial behavior. Accounting, 7(1), 691–700. https://doi.org/10.5267/j.ac.2020.12.007

Jeon, J. (2015). The strengths and limitations of the statistical modeling of complex social phenomenon: Focusing on SEM, path analysis, or multiple regression models. International Journal of Social, Behavioral, Educational, Economic, Business and Industrial Engineering, 9(5), 1629–1637. https://doi.org/10.5281/zenodo.1105869

Kempson, E., Finney, A., & Poppe, C. (2017). Financial well-being: A conceptual model and preliminary analysis. Consumption Research Norway.

Kempson, E., & Poppe, C. (2018). Understanding financial well-being and capability—a revised model and comprehensive analysis. Consumption Research Norway.

Kim, K. T., Anderson, S. G., & Seay, M. C. (2019). Financial knowledge and short-term and long-term financial behaviors of Millennials in the United States. Journal of Family and Economic Issues, 40(2), 194–208. https://doi.org/10.1007/s10834-018-9595-2

Krekel, C., Ward, G., & De Neve, J. (2019). Employee wellbeing, productivity and firm performance (CEP Discussion Paper No. 1605). Retrieved from Center for Economic Performance website: https://cep.lse.ac.uk/pubs/download/dp1605.pdf. Accessed 25 Mar 2020.

Landau, S., & Everitt, B. S. (2004). A handbook of statistical analyses using SPSS. Chapman and Hall.

Lapp, W. M. (2010). Behavior models for prosperity: A statistical assessment of savings and behavioral change (EARN Research Brief). Retrieved from Earned Assets Resource Network website: https://www.earn.org/wp-content/uploads/2015/03/5_-_Behavioral_Models_for_Prosperity-_A_Statistical_Assessment_of_Savings_and_Behavioral_Change-1.pdf. Accessed 10 May 2020.

Limbu, Y. B., & Sato, S. (2019). Credit card literacy and financial well-being of college students: A moderated mediation model of self-efficacy and credit card number. International Journal of Bank Marketing, 37(4), 991–1003. https://doi.org/10.1108/IJBM-04-2018-0082

Little, R. J. A. (1988). A test of missing completely at random for multivariate data with missing values. Journal of the American Statistical Association, 83(404), 1198–1202. https://doi.org/10.1080/01621459.1988.10478722

Mani, A., Mullainathan, S., Shafir, E., & Zhao, J. (2013). Poverty impedes cognitive function. Science, 341, 976–980. https://doi.org/10.1126/science.1238041

MAS (Money Advice Service). (2018). Financial Capability Survey 2018 (Technical Report). Retrieved from MAS website: https://www.fincap.org.uk/en/articles/financial-capability-survey. Accessed 10 Mar 2020.

Miller, H. V., Barnes, J. C., & Beaver, K. M. (2011). Self-control and health outcomes in a nationally representative sample. American Journal of Health Behavior, 35(1), 15–27. https://doi.org/10.5993/AJHB.35.1.2

Montford, W., & Goldsmith, R. E. (2016). How gender and financial self-efficacy influence investment risk taking. International Journal of Consumer Studies, 40(1), 101–106. https://doi.org/10.1111/ijcs.12219

Netemeyer, R. G., Warmath, D., Fernandes, D., & Lynch, J. G. (2018). How am i doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. Journal of Consumer Research, 45(1), 68–89. https://doi.org/10.1093/jcr/ucx109

Peterson, G. W., & Bush, K. R. (2013). Handbook of marriage and the family. Springer. https://doi.org/10.1007/978-1-4614-3987-5

Plantinga, A., Krijnen, J. M. T., Zeelenberg, M., & Breugelmans, S. M. (2018). Evidence for opportunity cost neglect in the poor. Journal of Behavioral Decision Making, 31(1), 65–73. https://doi.org/10.1002/bdm.2041

Pychyl, T. A. (2013). Strategies to strengthen executive function: Developing volitional skills to reduce procrastination. Psychology Today. https://www.psychologytoday.com/us/blog/dont-delay/201302/strategies-strengthen-executive-function. Accessed 5 June 2020.

Qamar, M. A. J., Khemta, M. A. N., & Jamil, H. (2016). How knowledge and financial self-efficacy moderate the relationship between money attitudes and personal financial management behavior. European Online Journal of Natural and Social Sciences, 5(2), 296–308.

Raveendran, J., Soren, J., Ramanathan, V., Sudharshan, R., Mahalanabis, S., Suresh, A. K., & Balaraman, V. (2021). Behavior science led technology for financial wellness. CSI Transactions on ICT, 9(2), 115–125. https://doi.org/10.1007/s40012-021-00331-w

Riitsalu, L., & Van Raaij, F. (2020). Self-control, future time perspective and savings: The keys to perceived financial well-being (Research Report). Retrieved from Think Forward Initiative website: https://www.thinkforwardinitiative.com/research/self-control-future-time-perspective-and-savings-the-keys-to-perceived-financial-well-being. Accessed 10 May 2020.

Riitsalu, L., & Murakas, R. (2019). Subjective financial knowledge, prudent behaviour and income: The predictors of financial well-being in Estonia. International Journal of Bank Marketing, 37(4), 934–950. https://doi.org/10.1108/IJBM-03-2018-0071

Rimal, A., & Moon, W. (2009). Self-efficacy a mediator of the relationship between dietary knowledge and behavior. Journal of Food Distribution Research, 42(3), 28–41. Retrieved from http://www.fdrsinc.org/wpcontent/uploads/2014/09/November-2011.pdf#page=32. Accessed 5 June 2020.

Rosseel, Y. (2012). Lavaan: An R package for structural equation modeling. Journal of Statistical Software, 48(2), 1–36. http://www.jstatsoft.org/v48/i02/. Accessed 20 Aug 2020.

Sabri, M. F., Wijekoon, R., & Rahim, H. A. (2020). The influence of money attitude, financial practices, self-efficacy and emotion coping on employees’ financial wellbeing. Management Science Letters, 10(4), 889–900. https://doi.org/10.5267/j.msl.2019.10.007

Selvia, G., Rahmayanti, D., Afandy, C., & Zoraya. I. (2020). The effect of financial knowledge, financial behavior and financial inclusion on financial well-being. Proceedings of the 3rd Beehive International Social Innovation Conference, https://doi.org/10.4108/eai.3-10-2020.2306600

Serido, J., & Shim, S. (2017). Adult financial capability, stability and well-being (Research Report). Retrieved from APLUS website: https://static1.squarespace.com/static/597b61a959cc68be42d2ee8c/t/598a844ecd39c31515c51c7f/1502250072075/APLUS_WAVE4.pdf. Accessed 5 June 2020.

Strömbäck, C., Skagerlund, K., Västfjäll, D., & Tinghög, G. (2020). Subjective self-control but not objective measures of executive functions predicts financial behavior and well-being. Journal of Behavioral and Experimental Finance, 27, 1–7. https://doi.org/10.1016/j.jbef.2020.100339

Tahmassian, K., & Moghadam, N. J. (2011). Relationship between self-efficacy and symptoms of anxiety, depression, worry and social avoidance in a normal sample of students. Iranian Journal of Psychiatry and Behavioral Sciences, 5, 91–98.

Tharp, D. (2018). Why financial self-efficacy is crucial to financial success. Kitces. https://www.kitces.com/blog/financial-self-efficacy-bandura-positive-psychology-planning-perma/. Accessed 28 Aug 2020.

The jamovi project. (2021). jamovi. (Version 1.6) [Computer Software]. Retrieved from https://www.jamovi.org. Accessed 20 Aug 2020.

Van der Elst, W., Ouwehand, C., Van der Werf, G., Kuyper, H., Lee, N., & Jolles, J. (2012). The Amsterdam executive function inventory (AEFI): Psychometric properties and demographically-corrected normative data. Journal of Clinical and Experimental Neuropsychology, 34, 160–171.

Van Dijk, W. W., Van der Werf, M., & Van Dillen, L. F. (2021). The psychological inventory of financial scarcity (PIFS): A psychometric evaluation. Manuscript submitted for publication.

Von Hippel, P. (2018). How many imputations do you need? A two-stage calculation using a quadratic rule. Sociological Methods & Research, 49(3), 1–17. https://doi.org/10.1177/0049124117747303

Vosloo, W., Fouché, J., & Barnard, J. (2014). The relationship between financial efficacy, satisfaction with remuneration and personal financial well-being. International Business & Economics Research Journal, 13(6), 1455–1470. https://doi.org/10.19030/iber.v13i6.8934

Wagner, J., & Walstad, W. B. (2018). The effects of financial education on short-term and long-term financial behaviors. The Journal of Consumer Affairs, 53(1), 234–259.

Wilmarth, M. J. (2020). Financial and economic well-being: A decade review from journal of family and economic issues. Journal of Family and Economic Issues. https://doi.org/10.1007/s10834-020-09730-8

Xiao, J. J., Tang, C., & Shim, S. (2008). Acting for happiness: Financial behavior and life satisfaction of college students. Social Indicators Research, 92, 53–68. https://doi.org/10.1007/s11205-008-9288-6

Funding

This work was supported by Leiden University.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Ethical Approval

The Psychology Research Ethics Committee of Leiden University approved the study (V1-2513, December 2020).

Consent to Participate

Informed consent was obtained from all respondents.

Consent for Publication

The authors hereby provide consent for publication. The data obtained for this study was completely anonymized.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dare, S.E., van Dijk, W.W., van Dijk, E. et al. How Executive Functioning and Financial Self-efficacy Predict Subjective Financial Well-Being via Positive Financial Behaviors. J Fam Econ Iss 44, 232–248 (2023). https://doi.org/10.1007/s10834-022-09845-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-022-09845-0