Abstract

We studied the association of individual differences in objective financial knowledge (i.e. competence), subjective financial knowledge (i.e. confidence), numeric ability, and cognitive reflection on a broad set of financial behaviors and feelings towards financial matters. We used a large diverse sample (N = 2063) of the adult Swedish population. We found that both objective and subjective financial knowledge predicted frequent engagement in sound financial practices, while numeric ability and cognitive reflection could not be linked to the considered financial behaviors when controlling for other relevant cognitive abilities. In addition, both objective and subjective financial knowledge served as a buffer against financial anxiety, while we did not detect similar buffering effects of numeric ability and cognitive reflection. Subjective financial knowledge was found to be a stronger predictor of sound financial behavior and subjective wellbeing than objective financial knowledge. Women reported a lower level of subjective financial wellbeing even though they reported a more prudent financial behavior than men, when controlling for sociodemographics and cognitive abilities. Our findings help to understand heterogeneity in people’s propensity to engage in sound financial behaviors and have implications for important policy issues related to financial education.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

People regularly make unwise financial decisions: they buy things they can’t afford, they do not save enough for retirement, and they fail to pay their bills on time. However, there is a substantial degree of heterogeneity in people’s propensity to engage in financial behaviors that could be considered unsound (Campbell 2006). Independent of their financial behavior, people also differ in the extent to which they worry about financial matters (Joo and Grable 2004). Despite the growing recognition of these issues, and rapidly evolving financial markets forcing people to deal with increasingly complex financial products and services, our understanding of individual differences that affect financial behaviors and subjective financial wellbeing is limited. This is surprising given that this knowledge is key when designing adequate interventions and educational programs aimed at improving financial behavior. Hence, it is important to increase knowledge about the role of financial knowledge when it comes to being able to tackle financial challenges. In this study we explored how individual differences in objective financial knowledge (competence) and subjective financial knowledge (confidence), numeracy, and cognitive reflection were associated with sound financial behavior and subjective financial wellbeing.

Financial knowledge here refers to the stock of knowledge specifically related to personal finance concepts and products. This can be assessed both objectively, by using knowledge-based questions, and subjectively, by asking people to rate their level of financial knowledge. The term, financial knowledge, is often used interchangeably with financial literacy. However, they do not completely overlap. As Huston (2010) puts it: “Financial knowledge is an integral dimension of, but not equivalent to, financial literacy. Financial literacy has an additional application dimension which implies that an individual must have the ability and confidence to use his/her financial knowledge to make financial decisions” (p. 307). Thus, a person that has low skills may be able to compensate by using tools (e.g., a calculator or a computer) and thereby be able to navigate successfully in matters related to personal finance.

Previous research suggests that objective financial knowledge, measured by standard financial literacy test questions, is key to understanding individual differences in financial behavior. Positive associations have been shown in connection to specific financial behaviors, such as retirement planning (Almenberg and Säve-Söderbergh 2011; Lusardi and Mitchell 2017a; van Rooij et al. 2011a), stock investing (van Rooij et al. 2011b), having an emergency fund (Babiarz and Robb 2014), and accumulation of credit-card debt (Norvilitis et al. 2006). Thus, there is substantial evidence that objective financial knowledge is positively correlated with important financial behaviors. Most studies of the role of financial knowledge in financial behavior have, however, neither considered aggregate measures of financial behaviors nor controlled for related cognitive abilities such as numeric ability and cognitive reflection.Footnote 1 Thus, it is unclear if financial knowledge or numeric processing is the key driver of financial behavior (Skagerlund et al. 2018). Indeed, previous research has shown that both numeric processing and the ability to inhibit impulses are predictive of financial behaviors (Cheung et al. 2014; Corgnet et al. 2015; Gerardi et al. 2013; Ghazal et al. 2014; Oechssler et al. 2009; Strömbäck et al. 2017). Thus, there is a need to measure these abilities simultaneously, and test the extent to which they are associated with (un)sound financial behavior.

Subjective financal knowledge, or the confidence in one’s ability to engage in a particular behavior, has also been shown to be an important driver of behavior in a variety of financial settings (e.g., Farrell et al. 2016; Robb et al. 2015). For example, Anderson et al. (2017) showed that people’s subjective financial knowledge (i.e., confidence) was a better predictor of savings behavior than their objective financial knowledge (i.e., competence). Similarly, Allgood and Walstad (2013) found that subjective financial knowledge was a stronger predictor of less costly practices in credit card use than objective financial knowledge. A possible mechanism is that people with high financial confidence might be less reluctant to avoid financial information, which could affect behavior (Barrafrem et al. 2020). Beliefs about the extent of one’s own knowledge might thus be as important (or more) as actual knowledge when it comes to sound financial behavior. To explore the role of financial competence in relation to financial confidence, we measured both objective and subjective financial knowledge in this study.

Subjective financial knowledge or confidence in one’s own financial competence is, however, not always perfectly correlated with performance (Parker et al. 2012). The extent to which one’s own beliefs are calibrated with actual financial competence is commonly referred to as financial sophistication (Woodyard and Robb 2016). Miscalibrated individuals with high subjective financial knowledge but low objective financial knowledge can be thought of as overconfident. Prior studies have shown that overconfidence in own competence often leads to worse financial performance (Barber and Odean 2001; Camerer and Lovallo 1999; Robb et al. 2015; Statman et al. 2006), as well as reluctance to seek financial advice (Kramer 2016; Lewis 2018). Similarly, individuals with low subjective financial knowledge but high objective financial knowledge can be thought of as underconfident. Underconfidence may also influence financial behavior negatively if, for example, individuals become increasingly reluctant to make necessary active financial choices. Peters et al. (2019) showed that people who exhibit “mismatched” levels of objective and subjective numeric ability self-report worse financial and medical outcomes. In addition to confidence, it is therefore important to assess the link between under- and overconfidence and financial behavior.

Although the primary focus of most financial education programs is to promote sound financial behavior, a perhaps equally important goal is to contribute to subjective financial well-being. This is emphasized by the American Consumer Financial Protection Bureau (CFPB) which proclaims that “…the ultimate measure of success for financial literacy efforts should be individual financial wellbeing” (CFPB, p. 9). Satisfaction in regards to financial matters has also been shown to be an important component of general life satisfaction (Diener et al. 2010; Easterlin 2006; Hojman et al. 2016; Johnson and Krueger 2006; van Praag et al. 2003; Woodyard and Robb 2016). Thus, it is important to understand if the abilities that influence financial behavior also affects subjective financial wellbeing in similar ways. Prior studies that have examined the relationship between financial knowledge and financial satisfaction have found mixed results (see Tharp 2017 for a review of relevant empirical studies). However, the general pattern from previous studies on financial satisfaction seems to be that subjective financial knowledge has a positive association (Joo and Grable 2004; Xiao et al. 2014), while objective financial knowledge has a negative association (Seay et al. 2015; Xiao et al. 2014). Most previous studies have used single-item measures of financial satisfaction simply by asking individuals to rate how satisfied they are with their current financial situation. This can lead to an imprecise measure of subjective financial wellbeing. In this study we therefore used multiple-item measures of two facets of subjective financial wellbeing: financial security and financial anxiety. Thus, subjective financial wellbeing was defined as (a) a sense of security about one’s own financial situation and (b) the lack of negative emotions (i.e. anxiety, worry) caused by financial matters.

Gender differences have been explored and established for different financial behaviors, such as trading behavior (Barber and Odean 2001), savings behavior (Fisher 2010), and keeping to a budget (Hayhoe et al. 2000). Gender differences have also been demonstrated for objective financial knowledge and numeric ability, where males typically perform better than females (Chen and Volpe 2002; Fonseca et al. 2012; Lusardi and Mitchell 2008). Less is known about gender differences related to subjective financial wellbeing and broader measures of financial behavior. Thus, there exists a knowledge gap concerning how gender differences in objective financial knowledge affects financial behavior and subjective financial wellbeing while taking differences in relevant cognitive abilities and demographics into account.

Method and Data

Recruitment and Procedure

Participants were recruited in collaboration with Origo Group and drawn from a sample of the general adult population previously included in their subject pool. Origo Group (www.origogroup.com) is a Swedish research company that specializes in data collection for national and international surveys. We hired them to collect a representative sample of 2000 participants (based on age and gender in the Swedish adult population). The survey was conducted online and was closed once the target of 2000 subjects was reached. However, at the time the survey actually closed, the number of participants had reached 2063. Participants received a small monetary payment upon completion of the survey. The survey was programmed in Qualtrics.

Materials

The survey collected information about financial behavior, subjective financial wellbeing, objective and subjective financial knowledge, cognitive reflection, numeric ability, self-control and sociodemographics.

Financial behavior was measured using the Financial Management Behavior Scale (FMBS) developed by Dew and Xiao (2011). The FMBS covers a wide range of financial behaviors needed to ensure a sound financial situation, both in the short run (e.g., paying all bills on time) and in the long run (e.g., saving for retirement or another long-term goal). The FMBS scale consists of 12 items, displayed in Table 1. For each item, participants were asked to indicate how often they had engaged in a certain financial behavior over the past 6 months on a scale from 1 (not at all) to 5 (every month). A higher FMBS score indicated that the individual more frequently engaged in sound financial behaviors. The average FMBS score was 3.53 (SD = 0.69) for the total sample, indicating that participants on average had engaged quite regularly in the listed activities over the past six months. Cronbach’s alpha was calculated and showed a reliability coefficient of 0.75.

To measure Subjective financial well-being, we combined two scales: the Financial Anxiety Scale (FAS) (Fünfgeld and Wang 2009) and the Financial Security Scale (FSS) (Strömbäck et al. 2017). All items used to measure subjective financial wellbeing are presented in Table 2. Respondents indicated on a five-point Likert scale how well each statement corresponded to their own experience: 5 indicating complete agreement with the statement and 1 indicating complete disagreement with the statement. A higher FAS score indicated that the individual felt more anxiety related to financial matters. A higher FSS score indicated that the individual experienced a higher level of security concerning own financial situation. On average participants scored 2.81(SD = 0.80) on FAS and 3.03(SD = 1.20) on FSS. Factor analysis confirmed that the two scales for subjective financial wellbeing measured different underlying constructs. A person can feel quite comfortable with his or her financial situation but still feel anxiety about financial matters. Cronbach’s alpha was calculated and showed a reliability coefficient of 0.68 (FAS) and 0.91 (FSS).

To measure objective financial knowledge, four knowledge-based questions commonly used to assess financial literacy were included. All questions were multiple-choice and have been used in previous studies (van Rooij et al. 2012). The first three questions tested rudimentary financial knowledge: Question 1 was about the interest rate, Question 2 was about inflation, and Question 3 concerned diversification. The last question tested participants’ knowledge of the relationship between bond prices and the interest rate. The mean number of correct answers was 2.1 (SD = 1.17), and 10.2% of the participants responded all four of the financial literacy questions correctly.

To measure subjective financial knowledge participants were asked to rate their own financial knowledge on a scale from 1 to 7 (1 meaning very low, and 7 meaning very high). On average participates rated their subjective financial knowledge as 4.32 (SD = 1.26). The correlation between the objective and the subjective financial knowledge was 0.34, suggesting that the two measures of financial knowledge were related but not identical.

To measure financial sophistication, we took the scores from the objective and subjective financial knowledge measures and categorized individuals into four mutually exclusive groups. Following prior work on financial sophistication by Woodyard and Robb (2016) and Allgood and Walstad (2013) individuals were divided into high and low for both measures. On subjective financial knowledge, individuals were categorized as “high” or “low” depending on whether they responded correctly on half or more of the questions. For subjective financial knowledge we did a mean split of the sample, so that subjects who rated their knowledge as five and above on the Likert scale were categorized as high, while subjects who rated their knowledge as four and below were categorized as low. When combining these measures individuals could be grouped into the following categories: (a) correct high confidence (high subjective–high objective), (b) correct low confidence (low subjective–low objective), (c) over confident (high subjective–low objective), and (d) under confident (low subjective–high objective).

Numeracy was measured using a combination of the three items adopted from Schwartz et al. (1997) and the Berlin Numeracy Test (BNT) developed by Cokely et al. (2012) (validated in Swedish by Lindskog et al. 2015). For example, participants were asked to predict how many times out of 1000 tosses a fair coin would show tails. The BNT was chosen since it tests statistical numeracy and risk literacy, both of which are important in financial issues. The combination of the questions from Schwartz et al. (1997) and the BNT was applied to a wider population; the original BNT items assessed numeracy in more educated samples. Cokely et al. (2012) advocated the combined use of these instruments.

To measure cognitive reflection, or deliberation, we administered the Cognitive Reflection Test (CRT) containing the three original items from Frederick (2005). The problems were phrased in such a way that there were intuitive but wrong solutions. The questions were: (1) “A bat and a ball cost $1.10. The bat costs $1.00 more than the ball. How much does the ball cost?”; (2) “If it takes five machines five minutes to make five widgets, how long would it take 100 machines to make 100 widgets?”; (3) “In a lake, there is a patch of lily pads. Every day, the patch doubles in size. If it takes 48 days for the patch to cover the entire lake, how long would it take for the patch to cover half of the lake?” The number of correct answers was used as an indicator of cognitive reflection ability.

To measure self-control, we used five items from a scale developed by Tangney et al. (2004). Participants responded to statements such as: “I get distracted easily” on a five-point Likert scale, with 5 indicating complete agreement with the statement and 1 indicating complete disagreement with the statement. Cronbach’s alpha was calculated and showed a reliability coefficient of 0.76. Complete instructions of all measures included can be found in the Supplementary Materials.

Hypotheses and Strategy for Analysis

We set out to test the following main hypotheses:

Hypothesis 1:

Objective financial knowledge/Subjective financial knowledge/ Numeracy/Cognitive reflection are positively associated with sound financial behavior measured by FMBS.

Hypothesis 2:

Objective financial knowledge/Subjective financial knowledge/ Numeracy/Cognitive reflection are positively associated with increased level of Financial satisfaction measured as financial security and financial anxiety.

To explore how the level of each cognitive ability (objective financial knowledge, subjective financial knowledge, numeracy and cognitive reflection) relates to financial behavior, we divided the sample into subgroups, those with low levels and those with high levels of a particular cognitive ability. People were categorized as “high” if they responded correctly on half or more of the questions for each of the performance-based measures. Accordingly, people who failed to answer at least half of the questions correctly were categorized as “low”. For subjective financial knowledge we did a mean split of the sample, so that subjects who rated their knowledge as five and above on the Likert scale were categorized as high, while subjects who rated their knowledge as four and below were categorized as low. In order to test for a difference between the divided sample with respect to their financial behavior we performed t-tests.

As a second step, we utilized an ordinary least squares regression framework to estimate the association between objective and subjective financial knowledge and sound financial behavior and financial satisfaction. In these regressions we included all cognitive measures as continuous variables. The full regression specification (Model 5) was:

where \({Y}_{i}\) is either financial behavior (measured by the FMBS) or level of subjective financial wellbeing (measured by the FAS or the FSS) for individual i. Before running the full regression model we first included each cognitive measure of interest separately (Model 1–4). We then included all cognitive abilities of interest: objective financial knowledge, subjective financial knowledge, numeracy and cognitive reflection. In all regressions we controlled for gender, stated self-control, age, if the participant was born in a non-European country, educational attainment, and income.

Results

Table 3 displays the sample characteristics as well as the general results for all included measures, separated by gender. The final sample consisted of 2063 participants (50.8% women). The mean age in the sample was 49.15 years (SD = 6.10) and 28.4% of the sample had at least a bachelor’s degree. When comparing the unadjusted results, males consistently scored higher than females on all measured cognitive abilities, including objective and subjective financial knowledge, numeracy, and cognitive reflection. Males also reported a more prudent financial behavior, while women felt less secure and more anxious about financial matters.

Financial Behavior

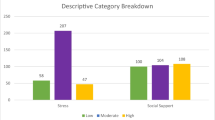

Figure 1 shows the association between sound financial behavior and the cognitive abilities under investigation without adjusting for sociodemographics and other cognitive abilities. As shown in Fig. 1a, respondents with low levels of objective financial knowledge engaged less frequently in sound financial behaviors. On average, respondents categorized as having low objective financial knowledge scored 3.27 (SD = 0.68) on the FMBS, while respondents with high objective financial knowledge scored 3.64 (SD = 0.67; t(2061) = − 11.86, p < 0.001). With regards to subjective financial knowledge the same pattern emerged: respondents with low self-reported knowledge had an average score of 3.30 (SD = 0.66), while individuals with a high level on average had a score of 3.78 (SD = 0.64; t(2061) = − 16.88, p < 0.001). The corresponding results for numeric ability and cognitive reflection are shown in Fig. 1c and d. Respondents with low numeric skills had a significantly lower score on the FMBS than those with high numeric skills (low numeracy M = 3.47 (SD = 0.69), high numeracy M = 3.66 (SD = 0.67), t (2061) = − 5.89, p < 0.001). Similarly, respondents categorized as having a low reflective ability also had a significantly lower score on FMBS (low CRT 3.49 (SD = 0.70), high CRT 3.63 (SD = 0.68), t(2061) = − 4.09, p < 0.001). Consequently, all analyses conducted when not taking sociodemographic factors and other cognitive abilities into account were supportive of Hypothesis 1.

To further explore the descriptive results on financial behavior shown in Fig. 1, we conducted regression analysis controlling for relevant sociodemographics and differences in cognitive abilities. Table 4 shows the results from theses analyses. The estimate for objective financial knowledge in Model 1 shows that one more correct answer to the financial literacy questions raised the average score on the FMBS by 0.13 points, all else equal. For subjective financial knowledge, the estimate increased to 0.18. For numeric ability and cognitive reflection, the effect sizes were smaller but still significant. In Model 5, where financial knowledge (objective and subjective), numeric ability and cognitive reflection entered the model specification simultaneously, only objective and subjective financial knowledge remained statistically significant predictors of financial behavior. Given that previous studies have shown a strong association between numeric ability and better decision making, it is noteworthy that there was no association between numeracy and financial behavior when financial knowledge was taken into account. In Model 6 the standardized beta coefficients are shown, allowing for a magnitude comparison between the measures. Subjective financial knowledge was the strongest predictor of financial behavior, followed by self-reported self-control and then objective financial knowledge. Thus, financial confidence seems to be more important than financial competence when it comes to sound financial behavior. Indeed, the coefficient for subjective financial knowledge was significantly larger than the coefficient for objective financial knowledge (F(1, 2041) = 11.12, p < 0.001). Looking at gender difference, the results from our general regression model (Model 5) showed that when controlling for all cognitive abilities, women were more likely to engage in sound financial behaviors compared to men.

Subjective Financial Wellbeing

To explore how financial knowledge and other cognitive abilities are associated with feelings of financial security and anxiety (Hypothesis 2) we performed the same type of analyses as conducted for financial behavior. As shown in Fig. 1 similar patterns emerged also for feelings related to financial anxiety and security. Figure 1a shows that participants categorized as having low objective financial knowledge felt more anxiety related to financial matters than those with higher objective financial knowledge. Those with low objective financial knowledge scored, on average, 2.98 (SD = 0.82) on the FAS and those with high levels of financial knowledge scored, on average, 2.73 (SD = 0.78; t(2061) = 6.86, p < 0.001). Similar results were found for subjective financial knowledge, as can be seen in Fig. 1b. Those who self-reported low levels of financial knowledge scored, on average, 3.01 (SD = 0.74) on the FAS and those who self-reported high levels scored, on average, 2.58 (SD = 0.80; t(2061) = 12.62, p < 0.001). Figure 1c shows a similar result but with regards to numeracy: people with low numeracy levels worried somewhat more about financial matters than those with high numeracy levels. Participants with low numeracy scored 2.86 (SD = 0.81) and those with high numeracy scored 2.70 (SD = 0.77, t(2061) = 4.11, p < 0.001). Participants with low levels of cognitive reflection scored, on average 2.72 (SD = 0.76) whereas those with high levels scored on average 2.84 (SD = 0.82, t(2061) = 3.12, p = 0.002).

As shown in Table 5, however, objective and subjective financial knowledge were the only measures besides self-control that had a statistically significant effect on financial anxiety when controlling for relevant demographics and differences in cognitive abilities. The signs were negative, indicating that higher financial knowledge (both objective and subjective) entailed less anxiety. The negative associations were robust across model specifications as shown in Table 5. Thus, objective and subjective financial knowledge independently influenced financial anxiety. Model 6, with standardized coefficients, showed that confidence in the form of subjective financial knowledge was more important than objective financial knowledge. Indeed, the coefficient for subjective financial knowledge was significantly larger than the coefficient for objective financial knowledge (F(1, 2041) = 5.19, p = 0.023). The full model in Table 5 also shows that women, independently of other factors, worried more about financial matters than men did.

Table 6 shows the results related to feeling of financial security. Objective financial knowledge was associated with a greater sense of financial security also when controlling for sociodemographics (Model 1 and 2). For numeracy the effect was also positive and statistically significant, but the effect size was small. The association between cognitive reflection and financial security was no longer significant when controlling for socio demographics. In Model 5, where all measures were included, the only measure that remained as a significant predictor was subjective financial knowledge. Thus, similar to the results presented for financial behavior, subjective financial knowledge was a stronger predictor than objective financial knowledge. Indeed, the coefficient for subjective financial knowledge was yet again significantly larger than the coefficient for objective financial knowledge (F(1, 2041) = 92.13, p < 0.001). The full model in Table 6 also shows that women felt less secure about their financial situation, albeit this association was significant only on 10% level.

Financial Sophistication

Figure 2 shows how miscalibrated levels of subjective and objective financial knowledge were associated with our main dependent variables (FMBS, financial anxiety and financial security). Individuals with matched levels of high subjective knowledge and high objective knowledge were the group with the highest FMBS Score (3,83), while individuals with matched levels of low subjective and objective knowledge had the lowest FMBS score (3,15). For miscalibrated individuals, overconfident individuals had a slightly higher FMBS score compared to individuals categorized as underconfident (FMBS score: 3,55 vs. 3,41). For financial anxiety and financial security similar patterns emerged. For additional regression analyses see Table S6 in the Supplementary Material. In general terms our results indicated that it was most beneficial to have matched levels of high subjective knowledge and high objective knowledge. However, it was also more beneficial for the individual to be overconfident rather than underconfident, i.e., having high objective knowledge but low subjective knowledge. Thus, it seemed like subjective financial knowledge had a positive effect in itself when it came to general financial behaviors and feelings about financial matters.

Discussion

Every day, individuals make countless decisions, many of which involve complex considerations and have both short- and long-term financial consequences. In addition, financial products and markets are becoming increasingly more complex, while individuals at the same time increasingly are becoming responsible for making adequate financial decisions. This puts a heavy burden on the individual decision maker within the financial domain. Being adequately equipped with skills and abilities to face these complex decisions is thus important both from an individual standpoint and from a societal perspective. Understanding how financial knowledge relates to financial behavior and subjective financial wellbeing is therefore important for policy-makers when thinking about designing interventions and educational programs.

A main finding from this study is that knowledge, both objective and subjective, predicts (un)sound financial behaviors, while other cognitive abilities are less influential. The finding that knowledge predicts (un)sound financial behaviors is perhaps not surprising and is in line with prior studies exploring similar matters for specific financial behaviors such as retirement planning (Almenberg and Säve-Söderbergh 2011; Lusardi and Mitchell 2017) and having emergency funds (Babiarz and Robb 2014). However, the finding that numeracy did not matter substantially for everyday financial behavior, when taking financial knowledge into account, is both novel and important since previous research has found that numeracy correlates with better decision making (Peters et al. 2006).

In this study we also investigated whether financial knowledge is related to subjective financial wellbeing, measured by combining two facets—financial anxiety and security. The determinants of these two aspects of financial wellbeing has been a largely neglected area of research; thus, our results make an important contribution. We show that financial anxiety is predicted by both subjective and objective financial knowledge, while financial security is predicted by subjective financial knowledge only. Importantly, neither numeric ability nor cognitive reflection were robustly linked to financial anxiety/security. The finding that subjective financial knowledge is positively related to subjective financial wellbeing is in line with previous studies showing that subjective financial knowledge is positively related to measures of financial satisfaction (Joo and Grable 2004; Seay et al. 2015; Xiao et al. 2014). However, the finding that objective financial knowledge is also positively related to subjective financial wellbeing is in contrast with previous research, which has shown a negative relationship between objective financial knowledge and financial satisfaction (Seay et al. 2015; Xiao et al. 2014). A possible explanation for this discrepancy is that our measures of subjective financial wellbeing focus more on emotions and feelings related to finance in general, while measures of financial satisfaction typically focus more on level of satisfaction related to current financial conditions.

Our results also show that women feel less secure in their financial situation and worry more about it than men. Further, we found a significant difference in financial behavior suggesting that women have more sound financial behaviors than men, when controlling for sociodemographic and cognitive measures. This suggests that although women more frequently engage in sound financial behaviors, they still feel more anxiety related to financial matters, also when controlling for factors such as income.

A particularly noteworthy finding from this study is that financial confidence (i.e., subjective financial literacy) seems to be more important than financial competence (i.e., objective financial knowledge). This was found in relation to both financial behavior and subjective financial wellbeing. The interplay between objective and subjective financial knowledge has been explored for some financial behaviors in prior studies (Allgood and Walstad 2013, 2016; Anderson et al. 2017; Robb et al. 2015). These studies have suggested that subjective financial knowledge may be as important as actual financial knowledge. Our results support these claims by showing that subjective financial knowledge is a stronger predictor than subjective financial knowledge when it comes to sound financial behavior. This finding is also in line with research showing that confidence is an important driver of behavior in the financial domain (Farrell et al. 2016; Robb et al. 2015). Although the best combination of subjective and objective financial knowledge is to have corresponding high levels on both, our results also indicate that subjective financial knowledge in itself is beneficial for financial outcomes. Thus, our results are not consistent with studies suggesting that the benefits from having high confidence accrue only on individuals with adequate competences (Peters et al. 2019). Further research is needed on when overconfidence is beneficial/harmful for financial behavior, and which underlying psychological mechanisms can help to explain why. A suggestive explanation for why confidence, regardless of competence, have positive effect on everyday financial behavior and feelings is that a stronger belief about own ability makes people more likely to approach everyday financial problems as ‘challenges to be mastered, rather than as threats to be avoided (Bandura 1994). Such an attitude toward everyday financial matters is likely to have a positive effect on both financial outcomes and wellbeing.

To sum up, our study makes several contributions to the literature on financial literacy and decision making. First, we explore how financial knowledge can be linked to both daily financial behaviors and subjective financial wellbeing. Second, we use broad and comprehensive measures of financial behavior, in contrast to previous studies that have mostly focused on specific financial behaviors. Third, we test for a rigorous set of cognitive control variables which have been shown to affect financial behavior. Fourth, we measure both objective and subjective financial knowledge so that we can explore the relative importance of financial competence and financial confidence. Finally, we have a large and diverse sample of the population so that we can examine if financial literacy differs between genders, and how financial literacy relates to financial behaviors across all levels of society.

Some limitations should be noted. First, the analyses presented in this paper are correlative in nature. Thus, we cannot make inferences about causality. Although it seems reasonable to believe that, for example, higher confidence leads to better financial behavior, it could also be that better financial behaviors lead to higher financial confidence. Future studies should attempt to experimentally manipulate financial confidence and competence in order to establish causality. Second, our measure of financial behavior relies on self-reports. Thus, we cannot be completely sure that people report behavior correctly. It is possible that a potential positive bias in self-reporting is correlated with confidence. For future studies it would be ideal to get access to objective data on financial behavior from banks or financial institutions. Third, our sample is limited to Swedish participants. Thus, we do not know how well our findings translate into other populations. However, given that our results seem to be much in line with some previous studies that used similar methods but were conducted on different samples, we see no obvious reason for why our findings should not extend to non-Swedish populations.

Implications and Conclusions

Our findings suggest that there is still lot to be learned about how financial knowledge contributes to (un)sound financial behavior and subjective financial wellbeing, and how one might help individuals to achieve better objective and subjective wellbeing. The finding that subjective financial knowledge (i.e., confidence) is (at least) as important as objective financial knowledge (i.e., competence) suggests that educators on financial matters should seek to boost a combination of the two in order to achieve the greatest possible effects. In addition, our findings also have clear implications for researchers on financial literacy who commonly only use test scores when assessing financial knowledge. Without also measuring subjective financial knowledge such an approach is likely to underestimate the effect of financial knowledge on behavior and subjective wellbeing. Thus, our findings underscore the importance of taking both subjective and objective financial knowledge into account when assessing financial literacy and how this affects financial behaviors and wellbeing.

References

Allgood, S., & Walstad, W. (2013). Financial literacy and credit card behaviors: A cross-sectional analysis by age. Numeracy, 6(2), 1–26.

Allgood, S., & Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Economic Inquiry, 54(1), 675–697. https://doi.org/10.1111/ecin.12255.

Almenberg, J., & Säve-Söderbergh, J. (2011). Financial literacy and retirement planning in Sweden. Journal of Pension Economics and Finance, 10(4), 585–598. https://doi.org/10.1017/S1474747211000497.

Almenberg, J., & Widmark, O. (2011). Numeracy, financial literacy and participation in asset markets. https://doi.org/10.2139/ssrn.1756674

Anderson, A., Baker, F., & Robinson, D. (2017). Precautionary savings, retirement planning and misperceptions of financial literacy. Journal of Financial Economics, 126(2), 383–398. https://doi.org/10.1016/j.jfineco.2017.07.008.

Babiarz, P., & Robb, C. A. (2014). Financial literacy and emergency saving. Journal of Family and Economic Issues, 35(1), 40–50. https://doi.org/10.1007/s10834-013-9369-9.

Bandura, A. (1994). Self-efficacy. In V. S. Ramachaudran (Ed.), Encyclopedia of human behavior (pp. 71–81). New York: Academic Press.

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. Quarterly Journal of Economics, 116(1), 261–292. https://doi.org/10.1162/003355301556400.

Barrafrem, K., Västfjäll, D., & Tinghög, G. (2020). Financial Homo Ignorans: Measuring vulnerability to behavioral biases in household finance. JAMA. https://doi.org/10.31234/osf.io/q43ca.

Camerer, C., & Lovallo, D. (1999). Overconfidence and excess entry: An experimental approach. American Economic Review, 89(1), 306–318. https://doi.org/10.1257/aer.89.1.306.

Campbell, J. Y. (2006). Household finance. Journal of Finance, 61(4), 1553–1604. https://doi.org/10.1111/j.1540-6261.2006.00883.x.

Chen, H., & Volpe, R. (2002). Gender differences in personal financial literacy among college students. Financial Services Review, 11, 289–307.

Cheung, S. L., Hedegaard, M., & Palan, S. (2014). To see is to believe: Common expectations in experimental asset markets. European Economic Review, 66, 84–96. https://doi.org/10.1016/j.euroecorev.2013.11.009.

Cokely, E. T., Galesic, M., Schulz, E., Garcia-Retamero, R., & Ghazal, S. (2012). Measuring risk literacy: The berlin numeracy test. Judgment and Decision Making, 7(1), 25–47.

Corgnet, B., Porter, D., Hernán-González, R., & Kujal, P. (2015). The effect of earned versus house money on price bubble formation in experimental asset markets. Review of Finance, 19(4), 1455–1488. https://doi.org/10.1093/rof/rfu031.

Dew, J., & Xiao, J. J. (2011). The financial management behavior scale: Development and validation. Journal of Financial Counseling and Planning, 22(1), 43–59.

Diener, E., Ng, W., Harter, J., & Arora, R. (2010). Wealth and happiness across the world: Material prosperity predicts life evaluation, whereas psychosocial prosperity predicts positive feeling. Journal of Personality and Social Psychology, 99(1), 52–61. https://doi.org/10.1037/a0018066.

Easterlin, R. A. (2006). Life cycle happiness and its sources. Intersections of psychology, economics, and demography. Journal of Economic Psychology, 27(4), 463–482. https://doi.org/10.1016/j.joep.2006.05.002.

Farrell, L., Fry, T. R. L., & Risse, L. (2016). The significance of financial self-efficacy in explaining women's personal finance behaviour. Journal of Economic Psychology, 54, 85–99. https://doi.org/10.1016/j.joep.2015.07.001.

Fernandes, D., Lynch, J. G., Jr., & Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60(8), 1861–1883.

Fisher, P. J. (2010). Gender differences in personal saving behaviors. Journal of Financial Counseling and Planning, 21(1), 14–24.

Fonseca, R., Mullen, K. J., Zamarro, G., & Zissimopoulos, J. (2012). What explains the gender gap in financial literacy? The role of household decision making. Journal of Consumer Affairs, 46(1), 90–106. https://doi.org/10.1111/j.1745-6606.2011.01221.x.

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic Perspectives, 19(4), 25–42. https://doi.org/10.1257/089533005775196732.

Fünfgeld, B., & Wang, M. (2009). Attitudes and behaviour in everyday finance: Evidence from Switzerland. International Journal of Bank Marketing, 27(2), 108–128. https://doi.org/10.1108/02652320910935607.

Gerardi, K., Goette, L., & Meier, S. (2013). Numerical ability predicts mortgage default. Proceedings of the National Academy of Sciences of the United States of America, 110(28), 11267.

Ghazal, S., Cokely, E. T., & Garcia-Retamero, R. (2014). Predicting biases in very highly educated samples: Numeracy and metacognition. Judgment and Decision Making, 9(1), 15–34.

Hayhoe, C. R., Leach, L. J., Turner, P. R., Bruin, M. J., & Lawrence, F. C. (2000). Differences in spending habits and credit use of college students. Journal of Consumer Affairs, 34(1), 113–133. https://doi.org/10.1111/j.1745-6606.2000.tb00087.x.

Hojman, D. A., Miranda, Á., & Ruiz-Tagle, J. (2016). Debt trajectories and mental health. Social Science & Medicine, 167, 54–62. https://doi.org/10.1016/j.socscimed.2016.08.027.

Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44(2), 296–316. https://doi.org/10.1111/j.1745-6606.2010.01170.x.

Johnson, W., & Krueger, R. F. (2006). How money buys happiness: Genetic and environmental processes linking finances and life satisfaction. Journal of Personality and Social Psychology, 90(4), 680–691. https://doi.org/10.1037/0022-3514.90.4.680.

Joo, S. H., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25(1), 25–50. https://doi.org/10.1023/B:JEEI.0000016722.37994.9f.

Kramer, M. M. (2016). Financial literacy, confidence and financial advice seeking. Journal of Economic Behavior and Organization, 131, 198–217. https://doi.org/10.1016/j.jebo.2016.08.016.

Lewis, D. R. (2018). The perils of overconfidence: Why many consumers fail to seek advice when they really should. Journal of Financial Services Marketing, 23(2), 104–111. https://doi.org/10.1057/s41264-018-0048-7.

Lindskog, M., Kerimi, N., Winman, A., & Juslin, P. (2015). A Swedish validation of the Berlin numeracy test. Scandinavian Journal of Psychology, 56(2), 132–139. https://doi.org/10.1111/sjop.12189.

Lusardi, A., & Mitchell, O. S. (2008). Planning and financial literacy: How do women fare? American Economic Review, 98(2), 413–417. https://doi.org/10.1257/aer.98.2.413.

Lusardi, A., & Mitchell, O. S. (2017). How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Quarterly Journal of Finance, 7(3), 1–31. https://doi.org/10.1142/S2010139217500082.

Norvilitis, J. M., Merwin, M. M., Osberg, T. M., Kamas, M. M., Roehling, P. V., & Young, P. (2006). Personality factors, money attitudes, financial knowledge, and credit-card debt in college students. Journal of Applied Social Psychology, 36(6), 1395–1413. https://doi.org/10.1111/j.0021-9029.2006.00065.x.

Oechssler, J., Roider, A., & Schmitz, P. W. (2009). Cognitive abilities and behavioral biases. Journal of Economic Behavior & Organization, 72(1), 147–152. https://doi.org/10.1016/j.jebo.2009.04.018.

Parker, A. M., de Bruin, W. B., Yoong, J., & Willis, R. (2012). Inappropriate confidence and retirement planning: Four studies with a national sample. Journal of Behavioral Decision Making, 25(4), 382–389. https://doi.org/10.1002/bdm.745.

Peters, E., Tompkins, M. K., Knoll, M. A. Z., Ardoin, S. P., Shoots-Reinhard, B., & Meara, A. S. (2019). Despite high objective numeracy, lower numeric confidence relates to worse financial and medical outcomes. Proceedings of the National Academy of Sciences of the United States of America, 116(39), 19386–19391. https://doi.org/10.1073/pnas.1903126116.

Peters, E., Västfjäll, D., Slovic, P., Mertz, C. K., Mazzocco, K., & Dickert, S. (2006). Numeracy and Decision Making. Psychological Science, 17(5), 407–413. https://doi.org/10.1111/j.1467-9280.2006.01720.x.

Robb, C. A., Babiarz, P., Woodyard, A., & Seay, M. C. (2015). Bounded rationality and use of alternative financial services. Journal of Consumer Affairs, 49(2), 407–435. https://doi.org/10.1111/joca.12071.

Schwartz, L. M., Woloshin, S., Black, W. C., & Welch, H. G. (1997). The role of numeracy in understanding the benefit of screening mammography. Annals of Internal Medicine, 127(11), 966–972. https://doi.org/10.7326/0003-4819-127-11-199712010-00003.

Seay, M., Asebedo, S., Thompson, C., Stueve, C., & Russi, R. (2015). Mortgage holding and financial satisfaction in retirement. Journal of Financial Counseling and Planning, 26(2), 200–216.

Skagerlund, K., Lind, T., Strömbäck, C., Tinghög, G., & Västfjäll, D. (2018). Financial literacy and the role of numeracy: How individuals’ attitude and affinity with numbers influence financial literacy. Journal of Behavioral and Experimental Economics, 74, 18–25. https://doi.org/10.1016/j.socec.2018.03.004.

Statman, M., Thorley, S., & Vorkink, K. (2006). Investor overconfidence and trading volume. Review of Financial Studies, 19(4), 1531–1565. https://doi.org/10.1093/rfs/hhj032.

Strömbäck, C., Lind, T., Skagerlund, K., Västfjäll, D., & Tinghög, G. (2017). Does self-control predict financial behavior and financial well-being? Journal of Behavioral and Experimental Finance, 14, 30–38. https://doi.org/10.1016/j.jbef.2017.04.002.

Tangney, J. P., Baumeister, R. F., & Boone, A. L. (2004). High self-control predicts good adjustment, less pathology, better grades, and interpersonal success. Journal of Personality, 72(2), 271–324. https://doi.org/10.1111/j.0022-3506.2004.00263.x.

Tharp, D. (2017). Three essays on personality characteristics and financial satisfaction. Thesis.

van Praag, B. M. S., Frijters, P., & Ferrer-i-Carbonell, A. (2003). The anatomy of subjective well-being. Journal of Economic Behavior and Organization, 51(1), 29–49. https://doi.org/10.1016/S0167-2681(02)00140-3.

van Rooij, M., Lusardi, A., & Alessie, R. (2011a). Financial literacy and retirement planning in the Netherlands. Journal of Economic Psychology, 32(4), 593–608. https://doi.org/10.1016/j.joep.2011.02.004.

van Rooij, M., Lusardi, A., & Alessie, R. (2011b). Financial literacy and stock market participation. Journal of Financial Economics, 101, 449–472. https://doi.org/10.1016/j.jfineco.2011.03.006.

van Rooij, M., Lusardi, A., & Alessie, R. (2012). Financial literacy, retirement planning and household wealth. Economic Journal, 122(560), 449–478. https://doi.org/10.1111/j.1468-0297.2012.02501.x.

Woodyard, A. S., & Robb, C. A. (2016). Consideration of financial satisfaction: What consumers know, feel and do from a financial perspective. Journal of Financial Therapy, 7(2), 41–61. https://doi.org/10.4148/1944-9771.1102.

Xiao, J. J., Chen, C., & Chen, F. (2014). Consumer financial capability and financial satisfaction. Social Indicators Research, 118(1), 415–432. https://doi.org/10.1007/s11205-013-0414-8.

Acknowledgements

Open access funding provided by Linköping University. We are grateful to David Andersson, Lina Koppel, Kinga Barrafrem, Anders Andersson, Morten Lau and two anonymous reviewers for valuable comments and suggestions. This research was funded by Länsförsäkringar Alliance Research Foundation [Grant No.: P15/2] and the Swedish Research Council [Grant No.: 2018.01755].

Funding

Funders had no role in study design, data collection, analysis, decision to publish, or preparation of the manuscript. Participation was voluntary and anonymous.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The study was conducted in compliance with ethical standards. All authors declare no conflict of interest that could have appeared to influence the submitted work.

Informed Consent

All participants gave informed consent and were informed that they could withdraw from the stud at any time.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lind, T., Ahmed, A., Skagerlund, K. et al. Competence, Confidence, and Gender: The Role of Objective and Subjective Financial Knowledge in Household Finance. J Fam Econ Iss 41, 626–638 (2020). https://doi.org/10.1007/s10834-020-09678-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-020-09678-9